#freefile

Explore tagged Tumblr posts

Text

Musk steals a billion dollars from low-income Americans and sends it to Intuit

I'm about to leave for a 20+ city book tour for my new novel PICKS AND SHOVELS. Catch me on Feb 14 in BOSTON for FREE at BOSKONE , and on Feb 15 for a virtual event with YANIS VAROUFAKIS. More tour dates here.

Let me tell you about the most wasteful US federal government spending I know about. It's a humdinger. You and everyone you know are mired in it for weeks, or perhaps months, every year. It will cost you, personally, thousands of dollars over your lifetime. I'm talking about filing your taxes.

Not paying your taxes. Paying your taxes is fine. It keeps the country running, though not because the government needs our "tax dollars" to pay for things. The government annihilates the money it taxes away from us, and creates new money to pay for programs. The USA needs US citizens' dollars to build highways the same way Starbucks needs its Starbucks gift cards to make lattes – that is, not at all:

https://theglobepost.com/2019/03/28/stephanie-kelton-mmt/

I'm talking about filing your taxes. In nearly every case, a tax return contains a bunch of things the IRS already knows: how much interest your bank paid you, how much your employer paid you, how many kids you have, etc etc. Nearly everyone who pays a tax-prep place or website to file their tax return is just sending data to the IRS that the IRS already has. This is insanely wasteful.

In most other "advanced" countries (and in plenty of poorer countries, too), the tax authority fills in your tax return for you and mails it to you at tax-time. If it looks good to you, you just sign the bottom and send it back. If there are mistakes, you can correct them. You can also just drop it in the shredder and hire an accountant to do your taxes for you, if, for example, you run a small business, or are self-employed, or have other complex tax needs. A tiny minority of tax filers fall into that bucket, and they keep the tax-prep industry in other countries alive, albeit in a much smaller form than in the USA.

In the US, we have a duopoly of two gigantic tax-prep outfits: H&R Block, and Intuit, owners of Turbotax. These companies make billions from low-income, working Americans every year, charging them to format a bunch of information the IRS already has, and then sending it to the IRS on their behalf. These companies lobbied like crazy for the right to tax you when you pay your taxes.

In 2003, it looked like the IRS would start sending Americans pre-completed returns, so H&R Block and Turbotax went into lobbying overdrive, whipping up a "public private partnership" called the "Free File Alliance," that promised to do free tax prep for most Americans. But once the threat of IRS free filing was killed, they turned Free File into a sick joke. Americans who tried to use Free File were fraudulently channeled into filing products that cost money – sometimes hundreds of dollars – to use, a fact that was only revealed after the taxpayer had spent hours keying in their information. Free File sites were also used to peddle unrelated financial products to tax filers, with deceptive language that implied that buying these services was needed to file your return:

https://www.propublica.org/article/inside-turbotax-20-year-fight-to-stop-americans-from-filing-their-taxes-for-free

The big winner from the Free File scam was Intuit, which bought Turbotax in 1993. They made about one billion dollars per year ripping off Americans they'd promised to file free tax returns for. After outstanding work by Propublica, lawmakers and the IRS were finally pressured to create an IRS-based free filing service that would cut Intuit out of the loop. Intuit went on a lobbying blitz without parallel, giving out $3.5m in bribes in 2022 in a bid to kill the Treasury Department's study of a free filing service:

https://pluralistic.net/2023/02/20/turbotaxed/#counter-intuit

In 2022, nearly every US state attorney general settled their lawsuits against Intuit for the Turbotax ripoff, bringing in $141m:

https://www.agturbotaxsettlement.com/Home/portalid/0

In 2023, the FTC won a case against Intuit over the scam:

https://www.ftc.gov/business-guidance/blog/2023/09/nine-takeaways-initial-decision-intuit-turbotax-action

But Intut was undeterred. They came back in 2023 with a campaign to say that ripping off American tax-filers was antiracist and anyone who wanted the IRS to make filing free was, therefore, a racist:

https://pluralistic.net/2023/09/27/predatory-inclusion/#equal-opportunity-scammers

Strangely, no one bought that one. By May, 2023 the IRS had announced its own, in-house free file program:

https://pluralistic.net/2023/05/17/free-as-in-freefile/#tell-me-something-i-dont-know

Now, no one is forcing you to use this program. Do you have a family accountant that your grandparents started using in the Eisenhower administration? Just keep going to them. Do you like using Turbotax? Keep using it! Wanna do your own taxes? Here's the forms:

https://www.irs.gov/pub/irs-pdf/f1040s.pdf

But if you want to file your taxes for free, and you earn $125,000/year or less, here's the IRS's service:

https://www.irs.gov/filing/irs-direct-file-for-free

Better use it quick, though. Elon Musk has just announced that he's killing it. Yeah, I know, no one elected him. That doesn't seem to matter to anyone, least of all Democrats on the Hill, who are still showing up for work every day and trying to engender a "spirit of comity" rather than screaming and throwing eggs:

https://apnews.com/article/irs-direct-file-musk-18f-6a4dc35a92f9f29c310721af53f58b16

Musk called IRS free file a "far left" program and announced that he had "deleted it." By the way, the median Trump voter's income is about $72k, meaning more than half of Trump voters qualified for free file:

https://fivethirtyeight.com/features/the-mythology-of-trumps-working-class-support/

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2025/02/11/doubling-up-on-paperwork/#rip-freefile

Image: Wcamp9 (modified) https://commons.wikimedia.org/wiki/File:Elon_Musk_-_March_28,_2024_%28cropped%29.jpg

CC BY 4.0 https://creativecommons.org/licenses/by/4.0/deed.en

258 notes

·

View notes

Text

IRS Free File starts Jan. 10

The program will start accepting individual returns to be held for filing once tax season kicks off.

1 note

·

View note

Text

I’ve been putting off doing mine, but I thought I should probably do it this weekend, so when this came across my dash, I just did it.

It took me longer than 15 minutes, but mainly because of a Series of Circumstances. (I switched to FreeFile from having used TurboTax for the last decade or so. They needed my previous year’s AGI to e-file, which previously TurboTax always filled in automatically. I also changed computers since last time, and I couldn’t find my tax return, so I had to request a copy from the IRS, and I’ve never done that before, so I had to set up an account, which involves taking pictures of your driver’s license and yourself, and there were lighting issues with both....)

Anyway, all that, and it was still well under an hour. And FreeFile (I used the option called FreeTaxUSA) did not attempt to trick me into purchasing a paid product, which TurboTax always did, but was just as easy.

My refund is only about $100, but that’s fine--a small refund (or payment) just means that your withholding is about right!

For anyone in the US who has just realized that they are nearly 1 month away from their taxes being due (April 18th) and is panicking because they don't know what to do,

Calm down.

If you're new to taxes, and in an early part of your life (just earning wages from a company that does withholdings), they're actually pretty easy to do and odds are you're just gonna get some free money (your tax refund).

Collect documents. Specifically, go get your get your W2, a form sent to you by whatever company you work for. Most will send you this online. Some might send you a paper copy.

https://www.irs.gov/filing/free-file-do-your-federal-taxes-for-free

Go to the above link, there's free filing options for federal taxes, and for some state taxes. It took me ~15 minutes to do my taxes in total, and then the government gave me like 1k back.

If your situation is more complicated than just having a W2, then go to the IRS's help page. They have a ton of super helpful tools that can walk you through different situations and what you need to do, they also have a toll-free help line.

https://www.irs.gov/help/ita

I know everyone talks about how much taxes suck, but legit, if you're an average wage earner and don't own a house or anything, odds are your taxes can be done in 15 minutes and then you get some of the taxes you paid back. It's not that scary, and the IRS has been working really hard to make the process as simple as possible.

Good luck!

4K notes

·

View notes

Text

🌟 Illuminate Authenticity! 🌟 Navigate your digital journey with confidence using our Free Download Editable Verification Template! 💻🔒 Unlock the key to genuine connections and trust in the online realm. 🌐👥 Dive in, download, and let your authenticity shine! ✨ #DigitalTrust

👉 Download Link:

https://roposh.com/product-category/download-free-template/

0 notes

Text

doing my taxes moodboard

#i am very sad and very confused and my brain hurts a lot <3#where is my fucking 1099 form why did i not get it in the mail yet i wanna FILEEEEE#is this ??? all the info i need???????? from that form????#im trying to do it through a free program that's partnered with the irs freefile thing so hopefully that works out ;;;;;;#HHHHHHHHHH#taxes suck i hate america i wanna leave#shh ac

7 notes

·

View notes

Text

An open letter to the U.S. Congress

Oppose any riders that attack the IRS or ban the implementation of Direct File!

920 so far! Help us get to 1,000 signers!

Filing our taxes online should be free and easy. I’m excited to be able to use the IRS’s new Direct File tax filing system. But I understand that some members of Congress are attempting to attach a rider to must-pass government funding legislation that would ban the IRS from implementing Direct File. I urge you to vote against any riders that attack the IRS or ban the implementation of Direct File. Investments in the IRS are already paying off: the agency is cracking down on wealthy and corporate tax cheats, processing tax returns more quickly, and answering more taxpayer questions with fewer delays. Direct File is an investment in the American people. Please allow the IRS to put our needs ahead of the greed of TurboTax and H&R Block.

▶ Created on February 26 by Jess Craven

📱 Text SIGN PRGORX to 50409

🤯 Liked it? Text FOLLOW JESSCRAVEN101 to 50409

#JESSCRAVEN101#PRGORX#resistbot#petition#OpenLetter#Congress#IRS#DirectFile#TaxFiling#GovernmentFunding#TaxReturns#Taxpayers#TaxCheats#Investments#AmericanPeople#TurboTax#HRBlock#FreeFiling#TaxSystem#Legislation#Riders#Opposition#Implementation#TaxPreparation#TaxAssistance#TaxPolicies#TaxCompliance#GovernmentSpending#FinancialServices#TaxCode

0 notes

Text

UNLESS HE DID IT YESTERDAY, FEB 9th, 2025, THEN,

NO, HE DID NOT "DELETE" IT!

I JUST USED IT ON FEB. 8th TO FILE MY RETURNS, WHICH WERE ACCEPTED LATER THAT SAME DAY.

STOP BELIEVING EVERYTHING THE RAT SAYS, HE'S A LIAR!

Can't Have Nice Things

The Ketamine King Musk has shutdown the IRS's Free Tax Filing system.

Of all the things a government could off, a way to Freely calculate and file your taxes seems like a good one. But the richest man in the world thinks we shouldn't have that.

29K notes

·

View notes

Text

I already got my federal tax refund and this could be you if you make less than 70k a year you can do your taxes online for free irs.gov/freefile

1 note

·

View note

Text

taxpayers: i hate filing taxes

tax preparers: you can pay me to do them for you

taxpayers: go fuck yourself

tax preparer: okay. you can file for free by going to the IRS website and selecting a freefile option and type in the numbers yourself

taxpayers: that stresses me out i dont understand the questions im scared i hate it

tax preparer: okay. want to pay me then?

taxpayers: guess i have no fucking choice. cunt.

tax preparer: -takes the W2 and starts typing the numbers in-

taxpayers: what the fuck. youre literally just typing numbers in. i could do that my fucking self!!!

tax preparer: -looks into the camera like theyre on the office-

6 notes

·

View notes

Photo

It goes up to $73k AGI, not 41k.

150K notes

·

View notes

Text

The IRS will do your taxes for you (if that's what you prefer)

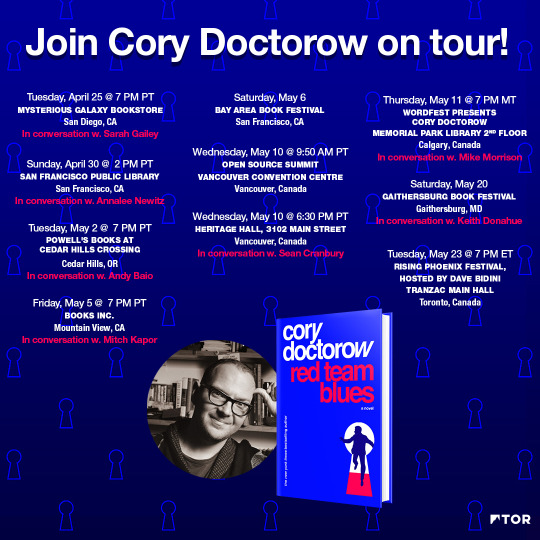

This Saturday (May 20), I’ll be at the GAITHERSBURG Book Festival with my novel Red Team Blues; then on May 22, I’m keynoting Public Knowledge’s Emerging Tech conference in DC.

On May 23, I’ll be in TORONTO for a book launch that’s part of WEPFest, a benefit for the West End Phoenix, onstage with Dave Bidini (The Rheostatics), Ron Diebert (Citizen Lab) and the whistleblower Dr Nancy Olivieri.

America is a world leader in allowing private companies to levy taxes on its citizens, including (stay with me here), a tax on paying your taxes.

In most of the world, the tax authorities prepare a return for each taxpayer, sending them a prepopulated form with all their tax details — collected from employers and other regulated entities, like pension funds and commodities brokers, who must report income to the tax office. If the form is correct, the taxpayer signs it and sends it back (in some countries, taxpayers don’t even have to do that — they just ignore the return unless they want to amend it).

No one has to use this system, of course. If you have complex finances, or cash income that doesn’t show up in mandatory reporting, or if you’d just prefer to prepare your own return or pay an accountant to do so for you, you can. But for the majority of people, those with income from a job or a pension, and predictable deductions, say, from caring for minor children, filing your annual tax return takes between zero and five minutes and costs absolutely nothing.

Not so in America. America is one of the very few rich countries (including Canada, though this is changing), where the government won’t just send you a form containing all the information it already has, ready to file. As is common in complex societies, America has a complex tax code (further complexified by deliberate obfuscation by billionaires and their lickspittle Congressjerks, who deliberately perforate the tax code with loopholes for the ultra-rich):

https://pluralistic.net/2021/08/11/the-canada-variant/#shitty-man-of-history-theory

That complexity means that most of us can’t figure out how to file our own taxes, at least not without committing scarce hours out of the only life we will ever have to poring over the ramified and obscure maze of tax-law.

Why doesn’t the IRS just send you a tax-return? Well, because the tax-prep industry — an oligopoly dominated by a handful of massive, ultra-profitable firms — bribes Congress (that is, “lobbies”) to prohibit this. They are aided in this endeavor by swivel-eyed lunatic anti-tax obsessives, like Grover Nordquist and Americans for Tax Reform, who argue that paying taxes should be as difficult and painful as possible in order to foment opposition to taxation itself.

The tax-prep industry is dominated by a single firm, Intuit, who took over tax-prep through its anticompetitive acquisition of TurboTax, itself a chimera of multiple companies gobbled up in a decades-long merger orgy. Inuit is a freaky company. For decades, its defining CEO Brad Smith ran the company as a cult of personality organized around his trite sayings, like “Do whatever makes your heart beat fastest,” stenciled on t-shirts worn by employees. Other employees donned Brad Smith masks for selfies with their Beloved Leader.

Smith’s cult also spent decades lobbying to keep the IRS from offering a free filing service. Instead, Intuit joined a cartel that offered a “Free File” service to some low- and medium-income Americans:

https://www.propublica.org/article/inside-turbotax-20-year-fight-to-stop-americans-from-filing-their-taxes-for-free

But the cartel sabotaged Free File from the start. They blocked search engines from indexing their Free File services, then bought Google ads for “free file” that directed searchers to soundalike programs (“Free Filing,” etc) that hit them for hundreds of dollars in tax-prep fees. They also funneled users to versions of Free File they were ineligible for, a fact that was only revealed after the user spent hours painstaking entering their financial information, whereupon they would be told that they could either start over or pay hundreds of dollars to finish filing with a commercial product.

Intuit also pioneered the use of binding arbitration waivers that stripped its victims of the right to sue the company after it defrauded them. This tactic blew up in Intuit’s face after its victims banded together to mass-file thousands of arbitration claims, sending the company to court to argue that binding arbitration wasn’t enforceable after all:

https://pluralistic.net/2022/02/24/uber-for-arbitration/#nibbled-to-death-by-ducks

But justice eventually caught up with Intuit. After a series of stinging exposes by Propublica journalists Justin Elliot, Paul Kiel and others, NY Attorney General Letitia James led a coalition of AGs from all 50 states and DC that extracted a $141m settlement for 4.4 million Americans who had been tricked into paying for Turbotax services they were entitled to get for free:

https://www.msn.com/en-us/news/us/turbotax-to-begin-payouts-after-it-cheated-customers-new-york-ag-says/ar-AA1aNXfi

Fines are one thing, but the only way to comprehensively end the predatory tax-prep scam is to bring the USA kicking and screaming into the 20th century, when most of the rest of the world brought in free tax-prep for ordinary income earners. That’s just what’s happening: the IRS is trialing a free tax prep service for next year’s tax season:

https://www.washingtonpost.com/business/2023/05/15/irs-free-file/

This, despite Intuit’s all-out blitz attack on Congress and the IRS to keep free tax-prep from ever reaching the American people:

https://pluralistic.net/2023/02/20/turbotaxed/#counter-intuit

That charm offensive didn’t stop the IRS from releasing a banger of a report that made it clear that free tax-prep was the most efficient, humane and cost-effective way to manage an advanced tax-system (something the rest of the world has known for decades):

https://www.irs.gov/pub/irs-pdf/p5788.pdf

Of course, Intuit is furious, as in spitting feathers. Rick Heineman, Intuit’s spokesprofiteer, told KQED that “A direct-to-IRS e-file system is wholly redundant and is nothing more than a solution in search of a problem. That solution will unnecessarily cost taxpayers billions of dollars and especially harm the most vulnerable Americans.”

https://www.kqed.org/news/11949746/the-irs-is-building-its-own-online-tax-filing-system-tax-prep-companies-arent-happy

Despite Upton Sinclair’s advice that “it is difficult to get a man to understand something, when his salary depends on his not understanding it,” I will now attempt to try to explain to Heineman why he is unfuckingbelievably, eye-wateringly wrong.

“e-file…is wholly redundant”: Well, no, Rick, it’s not redundant, because there is no existing Free File system except for the one your corrupt employer made and hid “in the bottom of a locked filing cabinet stuck in a disused lavatory with a sign on the door saying ‘Beware of the Leopard.’”

“nothing more than a solution in search of a problem”: The problem this solves is that Americans have to pay Intuit billions to pay their taxes. It’s a tax on paying taxes. That is a problem.

“unnecessarily cost taxpayers billions of dollars”: No, it will save taxpayers the billions of dollars (they pay you).

“harm the most vulnerable Americans”: Here is an area where Heineman can speak with authority, because few companies have more experience harming vulnerable Americans.

Take the Child Tax Credit. This is the most successful social program in living memory, a single initiative that did more to lift American children out of poverty than any other since the days of the Great Society. It turns out that giving poor people money makes them less poor, which is weird, because neoliberal economists have spent decades assuring us that this is not the case:

https://pluralistic.net/2023/05/16/mortgages-are-rent-control/#housing-is-a-human-right-not-an-asset

But the Child Tax Credit has been systematically sabotaged, by Intuit lobbyists, who successfully added layer after layer of red tape — needless complexity that makes it nearly impossible to claim the credit without expert help — from the likes of Intuit:

https://pluralistic.net/2021/06/29/three-times-is-enemy-action/#ctc

It worked. As Ryan Cooper writes in The American Prospect: “between 13 and 22 percent of EITC benefits are gulped down by tax prep companies”:

https://prospect.org/economy/2023-05-17-irs-takes-welcome-step-20th-century/

So yes, I will defer to Rick Heineman and his employer Intuit on the subject of “harming the most vulnerable Americans.” After all, they’re the experts. National champions, even.

Now I want to address the peply guys who are vibrating with excitement to tell me about their 1099 income, the cash money they get from their lemonade stand, the weird flow of krugerrands their relatives in South African FedEx to them twice a year, etc, that means that free file won’t work for them because the IRS doesn’t actually understand their finances.

That’s a hard problem, all right. Luckily, there is a very simple answer for this: use a tax-prep service.

Actually, it’s not a hard problem. Just use a tax-prep service. That’s it. No one is going to force you to use the IRS’s free e-file. All you need to do to avoid the socialist nightmare of (checks notes) living with less red-tape is: continue to do exactly what you’re already doing.

Same goes for those of you who have a beloved family accountant you’ve used since the Eisenhower administration. All you need to do to continue to enjoy the advice of that trusted advisor is…nothing. That’s it. Simply don’t change anything.

One final note, addressing the people who are worried that the IRS will cheat innocent taxpayers by not giving them all the benefits they’re entitled to. Allow me here to simply tap the sign that says “between 13 and 22 percent of EITC benefits are gulped down by tax prep companies.” In other words, when you fret about taxpayers being ripped off, you’re thinking of Intuit, not the IRS. Just calm down. Why not try using fluoridated toothpaste? You’ll feel better, and I promise I won’t tell your friends at the Gadsen Flag appreciation society.

Your secret is safe with me.

Catch me on tour with Red Team Blues in Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

If you’d like an essay-formatted version of this thread to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/17/free-as-in-freefile/#tell-me-something-i-dont-know

[Image ID: A vintage drawing of Uncle Sam toasting with a glass of Champagne, superimposed over an IRS 1040 form that has been fuzzed into a distorted halftone pattern.]

#pluralistic#earned income tax credit#eitc#irs#grover nordquist#guillotine watch#turbotax#taxes#death and taxes#freefile#monopoly#intuit

177 notes

·

View notes

Text

anyways usamericans fuck intuit turbotax and use an IRS freefile service that suits you

turbotax is an ass and tried to make me take an expensive upgrade just because i had the damn american opportunity credit from being a full-time student! fuck those guys, your taxes are just as simple even with the american opportunity credit or lifetime learning credit! you might have to do more manual entry but it's just gonna be copy and paste as long as you have digital tax forms from your work, college, etc. ! i used OLT through irs freefile, but I bet the other services work just fine too!

don't screw yourself over and get scammed this tax season! companies don't want you to know you can just do it for free most of the time as long as your income is in a qualifying range!

1 note

·

View note

Text

Intuit is firing a few thousand staff to focus on generative AI, so if you use Intuit for any financial services (TurboTax counts), might want to consider finding alternatives and telling them to not use your data.

I already dumped them this year for taxes because they left the FreeFile program and generally kinda suck anyways. Be careful if you use other Intuit products like CreditKarma or god forbid QuickBooks as well.

0 notes

Text

The lobbying against FreeFile has been successful in keeping HRB and their cohorts ultra profitable for a decade or more... the approval of FreeFile is Biden helping the people once again THANKS UNCLE JOE!

127K notes

·

View notes

Photo

📅 Need More Time for Taxes? File an Extension! If you can’t meet the April 15, 2024 deadline for filing your federal tax return, don’t panic! You can request an extension. Here’s how: Online Option (IRS Free File): Use IRS Free File at IRS.gov/freefile to request an automatic filing extension. You’ll have until October 16, 2024, to file your 2023 federal income tax return. Form 4868 (By Mail): File Form 4868, the Application for Automatic Extension of Time to File, before the regular tax filing deadline. This gives you extra months to prepare your tax return, no matter why you need more time. Remember, an extension is for filing your return, not for paying any taxes owed. Make sure to estimate and pay any tax liability by the April filing due date. 🗂️💰

0 notes

Text

Turbotax is blitzing Congress for the right to tax YOU

Every year, Americans spend billions on tax prep services, paying a heavily concentrated industry of giant, wildly profitable firms to send the IRS information it already has. Despite the fact that most other rich countries have a far more efficient process, many Americans believe that adopting this process here is either impossible, immoral, or both.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/02/20/turbotaxed/#counter-intuit

That puts tax preparation in the same bucket as other forms of weird American exceptionalism — like the belief that we’re too untrustworthy to have universal healthcare, or that we’re so violent that we must all have assault rifles to protect ourselves from one another.

For those of you who aren’t familiar with how they do it in, say, the UK, here’s how it works: your employer submits all of your paystubs to the tax authorities; likewise the custodians of your pension and other people who send you money. The tax authority also knows about your major deductions, like your kids or other dependents.

The tax authority uses this information to fill in a tax return for you and they mail it to you. It’s simple and easy to understand. If they missed some information, or if your tax status has changed, or if you’ve got new deductions, you can amend this return — or throw it away and start over by yourself or with a tax professional.

For the vast majority of Britons, filing their tax returns takes a few minutes once a year, and it’s free. For the minority who don’t fit the standard form, the system works like it does in the US — you either tackle it alone, or do it with professional help.

The IRS could easily do the same thing. Even in a world where many of us are being “casualized” and have income coming in as independent contractors, the IRS knows about it, thanks to the 1099 form. Sure, the IRS might make mistakes, and if you’re worried about that, you can either manually review the precompleted return or pay someone to do it.

It’s a no-brainer, or it would be — if it wasn’t for decades of lobbying by the massively concentrated tax-prep industry — wildly profitable corporate giants like HR Block and Intuit, the parent company of Turbotax, who spent 20 years lobbying congress, spending millions to ensure that Americans would have to pay the Turbotax tax in order to pay their income tax.

https://www.propublica.org/article/inside-turbotax-20-year-fight-to-stop-americans-from-filing-their-taxes-for-free

The tax-prep industry couldn’t have done this on their own — their astroturf campaigns were joined by a grassroots of useful idiots, betwetters like Grover Norquist and his acolytes, who openly demand that tax preparation be as difficult and painful as possible, to drum up support for their campaign to “get the US government down to the size where we can drown it in the bathtub.”

These extremists are joined by many independent tax-prep specialists, who are seemingly convinced that every taxpayer has 11 dependents, four different kinds of pension savings, and six all-cash side-hustles, two of them international. Some people do have complicated taxes — as a writer with income from all over the world, I’m one of them — but most people don’t.

The point of getting the IRS to send you pre-populated tax returns isn’t to deny you the opportunity to pay excellent, knowledgeable tax-prep specialists if you need them — it’s to spare most of us from the needless expense of paying Intuit and HR Block to perform the rote form-filling by which the rake in billions in profits.

In reality, the campaign to defund the IRS isn’t — and will never be — about helping “the little guy.” As Propublica’s IRS Files demonstrate, the defunded, shriveled IRS is a billionaire’s plaything, which is why America’s top 400 earners pay less tax than you do:

https://pluralistic.net/2022/04/13/taxes-are-for-the-little-people/#leona-helmsley-2022

The commonsense utility of the IRS supplying you with prepopulated returns is so obvious that the tax-prep industry has had to really work to hold it at bay. The most successful scam was Freefile, a program cooked up by the tax-prep cartel that claimed it would provide free tax-prep to low-income Americans.

Freefile was a literal fraud: Intuit and its co-monopolists used a raft of deceptive “dark patterns” to trick people — students, veterans, retirees, and the poorest among us — into paying for services that they were entitled to use for free. Almost no one managed to find and use the Freefile offerings they’d hidden in a locked filing cabinet in a disused subbasement behind a sign reading “Beward Of the Leopard.”

This was so obviously crooked that the companies were eventually forced to give it up, but they weren’t done — their eye-watering, voluminous terms of service contained buried binding arbitration clauses that prohibited the people they ripped off from suing them:

https://pluralistic.net/2022/02/24/uber-for-arbitration/#nibbled-to-death-by-ducks

Despite — or, more realistically, because of — the rising fury at the tax-prep industry’s years of unchecked corruption, Intuit has actually increased its lobbying spending this year: Open Secrets reports that in 2022, Intuit showered lawmakers with a record $3.5m:

https://www.opensecrets.org/news/2023/02/turbotax-parent-company-intuit-is-pouring-more-money-than-ever-into-lobbying-amid-push-for-free-government-run-tax-filing/

Their target? The $15m that the Inflation Reduction Act allocated to the Treasury Department to explore free tax filing. Intuit’s line is that this would be “a waste of taxpayer money” and a “conflict of interest” — the same tired boomer nonsense that Norquist has been shoveling since the Reagan administration. Once again, the proposal isn’t to ban Intuit from offering tax prep services — it’s to create a public option that lets people freely choose to pay for tax prep if they think they need it. It’s a breathtaking act of paternalism to claim that we’re all sheeple, too stupid to spot the IRS’s greedy attacks on our pocketbooks.

Here’s a choice quote from Intuit: “Creating a government run tax preparation program would be a waste of taxpayer dollars and further disenfranchise low income taxpayers. A direct to IRS tax prep system is a multi-billion dollar solution looking for a problem.”

https://www.businessinsider.com/turbotax-free-tax-filing-biden-inflation-reduction-act-hr-block-2023-1

Unsaid: the tax prep industry rakes in billions of dollars from American taxpayers every single year. The $44.8m the cartel has spent lobbying against free filing since 1998 is a fantastic investment — for them. The dividends they reap from it come out of all of our pockets.

Another bargain? Hiring ex-government officials to work for Intuit, lobbying their former colleagues:

https://www.opensecrets.org/federal-lobbying/clients/lobbyists?cycle=2022&id=D000026667&t0-Revolving+Door+Profiles=Revolving+Door+Profiles

Or, as Senator Elizabeth Warren bluntly put it, “adroit influence peddling”:

https://www.opensecrets.org/news/2022/06/members-of-congress-call-for-an-investigation-of-intuits-lobbying-practices-amid-mounting-turbotax-controversies/

The neoliberal economists’ theory of regulatory capture is a kind of helpless nihilism, grounded in the Public Choice Theory doctrine that says that regulators will always be captured, so we should just get rid of regulators or make them as weak as possible, so they won’t become cordyceps-ridden puppets of the industries they oversee:

https://doctorow.medium.com/regulatory-capture-59b2013e2526

But capture isn’t inevitable. Sure, if you have a referee that’s weaker than the teams, you’ll never get a fair game — nevermind what happens when the ref either used to work for one of the teams or is sure of a cushy job with them when the season’s over. If you want a small government, you need small corporations — need to block the anticompetitive mergers and predatory conduct that lets companies grow so large that they can fit their regulators into the little change pocket in their blue-jeans.

https://doctorow.medium.com/small-government-fd5870a9462e

Anyone who lived through witchhunts, torture and mass surveillance after 9/11 has good reason to want their government small enough to be accountable — but a doctrine of small governments and giant corporations is a plutocrat’s charter — a recipe for regulatory capture so grotesque it is indistinguishable from farce.

[Image ID: An ogrish, tophatted, cigar-chomping giant holds the US Capitol building aloft contemptuously, pinched between the thumb and forefinger of a white-gloved hand. He stands at a podium bearing the Turbotax checkmark logo, yanking a lever in the form of a golden dollar-sign. He stands before a IRS 1040 tax form.]

intuit, turbotax, irs, taxes, death and taxes, corruption, monopoly, freefile, grover norquist, regulatory capture,

#pluralistic#intuit#turbotax#irs#taxes#death and taxes#corruption#monopoly#freefile#grover norquist#regulatory capture

139 notes

·

View notes