#equity stocks bonds

Text

Choosing the Right Type of SIP: A Guide for Investors

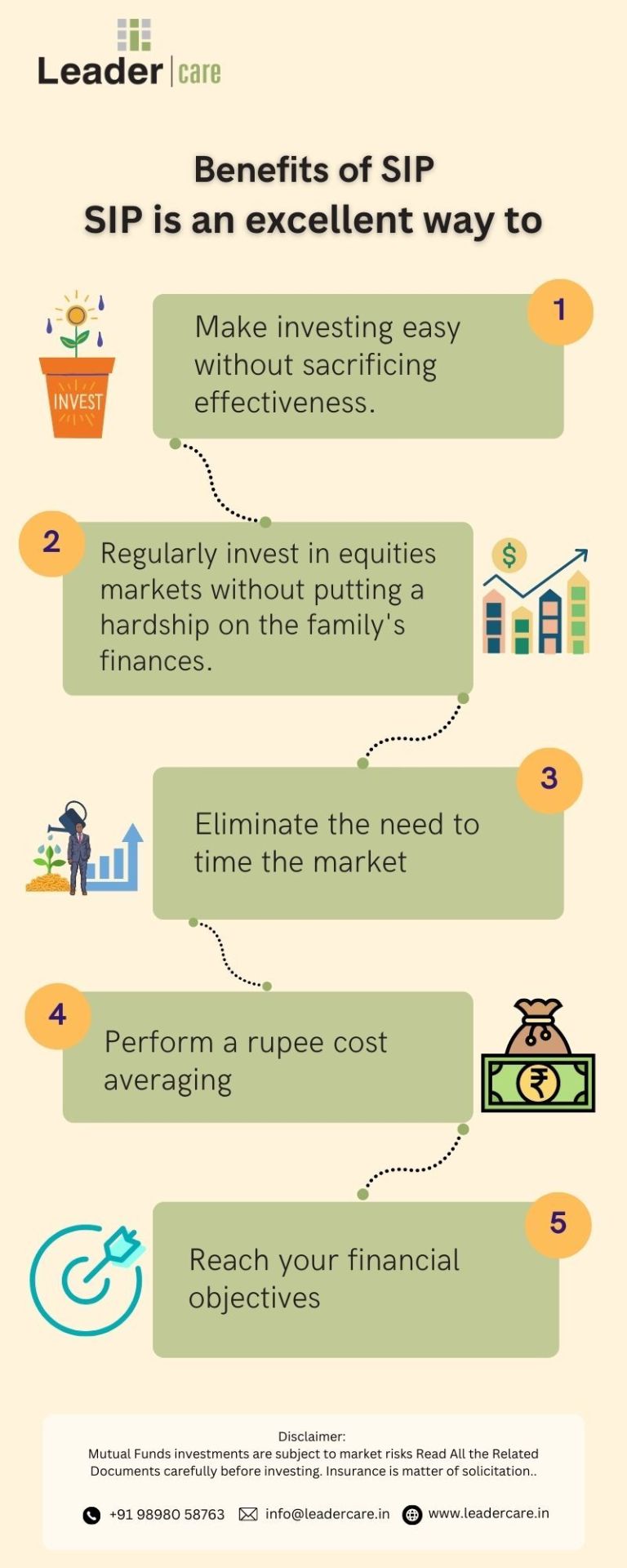

Investing in mutual funds through a Systematic Investment Plan (SIP) is one of the most effective ways to build wealth over time. However, with various types of SIPs available, choosing the right one can be a bit overwhelming. In this guide, we'll break down the different types of SIPs and help you understand how to choose the one that best suits your financial goals. We'll also explore how tools like the SIP return calculator can aid in making informed decisions and why mutual funds are a preferred option for mutual fund investment in India.

What is a SIP?

A Systematic Investment Plan (SIP) is a method of investing in mutual funds, where a fixed amount is automatically deducted from your bank account at regular intervals (monthly, quarterly, etc.) and invested in a chosen mutual fund scheme. SIPs are popular because they promote disciplined investing, reduce the impact of market volatility, and allow investors to benefit from rupee cost averaging.

Types of SIPs

Regular SIP

A Regular SIP is the most common type, where you invest a fixed amount at regular intervals, typically monthly. This type of SIP is ideal for investors who want to build a habit of regular investing without worrying about market conditions. It is a simple and straightforward approach to mutual fund investment in India, suitable for both beginners and experienced investors.

Flexible SIP

A Flexible SIP allows investors to change the investment amount based on their financial situation. For instance, you can increase the SIP amount when you have surplus funds or reduce it during financial constraints. This flexibility makes it an attractive option for those who have irregular income or want the ability to adjust their investments as per their cash flow.

Top-up SIP

Top-up SIPs are designed for investors who wish to increase their investment amount periodically. For example, you can opt to increase your SIP amount by a certain percentage every year. This helps in accelerating wealth creation, especially if your income is expected to grow over time. A SIP return calculator can be particularly useful in estimating the potential returns from a Top-up SIP, taking into account the incremental investments.

Perpetual SIP

A Perpetual SIP continues indefinitely until you instruct the mutual fund company to stop it. Unlike regular SIPs, which are typically set for a specific tenure (e.g., 1 year, 3 years), Perpetual SIPs do not have an end date. This is ideal for long-term investors who want to stay invested for extended periods, leveraging the power of compounding.

Trigger SIP

A Trigger SIP is more sophisticated and is suited for experienced investors who want to invest based on certain triggers. These triggers could be market levels, index values, or specific dates. While Trigger SIPs offer the opportunity to capitalize on market movements, they require a good understanding of market dynamics and regular monitoring.

#stock market advisory#equity investment advisory#international share market#mutual fund advisor#types of bonds#ajmeraxchange#online stock trading company#share market advisory company

0 notes

Text

Investing 101: Building Wealth for the Future

In the dynamic landscape of personal finance, one fundamental principle stands out as a cornerstone for achieving long-term financial success—investing. Whether you’re just starting your journey to financial independence or looking to enhance your existing portfolio, understanding the basics of investing is crucial. This blog aims to guide you through Investing 101, offering insights into the…

View On WordPress

#bond investments#compound interest#consistent investing#equity investment#financial education#financial independence#financial security#how to invest money#importance of investing#invest money#investing#investing basics#investing tips#investing wisely#investment portfolio#money#real estate investment#start investing early#stock market investing#wealth building

0 notes

Text

Investment Strategies for Different Life Stages: A Comprehensive Guide

Investing is a lifelong journey, and your financial needs and goals will change as you progress through different life stages. This comprehensive guide will explore investment strategies tailored to various life phases, providing examples and insights to help you navigate your financial future.

1. Starting: Early Career (20s to 30s)

Investment Focus: Growth and Risk Tolerance

a. Stocks and…

View On WordPress

#Annuities#asset allocation#Bonds#Diversification#Education Savings#emergency fund#Estate Planning#Financial planning#Fixed Income#Growth Investing#Healthcare Costs#Insurance#investing for beginners#Investment Strategies#Life Stages#My-Financials.com#Portfolio Management#retirement planning#Risk Tolerance#Stocks and Equities#Wealth Management

0 notes

Text

#Archers Wealth is a Exchange/SEBI registered#equity research firm and one of the leading financial services company. As an independent financial services firm#we offer Portfolio Management Services (PMS)#Alternative Investment Fund (AIF)#Arbitrage#Hedge Funds#Mutual Funds#Stock Trading#Bonds#and financial risk management products define our scope of work.

0 notes

Text

Krispy Kreme CEO discusses earnings, global expansion, pricing, strategy, and partnerships

The CEO of Krispy Kreme has recently sat down to discuss the company’s earnings, plans for global expansion, pricing strategies, as well as various partnership opportunities. This informative interview provides a glimpse into the inner workings of the iconic doughnut chain and gives insight into their plans for the future. Join us as we explore the key takeaways from this exclusive conversation with Krispy Kreme’s top executive.

#youtube #yahoofinance #stockmarket

This segment originally aired on May 11, 2023.

Krispy Kreme CEO Mike Tattersfield joins Yahoo Finance Live’s Seana Smith and Brooke DiPalma to discuss the performance of Krispy Kreme stock on Q1 beat, consumer demand, the company’s long-term growth strategy, and its partnership with McDonald’s.

Subscribe to Yahoo Finance: https://yhoo.it/2fGu5Bb

About Yahoo Finance:

At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage rates that help you manage your financial life.

Yahoo Finance Plus: With a subscription to Yahoo Finance Plus get the tools you need to invest with confidence. Discover new opportunities with expert research and investment ideas backed by technical and fundamental analysis. Optimize your trades with advanced portfolio insights, fundamental analysis, enhanced charting, and more.

To learn more about Yahoo Finance Plus please visit: https://yhoo.it/33jXYBp

Connect with Yahoo Finance:

Get the latest news: https://yhoo.it/2fGu5Bb

Find Yahoo Finance on Facebook: http://bit.ly/2A9u5Zq

Follow Yahoo Finance on Twitter: http://bit.ly/2LMgloP

Follow Yahoo Finance on Instagram: http://bit.ly/2LOpNYz

Follow Yahoo Finance Premium on Twitter: https://bit.ly/3hhcnmV

Introduction:

Krispy Kreme, the iconic doughnut chain, recently released its fourth-quarter earnings report. The company has been expanding globally and implementing new pricing strategies to meet the evolving demands of consumers. We sat down with the Krispy Kreme CEO to discuss the company’s earnings, global expansion, pricing, strategy, and partnerships.

Earnings:

Krispy Kreme has seen an increase in revenue in the fourth quarter, with sales up by 3.1%. The company’s net income has also seen an increase of 3.9%, surpassing analyst expectations. The CEO attributes this increase to the company’s effective marketing campaigns, partnerships, and expansion efforts.

Global Expansion:

Krispy Kreme plans to continue its expansion efforts globally, with a focus on the Asia-Pacific region. The company recently opened its 1000th store globally, and plans to open another 220 stores over the next five years. The CEO states that the company’s expansion strategy includes finding the right local partners and customizing menu offerings to meet local tastes.

Pricing:

Krispy Kreme has implemented new pricing strategies to remain competitive in the market. The CEO states that the company has focused on offering value to customers while also maintaining profitability. This includes offering promotional deals, such as a dozen doughnuts for a discounted price, and introducing premium menu items at a higher price point.

Strategy:

Krispy Kreme has always been known for its classic glazed doughnuts, but the company understands the importance of innovation to stay relevant. The CEO discusses the company’s strategy of introducing new, unique menu items that still maintain the Krispy Kreme brand identity. This includes introducing seasonal flavors and collaborating with other brands, such as Nutella and Oreo.

Partnerships:

Krispy Kreme has entered into partnerships with various companies, including convenience store chain 7-Eleven and snack company Mondelez. The CEO discusses how these partnerships have helped increase brand awareness and drive sales. The company plans to continue exploring strategic partnerships in the future.

FAQs:

- Does Krispy Kreme have plans to expand to other regions besides the Asia-Pacific?

- While the Asia-Pacific region is currently the focus of the company’s expansion efforts, Krispy Kreme is always exploring new markets to enter.

- How does Krispy Kreme decide on new menu items?

- The company conducts research on consumer preferences and collaborates with its culinary team to create innovative menu items while still maintaining the Krispy Kreme brand identity.

- Will Krispy Kreme continue to offer promotional deals?

- Yes, Krispy Kreme understands the importance of offering value to customers and plans to continue offering promotional deals.

- How does Krispy Kreme maintain its quality standards with its global expansion efforts?

- The company has a rigorous quality control process in place, with a strong focus on training and ensuring consistency across all stores.

- Does Krispy Kreme have plans to introduce more collaborations with other brands?

- Yes, the company believes that collaborations with other brands can help increase brand awareness and attract new customers, and plans to explore more partnerships in the future.

Conclusion:

Krispy Kreme’s earnings report and expansion efforts demonstrate the company’s ability to adapt to the evolving demands of consumers. The company’s innovative menu items and strategic partnerships have helped increase brand awareness and drive sales. As Krispy Kreme continues to grow globally, it will remain focused on maintaining its high-quality standards and delivering value to customers.

Read the full article

#Bonds#Business#Currencies#Equities#FX#Investing#Investment#Market#Markets#Money#News#NYSE#PersonalFinance#Politics#Savings#Stockmarket#Stocks#YahooFinance#YahooFInancePremium

0 notes

Photo

Financial Advice Services for Mutual Funds, Bonds, Equities, Annuities, Corporate Finance and Insurance along with Investment and Banking in india Leader Care

#securities market#equity mutual fund#general insurance#family health#mutual funds#bonds#equities#annuities#Corporate Finance and Insurance#sip return calculator#Leader care about us Securities#stocks#equity#health equity#equity capital#advisor#mutual fund advisor#leader care

1 note

·

View note

Text

Cannabis legalization 'odds are better' following President Biden's possession pardons: Analyst

Cannabis legalization 'odds are better' following President Biden's possession pardons:��Analyst

#Cannabis #marijuana #yahoofinance

Stifel Cannabis Analyst Andrew Carter joins Yahoo Finance Live anchor Dave Smith to discuss the implications of President Biden’s marijuana possession pardons and what it means for cannabis stocks and the future of legalization.

Don’t Miss: Valley of Hype: The Culture That Built Elizabeth Holmes

WATCH HERE:

https://youtu.be/Sb179GLPNYE

Subscribe to Yahoo…

View On WordPress

#bonds#business#Currencies#Equities#FX#investing#investment#Market#markets#MONEY#News#NYSE#Personal Finance#politics#savings#stock market#stocks#Yahoo Finance#Yahoo FInance Premium

1 note

·

View note

Link

Investing can be an intimidating topic, but it doesn’t have to be. Read our helpful tips on how to get started investing today.

#investing#stocks#equities#bonds#mutual fund#cryptocurrency#nfts#tangible assets#investing tips#investing 101#credit union#finance#banking#jacksonville credit union#community first credit union

1 note

·

View note

Text

Emma Mae Weber at MMFA:

Right-wing media attacked Minnesota Gov. Tim Walz, the Democratic nominee for vice president, for not owning stocks, bonds, or real estate. While some have celebrated Walz’s portfolio, or lack thereof, some right-wing media figures have drawn absurd conclusions about Walz’s ability to understand the economy or his support of capitalism because of his economic standing.

According to recent financial disclosures, Democratic vice presidential candidate Tim Walz doesn’t own stocks or securities. He also does not currently own any real estate. Walz and his wife Gwen Walz sold their most recent home and moved into the governor’s mansion in 2019 when Walz became the governor of Minnesota. Per the disclosures, the only investments Walz holds are his retirement, pension, and life insurance accounts. [The Hill, 8/7/24; The New York Times, 8/9/24]

It’s rare for elected officials not to hold financial assets, and some people are celebrating the modesty of Walz’s portfolio. Walz and his wife also reported no mutual funds, bonds, private equities, book deals, speaking fees, cryptocurrency, or racehorse interests. [Axios, 8/7/24; The Wall Street Journal, 8/12/24]

Most Americans don’t own stocks, bonds, or cryptocurrency. A Federal Reserve report on Americans’ economic well-being shows that just 31% of non-retirees in America own “Stocks, bonds, ETFs, or mutual funds held outside a retirement account.” The number only goes up to 35% for all adult Americans. The report also shows that 64% of Americans in 2023 owned a home, and that just 7% of Americans held or used cryptocurrency in 2023. [Federal Reserve, Economic Well-Being of U.S. Households in 2023, 5/24]

As a member of Congress in 2011, Walz co-sponsored the STOCK Act in an attempt to combat insider trading. Signed into law in 2012 by then-President Barack Obama, the STOCK Act aimed to prevent lawmakers and congressional staffers from trading on non-public information. While pushing for the legislation, Walz spoke about the importance of “restoring faith” among Americans that their lawmakers are not in office only to enrich themselves. [USA Today, 8/9/24; Twitter/X, 8/7/24]

What will the right-wing media whine about this time in regards to Tim Walz? Having a financial portfolio of an average American, and one that doesn’t have any stock market or bond investments.

39 notes

·

View notes

Text

Finding Your Investment Path: A Simple Guide

In the vast ocean of financial opportunities, finding the right investment scheme can feel like searching for a needle in a haystack. Every individual's financial goal, risk tolerance, and investment horizon are unique, making it crucial to navigate through the diffrent of options available in the market. From fixed income to equity and everything in between, understanding the various investment schemes is key to building a robust and diversified portfolio tailored to your needs.

Fixed Income: Let's begin with the fundamentals. Your investment portfolio's fixed income investments are similar to the consistent beat of a drum. The traditional examples are bonds and certificates of deposit (CDs). They are the best option for people looking for stability because they provide predictable returns at a lower risk. And you can earn average 8-10% return.

Managed Portfolios: Do you like someone else to do the grunt work? You may want to consider managed portfolios. These expertly managed funds provide a hands-off approach to investing, catered to your financial objectives and risk tolerance.

Insurance: Although the main goal of insurance is to provide protection, several plans also include investment options. For example, life insurance policies give you coverage and the opportunity to gradually build up cash value; for the astute investor, this is a two-for-one offer.

Derivatives: At this point, things become a little more intricate. The value of derivatives is derived from underlying securities or indexes. This group includes swaps, futures, and options. They can be employed speculatively or for hedging, but they're not for the timid. but do not invest in derivatives until and unless you are expert in this field.

Credit Instruments: Now let's talk about credit instruments, which include peer-to-peer lending websites and corporate bonds. With the range of risk and return potential offered by these products, you can tailor your portfolio to your degree of risk tolerance.

Equities: Ah, the stock market, the global investor community's playground. Purchasing stock entails obtaining ownership of shares in publicly traded corporations. It's all about dividends and growth potential, but be prepared for market turbulence.

Keep it straightforward: align your investments with your time horizon, risk appetite, and goals. To distribute the risk, diversify between several programs. And keep up with market developments at all times. Recall that there isn't a single, universal strategy for investing. Discover what works for you and get to work accumulating wealth!

#invetment#wealth#fixed income#security#risk#return#instrument#financial planning#financial services#low risk high reward

15 notes

·

View notes

Text

Making Money While Making a Difference: The Rise of Impact Investing

In a world increasingly driven by social consciousness, impact investing emerges as a powerful strategy for making money while contributing positively to society. This investment approach not only seeks financial returns but also aims to generate a measurable, beneficial social or environmental impact.

What is Impact Investing?

Impact investing challenges the traditional view that social issues should be addressed only by philanthropic donations, and that market investments should focus solely on achieving financial returns. Instead, it combines the best of both worlds, allowing investors to support issues they care about while also making profitable investments.

The Financial Returns of Impact Investing

Contrary to popular belief, impact investing can indeed be profitable. Investments in areas like renewable energy, sustainable agriculture, healthcare, and education have shown competitive returns compared to traditional investments. For instance, renewable energy projects often benefit from government subsidies and sell power at fixed prices, providing stable cash flows that are attractive to investors.

Market Growth and Diversification

The market for impact investments has grown significantly, with assets under management expected to continue to increase. This growth is driven by an expanding base of investors, ranging from institutional investors and family offices to individual investors who are increasingly aware of social and environmental issues.

How Does Impact Investing Work?

Investors looking to get involved in impact investing can start by identifying their interests in specific social or environmental causes. They can then seek out investment funds or platforms that offer opportunities to invest in businesses or projects that align with those values. Investments can range from community development projects and clean technology to microfinance loans and sustainable consumer products.

Conclusion

Impact investing offers a unique opportunity to create a positive influence while achieving financial gains. As this approach continues to evolve, it provides a compelling alternative for those looking to make money while actively contributing to a better world.

For more insights into how you can engage in impact investing and combine your financial objectives with your values, visit Ajmera x-change.

0 notes

Note

advice for people just wanting to be educated in the finance field?

I would start dipping your toe in the finance sections of reputable sources (i.e. Financial Times, Wall Street Journal, Harvard business review, MarketWatch, etc.) and start researching terms and companies you don’t know. I treat myself with a Bloomberg Businessweek subscription sent to my home because I love their design team and it’s actually very informative. You can also sign up for the Morning Brew finance newsletter, it’s free and I read it every morning to get a brief overview of what’s going on. Even just being informed of current events is helpful in learning about finance because all major events effect the market and businesses. Look at stock performance charts. Learn about different types of investment accounts and different kinds of investments. There are a lot of really great courses on platforms like Coursera as well, I just took one called Private Equity & Venture Capital from Università Bocconi. Flirt with equity crowdfunding platforms (I accidentally made a lot of money on one of these as an early investor with less than $1k). If you live in the US start looking into personal and business tax deductions. Even credit card rewards can actually get you a lot, I’ve gotten free hotel rooms and free flights from money I would have spent anyway. Investments also mean more than just individual stocks: could be index funds, mutual funds, bonds, CDs, REITs, forex, precious gems & metals, real estate, even some designer goods retain and increase in value if bought strategically and handled correctly. Even just having the fundamentals of a maxed out retirement account (a Roth IRA or a backdoor Roth IRA is my personal preference) full of index funds and mutual funds that are balanced well, a fully funded emergency fund of 3-12 months personal expenses, any debt above 7% interest paid off, and sinking funds for various expenses automatically set up in a high yield savings account will have you very well off. When you have a foundation like that you have the breathing room to change careers, take time off, buy investment properties, invest in volatile but potentially profitable ventures, start businesses, and set up additional streams of income.

#i am not a financial advisor but this is what I’ve learned from school and self education and personal trial and error#i think I’m gonna do a detailed finance books list if y’all would like that I think it could be very useful

150 notes

·

View notes

Text

What is Mutual Fund?

A mutual fund is a type of investment vehicle that pools money from multiple investors to invest in a diversified portfolio of securities such as stocks, bonds, and other assets. Investments in securities are spread across a wide cross-section of industries and sectors and thus the risk is reduced.

It is managed by a professional fund manager or an asset management company (AMC) who makes investment decisions on behalf of the investors.

Mutual funds offer good investment opportunities to the investors. Like all investments, they also carry certain risks

SEBI formulates policies and regulates the mutual funds to protect the interest of the investors.

OVERVIEW OF MUTUAL FUNDS INDUSTRY IN INDIA

The mutual fund industry in India was set up through a combination of regulatory changes, legislative reforms and the entry of various market players.

Unit Trust of India- UTI was founded in 1964, which is when the mutual fund sector in India first started to take off. To mobilize public funds and invest them in the capital markets, UTI was established as a statutory body under the UTI Act, 1963. The idea of mutual funds was greatly popularized in India because to UTI.

Regulatory Framework-In India, the mutual fund industry's regulatory structure began to take shape in the 1990s. The Securities and Exchange Board of India (SEBI) Act, which established SEBI as the governing body for the Indian securities markets, was passed in 1993. Among other market intermediaries, SEBI was responsible with regulating and supervising mutual funds.

The SEBI (Mutual Funds) Regulations,1996- This regulation established the legal foundation for the establishment, administration, and operation of mutual funds in India. These regulations outlined the standards for investor protection, investment restrictions, disclosure requirements, and eligibility requirements for asset management companies (AMCs).

Introduction of Private Sector Mutual Funds: UTI was the only active mutual fund provider in India prior to 1993. Private sector mutual funds were nevertheless permitted to enter the market as a result of the liberalization of the financial sector and the opening up of the Indian economy. Many domestic and foreign financial organizations launched their own AMCs and entered the mutual fund industry.

Product Line Evolution: The mutual fund sector in India has grown and increased its product selection throughout the years. Mutual funds initially mainly offered income and growth opportunities. To address various investor needs and risk profiles, the industry did, however, offer a wider range of products, such as equity funds, debt funds, balanced funds, and specialist sector funds.

Investor Education and Awareness: Serious efforts have been made to educate and raise investor awareness in order to encourage investor involvement in mutual funds. Industry groups, AMCs, and SEBI have run investor awareness campaigns, distributed instructional materials, and supported systems for resolving investor complaints. Systematic Investment Plans (SIPs) were introduced, and this was a significant factor in luring individual investors

Technological Advancements-The mutual fund sector in India has embraced technological development, making it possible for investors to access and invest in mutual funds through online platforms and mobile applications. Investors can now transact, track their investments, and get mutual fund information more easily thanks to digital platforms.

The mutual fund industry in India has developed into a strong and regulated sector through regulatory changes, market competition, and investor-centric initiatives. The sector keeps expanding, drawing in more investors and providing them with a wide variety of investment possibilities around the nation.

#business#writing#investment#mutual funds#security market#money#sebi registered investment advisor#equity#make money tips#savings#financial#raise funds#funds#profit#return#growth#reading#knowledge#personal finance#income

43 notes

·

View notes

Text

The Role of Diversification in Mitigating Investment Risk

Investing is one of the most critical strategies you can use to minimize your investment risk and this is why diversity is essential. In other words, it means spreading your investments across various types of assets so that you do not suffer great losses due to poor performance in any one share or investment. This article focuses on how diversification can help reduce investment risks while giving practical tips on how to diversify portfolios effectively.

Understanding Diversification

You do not put all your baskets in one egg carton. Therefore, by investing in different assets like stocks, bonds, real estate and commodities, if one investment fails then it will save a lot from losing anything with a greater amount. The rationale behind this system is simple: different kinds of investments usually react differently to market conditions. For example when some are going down others may be growing hence ensuring an overall stable return.

Importance of Diversification

Mitigates risk: diversification helps spread the risks. Investing everything into a single share which collapses leads to losing mostly all one's money. However if he had a diversified portfolio such a situation would not have affected much on the entire portfolio since before there used to be good gains in some areas but now as compared it seems lesser than before.

Smooth Returns: A portfolio that has good diversification would experience lesser fluctuations. This implies that you will not experience vast changes in values brought about by investing in just one category of assets. By doing this, your profits are likely to be constant even as time passes.

The Possibility of Higher Returns: Even though the assumption of constant returns from different classes is not true, yet on average it leads to stability over all returns. If you have different kinds of financial tools some may perform well making other investments more profitable.

Conduct a proper market research and analysis like fundamental analysis, technical analysis etc. There are lot of websites which provides various tools to conduct analysis. One of the best websites for fundamental analysis is Trade Brains Portal. Trade Brains Portal has various tools like Portfolio analysis, Stock compare, Stock research reports and so on. Also the website provides fundamental details of all the stocks listed in Indian stock market.

How to Create Diversification

First Invest In Different Asset Classes: The initial stage of diversifying is distributing investments among diverse asset classes. You might include:

Shares: For instance invest into various sectors and industries which protects against any concentration risk.

Debts: Join corporate and state obligations that have various due terms.

Property: Purchase land or consider REITs which will go a long way in further diversity for the filling

Blacksmith’s tools: This allows one to hedge against stock price fluctuations since there are shares made from gold or liquid petroleum.

Asset Classes: Inside Each, Diversify More: Inside every asset class, further diversification should be encouraged. For instance, your stock portfolio may comprise both large, mid- and small-cap stocks pulled from various industries such as technology, health care or finance. Conversely, for fixed income investments you could consider both short- and long-term bonds from different issuers.

Geographic Diversification: Don’t confine your investments to just one country; consider allocating funds to global equities and debts so that you can ride on worldwide growth spurts at the same time lowering chances of going broke due to national downturns only.

Utilize Index Funds and ETFs: Index funds along with exchange-traded funds (ETFs) create fantastic platforms for diversification. Basically, these are investment vehicles which collect funds from numerous investors to buy a spectrum of stocks or bonds which automatically leads to diversification in the fund itself. As such; investing in index or ETF money market accounts results in an instantily diversified portfolio.

Strategic Diversification

Design Balanced Portfolios: A balanced portfolio will include stocks, bonds and other assets. The exact mix of these three categories depend on your risk appetite, investment objectives and time frame. For example; if you are young with an extended investment period ahead like 30 years or more, then perhaps you could have a greater percentage of equity shares. Conversely before retirement age it is likely that one would move towards more fixed income securities and other low-volatility options. Inorder to reduce the risk, one can invest in large cap companies or also investing in companies which has good dividends, bonus and splits can be a better choice.

1. Re Judiciously: With the passage of time, every investment’s worth may change thus creating an uneven portfolio. “Rebalance” refers to the act of bringing back into line one's desired proportions of investments as stocks, bonds or other such asset categories. This ensures that risk levels correspond with individual investment objectives.

2. Follow Up and Amending: Literacy needs one given fiscal policy to always differ and be changing as per preferences of that certain individual in the market at a particular time upon follow up from it regularly. Periodic adjustments may be required so as to keep an overall investment mix in balance hence giving opportunity for some time before buying any new ones.

Common Mistakes

Over Diversification: It is evident that although diversification matters; it can also harm your profit margins through excessive dilution. Avoid extensionalizing too thin your assets or choosing funds too far too many Aim for a balanced approach based on few investments.

Ignoring Asset Correlation: Diversification works well when these assets are not related closely. Investing in closely related assets ends up negating the effects on one’s portfolio during downturns and making this strategy less beneficial. All your assets ought to have different levels of risks as well as respond independently to different market conditions.

Minimizing Hazardous Behavior: Asset allocation must be aligned with your appetite for risk as well as your investment objectives. Don’t just diversify simply for the purpose of it. Ensure that your portfolio represents your comfort with risk and conforms to your financial aims.

Conclusion

A potent strategy for curtailing investment risks and obtaining more steady returns is diversification. When you spread out investments throughout various asset classes, industries and regions, the effect of bad performance on one specific investment will be reduced thus enhancing stability of the entire portfolio. Remember to diversify within asset classes, utilize index mutual funds along with ETFs then periodically check and adjust the mix in order to have an ideal level of diversification throughout your life cycle; this way you will be able to handle any changes in the marketplace hence working towards fulfilling all your dreams.

#stock market#investment#stock market india#splits#stocks#fundamental analysis of stocks#Indian share market

3 notes

·

View notes

Text

Investment Options in India: Diversify Your Portfolio in 2024

Diversification is a fundamental principle of investing, essential for managing risk and optimizing returns. In 2024, as investors navigate an ever-changing economic landscape, diversifying their portfolios becomes even more critical. India, with its vibrant economy, diverse markets, and growth potential, offers a plethora of investment options for both domestic and international investors. In this comprehensive guide, we explore various investment avenues in India in 2024, from traditional options like stocks and real estate to emerging opportunities in startups and alternative assets.

1. Equities: Investing in the Stock Market

Investing in equities remains one of the most popular ways to participate in India's economic growth story. The Indian stock market, represented by indices such as the Nifty 50 and Sensex, offers ample opportunities for investors to capitalize on the country's booming sectors and emerging companies.

- Blue-Chip Stocks: Invest in established companies with a proven track record of performance and stability.

- Mid and Small-Cap Stocks: Explore growth opportunities by investing in mid and small-cap companies with high growth potential.

- Sectoral Funds: Diversify your portfolio by investing in sector-specific mutual funds or exchange-traded funds (ETFs) targeting industries such as technology, healthcare, and finance.

2. Mutual Funds: Professional Fund Management

Mutual funds provide an excellent avenue for investors to access a diversified portfolio managed by professional fund managers. In India, mutual funds offer a range of options catering to different risk profiles and investment objectives.

- Equity Funds: Invest in a diversified portfolio of stocks, including large-cap, mid-cap, and small-cap companies.

- Debt Funds: Generate stable returns by investing in fixed-income securities such as government bonds, corporate bonds, and treasury bills.

- Hybrid Funds: Combine the benefits of equity and debt investments to achieve a balanced risk-return profile.

- Index Funds and ETFs: Track benchmark indices like the Nifty 50 and Sensex at a lower cost compared to actively managed funds.

3. Real Estate: Tangible Assets for Long-Term Growth

Real estate continues to be a popular investment option in India, offering the dual benefits of capital appreciation and rental income. While traditional residential and commercial properties remain attractive, investors can also explore alternative avenues such as real estate investment trusts (REITs) and real estate crowdfunding platforms.

- Residential Properties: Invest in apartments, villas, or plots of land in prime locations with high demand and potential for appreciation.

- Commercial Properties: Generate rental income by investing in office spaces, retail outlets, warehouses, and industrial properties.

- REITs: Gain exposure to a diversified portfolio of income-generating real estate assets without the hassle of direct ownership.

- Real Estate Crowdfunding: Participate in real estate projects through online platforms, pooling funds with other investors to access lucrative opportunities.

4. Startups and Venture Capital: Betting on Innovation and Entrepreneurship

India's startup ecosystem has witnessed exponential growth in recent years, fueled by a wave of innovation, entrepreneurial talent, and supportive government policies. Investing in startups and venture capital funds allows investors to participate in this dynamic ecosystem and potentially earn high returns.

- Angel Investing: Provide early-stage funding to promising startups in exchange for equity ownership, betting on their growth potential.

- Venture Capital Funds: Invest in professionally managed funds that provide capital to startups and emerging companies in exchange for equity stakes.

- Startup Accelerators and Incubators: Partner with organizations that support early-stage startups through mentorship, networking, and access to resources.

5. Alternative Assets: Diversification Beyond Traditional Investments

In addition to stocks, bonds, and real estate, investors can diversify their portfolios further by allocating capital to alternative assets. These assets offer unique risk-return profiles and can act as a hedge against market volatility.

- Gold and Precious Metals: Hedge against inflation and currency fluctuations by investing in physical gold, gold ETFs, or gold savings funds.

- Commodities: Gain exposure to commodities such as crude oil, natural gas, metals, and agricultural products through commodity futures and exchange-traded funds.

- Cryptocurrencies: Explore the emerging asset class of digital currencies like Bitcoin, Ethereum, and others, which offer the potential for high returns but come with higher volatility and risk.

Conclusion

Diversifying your investment portfolio is essential for mitigating risk, maximizing returns, and achieving long-term financial goals. In 2024, India offers a myriad of investment options across various asset classes, catering to the preferences and risk profiles of different investors.

Whether you prefer the stability of blue-chip stocks, the growth potential of startups, or the tangible assets of real estate, India provides ample opportunities to diversify your portfolio and capitalize on the country's economic growth story. By carefully assessing your investment objectives, risk tolerance, and time horizon, you can construct a well-diversified portfolio that withstands market fluctuations and delivers sustainable returns in the years to come.

This post was originally published on: Foxnangel

#best investment options in india#diversify portfolio#share market#stock market#indian stock market#mutual funds#real estate#startups in india#venture capital#foxnangel#invest in india

4 notes

·

View notes

Note

I love your insights and agree that Jensen’s deal with Amazon seems to fit more like a actor’s holding deal. If I understand how those work, it’s where the studio pays the actor a salary for a year to hold them to try and find a role for him/her in a tv show or movie. Is that correct?

You’ve said Amazon doesn’t pay actors very well, so what is your guess to Jensen’s salary that Amazon is paying him? (Is that how he was able to afford a $10million mansion in Connecticut?)

Do those work like typical salaries (weekly/monthly) or because it was also tied to his production company, was that annual salary paid to him in an upfront sum with hopes the ackles would use the money to develop a project?

given the strike, the ackles cannot develop anything, do they have to refund any money back to amazon?

Thank you and yes, in typical holding deals the actor will receive a salary for at least one year while the studio finds a suitable project for them. Similarly, Jensen would get paid X amount of dollars for the term no matter what. He would get a check every month that comes out of the millions in his deal, this will go to pay for overhead of running Chaos Machine, including employee salaries., office space, etc. So any advanced money the Ackles received is their's to keep even if there are no project(s) for Amazon's original programming.

With that said, I highly doubt that the CMP received the typical starter $10 million for production overheads as the deal was to hire Jensen for his acting (and his fandom). Jensen may have received $1 million in retainer fee instead.

As for the Ackles' ~ investment in Connecticut, he's going to sell that house in a year or two to an Irrevocable Life Insurance Trust, then use the “sale” and the equity in the CT house to buy another house, just like he did with the Colorado house that was brought when he sold the Austin lake house (at half the market value) to the same trust. For example, if the Ackles put down at least 20% for the lake house, when the property’s value goes up by 20% (and it will), the Ackles have now made a 100% ROI and that’s before considering rents and tax write offs. Then when the houses like the lake house is sold for real in 10, 15, or 20 years, it will be sold at it's actual market price. It's a classic use of these types of trusts to make money by reaping the actual profit from the real sale and on top of the previous profit when the house was first sold into the trust.

Jensen can easily never work again in his life just by living off his net worth, which I’ve speculated to be 20-25 million dollars and if he invest conservatively his net worth will double in ten years. While he's ~investing in real estates, I suspect his main source of passive income comes from investing in target-date funds, they’re a mix of stocks, bonds, and alternative assets and probably in a collection of mutual funds. If Jensen keeps to the common rule of withdrawal limit of 4%, he’ll have at least $1 million fuck-you money every year, more than enough to cover property tax and he and his family will be comfortably wealthy for the rest of their lives without working. But men need to work, hence why he pitched to WB the ideal of continuing SPN after Jared leaves.

@supernaturalconvert techically the trusts own the houses, and the people currently living at the lake house are paying rent to the "beneficiaries", which are the Ackles.

16 notes

·

View notes