#equity investment

Explore tagged Tumblr posts

Text

Importance of chart analysis for equity investments

Image by freepik Chart analysis, or technical analysis, can be quite helpful for equity investment in the Indian stock market. Here are several reasons why it is beneficial: Benefits of Chart Analysis in the Indian Stock Market 1.Trend Identification The Indian stock market, like any other, exhibits trends over time. Chart analysis helps in identifying these trends, allowing investors to ride…

#chart analysis#equity investment#Financial Markets#Indian stock market#investment strategies#market analysis#Market Sentiment#Stock Charts#Stock Market#Stock Trading#Support and Resistance#Technical Analysis#Technical Indicators#Trading Patterns#Trend Identification#Volume Analysis

3 notes

·

View notes

Text

"Future-Proof Trading: How to Unlock Investment Opportunities"

Tradinghistorically has been a potent means for people to build wealth since it gives them the chance to increase their capital employing bothlong & short-termtactics. Making sensible choices and remaining informed are essential for success as investing markets move.

Traders hoping to reach their full earning capacity & Motilal Oswal Jaipur established company in the world of finance of offers state-of-the-art instruments and comprehensive research, and personalized guidance. Their comprehensive trading platforms appeal to both new and expert traders, whether they decide to trade equities commodities or currencies.

investingin the future through Motilal Oswal Jaipuryou can be trusting that you will have accessibility to danger control methods and deep-depth market information. trading with Motilal Oswal Jaipur is about creating a prosperous and financially viable future, not just about buying & selling assets. Traders can accomplish their fiscal goals as they navigate the market by making the greatest use of their resources. Investing into the future with Motilal Oswal Jaipur gives you access to endless possibilities and sophisticated trading techniques.

#article#investment#motilaloswal#news#broker#jaipur#motilaloswaljaipur#googlemaps#invest#stockmarket#investing#india#equity investment#investingfuture.in#market trading

0 notes

Text

How is a diversified portfolio similar to a thali that you order in a restaurant?

You might have gone to a restaurant and ordered a thali. It comes with multiple dishes including two types of vegetables, one daal, boondi raita, and a choice of bread, one sweet dish, and rice.

It doesn't make sense to only order rice/chapati/vegetables, right? It doesn't make your meal complete. We need variety to satisfy our appetite and get the taste of each dish.

Similarly, when you want to achieve your dreams, whether it is to retire early, buy a dream home, or achieve financial freedom, you need to have a diversified investment portfolio (an investment portfolio is the collection of investments that you own), just like a thali with multiple dishes.

So, how do you make your investment portfolio diversified, and why is it necessary? I will try to answer these questions in the blog. So, let's begin.

Firstly, let's understand what is investment portfolio diversification

Portfolio diversification is owning multiple assets like stocks, gold, real-estate, mutual funds in your portfolio. Just like you have multiple dishes in your thali.

Now, why it's necessary to diversify your portfolio.

Let's look back to our thali example. If we only eat rice, it will become boring and unhealthy. Because you are not getting the taste and other nutrients of vegetables, daal, etc.

Similarly, when you invest in a single asset, let's say gold or stocks becomes highly risky, and you may not achieve the desired results. What if the asset goes into a loss and your investment gets wiped out?

The performance of these assets depends on the market. And the market runs on the concepts of demand and supply. If there is a huge demand for something in the market and limited supply, then the price will go up, and vice versa.

To mitigate risk, it is advisable to diversify your portfolio with multiple assets. There is a famous analogy, which is essentially the essence of diversification. It says that you should not keep all your eggs in one basket.

To summarize, diversification is important to minimize Portfolio losses during market uncertainty.

Reduce risk due concentration in one type of assets.

Preserve invested capital.

How to diversify your portfolio?

To diversify your portfolio, you need to invest in multiple assets that perform differently under different market conditions.

For instance, when the economy of a country is doing well, equity usually performs well as corporate earnings go up. However, during this time, bonds typically do not perform well as interest rates increase, and they have an inverse relationship with equity.

On the other hand, during times of global uncertainty, gold is considered a safe haven asset and tends to perform well because people move their capital from equity.

Hence, it's essential to have a balanced mix of these asset classes to diversify your portfolio and mitigate the impact of various market conditions.

To achieve this, you can seek help from a mutual fund distributor who is an expert in identifying your risk profile, suggesting investments, and regularly reviewing your portfolio.

Their expertise can assist you in creating a diversified portfolio that aligns with your investment objectives and risk tolerance.

How can we help you? Here at

mutual fund distributor, we offer investment in different assets right from a single platform including:

Mutual fund SIP we can help you identify the top mutual funds for SIP and we are the Best SIP provider.

P2P service: peer-to-peer lending is an alternative to bank FD with potentially higher interest rates and flexibility.

Equity Investment: we provide India's first AI-powered wealth management platform which can generate returns of up to 30% with expert curated portfolios.

With us, you get:

Complete online investment in multiple assets

One-to-one support for your queries

Customized portfolio according to your risk profile and needs

Financial planning for your goals in life

Advice on asset allocation

So, are you ready to achieve your goals? Invest with us to diversify your investment portfolio and fulfill your dreams.

#best mutual fund distributor#mutual fund expert in jabalpur#p2p services#Best SIP Provider#Equity Investment#mutual fund distributor in india#personal financial planning in jabalpur

1 note

·

View note

Text

In the ever-evolving landscape of business, entrepreneurs and established companies alike seek avenues for growth and expansion. One powerful tool that has gained prominence in recent years is private equity services. These Financial Services play a pivotal role in shaping the trajectory of businesses, offering a unique blend of capital infusion, strategic guidance, and operational expertise. In this blog post, we will delve into the multifaceted world of private services for private equity and explore their indispensable role in fostering business growth.

#financial services compliance#financial services#financial planning#financial advisor#investors#california news#california#san jose california#investment banking#Financial Services Agency#equity investment#industry experts#smallbusinessitsupport#business growth#marketing#private equity#guidance#upcoming ipo#investments#financial health

0 notes

Text

Unlocking Infrastructure Growth: The Power of Convertible Debenture Equity Investment with Offshore Bank Guarantees

In the ever-evolving landscape of global finance, innovative funding mechanisms play a crucial role in driving infrastructure and development projects forward. Among these, convertible debenture equity investments, particularly when backed by guarantees from top-tier offshore banks, stand out as a compelling strategy for investors and project developers alike. The Essence of Convertible…

View On WordPress

0 notes

Text

Red Lobster was killed by private equity, not Endless Shrimp

For the rest of May, my bestselling solarpunk utopian novel THE LOST CAUSE (2023) is available as a $2.99, DRM-free ebook!

A decade ago, a hedge fund had an improbable viral comedy hit: a 294-page slide deck explaining why Olive Garden was going out of business, blaming the failure on too many breadsticks and insufficiently salted pasta-water:

https://www.sec.gov/Archives/edgar/data/940944/000092189514002031/ex991dfan14a06297125_091114.pdf

Everyone loved this story. As David Dayen wrote for Salon, it let readers "mock that silly chain restaurant they remember from their childhoods in the suburbs" and laugh at "the silly hedge fund that took the time to write the world’s worst review":

https://www.salon.com/2014/09/17/the_real_olive_garden_scandal_why_greedy_hedge_funders_suddenly_care_so_much_about_breadsticks/

But – as Dayen wrote at the time, the hedge fund that produced that slide deck, Starboard Value, was not motivated by dissatisfaction with bread-sticks. They were "activist investors" (finspeak for "rapacious assholes") with a giant stake in Darden Restaurants, Olive Garden's parent company. They wanted Darden to liquidate all of Olive Garden's real-estate holdings and declare a one-off dividend that would net investors a billion dollars, while literally yanking the floor out from beneath Olive Garden, converting it from owner to tenant, subject to rent-shocks and other nasty surprises.

They wanted to asset-strip the company, in other words ("asset strip" is what they call it in hedge-fund land; the mafia calls it a "bust-out," famous to anyone who watched the twenty-third episode of The Sopranos):

https://en.wikipedia.org/wiki/Bust_Out

Starboard didn't have enough money to force the sale, but they had recently engineered the CEO's ouster. The giant slide-deck making fun of Olive Garden's food was just a PR campaign to help it sell the bust-out by creating a narrative that they were being activists* to save this badly managed disaster of a restaurant chain.

*assholes

Starboard was bent on eviscerating Darden like a couple of entrail-maddened dogs in an elk carcass:

https://web.archive.org/web/20051220005944/http://alumni.media.mit.edu/~solan/dogsinelk/

They had forced Darden to sell off another of its holdings, Red Lobster, to a hedge-fund called Golden Gate Capital. Golden Gate flogged all of Red Lobster's real estate holdings for $2.1 billion the same day, then pissed it all away on dividends to its shareholders, including Starboard. The new landlords, a Real Estate Investment Trust, proceeded to charge so much for rent on those buildings Red Lobster just flogged that the company's net earnings immediately dropped by half.

Dayen ends his piece with these prophetic words:

Olive Garden and Red Lobster may not be destinations for hipster Internet journalists, and they have seen revenue declines amid stagnant middle-class wages and increased competition. But they are still profitable businesses. Thousands of Americans work there. Why should they be bled dry by predatory investors in the name of “shareholder value”? What of the value of worker productivity instead of the financial engineers?

Flash forward a decade. Today, Dayen is editor-in-chief of The American Prospect, one of the best sources of news about private equity looting in the world. Writing for the Prospect, Luke Goldstein picks up Dayen's story, ten years on:

https://prospect.org/economy/2024-05-22-raiding-red-lobster/

It's not pretty. Ten years of being bled out on rents and flipped from one hedge fund to another has killed Red Lobster. It just shuttered 50 restaurants and declared Chapter 11 bankruptcy. Ten years hasn't changed much; the same kind of snark that was deployed at the news of Olive Garden's imminent demise is now being hurled at Red Lobster.

Instead of dunking on free bread-sticks, Red Lobster's grave-dancers are jeering at "Endless Shrimp," a promotional deal that works exactly how it sounds like it would work. Endless Shrimp cost the chain $11m.

Which raises a question: why did Red Lobster make this money-losing offer? Are they just good-hearted slobs? Can't they do math?

Or, you know, was it another hedge-fund, bust-out scam?

Here's a hint. The supplier who provided Red Lobster with all that shrimp is Thai Union. Thai Union also owns Red Lobster. They bought the chain from Golden Gate Capital, last seen in 2014, holding a flash-sale on all of Red Lobster's buildings, pocketing billions, and cutting Red Lobster's earnings in half.

Red Lobster rose to success – 700 restaurants nationwide at its peak – by combining no-frills dining with powerful buying power, which it used to force discounts from seafood suppliers. In response, the seafood industry consolidated through a wave of mergers, turning into a cozy cartel that could resist the buyer power of Red Lobster and other major customers.

This was facilitated by conservation efforts that limited the total volume of biomass that fishers were allowed to extract, and allocated quotas to existing companies and individual fishermen. The costs of complying with this "catch management" system were high, punishingly so for small independents, bearably so for large conglomerates.

Competition from overseas fisheries drove consolidation further, as countries in the global south were blocked from implementing their own conservation efforts. US fisheries merged further, seeking economies of scale that would let them compete, largely by shafting fishermen and other suppliers. Today's Alaskan crab fishery is dominated by a four-company cartel; in the Pacific Northwest, most fish goes through a single intermediary, Pacific Seafood.

These dominant actors entered into illegal collusive arrangements with one another to rig their markets and further immiserate their suppliers, who filed antitrust suits accusing the companies of operating a monopsony (a market with a powerful buyer, akin to a monopoly, which is a market with a powerful seller):

https://www.classaction.org/news/pacific-seafood-under-fire-for-allegedly-fixing-prices-paid-to-dungeness-crabbers-in-pacific-northwest

Golden Gate bought Red Lobster in the midst of these fish wars, promising to right its ship. As Goldstein points out, that's the same promise they made when they bought Payless shoes, just before they destroyed the company and flogged it off to Alden Capital, the hedge fund that bought and destroyed dozens of America's most beloved newspapers:

https://pluralistic.net/2021/10/16/sociopathic-monsters/#all-the-news-thats-fit-to-print

Under Golden Gate's management, Red Lobster saw its staffing levels slashed, so diners endured longer wait times to be seated and served. Then, in 2020, they sold the company to Thai Union, the company's largest supplier (a transaction Goldstein likens to a Walmart buyout of Procter and Gamble).

Thai Union continued to bleed Red Lobster, imposing more cuts and loading it up with more debts financed by yet another private equity giant, Fortress Investment Group. That brings us to today, with Thai Union having moved a gigantic amount of its own product through a failing, debt-loaded subsidiary, even as it lobbies for deregulation of American fisheries, which would let it and its lobbying partners drain American waters of the last of its depleted fish stocks.

Dayen's 2020 must-read book Monopolized describes the way that monopolies proliferate, using the US health care industry as a case-study:

https://pluralistic.net/2021/01/29/fractal-bullshit/#dayenu

After deregulation allowed the pharma sector to consolidate, it acquired pricing power of hospitals, who found themselves gouged to the edge of bankruptcy on drug prices. Hospitals then merged into regional monopolies, which allowed them to resist pharma pricing power – and gouge health insurance companies, who saw the price of routine care explode. So the insurance companies gobbled each other up, too, leaving most of us with two or fewer choices for health insurance – even as insurance prices skyrocketed, and our benefits shrank.

Today, Americans pay more for worse healthcare, which is delivered by health workers who get paid less and work under worse conditions. That's because, lacking a regulator to consolidate patients' interests, and strong unions to consolidate workers' interests, patients and workers are easy pickings for those consolidated links in the health supply-chain.

That's a pretty good model for understanding what's happened to Red Lobster: monopoly power and monopsony power begat more monopolies and monoposonies in the supply chain. Everything that hasn't consolidated is defenseless: diners, restaurant workers, fishermen, and the environment. We're all fucked.

Decent, no-frills family restaurant are good. Great, even. I'm not the world's greatest fan of chain restaurants, but I'm also comfortably middle-class and not struggling to afford to give my family a nice night out at a place with good food, friendly staff and reasonable prices. These places are easy pickings for looters because the people who patronize them have little power in our society – and because those of us with more power are easily tricked into sneering at these places' failures as a kind of comeuppance that's all that's due to tacky joints that serve the working class.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/05/23/spineless/#invertebrates

#pluralistic#bust-outs#private equity#pe#red lobster#olive garden#endless shrimp#class warfare#debt#looters#thai union group#enshittification#golden gate#monopsony#darden#alden global capital#Fortress Investment Group#food#david dayen#luke goldstein

6K notes

·

View notes

Text

What is Equity Investment: Meaning, Types and How to Start

WHAT IS EQUITY INVESTING AND WHY IS IT ESSENTIAL?

Quite often it is exciting to hear stories of how certain stocks in India have multiplied manifold over the last 10-15 years. It is also interesting to see how global and Indian investors have made their fortunes in the equity markets.

Before we get into equity investment, there is an important aspect of risk-return trade-off that we must understand. Compared to bonds and FDs, equity investment is riskier and more volatile. But equities also have the potential for higher returns. The BSE Sensex, which represents 30 of the most liquid stocks on the BSE, has grown from 100 to 66,000 in the last 44 years. That is compounded annual returns of 15.9% each year over the last 44 years. It may not have happened each year, but if you had stuck on, you would have made a lot of profits. That is the core of long term investment in equities.

As the legendary mathematician, Euclid told King Ptolemy, “Your Highness, there is no royal route to geometry.” Similarly, there is no royal route to equity investing. To invest in equity calls for planning, analysis, and the willingness to stay put for the long term.

First things first: What is equity?

Equity is the risk capital for any business. When we buy equity or shares or stocks (they all mean the same), we become part owners of the company. It may be small, but it is still ownership. Returns in equity come from dividends distributed by the company and capital gains when the stock price goes above the purchase price. So, equity is ownership, and as the owner, the equity shareholder has potential to earn higher returns with a higher risk.

That brings us to the next practical question, how to invest in equity? For investing in equity in India, need to open a trading account with a broker and a demat account. Remember, trading account is for transactions and demat account is for holding the shares. Both these accounts are mandatory, as per SEBI regulations. And thanks to digital India, understanding the process of how to open demat account and trading account has become a lot quicker and simpler these days.

Types of equity investment

If you thought that opening a trading and demat account and buying shares was the only way to invest in equities, think again. Here are some other ways of participating in different types of equity shares, apart from direct investing.

A very popular way of investing in equities is the mutual funds route. You can invest in lumpsum or even monthly SIPs.

You can invest in preference shares of a company, which is between a pure equity share and a bond.

It is possible to take on higher risk and invest in private equity (PE), where you actually invest in start-ups.

You can also buy equities via index investing; through index funds and index ETFs (exchange traded funds) mirroring the market as a whole.

Why to invest in equities?

When you decide to invest in equities, your close friends and relatives may caution you about equities being risky. They are correct, to an extent. Equities entail higher risk, but do you know what is the biggest risk? It is not taking enough risk when you can afford it. It is looking beyond the risk of investing in share market.

If at the age of 25, you put all your money in bank deposits, your money may be safe, but it will yield nothing after inflation. Equities, not only beat inflation, but also create wealth in the long term. For example, by putting Rs. 5,000 a month in an equity fund giving 14% a year for 25 years, you end up with Rs. 1.36 crore on an investment of Rs. 15 lakhs. That is the power of sustained long-term investment in equities.

Key benefits of investing in equity shares

How do investors benefit by investing in equity shares? Here is a sampler.

Equities are the most reliable asset class to create wealth over 8-10 years and above.

A portfolio of 8-10 stocks can diversify risk. Alternatively, you may opt for an equity mutual fund.

Transfer of shares is simple and can be done by giving instructions online.

You can monitor the portfolio value live on your trading platform 24X7.

Equities are taxed lower compared to FDs and bonds.

How to start investing in equities?

The first step is to understand the risk and return in equities. Once you are mentally prepared for equities, the next step is to open a trading account and demat account with a broker and activate online trading.

Once you fund your trading account, you are all set to invest in equities. Don’t get carried away by tips and rumours on multi-baggers. Rely on solid research to identify quality stocks, monitor these stocks, and stick to them for the long haul. Equities manage risk and returns much better in the long run.

Risks of stock market investing

Stock market or equity investing is more volatile and unpredictable in the short term, but more consistent over the long term. Secondly, buy quality stocks or rely on the power of equity mutual funds. Thirdly, be patient with equities. Don’t expect miracles to happen. If you want instant gratification, stock market is not the place to be. Lastly, factors outside your control can often hit equities. You may have little control over what is happening in Russia or Israel. The best way to manage the risk of investing in share market is to diversify your portfolio.

Equity is not a luxury but a necessity if you want to create wealth in the long run. As Warren Buffett summed it up in his 1987 letter to shareholders: “In the short run, stock market is like voting machine, but in the long run it works like a weighing machine.”

Source: https://www.sbisecurities.in/blog/all-about-equity-investment

0 notes

Text

Investing 101: Building Wealth for the Future

In the dynamic landscape of personal finance, one fundamental principle stands out as a cornerstone for achieving long-term financial success—investing. Whether you’re just starting your journey to financial independence or looking to enhance your existing portfolio, understanding the basics of investing is crucial. This blog aims to guide you through Investing 101, offering insights into the…

View On WordPress

#bond investments#compound interest#consistent investing#equity investment#financial education#financial independence#financial security#how to invest money#importance of investing#invest money#investing#investing basics#investing tips#investing wisely#investment portfolio#money#real estate investment#start investing early#stock market investing#wealth building

0 notes

Text

#givepartners#equity investment#syndicate investing#equity investment syndicating platform#venture investment company#equity investment strategies#moonshot investment

0 notes

Text

Equity Investment vs Mutual fund’s investment

Image by freepik Choosing between equity investment and mutual fund investment depends on your financial goals, risk tolerance, time commitment, and investment knowledge. Here’s a comparison to help you decide which might be better for you: Equity Investment Pros: Potential for Higher Returns: If you pick the right stocks, individual equities can offer substantial returns. Control: You have…

#Diversification#equity investment#financial planning#Investing#Investment Strategy#long-term investment#mutual fund investment#Passive Income#Personal Finance#Portfolio Management#Risk Management#Stock Market#Stock Trading#Wealth Building

1 note

·

View note

Text

Investing Future with Motilal Oswal Jaipur: A Path to Financial Growth

One of the most successful strategies of generating money and safeguarding your financial future is equitiesinvestment. It might make a world of difference to have a reliable financial partner by your side whereas stock markets continue to change.Motilal Oswal has come to represent dependability & knowledgeable suggestion, and a strong emphasis on building wealth for investors in Jaipur.

Why Equity Investing?

Investing in equity has the potential to yield better returns than assets with fixed income and particularly in the long run. They present chances for rapid development, yet also carry an appropriate amount of danger. By purchasing stock, you can participate in the growth of businesses that have the potential for significant returns if they are successful.

The Motilal OswalAdvantage Offering reliableinvestments solutions catered to each person's financial objectives, Motilal Oswal Jaipur has been a pioneer in this field. The firm assists clients in making well-informed selections and assures that investments are in line with long-term wealth objective of equities research and market analysis. One of the biggest advantages of partnering with Motilal Oswal is the tailored strategy. regardless of your level of experience, their staff can provide tailored plans that reflect your risk patience and your financial goals & the current state of the market.

Why Invest in Equityfor Motilal Oswal Jaipur?

Research: Motilal Oswal is well known for producing exhaustive & high-quality research.

personalized Advisory: The financial path of each investor is distinct. A devoted financial advisor at Motilal Oswal Jaipur will assist you in building a portfolio that is customised to meet your individual goals.

Long-Term money Creation: Using equity investments as the primary means for guaranteeing a stable fiscal future & Motilal Oswal emphasizes on accumulating money over an extended period of time.

Technological Edge: Clients can simply navigate their portfolios and get real-time updates and execute transactions quickly thanks to modern instruments and software.

Investing in Your Future Whilst the stock market can be unpredictable, risks can be reduced and rewards can be increased with professional advice. Investingin the decades to come with Motilal Oswal of Jaipur guarantees you the backing of one of India's top financial service companies. Motilal Oswal Jaipur's equities spending can put you on the road to success whether the objectives are to grow your wealth, save for retiring, or reach other financial goals. In conclusion, partnering with Motilal Oswal Jaipur is a wise move for everyone wishing to invest in stocks and build an enjoyable financial future as markets change and possibilities present themself.

#article#investment#motilaloswal#news#broker#jaipur#motilaloswaljaipur#googlemaps#invest#stockmarket#investingfuture.in#googlenews#equity trading#equity#equity mutual funds#equity markets#equity financing#equity investment#employees#report#market#banks#debt

0 notes

Text

Grow your equity investments with our syndicate investing platform & venture investment company. Learn the best equity investment strategies and maximize returns.

#givepartners#equity investment#syndicate investing#equity investment syndicating platform#venture investment company#equity investment strategies#moonshot investment

0 notes

Text

Equity Investment

Unlocking Opportunities: A Comprehensive Guide to Equity Investment

Introduction:

In the world of finance, equity investment has surfaced as important vehicle for wealth creation and capital appreciation. Whether you are an individual investor or a seasoned fiscal professional, understanding the principles and strategies behind equity investment is pivotal for long- term success. This composition aims to give a comprehensive companion to equity investment, exploring its description, advantages, pitfalls, and essential considerations for aspiring investors.

What's Equity Investment?

Equity investment refers to the process of buying shares or stocks of a company, making you a partial proprietor and giving you the right to share in the company's growth and success. When you invest in equity, you come a shareholder, which entitles you to implicit tips and capital earnings. Equity investments can be made in colourful forms, including individual stocks, exchange- traded finances (ETFs), collective finances, and indicator finances.

Advantages of Equity Investment:

Long-term Growth Potential: Long-term Growth Prospects: Historically, stocks have outperformed alternative investment options such as bonds or savings accounts. Although previous success does not guarantee future outcomes, long-term wealth may be generated by investing in well-managed firms with great development potential.

Ownership and Influence: As an equity investor, you own a portion of the firm. This ownership entitles you to various benefits, including voting rights and the capacity to influence the company's decision-making processes, especially in situations needing shareholder approval.

Dividends and Income Generation: Many established firms pay out a percentage of their income to shareholders in the form of dividends. You may establish a consistent income stream by investing in dividend-paying equities. Furthermore, corporations with regular dividend increases can provide a steady stream of passive income.

Diversification: Investing in equity helps you to diversify your portfolio across several sectors, industries, and geographical areas. Diversification can serve to lessen the risk of investing in a single firm or industry, thereby lowering losses during market downturns.

Risks and Considerations:

Market Volatility: Prices in equity markets fluctuate in reaction to economic conditions, geopolitical events, and company-specific variables. To ride out market volatility, investors should be prepared for short-term price fluctuations and have a long-term investing perspective.

Company-specific Risk: Individual businesses may suffer risks as a result of management changes, competitive challenges, technology upheavals, legislative changes, or industry downturns. Before investing, conduct extensive study and analysis to assist reduce these risks.

Investor Knowledge and Research: A good grasp of financial statements, industry trends, and business fundamentals is required for equity investment. Before investing funds, it is critical to do research and analysis on possible investments. Investors can also seek expert guidance from financial advisors.

Capital Loss: Unlike fixed-income investments, stocks do not guarantee a return on investment. There is always the possibility of losing a portion or the entire investment if the company's performance deteriorates or the stock market falls.

Strategies for Equity Investment:

Fundamental Analysis: This method include assessing a company's financial health, business model, competitive stance, and growth prospects. Fundamental analysis is used by investors to find cheap or overpriced companies by focusing on characteristics such as earnings per share, sales growth, profit margins, and industry trends.

Value Investing: Value investors look for stocks that are trading at a discount to their inherent worth. They look at criteria like price-to-earnings ratio, price-to-book ratio, and dividend yield to discover firms that the market may be undervaluing. The long-term potential for price appreciation is emphasised in value investing.

Top 5 rules of Equity Investment:

Do not succumb to Herd Behaviour Pressure:

During the early stages of your financial adventure, you may succumb to the pressure of trading in the same manner as the majority of other investors. To avoid the temptation to follow the pack, do your study on equities investment. If you want to know how to invest your money in the financial markets, go to a financial counsellor.

Think Long-Term:

Another important aspect of equities investing is to consider the long term. Many investors place a high priority on generating rapid profits in the stock market. The disadvantage of this method is that it frequently leads to impulsive and dangerous actions. A better strategy would be to invest for the long term and move your attention to earnings over the next 5 to 10 years.

Refrain from Speculating:

First-time investors are prone to succumbing to speculations and tip-offs, which might put their capital at danger. That might be a danger that your assets are unable to endure. Speculation-based advice regarding the best time to buy or sell a stock are not based on research or facts, and hence are highly likely to be simple assumptions. Instead, perform study and watch the stock market to develop your trading technique.

Diversify:

This is certainly one of the most popular investing suggestions given to investors, and it is also the most hardest guideline to follow, since if a specific asset class performs well the first time you invest in it, you may find yourself heavily reliant on that investment.

Regardless of how easy it may appear to continue investing just in stocks that have previously provided gains for you, you must diversify your investment portfolio. This distributes your risk among several assets, which enhances your long-term profits.

Make a Plan and Stick to it:

Investing in stock without a plan in place is not a wise decision. If you're a first-time investor or searching for investment advice to help you streamline your approach, it's important to start with a plan that focuses on your short- and long-term financial objectives.

Instead of injecting funds each time you want to buy fresh stock, your focus should be on investing a certain amount each month. This allows you to balance your portfolio with other low-risk assets while staying within your budget.

Conclusion: Equity investing methods need a blend of expertise, discipline, and a long-term outlook. You may improve your chances of success in the equity markets by following the top five guidelines described in this article: completing extensive research, diversifying your portfolio, investing for the long term, taking a disciplined approach, and monitoring and evaluating on a frequent basis. Remember that investing in equities always involves some amount of risk, so examine your risk tolerance and consult with a financial counsellor if necessary. Equity investing can potentially generate big benefits and help you reach your financial objectives provided you use the appropriate tactics and strategy.

0 notes

Text

Private Equity Services are ways for specialised firms to help businesses grow and improve by giving them money. With the goal of improving the performance of private companies or buying public companies and making big profits for clients, these services involve investing money in a smart way. Private equity companies usually get money from institutional investors and wealthy individuals and put it into a special fund. This fund is then used in a planned way.

#equity#investment banking#equity investment#equity trading#equity capital markets#business growth#Equity Services#california#usa#san jose california#usa news#california news#investors#financial services#financial advisor#MitigatingRisks#capital infusion#equityinvestment#equityinvestor

0 notes

Text

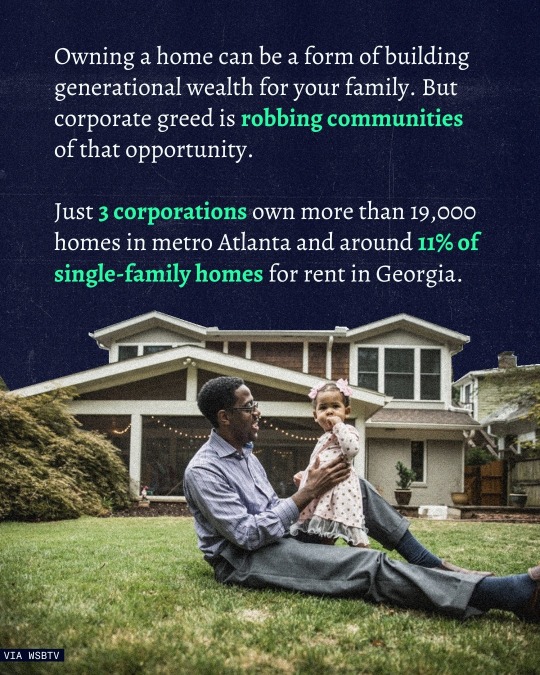

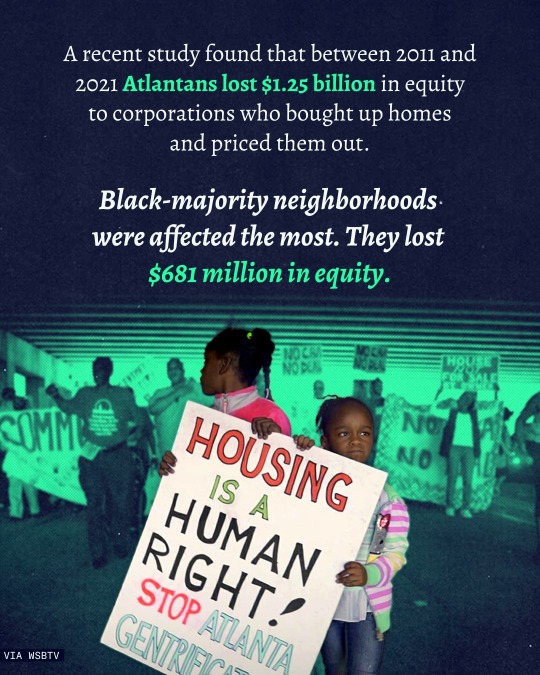

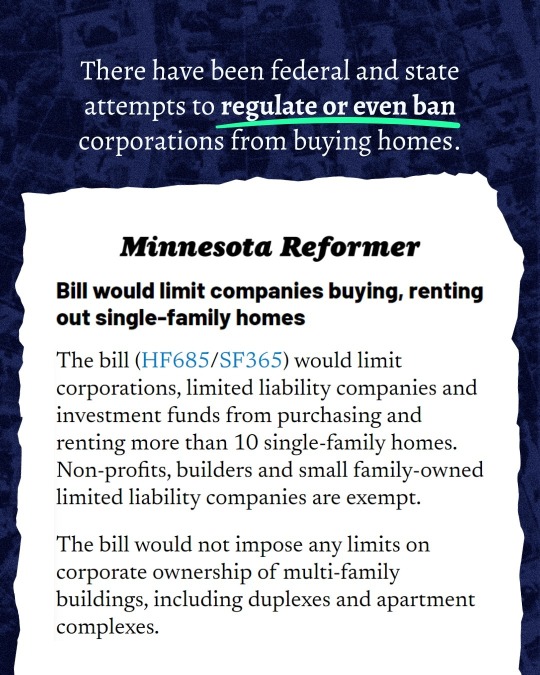

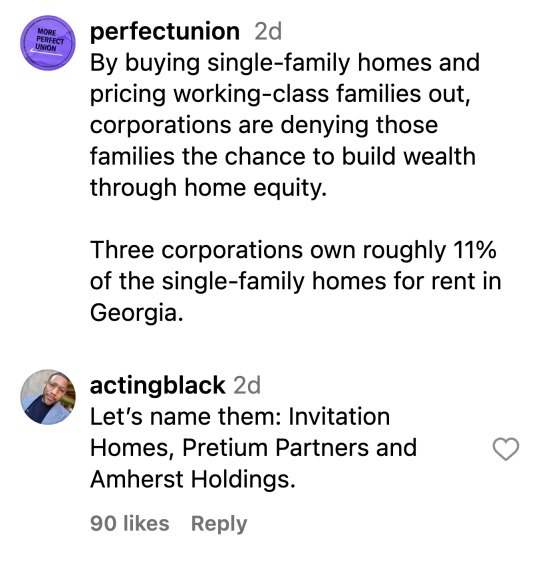

#housing inequality#corporate ownership#home equity#affordable housing#real estate market#wealth disparity#housing crisis#single-family homes#working-class families#corporate landlords#Georgia housing market#property investment#economic disparity#housing affordability#rental market#housing market inequality#corporate real estate#wealth gap#homeownership barriers#housing investment#financial disparity#real estate monopoly#housing affordability crisis#rental housing#economic inequality#property ownership#housing accessibility#corporate influence#affordable homeownership#investment firms in real estate

1K notes

·

View notes

Text

You may have noticed a bunch of companies dropping their DEI programs and I'm going to say that you should probably sell their stock if you own it, but not for the normal lefty reasons, for perfectly capitalist business reasons.

You see, if a company adopted DEI programs because they studied them carefully and determined that they provided a competitive advantage, they wouldn't be dropping now just because the political winds have shifted. What the companies that are hurrying to drop their programs in response to the inauguration or in response to other major companies dropping their programs are saying is that they're poorly managed. They're saying they don't actually adopt policies after careful study but that they just jump on whatever fad they find popular at the moment.

The number one rule of investing, at least for me, is that you should never invest in a poorly managed company. When they make it obvious, that's a sign you should be taking note of.

8 notes

·

View notes