#Business Expenses

Explore tagged Tumblr posts

Text

Unlocking the Power of Tax Knowledge: A Guide to Tax Advantages and Financial Literacy

Which topics would you like to be more informed about? Written by Delvin In the ever-changing landscape of business and finance, staying informed is crucial for success. One area that holds significant importance is taxes, which can often be complex and overwhelming. However, I believe that by understanding the various tax advantages, loopholes, and benefits available, you can optimize your…

View On WordPress

#Business Expenses#Capital Gains#dailyprompt#dailyprompt-2066#Financial#Financial Freedom#Financial Literacy#knowledge#Navigating Tax Advantages#Personal Finance#Tax Deductions and Credits#Tax Loopholes#Tax Writeoffs

3 notes

·

View notes

Text

How A Trucking Tax Specialist Helps You Track And Deduct Business Expenses?

A trucking tax specialist helps track and deduct business expenses by ensuring accurate record-keeping of fuel costs, maintenance, vehicle depreciation, and travel expenses. They stay updated on industry-specific tax laws, identifying eligible deductions such as per diem rates, tolls, and insurance premiums. Their expertise maximizes tax savings, reduces audit risks, and keeps your trucking business financially efficient.

0 notes

Text

How to Allocate Business Expenses for Amazon Sellers?

Effective expense allocation is crucial for Amazon sellers to maintain accurate financial records, optimize profitability, and stay compliant with tax laws. As an Amazon seller, you likely encounter a wide range of business expenses, from inventory costs to marketing fees. Properly allocating these expenses allows you to track your expenses accurately, determine your profit margins, and make informed business decisions. Here's a guide on how to allocate business expenses as an Amazon seller, with the help of an Amazon seller accountant for additional support.

1. Identify the Types of Expenses

Amazon sellers typically incur several types of expenses that must be categorized and tracked properly. Some common expenses include:

Cost of Goods Sold (COGS): This includes the cost of acquiring products that are sold on Amazon. For sellers using Amazon FBA, this also covers fulfillment fees and shipping costs.

Amazon Seller Fees: These include referral fees, subscription fees (for a Professional Seller account), and fulfillment fees (FBA storage, handling, etc.).

Advertising and Marketing Costs: Many Amazon sellers invest in sponsored product ads, promotions, and other marketing strategies to increase product visibility.

Software and Tools: Expenses related to Amazon selling tools, inventory management software, and accounting tools are also business costs.

Shipping and Packaging Costs: If you handle fulfillment or shipping independently, the cost of packaging, postage, and other shipping expenses should be recorded.

Miscellaneous Expenses: This includes office supplies, professional services, and accounting fees.

2. Set Up Your Chart of Accounts

A proper chart of accounts is essential for Amazon sellers to categorize and manage expenses. It’s advisable to work with an Amazon seller accountant to set up an organized chart of accounts specific to your business. The chart should have separate accounts for each major category, such as:

Inventory/COGS

Amazon seller fees (referral, fulfillment, subscription)

Advertising expenses

Shipping and packaging

Operating expenses (software, office supplies, etc.)

Professional fees (accounting, legal services)

By creating clear categories, you will find it easier to track and allocate each expense, which helps with tax filing and financial reporting.

3. Allocate Expenses Based on Usage

Not all expenses are directly tied to product sales. Some costs are shared across different areas of your business, such as software subscriptions, marketing, or office supplies. To allocate shared expenses, break them down based on usage.

For example, if you pay for an Amazon advertising subscription and use it for multiple product listings, allocate the cost proportionally to each product based on the revenue it generates. Similarly, software costs might be divided across various business functions, such as inventory management or accounting, depending on your usage.

4. Track Expenses Using Accounting Software

To simplify the process of tracking and allocating expenses, consider using accounting software tailored to Amazon sellers. Platforms like QuickBooks, Xero, and A2X integrate with Amazon’s reporting system, allowing you to automate much of the expense-tracking process. These tools can categorize expenses directly from Amazon’s reports and even integrate with your bank and payment processors for easy reconciliation.

For more accurate reporting, an Amazon seller accountant can help set up and manage your accounting software to ensure proper allocation and accurate record-keeping.

5. Monitor and Reconcile Regularly

Regular monitoring and reconciliation of your expenses are crucial. Set aside time each month to review your expense reports, ensure they are allocated correctly, and resolve any discrepancies. By maintaining up-to-date records, you can catch potential errors, avoid unexpected tax liabilities, and have a better understanding of your profit margins.

6. Tax Considerations for Expense Allocation

When it comes to tax filing, accurate expense allocation is critical to maximizing deductions. Expenses like COGS, advertising, and operating costs may be deductible, lowering your taxable income. To ensure that all eligible expenses are claimed, consult with an Amazon seller accountant who is familiar with tax rules and regulations for online businesses.

Conclusion

Properly allocating business expenses as an Amazon seller is essential for staying organized, optimizing profitability, and ensuring tax compliance. By identifying key expenses, setting up a clear chart of accounts, using accounting software, and regularly reconciling records, you can make sound business decisions and keep your finances in order. For more advanced guidance, an Amazon seller accountant can provide invaluable support in managing and allocating your expenses correctly.

0 notes

Text

Maximize Your Tax Deduction Like A Pro

As tax season approaches, maximizing your deductions is crucial for keeping more money in your pocket. Understanding the nuances of preparation can significantly affect your financial health. One of the most effective ways to do this is by leveraging accounting services in Toronto, Ontario. These services can help you identify deductions you may not be aware of, ensuring you get the most out of your tax return. Experienced accountants can analyze your financial situation and suggest tailored strategies that fit your specific needs.

Read more: https://www.smbconsult.ca/maximize-your-tax-deduction-like-a-pro

0 notes

Text

VAT Refunds

A VAT Refunds is a repayment of the Value Added Tax (VAT) paid on labor and products, typically accessible to non-occupants or organizations buying in an unfamiliar nation where VAT is charged. This cycle permits them to recover the VAT paid, forestalling twofold tax assessment since they are not obligated for charge in that country. Vacationers, global customers, and unfamiliar organizations frequently look for VAT discounts to recuperate these expenses. The VAT Refund process regularly includes a few stages: guaranteeing that the labor and products bought meet all requirements for a Tank discount, keeping all receipts and solicitations that obviously show the Tank paid, finishing up a VAT discount structure, introducing the bought merchandise and receipts at customs while passing on the country to get a traditions stamp on the discount structure, and presenting the stepped structure and receipts to the Tank discount office. Account-ease supported, the discount is handled and paid out, which can require half a month to a while, and might be given in real money, credited to a Mastercard, or sent through bank move. Every nation has explicit principles and edges for Tank discounts, so it is critical to know about these guidelines while making buys. Moreover, there might be least buy sums expected to fit the bill for a discount.

#VAT refund#Value Added Tax#tax reclaim#tax reimbursement#international taxation#business expenses#travel expenses#tourism economics#customs procedures#financial reimbursement#global commerce

0 notes

Text

Leveraging Tax Treatment Of Business Expenses: A Guide For Entrepreneurs

As an entrepreneur or small business owner, understanding the tax treatment of business expenses is essential for optimizing your tax strategy and maximizing your potential savings. By leveraging the various deductions and credits available, you can reduce your taxable income, lower your tax liability, and keep more of your hard-earned money. In this guide, we'll explore the tax treatment of business expenses and provide tips for optimizing your tax strategy.

Deductible Business Expenses

The Internal Revenue Service (IRS) allows businesses to deduct ordinary and necessary expenses incurred in the operation of their trade or business. These deductible expenses can include:

Operating Expenses: Costs associated with running your business, such as rent, utilities, office supplies, and insurance premiums, are generally deductible.

Employee Expenses: Salaries, wages, bonuses, and other compensation paid to employees are deductible business expenses. Additionally, expenses related to employee benefits, such as health insurance and retirement contributions, are also deductible.

Travel and Entertainment: Expenses related to business travel, meals, and entertainment can be deductible, but they must be directly related to the conduct of your business and not extravagant or lavish.

Marketing and Advertising: Costs associated with marketing and advertising your business, such as website development, advertising campaigns, and promotional materials, are deductible expenses.

Home Office Deduction

If you operate your business from a home office, you may be eligible to claim a home office deduction, which allows you to deduct expenses related to the business use of your home. To qualify for this deduction, you must use a portion of your home regularly and exclusively for business purposes.

Simplified Option: The IRS offers a simplified option for calculating the home office deduction, which allows you to deduct $5 per square foot of your home office space, up to a maximum of 300 square feet.

Regular Method: Alternatively, you can use the regular method, which requires calculating actual expenses such as mortgage interest, property taxes, utilities, and maintenance costs, and apportioning them based on the percentage of your home used for business.

Depreciation

Depreciation allows businesses to recover the cost of certain assets over time through annual deductions. Tangible assets such as buildings, equipment, vehicles, and furniture used in your business can be depreciated over their useful lives.

Section 179 Deduction: Under Section 179 of the tax code, businesses can elect to deduct the full cost of qualifying property purchased or financed during the tax year, up to a certain limit. This can provide significant upfront tax savings and help businesses invest in needed equipment and assets.

Bonus Depreciation: In addition to the Section 179 deduction, businesses may also be eligible for bonus depreciation, which allows for an immediate deduction of 100% of the cost of qualified property placed in service during the tax year.

Retirement Contributions

Contributions to retirement plans such as Simplified Employee Pension (SEP) IRAs, Solo 401(k) plans, and SIMPLE IRAs are tax-deductible business expenses. By making contributions to these retirement accounts, business owners can lower their taxable income and save for retirement simultaneously.

SEP IRA: Self-employed individuals and small business owners can contribute up to 25% of their net self-employment income, up to a maximum annual limit, to a SEP IRA.

Solo 401(k): Solo 401(k) plans allow self-employed individuals to make contributions both as an employee and as an employer, potentially enabling them to save more for retirement than with other retirement plans.

Navigating the tax treatment of business expenses requires careful planning, record-keeping, and a thorough understanding of IRS guidelines. By identifying deductible expenses, leveraging tax-saving opportunities such as the home office deduction and depreciation, and maximizing retirement contributions, entrepreneurs can minimize their tax liability and keep more money in their pockets.

It's essential to stay informed about changes to tax laws and consult with a tax professional to ensure compliance and optimize your tax strategy for maximum savings. With strategic planning and hiring the best tax preparer for small businesses in Mayfield Heights OH, you can make the most of the tax treatment of business expenses and set your business up for long-term success.

0 notes

Text

Control Business Expenses with Blended Shore Outsourcing and Financial Intelligence

As an accounting professional or advisory firm owner, you must be aware of the constant challenge of balancing costs while striving to maintain profitability. Every day, you’re confronted with the task of managing business expenses while ensuring the financial health of your firm. Whether it’s grappling with fluctuating staffing needs, contending with the high costs of hiring and training, or reconciling the budget with the salaries of your in-house accountants, the pressure is always on you to find practical solutions.

The combination of offshore accounting expertise with financial insights is revolutionizing the way accounting practices operate. By leveraging this powerful combination, firms can now access consolidated reporting, business forecasting, a dedicated team of certified professionals, and a plethora of other essential features seamlessly. This innovative approach is designed to eliminate traditional accounting woes.

Read More at https://pathquest.com/knowledge-center/blogs/control-business-expenses-with-blended-shore-outsourcing-and-financial-intelligence/

0 notes

Text

🏠💼 Agents and brokers, optimize your financial landscape in real estate! Dive into this guide exploring tax considerations, from commission structures to business deductions, to boost profits and minimize liabilities. #RealEstateTaxes #TaxConsiderations

#Real estate agents#commission structures#business expenses#deductions#RealEstateTaxes#TaxConsiderations#BrokerIncome#AgentDeductions

0 notes

Text

Business Expenses That Cannot Be Spared for the Safety of Your Workers

Business Expenses As a business owner, one of your top priorities is the safety of your workers. Ensuring safety in the workplace requires making investments in safety equipment, training, and other expenses that some may deem as non-essential. This blog post will take a closer look at some of the business expenses that cannot be spared for the safety of your workers. Personal Protective…

View On WordPress

1 note

·

View note

Text

In a competitive business landscape, efficient money management is a strategic advantage. Embracing expense management technology is not just a choice; it's a smart investment in the financial health and success of your corporate endeavors.

#moneymanagement#financial management#financial mastery#business expenses#reimbursement#employees#expense management#business software

0 notes

Text

"Reduction of Costs for Medium-sized, Large and Small Businesses" Online in the US & Massachusetts:

https://twitter.com/SMBrianPlain/status/1644301066119389184?t=_zK9Rqgdttemhsr-N8VTkA

http://www.linkedin.com/in/businessexpensereduction

Learn more about "Reduction of Expenses & Costs for Medium-sized Large and Small Businesses"

Brian Plain's Company Related & Popular Business Terms

Brian Plain's Company Related & Popular Business Terms is a comprehensive guide that provides a wealth of information about the terminologies and jargon used in the business world.

This guide serves as an essential resource for entrepreneurs, business professionals, and students who aspire to succeed in the corporate world.

Brian Plain delivers an insightful and easy-to-understand breakdown of business terminology, allowing readers to make informed decisions and effectively communicate within the industry. - Local MA Business Consultant Website BusinessCost.net

This guide is the perfect tool for anyone seeking to improve their understanding of the business world and communicate effectively with their colleagues and clients.

1. Revenue - the income generated by a business from its operations.

2. Profit - the money left over after all expenses have been paid.

3. Cash flow - the amount of cash coming in and going out of a business.

4. Return on investment (ROI) - the amount of profit generated compared to the amount of money invested.

5. Growth - the increase in revenue, profit, or market share over time.

6. Market share - the percentage of total sales for a particular product or service that a company captures.

7. Competition - other businesses operating in the same market and competing for customers.

8. Market segmentation - the process of dividing a larger market into smaller subgroups of consumers.

9. Customer lifetime value (CLV) - the estimated total revenue a customer will generate for a company over their lifetime.

10. Branding - the process of creating and promoting a unique image or identity for a company or product.

"We specialize in lower business expenses".

11. "MA Business Cost with Business Savings"

"We help local Boston Metrowest Massachusetts-based Companies Save Money "without any costs to start optimizing" with Brian Plain".

Follow us online Twitter, Business Cost & Business Savings Blog, and more in Marlborough Massachusetts 01752.

Contact Brian Plain at Catalytic Consulting Inc Today for Lower Company Expenses in 2023 & Beyond

Looking to reduce your company's expenses in 2023 and beyond? Look no further than Brian Plain at Catalytic Consulting Inc. and the team at Schooley Mitchell. With years of experience and specialized expertise, they can help your business save money on essential services, including telecom, merchant services, and waste management, among others. Don't miss out on the opportunity to lower your expenses and increase your bottom line with the help of Brian Plain and Schooley Mitchell. Contact them today by visiting one of the links below:

https://www.fyple.com/company/schooley-mitchell-brian-plain-iz6t4ze/

https://www.hotfrog.com/company/efcc4b57a06798b6a813dac0bb62eaf8/schooley-mitchell-brian-plain/marlborough/business-organizations

https://www.brownbook.net/business/51629825/schooley-mitchell-brian-plain/

https://foursquare.com/v/schooley-mitchell--brian-plain/643e5e7726be5c16596ceb3c

http://tupalo.com/en/marlborough-missouri/schooley-mitchell-brian-plain

https://www.tuugo.us/Companies/schooley-mitchell-brian-plain/0310006986670

https://us.enrollbusiness.com/BusinessProfile/6220194/Schooley-Mitchell-Brian-Plain-Marlborough-MA-01752

http://birmingham.bizlistusa.com/business/5357889.htm

https://www.freelistingusa.com/listings/schooley-mitchell-brian-plain

https://citysquares.com/b/schooley-mitchell-brian-plain-25226323

https://www.cylex.us.com/company/schooley-mitchell---brian-plain-36868374.html

https://ebusinesspages.com/Schooley-Mitchell-%7C-Brian-Plain_ek45q.co

https://schooley-mitchell-brian-plain.hub.biz/

https://www.callupcontact.com/b/businessprofile/Schooley_Mitchell_%7C_Brian_Plain/8481940

http://where2go.com/binn/b_search.w2g?function=detail&type=quick&listing_no=2078148&_UserReference=7F00000146564283A67FED9C709E643E7051

https://www.storeboard.com/schooleymitchellbrianplain

Whether you're looking to save money on telecom services, waste management, or other essential services, Brian Plain and Schooley Mitchell have you covered. Get in touch today to start saving.

#business#Large and Small Businesses#boston#cambridge#marlborough#framingham#worcester#springfield#massachusetts#ma#brian plain#catalytic consulting inc#cost reduction firm#Reduction of Costs for Medium-sized Large and Small Businesses#Reduction of Costs for Med-sized Large and Small Businesses#Business Cost & Business Savings Blog#Business Cost or Business Savings#Business Cost & Business Savings#Business Cost withBusiness Savings#business expenses#low business expenses#lower business expenses#Boston Metrowest Massachusetts-based Companies#Boston Metrowest Massachusetts-based Company

0 notes

Text

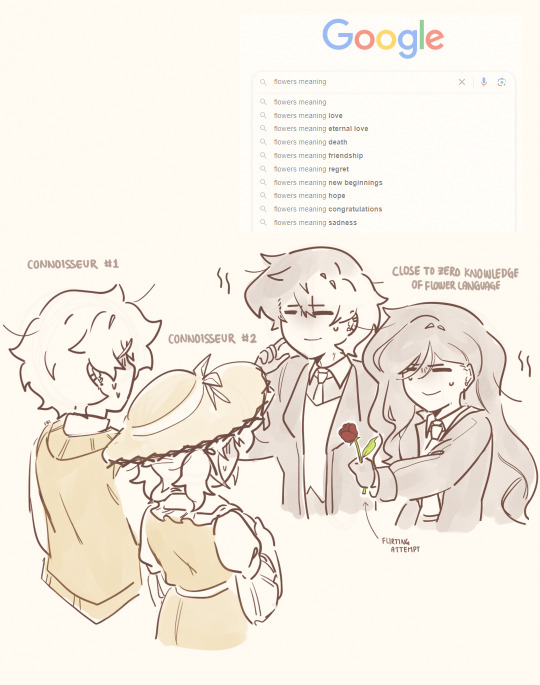

sunflowermafia if they're just idiots in love

#project sekai#prsk#akito shinonome#shinonome akito#toya aoyagi#aoyagi toya#kohane azusawa#azusawa kohane#an shiraishi#shiraishi an#sunflowermafia#anhane#akitoya#(implied at least)#leans on an expensive car. Heyyyy guys what's good#SORRY I'VE BEEN SUPER BUSY THESE DAYS#art of fbi's

1K notes

·

View notes

Text

How A Trucking Tax Specialist Helps You Track and Deduct Business Expenses?

A trucking tax specialist plays a vital role in helping trucking business owners track and deduct their business expenses, ensuring compliance with tax laws while maximizing potential deductions. These professionals understand the nuances of the trucking industry and the specific tax challenges faced by owner-operators and fleet managers. By working with a specialist, trucking businesses can streamline their financial management and optimize their tax savings.

Understanding Deductible Business Expenses

One of the first steps a trucking tax specialist takes is educating their clients about which expenses are tax-deductible. Trucking businesses incur a variety of costs related to vehicles, maintenance, operations, and more. Common deductible expenses include:

Fuel Costs: Gasoline and diesel fuel are some of the largest expenses for trucking businesses. A tax specialist ensures that fuel expenses are properly tracked and documented, allowing the business to claim them as deductions.

Truck Maintenance and Repairs: Regular maintenance, tire replacements, and repairs are necessary to keep the trucks in good working order. A tax professional ensures that all related expenses are deducted from taxable income.

Insurance: Insurance premiums, including truck insurance, cargo insurance, and liability insurance, are deductible business expenses. A trucking tax specialist will ensure these costs are accurately accounted for.

Depreciation of Vehicles: The cost of purchasing and maintaining trucks is a long-term expense. A tax specialist helps calculate and apply vehicle depreciation over time, which reduces taxable income and maximizes deductions.

Tracking Expenses Effectively

Accurate record-keeping is essential for maximizing deductions and avoiding issues during an audit. A trucking tax specialist can set up systems to track expenses in real-time, ensuring nothing is missed. This includes recommending software or tools for logging fuel purchases, mileage, repairs, and other business-related expenditures.

For example, specialists often suggest using a mileage log for tracking business miles driven, ensuring that only the appropriate portion of fuel and maintenance expenses are claimed. With proper tracking, the business owner can separate personal expenses from business-related costs, which is critical for accurate deductions.

Maximizing Tax Deductions with Industry-Specific Strategies

Trucking businesses have unique opportunities to minimize taxes that other industries might not. A trucking tax specialist can take advantage of these opportunities, such as:

Per Diem Deductions: Truck drivers who are on the road for long periods can claim a per diem deduction for meals and lodging. This flat-rate deduction makes it easier for business owners to account for these costs without itemizing every receipt.

Fuel Tax Credits: In some cases, trucking companies may be eligible for fuel tax credits, particularly if they purchase fuel in certain states or engage in specific types of transportation. A tax specialist knows how to navigate these regulations and ensure that all possible credits are applied.

Section 179 Deductions: Under Section 179, businesses can deduct the full purchase cost of qualifying equipment, including trucks and trailers, in the year of purchase, instead of spreading it over several years. A trucking tax specialist can guide the business through this process, ensuring that it takes full advantage of this valuable tax benefit.

Compliance and Audit Protection

A trucking tax specialist ensures that all deductions and expenses comply with IRS rules and regulations. They help avoid common pitfalls, such as claiming non-deductible personal expenses or failing to provide proper documentation during an audit. Their expertise in tax law reduces the risk of penalties and ensures that every eligible deduction is claimed.

Conclusion

A trucking tax specialist provides essential support to trucking business owners by helping them track and deduct business expenses. By understanding the unique needs of the industry, offering tailored tax-saving strategies, and ensuring compliance, they help business owners maximize their tax benefits and reduce their financial burden. With the right specialist on their side, trucking businesses can focus on growth while keeping their tax liabilities in check.

0 notes

Text

Understanding business expenses!

In this guide, we help provide an overview of the major business expenses and the type of expenses that most businesses incur.

0 notes

Text

space sweepers but they're delivery people and are at no point on screen through the entire movie

#fantasy high#riz gukgak#kristen applebees#gorgug thistlespring#adaine abernant#fabian seacaster#figueroth faeth#the bad kids#half tempted to say these names are forum handles they use so much it pretty much became their professional names lol#I keep them teenagers bc its funnier that way#no real lore I just like drawing this. but I do think abt how theyre all weirdos too also bc thats funny to me#riz is a huge conspiracyhead who does everything by hands. he has a casio fx-570 in mint condition. nobody knows how he's maintaining it#he is nonetheless Really Good at his job. which somewhat tracks bc it's a job that requires keeping up with interstation conflicts#and new policies and an obsessive amount of planning. but he is Too Good at it. and also he dresses like that#kristen has the atomic engine that theoretically lets her unmake and remake matters with her mind. but it consumes a huge amount#of energy so it's mostly useless. she's still a cult survivor also#gorgug lives his entire life on a ship with his parents who quit a cushy deal maintaining a space station bc he wouldn't be allowed on#the low gravity let him grow very tall but also his oxygen saturation is pretty bad so he's got breathing support#fig is a robot who just found out she's a robot like two months ago. she's been assuming everyone's a robot like her and she's been feeling#very betrayed by her mom lying about that part. she's on a body mod spree which is rough bc system-specific parts are expensive#and so is adapting random parts to her system#fabian's still a pirate captain's son. can't say anything that'd be able to get the vibes across clearer than that#adaine went to tech/business school. she put her monthly allowance towards an ecoterrorist group in her academy which turned out to be an o#and she's currently wanted by UTS. more than fabian. which makes him slightly mad#she's also acquired a passion for low-tech weaponry on the way. she likes ice picks and cleavers#I think up all of this for no reason except that once again the idea of all these people being 1/teens and 2/on the same ship to be posties#is hilarious to me. esp. if they were in a forum group chat beforehand

558 notes

·

View notes

Text

dracula daily horrors last year: this man is fully unaware of the scary omens

dracula daily horrors this year: this man is fully aware of the scary omens but facing unemployment is scarier

#it’s his first big boy job and this is a hefty business expense he’s gotta land this deal#homeboy is trying to save up for his WEDDING#dracula daily

8K notes

·

View notes