#financial wealth

Explore tagged Tumblr posts

Text

Real Estate Investment: Building Millionaire Wealth through Strategic Property Investments

Dive into the world of Real Estate Investment: A Pathway to Millionaire Wealth! 🏡💰 🚀🏠 #RealEstateInvestment #MillionaireWealth #WealthBuilding #PropertyInvestment #FinancialSuccess

Introduction In the vast arena of wealth creation, one avenue stands out as a formidable path to financial prosperity—Real Estate Investment. The appeal of property ownership, the allure of generating passive income, and the potential for substantial appreciation over time make real estate an enticing venture for those aspiring to achieve millionaire status. This blog aims to delve deep into the…

View On WordPress

#Financial Wealth#Investing Wisely#Millionaire Investors#Passive Income#Property Investment#Real Estate Investment#Real Estate Strategies#Real Estate Wealth#Wealth building#Wealth creation

0 notes

Text

National Lottery Draws

in the space of twenty nine years the UK has gone from one weekly weekend draw of the national lottery to a national draw every night of the week, except on a Sunday.

what has improved with regards to our need for financial gain? how much do Canadians and the teachers union make from the proceeds? are we still piously hypnotised about a day called Sunday? what have the Dutch and Germans to do with it anyway? and what are we to do on the night before Monday?

0 notes

Text

Unusual things left in Wills

It’s an interesting quirk that the concept of Wills is universal, however they are equally incredibly nuanced and personal. Dive into stories of unusual items and strange requests left in wills, reminding us of the unexpected and personal side of legacy planning.

0 notes

Text

OutSpoken Belle

“I Choose to Press Through” Been mocked for saying I have been working 14-16 hour work days! I have accepted the fact people tend to support you as long as you are on their same level! I made the decision to level up and I now appreciate the art of hard work, less socializing, less sleep, and I appreciate and understand the importance of pushing hard! Outside of my regular 9-5, I am a published…

View On WordPress

#balance#black history#black knowledge#black men#black women#country#family#family time#featured#financial wealth#generational wealth#grateful#gratitude#lethasrealtalk#millennial mom#mom#moms#motivational talk#parents#Peopleoftheheart#politics#poverty#promote#saving lives#society#songwriter#Spotify#teensummit#true talk#watchusthrive

0 notes

Text

Basic Financial Rules To Live By 💰✨

Create a plan that shows how much money you get and how much you spend. This helps you see where your money goes.

Set aside a part of your money as savings. Try to save at least 10-20% of what you earn.

Be careful with borrowing money, especially if you have to pay back a lot of extra money (interest).

Save some money for unexpected things like medical bills or losing your job. Aim to have enough to cover your living costs for a few months.

Put your saved money into different things that can make it grow, like stocks or real estate. Be patient, as it takes time.

Don't spend more money than you make. Stick to buying what you really need, not just what you want.

Decide what you want to do with your money, both in the short term (like a vacation) and long term (like retirement).

Set up automatic transfers to your savings and bills so you don't forget to save or pay your bills on time.

Make saving money a top priority before spending on other things.

Regularly look at your money situation, adjust your plan as needed, and see how your investments are doing.

Pay your bills on time and use credit wisely (like credit cards) to keep a good credit score, which can help you get better deals on loans.

Save money for when you're older and don't work anymore. Use retirement accounts to help with this.

Think before you buy things. Don't buy something just because you want it; think if it's necessary.

Keep learning about how money works and how to make smart money choices.

Only use your emergency fund for real unexpected problems, not for things you just want to buy.

#financial planning#finance#investing#money#girl math#wealth#level up journey#it girl#dream girl#dream girl guide#dream girl tips#dream girl journey#that girl#becoming that girl#educate yourself#wealth mindset#growth mindset#success mindset

3K notes

·

View notes

Text

This is your sign that your financial situation is improving drastically. You will now experience money flowing into your life easily and effortlessly. Attracting money will no longer feel like a struggle to you. You will now see yourself as financially abundant. Pass this along.

3K notes

·

View notes

Text

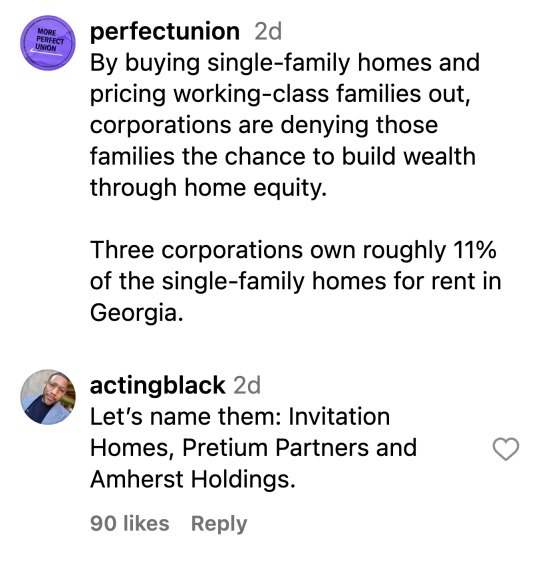

#housing inequality#corporate ownership#home equity#affordable housing#real estate market#wealth disparity#housing crisis#single-family homes#working-class families#corporate landlords#Georgia housing market#property investment#economic disparity#housing affordability#rental market#housing market inequality#corporate real estate#wealth gap#homeownership barriers#housing investment#financial disparity#real estate monopoly#housing affordability crisis#rental housing#economic inequality#property ownership#housing accessibility#corporate influence#affordable homeownership#investment firms in real estate

1K notes

·

View notes

Text

HOW YOU CAN GAIN WEALTH

THE 11TH HOUSE AND FINANCIAL GAINS

The 11th house in astrology is known for representing friends, socialization, technology, hopes/wishes, etc. However, a lot of people don’t know it also represents material gains (which includes financial gains)

The 10th house represents your career and the 2nd house represents money, so using Derivative Astrology you count 2 houses including 10 (10,11) meaning the 11th house gives insight on money made from your career

This is an underrated placement to check for your long term career to see which career path you should go down in order to make the most money. I discuss this in my readings

ARIES 11H: You can benefit the most financially from careers where you motivate others or ones that motivate you. You would struggle financially in careers you weren’t passionate about. Careers involving courage, athletics, physical fighting/aggression, tattoos, war, heat/fire, confidence, energy, enthusiasm, and/or lust would suit you best (Example- personal trainer)

TAURUS 11H: You can benefit the most financially from careers that bring sentimentality to your life. You would struggle financially in careers that were too high stress. Careers involving material items, beauty, romance/love, art/artistry, pleasures, festivities, your voice, and/or luxury would suit you best (Example- singer)

GEMINI 11H: You can benefit the most financially from careers that let you communicate your ideas. You would struggle financially in careers that didn’t require much communicating. Careers involving literature/writing, social media, the mind, speaking, lower education, short trips, ground transportation, trading, the press, gossip, and/or math would suit you best (Example- social media influencer)

CANCER 11H: You can benefit the most financially from careers that are an emotional outlet for you. You would struggle financially in careers that make you suppress all your feelings. Careers involving emotional expression, family, homes/houses, taking care of people, femininity, the ocean, fertility/pregnancy, baking/cooking, and/or boobs would suit you best (Example- real estate agent)

LEO 11H: You can benefit the most financially from careers that allow you to be in the spotlight and shine. You would struggle in careers that you never get to express yourself creatively in. Careers involving drama, your talents, happiness, development, pride, the ego, identity, festivals, royalty, creativity, attention/spotlight, entertainment, and/or leadership would suit you best (Example- actor)

VIRGO 11H: You can benefit the most financially from careers where you can put your analytical nature to use. You would struggle financially in careers where you couldn’t seem to voice your opinion. Careers involving analyzing with reason, health/fitness, literary works, the mind, and/or routine would suit you best (Example- author)

LIBRA 11H: You can benefit the most financially from careers where you’re expressing yourself artistically. You would struggle financially in careers where you can’t have a balance of work and play. Careers involving art, beauty, fashion, harmony/harmonies, romance, pleasures, compromise/cooperation, values, and/or festivities would suit you best (Example- dancer)

SCORPIO 11H: You can benefit the most financially from careers where you use your power for good and that you feel powerful in. You would struggle financially in careers where you have no control. Careers involving transformation, mystery/crime, surgery, sex, athletics, tattoos, aggression, and/or heat/fire would suit you best (Example- surgeon)

SAGITTARIUS 11H: You can benefit the most financially from careers where you’re learning something new daily or going on new adventures daily. You would struggle financially in careers where you’re surrounded by negativity or negative coworkers. Careers involving travel, law/justice, teaching, religion/spirituality, gambling, honesty, and/or fulfillment would suit you best (Example- lawyer)

CAPRICORN 11H: You can benefit the most financially from careers where there’s stability. You would struggle financially in careers where there’s lack of consistency in your income or just in general. Careers involving business, being the boss, responsibility, confinement, restriction, old age, and/or bones would suit you best (Example- manager)

AQUARIUS 11H: You can benefit the most financially from careers where you have freedom. You would struggle financially in careers where you can’t create/invent new things and be your unique self. Careers involving technology, politics, socialization/groups/friendship, invention, film, fluctuation, rebellion, electricity, natural disasters/science, chaos, p*rnography, and/or followers would suit you best (Example- film producer)

PISCES 11H: You can benefit the most financially from careers that are an escape for you. You would struggle financially in careers that cause you lots of confusion. Careers involving compassion/kindness, spirituality, disguise, glamour, idealization, hypnotism, music, disappearance, and/or the hidden would suit you best (Example- model)

Sub to my Patreon - My Masterlist

© 𝐚𝐬𝐭𝐫𝐨𝐬𝐤𝐲 𝟐𝟎𝟐𝟑 𝐚𝐥𝐥 𝐫𝐢𝐠𝐡𝐭𝐬 𝐫𝐞𝐬𝐞𝐫𝐯𝐞𝐝

#11th house#11th house in astrology#money astrology#financial gains#wealth astrology#wealth#astro community#astrology#zodiac#astro placements#astrology tumblr#astro chart#birth chart#derivative astrology

2K notes

·

View notes

Text

art by @martharich63 on insta

#economic#politics#us politics#political#donald trump#news#president trump#elon musk#american politics#jd vance#buying power#middle class wealth#middle class#money#authoritarianism#government#us news#financial blackout

236 notes

·

View notes

Text

There are no excuses anymore. It's time to invest in yourself and create your own opportunities. Start sharing your gifts with the world, even if you have to start small. Abundance is awaiting you. All you must do is claim it.

💋

#succulentsiren#writers and poets#patreon#mindset#dark feminine energy#divine feminine#affirmations#it girl#blogger#confidence#femininity#growth#2025#dark femininity#success#win#winner#wealthy#wealth#rich#abundance#we are abundance#abundant#opulent#popular#millionaire#financial abundance#romance#love#feminine

180 notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about Repairing Our Busted-Ass World

On poverty:

Starting from nothing

How To Start at Rock Bottom: Welfare Programs and the Social Safety Net

How to Save for Retirement When You Make Less Than $30,000 a Year

Ask the Bitches: “Is It Too Late to Get My Financial Shit Together?“

Understanding why people are poor

It’s More Expensive to Be Poor Than to Be Rich

Why Are Poor People Poor and Rich People Rich?

On Financial Discipline, Generational Poverty, and Marshmallows

Bitchtastic Book Review: Hand to Mouth by Linda Tirado

Is Gentrification Just Artisanal, Small-Batch Displacement of the Poor?

Coronavirus Reveals America’s Pre-existing Conditions, Part 1: Healthcare, Housing, and Labor Rights

Developing compassion for poor people

The Latte Factor, Poor Shaming, and Economic Compassion

Ask the Bitches: “How Do I Stop Myself from Judging Homeless People?“

The Subjectivity of Wealth, Or: Don’t Tell Me What’s Expensive

A Little Princess: Intersectional Feminist Masterpiece?

If You Can’t Afford to Tip 20%, You Can’t Afford to Dine Out

Correcting income inequality

1 Easy Way All Allies Can Help Close the Gender and Racial Pay Gap

One Reason Women Make Less Money? They’re Afraid of Being Raped and Killed.

Raising the Minimum Wage Would Make All Our Lives Better

Are Unions Good or Bad?

On intersectional social issues:

Reproductive rights

On Pulling Weeds and Fighting Back: How (and Why) to Protect Abortion Rights

How To Get an Abortion

Blood Money: Menstrual Products for Surviving Your Period While Poor

You Don’t Have to Have Kids

Gender equality

1 Easy Way All Allies Can Help Close the Gender and Racial Pay Gap

The Pink Tax, Or: How I Learned to Love Smelling Like “Bearglove”

Our Single Best Piece of Advice for Women (and Men) on International Women’s Day

Bitchtastic Book Review: The Feminist Financial Handbook by Brynne Conroy

Sexual Harassment: How to Identify and Fight It in the Workplace

Queer issues

Queer Finance 101: Ten Ways That Sexual and Gender Identity Affect Finances

Leaving Home before 18: A Practical Guide for Cast-Offs, Runaways, and Everybody in Between

Racial justice

The Financial Advantages of Being White

Woke at Work: How to Inject Your Values into Your Boring, Lame-Ass Job

The New Jim Crow, by Michelle Alexander: A Bitchtastic Book Review

Something Is Wrong in Personal Finance. Here’s How To Make It More Inclusive.

The Biggest Threat to Black Wealth Is White Terrorism

Coronavirus Reveals America’s Pre-existing Conditions, Part 2: Racial and Gender Inequality

10 Rad Black Money Experts to Follow Right the Hell Now

Youth issues

What We Talk About When We Talk About Student Loans

The Ugly Truth About Unpaid Internships

Ask the Bitches: “I Just Turned 18 and My Parents Are Kicking Me Out. How Do I Brace Myself?”

Identifying and combatting abuse

When Money is the Weapon: Understanding Intimate Partner Financial Abuse

Are You Working on the Next Fyre Festival?: Identifying a Toxic Workplace

Ask the Bitches: “How Do I Say ‘No’ When a Loved One Asks for Money… Again?”

Ask the Bitches: I Was Guilted Into Caring for a Sick, Abusive Parent. Now What?

On mental health:

Understanding mental health issues

How Mental Health Affects Your Finances

Stop Recommending Therapy Like It’s a Magic Bean That’ll Grow Me a Beanstalk to Neurotypicaltown

Bitchtastic Book Review: Kurt Vonnegut’s Galapagos and Your Big Brain

Ask the Bitches: “How Do I Protect My Own Mental Health While Still Helping Others?”

Coping with mental health issues

{ MASTERPOST } Everything You Need to Know about Self-Care

My 25 Secrets to Successfully Working from Home with ADHD

Our Master List of 100% Free Mental Health Self-Care Tactics

On saving the planet:

Changing the system

Don’t Boo, Vote: If You Don’t Vote, No One Can Hear You Scream

Ethical Consumption: How to Pollute the Planet and Exploit Labor Slightly Less

The Anti-Consumerist Gift Guide: I Have No Gift to Bring, Pa Rum Pa Pum Pum

Season 1, Episode 4: “Capitalism Is Working for Me. So How Could I Hate It?”

Coronavirus Reveals America’s Pre-existing Conditions, Part 1: Healthcare, Housing, and Labor Rights

Coronavirus Reveals America’s Pre-existing Conditions, Part 2: Racial and Gender Inequality

Shopping smarter

You Deserve Cheap Toilet Paper, You Beautiful Fucking Moon Goddess

You Are above Bottled Water, You Elegant Land Mermaid

Fast Fashion: Why It’s Fucking up the World and How To Avoid It

You Deserve Cheap, Fake Jewelry… Just Like Coco Chanel

6 Proven Tactics for Avoiding Emotional Impulse Spending

Join the Bitches on Patreon

#poverty#economics#income inequality#wealth inequality#capitalism#working class#labor rights#workers rights#frugal#personal finance#financial literacy#consumerism#environmentalism

567 notes

·

View notes

Text

Increased Taxation For Poorest After Twenty Five Years of High Income

society should place a cap on how much entertainers and their companies can gain. government should implement laws that limit the amount of time these companies and their employees can work and accumulate financial wealth in entertainment industry networks.

example: after a period of twenty five years have elapsed actors and musicians, who have gained significant income, can either leave the industry or continue working at a reduced rate with higher taxes on their working income directly funding help for the poorest of society.

0 notes

Text

rough days

#haikaveh#kavetham#my art#considered not posting this bc its just. npt at all my usual standard even for a sketch but#for archiving purposes and in case it touches anyones heart#putting this up in my tumbl#i wish uni were over im feeling miserable over how its going workload wise and financially#im very burnt out#this is all i could muster for comfort#sending positive energy and wealth to all architecture students out there :(#kaveh#doodle

160 notes

·

View notes

Text

Wealth Building: Money Topics You Should Learn About If You Want To Make More Money

Budgeting: This means keeping track of how much money you have and how you spend it. It helps you save money and plan for your needs.

Investing: This is like putting your money to work so it can grow over time. It's like planting seeds to grow a money tree.

Saving: Saving is when you put some money aside for later. It's like keeping some of your treats for another day.

Debt Management: This is about handling money you owe to others, like loans or credit cards. You want to pay it back without owing too much.

Credit Scores: Think of this like a report card for your money habits. It helps others decide if they can trust you with money.

Taxation: Taxes are like a fee you pay to the government. You need to understand how they work and how to pay them correctly.

Retirement Planning: This is making sure you have enough money to live comfortably when you're older and no longer working.

Estate Planning: This is like making a plan for your stuff and money after you're no longer here.

Insurance: It's like paying for protection. You give some money to an insurance company, and they help you if something bad happens.

Investment Options: These are different ways to make your money grow, like buying parts of companies or putting money in a savings account.

Financial Markets: These are places where people buy and sell things like stocks and bonds. It can affect your investments.

Risk Management: This is about being careful with your money and making smart choices to avoid losing it.

Passive Income: This is money you get without having to work for it, like rent from a property you own.

Entrepreneurship: It's like starting your own business. You create something and try to make money from it.

Behavioral Finance: This is about understanding how your feelings and thoughts can affect how you use money. You want to make good choices even when you feel worried or excited.

Financial Goals: These are like wishes for your money. You need a plan to make them come true.

Financial Tools and Apps: These are like helpers on your phone or computer that can make it easier to manage your money.

Real Estate: This is about buying and owning property, like a house or land, to make money.

Asset Protection: It's about keeping your money safe from problems or people who want to take it.

Philanthropy: This means giving money to help others, like donating to charities or causes you care about.

Compounding Interest: This is like a money snowball. When you save or invest your money, it can grow over time. As it grows, you earn even more money on the money you already earned.

Credit Cards: When you borrow money or use a credit card to buy things, you need to show you can pay it back on time. This helps you build a good reputation with money. The better your reputation, the easier it is to borrow more money when you need it.

Alternate Currencies: These are like different kinds of money that aren't like the coins and bills you're used to like Crypto. It's digital money that's not controlled by a government. Some people use it for online shopping, and others think of it as a way to invest, like buying special tokens for a game.

1K notes

·

View notes

Text

This is your sign. You will manifest the money you need to meet your monetary needs and make your desired shifts in life. The money is on its way to you, and quicker than you think. Give thanks for its arrival now.

1K notes

·

View notes