#equity securities

Explore tagged Tumblr posts

Text

Understanding Securities: A Crucial Guide for Startups and Investors Equity securities, or stocks, represent ownership in a company, giving investors rights to assets, and profits, and voting on key decisions like electing the board. However, if the company isn't profitable, equity holders won't receive dividends, and in the event of a sale, they are paid last after other stakeholders.

0 notes

Text

How to shatter the class solidarity of the ruling class

I'm touring my new, nationally bestselling novel The Bezzle! Catch me WEDNESDAY (Apr 11) at UCLA, then Chicago (Apr 17), Torino (Apr 21) Marin County (Apr 27), Winnipeg (May 2), Calgary (May 3), Vancouver (May 4), and beyond!

Audre Lorde counsels us that "The Master's Tools Will Never Dismantle the Master's House," while MLK said "the law cannot make a man love me, but it can restrain him from lynching me." Somewhere between replacing the system and using the system lies a pragmatic – if easily derailed – course.

Lorde is telling us that a rotten system can't be redeemed by using its own chosen reform mechanisms. King's telling us that unless we live, we can't fight – so anything within the system that makes it easier for your comrades to fight on can hasten the end of the system.

Take the problems of journalism. One old model of journalism funding involved wealthy newspaper families profiting handsomely by selling local appliance store owners the right to reach the townspeople who wanted to read sports-scores. These families expressed their patrician love of their town by peeling off some of those profits to pay reporters to sit through municipal council meetings or even travel overseas and get shot at.

In retrospect, this wasn't ever going to be a stable arrangement. It relied on both the inconstant generosity of newspaper barons and the absence of a superior way to show washing-machine ads to people who might want to buy washing machines. Neither of these were good long-term bets. Not only were newspaper barons easily distracted from their sense of patrician duty (especially when their own power was called into question), but there were lots of better ways to connect buyers and sellers lurking in potentia.

All of this was grossly exacerbated by tech monopolies. Tech barons aren't smarter or more evil than newspaper barons, but they have better tools, and so now they take 51 cents out of every ad dollar and 30 cents out of ever subscriber dollar and they refuse to deliver the news to users who explicitly requested it, unless the news company pays them a bribe to "boost" their posts:

https://www.eff.org/deeplinks/2023/04/saving-news-big-tech

The news is important, and people sign up to make, digest, and discuss the news for many non-economic reasons, which means that the news continues to struggle along, despite all the economic impediments and the vulture capitalists and tech monopolists who fight one another for which one will get to take the biggest bite out of the press. We've got outstanding nonprofit news outlets like Propublica, journalist-owned outlets like 404 Media, and crowdfunded reporters like Molly White (and winner-take-all outlets like the New York Times).

But as Hamilton Nolan points out, "that pot of money…is only large enough to produce a small fraction of the journalism that was being produced in past generations":

https://www.hamiltonnolan.com/p/what-will-replace-advertising-revenue

For Nolan, "public funding of journalism is the only way to fix this…If we accept that journalism is not just a business or a form of entertainment but a public good, then funding it with public money makes perfect sense":

https://www.hamiltonnolan.com/p/public-funding-of-journalism-is-the

Having grown up in Canada – under the CBC – and then lived for a quarter of my life in the UK – under the BBC – I am very enthusiastic about Nolan's solution. There are obvious problems with publicly funded journalism, like the politicization of news coverage:

https://www.theguardian.com/media/2023/jan/24/panel-approving-richard-sharp-as-bbc-chair-included-tory-party-donor

And the transformation of the funding into a cheap political football:

https://www.cbc.ca/news/politics/poilievre-defund-cbc-change-law-1.6810434

But the worst version of those problems is still better than the best version of the private-equity-funded model of news production.

But Nolan notes the emergence of a new form of hedge fund news, one that is awfully promising, and also terribly fraught: Hunterbrook Media, an investigative news outlet owned by short-sellers who pay journalists to research and publish damning reports on companies they hold a short position on:

https://hntrbrk.com/

For those of you who are blissfully distant from the machinations of the financial markets, "short selling" is a wager that a company's stock price will go down. A gambler who takes a short position on a company's stock can make a lot of money if the company stumbles or fails altogether (but if the company does well, the short can suffer literally unlimited losses).

Shorts have historically paid analysts to dig into companies and uncover the sins hidden on their balance-sheets, but as Matt Levine points out, journalists work for a fraction of the price of analysts and are at least as good at uncovering dirt as MBAs are:

https://www.bloomberg.com/opinion/articles/2024-04-02/a-hedge-fund-that-s-also-a-newspaper

What's more, shorts who discover dirt on a company still need to convince journalists to publicize their findings and trigger the sell-off that makes their short position pay off. Shorts who own a muckraking journalistic operation can skip this step: they are the journalists.

There's a way in which this is sheer genius. Well-funded shorts who don't care about the news per se can still be motivated into funding freely available, high-quality investigative journalism about corporate malfeasance (notoriously, one of the least attractive forms of journalism for advertisers). They can pay journalists top dollar – even bid against each other for the most talented journalists – and supply them with all the tools they need to ply their trade. A short won't ever try the kind of bullshit the owners of Vice pulled, paying themselves millions while their journalists lose access to Lexisnexis or the PACER database:

https://pluralistic.net/2024/02/24/anti-posse/#when-you-absolutely-positively-dont-give-a-solitary-single-fuck

The shorts whose journalists are best equipped stand to make the most money. What's not to like?

Well, the issue here is whether the ruling class's sense of solidarity is stronger than its greed. The wealthy have historically oscillated between real solidarity (think of the ultrawealthy lobbying to support bipartisan votes for tax cuts and bailouts) and "war of all against all" (as when wealthy colonizers dragged their countries into WWI after the supply of countries to steal ran out).

After all, the reason companies engage in the scams that shorts reveal is that they are profitable. "Behind every great fortune is a great crime," and that's just great. You don't win the game when you get into heaven, you win it when you get into the Forbes Rich List.

Take monopolies: investors like the upside of backing an upstart company that gobbles up some staid industry's margins – Amazon vs publishing, say, or Uber vs taxis. But while there's a lot of upside in that move, there's also a lot of risk: most companies that set out to "disrupt" an industry sink, taking their investors' capital down with them.

Contrast that with monopolies: backing a company that merges with its rivals and buys every small company that might someday grow large is a sure thing. Shriven of "wasteful competition," a company can lower quality, raise prices, capture its regulators, screw its workers and suppliers and laugh all the way to Davos. A big enough company can ignore the complaints of those workers, customers and regulators. They're not just too big to fail. They're not just too big to jail. They're too big to care:

https://pluralistic.net/2024/04/04/teach-me-how-to-shruggie/#kagi

Would-be monopolists are stuck in a high-stakes Prisoner's Dilemma. If they cooperate, they can screw over everyone else and get unimaginably rich. But if one party defects, they can raid the monopolist's margins, short its stock, and snitch to its regulators.

It's true that there's a clear incentive for hedge-fund managers to fund investigative journalism into other hedge-fund managers' portfolio companies. But it would be even more profitable for both of those hedgies to join forces and collude to screw the rest of us over. So long as they mistrust each other, we might see some benefit from that adversarial relationship. But the point of the 0.1% is that there aren't very many of them. The Aspen Institute can rent a hall that will hold an appreciable fraction of that crowd. They buy their private jets and bespoke suits and powdered rhino horn from the same exclusive sellers. Their kids go to the same elite schools. They know each other, and they have every opportunity to get drunk together at a charity ball or a society wedding and cook up a plan to join forces.

This is the problem at the core of "mechanism design" grounded in "rational self-interest." If you try to create a system where people do the right thing because they're selfish assholes, you normalize being a selfish asshole. Eventually, the selfish assholes form a cozy little League of Selfish Assholes and turn on the rest of us.

Appeals to morality don't work on unethical people, but appeals to immorality crowds out ethics. Take the ancient split between "free software" (software that is designed to maximize the freedom of the people who use it) and "open source software" (identical to free software, but promoted as a better way to make robust code through transparency and peer review).

Over the years, open source – an appeal to your own selfish need for better code – triumphed over free software, and its appeal to the ethics of a world of "software freedom." But it turns out that while the difference between "open" and "free" was once mere semantics, it's fully possible to decouple the two. Today, we have lots of "open source": you can see the code that Google, Microsoft, Apple and Facebook uses, and even contribute your labor to it for free. But you can't actually decide how the software you write works, because it all takes a loop through Google, Microsoft, Apple or Facebook's servers, and only those trillion-dollar tech monopolists have the software freedom to determine how those servers work:

https://pluralistic.net/2020/05/04/which-side-are-you-on/#tivoization-and-beyond

That's ruling class solidarity. The Big Tech firms have hidden a myriad of sins beneath their bafflegab and balance-sheets. These (as yet) undiscovered scams constitute a "bezzle," which JK Galbraith defined as "the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it."

The purpose of Hunterbrook is to discover and destroy bezzles, hastening the moment of realization that the wealth we all feel in a world of seemingly orderly technology is really an illusion. Hunterbrook certainly has its pick of bezzles to choose from, because we are living in a Golden Age of the Bezzle.

Which is why I titled my new novel The Bezzle. It's a tale of high-tech finance scams, starring my two-fisted forensic accountant Marty Hench, and in this volume, Hench is called upon to unwind a predatory prison-tech scam that victimizes the most vulnerable people in America – our army of prisoners – and their families:

https://us.macmillan.com/books/9781250865878/thebezzle

The scheme I fictionalize in The Bezzle is very real. Prison-tech monopolists like Securus and Viapath bribe prison officials to abolish calls, in-person visits, mail and parcels, then they supply prisoners with "free" tablets where they pay hugely inflated rates to receive mail, speak to their families, and access ebooks, distance education and other electronic media:

https://pluralistic.net/2024/04/02/captive-customers/#guillotine-watch

But a group of activists have cornered these high-tech predators, run them to ground and driven them to the brink of extinction, and they've done it using "the master's tools" – with appeals to regulators and the finance sector itself.

Writing for The Appeal, Dana Floberg and Morgan Duckett describe the campaign they waged with Worth Rises to bankrupt the prison-tech sector:

https://theappeal.org/securus-bankruptcy-prison-telecom-industry/

Here's the headline figure: Securus is $1.8 billion in debt, and it has eight months to find a financier or it will go bust. What's more, all the creditors it might reasonably approach have rejected its overtures, and its bonds have been downrated to junk status. It's a dead duck.

Even better is how this happened. Securus's debt problems started with its acquisition, a leveraged buyout by Platinum Equity, who borrowed heavily against the firm and then looted it with bogus "management fees" that meant that the debt continued to grow, despite Securus's $700m in annual revenue from America's prisoners. Platinum was just the last in a long line of PE companies that loaded up Securus with debt and merged it with its competitors, who were also mortgaged to make profits for other private equity funds.

For years, Securus and Platinum were able to service their debt and roll it over when it came due. But after Worth Rises got NYC to pass a law making jail calls free, creditors started to back away from Securus. It's one thing for Securus to charge $18 for a local call from a prison when it's splitting the money with the city jail system. But when that $18 needs to be paid by the city, they're going to demand much lower prices. To make things worse for Securus, prison reformers got similar laws passed in San Francisco and in Connecticut.

Securus tried to outrun its problems by gobbling up one of its major rivals, Icsolutions, but Worth Rises and its coalition convinced regulators at the FCC to block the merger. Securus abandoned the deal:

https://worthrises.org/blogpost/securusmerger

Then, Worth Rises targeted Platinum Equity, going after the pension funds and other investors whose capital Platinum used to keep Securus going. The massive negative press campaign led to eight-figure disinvestments:

https://www.latimes.com/business/story/2019-09-05/la-fi-tom-gores-securus-prison-phone-mass-incarceration

Now, Securus's debt became "distressed," trading at $0.47 on the dollar. A brief, covid-fueled reprieve gave Securus a temporary lifeline, as prisoners' families were barred from in-person visits and had to pay Securus's rates to talk to their incarcerated loved ones. But after lockdown, Securus's troubles picked up right where they left off.

They targeted Platinum's founder, Tom Gores, who papered over his bloody fortune by styling himself as a philanthropist and sports-team owner. After a campaign by Worth Rises and Color of Change, Gores was kicked off the Los Angeles County Museum of Art board. When Gores tried to flip Securus to a SPAC – the same scam Trump pulled with Truth Social – the negative publicity about Securus's unsound morals and financials killed the deal:

https://twitter.com/WorthRises/status/1578034977828384769

Meanwhile, more states and cities are making prisoners' communications free, further worsening Securus's finances:

https://pluralistic.net/2024/02/14/minnesota-nice/#shitty-technology-adoption-curve

Congress passed the Martha Wright-Reed Just and Reasonable Communications Act, giving the FCC the power to regulate the price of federal prisoners' communications. Securus's debt prices tumbled further:

https://www.govtrack.us/congress/bills/117/s1541

Securus's debts were coming due: it owes $1.3b in 2024, and hundreds of millions more in 2025. Platinum has promised a $400m cash infusion, but that didn't sway S&P Global, a bond-rating agency that re-rated Securus's bonds as "CCC" (compare with "AAA"). Moody's concurred. Now, Securus is stuck selling junk-bonds:

https://www.govtrack.us/congress/bills/117/s1541

The company's creditors have given Securus an eight-month runway to find a new lender before they force it into bankruptcy. The company's debt is trading at $0.08 on the dollar.

Securus's major competitor is Viapath (prison tech is a duopoly). Viapath is also debt-burdened and desperate, thanks to a parallel campaign by Worth Rises, and has tried all of Securus's tricks, and failed:

https://pestakeholder.org/news/american-securities-fails-to-sell-prison-telecom-company-viapath/

Viapath's debts are due next year, and if Securus tanks, no one in their right mind will give Viapath a dime. They're the walking dead.

Worth Rise's brilliant guerrilla warfare against prison-tech and its private equity backers are a master class in using the master's tools to dismantle the master's house. The finance sector isn't a friend of justice or working people, but sometimes it can be used tactically against financialization itself. To paraphrase MLK, "finance can't make a corporation love you, but it can stop a corporation from destroying you."

Yes, the ruling class finds solidarity at the most unexpected moments, and yes, it's easy for appeals to greed to institutionalize greediness. But whether it's funding unbezzling journalism through short selling, or freeing prisons by brandishing their cooked balance-sheets in the faces of bond-rating agencies, there's a lot of good we can do on the way to dismantling the system.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/04/08/money-talks/#bullshit-walks

Image: KMJ (modified) https://commons.wikimedia.org/wiki/File:Boerse_01_KMJ.jpg

CC BY-SA 3.0 https://creativecommons.org/licenses/by-sa/3.0/deed.en

#pluralistic#shorts#short sellers#news#private equity#private prisons#securus#prison profiteers#the bezzle#anything that cant go on forever eventually stop#steins law#hamilton nolan#Platinum Equity#American Securities#viapath#global tellink#debt#jpay#worth rises#insurance#spacs#fcc#bond rating#moodys#the appeal#saving the news from big tech#hunterbrook media#journalism

804 notes

·

View notes

Text

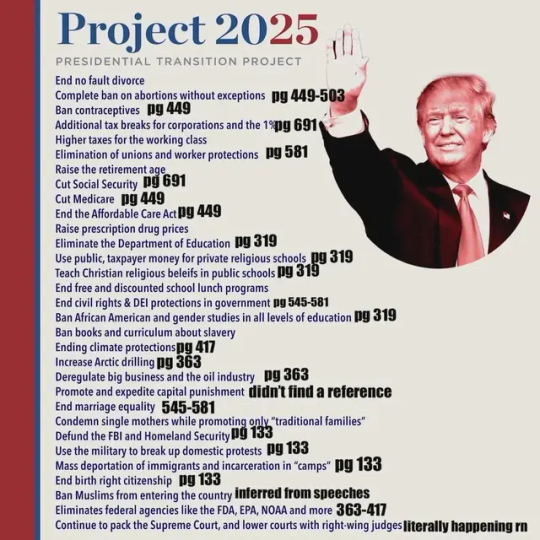

#us politics#republicans#conservatives#2024#2024 elections#gop#donald trump#project 2025#mandate for leadership#vote blue#women's rights#equal rights#diversity equity and inclusion#climate change#immigration#reproductive rights#no fault divorce#pornography bans#worker's rights#birth right citizenship#social security#medicare#federal oversight#federal regulations

48 notes

·

View notes

Quote

All is for all! If the man and the woman bear their fair share of work, they have a right to their fair share of all that is produced by all, and that share is enough to secure them well-being. No more of such vague formulas as "the right to work," or "to each the whole result of his labour." What we proclaim is the right to well-being: well-being for all!

Peter Kropotkin, The Conquest of Bread

#philosophy#quotes#Peter Kropotkin#The Conquest of Bread#equality#equity#justice#security#property#ethics

50 notes

·

View notes

Text

The complete incompetence of the ladies of the Secret Service are on full display. One of the agents can’t properly holster her sidearm while another fiddles around with her sunglasses trying to look cool for the crowd.

An assassination attempt was made on former US President Donald Trump at a rally in Pennsylvania. It happened when Donald Trump was leading a public meeting before the elections. The bullet grazed past the upper part of Trump’s right ear. Recalling this incident, he said that he heard a whizzing sound and shots and immediately felt the bullet ripping through his skin. The FBI (Federal Bureau of Investigation) announced that Thomas Mattew Crook is the individual identified in the assassination attempt of the former President.

After this, the security formed a human chain around him and exited the area, but the video caught the panicking situation of the women security of Secret Services deployed in the area. One of the security personnel was panicking and failed to put her gun in the holster while Trump was sitting in his car.

“Imagine if the sh**ter hadn’t been this kid but [someone] well-trained? Our enemies are looking at us thinking we can take [him] or anyone out now without a problem.”

#ssassination attempt#Biden#Department of Homeland Security#Donald Trump#House Oversight Committee#Kimberley Cheatle#Lauren Boebert#resignation#Secret Service#secret service director#Incompetent SS#Awareness#diversity#equity and inclusion (DEI)#HIRE FOR MERITS

5 notes

·

View notes

Text

What is Mutual Fund?

A mutual fund is a type of investment vehicle that pools money from multiple investors to invest in a diversified portfolio of securities such as stocks, bonds, and other assets. Investments in securities are spread across a wide cross-section of industries and sectors and thus the risk is reduced.

It is managed by a professional fund manager or an asset management company (AMC) who makes investment decisions on behalf of the investors.

Mutual funds offer good investment opportunities to the investors. Like all investments, they also carry certain risks

SEBI formulates policies and regulates the mutual funds to protect the interest of the investors.

OVERVIEW OF MUTUAL FUNDS INDUSTRY IN INDIA

The mutual fund industry in India was set up through a combination of regulatory changes, legislative reforms and the entry of various market players.

Unit Trust of India- UTI was founded in 1964, which is when the mutual fund sector in India first started to take off. To mobilize public funds and invest them in the capital markets, UTI was established as a statutory body under the UTI Act, 1963. The idea of mutual funds was greatly popularized in India because to UTI.

Regulatory Framework-In India, the mutual fund industry's regulatory structure began to take shape in the 1990s. The Securities and Exchange Board of India (SEBI) Act, which established SEBI as the governing body for the Indian securities markets, was passed in 1993. Among other market intermediaries, SEBI was responsible with regulating and supervising mutual funds.

The SEBI (Mutual Funds) Regulations,1996- This regulation established the legal foundation for the establishment, administration, and operation of mutual funds in India. These regulations outlined the standards for investor protection, investment restrictions, disclosure requirements, and eligibility requirements for asset management companies (AMCs).

Introduction of Private Sector Mutual Funds: UTI was the only active mutual fund provider in India prior to 1993. Private sector mutual funds were nevertheless permitted to enter the market as a result of the liberalization of the financial sector and the opening up of the Indian economy. Many domestic and foreign financial organizations launched their own AMCs and entered the mutual fund industry.

Product Line Evolution: The mutual fund sector in India has grown and increased its product selection throughout the years. Mutual funds initially mainly offered income and growth opportunities. To address various investor needs and risk profiles, the industry did, however, offer a wider range of products, such as equity funds, debt funds, balanced funds, and specialist sector funds.

Investor Education and Awareness: Serious efforts have been made to educate and raise investor awareness in order to encourage investor involvement in mutual funds. Industry groups, AMCs, and SEBI have run investor awareness campaigns, distributed instructional materials, and supported systems for resolving investor complaints. Systematic Investment Plans (SIPs) were introduced, and this was a significant factor in luring individual investors

Technological Advancements-The mutual fund sector in India has embraced technological development, making it possible for investors to access and invest in mutual funds through online platforms and mobile applications. Investors can now transact, track their investments, and get mutual fund information more easily thanks to digital platforms.

The mutual fund industry in India has developed into a strong and regulated sector through regulatory changes, market competition, and investor-centric initiatives. The sector keeps expanding, drawing in more investors and providing them with a wide variety of investment possibilities around the nation.

#business#writing#investment#mutual funds#security market#money#sebi registered investment advisor#equity#make money tips#savings#financial#raise funds#funds#profit#return#growth#reading#knowledge#personal finance#income

42 notes

·

View notes

Text

AN OPEN LETTER to THE U.S. CONGRESS

Put the Good Jobs for Good Airports standards in the FAA reauthorization bill!

104 so far! Help us get to 250 signers!

I’m calling on you to stand with working people, passengers and our communities by supporting Good Jobs for Good Airports standards (GJGA) in the FAA reauthorization bill. Airports should and can be strong, vibrant drivers of good jobs in every part of our country. The Good Jobs for Good Airports standards are central to that mission and our nation’s future prosperity. Billions of our public dollars are invested in our nation’s aviation system every year, and we must ensure that our public resources serve the public good. That includes ensuring airports better serve the needs of our families, our passengers, our communities and the airport service workers who make it all possible.

It is evident that our air travel industry is in crisis. From record flight cancellations during summer travel peaks to mountains of lost luggage during the holiday travel season. Airports are critical publicly-funded infrastructure vital to the health of our local communities and global economy, but right now airports aren't working the way they should for travelers or airport service workers — a largely Black, brown, multiracial and immigrant service workforce. These working people, including cleaners, wheelchair agents, baggage handlers, concessionaires and ramp workers, keep airports safe and running smoothly even through a global pandemic, climate disasters and busy travel seasons. Yet many are underpaid and underprotected--even as some major airlines rake in record profit and billions of our tax dollars are invested in our national air travel system.

Domestic passenger numbers increased by 80% between 2020 and 2021, total industry employment fell by nearly 14%, leaving airport service workers to sometimes clean entire airplanes in as little as five minutes as many take on additional responsibilities outside of their typical job duties. Meanwhile, wages have barely budged for airport service workers in 20 years. The Good Jobs for Good Airports standards has the power to transform workers’ lives by ensuring airport service workers have the pay and benefits they need to care for their families.

The Good Jobs for Good Airports standards would help build a stronger, safer, more resilient air travel industry by making airport service jobs good jobs with living wages and benefits like affordable healthcare for all airport workers. Airport service workers at more than 130 covered airports would be supported through established wage and benefit standards, putting money back into hundreds of local economies and helping families thrive. If passed over 73% of wage increases will go to workers making $20 or less, estimates show.

I urge you to include the Good Jobs for Good Airports standards in the FAA reauthorization bill, and help ensure our public money serves the public good.

▶ Created on September 20, 2023 by Jess Craven

📱 Text SIGN PNXUOF to 50409

🤯 Liked it? Text FOLLOW JESSCRAVEN101 to 50409

#JESSCRAVEN101#PNXUOF#resistbot#FAA reauthorization#Good Jobs for Good Airports#airport workers#aviation industry#public infrastructure#labor rights#economic justice#workers' rights#fair wages#benefits#community support#passenger rights#public investment#economic prosperity#airport service workers#living wages#healthcare#job security#labor standards#economic equity#social welfare#income equality#workplace conditions#economic development#local economies#financial stability#worker empowerment

6 notes

·

View notes

Text

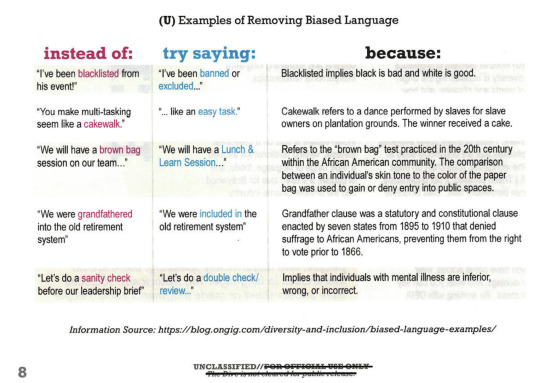

By: Adam Kredo

Published: Mar 27, 2024

Office of the Director of National Intelligence also instructs employees to avoid 'blacklisted,' 'cakewalk,' and 'sanity check'

The United States' top intelligence agency wants to ban its spies from using "biased language," including the terms "radical Islamists" and "jihadist," saying these words "are hurtful to Muslim-Americans and detrimentally impact our efforts as they bolster extremist rhetoric," according to a language guide published internally.

The Office of the Director of National Intelligence (ODNI), which is responsible for handling the country's spy apparatus, seeks to ban a range of common terms because it says they offend Muslims and foment racism against employees. In addition to terms describing Islamic terrorists, ODNI instructs employees to avoid phrases such as "blacklisted," "cakewalk," "brown bag," "grandfathered," and "sanity check."

"Blacklisted," for instance, "implies black is bad and white is good," while "cakewalk" is said to refer "to a dance performed by slaves for slave owners on plantation grounds." "Brown bag," a term most often used to describe a paper bag that holds one's lunch, actually "refers to the 'brown bag' test practices in the 20th century within the African American community," according to ODNI, which outlined these terms in an internal magazine produced by the agency's Office of Diversity, Equity, Inclusion, and Accessibility.

The document, which was first reported by the Daily Wire, is the latest example of how Diversity, Equity, and Inclusion (DEI) initiatives inside the American government are reshaping how employees speak to one another and perform their national security jobs. Critics describe these programs as part of a "woke" cultural shift promoted by far-left activists and their allies in the Biden administration. Republicans in Congress are looking to strip millions in federal funding for DEI programs across the military and other agencies, arguing they fundamentally harm the country’s national security operations across the globe.

ODNI did not respond to a request for comment.

Rep. Jim Banks (R., Ind.), a member of the House Armed Services Committee, which oversees the intelligence community, said woke initiatives like the ones laid out in the magazine are "a gift to our adversaries."

"U.S. intelligence officials are being trained to use terms that don’t 'disparage' China or Islamic terrorists," Banks said. "Wokeness is a gift to our adversaries."

The quarterly magazine, called The Dive, also includes an anonymous article by a male intelligence officer who discusses the benefits of being a crossdresser. "I am an intelligence officer, and I am a man who likes to wear women's clothes sometimes," the anonymous employee wrote. "I think my experiences as someone who crossdresses have sharpened the skills I use as an intelligence officer, particularly critical thinking and perspective-taking."

The ODNI magazine was published earlier this year and focuses on "the importance of words."

"What we say can make or break rapport, elevate or tarnish a reputation, and even support or refute a narrative," wrote the magazine's editor in chief, a DEI employee whose name is redacted. "As employees of the [intelligence community], our work and our words are forever etched in history and speak volumes to the important work we carry out in service of the greater good. It is paramount that we are cognizant about the terminology we use in every aspect of our duties."

The magazine is a product of discussion among "all nine diversity advisory committees" housed in the U.S. intelligence community. The officials are "working tirelessly to identify their constituents' challenges, concerning terminology, and themes to incorporate in their respective language guidance reports."

Discussions about Islamic terrorists and their ideology remain a central concern for the intelligence community, which is prioritizing "disentangling Islam from words and phrases used to discuss terrorism and extremist violence."

Officials say they "noticed how some trainings and official presentations conflated Islamic beliefs with terrorism, which is offensive and alienates our Muslim-American colleagues." Additionally, they "noticed how the [U.S. government], particularly the [intelligence community], used certain phrases to identify international terrorism threats that are hurtful to Muslim-Americans and detrimentally impact our efforts as they bolster extremist rhetoric."

These observations led to several common phrases being listed as "problematic" and banned from use. Intelligence community employees should not say "Salafi-Jihadist," "Jihadist," "Islamic-Extremist," "Sunni/Shia-Extremism," or "Radical Islamists," according to the document. "These terms incorrectly suggest that Islamic beliefs somehow condone the actions and rhetoric espoused by these foreign terrorist organizations."

Intelligence community officials spoke with a range of academic and community activists when sculpting this policy.

"The majority of people we spoke with mentioned how they 'cringe' when hearing [government] officials use these offensive terms and noted it creates an incorrect perception that the American identity conflicts with Islamic beliefs, even though Muslim-Americans have been a part of the fabric of this society as far back as the war for independence," the magazine says.

"Together," the publication states, "we can make micro-changes in our culture and in our personal and professional environments."

The document outlines other terms that are not racially charged but are nonetheless labeled problematic.

"Grandfathered," for instance, refers to a "statutory and constitutional clause enacted by seven states from 1895 to 1910 that denied suffrage to African Americans, preventing them from the right to vote prior to 1866," according to a list of hurtful words included in the documents.

"Sanity check" is also listed as a term that could offend colleagues because it "implies that individuals with mental illness are inferior, wrong, or incorrect."

In the article on crossdressing, headlined "My Gender Identity and Expression Make Me a Better Intelligence Officer," the employee writes that "I'm more aware of, and hopefully supporting, my women colleagues."

"I now have a better appreciation for how it can be uncomfortable to wear women's clothes sometimes," he writes. "I know firsthand how wearing heels can make your feet hurt and make it take longer to walk somewhere. Although I like wearing a bra, I know it isn't comfortable for everyone, and is less comfortable after a few hours. On top of the biases that women often face at work, it must be hard to be uncomfortable, too."

Crossdressing, the employee says, makes him "better at understanding clandestine assets and their motivations. I understand the motivation to keep secrets about who you are and what you are doing, which sounds similar to some of the experience of an asset."

The magazine also includes a word search game that includes terms like "accessibility," "inclusion," "equality," and "ally."

Sen. Ted Cruz (R., Texas) said the intelligence community's avoidance of phrases like "Islamic terrorism" interferes with efforts to crackdown on Palestinian terror groups, like Palestinian Islamic Jihad, which participated in the Oct. 7 attack on Israel.

"October 7 was carried out by Hamas and Palestinian Islamic Jihad. Apparently, that is an inconvenient fact to the language, commissars, who I presume want to edit out the word Islamic from the name of the terrorist group, Palestinian Islamic Jihad," Cruz said in a recent episode on his podcast. "If the intelligence community has no idea, refuses to acknowledge what is actually happening, it means they will be utterly ineffective in fighting against it and keeping Americans and our allies safe."

==

Evidently, all the security threats and all the terrorism have been solved when top national intelligence agencies have time and money to waste on DEI nonsense.

For the record, this looks to be an implementation of Stanford University's "Elimination of Harmful Language Initiative" from 2022. So, someone seems to just be re-grifting their previous grift.

#Adam Kredo#virtue signaling#virtue signal#language games#woke#wokeness#wokeness as religion#cult of woke#wokeism#national security#DEI#ideological corruption#ideological capture#diversity equity and inclusion#diversity#equity#inclusion#religion is a mental illness

6 notes

·

View notes

Text

Advice On How To Get A Renovation Loan For Your Project In Houston

Do you need a loan for a renovation project you have coming up? We must have thought of you. While many people find the process of applying for a remodeling loan to be tedious, we make it very simple in this post.

This article discusses the numerous loan requirements, different forms of renovation loans in Houston, and expert suggestions for a successful project if you didn't know you could receive a loan for your restoration work or believed it would be difficult to secure a loan.

A 203(K) FHA loan

The most well-liked and reasonably priced loans in the US are FHA 203(L) loans. And the reason for this is because they are supported by the government and have the most favourable qualification standards. You can refinance or purchase a primary residence using an FHA 203(k) loan, and you can add the whole cost of the modifications to your mortgage to pay for them over time.

Loans for Home Equity

You can borrow money based on the value of your property with a renovation home equity loan. Your equity house payment will need to be made separately if you already have a mortgage because it doesn't cancel off the previous loan. Applying for a home equity loan may make sense if you have accumulated a considerable amount of home equity or if you need to finance a significant one-time project.

Individual Loan

A personal loan is yet another option to pay for your home remodeling. Using an unsecured home renovation loan has the benefit of not requiring security for the loan. They are also the easiest loans to obtain because of this. Despite having higher interest rates, personal loans can be repaid over durations of two to five years and have flexible rates (fixed and adjustable). in order to be eligible for an unsecured personal loan.

Employ Qualified Personnel

Your remodeling expense can easily balloon and spiral out of control without a proper plan. Working with experts is beneficial in this regard. At Smart Remodeling, we make an extra effort to develop a plan that works for your circumstances and make sure we stick to that plan throughout the remodeling process to get the desired outcomes. Additionally, we'll work with you to prevent unforeseen catastrophes and ensure that the project is completed successfully and under budget.

Select the Best Loan for You

Make important to search around and become familiar with the conditions of each loan before applying for any home renovation loan. You shouldn't take out a loan that will take you a lifetime to pay back or, worse yet, one that you're likely to fail on. Should you refinance your mortgage or combine your savings with your remodeling loan, or would you want to cash them out? Compare the many financing options and choose the one that best suits your needs.

Cove Security - Always here to get the door. All of our cameras include intercom features and mobile controls that enable you to sit back, watch, listen, greet friends, warn lurkers, or arrange to meet surprise visitors at a better time. Try one—or four—and see what a new level of connection feels like.

#cove#covesecurity#covesmart#homesecurity#diyhomesecurity#loan#rates#remodeling#expenses#equity#mortal kombat#financial#finance#security#budget

2 notes

·

View notes

Text

Every company needs proper valuation of securities in order to have realistic financial plans. ASC Group provides professional services to provide accurate analysis of stocks, bonds or any derivative; helping the customers to make intelligent investment decisions.

0 notes

Text

Launch of WHO book 'Health inequality monitoring: harnessing data to advance health equity'.

Over the past decades there have been remarkable improvements to human health around the world. Yet, further progress remains hampered by persistent inequalities between and within populations. Robust health inequality monitoring systems and practices are needed to identify and address unfair differences in health and ensure no one is left behind in the pursuit of better health for all.

The forthcoming WHO book Health inequality monitoring: harnessing data to advance health equity is a comprehensive and contemporary resource for health inequality monitoring, consolidating foundational and emerging knowledge in the field. It aims to support the expansion and strengthening of health inequality monitoring practices across different applications around the world, in service of the broader goal of advancing health equity.

The book covers a range of topics, spanning the importance and general applications of health inequality monitoring, to ways to align monitoring activities to generate impact. It details strategies for sourcing and using data for health inequality monitoring, as well as techniques for analyzing, interpreting and reporting health inequality data. The book was developed for a diverse readership, including technical experts (e.g. statistical, planning, and monitoring and evaluation officers), public health professionals, researchers, analysts and students.

Launch event

A webinar will be held on 11 December 2024, 13:00-14:15 CET to mark the release of the WHO book, Health inequality monitoring: harnessing data to advance health equity. Book contributors will introduce this new resource, and a panel of health equity experts will explore the theme “harnessing data to advance health equity”.

Language interpretation will be available in Arabic, French and Spanish.

Agenda

Welcome: Pavel Ursu, Acting Director, Department of Data and Analytics, WHO

Opening remarks: Marnie Johnstone, Executive Director, Health Equity Policy Directorate, Strategic Policy Branch, Public Health Agency of Canada

Introduction to health inequality monitoring at WHO: Ahmad Hosseinpoor, Lead, Health Inequality Monitoring, Department of Data and Analytics, WHO

Overview of book contents: Nicole Bergen, Consultant, Health Inequality Monitoring Team, Department of Data and Analytics, WHO

Endorsements from the Expert Review Group

Panel discussion:

Ana Estela Haddad, Secretary of Information and Digital Health, Ministry of Health, Brazil

Anthony Adofo Ofosu, Deputy Director-General, Ghana Health Service, Ministry of Health, Ghana

Yukiko Asada, Investigator, Department of Bioethics, National Institutes of Health, USA

Arash Rashidian, Director, Science, Information and Dissemination Division, Eastern Mediterranean Regional Office, WHO

Hope Johnson, Special Advisor to the CEO and Director of Measurement, Evaluation and Learning, Gavi, the Vaccine Alliance

Rajat Khosla, Executive Director, Partnership for Maternal, Newborn and Child Health

Alia el-Yassir, Director, Department for Gender, Equity, Diversity and Rights for Health, WHO

Moderator: Devaki Nambiar, Consultant, Health Inequality Monitoring Team, Department of Data and Analytics, WHO

Learn more about WHO's work on health inequality monitoring

If you would like to receive periodic emails from the WHO Health Inequality Monitoring team about events, resources and training opportunities, please sign up here.

#health inequality#universal health coverage#panel discussion#sdg3#health equity#data monitoring#world health organization (who)#Information and Digital Health#webinar#health security#healthcare sector#right to health#universalhealthcoverage#universal health care

0 notes

Text

Top 10 Common Mistakes Entrepreneurs Make When Seeking Investor Funding

Introduction: Seeking investor funding can be a crucial step for entrepreneurs looking to scale their businesses and achieve growth. However, many entrepreneurs make common mistakes that can hinder their chances of securing funding. In this article, we will explore the top 10 mistakes that entrepreneurs often make when seeking investor funding and provide insights on how to avoid them. 1. Lack of…

#best practices for startup pitches#common mistakes in seeking funding.#crowdfunding strategies for startups#essential elements of a business plan#finding angel investors#how to bootstrap a startup#How to secure startup funding#navigating the seed funding process#startup funding options#startup funding stages#startup growth and scaling strategies#success stories of funded startups#tips for pitching to investors#top venture capital firms 2024#understanding equity and valuation

0 notes

Text

UBI in the Age of AI: Necessary Evolution or Risky Experiment?

Universal Basic Income Challenges

New Base CSS 1

What’s On My Mind Today? The rapid advancement of AI and automation is reshaping the job market in unprecedented ways. As machines take over tasks previously performed by humans, the concept of Universal Basic Income (UBI) is gaining traction as a potential solution to the economic displacement caused by these technological shifts. This opinion piece explores the pros and cons…

#AI and automation#automation challenges#automation impacts#economic resilience#economic security#Future of Work#income inequality#innovation economy#Job displacement#social equity#UBI#UBI pros and cons#Universal Basic Income#welfare reform

0 notes

Text

House committee launches investigation into alleged misuse of FEMA money

View Source: Republican members of the U.S. House Committee on Homeland Security have launched an investigation into the alleged misuse of Federal Emergency Management Agency funds by Department of Homeland Security Secretary Alejandro Mayorkas. DHS, which has oversight of FEMA, has directed that billions of dollars of FEMA funds be used to pay for food, housing, transportation and other services…

#border#carolina#censorship#destruction#DHS#diversity#Dixie#equity#federal#Florida#food#funds#Georgia#homeland security#hurricane#mayorkas#money#news#North Carolina#republican#security#South#south carolina#states#tennessee

0 notes

Text

Jim Boswell, President & CEO of OnPoint Healthcare – Interview Series

New Post has been published on https://thedigitalinsider.com/jim-boswell-president-ceo-of-onpoint-healthcare-interview-series/

Jim Boswell, President & CEO of OnPoint Healthcare – Interview Series

Jim Boswell is the President & CEO of OnPoint Healthcare, Jim is a strategic thinker who has devoted his 28-year career to building, optimizing, and leading large, multi-specialty group practices within a large health system and private practice group, Jim is passionate about driving alignment, growth, performance improvement, and transformation.

OnPoint Healthcare Partners was established in response to various unmet needs in the healthcare industry, including the demand for innovative clinical support services, effective physician and staff engagement strategies, and operational change management.

You founded OnPoint Healthcare Partners in 2019 after a long career in the healthcare industry. What inspired you to start this company, and how did your previous experiences shape your vision for OnPoint?

I founded OnPoint Healthcare Partners after spending many years on the “buy side” of healthcare, working closely with physicians, nurses, and other healthcare professionals. Throughout my career, I saw firsthand the immense administrative burdens that were taking valuable time away from patient care. This experience inspired me to create a company that could leverage technology to eliminate inefficiencies and allow healthcare providers to focus on what truly matters—caring for their patients.

Can you elaborate on the early challenges you faced in bringing this vision to life, especially in a highly regulated and complex industry like healthcare?

Starting OnPoint in such a highly regulated industry like healthcare came with significant challenges, particularly around data privacy and HIPAA compliance. From the beginning, we knew that safeguarding patient information had to be our top priority. We built our system on Microsoft Azure, ensuring it was high-trust and SOC 2 certified, which allowed us to provide a secure, cloud-based solution that met all necessary regulatory standards. Our deep understanding of healthcare regulations, gained from our years working within the system, was crucial in overcoming these initial hurdles.

Iris, your AI-driven system, boasts a 98% clinical accuracy rate and significantly reduces the time healthcare providers spend on documentation. Could you explain the technology behind Iris and what sets it apart from other AI solutions in the market?

Iris is truly a groundbreaking solution because it combines advanced AI with human oversight. The AI engine is supported by a continuous learning loop, which has accumulated over a million notes that improve the system’s accuracy every day. What sets Iris apart is our proprietary workflow where AI handles up to 80% of the work, and then our W2-employed clinicians step in to complete the last, most critical mile. This approach allows us to achieve near-perfect accuracy and provides our clients with the flexibility to tailor the solution to their specific needs.

AI in healthcare is often met with both excitement and skepticism, particularly around the topics of data security and the risk of “hallucinations” in AI outputs. How does Iris address these concerns, and what measures are in place to ensure patient safety and data privacy?

We take data security very seriously at OnPoint. Our systems are fully encrypted and cloud-based, with no human access to encryption keys and no storage of protected health information (PHI) within our system.

When it comes to preventing AI hallucinations, we rely on a combination of advanced technology and human oversight. Our clinicians play a key role in reviewing and validating AI-generated outputs, which ensures the highest level of patient safety and data accuracy. We’ve designed our platform with a “safety first” approach, prioritizing patient safety above all else.

One of Iris’s key features is its continuous learning loop that improves over time using real-world data. How do you manage the balance between automated processes and the need for human oversight in ensuring the highest accuracy and reliability in clinical documentation?

At OnPoint, we believe in deploying the appropriate level of technology based on the complexity of each patient encounter. For more straightforward cases, AI handles most of the documentation, but for more complex scenarios, our clinicians step in to ensure that the documentation is both accurate and reliable. This balance allows us to maintain high levels of efficiency without compromising on the quality of care.

Iris can save healthcare providers 3-4 hours per day, which is a significant impact on their workload. Can you share some feedback you’ve received from physicians and healthcare staff about how Iris has changed their day-to-day operations?

The feedback we’ve received from healthcare providers using Iris has been incredibly positive. Many have shared stories about how Iris has given them back precious time, allowing them to have dinner with their families or leave work on time for the first time in years. One doctor even told me that our obsession with accuracy has improved his livelihood because he no longer has to worry about documentation errors. These are the kinds of impacts that motivate us to keep pushing for excellence in everything we do.

With the reduction in documentation time, healthcare providers can focus more on patient care. How does OnPoint ensure that this reclaimed time is being used effectively, and what are the broader implications for patient outcomes and satisfaction?

While it’s not OnPoint’s role to dictate how providers use the time they save with Iris, we do provide robust dashboards and analytics that offer visibility into their operations. This data empowers healthcare providers to make informed decisions about how to best use their time, whether that’s seeing more patients, focusing on wellness, or improving their work-life balance.

The integration of AI in healthcare is still in its early stages. Looking ahead, how do you see AI evolving in this space, and what role do you envision OnPoint playing in the future of healthcare technology?

AI is still in its early stages in healthcare, but its potential is enormous. At OnPoint, we’re constantly exploring new ways to integrate AI into our services to create more efficient and connected healthcare systems. We’re also committed to the responsible use of AI, which is why we’re involved with organizations like CHI that focus on ethical AI practices. Looking ahead, I see OnPoint playing a significant role in advancing AI technologies that improve patient care and operational efficiency.

OnPoint recently received a growth investment from Peloton Equity. How will this new funding be utilized to accelerate OnPoint’s mission, and what strategic priorities are you focusing on in the near term?

The recent investment from Peloton Equity is being utilized to advance our AI technology and develop new products that provide a more comprehensive offering across the care continuum. We’re also investing in universal integration capabilities, which will make it even easier for healthcare providers to implement our solutions regardless of their existing EHR platform.

You’ve led large healthcare organizations before starting OnPoint. How does your leadership approach differ in a tech-driven startup compared to traditional healthcare organizations, and what lessons have you brought from your past roles into OnPoint?

Leading OnPoint is different from my previous roles in larger healthcare organizations because it requires a more agile and innovative approach. However, the lessons I’ve learned from those experiences—particularly the importance of understanding the needs of healthcare providers—have been invaluable in shaping our strategy at OnPoint. My goal is to create a company that not only drives technological innovation but also makes a real difference in the lives of healthcare professionals and their patients.

Thank you for the great interview, readers who wish to learn more should visit OnPoint Healthcare Partners.

#agile#ai#AI hallucinations#AI in healthcare#amp#Analytics#approach#azure#Building#career#CEO#change#change management#Cloud#complexity#compliance#comprehensive#continuous#data#data privacy#data security#deploying#documentation#driving#efficiency#employed#encryption#encryption keys#engine#equity

0 notes

Text

Emma Scott Joins Vermont Law and Graduate School as Director of Food and Agriculture Clinic: A Bold Step for Food System Equity

Vermont Law and Graduate School (VLGS) has taken an exciting leap forward with the appointment of Emma Scott as the new director of the Food and Agriculture Clinic. With a stellar background in food law, policy, and social justice, Scott brings a wealth of experience to this role. She’s not just stepping into a position; she’s here to make a lasting impact, and the timing couldn’t be better. A…

#agriculture law#agriculture policy#California Rural Legal Assistance Foundation#Center for Agriculture and Food Systems#clinical education#Emma Scott#experiential learning#farm bill policy#farmworker rights#farmworkers#Food and Agriculture Clinic#food justice#food law#food law and policy#Food Security#food system equity#food systems advocacy#H-2A visa program#Harvard Law School#immigrant workers#Social Justice#Sustainability#USDA programs#Vermont Law#Vermont Law and Graduate School

0 notes