#deficit financing

Explore tagged Tumblr posts

Text

Learn more from our newest video essay.

118 notes

·

View notes

Video

youtube

WATCH: GOP Rep. Schweikert urges Congress to avoid 'financial armageddon'

GOP Rep. David Schweikert of Arizona criticized Republican plans for the national debt and spending cuts on the House floor Friday, urging Congress to avoid a "financial armageddon."

In a passionate speech, Schweikert emphasized the difficulty of cutting federal spending and that current plans to go after certain programs that are oft discussed by members of his party aren't going to change the financial landscape as much as promised.

"If you get rid of the Department of Education salaries ... you just covered nine hours of borrowing," he said.

He also added that eliminating foreign aid would only cover a week of borrowing. "Am I starting to make a point on the scale of what we have to actually tell the truth and deal with," he asked.

This is against the landscape that President Donald Trump has centered federal spending in the creation of the Department of Government Efficiency, or DOGE, led by Elon Musk.

#us politics#Congress#finance#federal deficit#us news#PBS#PBS Newshour#David Schweikert#House of Representatives#us economy#Trump#Elon Musk#DOGE

12 notes

·

View notes

Text

work wants us to do an mbti test for our upcoming retreat..... i cannot express just how useless and a waste of money this will be

#this is why we're in deficit btw#stupid frivolous shit like this#ironic considering we are literally the admin and finance division#g.txt

6 notes

·

View notes

Text

“Things come apart so easily when they have been held together with lies." - Dorothy Allison

“Five ways to fix the £40bn hole in UK’s public finances.” (FT: 18/10/22)

“Fast-rising borrowing costs putting UK public finances at greater risk, warns OBR.” (Guardian: 13/07/23)

“Britain’s debt timebomb is about to explode – and politicians are too timid to defuse it.” (The Telegraph: 09/12/23)

“The Institute for Fiscal Studies (IFS) suggested some government departments could see cuts of between £10bn and £20bn – something Labour was reluctant to engage with during the election campaign." (BBC News: 27/07/24)

Given that the above news outlets – along with many others – have been telling us about the hole in UK public sector finances for at least 2 years why does it seem to have come as a great shock to Rachel Reeves?

“Chancellor Rachel Reeves said there was a £22 billion black hole in the public finances as she accused the Tories of covering up the scale of the problems.” (Northwich & Winsford Guardian: 29/07/24)

Either Rachel Reeves does not read official financial reports (in which case why is she Chancellor of the Exchequer) - or she is simply lying. I suspect the latter. This is what fullfact.org had to say:

“The IFS says many of the challenges Labour outlined this week were “entirely predictable”, and during the election campaign the think tank said that a new government would likely see a shortfall of £10-£20 billion by 2028/29.” (30/07/24)

How disappointing that Starmer’s Labour Government has the same relationship with the truth as the Tories - utter distain!

5 notes

·

View notes

Text

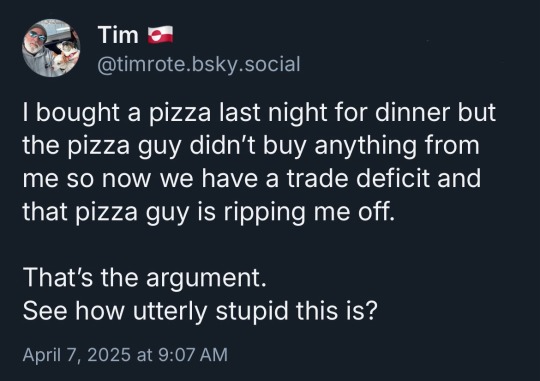

Except it is even more egregious, because you paid the pizza guy in your currency. Therefore the pizza guy is now interested in the currency they hold retaining its value. And because you are such a stable, reliable customer, the pizza guy will now go to you to get money just for the purposes of getting other customers who are not as reliable to pay with your money instead of theirs. And this further stabilizes the value of the money you print against other people printing their own money.

1K notes

·

View notes

Text

OP-ED: The Vanishing Surplus — How Wes Moore Let Maryland’s Budget Fall Off a Cliff

Not long ago, Maryland’s finances were the envy of the region. Former Governor Larry Hogan, despite fierce opposition from a Democratic-controlled legislature, managed to keep the state’s fiscal house in order—holding the line on taxes, building a surplus, and maintaining Maryland’s AAA bond rating. His administration’s approach was simple: balance the books, spend wisely, and resist the urge to…

#Annapolis#budget deficit#economic policy#failed leadership#fiscal mismanagement#government spending#investigative op-ed#Kirwan Commission#Larry Hogan#Maryland budget#Maryland surplus#political cartoon#political leadership#progressive spending#public finance#state debt#state government#state politics#taxpayer accountability#Wes Moore

0 notes

Text

UK Chancellor Rachel Reeves faces bad news on the public finances and economic growth

This morning has brought news that brings several of our themes into play. For some time now I have been pointing out that the Western democracies have become fiscally spendthrift and addicted to deficits. The additional nuance came post Covid as one might think that there would be some retrenchment after the Helicopter Money splurge that was supposed to be a one-off. But instead governments…

#Bank of England#bond yields#business#Debt Costs#Debt Interest#Economics#economy#Finance#First Rule of OBR Club#Fiscal Deficit#GDP#labour-party#news#OBR#politics#Public Finances#public sector pay rises#UK#UK Chancellor Rachel Reeves

0 notes

Text

youtube

0 notes

Text

Dazi USA, crollo dei mercati e rischi per le filiere globali. Ubaldo Livolsi analizza la crisi e invita UE e Italia a puntare su Asia, Africa e storytelling del Made in Italy. Scopri di più su Alessandria today.

#Alessandria today#bilancia commerciale#BRICS#consumo interno#Corporate Finance#crisi delle supply chain#crisi di Wall Street#crisi economica globale#crollo delle Borse#dazi su Cina#dazi su Europa#dazi Trump#Dazi Usa#deficit pubblico#economia internazionale#economia italiana#eurozona#export agroalimentare#export in Africa#export in Asia#export italiano#filiere produttive#geopolitica economica#Globalizzazione#Google News#internazionalizzazione PMI.#investimenti pubblici#italianewsmedia.com#Lava#Livolsi & Partners

0 notes

Text

youtube

Get Busy Living or Get Busy Dying: Finance Philosophy Explained by The Shawshank Redemption

The Shawshank Redemption as an extended metaphor for the deficit prison you're trapped in? It's more likely than you think.

Did we just help you out? Say thanks on Patreon!

#debt#deficit#movies#the shawshank redemption#tortured metaphors#personal finance#money#capitalism#Youtube

19 notes

·

View notes

Text

Babylon Bee - Republicans Clarify That Deficit Spending Only A Problem When Democrats Do It:

ProfligateSpending #DeficitSpending #Deficit #Spending #FederalBudget #Budget #NationalDebt #Debt #Bankruptcy #BlameGame #Hypocrisy #Finance #Humor

#profligatespending#deficitspending#deficit#spending#federalbudget#budget#nationaldebt#debt#bankruptcy#blamegame#hypocrisy#finance#humor

0 notes

Text

India's Rising Climate Vulnerability: A Call for Urgent Action

India has emerged as one of the world’s most climate-vulnerable nations, ranking sixth in the Climate Risk Index 2025 published by Germanwatch. Between 1993 and 2022, the country accounted for 10% of global fatalities caused by extreme weather events and 4.3% of total economic damages worldwide. These staggering figures highlight the urgent need for robust climate resilience strategies and policy interventions to mitigate future risks.

Expand to read more

#India climate vulnerability#Climate Risk Index 2025#Extreme weather events in India#Climate finance deficit#Climate adaptation strategies#Renewable energy in India#Climate resilience policies#Global climate crisis#Sustainable development India#COP29 climate finance#Insights on Indian's climate change vulnerability. Insightful story on climate change.

0 notes

Link

#Economy#Finance#Deficit#FederalBudget#EconomicNews#GovernmentSpending#FiscalPolicy#USNews#MoneyMatters#DebtCrisis#bidennomics

0 notes

Text

Massive £3.5K Tax Hike Looms for UK! Shocking IFS Report!

UK households are bracing for a substantial tax hike, with an average increase of £3,500 per year anticipated by the next election, marking the most significant fiscal burden over a parliamentary term in over seven decades, according to the Institute for Fiscal Studies (IFS), the country’s foremost economic think tank.

For more visit: financeprozone.com -

#Budget Deficit#Economic Analysis#Economic Consequences#Economic Projections#Financial news#Financial Outlook#Fiscal Policy#Government Budget#Government Spending#IFS Report#Income Tax#Personal Finance#Public Finances#Revenue Forecast#Tax Burden#Tax Impact#Taxation Changes#Taxation Trends#UK Tax Hike

0 notes

Text

Reducing Debt: Minimizing Financial Burdens

Reducing Debt Debt can make it hard to manage your money and achieve financial stability. To reduce your debt, start by making a plan. Figure out which debts to pay off first based on their interest rates and amounts owed. You can choose to focus on paying off smaller debts first or tackling debts with higher interest rates. Avoid taking on new debt while you’re paying off existing ones. You can…

View On WordPress

#000 debt!#collect debts#companies reducing debt#debt ceiling#debt financing#debt meaning#debts#debts and deficits#financial education#how do i deal with anxiety while paying off debt?#how to collect debts for small business#i just lost my job! should i keep paying off debt?#i&039;m afraid to drain my savings to pay off debt!#outstanding debts#pay all debts#paying off debt#prayer to pay debts#raise debt ceiling#Reducing Debt#us debt ceiling

0 notes

Text

Then there is the dollar. Trump’s team considers it very overvalued. Scott Bessent, Treasury secretary nominee, told the Manhattan Institute this summer that “in the next few years . . . we are going to have to have some kind of a grand global economic reordering, something on the equivalent of a new Bretton Woods”. Indeed, Takatoshi Ito, Japan’s former finance minister, notes that “some observers, including myself, speculate that . . . Bessent might even call for a special G20 meeting” to reproduce “the 1985 Plaza Accord”. However, Bessent also told the same Manhattan Institute meeting that two-thirds of any tariff impact typically shows up through currency gains — implying that tariffs will strengthen the dollar. Most economists agree. Go figure. This creates a fourth uncertainty around the trade deficit. Trump’s team tell me they explicitly reject the economic orthodoxy inspired by the 19th-century economist David Ricardo — specifically, the idea that countries export goods to earn money to pay for imports, and if each country specialises in areas of comparative advantage, everyone is better off. Instead, Trump’s advisers want to slash the deficit by using America’s political and commercial dominance (via tariffs), while also maintaining capital inflows. Doing both may be hard. And any dollar strength could suck in more, not fewer, imports, particularly if growth accelerates.

December 13, 2024

90 notes

·

View notes