#CMA FEES

Explore tagged Tumblr posts

Text

💥 FAILED your CMA exam? STOP right there! 🚨

📢 Remember: Great CMAs aren’t born, they’re coached! 🚀

Before you drown yourself in chai or memes, let’s talk. Failure is NOT the end—it's your plot twist! 🌟 Every CMA legend started somewhere, and this is just YOUR beginning.

At FINAIM, the Best Coaching Institute in Delhi, we've turned "oops" into "OMG I PASSED!" more times than we can count. From expert guidance to killer strategies, we've got your back. 💪

🎯 Don’t let one bad result define your journey. DM us today for a FREE strategy session and let's make sure your next attempt is your last!

For more INFO

FINAIM

ADDRESS: First Floor, Tewari House, 102 - B, Pusa Rd, Block 11, Old Rajinder Nagar, Rajinder Nagar, New Delhi, Delhi, 110005

PHONE NO: 8700924049

3 notes

·

View notes

Text

Best CMA Coaching in Bangalore | SuccessEdge Academy

Are you aspiring to become a Certified Management Accountant (CMA) and looking for the best CMA coaching in Bangalore? Choosing the right institute is crucial for your CMA preparation, and SuccessEdge Academy is the perfect place to help you achieve success.

Why Choose SuccessEdge Academy for CMA Coaching in Bangalore?

1️⃣ Expert-Led Coaching & Mentorship

SuccessEdge Academy offers live interactive classes led by industry experts and experienced CMA professionals. The personalized mentorship and one-on-one doubt-solving sessions help students strengthen their concepts and improve their exam performance.

2️⃣ Comprehensive Study Materials & Mock Tests

Students receive high-quality study materials, pre-recorded video lectures, and topic-wise practice tests. Regular mock exams ensure that they are well-prepared for the real CMA exam environment.

3️⃣ Flexible Learning Options

SuccessEdge provides multiple learning modes, including classroom coaching, online live classes, and self-paced learning options. This flexibility allows students to study at their own convenience while receiving expert guidance.

4️⃣ 100% Placement Assistance

Beyond exam preparation, SuccessEdge Academy supports students with career guidance and placement assistance. CMA-certified professionals have excellent career opportunities in Big 4 firms, multinational corporations, and leading financial institutions.

Kickstart Your CMA Journey with SuccessEdge Academy!If you're serious about becoming a CMA professional, enroll in the best CMA coaching in Bangalore at SuccessEdge Academy today. With expert faculty, result-oriented strategies, and top-notch study materials, your CMA journey is in the right hands.

0 notes

Text

Common Mistakes CMA USA Students Make & How to Avoid Them

For those working in accounting and finance, the CMA USA (Certified Management Accountant) certification is a highly esteemed qualification. However, a lot of students have trouble with time management, exam tactics, and preparation, which causes them to fail or take longer to pass the tests.

Let's examine the most typical errors made by CMA USA students and how to prevent them to help you succeed.

1. Underestimating the Exam Difficulty

Mistake: Thinking the CMA USA exam is easy

Many students assume that because CMA USA consists of only two parts, it is an easy certification. However, the passing rate is around 45–50%, meaning it requires serious preparation.

How to Avoid:

Understand that CMA USA is not just about memorization but application-based concepts.

Study each topic in depth, covering both theory and practical applications.

Solve past papers and mock exams to gauge your readiness.

2. Poor Time Management

Mistake: Not allocating enough time for preparation

Some students start studying too late or fail to stick to a study plan, leading to incomplete preparation.

How to Avoid:

Follow a structured study schedule (ideally 3-6 months per exam part).

Use the 80/20 rule—focus on high-weightage topics while ensuring you cover all areas.

Allocate at least 10-15 hours per week for consistent progress.

3. Neglecting MCQ Practice

🚨 Mistake: Focusing only on theory, ignoring MCQs

Since 75% of the exam is Multiple-Choice Questions (MCQs), some students focus too much on theory and fail to practice MCQs properly.

How to Avoid:

Solve at least 1,000 MCQs per exam part before the test.

Use mock exams to get used to the CMA exam format and time constraints.

Understand why answers are right or wrong, instead of just memorizing them.

4. Not Practicing Essay Questions

🚨 Mistake: Ignoring essay-type questions

Essay questions contribute 25% of the exam score, but many students neglect them.

How to Avoid:

Practice writing clear and concise responses.

Learn to structure your answers using bullet points, key formulas, and logical explanations.

Work on time management to complete essays within the allotted time.

5. Studying Without a Proper Strategy

Mistake: Studying randomly without a clear plan

Jumping between topics without a clear strategy leads to confusion and ineffective preparation.

How to Avoid:

Follow the official CMA USA syllabus step by step.

Use a study planner to track progress and ensure you cover all topics.

Focus on conceptual clarity rather than rote learning.

6. Using the Wrong Study Materials

Mistake: Relying on outdated or insufficient materials

Some students use free or old materials that don’t align with the latest CMA USA syllabus.

How to Avoid:

Use official IMA study materials or reputable providers like Gleim, Wiley, or Becker.

Regularly check for syllabus updates to stay aligned with the exam structure.

7. Not Taking Mock Exams Seriously

Mistake: Skipping full-length mock exams

Many students study well but fail to simulate real exam conditions before the actual test.

How to Avoid:

Take at least 3-5 full-length mock exams before the real test.

Review mistakes thoroughly and improve weak areas.

Practice under timed conditions to build exam stamina.

8. Failing to Manage Stress & Burnout

Mistake: Overloading yourself with studies without breaks

CMA USA requires dedication, but burning out before the exam can be counterproductive.

How to Avoid:

Take regular breaks using the Pomodoro technique (25 min study, 5 min break).

Get enough sleep, exercise, and relaxation to stay focused.

Stay motivated by joining CMA study groups or connecting with mentors.

Clearing CMA USA requires smart planning, effective study strategies, and consistency. By avoiding these common mistakes and following a structured approach, you can improve your chances of passing on the first attempt.

Are you preparing for CMA USA? Let us know your biggest challenge in the comments below! 🚀

0 notes

Text

#CMA#US CMA#CMA COURSE#CMA EXAM#CMA FEES#CMA ELIGIBILITY#CMA EXEMPTIONS#CMA STUDENT#CMA JOB#CMA SALARY

0 notes

Text

Achieve Your Career Goals with Professional Accounting and Finance Training at Emerge Pro in Dubai

For professionals in accounting and finance, certifications like CPA (Certified Public Accountant), CMA (Certified Management Accountant), and IFRS (International Financial Reporting Standards) are gateways to success in a competitive global market. At Emerge Pro, we are committed to helping you achieve your career aspirations with comprehensive and industry-approved training programs in Dubai and across the UAE.

Why Choose Emerge Pro?

As an IMA-approved center in UAE, Emerge Pro stands out as a leading training provider for accounting and finance certifications. Our world-class instructors and customized coaching methods make us the preferred choice for students and professionals seeking:

CPA Certification in Dubai

CMA Training Center Dubai

IFRS Certification Dubai

We provide tailored courses that meet the needs of aspiring professionals, equipping them with the knowledge and skills to excel in their careers.

Comprehensive CPA Training in Dubai

The CPA certification in Dubai is highly regarded worldwide for its rigorous standards and professional recognition. Emerge Pro offers the best CPA classes in Dubai, providing:

Expert-led CPA exam prep classes in UAE

Flexible schedules for working professionals

Hands-on training to prepare for real-world challenges

Whether you’re just starting your journey or looking to enhance your credentials, Emerge Pro is the top CPA training center in Dubai.

CMA USA Course and Coaching in Dubai

Emerge Pro is a trusted destination for CMA training in Dubai, offering students a structured approach to mastering the CMA USA course. With CMA exam prep classes in UAE, we focus on:

Conceptual clarity through detailed lessons

Exam-focused strategies and practice sessions

Supportive guidance from experienced instructors

Our reputation as the provider of the best CMA classes in Dubai ensures students receive high-quality coaching for this globally respected certification.

Master IFRS with Emerge Pro

For professionals working with international financial standards, Emerge Pro offers the best IFRS training in Dubai. Our IFRS course in Dubai UAE is designed to help you gain a deep understanding of these crucial standards.

Take the Next Step with Emerge Pro

Whether you’re pursuing CPA certification, CMA coaching in UAE, or the IFRS course, Emerge Pro has the tools and expertise to make your aspirations a reality. Visit Emerge Pro today and start your journey toward professional excellence in accounting and finance.

Empower your future with the leaders in professional training in Dubai!

#CMA#CPA#cma dubai#cpa dubai#cpa training in dubai#cma course#cma fees#cma exam#cma awards#cpa classes

0 notes

Text

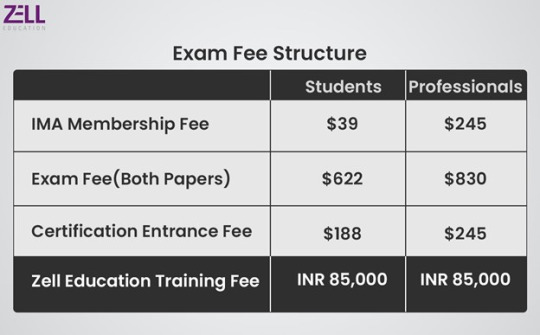

CMA Fees

Those seeking the esteemed CMA certification must pay the CMA (Certified Management Accountant) fees. Exam registration, membership, and study materials are all included in the pricing structure, which offers a variety of payment alternatives. In order to join the IMA, candidates must first pay an admission fee. Then, they must pay separate costs for each section of the CMA exam. Study materials, review courses, and, if necessary, reexamination fees are examples of additional expenses. The candidate's location and membership status affect the CMA fees. The CMA designation provides access to more lucrative job options and increased earning potential in management accounting and finance, despite the fees being an investment.

#cma#cma course#cma exam#cma fees#cma eligibility#cma student#cma india#cma certification#cma syllabus

0 notes

Text

Essential Steps to Kickstart Your CMA USA online Course Journey

To pursue the CMA USA certification, they can begin by enrolling in a CMA online course. A Team Commerce Academy offers expert-led training, providing them with all the knowledge needed to meet CMA USA eligibility requirements and excel in the exams, ensuring a successful career in management accounting.

Enroll Today at - A Team Commerce Academy

#online education#commercestudents#finance and accounting#cmacertification#cmausa#cma course#cma#cma fees

0 notes

Text

Are you ready to advance in management accounting? Join FinChartered Academy, the leading CMA institute in Chennai! Our program is tailored to help you reach global standards, with high pass rates and in-depth coaching from industry experts. Dive into a supportive learning environment with interactive sessions, comprehensive study materials, and guidance every step of the way.

📞 Enroll now and start building your career with confidence! Call us at 7550364196.

0 notes

Text

CMA In India

A distinguished credential for experts in cost accounting, financial management, and business strategy, the CMA (Cost Management Accounting) certification in India is granted by the Institute of Cost Accountants of India (ICMAI). The purpose of this certification is to provide people with knowledge of financial analysis, cost control, and strategic decision-making. Employers in a variety of industries, including industry, banking, and government, greatly value the CMA India qualification, which provides prospects for career progression in senior financial and managerial positions.

0 notes

Text

CMA In India

The Institute of Cost Accountants of India (ICAI) in India offers the esteemed CMA (Cost and Management Accountant) certification, which is concentrated on cost management, financial analysis, and strategic decision-making. Professionals who complete the program will have the necessary abilities to maximize corporate resources and enhance financial performance. Candidates must successfully complete three exam levels, practical training, and a required amount of work experience in order to earn the CMA certification. With its potential to provide insights that promote efficiency and profitability, CMAs are essential in a variety of industries, including manufacturing, services, and public organizations. Professionals who hold this qualification have better job opportunities and can make substantial contributions to the development of businesses.

#US CMA#US CMA COURSE#CMA INDIA#CMA ELIGIBILITY#CMA EXEMPTION#CMA EXAM#CMA FEES#CMA JOB#CMA SALARY#CMA STUDENT#CMA CERTIFICATION

0 notes

Text

🚀 Did You Know?

The US CMA (Certified Management Accountant) is more than just accounting—it’s about financial strategy, decision-making, and business leadership. Since the 1970s, it has shaped top finance professionals, equipping them with skills in performance management, risk analysis, and corporate finance.

If you’re aiming for a high-growth career in management accounting, financial planning, and strategic finance, the US CMA is your gateway! And with FINAIM, your success is just a step away.

📊 Elevate your career with the best US CMA coaching at FINAIM! 🔗 VISIT: https://finaim.in/cma-course-in-delhi/

FINAIM ADDRESS: First Floor, Tewari House, 102 - B, Pusa Rd, Block 11, Old Rajinder Nagar, Rajinder Nagar, New Delhi, Delhi, 110005 PHONE NO: 087009 24049

#CMA COURSE#CMA COURSE DURATION#CMA FEES#US CMA SALARIES#US CMA JOB OPPORTUNITIES#US CMA PART1 CLASSES#US CMA PART2 CLASSES#us cma exam#FINAIM#BEST CMA COACHING IN DELHI

0 notes

Text

0 notes

Text

Top CMA Inter Notes PDF Free Download

Passing the CMA Inter exam is a significant milestone for aspiring cost and management accountants. Among the subjects in the CMA Inter curriculum, law is both crucial and challenging. Quality study materials are essential to succeed, and having access to the best notes can make all the difference. In this article, we'll explore the top CMA Inter Law notes PDF free download options available, and guide you on how to make the most of these resources.

What is CMA Inter Law?

CMA Inter Law is a comprehensive subject that covers various legal aspects relevant to cost and management accounting. It includes topics like corporate law, industrial law, and economic law. Mastering these topics is essential for a successful career in cost accounting.

Importance of Quality Notes

Quality notes simplify complex topics, making it easier to understand and remember the content. They often include summaries, important points, and practice questions that are invaluable for exam preparation.

Top CMA Inter Notes PDF Free Download

Finding reliable CMA Inter Law notes in PDF format can save you both time and money. Here are some of the top resources for free downloads:

1. Official ICMAI Resources

The Institute of Cost Accountants of India (ICMAI) provides official study materials for CMA Inter students. These notes are comprehensive and updated regularly to reflect the latest syllabus changes. You can find these resources on the ICMAI website.

2. Online Educational Platforms

Several online educational platforms offer free CMA Inter Law notes. Websites like EduPristine, SuperProfs, and CAclubindia provide high-quality notes prepared by experienced educators. These platforms often include additional resources like video lectures and mock tests.

3. Student Forums and Groups

Joining student forums and groups on platforms like Telegram, Facebook, and WhatsApp can be a great way to find shared notes. Many students and educators share their own prepared notes, which can be downloaded for free.

4. YouTube Channels

Educational YouTube channels often provide links to free notes in the video descriptions. Channels like Lectures4u, StudyAtHome, and CA Guruji are known for their valuable content on CMA Inter Law.

5. Library and E-book Resources

Many libraries and e-book platforms offer free access to CMA Inter Law notes. Websites like Google Books and Project Gutenberg have a wealth of resources that can be accessed at no cost.

How to Make the Most of Your Notes

Having access to the top CMA Inter Notes PDF free download is just the first step. Here are some tips on how to use these notes effectively:

Organize Your Study Schedule

Create a study plan that covers all the topics in the CMA Inter Law syllabus. Allocate specific times for each topic and stick to your schedule.

Highlight Important Points

As you go through your notes, highlight important points and make margin notes. This will make it easier to review key concepts before the exam.

Practice Regularly

Practice is crucial for mastering CMA Inter Law. Use the practice questions in your notes and take as many mock tests as possible.

Join Study Groups

Study groups can provide additional support and motivation. Discussing topics with peers can also help clarify doubts and deepen your understanding.

Review and Revise

Regular revision is essential to retain what you've learned. Make sure to review your notes regularly, focusing on weaker areas.

Where can I find the best CMA Inter Law notes PDF free download?

You can find quality CMA Inter Law notes on the ICMAI website, online educational platforms, student forums, YouTube channels, and e-book resources.

Are the free notes reliable and up-to-date?

Most free notes available on reputable platforms are reliable and updated regularly. However, always cross-check with the latest syllabus provided by ICMAI.

How can I effectively use these notes for exam preparation?

Organize your study schedule, highlight important points, practice regularly, join study groups, and review and revise your notes frequently.

Can I rely solely on free notes for my exam preparation?

While free notes are valuable, it's advisable to supplement them with official study materials and textbooks. This ensures comprehensive coverage of the syllabus.

How can I join study groups for CMA Inter Law?

You can join study groups on social media platforms like Telegram, Facebook, and WhatsApp. Look for groups specifically for CMA Inter students.

Access to the top CMA Inter Notes PDF free download can significantly enhance your exam preparation. Utilize these resources wisely, follow a structured study plan, and practice regularly to master CMA Inter Law. With the right approach and dedication, you'll be well-prepared to succeed in your CMA Inter exam. Good luck!

0 notes

Text

Professionals can pursue better employment options in financial management and management accounting by earning the US CMA (Certified Management Accountant) credential. It offers comprehensive expertise in strategic planning, financial analysis, and decision-making. Possessing a CMA certification positions people for leadership positions in multinational corporations and increases credibility, earning potential, and job stability. It also shows employers that an individual is knowledgeable about financial management.

#cma#us cma#cma course#cma exam#cma fees#cma eligibility#cma exemption#us cma certification#cma study

0 notes

Text

https://vocal.media/education/cma-foundation-registration-last-date-and-exam-form-fees-b9asp0ppr

0 notes

Text

US CMA Exam

Candidates are put to the test on key management accounting and financial management skills in the demanding two-part US CMA (Certified Management Accountant) exam. The test is given by the Institute of Management Accountants (IMA) and assesses knowledge in areas like professional ethics, financial planning, analysis, control, and decision support. Part 2 discusses financial decision-making, including risk management and strategic planning, whereas Part 1 concentrates on financial reporting, planning, performance, and control. A high degree of skill is demonstrated by passing the US CMA exam, which also equips people for leadership positions in accounting and finance. For individuals hoping to obtain the esteemed CMA certification and progress in the international banking sector, passing the exam is a crucial first step.

#cma#us cma#cma course#us cma exam#cma fees#cma eligibility#cma exemptions#cma student#cma job#cma syllabus#us cma certification

0 notes