#education loans

Explore tagged Tumblr posts

Text

ICICI Bank शेतकऱ्यांसाठी: आर्थिक उन्नतीसाठी उपयुक्त योजना आणि सेवा

शेतकऱ्यांसाठी आर्थिक विकास साधण्याच्या उद्देशाने ICICI Bank ने विविध उपयुक्त योजना आणल्या आहेत. या योजनांमुळे शेतकऱ्यांना आर्थिक सहाय्य मिळते आणि त्यांच्या शेती व्यवसायात सुधारणा होते. या लेखात ICICI बँकेच्या योजनांची माहिती देऊन, त्याचा उपयोग ग्रामीण भागातील शेतकऱ्यांसाठी कसा होतो हे समजून घेऊ.

#ICICI Bank#naruto#news#marathi#good omens#breaking news#agriculture#Banking Solutions#Financial Services#Personal Banking#Corporate Banking#ICICI Credit Card#Digital Banking#Wealth Management#ICICI Loans#Savings Account#Current Account#Banking App#ICICI Net Banking#Investment Plans#Home Loans#Education Loans#Business Banking#ICICI Bank Offers#Banking MadeEasy#Premier Banking#ICICI Bank India

0 notes

Text

https://wefundyourfuture.com/

1 note

·

View note

Text

How to secure an education loan for studying abroad: A step-by-step guide

Find Education Loans for Studying Abroad with competitive rates and flexible terms to fund your global education journey. knowledgeworldhere

0 notes

Text

Empowering the Backward Classes: An In-depth Look at NBCFDC Loan Schemes

NBCFDC Loan Schemes: The National Backward Classes Finance and Development Corporation (NBCFDC) is a government undertaking committed to the financial empowerment of India’s backward classes. Operating under the Ministry of Social Justice and Empowerment, it aims to provide concessional loans to eligible individuals and groups, enabling them to engage in sustainable income-generating…

#group loan scheme#government loan schemes India.#NBCFDC Loan Schemes#financial assistance for backward classes#concessional loans#individual loan scheme#SHG loans#affordable loans India#NBCFDC eligibility#income criteria for loans#OBC caste loans#backward class empowerment#low-interest loans#business loans for backward classes#education loans#Techmin Consulting

0 notes

Text

Education Loans in Punjab - Mexmon Financials

Want to go abroad and search for Education Loans in Punjab? Mexmon Financials is here to help you with providing solutions to all your financial needs. Whether you are planning to study in Canada, Australia, USA, UK, Europe, or any other country, we are here to finance your dreams. We specialize in providing customized education loans with quick and easy approvals, low EMI options, and affordable solutions. To learn more about our loan services such as business loans, agriculture loans, personal loans, and more contact us now at 9875995991 or email us at [email protected]. Book your appointment now! Address: ES-66, Nakodar Road, Jalandhar, Punjab 144001

#education loan#finance#loan services#personal loan#education#loanservices#educationloans#education loans

0 notes

Text

Incred Education Loan

Education is a powerful investment in one's future, but the rising cost of higher education often poses challenges for students and their families. InCred Education Loan has emerged as a reliable solution, empowering students to pursue their academic dreams without financial stress. Here’s a detailed look at what the InCred Education Loan offers and why it could be the ideal choice for your educational financing needs.

What is the InCred Education Loan?

InCred is a financial services company that specializes in providing tailored loans, including education loans, to help students achieve their academic ambitions. The InCred Education Loan is designed to support students in financing tuition fees, living expenses, travel, and other associated costs for studies both in India and abroad.

With its streamlined application process, competitive interest rates, and flexible repayment options, InCred ensures that financial limitations do not stand in the way of higher education.

Key Features of InCred Education Loan

Wide Range of Courses CoveredInCred supports funding for a variety of programs, including undergraduate, postgraduate, diploma, and certification courses in reputed institutions worldwide.

Loan AmountStudents can avail of loans up to ₹1 crore for studies abroad and up to ₹40 lakhs for studies in India. The amount varies based on the applicant's financial profile and the course's requirements.

Minimal DocumentationThe application process is simplified, with minimal documentation needed. This ensures a hassle-free experience for students and parents alike.

No Collateral OptionsInCred offers unsecured loans for eligible applicants, meaning you don’t necessarily have to provide collateral for borrowing, especially for admissions to reputed universities or courses.

Quick Approval ProcessInCred prides itself on speedy loan approvals, often disbursing funds within a few days to ensure students can meet their deadlines.

Competitive Interest RatesInterest rates are designed to be affordable, ensuring that repayment does not become a long-term burden for students.

Flexible Repayment TermsBorrowers can opt for flexible repayment options, including moratorium periods during the course and for a specified period after course completion.

Eligibility Criteria

To qualify for an InCred Education Loan, applicants typically need to meet the following conditions:

Academic Admission: Proof of admission to a recognized institution in India or abroad.

Age: Applicants must be within a specified age bracket, usually 18-35 years.

Creditworthiness: Assessment of the co-applicant’s or sponsor’s financial stability if required.

Course Selection: The chosen course should have a clear potential for future employability.

Benefits of Choosing InCred Education Loan

Personalized Assistance: Dedicated relationship managers guide borrowers through every step of the loan process.

Support for Diverse Needs: From tuition fees to exam-related travel, InCred covers all aspects of educational expenses.

Transparent Policies: Clear and upfront communication ensures there are no hidden charges.

Global Network: Ideal for students planning to study abroad, with loans tailored for institutions in the US, UK, Canada, and other popular destinations.

How to Apply for an InCred Education Loan?

Online Application: Fill out the application form on InCred’s website or mobile app.

Submit Documents: Provide necessary documentation such as identity proof, admission letter, fee structure, and co-applicant details.

Loan Assessment: InCred evaluates the application and eligibility criteria.

Approval and Disbursement: Upon approval, the loan amount is disbursed directly to the institution or as per the agreed terms.

Repayment Options

Repayment terms are flexible, with options like:

EMI-Based Repayment: Equal monthly installments after the moratorium period.

Part-Payment and Foreclosure: Borrowers can make part payments or foreclose the loan early without hefty penalties.

Conclusion

The InCred Education Loan stands out as a dependable and student-friendly financial tool, enabling students to focus on their studies instead of worrying about finances. Whether you aspire to study at a premier institution abroad or pursue a top-tier course in India, InCred ensures that your educational goals are within reach.

Take the first step toward securing your future with the InCred Education Loan and embark on your academic journey with confidence!

1 note

·

View note

Text

Education loans provide financial support for students pursuing higher education, both domestically and abroad. These loans cover tuition fees, living expenses, and other related costs, making it easier for students to achieve their academic dreams without financial constraints.

Call- 91+8826003209

Learn More:- https://www.24x7loanservice.in/loansoverview.php

0 notes

Text

34K notes

·

View notes

Text

Congress-JMM Govt Increased Wages, Launched Schemes for Women: Dr. Ajoy Kumar

Minimum wages hiked, women to receive ₹1,000 per month under Maiyan Samman Yojana The Congress-JMM alliance government in Jharkhand has launched several welfare schemes to uplift women, laborers, farmers, and youth, according to Dr. Ajoy Kumar. JAMSHEDPUR – Dr. Ajoy Kumar, former MP and senior Congress leader, announced that the Jharkhand India alliance government has launched several welfare…

#जनजीवन#Dr. Ajoy Kumar#education loans#farmer loan waiver#free electricity#hemant soren government#Jharkhand government#Life#Mayya Samman Yojana#minimum wage increase#women empowerment#Youth Employment

0 notes

Text

At EOI Loans, we understand that everyone’s financial journey is unique. That's why we offer a comprehensive range of loan products designed to meet the diverse needs of our clients. Our mission is to provide flexible, affordable, and transparent loan solutions that empower you to achieve your financial goals.

Personal Loans: Whether you need funds for unexpected expenses, medical bills, or a major purchase, our personal loans offer quick and easy access to cash with competitive rates and flexible repayment terms.

Home Loans: Owning your dream home is within reach with EOI Loans. We provide various mortgage options, including fixed and variable rate loans, to suit your specific needs. Our expert team will guide you through the home-buying process, ensuring a smooth and stress-free experience.

Business Loans: Fuel your business growth with our tailored business loan solutions. From startup capital to expansion funding, we offer flexible financing options that help you seize opportunities and drive success.

Competitive Rates: At EOI Loans, we strive to offer some of the most competitive rates in the industry, ensuring that you get the best possible deal. Our transparent pricing and no hidden fees policy mean you can borrow with confidence.

Financial Planning: Beyond providing loans, we offer financial planning services to help you manage your finances effectively. Our advisors work with you to create a comprehensive financial plan that aligns with your long-term goals.

At EOI Loans, we believe in building lasting relationships with our clients based on trust, integrity, and exceptional service. Whether you’re planning for the future or managing current financial needs, we’re here to support you every step of the way. Choose EOI Loans for reliable, personalized, and innovative loan solutions that empower you to take control of your financial future.

0 notes

Text

Education Loan Scheme

Education is the cornerstone of personal and societal development, providing individuals with the knowledge and skills needed to navigate an ever-evolving world. Recognizing the pivotal role education plays, governments and financial institutions around the globe have introduced Education Loan Schemes to make higher education accessible to a broader spectrum of students.

Education Loan Schemes are financial tools designed to support aspiring students in pursuing their academic goals. These schemes aim to bridge the gap between the cost of education and an individual's financial means. One of the key advantages of these loans is that they enable students to focus on their studies without the immediate burden of hefty tuition fees and related expenses.

One notable feature of Education Loan Schemes is their flexibility. These loans typically cover a range of academic disciplines, allowing students to pursue courses in fields as diverse as engineering, medicine, business, and the arts. Additionally, the repayment terms are often designed to be student-friendly, taking into account the post-graduation phase when individuals are establishing their careers.

Interest rates on education loans are generally lower compared to other types of loans, and some schemes offer special provisions such as a moratorium period, allowing students time to find employment before commencing repayments. This not only eases the financial burden on students but also promotes a smoother transition from academia to the professional realm.

Education Loan Schemes not only benefit individual students but also contribute to the overall development of society. By empowering more individuals to access higher education, these schemes foster a skilled and knowledgeable workforce, which, in turn, fuels innovation, economic growth, and societal progress.

In conclusion, Education Loan Schemes are catalysts for realizing dreams and ambitions. They embody the collective commitment to making quality education a reality for a wider audience, ensuring that financial constraints do not hinder the pursuit of knowledge and the fulfillment of aspirations. As we continue to invest in education, we sow the seeds for a brighter, more empowered future.

0 notes

Text

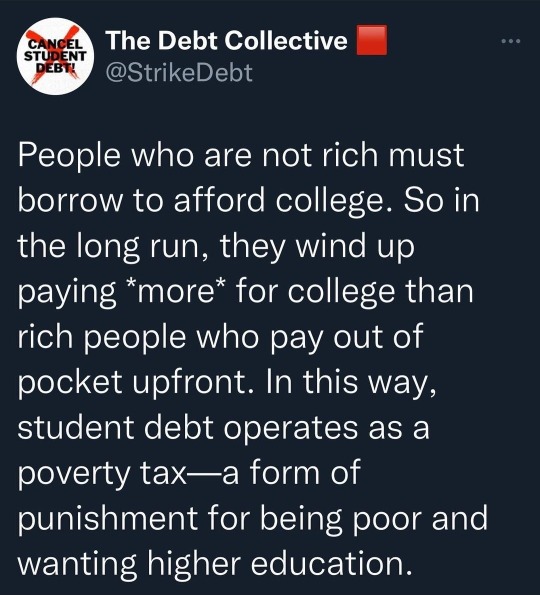

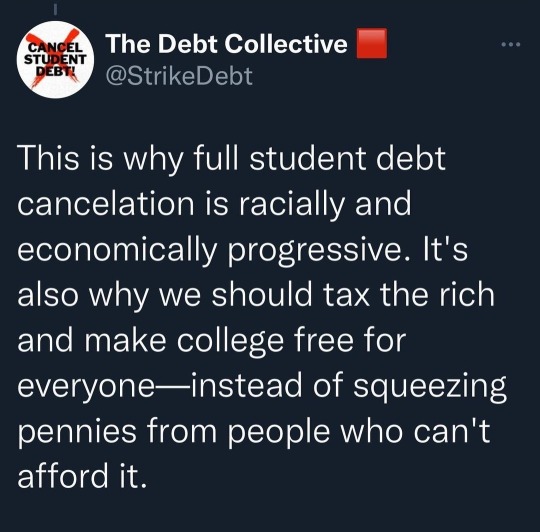

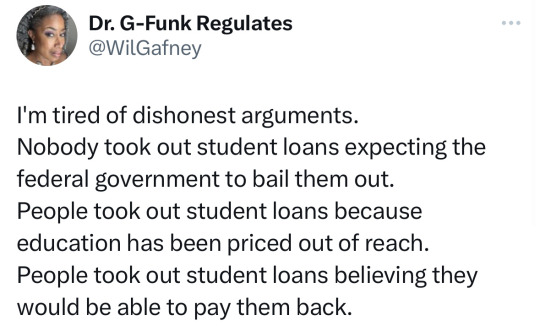

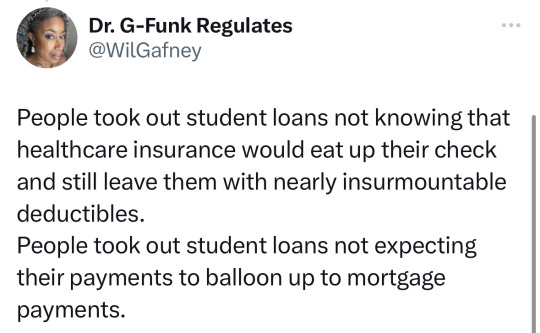

#cancel student debt#student loans#current events#government#education#college#capitalism#eat the rich

33K notes

·

View notes

Text

Education Loans :

Education loans are a very useful tool with which you can shape your dreams of higher education.

0 notes

Text

How to secure an education loan for studying abroad: A step-by-step guide

Find Education Loans for Studying Abroad with competitive rates and flexible terms to fund your global education journey. knowledgeworldhere

0 notes

Text

What Happens If a Student Faces Difficulty in Repaying The Education Loan

What Happens If a Student Faces Difficulty in Repaying The Education Loan Education is a transformative journey that empowers individuals with knowledge, skills, and opportunities for personal and professional growth. However, for many students, financing higher education can be a substantial challenge. To bridge this gap, education loans serve as a lifeline, enabling students

#education loan#education loan in india#how to get education loan#sbi education loan#education loan interest rate#education loan kaise milta hai#education loan interest rate in india#education loan for abroad#education loans#education loan kaise le#education loan process#education loan without collateral#education#education loan process in hindi#abroad education loan#free education loan#educatio loans#sbi education loans#education loan for mba

0 notes

Text

Education Loan: A list of Banks offering The lowest Interest Rates

Education loans are your key to academic success and a brighter future. Achieve your goals without financial worries. Invest in knowledge and let your potential soar. Embrace opportunities today with an education loan by your side! Here is a list of banks that offer education loans at low-interest rates: https://www.opennaukri.com/education-loan-a-list-of-banks-offering-the-lowest-interest-rates/

0 notes