#easy accounting software for small business

Explore tagged Tumblr posts

Text

5 Must-Have Features in GST-Enabled Billing Tools

As businesses are getting accustomed to changing compliance standards, a reliable GST-enabled billing tool has become the need of the hour. The right software ensures that tax regulations are complied with and business operations are streamlined. If you are considering an option for your business, here are five must-have features that every GST-enabled billing tool, like TRIRID Biz Accounting and Billing Software, must offer.

Seamless GST Compliance

The most important feature would be complete compliance with GST regulations. Your billing software must:

Calculate CGST, SGST, and IGST automatically.

Generate an error-free GST invoice

Provide real-time GST return filing

TRIRID Biz ensures smooth tax processes by reducing manual errors and staying compliant effortlessly.

Customizable Invoice Templates

Professional-looking invoices are crucial for the credibility of your brand. A good billing tool should enable you to:

Design invoices with your company's logo and details.

Include mandatory GST fields, HSN codes, tax breakdown, etc.

Support for multicurrency and multilingual operation to cater to various clientele.

TRIRID Biz offers a wide range of invoice templates that comply with GST requirements while ensuring it looks professional.

Reporting and Analytics

The most important thing is knowing about the financial health of the business. Seek out software that can offer:

Summary statements of GST and detailed reports of transactions

Advanced analytics tracking sales trends and tax liabilities

Real-time dashboards with key metrics.

With TRIRID Biz, you can generate actionable insights and manage your finances easily.

Multi-Platform Accessibility

In the world of today, being on the go is an attribute. Make sure that the billing tool you're working with has the following characteristics:

Cloud-based operations: Work from anywhere.

Mobile-friendliness: Take time to create invoices or run reports on the go.

Safe data synchronization across devices.

TRIRID Biz allows you to stay connected with your business, whether you're working from the office or on the go.

Integration with Accounting and ERP Systems

Your GST billing tool should integrate seamlessly with existing systems, including:

Accounting software for accurate bookkeeping.

ERP systems for inventory and supply chain management.

Payment gateways for hassle-free transactions.

TRIRID Biz simplifies workflows by connecting with your favorite tools, making financial management a breeze.

Why Choose TRIRID Biz for GST-Enabled Billing?

All these features and more TRIRID Biz Accounting and Billing Software offers to make GST compliance effortless for businesses in Gujarat and beyond. User-friendly interfaces, robust security, and round-the-clock support make TRIRID Biz the perfect partner for your business growth.

Optimize Your Billing Today!

Are you ready to take billing and accounting processes to the next level? Discover how TRIRID Biz Accounting and Billing Software can help simplify operations, ensure compliance, and drive growth.

Call @ +91 8980010210 / +91 9023134246

Visit @ https://tririd.com/tririd-biz-gst-billing-accounting-software

#TRIRID Biz Accounting and Billing Software#Best Accounting & Billing Software In India#Easy-to-use online accounting software#GST Billing Software for Small Business#small business billing software

0 notes

Text

In the dynamic landscape of Indian business, efficient financial management is key. Gbooks emerges as the beacon, offering a comprehensive suite of accounting solutions tailored to Indian enterprises. From seamless invoicing to robust expense tracking, it simplifies complexities. Its user-friendly interface ensures accessibility for all, while its powerful features cater to diverse needs. With customizable reports and real-time insights, decision-making becomes intuitive. Gbooks not only streamlines operations but also fosters growth through informed strategies. Embrace the future of accounting with Gbooks, your trusted partner in navigating the intricacies of Indian finance.

#Best Accounting Software in India#free online accounting software#easy accounting software#free accounting software#best accounting software#best accounting software for small business#accounting software

0 notes

Note

Hello it's me with another very naive computer question!

One of the really common complaints you see about modern software (from Adobe, Microsoft, etc.) is the move from the single-purchase model to a subscription-based model. While I understand that people are upset about paying more money over time, this also feels like the only viable option for shipping products that work with modern OSes, especially Windows (I don't have any experience with MacOS). Windows pretty regularly updates, and if you want your product to continue to work, you have to continue paying your engineers to maintain compatibility through time.

Obviously I understand that there are lots of FOSS options out there, but for the companies that are built on making money from these sorts of software products, I don't see another way. Am I way off the mark here?

This is a really good question. I don't have a great answer, but the model I have in my head is that "traditional software distribution" is partially an artifact of an era where companies were starting to use computers but internet use was still spotty so providing support for software was just a very different ballgame. A lot of what I'm saying here is not like. Fact as much as it is my understanding of The Software Business from the side of someone who is a little involved in that but mostly not in that.

(This is mostly about "business software", that is to say, accounting packages, creative suites, design packages, modelling tools, etc. This model does not explain like. Spotify. But that's much easier to explain.)

You're not wrong that the subscription model really make sense given modern software development, where patches come out continuously and you get upgraded to the latest version every time something changes, but there has been a significant change in how software is developed and sold that makes it noticeably different. I think that the cause of this is mostly because it's finally practical to do contract-style deals with hundreds of thousands of customers instead of doing one-off sales like we used to do.

In the Traditional model you charge a pretty sizeable upfront cost for a specific version of the software, you buy Windows XP or Jasc Paint Shop 7 or whatever and then you get That Version until we release The Next Version, plus a couple years of security and support. When the next version hits, we stop adding any new features to your version, and when that hits end of life, you maybe get offered a discount to buy licensing for the latest version, or you drop out of support.

Traditional software with robust support typically costs an awful lot, Photoshop CS2 was $600 new in 2005, or $150 to upgrade from CS, because you're paying for support and engineering time in advance. A current subscription for just Photoshop is $20/mo, and that's after twenty years of inflation. Photoshop is also cheap, a seat for something like SolidWorks 2003 could probably have run you $3000-4000 easy. I can't even give you a better guess there because SolidWorks still doesn't sell single commercial licenses online, you have to talk to their salespeople.

The interesting thing to me about Traditional pricing was that I think it was typically offered to medium to small businesses or individuals, because it's an easy way to sell to smaller customers, especially if it's the 90's and you're maybe selling your software through an intermediary reseller who works with local businesses or just a store shelf.

Independent software resellers were a big business back in the day, they served as a go-between for the software company and smaller businesses, they sold prepared packages in a few sizes and handled the personal relationship of phoning you up and saying "Hey there's a patch for your accounting software so that it doesn't crash when someone's surname is Zero, we'll send you a floppy disk in the mail with some instructions on how to install it." Versioned standard releases are a thing you can put in a box and give to resellers along with a spec sheet and sales talking points. This business still exists but it's much smaller than it once was, it's largely gone upmarket.

If you were bigger, say, if you were a publishing house that needed fifty seats of editing software you'd probably call the sales department of Jasc or whoever and get a volume deal along with a support contract.

Nowadays why would you bother going through resellers and making this whole complicated pricing model when you could just sell subscriptions with well-established e-commerce tools. You can make contract support deals with individuals at scale, all online, without hiring thousands of salespeople. You can even provide varying support levels at multiple cost brackets directly, so you don't need to cultivate a direct business relationship with all your customers in order to meet their needs. Your salespeople handle the really big megacorp and government deals and you let everyone else administer themselves.

It also makes development easier. You can also deploy patches over the net, you just do it in software. You can obsolete older versions faster, since you can make sure most people are using the latest version, and significantly cut down on engineering time spent backporting fixes to older versions. I think a lot of this is straightforwardly desirable on most software.

Now, there are still packages sold by the version, and there are even companies selling eternal licenses.

Fruity Loops Studio is still a "Buy once forever" type deal.

MatLab can be purchased as a subscription or as a perpetual one-version license.

Windows is still sold like this, but also direct to customer sales of Windows are minimal, Windows is primarily sold to OEM's who preinstall it on everything.

But it's a dying breed, your bigger customers are going to want current support and while there are industries where people want to hang around on older versions, for a lot of software your customer wants the latest thing with all the features and patches, and they'd rather hold on to their money until later using a subscription rather than spend it all upfront. Businesses love subscriptions, they make accounts books balance well, they're the opposite of debt.

Personal/private users who might just want the features of Photoshop CS2 and that's fine forever don't matter to you. They're not your major customers. This kind of person is not a person who your business cares to service, so you don't really care if you annoy them.

Even in the Open Source business world, subscriptions are how the money is made, just on support rather than for the software itself. You can jump through relatively few hoops to run Ubuntu Enterprise or SUSE Enterprise Linux on your own systems for free, but really there's not much benefit to that unless you pay for the dedicated support subscription.

In many ways I think a lot of things have changed in this way, I have a whole thing about the way medium-scale industrial manufacturing has changed in the past thirty years somewhere around here.

While there are valid reasons you might want to buy a single snapshot of some software and run that forever, the reality is that that's a pretty rare desire, or at least that desire is rarely backed by money. If you want to do that you either need access to the source code so that you can maintain it yourself, or you need to strike a deal with someone who will, or it needs to be software so limited that it (and the system it runs on!) never need updates. Very few useful programs are this simple. As a result subscription models make sense, but until recently you couldn't really sell a subscription to small businesses and individuals. Changes in e-commerce and banking have enabled such contracts to be made, and hey presto, it's subscription world.

47 notes

·

View notes

Text

The Top 10 Hardest Things About Starting a Small Business (And How to Overcome Them)

Starting a small business is an exciting journey, but it is not all passion projects and overnight success. Whether you’re launching a sticker business, an online store, or a local shop, the process is filled with challenges, setbacks, and lessons you never saw coming.

From funding struggles to burnout, many entrepreneurs face unexpected obstacles that can make or break their business. But knowing what to expect—and how to overcome these hurdles—can help turn challenges into opportunities.

Here are the ten hardest things about starting a small business and how to tackle them successfully.

1. Finding the Right Business Idea

The Challenge:

You might have too many ideas, or you may not be able to think of a single good one. Choosing the right business idea is tough because:

• It needs to be profitable.

• It should align with your skills and passion.

• It has to have market demand, meaning people actually want to buy it.

How to Overcome It:

• Test your idea before going all in—survey potential customers or create a prototype.

• Research the competition—if no one is doing it, there may be a reason such as lack of demand.

• Solve a problem—successful businesses fill a gap in the market.

Your first business idea does not have to be your last. Many entrepreneurs pivot after learning what works.

2. Getting Funding for Your Business

The Challenge:

Most businesses need money to start, but where do you get it? Banks require strong credit, investors want proof of success, and using your own savings is risky.

How to Overcome It:

• Start small and test with low-cost products before expanding.

• Look for alternative funding such as crowdfunding, grants, or small business loans.

• Consider bootstrapping by reinvesting early profits instead of taking on debt.

Pre-selling your products is a smart way to generate cash flow before investing too much.

3. Learning Everything (Marketing, Sales, Accounting, and More)

The Challenge:

As a business owner, you wear all the hats—you are the marketer, accountant, customer service rep, and CEO all at once.

How to Overcome It:

• Learn the basics with free online courses on marketing, finance, and branding.

• Use business tools such as accounting software, AI for content creation, and social media planners.

• Outsource when possible by hiring freelancers for things you do not have time to master.

Focus on your strengths and outsource the rest once you can afford it.

4. Building a Customer Base from Scratch

The Challenge:

No customers means no sales. But how do you get people to trust a brand that just launched?

How to Overcome It:

• Leverage social media by consistently posting valuable content.

• Offer early discounts or freebies to incentivize first-time buyers.

• Encourage word-of-mouth by asking happy customers for reviews.

Building a strong brand identity, including a logo, website, and social proof, makes people more likely to buy from you.

5. Managing Time and Avoiding Burnout

The Challenge:

Most small business owners work much more than 40 hours a week—without a boss to set limits, it is easy to burn out.

How to Overcome It:

• Set a schedule and balance work time with personal time.

• Prioritize tasks by focusing on what moves the business forward.

• Take breaks because burnout leads to bad decisions and lower productivity.

You are more productive when well-rested. Take at least one day off per week to recharge.

6. Handling Self-Doubt and Fear of Failure

The Challenge:

Every entrepreneur asks themselves, “What if this fails?” Self-doubt can kill motivation before you even start.

How to Overcome It:

• Focus on progress, not perfection—you will learn as you go.

• Surround yourself with support by connecting with other business owners.

• Celebrate small wins—every sale is proof that you are on the right track.

Every successful business owner has failed before. The key is learning and pivoting when needed.

7. Dealing with Slow Sales and Unpredictable Income

The Challenge:

Some months are great, while others are painfully slow—especially in the beginning.

How to Overcome It:

• Have a backup fund by setting aside money during good months.

• Create multiple revenue streams by selling online, at markets, and on different platforms.

• Run promotions during slow periods, such as flash sales or limited-time discounts.

Focus on repeat customers because loyal customers spend more and shop often.

8. Standing Out in a Crowded Market

The Challenge:

No matter what business you start, there is competition. So how do you make people choose you over others?

How to Overcome It:

• Find your Unique Selling Proposition (USP)—what makes your brand different?

• Offer top-tier customer service because people remember great experiences.

• Build a personal brand so that people connect with you, not just your product.

Brand story matters—people buy from businesses they relate to.

9. Managing Inventory and Supply Chain Issues

The Challenge:

Whether you are selling physical products or digital goods, inventory management can be a headache—especially when suppliers have delays or price increases.

How to Overcome It:

• Start with small batches and do not overstock before testing demand.

• Work with reliable suppliers and always have a backup plan.

• Track inventory closely using software to avoid running out or over-ordering.

Having a pre-order system can help manage unexpected inventory shortages.

10. Staying Motivated When Things Get Hard

The Challenge:

Not every day will be exciting. Some days, you will want to quit. Motivation comes and goes, but consistency is key.

How to Overcome It:

• Remember your “why”—what made you start this business?

• Join entrepreneur communities because talking to other business owners helps.

• Set small goals by breaking big tasks into manageable wins.

Mindset is everything—keep pushing forward, even when it is tough.

Final Thoughts: Is Starting a Small Business Worth It?

Absolutely. Even though starting a business is hard, the freedom, creativity, and potential for success make it worth the effort. Every challenge you face is a learning opportunity that brings you closer to long-term success.

What is the hardest part of starting a business for you? Share your thoughts in the comments.

Looking for custom stickers for your small business? Check out BeaStickers.ca for high-quality, waterproof branding solutions.

7 notes

·

View notes

Text

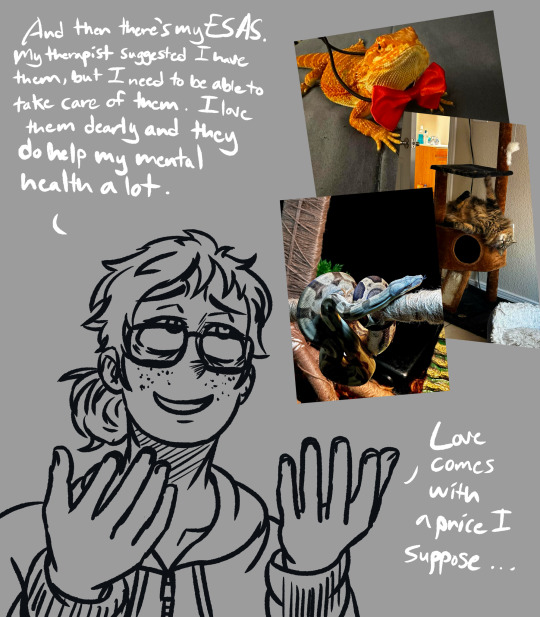

ZeStupidArt Artist Information:

The ZeStupid Corner Art Commissions & Pricing

Introduction:

Now I know I’m not a very big or popular artist, but it warms my heart to see that you all love my content and I wanted to make it official. I have opened commissions (correction I’ve always been open to commissions), but I want to be able to get paid for what I do. I love art and I love making you guys happy. I do way more than just digital art, so here’s my criteria.

Artist Commission Pricing:

Sketches: USD 10.00

Linework: USD 15.00

Full Colored Linework: USD 25.00

Full Detailed Artwork (Backgrounds etc.): USD 40.00

Comics: USD 10.00 - 30.00

Comics are uncolored.

Case-by-Case Artwork: I can work out a price depending on what you want and what I’m capable of.

Deadlines: I try to complete artwork within 15 days. I have life events and work a full-time job like most adults, so I have to work around this too.

Refunds: No refunds after we come to an agreement on what you want, and I have already completed the artwork.

You can find some of my work on these pages:

Redbubble: https://www.redbubble.com/people/ZeStupidAUs/shop?asc=u&ref=account-nav-dropdown

Tumblr: https://zestupidart.tumblr.com/

3-D Printing Pricing:

I have recently gotten into 3-D printing, specifically resin printing and I wanted to start implementing it more for business purposes. I will list some information on my 3-D Printer and the dimensions of what I can print if you’re interested.

3-D Printer Model:

Anycubic Mono X 6KS

3-D Printer Dimensions

Machine Dimensions:

417x290x260mm/

16.4x11.4x10.2 in.(HWD)

Printing Dimensions:

200x195.84x122.4mm/

7.8x7.7x4.8 in. (HWD)

3-D Print Resolution:

6K (5,760 x 3,600 pixels) resolution

Printing Speed:

15-60mm/h

Pricing: USD 15.00 – USD 200.00

Pricing will be case-by-case on this too. People usually charge for 3-D printing speed by the hour, but I am not so certain I would keep track of that, so I am making it case by case. A lot of things go into 3-D printing. The type of resin you use, the quality of the 3-D model, and the time it takes to make your vision a reality.

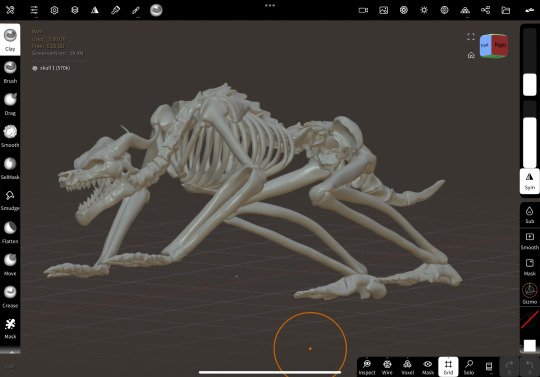

For example, I start this guy at USD 15.00 because he is a very detailed 3-D model on a small scale, plus I put so much detail into him:

Custom 3-D Model Commission Pricing:

3-D Model Pricing: USD 5.00 – USD 100.00

Most of my custom 3-D Models are made in Nomad Sculpt because I find it to be a very flexible and easy software to use. I have created such great content with it and would like to share my capabilities with you. I do create custom 3-D Models and sell .STL 3-D Model files over on my Etsy.

Etsy: https://www.etsy.com/your/shops/ZeStupidShop/tools/listings?ref=seller-platform-mcnav

These are also case-by-case.

Sources:

You can reach out to me at these sources:

https://www.redbubble.com/people/ZeStupidAUs/shop?asc=u&ref=account-nav-dropdown

https://zestupidart.tumblr.com/

https://www.reddit.com/user/EndPotential3659

https://www.etsy.com/shop/ZeStupidShop

https://twitter.com/ZeStupidArt

#the owl house#luz noceda#lumity#toh#amity blight#toh spoilers#comic#my art#original#zestupidart#steven universe#su#chainsaw man#fandom#art commisions#art commissions open#Etsy#redbubble

36 notes

·

View notes

Text

With Innrly | Streamline Your Hospitality Operations

Manage all your hotels from anywhere | Transformation without transition

Managing a hotel or a multi-brand portfolio can be overwhelming, especially when juggling multiple systems, reports, and data sources. INNRLY, a cutting-edge hotel management software, revolutionizes the way hospitality businesses operate by delivering intelligent insights and simplifying workflows—all without the need for system changes or upgrades. Designed for seamless integration and powerful automation, INNRLY empowers hotel owners and managers to make data-driven decisions and enhance operational efficiency.

Revolutionizing Hotel Management

In the fast-paced world of hospitality, efficiency is the cornerstone of success. INNRLY’s cloud-based platform offers a brand-neutral, user-friendly interface that consolidates critical business data across all your properties. Whether you manage a single boutique hotel or a portfolio of properties spanning different regions, INNRLY provides an all-in-one solution for optimizing performance and boosting productivity.

One Dashboard for All Your Properties:

Say goodbye to fragmented data and manual processes. INNRLY enables you to monitor your entire portfolio from a single dashboard, providing instant access to key metrics like revenue, occupancy, labor costs, and guest satisfaction. With this unified view, hotel managers can make informed decisions in real time.

Customizable and Scalable Solutions:

No two hospitality businesses are alike, and INNRLY understands that. Its customizable features adapt to your unique needs, whether you're running a small chain or managing an extensive enterprise. INNRLY grows with your business, ensuring that your operations remain efficient and effective.

Seamless Integration for Effortless Operations:

One of INNRLY’s standout features is its ability to integrate seamlessly with your existing systems. Whether it's your property management system (PMS), accounting software, payroll/labor management tools, or even guest feedback platforms, INNRLY pulls data together effortlessly, eliminating the need for system overhauls.

Automated Night Audits:

Tired of labor-intensive night audits? INNRLY’s Night Audit+ automates this crucial process, providing detailed reports that are automatically synced with your accounting software. It identifies issues such as declined credit cards or high balances, ensuring no problem goes unnoticed.

A/R and A/P Optimization:

Streamline your accounts receivable (A/R) and accounts payable (A/P) processes to improve cash flow and avoid costly mistakes. INNRLY’s automation reduces manual entry, speeding up credit cycles and ensuring accurate payments.

Labor and Cost Management:

With INNRLY, you can pinpoint inefficiencies, monitor labor hours, and reduce costs. Detailed insights into overtime risks, housekeeping minutes per room (MPR), and other labor metrics help you manage staff productivity effectively.

Empowering Data-Driven Decisions:

INNRLY simplifies decision-making by surfacing actionable insights through its robust reporting and analytics tools.

Comprehensive Reporting:

Access reports on your schedule, from detailed night audit summaries to trial balances and franchise billing reconciliations. Consolidated data across multiple properties allows for easy performance comparisons and trend analysis.

Benchmarking for Success:

Compare your properties' performance against industry standards or other hotels in your portfolio. Metrics such as ADR (Average Daily Rate), RevPAR (Revenue Per Available Room), and occupancy rates are presented in an easy-to-understand format, empowering you to identify strengths and areas for improvement.

Guest Satisfaction Insights:

INNRLY compiles guest feedback and satisfaction scores, enabling you to take prompt action to enhance the guest experience. Happy guests lead to better reviews and increased bookings, driving long-term success.

Key Benefits of INNRLY

Single Login, Full Control: Manage all properties with one login, saving time and reducing complexity.

Error-Free Automation: Eliminate manual data entry, reducing errors and increasing productivity.

Cost Savings: Pinpoint problem areas to reduce labor costs and optimize spending.

Enhanced Accountability: Hold each property accountable for issues flagged by INNRLY’s tools, supported by an optional Cash Flow Protection Team at the enterprise level.

Data Security: Protect your credentials and data while maintaining your existing systems.

Transforming Hospitality Without Transition

INNRLY’s philosophy is simple: transformation without transition. You don’t need to replace or upgrade your existing systems to benefit from INNRLY. The software integrates effortlessly into your current setup, allowing you to focus on what matters most—delivering exceptional guest experiences and achieving your business goals.

Who Can Benefit from INNRLY?

Hotel Owners:

For owners managing multiple properties, INNRLY offers a centralized platform to monitor performance, identify inefficiencies, and maximize profitability.

General Managers:

Simplify day-to-day operations with automated processes and real-time insights, freeing up time to focus on strategic initiatives.

Accounting Teams:

INNRLY ensures accurate financial reporting by syncing data across systems, reducing errors, and streamlining reconciliation processes.

Multi-Brand Portfolios:

For operators managing properties across different brands, INNRLY’s brand-neutral platform consolidates data, making it easy to compare and optimize performance.

Contact INNRLY Today

Ready to revolutionize your hotel management? Join the growing number of hospitality businesses transforming their operations with INNRLY.

Website: www.innrly.com

Email: [email protected]

Phone: 833-311-0777

#Innrly#Innrly Hotel Management Software#Bank Integrations in Hospitality Software#Tracking Hotel Compliance#hotel performance software#hotel portfolio software#Hotel Performance Management Software#hotel reconciliation software#Hotel Data Entry Software#accounting software hotels#hotel banking software#hospitality automated accounting software#hotel automation software hotel bookkeeping software#back office hotel accounting software#hospitality back office software#accounting hospitality software#Hotel Management Accounting Software#Hotel Accounting Software#Hospitality Accounting Software#Accounting Software for Hotels#Hotel Budgeting Software#Automate Night Audit Software#Automate Night Audit Process#Best Hotel Accounting Software#Best Accounting Software For Hotels#Financial & Hotel Accounting Software#Hospitality Accounting Solutions

2 notes

·

View notes

Text

Melio is a financial technology platform designed to streamline accounts payable and receivable processes for small and medium-sized businesses. It aims to simplify bill payments, improve cash flow management, and enhance overall financial operations. Here is a detailed review of its features and functionalities:

Key Features

Bill Payments:

Multiple Payment Methods: Melio allows businesses to pay vendors using ACH bank transfers, credit cards, or checks. This flexibility helps businesses manage cash flow and earn credit card rewards, even if the vendor only accepts checks. Schedule Payments: Users can schedule payments in advance, ensuring timely bill payments and avoiding late fees. Batch Payments: The platform supports batch payments, allowing users to pay multiple bills at once, saving time and reducing administrative burden.

Accounts Receivable:

Payment Requests: Businesses can send payment requests to customers via email, including a link for customers to pay directly through the platform.

Customer Management: Track customer payments, manage outstanding invoices, and automate reminders to improve collection rates.

Integration and Syncing:

Accounting Software Integration: Melio integrates with popular accounting software like QuickBooks, Xero, and FreshBooks, ensuring seamless data synchronization and reducing manual data entry.

Bank Integration: Direct integration with banks facilitates easy payment processing and reconciliation. User-Friendly Interface:

Dashboard: A clean and intuitive dashboard provides an overview of pending and completed payments, cash flow status, and upcoming bills.

Mobile Access: The platform is accessible via mobile devices, allowing users to manage payments and view financial data on the go.

Security and Compliance:

Secure Transactions: Melio employs robust security measures, including encryption and secure data storage, to protect user information and financial transactions.

Compliance: The platform adheres to financial regulations and industry standards, ensuring compliance with relevant laws.

Cash Flow Management:

Flexible Payment Options: By allowing credit card payments for bills, Melio helps businesses manage cash flow more effectively, providing the flexibility to defer payments while still meeting obligations.

Payment Scheduling: Advanced scheduling options enable better planning and control over outgoing cash flow.

Collaboration Tools:

Team Access: Multiple users can be granted access to the platform, allowing for collaborative financial management. Permission settings ensure that sensitive information is accessible only to authorized personnel.

Audit Trail: Detailed records of all transactions and activities help maintain transparency and accountability.

Pros Flexibility in Payments: The ability to pay bills via credit card, even when vendors don’t accept them, provides a unique advantage in managing cash flow and earning rewards. Ease of Use: The platform’s user-friendly interface and straightforward setup make it accessible for businesses of all sizes.

Integration with Accounting Software: Seamless integration with major accounting tools ensures accurate financial tracking and reduces manual workload.

Security: Strong security measures and compliance with industry standards provide peace of mind for users.

Batch Payments: Support for batch payments simplifies the process of paying multiple bills, saving time and reducing errors.

Cons Cost: While Melio offers a free version, certain advanced features and payment methods (like credit card payments) incur fees, which might be a consideration for cost-sensitive businesses. Limited Global Reach: Melio primarily serves businesses in the United States, which may limit its usefulness for companies with significant international operations or those based outside the U.S. Learning Curve for Advanced Features: Some users might find the advanced features complex initially, requiring time to fully utilize all functionalities.

Melio is a powerful and flexible tool for small and medium-sized businesses looking to streamline their accounts payable and receivable processes. Its ability to manage payments through various methods, integration with popular accounting software, and user-friendly design make it an attractive option for businesses aiming to enhance their financial operations. While there are costs associated with some features and a learning curve for advanced functionalities, the overall benefits, including improved cash flow management and operational efficiency, make Melio a valuable tool for modern businesses.

4 notes

·

View notes

Text

Understanding Petty Cash Reconciliation: A Quick Guide! 💸✨

Petty cash reconciliation might sound like a dry topic, but it’s essential for anyone managing small business expenses. Let’s break it down in an easy-to-understand way. 📚💡

What is Petty Cash?

Petty cash is a small amount of cash on hand used for minor business expenses, like buying office supplies or paying for a team lunch. Think of it as the business's wallet for everyday incidental costs. 👜💵

Why Reconcile Petty Cash?

Reconciliation ensures that all transactions are accurately recorded and the cash on hand matches the recorded amount. It helps in:

Preventing fraud

Ensuring accountability

Maintaining accurate financial records

Steps to Reconcile Petty Cash:

Count the Cash: Start by counting the cash remaining in the petty cash box. 🧮

Collect Receipts: Gather all receipts and vouchers that account for the money spent. Each expense should have a corresponding receipt. 📜✅

Summarize Expenses: List down all the expenses categorized by type (e.g., office supplies, travel expenses). Add up the total amount spent. 📝💰

Compare Totals: Compare the total of the receipts plus the remaining cash to the original petty cash amount. Ideally, they should match. 🧐🔍

Document Discrepancies: If there's a difference, document it and investigate. Common issues include missing receipts or errors in counting. 📊🔍

Adjust the Balance: If necessary, adjust the petty cash fund to reflect the actual cash on hand. This might involve adding more cash to the fund to restore it to its original amount. 🏦💼

Record in Ledger: Update the accounting ledger or software with the reconciled amount and note any discrepancies. This keeps your financial records accurate. 📈💻

Tips for Smooth Petty Cash Management:

Regular Reconciliation: Perform reconciliation regularly, ideally at the end of each week or month. ⏳✔️

Receipt Management: Ensure everyone who uses petty cash provides receipts for every transaction. 📸🗃️

Clear Policies: Establish clear guidelines on what petty cash can be used for and how to document expenses. 📜🖋️

Designate Responsibility: Assign a responsible person to manage and reconcile petty cash to maintain accountability. 🙋♂️🙋♀️

By keeping a close eye on petty cash, businesses can prevent misuse and ensure financial accuracy. Remember, it’s the small details that make a big difference in financial management! 🌟💼

Feel free to share your own tips and experiences with petty cash reconciliation! Let’s keep the conversation going. 🗣️👇

2 notes

·

View notes

Text

What are the best Plesk reseller hosting services?

Plesk Web Hosting uses a Plesk control panel to let you handle all aspects of your website hosting requirements, including DNS records, email addresses, domain names, and more. Plesk is an easy-to-use control panel that guarantees website security, automates server tasks, and supports both Linux and Windows hosting. Plesk is best suited for you if you need to manage your multiple customer accounts seamlessly and automate your admin functions.

Plesk reseller hosting: What is it?

In order to meet the requirements of individuals and businesses that want to administer multiple websites on a single platform, the Plesk reseller hosting platform offers a solution that is not only effective but also flexible. This particular hosting option is going to be highly appealing to web designers, web developers, and businesses that want to provide hosting services to their consumers but do not want to deal with the hassle of managing individual accounts.

Regardless of whether you handle a small number of domains or a large portfolio of websites, the user-friendly interface and wide feature set of Plesk make it simple to streamline your web hosting operations. This is true regardless of the magnitude of your website portfolio. This article will give you the knowledge you need to make decisions that are based on accurate information by delving into the most significant features, benefits, and best hosting service providers of Plesk reseller hosting.

The advantages of Plesk reseller hosting-

The Plesk reseller hosting platform offers a plethora of benefits, which makes it an enticing option for online professionals who have extensive experience in the field. One of the most important aspects of this product is the fact that it has a user-friendly design, which makes it simpler to manage a variety of websites and accounts.

Customers have the ability to effortlessly manage databases, email accounts, and domains with the help of Plesk, which features an interface that is simple to use. Furthermore, the reseller plans include support for an unlimited number of domains. This enables resellers to provide their customers with the most affordable hosting pricing possible for multi-domain publishing operations.

Using this cloud management platform comes with a number of important benefits, one of which is the complete security measures that are built into Plesk. These features include firewalls, intrusion detection, and antivirus protection. These qualities assist in the safety of websites against the dangers that can be found on the internet.

As an additional benefit, Plesk is compatible with a wide range of applications and extensions, which enables customers to customize their hosting environment to meet the specific needs of their businesses.

Plesk reseller hosting gives resellers the ability to create unique hosting packages, efficiently allocate resources, and deliver dependable services to their customers. This is made possible by the usage of Plesk. As a consequence of this adaptability, scaling and expanding the hosting business is a far simpler process.

Features of Plesk reseller hosting-

Security features

Plesk reseller hosting has many security tools to protect your hosting environment. Firewalls in Plesk prevent unwanted access and cyberattacks. The software also supports SSL certificates for encrypted server-client communication. Intrusion detection and prevention systems in Plesk monitor for suspicious activity and automatically mitigate threats.

Antivirus and anti-spam capabilities are incorporated to safeguard your email services from dangerous assaults and undesirable information. Regular security updates and patches are provided to maintain the system's security against current vulnerabilities. Plesk lets you create user roles and permissions to restrict authorized users' access to sensitive control panel areas.

User-friendly interface

One of the major characteristics of Plesk reseller hosting is its user-friendly interface. Plesk's control panel is simple and efficient, even for web hosting beginners. Domain management, email configuration, and database administration are easily accessible from the dashboard. As a complete WordPress site update, security, and management solution, the WordPress Toolkit improves user experience. Users may manage their hosting environment right away, thanks to this simplified UI.

Plesk lets users customize the dashboard to their preferences and workflow. Additionally, the responsive design guarantees that the interface is accessible and functioning across many devices, including PCs, tablets, and smartphones. The Plesk reseller hosting interface makes managing multiple websites and customer accounts easy and boosts productivity.

Performance and reliability

Performance and reliability are key to Plesk reseller hosting. Compared to typical shared hosting, reseller hosting offers better scalability and control, making it a more powerful choice for managing several websites. User satisfaction and SEO rankings depend on fast loading times and high uptime, which the platform optimizes. Plesk optimizes server performance with smart caching and resource management. Plesk websites perform well even during traffic spikes with minimal downtime.

Plesk also enables load balancing and clustering to spread traffic between servers. Having no single server bottleneck improves dependability. The platform’s solid architecture also features automatic backups and restoration capabilities, providing peace of mind that your data is safe and can be retrieved promptly in case of an incident. These performance and stability characteristics make Plesk reseller hosting a reliable alternative for administering several websites, giving your clients continuous service.

Expanding your company's reseller hosting operations-

Scaling your services

Growing your business requires scaling your Plesk reseller hosting services. Start by evaluating your current resource utilization and discovering any restrictions in your existing configuration. To handle traffic and data storage, you may need to modify your hosting plan or add servers as your client base expands. Plesk lets you add CPU, memory, and bandwidth to customer accounts for easy scaling. Load balancing and clustering can also evenly distribute traffic across servers for better performance and reliability.

Consider broadening your service offerings by introducing new features such as better security solutions, premium assistance, or specialized hosting plans for specific sectors. To match client needs and industry developments, regularly review and update hosting packages. Scaling your services efficiently lets you accommodate customer growth while retaining performance and dependability.

Effective marketing strategies

Effective marketing strategies are crucial for expanding your Plesk reseller hosting business. Determine your target audience—small businesses, bloggers, or e-commerce sites—and personalize your marketing to them. Explain Plesk reseller hosting benefits in blog posts, tutorials, and guides. This draws customers and establishes your hosting authority. Social networking can expand your audience. To develop trust, provide updates, promotions, and client testimonials.

Email marketing campaigns with unique discounts or new features can also be beneficial. To increase your website's exposure to search engines, you should also spend money on search engine optimization or SEO. To draw in organic traffic, use keywords such as Plesk reseller hosting. In order to broaden your reach, lastly, think about forming alliances or working together with web developers and agencies. By putting these marketing ideas into practice, you can increase your clientele and income dramatically.

For better value, bundle

Another efficient strategy to expand margins and stand out is by combining domains with critical web services. Besides delivering additional value to your consumer, bundling also boosts the average order value, which is vital in a market with intrinsically tiny per-product margins.

Web hosts frequently purchase SSL certificates, DDoS protection, email services, and CDNs as part of bundles. Although popular, these products are highly competitive. Besides bundling products, you might offer specialist products like DMARC or VPN services that your competitors may not offer.

Improving customer satisfaction

Enhancing customer experience is important to the success of your Plesk reseller hosting business. Start by giving your clients an easy-to-use control panel for managing their websites, email, and other services. Comprehensive documentation and tutorials can help clients solve common problems on their own. Give customers several support channels, including live chat, email, and phone, and answer questions quickly. Call clients by name and understand their needs.

Request feedback via surveys or direct communication to identify areas for improvement. Furthermore, providing value-added services like performance optimization, security upgrades, and automated backups can greatly enhance the general clientele experience. Providing customers with information about upgrades, new features, and maintenance plans fosters openness and confidence. By focusing on client satisfaction, you may develop long-term connections and drive favorable word-of-mouth referrals.

Best Plesk reseller hosting service providers-

MyResellerHome

One of the most well-known resale hosts is MyResellerHome. Every reseller plan from MyResellerHomecomes with a free domain broker and a free domain name for life. MyResellerHome has a great name for being innovative, dependable, and safe. This is important when you agree to be a reseller for a long time with a company. It is known to release new versions of PHP and MySQL faster than other hosts. With white-label billing, you can give your customers this benefit. A free WHMCS and cPanel license comes with most of MyResellerHome’s Hosting reselling plans.

AccuWebHosting

AccuWebHosting takes the tried-and-true approach of giving shared Linux reseller accounts cPanel and shared Windows reseller accounts Plesk. Although AccuWebHosting has a lot of great features like shared Linux and Windows servers and Windows VPS servers, dealers really like the company's hardware, data center engineering, and customer service.

ResellerClub

ResellerClub's plans come with the Plesk control panel, and you can choose from three different registration options: WebAdmin, WebPro, or WebHost. Business owners who want to run a shared Windows server environment can get Windows reseller products that come with an endless number of Plesk control panels.

InMotionHosting

In its reseller hosting plans, InMotion Hosting gives you a free WHMCS license. These plans use the same NVMe SSD hardware that a lot of users swear by. At InMotion Hosting, there are four main levels of reseller bills that go up to 100 cPanel licenses.

Conclusion-

When looking for the best Plesk reseller hosting, stability, performance, scalability, and support are crucial. Each hosting provider has unique characteristics, and choosing one that meets your demands can greatly impact your reseller business. After careful consideration, MyResellerHome is the best Plesk reseller hosting option. MyResellerHome is the top Plesk reseller provider, giving you the tools and resources to succeed in the hosting industry with its powerful infrastructure, excellent customer service, and extensive range of reseller-focused features.

Janet Watson

MyResellerHome MyResellerhome.com We offer experienced web hosting services that are customized to your specific requirements. Facebook Twitter YouTube Instagram

1 note

·

View note

Text

Best Billing Machines in India

Effectiveness in transactions is essential in the busy realms of commerce and retail. Billing machines, a crucial tool in this process, have advanced significantly over time, with UDYAMA POS setting the standard in India. This article highlights UDYAMA POS's ground-breaking position in the industry while examining the innovations, customer satisfaction, and variety of (Best Billing Machines in India) that are supplied. (Best Billing Machines in Delhi) are essential for streamlining billing processes because they provide cutting-edge functionality catered to various corporate requirements. The choice of billing machines can have a big impact on revenue creation and productivity for businesses of all sizes, from small merchants to multinational corporations.

Considering the Value of Billing Equipment

Competent billing is the foundation of any flourishing company. For any type of business—retail, dining, or service—accurate and timely invoicing is essential to preserving both the company's finances and its reputation with clients. This procedure is automated using billing machines, which streamlines transactions and lowers the possibility of errors. Contemporary billing machines enable organizations to improve operational efficiency and concentrate on their core competencies by providing functions such as inventory management, sales analysis, and tax calculation.

Essential Factors to Take-into-Account:

Creative Software for Billing:

Linked billing software is the cornerstone of modern billing systems. Look for systems with powerful reporting features, user-friendly interfaces, and customizable invoice templates. These features simplify the process of creating invoices and provide useful information on sales patterns and inventory management.

Choices for Internet Access:

In today's networked environment, billing machines with several connectivity options are more versatile and easy. Bluetooth and Wi-Fi enabled devices facilitate seamless communication with other corporate systems, allowing for real-time data synchronization and remote management.

Reliable Payment Processing:

Security is essential while processing financial transactions. Choose billing machines with robust encryption features and PCI-compliant payment processing services installed. This ensures the confidentiality and integrity of client data while lowering the risk of fraud and data breaches.

Design compactness and portability:

Small, portable billing devices are ideal for businesses with limited space or that are mobile. Look for portable devices with long-lasting batteries and sturdy construction. This simplifies invoicing in a number of contexts, including shop counters and outdoor events.

Possibility of Development and Enhancement:

Invest in scalable and easily upgraded invoicing solutions to accommodate future business growth and changing needs. Modular systems with interchangeable parts facilitate the easy integration of additional features as your business expands.

UDYAMA Point of Sale Advantages

The Indian billing machine market has seen a radical transformation thanks to UDYAMA POS's state-of-the-art technology and customer-focused mentality. A selection of models designed to satisfy particular business needs are available from UDYAMA POS. These approaches have improved the checkout experience for customers while also increasing operational efficiency.

There are many different types of billing machines available on the market, ranging from sturdy desktop models for high-volume organizations to portable devices for transactions while on the go. Every kind has distinctive qualities designed for particular commercial settings, which emphasizes how crucial it is to choose a machine that fits your operational requirements.

Features of a Billing System to Take-into-Account

Durability, connectivity choices, and convenience of use are important factors to take-into-account when selecting a billing machine. A machine that performs well in these categories can significantly improve business operations by facilitating faster and more dependable transactions.

(Best UDYAMA POS Billing Machine) Models

A range of models that are notable for their cost, dependability, and functionality are available from UDYAMA POS. With the help of this section's thorough analysis of these best models, you can make an informed choice depending on your unique business needs.

How to Choose the Right Invoicing Equipment

When choosing a billing machine, it's important to evaluate your company's needs, budget, and the features that are most important to your daily operations. This guide provides helpful guidance to assist you in navigating these factors.

Benefits of Changing to a Modern Billing System

Modern billing systems, such as those provided by UDYAMA POS, can greatly improve customer satisfaction and efficiency. The several advantages of performing such an upgrade are examined in this section, ranging from enhanced client satisfaction to streamlined operations.

Advice on Installation and Upkeep

Making sure your billing machine is installed correctly and receiving routine maintenance is essential to its longevity and dependability. Important setup and maintenance advice for your new gadget is included in this section.

Field Research: UDYAMA POS Success Stories

The revolutionary effect of UDYAMA POS billing devices on businesses is demonstrated by actual success stories from the retail and hospitality industries. These case studies demonstrate how businesses have benefited from increased customer satisfaction and operational efficiency thanks to UDYAMA POS technology.

All products in the Billing Machine are:

(Handy POS Billing Machine)

(Android POS Billing Machine)

(Windows POS billing Machine)

(Thermal Printer Machine)

(Label Printer Machine)

Enhancing Efficiency with Best Billing Machines in India:

The adoption of the (best billing machines in Noida) has revolutionized the way businesses manage their finances. These advanced solutions offer a myriad of benefits, including:

Simplified Billing Procedures: By automating invoice generation and payment retrieval, billing procedures are made more efficient and less prone to human error and delay.

Enhanced Accuracy: Up-to-date billing software guarantees precise computations, removing inconsistencies and billing conflicts.

Improved Customer Experience: Easy and quick transactions increase client happiness and loyalty and encourage recurring business.

Real-Time Insights: Rich reporting tools offer insightful information on inventory control and sales performance, facilitating well-informed decision-making.

Observance of Regulatory Mandates: Pre-installed compliance tools guarantee that financial reporting requirements and tax laws are followed, lowering the possibility of fines and audits.

Frequently Asked Questions:

Are billing systems appropriate for all kinds of companies?

Absolutely! Billing machines come in various configurations and are tailored to suit the needs of diverse businesses, from small retailers to large enterprises.

Can billing devices accept several forms of payment?

Yes, most modern billing machines support multiple payment options, including cash, credit/debit cards, mobile wallets, and online payments.

How frequently should the software on billing machines be updated?

It's recommended to update billing machine software regularly to ensure optimal performance, security, and compatibility with the latest regulations and technologies.

Do billing machines need to be connected to the internet?

While internet connectivity is not mandatory for basic billing operations, it may be necessary for accessing cloud-based features, software updates, and remote management capabilities.

Is it possible to link accounting software with billing machines?

Yes, many billing machines offer integration with popular accounting software packages, facilitating seamless data transfer and reconciliation.

Are POS terminals easy to use?

Most billing machines are designed with ease of use in mind, featuring intuitive interfaces and straightforward setup processes. Training and support are typically provided to ensure smooth adoption and operation.

UDYA MA POS, a business renowned for its wide range of products, innovative solutions, and happy clients, is the result of searching for the (best billing machines in India). Considering how organizations are always changing, choosing the right billing system is essential. Thanks to its commitment to quality and innovation, UDYAMA POS is a leader in the billing machine industry, ensuring that transactions will become more streamlined, dependable, and fast in the future. The strategic decision to invest in the (top billing machines in Gurgaon) could have a significant effect on businesses of all kinds. These innovative solutions help organizations thrive in the present competitive market by streamlining billing processes, increasing precision, and providing insightful data.

Regardless of the size of your business, selecting the correct billing equipment is critical to increasing productivity and spurring expansion.

Visit the website for more information: www.udyamapos.com

2 notes

·

View notes

Text

Reach Financial Accuracy with Our Advanced Accounting Tools

Financial accuracy is the key to informed decision-making and sustainable growth in today's fast-paced business world. TRIRID Accounting and Billing Software provides cutting-edge tools to ensure precision, streamline processes, and eliminate errors.

Key Features of Our Advanced Accounting Tools:

Automated Calculations

Eliminate manual errors. Our software automates complex calculations, saving time and improving accuracy.

Real-Time Data Synchronization

Access current financial data across devices, ensuring consistency and reliability in all your reports.

Customizable Invoicing & Billing

Create professional GST-compliant invoices with ease, all in a few clicks.

Multi-Currency Support

Simplify international transactions with powerful multi-currency functionality.

Tax Compliance Made Easy

Keep track of GST and other tax obligations with automated tax calculations and reports.

Benefits for Your Business:

Error-Free Reporting: Detailed and accurate financial statements.

Improved Efficiency: Remove tedious tasks and focus on business growth.

Compliance Made Easy: Ensure all legal compliances are met.

Scalable Solutions: Adapt to the needs of businesses regardless of size.

Why Choose TRIRID?

Backed by businesses across industries, TRIRID Accounting and Billing Software is user-friendly with mighty functionalities. Our aim is to make your financial functions as simple as possible to enable you to focus more on what matters most-your business.

Experience the financial accuracy that you've always wanted. TRIRID will help take control of accounting processes. Reach out today to get a free demo!

Call @ +91 8980010210 / +91 9023134246

Visit @ https://tririd.com/tririd-biz-gst-billing-accounting-software

#TRIRID Biz Accounting and Billing Software#Best Accounting Software In India#advanced accounting tools#Top 10 Easy To Use Billing and Invoicing Software in India#GST Billing Software for Small Businesses in India

0 notes

Text

In the dynamic landscape of Indian business, efficient financial management is key. Gbooks emerges as the beacon, offering a comprehensive suite of accounting solutions tailored to Indian enterprises. From seamless invoicing to robust expense tracking, it simplifies complexities. Its user-friendly interface ensures accessibility for all, while its powerful features cater to diverse needs. With customizable reports and real-time insights, decision-making becomes intuitive. Gbooks not only streamlines operations but also fosters growth through informed strategies. Embrace the future of accounting with Gbooks, your trusted partner in navigating the intricacies of Indian finance.

#Best Accounting Software in India#free online accounting software#easy accounting software#free accounting software#best accounting software#best accounting software for small business#accounting software

0 notes

Text

Bookkeeping Mistakes Made By Small Businesses: How To Avoid Them

Small and Medium-sized businesses are eager to grow, but they often miss the fundamentals like understanding the value of Bookkeeping which may undermine business procedures.

Accounting is often overlooked by business owners who consider it easy. Incorrect accounting and bookkeeping processes may adversely impact any company’s finances. Recurring bookkeeping errors can actually bankrupt your business.

Bookkeeping Mistakes

Keeping financial records is a very important part of running a business, big or small. Bookkeeping that is accurate and well-organized makes sure that your financial records are up-to-date and precise, which helps you make good decisions and compliance with legal policies.

There are however some mistakes that small businesses often make with their books. Here are some of these mistakes.

Failure To Keep Records

Some small businesses fail to keep accurate financial records, which can lead to confusion and errors. Record-keeping is an essential process in organizing your financial records. Adopt best practices and create a system for organizing and storing your financial documents. These relevant documents may include invoices, receipts, and bank statements. It is helpful to consider using accounting software to automate the process and centralize everything.

Irregular Reconciling of Accounts

Failure to reconcile your bank and credit card accounts on a regular basis can lead to inconsistencies and inaccuracies. Reconciliation entails matching your financial records with your bank and credit card statements. Reconcile your accounts on a regular basis and resolve any discrepancies quickly to avoid problems.

Combining Personal and Business-Related Finances

It is critical to separate your personal and business finances by avoiding using personal accounts for business transactions. This can complicate bookkeeping and make it difficult to accurately track expenses and income. You must establish a separate business bank account and use it solely for business transactions.

Inconsistent Categorization

It is critical to properly categorize your income and expenses for accurate financial reporting. Refrain from inconsistent or ambiguous categorization, as it can make evaluating of your company’s financial health a lot more difficult. It will be helpful to create a chart of accounts with distinct categories that correspond to your field of business and use it regularly.

Neglecting Cash Transactions

Small businesses often transact in cash, which can be overlooked easily and not properly recorded. To ensure that cash transactions are accurately accounted for, use cash registers, petty cash logs, or digital tools. Better yet, set up a system for keeping track of and documenting all cash transactions, including sales and expenses.

Failure To Keep Track of Receivables and Payables

Failure to maintain track of unpaid invoices (accounts receivable) and bills to be paid (accounts payable) might jeopardize your cash flow and client-vendor relationships. Use accounting software with invoicing and payment tracking features to implement a structured strategy for monitoring and following up on both receivables and payables.

Mishandling Payroll

Payroll can be complicated, and mistakes can have legal and financial ramifications. Keep up with advances in payroll requirements, calculate wages and taxes accurately, and make timely payments to employees and tax authorities. To ensure accuracy and compliance, consider adopting efficient payroll software or you can also outsource payroll duties.

Failure To Keep Backup of Records

Financial records might be lost because of corrupted data, hardware failure, or other unanticipated factors. Back up your financial data on a regular basis and keep it secure. Cloud accounting software can back up your data automatically to add an extra degree of security.

Neglect To Track and Remit Sales Taxes

If your company is obligated to collect sales taxes, it is critical that you track and remit them appropriately. Understand your sales tax duties, register with the proper tax authorities, and maintain accurate sales and tax collection records. To simplify the process, consider employing seamless sales tax automation software.

Doing-It-Yourself

This is a critical error that can have serious consequences for your company. Because bookkeeping is a complex process, it is best to seek professional help from a bookkeeper or accountant to set up and review your bookkeeping system on a regular basis. They can assist you in avoiding mistakes, providing financial insights, and ensuring tax compliance.

You can reduce the likelihood of these frequent errors and retain accurate financial records for your small business by being proactive and following appropriate bookkeeping practices with the help of expert bookkeepers and record-keepers.

How to Avoid Bookkeeping Errors

To avoid bookkeeping errors some proactive steps must be taken by small business owners. This may include familiarizing yourself with basic bookkeeping principles and practices to help you navigate your financial records effectively and make informed decisions.

This can be further established by using a good bookkeeping system coupled with reliable accounting software. As a business owner, it is important to invest in a reputable accounting software solution that suits the needs of your business and reduces errors.

In addition, it is important to reconcile accounts regularly to ensure your financial records match financial statements to help identify discrepancies and errors promptly.

Keep meticulous records by maintaining detailed records of all financial transactions and accept that it is always best to seek professional assistance from reliable bookkeepers and record-keepers who specializes in small business finances.

By implementing these practices, small business owners can reduce the likelihood of committing bookkeeping errors while maintaining accurate financial records.

The Bottomline

When you own a company, you put yourself in a position to take advantage of many different possibilities, including the chance to learn from your errors. When it comes to making mistakes, the key to success is to steer clear of those that are readily apparent and cut down on others as much as you possibly can. Remember that good bookkeeping and record-keeping practices contribute to informed decision-making and long-term business success.

Consider this list seriously and implement its suggestion so you will be well on your way to running your business in profitable ways and expanding it in all ways possible.

There is more that you can achieve with the most reliable team of professional bookkeepers and record-keepers. Visit us now and get started!

#bookkeepingservicesca#recordkeepingcalifornia#smallbusinesssolutionsca#healthcaresupport#healthcare bookkeeping#cpa firm

7 notes

·

View notes

Text

What is the best web-based enterprise accounting software?

In the fast-paced and ever-evolving landscape of business, staying on top of your finances is crucial. As enterprises expand their operations, managing accounts efficiently becomes a daunting task. Thankfully, with the advent of technology, businesses now have access to a plethora of web-based enterprise accounting software options to streamline their financial processes. In this comprehensive guide, we will explore the ins and outs of web-based enterprise accounting software, helping you make an informed decision on the best solution for your business needs.

Understanding Web-Based Enterprise Accounting Software

Web-based enterprise accounting software, often referred to as cloud accounting software, is a digital solution that allows businesses to manage their financial activities online. Unlike traditional accounting systems that rely on on-premise software, web-based accounting tools operate in the cloud, offering users the flexibility to access their financial data from anywhere with an internet connection.

Advantages of Web-Based Enterprise Accounting Software

1. Accessibility

One of the primary advantages of web-based accounting software is accessibility. With data stored securely in the cloud, users can access their financial information anytime, anywhere. This proves especially beneficial for enterprises with multiple locations or remote teams, fostering collaboration and efficiency.

2. Cost Efficiency

Web-based accounting solutions often follow a subscription-based model, eliminating the need for costly upfront investments in software and hardware. This cost-effective approach makes it easier for businesses to scale their accounting infrastructure according to their needs without breaking the bank.

3. Real-Time Updates

In the dynamic world of business, real-time data is invaluable. Web-based accounting software provides instant updates, ensuring that users have access to the most recent financial information. This feature is crucial for making informed decisions and adapting to market changes promptly.

4. Automatic Updates and Maintenance

Gone are the days of manual software updates and maintenance. With web-based accounting solutions, updates are automatic, and maintenance is handled by the service provider. This frees up valuable time for businesses to focus on core operations rather than managing software updates.

Features to Look for in Web-Based Enterprise Accounting Software

1. User-Friendly Interface

A user-friendly interface is essential for ensuring that your team can navigate the software seamlessly. Look for solutions with intuitive dashboards and easy-to-understand features to minimize the learning curve for your staff.

2. Scalability

As your enterprise grows, so do your accounting needs. Choose a web-based accounting solution that can scale with your business, accommodating increased transaction volumes and additional users without compromising performance.

3. Integration Capabilities

Efficient accounting doesn't happen in isolation. Ensure that the web-based accounting software you choose integrates seamlessly with other essential business tools, such as CRM systems, project management software, and e-commerce platforms.

4. Security

The security of your financial data should be a top priority. Opt for web-based accounting software that employs robust encryption protocols and follows industry best practices for data protection. Additionally, check for features such as multi-factor authentication to add an extra layer of security.

Top Contenders in the Web-Based Enterprise Accounting Software Market

1. MargBooks

MargBooks Online is a India's popular online accounting solution known for its user-friendly interface and robust features. It offers a range of plans to suit businesses of all sizes and provides tools for invoicing, expense tracking, and financial reporting.

2. Xero

Xero is another cloud accounting software that caters to small and medium-sized enterprises. With features like bank reconciliation, inventory management, and payroll integration, Xero is a comprehensive solution for businesses looking to streamline their financial processes.

3. NetSuite

NetSuite, owned by Oracle, is a cloud-based ERP (Enterprise Resource Planning) solution that includes robust accounting functionalities. It is suitable for larger enterprises with complex financial needs and offers features such as financial planning, revenue recognition, and multi-currency support.

4. Zoho Books

Zoho Books is part of the Zoho suite of business applications and is designed for small and medium-sized enterprises. It provides features such as automated workflows, project billing, and collaborative client portals, making it a versatile choice for businesses with diverse needs.

Making the Right Choice for Your Business

Choosing the best web-based enterprise accounting software for your business requires careful consideration of your specific needs and objectives. Here are some steps to guide you through the decision-making process:

1. Assess Your Business Requirements

Start by identifying your business's specific accounting requirements. Consider factors such as the number of users, the complexity of your financial transactions, and the need for integration with other business applications.

2. Set a Budget

Determine a realistic budget for your accounting software. While web-based solutions often offer cost savings compared to traditional software, it's essential to choose a solution that aligns with your financial resources.

3. Explore Free Trials

Many web-based accounting software providers offer free trials of their platforms. Take advantage of these trials to explore the features and functionalities of different solutions before making a commitment.

4. Seek Recommendations and Reviews

Consult with other businesses in your industry or network to gather recommendations and insights. Additionally, read reviews from reputable sources to gain a better understanding of the user experiences with different accounting software options.

The Evolution of Web-Based Enterprise Accounting Software

As technology continues to advance, so does the landscape of web-based enterprise accounting software. The evolution of these platforms is driven by the ever-changing needs of businesses and the ongoing developments in cloud technology. Let's delve deeper into the evolving trends shaping the future of web-based accounting solutions.

1. Artificial Intelligence (AI) and Automation

The integration of artificial intelligence and automation is revolutionizing how businesses handle their financial processes. Modern web-based accounting software is incorporating AI algorithms to automate repetitive tasks, such as data entry and invoice categorization. This not only increases efficiency but also minimizes the risk of human error.

2. Enhanced Data Analytics

In the age of big data, the ability to derive meaningful insights from financial data is paramount. Advanced web-based accounting solutions are now equipped with powerful data analytics tools. These tools help businesses analyze trends, forecast future financial scenarios, and make data-driven decisions.

3. Mobile Accessibility

The shift towards mobile accessibility is a notable trend in web-based enterprise accounting software. Businesses are increasingly relying on mobile devices for day-to-day operations, and accounting software providers are responding by offering mobile-friendly applications. This allows users to manage their finances on the go, providing unparalleled flexibility.

4. Integration with E-Commerce Platforms

As e-commerce continues to thrive, businesses are looking for accounting solutions that seamlessly integrate with their online sales platforms. Modern web-based accounting software often includes features tailored for e-commerce, such as automated transaction reconciliation with online sales channels and inventory management.

5. Blockchain Technology

Blockchain technology is making waves in various industries, and accounting is no exception. Some web-based accounting solutions are exploring the integration of blockchain for enhanced security and transparency in financial transactions. This could revolutionize how businesses handle aspects like auditing and transaction verification.

Common Challenges and How to Overcome Them

While web-based enterprise accounting software offers numerous benefits, it's important to be aware of potential challenges and how to overcome them. Here are some common issues businesses may face:

1. Security Concerns

The sensitive nature of financial data raises concerns about security in the cloud. To address this, choose a web-based accounting solution that employs robust encryption protocols and complies with industry security standards. Additionally, educate your team about best practices for secure online behavior.

2. Connectivity Issues

Reliable internet connectivity is crucial for accessing web-based accounting software. In regions with unstable internet connections, businesses may face challenges in real-time collaboration and data accessibility. Consider implementing backup solutions for offline access or explore accounting software with offline capabilities.

3. Customization Needs

Every business has unique accounting requirements. Some businesses may find that certain web-based accounting solutions lack the level of customization they need. In such cases, explore platforms that offer extensive customization options or consider integrating additional specialized accounting tools.

4. Data Ownership and Control

Understanding the terms of service and data ownership is essential when using web-based accounting software. Ensure that the chosen platform allows you to retain control over your financial data and provides mechanisms for data export in case of migration to a different system.

Conclusion: Making the Right Choice for Long-Term Success