#fuel tax credits

Explore tagged Tumblr posts

Text

Leveraging Fuel Tax Credits To Reduce Operating Costs

Fuel is one of the most significant expenses in the trucking industry. Owner-operators and small trucking businesses can alleviate some of this financial burden by leveraging fuel tax credits. These credits not only reduce taxable income but also help lower operating costs, enhancing profitability. Here’s how you can take advantage of these credits effectively.

Understanding Fuel Tax Credits

Fuel tax credits are incentives provided by federal and state governments to offset fuel taxes paid during specific operations. For the trucking industry, this often applies to off-road or tax-exempt uses, such as operating refrigeration units or auxiliary equipment. Identifying where and how fuel was used is the first step to claiming these credits.

Track and Document Fuel Usage

Accurate record-keeping is essential when claiming fuel tax credits. Keep detailed logs of mileage, fuel purchases, and equipment usage. Many truckers use electronic logging devices (ELDs) or fuel-tracking software to simplify this process. By tracking your fuel usage meticulously, you’ll ensure compliance and maximize the credits you’re entitled to.

Understand State and Federal Regulations

Each state has different rules and rates for fuel tax credits. Researching or consulting with experts on these variations is crucial. For example, while federal credits may cover certain off-road uses, state-level programs might include additional exemptions. Experts offering trucking small business advisory services can help navigate these complexities, ensuring you claim all available credits without errors.

Identify Eligible Fuel Usage Categories

Fuel tax credits are typically available for:

Off-Road Equipment Use – Fuel used in auxiliary power units (APUs), refrigeration units, or other non-transportation equipment.

Non-Taxable Routes – Operating in areas exempt from certain fuel taxes, such as on private roads or agricultural sites.

Exported Fuel – Fuel purchased in one state but consumed in another may qualify for reimbursement or credit under specific programs.

By identifying eligible categories, you can optimize your claims and reduce your tax liability significantly.

Automate Fuel Tax Calculations

Manual calculations can lead to errors and missed opportunities. Many trucking software solutions integrate fuel tax management features, automatically calculating credits based on your operations. These tools simplify the process and ensure accuracy, allowing you to focus on your business.

Work with Experts

Navigating the rules surrounding fuel tax credits can be challenging, especially for small trucking businesses. Partnering with professionals who specialize in trucking taxation ensures you’re not leaving money on the table. A trucking small business advisory team can analyze your operations, identify credit opportunities, and help file accurate claims.

Plan Strategically for Savings

Fuel tax credits can do more than reduce your tax liability—they can improve your overall cash flow. By incorporating these credits into your financial strategy, you can allocate savings toward other operating costs, such as maintenance or equipment upgrades, further reducing long-term expenses.

Conclusion

Leveraging fuel tax credits is a smart way for truckers to reduce operating costs and improve profitability. With careful tracking, strategic planning, and the right professional guidance, you can maximize these benefits. By working with a trucking small business advisory service, you ensure compliance and unlock potential savings that can make a significant difference in your bottom line.

0 notes

Text

Starmer faces union pressure over the winter fuel payment decrease

Starmer faces union pressure over the winter fuel payment decrease #governmentcuts #industrialaction #KeirStarmer

#government cuts#industrial action#Keir Starmer#Labour MPs#Paul Nowak#PCS#pension credit#pensioners#Unite#wealth tax#winter fuel subsidies

0 notes

Text

How to Upgrade Your Truck Without Breaking the Bank: A Guide for the Individual Trucker

The new EPA regulations are probably the last thing you want to hear about right now. It feels like every time we turn around, there’s another rule or restriction. And honestly, it’s frustrating! But before you throw your hands up in anger, let’s talk about how these changes could actually work in your favor and, more importantly, what options are out there to help you upgrade your trucks without…

View On WordPress

#alternative fuel trucks#business#DERA grants#diesel emissions#electric truck incentives#emission reduction grants#EPA compliance#EPA regulations#federal tax credits#Freight#freight industry#Freight Revenue Consultants#green freight programs#logistics#low-interest truck loans#small carriers#small fleet loans#small trucking business#Transportation#truck financing#Truck Fuel Efficiency#truck maintenance savings#truck manufacturer rebates#truck rebates#truck replacement programs#truck retrofitting#truck scrappage programs#truck upgrade costs#truck upgrades#trucker incentives

0 notes

Text

The global Carbon Offset/Carbon Credit Market is expected to grow from an estimated USD 414.8 billion in 2023 to USD 1,602.7 billion by 2028, at a CAGR of 31.0% during the forecast period.

The carbon offset/carbon credit market growth has been attributed to rising global warming and the need to remove carbon from the atmosphere. Increasing investments in carbon capture technologies and solutions along with the rise in projects that are helping communities and creating social impact, is expected to drive the carbon offset/carbon credit market.

#carbon credit#carbon capture#carbon credits#carbon footprint#carbon emissions#carbon dioxide#carbon#energy#energia#power generation#utilities#renewable power#renewableenergy#carbon offset#carbon removal#carbon reduction#carbon tax#hydrogen future#hydrogen technologies#hydrogene#hydrogen fuel cells#hydrogen#reduce carbon emission#sustainable development#sustainable energy#sustainable#sustainability#enviromental#Carbon free#Carbon capture

0 notes

Text

The Green Revolution: Eco-Friendly Cars and Their Benefits

Eco-friendly cars have emerged not just as a trend but as a necessity to combat environmental challenges and reduce our carbon footprint.

In the 21st century, the automotive industry has seen a significant shift towards sustainability, marking the advent of the green revolution. Eco-friendly cars have emerged not just as a trend but as a necessity to combat environmental challenges and reduce our carbon footprint. This comprehensive guide delves into the world of eco-friendly cars, highlighting their benefits, innovations, and the…

View On WordPress

#Advanced Aerodynamics#Affordable Electric Cars#Air Pollution Reduction#Automotive Innovation#autonomous driving#battery technology#Carbon Footprint Reduction#charging infrastructure#Chevrolet Bolt EV#Clean Energy#Clean Transportation Solutions#Eco-Conscious Consumers#Eco-Friendly Cars#Economic Benefits#electric vehicles#Environmental Impact#environmental stewardship#EV Tax Credits#Fuel Cell Electric Vehicles#Future Mobility Trends#Government Incentives#Green Automotive Technology#Green Revolution#Hybrid Electric Vehicles#Hydrogen Fueling#Hydrogen-Powered Vehicles#Hyundai Nexo#Instant Torque#Long-Term Savings#Luxury Electric Vehicles

0 notes

Text

Aussie Mining Masters the Maze: How GPS Innovation Navigates Complex Operations

Lost in the Australian outback? Not anymore. Navigating the intricate web of tunnels, open pits, and sprawling landscapes of Aussie mines used to be a constant challenge. But GPS innovation has transformed the game, turning miners into masters of the maze.

Beyond pinpointing locations, GPS is revolutionizing mining in multiple ways:

Precision Mapping: Imagine detailed, real-time maps of your entire mine, revealing hidden resources, optimizing exploration, and avoiding hazards. GPS mapping makes it a reality.

Fleet Management: Forget paper tracking and dusty logbooks. Track every truck, excavator, and dozer in real-time. Optimize routes, boost efficiency, and fuel savings soar.

Safety First: Locate personnel instantly in emergencies. Enforce geofences to prevent accidents. GPS keeps your people safe and operations secure.

Digging Deeper: Advanced GPS mapping techniques pinpoint valuable ore deposits without the need for costly, blind drilling. Extract smarter, not harder.

But the benefits go beyond efficiency and safety:

Fuel Tax Credits: Claim every drop! Utilize built-in fuel tax credit calculators within your GPS system to ensure you receive the rebates you deserve.

Tyre Pressure Prowess: Optimize tyre pressure across your fleet with real-time monitoring systems. Fuel consumption plummets, and tyre life skyrockets.

Peace of Mind: Leave the guesswork behind. Know where everything is, how it's performing, and who's doing what, all in real-time.

GPS innovation isn't just a tool, it's a transformation. It's about turning complex operations into streamlined success stories. So, Aussie miners, master the maze with GPS, and watch your productivity soar, costs plummet, and safety reign supreme.

Ready to navigate the future of mining? Explore how Orbitus's cutting-edge GPS solutions can take your operations to the next level.

#mining fleet tracking#gps mining#mining vehicle tracking system#mining vehicle tracking and devices#GPS Tracking Devices#Mining Operations#fuel tax credit calculator#tyre pressure monitoring system

0 notes

Text

Retiring the US debt would retire the US dollar

THIS WEDNESDAY (October 23) at 7PM, I'll be in DECATUR, GEORGIA, presenting my novel THE BEZZLE at EAGLE EYE BOOKS.

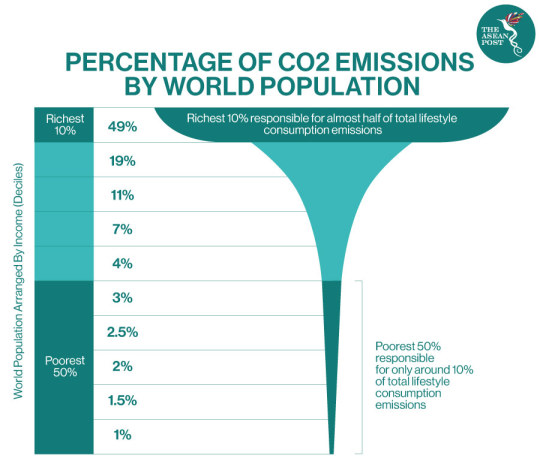

One of the most consequential series of investigative journalism of this decade was the Propublica series that Jesse Eisinger helmed, in which Eisinger and colleagues analyzed a trove of leaked IRS tax returns for the richest people in America:

https://www.propublica.org/series/the-secret-irs-files

The Secret IRS Files revealed the fact that many of America's oligarchs pay no tax at all. Some of them even get subsidies intended for poor families, like Jeff Bezos, whose tax affairs are so scammy that he was able to claim to be among the working poor and receive a federal Child Tax Credit, a $4,000 gift from the American public to one of the richest men who ever lived:

https://www.propublica.org/article/the-secret-irs-files-trove-of-never-before-seen-records-reveal-how-the-wealthiest-avoid-income-tax

As important as the numbers revealed by the Secret IRS Files were, I found the explanations even more interesting. The 99.9999% of us who never make contact with the secretive elite wealth management and tax cheating industry know, in the abstract, that there's something scammy going on in those esoteric cults of wealth accumulation, but we're pretty vague on the details. When I pondered the "tax loopholes" that the rich were exploiting, I pictured, you know, long lists of equations salted with Greek symbols, completely beyond my ken.

But when Propublica's series laid these secret tactics out, I learned that they were incredibly stupid ruses, tricks so thin that the only way they could possibly fool the IRS is if the IRS just didn't give a shit (and they truly didn't – after decades of cuts and attacks, the IRS was far more likely to audit a family earning less than $30k/year than a billionaire).

This has become a somewhat familiar experience. If you read the Panama Papers, the Paradise Papers, Luxleaks, Swissleaks, or any of the other spectacular leaks from the oligarch-industrial complex, you'll have seen the same thing: the rich employ the most tissue-thin ruses, and the tax authorities gobble them up. It's like the tax collectors don't want to fight with these ultrawealthy monsters whose net worth is larger than most nations, and merely require some excuse to allow them to cheat, anything they can scribble in the box explaining why they are worth billions and paying little, or nothing, or even entitled to free public money from programs intended to lift hungry children out of poverty.

It was this experience that fueled my interest in forensic accounting, which led to my bestselling techno-crime-thriller series starring the two-fisted, scambusting forensic accountant Martin Hench, who made his debut in 2022's Red Team Blues:

https://us.macmillan.com/books/9781250865847/red-team-blues

The double outrage of finding out how badly the powerful are ripping off the rest of us, and how stupid and transparent their accounting tricks are, is at the center of Chokepoint Capitalism, the book about how tech and entertainment companies steal from creative workers (and how to stop them) that Rebecca Giblin and I co-authored, which also came out in 2022:

https://chokepointcapitalism.com/

Now that I've written four novels and a nonfiction book about finance scams, I think I can safely call myself a oligarch ripoff hobbyist. I find this stuff endlessly fascinating, enraging, and, most importantly, energizing. So naturally, when PJ Vogt devoted two episodes of his excellent Search Engine podcast to the subject last week, I gobbled them up:

https://www.searchengine.show/listen/search-engine-1/why-is-it-so-hard-to-tax-billionaires-part-1

I love the way Vogt unpacks complex subjects. Maybe you've had the experience of following a commentator and admiring their knowledge of subjects you're unfamiliar with, only have them cover something you're an expert in and find them making a bunch of errors (this is basically the experience of using an LLM, which can give you authoritative seeming answers when the subject is one you're unfamiliar with, but which reveals itself to be a Bullshit Machine as soon as you ask it about something whose lore you know backwards and forwards).

Well, Vogt has covered many subjects that I am an expert in, and I had the opposite experience, finding that even when he covers my own specialist topics, I still learn something. I don't always agree with him, but always find those disagreements productive in that they make me clarify my own interests. (Full disclosure: I was one of Vogt's experts on his previous podcast, Reply All, talking about the inkjet printerization of everything:)

https://gimletmedia.com/shows/reply-all/brho54

Vogt's series on taxing billionaires was no exception. His interview subjects (including Eisinger) were very good, and he got into a lot of great detail on the leaker himself, Charles Littlejohn, who plead guilty and was sentenced to five years:

https://jacobin.com/2023/10/charles-littlejohn-irs-whistleblower-pro-publica-tax-evasion-prosecution

Vogt also delved into the history of the federal income tax, how it was sold to the American public, and a rather hilarious story of Republican Congressional gamesmanship that backfired spectacularly. I'd never encountered this stuff before and boy was it interesting.

But then Vogt got into the nature of taxation, and its relationship to the federal debt, another subject I've written about extensively, and that's where one of those productive disagreements emerged. Yesterday, I set out to write him a brief note unpacking this objection and ended up writing a giant essay (sorry, PJ!), and this morning I found myself still thinking about it. So I thought, why not clean up the email a little and publish it here?

As much as I enjoyed these episodes, I took serious exception to one – fairly important! – aspect of your analysis: the relationship of taxes to the national debt.

There's two ways of approaching this question, which I think of as akin to classical vs quantum physics. In the orthodox, classical telling, the government taxes us to pay for programs. This is crudely true at 10,000 feet and as a rule of thumb, it's fine in many cases. But on the ground – at the quantum level, in this analogy – the opposite is actually going on.

There is only one source of US dollars: the US Treasury (you can try and make your own dollars, but they'll put you in prison for a long-ass time if they catch you.).

If dollars can only originate with the US government, then it follows that:

a) The US government doesn't need our taxes to get US dollars (for the same reason Apple doesn't need us to redeem our iTunes cards to get more iTunes gift codes);

b) All the dollars in circulation start with spending by the US government (taxes can't be paid until dollars are first spent by their issuer, the US government); and

c) That spending must happen before anyone has been taxed, because the way dollars enter circulation is through spending.

You've probably heard people say, "Government spending isn't like household spending." That is obviously true: households are currency users while governments are currency issuers.

But the implications of this are very interesting.

First, the total dollars in circulation are:

a) All the dollars the government has ever spent into existence funding programs, transferring to the states, and paying its own employees, minus

b) All the dollars that the government has taxed away from us, and subsequently annihilated.

(Because governments spend money into existence and tax money out of existence.)

The net of dollars the government spends in a given year minus the dollars the government taxes out of existence that year is called "the national deficit." The total of all those national deficits is called "the national debt." All the dollars in circulation today are the result of this national debt. If the US government didn't have a debt, there would be no dollars in circulation.

The only way to eliminate the national debt is to tax every dollar in circulation out of existence. Because the national debt is "all the dollars the government has ever spent," minus "all the dollars the government has ever taxed." In accounting terms, "The US deficit is the public's credit."

When billionaires like Warren Buffet tell Jesse Eisinger that he doesn't pay tax because "he thinks his money is better spent on charitable works rather than contributing to an insignificant reduction of the deficit," he is, at best, technically wrong about why we tax, and at worst, he's telling a self-serving lie. The US government doesn't need to eliminate its debt. Doing so would be catastrophic. "Retiring the US debt" is the same thing as "retiring the US dollar."

So if the USG isn't taxing to retire its debts, why does it tax? Because when the USG – or any other currency issuer – creates a token, that token is, on its face, useless. If I offered to sell you some "Corycoins," you would quite rightly say that Corycoins have no value and thus you don't need any of them.

For a token to be liquid – for it to be redeemable for valuable things, like labor, goods and services – there needs to be something that someone desires that can be purchased with that token. Remember when Disney issued "Disney dollars" that you could only spend at Disney theme parks? They traded more or less at face value, even outside of Disney parks, because everyone knew someone who was planning a Disney vacation and could make use of those Disney tokens.

But if you go down to a local carny and play skeeball and win a fistful of tickets, you'll find it hard to trade those with anyone outside of the skeeball counter, especially once you leave the carny. There's two reasons for this:

1) The things you can get at the skeeball counter are pretty crappy so most people don't desire them; and ' 2) Most people aren't planning on visiting the carny, so there's no way for them to redeem the skeeball tickets even if they want the stuff behind the counter (this is also why it's hard to sell your Iranian rials if you bring them back to the US – there's not much you can buy in Iran, and even someone you wanted to buy something there, it's really hard for US citizens to get to Iran).

But when a sovereign currency issuer – one with the power of the law behind it – demands a tax denominated in its own currency, they create demand for that token. Everyone desires USD because almost everyone in the USA has to pay taxes in USD to the government every year, or they will go to prison. That fact is why there is such a liquid market for USD. Far more people want USD to pay their taxes than will ever want Disney dollars to spend on Dole Whips, and even if you are hoping to buy a Dole Whip in Fantasyland, that desire is far less important to you than your desire not to go to prison for dodging your taxes.

Even if you're not paying taxes, you know someone who is. The underlying liquidity of the USD is inextricably tied to taxation, and that's the first reason we tax. By issuing a token – the USD – and then laying on a tax that can only be paid in that token (you cannot pay federal income tax in anything except USD – not crypto, not euros, not rials – only USD), the US government creates demand for that token.

And because the US government is the only source of dollars, the US government can purchase anything that is within its sovereign territory. Anything denominated in US dollars is available to the US government: the labor of every US-residing person, the land and resources in US territory, and the goods produced within the US borders. The US doesn't need to tax us to buy these things (remember, it makes new money by typing numbers into a spreadsheet at the Federal Reserve). But it does tax us, and if the taxes it levies don't equal the spending it's making, it also sells us T-bills to make up the shortfall.

So the US government kinda acts like classical physics is true, that is, like it is a household and thus a currency user, and not a currency issuer. If it spends more than it taxes, it "borrows" (issues T-bills) to make up the difference. Why does it do this? To fight inflation.

The US government has no monetary constraints, it can make as many dollars as it cares to (by typing numbers into a spreadsheet). But the US government is fiscally constrained, because it can only buy things that are denominated in US dollars (this is why it's such a big deal that global oil is priced in USD – it means the US government can buy oil from anywhere, not only the USA, just by typing numbers into a spreadsheet).

The supply of dollars is infinite, but the supply of labor and goods denominated in US dollars is finite, and, what's more, the people inside the USA expect to use that labor and goods for their own needs. If the US government issues so many dollars that it can outbid every private construction company for the labor of electricians, bricklayers, crane drivers, etc, and puts them all to work building federal buildings, there will be no private construction.

Indeed, every time the US government bids against the private sector for anything – labor, resources, land, finished goods – the price of that thing goes up. That's one way to get inflation (and it's why inflation hawks are so horny for slashing government spending – to get government bidders out of the auction for goods, services and labor).

But while the supply of goods for sale in US dollars is finite, it's not fixed. If the US government takes away some of the private sector's productive capacity in order to build interstates, train skilled professionals, treat sick people so they can go to work (or at least not burden their working-age relations), etc, then the supply of goods and services denominated in USD goes up, and that makes more fiscal space, meaning the government and the private sector can both consume more of those goods and services and still not bid against one another, thus creating no inflationary pressure.

Thus, taxes create liquidity for US dollars, but they do something else that's really important: they reduce the spending power of the private sector. If the US only ever spent money into existence and never taxed it out of existence, that would create incredible inflation, because the supply of dollars would go up and up and up, while the supply of goods and services you could buy with dollars would grow much more slowly, because the US government wouldn't have the looming threat of taxes with which to coerce us into doing the work to build highways, care for the sick, or teach people how to be doctors, engineers, etc.

Taxes coercively reduce the purchasing power of the private sector (they're a stick). T-bills do the same thing, but voluntarily (they the carrot).

A T-bill is a bargain offered by the US government: "Voluntarily park your money instead of spending it. That will create fiscal space for us to buy things without bidding against you, because it removes your money from circulation temporarily. That means we, the US government, can buy more stuff and use it to increase the amount of goods and services you can buy with your money when the bond matures, while keeping the supply of dollars and the supply of dollar-denominated stuff in rough equilibrium."

So a bond isn't a debt – it's more like a savings account. When you move money from your checking to your savings, you reduce its liquidity, meaning the bank can treat it as a reserve without worrying quite so much about you spending it. In exchange, the bank gives you some interest, as a carrot.

I know, I know, this is a big-ass wall of text. Congrats if you made it this far! But here's the upshot. We should tax billionaires, because it will reduce their economic power and thus their political power.

But we absolutely don't need to tax billionaires to have nice things. For example: the US government could hire every single unemployed person without creating inflationary pressure on wages, because inflation only happens when the US government tries to buy something that the private sector is also trying to buy, bidding up the price. To be "unemployed" is to have labor that the private sector isn't trying to buy. They're synonyms. By definition, the feds could put every unemployed person to work (say, training one another to be teachers, construction workers, etc – and then going out and taking care of the sick, addressing the housing crisis, etc etc) without buying any labor that the private sector is also trying to buy.

What's even more true than this is that our taxes are not going to reduce the national debt. That guest you had who said, "Even if we tax billionaires, we will never pay off the national debt,"" was 100% right, because the national debt equals all the money in circulation.

Which is why that guest was also very, very wrong when she said, "We will have to tax normal people too in order to pay off the debt." We don't have to pay off the debt. We shouldn't pay off the debt. We can't pay off the debt. Paying off the debt is another way of saying "eliminating the dollar."

Taxation isn't a way for the government to pay for things. Taxation is a way to create demand for US dollars, to convince people to sell goods and services to the US government, and to constrain private sector spending, which creates fiscal space for the US government to buy goods and services without bidding up their prices.

And in a "classical physics" sense, all of the preceding is kinda a way of saying, "Taxes pay for government spending." As a rough approximation, you can think of taxes like this and generally not get into trouble.

But when you start to make policy – when you contemplate when, whether, and how much to tax billionaires – you leave behind the crude, high-level approximation and descend into the nitty-gritty world of things as they are, and you need to jettison the convenience of the easy-to-grasp approximation.

If you're interested in learning more about this, you can tune into this TED Talk by Stephanie Kelton, formerly formerly advisor to the Senate Budget Committee chair, now back teaching and researching econ at University of Missouri at Kansas City:

https://www.ted.com/talks/stephanie_kelton_the_big_myth_of_government_deficits?subtitle=en

Stephanie has written a great book about this, The Deficit Myth:

https://pluralistic.net/2020/05/14/everybody-poops/#deficit-myth

There's a really good feature length doc about it too, called "Finding the Money":

https://findingmoneyfilm.com/

If you'd like to read more of my own work on this, here's a column I wrote about the nature of currency in light of Web3, crypto, etc:

https://locusmag.com/2022/09/cory-doctorow-moneylike/

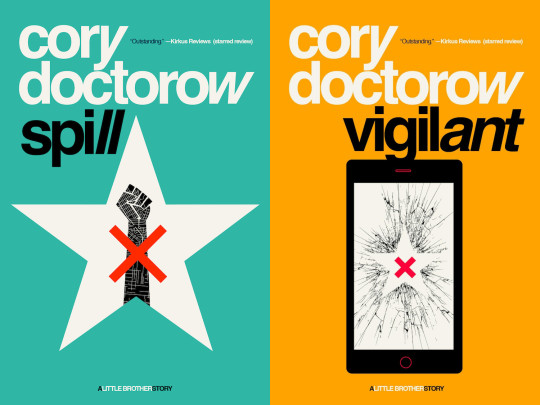

Tor Books as just published two new, free LITTLE BROTHER stories: VIGILANT, about creepy surveillance in distance education; and SPILL, about oil pipelines and indigenous landback.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/10/21/we-can-have-nice-things/#public-funds-not-taxpayer-dollars

#pluralistic#mmt#modern monetary theory#warren buffett#podcasts#pj vogt#billionaires#economics#we can have nice things#taxes#taxing billionaires#the irs files#irs files#jesse eisenger#propublica

1K notes

·

View notes

Note

I am FULLY ONBOARD the Harris/Waltz train, tho before this i was leaning towards Mark Kelly (AZ is a swing state! He's an ASTRONAUT!) If you want or have time, no pressure, but any thoughts on what makes Waltz a better pick?

I like Mark Kelly too, and since he's married to Gabby Giffords (having run for public office after she got shot and could no longer do so) he would have been an amazing pick in terms of supporting the first female POTUS. But he is a less charismatic public speaker than Walz (for whatever that's worth, but politics is a mess of Aesthetics and Vibes that matter as much and/or more than actual facts) and more moderate/conservative. He's been a great senator and picking him would defuse some of the BORDER IMMIGRATION BLAH BLAH!!! scaremongering that Republicans love to run on, but it would also leave open the possibility of losing a special election and other dangers with the Democratic senate that we really need to minimize. So Walz is a better choice for that alone, but also:

He really has serious progressive credentials as governor, even if he was a fairly mainstream Democrat (who flipped a rural red House district in Minnesota that Democrats have not been able to win again after he left) during his 12 years in the House. This is an INCOMPLETE LIST of what he was able to do in two years with a one-seat Democratic majority in Minnesota:

A Climate Action Plan that included:

Investing in energy infrastructure

100% carbon-free electricity by 2040 goal

Transition off of fossil fuels and onto clean energy resources

Building more electric vehicle charging stations

Providing funding to help workers acquire new skills through apprenticeship programs in clean energy fields

Direct state funding for transit

Money for rail

Tax credit for e-bikes

Permitting form to fast-track clean energy projects

And that was in addition to:

Codified abortion access in Minnesota

Guaranteed paid sick time and paid family and medical leave

Funded replacing ALL LEAD PIPES IN THE STATE

Free school breakfasts and lunches for all

Made public college free

Stronger labor protections

Drivers’ Licenses for All

Voting Rights Act to reverse recent court rulings that make voting harder, including restored voting rights to convicted felons

Banning medical debt from credit bureaus

The "Taylor Swift Bill" requiring all ticket "junk fees" be shown up front

Banning most "junk fees"

No book bans

Protection for tipped workers

Banned non-competes

Legalized recreational cannabis

Gun control, including increased penalties for straw purchases of firearms, expanded background checks and enacted red-flag laws, passing gun safety measures that the GOP has thwarted for years

Made MN a Trans Refuge State, and required health plans to cover “medically necessary gender-affirming care.”

Pay increase for Uber and Lyft drivers

Elimination of the so-called “gay panic defense”

A ban on “doxxing” election workers

A prohibition on “swatting” elected officials

In March, during the height of the Gaza/uncommitted primary protests against Biden, Walz said that young people should be listened to and they had a right to be speaking up and the situation in Gaza was horrible and intolerable, without directly slamming Biden or getting involved in the issue in a way to draw negative headlines. Regardless of what you think about any of it, that is a very deft way to handle it and pairs well with Kamala's better responsiveness on the Gaza issue overall. That was a big part of the reason why Gen Z/younger voters were very excited about Walz despite him being an "old" (actually the same age as Kamala but he has joked that teaching high school for 20 years will do that to a guy) white guy. If half the battle in politics is making the right pick to excite your core voters and reach out to new ones, then Harris nailed it. As I have said in earlier posts, there was just too much energy with young voters FINALLY checking in when Harris became the candidate, to risk introducing a big ideological split with Shapiro.

Aside from that: the most insufferable Smart White-Bro Political Pundits (TM) are big mad about Walz, many Never Trumper Republicans thought they were entitled to a "moderate" in exchange for oh-so-generously lending us their vote against Trump and not run the risk that we might end up with someone *gasp* progressive, and the regular MAGA Republicans are hysterical, which means they're terrified. It's also incredibly hard to paint Literal Midwestern Stereotype Dad (football coach, social studies high school teacher, military veteran, etc) as THE EVIL END OF AMERICA in the way they desperately want to do, though the fact that they're trying shows that they've got literally nothing. The fact that Kamala picked Walz against the PREVAILING WISDOM!!! that she had to take Shapiro (for whatever reason that might have been) is also a good sign, because by far the most genuine and extensive enthusiasm that I have seen from Democratic voters, especially those feeling burned out or disillusioned or angry with specific policy choices of the current administration, was for Walz. Having everyone excited for the pick beforehand, effectively using the "weird" line, and rallying behind the guy, only for her to actually go for him, is inspiring. It makes people feel like they're being heard and the Democrats have decided to win by being progressive, and not just endlessly Catering To The (Imaginary) Middle as they have always been told to do (and often done). That alone is MASSIVE.

Walz is tremendously funny, personable, has Democrats from AOC to Joe Manchin praising it (again, shocking), was right out the gate supporting Kamala, has already been majorly successful on TV, was by far the most progressive-on-policy picks of the VP finalists, is incredibly, hilariously wholesome and small-town Midwestern (he's the JD Vance that they wish JD Vance was), and is already sending ActBlue gangbusters with donations again. And when you're getting this kind of response on the Cursed Bird Hellsite, just:

Just. I don't know what's happening either. But let's enjoy it, and then work hard, because we gotta fucking do this and for possibly the first time this entire year, I really think we might. Heck yeah.

450 notes

·

View notes

Text

Dandelion News - November 15-21

Like these weekly compilations? Tip me at $kaybarr1735 or check out my Dandelion Doodles! (sorry it's slightly late, the links didn't wanna work and I couldn't figure it out all day)

1. Wyoming's abortion ban has been overturned, including its ban on abortion medication

“Wyoming is the second state to have its near-total abortion ban overturned this month[…. Seven other states] also approved amendments protecting the right to an abortion. A lawsuit seeking to challenge the [FDA]’s approval of abortion medication recently failed when the Supreme Court refused to hear it[….]”

2. Patches of wildflowers in cities can be just as good for insects as natural meadows – study

“This study confirmed that small areas of urban wildflowers have a high concentration of pollinating insects, and are as valuable to many pollinators as larger areas of natural meadow that you would typically find rurally.”

3. Paris could offer new parents anti-pollution baby 'gift bags' to combat 'forever chemicals'

“The bag includes a stainless steel baby cup, a wooden toy, reusable cotton wipes, and non-toxic cleaning supplies as part of a "green prescription". […] The city will also have 44 centres for protecting mothers and infants that will be without any pollutants[….]”

4. Indigenous guardians embark on a sacred pact to protect the lowland tapir in Colombia

“The tapir is now the focus of an Indigenous-led conservation project[… A proposed “biocultural corridor”] will protect not only the populations and movements of wildlife such as tapirs, but also the cultural traditions and spirituality of the Inga and other neighboring Indigenous peoples[….]”

5. Denmark will plant 1 billion trees and convert 10% of farmland into forest

“[…] 43 billion kroner ($6.1 billion) have been earmarked to acquire land from farmers over the next two decades[.… In addition,] livestock farmers will be taxed for the greenhouse gases emitted by their cows, sheep and pigs from 2030, the first country to do so[….]”

6. The biggest grid storage project using old batteries is online in Texas

“[Element operates “used EV battery packs” with software that can] fine-tune commands at the cell level, instead of treating all the batteries as a monolithic whole. This enables the system to get more use out of each cell without stressing any so much that they break down[….]””

7. Durable supramolecular plastic is fully ocean-degradable and doesn't generate microplastics

“The new material is as strong as conventional plastics and biodegradable, [… and] is therefore expected to help reduce harmful microplastic pollution that accumulates in oceans and soil and eventually enters the food chain.”

8. Big Oil Tax Could Boost Global Loss and Damage Fund by 2000%

“[… A] tax on fossil fuel extraction, which would increase each year, combined with additional taxes on excess profits would […] generate hundreds of billions of dollars by the end of the decade to assist poor and vulnerable communities with the impact of the climate crisis[….]”

9. Rooftop solar meets 107.5 pct of South Australia’s demand, no emergency measures needed

“[T]he state was able to export around 658 MW of capacity to Victoria at the time[….] The export capacity is expected to increase significantly as the new transmission link to NSW[…] should be able to allow an extra 150 MW to be transferred in either direction by Christmas.”

10. Light-altering paint for greenhouses could help lengthen the fruit growing season in less sunny countries

“[Scientists] have developed a spray coating for greenhouses that could help UK farmers to produce more crops in the future using the same or less energy[… by optimising] the wavelength of light shining onto the plants, improving their growth and yield.”

November 8-14 news here | (all credit for images and written material can be found at the source linked; I don’t claim credit for anything but curating.)

#hopepunk#good news#abortion#abortion rights#reproductive rights#pollinators#guerrilla gardening#wildflowers#paris#babies#new parents#tapir#indigenous#denmark#reforestation#electric vehicles#energy storage#plastic#microplastics#biodegradable#fossil fuels#solar panels#gardening#solar energy#solar power#nature#us politics#technology#australia#uk

138 notes

·

View notes

Text

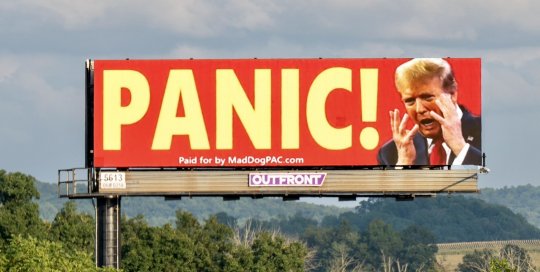

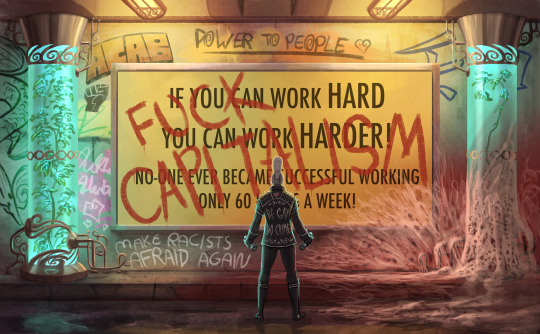

Billboard project

* * * *

One for the history books!

September 12, 2024

Robert B. Hubbell

After delivering one of the best debate performances in American political history, Kamala Harris is receiving begrudging and stinting praise from many in the media and commentary class. But 67 million people saw Kamala Harris demonstrate she is made of presidential timber. They witnessed a masterful performance that revealed a penetrating intellect tempered by decency and humanity. On the substance and execution, she should have earned the support of all voters and unqualified praise from the media and political commentators.

Trump's performance was vile and disqualifying. It was worse than Joe Biden’s widely panned debate by far. While Joe Biden turned in a horrible debate performance as measured by the artificial rules of made-for-tv spectacles, Donald Trump made dozens of statements that were objectively depraved, racist, antidemocratic, delusional, and deceitful.

Trump transcended the debate format and devolved into fascist demagoguery that should have resulted in universal condemnation by all voters, the media, and political commentators. If Joe Biden was driven from the presidential race because of his poor debate performance, Trump should be banished from politics, expelled from his party, and relegated to a place of dishonor in the annals of American history.

Talking about the debate is difficult because of the urge to focus on Kamala Harris’s brilliantly executed strategy of baiting Trump into ranting about his insecurities and the horror of Trump's worst-in-the-history-of-the-nation performance on substance.

I get it. Harris’s ninja debating moves and Trump's racist deer-in-the-headlights stare made for riveting television. But we focus on those aspects of the debate to the detriment of the substance of Kamala Harris’s message. She spent a substantial portion of the debate discussing her policies and her plan to help heal the divisions that beset America.

It is disappointing to see so many stories and commentators describe the debate as “fierce” or “contentious.” I heard one commentator on MSNBC bemoan the fact that neither candidate seemed interested in bridging the divide in America. That is false. Kamala Harris promised to be a president for all Americans and to focus on the needs of the people, not the needs and wants of the president. She said, in part,

And I think the American people want better than that. Want better than this. Want someone who understands as I do, I travel our country, we see in each other a friend. We see in each other a neighbor. We don't want a leader who is constantly trying to have Americans point their fingers at each other. I meet with people all the time who tell me "Can we please just have discourse about how we're going to invest in the aspirations and the ambitions and the dreams of the American people?" [¶¶] I've only had one client. The people. And I'll tell you, as a prosecutor I never asked a victim or a witness are you a Republican or a Democrat. The only thing I ever asked them, are you okay? And that's the kind of president we need right now. Someone who cares about you and is not putting themselves first. I intend to be a president for all Americans and focus on what we can do over the next 10 and 20 years to build back up our country by investing right now in you the American people.

Kamala Harris repeatedly offered her policy vision for America, including tax breaks for business startups; subsidizing downpayments for first-time home purchases; incentivizing the construction of starter homes; granting tax credits for families with newborns; investing in American chip technology, quantum computing, and AI; supporting worker’s rights; reducing reliance on fossil fuels; granting tax cuts for the middle class; requiring the ultra-wealthy to pay their fair share of taxes; and protecting the Affordable Care Act, Medicare, and Medicaid. She also promised to protect reproductive liberty, LGBTQ equality, and voting rights of all Americans.

The media has hounded Kamala Harris for weeks about the alleged absence of policies in her campaign. On Tuesday, she talked about dozens of specific policies—and the media is not saying a word about those policies after the debate.

Not. A. Word.

It’s almost as if the media didn’t really care about Kamala Harris’s policies but were only interested in a talking point they could use to criticize her. Hypocrites!

So, before talking about how well Kamala Harris executed her strategy of baiting Trump and how abhorrent Trump's performance and positions were, let’s give Kamala Harris her due on the substance: She gave a presidential-level discourse on policies that will affect the lives of hundreds of millions of Americans. The fact that Trump and the moderators ignored those policies does not diminish the respect she showed for the American people by clearly setting forth her policies if elected as president.

Among the many insipid criticisms of Kamala Harris was that she used facial expressions to convey her disapproval, amusement, and disbelief over Trump's utterances. This was an effective use of her non-speaking time and allowed her to diminish Trump without saying a word.

Dahlia Lithwick demolishes the critics who faulted Kamala’s facial expressions—a criticism that would only be leveled against a woman. See Dahlia Lithwick, Slate, Harris–Trump debate: Kamala Harris’ face on Tuesday was the stuff of legend. (slate.com). Lithwick writes,

It must be beyond maddening for a political actor to be summoned into a “debate” that is not really a debate, pitted against some frothing amalgam of WWE reenactor and Tasmanian devil, warned that your microphone will be muted while he is speaking, cautioned that he will be allowed to talk over you and the moderators, then be criticized for … blinking? [¶¶] Harris’ face roamed free and far on Tuesday, and it was thoroughly warranted and frequently enjoyable. I think of her mobile, legible face as a satisfying call-and-response to Trump’s lifelong preference for female adulation and Botox. Women have faces. Their faces have expressions. If that was upsetting to you during Tuesday’s debate, you might be dismayed to learn that deep beneath our expressive faces lie thoughts, dreams, frustrations, and other markers of human agency. If a woman smiling freaks you out, imagine what happens when a woman votes.

While talking about Kamala Harris’s facial expressions may seem superficial, it is not. One of Harris’s most significant accomplishments was her ability to show herself to be a likable, relatable human being. She did so by using the medium of television to her advantage. Were the expressive facial reactions real or practiced? It doesn’t matter; they were successful. People liked Kamala Harris. For a candidate who has been on the national scene since 2018, the percentage of voters who still say they don’t “know” her is shocking. But she went some distance in the debate to introduce herself to those voters in a positive way.

Among Harris’s many pointed and powerful answers on Tuesday, none were better than her response to Trump's gloating over the demise of Roe v. Wade. Harris said,

In over 20 states there are Trump abortion bans which make it criminal for a doctor or nurse to provide health care. In one state it provides prison for life. Trump abortion bans that make no exception even for rape and incest. Which—understand what that means. A survivor of a crime, a violation to their body, does not have the right to make a decision about what happens to their body next. That is immoral. And one does not have to abandon their faith or deeply held beliefs to agree: The government, and Donald Trump certainly, should not be telling a woman what to do with her body. You want to talk about, this is what people wanted? Pregnant women who want to carry a pregnancy to term, suffering from a miscarriage, being denied care in an emergency room because the health care providers are afraid they might go to jail, and she’s bleeding out in a car in the parking lot? She didn’t want that. Her husband didn’t want that. A 12 or 13-year-old survivor of incest being forced to carry a pregnancy to term? They don’t want that. Understand in his Project 2025, there would be a national abortion—a monitor that would be monitoring your pregnancies, your miscarriages.

There is more room to praise Kamala Harris’s performance in the debate, but we must turn to Trump's horrific statements during the debate. So, let’s get Trump’s “debate performance” out of the way: It was the worst debate performance (in terms of style) in the history of political debates. See The Guardian, Republicans dismayed by Trump’s ‘bad’ and ‘unprepared’ debate performance. Brit Hume of Fox News said, “Let’s make no mistake. Trump had a bad night. We just heard so many of the old grievances that we all know aren’t winners politically.” Coming from a Fox commentator, that is as bad as it gets for Trump.

There were many disgraceful, disqualifying statements during the debate by Trump: Refusing to say that he hoped Ukraine would defeat the Russian invasion; refusing to acknowledge that he lost in 2020; refusing to express any regret for his actions on January 6; claiming that “every Democrat” wanted to “get rid of” Roe v. Wade.; and repeatedly saying that execution of babies after a full-term delivery was permissible under existing law.

To state the obvious, if Kamala Harris had uttered a single statement that was one-tenth as egregious as any of the above, the major media would be calling for her withdrawal from the race.

But Trump's worst statement was the race-baiting claim that Haitian immigrants are capturing domestic pets in Springfield, Ohio and eating them. That trope was originally directed at immigrants from other countries but has been repurposed by Trump to slander Haitian immigrants who are legally in the US.

The claim is false and started as triple-hearsay thrice-removed:

On Sept. 6, a post surfaced on X that shared what looked like a screengrab of a social media post apparently out of Springfield. The retweeted post talked about the person’s “neighbor’s daughter’s friend” seeing a cat hanging from a tree to be butchered and eaten, claiming without evidence that Haitians lived at the house.

So, a “screenshot” of a retweet (three levels removed from personal knowledge) talked about a “neighbor’s daughter’s friend” (three more levels removed from personal knowledge). In short, the claim is the worst sort of internet rumor—intentionally unverifiable. Repeating such a rumor is beneath a candidate for the presidency.

But the crassness of repeating the rumor is the least of the offense. Trump did not repeat a rumor—he asserted the rumor as “fact” for the purpose of stirring racial hatred against Haitian immigrants. The false rumor has been circulating for weeks among right-wing websites that attack Haitian immigrants as the cause of an increase in crime in Springfield. See WaPo, Anatomy of a racist smear: How false claims of pet-eating immigrants caught on.

Trump then leveraged the cat-eating Haitian claim to smear all immigrants as law-breaking, violent, less-than-human invaders whom he would deport en masse from the US. The entire episode was an appeal to the most racist, xenophobic backwaters of American society. It was shameful and divisive. It may lead to violence against immigrants—just as past statements by Trump have led to violence against immigrants in Texas. See NBC (8/5/2019), Trump's anti-immigrant 'invasion' rhetoric was echoed by the El Paso shooter for a reason.

No modern presidential candidate has appealed to racial animus during a presidential debate. Trump's attack on the Haitian community should have been the end of his candidacy. As should his statements about Ukraine, the 2020 election, January 6, and abortion—and that list excludes his dozens of other falsehoods.

In short, the debate should move the needle in favor of Kamala Harris. Whether it will do so is a different question—one that will be determined, in part, by whether the media maintains the same intense focus on Trump's debate performance that it maintained on Biden’s debate performance in July. On the substance, Trump's debate performance was objectively worse, by far. Let’s hope the media doesn’t get distracted by the less consequential matters.

[Robert B. Hubbell Newsletter]

#Robert b. Hubbell#Robert b.Hubbell Newsletter#political#debate#anti-immigartion#falsehoods#racist smear#project 2025#facial expressions#expression

142 notes

·

View notes

Text

How the Biden-Harris Economy Left Most Americans Behind

A government spending boom fueled inflation that has crushed real average incomes.

By The Editorial Board -- Wall Street Journal

Kamala Harris plans to roll out her economic priorities in a speech on Friday, though leaks to the press say not to expect much different than the last four years. That’s bad news because the Biden-Harris economic record has left most Americans worse off than they were four years ago. The evidence is indisputable.

President Biden claims that he inherited the worst economy since the Great Depression, but this isn’t close to true. The economy in January 2021 was fast recovering from the pandemic as vaccines rolled out and state lockdowns eased. GDP grew 34.8% in the third quarter of 2020, 4.2% in the fourth, and 5.2% in the first quarter of 2021. By the end of that first quarter, real GDP had returned to its pre-pandemic high. All Mr. Biden had to do was let the recovery unfold.

Instead, Democrats in March 2021 used Covid relief as a pretext to pass $1.9 trillion in new spending. This was more than double Barack Obama’s 2009 spending bonanza. State and local governments were the biggest beneficiaries, receiving $350 billion in direct aid, $122 billion for K-12 schools and $30 billion for mass transit. Insolvent union pension funds received a $86 billion rescue.

The rest was mostly transfer payments to individuals, including a five-month extension of enhanced unemployment benefits, a $3,600 fully refundable child tax credit, $1,400 stimulus payments per person, sweetened Affordable Care Act subsidies, an increased earned income tax credit including for folks who didn’t work, housing subsidies and so much more.

The handouts discouraged the unemployed from returning to work and fueled consumer spending, which was already primed to surge owing to pent-up savings from the Covid lockdowns and spending under Donald Trump. By mid-2021, Americans had $2.3 trillion in “excess savings��� relative to pre-pandemic levels—equivalent to roughly 12.5% of disposable income.

So much money chasing too few goods fueled inflation, which was supercharged by the Federal Reserve’s accommodative policy. Historically low mortgage rates drove up housing prices. The White House blamed “corporate greed” for inflation that peaked at 9.1% in June 2022, even as the spending party in Washington continued.

In November 2021, Congress passed a $1 trillion bill full of green pork and more money for states. Then came the $280 billion Chips Act and Mr. Biden’s Green New Deal—aka the Inflation Reduction Act—which Goldman Sachs estimates will cost $1.2 trillion over a decade. Such heaps of government spending have distorted private investment.

While investment in new factories has grown, spending on research and development and new equipment has slowed. Overall private fixed investment has grown at roughly half the rate under Mr. Biden as it did under Mr. Trump. Manufacturing output remains lower than before the pandemic.

Magnifying market misallocations, the Administration conditioned subsidies on businesses advancing its priorities such as paying union-level wages and providing child care to workers. It also boosted food stamps, expanded eligibility for ObamaCare subsidies and waved away hundreds of billions of dollars in student debt. The result: $5.8 trillion in deficits during Mr. Biden’s first three years—about twice as much as during Donald Trump’s—and the highest inflation in four decades.

Prices have increased by nearly 20% since January 2021, compared to 7.8% during the Trump Presidency. Inflation-adjusted average weekly earnings are down 3.9% since Mr. Biden entered office, compared to an increase of 2.6% during Mr. Trump’s first three years. (Real wages increased much more in 2020, but partly owing to statistical artifacts.)

Higher interest rates are finally bringing inflation under control, which is allowing real wages to rise again. But the Federal Reserve had to raise rates higher than it otherwise would have to offset the monetary and fiscal gusher. The higher rates have pushed up mortgage costs for new home buyers.

Three years of inflation and higher interest rates are stretching American pocketbooks, especially for lower income workers. Seriously delinquent auto loans and credit cards are higher than any time since the immediate aftermath of the 2008-09 recession.

Ms. Harris boasts that the economy has added nearly 16 million jobs during the Biden Presidency—compared to about 6.4 million during Mr. Trump’s first three years. But most of these “new” jobs are backfilling losses from the pandemic lockdowns. The U.S. has fewer jobs than it was on track to add before the pandemic.

What’s more, all the Biden-Harris spending has yielded little economic bang for the taxpayer buck. Washington has borrowed more than $400,000 for every additional job added under Mr. Biden compared to Mr. Trump’s first three years. Most new jobs are concentrated in government, healthcare and social assistance—60% of new jobs in the last year.

Administrative agencies are also creating uncertainty by blitzing businesses with costly regulations—for instance, expanding overtime pay, restricting independent contractors, setting stricter emissions limits on power plants and factories, micro-managing broadband buildout and requiring CO2 emissions calculations in environmental reviews.

The economy is still expanding, but business investment has slowed. And although the affluent are doing relatively well because of buoyant asset prices, surveys show that most Americans feel financially insecure. Thus another political paradox of the Biden-Harris years: Socioeconomic disparities have increased.

Ms. Harris is promising the same economic policies with a shinier countenance. Don’t expect better results.

#Wall Street Journal#kamala harris#Tim Walz#Biden#Obama#destroyed the economy#america first#americans first#america#donald trump#trump#trump 2024#president trump#ivanka#repost#democrats#Ivanka Trump#art#landscape#nature#instagram#truth

165 notes

·

View notes

Text

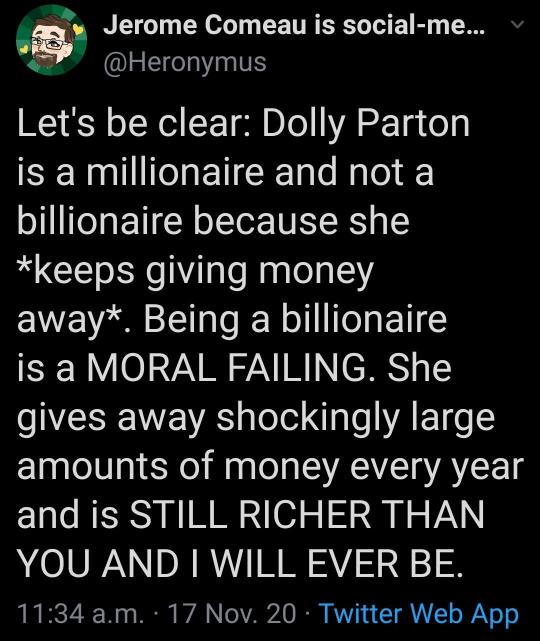

Because of what's happening on Twitter...

I've made a little diagram to demonstrate why billionaires and the ultra-wealthy are bad for society.

(Text in Image)

"If we view society as a body, every sector is like a different organ within the body that serves a function and works in harmony with other organs to maintain balance. Every part of the body is important for the whole thing to function."

"The ultra-wealthy want you to believe they are the beating heart and thinking mind of the society – they are the innovators who create our jobs and their brilliance drives society forward. They deserve to be at the top of society because they have earned that. Without them, the body won’t function because they are the most important part."

"In reality, they are more like a malignant tumour, sucking all of the blood (resources) away from everything else (people and the planet) to fuel its own infinite growth, depriving the rest of the body and slowly killing it. Workers create all of the innovation and keep things running, the ultra-wealthy take all the credit."

------------------------------------------------------------------------

This is a public domain image so feel free to pinch it for whatever.

Elon Musk has put the careers of thousands of small business owners who depend on Twitter (myself included) in jeopardy by completely running it into the ground. Before this, Mark Zuckerberg had already been doing the same when he started pursuing Metaverse, making Instagram and Facebook much more unusable for artists. Do I really need to go into other examples of CEOs and very normalised practise of wage theft?

Meanwhile, the UK currently has the richest Prime Minister in its history. What is this man doing with this wealth? Continuing the Tory legacy of austerity in order to line his pockets and the pockets of his crony friends. This has resulted in a devastating cost of living crisis that continues to ravage the country as people's energy bills skyrocket out of control.

My diagram is pretty basic and lacks nuance, there's definitely more I could elaborate on with this comparison but I really don't have time. I just want people to get the basic point of how billionaires view themselves vs what function they actually serve. I'm also not here to debate whether some organs are more important than others since I'm not a doctor, that's not really the point here. And no, I don't care if people think I'm being harsh by comparing billionaires to a tumour. If they don't want to be compared to one they should stop acting like one. Jeff Bezos could end world hunger right now and chooses not to.

Also, I know a lot of people are going to come at me with the argument that billionaires give away massive amounts of money. First off, people like Jeff Bezos only give large sums of money to charity a.) for the sake of improving their public image and b.) because giving to charity allows them to write it off in their taxes. Also, charities in of themselves have a lot of problems, but that's a blog post for another day. Mutual Aid is a better way to help people directly. Really, the ultra wealthy need to be taxed, of course they do everything within their power to avoid taxes.

Also:

"Earning a lot of money" and "holding onto a lot of money" are two different things. You cannot be a multi-millionaire unless you hold onto that money. If you give away massive chunks of it to enrich society, you cease to be a billionaire.

Oh and this is worth a watch, too.

Furthermore:

Also before the inevitable great man comments:

Being a billionaire is a moral failing. Nobody needs that much money.

[Slight edit here - I made the assertion that a billionaire could not spend all of their money in their lifetime, but as someone in the comments pointed out it's very easy for them to completely waste billions in no time. Elon Musk and Mark Zuckerberg have shown that].

Anyway, if you would like to see more anti-Capitalist art from me, I am currently working on a webcomic called "Flowerpunk" - a story about a group of anarchists who are trying to save the city of Wyrdon from a supernatural plague known as "the rot." The comic heavily discusses disaster Capitalism and how the rich will use mass death and destruction as an opportunity to further line their pockets.

I also like to do little anti-Capitalist doodles relating to this project, which I plan to make into posters at some point.

Please consider donating a Ko-Fi also if you would like to help support this project. I am really struggling at the moment because I've basically lost a massive chunk of my client base due to this Twitter implosion and also because of the AI BS that has made it impossible for me to get any reach nowadays. The last year or so has been an absolute nightmare for my career because of all of this.

Thank you all for your continued support! Hopefully I can re-establish my audience here on Tumblr and wherever else I decide to go.

#Twitter#twitpocalypse#elongated muskrat#eat the rich#eat the fucking rich#tax the rich#tax the 1%#tax the billionaires#anti capitalism#workers of the world unite#working class solidarity#Can you tell that I am absolutely fucking done with this BS?

787 notes

·

View notes

Text

@Real_RobN

The Drunk Driver Paul Pelosi, the husband of Insider Trading Inc. Nancy Pelosi, has received $1,709,100 of PPP loans from the federal government, which won’t have to be repaid ever.

Net worth:

1987 $165,000

2024 $265 million

In office 34 fucken years.

Speaker’s salary $193,400

A: In July 2021, the Drunk Driver purchased 20,000 shares of Nvidia, a multinational semiconductor company, worth between $1 million and $5 million. This trade came ahead of a vote in the Senate that set aside $52 billion to boost domestic semiconductor manufacturing and give tax credits for production.

B: In May of 2021, the Sleazebag’s husband placed a bet of up to $6 million on Apple, Amazon and Google-parent company Alphabet ahead of a powerful House committee moving forward with bills aimed at reining in the powers of Big Tech.

C: In March 2021, the Drunk Driver purchased $1.95 million worth of Microsoft call options less than two weeks before the tech giant secured a $22 billion contract to supply U.S. Army combat troops with augmented reality headsets.

D: In January 2021, the Drunk Driver purchased up to $1 million of Tesla calls before the Biden Criminal Administration delivered its plans to provide incentives to promote the shift away from fossil fueled automobiles and toward fossil fueled electric vehicles.

E: The Treacherous Witch’s biggest financial gains came from when her Drunk Driver sold 30,000 shares of Google from Dec 20 to Dec 2023 —just before the Department of Justice launched an antitrust probe of the tech giant.

In 2020, Sleazebag Nancy Pelosi and her Drunk Driver Paul Pelosi outperformed the S&P 500 by a whopping 14.3 percent.

Now, why did Martha Stewart go to prison for insider trading and the Treacherous Witch has not?!

37 notes

·

View notes

Text

hello humble tumblr I come to you to you in my time of need, haha.

basically, discovered today that the fuel pump on my car is going out; I don't quite know how long I have until it goes out completely though, I'm hoping that I caught it pretty early, as it only just started jerking/jumping when idling and it stalled once today and once when I started it on Saturday after getting gas.

However, it's possible that it's been happening for a while, because I have noticed a significant difference in how my car runs (seems sluggish when accelerating, less power than usual) in the past couple of weeks.

Anyway, even with my raise at work, I can't afford a new fuel pump outright, so I'm reaching out in hopes that someone's interested in commissioning me.

Here's my ko-fi page with info, my commissions are cheap and in tiers, $3, $6 and $10.

I can change the thing myself, so no worries about the cost of someone having to do it. I just can't afford the part. Non-OEM is about $215 after applicable taxes which I'm perfectly fine with using something not OEM.

I was going to open a credit card but ofc the one option I did have is no longer an option for me (Synchrony bank is so hard to get into. There's an Auto Care Credit that I'm not eligible for ugh.)

If you got this far, thanks! Please share this around if you can, I'm not sure what else to do at this point but I need to do something! Otherwise I'm not gonna have a working car haha.

#i am very stressed#commission post#im working on a commission now but its loooong#but i will do my very best to get them out within a couple weeks if i get any#thank you for considering me!#my car stalled right as soon as i pulled into a parking lot and i was so scared cause like what if it does that with my kid in the car

59 notes

·

View notes

Text

As usual credit to Hiki (@shyanimeboi) for this god sent gift they grace me. The amount of lore drops got me feral, it feels like Christmas, it feels like summer coming.

I won't post all of it since it is best that you go support the original poster at here: Hikifans on X: "Here is part 3 of the story. Sorry it was abit of a long wait, was stuck grinding for satans beginner nightmere candy https://t.co/IStdo8f7Xs #whatinhellisbad" / X (twitter.com)

Anyway here is the ramble

True but I don't lust as much as you girl (no problem with anyone that related to MC, she's just not for me). If I have that much sexual drive in me, for more than 70 guys at that??? I need to check myself out for medical attention, or else I gonna feel dread every time the lust comes (it is surprisingly a thing that I saw people talk about on TikTok)

Ppyong is a deadly combo man, he is cocky but also a masochist. His appearance is so my type too

MC being a freak, as usual, you go sis ᕕ( ᐛ )ᕗ

THE WAY I CHOKE ON MY OWN SPIT- Like wtf do you mean?!!!! Why are you doing this to my fujoshi kokoro??!!! I know you want to do it but how do you want to do it?!! Shibari? Choking? WHat Ishb Ittzdhbjsfbnv?!- *Error*

NAURRRRR ༼;´༎ຶ ༎ຶ༽ MC DON'T TAKE THIS AWAY FROM ME!!!!

ASK HIM!! ASK HIM TO SPILL IT ALL OUT!! I NEED TO KNOW!! TELL HIM TO SPELL IT OUT-

*Error*

So, uh, they show a close-up shot of Juno's chest and he asks if Minhyeok is hard like his and MC is a bad liar, said "probably" and Juno calls her out on it.

And MC actually admitted and said that Minhyeok's chest is actually "wide like this"???

You did??? But then again why am I surprised that she did, they had to be kissing at some point if they stuck together for more than a decade with that amount of tension between them

Ok so Minhyeok played soccer in high school, MC and he are in different classes and they were going to give him back something they lent. But come across Minhyeok changing in the classroom, pretty standard

Yup, he knows, he definitely knows and he is tempting her. Also, apparently, Minhyeok's chest is toned, but flatter than Juno's, his abs also feel different than Juno's...

If you can't tell I'm furiously taking notes right now, someone on the dev team is looking out for my shipper's heart and I wish that person woke up on the right side of the bed every day and had their taxes filled on time, etc.

Woah that has to be some intense session you got there, I awake until 3am before and I still have energy fueling me.

Relatable, highly so, I got deadlines every day during the semester. You think it's fine when you get used to it after 3-4 weeks but then it hits you with a week's worth of exams that you need to finish within that time while maintaining other stuff outside your major, and then combine it with other stuff outside uni (҂ ꒦ິヮ꒦ິ)

Too high of a standard girl, if I were him, I would already be too high on coffee and delirium to even see what I'm typing on the computer.

I'm surprised he's only tired, I expected some breakdown but then again, it's Minhyeok. The guy built different

Wait that's so cute!!! Awww (∗˃̶ ᵕ ˂̶∗)

Minhyeok sure is deep in his sleep, cause the slightest noise or outside touch would wake me tf up, I will go straight back to sleep later if it is nothing but if this happens it would me start kicking before I could even think

Built like a campus crush and act like a campus crush. If he has time to be good at sports then he most likely be in one of the SKY universities in Korea. If he also doesn't go to Hagwon then that would be even more crazy

Ok rude, you not even gonna clean the wet chair up??? Even if you're my best friend, I would still drag you back to clean the mess yourself cause ain't no way I'm touching the juice that came out of your bussy

THE TENSION IS REAL BOISSS

I know what you are MC and don't worry I won't judge, just tell me how big the file is compare to others

Ok, that is it, love part 3, they feed me a good amount of lores, and thank you again to the heaven-sent Hiki (@shyanimeboi), please watch the full video on their channel. I couldn't do this without them sharing this with all of us for free at that 🛐🛐🛐

Thank you for reading through my fangirling and good days to everyone!

114 notes

·

View notes

Text

Fuel Tax Credits 101: Maximize Your Fuel Tax Credits with Ease (Australia)

Feeling the pinch at the pump? You're not alone. Whether you're a business owner running a fleet or a driver hitting the road for work or leisure, Australia's rising fuel prices can drain your wallet. But fear not! There's a powerful tool in your arsenal called fuel tax credits, and unlocking them can turn every fuel stop into a mini victory for your finances.

So, what are fuel tax credits and how can you claim them? Buckle up, we're taking a quick ride through the basics:

Fuel Tax Credit Fundamentals:

The Good News: Both businesses and individuals in Australia can claim fuel tax credits for fuel used on-road.

The Key Factors: The amount you can claim depends on the fuel type, vehicle type, and the distance you travel.

The Catch: Keeping accurate records is crucial for claiming the right amount. That's where Orbitus's fuel tax credit calculator comes in handy.

Orbitus: Your Credit Calculation Copilot:

Say goodbye to spreadsheets! Our user-friendly calculator does the heavy lifting, providing an estimate of your refundable credit amount in a breeze.

Accuracy is key: Enter your details like fuel type, vehicle, and distance, and the calculator handles the rest, eliminating the risk of underclaims or overclaims.

Beyond the Calculator:

Maximizing your fuel savings goes beyond just claiming credits. Here are some smart strategies to consider:

Fleet Management for Efficiency: For businesses, GPS-powered fleet management systems like Orbitus's offer valuable tools to optimize routes, reduce idle time, and promote fuel-efficient driving habits.

Tire Pressure Matters: Properly inflated tires can significantly improve fuel efficiency. Invest in tire pressure monitoring systems (TPMS) for real-time tire pressure insights and avoid fuel-guzzling underinflation.

Driver Safety Pays Off: Safe driving habits directly impact fuel consumption. Encourage eco-friendly driving practices among your team and see the savings pile up.

Fueling a Brighter Future:

Claiming your fuel tax credits isn't just about saving money; it's about making responsible choices. By using fuel efficiently, we all contribute to reducing emissions and promoting a sustainable future. With Orbitus's suite of fuel-saving solutions, you can navigate the road to a greener tomorrow, one efficient kilometer at a time.

Ready to pump up your savings and drive towards a brighter future?

Visit the Orbitus website www.orbitus.com.au today and explore our fleet management systems, fuel tax credit calculator, and TPMS solutions. Remember, every drop counts!

#fuel tax credit calculator#tire pressure monitoring system#fuel tax credit#truck GPS#Fleet Management#GPS#driver safety#Real-time Monitoring

0 notes