#Corporate Banking

Explore tagged Tumblr posts

Text

ICICI Bank शेतकऱ्यांसाठी: आर्थिक उन्नतीसाठी उपयुक्त योजना आणि सेवा

शेतकऱ्यांसाठी आर्थिक विकास साधण्याच्या उद्देशाने ICICI Bank ने विविध उपयुक्त योजना आणल्या आहेत. या योजनांमुळे शेतकऱ्यांना आर्थिक सहाय्य मिळते आणि त्यांच्या शेती व्यवसायात सुधारणा होते. या लेखात ICICI बँकेच्या योजनांची माहिती देऊन, त्याचा उपयोग ग्रामीण भागातील शेतकऱ्यांसाठी कसा होतो हे समजून घेऊ.

#ICICI Bank#naruto#news#marathi#good omens#breaking news#agriculture#Banking Solutions#Financial Services#Personal Banking#Corporate Banking#ICICI Credit Card#Digital Banking#Wealth Management#ICICI Loans#Savings Account#Current Account#Banking App#ICICI Net Banking#Investment Plans#Home Loans#Education Loans#Business Banking#ICICI Bank Offers#Banking MadeEasy#Premier Banking#ICICI Bank India

0 notes

Text

The Evolution of Corporate Banking: Why SFTP Banking is Becoming Obsolete - Data Nimbus

Introduction

Corporate banking is undergoing a rapid transformation driven by digital advancements and a growing need for security and efficiency. Businesses now expect real-time access to their funds, secure online banking, and streamlined processes. Financial institutions are responding by investing in cutting-edge technology to protect sensitive information and automate routine tasks, ultimately improving customer experience and operational efficiency.

This shift towards digital banking has also impacted the methods of transferring data between corporations and banks. While historically effective, the secure File Transfer Protocol (SFTP) has struggled to meet the evolving needs of modern financial operations.

This article explores the decline of SFTP and the rise of Application Programming Interfaces (APIs) as the new standard for seamless and efficient corporate banking.

For more info visit : - https://datanimbus.com/blog/corporate-banking-evolution-why-sftp-is-becoming-obsolete/

0 notes

Text

Navigating Regulatory and Technological Risks Through Corporate Banking Market Segmentation

Introduction

In the corporate banking sector, heightened regulatory scrutiny and technological advancements pose ongoing challenges. Market segmentation has become a strategic response, enabling banks to efficiently address these risks while delivering specialized services. By breaking down their customer base into segments, banks can ensure that their operations are aligned with both regulatory standards and technological needs, mitigating potential risks and driving operational efficiency.

Regulatory Compliance Through Segmentation

With market segmentation, banks can identify which segments face higher regulatory scrutiny and allocate resources accordingly. Larger clients or international firms often have more complex compliance requirements, while smaller businesses may not face the same challenges. This approach ensures that each customer receives the appropriate level of attention and service, reducing non-compliance risks and optimizing resources.

Addressing Technological Needs

Technological advancements in banking also come with their own set of challenges. From cybersecurity to outdated IT infrastructure, segmenting the customer base allows banks to prioritize the most technologically demanding segments. For instance, larger firms might require more sophisticated cybersecurity solutions, while smaller businesses may focus on simpler digital banking tools. Segmentation helps banks allocate resources effectively, ensuring they are investing in the right technologies for the right customer groups.

Effective Risk Management

Segmentation also enables banks to implement more targeted risk management strategies. By understanding the specific risks associated with different customer segments—whether related to credit, geopolitical, or economic factors—banks can adjust their approach to mitigate exposure and improve profitability.

Conclusion

Market segmentation allows corporate banks to navigate regulatory and technological challenges more effectively. By understanding the unique needs of each segment, banks can allocate resources efficiently, comply with regulations, and reduce risk, ensuring long-term stability and growth.

Click here to talk to our experts

0 notes

Text

RBI Governor Shaktikanta Das Discusses Banking Licenses, Interest Rates, and Rural Consumption

In a recent interview with Shyamal Majumdar, Editor of Financial Express, Reserve Bank of India (RBI) Governor Shaktikanta Das addressed several key issues including the relationship between the central bank and the government, the prospect of giving banking licenses to business houses, interest rates, regulatory actions, and the rise in rural consumption.

No Banking Licenses for Business Houses

Governor Das made it clear that the RBI is not considering granting banking licenses to corporate houses at present. He cited global experiences indicating potential conflicts of interest and significant risks associated with related-party transactions when real sector companies enter the banking space.

“Experience world over has shown that when real sector companies enter into the banking space, there are potential conflicts of interest. The problem around related-party transactions is also a major issue,” Das emphasized.

Related-party transactions involve any transaction or relationship where the company or its subsidiaries are participants, and any related party has a direct or indirect interest. The difficulty in monitoring and regulating these transactions makes them highly risky.

When asked if the RBI is currently ruling out corporate entries into the banking sector, Das responded, “At this point, there is no thinking in that direction.”

Banking Penetration and Technology

Governor Das highlighted that India’s banking penetration has become quite extensive. The significance of physical bank branches has diminished due to technological advancements.

“Therefore, what India needs is not proliferation in the number of banks. What India needs is sound, healthy, and well-governed banks, which, we feel, will be able to mobilize savings and meet credit requirements throughout the country through technology,” he stated.

Open to New Applications for Universal Banks

Despite the hesitation towards business houses, Das mentioned that the RBI remains open to new applications for setting up universal banks. He assured that any appropriate and proper application would be thoroughly examined by the RBI.

RBI’s Role and Coordination with the Government

Responding to a comment from former RBI Governor D Subbarao about the RBI being a cheerleader for the government, Das asserted, “At least I am saying from my experience that nobody expects the RBI to be a cheerleader.” He mentioned that during his tenure, he has never faced such demands.

Das praised the smooth coordination between the RBI and the government during the COVID-19 crisis, which helped the country’s economy recover quickly and robustly. While differences in opinion between the RBI and the government are natural, they are resolved amicably.

Interest Rates and Economic Growth

On the topic of interest rates and growth, Governor Das reiterated the RBI’s mandate to maintain price stability while considering growth objectives. Despite the current interest rates, India has experienced robust growth, with an average growth rate of 8.3% over the last three years. The projection for FY2025 is 7.2%, and Das expressed optimism about achieving this target.

Regulatory Actions and Customer Interests

Governor Das defended the recent regulatory actions taken against banks, NBFCs, and other financial institutions for non-compliance with norms. He explained that these actions are taken in the interest of customers. The RBI’s initial approach involves bilateral engagement with non-compliant entities. However, if compliance remains inadequate, business restrictions are imposed to protect customer interests.

Optimism about Rural Consumption

Regarding rural demand, Governor Das expressed optimism about a rise in rural consumption, driven by expectations of a good monsoon season.

In summary, RBI Governor Shaktikanta Das provided insights into the current stance on banking licenses for business houses, the importance of technology in banking penetration, the RBI’s openness to new universal bank applications, and the central bank’s role in maintaining economic stability and growth.

0 notes

Text

Mak Joon Nien Named BMCC Chairman to Boost Trade

Mak Joon Nien, CEO of Standard Chartered Malaysia, has been appointed as the new Chairman of the British Malaysian Chamber of Commerce (BMCC) effective 28 June 2024, following the 6th BMCC Annual General Meeting. Mak Joon Nien – Experience With 26 years of experience in investment and corporate banking, Mak is the first Malaysian CEO of Standard Chartered Malaysia and has been on the BMCC Board…

View On WordPress

0 notes

Text

We at DBS extend our warm wishes to the incredible startups of our country who are constantly changing the rules of the game. We look forward to becoming a part of your journey. https://www.dbs.com/in/corporate/default.page

0 notes

Text

Payment service provider in India | Connected Banking (CIB) providers | Zyro

Discover Zyro, the leading Payment Service Provider in India, revolutionizing financial transactions with our cutting-edge Connected Banking (CIB) solutions. Streamline your business operations with seamless, secure, and efficient payment processing.

get more info :- www.zyro.in/blog/

#banking#connected banking#kpmg connected banking#icici connected banking#keeping banking connected#kpmg connected enterprise for banking#connected bank#connected world#digital agile banking services#corporate banking#banking system#open banking#accounting and banking

0 notes

Text

Financing The Green Transition in Asia

In recent years, growth in solar, wind and battery deployment has gained momentum, as the world shifts away from thermal power to renewable energy sources.

By 2030, solar and wind could generate up to 14,000 Terawatt-hours (TWh) of electricity, up to four times higher than 2022 levels, predicts clean energy think tank RMI1. This could supply more than one-third of global electricity by 2030, up from about 12 percent today.

However, the intermittent, seasonal nature of standalone wind or solar power systems limit their ability to meet variable electricity demand. The need for stable, uninterrupted supplies of renewable energy – or “round-the-clock (RTC) power – has in turn driven up investments and technology advances in co-located hybrid systems.

These RTC systems typically combine two or more renewable energy assets; storage technologies such as Battery Energy Storage Systems (BESS) or pumped hydro systems; as well as smart grid management.

“Developers are increasingly choosing to configure their renewable generation assets as hybrid assets combining solar, wind and storage projects that extend reliable generation hours to accommodate grid capacity constraints and meet the economic imperative to enhance returns,” said Rajiv Vishwanathan, DBS Bank executive Director of Project Finance.

0 notes

Text

Corporate and investment banking solutions play a crucial role in unleashing the full potential of your business and attaining the desired financial stability. Hence, it's imperative to align with a company possessing trusted industry expertise and comprehensive offerings for your corporate and investment banking requirements.

With a remarkable track record spanning over two decades, FBNQuest stands as a foremost corporate and investment banking entity in Nigeria, collaborating at the highest echelons with major corporations in the nation, as well as Federal and State governments.

Corporate and Investment Banking ServicesFBNQuest stands as a leading provider of corporate and investment banking solutions in Nigeria, catering to a diverse clientele spanning all sectors of the country's economy. Our services encompass every facet of corporate financing, embracing equity and debt financing, as well as long-term financial management.

Corporate Banking Services

FBNQuest's corporate banking solutions encompass a spectrum of financial planning, ranging from short to long-term, along with provisions for loans and capital financing for project and infrastructure development, and international trade financing services:

Short to long-term loans

Overdraft loans

Revolving working capital

Bonds and guarantees

Liquidity support facility

Receivables financing

Invoice discounting

Project Finance

Trade finance

Asset-backed lending

Investment Banking Services

FBNQuest's investment banking services furnish businesses with financial advisory and expertise across a wide array of sophisticated financing strategies and intricate capital-raising transactions, including debt financing, mergers and acquisitions, bond issuance, and public or private equity raising:

Debt solutions

Financial advisory

Capital Markets

Why We're a Premier Corporate and Investment Banking Firm Holistic Solutions

FBNQuest delivers tailored solutions to a diverse clientele across all sectors of the economy. Our integrated approach affords corporations complete access to a spectrum of corporate and investment banking solutions, encompassing financial advisory, treasury management, capital financing, and equity raising.

Profound Industry Insight

We possess an intimate understanding of various industries and regional market dynamics, with decades of diversified experience in investment banking, corporate banking, and capital market operations. Coupled with a robust network of investors and financial institutions, this positions us to provide optimal solutions for emerging opportunities.

Robust Client Relationships

We nurture enduring relationships with corporations spanning various industries in the Nigerian economy. Serving as a pivotal point of contact, we cater to clients across diverse industries and asset classes, addressing their corporate financing and investment banking requisites. Our clientele includes some of the largest Nigerian and multinational corporations across FMGC, energy, construction, logistics sectors, among others, in addition to Federal and State governments, as well as other prominent entities across sub-Saharan Africa.

Explore our Corporate and Investment Banking Services Eager to delve deeper into our corporate banking solutions and investment banking services? Reach out to a knowledgeable member of our team for further insights.

Contact Us:

Phone: 01-2801340-4 Email: [email protected] Address: Lagos, 16 Keffi Street, Off Awolowo Road, S.W. Ikoyi, Lagos, Nigeria

0 notes

Link

Bank of Maharashtra is one of the oldest public sector banks in India headquartered at Pune, Maharashtra. It has a total of 2022 branches along with 29 million customers. It provides services in both consumer and corporate banking. Let’s have a look at the Bank of Maharashtra timings.

0 notes

Text

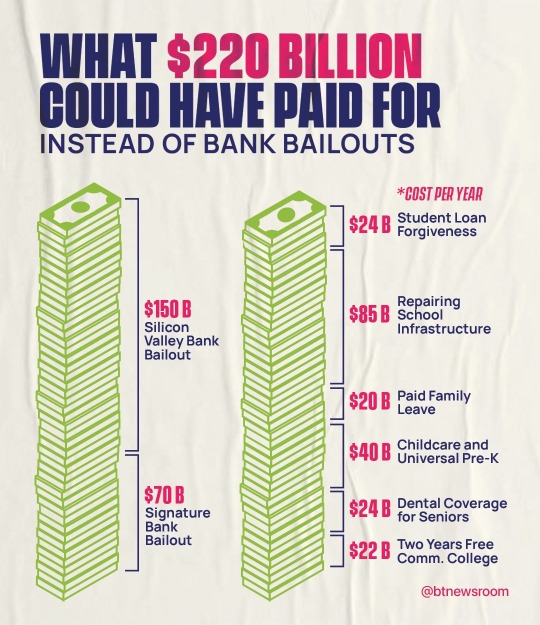

I hate it here

Let this be a lesson against believing politicians lies.

Keeping wealth concentrated in the 1% is the end goal of capitalism.

They will do whatever is necessary to keep the working class desperate and dependent on the system that impoverishes them.

#at what point to wh break out the guillotine#i’m so serious#capitalism#late stage capitalism#silicon valley bank#bank bailout#corruption#corporate corruption#corporate greed#eat the rich#tax the 1%#tax the rich#government bailout

8K notes

·

View notes

Text

#its a wonderful life#housing#capitalism#banking#home loans#mr potter#george bailey#henry potter#christmas#christmas movies#corporate greed

204 notes

·

View notes

Note

Hi! Do you mind doing like an angsty fluff with Diego where you finally meet him again in the 60s at Elliot’s after he’s been stuck at the mental institution, but somethings off, he’s got someone else glued to his hip.

Meeting again

Summary: You were the last sibling, landing onto your feet, infront of a usual looking ally. The first thing, which came to your mind was finding the others, especially Diego. But little did you know, after finding him you wish you never did.

Thank you for your lovely request, even tho it broke my heart! Also, here a sexy poster from Five I fell in love with! With every purchase you automatically support me :) https://amzn.to/3yGK6Fm

“She’s… we’ve been through a lot together”

After getting brutally teleported into a different timeline, falling out of two meters onto hard concrete and getting cat-called by multiple old man on the streets, your day already was ruined. Thinking that it couldn't get any worse was understandable but at the same time so wrong. It got worse, it got incredibly worse.

You were on a hunt. `your prey?', you may ask. A six foot tall, handsome (you would never tell him that, his ego is big enough), and amazingly accurate knife throwing man. It was difficult to overlook him. You were kind of disappointed, that he didn't make you a trail out of knifes like in Hensel and Gretel. Something like that would have made it easier to find him. But as you knew him, everywhere he stepped a foot, he left a mark. Involuntary most times.

34 days later...

You’ve been searching for Diego for what feels like forever, a gnawing worry in your gut that only grew with each passing day. When you finally heard that he’d been taken to a mental institution after landing in the 60s, your heart dropped. The relief of knowing he was alive was quickly overshadowed by the fear of what he’d been through.

The day you finally walk into Elliot’s place, you spot him immediately. Your heart leaps at the sight of him—alive, whole, and so achingly familiar. But something’s off. He’s not alone. There’s a woman glued to his side, her hand resting on his arm as if it belongs there. She’s talking to him, and he’s smiling down at her, a softness in his eyes that you’ve only ever seen directed at you.

You freeze in the doorway, the world tilting on its axis. The Diego you know would have come running to you, would have swept you into his arms without a second thought. But this Diego just glances up, his eyes widening in surprise, then flicking back to the woman beside him. It’s like a punch to the gut, leaving you breathless and disoriented.“Diego?” Your voice is small, uncertain, as if you’re not sure if this is really happening. His gaze finally locks onto yours, and for a moment, you see the Diego you know—the one who fought for you, who would do anything to keep you safe. But then he steps back, putting a small distance between the two of you, as if he’s unsure of how to bridge the gap that’s formed between you.

“Y/N,” he says, your name coming out in a breath, like he’s been holding it in this whole time. But his tone is guarded, almost hesitant, and it breaks your heart a little more. The woman at his side looks between the two of you, confusion and maybe a hint of understanding dawning on her face. You force yourself to smile, but it feels brittle. “It’s good to see you,” you say, even though every part of you is screaming that this isn’t right. That something has changed, something you don’t know if you can fix.

Diego glances at the woman beside him, then back at you. “This is Lila,” he introduces, and there’s something in the way he says her name that makes your stomach churn. “She’s… she helped me get out of the hospital.” “Helped?” The word comes out sharper than you intended, and you see Diego flinch. Lila doesn’t seem to notice, or maybe she just doesn’t care. She smiles at you, and it’s almost too easy, too friendly. “Yeah, helped,” Diego replies, his voice softer now, like he’s trying to ease you into something you’re not ready to hear. “She’s… we’ve been through a lot together.”

The unspoken words hang in the air between you, and you can feel your heart cracking just a little more with each passing second. “I’m glad you’re okay,” you manage to say, even though your voice trembles. Diego’s eyes soften, and for a brief moment, it’s just the two of you again, like it used to be. “I’m glad you’re here,” he says, and you know he means it, but there’s still that barrier between you, the one you’re not sure how to cross.

Lila touches his arm, and the moment shatters. “We should go,” she says, looking up at Diego, and he nods, though he looks back at you as if he wants to say something more. “Yeah,” he agrees, and the word feels like a goodbye. “We’ll talk later, okay?”

You nod, unable to trust your voice. You watch as they walk away, side by side, and it feels like your heart is being wrenched out of your chest. But just before they disappear, Diego glances back at you one last time, and in his eyes, you see it—the regret, the confusion, the love he’s trying so hard to push down. And you know, deep down, that this isn’t the end. But it doesn’t stop it from hurting like hell.

Alright I will go cry now but still thanks for the request :)

#smut#reader#request#aesthetic#five#tua#five hargreeves#five x reader#five hargreaves x reader#outer banks#diego#diego hargreeves#pt3#tua spoliers#the unbrella academy#umbrella academy#umbrella ben#umbrella corporation#umbrella acedmy#lila hargreeves#Diego hargreeves x reader#diego x you#diego x reader#diego hargreeves x you

184 notes

·

View notes

Text

I'm so immersed in my jason grace new rome uni fic that I'm studying ancient roman law terms using this as an excuse. help.

#I'm COMMITTED fr#I become smart just for these fanfics i swear. i thank the fanfic and fandom community for my thirst for knowledge 😮💨✨#I also remember listening to latin asmrs and learning latin words for reyna and jason :) I need help fr#i hate how I feel the need to want to know EVERYTHING tho 😭 like why do I have to overthink everything#I'm not sure if I should include ancient roman law or common law for jason tho#or he could just learn both as separate classes. the roman law can come under the history category#so he has to learn a bit of everything#political science criminal law economics history civil law corporate law banking law#I'm tired. law students I have always had nothing but respect for you#I won't go TOO deep into what he's studying in the fics tho like I won't mention his lessons in the fic every 5 mins#prolly just him doing presentations and projects then and there#bc like if I go too deep in then I'll get into a writing slump again#bc info dumping is EXHAUSTING it would feel like a school assignment not a fic#pjo#pjo fandom#percy jackson#pjo series#jason grace#pjo hoo#pjo hoo toa#annabeth chase#leo valdez#piper mclean#frank zhang#hazel levesque#jason grace x y/n#jason grace fanfic#jason grace x you#jason grace x reader#࿔‧ ֶָ֢˚˖𐦍˖˚ֶָ֢ ‧࿔ elora's PhD in overthinking

88 notes

·

View notes

Text

#mercedes mone#aew#all elite wrestling#pro wrestling#wrestling#the ceo#ceo#the mone corporation#sasha banks#メルセデス・モネ

134 notes

·

View notes

Text

Payment service provider in India | Connected Banking (CIB) providers | Zyro

Discover Zyro, the leading Payment Service Provider in India, revolutionizing financial transactions with our cutting-edge Connected Banking (CIB) solutions. Streamline your business operations with seamless, secure, and efficient payment processing.

get more info :- www.zyro.in/blog/

#banking#connected banking#kpmg connected banking#icici connected banking#keeping banking connected#kpmg connected enterprise for banking#connected bank#connected world#digital agile banking services#corporate banking#banking system#open banking#accounting and banking

0 notes