#end of year tax deduction

Explore tagged Tumblr posts

Text

Last Minute Tax-Deduction!

Thank you for 2022 and Happy 2023!

Cynthia Brian

29 min ago

Miracle Moment®

“Do all the good you can

By all the means you can

In all the ways you can

In all the places you can

To all the people you can

As long as you ever can.”

Great Non Profits

A Message from Founder/Executive Director, Cynthia Brian

For twelve consecutive years, ever since the inception of Great Non Profits, Be the Star You Are!® has been honored as a Top Non Profit by Great Non Profits and Candid, formerly known as Guidestar. We don’t take this award lightly.

The volunteers work diligently to consistently provide the highest level of service to the programs we provide and the outreach we serve. Teen radio hosts, Book Reviewers, Researchers, Content Providers, Event Volunteers, Disaster Relief Workers, Book Review Director, Kindness Coordinator, and many others from around the world show up to provide their talent, skills, time, and efforts. At Be the Star You Are!®, we truly care about the development and empowerment of our volunteers as much as the people we serve. Teen volunteers indicate that their involvement with Be the Star You Are!® has played a pivotal role in their positive development and growth. As the Executive Director, I am proud of our volunteers and the work we all do to make our world a more kind and inclusive place.

And we do all of this through individual and personal donations and a 100% volunteer staff, including myself. We don’t receive state or federal funding. We depend on YOU!

We are grateful to the donors, sponsors, and supporters who have contributed financially to our mission of empowering and encouraging women, families, and youth. Thank you, thank you!

As we say goodbye to 2022 and welcome 2023, we extend our deepest gratitude to everyone who has been part of our galaxy. We look forward to continuing the journey together.

If you want an end-of-year tax-deduction, or just want to make a final donation, you can easily do that online through PAYPAL Giving Fund, with no fees. DONATE here: https://www.paypal.com/fundraiser/charity/1504

Checks can be sent to Be the Star You Are!®, PO Box 376, Moraga, Ca. 94556

At the end of this newsletter, you can read a summary of a few of the accomplishments of this grassroots, all-volunteer charity and other ways you can help.

From all of us, to you and your families, continue shining.

May 2023 be the best year ever!

HAPPY NEW YEAR!

With gratitude,

Cynthia Brian

Founder/Executive Director

Be the Star You Are!®

PO Box 376

Moraga, California 94556

https://www.BetheStarYouAre.org

http://www.BTSYA.org

DONATE: https://www.paypal.com/fundraiser/charity/1504

Turning over a new leaf

by Shubham Acharya

Another year has gone by, and a new one approaches. Starting from Christmas through the new year, the air is filled with such a festive feeling and a renewed sense of hope that it is almost tangible. The new year presents a strange paradox, on the one hand, we are elated for the fresh chance we are given, followed by disappointment when we inevitably fail to fulfil the laundry list of new year's resolutions we undertake. So, this new year, let's keep things simple and instead of making a list, let's follow the tagline, "A little something for me and a little something for you." Do something for yourself—take a trip you've always wanted to take, buy a gadget you've always wanted to buy (within reason, of course!)—as a reward for surviving the previous year, and do something for someone less fortunate than you, whether economically or in terms of family: spend some time with them, lend a sympathetic ear to their problems, as little and as much as you can to alleviate some of their pain and return some of your festive happiness and hope. Lastly, I wish you a very happy and prosperous new year 2023!

Shubham Acharya is an IT professional, passionate about history and antiques living and working in India. He loves reading books and collecting antique coins. As a Be the Star You Are!® volunteer in Mumbai, he believes strongly in women’s empowerment and children’s literacy. Shubbam writes: “My mother was a teacher in a government sponsored school in one of the poorest localities in my area, so I grew up very aware of the importance of education and literacy in changing people’s lives. Having said this, I fell in love with the Be the Star You are!® motto ‘To be a leader, you must be a READER’.”

Bragging Rights!

With no paid staff and all volunteers, since receiving our 501c3 status in 1999, Be the Star You Are! has:

Served 555,927 individuals and families

Donated to 118 organizations

Logged 670,999 volunteer hours and growing

Distributed $2.1 million plus in resources

Broadcast 2200 unique hours of positive programming through radio broadcasts.

Published 5 signature award-winning books, Be the Star You Are!® 99 Gifts, Be the Star You Are!® for Teens, Be the Star You Are!® Millennials to Boomers, No Barnyard Bullies, and Miracle Moments®,

Written and published over 2530 book reviews in collaboration with The Reading Tuband Express Yourself!™ Creative Community.

Interviewed over 2500 authors, experts, and celebrities.

Honored by the California Assembly for 20 years of community service.

Nominated for the California Governor’s and First Lady’s Service Awards

Honored with five-star ratings as a Top Rated Non-Profit by GuideStar and Great Non Profits for the Women’s Empowerment, Arts and Culture, and the Arts Appreciation Campaigns since 2010.

Be the Star You Are!® encourages and supports its volunteers to GROW people.

READ the congratulation letter from California Assemblywoman Catherine Baker

READ recognition letter from Assembly California Legislature Assemblymember, Rebecca Bauer-Kahan

2021 Founder Cynthia Brian honored and featured on the Points of Light Inspiration Honor Roll celebrating outstanding individuals who improve the lives of others.

2022 Founder Cynthia Brian honored and featured on the Points of Light Inspiration Honor Roll celebrating outstanding individuals who take action to create change in communities

3 original films by volunteers accepted into International Earth Gratitude Festival: Cynthia Brian, Ruhani Chhabra, Sharanya Roy

BTSYA

Do You Want to Help? Here are lots of ways to make a difference.

Send a tax-deductible contribution or offer a monetary tribute or memorial for a loved one.

BUY an unique NFT

Buy our books by the case or as singles through our office

Buy our "Read, Lead, Succeed!" T-Shirts to give as gifts.

Buy a unique NFT to hold, share, or sell.

Make $100 donation and receive our 3 signature books

Donate air miles

Sponsor or advertise on our radio programs

Donate goods that can be auctioned off at an event

Make BTSYA a beneficiary of your UNITED WAY donation

Sponsor an event making the charitable beneficiary

Buy or Sell on eBay through GivingWorks

Shop online at thousands of stores by using one of these sites that give back:

Amazon

Amazon Books

GoodSearch

Giving Assistant

IGIVE

Humble Bundle Digital Content

#Giving Tuesday PayPal adds 1%, Donate at https://www.paypal.com/fundraiser/charity/1504

Volunteer time

Become a Benefactor

Establish A Charitable Giving Account with an Investment Firm in the name of Be the Star You Are!® 501 c3

Donate rent money for our storage space

Please join our Galaxy of Stars and support BE THE STAR YOU ARE!® with your contributions and/or ask your company to be on our team. Visit our creative community at http://www.BTSYA.org for book reviews, news items, newsletters, and press pass clips.

SEND CHECKS TO:

BE THE STAR YOU ARE!®

PO Box 376,

Moraga, California 94556

Make a donation via Paypal Giving Fund

View a partial list of beneficiaries we have served.

All donations are tax-deductible according to law. A tax receipt will be emailed to you for all donations over $25.00.

Thank you again for being stars in our universe. Enjoy a happy, healthy, blessed New Year! And remember to do all the good possible, always!

HAPPY NEW YEAR!

Share StarStyle® Empowerment: https://cynthiabrian.substack.com/p/do-all-the-good-possible

0 notes

Text

bc of my misery i decided to get started on my tax return, bc i figure why waste a good mood on such things

#and actually it ended up not being too bad#the 23-24 tax year i think i didnt earn as much as i thought i did#probably bc of the wedding and such#and i haven't done any of the tax deductibles yet#so it should be maybe not too bad.....

3 notes

·

View notes

Text

getting a pay reduction next month and then getting laid off in october damn fuck this year 😍

#i posted enough funny things for the whole week today so now i get to make one pathetic miserable little post ‼️#FUCK this job btw they literally told me they'll sign me on for full-time and i was like. okay cool#im working as an accountant with a graphic design degree#and i do it WELL btw. and i havent started looking for jobs because i thought i have a fucking job#the bitch in hr hates me anyway#i was like. hello ive been working here for a year. my tax deduction ends next month. i did the onboarding for FOUR different positions#can i please get a raise. AND THIS BITCH. uhm we gave you a raise this january.... AND???#im literally gonna earn barely above minimum wage do they think im a fucking joke#if they think im gonna do the accounting for 3 different banks in 2 currencies then they've got it fucked#im gonna throw myself out the window if they dont backtrack by the end of the month. just to ruin their day

2 notes

·

View notes

Text

Essential tax tips every small business owner should know to maximize savings

Tips for tax savings

1. Deferring income/expenses

As a small business owner, you can consider deferring incomes or expenses based on business conditions. If business for the year has been slow and profits are lower than expected, you can consider deferring expenses and increasing income for taxation purposes. However, such a step should only be adopted if you are anticipating higher profits during the following year. Income growth is accelerated by speeding up cash collection before December 31 while simultaneously deferring the payment of expenses till after the new year. This will result in the income received during this year being taxed at a lower rate, while the expenses carried forward to the next year can be useful to set off against the higher income of the new year. On the contrary, if profits are expected to be high this year, you can consider deferring income to the next year and increasing expenses in the current year to reduce the taxable income for the year. This can be achieved by paying some of next year’s expenses in the current year.

2. Qualified business income deduction

If your business is structured appropriately, you can claim a Qualified Business Income deduction under the Section 199A. As a small business owner, you can avail of a 20% deduction in qualified business income when calculating federal taxes. However, this deduction is applicable on “pass-throughs”, a process where the owner pays the tax on the business income rather than the business itself paying the tax. That tax break is scheduled to expire after 2025without changes from Congress, which could affect millions of filers. Consult a tax professional to know if this deduction is applicable to your business.

3. Resourceful tax planning

If you have a fairly good idea of how your business is likely to perform during the next tax year, you can prepare for the possibility of higher taxes by creating a cash reserve that can be used to pay the IRS. This will ensure you do not face liquidity problems when it is time to pay your taxes. Another way to meet your tax liabilities for the year is to pay estimated taxes based on the tax paid during the previous year. So, if your business did not do well the previous year, you would be required to pay a relatively low amount of estimated tax for the current year which would preserve your liquidity. Ensure you pay at least 90% of the tax estimated for the current year or 100% of the tax on your return for the previous year whichever is lower, to avoid being penalized. The balance would be due at the end of the current year. These figures should be worked out with the help of your tax consultant or accountant.

4. Use your car for business purposes

Using your car for your business can have several tax benefits for your small business. Car expenses are permitted as deductions from taxable income. Deductible car expenses are calculated at a standard mileage rate of cents per mile or actual expenses are considered. Eligibility for this deduction will depend upon taxable income.

5. Create a retirement savings plan

Creating a retirement plan secures your future and helps reduce the tax rate on your income. Individuals and businesses can contribute to a SEP IRA or 401(k)-retirement plan. Business owners can set up retirement plans for their employees and the cost of setting up and administering these plans can be claimed as a deduction.

These are just a few ways in which small businesses can reduce their tax liability and increase liquidity. These steps to reduce your tax liability can be adopted in consultation with a tax professional based on your business size and organizational structure.

Finlotax: A professional accounting and taxation firm in CA

We are Finlotax, a prominent bookkeeping, CFO and taxation firm based in CA. We take care of all your complex bookkeeping and financial needs at affordable prices. We can help you save on taxes with our tax planning and consultation services. Just reach out to us at 4088229406 and talk to our experts.

#Bookkeeping Services#Business Expenses#Business Tax Advice#Business Tax Filing#Business Tax Tips finance#financial-planning#Finlotax#personal-finance#Qualified Business Income#Reduce Tax Liability#Retirement Savings Plan#Small Business Owners#Small Business Tax#Tax Compliance#Tax Consultation#Tax Deduction#Tax Planning Tips#Tax Professional#tax savings#Tax Strategy#tax-planning#Year-End Tax Planning

0 notes

Text

Strategic Tax Compliance & Year-End Planning with SAI CPA Services

As the year comes to a close, tax compliance and year-end planning become top priorities for businesses. At SAI CPA Services, we offer expert guidance to help you navigate these critical tasks and maximize your tax savings.

Why Year-End Tax Planning Matters

Preparing for year-end taxes can help you make strategic financial decisions that benefit your business. Here’s how SAI CPA Services can help:

Minimize Tax Liabilities: Our team reviews your financials to identify opportunities for tax deductions and credits. From expense tracking to investment planning, we help reduce your overall tax liability.

Ensure Compliance: Staying compliant with federal and state tax laws is essential to avoid penalties. We ensure all tax forms are filed accurately and on time, so you can avoid costly errors.

Optimize Cash Flow: Proper year-end planning helps you manage your cash flow efficiently. We provide strategies to balance your finances and keep your business in a strong financial position heading into the new year.

How SAI CPA Services Can Help

At SAI CPA Services, we tailor our tax compliance and year-end planning services to meet your unique business needs, ensuring you close out the year on a financially sound note.

Connect Us: https://www.saicpaservices.com https://www.facebook.com/AjayKCPA https://www.instagram.com/sai_cpa_services/ https://twitter.com/SaiCPA https://www.linkedin.com/in/saicpaservices/ https://whatsapp.com/channel/0029Va9qWRI60eBg1dRfEa1I

908-380-6876

1 Auer Ct, 2nd Floor

East Brunswick, NJ 08816

#SAICPAServices#CashFlowManagement#year end#tax planning#tax compliance#tax credit#tax#financial services#tax consulting services#finances#accounting#tax deductions#business strategy#cash flow

1 note

·

View note

Text

Vigilante violence is at an all-time high in the occupied West Bank. Emboldened by the war in the Gaza Strip and backed by the military, Israeli settlers aiming to annex more and more of the Palestinian territory have launched hundreds of attacks, displacing people from at least 17 communities over the past month, while soldiers and settlers have killed nearly 200.

And at least three New York nonprofit organizations are calling on donors to help outfit those settlers with combat gear, in a fundraising blitz funneling millions of tax-deductible dollars to the West Bank aggression.

By chipping in to a “thermal drone matching campaign,” donors can help the Long Island–based One Israel Fund buy remote-controlled aerial vehicles for settler militias. With a contribution to the American Friends of Ateret Cohanim’s “security projects,” they can equip settlers with accessories for their guns and tools to keep an eye on “Arab thugs” in occupied east Jerusalem. Donating to the Brooklyn-based Hebron Fund’s “Israel Is Under Attack” campaign helps expand one of Israel’s most extensive local surveillance networks. If New Yorkers contribute by the end of the year, they can write it off on their 2023 tax returns.

Since the Oct. 7 Hamas attack, which killed around 1,200 Israelis, the New York–based nonprofits have raised millions for tactical equipment for settlers across the West Bank. The organizations—right-wing groups dedicated to Jewish rule over the Holy Land—work directly with the Israeli military and with the settlements, which are illegal under international law.

“The ties between New York state and war crimes being carried out by Israeli settlers are egregious,” said Jay Saper, a New York–based organizer with Jewish Voice for Peace. “It’s long overdue for the state to take action.”

2K notes

·

View notes

Text

Jason DeMarco (main guy for Toonami and the producer for the Toonami original animes, including Uzumaki)'s piece on the sudden drop of quality

From this language, it seems like 3 and 4 will probably not fair much better. It also sounds as if someone or some people screwed them over- naturally there's probably some NDAs at play that prevent any direct finger pointing, but it could be anywhere from a studio, a fuck up from an intern or employee, a greedy exec, DeMarco himself- it's likely we'll never know the full picture of what went wrong, at least not until the nda runs it's course, and even then we may never know.

It certainly does suck that something as important as this that people have been looking forward to for years was treated this way, god knows covid didn't help matters. Poor Junji Ito is just cursed to have bad adaptations I guess.

There's a lot of outrage that can be had about this, but a friend of mine made me realize that it was either they show us what they had or risk it becoming lost media and it NEVER see the light of day. Remember the Coyote Vs Acme movie that got finished and completely trashed because one worthless asshole up top decided the hard work and passion of many workers making the film was worth less than a legally questionable tax deduction? Several over movies like that too. Lots of media just GONE that we won't ever have access to because 1 person made a decision for the rest of us. That doesn't sit right with me, high or low quality of the product aside.

It's not ideal, but these are the cards dealt. In that regard, I can kind of appreciate the effort to release it anyway. I'll always be bitter at whoever fucked it over, and if its a case of executive meddling or embezzling then i hope they get locked up, but I think I'd rather see the end result than have it all tossed in a vault to never be seen again.

I for SURE would rather stupid executives leave art alone until it's fully fucking baked, but they won't. As an adult, you learn to try and make the best of bad situations, and that's all I'm gonna do here.

In any case this is certainly an interesting real-world incident to follow further development on.

199 notes

·

View notes

Text

The thing that gets me so worked up about universal healthcare is how people say that it will be so expensive for the tax payer.

This is long rant warning so I added a break lol.

The TLDR is that even in a low tax state like Florida, someone making 50k a year will have an effective rate of of 32% (for taxes, healthcare, costs for an undergraduate degree).

Someone making 50k a year in a 'high tax' country like New Zealand has an effective rate of 21% (for taxes, healthcare, costs for an undergraduate degree).

For an American and a Kiwi with the same salary of $50k, if they have the same disposable income, the Kiwi will be able to save an extra $75,000 over 10 years that they can use for a downpayment on a home to further build wealth.

Low tax states just have the costs shuffled to other places, you end up paying a LOT more for the same services.

Here's a comparison of someone who makes $50,000 a year in New Zealand and Florida (I chose Florida as an extreme example because they have 0% state tax rate) and each person makes $15,000 worth of purchases that are taxable.

New Zealand

$7,658 in combined income taxes and levies

$2,250 in taxes on $15k of purchases (15% sales tax)

Total of $9,908 - an effective total rate of 19.8% paid to taxes and purchases and healthcare

Florida

$7,945 in combined taxes (federal taxes, social security, medicaid etc)

$1,050 in taxes on $15k of purchases (7% sales tax)

$1,700 average annual health insurance premium for Florida

$2,060 average annual health insurance deductible for Florida

Total of $12,755 - an effective total rate of 25.5% paid to taxes and purchases and healthcare

Even in a low tax state, you're already have less take-home income than someone with the same salary in New Zealand.

But

... in New Zealand with your taxes you're also getting public education. It's not completely free, but costs are fixed, and you get one year of your undergraduate free, so for example a Bachelor of Arts would cost a total of $13,548 (USD $8,347)

If you can't pay that upfront, you can get a 0% loan from the government, which you don't need to start paying off until you earn at least $23k per year. For someone making $50k that would be an extra 6.5% deducted from your income ($270/month) until the loan is paid off (which would be 2 years and 8 months).

In Florida the average student loan debt is 25k and if you're making the same payments as someone in NZ ($270/month) then you'll be paying that off for 11 years. [Note: I believe that some private loan interest rates go as high as 15%].

Bachelor of Arts in NZ $13,548, paid off over ~2.7 years.

Bachelor of Arts in Florida $35,539, paid off over ~11 years.

So lets look at effective payments over 11 years (for simplicity salary stays at 50k).

New Zealand works out to be 21% effective rate over 11 years (including taxes, healthcare, and undergraduate degree).

Florida works out to be 32% effective rate over 11 years (including taxes, healthcare, and an undergraduate degree) - you're paying 52% more!

That means someone with the same income will effectively be able to save an additional $5,000 per year over 11 years, if they invest that extra amount and get a 5% return, the New Zealander will have savings of about $75k which they can use for downpayment for a home etc.

In conclusion, even though it may seem like you're getting a good deal in a low tax state like Florida, you end up paying soooo much more in healthcare and education costs compared to a country where taxes are a little higher, but you get public healthcare and education.

Why is the U.S. so expensive? Well once place to look is defense, intelligence, and police. In the United States this costs on average $3,700 per person. New Zealand spends $1,600 per person (USD ~1,000).

62 notes

·

View notes

Text

I'm addicted to the Circa system from Levenger for organizing, filing, and storing my analogue sketches and notes. I love how organic and adaptable it is.

The products are also very sturdy and attractive.

I use the Levenger hole punch to perforate my layout paper. It fits perfectly into the Circa notebook and can be removed and rearranged as I make changes to a project.

The Levenger Circa system is not cheap: I usually buy extra stuff toward the end of the year if I need a tax deduction. But you can often find amazing bargains on ebay. I've saved 80-90% on a few items. Takes some time to hunt for those, but can be worth it.

The Canson Layout paper is my favorite. It is acid free, heavier than some other papers, and has a bit of tooth. Pencil shows up a bit darker than it does on slicker, lighter paper. Easy to find, here's a link with more info and you can also order here.

Sometimes I go over my prelim noodling in ink. Sometimes I don't.

79 notes

·

View notes

Note

IATA: I have committed Grand Theft Dildo, and I regret nothing.

Background: For a while I was the health teacher at a school that had one of those awful wooden cylinders for condom demos. I hated it, it didn't impress my kids, and so I went to the principal for permission to acquire a new condom model. He okayed it just as long as it didn't cost the school money, so I emailed some sex toy shops about a tax-deductible donation. One of them wrote back to me right away, gushing about how much they loved teachers, and they made me a gift basket with condoms, lube, and a giant, suction-cup bottomed, glow in the dark, Dr. Manhattan-blue dildo. (They also gave me an educator discount so I could buy some stuff for myself. Bless them.)

The kids loved the dildo, which I dubbed Moby Dick. It was supposed to be my pride and joy, my enduring contribution to a school I had to leave soon to start an MSc in another city.

Crime Time: At the end of the school year, the ED went rogue and I was fired for labor organizing, one of the only illegal ways to fire someone in the US. Because everything was chaos, and we didn't even know if the school would still exist in the fall, a coworker and I conspired to steal the dildo so it wouldn't go to waste. I snuck into the graduation ceremony (I wasn't supposed to be there since I was fired) while my coworker slipped into my classroom and smuggled out Moby Dick.

(Oh, and I was rehired with apologies and a bonus a week later to keep me from filing an NLRB complaint. Know your rights at work, everybody.)

Is it still illegal to steal a dildo from a school if you're the one who gave it to them? Does the fact that it was a tax-exempt donation matter? Either way, Moby Dick is still a proud pillar of my home decor - a shining blue beacon of good memories to light up my lonely nights.

this is not assholery at all anon. you should have stolen much more from your job. but thank you for the message and i'm glad you got your job back

90 notes

·

View notes

Note

Hey Sam, I remember reading a post or response from you about how to give to charities anonymously, but now that I’m searching, I’m finding a few different responses but still have questions. Any chance you could do a round up post? Wondering about the following:

1. How to give cash

2. How to give small amounts anonymously (e.g., if you can’t set up a DAF)

3. How to opt out of being sent branded junk if you can’t give anonymously, because it will end up in the garbage (seriously, no more pens, stickers or magnets please)

4. In giving anonymously, how important is the tax receipt? I only take the standard deduction on my taxes… is there a reason to bother with tracking the receipts?

Appreciate your help!

Ah yeah, it's rough knowing how to do some of these things. I've written about some of them, probably most of them, but disparately over several posts, so let me see if I can answer succinctly and all in one place.

How to give cash: You are pretty much confined to two options, giving cash to a staffer in person or mailing cash in an envelope. If you have access to the office of the nonprofit you may be able to swing by and drop the cash off, but it's not super convenient and often not possible. If you're at an event you can hand it in an envelope to a staffer, and that's really the only way my organization gets cash donations, but that requires you to be at the event. And technically I can't recommend mailing cash since the risk of theft is a real one. Giving cash is fine legally, but nonprofits often aren't thrilled with it because it can put their staff at risk and also there's, well, there's no way to track that donation to a person. But yeah, throw them dollars between two thick sheets of paper and mail that in with a note saying "This is for the XYZ organization" so they know they can accept it.

2. Giving small amounts anonymously: It depends on how you're defining 'small'; I have a DAF (for the readers: a Donor Advised Fund -- I talk a little about them here but I've never gone indepth) which has no minimum deposit or minimum monthly contribution, but they do have a minimum donation amount of $20. To me that's not especially large, but I know to many people it can be. Pretty much the only way to give an amount smaller than $20 anonymously is to give online through the nonprofit's website using a cash giftcard (like a Visa gift debit card), and just not give an address. If you custom-order checks you can sometimes order checks without a home address, or with the bank's address, and pay with one of those, but I've never tried that.

If you do use a DAF (and I can recommend Charityvest, they've been mine for several years now) you can always set up to pay small amounts into it and just have them send all that money in a lump sum once or twice a year. I pay in $75/mo and from that they pay out three $20 donations a month, and at the end of the year the extra $180 that has just sat there becomes a nice extra donation. Always bearing in mind of course that once you pay into a DAF that money is gone, you can't claw it back even if you haven't "donated" it yet -- just putting money in a DAF is considered a donation. Readers, if you're curious about DAFs I recommend googling, lots of banks have "what is a DAF" pages, but if you're not finding what you want to know do feel free to come ask me.

3. Opting out of swag when not giving anonymously: I'm tempted to just say "Ya can't" because it's hard, especially with larger orgs. Even if you opt out, often you'll still get mailings that are considered "stewardship" (maintaining a relationship) rather than "solicitation" (asking for giving) and swag counts as stewardship. You can always start with sending the org a letter saying "Please put me on a Do Not Contact list, I will continue to give but don't want to get your swag". If that doesn't work, start returning mailings -- if you get something from the org don't even open it, just write "return to sender -- no longer resident" and drop it in the mail. This is not guaranteed effective; some places will either just change the name to 'resident' or retry every so often just in case. You can call the org and ask to speak to "records" or "data", and then just be super up front: "I want to keep supporting you but I really don't want the swag, how do I get that turned off?" They can help, but if you give to another similar org, a lot of times orgs will do "list exchanges" where they swap mailing lists, and if the org does that and you're on the other org's list, you get put right back on the "ok to mail" list for the first org.

I will say, swag is very, very cheap and gets results, so you can also look at this as "well, it was wasted on me, but the five cents this pen cost will get them $1 from someone, so in accepting it, I am still helping them to gain donations." This depends on your tolerance for waste, of course, which I'll talk more about in a minute.

(I personally like getting magnets, because I put stickers over top of whatever's printed on the magnet, cut it out to the shape of the sticker, and behold! I have a cool magnet!)

4. Tax receipting: I'm not a CPA or a tax lawyer and I fucked this up the last time I talked about it, so take this with a grain of salt, but there is an "above and beyond" deduction -- after the standard deduction I believe you can deduct an additional up-to-$300 for charitable giving, and if you were to be audited you'd need receipts to prove that. (As I said, if you're planning on this, fact-check first, I am not a strong source for this information.) (Edited to add: comments informed me this is no longer the case, so I'm glad I added in the disclaimer :D) If you give via a DAF, no problem; the DAF tracks where and when and how much you gave, so I could use my DAF's records as "receipts". You can also, if you lost or didn't get a receipt, contact the org and ask them for your giving record for the year. Here's the problem -- if you are giving in a way that allows you to avoid giving your address, there may be no way to get those receipts, since you can't prove their record with your name on it is you. So if you want receipts but want to give semi-anonymously definitely make sure they have your email address. If you're giving $300 a year, you probably want to take that deduction; if you're giving $20 a year, probably it isn't worth it. But yeah, to get a receipt you generally have to give them enough information for them to identify you, but you don't need giving receipts if all you take is the standard deduction.

All in all, the options are -- give cash and get no receipt, give via DAF or using a giftcard and get receipts to your email, give with your address attached and just hope they honor your request to be removed from swag mailing, or give however you want, put up with the swag, and bear in mind that them sending you the pen or magnet or keychain wasn't much of a problem or cost for them and will get them money from someone.

Honestly, option four isn't the least irritating, but it's probably the least labor-intensive for you. But it really is a question of what you want from your relationship to the nonprofits you support, and how passionately you feel about the "waste" status of swag they send. Only you can determine where your tolerance point is between "having to put in so much effort not to get this stuff" and "having to throw this stuff in a landfill". It's a regrettable part of being a donor and building a relationship with a nonprofit, but we in the nonprofit field do appreciate your giving and your tolerance :) While there are some outlier bad-actors in the space, trust me, for most nonprofits, nothing we do is gratuitous. Almost all of us are on such a thin wire that if something costs us money and doesn't get us more money, it gets binned very quickly.

93 notes

·

View notes

Text

RIP Cohost

Cohost is shutting down the end of the year. While I'm kinda sad because it was a good experiment to see if non-federated social media could be viable that doesn't rely on selling data or anything, I think Anti-Software Software Club just made too many assumptions that didn't or couldn't pan out. Including just... not understanding what they wanted in the end.

(Read more because this was originally a Bluesky post and got long)

Number 1 mostly being them being "blindsided" by Stripe clarifying their policy that, in the end, means ASSC couldn't use them as a way for users to tip each other or the Artists Alley section and such. That policy existed for years, well before Cohost ever existed. For context, ASSC originally wanted to build a Patreon competitor, not a social media site. They would have failed so hard if they stuck to a Patreon competitor on this alone.

And in my opinion, number 2 is their pay. They were paying themselves very well-off all things considered, and everyone was paid the exact same amount (~94k last I heard). That's… a lot of money going towards pay that could've gone to hosting costs. They're a startup. You pay yourselves what you can. I appreciate that they paid themselves well, but again. Startup. You pay what you can, and they were nowhere close to breaking even at any point.

I think their financial model didn't do themselves any favors - they started out with "we got a lot of loan money to do this and now we have to make it profitable" which, yeah, sometimes that's what it takes. But that's venture capitalism. Especially since Cohost's source code WAS the collateral! They acted as a leftist group trying to market themselves as a non-profit/not-for-profit (they're a LLC, they're legally not forced to do either), paying themselves well more than they realistically, and hoped they could get enough people to subscribe monthly to break even.

That… doesn't work.

Not to say this would've fixed things, but I think them registering as an LLC didn't help. That prevented them from bringing on anything resembling a volunteer, and since their whole thing was "everyone gets paid the same" it meant they had to operate with very few people. If I recall correctly, they had one moderator. Maybe two. Maybe. Two developers, an artist, and a moderator. Four people. MAYBE five, I forget the exact number.

This is entering hypothetical territory so everything is unknown and is me guessing a lot of things, but is based on what I do know.

Being a non-profit comes with its own set of problems, but if they could become and maintain a 501(c)3 non-profit, they could pay themselves what they could and have people willing to help volunteer moderate. They could never get code contributors, though, since their source code was their collateral it by nature had to be closed off. Also, donations (recurring or one-off) are tax-deductible for US-members, so while it's not a HUGE benefit it offers at least that small bonus.

I'm glad that they tried, and got as far as they did (even if it meant loan after loan to not die instantly). It showed that it could be possible - that there's hope in this idea. It's just a question of HOW to make it a sustainable reality. I don't think there's a clear answer there, though. Like my non-profit idea hinges heavily on maintaining 501(c)3 status (or similar) and being able to bring on volunteers as-needed. Using a public spec for the back-end (like ActivityPub or ATProto) so the focus can be on implementing it (even if federation is never a thing) instead of doing it raw - which avoids the back-end development time but then means having to work with an existing spec that may or may not change substantially over time.

IDK. I have no idea what would make a medium-form social media such as Cohost viable. Maybe it's the same idea but with lower pay so it's easier to bring new people on as-needed, with the expectation that this is a passion project 'til it gets off the ground. Maybe it takes the "use a public spec for back-end" approach and focuses on the implementation of it with their own additions and flair. ActivityPub is one spec, but you have Mastodon, Pixelfed, Misskey, Wafrn, etc. that all go in different directions. ATProto will likely be the same one day - Bluesky being the obvious "reference" implementation right now.

Maybe it's something else entirely that I could never ever think of. I don't know, but all I do know is that I'm glad they tried. Unfortunately, the writing has been on the wall for months now and honestly? If you didn't expect that, that's on you. People have been saying that Cohost wasn't sustainable for months.

#cohost#they tried but ultimately failed#I just hope that someone gives it an honest go again and learns from their mistakes#because it would be great to see more platforms comparable to tumblr#instead of just trying to mimic twitter or instagram#wafrn is pretty early on but it's the closest ActivityPub-based thing to tumblr#hopefully it becomes much better with time

17 notes

·

View notes

Text

The IRS will do your taxes for you (if that's what you prefer)

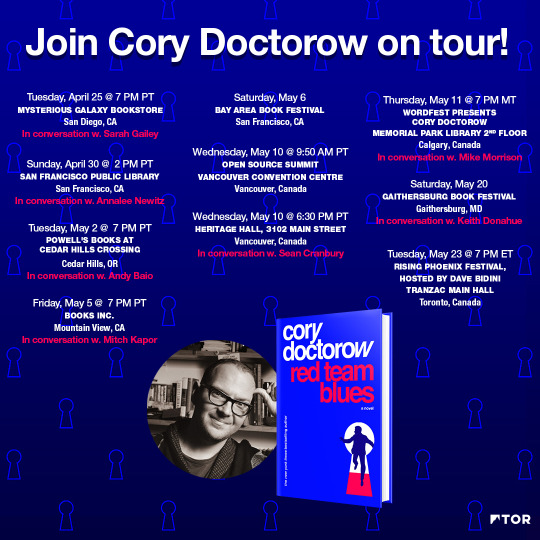

This Saturday (May 20), I’ll be at the GAITHERSBURG Book Festival with my novel Red Team Blues; then on May 22, I’m keynoting Public Knowledge’s Emerging Tech conference in DC.

On May 23, I’ll be in TORONTO for a book launch that’s part of WEPFest, a benefit for the West End Phoenix, onstage with Dave Bidini (The Rheostatics), Ron Diebert (Citizen Lab) and the whistleblower Dr Nancy Olivieri.

America is a world leader in allowing private companies to levy taxes on its citizens, including (stay with me here), a tax on paying your taxes.

In most of the world, the tax authorities prepare a return for each taxpayer, sending them a prepopulated form with all their tax details — collected from employers and other regulated entities, like pension funds and commodities brokers, who must report income to the tax office. If the form is correct, the taxpayer signs it and sends it back (in some countries, taxpayers don’t even have to do that — they just ignore the return unless they want to amend it).

No one has to use this system, of course. If you have complex finances, or cash income that doesn’t show up in mandatory reporting, or if you’d just prefer to prepare your own return or pay an accountant to do so for you, you can. But for the majority of people, those with income from a job or a pension, and predictable deductions, say, from caring for minor children, filing your annual tax return takes between zero and five minutes and costs absolutely nothing.

Not so in America. America is one of the very few rich countries (including Canada, though this is changing), where the government won’t just send you a form containing all the information it already has, ready to file. As is common in complex societies, America has a complex tax code (further complexified by deliberate obfuscation by billionaires and their lickspittle Congressjerks, who deliberately perforate the tax code with loopholes for the ultra-rich):

https://pluralistic.net/2021/08/11/the-canada-variant/#shitty-man-of-history-theory

That complexity means that most of us can’t figure out how to file our own taxes, at least not without committing scarce hours out of the only life we will ever have to poring over the ramified and obscure maze of tax-law.

Why doesn’t the IRS just send you a tax-return? Well, because the tax-prep industry — an oligopoly dominated by a handful of massive, ultra-profitable firms — bribes Congress (that is, “lobbies”) to prohibit this. They are aided in this endeavor by swivel-eyed lunatic anti-tax obsessives, like Grover Nordquist and Americans for Tax Reform, who argue that paying taxes should be as difficult and painful as possible in order to foment opposition to taxation itself.

The tax-prep industry is dominated by a single firm, Intuit, who took over tax-prep through its anticompetitive acquisition of TurboTax, itself a chimera of multiple companies gobbled up in a decades-long merger orgy. Inuit is a freaky company. For decades, its defining CEO Brad Smith ran the company as a cult of personality organized around his trite sayings, like “Do whatever makes your heart beat fastest,” stenciled on t-shirts worn by employees. Other employees donned Brad Smith masks for selfies with their Beloved Leader.

Smith’s cult also spent decades lobbying to keep the IRS from offering a free filing service. Instead, Intuit joined a cartel that offered a “Free File” service to some low- and medium-income Americans:

https://www.propublica.org/article/inside-turbotax-20-year-fight-to-stop-americans-from-filing-their-taxes-for-free

But the cartel sabotaged Free File from the start. They blocked search engines from indexing their Free File services, then bought Google ads for “free file” that directed searchers to soundalike programs (“Free Filing,” etc) that hit them for hundreds of dollars in tax-prep fees. They also funneled users to versions of Free File they were ineligible for, a fact that was only revealed after the user spent hours painstaking entering their financial information, whereupon they would be told that they could either start over or pay hundreds of dollars to finish filing with a commercial product.

Intuit also pioneered the use of binding arbitration waivers that stripped its victims of the right to sue the company after it defrauded them. This tactic blew up in Intuit’s face after its victims banded together to mass-file thousands of arbitration claims, sending the company to court to argue that binding arbitration wasn’t enforceable after all:

https://pluralistic.net/2022/02/24/uber-for-arbitration/#nibbled-to-death-by-ducks

But justice eventually caught up with Intuit. After a series of stinging exposes by Propublica journalists Justin Elliot, Paul Kiel and others, NY Attorney General Letitia James led a coalition of AGs from all 50 states and DC that extracted a $141m settlement for 4.4 million Americans who had been tricked into paying for Turbotax services they were entitled to get for free:

https://www.msn.com/en-us/news/us/turbotax-to-begin-payouts-after-it-cheated-customers-new-york-ag-says/ar-AA1aNXfi

Fines are one thing, but the only way to comprehensively end the predatory tax-prep scam is to bring the USA kicking and screaming into the 20th century, when most of the rest of the world brought in free tax-prep for ordinary income earners. That’s just what’s happening: the IRS is trialing a free tax prep service for next year’s tax season:

https://www.washingtonpost.com/business/2023/05/15/irs-free-file/

This, despite Intuit’s all-out blitz attack on Congress and the IRS to keep free tax-prep from ever reaching the American people:

https://pluralistic.net/2023/02/20/turbotaxed/#counter-intuit

That charm offensive didn’t stop the IRS from releasing a banger of a report that made it clear that free tax-prep was the most efficient, humane and cost-effective way to manage an advanced tax-system (something the rest of the world has known for decades):

https://www.irs.gov/pub/irs-pdf/p5788.pdf

Of course, Intuit is furious, as in spitting feathers. Rick Heineman, Intuit’s spokesprofiteer, told KQED that “A direct-to-IRS e-file system is wholly redundant and is nothing more than a solution in search of a problem. That solution will unnecessarily cost taxpayers billions of dollars and especially harm the most vulnerable Americans.”

https://www.kqed.org/news/11949746/the-irs-is-building-its-own-online-tax-filing-system-tax-prep-companies-arent-happy

Despite Upton Sinclair’s advice that “it is difficult to get a man to understand something, when his salary depends on his not understanding it,” I will now attempt to try to explain to Heineman why he is unfuckingbelievably, eye-wateringly wrong.

“e-file…is wholly redundant”: Well, no, Rick, it’s not redundant, because there is no existing Free File system except for the one your corrupt employer made and hid “in the bottom of a locked filing cabinet stuck in a disused lavatory with a sign on the door saying ‘Beware of the Leopard.’”

“nothing more than a solution in search of a problem”: The problem this solves is that Americans have to pay Intuit billions to pay their taxes. It’s a tax on paying taxes. That is a problem.

“unnecessarily cost taxpayers billions of dollars”: No, it will save taxpayers the billions of dollars (they pay you).

“harm the most vulnerable Americans”: Here is an area where Heineman can speak with authority, because few companies have more experience harming vulnerable Americans.

Take the Child Tax Credit. This is the most successful social program in living memory, a single initiative that did more to lift American children out of poverty than any other since the days of the Great Society. It turns out that giving poor people money makes them less poor, which is weird, because neoliberal economists have spent decades assuring us that this is not the case:

https://pluralistic.net/2023/05/16/mortgages-are-rent-control/#housing-is-a-human-right-not-an-asset

But the Child Tax Credit has been systematically sabotaged, by Intuit lobbyists, who successfully added layer after layer of red tape — needless complexity that makes it nearly impossible to claim the credit without expert help — from the likes of Intuit:

https://pluralistic.net/2021/06/29/three-times-is-enemy-action/#ctc

It worked. As Ryan Cooper writes in The American Prospect: “between 13 and 22 percent of EITC benefits are gulped down by tax prep companies”:

https://prospect.org/economy/2023-05-17-irs-takes-welcome-step-20th-century/

So yes, I will defer to Rick Heineman and his employer Intuit on the subject of “harming the most vulnerable Americans.” After all, they’re the experts. National champions, even.

Now I want to address the peply guys who are vibrating with excitement to tell me about their 1099 income, the cash money they get from their lemonade stand, the weird flow of krugerrands their relatives in South African FedEx to them twice a year, etc, that means that free file won’t work for them because the IRS doesn’t actually understand their finances.

That’s a hard problem, all right. Luckily, there is a very simple answer for this: use a tax-prep service.

Actually, it’s not a hard problem. Just use a tax-prep service. That’s it. No one is going to force you to use the IRS’s free e-file. All you need to do to avoid the socialist nightmare of (checks notes) living with less red-tape is: continue to do exactly what you’re already doing.

Same goes for those of you who have a beloved family accountant you’ve used since the Eisenhower administration. All you need to do to continue to enjoy the advice of that trusted advisor is…nothing. That’s it. Simply don’t change anything.

One final note, addressing the people who are worried that the IRS will cheat innocent taxpayers by not giving them all the benefits they’re entitled to. Allow me here to simply tap the sign that says “between 13 and 22 percent of EITC benefits are gulped down by tax prep companies.” In other words, when you fret about taxpayers being ripped off, you’re thinking of Intuit, not the IRS. Just calm down. Why not try using fluoridated toothpaste? You’ll feel better, and I promise I won’t tell your friends at the Gadsen Flag appreciation society.

Your secret is safe with me.

Catch me on tour with Red Team Blues in Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

If you’d like an essay-formatted version of this thread to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/17/free-as-in-freefile/#tell-me-something-i-dont-know

[Image ID: A vintage drawing of Uncle Sam toasting with a glass of Champagne, superimposed over an IRS 1040 form that has been fuzzed into a distorted halftone pattern.]

#pluralistic#earned income tax credit#eitc#irs#grover nordquist#guillotine watch#turbotax#taxes#death and taxes#freefile#monopoly#intuit

177 notes

·

View notes

Text

Maximize Your Tax Savings with Year-End Tax Planning at SAI CPA Services

Welcome back to the SAI CPA Services blog! As we approach the end of the year, it’s crucial to start thinking about year-end tax planning to maximize your tax savings.

Why Year-End Tax Planning Matters

Year-end tax planning allows you to review your financial situation and take advantage of tax-saving opportunities before the year closes. Here’s how SAI CPA Services can help:

Optimize Deductions and Credits: Our experienced CPAs ensure you’re taking full advantage of all available tax deductions and credits. Whether it’s charitable donations, retirement contributions, or business expenses, we help you minimize your tax liability.

Reduce Surprises: By planning ahead, you can avoid any unwelcome surprises when it’s time to file your tax return. We help you project your tax obligations and adjust strategies to keep more money in your pocket.

Tax Compliance: Staying on top of tax regulations is essential to avoid penalties. We ensure you’re compliant with the latest tax laws and regulations, giving you peace of mind.

How SAI CPA Services Can Help

Let SAI CPA Services guide you through year-end tax planning to optimize your savings and prepare for a smooth tax season. Our team is dedicated to making the tax process stress-free and financially rewarding.

Connect Us: https://www.saicpaservices.com https://www.facebook.com/AjayKCPA https://www.instagram.com/sai_cpa_services/ https://twitter.com/SaiCPA https://www.linkedin.com/in/saicpaservices/ https://whatsapp.com/channel/0029Va9qWRI60eBg1dRfEa1I

908-380-6876

1 Auer Ct, 2nd Floor

East Brunswick, NJ 08816

#saicpaservices#tax planning#year end#taxsavings#tax deductions#tax returns#taxstrategies#tax strategy#finance#accounting#business#cpa

1 note

·

View note

Text

Comment on Fark that is better journalism than I’ve seen in the actual news so far.

Text:

Harris policies last night:

50k Small Business deduction

6k Child Tax Credits

Work with builders to get 3M new homes in the market over 4 years.

Stop price fixing by grocery stores

Support Ukraine and other democracies defending themselves against invasion by dictators.

Restore the standard set by Roe v. Wade.

Strengthen the ACA and increase the percentage of Americans with health insurance by increasing subsidies for people at the bottom end.

Trump Policies last night:

20% Tariffs on all imported goods

Deport millions of people.

"I have a concept of a plan"

When the media comes out and says Trump lost and was super unhinged, but we didn't get enough specific policies out of Kamala last night, I just don't know wtf they're talking about. Like, debates aren't a great place to do a 50 page deep dive into tax policy as a vehicle for social mobility, and what Kamala did was lay out her broad vision for how to create more opportunities for lower and middle class families to be successful.

13 notes

·

View notes

Text

A summary of the stances spoken by Kamala Harris during the presidential debate on September 10, 2024.

Reinstating protections of Roe v. Wade

Continue addressing, as she refers to it, transnational organizations trafficking fentanyl and weapons

She does not refer to individuals, but to organizations during this portion

Not banning fracking

In fact, she mentions that the Inflation Reduction Act provided new leases for oil drilling

Investing in diverse energy sources

Decreasing dependence on foreign oil

Support starting up small businesses through tax deductions

Increase the child tax cut ($6,000 for the first year after birth)

Increase homes by 3 million by the end of her first term

Downpayment assistance for first-time home-buyers ($25,000 tax credit)

Protect social security and medicare

Protect seniors from scams

Needing a ceasefire deal for Palestine-Israel

Two state solution

Security in equal measure for both sides

Ensuring the U.S. has the most lethal fighting force in the world

A break from extraneous language, stating plain policy intentions. As stated in her closing statement, Harris is a candidate with the future in mind, seeking, generally, to help U.S. citizens. She unfortunately invokes politically ‘moderate’ stances such as her statements about Israel and military support, which should both be worded better. However, we can understand this within the context of a political system that would never permit someone rising to power while acknowledging the deep wrongs of the military and Israel. Overall, Harris is a far healthier candidate for the United States based on the principles claimed in this debate.

#us politics#news#2024 elections#2024 presidential election#kamala harris#harris policies#political policies#article#climate change#politics#renewable energy#Not going into analysis of all of these#Just the fact that she has a damn plan#that doesn't involve making life worse for a majority of people#like yeah it's not all great#but at least fewer people will die with her presidency than with Trump's#Also#like it was interesting that she didn't refer to individuals during the border talk#but to organizations#but I don't have the energy to investigate the implications of that right now

12 notes

·

View notes