#cma student

Explore tagged Tumblr posts

Text

The strength of a tree's roots enables it to withstand any storm. Just as sturdy roots provide stability, a strong foundational level is essential for overcoming challenges in your academic journey. We are committed to nurturing these strong foundations. Join us, as we offer the most skilled, experienced, professionally qualified, and dedicated faculty for all subjects. We understand what it takes to help you achieve success. Additionally, one of our unique advantages is that, after covering the syllabus, we conduct a comprehensive and in-depth revision. We invite you to give us a try before exploring other options."

0 notes

Text

#CMA#US CMA#CMA COURSE#CMA EXAM#CMA FEES#CMA ELIGIBILITY#CMA EXEMPTIONS#CMA STUDENT#CMA JOB#CMA SALARY

0 notes

Text

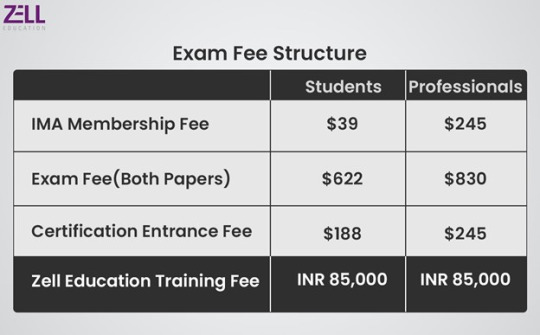

CMA Fees

Those seeking the esteemed CMA certification must pay the CMA (Certified Management Accountant) fees. Exam registration, membership, and study materials are all included in the pricing structure, which offers a variety of payment alternatives. In order to join the IMA, candidates must first pay an admission fee. Then, they must pay separate costs for each section of the CMA exam. Study materials, review courses, and, if necessary, reexamination fees are examples of additional expenses. The candidate's location and membership status affect the CMA fees. The CMA designation provides access to more lucrative job options and increased earning potential in management accounting and finance, despite the fees being an investment.

#cma#cma course#cma exam#cma fees#cma eligibility#cma student#cma india#cma certification#cma syllabus

0 notes

Text

CMA In India

A distinguished credential for experts in cost accounting, financial management, and business strategy, the CMA (Cost Management Accounting) certification in India is granted by the Institute of Cost Accountants of India (ICMAI). The purpose of this certification is to provide people with knowledge of financial analysis, cost control, and strategic decision-making. Employers in a variety of industries, including industry, banking, and government, greatly value the CMA India qualification, which provides prospects for career progression in senior financial and managerial positions.

0 notes

Text

CMA In India

The Institute of Cost Accountants of India (ICAI) in India offers the esteemed CMA (Cost and Management Accountant) certification, which is concentrated on cost management, financial analysis, and strategic decision-making. Professionals who complete the program will have the necessary abilities to maximize corporate resources and enhance financial performance. Candidates must successfully complete three exam levels, practical training, and a required amount of work experience in order to earn the CMA certification. With its potential to provide insights that promote efficiency and profitability, CMAs are essential in a variety of industries, including manufacturing, services, and public organizations. Professionals who hold this qualification have better job opportunities and can make substantial contributions to the development of businesses.

#US CMA#US CMA COURSE#CMA INDIA#CMA ELIGIBILITY#CMA EXEMPTION#CMA EXAM#CMA FEES#CMA JOB#CMA SALARY#CMA STUDENT#CMA CERTIFICATION

0 notes

Text

Udaan Batch- DT+IDT Free For All | Ultimateca

🌟 Get Ready to Soar with the UDAAN Batch! 🌟

🎯 DT + IDT Classes

💥 FREE FOR ALL CA/CMA Inter Students (May/June/Sept '25)

📅 Starting 27th January | 🕔 5 PM

📍 https://youtu.be/oV2vXuUmUik?si=4dnhg0tYiX1wpwUW

🚀 Don't miss this golden opportunity to ace your exams! Share with your friends and join the revolution! 💪✨

#UDAAN Batch#CA Inter DT IDT Classes#CMA Inter Classes#Free CA Classes#CA Coaching Classes#CMA Coaching Classes#Swapnil Patni Classes#CA Online Classes#CMA Online Classes#May 2025 CA Exams#June 2025 CMA Exams#September 2025 CA Exams#Free Classes for CA Students

0 notes

Text

US CMA EXEMPTIONS

For eligible applicants, the US CMA (Certified Management Accountant) program provides a few exemptions that speed up the certification procedure. Certain educational requirements may not apply to people who possess accredited professional certificates, such as ACCA (Association of Chartered Certified Accountants), CPA (Certified Public Accountant), or CFA (Chartered Financial Analyst). Furthermore, applicants may be eligible for exemptions if they hold postgraduate degrees, such as an MBA with a finance or accounting specialization. These provisions, which allow seasoned professionals to accelerate their route to becoming CMAs while upholding strict standards for management accounting certification, are intended to recognize the skills and knowledge acquired through extensive professional training and study.

#US CMA#US CMA COURSE#US CMA EXEMPTIONS#US CMA ELIGIBILITY#US CMA EXAM#US CMA FEES#US CMA CERTIFICATION#US CMA JOB#US CMA SALARY#US CMA INDIA#US CMA STUDENT

0 notes

Text

Srinath University Partners With International Navodaya Chamber Of Commerce

MoU Aims To Boost Entrepreneurship And Skill Development For Students Collaboration to offer workshops, certification programs, and start-up support. JAMSHEDPUR – Srinath University and the International Navodaya Chamber of Commerce have signed a Memorandum of Understanding (MoU) to enhance entrepreneurial opportunities for students. J Rajesh, Dean of Administration at Srinath University, and CMA…

#शिक्षा#CMA Sandeep Kumar#education#Entrepreneurship Education Jamshedpur#International Navodaya Chamber of Commerce#J Rajesh Dean of Administration#Jamshedpur Business Education#Jamshedpur Higher Education Initiatives#Srinath University Partnerships#Student Skill Development Programs#Student Start-up Support#university-industry collaboration

0 notes

Text

@caajayvermaclasses

#cafoundation#ca inter#ca online classes#castudents#ca course#cs executive#caclasses#csstudents#cma student#cma course#cseet#cma awards

0 notes

Text

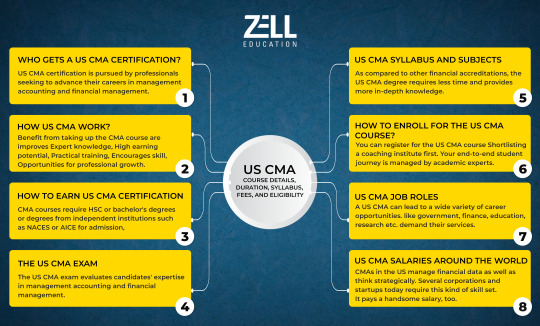

US CMA Course Details

Professionals wishing to progress in management accounting and financial management can earn the esteemed US Certified Management Accountant (CMA) credential. Two sections make up the course's structure: While Part 2 discusses financial decision-making, encompassing subjects like cost management, internal controls, and risk management, Part 1 concentrates on financial reporting, planning, performance, and control. In order to demonstrate their mastery of financial analysis and strategic decision-making, candidates must pass both sections of the test. Candidates must have two years of relevant work experience in addition to passing the examinations. With potential for leadership roles in accounting, corporate management, and finance as well as worldwide recognition, the US CMA qualification improves professional prospects.

#cma#us cma#cma course#cma course details#cma exam#cma fees#cma eligibility#cma exemptions#cma certification#cma job#cma student#cma subjeccts#cma syllabus

0 notes

Text

US CMA Exam

Candidates are put to the test on key management accounting and financial management skills in the demanding two-part US CMA (Certified Management Accountant) exam. The test is given by the Institute of Management Accountants (IMA) and assesses knowledge in areas like professional ethics, financial planning, analysis, control, and decision support. Part 2 discusses financial decision-making, including risk management and strategic planning, whereas Part 1 concentrates on financial reporting, planning, performance, and control. A high degree of skill is demonstrated by passing the US CMA exam, which also equips people for leadership positions in accounting and finance. For individuals hoping to obtain the esteemed CMA certification and progress in the international banking sector, passing the exam is a crucial first step.

#cma#us cma#cma course#us cma exam#cma fees#cma eligibility#cma exemptions#cma student#cma job#cma syllabus#us cma certification

0 notes

Text

CMA Course

The Certified Management Accountant (CMA) program is a professional credential intended for those seeking to become experts in financial management and management accounting. Financial planning, analysis, and control as well as financial decision-making are two of the course's main topics. Financial reporting, planning, and performance management are the main topics of Part 1, and decision analysis and strategic financial management are covered in Part 2. Candidates holding the CMA degree are prepared for leadership positions in corporate management and finance.

0 notes

Text

US CMA Certification

The US CMA (Certified Management Accountant) Certification is a widely accepted qualification that attests to one's proficiency in financial and management accounting. Financial planning, analysis, control, decision support, and professional ethics are among the key competencies covered by the certification, which is offered by the Institute of Management Accountants (IMA). A vital tool for professionals looking to develop in the finance and accounting industries, the CMA certifies competency in strategic management. The certification procedure entails fulfilling educational and experience criteria in addition to passing two difficult tests. Because they play a major role in successful decision-making and organizational performance, CMAs are in great demand across a wide range of industries. Numerous employment options and increased earning potential are made possible by this credential.

#US CMA#US CMA COURSE#US CMA EXAM#US CMA FEES#US CMA CERTIFICATION#US CMA ELIGIBILITY#US CMA EXEMPTIONS#US CMA JOB#US CMA SALARY#US CMA STUDENT

0 notes

Text

Top Faculties for CA Inter Costing

#career#education#students#student#exams#ca classes#cainter#castudents#caintercosting#ca inter costing#Cma#top faculties

1 note

·

View note

Text

US Certified Management Accountant(CMA) | Eligibility Criteria | Syllabus | Fees | Salary | Comparision of CA & USCMA

Certified Management Accountant is what USCMA stands for. For people who specialise in management accounting, it is a professionally recognised credential that is accepted all around the world. To assist in making business choices, CMAs offer analysis and insights........... Read More

0 notes

Text

How many Types of B.com Courses are available?

Many types of B.com courses are available in India through which you can get many job opportunities. Here we will discuss how many types of B.com courses are available and we’ll give you some knowledge about every type of course that will help you through your career. To know more about such topics you can refer to Our Career advice.

#bcom#commerce#mba#bba#mcom#ca#commercestudents#commercememes#charteredaccountant#icai#education#cma#csstudents#students#college#bca#cafoundation#cafinal#india#castudents#cs#business#cbse#finance#economics#commercestudent#commercegirls#class

0 notes