#taxslayer

Explore tagged Tumblr posts

Text

Reasons in favor of using TaxSlayer — or another of the IRS Free File Guided Tax Preparation Options — if you need to file US taxes and don't want to fill out the forms yourself:

free filing for federal taxes if you earn less than $73K a year; state taxes may be free as well depending on state

easy to use and relatively intuitive (as much as anything tax-related can be, anyway)

fills out the forms for you based on the information you enter, but you can still look the forms over before filing if you want to double-check

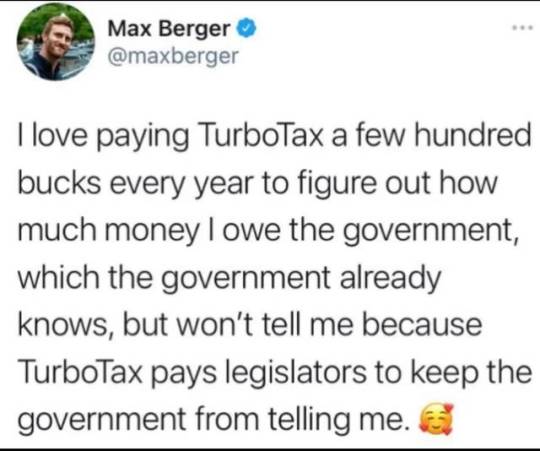

avoids giving money to the evil of TurboTax

no special software installation required; all you need is an internet browser

Reasons in favor of using TaxSlayer specifically:

whoever came up with the name was unequivocally a marketing genius

• you might not particularly want to DO your taxes, but I'm willing to bet you want to MURDER them

35 notes

·

View notes

Text

ATTENTION BUSINESS OWNERS: The IRS is giving select businesses up to $26,000 per employee in payroll tax refunds that they don't have to pay back.

All you need to do is click "Learn More" below take our 100% free survey to see if you qualify under IRS guidelines.

The only catch is that the funds will dry up soon so click the button below and fund out exactly how much you could be entitled to receive under IRS guidelines.

Why This Is An Amazing Opportunity:

✅ Up to $26,000 per employee.

✅ No limit on funding.

✅ This is not a loan so you will not have to pay it back.

✅ We've helped fund $3,000,000,000 for business owners just like you.

"Inbox me" below and instantly see how much you're eligible for under IRS guidelines.

0 notes

Text

Whew, OKAY.

Cutting it close this year, but I finally got my taxes filed. (Under an extension, of course. I think the money I paid in April to get the extension is part of why my return is so big... because I do actually get a return this year, but I had to Pay Something to get the extension, according to what I could figure out.)

Also: Who knew having so many health issues means a healthier tax return? (Thank you, HSA! The "high deductible" part of my employer's health insurance plan sucks, but I'm really starting to see the beauty of the tax benefits you get with an HSA.)

#That was actually simpler than I thought it would be. Didn't get it filed for free but TaxSlayer was a lot more helpful#than the FreeTaxUSA thing I used last year! Offered a lot more guidance and options and ways to deductions than the free one.#rhs personal posts#Hopefully this year I'll have time to get my tax documents together before fricking April 2025 and I won't need an extension again...#Now that I know what documents I actually NEED and which ones I don't have to grab any information from at all to file.#The one thing I couldn't figure out was getting a deduction on vehicle registration fees. But I don't know what Ad Valorum Tax is. At all.

5 notes

·

View notes

Text

Gator Bowl: Duke Blue Devils vs. Ole Miss Rebels | Full Game Highlights

Check out these highlights as No. 14 Ole Miss dominates the Duke Blue Devils, 52-21, in the TaxSlayer Gator Bowl. Rebels QB Jaxson Dart threw for over 400 yards and 4 touchdowns in his last game with the team. FULL WATCH

#duke vs ole miss#jaxson dart#ole miss#ole miss vs duke#gator bowl#ole miss bowl game#gator bowl 2025#duke#ole miss score#ole.miss football#ole miss game#duke ole miss#manny diaz#ole miss duke#jackson dart#everbank stadium#jaxson dart draft#duke vs ole miss prediction#henry belin iv#taxslayer bowl#taxslayer gator bowl#ole miss vs duke prediction#duke blue devils football vs ole miss rebels football match player stats#duke qb#duke football coach#duke ole miss prediction#taxslayer bowl 2025#where is the gator bowl 2025#duke quarterback#henry belin

0 notes

Text

finally remembered to file my taxes. if you're in the usa and haven't done so, you should consider filing your taxes since April 15 is getting closer and closer

#i make under 74k or w/e that threshold is and efiled on fileyourtaxes.com completely for free so!!#i think there's a small fee for state returns but didn't have that so i can't speak for that#i used to use taxslayer but they kept bumping me up into premium options and not telling me why so-#i don't owe this year so always a good thing!#talking tag

1 note

·

View note

Text

Bobby Bones Show TaxSlayer 2024 Sweepstakes - Chance To Win $3,140 Cash Prize

Entering into the Bobby Bones Show TaxSlayer 2024 Sweepstakes and chance to win $3,140 cash prize. So, all United States residents enter the Sweepstakes before January 28th, 2024 to fix your chances to win. Sweepstakes Entry Page Sweepstakes Rules How To Enter : Any purchase or Payment not make you winner, odds of winning of this Sweepstakes Depends on valid entries. First of all open the…

View On WordPress

#Bobby Bones Show Sweepstakes#bobbybones.iheart.com#Chance To Win $3140 Cash Prize#Chance To Win Cash Prize#Premiere Networks Sweepstakes#TaxSlayer 2024 Sweepstakes

0 notes

Text

So. Um. Good year to calculate your own taxes instead of using an online service.

Dammit.

45 notes

·

View notes

Text

The IRS site gave me multiple options for filing my tax return but I picked the taxslayer software solely because it sounds badass as fuck

2 notes

·

View notes

Text

um so like fuck turbotax use taxslayer or any of the other free file tools, but I'm a big fan of their comercial with the they/them client

2 notes

·

View notes

Text

Quick PSA since T*rboTax is getting worse and more predatory by the year—people with low-ish income (under $60k) qualify for free federal filing, and many for free state (AR, AZ, DC, GA, IA, ID, IN, KY, MA, MI, MN, MO, MS, MT, NC, ND, NT, OR, RI, SC, VA, VT, AND WV are free if you meet the qualifications for free federal) through TaxSlayer.

It's not quite as easy as T*rboTax, you have to input everything from the documents manually, which is initially intimidating, but it's really not that hard. Not only am I not paying $70 to TT for the privilege of filing my taxes, I'm getting back like $100 more than TT on top of that. And this year is rough for tax returns, we need all we can get.

https://freefile.taxslayer.com

#seriously turbotax sucks so bad#and idk how but my return is so much better#please signal boost#psa#signal boost#taxes#tax filing#tax#low income#poverty

2 notes

·

View notes

Text

Ole Miss 2025 Taxslayer Gator Bowl Champions signatures shirt

Celebrate the Los Angeles Dodgers’ unforgettable 2024 World Series Championship with this Ceramic Christmas Ornament, a perfect keepsake for fans and collectors! This beautifully crafted ornament captures the pride and excitement of the Dodgers' historic victory, making it a standout addition to your holiday decor or sports memorabilia collection.

Key Features:

Official Champions Design: Show off your Dodgers pride with the official 2024 World Series Champions logo.

Premium Ceramic Quality: Made from durable ceramic to ensure this keepsake lasts for years to come.

Perfect for Dodgers Fans: Celebrate the Dodgers’ triumphant season in style with this must-have collectible.

Ideal Gift: Great for Christmas, birthdays, or any special occasion for sports fans or memorabilia collectors.

Why You’ll Love It:

This ornament isn’t just a holiday decoration—it’s a piece of Dodgers history. Featuring vibrant colors and intricate details, it perfectly commemorates the team's championship season. Hang it on your tree or display it year-round to showcase your unwavering team spirit.

Product Details:

Material: High-quality ceramic with a smooth, durable finish.

Design: Vibrant Dodgers colors and the 2024 World Series Champions logo.

Size: Lightweight and compact, perfect for holiday decor or home display.

Relive the excitement of the Dodgers’ 2024 World Series victory and celebrate this milestone achievement. Add this ornament to your collection or gift it to the Dodgers fan in your life.

Order Yours Today! 👉 Get your 2024 World Series Champions Ornament here! For more incredible products, check out the TeeClover Homepage.

4o

0 notes

Text

Ole Miss Rebels Defeat Duke Blue Devils Mascot TaxSlayer Gator Bowl Champions NCAA Bowl Games Season 2024 2025 T Shirts

Ole Miss Rebels – 2024-2025 TaxSlayer Gator Bowl Champions Shirt! 🏈🔴🔵

Celebrate the Ole Miss Rebels' victory over the Duke Blue Devils in the 2024-2025 TaxSlayer Gator Bowl with this exclusive Champions Mascot T-Shirt! This commemorative design highlights the Rebels' incredible performance and adds a must-have piece to any fan’s collection.

Show off your school spirit and remember this exciting win for seasons to come! Perfect for game days, tailgates, or just repping the Rebels wherever you go.

🔥 Order now and celebrate the Rebels' Bowl victory in style! 👉 Get the Ole Miss Gator Bowl Champions Shirt here

Explore more Ole Miss gear and championship merch: 👉 TeeClover

Hotty Toddy! 🔴🔵 #GatorBowlChamps

.https://x.com/teeshirt7568581/status/1875412418492559791

.https://x.com/teeshirt7568581/status/1875412877601087733

.https://x.com/teeshirt7568581/status/1875413336994771085

.https://x.com/teeshirt7568581/status/1875413820946182646

.https://x.com/teeshirt7568581/status/1875414717986173042

.https://x.com/teeshirt7568581/status/1875415176759111930

.https://x.com/teeshirt7568581/status/1875416093701108097

.https://x.com/teeshirt7568581/status/1875416551765278797

.https://x.com/teeshirt7568581/status/1875417009758060949

.https://x.com/teeshirt7568581/status/1875417468719788164

.https://x.com/teeshirt7568581/status/1875417926796505203

.https://x.com/teeshirt7568581/status/1875418394356498847

.https://x.com/teeshirt7568581/status/1875418853276315695

0 notes

Photo

YES! Just go through the IRS website. I used Taxslayer last year.

The new program sounds cool. As a resident of one of those listed states, I'm going to give it a go!

Fuck TurboTax 🥰

150K notes

·

View notes

Text

Financial Management Solutions: Streamlining Your Path to Financial Success

In today’s fast-paced world, managing finances effectively is more important than ever. Whether you're running a business or managing your personal finances, having the right financial management solutions in place can make all the difference. These solutions not only ensure that your financial operations are organized but also help you make informed decisions that drive growth and stability.

In this blog post, we will explore various financial management solutions and how they can benefit both individuals and businesses alike.

1. The Importance of Financial Management

Effective financial management is the backbone of any successful business or individual financial plan. It helps you track income, manage expenses, and make strategic decisions that align with long-term financial goals. By keeping a clear overview of your financial situation, you can identify areas for improvement, reduce costs, and ensure that resources are allocated efficiently.

For businesses, strong financial management ensures cash flow is steady, profitability is maximized, and financial risks are minimized. For individuals, it helps with budgeting, saving for the future, and planning for unexpected expenses.

2. Accounting Software: Automating Your Finances

One of the most powerful financial management tools available today is accounting software. These tools automate many of the routine financial tasks, such as tracking expenses, generating invoices, and reconciling accounts. Popular options like QuickBooks, Xero, and FreshBooks allow businesses and individuals to save time and reduce the risk of errors.

Accounting software can integrate with your bank accounts and credit cards, pulling in transactions automatically and categorizing them. This not only makes bookkeeping easier but also provides real-time insights into your financial situation.

For businesses, using accounting software helps ensure compliance with tax regulations and provides valuable financial reports, such as profit and loss statements, balance sheets, and cash flow forecasts. This data can guide your decision-making and help you plan for the future.

3. Budgeting Tools: Keeping Your Finances on Track

Whether you’re managing personal or business finances, budgeting is a critical part of financial management. Budgeting tools like Mint, YNAB (You Need A Budget), and EveryDollar allow you to set up budgets, track your spending, and see where your money is going.

For businesses, budgeting software can help allocate funds for various departments, track expenses, and identify areas where cost savings can be made. For individuals, these tools can provide insights into how much money is available for savings, investments, and discretionary spending.

4. Cash Flow Management: Maintaining Financial Stability

Cash flow is one of the most critical elements of financial health, especially for businesses. Poor cash flow management can lead to operational disruptions and missed opportunities. To maintain steady cash flow, businesses need to have a system for invoicing, tracking payments, and managing receivables.

There are many cash flow management tools available, such as Float, Pulse, and Fluidly, which help businesses forecast cash flow and ensure that they have enough liquidity to meet their financial obligations. These tools can also alert you to potential cash flow issues before they become critical, allowing you to take action early.

5. Tax Preparation and Filing Solutions

Tax compliance can be complex and time-consuming, but the right solutions can make this process more manageable. Tools like TurboTax, TaxSlayer, and H&R Block offer tax preparation services for both businesses and individuals. These tools help ensure that you’re maximizing deductions and credits while staying compliant with tax laws.

For businesses, using tax-specific software can help track deductible expenses and provide reports that simplify the filing process. Many of these tools also integrate with accounting software, ensuring that your financial records are up to date and accurate.

6. Financial Forecasting and Planning Tools

Planning for the future is essential for both individuals and businesses. Financial forecasting tools help you project your future financial position based on historical data and current trends. These tools can assist businesses in budgeting, strategic planning, and investment decisions.

For individuals, forecasting tools can help with retirement planning, saving for education, or purchasing a home. Financial planning software like Personal Capital, Wealthfront, and Betterment allows you to set long-term financial goals and track your progress over time.

7. Financial Advisory Services

While technology has revolutionized financial management, many individuals and businesses still benefit from professional financial advice. Financial advisors can help you navigate complex financial decisions, such as investments, retirement planning, and risk management.

For businesses, financial advisors can assist with strategic planning, mergers and acquisitions, and improving financial performance. For individuals, they can offer guidance on retirement, estate planning, and wealth management.

Conclusion

Financial management solutions have come a long way, offering a wide range of tools and services that can streamline your financial operations. Whether you're looking to automate accounting tasks, track spending, manage cash flow, or plan for the future, the right financial management tools can provide you with the insights and support needed to achieve your goals.

For businesses, these solutions help ensure financial stability, compliance, and growth, while for individuals, they enable better budgeting, saving, and investing. The key is to find the right combination of tools that fit your needs and allow you to take control of your financial future.

If you're looking for professional financial management assistance, businesses like Bizee Bookkeeper offer expert solutions tailored to your needs, helping you navigate the complexities of business finance with ease.

Embrace the power of financial management solutions today and set yourself up for success in the future!

0 notes

Text

Top Tips for Finding the Best Online Tax Preparation Services & Affordable Tax Consultants

Tax season can be stressful, but finding the right tax preparation service can make all the difference. Whether you’re looking for the best online tax preparation, searching for an experienced tax consultant, or need cheap income tax services, there are options that fit your needs and budget. In this blog, we’ll guide you through the process of finding high-quality, affordable tax help so you can file your taxes with ease and confidence.

Why Online Tax Preparation is the Way to Go

With the increasing number of digital tools and services, online tax preparation has become a popular option for many taxpayers. It’s fast, convenient, and allows you to file from the comfort of your own home. The best part? Many online tax preparation platforms are cost-effective and offer user-friendly interfaces that guide you through the entire process.

When looking for the best online tax preparation services, consider the following:

Security and Privacy: Choose a service with robust security features to protect your personal and financial information.

Ease of Use: The software should be easy to navigate and designed for your level of tax knowledge—whether you're a first-time filer or have years of experience.

Customer Support: Having access to professional help when you need it can make all the difference. Opt for services that provide excellent customer support, either by phone or chat.

Affordable Pricing: Look for tax preparation platforms that offer transparent pricing and provide different tiers to fit various budgets.

Popular online services like TurboTax, H&R Block, and TaxSlayer are known for their ease of use, reliability, and affordable pricing. Most of these platforms also offer free basic filing options for simple returns.

Choosing the Best Tax Consultant for Your Needs

For those with more complex tax situations, such as self-employed individuals, business owners, or investors, seeking a tax consultant might be a better option. A professional tax consultant can help you navigate complicated tax laws and identify opportunities for savings that you may not be aware of.

Here are a few tips for selecting the best tax consultant:

Experience and Specialization: Choose a consultant with experience in the area of taxes that apply to your specific situation. For instance, if you run a business, look for a consultant who specializes in corporate tax laws.

Reputation: Check reviews, ask for recommendations, and verify their credentials to ensure that they are qualified and trustworthy.

Communication Skills: Your tax consultant should be able to explain complex tax laws in a way that makes sense to you. Clear communication is key to ensuring that you understand your tax situation and the steps you need to take.

Affordability: While you may be willing to pay more for expert advice, ensure that the consultant’s fees are reasonable and within your budget.

Working with a qualified tax consultant can not only help you file your taxes accurately but also offer valuable insights into tax planning and strategies to minimize your tax liabilities.

Affordable Tax Services: Finding Cheap Income Tax Solutions

When it comes to cheap income tax services, many individuals shy away, fearing that they may not receive quality service at a low price. However, there are plenty of affordable options that don’t sacrifice the quality of their work.

Here’s how you can find cheap income tax services without compromising on quality:

Look for Free Filing Services: For those with simple tax returns, there are many free services available. IRS Free File, for instance, provides free tax filing for individuals with an income of $72,000 or less.

Consider Online Platforms: Online tax preparation platforms like TaxAct and H&R Block offer affordable filing options, and some even offer discounted packages for customers filing simple returns.

Use Local Tax Preparers: Local accounting firms or tax preparers may offer lower fees compared to large national services, especially if you have a straightforward return. Just be sure to verify their qualifications and experience.

Seasonal Discounts: Keep an eye out for discounts or promotional deals during tax season, as many services offer reduced prices in January and February.

Why Affordable Doesn’t Mean Compromise

While cost is always an important factor, it’s important to remember that affordable tax services can still offer excellent quality. The key is to do your research, read reviews, and compare pricing and services. Whether you’re looking for the best online tax preparation, an experienced tax consultant, or cheap income tax services, there’s no reason you can’t find a solution that fits both your needs and your budget.

1 note

·

View note

Text

youtube

It seems like Tumblr as a whole isn't big into football, but thankfully there's video of this one, for their education

There's also the Cheez-It Bowl, where they dump thousands of Cheezes-It in people's faces, and eyes

Tbc a lot of bowl games don't have funny sponsors but are sponsored by nebulous finance and tech companies. Though that does give us names like the "TaxSlayer Gator Bowl" so

Meanwhile, in the world of football, the Pop Tart Bowl had an anthropomorphic Pop Tart who asked to be lowered into a giant toaster, holding a sign saying "DREAMS REALLY DO COME TRUE"

The toaster then spat out a human-sized Pop Tart with a face for the winning team to eat

And they devoured the edible mascot ravenously

55K notes

·

View notes