#financing and reforms

Explore tagged Tumblr posts

Text

(1st plenary meeting) Preparatory Committee for the Fourth International Conference on Financing for Development, Third Session.

Opening of the session: Co-Chairs of the Preparatory Committee; Deputy Secretary-General (pre-recorded video); Representative of the host country of the Conference (Spain); Representative of Mexico

Adoption of the agenda and other organizational matters

Preparations for the Conference: Organizational and procedural preparations

Presentation of the zero draft outcome document of the Conference

Ministerial scene-setter

The Fourth International Conference on Financing for Development (FfD4) will take place in Seville, Spain from 30 June to 3 July, 2025. The Conference will address new and emerging issues, and the urgent need to fully implement the Sustainable Development Goals, and support reform of the international financial architecture.

FfD4 will assess the progress made in the implementation of the Monterrey Consensus, the Doha Declaration and the Addis Ababa

Related Documents

Third Preparatory Committee Session for FfD4 website

Proposed organization of work of the third session of the Preparatory Committee

The Third Session of the Preparatory Committee for the Fourth International Conference on Financing for Development will be held at the United Nations Headquarters in New York from 10 to 14 February 2025.

(1st plenary meeting) Preparatory Committee for the Fourth International Conference on Financing for Development, Third Session!

#inclusive finance#global financial systems.#financing and reforms#public and private finances#coordinated financial support#financing for development#sustainable development goals#United Nations Headquarters#Preparatory Committee#united nations general assmbly#unga79#FfD4#agenda 2030#new and emerging issues

0 notes

Text

STUPID POLITICAL IDEAS I HAVE HAD #3

Total financial transparency. Any purchase or transfer of over $1000 is logged and posted publicly as it happens, searchable by spender and recipient. We can carve out some exceptions (stuff that would be covered by HIPAA, etc) but most of it is just out there. Find out what your coworkers are making, what your elected officials are spending their money on, where all that money is coming from, who’s buying crypto and who’s withdrawing interesting amounts of cash. Make financial crime much, much easier to prosecute and tax avoidance more difficult. Make conspicuous consumption redundant. As long as we’re stuck with the panopticon we might as well democratize it.

#stupid political ideas I have had#universal campaign finance reform#we would need to hire a few database admins to pull this off#I suggest nationalizing google

538 notes

·

View notes

Note

What do you think would have happened if (somehow, idk how but somehow) Machete rose to the rank of pope?

To be perfectly honest? I think most realistically he would've ruled maybe six months at best and then keeled over from stress and exhaustion.

#seriously he wouldn't want to be the pope papacy is for chumps but if he had to#he would've kicked out so many cardinals#his former colleagues riddled with corruption nepotism incompetence and moral decay#it would've upsetted so many elite families but what are they gonna do#pope's power is absolute he could totally do that#just excommunicate the whole lot#do something to get Holy See's finances in order he's been crunching numbers they aren't looking good#build sturdier foreign relations probably he's a diplomat I think he'd likely be extremely done with superfluous wars and useless bickering#maybe commission some extravagant artworks art is nice he knows to appreciate beauty when he sees it#become the senselessly rich patron to a handful of top notch artists although I think he already does that in canon timeline#I'm not sure how he'd handle the ongoing counter-reformation I guess it depends whether this was before or after the inquisition times#minimal public appearances because lord that's way too many people too many eyes being a figurehead is not his strongest suit#develop stomach ulcers get sepsis#historically it's actually not very uncommon for popes to expire relatively quickly after they're elected#they don't even have to be particularly old stuff's just tiring they get frazzled out#answered#anonymous#Machete

230 notes

·

View notes

Text

Well… riot games is next in line with a huge layoff.

Massive amount of people losing their jobs in the gaming industry yet again. Over 500 from what I’ve read. What a fucking shame.

Just frightening to see how this industry is crumbling (especially if you’re trying to get a job in it like me. Feels hopeless at this point also) 😔

#we really need some sort of finances reform for the entertainment industry#the way investors have an iron grip on these industries is a catastrophe at this point#also this feeling of a completely messed up hierarchy dynamic like the upper line has absolute power and just mows over their workers

55 notes

·

View notes

Text

Changes to the Tax Collection System in Revolutionary and Napoleonic France

My translation from Le prix de la gloire: Napoléon et l’argent by Pierre Branda.

This part is specifically about the reforms made to the tax collection system. Problems with taxation had been the source of many woes, so it went through major changes.

“The [tax] work of the Consulate mainly concerned the reorganization of tax collection. Until now, this essential element was not administered directly by the Ministry of Finance. The Constituent Assembly had wanted the tax rolls for direct contributions, that is to say the ‘tax slips’, to be established by municipal administrations. Their work was complex, because each year it was necessary to draw up a list of taxpayers, determine each person’s share of tax and send them the amount of the contribution to pay. Poorly motivated (or even corrupt), the municipalities had put little care in the execution of their mission since a large part of the taxpayers had not yet received anything for their taxes of year VIII, or even of year VII or year VI. Also, with two or three years of delay in preparing the rolls, it was not surprising that tax revenues were low (nearly 400 million francs were thus left outstanding). If the sending of tax matrices left something to be desired, the collection of direct contributions was hardly better. The tax collector was also not an agent of the administration: this function was assigned to any person who agreed to collect taxes with the lowest possible commission (otherwise called ‘collecte à la moins-dite’). With such a system, there were numerous inadequacies, often due to incompetence, but also due to the prevailing spirit of fraud. However, in their defense, the profits of the collectors were most of the time too low to provide such a service; also, to compensate for their losses, they were ‘forced’ to multiply small and big cheats. In any case, in such a troubled period, letting simple individuals carry out such a delicate mission could only be dangerous for the regularity of public accounts. In short, the mode of operation of taxation that Bonaparte and Gaudin inherited was failing on all sides and threatened to sink the State.”

“One month after Gaudin’s appointment, on December 13, 1799, the Directorate of Direct Contributions was created with the mission of establishing and sending tax matrices. This administration, dependent on the Ministry of Finance, was made up of a general director, 99 departmental directors and 840 inspectors and controllers. The organization of direct contributions became both centralized and pyramidal, the opposite of the previous system, decentralized and with a confused hierarchy. The work of preparing the rolls, for so long entrusted to local authorities, passed entirely ‘in the hands of the Minister of Finance’ and in this way the taxpayer found himself in direct contact with the administration. The tax system no longer having any obstacles, the beneficial effects of such a measure did not take long to be felt. With ardor, the agents of this new administration carried out considerable work: three series of rolls, that is to say more than one hundred thousand tax slips, were established in a single year. It must be said that the ministry had not skimped on their pay (6,000 francs per year for a director, 4,000 for an inspector and 1,800 for a controller), which was undoubtedly not unrelated to such success.”

“Tax reform was slower. It was not until 1804 that all tax collectors were civil servants. The consular system gradually replaced the collectors of the departments, then of the main cities and finally of all the municipalities whose tax rolls exceeded 15,000 francs. At the end of the Consulate, the entire tax administration was thus entirely dependent on the central government. Subsequently, the one in charge of indirect contributions (taxes on tobacco, alcohol or salt) created on February 25, 1804 and called the Régie des droits réunis was built on the same pyramidal and centralized model. It was the same later for customs.”

“According to Michel Bruguière, historian of public finances, ‘Napoleon and Gaudin can be considered the builders of the French tax administration. [...] They had also developed and codified the essential principles of our tax law, so profoundly derogatory from the rules of French law, since the taxpayer has nothing to do with it, while the administration has all the powers’. Basically, after having clearly understood the true cause of the ‘financial wound’, Bonaparte wanted an effective, almost ‘despotic’ instrument to avoid experiencing the unfortunate fate of his predecessors. As a good soldier, he created a fiscal ‘army’ responsible for providing the regime with the sinews of war. It was also necessary to definitively break the link between private interests and state service in everything that concerned public revenue. The time of the farmer generals of the Ancien Régime or the ‘second-hand’ collectors of the Directory was well and truly over. Napoleon Bonaparte, with his fierce desire to centralize power in this area as in many others, undoubtedly gave his regime the means to last.”

French:

Page 208

Page 209

Page 210

#Le prix de la gloire: Napoléon et l’argent#Le prix de la gloire#Napoléon et l’argent#napoleon#napoleonic era#napoleonic#napoleon bonaparte#19th century#first french empire#1800s#french empire#france#history#reforms#finance#economics#french revolution#frev#la révolution française#révolution française#Gaudin#tax#tax collection system#taxation#law#napoleonic code#source#french history#branda#Pierre branda

36 notes

·

View notes

Text

I’m sorry but the best Jon Snow AUs are those where he is some sort of civil servant. I always see people headcannon him as ROTC/soldier or cop but I think they kind of miss the mark. GRRM has steadily been moving away from the traditional warrior archetype with Jon and more into the counts-pebbles ruler type. So the cannon compliant AUs are the ones where he ends up as some sort of government official. Maybe he could be a city hall manager or an ombudsman. He could be a state representative or maybe even a senator. Let me remind people that he’s the only elected leader in the series. AU!Jon Snow would totally be the extremely competent but also extremely depressed congressional representative from like, idk, Alaska.

#jon snow#asoiaf#Not to discount Jon’s arc as a warrior#Maybe modern day Jon served in the army for a bit then turned to politics#Army makes more sense than him being a cop because he’s all about#Defending the realm’s freedom RAAAHHH 🦅🦅#Or that’s what he thought it would be like…#I could also see him being a progressive - not just a democrat#But he’d be the guy who’s always annoying and insistent#About the pressing need for extensive governmental reform#He’s extremely popular with his constituents but congress hates him lmaooo#He’d be the guy obsessing over govt corruption and reforming the country’s finances#You know a cool modern au idea for Jonathan?#FBI director - he does counter terrorism#OR MAYBE!!!#Secretary of State - cause of diplomacy stuff which he’s good at idk#He serves for a bit but is then ousted in a nasty coup after a particularly messy election#But he has a sort of cult like following with younger voters#So he stages a major comeback and becomes president ajsnaknaba#He signs a bunch of revolutionary but much needed executive orders#And is assassinated like two years into his term 😭#And goes down a polarizing figure - to some a martyr to others a nuisance#Someone write this down!

94 notes

·

View notes

Text

youtube

“We created these problems, we can solve these problems.” -Doris Kearns Goodwin

youtube

Jon Stewart on Never Ending Elections with Doris Kearns Goodwin and Eugene Daniels

“The idea that this vetting process is somehow getting us closer to more competent and better leadership is nonsense and insane. And we have created an electoral campaign system that does the opposite.” On this week’s episode Jon Stewart is joined by Doris Kearns Goodwin and Eugene Daniels.

youtube

Biden Is Out, Harris Is In with Jon Stewart, Doris Kearns Goodwin & Eugene Daniels

In the turbulent month since President Biden’s disastrous debate performance, the media has been speculating as to whether it was probable, or even possible, for him to drop out of the race. Turns out, it was both. In light of Biden’s historic decision, how effectively did the media guide the public through the election chaos? This week, helping us to contextualize the moment and understand the challenges in covering it, Jon Stewart is joined by Doris Kearns Goodwin, presidential historian and author of whose most recent book is An Unfinished Love Story: A Personal History of the 1960s, as well as Eugene Daniels, POLITICO White House correspondent and Playbook co-author. Together, they examine the flaws in our electoral process and media coverage, offer some possible fixes, and provide facts —not speculation — about what to expect in the weeks ahead.

#jon stewart#bearded jon#the jon stewart show#the daily show with jon stewart#the colbert report#the late show with stephen colbert#the problem with jon stewart#the weekly show with jon stewart#doris kearns goodwin#eugene daniels#indecision 2024#joe biden#kamala harris#elections#campaigning#primaries#campaign finance reform#voting#our long ass campaign season#seriously what the fuck#this could be done in 1-2 months#psa to fucking vote#interview#discussion#short#videos

5 notes

·

View notes

Text

It's very easy to buy the US government.

Some have said that blaming the complicity of the US govern on the Israel lobby is an "antisemitic conspiracy" (even though the campaign donations are plain for everyone to see & no one said anything about equating them with all Jews - indeed many of the lobbyist are evangelical Christians... who seem to care precious little about the Christian Palestinian minority.)

So I want to stress the following:

This isn't unique to Israel AT ALL.

Money in politics, lobbying & corruption has been a mounting problem in the US (and to a lesser extent, but still very significant extent, other western countries)

US Politicians are, frankly, easily bought. Biden's bought by Israel, the previous guy was likely bought by Russia.

Fossil Fuel Companies buy them. Big Pharma buy them. Anti-Union ppl buy them. The Military Industrial Complex buy them (and are as guilty here as the Israel lobby) - and each of these had their propaganda campaigns to rile up people against unions for example, or spread climate denialism.

This was an ongoing, unfixed problem for ages, and now it has lead to catastrophe.

Since the "money is speech" decision under Reagan, nearly everything in the US has gone to shit. That's when poverty began increasing. That's when wages and life expectancy stopped going up.

This is why Americans are so poor. Why they have poor healthcare. Why the USA keeps poluting. And yes, why foreign governments can just buy whatever policy they want if they offer, say, oil in return.

This is a corruption problem. Some may term it a capitalism problem, too, but even if you don't want to go so far, it's just plain corruption. No conspiracy required.

It's just chaos. The throne is empty. There is no great mastermind behind anything. No one's in charge but market forces and inertia. Like many disastrous events in history, it's a clusterfuck.

Notice also how when I say, "Trump had financial ties to Russia", I'm not accused of wanting to kill all Slavs or anti-slavic prejudice? You immediately realize I mean the government, not Russians in general including average joe russians living in foreign countries?

#gaza#palestine#israel#free gaza#free palestine#israel-hamas war#israel-palestine war#money in politics#campaign finance reform#citizens united

11 notes

·

View notes

Text

Biden and Trump First TV Debate

As I watch Biden and Trump face off in their first televised debate, I can't help but reflect on a country that has a population of 333.3 million people (as of 2022). With so many citizens, one would think there would be a wealth of candidates eager to run for the highest office in the land. Yet, here we are again, faced with a choice between Joe Biden and Donald Trump.

I am no fan of Joe Biden by any means, and I am not saying that Donald Trump is the "savior" of America either. The reality is far more complex. Surely, there must be more people who can run for office, bringing fresh perspectives and new energy to our political landscape. Instead, we seem trapped in a cycle of familiar faces and entrenched political battles.

The Problem with the Status Quo

No matter who wins the upcoming election, one thing is certain: the American people will lose out. This isn't just a uniquely American problem, either. Over in the United Kingdom, we're facing a similar scenario. Our general election on the 4th of July this year feels like a rerun of old political dramas, with little hope for real change.

In both countries, the political landscape seems devoid of truly inspiring leaders. We see the same names, the same faces, and hear the same tired rhetoric. It's as if our political systems are designed to recycle the past rather than innovate for the future.

Where Are the Fresh Faces?

One of the biggest questions is why we aren't seeing more new faces in politics. With so many intelligent, capable, and passionate individuals in both the U.S. and the U.K., why do so few step up to run for office? The reasons are multifaceted:

The Financial Barrier: Running for office is incredibly expensive. Campaigns require vast amounts of money, which often means that only those with substantial financial backing or connections can realistically consider running.

Political Entrenchment: Established politicians have a stronghold on their positions, making it difficult for newcomers to break through. The political machinery often favors incumbents, who have name recognition and a network of support.

Public Disillusionment: Many potential candidates are dissuaded by the current state of politics. The negativity, polarization, and media scrutiny can be overwhelming. This discourages fresh talent from entering the fray, preferring to make a difference in less public, and perhaps less contentious, ways.

The Impact on Democracy

The lack of diversity in our political candidates has a direct impact on democracy. When voters are presented with limited choices, it undermines the very principles of democratic governance. Democracy thrives on variety and choice, enabling the electorate to select leaders who truly represent their values and aspirations.

In the absence of this variety, elections become exercises in choosing the lesser of two evils rather than selecting the best possible leader. This, in turn, leads to widespread disillusionment and apathy among the electorate. When people feel that their vote won't bring about meaningful change, they are less likely to participate in the democratic process.

Looking Forward

As we watch Biden and Trump debate, we should be asking ourselves what we can do to encourage more people to run for office. How can we lower the financial barriers, dismantle the entrenched political systems, and inspire a new generation of leaders?

We need to foster a political culture that values innovation, inclusivity, and genuine public service. This means supporting candidates from diverse backgrounds and with new ideas. It also means holding our current leaders accountable and demanding more from them.

In the end, the future of our democracy depends on our ability to broaden the pool of candidates and ensure that our political systems are open to fresh voices and new perspectives. Only then can we hope to elect leaders who truly represent the will of the people and can bring about the change that so many of us desire.

In both the United States and the United Kingdom, the time for political renewal is now. Let's hope that the next debate, and the next election, will feature a more diverse and inspiring lineup of candidates, giving us all a reason to believe in the future of our democracy.

#Biden vs Trump#2024 Election#Presidential Debate#US Politics#Joe Biden#Donald Trump#Political Alternatives#Election 2024#American Democracy#Political Landscape#UK General Election#Political Entrenchment#Voter Disillusionment#Campaign Finance#New Political Leaders#Political Renewal#Democratic Process#Fresh Faces in Politics#Election Choices#Political Reform#new blog#today on tumblr

3 notes

·

View notes

Note

But yeah. Love my state, despite the Horrors (looking at you Lindsey Graham) and could talk about the politics and history of it for hours.

lindsey graham has never bragged in detail about stuffing ballot boxes or violently overthrowing the government or admitted to murder unprompted or beat the shit out of a colleague on the senate floor he might be the most normal kind of evil senator y’all have ever had.

#circle time followers it’s time to talk about the senate fistfight of 1902#listen benjamin tillman did all of these things in one day in 1902 just fully like WE KILL PEOPLE HERE WE OVERTURN ELECTIONS#in front of 100 witnesses#and he’s most known for campaign finance reform

18 notes

·

View notes

Text

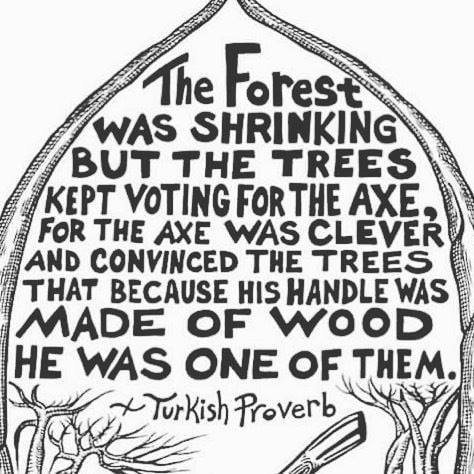

The parable of Trump—worth reposting regularly. It goes for most of our politicians, of course, but especially for this current crop of Republicans.

Read as many times as needed

#politics#us politics#two party system#political manipulation#campaign finance reform#campaign finance

32K notes

·

View notes

Text

(Part 2) Intersessional Multi-stakeholder Hearing in preparation for the Fourth International Conference on Financing for Development (FfD4).

The Multi-stakeholder hearing will offer all actors including Member States, civil society, academia, private sector, and philanthropy organizations, among others, to actively engage in discussions towards an ambitious FfD4 outcome.

Watch (Part 2) Intersessional Multi-stakeholder Hearing in preparation for the Fourth International Conference on Financing for Development (FfD4)!

#public and private finances#global financial systems.#financing and reforms#private sector#philanthropy organizations#academia#member states#civil society#ffd4#economic development#panel discussion#Fourth International Conference on Financing for Development#financing for development#multistakeholders

0 notes

Text

All the Presidents Minions

Dive into the political intricacies of Donald Trump’s second term in our latest episode of “Occupy 2.5”! In this engaging analysis, we explore the first 100 days of his presidency, examining his key promises on economic reforms, immigration, and healthcare. Discover how Trump’s relationship with Congress will shape his agenda and delve into his reliance on executive orders amidst potential…

#book review#capitalism#critical thinking#cultural commentary#Donald Trump#economic insights#economic reforms#Education#Executive Orders#finance#future predictions#gender roles#global power#Healthcare#history#Immigration#literary masterpiece#literature#media influence#nonfiction#Occupy 2.5#Ph.D.#political analysis#public sentiment#second term#social dynamics#theology#thought-provoking#War#Wealth

1 note

·

View note

Text

#End Corporate Lobbying#Political Reform#Government Accountability#Transparency in Politics#Democracy Restoration#Anti-Corruption Movement#Citizen Empowerment#Public Campaign Financing#Ethical Governance#Lobbying Ban Advocacy

0 notes

Text

This is just smoke and mirrors from the Right. Politicians mostly don't need to steal your public funds. The billionaires who Republicans and MAGA allow to buy them pay well enough.

To suggest that Democrats don't want money out of politics and MAGA does is ludicrous.

Republicans and MAGA shoot down every proposal from Democrats limiting the so-called "free speech" of corporations through monetary donations to political campaigns.

Who is trying to investigate Clarence Thomas for all the gifts he has received from rich donors? Not the Right.

"Misappropriating public funds" is just Right-Wing code for "We're going to funnel public funds needed by struggling communities to Right-Wing causes and institutions only".

#right-wings falsehoods#republicans#us politics#republican tricks#public funds#campain finance reform

897 notes

·

View notes

Text

Napoleon & the creation of the tax collection system

Not wanting to impose new taxes on the people, the tax work under Napoleon was focused on reforming tax collection by creating a system which was more efficient, complete and equitable. He also worked to destroy the link which existed between private interests and state service concerning public revenue.

From Le prix de la gloire: Napoléon et l'argent by Pierre Branda. Translated by me, so any mistakes are my own 🙂

The [financial] work of the Consulate mainly concerns the reorganization of tax collection. Until now, this essential element was not administered directly by the Ministry of Finance. The Constituent Assembly had wanted the tax rolls for direct contributions, that is to say the “tax sheets”, to be established by municipal administrations. Their work was complex, since each year they had to draw up a list of taxpayers, determine each person’s share of tax and send them the amount of contribution to be paid. Unmotivated (or even corrupt), the municipalities had taken little care in the execution of their mission, since a large proportion of taxpayers had not yet received their tax assessments for Year VIII, or even from Year VII or year VI. Also, with two or three years of delay in preparing the rolls, it was not surprising that tax revenues were low (nearly 400 million francs were thus left in abeyance). If the mailing of tax matrices left much to be desired, the collection of direct contributions was not much better. The tax collector was not an agent of the administration either: this function was assigned to any person who was willing to collect taxes with the lowest possible commission (otherwise called “least collected”). With such a system, failures were numerous, often due to incompetence, but also due to the prevailing spirit of fraud. However, in their defense, the collectors’ profits were most of the time too low to provide such a service; so to compensate for their losses, they were “forced” to increase the number of small and big cheats. In any case, in such a troubled period, letting private individuals carry out such a delicate mission could only be dangerous for the regularity of public accounts. In short, the mode of operation of taxation that Bonaparte and Gaudin inherited was failing on all sides and threatened to sink the State.

One month after Gaudin’s appointment, on 13 December 1799, the Direction des contributions directes was created with the mission of establishing and sending tax matrices. This administration, dependent on the Ministry of Finance, was made up of a general director, 99 departmental directors and 840 inspectors and controllers. The organization of direct contributions became both centralized and pyramidal, the opposite of the previous system, decentralized and with a confused hierarchy. The work of preparing the rolls, for so long entrusted to local authorities, passed entirely “in the hands of the Minister of Finance” putting the taxpayer in direct contact with the administration. With the tax system now free of obstacles, the beneficial effects of such a measure were soon felt. With ardor, the agents of this new administration carried out considerable work: three series of tax rolls, that is to say more than one hundred thousand tax slips, were established in a single year. It must be said that the Ministry had not skimped on their salaries (6,000 francs per year for a director, 4,000 for an inspector and 1,800 for a controller), which was no doubt a factor in their success.

Reform of tax collection was slower. It wasn’t until 1804 that all tax collectors became civil servants. Under the Consulate, tax collectors were gradually replaced in the departments, then in the main towns, and finally in all communes whose tax rolls exceeded 15,000 francs. By the end of the Consulate, the entire tax administration was entirely dependent on the central government. Subsequently, the administration in charge of indirect taxation (taxes on tobacco, alcohol or salt), created on 25 February 1804 and known as the Régie des droits réunis, was built on the same pyramidal, centralized model. It was the same, later, for customs.

According to Michel Bruguière, historian of public finances, “Napoleon and Gaudin can be considered the builders of French tax administration. They had also developed and codified the essential principles of our tax law, so profoundly at variance with the rules of French law, since the taxpayer has nothing to do with it, while the administration has all the powers.” Having understood the true cause of the “financial plague”, Bonaparte wanted an effective, almost “despotic” instrument to avoid the unfortunate fate of his predecessors. As a good military man, he created a fiscal “army” to provide the regime with the sinews of war. It was also necessary to definitively break the link between private interests and state service in all matters concerning public revenue. The days of the fermiers généraux of the Ancien Régime and the “second-hand” tax collectors of the Directory were well and truly over. Napoleon Bonaparte’s fierce determination to centralize power in this area, as in many others, undoubtedly gave his regime the means to last.

———

French:

Pg. 208

Pg. 209

Pg. 210

#Le prix de la gloire: Napoléon et l'argent#Pierre Branda#Branda#Le prix de la gloire#Napoleon’s reforms#history#napoleon#napoleonic era#napoleonic#napoleon bonaparte#first french empire#money#french empire#economics#financial#finance#Economic history#financial history#france#19th century#tax collection#tax collection system#french history#Michel Bruguière#Constituent Assembly#gaudin#Martin-Michel-Charles Gaudin#french revolution#directory#the directory

6 notes

·

View notes