#ftc violations

Explore tagged Tumblr posts

Text

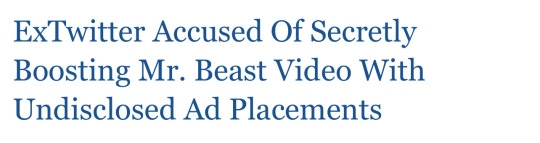

People are pointing out that it appears someone is juicing the views anyway, by promoting the video post as an ad… but without the (required by law) disclosure that it’s an ad. This certainly suggests that it’s being done by ExTwitter itself, rather than MrBeast directly. If it were being done by MrBeast or someone else, then it would say that it was a promoted/advertised slot. The fact that it’s hidden suggests the call is coming from inside the house.

The evidence that it’s an undisclosed ad is pretty strong. People are seeing it show up in their feeds without the time/date of the post, which is something that only happens with ads. Other tweets show that info.

Even stronger proof? If you click on the three dots next to the tweet… it says “Report ad” and “Why this ad?” which, um, is pretty damning.

Cody Johnston notes that he has refused to update his Twitter app in ages, and on the old app, it is properly designated as a “Promoted” tweet, which is how ads were normally disclosed.

Elon is denying that he’s done anything to goose the numbers, but the evidence suggests someone at the company is doing so, whether or not Elon knows about it.

Of course, the evidence still suggests otherwise. Meanwhile, Ryan Broderick was told by an ExTwitter employee that they don’t have to label promoted tweets that have videos because there’s also a pre-roll video and that is disclosed. Of course, that… makes no sense at all. Those are two totally separate things, and not labeling the promoted tweet is a likely FTC violation (and potentially fraudulent in misrepresenting to people how much they might make from videos posted to the platform).

(continue reading)

#politics#twitter#elon musk#mr beast#ftc#ftc violations#ponzy schemes#undisclosed ads#technology#paid ads#mr. beast#ad revenue#tech#promoted ads#techno grifters#crypto bros#mrbeast#twitter monetization#truth in advertising#twitter creator system#eugenics musk#apartheid clyde

56 notes

·

View notes

Text

Usually, I consider Morning Brew an entertaining element of my morning, but not necessarily the most on-topic (for my interests) of the newscasts I listen to.

However, they had a LOT of good topics today, like:

an overview of the tax and welfare elements of the budget that Biden is proposing (understandably, most of the others are focused on the immigration policy), and how it relates to the election

the increasing number of incidents with Boeing, touching on the suspicious death of a whistle-blower

automakers are sharing your personal information with insurance companies without your knowledge (consent was gained in the tiny fine print), and the expected involvement of the FTC

#current events#politics#united states#domestic politics#boeing#taxes#tax policy#privacy violations#ftc#Phoenix Politics

51 notes

·

View notes

Text

Sweeping changes to Federal Trade Commission (FTC) guidelines aimed at cleaning up the polluted, confusing world of online product reviews went into effect on Monday, meaning the federal agency is now allowed to levy civil penalties against bad actors who knowingly post product reviews and testimonials deemed misleading to American consumers.

Fucking finally.

Curious to see how enforcement works, and/or if they're going after retroactive violations. Full text of the August 2024 rules change here.

If you like this kind of thing, don't let Trump back into office. Because, well, you know...

8K notes

·

View notes

Text

Tell the Trump Administration What REAL Censorship Is

The U.S. Federal Trade Commission is soliciting public comment "to better understand how technology platforms deny or degrade (such as by 'demonetizing' and 'shadow banning') users’ access to services based on the content of the users’ speech or their affiliations, including activities that take place outside the platform."

This is the brainchild of FTC Chairman and rabid Trumpista Andrew Ferguson, who recently said that DEI "violates natural law." He is hoping these comments will say that social media companies are persecuting poor innocent right-wing transphobes by shutting down their accounts when they post hate speech/misinformation.

In the real world, we know that many victims of deplatforming are (a) queer people and (b) sex workers and other folks who post content about sex. If you or someone you know has had an account shut down, had content removed, or otherwise had their access to services denied or degraded for those reasons, please consider submitting a comment about it. The comment period closes May 21st. I understand folks may not be comfortable giving any info to the government right now, but you have the option to submit anonymously, or as part of an organization.

Right now, most of the comments are exactly what this guy wants: they're from conservatives complaining about being banned for, e.g., spreading vaccine misinformation. If that continues, the FTC will able to use that record of comments as justification to go after companies that are trying to fight misinformation and hate speech. By submitting a comment, you can prevent that! (Also, it would be incredibly satisfying to watch drag queens and cam girls crash this dude's conservative pity party. Even if you don't believe it will really make a difference (it will!), do it for that.)

745 notes

·

View notes

Text

Trump’s Purge of the FTC: The Dismantling of Consumer Protections and the Rule of Law

What’s at Stake?

In a shocking and blatantly illegal move, Donald Trump has fired Democratic-appointed officials from the Federal Trade Commission (FTC), violating longstanding norms and potentially breaching federal law. By unlawfully purging the agency of opposition, Trump is not only undermining consumer rights but also attacking the very foundation of democratic governance. This unprecedented action sets a dangerous precedent for the executive branch to override legal safeguards and seize unchecked power.

Why This Should Terrify You

The FTC is a regulatory body designed to operate independently, ensuring that corporate power does not override consumer protection. By illegally dismissing commissioners who were lawfully appointed, Trump is gutting the agency’s ability to function fairly. Here’s why this is a direct threat to democracy:

It’s a Violation of the Law – FTC commissioners serve fixed terms and cannot be removed without cause. Trump’s move is a blatant disregard for legal norms and an unconstitutional power grab.

Big Business Gets Free Reign – Without an independent FTC, corporations can exploit consumers without fear of regulation.

Silencing Opposition – Removing officials based on political affiliation erodes democratic checks and balances, turning regulatory agencies into authoritarian tools.

Monopolies Will Thrive – Tech giants and corporate behemoths will have fewer checks on their power, leading to price hikes, reduced competition, and worse conditions for workers and consumers alike.

Why This Matters to You

This isn’t just about Washington politics; it’s about your everyday life. If Trump gets away with this illegal power grab, it sets a precedent for him—or any future president—to ignore the law whenever it suits them. If the FTC becomes a rubber-stamp agency for corporate greed, you will feel the impact:

Higher Prices – Without regulation, companies can increase costs on everything from groceries to healthcare.

Fewer Consumer Protections – Companies engaging in fraud or deceptive practices will face little accountability.

More Surveillance and Data Exploitation – Tech companies will have fewer restrictions on how they use and sell your personal data.

This is particularly dangerous for young people and low-income communities, who rely on regulatory protections to ensure fair economic opportunities and prevent corporate abuse.

The Bigger Picture

Trump’s move isn’t just about the FTC—it’s part of a broader effort to dismantle democratic institutions and consolidate power. This echoes tactics used in authoritarian regimes, where leaders remove independent oversight and install loyalists to control every aspect of governance. If left unchecked, this could extend to other agencies, eroding the very fabric of American democracy.

By blatantly disregarding the law to fire FTC officials, Trump is signaling that he believes he is above legal constraints. If he can ignore these rules without consequences, what stops him from undermining election results, bypassing Congress, or silencing dissenting voices in the judiciary?

What Can You Do?

Stay Informed – Follow news on regulatory agencies and corporate influence.

Support Consumer Advocacy Groups – Organizations fighting for fair trade and consumer rights need public support.

Vote for Leaders Who Defend the Rule of Law – Elections determine who has the power to hold corporations—and presidents—accountable.

Raise Awareness – The more people know about this illegal power grab, the harder it will be for Trump to get away with it.

Demand Accountability – Pressure lawmakers to challenge Trump’s unlawful actions and take legal action if necessary.

Trump’s purge of the FTC is not just a direct assault on consumer protections—it is a brazen attack on democracy itself. If we don’t act now, the consequences will be felt for generations to come.

#president trump#trump is a threat to democracy#us politics#donald trump#trump administration#politics#white house#usa politics#trump#america

447 notes

·

View notes

Text

The Best News of Last Year - 2024 Edition

Welcome to our special edition newsletter recapping the best news from the past year. I've picked one highlight from each month to give you a snapshot of 2024. No frills, just straightforward news that mattered. Let's relive the good stuff that made our year shine.

1. January - South Korea passes law banning dog meat trade

The slaughter and sale of dogs for their meat is to become illegal in South Korea after MPs backed a new law. The legislation, set to come into force by 2027, aims to end the centuries-old practice of humans eating dog meat.

2. February - Greece legalises same-sex marriage

Greece has become the first Christian Orthodox-majority country to legalise same-sex marriage. Same-sex couples will now also be legally allowed to adopt children after Thursday's 176-76 vote in parliament. Prime Minister Kyriakos Mitsotakis said the new law would "boldly abolish a serious inequality".

3. March - Global child deaths reach historic low in 2022 – UN report

The number of children who died before their fifth birthday has reached a historic low, dropping to 4.9 million in 2022. The report reveals that more children are surviving today than ever before, with the global under-5 mortality rate declining by 51 per cent since 2000.

4. April - Restoring sight is possible now with optogenetics

Max Hodak's startup, Science, is developing gene therapy solutions to restore vision for individuals with macular degeneration and similar conditions. The Science Eye utilizes optogenetics, injecting opsins into the eye to enhance light sensitivity in retinal cells. Clinical trials and advancements in optogenetics are showing promising results, with the potential to significantly improve vision for those affected by retinal diseases.

5. May - Vaccine breakthrough means no more chasing strains

Scientists at UC Riverside have demonstrated a new, RNA-based vaccine strategy that is effective against any strain of a virus and can be used safely even by babies or the immunocompromised.

6. June - Bill Gates-backed startup creates Lego-like brick that can store air pollution for centuries

The Washington Post detailed a "deceptively simple" procedure by Graphyte to store a ton of CO2 for around $100 a ton, a number long considered a milestone for affordably removing carbon dioxide from the air. Direct air capture technologies used in the United States and Iceland cost $600 to $1,200 per ton, per the Post.

7. July - Stem cell therapy cures man with type 2 diabetes

A 59-year-old man had been suffering from diabetes for 25 years, needing more and more insulin every day to avoid slipping into a diabetic coma and was at risk of death. But then Chinese researchers cured his disease for the first time in the world. The patient received a cell transplant in 2021 and has not taken any medication since 2022.

8. August - Chinese drones will fly trash out of Everest slopes

Come autumn, Nepal will deploy heavy lifter drones to transport garbage from the 6,812-metre tall Ama Dablam, south of Everest. This will be the first commercial work an unmanned aerial vehicle does in Nepal’s high-altitude zone.

9. November - Tokyo to make day care free to boost birth rate

Tokyo plans to make day care free for all preschool children starting in September, the city governor has announced as part of efforts to boost Japan's low birth rate.

10. October - FTC Rule Banning Fake Product Reviews Takes Effect With Stiff Penalties

Federal Trade Commission (FTC) Chair Lina Khan announced on Oct. 21 that the agency’s prohibition on fake online reviews was taking effect, imposing fines as high as $50,000 for violations. Khan encouraged followers to report the proscribed practices at reportfraud.ftc.gov.

11. November - Bumblebee population increases 116 times over in 'remarkable' Scotland rewilding project

The bumblebee population has made an impressive comeback in a developed area by increasing to 116 times what it was two years ago thanks to a nature restoration group.

12. December - Spain to enshrine gay marriage and abortion rights into its constitution so 'they cannot be undone in the future'

The left-wing PSOE leader made the announcement at an event marking the 46th anniversary of the Spanish Magna Carta.

“We believe that these are rights that we must protect in the Constitution so that no one can touch them in the future,” Sanchez said in a statement in parliament on Friday.

----------

That's it for last year :)

This newsletter will always be free. If you liked this post you can support me with a small kofi donation here:

Buy me a coffee ❤️

Also don’t forget to share this post with your friends.

461 notes

·

View notes

Text

The CFPB is genuinely making America better, and they're going HARD

On June 20, I'm keynoting the LOCUS AWARDS in OAKLAND.

Let's take a sec here and notice something genuinely great happening in the US government: the Consumer Finance Protection Bureau's stunning, unbroken streak of major, muscular victories over the forces of corporate corruption, with the backing of the Supreme Court (yes, that Supreme Court), and which is only speeding up!

A little background. The CFPB was created in 2010. It was Elizabeth Warren's brainchild, an institution that was supposed to regulate finance from the perspective of the American public, not the American finance sector. Rather than fighting to "stabilize" the financial sector (the mission that led to Obama taking his advisor Timothy Geithner's advice to permit the foreclosure crisis to continue in order to "foam the runways" for the banks), the Bureau would fight to defend us from bankers.

The CFPB got off to a rocky start, with challenges to the unique system of long-term leadership appointments meant to depoliticize the office, as well as the sudden resignation of its inaugural boss, who broke his promise to see his term through in order to launch an unsuccessful bid for political office.

But after the 2020 election, the Bureau came into its own, when Biden poached Rohit Chopra from the FTC and put him in charge. Chopra went on a tear, taking on landlords who violated the covid eviction moratorium:

https://pluralistic.net/2021/04/20/euthanize-rentier-enablers/#cfpb

Then banning payday lenders' scummiest tactics:

https://pluralistic.net/2022/01/29/planned-obsolescence/#academic-fraud

Then striking at one of fintech's most predatory grifts, the "earned wage access" hustle:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

Then closing the loophole that let credit reporting bureaus (like Equifax, who doxed every single American in a spectacular 2019 breach) avoid regulation by creating data brokerage divisions and claiming they weren't part of the regulated activity of credit reporting:

https://pluralistic.net/2023/08/16/the-second-best-time-is-now/#the-point-of-a-system-is-what-it-does

Chopra went on to promise to ban data-brokers altogether:

https://pluralistic.net/2024/04/13/goulash/#material-misstatement

Then he banned comparison shopping sites where you go to find the best bank accounts and credit cards from accepting bribes and putting more expensive options at the top of the list. Instead, he's requiring banks to send the CFPB regular, accurate lists of all their charges, and standing up a federal operated comparison shopping site that gives only accurate and honest rankings. Finally, he's made an interoperability rule requiring banks to let you transfer to another institution with one click, just like you change phone carriers. That means you can search an honest site to find the best deal on your banking, and then, with a single click, transfer your accounts, your account history, your payees, and all your other banking data to that new bank:

https://pluralistic.net/2023/10/21/let-my-dollars-go/#personal-financial-data-rights

Somewhere in there, big business got scared. They cooked up a legal theory declaring the CFPB's funding mechanism to be unconstitutional and got the case fast-tracked to the Supreme Court, in a bid to put Chopra and the CFPB permanently out of business. Instead, the Supremes – these Supremes! – upheld the CFPB's funding mechanism in a 7-2 ruling:

https://www.scotusblog.com/2024/05/supreme-court-lets-cfpb-funding-stand/

That ruling was a starter pistol for Chopra and the Bureau. Maybe it seemed like they were taking big swings before, but it turns out all that was just a warmup. Last week on The American Prospect, Robert Kuttner rounded up all the stuff the Bureau is kicking off:

https://prospect.org/blogs-and-newsletters/tap/2024-06-07-window-on-corporate-deceptions/

First: regulating Buy Now, Pay Later companies (think: Klarna) as credit-card companies, with all the requirements for disclosure and interest rate caps dictated by the Truth In Lending Act:

https://www.skadden.com/insights/publications/2024/06/cfpb-applies-credit-card-rules

Next: creating a registry of habitual corporate criminals. This rogues gallery will make it harder for other agencies – like the DOJ – and state Attorneys General to offer bullshit "delayed prosecution agreements" to companies that compulsively rip us off:

https://www.consumerfinance.gov/about-us/newsroom/cfpb-creates-registry-to-detect-corporate-repeat-offenders/

Then there's the rule against "fine print deception" – which is when the fine print in a contract lies to you about your rights, like when a mortgage lender forces you waive a right you can't actually waive, or car lenders that make you waive your bankruptcy rights, which, again, you can't waive:

https://www.consumerfinance.gov/about-us/newsroom/cfpb-warns-against-deception-in-contract-fine-print/

As Kuttner writes, the common thread running through all these orders is that they ban deceptive practices – they make it illegal for companies to steal from us by lying to us. Especially in these dying days of class action suits – rapidly becoming obsolete thanks to "mandatory arbitration waivers" that make you sign away your right to join a class action – agencies like the CFPB are our only hope of punishing companies that lie to us to steal from us.

There's a lot of bad stuff going on in the world right now, and much of it – including an active genocide – is coming from the Biden White House.

But there are people in the Biden Administration who care about the American people and who are effective and committed fighters who have our back. What's more, they're winning. That doesn't make all the bad news go away, but sometimes it feels good to take a moment and take the W.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/06/10/getting-things-done/#deliverism

#pluralistic#cfpb#consumer finance protection board#rohit chopra#scotus#bnpl#buy now pay later#repeat corporate offenders#fine print deception#whistleblowing#elizabeth warren

1K notes

·

View notes

Text

The FTC issued an order against NGL for violating the Children's Online Privacy Protection Act ("COPPA"), not KOSA. COPPA has been implemented for over a decade.

Just got the news: NGL has become the first app barred from minors by the FTC. While I do not use the app, I should say:

THIS IS ALL YOUR FAULT, KOSA!

#know your rights#there were other acts violated too but that's the one relevant to what youre saying here#also the FTC's capacity is limited#i would be checking your state's laws first#since there is a wave of child protection legislation that's moving significantly faster in state law than federal law

19 notes

·

View notes

Text

To talk about monopoly & antitrust, I want to start off with your first day in Econ 101, when you learn "how prices work". The toy model that nearly everyone learns as one of the first things ever is that classic supply-and-demand graph of price and quantity; you know it, I don't need to show it. And in relation to how firms set price in a market, the explanation you get is something like:

"In a world with perfect information, zero transaction costs, rational agents, and no barriers to entry, new firms and/or increased output will enter the market until marginal price equals marginal cost"

This (seemingly) portrays a model where new companies "entering the market" is how prices go down. Like say there are Firms A, B, and C, engaging in oligopolistic pricing for a normal good; what happens is some new Firm X (with the same production costs) emerges with the sole business strategy of "offer prices lower than them because they are skimming" and it drives everyone's prices down in a race to the bottom. That, in a sense, competition between identical firms drives the price equilibrium.

That isn't very true, not in practice and not even theoretically; the 101 stuff just sort of biases you to see it that way. Firm X above is being rational in one way but silly in others; why would it enter a market where its competitors are making healthy profits just to fuck that up, knowing it has no advantage they can't immediately replicate in response? And pay all the fixed costs other firms have already paid to make that 0.1% profit? In real life firms almost never do this, they compete over (actual or perceived) advantage or market segmentation. And it also means that - if all firms are truly the same in a market - cooperating on price, far from being aberrant behavior, is the natural thing to do. Why would I look at my rival firm and lower my price to "undercut" them, knowing that they 100% can just lower it too? We both lose, immediately. In practice, companies often set their prices by looking at the prices of competing firms and matching them!

Many things actually drive the price equilibrium of course, but one of the biggest - and most useful for our purposes - is the substitution effect. If companies defacto cooperate on prices all the time, why is the price not infinity? Well because if you are selling steaks and set the price to infinity, I'm not gonna buy it! I can just buy chicken, for me it's pretty much the same. And chicken is cheaper to make than steak. As a chicken firm, I totally can set my price under your steak and you can never, ever match it; that is a real advantage, one from asymmetries of production. The price of steak is driven by the need to compete with chicken much more than it is driven by the need to compete with "other steaks". And so on down a chain of a million desires and costs and needs.

So to wrap this around to antitrust, there is a common idea out there that monopolistic pricing is increasing from the past because if I look at different industries, so many of them today are consolidated into 2-3 big firms. Your grocery stores are all Giant or Safeway or w/e it is in your city, if you are buying a TV Samsung & LG are half the entire US market. How could these companies not collude on price? Of course they do, and they don't need explicit agreements that would violate extant FTC regulations to do it; they can just softly communicate and feel out cooperation. So you gotta break them up and change the rules so they can't do that.

The trap is thinking this is any different if it was 10 firms - it really isn't! Maybe marginally, sure, and if it was 2000 firms yeah okay the sheer chaos would probably create some price churn; but in the past prices were not driven down by the diversity of firms making price cooperation impossible. The long history of guilds, business associations, chambers of commerce, and so on shows that they had plenty of avenues for cooperation - and often did straight-up set prices. Meanwhile, when Wal-Mart, Target, Aldi, and others all cut prices at around the same time, they are not mainly competing with each other. If they were they would just mutually agree to not do that, without even saying anything! How stupid do you think they are? That isn't hard to do. Instead they are competing with Amazon; with boutique local stores; with restaurants; with the changing price of labor; with shifting consumer sentiment and expectations. The industry concentration doesn't matter.

Until it does of course! Because what is the substitution good for oil? They exist of course, but they ain't cheap; people will still buy gas at gigantic ranges of prices. Here, the fundamental structure of the market is monopolistic - and also a geopolitical clusterfuck, but let's not get into that. Producers openly rig prices sometimes, and antitrust actively regulates against it, and it is a hot mess of governments and companies and all that. Are people who hold patents engaging in monopoly pricing? Obviously, that is the point of patents! It is by design; but there are tons of arguments to be made around creeping exploitation of the IP system. Sometimes hundreds of firms in a dominant market niche will offer complex, bundled products where the price of each piece of obfuscated and the value is subjective, but consensus is you can't not buy the product or you will be screwed and since you can't tell what the product even is, let alone how valuable it is, you can't object when they set the price - I hear these are called "universities", but they go by other names in other sectors.

All of the above are something like "monopolies", which maybe are getting worse over time, but they are monopolies for different, product-specific reasons. I think there is a good deal of FTC work and other reforms that could be done in the US to identify areas where this kind of rent extraction is happening. But what it doesn't look like is opposing blanket industry consolidation. And in fact the correlation is honestly pretty weak. Because identical firm competition does not drive the price equilibrium.

#antitrust discourse#This is not a review of Biden's FTC policy - they are aware of this reality at least in part#This is obliquely a critique of Matt Stoller he is not aware of this

198 notes

·

View notes

Text

The Trump administration’s Federal Trade Commission has removed four years’ worth of business guidance blogs as of Tuesday morning, including important consumer protection information related to artificial intelligence and the agency’s landmark privacy lawsuits under former chair Lina Khan against companies like Amazon and Microsoft. More than 300 blogs were removed.

On the FTC’s website, the page hosting all of the agency’s business-related blogs and guidance no longer includes any information published during former president Joe Biden’s administration, current and former FTC employees, who spoke under anonymity for fear of retaliation, tell WIRED. These blogs contained advice from the FTC on how big tech companies could avoid violating consumer protection laws.

One now deleted blog, titled “Hey, Alexa! What are you doing with my data?” explains how, according to two FTC complaints, Amazon and its Ring security camera products allegedly leveraged sensitive consumer data to train the ecommerce giant’s algorithms. (Amazon disagreed with the FTC’s claims.) It also provided guidance for companies operating similar products and services. Another post titled “$20 million FTC settlement addresses Microsoft Xbox illegal collection of kids’ data: A game changer for COPPA compliance” instructs tech companies on how to abide by the Children’s Online Privacy Protection Act by using the 2023 Microsoft settlement as an example. The settlement followed allegations by the FTC that Microsoft obtained data from children using Xbox systems without the consent of their parents or guardians.

“In terms of the message to industry on what our compliance expectations were, which is in some ways the most important part of enforcement action, they are trying to just erase those from history,” a source familiar tells WIRED.

Another removed FTC blog titled “The Luring Test: AI and the engineering of consumer trust” outlines how businesses could avoid creating chatbots that violate the FTC Act’s rules against unfair or deceptive products. This blog won an award in 2023 for “excellent descriptions of artificial intelligence.”

The Trump administration has received broad support from the tech industry. Big tech companies like Amazon and Meta, as well as tech entrepreneurs like OpenAI CEO Sam Altman, all donated to Trump’s inauguration fund. Other Silicon Valley leaders, like Elon Musk and David Sacks, are officially advising the administration. Musk’s so-called Department of Government Efficiency (DOGE) employs technologists sourced from Musk’s tech companies. And already, federal agencies like the General Services Administration have started to roll out AI products like GSAi, a general-purpose government chatbot.

The FTC did not immediately respond to a request for comment from WIRED.

Removing blogs raises serious compliance concerns under the Federal Records Act and the Open Government Data Act, one former FTC official tells WIRED. During the Biden administration, FTC leadership would place “warning” labels above previous administrations’ public decisions it no longer agreed with, the source said, fearing that removal would violate the law.

Since President Donald Trump designated Andrew Ferguson to replace Khan as FTC chair in January, the Republican regulator has vowed to leverage his authority to go after big tech companies. Unlike Khan, however, Ferguson’s criticisms center around the Republican party’s long-standing allegations that social media platforms, like Facebook and Instagram, censor conservative speech online. Before being selected as chair, Ferguson told Trump that his vision for the agency also included rolling back Biden-era regulations on artificial intelligence and tougher merger standards, The New York Times reported in December.

In an interview with CNBC last week, Ferguson argued that content moderation could equate to an antitrust violation. “If companies are degrading their product quality by kicking people off because they hold particular views, that could be an indication that there's a competition problem,” he said.

Sources speaking with WIRED on Tuesday claimed that tech companies are the only groups who benefit from the removal of these blogs.

“They are talking a big game on censorship. But at the end of the day, the thing that really hits these companies’ bottom line is what data they can collect, how they can use that data, whether they can train their AI models on that data, and if this administration is planning to take the foot off the gas there while stepping up its work on censorship,” the source familiar alleges. “I think that's a change big tech would be very happy with.”

77 notes

·

View notes

Text

In a press release, the FTC said that "Ring deceived its customers by failing to restrict employees' and contractors' access to its customers' videos, using customer videos to train algorithms, among other purposes, without consent, and failing to implement security safeguards." In one case, an employee "viewed thousands of video recordings belonging to female users of Ring cameras that surveilled intimate spaces in their homes such as their bathrooms or bedrooms," the FTC said.

That allegedly occurred between June and August 2017 and invaded the privacy of at least 81 female users of Ring products. "The employee wasn't stopped until another employee discovered the misconduct. Even after Ring imposed restrictions on who could access customers' videos, the company wasn't able to determine how many other employees inappropriately accessed private videos because Ring failed to implement basic measures to monitor and detect employees' video access," the FTC said.

...

Amazon completed its purchase of Ring in April 2018. The FTC complaint says that in August 2020, "a whistleblower notified Ring that between March 2018 and September 2019, a former employee had provided Ring devices to numerous individuals and then accessed their videos without their knowledge or consent."

The complaint continued: When the employee left Ring in September 2019, the whistleblower alleged that he took copies of these videos with him—without the knowledge or consent of his unsuspecting victims and without Ring noticing that anything was amiss. In February 2019, Ring changed its access practices so that most Ring employees or contractors could only access a customer's private video with that customer's consent.

"Importantly, because Ring failed to implement basic measures to monitor and detect inappropriate access before February 2019, Ring has no idea how many instances of inappropriate access to customers' sensitive video data actually occurred," the FTC said. "Indeed, Ring only discovered the incidents described above through the good fortune of employee reporting, despite having given employees zero security training and no responsibility to engage in such reporting. It is highly likely that numerous other incidents of spying, prurient behavior, and other inappropriate access occurred entirely undetected."

(emphasis is mine)

1K notes

·

View notes

Text

Made in the USA: Wage Theft, Fraud and Hidden Sweatshops

Unrolled twitter thread by derek guy (@dieworkwear)

4 Oct 24 • Read on X

ALT enabled on all images. Video has closed captions but is not transcribed.

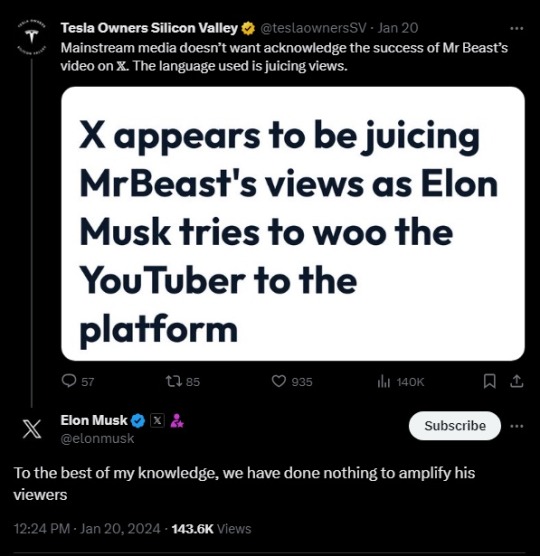

Not trying to create a pile-on here. But let's talk about why something might still be made in unethical conditions even though it bears a "made in USA" tag. 🧵

The first thing to understand is that not all workers are covered by US labor laws. You might assume that workers get paid a minimum wage (after all, it says "minimum"). In fact, many garment workers in the US toil under what's known as the piecework system.

Piecework means you get paid not by the amount of time you work but the number of operations you complete. This system should be familiar to many of you. As a writer, I get paid per word. The pay is the same whether it takes me 100 or 10 hours to write a 1,000 word article.

My situation is fine bc I get paid enough to eat. But for a garment worker, the pay structure can be peanuts: three cents to sew a zipper or sleeve, five cents for a collar, and seven cents to prepare the top part of a skirt. These are real numbers for LA-based garment workers.

Piecework is how companies skirt minimum wage laws. Among labor organizers, the term "wage theft" refers to the difference between what a worker should have earned under min wage laws and what they actually earned through the piece rate system.

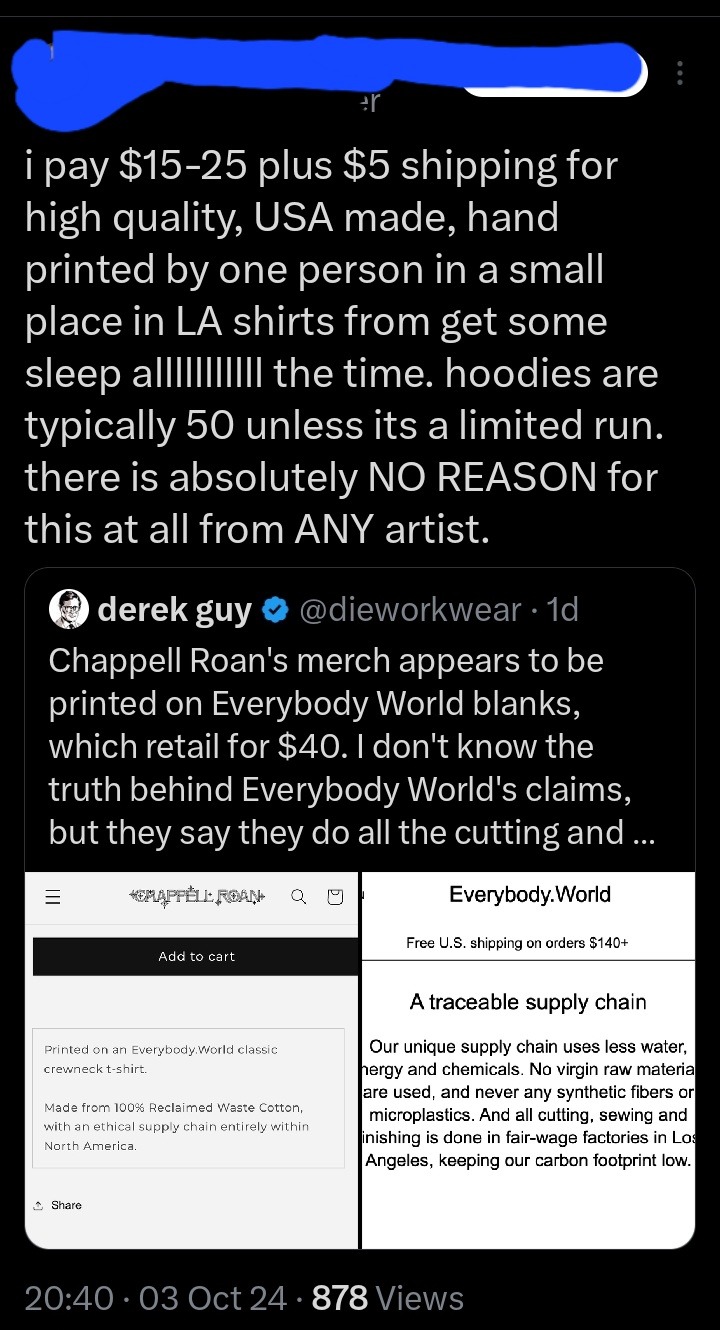

This system is incredibly common. A 2016 UCLA Labor Center study showed the median piece-rate worker in Los Angeles scrapes together $5.15 per hour—less than half the state’s mandated minimum wage. Labor conditions are also very bad: poor ventilation, dusty air, rats and mice.

A Federal Department of Labor investigation the same year found that 85 percent of Los Angeles garment factories were breaking labor laws. In 2016, these violations amounted to $1.3 million in back wages owed to 865 workers in a sample of 77 factories. This is wage theft.

In 2021, labor organizers won a fight to get piecework banned in California. But two years later, it's still incredibly common. I interviewed an LA-based garment worker who toils 12 hrs a day for $50. She sleeps in the corner of a kitchen. From my article in The Nation:

Currently, there's a new fight get piecework banned nationwide through the FABRC Act. I would link, but Twitter throttles threads that have outbound links, so I would prefer if you Google how you can support this legislation. Or follow @GarmentWorkerLA for more info.

The other reason why a "made in USA" tag may not mean much has to do with how the label is applied.

When you see this label inside your garment, what do you assume? Think about this before moving on to the next tweet.

The Federal Trade Commission has pretty strict rules on who gets to apply that label. For clothes, the item has to be cut and sewn in the US using materials that were made in the US. The FTC tries to match its rules with the common understanding of what "made in US" means.

If you're a giant company like Levi's or LL Bean, you may have lawyers who are advising you on these rules. This is why you see labels like "imported," which means the item was made abroad. Or "made in the US from imported materials" when they can't meet the MiUSA standard.

But it's incredibly common for companies to violate FTC rules. In 2022, the FTC fined the pro-Trump brand Lions Not Sheep $211k for labeling their t-shirts "made in USA" when the shirts were actually imported from China and other countries.

The company was basically importing blanks from China, ripping out the "made in China" label, screen printing the shirt in the US, and then applying a new screen-printed "made in US" label. CEO Sean Whalen claimed he was being persecuted for his pro-Trump views.

But the whole thing started bc Whalen made a video about how his customers are price sensitive, so he imports blanks from China. That's what kicked off the FTC investigation. So while this mislabeling is common, it's hard to get caught unless you make a video about your crimes.

The truth is that making a t-shirt in the USA according to FTC standards will result in a relatively expensive garment. Heddels and Velva Sheen both produce shirts in the US from US grown cotton. The first is $26; second is $90 for a two-pack.

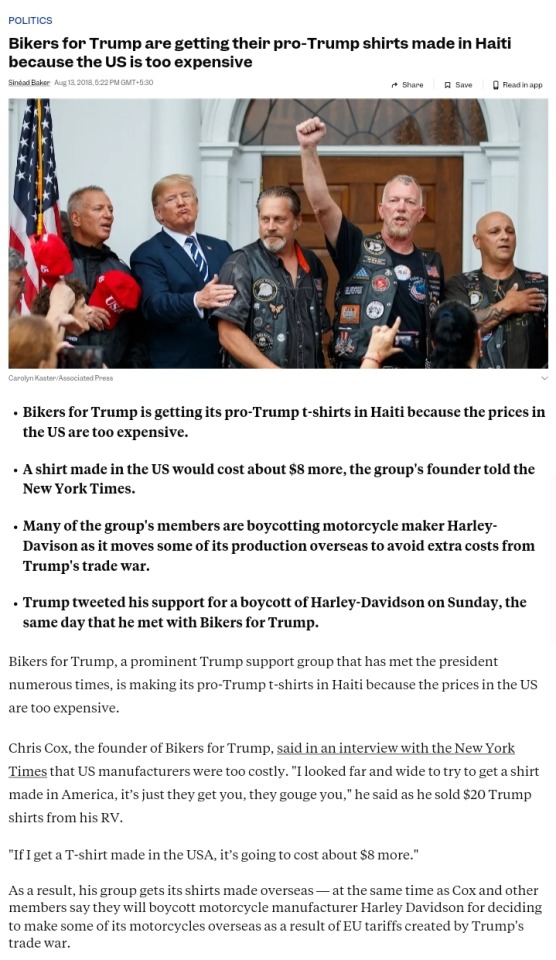

Once you add things such as screenprinting—or if you want a more unique cut and not just basic blanks—the costs go up. This is why Bikers for Trump sourced their merch from Haiti. They knew their customers would not pay an extra $8 for true made-in-USA production.

Today, there are countless companies that make merch for other organizations. They source their t-shirts from a variety of places—some made in the US, most not—and then screenprint a design and fulfill orders. This way, the other org doesn't have to do any work but marketing.

When you see a screenprinted t-shirt for $20, ask yourself: Where was the material grown? Where were the yarns spun? Where was the cutting, sewing, and finishing performed? Where was the screenprinted done? What were the wages and labor conditions along these steps?

I'm not a nationalist, so I don't prioritize American jobs over foreign ones. But I do care about fair wages and labor protections. Just because something was made abroad doesn't mean it was made in a sweatshop. Just because it was made in the US doesn't mean fair wages.

Paying more for a garment is also no guarantee of ethical manufacturing. But when the price of a garment is so low, you leave little on the table for workers. Just because you see a $20 t-shirt that says "made in USA" doesn't mean it was made fairly.

Please don't harass the person who posted that original tweet. My intention is not to cause harm or stress for anyone. Only to help shed light on what goes into garment manufacturing, fair labor, and labeling. Hopefully, you will consider these issues when shopping.

For the inevitable question: "How do I make sure my clothes were made ethically?" This is very difficult to answer in a thread. My simplest answer is that we should elect pro-worker politicians, fight for pro-labor laws, and empower unions so workers can advocate for themselves.

--------------------End----------------------

TL; DR: Doesn't matter if it's the US, if it's not union it's probably a sweatshop. And not all merch is priced high because of fair labour conditions (looking at Taylor Swift and Beyoncé). Look for supply chain transparency.

#sweatshops#fashion#american sweatshop#chappell roan merch#sweatshirt#chappell roan#merchandise#made in usa#garment industry#fast fashion#worker rights#labour rights#labour unions#capitalism#worker exploitation#us politics#us law#knee of huss

133 notes

·

View notes

Text

More of Trump's descent into dictatorship

Two illegal firings that will increase prices for consumers and concentrate more power in Trump's hands — unless the courts stop him.

ROBERT REICH

MAR 19

Friends,

I would not impose on you for a third time today unless it was particularly urgent.

This afternoon, Trump illegally fired the two Democratic commissioners on the five-member Federal Trade Commission — Rebecca Kelly Slaughter and Alvaro Bedoya.

Commissioner Slaughter had this to say:

"The President illegally fired me from my position as a Federal Trade Commissioner, violating the plain language of a statute and clear Supreme Court precedent."

Commissioner Bedoya said this:

I’m a commissioner at the Federal Trade Commission. The president just illegally fired me. The FTC is an independent agency founded 111 years ago to fight fraudsters and monopolists. Our staff is unafraid of the Martin Shkrelis and Jeff Bezos of the world. They take them to court and they win. Now, the president wants the FTC to be a lapdog for his golfing buddies. Together with Chair Lina Khan and Commissioner Rebecca Slaughter, I spent my time at the FTC fighting for small town grocers and pharmacists and for people in Indian country going hungry because food was too expensive. I fought for workers getting screwed on pay and benefits and overtime. I fought for their right to organize. I fought tech companies who think they can track you and your kids every hour of every day so they can pocket their next billion. Whether you’re a Republican or a Democrat or someone who’s so disgusted with Washington you can barely watch the news, the FTC has worked for you. Who will Trump’s FTC work for? Will it work for the billionaires? Or will it work for you? It was an honor to serve my country at the FTC. It was an honor to work alongside its staff. And to everyone who is watching all of this unfold, don’t be scared. Fight back.

***

The FTC enforces consumer protection and antitrust laws, and has had a bipartisan structure where no more than three of the five commissioners can come from the same party.

I have no doubt that one result of Trump’s illegal firings today will be higher prices for American consumers because the FTC cop is now off the beat.

In the 1976, President Carter appointed me to run the FTC’s policy team, which advised the commissioners on which corporations were committing the most heinous frauds and were the worst monopolists. I had the honor of doing that for four years. We saved American consumers a huge amount of money.

Trump’s actions today also pose a direct challenge to settled law. Congress established the Federal Trade Commission as an independent commission in 1914, and gave each of the FTC’s five commissioners a fixed term of office and protection from being fired by a president.

In 1935, in a case entitled Humphrey’s Executor vs. the United States, the Supreme Court upheld the law protecting FTC commissioners from being fired by a president.

President Herbert Hoover had appointed and the Senate had confirmed William E. Humphrey to be a commissioner of the Federal Trade Commission. In 1933, President Franklin D. Roosevelt asked for Humphrey's resignation because Humphrey was a conservative, and was hobbling many of Roosevelt's New Deal policies.

When Humphrey refused to resign, Roosevelt fired him. But the FTC Act only allows a president to remove a commissioner for "inefficiency, neglect of duty, or malfeasance in office." (Since Humphrey died shortly after being dismissed, his executor sued to recover Humphrey's lost salary.)

A unanimous Supreme Court found that the FTC Act was constitutional and that Humphrey's dismissal on policy grounds was unjustified. The Court reasoned that the Constitution had never given "illimitable power of removal" to the president.

The Court rejected the government's main argument, which relied on the Supreme Court's prior decision in Myers v. United States (1926). In that case the Court had upheld the president's right to remove officers who were "units of the executive department."

But in Humphrey’s Executor, the Court ruled that the FTC was different because it was a body created by Congress to perform quasi-legislative and judicial functions. The Myers precedent, therefore, did not apply.

Until Trump’s blatant move today, the Humphrey’s ruling had shielded independent, bipartisan multi-member agencies from direct control by the White House.

Commissioners Rebecca Kelly Slaughter and Alvaro Bedoya are appealing their firings by Trump. I expect their cases will find their way to the Supreme Court, where a few justices may want to overrule Humphrey’s Executor. My betting is that most justices will abide by this precedent. Then the question becomes whether Trump will abide by the Supreme Court.

Trump’s descent into dictatorship continues unabated. The losers today are not only American consumers. They are all of us who care about American democracy.

42 notes

·

View notes

Text

UnitedHealth, Cigna, CVS sue FTC over insulin litigation process | Healthcare Dive

CVS, Cigna and UnitedHealth are suing the Federal Trade Commission in a bid to block the agency’s lawsuit against their pharmacy benefit managers for allegedly inflating U.S. insulin prices.

The three companies are claiming the FTC’s suit is unconstitutional because it was lodged in the agency’s administrative court instead of a federal court, violating their right to due process under the Fifth Amendment.

The FTC slammed the move as a tactic to distract from the allegations against the PBMs.

89 notes

·

View notes

Text

Living online means never quite understanding what’s happening to you at a given moment. Why these search results? Why this product recommendation? There is a feeling—often warranted, sometimes conspiracy-minded—that we are constantly manipulated by platforms and websites.

So-called dark patterns, deceptive bits of web design that can trick people into certain choices online, make it harder to unsubscribe from a scammy or unwanted newsletter; they nudge us into purchases. Algorithms optimized for engagement shape what we see on social media and can goad us into participation by showing us things that are likely to provoke strong emotional responses. But although we know that all of this is happening in aggregate, it’s hard to know specifically how large technology companies exert their influence over our lives.

This week, Wired published a story by the former FTC attorney Megan Gray that illustrates the dynamic in a nutshell. The op-ed argued that Google alters user searches to include more lucrative keywords. For example, Google is said to surreptitiously replace a query for “children’s clothing” with “NIKOLAI-brand kidswear” on the back end in order to direct users to lucrative shopping links on the results page. It’s an alarming allegation, and Ned Adriance, a spokesperson for Google, told me that it’s “flat-out false.” Gray, who is also a former vice president of the Google Search competitor DuckDuckGo, had seemingly misinterpreted a chart that was briefly presented during the company’s ongoing U.S. et al v. Google trial, in which the company is defending itself against charges that it violated federal antitrust law. (That chart, according to Adriance, represents a “phrase match” feature that the company uses for its ads product; “Google does not delete queries and replace them with ones that monetize better as the opinion piece suggests, and the organic results you see in Search are not affected by our ads systems,” he said.)

Gray told me, “I stand by my larger point—the Google Search team and Google ad team worked together to secretly boost commercial queries, which triggered more ads and thus revenue. Google isn’t contesting this, as far as I know.” In a statement, Chelsea Russo, another Google spokesperson, reiterated that the company’s products do not work this way and cited testimony from Google VP Jerry Dischler that “the organic team does not take data from the ads team in order to affect its ranking and affect its result.” Wired did not respond to a request for comment. Last night, the publication removed the story from its website, noting that it does not meet Wired’s editorial standards.

It’s hard to know what to make of these competing statements. Gray’s specific facts may be wrong, but the broader concerns about Google’s business—that it makes monetization decisions that could lead the product to feel less useful or enjoyable—form the heart of the government’s case against the company. None of this is easy to untangle in plain English—in fact, that’s the whole point of the trial. For most of us, evidence about Big Tech’s products tends to be anecdotal or fuzzy—more vibes-based than factual. Google may not be altering billions of queries in the manner that the Wired story suggests, but the company is constantly tweaking and ranking what we see, while injecting ads and proprietary widgets into our feed, thereby altering our experience. And so we end up saying that Google Search is less useful now or that shopping on Amazon has gotten worse. These tools are so embedded in our lives that we feel acutely that something is off, even if we can’t put our finger on the technical problem.

That’s changing. In the past month, thanks to a series of antitrust actions on behalf of the federal government, hard evidence of the ways that Silicon Valley’s biggest companies are wielding their influence is trickling out. Google’s trial is under way, and while the tech giant is trying to keep testimony locked down, the past four weeks have helped illustrate—via internal company documents and slide decks like the one cited by Wired—how Google has used its war chest to broker deals and dominate the search market. Perhaps the specifics of Gray’s essay were off, but we have learned, for instance, how company executives considered adjusting Google’s products to lead to more “monetizable queries.” And just last week, the Federal Trade Commission filed a lawsuit against Amazon alleging anticompetitive practices. (Amazon has called the suit “misguided.”)

Filings related to that suit have delivered a staggering revelation concerning a secretive Amazon algorithm code-named Project Nessie. The particulars of Nessie were heavily redacted in the public complaint, but this week The Wall Street Journal revealed details of the program. According to the unredacted complaint, a copy of which I have also viewed, Nessie—which is no longer in use—monitored industry prices of specific goods to determine whether competitors were algorithmically matching Amazon’s prices. In the event that competitors were, Nessie would exploit this by systematically raising prices on goods across Amazon, encouraging its competitors to follow suit. Amazon, via the algorithm, knew that it would be able to charge more on its own site, because it didn’t have to worry about being undercut elsewhere, thereby making the broader online shopping experience worse for everyone. An Amazon spokesperson told the Journal that the FTC is mischaracterizing the tool, and suggested that Nessie was a way to monitor competitor pricing and keep price-matching algorithms from dropping prices to unsustainable levels (the company did not respond to my request for comment).

In the FTC’s telling, Project Nessie demonstrates the sheer scope of Amazon’s power in online markets. The project arguably amounted to a form of unilateral price fixing, where Amazon essentially goaded its competitors into acting like cartel members without even knowing they’d done so—all while raising prices on consumers. It’s an astonishing form of influence, powered by behind-the-scenes technology.

The government will need to prove whether this type of algorithmic influence is illegal. But even putting legality aside, Project Nessie is a sterling example of the way that Big Tech has supercharged capitalistic tendencies and manipulated markets in unnatural and opaque ways. It demonstrates the muscle that a company can throw around when it has consolidated its position in a given sector. The complaint alleges that Amazon’s reach and logistics capabilities force third-party sellers to offer products on Amazon and for lower prices than other retailers. Once it captured a significant share of the retail market, Amazon was allegedly able to use algorithmic tools such as Nessie to drive prices up for specific products, boosting revenues and manipulating competitors.

Reading about Project Nessie, I was surprised to feel a sense of relief. In recent years, customer-satisfaction ratings have dipped among Amazon shoppers who have cited delivery disruptions, an explosion of third-party sellers, and poor-quality products as reasons for frustration. In my own life and among friends and relatives, there has been a growing feeling that shopping on the platform has become a slog, with fewer deals and far more junk to sift through. Again, these feelings tend to occupy vibe territory: Amazon’s bigness seems stifling or grating in ways that aren’t always easy to explain. But Nessie offers a partial explanation for this frustration, as do revelations about Google’s various product adjustments. We have the sense that we’re being manipulated because, well, we are. It’s a bit like feeling vaguely sick, going to the doctor, and receiving a blood-test result confirming that, yes, the malaise you experienced is actually an iron deficiency. It is the catharsis of, at long last, receiving a diagnosis.

This is the true power of the surge in anti-monopoly litigation. (According to experts in the field, September was “the most extraordinary month they have ever seen in antitrust.”) Whether or not any of these lawsuits results in corporate breakups or lasting change, they are, effectively, an MRI of our sprawling digital economy—a forensic look at what these larger-than-life technology companies are really doing, and how they are exerting their influence and causing damage. It is confirmation that what so many of us have felt—that the platforms dictating our online experiences are behaving unnaturally and manipulatively—is not merely a paranoid delusion, but the effect of an asymmetrical relationship between the giants of scale and us, the users.

In recent years, it’s been harder to love the internet, a miracle of connectivity that feels ever more bloated, stagnant, commercialized, and junkified. We are just now starting to understand the specifics of this transformation—the true influence of Silicon Valley’s vise grip on our lives. It turns out that the slow rot we might feel isn’t just in our heads, after all.

212 notes

·

View notes

Text

I'm still on my advertising in magical spaces shit, so here's an important follow-up:

If you're going to advertise the sale of your products or services in any market, you should have at least a passable knowledge of advertising laws in your country (or state, as may be applicable). You should know about the regulatory bodies that oversee business and advertisement where you live.

In the US, for example, this means knowing about the FTC Act. This is a set of laws allowing the Fair Trade Commission (FTC) to regulate advertisement, endorsements, credential claims, and more on a national level. There's also the Better Business Bureau (BBB) and each state's Attorney General office. The BBB has offices all over the place, and they mostly deal with individual complaints. State Attorney Generals deal with a range of issues, from scams to employee rights violations to investment fraud to corruption to unfair online services and more. Check out your state's AG website -- the stuff they cover might honestly surprise you.

In any case, being purposefully deceptive and unfair in your advertising can get you into serious hot water. Get enough complaints or cause enough damage to someone, and you can be smacked with cease and desist orders or even fines.

You should have, at the very least, an understanding of what it means for an advertisement to be deceptive and unfair. This FAQ from the FTC is a great starting place to learn about these terms and to see some examples. This article about international e-commerce, also from the FTC, is a must-read if you're going to sell online.

Beyond that, you should look into your particular state's (or county's or even city's/town's, sometimes) laws about the sale of metaphysical goods and services. For example, in New York State, fortune-telling is illegal! I'm required to state that my divination services are for entertainment purposes only, because it isn't illegal to entertain -- just to claim to tell the future for money. These laws differ depending on where you live, so look into your local laws before setting up shop.

(And that's not even getting into business licenses and registering with a tax ID... but that's another topic, lmao.)

Basically, you need to know how you're allowed to advertise whatever it is you're selling. You can't just say shit, you know? There are rules about this stuff, and for good reason. Consumers should be protected from charlatans, scammers, and unfair business practices. The system sucks, but if we're going to have to operate inside it, regulations like the FTC Act and other fairness-related laws are important to have to keep businesses from exploiting consumers any more than they already do.

Now, it's important to note that a business can (seemingly) be following all of these rules and still end up being a scam! The number one way to verify the information found in an advertisement of a small business is to contact the seller.

If you can't easily find their contact information, if you have to jump through hoops to talk to a real person, or if they refuse to give you details about the product or service they're advertising, it's likely a scam, and you've dodged a bullet.

A reputable business, particularly a small one run by one person or a handful of people, should be more than happy to discuss details and terms with a prospective buyer. If they aren't, even if they're legitimate, why the fuck would you want to give your money to someone who doesn't respect you enough to take your concerns seriously??

Anyways, learn the basics of advertising law if you're gonna sell witchy shit on the internet or elsewhere. And frankly, learn the basics anyways so you can spot bullshit artists more easily.

#aese speaks#witchcraft#witchblr#advertising#advertising in witchy spaces#ok ok ok ok i think i'm done ranting about advertising now#.................for now.

36 notes

·

View notes