#Maximizing solar energy for profit

Explore tagged Tumblr posts

Text

Turning Solar Energy into Money: 10 Ways to Profit from Sunlight

The sun is an incredibly powerful and abundant source of energy, and there are many ways to turn sunlight into money. In this article, we will explore some of the most effective ways to do so. Install Solar Panels on Your Property One of the most direct ways to turn sunlight into money is by installing solar panels on your property. Solar panels are made up of photovoltaic (PV) cells that…

View On WordPress

#Capitalizing on the solar energy industry#Creative ways to turn sunlight into money#energy efficiency#Energy savings#Generating revenue with solar panels#green energy#Innovative ideas for making money with solar power#Maximizing solar energy for profit#Monetizing solar technology#Net metering#Photovoltaic cells#Profitable solar energy ventures#Real estate development#renewable energy#Solar consulting#solar energy#Solar energy business opportunities#Solar energy education#Solar energy investment#Solar energy investment strategies#Solar farms#Solar financing#Solar installation#Solar panels#solar power#Solar technology#Solar-powered art#Sunlight#Sustainable energy#Ways to earn money with solar energy

11 notes

·

View notes

Text

2024 - 2025 masterlist

specific placements scorpio moon chiron moon signs & how their express empathy moon signs as greek mythics ic & inherited behaviors aquarius as icarus | leo as sun behavior during conflict | mars signs the physical essence of venus rising signs & first impressions hypothetical death | 8th house majors/higher education | signs in the 9th house roast : ascendants + sagittarius in their house

astrology observations astro observations: roasting edition astrology observations | jukebox

human design energy types right angle incarnation crosses repost pile

career astrology maximize profits w/ 2nd house what are you known for - midheaven how do you serve society - 6th house

transits shadow work for each rising sign: navigating the transformative transits of 2025-2026 scorpio new moon 11/1/24 new moon in sagittarius and its aspects | 12/1/24

solar return indicators of financial gain in solar return indicators of moving in solar return

cosmetic/health astrology skin care & the ascendant 2nd house & diets sleep | planets in 12th house

18+ mars signs kink/positions

dark/supernatural astrology indicators of an abusive household indicators of psychic abilities dark truth of the planets in 12th

asks answered "Can you explain when a venus in 8th in Aries woman meet 8th house mars in leo man romantically"

#astrology#astrology observations#astro observations#human design#human design chart#tryna keep things organized! couldnt fit these posts on my other masterlist

98 notes

·

View notes

Text

Solar is a market for (financial) lemons

There are only four more days left in my Kickstarter for the audiobook of The Bezzle, the sequel to Red Team Blues, narrated by @wilwheaton! You can pre-order the audiobook and ebook, DRM free, as well as the hardcover, signed or unsigned. There's also bundles with Red Team Blues in ebook, audio or paperback.

Rooftop solar is the future, but it's also a scam. It didn't have to be, but America decided that the best way to roll out distributed, resilient, clean and renewable energy was to let Wall Street run the show. They turned it into a scam, and now it's in terrible trouble. which means we are in terrible trouble.

There's a (superficial) good case for turning markets loose on the problem of financing the rollout of an entirely new kind of energy provision across a large and heterogeneous nation. As capitalism's champions (and apologists) have observed since the days of Adam Smith and David Ricardo, markets harness together the work of thousands or even millions of strangers in pursuit of a common goal, without all those people having to agree on a single approach or plan of action. Merely dangle the incentive of profit before the market's teeming participants and they will align themselves towards it, like iron filings all snapping into formation towards a magnet.

But markets have a problem: they are prone to "reward hacking." This is a term from AI research: tell your AI that you want it to do something, and it will find the fastest and most efficient way of doing it, even if that method is one that actually destroys the reason you were pursuing the goal in the first place.

https://learn.microsoft.com/en-us/security/engineering/failure-modes-in-machine-learning

For example: if you use an AI to come up with a Roomba that doesn't bang into furniture, you might tell that Roomba to avoid collisions. However, the Roomba is only designed to register collisions with its front-facing sensor. Turn the Roomba loose and it will quickly hit on the tactic of racing around the room in reverse, banging into all your furniture repeatedly, while never registering a single collision:

https://www.schneier.com/blog/archives/2021/04/when-ais-start-hacking.html

This is sometimes called the "alignment problem." High-speed, probabilistic systems that can't be fully predicted in advance can very quickly run off the rails. It's an idea that pre-dates AI, of course – think of the Sorcerer's Apprentice. But AI produces these perverse outcomes at scale…and so does capitalism.

Many sf writers have observed the odd phenomenon of corporate AI executives spinning bad sci-fi scenarios about their AIs inadvertently destroying the human race by spinning off in some kind of paperclip-maximizing reward-hack that reduces the whole planet to grey goo in order to make more paperclips. This idea is very implausible (to say the least), but the fact that so many corporate leaders are obsessed with autonomous systems reward-hacking their way into catastrophe tells us something about corporate executives, even if it has no predictive value for understanding the future of technology.

Both Ted Chiang and Charlie Stross have theorized that the source of these anxieties isn't AI – it's corporations. Corporations are these equilibrium-seeking complex machines that can't be programmed, only prompted. CEOs know that they don't actually run their companies, and it haunts them, because while they can decompose a company into all its constituent elements – capital, labor, procedures – they can't get this model-train set to go around the loop:

https://pluralistic.net/2023/03/09/autocomplete-worshippers/#the-real-ai-was-the-corporations-that-we-fought-along-the-way

Stross calls corporations "Slow AI," a pernicious artificial life-form that acts like a pedantic genie, always on the hunt for ways to destroy you while still strictly following your directions. Markets are an extremely reliable way to find the most awful alignment problems – but by the time they've surfaced them, they've also destroyed the thing you were hoping to improve with your market mechanism.

Which brings me back to solar, as practiced in America. In a long Time feature, Alana Semuels describes the waves of bankruptcies, revealed frauds, and even confiscation of homeowners' houses arising from a decade of financialized solar:

https://time.com/6565415/rooftop-solar-industry-collapse/

The problem starts with a pretty common finance puzzle: solar pays off big over its lifespan, saving the homeowner money and insulating them from price-shocks, emergency power outages, and other horrors. But solar requires a large upfront investment, which many homeowners can't afford to make. To resolve this, the finance industry extends credit to homeowners (lets them borrow money) and gets paid back out of the savings the homeowner realizes over the years to come.

But of course, this requires a lot of capital, and homeowners still might not see the wisdom of paying even some of the price of solar and taking on debt for a benefit they won't even realize until the whole debt is paid off. So the government moved in to tinker with the markets, injecting prompts into the slow AIs to see if it could coax the system into producing a faster solar rollout – say, one that didn't have to rely on waves of deadly power-outages during storms, heatwaves, fires, etc, to convince homeowners to get on board because they'd have experienced the pain of sitting through those disasters in the dark.

The government created subsidies – tax credits, direct cash, and mixes thereof – in the expectation that Wall Street would see all these credits and subsidies that everyday people were entitled to and go on the hunt for them. And they did! Armies of fast-talking sales-reps fanned out across America, ringing dooorbells and sticking fliers in mailboxes, and lying like hell about how your new solar roof was gonna work out for you.

These hustlers tricked old and vulnerable people into signing up for arrangements that saw them saddled with ballooning debt payments (after a honeymoon period at a super-low teaser rate), backstopped by liens on their houses, which meant that missing a payment could mean losing your home. They underprovisioned the solar that they installed, leaving homeowners with sky-high electrical bills on top of those debt payments.

If this sounds familiar, it's because it shares a lot of DNA with the subprime housing bubble, where fast-talking salesmen conned vulnerable people into taking out predatory mortgages with sky-high rates that kicked in after a honeymoon period, promising buyers that the rising value of housing would offset any losses from that high rate.

These fraudsters knew they were acquiring toxic assets, but it didn't matter, because they were bundling up those assets into "collateralized debt obligations" – exotic black-box "derivatives" that could be sold onto pension funds, retail investors, and other suckers.

This is likewise true of solar, where the tax-credits, subsidies and other income streams that these new solar installations offgassed were captured and turned into bonds that were sold into the financial markets, producing an insatiable demand for more rooftop solar installations, and that meant lots more fraud.

Which brings us to today, where homeowners across America are waking up to discover that their power bills have gone up thanks to their solar arrays, even as the giant, financialized solar firms that supplied them are teetering on the edge of bankruptcy, thanks to waves of defaults. Meanwhile, all those bonds that were created from solar installations are ticking timebombs, sitting on institutions' balance-sheets, waiting to go blooie once the defaults cross some unpredictable threshold.

Markets are very efficient at mobilizing capital for growth opportunities. America has a lot of rooftop solar. But 70% of that solar isn't owned by the homeowner – it's owned by a solar company, which is to say, "a finance company that happens to sell solar":

https://www.utilitydive.com/news/solarcity-maintains-34-residential-solar-market-share-in-1h-2015/406552/

And markets are very efficient at reward hacking. The point of any market is to multiply capital. If the only way to multiply the capital is through building solar, then you get solar. But the finance sector specializes in making the capital multiply as much as possible while doing as little as possible on the solar front. Huge chunks of those federal subsidies were gobbled up by junk-fees and other financial tricks – sometimes more than 100%.

The solar companies would be in even worse trouble, but they also tricked all their victims into signing binding arbitration waivers that deny them the power to sue and force them to have their grievances heard by fake judges who are paid by the solar companies to decide whether the solar companies have done anything wrong. You will not be surprised to learn that the arbitrators are reluctant to find against their paymasters.

I had a sense that all this was going on even before I read Semuels' excellent article. We bought a solar installation from Treeium, a highly rated, giant Southern California solar installer. We got an incredibly hard sell from them to get our solar "for free" – that is, through these financial arrangements – but I'd just sold a book and I had cash on hand and I was adamant that we were just going to pay upfront. As soon as that was clear, Treeium's ardor palpably cooled. We ended up with a grossly defective, unsafe and underpowered solar installation that has cost more than $10,000 to bring into a functional state (using another vendor). I briefly considered suing Treeium (I had insisted on striking the binding arbitration waiver from the contract) but in the end, I decided life was too short.

The thing is, solar is amazing. We love running our house on sunshine. But markets have proven – again and again – to be an unreliable and even dangerous way to improve Americans' homes and make them more resilient. After all, Americans' homes are the largest asset they are apt to own, which makes them irresistible targets for scammers:

https://pluralistic.net/2021/06/06/the-rents-too-damned-high/

That's why the subprime scammers targets Americans' homes in the 2000s, and it's why the house-stealing fraudsters who blanket the country in "We Buy Ugly Homes" are targeting them now. Same reason Willie Sutton robbed banks: "That's where the money is":

https://pluralistic.net/2023/05/11/ugly-houses-ugly-truth/

America can and should electrify and solarize. There are serious logistical challenges related to sourcing the underlying materials and deploying the labor, but those challenges are grossly overrated by people who assume the only way we can approach them is though markets, those monkey's paw curses that always find a way to snatch profitable defeat from the jaws of useful victory.

To get a sense of how the engineering challenges of electrification could be met, read McArthur fellow Saul Griffith's excellent popular engineering text Electrify:

https://pluralistic.net/2021/12/09/practical-visionary/#popular-engineering

And to really understand the transformative power of solar, don't miss Deb Chachra's How Infrastructure Works, where you'll learn that we could give every person on Earth the energy budget of a Canadian (like an American, but colder) by capturing just 0.4% of the solar rays that reach Earth's surface:

https://pluralistic.net/2023/10/17/care-work/#charismatic-megaprojects

But we won't get there with markets. All markets will do is create incentives to cheat. Think of the market for "carbon offsets," which were supposed to substitute markets for direct regulation, and which produced a fraud-riddled market for lemons that sells indulgences to our worst polluters, who go on destroying our planet and our future:

https://pluralistic.net/2021/04/14/for-sale-green-indulgences/#killer-analogy

We can address the climate emergency, but not by prompting the slow AI and hoping it doesn't figure out a way to reward-hack its way to giant profits while doing nothing. Founder and chairman of Goodleap, Hayes Barnard, is one of the 400 richest people in the world – a fortune built on scammers who tricked old people into signing away their homes for nonfunctional solar):

https://www.forbes.com/profile/hayes-barnard/?sh=40d596362b28

If governments are willing to spend billions incentivizing rooftop solar, they can simply spend billions installing rooftop solar – no Slow AI required.

Berliners: Otherland has added a second date (Jan 28 - TOMORROW!) for my book-talk after the first one sold out - book now!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/01/27/here-comes-the-sun-king/#sign-here

Back the Kickstarter for the audiobook of The Bezzle here!

Image:

Future Atlas/www.futureatlas.com/blog (modified)

https://www.flickr.com/photos/87913776@N00/3996366952

--

CC BY 2.0

https://creativecommons.org/licenses/by/2.0/

J Doll (modified)

https://commons.wikimedia.org/wiki/File:Blue_Sky_%28140451293%29.jpeg

CC BY 3.0

https://creativecommons.org/licenses/by/3.0/deed.en

#pluralistic#solar#financialization#energy#climate#electrification#climate emergency#bezzles#ai#reward hacking#alignment problem#carbon offsets#slow ai#subprime

233 notes

·

View notes

Text

Best Builders In Chennai | Icon Properties

Icon Properties is one of the leading and most trusted and best builders in Chennai, renowned for their exceptional craftsmanship, innovative designs, and uncompromising commitment to quality. With a rich legacy of delivering premium residential and commercial projects, Icon Properties has carved a niche for itself in the real estate industry.

At Icon Properties, every project is a testament to their unwavering dedication to excellence. Meticulously planned layouts, superior construction techniques, and attention to detail are the hallmarks of their creations. They blend contemporary aesthetics with functional spaces, creating homes that reflect the aspirations and lifestyle of their discerning customers.

The team at Icon Properties comprises seasoned professionals who bring a wealth of expertise and experience to the table. From architects and engineers to skilled laborers and project managers, each member is driven by a shared vision of transforming dreams into reality. They adhere to stringent quality standards, ensuring that every aspect of construction meets or exceeds expectations.

In addition to their commitment to quality, Icon Properties is also committed to sustainability and environmental consciousness. They incorporate eco-friendly practices into their projects, such as rainwater harvesting, solar energy utilization, and green landscaping, reducing the ecological footprint while enhancing the overall well-being of residents.

Transparency and integrity are the pillars of Icon Properties' business philosophy. They maintain open lines of communication with their customers, providing regular updates and ensuring complete transparency throughout the project life cycle. By fostering trust and delivering on their promises, they have earned an impeccable reputation among home buyers.

Icon Properties portfolio includes a diverse range of projects, ranging from luxurious apartments and villas to contemporary commercial spaces. Each project is thoughtfully designed to maximize space utilization, natural lighting, and ventilation, ensuring a harmonious blend of comfort and functionality.

Customer satisfaction is at the core of Icon Properties' ethos. They go the extra mile to understand the unique requirements and preferences of their customers, ensuring that their projects are tailor-made to suit individual needs. Their efficient after-sales service and prompt response to queries further strengthen their customer-centric approach.

Beyond constructing exceptional properties, Icon Properties also focuses on building lasting relationships with their customers. They strive to create communities where residents can thrive, fostering a sense of belonging and camaraderie. By incorporating amenities like parks, recreational facilities, and community spaces, they create environments that promote a high quality of life.

When it comes to reliability, innovation, and a commitment to delivering excellence, Icon Properties stands tall as one of the best builders in Chennai. With a legacy built on trust and a vision for the future, they continue to redefine the real estate landscape, creating spaces that inspire and elevate lifestyles. Whether you are seeking a dream home or a profitable investment, Icon Properties is the name you can trust to fulfill your aspirations.

#luxuryhomes#iconproperties#chennai#nungabakkam#iconproperties_alcazar#apartmentsinnungabakkam#buyhome#flatsinchennai#homesinchennai#buyflats#flatsforsale#elitehomes#apartments#realestate#2bhk#3bhk

2 notes

·

View notes

Text

The main argument against that is maintenance, though it's not a very strong one. Lots of supermarkets in Europe have them and proudly display a digital counter for how much power they've generated on their own, to appear greener. So it's not even slightly impossible. For lower buildings, such as in the suburbs, it's even easier.

Putting solar panels in fields has been shown to be beneficial for crops, though it makes harvesting a bit finicky. If you've got cattle, it's a good way to provide shade, provided they can't injure themselves on it.

The one place it makes all the sense, though? Parking lots. Easy access for repairs. (Possibly) extra profit for businesses and towns which own the lots. If it's a business lot, you can even combine it with solar panels on the roof to maximize output. Support pillars as visual aid to where a parking spots sides are on the outside, and as an attachment point for trash cans and pedestrian protection on the other. Protection from snow, rain and sun for people on the lot. Wind breaks on large lots. Less heat absorption on the surface. (If we must) space for advertising and/or security cameras on the underside.

You could even just do the most popular spots near the store, leaving the less used space free for if the lot gets used for, e.g. an annual classic car meet. You can put it on the less used spaces if those spaces tend to e.g. get wrecked by teens doing donuts on a Friday night as opposed to paying for access to a place with lighting, and safe barriers, and 112 on speed dial.

This also enables more niche businesses to exist when profit is unpredictable, especially niche businesses that are necessary and otherwise several hours/days travel away.

Tl;dr: the problem with solar panels isn't space. It's that we don't have enough infrastructure to store the energy we could generate with absolutely minimal incentives.

I was talking to my dad about renewable energy and he was like “the only problem with solar farms is they take up so much space.”

And it made me think about a city and how much sun exposure all the rooftops in a city get and…why not just make the city it’s own solar farm by putting solar panels on every rooftop?

45K notes

·

View notes

Text

Key Sectors to Invest in India for Maximum Growth

India has emerged as one of the fastest-growing economies in the world, presenting a wealth of opportunities for investors seeking high returns. With its expanding consumer base, digital transformation, and government-driven initiatives, investing in India has never been more promising. For businesses and entrepreneurs looking to maximize their growth potential, identifying the right sectors is crucial. Here are the key sectors that offer significant investment potential in India:

1. Technology & Digital Economy

India's digital revolution is reshaping industries, with rapid adoption of artificial intelligence (AI), cloud computing, and blockchain technology. The IT and software services sector continues to thrive, fueled by global demand and innovation. E-commerce, fintech, and digital payments are also experiencing explosive growth, making the technology sector a prime choice for those looking to invest in India.

2. Renewable Energy

India has set ambitious targets to transition toward clean energy, with a focus on solar, wind, and hydroelectric power. The government's commitment to sustainability and incentives for green energy projects make this sector highly attractive for investment. With increasing demand for renewable energy solutions, this sector offers long-term profitability and environmental impact.

3. Healthcare & Pharmaceuticals

The Indian healthcare sector is expanding rapidly, driven by increasing medical needs, technological advancements, and policy support. From telemedicine to biotechnology, investors can explore opportunities in pharmaceuticals, healthcare infrastructure, and medical device manufacturing. India's strong position as a global supplier of affordable medicines further solidifies its potential in this sector.

4. Infrastructure & Real Estate

India’s urbanization is accelerating, leading to a growing demand for smart cities, modern transportation, and commercial spaces. Government-backed initiatives such as the Smart Cities Mission and Make in India program have opened lucrative investment avenues in infrastructure and real estate. Investing in India’s construction and real estate sector ensures access to long-term growth and high-yield opportunities.

5. Manufacturing & Industrial Growth

The ‘Make in India’ campaign has propelled the manufacturing sector into the spotlight. With favorable government policies, a skilled workforce, and improved ease of doing business, India is becoming a global manufacturing hub. Key industries such as automobiles, electronics, and consumer goods offer immense potential for investors looking to tap into industrial growth.

6. Agriculture & Agri-Tech

Agriculture remains the backbone of India’s economy, but technological advancements have introduced a new wave of growth. Agri-tech innovations, precision farming, and food processing industries are creating investment opportunities. Companies investing in India’s agricultural sector can benefit from increasing demand for sustainable and technology-driven farming solutions.

7. Financial Services & Fintech

India's financial sector is evolving rapidly, with digital banking, insurance, and microfinance playing a crucial role in economic development. The fintech revolution, powered by mobile banking and digital wallets, has transformed the way Indians manage finances. Investors in this sector can leverage India’s growing digital adoption and expanding financial inclusion.

Conclusion: Seize the Opportunity with Fox&Angel

Investing in India offers unparalleled opportunities for growth across diverse sectors. Whether it's technology, renewable energy, healthcare, infrastructure, manufacturing, agriculture, or financial services, each industry presents lucrative possibilities for investors. To navigate this dynamic landscape and unlock maximum growth potential, partnering with experts like Fox&Angel can provide the strategic guidance you need.

Ready to invest in India? Contact us today to explore customized investment strategies and capitalize on the best opportunities India has to offer.

0 notes

Text

Best Architects in Coimbatore

The Power of Architecture Transforming Spaces and Lives

Architecture is far further than the bare act of constructing structures; it's an intricate mix of art, wisdom, and invention. courteously designed spaces impact how we live, work, and interact with our surroundings.

Why Great Architecture Matters

A well- designed space does more than just give sanctum — it creates a terrain that fosters well- being, productivity, and creativity. The impact of armature extends beyond physical structures, impacting feelings, social relations, and indeed profitable factors. Then there are some crucial reasons why armature is further than just erecting design. Architects in Coimbatore focus on innovative and sustainable solutions that blend aesthetics with purpose.

1. Enhanced Quality of Life

Thoughtful armature optimizes space, light, and ventilation to produce surroundings that promote comfort and well- being. A home with ample natural light, smart space application, and ergonomic layouts enhances daily living guests . Likewise, marketable spaces designed with stoner- centric approaches boost productivity and effectiveness.

2. Increased Property Value

Distinctive Best Architects in Coimbatore architectural features add a unique appeal to parcels, thereby adding their request value. Homes or structures with innovative designs, effective layouts, and aesthetic appeal attract advanced demand and command better resale prices.

3. Environmental Responsibility

Sustainable armature is no longer an option, it's a necessity. With growing enterprises about climate change and resource reduction, engineers are fastening oneco-friendly accoutrements , energy-effective designs, and green structure ways. Smart armature integrates renewable energy results, water conservation strategies, andeco-conscious construction styles to reduce carbon vestiges.

crucial Features of Modern Architecture

ultramodern armature integrates functionality with cultural vision, pushing the boundaries of design and technology. Some of the most significant rudiments that define contemporary armature include

1. Sustainability and Green Design

Eco-friendly armature emphasizes energy-effective accoutrements , unresistant cooling and heating strategies, and renewable energy sources. Features similar to green roofs, solar panels, and rainwater harvesting systems contribute to environmental conservation while reducing functional costs.

2. Innovative Use of Space

With urbanization on the rise, space optimization has come a critical design element. Engineers produce multi-functional spaces, open bottom plans, and modular structures that acclimatize to changing requirements. Clever storehouse results, hidden chambers, and flexible layouts maximize functionality indeed in compact spaces.

3. Technology Integration

Smart structures equipped with automation, IoT( Internet of effects), and AI- driven systems enhance convenience and effectiveness. From voice- actuated lighting systems to energy-effective climate control, technology is revolutionizing architectural design.

4. Aesthetic Excellence

Architecture Designing Services in Coimbatore Is as important about visual appeal as it's about function. ultramodern designs embrace satiny lines, minimalistic aesthetics, and innovative materials to produce visually striking yet practical structures. Natural rudiments similar to wood, gravestone, and glass are constantly used to produce an elegant, dateless look.

5. Customization and Personalization

Every space should reflect the personality and requirements of its inhabitants. Custom- erected homes, knitter- made office spaces, and substantiated innards ensure that designs resonate with individual cultures and preferences.

6. Focus on Community and Wellness

Architectural designs are decreasingly incorporating rudiments that promote community commerce and well- being. Parks, green spaces, open forecourts, and heartiness- centric domestic communities encourage a sense of belonging and enhance the overall living experience.

Kitchen Interior Design The Heart of Every Home

Among colorful Top Architects in coimbatore architectural and interior design rudiments, the kitchen holds a special place. It's further than just a space for cooking; it is a mecca for socialization, family cling, and culinary creativity. A well- designed Kitchen interior design kitchen seamlessly blends functionality, aesthetics, and technology.

crucial Aspects of ultramodern Kitchen Design

Ergonomic Layouts: Efficient kitchen designs follow the “ work triangle ” principle, ensuring that the sink, cookstove, and refrigerator are strategically placed for maximum convenience.

Smart Storage Solutions: Innovative cabinetry, pull- out shelves, and modular storehouse systems help in keeping the kitchen organized and clutter-free. Famous architects in Coimbatore incorporate smart storage solutions into their designs, ensuring both functionality and aesthetics.

Quality Materials: Durable countertops, high- quality cabinetry, and easy- to- maintain flooring accoutrements enhance both aesthetics and life.

Lighting and Ventilation: Proper lighting, including task lighting and ambient lighting, enhances both functionality and air. Acceptable ventilation, including chimneys and exhaust systems, ensures a fresh and comfortable cooking environment.

Integration of Smart Technology: Modern kitchens incorporate smart appliances, touchless gates, and energy-effective cooking bias to enhance convenience and sustainability.

The Future of Architecture and Design

The future of armature is driven by sustainability, technology, and mortal- centric designs. inventions similar as 3D- published structures, AI- driven design tools, and modular constructions are revolutionizing the assiduity. Engineers and contrivers are continuously exploring new ways to produce spaces that are n't only visually switching but also energy-effective and adaptable to evolving cultures.

As we move towards a more conscious and technologically advanced period, armature will continue to shape the way we live, work, and connect with the world around us. Whether you’re designing a dream home, revamping an office space, or planning a large- scale marketable design, thoughtful Best Architects in Coimbatore Near Me architecture is the key to creating spaces that inspire and endure.

Casting dateless spaces where design meets invention, and dreams find their foundation — this is the substance of great architecture.

Visit Us: https://krivaassociates.com/contact.html

#Architects in Coimbatore#Best Architects in Coimbatore#Best residential architects in Coimbatore#Architecture Designing Services in Coimbatore#Top Architects in coimbatore#Architects in coimbatore for house#Best Residential Architects In Coimbatore#Turnkey interiors in coimbatore#Best turnkey interiors in coimbatore#Best Architecture Firms for Luxury Home Designs#Home architecture interior design#Kitchen interior design#Famous architects in coimbatore#Best Architects in Coimbatore Near Me

1 note

·

View note

Text

Solar Module Transportation: Ensuring Safe Delivery for Renewable Energy Projects

Introduction to Solar Module Transportation

The renewable energy sector is booming, and solar power is at the forefront of this green revolution. As demand for solar modules rises, so does the need for efficient SOLAR MODULE TRANSPORTATION. But transporting these delicate components isn’t as straightforward as it seems. Each module must arrive safely at its destination to harness the sun's energy effectively. With various challenges along the way—from logistics hurdles to environmental factors—ensuring safe delivery becomes essential for project success. Let's dive into what makes SOLAR MODULE TRANSPORTATION a critical aspect of renewable energy projects and explore how businesses can navigate this complex landscape with ease.

Importance of Safe Delivery in Renewables

Safe delivery is crucial in the renewable energy sector, especially for solar projects. Solar modules are delicate and expensive components that require careful handling. When solar panels arrive damaged, it can lead to delays in installation. This not only affects project timelines but also increases costs significantly. A safe transportation process minimizes these risks and ensures that projects stay on track. Moreover, reliable delivery reinforces trust between manufacturers, suppliers, and contractors. Consistent quality assurance fosters strong business relationships vital for long-term success. Sustainable practices begin with responsible logistics. Ensuring safe transport aligns with the core values of the renewable industry—protecting resources while promoting eco-friendly solutions. In a growing market like renewables, effective transportation strategies are fundamental for maximizing efficiency and profitability while contributing positively to environmental goals.

Challenges in Transporting Solar Modules

Transporting solar modules comes with its own set of challenges. The fragility of these components means they require careful handling throughout the shipping process. Road conditions can vary greatly, leading to potential damage during transit. Uneven surfaces and sudden stops pose risks that are hard to mitigate. Weather is another unpredictable factor. Rain, snow, or extreme heat can affect both the modules and the transportation vehicles. Additionally, supply chain disruptions often occur due to rising demand for renewable energy solutions. This makes scheduling deliveries more complex than ever before. Training personnel in proper loading techniques is crucial but frequently overlooked. Without expertise in handling solar equipment, accidents become more likely. These challenges emphasize the need for a comprehensive strategy tailored specifically for solar module transportation.

Best Practices for Secure Shipping

When it comes to solar module transportation, securing the cargo is paramount. Using appropriate shipping methods can significantly reduce potential damage during transit. First, choose a reliable carrier with experience in handling sensitive materials. Their expertise ensures that solar modules are treated with the care they need. Next, consider using dedicated transport vehicles designed for delicate equipment. These trucks often feature air-ride suspensions that minimize vibrations and shocks. Ensure proper loading techniques are employed. Utilize soft straps or padded supports to hold the modules firmly in place without applying excessive pressure on their surfaces. Tracking technology also plays a crucial role. Real-time monitoring allows you to stay updated on your shipment’s location and conditions throughout its journey. Communication with all parties involved helps coordinate efforts and address any issues promptly during transit.

Packaging Solutions for Solar Modules

Effective packaging is crucial for solar module transportation. It safeguards the integrity of delicate components during transit. Custom-designed crates and pallets are popular options. They provide robust protection against impacts and environmental factors. Using materials like plywood or corrugated cardboard ensures durability without excessive weight. Foam inserts play a vital role as well. They cushion fragile parts, preventing movement within the package. This minimizes the risk of damage during handling. Strapping and shrink-wrapping further enhance stability. These techniques keep packages securely closed, even on bumpy roads or in rough weather conditions. Labeling is another essential aspect of packaging solutions. Clear instructions help handlers understand special care requirements, reducing the chances of mishandling. Innovative trends include eco-friendly packaging made from recycled materials, aligning with sustainability goals in renewable energy projects while maintaining effective protective features.

Regulatory Compliance and Safety Standards

Navigating the landscape of solar module transportation requires adherence to various regulatory compliance and safety standards. These regulations are designed to protect both the cargo and those handling it. Each country may have specific guidelines governing the transport of renewable energy equipment. Understanding these nuances is crucial for businesses involved in solar projects. Safety standards often relate to packaging, labeling, and documentation. Proper labeling not only identifies the contents but also signals any hazards associated with them. Compliance ensures that companies avoid legal liabilities while fostering trust among stakeholders. It demonstrates a commitment to quality and responsibility in every shipment. Moreover, staying current with evolving regulations can offer competitive advantages. Companies that proactively align their practices with industry standards set themselves apart in a rapidly growing market.

Innovations in Solar Module Transport

The landscape of solar module transportation is evolving rapidly. Innovative technologies are streamlining the shipping process, making it more efficient and safer. Autonomous vehicles are emerging as a game-changer. These self-driving trucks can optimize routes, reducing transit times and costs. Meanwhile, drones are being explored for last-mile delivery to remote sites. This reduces logistical hurdles and speeds up project timelines. Smart packaging solutions also play a crucial role in enhancing transport safety. Advanced materials offer better protection against environmental factors while minimizing weight. Data analytics now help in tracking shipments in real-time. This visibility ensures that stakeholders remain informed throughout the entire journey. Partnerships between manufacturers and logistics providers are fostering collaborative approaches to streamline operations further. Embracing these innovations not only benefits individual projects but drives the renewable energy sector forward as a whole.

Future of Solar Module Delivery

The future of solar module delivery is on the brink of transformation. Emerging technologies promise to streamline logistics and enhance efficiency. Drones are set to revolutionize how modules reach remote sites. Their ability to navigate difficult terrains could significantly reduce transportation times. Moreover, autonomous vehicles are becoming viable options for ground transport. These innovations can minimize human error and optimize routes based on real-time data. Blockchain technology also stands out as a game-changer in tracking shipments. It offers transparent records that enhance accountability throughout the supply chain. Sustainability will further influence delivery models, encouraging companies to adopt eco-friendly practices in their logistics operations. With advancements like smart packaging and IoT devices, monitoring conditions during transit becomes more feasible than ever before. All these developments hint at a dynamic landscape where efficiency meets sustainability, paving the way for more robust renewable energy projects worldwide.

0 notes

Text

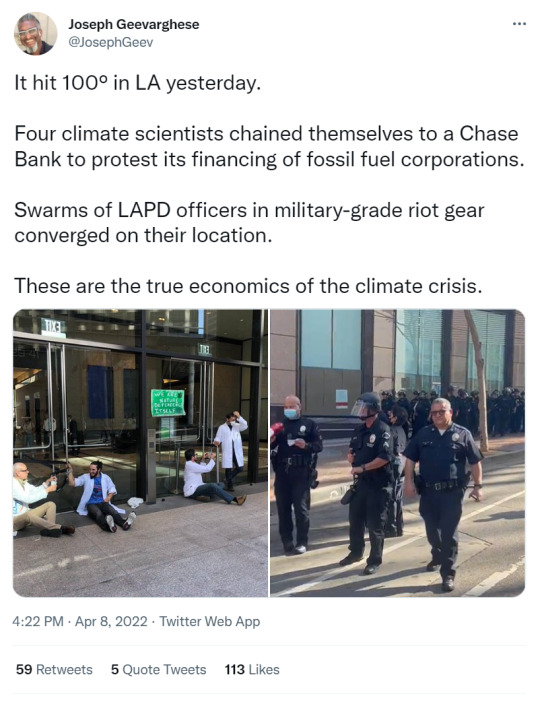

Sometimes, I think the only way things are going to get better - to get the corps. to stop polluting, to actually get cheap and efficient electric / solar cars and decent transit systems and everything else we actually need to keep from destroying everything is to find a way to make clean energy profitable. As in more profitable than the current system. Perhaps even in a way that status-quo is secured and the poor stay poor and the rich stay rich and the profits are maximized and we continue on in Hell - but... not destroyed, at least. I am not defending the current system. I hate late-stage Capitalism as much as any tumblrina, I just feel like nothing’s going to change, I’m losing hope and I think the only way to get the people who would sell each and every one of us out for a penny to STOP is to make it actually more money-and-power-generating for them to save the Earth than to kill it. God knows they aren’t going to turn around without a profit-motive.

"... “I’m taking action because I feel desperate,” said U.S. climate scientist Peter Kalmus, who along with several others locked himself to the front door of a JPMorgan Chase building in Los Angeles. A recent report found that the financial giant is the biggest private funder of oil and gas initiatives in the world.

“It’s the 11th hour in terms of Earth breakdown, and I feel terrified for my kids, and terrified for humanity,” Kalmus continued. “World leaders are still expanding the fossil fuel industry as fast as they can, but this is insane. The science clearly indicates that everything we hold dear is at risk, including even civilization itself and the wonderful, beautiful, cosmically precious life on this planet. I actually don’t get how any scientist who understands this could possibly stay on the sidelines at this point.” ..."

107K notes

·

View notes

Text

Powering a Sustainable Future: The Role of Battery Recycling in EV Growth

As the world transitions towards electrified mobility, lithium-ion batteries (LIBs) are at the heart of this transformation. From electric vehicles (EVs) to energy storage solutions, the demand for LIBs is skyrocketing. Analysts predict that by 2030, over 2 million metric tonnes of used batteries will retire annually, highlighting the urgent need for sustainable recycling and reuse solutions.

LOHUM is leading the way in maximizing the lifecycle of lithium-ion batteries by pioneering innovative second-life applications and sustainable recycling processes. By focusing on resource efficiency, we are ensuring that every battery can have an extended and profitable journey beyond its first use.

The Future of Lithium-Ion Battery Recycling

The growing adoption of EVs is generating an unprecedented demand for critical minerals such as lithium, cobalt, and nickel. However, mining these materials has significant environmental and ethical concerns. With over 60% of the world’s cobalt supply coming from the Democratic Republic of Congo—where mining practices have been linked to human rights violations—battery recycling emerges as the key to a more responsible and self-sufficient supply chain.

Currently, large-scale recycling facilities primarily use pyrometallurgical processes (smelting) to recover valuable metals, but these are energy-intensive and have lower recovery rates. More sustainable hydrometallurgical and direct recycling methods are gaining traction, with the potential to recover nearly 95% of battery materials while significantly reducing environmental impact.

Lithium-Ion Battery Second-Life Applications: A Game-Changer

One of the most promising opportunities in the Lithium-Ion Battery second-life applications. When an EV battery reaches 80% of its original capacity, it is no longer viable for vehicles but still holds immense potential for stationary storage applications. Second-life batteries can extend their useful life by another 6 to 10 years, making them ideal for:

Renewable energy storage for solar and wind power

Backup power for commercial and residential buildings

Grid stabilization and peak demand management

By tapping into these second-life applications, LOHUM is redefining the way batteries are utilized, reducing the demand for virgin materials, and ensuring a lower carbon footprint across the entire battery lifecycle.

The Economics of Lithium-Ion Battery Resale Value

The resale value of lithium-ion batteries is a crucial factor in shaping the EV and energy storage market. As battery technology advances and new production methods lower costs, second-life and recycled batteries are becoming increasingly viable alternatives.

Research indicates that direct recycling can create cathode materials that outperform newly manufactured ones, allowing for faster charging and longer lifespans. The key challenge lies in integrating efficient logistics, automated disassembly, and advanced material recovery processes. With LOHUM’s cutting-edge recycling technology, we are turning used batteries into high-value resources, optimizing lithium-ion battery resale value, and contributing to a circular economy.

Closing the Loop: Policy & Industry Collaboration

Governments and industry leaders are now prioritizing policies to ensure 100% recycling or reuse of EV batteries. California is setting ambitious targets for battery recycling, and similar initiatives are gaining momentum worldwide. Labeling standards, extended producer responsibility (EPR), and incentives for responsible sourcing will be critical to scaling the recycling ecosystem.

LOHUM is committed to driving innovation in lithium-ion battery recycling and second-life applications. By investing in advanced recovery technologies and collaborating with stakeholders across the value chain, we are building a future where batteries power sustainability, not just mobility.

Join us in our mission to create a truly circular battery economy. The future is electric, and with LOHUM, it’s also sustainable.

Visit us at: Reverse logistics for lithium-ion batteries

Originally published on: Medium

0 notes

Text

Industrial solar installer Brisbane

Industrial Solar Installers in Brisbane: Powering Businesses with Renewable Energy

Brisbane, a city known for its abundant sunshine, presents a golden opportunity for industries to harness solar power. Industrial solar installation is rapidly gaining traction as businesses seek to reduce energy costs, lower carbon footprints, and achieve sustainability goals.

Why Industrial Solar?

Industries consume vast amounts of electricity to run operations, making power costs a significant expense. With rising electricity prices and growing environmental concerns, switching to solar energy is a smart investment. Solar power allows businesses to:

Reduce Operating Costs: Solar energy lowers electricity bills, freeing up capital for other business investments.

Achieve Energy Independence: Protect against fluctuating energy prices and potential power outages.

Enhance Sustainability: Meet corporate social responsibility goals and improve brand reputation.

Take Advantage of Incentives: Government rebates, grants, and incentives make solar installations more affordable.

Choosing the Right Industrial Solar Installer in Brisbane

Selecting a reliable solar installer is crucial to maximizing the benefits of solar energy. Here are key factors to consider:

1. Experience and Expertise

Look for a company with a proven track record in industrial solar installations. Experienced installers understand the complexities of large-scale systems and can design solutions tailored to your business needs.

2. Quality of Solar Components

Ensure that the installer provides high-quality solar panels, inverters, and mounting systems from reputable manufacturers. Premium components ensure long-term efficiency and durability.

3. Custom Solutions

Each industry has unique energy requirements. A top-tier installer will conduct an in-depth energy audit and design a system that maximizes energy production while considering site-specific factors.

4. Accreditations and Certifications

Verify that the installer is accredited by the Clean Energy Council (CEC) and follows industry best practices. Proper licensing and certifications ensure compliance with Australian standards.

5. After-Sales Support and Maintenance

A good solar installer will offer ongoing support, including system monitoring, maintenance, and performance optimization to ensure maximum return on investment.

Industrial Solar Trends in Brisbane

The industrial solar sector in Brisbane is witnessing several trends, including:

Battery Storage Integration: Many businesses are pairing solar with battery storage to ensure energy availability even during peak demand periods.

Microgrids and Smart Energy Management: Advanced technology is enabling industries to optimize energy usage and reduce grid dependence.

Power Purchase Agreements (PPAs): Businesses are leveraging PPAs to access solar power without upfront capital investment.

Conclusion

Investing in industrial solar in Brisbane is a strategic move for businesses aiming to cut costs and embrace sustainability. By partnering with an experienced and accredited solar installer, industries can harness the power of the sun to drive efficiency, profitability, and environmental responsibility. With government incentives and rapidly advancing technology, there has never been a better time to go solar.

0 notes

Text

How to Lower The Electricity Bill with Solar Panels

The following article provides brief information to reduce the electricity bills by installing solar panels.

With the increasing price of power, many owners are looking for ways to cut down on their usefulness bills. One of the most effective and maintainable solutions is installing solar panels. By connecting the power of the sun, you can produce your own electricity, lessening dependence on the grid, and significantly lower your regular expenses.

How Solar Panels Reduce Electricity Bills

1. Generating Your Own Power

Northern Virginia solar panel roof adapt sunlight into electricity, which can be used to power your home. Instead of trusting solely on energy from the grid, you produce your own power, reducing the amount of electricity you buying from your utility provider. This leads to important savings over time and helps create a more workable energy consumption model.

2. Net Metering Profits

Many utility companies deliver net metering, a program that lets owners to sell extra energy produced by their solar panels back to the network. It can lead to credits on your energy bill, further reducing your expenditures. Net metering policies vary by place, so it is essential to check with your local usefulness provider to understand how much credit you can take for excess energy production.

3. Lowering Peak-Time Consumption

Electricity rates are often advanced during peak hours when demand is high. With solar energy, you can use kept energy from battery systems or produce power during these high-cost periods, minimalizing the amount of select electricity you need from the grid. Dipping peak-time consumption also helps lessen the strain on the electrical grid, making the energy delivery system more efficient.

Factors That Influence Savings

1. Location and Sunlight Exposure

The amount of sunlight your area receives directly affects how much energy your solar panels can generate. Homes in sunnier locations typically see greater savings. Even in areas with less direct sunlight, solar panels can still generate sufficient power through advanced photovoltaic technology and optimal panel placement.

2. System Size and Efficiency

The size and efficiency of your solar panel system determine how much of your electricity needs it can cover. Arlington VA solar panel installation system with high-efficiency panels will provide more energy, leading to higher savings. Additionally, advancements in solar panel technology continue to improve efficiency rates, making solar energy more accessible and effective for a wide range of households.

3. Energy Consumption Patterns

Households that consume more electricity during daylight hours benefit the most from solar energy, as they use more of the power generated in real time. By adjusting daily routines to align energy-intensive activities with peak solar production hours, homeowners can further optimize their energy savings.

4. State Incentives and Rebates

Government incentives, tax credits, and rebates can significantly lower the initial cost of installing solar panels. Researching available programs in your area can maximize your savings. Many federal and state programs encourage solar adoption by offering financial assistance, making solar panel installation more affordable and accessible.

5. Battery Storage Systems

Investing in a solar battery storage system allows you to store excess energy for use at night or during cloudy days, further reducing your dependence on the grid. Battery storage solutions also provide backup power during outages, ensuring that you have a reliable energy source even in emergencies.

Tips for Maximizing Savings

1. Optimize Panel Placement

Ensure that your solar panels are installed in a location with maximum sun exposure, free from shade or obstructions. Proper positioning and tilt adjustments based on your geographical location can significantly enhance energy production.

2. Use Energy-Efficient Appliances

Pairing solar panels with energy-efficient appliances and LED lighting can enhance your savings by reducing overall electricity consumption. Smart appliances that can be programmed to run during peak solar production hours can further improve efficiency.

3. Monitor Your Energy Usage

Using a smart energy management system helps track your electricity consumption and solar energy production, allowing you to adjust usage for optimal savings. Many modern monitoring systems provide real-time insights, helping homeowners make data-driven decisions to maximize energy efficiency.

4. Schedule High-Consumption Activities During the Day

Running appliances like washing machines, dishwashers, and air conditioners during daylight hours allows you to use solar-generated electricity directly, minimizing grid usage. Additionally, pre-cooling or pre-heating your home using solar power can further reduce energy costs.

5. Regular Maintenance and Cleaning

Keeping your solar panels clean and well-maintained ensures maximum efficiency and energy production. Dust, dirt, and debris can reduce the effectiveness of solar panels, so routine inspections and occasional professional servicing can help maintain optimal performance.

6. Consider Upgrading Your Home's Insulation

Proper insulation reduces the need for heating and cooling, further maximizing the benefits of solar energy. Sealing gaps, using energy-efficient windows, and installing proper insulation in walls and attics can significantly lower overall electricity consumption.

If you're considering solar panel system installer Richmond VA, consult a professional installer to determine the best system for your needs and start enjoying lower electricity bills today. Making the switch to solar not only saves money but also promotes sustainability, helping create a cleaner and more energy-efficient future for all.

#Northern Virginia solar panel roof#solar panel system installer Richmond VA#Arlington VA solar panel installation

0 notes

Text

Empower Your Business with Solar in South Australia

Looking to reduce energy costs and boost sustainability? Business Solar South Australia offers cutting-edge solar solutions tailored for enterprises. At P4B Solar, we specialize in high-efficiency solar panel installations, helping businesses lower carbon footprints while maximizing savings. With government incentives and advanced technology, transitioning to solar has never been easier. Our expert team ensures seamless integration, providing reliable, cost-effective energy solutions. Future-proof your business with renewable energy and enjoy long-term financial and environmental benefits. Invest in Business Solar South Australia today for a greener, more profitable tomorrow. Visit our website to get started!

0 notes

Text

Reducing Fuel Costs and Emissions with a Solar Diesel Hybrid Generator

As the demand for sustainable and cost-effective energy solutions increases, businesses and industries are turning toward hybrid power systems to optimize energy efficiency. A solar diesel generator combines renewable solar energy with conventional diesel power to create a balanced and efficient energy solution. By integrating an advantages of solar tracking system, these hybrid generators can significantly increase energy capture and efficiency. Furthermore, effective solar asset management ensures the longevity and profitability of the system, making it a viable investment for various applications.

Understanding Solar Diesel Hybrid Generators

A solar diesel generator is an innovative power system that merges photovoltaic (PV) solar panels with traditional diesel generators. This hybrid setup ensures energy availability even during periods of low solar generation while reducing reliance on fossil fuels. By leveraging solar asset management, users can optimize the system’s performance, monitor energy production, and minimize operational costs.

Key Components

Solar Panels – Convert sunlight into electricity.

Diesel Generator – Provides backup power when solar energy is insufficient.

Energy Storage (Optional) – Batteries store excess solar power for later use.

Hybrid Controller – Manages the seamless transition between solar and diesel power.

Solar Tracking System – Enhances solar panel efficiency by adjusting panel angles for maximum sunlight exposure.

Monitoring and Management Software – Facilitates solar asset management by tracking system performance in real time.

Advantages of Solar Diesel Hybrid Generators

1. Reduced Fuel Costs

One of the most significant benefits of a solar diesel generator is the reduction in fuel consumption. By harnessing solar energy, businesses can decrease their dependence on diesel, leading to lower fuel expenses. With an advantages of solar tracking system, energy yield increases, reducing the need for diesel generator operation.

2. Lower Carbon Emissions

Integrating solar power into a diesel-based system significantly decreases greenhouse gas emissions. As solar energy is clean and renewable, it helps offset the carbon footprint associated with burning fossil fuels.

3. Improved Energy Efficiency

The inclusion of an advantages of solar tracking system enhances energy capture, ensuring that solar panels operate at peak efficiency. This maximized energy production reduces the need for diesel-generated electricity, further lowering costs and emissions.

4. Enhanced Reliability and Energy Security

With a hybrid setup, energy security improves as the system has dual power sources. If solar energy is insufficient, the diesel generator provides backup, ensuring uninterrupted power supply.

5. Optimized Performance Through Solar Asset Management

Proper solar asset management enables system operators to monitor performance, schedule maintenance, and detect issues early, ensuring long-term efficiency and cost savings.

Role of Solar Tracking Systems in Hybrid Generators

An advantages of solar tracking system plays a crucial role in increasing energy output. Unlike fixed solar panels, tracking systems adjust panel angles throughout the day to follow the sun’s movement, capturing more sunlight and enhancing energy production. This results in higher efficiency and greater savings on fuel costs.

Types of Solar Tracking Systems

Single-Axis Tracking – Moves panels along one axis (horizontal or vertical) to follow the sun.

Dual-Axis Tracking – Adjusts panels in two directions, further maximizing energy absorption.

Importance of Solar Asset Management

Effective solar asset management is critical for ensuring the long-term performance and profitability of a solar diesel generator system. With real-time data monitoring, predictive maintenance, and energy analytics, asset management platforms provide insights that help optimize operations and reduce downtime.

Benefits of Solar Asset Management

Proactive Maintenance – Prevents system failures and extends equipment lifespan.

Performance Optimization – Identifies inefficiencies and ensures optimal energy production.

Cost Savings – Reduces operational expenses by optimizing energy generation and usage.

Remote Monitoring – Enables users to track performance from any location.

Applications of Solar Diesel Hybrid Generators

A solar diesel generator is suitable for various industries and applications, including:

Remote Off-Grid Locations – Providing reliable power in areas with limited grid access.

Telecommunications Towers – Ensuring uninterrupted power supply for communication networks.

Mining Operations – Reducing fuel costs in energy-intensive industries.

Agriculture and Irrigation – Powering pumps and equipment efficiently.

Commercial and Industrial Use – Lowering energy costs for businesses.

Challenges and Solutions

While a solar diesel generator offers many benefits, it also comes with challenges. However, these can be addressed through advanced technologies and proper system design.

1. Initial Investment Costs

The upfront cost of installing a hybrid system may be high. However, long-term savings on fuel and maintenance offset the initial investment. Government incentives and financing options can also help reduce the financial burden.

2. Maintenance Requirements

Both solar panels and diesel generators require maintenance. However, with solar asset management, predictive maintenance strategies can minimize downtime and repair costs.

3. Weather Dependence

Solar power generation varies with weather conditions. The diesel generator acts as a backup, ensuring consistent energy availability.

Future Trends in Solar Diesel Hybrid Systems

The future of solar diesel generator systems looks promising, with advancements in technology driving efficiency and cost reductions. Emerging trends include:

Artificial Intelligence in Solar Asset Management – AI-driven analytics improve energy forecasting and system optimization.

Enhanced Battery Storage Solutions – More efficient batteries extend energy storage capacity.

Smart Grid Integration – Connecting hybrid systems to smart grids for optimized energy distribution.

Conclusion

A solar diesel generator presents a practical solution for reducing fuel costs and emissions while ensuring reliable power supply. The integration of an advantages of solar tracking system boosts efficiency, while solar asset management enhances performance and cost-effectiveness. As technology advances, these hybrid systems will continue to play a crucial role in the transition to sustainable energy solutions.

0 notes

Text

Why Solar1000.com is Your Best Choice for Photovoltaic Systems in Romania

Thinking about switching to solar energy but unsure where to start? With so many options available, finding the right provider can feel overwhelming. That’s where Solar1000.com comes in—a trusted name in Romania’s panouri fotovoltaice (photovoltaic panels) industry. Whether you’re looking to reduce electricity bills, increase energy independence, or go green, Solar1000.com has the solutions you need.

This guide will walk you through why Solar1000.com is the best choice for your solar needs, covering everything from quality and affordability to installation and customer service.

Who is Solar1000.com?

Solar1000.com is one of Romania’s leading providers of photovoltaic systems, offering top-tier solar panels, expert installation, and affordable financing options. Their mission is simple: make solar energy accessible and affordable for everyone—whether you’re a homeowner, a business, or an industrial facility.

Why Choose Solar1000.com?

With so many solar providers in Romania, why should you pick Solar1000.com? Here’s what sets them apart:

High-efficiency solar panels that maximize energy production

Competitive pricing with transparent quotes

Certified installation teams ensuring top-notch service

Flexible financing options for all budgets

Exceptional customer service and ongoing support

High-Quality Panouri Fotovoltaice

Not all panouri fotovoltaice are the same. The quality of your solar panels directly impacts energy efficiency, durability, and savings. Solar1000.com only works with top-tier manufacturers, ensuring high-performance panels with long lifespans and excellent warranties.

Affordable Pricing with No Hidden Costs

Many people hesitate to switch to solar due to high upfront costs, but Solar1000.com makes it affordable. Their pricing is:

Transparent – No surprise fees or hidden charges.

Competitive – They offer some of the best prices in Romania.

Flexible – Various financing options make solar systems accessible for all budgets.

Expert Installation Services

Even the best solar panels won’t perform well without professional installation. Solar1000.com provides:

Certified solar installers with years of experience.

Custom-designed systems based on your home or business’s energy needs.

Fast and efficient installation, usually completed within 1-3 days.

Government Incentives & Financing Options

Romania offers several government incentives for solar panel installations. Solar1000.com helps customers navigate rebates, grants, and financing options, including:

Casa Verde (Green House) Program – Covers up to 90% of costs for residential solar systems.

Net Metering – Sell excess energy back to the grid for credits.

Flexible Loans – Partner banks offer low-interest solar loans.

Residential Solar Solutions

For homeowners, switching to panouri fotovoltaice with Solar1000.com means:

Lower electricity bills – Generate your own power and reduce dependence on the grid.

Increased property value – Solar homes sell faster and at higher prices.

Energy independence – No more worrying about rising electricity costs.

Commercial & Industrial Solar Solutions

Businesses and industries can also benefit from Solar1000.com’s tailored solar solutions, which offer:

Reduced operational costs – Cut down electricity expenses and improve profitability.

Sustainability leadership – Show customers you care about the environment.

Reliable energy supply – Protect your business from power outages.

Long-Term Savings and ROI

Solar isn’t just an investment—it’s a long-term financial win. With a solar system from Solar1000.com, you can:

Save 50-70% on energy bills.

Recover investment in 5-7 years.

Enjoy free electricity for 25+ years.

Customer Reviews & Satisfaction

Wondering if Solar1000.com delivers on its promises? Just ask their satisfied customers! Homeowners and businesses across Romania praise their:

Professional and friendly service.

Honest pricing with no surprises.

Reliable and efficient solar panels.

Warranty & After-Sales Support

Buying solar panels is a big decision, and Solar1000.com backs its products with:

Long-term warranties (10-25 years) for peace of mind.

Ongoing technical support to keep your system running smoothly.

Quick response times for troubleshooting and maintenance.

Innovative Solar Technology & Smart Monitoring

Solar1000.com stays ahead of the curve with cutting-edge technology, including:

High-efficiency solar cells that generate more power.

Smart inverters that maximize energy conversion.

Remote monitoring apps so you can track energy production in real-time.

Sustainable & Eco-Friendly Solutions

By choosing Solar1000.com, you’re not just saving money—you’re also helping the planet. Their solar solutions:

Reduce carbon emissions and reliance on fossil fuels.

Support Romania’s transition to renewable energy.

Create a cleaner, greener future for generations to come.

Step-by-Step Process to Get Started

1. Free Consultation & Site Assessment

A solar expert visits your home or business to assess energy needs and available space.

2. Custom Solar System Design

A tailored system is created based on your electricity usage and budget.

3. Transparent Quote & Financing Options

Receive a clear pricing breakdown and explore financing options.

4. Professional Installation

Certified installers complete the setup quickly and efficiently.

5. System Activation & Monitoring

Once connected, you start generating clean, cost-effective solar energy!

Final Thoughts: Is Solar1000.com Right for You?

If you’re looking for high-quality, affordable panouri fotovoltaice in Romania, Solar1000.com is your best bet. With reliable solar panels, expert installation, and excellent customer support, they make going solar easy and stress-free.

0 notes