#industrial real estate investment

Explore tagged Tumblr posts

Text

Atlanta Industrial Realtors

Partner with the experienced industrial realtors at Stratus Property Group to unlock prime industrial opportunities in Atlanta, tailored to your specific requirements and goals!

#Atlanta industrial real estate#Atlanta commercial real estate#Industrial real estate market#Atlanta commercial property#Industrial Property Leasing Atlanta#Atlanta industrial real estate trends#Atlanta Industrial Property Management#Atlanta real estate brokerage services#Atlanta industrial properties#Commercial real estate Atlanta#Atlanta industrial realtors#Industrial Property Management Atlanta#Atlanta commercial leasing#Atlanta industrial real estate agents#Atlanta industrial property listings#industrial real estate investment#industrial property developers#industrial real estate brokers#Atlanta infrastructure#Connectivity in Atlanta#Atlanta transportation network#Manufacturing facilities in Atlanta#Warehouse facilities Atlanta#Atlanta logistics operations#Skilled workforce Atlanta#Atlanta business environment#Atlanta consumer market#Distribution centers Atlanta#Atlanta metropolitan area#Growth opportunities in Atlanta

1 note

·

View note

Text

The apartment block. 🏙🌃 🟧🟪(mixed media collage)🏢

#apartment#apartment complex#apartment buildings#condo#real#real estate#real estate investing#real estate industry#real estate agent#bronx#staten island#city life#cityscape#skyscraper#pop art#contemporary art#fine art#folk art#childrens book illustration#modern art#basquiat#naive art#fort greene#williamsburg#collage art#town house#affordable house#affordable housing#public housing#andy warhol

34 notes

·

View notes

Text

Blackstone Surges to Record High: A Closer Look at Their Impressive Q3 Results

Blackstone, the world's largest commercial property owner, achieved a remarkable milestone on Thursday as its shares surged to a record high. This impressive performance comes on the heels of better-than-expected third-quarter results and an improved real estate investment performance. Let’s dive into the factors driving this success and what it means for the market.

Key Highlights from Q3

In the third quarter, Blackstone invested or committed a staggering $54 billion, marking the highest amount in over two years. This surge in investment activity is attributed to the Federal Reserve’s recent rate cut in September, which significantly reduced the cost of capital. The U.S. central bank’s previous rate hikes had stymied real estate deals and financing, leading to increased defaults in the office market affected by corporate cost-cutting and the rise of hybrid and remote work.

Stephen Schwarzman, Blackstone’s Chief Executive, emphasized the positive impact of the rate cut, stating, “Easing the cost of the capital will be very positive for Blackstone’s asset values. It will be a catalyst for transaction activity.” This sentiment was echoed by Jonathan Gray, President and Chief Operating Officer, who noted that while commercial real estate sentiment is improving, it remains cautious.

Strategic Investments and Areas of Focus

Blackstone has been proactive in planting the “seeds of future value” by substantially increasing its pace of investment. A key area of focus is the revolutionary advancements in artificial intelligence (AI) and the associated digital and energy infrastructure. In September, Blackstone announced the $16 billion purchase of AirTrunk, the largest data center operator in the Asia-Pacific region. This acquisition is part of Blackstone’s $70 billion investment in data centers, with over $100 billion in prospective pipeline development.

Other notable investment themes include renewable energy transition, private credit, and India’s emergence as a major economy. These strategic areas highlight Blackstone’s commitment to innovation and growth.

Recovery in Commercial Real Estate

The Blackstone Real Estate Income Trust (BREIT), a benchmark for the industry, reported a 93% slump in investor stock redemption requests from a peak. This indicates a recovery in investor confidence and a shift towards positive net inflows of capital. BREIT’s core-plus real estate investments, which include stable, income-generating, high-quality real estate, showed a 0.5% decline in Q3 performance, an improvement from a 3.8% drop over the past 12 months. The riskier opportunistic real estate investments posted a 1.1% increase, reversing previous declines.

Student Housing and Data Centers

Among rental housing, student housing has emerged as a significant focus. Wesley LePatner, set to become BREIT CEO on Jan. 1, highlighted the structural undersupply in the U.S. student housing market, emphasizing its potential as an all-weather asset class. BREIT has consistently met investor redemption requests for several months, showcasing strong performance.

Furthermore, the demand for data centers remains robust. QTS, which Blackstone took private in 2021, recorded more leasing activity last year than the preceding three years combined. Such sectors, once considered niche, are now integral to the commercial real estate landscape.

Financial Performance and Outlook

Blackstone’s third-quarter net income soared to approximately $1.56 billion, up from $920.7 million a year earlier. Distributable earnings, profit available to shareholders, rose to $1.28 billion from $1.21 billion. Total assets under management jumped 10% to about $1.11 trillion, driven by inflows to its credit and insurance segment.

The Path Forward

As Blackstone continues to navigate the evolving market landscape, it remains focused on identifying “interesting places to deploy capital.” With a robust investment strategy and a keen eye on emerging trends, Blackstone is well-positioned for future growth.

Join the Conversation: What are your thoughts on Blackstone’s impressive Q3 performance and strategic investments? How do you see these trends impacting the broader real estate market? Share your insights and engage with our community!

#real estate investing#investing#money#investment#danielkaufmanrealestate#real estate#economy#housing#daniel kaufman#homes#ai#artificial intelligence#student housing#commercial and industrial sectors#commercial real estate#self storage#investing stocks

5 notes

·

View notes

Text

*دليلك الشامل لتحقيق النجاح مع Perfect Real Estate* مقدمة: استثمار العقارات هو واحد من أكثر الاستثمارات أمانًا وربحًا. مع توفر العديد من الفرص في السوق العقاري بمدينة العاشر من رمضان، تقدم Perfect Real Estate حلولاً مثالية للأفراد والشركات الراغبين في تحقيق النجاح في هذا المجال. النقاط الرئيسية: 1. مزايا الاستثمار في العقارات: - العوائد المادية المستمرة. - حماية رأس المال من التضخم. - زيادة القيمة العقارية على المدى الطويل. 2. خدمات Perfect Real Estate: - الاستشارات العقارية: فريق من الخبراء يقدمون استشارات مخصصة تلبي احتياجات العملاء. - الإدارة العقارية: خدمات إدارة متكاملة للعقارات تضمن زيادة القيمة والإيرادات. - التسويق العقاري: استراتيجيات تسويقية مبتكرة تزيد من ظهور العقارات وجذب المشترين. 3. المشاريع العقارية المتميزة: - تفاصيل عن المشاريع الحالية مثل موقعها، نوع العقارات، الخدمات المتوفرة، والأسعار التنافسية. - أمثلة على مشاريع ناجحة تم تنفيذها. - [تفاصيل المشاريع](https://lnkd.in/gbh53XEp) 4. الطريقة الصحيحة لاختيار عقارك في العاشر من رمضان: - تحديد الميزانية: قبل البدء في البحث، قم بتحديد ميزانية تتناسب مع إمكانياتك المالية. - اختيار الموقع المناسب: اختر موقع العقار بعناية بناءً على قربه من الخدمات الأساسية مثل المدارس، المستشفيات، والأسواق. - البحث عن البنية التحتية: تأكد من توفر بنية تحتية قوية مثل الطرق والمواصلات العامة، وكذلك خدمات الميا�� والكهرباء. - مراجعة التراخيص والتصاريح: تأكد من أن العقار يحمل كافة التراخيص والتصاريح القانونية المطلوبة. - الاستفادة من الخبراء: احرص على الاستفادة من خبراء Perfect Real Estate في تقديم النصائح والمشورة. 5. نصائح قيمة للعملاء: - الاستثمار طويل الأمد: العقارات تعتبر استثمارًا طويل الأمد، فلا تتوقع العوائد الفورية. - الاستثمار في المناطق الناشئة: المناطق الناشئة غالبًا ما توفر فرصًا استثمارية جيدة بأسعار معقولة. - مقارنة الأسعار: قبل اتخاذ القرار، قم بمقارنة الأسعار بين عدة عقارات للتأكد من الحصول على أفضل صفقة. - متابعة السوق: ابقَ على اطلاع دائم بحالة السوق العقاري وتغيراته للاستفادة من أفضل الفرص. استمتع بتجربة تملك آمنة وسهلة مع شركة بيرفكت للتطوير العقاري 🌟 للحجز أو الاستفسار: 📞 01000905211 📞 01050277682 📞 01050277681 📞 01050277680 لمعرفة التفاصيل الكاملة، يمكنك زيارة الموقع الإلكتروني: 🌐 [www.perfectrealestate.net](https://lnkd.in/g7s8B3Q2) الوسومات (هاشتاغ)#بي_فيلا الوسومات (هاشتاغ)#العاشر_من_رمضان خاتمة: استثمر في عقاراتك بثقة مع Perfect Real Estate، واجعل حلمك بالنجاح في الاستثمار العقاري حقيقة.

3 notes

·

View notes

Text

Turning Solar Energy into Money: 10 Ways to Profit from Sunlight

The sun is an incredibly powerful and abundant source of energy, and there are many ways to turn sunlight into money. In this article, we will explore some of the most effective ways to do so. Install Solar Panels on Your Property One of the most direct ways to turn sunlight into money is by installing solar panels on your property. Solar panels are made up of photovoltaic (PV) cells that…

View On WordPress

#Capitalizing on the solar energy industry#Creative ways to turn sunlight into money#energy efficiency#Energy savings#Generating revenue with solar panels#green energy#Innovative ideas for making money with solar power#Maximizing solar energy for profit#Monetizing solar technology#Net metering#Photovoltaic cells#Profitable solar energy ventures#Real estate development#renewable energy#Solar consulting#solar energy#Solar energy business opportunities#Solar energy education#Solar energy investment#Solar energy investment strategies#Solar farms#Solar financing#Solar installation#Solar panels#solar power#Solar technology#Solar-powered art#Sunlight#Sustainable energy#Ways to earn money with solar energy

11 notes

·

View notes

Text

A Comprehensive Guide to Car Leasing, Real Estate, and Vehicle Purchases in Kenya

Looking for the cost of leasing a car in Kenya? Leasing a car in Kenya offers flexible payment plans, helping individuals and businesses access vehicles without the high upfront cost. If you're interested in real estate, Thika property for sale provides promising investment opportunities with the assistance of real estate agents companies in Kenya. For those in need of reliable transportation, consider visiting Mitsubishi industrial truck dealers in Kenya or exploring Fuso trucks dealers in Kenya for durable, heavy-duty vehicles. If you're looking for something more personal, Proton X70 dealers in Kenya offer a sophisticated choice. Additionally, Mitsubishi Outlander dealers in Kenya and transport trucks for sale cater to customers seeking versatile vehicles for both commercial and personal use. Whether it's leasing a car, buying a home, or acquiring a vehicle, Kenya offers a wide range of options to meet your needs.

#- Cost of Leasing a Car in Kenya#- Thika Property for Sale#- Real Estate Agents Companies in Kenya#- Best Hospitality Services in Nairobi#- Buy Mitsubishi Industrial Truck#- Mitsubishi Outlander Dealers in Kenya#- Fuso Trucks Dealers in Kenya#- Transport Trucks for Sale#- Proton X70 Dealers in Kenya#- Car Leasing Kenya#- Real Estate Kenya#- Mitsubishi Trucks Kenya#- Fuso Trucks Kenya#- Property Investment Kenya#- Nairobi Hospitality Services#- Vehicle Dealers Kenya

0 notes

Text

Investing in Dholera Residential Plots: A Smart Choice for Future Growth

In the past few years, Dholera has risen as one of India's most exciting real estate destinations. This emerging region, which is part of the Dholera Smart City Project, presents tremendous growth potential for investors seeking long-term returns. Known as India’s first greenfield smart city, Dholera SIR (Special Investment Region) is a high-profile urban development that has garnered attention from both local and international investors, particularly Non-Resident Indians (NRIs).

The strategic location of Dholera, its cutting-edge infrastructure, and its focus on sustainable development make it an ideal place for residential plot investment. For anyone interested in securing their future in a forward-thinking city, Dholera residential plots are an excellent choice. In this article, we will explore why investing in Dholera residential plots is a smart move and how GAP Group, a trusted developer in the region, can help you navigate this exciting opportunity.

Why Invest in Dholera Residential Plots?

The allure of Dholera Smart City lies in its promise of exponential growth. Located within the Delhi-Mumbai Industrial Corridor (DMIC), Dholera has been planned as a high-tech urban center with world-class infrastructure, such as intelligent transportation systems, digital connectivity, and a renewable energy focus. For investors, the combination of these features makes it a high-potential location for residential real estate.

Long-Term Returns and High Growth Potential

One of the biggest advantages of investing in Dholera residential plots is the city’s long-term growth prospects. As the Dholera Smart City project moves forward, the demand for both residential and commercial spaces is expected to rise sharply. The prices of Dholera plots have already shown consistent growth, and with the completion of major infrastructure projects, including the Dholera International Airport and the Ahmedabad-Dholera Expressway, the demand for land is only expected to increase.

Investors who choose to buy Dholera residential plots now are likely to enjoy significant appreciation in property values as the city develops. The Dholera plot price trends have been consistently climbing, making this a prime opportunity for anyone looking to benefit from substantial long-term gains.

Strategic Location within the Delhi-Mumbai Industrial Corridor

Dholera SIR’s strategic location plays a crucial role in its appeal as an investment hotspot. Being part of the DMIC project, Dholera is positioned as a major link between two of India’s largest metropolitan areas—Delhi and Mumbai. This provides both commercial and residential investors with a unique advantage, as the connectivity between these two cities is vital for the movement of goods, services, and people.

The Dholera Smart City Project is designed to foster an environment that attracts industries and businesses, ensuring continuous demand for residential plots. Furthermore, the ongoing development of the Dholera International Airport will elevate the city’s global connectivity, making it even more attractive for business and residential investors.

Dholera Smart City: A Vision for the Future

What Makes Dholera Special?

Dholera SIR is part of the Indian government’s ambitious plan to create world-class smart cities. The development covers an area of 920 sq. km and is expected to be a hub for industries, technology, and residential living. The combination of modern infrastructure and eco-friendly initiatives, such as a 5000 MW solar park, ensures that Dholera is not only future-ready but also aligned with global sustainability standards.

Infrastructure and Global Connectivity

The Dholera Smart City is designed to feature cutting-edge infrastructure, including smart grids, digital connectivity, and intelligent transportation systems. The Dholera International Airport will serve as a gateway for global business, while the Ahmedabad-Dholera Expressway will drastically reduce travel time to key commercial hubs, making the area highly accessible.

With these infrastructural developments, Dholera City is poised to become one of India’s most advanced urban centers, attracting both business investors and residential buyers.

The Case for Dholera Residential Plot Investment

High Return on Investment (ROI)

Investors in Dholera residential plots can expect excellent returns as the city develops. The demand for land in Dholera has been increasing steadily, and with the completion of major infrastructure projects, property prices are projected to surge. This makes Dholera land price a key consideration for anyone looking to capitalize on future growth.

By investing in Dholera residential plots now, you position yourself to benefit from the anticipated rise in land prices as the city’s development progresses. This is an ideal opportunity for investors looking for high returns in a growing market.

Government Support and Favorable Policies

The development of Dholera SIR is supported by the Indian government through the Special Investment Region (SIR) Act, which offers favorable policies and incentives for investors. The government’s commitment to building sustainable infrastructure and facilitating business operations in Dholera provides additional confidence in the region’s future growth.

For investors, the government’s backing ensures that Dholera Smart City is a safe and promising place to invest. The continuous development of transportation networks, industrial zones, and residential areas will guarantee steady appreciation in Dholera land price.

Excellent Connectivity

The connectivity offered by Dholera is another major draw for investors. With the Ahmedabad-Dholera Expressway, proximity to ports, and the upcoming Dholera International Airport, the city is positioned to become a globally connected hub. Whether you're investing in Dholera residential plots for personal use or commercial development, this connectivity ensures that the city will remain attractive to both businesses and residents.

The seamless integration with major cities and industrial hubs makes Dholera Smart City an ideal location for those looking for modern, well-connected living spaces.

Why Choose GAP Group for Your Investment in Dholera Residential Plots?

GAP Group stands out as a trusted and experienced developer in Dholera SIR, offering a range of services designed to support investors throughout their journey. As a developer focused on sustainable growth and long-term returns, GAP Group offers everything you need to make your investment in Dholera residential plots a success.

Comprehensive Support and Services

GAP Group provides a wide array of services to help investors make informed decisions and manage their properties. From financial advisory services to investment tracking tools, GAP Group ensures that investors are equipped with the right resources to maximize their returns.

The company also offers rental management services, providing assistance to those looking to generate passive income from their Dholera residential plots. Additionally, GAP Group’s after-sales support ensures that investors continue to receive assistance long after the purchase is complete.

Proven Track Record of Success

GAP Group has a proven track record in delivering successful real estate projects in Dholera. With a focus on sustainable development and ethical practices, GAP Group has built a reputation as one of the most trusted developers in Dholera SIR. Past projects have shown significant growth, and GAP Group’s commitment to maximizing returns for investors has earned it a loyal customer base.

Conclusion: The Smart Choice for Future Growth

Investing in Dholera residential plots offers a rare opportunity to be part of India’s first Smart City Project, a city designed for the future. With its strategic location, world-class infrastructure, government backing, and exceptional growth potential, Dholera SIR is poised to become one of India’s most successful urban developments.

If you’re looking for a reliable partner in your investment journey, GAP Group is the ideal choice. As a trusted developer with a strong commitment to sustainability and long-term returns, GAP Group ensures that your investment in Dholera residential plots is a smart decision that will yield rewards for years to come.

With Dholera smart city plot booking now open, this is the perfect time to invest in one of India’s most promising real estate markets. Secure your future today with GAP Group and become a part of the thriving Dholera SIR development.

#dholera plot price#dholera land price#dholera city#dholera gujarat#dholera ahmedabad#dholera smart city plot booking#dholera real estate#dholera plots#dholera investment#dholera smart city project cost#dholera smart city india#dholera residential plots#dholera industrial land price#dholera project#dholera sir#dholera city project#dholera special investment region#dholera sir city#dholera#dholera smart city plot price#dholera smart city project#dholera smart city project details#dholera smart city gujarat

0 notes

Text

From Struggles to Success : Challenges in Early-Stage Startups

The journey from struggles to success is a well-known narrative in the startup world. Early-stage startups face numerous challenges that can either make or break their trajectory. Here are some common struggles startups experience, along with strategies that have helped many founders turn these challenges into success stories:

1. Financial Strain and Fundraising

Challenge: Startups often have limited financial resources, and securing funding is a constant struggle. Many founders face the challenge of running out of cash before reaching profitability. Success Strategy: Founders who succeed often diversify their funding sources—bootstrapping, angel investors, venture capital, or even crowdfunding. It's important to clearly communicate your vision and demonstrate early traction to appeal to potential investors.

2. Product-Market Fit

Challenge: Finding the right product-market fit can be elusive. Many startups fail because they build a product nobody wants or needs, leading to wasted resources and frustration. Success Strategy: Successful startups iterate quickly based on feedback. They prioritize customer discovery, validating ideas through minimum viable products (MVPs), and adapting their offerings based on real market demand.

3. Building a Strong Team

Challenge: Startups often struggle to attract and retain top talent due to limited budgets and the uncertainty of success. Many early-stage teams are small, and each member carries significant responsibility. Success Strategy: Founders who overcome this challenge often focus on creating a strong company culture, offering equity as part of compensation, and being transparent about the vision. A shared sense of purpose helps attract passionate individuals willing to take the risk.

4. Competition and Market Saturation

Challenge: The market is competitive, and often, startups face larger, established players with more resources. Success Strategy: Differentiation is key. Startups that succeed focus on unique value propositions, niche markets, or innovative business models that allow them to compete with bigger companies. It's essential to know your competitors and find areas where you can excel.

5. Scaling Operations

Challenge: While initial growth can be promising, scaling a startup presents challenges in maintaining quality, service, and operational efficiency. Success Strategy: Successful startups focus on building scalable processes early on. Automating repetitive tasks, investing in technology, and ensuring that customer service can scale with demand are critical. Founders also emphasize strategic hiring as they grow.

6. Marketing and Customer Acquisition

Challenge: Early-stage startups often lack the marketing budget to compete with established brands, making it difficult to build a customer base. Success Strategy: Creativity and targeted efforts are often the answer. Growth hacking, leveraging social media, partnerships, and building organic reach through content marketing can help startups gain visibility without overspending.

7. Dealing with Uncertainty and Pivoting

Challenge: Startups must navigate a constantly changing landscape. Uncertainty is inevitable, and founders often need to pivot their business model or product offerings. Success Strategy: Flexibility and resilience are key. Startups that succeed are willing to pivot when needed, whether it's changing their target market, pricing strategy, or product focus. Founders who listen to the market and adapt accordingly increase their chances of success.

8. Mental and Emotional Strain

Challenge: The pressure of running a startup can lead to burnout, anxiety, and self-doubt. Founders often experience loneliness and isolation as they deal with the highs and lows. Success Strategy: Founders who build a support system—whether through mentorship, peers, or communities—find it easier to navigate these challenges. Taking care of mental and physical health is also crucial for long-term success.

9. Regulatory Hurdles

Challenge: Startups in industries like fintech, healthtech, or biotech often face strict regulatory requirements that can delay product launches or increase costs. Success Strategy: Founders need to stay informed about industry regulations and hire legal experts who can navigate compliance. Early engagement with regulators can also help smooth the process.

10. Customer Retention

Challenge: Acquiring customers is just the beginning; retaining them and building long-term loyalty can be more challenging. Success Strategy: Startups that focus on customer success, personalization, and providing excellent service have higher retention rates. Building a community around the product or service can also strengthen customer relationships.

#commercial real estate investment#industrial investing#multi family real estate investments#multi family real estate investing

0 notes

Text

How to Progress ahead with Mathematics?

#Mathematics graduates are versatile and can find opportunities in many other industries as well#depending on their specific interests and areas of expertise. The strong analytical and problem-solving skills acquired through a Mathemati#Market Research Analyst#As a market researcher for a company#you gather data from customers and competitors#assist in developing goals and strategies#improve your customer base#and beat your competitors.#As a market researcher#you will also design surveys#formulate reports#track market trends#and present information to executives. As you gain experience#there are plenty of scopes for you to manage a team of researchers and evaluate strategies.#The Faculty of Mathematics at Poddar International College is simply outstanding and proficient. Besides#the students have bright prospects as they have the best placements here.#Financial Planner#Financial planners assist individuals and companies in managing their financial assets. They are also involved in assisting individuals wit#Developing effective financial strategies for businesses and individuals.#Setting financial goals#assessing financial risks#and helping to ensure retirement or investment plans are among their primary duties.#They help companies formulate stock market investment strategies#real estate investing strategies#and new business ventures.#There are many professional skill and soft skills enhancement sessions for the students of Mathematics at Poddar International College.#Insurance Underwriter#Insurance underwriters are the ones who#on behalf of the insurance company#evaluate

1 note

·

View note

Text

Are Co-Warehousing Solutions a Game-Changer for Industrial Real Estate?

The rise of co-warehousing solutions is reshaping the industrial real estate landscape, offering a compelling alternative for the growing number of small businesses and users with short-term needs. With over 5.5 million new business applications filed in 2023 alone, according to Census data, this niche market is gaining significant traction. Small businesses, which contribute nearly 44 percent…

View On WordPress

#co-warehousing#Commercial Real Estate#Daniel Kaufman Real Estate#Economy#industrial#investing#property management#Real Estate#real estate investing#technology#venture capital#warehouse

0 notes

Text

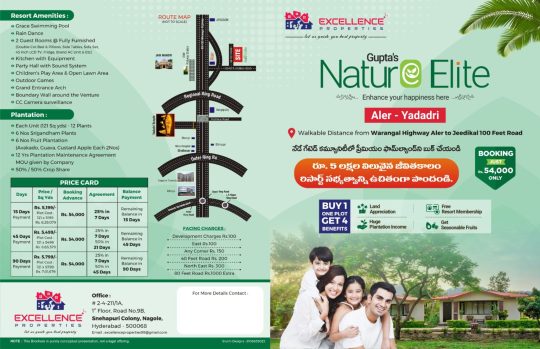

Hyderabad’s Best Real Estate Services by Excellence Properties"

#with over three years of experience helping customers find the perfect open plots and homes. We offer#personalized solutions tailored to each client’s unique needs and profiles. Our mission is to redefine#real estate services by providing reliable#expert guidance for buying#selling#investing#and development.#At Excellence Properties#we are more than just a real estate company – we are a team of dedicated#professionals committed to delivering excellence#backed by our industry expertise and deep knowledge of#local markets. Trust us to make your real estate aspirations a reality.#RealEstateHyderabad#ExcellenceProperties#OpenPlots#HomesForSale#PropertyInvestments#HyderabadRealEstate#TailoredRealEstateSolutions#BuySellInvest#PropertyDevelopment

0 notes

Text

Dollar daruma. 🟥🟨💵💲

#daruma doll#daruma ikka#daruma256#daruma matsuura#daruma#Chinese brush painting#sumie#sumie painting#dollars#us dollar#dollar bills#nasdaq#stock market#stocks to watch#banking#mortgage broker#bitcoin#bitcoin mining#billionaire#millionaires#wall street#investment#make money online#make money#euro#real estate#real estate investing#dow jones industrial average#pop art#basquiat

4 notes

·

View notes

Text

Construction Industry Braces for Tariffs: How Developers Are Adapting to Uncertainty

The construction and real estate development industries are navigating a perfect storm of potential cost increases, labor shortages, and policy-driven uncertainties. The latest concerns center around proposed tariffs on goods from Mexico and Canada, combined with immigration policies that could disrupt labor availability. These challenges are pushing developers to rethink their strategies in real time.

Material Costs: The Tariff Factor

Developers are on edge as the U.S. government considers imposing a 25% tariff on key construction materials like lumber, steel, and drywall. Suburban multifamily developments, which often rely heavily on Canadian lumber, are particularly vulnerable. Although material prices are well below their pandemic-era peaks, these new tariffs could tighten profit margins for new projects.

What It Means for Developers

• Higher Material Costs: A 25% tariff could significantly inflate budgets for projects already in the pipeline.

• Strategic Stockpiling: Builders are preemptively stockpiling materials, driving demand for industrial outdoor storage (IOS) spaces—a boon for investors in the IOS sector.

• Supply Chain Pressures: The surge in demand for storage is adding new stress to an already tight supply chain, creating logistical hurdles for developers.

Labor Shortages: A Growing Concern

Undocumented workers make up about 13% of the construction workforce nationwide, with higher concentrations in key markets like Texas, Florida, and California. Proposed immigration policies could lead to deportations, exacerbating labor shortages in an industry already stretched thin.

Who Will Be Impacted the Most?

• Small Projects: These often rely heavily on undocumented labor, putting them at the highest risk of delays and cost overruns.

• Unionized Developments: Larger, unionized projects may be less immediately affected, thanks to a more stable labor force.

The Economic Wildcard

The combination of tariffs, labor disruptions, and recent corporate tax cuts has economists warning of potential inflationary pressures. Rising costs for construction loans and bridge financing could ripple across the industry. However, some experts believe the Federal Reserve may act faster than in previous cycles to curb inflation, potentially mitigating the long-term impact.

Key Questions to Consider

• How will rising costs affect housing affordability?

• Could these challenges slow down the development of suburban multifamily projects?

• What steps should developers take now to hedge against these risks?

The Big Picture

In response to looming tariffs, developers are adjusting their strategies by stockpiling materials and rethinking project timelines. The ripple effects extend beyond construction sites to include industrial storage markets and broader economic trends.

For real estate developers and investors, this is a critical moment to stay informed and agile. Collaborating with supply chain experts, exploring alternative materials, and securing financing with built-in contingencies are just a few ways to stay ahead in this evolving landscape.

Let’s Discuss

What strategies are you considering to navigate these challenges? Share your thoughts and insights below—we’d love to hear how you’re adapting in these uncertain times.

#construction#supply chain management#supply chain optimization#supply chain solutions#commercial and industrial sectors#self storage#real estate#investment#danielkaufmanrealestate#economy#real estate investing#daniel kaufman#housing#homes#politics#donald trump#economics

0 notes

Text

Commercial Property Buy, Sale & Rent in Gift City

Explore for commercial real estate in gift city gandhinagar? Access a range of properties available for buy, sale, or rent to suit your business requirements.

#Commercial Property for Sale#Buy Commercial Property#Sell Commercial Property#Commercial Property for Rent#Office Space for Sale#Retail Space for Rent#Commercial Real Estate#Lease Commercial Property#Industrial Property for Sale#Rent Office Space#Commercial Listings#Commercial Investment Property#Warehouse for Rent#Buy Office Space#Sell Office Space#Commercial Property Listings#Business Property for Sale#Commercial Lease Opportunities#Commercial Space for Rent#Real Estate for Businesses#Office Space for Lease#Commercial Property Deals#Retail Property for Sale#Industrial Space for Lease#Commercial Property Market

1 note

·

View note

Text

#homebuying#property#indorerealestate#propertyinvestment#property investing#realestate#propertyinvestor#1 bhk apartments#1 bhk flat in indore#1 bhk in indore#realestateagent#real estate agency in indore#real estate#realtor#properties#real estate agent#real estate agency near me#real estate marketing#propertyforsale#villas#property for sale#plotsforsale#plots#industrial plots#open plots#realtorlife#propertymanagement#realty#realestatetips#indore

1 note

·

View note

Text

GAP Group: Pioneering Smart and Sustainable Real Estate in Dholera SIR

At GAP Group, we bring visionary real estate development to Dholera SIR, creating sustainable spaces that honor tradition while embracing innovation. GAP Group is the trusted developer for Dholera SIR, leading in the Dholera Smart City project with opportunities for investment in residential and commercial land. Led by industry experts, we focus on projects that bridge the gap between present potential and future possibilities. Our mission is to drive India’s growth by developing eco-friendly, smart infrastructure that enhances quality of life. Partner with GAP Group to invest in a vision of smart living, sustainability, and shared growth, positioning you at the forefront of Dholera's evolution.

#real estate development to Dholera SIR#dholera investment#dholera smart city project cost#dholera smart city india#dholera residential plots#dholera industrial land price#dholera projectx#dholera sir#dholera city project#dholera special investment region#dholera sir city#dholera#dholera smart city plot price#dholera smart city project#dholera smart city project details#dholera smart city gujarat

0 notes