#education loan explained

Text

Loan लेने के लिए CIBIL SCORE कितना होना चाहिए-जानिए किस आधार पर आपको लोन मिल सकेगा

Loan लेने के लिए CIBIL SCORE कितना होना चाहिए-जानिए किस आधार पर आपको लोन मिल सकेगा

CIBIL SCORE : Loan लेने के लिए CIBIL SCORE कितना होना चाहिए, सिबिल स्कोर डाउन ना हो इसके लिए समय पर पहले लिए गए Pending Loan और Instalment का भुगतान करें, बैंक से लोन लेने के लिए कम से कम 750 होना चाहिए CIBIL SCORE, इस पोस्ट के माध्यम से हम आपको How To Maintain Bank Account CIBIL Score के कुछ टिप्स भी बता रहे हैं l

आज के समय में Loan हर किसी की जरूरत ही बनता जा रहा है l चाहे Middle Class Family…

View On WordPress

#10000 का लोन कैसे ले#bad cibil score#bank se education loan kaise le#CIBIL SCORE#cibil score check#cibil score check free#cibil score hindi#cibil score increase#cibil score kaise badhaye#cibil score kaise check kare#cibil score kaise thik kare#cibil score kya hota hai#credit score#credit score check#credit score kaise check kare#credit score range#education loan#education loan explained#education loan for mba#education loan for study abroad#education loan in india#education loan kaise le#education loans#free cibil score check#good cibil score#how to apply education loan#how to check cibil score#how to improve cibil score#how to improve credit score#how to increase cibil score

0 notes

Text

still cant decide whether i should just fail my eng class or not ://

#personally i dont care#i can fail it it doesnt matter to me#buuuut... im trying to figure out if i can get away w it..#or if it'll create issues for me#maybe i can fail it nd not say anything#nd only tell her if she brings it up and then i can explain it away#nd then i can fail it and put it out of my mind#and just keep going w my two classes for now#im thinking until the end of summer#then my hopes are to apply for a loan nd finish up my classes on distance#(but i will do it in class if they remove distance classes which they say they will)#and then apply for a program and get an education then a job#i thiiink thats possible#but yeah im mostly worried that if i fail#the school will suspend me from my other classes and my social worker will say that i cant be approved for wellfare skskks#but if that doesnt happen then idc!!! nd im ok w failing this class...#im just worried bc i gotta sit nd ruminate nd see if i can connect all the dots nd figure it out#idk if it can work....#ughhh sighhhh maybe i can make it work like that#then i dont have to be so fkn stressed rn

2 notes

·

View notes

Text

How to Refinance Your Student Loans and Save Thousands!

Originally written on 4/14/2022 for KennethVincent.com

Migrated on 9/14/2023

Intro

So, you want to refinance your student loans. That’s great! No one likes making their student loan payments month after month. So let’s do something about it.

Why you should refinance your student loans ASAP

With interest rates at historic lows, now is the best time in recent history to refinance your student…

View On WordPress

0 notes

Text

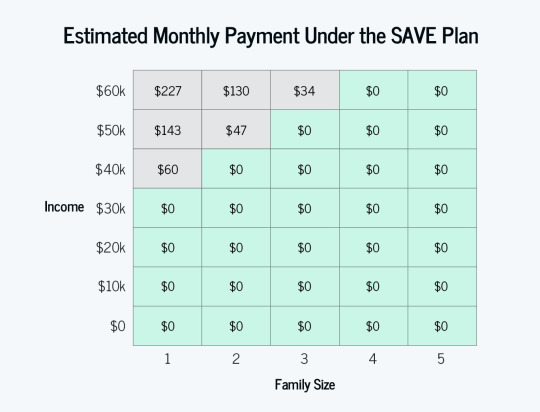

The Biden administration yesterday rolled out its latest tool to tackle the student debt crisis, and as we discussed earlier this year, it’s a good one. While the administration is still working on a broader debt forgiveness plan that it hopes will survive the Trump/McConnell Supreme Court, the new income-driven repayment program, called the “Saving on a Valuable Education” (SAVE) plan, should drastically cut the amount of student loan payments for lower-income borrowers, and for many, will actually get those payments down to zero.

[ ]

With the SAVE plan, the Education Department will no longer charge any interest that isn’t covered by the monthly loan payment, putting an end to the interest-accumulating hamster wheel that so many of us know all too well, where you make your payments on time but your goddamn loan balance keeps growing. As the fact sheet explains:

For example, if a borrower has $50 in interest that accumulates each month and their payment is $30 per month under the new SAVE plan, the remaining $20 would not be charged as long as they make their $30 monthly payment. The Department of Education estimates that 70 percent of borrowers who were on an IDR plan before the payment pause would stand to benefit from this change.

As with other income-driven plans, once a borrower has made payments for 20 years (for undergrad debt) or 25 years (for grad school debt), any remaining balance will be forgiven — yes, even if the monthly payment amount was zero for some or all of that period. Explain to your rightwing uncle that such forgiveness is not a new gimmick Joe Biden made up; it’s how IDR plans have worked since Congress authorized them in the 1990s.

#student debt relief#SAVE plan#us politics#in support of an informed and engaged electorate#recommended reading

1K notes

·

View notes

Text

yall are about to piss me off by not having any PASSING basic knowledge of the way the u.s. military manipulates its recruits into joining by typing up one of your uninformed, unresearched, unempathetic, individualistic, unbelievably annoying posts about how 100% of the people in the military ended up there because they just Love America So Damn Much! they're extremely mature and informed at time of recruitment, they can totally leave anytime they want, they totally had tons of other avenues in life they could've taken, there was no rush at all to get income as fast as possible, and everyone in the military also totally is part of the combat divisions and personally enjoys being IN the military very much, big believers of violence. everyone in the military is shooting guns all day, that's how that works. they LOVE BLOODSHED.

also I love the "amewicans haha" twang to this type of shit because you're actually TOTALLY stealing our Thing, which is turning systemic issues into Individual Issues. Instead of talking about the powers that be, it's so Personal Choice up in here. It's, "well you shouldn't have done it then. I totally wouldn't because I know better." you don't wanna talk about the military industrial complex as a whole, and you don't want to talk about recruiters, you just want to pin the blame on Specific Individual People one-by-one, as if they're responsible for the system that they're being ground up in. someone was in the military? bad person, no matter what. it's easier to believe that, I guess, than to acknowledge that Normal People (with high school educations) are manipulated and incentivized into joining a system that is Bad. at like age 18. but yeah no that 18 year old should have just been smarter lol haha

anyway here are some screenshots for no particular reason

side note this reply of someone going "umm just get loans and go into a high paying field it's easy XD" as a direct response to someone trying to explain how most americans joining the military are being funneled in that direction out of a need for money.

and another person who Decided that americans join the military just CLENCHING their teeth thinking of other people, and not thinking completely selfishly about their own selves and their own income/housing/healthcare.

#I had a longer post w more bullshit in it but ukw nobody's even gonna read THIS one. so.#dumb ass cunts seriously LMAO just the individualism of it all....#we're all just selectively forgetting that most people join the military straight out of high school / after failing to kickstart#their lives so they don't know shit yet and they are categorically not educated and don't have money#you NEED money and have been groomed by recruiters ALREADY into believing this is#The Best and Only to make a survivable amount of money without a college education-- bc they can't afford college btw#and they don't want to take on student debt either bc everyone already knows what a big fuckeroo that is#recruiters WILL DO ANYTHING TO GET YOU TO JOIN. they will KEEP CALLING YOU. they'll answer your questions#to make it sound like this is going to be a GREAT life decision. you can get all KINDS of jobs (true)#they love to say the thing about how only about 15% of the military will actually see combat in any way#they love to list all the jobs where you will literally just be working at an office or a pharmacy or in tech etc etc etc#the recruiters are offering housing healthcare steady pay and BONUSES if you sign on for longer.#so you let your guard down because you were so scared of the actual fighting. BECAUSE YOU'RE 18 IN THIS SCENARIO BTW.#you cunts will not meet anyone who hates the military as much as people who are NOW DONE working in the military#you don't know enough when they get you and then either you stay placated by the benefits or you scramble away as fast as possible#the number one military haters are people who know what goes on bc they already did it#source: I LIVE NEXT TO A MILITARY BASE LMAO PEOPLE HATE IT HERE!! they are NORMAL PEOPLE#I need you to get it into your head that the people committing atrocities in war were NORMAL when they joined#and that for every person in the military who's actively shedding blood there's 20 who do PAPERWORK#and they both are being put in the same category by you!! and they are BOTH being controlled by the same system!!#sergle.txt#I hate yall I really do.

260 notes

·

View notes

Text

Scans ( a little long)

When I ask people not to steal my scans I assure you it has nothing to do with my ego. I have relationships with a number of people that trust me to provide full credits and copyrights and supervise, as much as possible, how things are used. And it gets a little complex, like some people will give me a photo I can only use on instagram. I have to honor these agreements.

And, Rothko paintings are copyrighted so, unlike some artists, if you make tee shirts or use it in a movie or something , it's actually illegal (without permission) They are not going to come after you for casual use of you own, but I know of many examples where people were hit with a copyright notice for trying to profit in the work.

It took me a long time to build these relationships and get all of these scans, including many i have done myself. I gave myself this Rothko job I do, and because of that I didn't have background to give me things or answer questions. It was only after years of doing it that people started to reach out to me in a bigger way and help.

The art world is strange, I was talking to a museum curator recently and there several questions I had that I was told they were not at liberty to answer. In the case of Rothko, there's nothing really cloak and dagger about it, it's just the family (who I think are great) fought really hard for these rights and spend a lot of time trying to control how the work is used and seen. It's a good thing because we get things like the Paris exhibit which took an insane amount of planning, loans, insurance etc. All the paintings had to be inspected before they were shipped over seas, in case damage was done to them over there. These paintings are BIG and in the hands of many different people, so it really took tons of effort and (sadly) money to do it, but it's something like (can't recall exactly) 179 paintings. The biggest Rothko show since 1978.

People on tumblr do sometimes (as we all know) take stuff from here or from my other social media accounts and I know it's typical social media behavior, as people like the credit and notes to their own blog, but I mention this now because I have some things coming up that almost no one has ever seen and I don't want to lose this privilege because I won't be able to show you cool stuff and big scans.

So, sorry for the ponderousness, I just thought a little background might explain that I'm not just being grumpy about it. I think people may see it as "It's the internet get over yourself" but I honestly feel a responsibility to do the best I can for people following these accounts and I am just trying to keep doing it and hopefully, expand as I go.

This blog started on out tumblr and it was the support of all of you that made me continue it, I will be 10 years in July. I can't take a lot of credit for it, it's not my art. My only idea was the once a day aspect. However, I try to do my homework and striving for accuracy is part of that, including copyrights and credits.

So thanks for everything too, people participating in this has been very valuable and educational for me.

#mark rothko#markrothko#rothko#daily rothko#dailyrothko#abstract expressionism#modern art#abstraction#colorfield#ab ex#colorfield painting#mid century#personal

195 notes

·

View notes

Text

If you're wondering how so many books got lost and also how we have surviving ones, let me explain how books used to circulate before the invention of the printing press.

These days, a writer gets into a partnership with a publisher and this publisher prints and circulates these books to bookstores or other sellers and a percentage of every new sale goes to the writer and their agent. Used books are either resold privately or in used book stores or thrift stores or online. Some books are gifted to libraries. When the libraries have no more use for these books they are sold or thrown out.

In ancient times, there was no "books" as we currently understand them. Everything was written down or drawn on long scrolls of papyrus or parchment.

A writer would likely finish their final draft and do all their editing on cheap scrap paper or other writing surfaces like tree bark. Then they would either hire a scribe to make a few expensive copies or make the copies themselves if they were trained to do it all with good handwriting or calligraphy all in columns so that you could roll the scroll from side to side, only reading one column at a time.

The writer would then give these copies to their friends and family members, or as a gift to some important person, or perhaps just to someone who hired them to write it.

So let's say you are an educated courtesan or prostitute in the 1st century BC in Roman Greece and you write a fun and informative sex manual going over sex moves and sexual health complete with pictures. So you finish writing this sex manual and have a copy of it made and sent to a few of your other rich friends.

Your other rich friends think your sex manual is really cool and they take care of it and keep it unscrolled and flat stored in their personal libraries along with all of their other books. When they're moving it around or loaning it out to other people they keep it tightly rolled up to keep it compact.

Some people who borrow your sex manual from your friends really like it and want their own copy. So then either your friends will pay a scribe to make a copy of it and gift it to these people or the people who want it will borrow the copy and pay to have a copy made themselves. Copying your book in particular is even more expensive than normal because it has drawings in it so they need to find a scribe that is trained in copying drawings and not every scribe will take a commission for a sexual book, but they like your books so much that they're willing to take on the expense.

So this keeps going. People keep paying to make copies of your book. People like it a lot and eventually it becomes well-liked by the rich and they pay people to make copies of it for all their friends. After a couple of centuries of your book getting copied over and over again your book is a "bestseller" of sorts but you and your descendants never really saw any money from it because the people getting paid in the circulation of your book are scribes being paid to make copies of it and merchants selling what scrolls of it they can get their hands on.

By now the original copies you gave your friends are likely in the hands of their descendants, if the original copies still exist at all. They might've been burned in a fire when your friend's daughter dropped her lantern, or maybe worms ate it, or maybe your friends didn't keep it in a dry enough place and it just started to rot.

If the people who own a copy of your book like it enough or think it's important enough and they see that their copy is rotting or torn or charred, they can pay to have another copy made, but they also might not care enough and throw it out or just let it rot.

Over the centuries, your book slowly circulates less and less and the existing copies of your sex manual slowly rot in libraries or are purposefully burned as Christianity takes over, Rome falls, and literacy rates plummet while attitudes towards sexual books become even worse than they were in your time. Less people can read, less people work as scribes, less people have the skills to copy the drawings that were in your book.

And then on some unknown date, the last copy of your book is quietly eaten by worms in a damp and poorly cared for library.

This is what happened to The Book of Elephantis, a sex manual written by a prostitute or some other kind of sex worker working under a pseudonym somewhere in Greece in the 1st century BC. Her book was really popular in the time of the Roman Empire but it's since been lost. All the copies of her book just rotted away or burned over a thousand years ago. People just didn't care about sex manuals anymore and most people couldn't read them either.

It's also why most of the oldest copies of stuff like the Iliad we have are from the middle ages. The surviving works we have for the most part are the ones that people kept making new copies of and were stored properly.

Sometimes we get lucky and find some really old parchment scrolls in a dry cave or something or we scan books we have and can find where ink was scraped off and the paper was reused. But for the most part stuff gets lost because someone just didn't want to pay the expense to make a new copy.

Be thankful it's so cheap to make copies of books now and that modern paper lasts longer than parchment.

1K notes

·

View notes

Text

TWO YEARS AGO, by a series of strange coincidences, I found myself attending a garden party at Westminster Abbey. I was a bit uncomfortable. It’s not that other guests weren’t pleasant and amicable, and Father Graeme, who had organized the party, was nothing if not a gracious and charming host. But I felt more than a little out of place. At one point, Father Graeme intervened, saying that there was someone by a nearby fountain whom I would certainly want to meet. She turned out to be a trim, well-appointed young woman who, he explained, was an attorney—“but more of the activist kind. She works for a foundation that provides legal support for anti-poverty groups in London. You’ll probably have a lot to talk about.”

We chatted. She told me about her job. I told her I had been involved for many years with the global justice movement—“anti-globalization movement,” as it was usually called in the media. She was curious: she’d of course read a lot about Seattle, Genoa, the tear gas and street battles, but … well, had we really accomplished anything by all of that?

“Actually,” I said, “I think it’s kind of amazing how much we did manage to accomplish in those first couple of years.”

“For example?”

“Well, for example, we managed to almost completely destroy the IMF.”

As it happened, she didn’t actually know what the IMF was, so I offered that the International Monetary Fund basically acted as the world’s debt enforcers—“You might say, the high-finance equivalent of the guys who come to break your legs.” I launched into historical background, explaining how, during the ’70s oil crisis, OPEC countries ended up pouring so much of their newfound riches into Western banks that the banks couldn’t figure out where to invest the money; how Citibank and Chase therefore began sending agents around the world trying to convince Third World dictators and politicians to take out loans (at the time, this was called “go-go banking”); how they started out at extremely low rates of interest that almost immediately skyrocketed to 20 percent or so due to tight U.S. money policies in the early ’80s; how, during the ’80s and ’90s, this led to the Third World debt crisis; how the IMF then stepped in to insist that, in order to obtain refinancing, poor countries would be obliged to abandon price supports on basic foodstuffs, or even policies of keeping strategic food reserves, and abandon free health care and free education; how all of this had led to the collapse of all the most basic supports for some of the poorest and most vulnerable people on earth.

I spoke of poverty, of the looting of public resources, the collapse of societies, endemic violence, malnutrition, hopelessness, and broken lives.

“But what was your position?” the lawyer asked.

“About the IMF? We wanted to abolish it.”

“No, I mean, about the Third World debt.”

“Oh, we wanted to abolish that too. The immediate demand was to stop the IMF from imposing structural adjustment policies, which were doing all the direct damage, but we managed to accomplish that surprisingly quickly. The more long-term aim was debt amnesty. Something along the lines of the biblical Jubilee. As far as we were concerned,” I told her, “thirty years of money flowing from the poorest countries to the richest was quite enough.”

“But,” she objected, as if this were self-evident, “they’d borrowed the money! Surely one has to pay one’s debts.”

It was at this point that I realized this was going to be a very different sort of conversation than I had originally anticipated. Where to start? I could have begun by explaining how these loans had originally been taken out by unelected dictators who placed most of it directly in their Swiss bank accounts, and ask her to contemplate the justice of insisting that the lenders be repaid, not by the dictator, or even by his cronies, but by literally taking food from the mouths of hungry children. Or to think about how many of these poor countries had actually already paid back what they’d borrowed three or four times now, but that through the miracle of compound interest, it still hadn’t made a significant dent in the principal. […]

But there was a more basic problem: the very assumption that debts have to be repaid. Actually, the remarkable thing about the statement “one has to pay one’s debts” is that even according to standard economic theory, it isn’t true. A lender is supposed to accept a certain degree of risk. If all loans, no matter how idiotic, were still retrievable—if there were no bankruptcy laws, for instance—the results would be disastrous. What reason would lenders have not to make a stupid loan?

[…] For several days afterward, that phrase kept resonating in my head. “Surely one has to pay one’s debts.” The reason it’s so powerful is that it’s not actually an economic statement: it’s a moral statement. After all, isn’t paying one’s debts what morality is supposed to be all about? Giving people what is due them. Accepting one’s responsibilities. Fulfilling one’s obligations to others, just as one would expect them to fulfill their obligations to you. What could be a more obvious example of shirking one’s responsibilities than reneging on a promise, or refusing to pay a debt?

It was that very apparent self-evidence, I realized, that made the statement so insidious. This was the kind of line that could make terrible things appear utterly bland and unremarkable. This may sound strong, but it’s hard not to feel strongly about such matters once you’ve witnessed the effects. I had. For almost two years, I had lived in the highlands of Madagascar. Shortly before I arrived, there had been an outbreak of malaria. It was a particularly virulent outbreak because malaria had been wiped out in highland Madagascar many years before, so that, after a couple of generations, most people had lost their immunity. The problem was, it took money to maintain the mosquito eradication program, since there had to be periodic tests to make sure mosquitoes weren’t starting to breed again and spraying campaigns if it was discovered that they were. Not a lot of money. But owing to IMF-imposed austerity programs, the government had to cut the monitoring program. Ten thousand people died. I met young mothers grieving for lost children. One might think it would be hard to make a case that the loss of ten thousand human lives is really justified in order to ensure that Citibank wouldn’t have to cut its losses on one irresponsible loan that wasn’t particularly important to its balance sheet anyway. But here was a perfectly decent woman—one who worked for a charitable organization, no less—who took it as self-evident that it was. After all, they owed the money, and surely one has to pay one’s debts.

Debt, the First 5000 Years

51 notes

·

View notes

Text

I feel like I should explain ENEM, aka why the brazilians have been grieving since the date of the november 4th event was announced

ENEM stands for Exame Nacional do Ensino Médio (National High School Exam). It happens once a year since 1998, and, although at first it was just to gage how the education was on a national level, it soon became a gateway to university.

The test takes place on two days (that are now two consecutive sundays), from 13:30 to 19:00, and each day the student has to answer 90 questions. The first day is always human sciences and languages (Portuguese language and literature, foreign language (English or Spanish), history, geography, sociology, and philosophy) plus an essay. Nobody knows what the essay is about until the moment of the exam, so there’s always a lot of speculation. The theme is always about a social issue: last year's, for exemple, was "the challenges for the appreciation/respect of the traditional communities and peoples of Brazil", like the quilombolas and natives. The second day tests the students' knowledge on maths and exact sciences (biology, physics, and chemistry).

ENEM is famously a very "read-y" test. Every question requires a lot of reading comprehension, interpretation, and interdisciplinarity. Maybe the internet has done americans wrong, but the SAT's look so easy in comparison. We always make fun of them by saying Harvard it's not actually hard, it's just expensive.

Which brings me to my next point: college! The grade you get on the ENEM can get you into a university using three different programs

SISU: gets you into a public (and free) university (the best university in the country is public btw, University of São Paulo - USP)

PROUNI: gets you a scholarship in a private university (it can get you a 100% scholarship but you need a VERY good grade)

FIES: student loans

And, obviously, the better your grades, the better your chances. You are graded from 0 to 1000 in every subject and also get a general grade. So if you want to study physics, you don’t need to do great in literature, but you should still try to get a decent grade. The more competitive courses, like medicine (there's no such thing was pre-med), can get down to the decimals, especially in prestigious schools.

ENEM isn't the only test you can do to get into a university, though! Some schools have their own test. USP, for exemple, has the FUVEST, so you can get in through either test, but FUVEST is always paid and you can only do it in, like, three cities in São Paulo, while the ENEM happens countrywide, which is why it's so important. The tests are called "vestibular" and the people taking them are "vestibulando".

Therefore, most 3rd year high school students take the test. It's basically a rule to do it if you want to get into a university, but if you are not on your last year of high school, you have to pay to take it (my case). Some people have to go to another city to take the test, it's a whole thing.

This year, the first day of ENEM is happening on Sunday, November 5th. And QSMP's most important event so far is happening on Saturday night, November 4th. May the Lord have mercy on our souls

You can check out the "atrasados do enem" for some giggles though. It's the "event" that happens because some people always arrive after the gates close at 13:00 and then break down crying in the middle of the street. It got so famous people started hiring actors to pose as vestibulandos just to go viral.

Now you know a bit more about brazilian culture!

Here's a link to download last year's exam if you want: first day | second day

#qsmp#qsmp event#brasil#brazil#brazilian culture#cultura brasileira#enem#brazil: putting ENEM in enemies since 1998#high school#university

139 notes

·

View notes

Text

This is maybe a niche thing, but again and again in real life I've heard people explain the Biden student loan debt thing like this:

"Biden tried to eliminate student loan debt using a crazy convoluted legal theory that was so obviously twisted and wrong that the court had absolutely no choice but to strike it down."

Left-wingers I know often add, "And there were way more obvious ways he could have done it that the court wouldn't be able to challenge but he stupidly refuses to do them."

I've read the Heroes Act of 2003 (It's like five pages wrong) and I've read the Court's opinion.

The Heroes Act allows the Secretary of Education to "waive or modify" relevant procedures to ensure that people affected by a national emergency are not left worse off financially because of the emergency. This is the same law used by Betsy DeVos to authorize a pause on payments because of COVID.

The court's decision hangs on the idea that the word "modification" is *not* synonymous with the word "change" and that the Biden administration is trying to make changes to the relevant procedures, when actually they are only allowed to make modifications.

After reading both things myself, the Biden administration appears to be completely in line with the text of the statute and the Court's weird, specific but undefined reading of the word modification seems like the bizarre and convoluted part.

But the law is difficult for laymen to understand! I am happy for someone to provide a specific rationale to explain why I am wrong.

Not *one* of the people confidently talking about Biden's crazy reasoning has ever done this. Not my right wing tulblr peeps or my real life left-wing friends.

Everybody just sort of clams up or insists that if I really did the research I'd know they were right but it's not their job to have citations on hand.

#Seriously you are telling me that 'you can make modifications but that doesn't mean you can make changes'#Is an example of straightforward legal reasoning#Reasoning so obvious that everybody should have known the court was going to say it?#And then just pretend that's so obviously true that nobody could possibly pretend to disagree or even be confused?#Seriously???#supreme court

29 notes

·

View notes

Text

Filbrick was in the wrong the whole time and made Ford the "bad guy"

Filbrick was WAY too quick to throw out Stan, not even giving him a second to explain. WHY??? You're the fucking adult in this situation. Surely he knew that Ford would still make it out there no matter what kind of college he'd wound up in. Backupsmore might've still been a good college. Look at what Ford's done with his degrees, his education!

But Filbrick never believed in Ford. He never has been proud of him, never been impressed by him until he was about to go to an esteemed college. But it wasn't about Ford's qualities. To him, Ford was nothing without that school. And with that, Ford believed it.

That belief was cemented once Filbrick kicked out Stan without a second of explanation. Ford was 17 at the time and was desperate to make something of himself as an individual, not as the defective freakish copy of a person. He knew that smarts didn't anything in his town but somewhere out there, it does. He just has to get out of here first.

Fucking hell, Filbrick didn't believe in his son one bit. I bet he was too cheap to pay for Ford's college too and maybe even convinced Ford he has to go to Backupsmore. Probably told him that he wouldn't pay for any other college. (I don't think college loans were a thing until the 1980's)

#im high af and lost my memory. i just know that im mad about Filbrick#FUCK filbrick. suck my dick you clown. you dumb clown with your dumn sunglasses#gravity falls#meta#ford pines#post#high time

22 notes

·

View notes

Text

""Moreover, it turns out that the United States is not all that tightfisted when it comes to social spending. “If you count all public benefits offered by the federal government, America’s welfare state (as a share of its gross domestic product) is the second biggest in the world, after France’s,” Desmond tells us. Why doesn’t this largesse accomplish more?

For one thing, it unduly assists the affluent. That statistic about the U.S. spending almost as much as France on social welfare, he explains, is accurate only “if you include things like government-subsidized retirement benefits provided by employers, student loans and 529 college savings plans, child tax credits, and homeowner subsidies: benefits disproportionately flowing to Americans well above the poverty line.” To enjoy most of these, you need to have a well-paying job, a home that you own, and probably an accountant (and, if you’re really in clover, a money manager).

“The American government gives the most help to those who need it least,” Desmond argues. “This is the true nature of our welfare state, and it has far-reaching implications, not only for our bank accounts and poverty levels, but also for our psychology and civic spirit.” Americans who benefit from social spending in the form of, say, a mortgage-interest tax deduction don’t see themselves as recipients of governmental generosity. The boon it offers them may be as hard for them to recognize and acknowledge as the persistence of poverty once was to Harrington’s suburban housewives and professional men. These Americans may be anti-government and vote that way. They may picture other people, poor people, as weak and dependent and themselves as hardworking and upstanding. Desmond allows that one reason for this is that tax breaks don’t feel the same as direct payments. Although they may amount to the same thing for household incomes and for the federal budget—“You can benefit a family by lowering its tax burden or by increasing its benefits, same difference”—they are associated with an obligation and a procedure that Americans, in particular, find onerous. Tax-cutting Republican lawmakers want the process to be both difficult and Swiss-cheesed with loopholes. (“Taxes should hurt,” Ronald Reagan once said.) But that’s not the only reason. What Desmond calls the “rudest explanation” is that if, for whatever reason, we get a tax break, most of us like it. That’s the case for people affluent and lucky enough to take advantage of the legitimate breaks designed for their benefit, and for the wily super-rich who game the system with expensive lawyering and ingenious use of tax shelters.

And there are other ways, Desmond points out, that government help gets thwarted or misdirected. When President Clinton instituted welfare reform, in 1996, pledging to “transform a broken system that traps too many people in a cycle of dependence,” an older model, Aid to Families with Dependent Children, or A.F.D.C., was replaced by Temporary Assistance for Needy Families, or TANF. Where most funds administered by A.F.D.C. went straight to families in the form of cash aid, TANF gave grants to states with the added directive to promote two-parent families and discourage out-of-wedlock childbirth, and let the states fund programs to achieve those goals as they saw fit. As a result, “states have come up with rather creative ways to spend TANF dollars,” Desmond writes. “Nationwide, for every dollar budgeted for TANF in 2020, poor families directly received just 22 cents. Only Kentucky and the District of Columbia spent over half of their TANF funds on basic cash assistance.” Between 1999 and 2016, Oklahoma directed more than seventy million dollars toward initiatives to promote marriage, offering couples counselling and workshops that were mostly open to people of all income levels. Arizona used some of the funds to pay for abstinence education; Pennsylvania gave some of its TANF money to anti-abortion programs. Mississippi treated its TANF funds as an unexpected Christmas present, hiring a Christian-rock singer to perform at concerts, for instance, and a former professional wrestler—the author of an autobiography titled “Every Man Has His Price”—to deliver inspirational speeches. (Much of this was revealed by assiduous investigative reporters, and by a 2020 audit of Mississippi’s Department of Human Services.) Moreover, because states don’t have to spend all their TANF funds each year, many carry over big sums. In 2020, Tennessee, which has one of the highest child-poverty rates in the nation, left seven hundred and ninety million dollars in TANF funds unspent."

- The New Yorker: "How America Manufactures Poverty" by Margaret Talbot (review of Matthew Desmond's Poverty by America).

195 notes

·

View notes

Text

Ch 14 - The Bottle Job

Series Rewrite Masterlist

Pairing: Eliot Spencer x Ford!Reader

Description: A quick job on a time limit to save McRory's pub from an Irish loan shark.

Words: 4256

~~~~~~~~~~~~~~~~~~~~~~

I sat at the bar at McRory’s, watching the crowd celebrate and honor the pub’s former owner, Mr. McRory himself. His passing would spark sorrow and mourning, but many in this neighborhood chose to line that sorrow with joy, remembering his life, with a drink, of course. Nate invited the rest of the crew over to share in the solemn festivities, and I watched as Nate walked them through the pub, explaining some of the history and context surrounding the celebration and the pub itself.

He finally meandered over to where I was sitting, “This was my father’s office, right here.” He gestured to the spot next to me, “He held court there, on that stool, and… I grew up in this place.”

“It must have been an interesting education,” Hardison commented.

I recalled some of the stories Nate told me about Grandad Jimmy, they were morally questionable at times, but interesting for sure.

“Yup, better than prep school,” Nate said.

Eliot turned his attention to me, “Did you grow up here too?”

I shrugged, “I mean, everyone here was certainly family, but it was nothing like Nate. And, you know, times change.”

Eliot nodded.

“What kind of crook was your dad?” Parker asked bluntly.

I laughed before I could stop myself while Hardison tried to correct her on social etiquette.

But that didn’t stop Nate from answering, “He… ran numbers.”

“Let me get this straight,” Eliot said. “You stopped stealing, you stopped drinking, and you moved upstairs from a thief bar?”

“He did,” Parker answered, “I get that. You don’t get that? Why does nobody get that?”

“The thing about it is that, now, it’s just a neighborhood bar,” Nate said, ignoring Parker, “but I mean, back in the day, you never knew who you were drinking next to. You know, the mob on one side, the law on the other.”

“Times have changed,” Hardison said, mirroring my earlier statement.

“Well, you know, not that much,” Nate commented, and pointed towards a girl behind the bar, “Cora, I remember the day she was born, she grew up here too. She turned out alright, huh Cora?”

She seemed stressed and nearly distraught as she grabbed money from the register and dashed towards the backrooms, not answering Nate.

“Ooh,” Eliot commented, a little excited, “Redheads burn the hottest, don’t they?”

Nate gave him a subtle glare, “Easy, she’s like my niece.”

“It’s not like your daughter though,” he replied cautiously. “Besides, you already have a niece.”

I looked at him, slightly annoyed, “You really don’t know how families work, do you Eliot?”

“The point is, she’s like my niece,” Nate repeated, “and I don’t want you to like my niece.”

“Yeah, you’ve made that abundantly clear.”

They continued to argue a bit, but I watched Cora as she confronted a man, shoving the bundle of money she had into his chest.

“Guys,” I said softly from between them, nodding to what was going on in the back of the pub. They quieted down and watched as one of the men counted the money and Cora dashed out of the pub, clearly crying and without a coat despite the snow outside. I looked at Nate and he gave me a nod. I stood to go after her when he stopped me for a moment.

“Bring her up to your place, okay?”

“Yeah, meet you there. If you don’t have the key, Parker can get you in.”

Cora has always been a straight shooter, standing up for what was right, but not afraid of getting her hands dirty. Something must be seriously wrong for her to be this upset. It’s understandable since both her parents have passed, but I don’t think I’ve ever seen her so distressed. Luckily, she didn’t run too far, just standing at the front corner of the building as she cried, trying to compose herself. I instantly saw her shivering in the cold, so I went up and hugged her, both for comfort and warmth.

“Hey,” I soothed, “I don’t know what’s going on, but let’s head up to my apartment, me and Nate are going to try and fix it okay?”

I felt her nod into my shoulder, so I guided her towards the stairs. Cora would sometimes come up to my apartment if either of us were stressed, or just needed some girl time. I tried to keep her out of the con stuff as much as possible, because though she knew the lay of the land, especially growing up in the pub, she didn’t want to be too involved with it. Still, we had some fun evenings on my living room couch which is why I think Nate wanted me to bring her there. Somewhere comfortable for her.

Once we got up to my apartment, I sat her down and she explained the situation to me and Nate. The others stood back, but listened. She explained that the man she was giving money to was an Irish guy named Mark Doyle. He told her that her dad took out a loan from him about a year ago. She didn’t think it was true, but with her mom diagnosed with cancer at the time, he needed help with bills, though her dad told her he had it under control.

“I could have stopped this!” She cried.

“No, no, no, listen,” Nate comforted, “This guy, Doyle, he’s a loan shark. I don’t think you could have helped, but maybe we can.”

“No, he wants fifteen thousand in the next two hours, Nate, or he’s taking the bar” she emphasized. “I can’t get that kind of money. In two hours!?”

“It's okay,” Nate assured, “Why don’t you go back downstairs and tend to the guests and everything. We’ll try to figure something out here.”

She agreed and thanked us. She gave me one last hug before leaving.

“We are going to figure this out, okay? Maybe I’ll be able to come down and help at the bar too. We’ve got you,” I reassured before letting go.

Once she was out of my apartment Parker asked, “Why don’t we just send her to the police? I mean, I don’t use them, but this is what they're for, right?”

“No, if Cora says to the police that she owes Doyle money,” Nate explained, “Doyle denies it, six months later he comes and burns down the bar. And that’s assuming that he doesn’t have a couple of local police on the arm.”

“That’s what sucks about the credit crunch,” Hardison said. “Honest people can’t get loans, sharks move in. Twelve points on the interest every month, there’s no way to get out from under that.”

“I don’t care,” Eliot said. “You don’t collect debts at a wake. You just don’t do it.” He paused, “Want me to go downstairs? Break this guy's knees?”

“Kinda,” I commented. Anyone who messes with family, with someone like Cora, didn’t deserve to walk with a pep in their step, in my book at least. Or in this case, walk at all.

Eliot stood at my word, ready to follow through, but Nate stopped him.

“No, we need some reconnaissance. Like, you know, why is this Irish loan shark here, and what is this two hour time table?” He asked thoughtfully. “Why don’t you call Tara, tell her we have a job.”

Eliot groaned as Parker went to do so.

I put my hair up and out of the way, ready to work, “I’m going to go help Cora out at the bar while we wait for her.” I grabbed my earbud and slid it into place, “Let me know if you need anything, or any updates.”

The others put in their own earbuds as I walked out the door.

“You know how to work at a bar?” Hardison asked me through comms as I made my way down the stairs.

“Yeah, I went to school out here and worked here in the pub. I would occasionally pick up shifts for Cora and her dad while I was freelancing too,” I responded. I got down to the bar and I started pouring and running drinks once I told Cora I was there to help out.

I noticed Tara arrived, and Nate gave her some quick instructions on who the target was and that she needed to get information from him. She quickly adjusted her outfit and came over to order a drink. I poured it for her and she instantly got Doyles attention.

So the game begins.

Parker swiped his passport and Hardison ran it to find that Doyle was completely off-grid financial-wise. His dad, however, was found to run the family loan shark business and used to kill people for the IRA, aka the terrorist organization, the Irish Republican Army. Overall, a scary family.

Tara found out that Doyle convinced his dad to expand the business to Boston. After Hardison found that he was leaving town that night, which explained the deadline, Tara pulled out of him that he had a so-called performance review, which explained why he needed the cash. He needed to repay his dad for the investment and prove that his branch was profitable.

Tara slipped away to talk strategy with everyone else and I poured Doyle a couple drinks upon his request. I listened to the others discuss what to do. We couldn’t just steal the note that held the McRory contract, that could cause more problems. The question was, could we con him in two hours.

Nate asked everyone for cash, Tara to set the hook, and Eliot to check what sports games were on. Well, it seemed like he already had a plan. Parker caught on to the con Nate wanted to run, she called it ‘the wire.’ The others argued that it wasn’t possible to pull off in the time we had, but Nate was insistent that it would work.

I glanced at Doyle who was tapping his hand against the bar absentmindedly as he kept looking back at where the bathrooms were. “Whatever you guys decide to do, make it quick please, Doyle is getting a little antsy. At least send Tara back down.”

Everyone finally agreed, though not confidently, and Tara came down to entertain Doyle some more. Nate gave me a quick rundown of the plan, Hardison would delay the sports feed in the bar and give Nate live updates on what was going on. Nate would make a betting game with Doyle, and hopefully con him into giving us the bar. In order for this to work though, Nate needed some cash to bet with.

“Look man,” Hardison said, “it is nine pm on a Friday night. All the banks are closed.”

“ATMs,” Parker suggested.

“Daily withdrawal limit,” Hardison rebuffed.

“Oh my gosh, how much cash do you need?” I asked. I’ve only reached that limit a couple of times, but it's usually a decent chunk of change to get there.

Nobody answered me. Hardison rattled off what he could do with electronic financials, but that physical cash was a whole different story. Hardison eventually said that they needed to use their emergency fund. I heard scrambling around until they said they had it. I didn’t know where Parker or Eliot’s stash was, but apparently Hardison’s was inside the ‘Old Nate’ painting that he brought all the way from LA.

Eliot came downstairs with bundles of cash and handed it to Nate.

“That’s a little over nine grand. Is that enough?” He asked.

I tried not to show it in my face my reaction to just handing over that much cash as I served another customer.

“I don’t need enough to win, just enough to lose. It's perfect,” Nate replied.

I scoffed as I turned away from the guests to grab a bottle of liquor, “My mindset about money has clearly not shifted yet to cope with how much money is involved in this job.”

Nate scared Tara off by playing a slimy ex boyfriend, catching Doyle’s attention. He then established himself as a local bookie, taking on the role Grandad Jimmy had, sitting in his spot no less. Doyle suggested betting on the basketball game, and Nate made sure to lose the first few bets. It continued like this for a while until Doyle noticed that Nate hadn't been drinking with him.

“What, you too good to drink with me?” Doyle asked in his thick Irish accent.

Nate tried to deny it, but he wouldn’t have it.

“I’m not bettin’ again if you have the advantage over me, Jimmy boy.”

At that moment, it seemed that everything in the pub slowed down. I made eye contact with Eliot before turning my gaze to Nate. He had been doing so well since coming out to Boston; hadn’t had a drop. But as he lifted his gaze, giving Doyle and himself excuses as to why he should drink, he looked at me and then shifted over to Cora. I knew that he felt he had to do it. As much as he loved me and the team, he couldn’t give up on a con once he’s started, let alone one so personal.

I looked away before he took that first sip, but we all knew that he took it.

“So this is…” Tara said after a significant length of the silence.

“Not good,” Hardison finished.

I distracted myself from Nate’s breaking of sobriety with what Hardison and Tara were working on. Hardison seemed to think that he could triangulate the location of Doyle’s office with the help of his goons’ phones which Parker swiped along with Doyle’s ledger. Tara was decoding that, determining just how big of a problem this guy was.

“You know how to read that?” Parker asked her.

“Yeah, I trained in cryptog–” she stopped, “nevermind.”

“Cryptography?” I asked, “You might have to teach me something, that sounds interesting.”

“Look at you, busy bee,” she commented, clearly still focused on the ledger.

“Well, you know,” I said as I picked up some empty glasses from tables, “I like to learn. I’m trying to pick stuff up from everybody so I’m not too much of a burden. I think all that’s left now is for Eliot to teach me how to knock out Hardison.”

“That can be arranged,” Eliot replied, humorously making eye contact with me behind the goons’ back as he entertained them with darts.

“Hey now,” Hardison cut in, clearly offended, between giving Nate cues.

It was coming to the end of the basketball game when Hardison told us that Doyle was much more ingrained into the neighborhood than we thought. He also gave Nate the final bet of the game.

Nate had won back all and more of the cash, strategically to the point where the two of them did an all in bet for the last few seconds of the game. Nate had his ten thousand and baited Doyle to offer up the note for the bar. Nate waited long enough to place the bet that the rest of us were sweating.

Finally, he placed it and won back the pub.

We all heaved a sigh of relief, with Hardison cheering in my ear. I watched as Doyle and Nate shook hands, and the former stood to go join his goons. I looked at Cora and smiled, which she caught. I nodded at her, trying to show her that we had it figured out, that we fixed it. Cora smiled back at me, seemingly more relaxed as she continued to serve drinks.

“We got lucky on that one,” Eliot said, meeting up with Nate and Parker as he walked towards the back of the bar.

“We’re not letting him go,” Nate said.

“But we saved the bar,” Parker reminded him.

“We’re not letting him go,” he repeated, “the night’s just getting started.”

I set down the dirty glasses I was gathering and followed them. Nate explained to us how if Doyle goes back to his dad with all that cash, they were going to expand with more money and muscle to the point where the Doyle’s were going to be on every corner with no way to remove them.

“How can you be sure?” Eliot asked.

“Because that’s what my father did,” Nate said simply. “I know this guy, know what he’s about. Right now, right here, this is the time to put a spike in him, for good. It’s our only shot.”

“Nate? Do you have another con up your sleeve?” Hardison asked.

He stuttered around yeses and nos, “This one’s maybe a little bit more, well, impossible.”

“Lovely,” I said.

He told Tara to stall Doyle and I went to help if I could. Nate pulled Eliot and Parker into the storage room to explain the rough gameplan. We were going to pull Doyle into a high stakes poker game, hopefully be able to snag Doyle’s money and have him leave with all his money on the table. That was, if Hardison could find Doyle’s office and grab all of his other cash, and we somehow make a high stakes poker game when we neither had high stakes or a poker game.

I cleaned up the bar before Tara came walking in again, immediately catching Doyle’s attention. She made an excuse about him not being able to leave due to the weather, and he suggested they check the weather on the news.

I heard Hardison scramble to put together something to spoof the weather channel before they could get the TV up and running. Tara asked me for the remote since I had taken it from off the bar when I was cleaning. I made a show of looking around, stalling to give Hardison some time, before I ‘found’ it and handed it to Tara. She then was able to extend the time even further by having the remote ‘not work’ and ‘need batteries.’

I had walked off by then so they couldn’t ask me for some more. When Doyle finally fiddled with it enough before trying it again, I was pleasantly surprised to see Hardison on the screen giving a bogus weather forecast, grounding any flights that Doyle planned to catch.

“The next time y’all call me,” Hardison said once the TV was turned off, “it better be for something easy, like faking a moon landing!”

I laughed while Nate walked past me with Cora to the backroom where a much smaller staked poker game than what we needed was going on. Nate explained what the plan was to Cora so she could introduce him to the poker game. Nate, with the help of Cora, was able to convince the men to play along in his little act and let him and Doyle join.

Meanwhile, Tara was using some sort of reverse psychology on Doyle to get him to want into the game and cheat Nate out of his money. Though, I don’t think that last desire was all that hard to instill.

Once they began playing, there wasn’t much for me to pay attention to since Nate’s plan was similar to the first betting game he had with Doyle. Lose slowly, then, once Eliot and Parker were able to grab Doyle’s cash from their warehouse, play with Doyle’s own money until Doyle left every penny on the table, running home to daddy with nothing. Since we hadn’t gotten to that point yet, I focused on the bar, serving drinks, and cleaning up. It brought me back to my college days a little bit. I still worried, but the topic of that worry was much different, and seemed so small now.

I tuned out all the commotion that was going on between the poker game and Parker and Eliot breaking into a safe until Parker walked into the pub with the cash. It didn’t take long at all for Doyle to notice that it was his money that Nate was trying to play with. I heard a click that suspiciously sounded like a gun being cocked.

“Hey, Doyle, what are you getting so upset for, we’re just playing a little game here,” Nate said quickly.

“I know exactly what game you’re playing,” Doyle said, “You’re all playing it together, with my money. This is my mark. I’ve just spent the last year running the only bank that would lend to any plank and neddy in this hole. And I mark every damn dollar I collected like so.”

“Did we know he did that?” I asked the group.

I got a few noncommittal muttered responses that I concluded was a no.

“So you’re a loan shark,” one of the other poker players said, Micky I think.

“Aye, I’m a loan shark. And these are my teeth, no one cheats a Doyle.”

“Do you need someone in there Nate?” I asked, it sounded like it was getting nasty in there. I’m sure Eliot could go in there and kick his ass, but I also knew that Cora and her dad kept at least a shotgun behind the bar, just in case.

“Woah woah woah,” Nate said, “I’d put that thing down unless you wanna get killed. You don’t know who these guys are.”

I took the response as he had it under control, but I didn’t go back to serving, I tucked myself in a corner, closer to the back so I could pay better attention.

“I know exactly who they are,” Doyle yelled, “a bunch of local thicks you recruited for this little game of yours! Well, game’s over boys. Start handing over your money.”

“I’d put that gun down, if I were you,” Mickey said.

“What? This another prop for your wee game?”

“Yeah, and this is a prop I got from the Boston Police Department,” he responded with a gun cocking click of his own. “Point that gun at me again, and I’ll be calling my friend at the coroner’s office.”

“Yeah, sounds like you have it under control,” I said with a slightly amused huff.

The other poker players were introduced as other high ranking members of the force and recalled the crimes Doyle confessed to when he thought they were local crime bosses. He gave them a couple breaks in some organized crime cases.

“Fair enough,” he said. “How’s about I walk away with what’s mine, you walk away with what’s yours. And for your understanding, I’ll make a little contribution to your retirement funds?”

Before the cops could respond, I heard a shuffle that sounded like someone being slammed onto the table. If I had a guess, it was Doyle hitting the table.

“Alright, now listen to me, this is what you’re gonna do,” Nate said in a scarily steady and determined voice, but it had a quality to it that only really came out when he was drunk and upset. “You’re gonna leave this bar, you’re gonna get out of town, and you’re going to go home to daddy and tell him that your business went bust. Or I will call him and tell him that you gambled away all his profits to a room full of cops. You will never step foot in this town again or they will throw your ass in jail. Understood?” There was a pause where Doyle didn’t object. “Yeah, and one more thing.”

There was a sickening crack and Doyle screaming in pain. A moment later Doyle was rushing out of the room and out of the bar in a way I could only describe as his tail between his legs. His goons weren’t very far behind him, trying to catch up.

I peeked my head into the room right as Mickey told Nate, “You’re exactly like your father.”

“Everything okay in here?” I asked, feigning naivety as to what happened before.

Nate sighed, “Yes, we’re all fine, birdie.”

Tara started gathering all the cash that sat on the table, “So I guess this is all evidence, huh? It’ll never make it back to the people it belongs to.”

“I don’t know what you’re talking about,” Mickey said deliberately after a thoughtful moment. “I’ve been at the movies all night long.”

“Me and Johnny had tickets to the game today,” the one to the right of Mickey said as they all gathered their coats.

“Great game,” Johnny said with a joyful thumbs up as he followed the other two out the back door.

Tara handed Nate the ledger so we could sort out who and how much. It took another couple of hours to get all of that sorted out, but we were able to get everyone’s money returned to them.

“I can’t believe you actually pulled this off in two hours,” Tara said as I approached the table where she, Eliot, and Nate were sitting.

“Hour and a half,” Nate corrected and said to Eliot, “Softening.”

“Definitely softening,” he replied.

“Everything squared away,” Nate asked Hardison, Parker, and I.

“Yup,” Hardison confirmed, “Every last dollar.”

“Every last one,” Parker repeated, much more reluctantly.

Cora came over with a tray of shots on the house as a thank you. Nate declined, saying that he wanted to go to bed. Hardison quickly vetoed that idea, insisting that Nate stayed there while he went to clean up his apartment. He asked for our help to clean up but everyone declined, leaving the pub quickly to avoid it.

I decided to have pity on him and yawned, “Fine, Hardison, I’ll help, but you’ve only got me for half an hour and then I’m gonna crash.”

A/n: Reblogs and comments are welcome and encouraged! Thank you for reading!

Tags: @instantdinosaurtidalwave @kniselle @technikerin23 @kiwikitty13 @plasticbottleholder

#eliot spencer x reader#eliot spencer#leverage#rewrite#slow burn#multichapter#nate ford#sophie devereaux#alec hardison#parker#ford!reader

21 notes

·

View notes

Text

ryan walters, the superintendent of education in oklahoma everybody! as we all know, the height of professionalism is to purposely conflate being a queer child with pedophilia. This video explains quite well :)

he refused to cooperate with the education secretary and provide records of what taxpayer money was spent on, leading to her resignation because she could not do her job without the data he withheld.

he is accused of misspending up to $29 million dollars in pandemic relief funds by showing preferential treatment to private schools and (well to-do) individual families, leaving impoverished kids behind.

he is accusing at least nine teachers of lying on their applications for the $50k bonus paid out to them last year and is requiring them pay back the full $50k each- nevermind that after taxes, they receive just under $30k apiece. nevermind that these people- who are teachers, and are already struggling to support their families- have had the money for weeks and have spent it on things like healthcare and paying off loans. he also claims that 'the media' is contributing to 'the problem'. what problem, im not sure. maybe that people are paying attention to his incompetence?

ryan walters is a fucking disgrace and oklahomans ought to be fucking seething. we deserve better. kids deserve better. teachers deserve better.

20 notes

·

View notes

Text

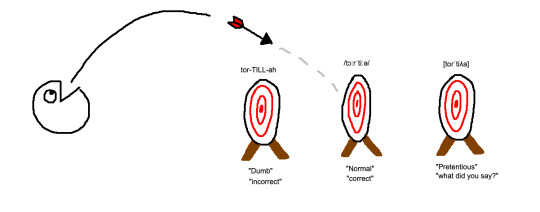

What is the "correct" pronunciation of a loan word?

In English, we often try to attempt the native pronunciation of loan words. And we don’t allow our writing system to control the way we pronounce foreign words. For example, we don’t pronounce “faux pas” as “fowks pass”, and if a friend asked for a “tor-till-ah” instead of “tor-tee-ya”, or “ka-rah-jee” instead of “kara-ah-gee”, you might politely correct them.

In Japanese however, it seems like no such effort is made. Foreign words are transposed into the Japanese writing system, and then read phonetically with seemingly little effort at maintaining the original pronunciation. Muhk-don-aldz becomes ma-ku-don-aru-do; work becomes waa-ku.

In English we know that a Spanish-origin word with two consecutive Ls makes a Y sound. Why then, don’t Japanese people know that you don’t need to pronounce all the extraneous vowels that the Japanese writing system forces into English-origin words? Japanese people certainly use more English loan words than English people use Spanish loan words, so it’s not an issue of familiarity.

I have a theory to expain this phenomenon. First, we have to assume the following things are true:

Some sounds or combinations of sounds that exist in one language don’t exist in many others. This means when a word is borrowed from a different language, the borrowing language often can’t reproduce the pronunciation perfectly as it appears in the native language.

People generally try to pronounce words correctly, as this leads to better communication and understanding, even if this effort is subconscious.

My theory is this, and it applies to any language: the “correct” pronunciation of a loan word is not the native pronunciation. It is actually the pronunciation that gets the closest to the native pronunciation while still only using sounds and combinations of sounds that exist in the language borrowing the word.

I was really satified when I came up with this because it explains a few odd happenings.

It explains why Japanese people make no effort to avoid pronouncing the extraneous vowels they add between consonants in English loan words (because such combinations of sounds simply don’t exist in the Japanese phonetic system).

It explains why people find cooking show hosts pretentious when they suddenly pronounce an ingredient with its native pronunciation, like “parmesan” (because the native pronunciation is “overshooting” - they did not use the agreed upon english pronunciation of the loan word).

It explains why, if I ask a supermarket staff member where the “tofu” is, with perfect Japanese pronunciation, they most likely will not understand me.

That said, my theory may be wrong, and as someone with no formal education in linguistics, I would love it if a real linguist or linguistics student responded to this post with a different opinion or more information!

#linguistics#language#pronunciation#loan words#langblr#language learning#language acquisition#japanese langblr#studyblr

271 notes

·

View notes

Text

Venture predation

Tomorrow (May 20), I’ll be at the GAITHERSBURG Book Festival with my novel Red Team Blues; then on Monday (May 22), I’m keynoting Public Knowledge’s Emerging Tech conference in DC.

On Tuesday (May 23), I’ll be in TORONTO for a book launch that’s part of WEPFest, a benefit for the West End Phoenix, onstage with Dave Bidini (The Rheostatics), Ron Diebert (Citizen Lab) and the whistleblower Dr Nancy Olivieri.

They said it couldn’t happen. After decades of antitrust enforcement against Predatory Pricing — selling goods below cost to kill existing competitors and prevent new ones from arising — the Chicago School of neoliberal economists “proved” that predatory pricing didn’t exist and that the courts could stand down and stop busting companies for it.

Predatory pricing — the economists explained — may be illegal, but it was also imaginary. A mirage. No one would do predatory pricing, because it was “irrational.” And even if there was someone irrational enough to try it, they would fail. Stand down, judges of America — predatory pricing is solved.

Chicago School economists — whose job (to quote David Roth) is to find new ways to say “actually, your boss is right” — held enormous sway of the federal judiciary. The billionaire-backed Manne Seminars offered free “continuing education” junkets to judges — all-expense-paid luxury vacations salted with lengthy your-boss-is-right econ seminars. 40% of the US federal judiciary got their heads filled up at a Manne Seminar.

For monopolists and other predators, the Manne Seminar was an excellent return on investment. After attending a Manne Seminar, the average judge’s legal decisions tipped decidedly in favor of monopoly, operating on the Chicago bedrock assumption that monopolies are “efficient,” and, where we see them in nature, we should celebrate them as the visible manifestation of the entrepreneurial genius of some Ayn Rand hero in a corporate boardroom:

https://pluralistic.net/2021/08/13/post-bork-era/#manne-down

A little knowledge is a dangerous thing. Even as post-Chicago economists showed that predatory pricing was both possible and rampant, a “rational” and effective strategy for cornering markets, suppressing competition, crushing innovation and gouging on price, judges continued to craft tortuous, unpassable tests that any predatory pricing case would have to satisfy to proceed. Economics moved on, but predatory pricing cases continued to fail the trial-by-ordeal constructed by Chicago-pilled judges.

Which is a shame, because there are at least three ways that predatory pricing can be effective:

Cost Signaling Predation: A predator tricks competitors into thinking they’ve found a new way to cut their costs, which allows them to drop prices. Competitors, fooled by the ruse, exit the market, not realizing that the predator is merely subsidizing their products’ costs to trick them.

Financial Market Predation: A predator tricks the competitors’ creditors into thinking the predator has a new way to cut costs. The creditors refuse to loan the prey companies the money needed to survive the price war, and the prey drops out of the war.

Reputation Effect Predation: A predator subsidizes prices in one region or one line of goods in order to trick prey into thinking that they’ll do the same elsewhere: “Don’t try to compete with us in Cleveland, or we’ll drop prices like we did in Tampa.”

These models of successful predation are decades old, and have broad acceptance within economics — outside of Chicago-style ideologues — but they’ve yet to make much of a dent in minds of the judges who hear Predatory Pricing cases.

While judges continue to hit the snooze-bar on any awakening to this phenomenon, a new kind of predator has emerged, using a new kind of predation: the Venture Predator, a predatory company backed by venture capital funds, who make lots of high-risk bets they must cash out in ten years or less, ideally for a 100x+ return.

Writing in the Journal of Corporation Law Matthew Wansley and Samuel Weinstein — both of the Cardozo School of Law at Yeshiva University — lay out a theory of Venture Predation in clear, irrefutable language, using it to explain the recent bubble we sometimes call the Millennial Lifestyle Subsidy:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4437360

What’s a Venture Predator? It’s “a startup that uses venture finance to price below its costs, chase its rivals out of the market, and grab market share.” The predator sets millions or billions of dollars on fire chasing “rapid, exponential growth” all in order to “create the impression that recoupment is possible” among future investors, such as blue-chip companies that might buy them out, or sucker retail investors who buy in at the IPO, anticipating years of monopoly pricing.

In other words, the Venture Predator constructs a pile of shit so large and impressive that investors are convinced that there must be a pony under there somewhere.

There’s another name for this kind of arrangement: a bezzle, which Galbraith described as “the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it.”

Millennial Lifestyle Subsidy companies are bezzles. Uber, annihilated tens of billions of dollars on its bezzle, destroying the taxi industry and laying waste to public transit investment, demolishing labor protections and convincing people that impossible self-driving robo-taxis were around the coner:

https://pluralistic.net/2021/02/16/ring-ring-lapd-calling/#uber-unter

But while Uber the company lost billions of dollars, Uber’s early investors and executives made out like bandits (or predators, I suppose). The founders were able to flog their shares on the secondary market long before the IPO. Same for the early investors, like Benchmark capital.

Since the company’s IPO, its finances have steadily worsened, and the company has resorted to increasingly sweaty balance-sheet manipulation tactics and PR offensives to make it seem like a viable business:

https://pluralistic.net/2022/08/05/a-lousy-taxi/#a-giant-asterisk

But Uber can’t ever recoup the billions it spent convincing the market that there was a pony beneath its pile of shit. The app Uber uses to connect riders with the employees it misclassifies as contractors isn’t hard to clone, and it’s not hard for drivers or riders to switch from one app to another:

https://locusmag.com/2019/01/cory-doctorow-disruption-for-thee-but-not-for-me/

Nor can Uber prevent its rivals from taking advantage of the hundreds of millions of dollars it spent on “regulatory entrepreneurship” — changing the laws to make it easier to misclassify workers and operate unlicensed taxi services.

It’s not clear whether Uber ever believed in robo-taxis, or whether they were just part of the bezzle. In any event, Uber’s no longer in the robotaxi races: after blowing $2.5B on self-driving cars, Uber produced a vehicle whose mean-distance-between-fatal-crashes was 0.5 miles. Uber had to pay another company $400M to take its self-driving unit off its hands:

https://pluralistic.net/2022/10/09/herbies-revenge/#100-billion-here-100-billion-there-pretty-soon-youre-talking-real-money

Uber’s prices rose 92% between 2018–21, while its driver compensation has plunged. The company is finding it increasingly difficult to passengers into cars, and drivers onto the road. They have invented algorithmic wage disrimination, an exciting new field of labor-law violations, in order to trick drivers into thinking there’s a pony under all that shit:

https://pluralistic.net/2023/04/12/algorithmic-wage-discrimination/#fishers-of-men

To Uber’s credit, they have been a wildly innovative company, inventing many new ways to make the pile of shit bigger and the pony more plausible. Back when Uber and Lyft were locked in head-to-head competition, Uber employees created huge pools of fake Lyft rider accounts, using them to set up and tear down rides in order to discover what Lyft was charging for rides in order to underprice them. Uber also covertly operated the microphones in its drivers’ phones to listen for the chimes the Lyft app made: drivers who had both Lyft and Uber installed on their devices were targeted for (strictly temporary) bonuses.

Uber won’t ever recoup, but that’s OK. The investors and execs made vast fortunes. Now, normally, you’d expect company founders and other managers with large piles of stocks in a VC-backed company to be committed to the business’s success, at least in the medium term, because their shares can’t be liquidated until well after the company goes public.

But the burgeoning “secondary market” for managers’ shares has turned investors and managers into co-conspirators in the Venture Predation bezzle: “half of Series A and B deals now have some secondary component for founders.” That means that founders can cash out before the bezzle ends.

The trick with any bezzle is to skip town while the mark is still energetically digging through the shit, before the pony is revealed for an illusion. That’s where crypto comes in: during the cryptocurrency bubble, VCs cashed out of their investments early through Initial Coin Offerings and other forms of securities fraud. The massive returns this generated were well worth the millions they sprinkled on Superbowl ads and bribes for Matt Damon.

But woe betide the VC who mistimes their exit. As Wework showed, it’s entirely possible for VCs to be left holding the bag if they get the timing wrong. Wework blew $12b on predatory pricing — promising tenants at rivals’ businesses moving bonuses or even a year’s free rent, all to make the pile of shit look larger and thus more apt to contain a pony. The company opened its co-working spaces as close as possible to existing shops, oversaturating hot markets and showing “growth” by poaching customers through deep subsidies, then pretending that those customers would stay when the subsidies evaporated. But Wework’s “product” was temporary hot-desks, occupied by people who could (and did) move at the drop of a hat.

To its competitors, its competitors’ creditors, and credulous investors, it appeared that Wework had developed some kind of “efficiency advantage” — a secret sauce that let it sell a product at a price that was far below its rivals’ costs. But once Wework filed for its IPO, its S-1 — the form that discloses the company’s finances — revealed the truth. Wework’s only “advantage” was the bafflegab of its cult-like leader and the torrent of cash supplied by its VCs.

Wework’s IPO was a disaster. After canceling a real IPO, the company eventually went public through a scammy SPAC, saw its shares immediately tank, and continue to fall, as its balance-sheet is still blood-red with losses.

Another Venture Predator is Bird, the company that flooded American cities with cheap, flimsy Chinese scooters, choking curbs and sidewalks. 25% of the gross revenues from each scooter ride had to be written off as depreciation on the scooter. As a Bird spokesperson told the LA Times: “There are very few unique companies for which you can build global scale really quickly and build a dominant market position before other people do, and for those rarefied companies scaling quickly matters more than short-term profits.”

Bird was another company that could never recoup, whose executives and investors could only cash out if they could maintain the faint hope of the pony underneath its pile of shitty scooters. It drove the company to some genuinely surreal lengths. For example, in 2018, I reported on the existence of a kit that let you buy an impounded Bird scooter for pennies and retrofit it to run without an app, so you could take it anywhere:

https://boingboing.net/2018/12/08/flipping-a-bird.html

Shortly thereafter, I got a legal threat from Linda Kwak, Bird’s Senior Corporate Counsel, claiming that publishing a link to a website that sells you a product you install by unscrewing one board and inserting another was a violation of Section 1201 of the DMCA, which was an astonishingly stupid claim:

https://www.eff.org/document/bird-rides-takedown-boing-boing-dec-20-2018

It was also an astonishingly stupid claim to make to me, a career activist with 20 years experience fighting DMCA1201, a decades-old professional affiliation with EFF, and a giant megaphone:

https://boingboing.net/2019/01/11/flipping-the-bird.html

But Bird was palpably desperate to keep its bezzle going, and Kwak — an employment lawyer with undeniable deficits in her understanding of copyright and cyber-law — was their champion

Fascinatingly, one thing Bird didn’t worry about was competition from Uber and Lyft, who piled into the e-scooter market. Bird circulated a (leaked) pitch-deck reassuring investors that Uber/Lyft weren’t gunning for them, because they ““won’t subsidize prices” as they prepared for their IPOs, which involved disclosing their finances to their investors.