#financial services compliance

Explore tagged Tumblr posts

Text

Benefits of Hiring a Compliance Consultant for Financial Services

Discover how a compliance consultant can help your financial services business stay compliant, reduce costs, and mitigate risks with expert, tailored solutions. Click on https://www.regulatoryrisks.com/blog-details/benefits-hiring-compliance-consultant-financial-services

#compliance consultant#financial services compliance#regulatory compliance#risk management#compliance strategy#cost-effective compliance#regulatory expertise#customized compliance solutions

0 notes

Text

With our rich expertise, we have been providing a complete range of support services to the top investment banking companies worldwide for over half a decade.

We turn opportunities into high profit-yielding businesses with our dynamic team of experts who hold extensive domain-specific research and analytics knack. We practice precision in establishing processes, predicting upcoming market trends, and delivering game-changing investment strategies. Our long-term client relationship and strategic goal setting define our brand’s commitment.

#investment banking#advanced analytics#california#data strategy#accounting#san jose california#business growth#california news#corporate finance#Equity Capital Markets#Debt Capital Markets#Investment Banking Trends#financial services compliance#Business Finance Consulting#small business consulting services#Business Intelligence Consultancy

0 notes

Text

Why Accurate Financial Statements Matter for Your Business

Accurate financial statements are the backbone of any successful business, providing insights into your company’s financial health and guiding decision-making. At SAI CPA Services, we offer expert financial statement preparation, ensuring your records are precise and reliable.

Why Accurate Financial Statements Matter

Accurate financial statements allow businesses to plan for the future, meet regulatory requirements, and demonstrate financial stability. Here’s how our services benefit your business:

Informed Decision-Making: Our financial statement services give you a clear understanding of your revenue, expenses, and overall financial position, enabling you to make informed business decisions.

Investor Confidence: Lenders and investors rely on accurate financial statements to evaluate your business’s health. A professionally prepared statement adds credibility and trust.

Regulatory Compliance: We ensure that your financial statements comply with all necessary accounting standards and regulations, avoiding penalties and ensuring transparency in your operations.

How SAI CPA Services Can Help

At SAI CPA Services, we provide accurate and detailed financial statements to help your business stay on track. Our team ensures that your financial records are up-to-date, reliable, and compliant.

Connect Us: https://www.saicpaservices.com https://www.facebook.com/AjayKCPA https://www.instagram.com/sai_cpa_services/ https://twitter.com/SaiCPA https://www.linkedin.com/in/saicpaservices/ https://whatsapp.com/channel/0029Va9qWRI60eBg1dRfEa1I

908-380-6876

1 Auer Ct, 2nd Floor

East Brunswick, NJ 08816

#SAICPAServices#financial statements#business growth#financial services#accounting#accounting services#cpa#new jeresy#investor confidence#regulatory compliance services

2 notes

·

View notes

Text

Website : https://en.intertaxtrade.com

Intertaxtrade, established in the Netherlands, excels in facilitating international business and assisting individuals in Europe with integrated solutions in tax, finance, and legal aspects. Registered with the Chamber of Commerce, they offer services like company management in the Netherlands, Dutch company accounting, tax intermediation, international tax planning, business law consulting, EU trademark and intellectual property registration, international trade advice, and GDPR compliance. Their expertise in financial and accounting services ensures clients have a clear financial overview, aiding in business success.

Facebook : https://www.facebook.com/intertaxtrade

Instagram : https://www.instagram.com/intertaxtrade/

Linkedin : https://www.linkedin.com/in/ramosbrandao/

Keywords: company registration netherlands legal advice online comprehensive financial planning financial planning consultancy international business services international business expansion strategies gdpr compliance solutions international trade consulting european investment opportunities gdpr compliance consulting services in depth financial analysis gdpr compliance assistance cross border tax solutions netherlands business environment european union business law dutch accounting services tax intermediation solutions international tax planning advice eu trademark registration services investment guidance online business law consultancy corporate tax services netherlands financial analysis experts business immigration support startup legal assistance online european market entry consulting international financial reporting services business strategy netherlands tax authority communication support international business law expertise dutch commercial law advice global business strategy services european business consulting online international business services platform expert legal advice online efficient company registration netherlands reliable dutch accounting services strategic tax intermediation proactive international tax planning eu trademark registration support tailored investment guidance specialized business law consultancy dynamic international trade consulting holistic corporate tax services netherlands streamlined business immigration support online startup legal assistance strategic international business expansion european market entry planning innovative cross border tax solutions navigating the netherlands business environment european union business law insights accurate international financial reporting proven business strategy netherlands exclusive european investment opportunities seamless tax authority communication in depth dutch commercial law advice comprehensive global business strategy proactive european business consulting one stop international business services personalized financial planning solutions expert legal advice for businesses quick company registration in netherlands trustworthy dutch accounting services strategic tax intermediation solutions innovative international tax planning efficient eu trademark registration tailored investment guidance online business law consultancy expertise comprehensive corporate tax services netherlands thorough financial analysis support streamlined business immigration assistance navigating netherlands business environment european union business law guidance international financial reporting accuracy business strategy for netherlands market european investment opportunities insights efficient tax authority communication international business law excellence dutch commercial law proficiency global business strategy implementation european business consulting excellence comprehensive international business services proactive financial planning strategies expert legal advice on international matters

#company registration netherlands#legal advice online#comprehensive financial planning#financial planning consultancy#international business services#international business expansion strategies#gdpr compliance solutions#international trade consulting#european investment opportunities#gdpr compliance consulting services#in depth financial analysis#gdpr compliance assistance#cross border tax solutions#netherlands business environment#european union business law#dutch accounting services#tax intermediation solutions#international tax planning advice#eu trademark registration services#investment guidance online#business law consultancy

4 notes

·

View notes

Text

Equi Corp Legal has the best lawyers in Delhi NCR

#Corporate Disputes Litigation Lawyers in Delhi#Insolvency Bankruptcy NCLT Lawyers in Delhi#Private Equity Funds Investment Transaction Advisory M&A Lawyers in Delhi#Technology E-Commerce Fintech Blockchain Lawyers in Delhi#Regulatory Compliance Legal Audits in Delhi Noida#Director Investor Shareholder Dispute Litigation Lawyers in Delhi#Sports Gaming lawyers in Delhi#Startup Investor Lawyers in Delhi#Banking NBFC Financial Services DRT Debt Restructuring Lawyers in Delhi#Corporate lawyers in Delhi#Arbitration Lawyers in Delhi#Consumer Protection Lawyers in Delhi#Commercial Civil Disputes Litigation Lawyers in Delhi

10 notes

·

View notes

Text

Boost Your Liquor Store Profits with Expert Accounting Solutions

Running a successful liquor store involves more than just stocking the right products and attracting customers—it requires precise financial management. Without accurate accounting, even a profitable liquor store can struggle with cash flow issues, tax compliance, and financial forecasting. That’s where Holiq’s expert accounting solutions come in, offering liquor store owners a streamlined way to manage their finances and maximize profits.

The Importance of Expert Accounting for Liquor Stores

Liquor stores operate with tight margins, fluctuating inventory costs, and strict regulations. Poor financial management can lead to revenue loss, tax penalties, and even legal troubles. With Holiq’s advanced accounting services, you can:

Track Every Transaction with AccuracySay goodbye to manual bookkeeping errors. Holiq’s accounting system ensures every sale, purchase, and expense is recorded automatically, giving you a clear financial picture.

Simplify Tax ComplianceLiquor businesses must navigate complex tax rules, including sales tax, excise tax, and inventory reporting. Holiq helps you stay compliant with built-in tax calculation and reporting features, reducing the risk of costly penalties.

Gain Real-Time Financial InsightsHoliq provides detailed reports and dashboards that give you real-time insights into your revenue, profit margins, and expenses. With a clear financial overview, you can make smarter business decisions.

Automate Payroll and Vendor PaymentsManaging employee wages and supplier payments manually can be time-consuming and prone to errors. Holiq’s automated payroll and vendor payment solutions ensure timely and accurate payments, improving efficiency.

How Holiq Helps Boost Your Liquor Store Profits

Holiq is designed to eliminate financial inefficiencies and maximize profitability through:

Cost-Saving Financial AutomationReduce the time and money spent on manual accounting tasks with Holiq’s automated system. By streamlining processes, you can focus more on growing your business.

Optimized Cash Flow ManagementHoliq’s financial tools help you manage cash flow effectively, preventing shortages and ensuring you always have funds available for inventory and operations.

Profit-Driven Decision MakingWith easy access to sales trends, expense breakdowns, and profit margins, Holiq enables liquor store owners to make data-backed decisions that drive growth.

Get Started with Holiq Today

Don’t let accounting challenges hold your liquor store back. With Holiq’s expert accounting solutions, you can take control of your finances, increase efficiency, and maximize profits. Schedule a demo today and see how Holiq can transform your business!

#accounting services#accounting and bookkeeping#financial insights#automated bookkeeping#track inventory#tax compliance#tax savings#tax regulations#budgeting and forecasting

0 notes

Text

Streamline Your Business with Year-End Accounts Outsourcing

Simplify your year-end accounts preparation with professional outsourcing services from SAS KPO. We offer efficient, accurate, and timely year-end accounts preparation to ensure your business remains compliant and financially organized. Trust our expert team to handle the complexities of financial reporting, so you can focus on growing your business. Visit: https://saskpo.co.uk/year-end-accounts-outsourcing/

#Year-End Accounts Outsourcing Services#Year-End Accounts#Year-End Accounts Services#Accounting Services#Financial Reporting#Business Compliance#Tax Preparation

0 notes

Text

NRI Business Setup Assistance in India

Start your business in India with ease! Murvin NRI Services offers expert assistance for company registration, legal compliance, and strategic planning.

#NRI business setup assistance#Murvin NRI Services#Company registration for NRIs#Business planning in India#Legal support for NRI businesses#Financial advisory for startups#Investment consulting for NRIs#Business opportunities in India#Tax compliance for NRIs#Entrepreneur support for NRIs

0 notes

Text

#compliance services#regulatory compliance services#financial consultant#regulatory compliance#foreign exchange amendment#cross border investment#financial reporting#financial consulting services#indian corporate news

0 notes

Text

Financial Crime Risk Services in 2024 for Cross-Border SMEs

Explore our 2024 guide on navigating financial crime risk services tailored for cross-border SMEs. Learn essential strategies to protect your business and ensure regulatory compliance. Go here https://www.regulatoryrisks.com/blog-details/financial-crime-risk-services-cross-border-smes

#financial crime risk services#financial crime compliance consultant#financial services compliance#financial crime risk assessment

0 notes

Text

In the ever-evolving landscape of business, entrepreneurs and established companies alike seek avenues for growth and expansion. One powerful tool that has gained prominence in recent years is private equity services. These Financial Services play a pivotal role in shaping the trajectory of businesses, offering a unique blend of capital infusion, strategic guidance, and operational expertise. In this blog post, we will delve into the multifaceted world of private services for private equity and explore their indispensable role in fostering business growth.

#financial services compliance#financial services#financial planning#financial advisor#investors#california news#california#san jose california#investment banking#Financial Services Agency#equity investment#industry experts#smallbusinessitsupport#business growth#marketing#private equity#guidance#upcoming ipo#investments#financial health

0 notes

Text

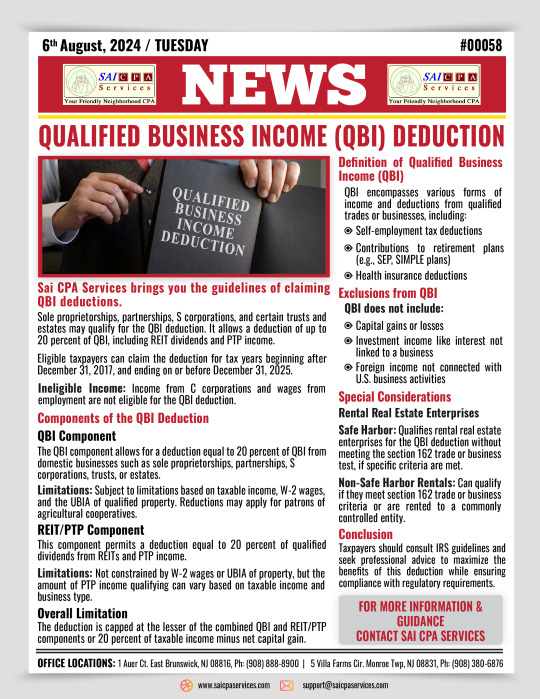

Connect Us: https://www.saicpaservices.com https://www.facebook.com/AjayKCPA https://www.instagram.com/sai_cpa_services/ https://twitter.com/SaiCPA https://www.linkedin.com/in/saicpaservices/ https://whatsapp.com/channel/0029Va9qWRI60eBg1dRfEa1I

908-380-6876

1 Auer Ct, 2nd Floor

East Brunswick, NJ 08816

#saicpaservices#financial services#irs#tax debt#audit#tax compliance#peace of mind#business growth#cpa#new jeresy#accounting#bookeeping#financial planning#BusinessForecasting#financial statements#strategic planning#representation#news#breaking news

2 notes

·

View notes

Text

Unlock Business Growth with NBFC Registration Benefits

An NBFC registration certificate offers unparalleled opportunities, from accessing financial markets to serving unbanked sectors. It empowers your company with trust and credibility in the financial world. Learn how this certification drives your business forward. Take the first step toward growth—reach out for NBFC registration assistance!

#NBFC Registration#NBFC Benefits#Financial Inclusion#NBFC Growth Opportunities#Legal Recognition#Business Credibility#RBI Compliance#Financial Services#NBFC Opportunities#Business Registration#NBFC India

0 notes

Text

Best Accounting Firms in Abu Dhabi @0502510288

Accounting and Bookkeeping Company in UAE - We are one of the best Accounting firms in Abu Dhabi, Dubai UAE provides top finance vision etc. Even though there are numerous accounting firms all over Abu Dhabi, this guide for selecting the right partner for your financial management includes top organizations.

#accountants in abu dhabi#accounting & finance expert in uae#accounting and bookkeeping companies in uae#accounting companies in abu dhabi#accounting companies in uae#accounting company in abu dhabi#accounting firms in abu dhabi#accounting firms in business bay dubai#audit firms in abu dhabi#best business consultancies in uae#best business consultants in uae#best business setup consultants in uae#bookkeeping and accounting firms in abu dhabi#business consultancy firms in uae#business consulting companies in uae#business consulting firms in dubai#business set up consultants in uae#business setup services and consultants in uae#compliance & regulatory reporting services in the uae#compliance services in uae#compliance services uae#internal audit consultants in uae#audit & assurance consultant uae#corporate banking & finance advisory in the uae#corporate finance services uae#erp advisory services in uae#financial regulatory compliance services uae#mainland business setup consultants in dubai#corporate tax planning dubai#management consulting firms in uae

0 notes

Text

Maximize Liquor Store Profits with Tailored Accounting Solutions

Running a liquor store is more than just stocking shelves with top-selling spirits and managing daily transactions. Behind the scenes, efficient financial management plays a crucial role in maintaining profitability and business growth. Without accurate bookkeeping, tax planning, and real-time financial insights, even the most successful liquor stores can face cash flow issues and missed revenue opportunities.

That’s where Holiq’s Accounting Services come in—helping liquor store owners streamline financial operations, optimize tax savings, and boost overall profitability.

The Challenges of Liquor Store Accounting

Managing finances for a liquor store is different from handling accounts for other businesses. Liquor stores face unique challenges, including:

Complex Inventory Costs – Tracking fluctuating wholesale prices, supplier discounts, and bulk purchases.

Tax Compliance & Regulations – Ensuring proper sales tax reporting and compliance with alcohol tax laws.

Cash Flow Management – Balancing inventory costs with daily cash flow and preventing losses.

Profitability Tracking – Identifying which products and categories yield the highest margins.

Without the right accounting solution, liquor store owners risk financial inefficiencies, errors, and potential tax penalties.

How Holiq’s Accounting Services Help

Holiq offers a tailored accounting solution designed specifically for liquor store owners, giving them real-time financial insights, automated bookkeeping, and tax compliance support—all within a single platform.

Key Benefits of Holiq’s Accounting Solutions

Automated Bookkeeping & Financial Tracking

Manually tracking daily sales, expenses, and profits can be time-consuming and prone to errors. Holiq automates bookkeeping, ensuring accurate financial records and reducing human errors. With real-time dashboards, you can see daily, weekly, or monthly revenue trends at a glance.

Optimized Tax Compliance & Reporting

Holiq helps liquor store owners stay compliant with state and federal alcohol tax laws, automatically calculating and filing taxes. Avoid costly penalties and ensure every transaction is accounted for with precise sales tax tracking.

Profitability Insights & Cost Optimization

With Holiq’s smart analytics, liquor store owners can identify which products are the most profitable, track seasonal trends, and optimize inventory purchasing to increase margins. No more guessing—just data-driven decision-making.

Seamless Integration with Business Operations

Holiq doesn’t just handle accounting—it integrates with online ordering, delivery, and loyalty programs, ensuring all revenue streams are accurately tracked. Get a full financial picture of your business without switching between multiple tools.

Ready to Boost Your Liquor Store’s Profits?

Investing in the right accounting solution can save you time, reduce financial errors, and maximize profits. Holiq’s comprehensive accounting services are designed specifically for liquor store owners who want to stay on top of their finances without the hassle.

Schedule a demo today to see how Holiq can transform your liquor store’s financial management and help you grow your business.

#accounting services#accounting and bookkeeping#financial insights#automated bookkeeping#track inventory#tax compliance#tax savings#tax regulations#budgeting and forecasting

0 notes

Text

"Rajasthan High Court Ensures Justice: Employee Entitled to Full Benefits for Suspension Period"

➡️The petitioner, Chandra Prakash Bharadwaj, was employed as a Stenographer Grade-I by the Rajasthan Financial Corporation (RFC).

► He was placed under suspension on August 22, 2011, following his arrest and criminal prosecution under several provisions of the IPC, Immigration Act, and Passport Act.

► The petitioner was acquitted of the charges on March 12, 2015, with the benefit of the doubt.

► RFC revoked his suspension on June 15, 2015, and entitled him to his last drawn salary for the suspension period. However, RFC withheld annual grade increments and arrears through an order dated August 28, 2015.

► The petitioner retired after attaining the age of superannuation and filed this writ petition challenging the order withholding increments and arrears.

#Suspensionperiodbenefits #Employeerights

➡️ The primary legal issue in this *Case was whether the petitioner is entitled to arrears of salary and annual grade increments during the period of suspension, despite the absence of departmental charges or inquiry and his acquittal in criminal proceedings.

#Acquittalandreinstatement #PensionRevision

➡️The petitioner referred to the judgment passed in Rajendra Singh Gehlot v. RFC and Prem Shankar Verma v. RFC where employees were granted financial benefits during suspension.

► Contended that withholding increments and arrears violated the law and applicable regulations.

➡️The Respondents opposed the petition but could not provide legal justification for withholding monetary benefits.

► The Respondent admitted that no charge sheet or departmental inquiry was initiated against the petitioner.

#financialentitlements

➡️The High Court observed that

► the petitioner’s suspension was not followed by any departmental inquiry or charge sheet.

► The petitioner’s acquittal and the absence of any departmental inquiry rendered the suspension unjustified for withholding increments and arrears.

► Rule 37-A of the Rajasthan Service Rules and RFC (Staff Regulations), 1958, does not support withholding increments during the suspension period.

► Precedents establish the entitlement of employees to full financial benefits during suspension if no misconduct is proven.

► The precedents cited by the petitioner were applicable, and RFC’s actions were found contrary to established legal principles.

➡️The Court partly allowed the petition, ordering:

► Quashing the RFC’s order dated August 28, 2015, concerning the withholding of increments.

► Payment of arrears for the suspension period with 6% interest within six weeks.

► Notional benefits of annual increments during the suspension period, with corresponding revisions to the petitioner’s pension and payment of actual benefits.

*Case ⬇️

Chandra Prakash Bhardwaj v. Rajasthan Financial Corporation

Writ Petition No. 18159/2019, Before the High Court of Rajasthan at Jaipur

Heard by Hon'ble Mr. Justice Sudesh Bansal J

#Suspension period benefits#Rajasthan High Court#Annual grade increments#Acquittal and reinstatement#Employee rights#Service rules compliance#Pension revision#Judicial precedents#Financial entitlements#Workplace fairness

1 note

·

View note