#file taxes for free

Explore tagged Tumblr posts

Text

Americans and friends of Americans: please reblog this, here and elsewhere. Reblog it often. Propublica can be trusted and it should not cost money to file our fucking taxes.

#for my american friends#taxes#propublica#file for free#file taxes for free#how to file free#how to file taxes for free#free tax filing

1K notes

·

View notes

Text

PSA

2 notes

·

View notes

Text

psa for usamericans

if you live in any of the states below: the tax filing resource you should be looking for is IRS Direct File; you can file federal taxes directly on the IRS' website, they have a free support helpline if you're stuck, they'll also redirect you to a free preparer for state taxes, and it should work with most tax situations

if you live in any other state (or aren't eligible for Direct File) and your total income for the year was $84,000 or less, you're eligible for IRS Free File; this only covers federal taxes, and works through external providers, but will guarantee that you can use their tax preparation services for free

if you are eligible for Direct File, though, you should use it! obviously very few things about the current political situation are certain right now, but it is a genuinely good and revolutionary way to handle tax paperwork and it's a lot more likely to stick around and expand into more states if more people actually know how to access it and end up using it

#maple.txt#taxes#have seen like 3 different PSAs talking about direct file and how cool it is before promptly linking exclusively to free file#so this is my attempt to correct the record

13K notes

·

View notes

Text

Au where they escape the circus: Pomni tries to teach the 22 year olds how to do taxes. It goes as well as expected with Jax & Zooble

(Please click for better quality!!)

#drag's art#tadc#the amazing digital circus#tadc fanart#tadc pomni#tadc jax#tadc zooble#pomni#jax#zooble#this has lived in my mind rent free. for a year.#and I’m only now drawing it LOL#is the jumper zooble is wearing one of gangle’s?? you decide ✨#the one and only time anyone has seen them cry was over taxes according to me#anyways I’m Irish idk how filing taxes works. don’t yell at me

527 notes

·

View notes

Text

IRS Direct File

Hey, if you're in the US, it's tax season again!

Want to make it easy to deal with? And not pay someone else to do it for you? The IRS has continued to expand their free online services - if you live in any of these states (and don't have a more complicated situation), you can file directly with the government and cut out a lot of the cruft in the middle!

(That's almost half the country on-board now; if your state _isn't_ on the list, why don't you contact your governor and state legislature, and ask why they won't let the government money you spend on the IRS be used to provide government services for you...)

ALT

Here: IRS Direct File

Also, not to get political, but this would be a great time to do your taxes early, and support your professional civil servants by taking advantage of the services they provide. There's too many assholes out there who want to take it away from you, because they don't think the government should work for people; don't let them win. :)

#IRS#taxes#US government#free tax filing#Direct File#I suport getting the government you paid for and deserve#If you're not in the US#hope your taxes are simple and easy too

122 notes

·

View notes

Text

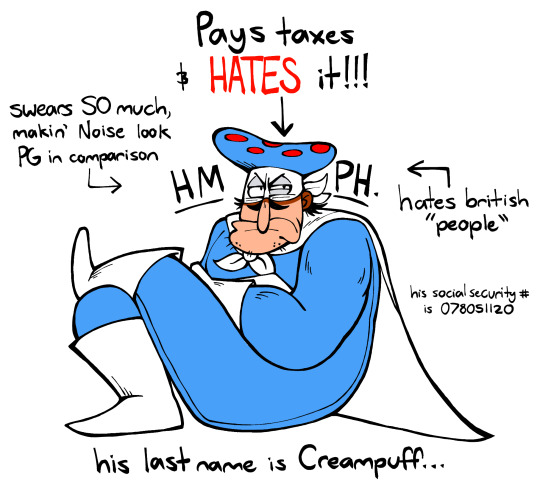

learning a lot about pizzano from the newest website update gotta say, learning he's done taxes was a real surprise to me

(check out pizzano's super cool epic site here)

#pizza tower#sugary spire#pizzano#drawing#digital mess#I mean he doesnt file his taxes good but like I get where you're coming from pizzano#and when I mean he swears so much I mean he was so obscene on tv it got his show pulled#but he does give a pizza recipe for free that's nice

902 notes

·

View notes

Text

Instead of reblogging the OP which didn't have correct information, I'm signal-boosting these links which another helpful person added. I won't tag them because i don't know them and it might be rude idk.

The free tax-filing on the IRS page is still operational! It's still only been rolled out in 25 states, but check and see if yours is one of them.

#irs#tax season#income tax#tax filing services#file federal taxes for free#us politics#elon musk is fortunately incompetent

12 notes

·

View notes

Text

Your tax dollars hard at work

#Your tax dollars hard at work#property taxes#us taxes#death and taxes#filing taxes#taxes#tax#tax dollars#israel#israhell#palestine#gaza#rafah#free palestine#freepalastine🇵🇸#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#free gaza#gaza genocide#gaza strip#gazaunderattack#all eyes on rafah

14 notes

·

View notes

Text

IRS Free File Program

US taxpayers whose adjusted gross income (AGI) is less than $79,000 for 2023 can use the IRS Free File Program to file their taxes: https://www.irs.gov/irs-free-file-do-your-taxes-for-free

It's offered through a number of partners, but you have to start on the IRS Free File site to have the fee waived.

If you made more than the limit, you can still use the Free File site to get fillable forms if you want to file a paper return, or have them for calculation purposes.

You can also use the site to file an extension for free, regardless of your income.

47 notes

·

View notes

Text

I've had at least one friend get her federal and state taxes filed for free through the IRS.gov website!!!

Highly recommend looking at what they offer for free filing. You DO have to use their link from their website to get it free. If you've made an account with your provider of choice they list, just make a new account. That's what my friend did and it worked!

Different providers have different conditions, so take a look at what they offer.

4 notes

·

View notes

Text

Lord knows if this will work in our horrible new world of Drumph and Mush and DOGE, but nonetheless, it's worth a try and a reblog.

So Americans and friends of Americans: please reblog this, here and elsewhere. Reblog it often. Propublica can be trusted and it should not cost money to file our fucking taxes.

#for my american friends#taxes#propublica#file for free#file taxes for free#how to file free#how to file taxes for free#free tax filing

2 notes

·

View notes

Text

Whew, OKAY.

Cutting it close this year, but I finally got my taxes filed. (Under an extension, of course. I think the money I paid in April to get the extension is part of why my return is so big... because I do actually get a return this year, but I had to Pay Something to get the extension, according to what I could figure out.)

Also: Who knew having so many health issues means a healthier tax return? (Thank you, HSA! The "high deductible" part of my employer's health insurance plan sucks, but I'm really starting to see the beauty of the tax benefits you get with an HSA.)

#That was actually simpler than I thought it would be. Didn't get it filed for free but TaxSlayer was a lot more helpful#than the FreeTaxUSA thing I used last year! Offered a lot more guidance and options and ways to deductions than the free one.#rhs personal posts#Hopefully this year I'll have time to get my tax documents together before fricking April 2025 and I won't need an extension again...#Now that I know what documents I actually NEED and which ones I don't have to grab any information from at all to file.#The one thing I couldn't figure out was getting a deduction on vehicle registration fees. But I don't know what Ad Valorum Tax is. At all.

5 notes

·

View notes

Text

tax season tip

in a time of more and more ads: gentle reminder that if your AGI is less than like $80k and you can file the 1040EZ, check out https://freefile.taxslayer.com (which i accessed via the irs.gov website trusted tax partners page)

i suggest that you use this free tax prep website and e-file your tax return !!! very simple, very user friendly and didn't even take me the full 16 mins duration of the podfic i was listening to in order to complete and upload (granted my tax situation is fairly simple for last year so (¬⤙¬ )

2 notes

·

View notes

Text

How to File Your Taxes FOR FREE in 2022: Simple Instructions for the Stressed-out Taxpayer

The United States is known for many things. It’s the global center of hot dog eating contests; the birthplace of Dwayne “The Rock” Johnson; and one of the only countries whose tax collectors say, “We know how much you owe in taxes this year, but we want you to take a guess at it. And if you guess wrong, we’re going to punish you.”

No seriously: that’s literally what tax filing season is all about.

Most people with jobs have taxes deducted from their paychecks throughout the year. The Internal Revenue Service (IRS), the entity responsible for handling tax matters in the United States, keeps pretty good records of that shit. They almost always over-tax some of us for reasons that are convoluted and boring and best left to another article. And they under-tax others for much less complex reasons.

But what that means is, at the end of a tax year, the IRS will owe some of us money, and some of us will owe the IRS money. And we have to file paperwork with the government (“filing taxes“) to get that all sorted out.

Keep reading.

If you liked this article, join our Patreon!

#taxes#tax season#tax return#IRS#file your taxes for free#April 15#file your taxes#filing taxes#tax day

50 notes

·

View notes

Text

in this house, we celebrate superbowl by having the tv going in the background, while sitting on the floor, surrounded by papers, doing taxes with the free irs tool

7 notes

·

View notes

Text

Reasons in favor of using TaxSlayer — or another of the IRS Free File Guided Tax Preparation Options — if you need to file US taxes and don't want to fill out the forms yourself:

free filing for federal taxes if you earn less than $73K a year; state taxes may be free as well depending on state

easy to use and relatively intuitive (as much as anything tax-related can be, anyway)

fills out the forms for you based on the information you enter, but you can still look the forms over before filing if you want to double-check

avoids giving money to the evil of TurboTax

no special software installation required; all you need is an internet browser

Reasons in favor of using TaxSlayer specifically:

whoever came up with the name was unequivocally a marketing genius

• you might not particularly want to DO your taxes, but I'm willing to bet you want to MURDER them

35 notes

·

View notes