#CMA JOB

Explore tagged Tumblr posts

Text

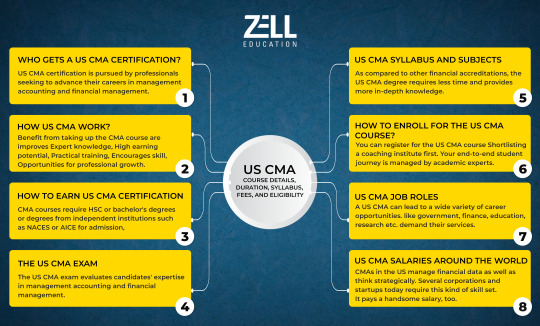

How CMA USA Certification Boosts Your Career in the Finance Industry

Becoming a CMA USA can propel your CMA career to new heights. In this post, we’ll explore how this prestigious certification can open doors and give you the competitive edge in the finance industry.

1. Global Recognition and Career Flexibility

The CMA USA certification is recognized worldwide, which means that you’re not limited to job opportunities in India. Whether you want to work in the Middle East, Europe, or the United States, your certification will be respected and recognized globally, offering you more flexibility and career mobility.

2. Strategic Leadership Opportunities

CMAs are trained to provide strategic insights into an organization’s financial decisions. This unique skill set makes you an ideal candidate for senior-level roles in finance, such as financial analyst, risk manager, or even CFO. It also allows you to work closely with executives, shaping key business strategies.

3. Job Market Demand

As the business world becomes more data-driven, companies are increasingly seeking professionals who can analyze financial data and provide insights that drive profitability. With the CMA USA certification, you’re equipped with the knowledge and skills to meet this demand, making you a highly sought-after professional in the finance industry.

Conclusion:

The CMA USA certification can dramatically enhance your career trajectory by opening doors to leadership roles, global opportunities, and higher demand within the industry.

0 notes

Text

#CMA#US CMA#CMA COURSE#CMA EXAM#CMA FEES#CMA ELIGIBILITY#CMA EXEMPTIONS#CMA STUDENT#CMA JOB#CMA SALARY

0 notes

Text

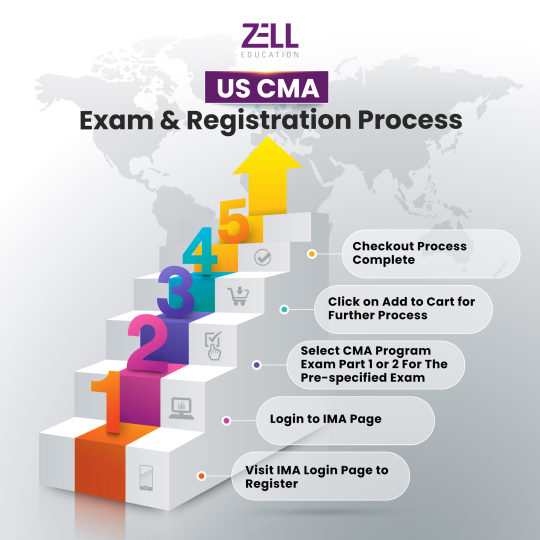

US CMA Exam

Candidates are put to the test on key management accounting and financial management skills in the demanding two-part US CMA (Certified Management Accountant) exam. The test is given by the Institute of Management Accountants (IMA) and assesses knowledge in areas like professional ethics, financial planning, analysis, control, and decision support. Part 2 discusses financial decision-making, including risk management and strategic planning, whereas Part 1 concentrates on financial reporting, planning, performance, and control. A high degree of skill is demonstrated by passing the US CMA exam, which also equips people for leadership positions in accounting and finance. For individuals hoping to obtain the esteemed CMA certification and progress in the international banking sector, passing the exam is a crucial first step.

#cma#us cma#cma course#us cma exam#cma fees#cma eligibility#cma exemptions#cma student#cma job#cma syllabus#us cma certification

0 notes

Text

CMA In India

The Institute of Cost Accountants of India (ICAI) in India offers the esteemed CMA (Cost and Management Accountant) certification, which is concentrated on cost management, financial analysis, and strategic decision-making. Professionals who complete the program will have the necessary abilities to maximize corporate resources and enhance financial performance. Candidates must successfully complete three exam levels, practical training, and a required amount of work experience in order to earn the CMA certification. With its potential to provide insights that promote efficiency and profitability, CMAs are essential in a variety of industries, including manufacturing, services, and public organizations. Professionals who hold this qualification have better job opportunities and can make substantial contributions to the development of businesses.

#US CMA#US CMA COURSE#CMA INDIA#CMA ELIGIBILITY#CMA EXEMPTION#CMA EXAM#CMA FEES#CMA JOB#CMA SALARY#CMA STUDENT#CMA CERTIFICATION

0 notes

Text

US CMA EXAM

A professional credential intended for those seeking a career in financial management and management accounting is the US CMA (Certified Management Accountant) test. The test, which is given by the Institute of Management Accountants (IMA), is divided into two sections: Strategic financial management is covered in Part 2, while financial planning, performance, and analytics are the main topics of Part 1. Each section evaluates the candidates' understanding of topics such as risk assessment, cost management, forecasting, and budgeting. Typically, candidates must have two years of relevant work experience in addition to a bachelor's degree to be qualified. Professionals may drive decision-making, contribute strategically to enterprises, and improve financial performance with the CMA certification, which improves employment possibilities.

#US CMA#US CMA COURSE#CMA EXAM#CMA FEES#CMA ELIGIBILITY#CMA EXEMPTIONS#US CMA CERTIFICATION#CMA INDIA#CMA STUDENT#CMA JOB#CMA SALARY

0 notes

Text

Job Opportunities After CMA in India for Freshers

Certified Management Accountant (CMA) is one of the most prestigious professional certifications in the field of management accounting. Freshers who have recently completed their CMA certification often wonder about the job opportunities available to them in India. This article explores various CMA job opportunities prospects, industries, and roles that freshers can consider to kickstart their careers.

What is CMA?

The CMA certification is globally recognized and demonstrates proficiency in financial management and strategic business management. It equips candidates with skills in areas such as financial analysis, budgeting, cost management, and internal control.

Importance of CMA Certification

The CMA certification opens doors to a plethora of job opportunities in India. Companies value the strategic financial management skills that CMAs bring to the table. Freshers with a CMA certification are well-prepared to handle complex financial scenarios and contribute significantly to business growth.

Industries Offering CMA Job Opportunities

1. Financial Services

The financial services sector is one of the largest employers of CMA-certified professionals. Banks, investment firms, and insurance companies are constantly on the lookout for skilled financial analysts, cost accountants, and financial planners.

2. Manufacturing

Manufacturing companies require CMAs for various roles, including cost management, financial planning, and analysis. These professionals help in optimizing production costs and improving profitability.

3. Consulting Firms

Consulting firms hire CMA-certified individuals for their expertise in financial and strategic management. Freshers can start as junior consultants and gradually move up the ladder.

4. IT and Technology

The IT sector offers numerous opportunities for CMAs, especially in roles related to financial analysis, budgeting, and project management. Tech companies value the analytical skills that CMAs bring to their financial teams.

5. Government Sector

The government sector also offers promising opportunities for CMA-certified freshers. Various public sector undertakings (PSUs) and government departments require CMAs for financial management and auditing roles.

Key Roles for CMA-Certified Freshers

1. Financial Analyst

Financial analysts play a crucial role in businesses by analyzing financial data, preparing reports, and making recommendations for improvement. This role is ideal for CMAs who excel in data analysis and financial planning.

2. Cost Accountant

Cost accountants help companies control and reduce costs. They analyze production costs and develop strategies to improve efficiency and profitability. This role is particularly important in manufacturing and production industries.

3. Management Accountant

Management accountants focus on internal financial processes. They prepare internal reports, budgets, and financial statements, helping management make informed decisions. This role is essential in all types of organizations.

4. Internal Auditor

Internal auditors assess a company's internal controls and processes. They identify areas of risk and suggest improvements. This role is critical in ensuring compliance and improving operational efficiency.

5. Budget Analyst

Budget analysts are responsible for developing and managing an organization's budget. They ensure that financial resources are allocated efficiently and monitor spending to stay within budget. This role is vital in both private and public sector organizations.

How to Prepare for CMA Job Opportunities

1. Build a Strong Resume

A well-crafted resume is your first step towards landing a job. Highlight your CMA certification, relevant skills, and any internships or projects you have completed.

2. Network Effectively

Networking plays a significant role in job hunting. Connect with professionals in your field through LinkedIn, attend industry conferences, and join CMA-related forums and groups.

3. Gain Practical Experience

Internships and part-time jobs can provide valuable practical experience. Look for opportunities that allow you to apply your CMA skills in real-world scenarios.

4. Continue Learning

Stay updated with the latest trends and developments in management accounting. Continuous learning and professional development will make you more attractive to potential employers.

5. Prepare for Interviews

Prepare thoroughly for interviews by researching the company and practicing common interview questions. Demonstrating your knowledge and confidence during interviews can significantly increase your chances of landing a job.

What is the average salary for a CMA fresher in India?

The average salary for a CMA fresher in India ranges from INR 4 to 6 lakhs per annum, depending on the industry and location.

Are there opportunities for CMAs in the public sector?

Yes, there are numerous opportunities for CMAs in the public sector, including roles in public sector undertakings (PSUs) and government departments.

Can CMAs work internationally?

Yes, the CMA certification is globally recognized, and CMAs can find job opportunities in various countries around the world.

What skills are essential for CMA job roles?

Key skills for CMA job roles include financial analysis, budgeting, cost management, strategic planning, and strong analytical abilities.

How can I enhance my chances of getting a CMA job?

Enhance your chances by building a strong resume, networking effectively, gaining practical experience, continuing your education, and preparing thoroughly for interviews.

CMA certification opens up a world of opportunities for freshers in India. With the right skills, preparation, and determination, CMAs can secure promising roles in various industries. Whether you are interested in financial services, manufacturing, consulting, IT, or the government sector, the CMA qualification will serve as a strong foundation for a successful career.

In summary, the CMA Job opportunities for freshers in India are vast and varied. By leveraging the knowledge and skills gained during the CMA certification process, freshers can embark on a rewarding and fulfilling career path.

0 notes

Text

Top Career Opportunities after CMA in India

One of the CMA professional courses in India is relatively well-known and offers the learner deep insights into costing, financial planning, strategy, and management. CMAs have always been integral to organizations, and with the increased reliance on data-centric decision-making, the requirement for skilled CMAs is skyrocketing.

Top Job Roles for CMAs:

Cost Accountant

Assist businesses in optimizing costs with appropriate cost auditing and control strategies.

2. Financial Analyst

Evaluate the financial data of an investment banking firm, corporate organization, or even a bank to aid in forming key strategic decisions.

3. Internal Auditor

Conduct internal systems and processes audits to ascertain operational efficiency and compliance with relevant regulations.

4. Management Accountant

Assist in preparing budgets, evaluating organizational performance, and developing risk management strategies.

5. Chief Financial Officer (CFO) (After Experience)

Oversee the company's financial activities and take responsibility for strategic financial decisions at the highest level.

Industries Hiring CMAs Include:

Manufacturing & FMCGs

Banking and Financial Services

Information Technology and Consulting Organizations

Government and Public Sectors Undertakings

Pharmaceutical and Healthcare Corporations

The CMA credential provides an abundance of rewarding and innovative career options. From aspiring to work in global corporations to spearheading one’s own advisory firm, CMA empowers one to drive change. Cost management alongside strategic business financial foresight will be pivotal as industries shift, leaving CMA specialists crucial to organizational growth.

#cma#cma course#cma certification#cma coaching#cma courses#cma jobs#finance#finance career#finance jobs#finance management#financial

2 notes

·

View notes

Text

CPA Jobs in the USA for Indians: The Miles Pathway Advantage

For Indian professionals and students, aspiring to carve out a successful career in accounting, CPA jobs at top accounting firms in the USA represent an exciting opportunity. The US accounting industry is thriving, with a high demand for skilled CPAs across various sectors, including finance, tax, and audit. However, navigating the path to becoming a CPA can be complex, which is where the Miles Education comes into play.

The Miles US Pathway Program is a game-changer for Indian candidates aiming to secure CPA jobs overseas. Through this program, a candidate can complete their MS in accounting in one of the top universities in America, while parallelly preparing for CPA exam. Through this STEM integrated masters program, candidates automatically earn their 3F Visa from the USwhich allows them to work for three years. As you read, there are already 1000s of Miles alumni in US earning an average of $60,000+ salaries (50 Lakhs+)

Additionally, one of the most significant benefits of the Miles US Pathway Program is its comprehensive exam preparation resources. The program offers access to high-quality study materials, one on one sessions, mock tests and interviews, exam-ready study notes and guidance from more than 100 of industry experts. Varun Jain’s (The World's Favorite CPA/CMA Instructor) videos are globally recognised for its expertise in understanding complex topics to even candidates who aren’ aware of the ABCs of accounting.

Moreover, the program assists with job placement, connecting candidates with leading U.S. employers and this support is crucial in a competitive job market where having a strong network and the right credentials can make all the difference.

Indian professionals seeking CPA jobs in the USA will find that the Miles US Pathway Program not only simplifies the certification process but also enhances their career prospects. By leveraging this program, candidates can gain a competitive edge, achieve their dream designation, and embark on a successful career.

#cpa jobs#cpa course#cpa syllabus#cpa course full form#accounting jobs for indians in usa#best cma institute in india

2 notes

·

View notes

Text

What is the career path in financial accounting?

A career in accounting offers a well-defined path for professionals seeking to navigate the intricate world of financial reporting and analysis. Beginning as entry-level staff accountants, individuals typically handle day-to-day financial transactions, including recording expenses and revenues. As they gain experience, they may advance to roles such as senior accountant or accounting supervisor, taking on responsibilities like financial statement preparation and supervising junior staff.

The next step in the accounting career path often involves becoming a manager, overseeing a team, and managing broader financial activities. Some may specialize in areas like tax accounting or cost accounting, further honing their expertise. As managers gain experience, they may progress to higher positions such as Controller, responsible for overseeing an organization's entire financial operation.

For those aiming for executive roles, the pinnacle of the financial accounting career path is often the Chief Financial Officer (CFO). CFOs play a strategic role in shaping an organization's financial policies, managing risks, and contributing to overall business strategy. In some cases, professionals may also pursue the Certified Public Accountant (CPA) designation to enhance their career prospects and credibility.

The career path in accounting is not only linear but also versatile, offering opportunities for specialization and advancement based on individual interests and strengths. Continuous professional development and staying abreast of industry trends are key to a successful and fulfilling journey in financial accounting.

#Demand of Indian accountants in usa#accounting career in usa for indians#cpa course#cpa certification#cma course#cpa jobs#cma jobs#starting accounting salary in USA#Accounting jobs in India

2 notes

·

View notes

Text

Ups jobs 📦 USA UPS Jobs 🔥 Weekly Pay ✅ No Experience Needed 👉 Apply Now https://tinyurl.com/udnz3r4z

#Keywords#Search Volume#usa job#how to get usa job from india#usa job search#usa jobs air traffic controller#remote usa job#us job market#cma usa job opportunities#usa job gov#usa job portals#data analyst usa job#usa job sites#usa job resume builder#usa job application#usa job agency#usa job application status#usa job account#usa job alerts#usa job apps#usa job age limit#usa job agency in sri lanka#usa job apply from india#usa job agents in kenya#amazon usa job#apply for usa job#usa company job apply online#nxsouk com for apply job usa#what are the job portals in usa#job at usa for indian

0 notes

Text

Earn $70 to $100 Daily from the Comfort of Your Home!.... see more

#ms in usa#how to get a job in usa#jobs in usa#usa jobs#usa job market#study abroad in usa#yudi j ms in usa#usa#jobs usa#ms in usa jobs#usa visa#job in usa#usa in job#usa job search#indian students gets a job in usa#usa in jobs#find a job in usa#us cma jobs in usa#study in usa#usa job market 2025#job search usa#tech jobs in usa#usa job success story#student jobs usa#job search in usa#how to find job usa#how to get a job in the usa

0 notes

Text

US CMA Course Details

Professionals wishing to progress in management accounting and financial management can earn the esteemed US Certified Management Accountant (CMA) credential. Two sections make up the course's structure: While Part 2 discusses financial decision-making, encompassing subjects like cost management, internal controls, and risk management, Part 1 concentrates on financial reporting, planning, performance, and control. In order to demonstrate their mastery of financial analysis and strategic decision-making, candidates must pass both sections of the test. Candidates must have two years of relevant work experience in addition to passing the examinations. With potential for leadership roles in accounting, corporate management, and finance as well as worldwide recognition, the US CMA qualification improves professional prospects.

#cma#us cma#cma course#cma course details#cma exam#cma fees#cma eligibility#cma exemptions#cma certification#cma job#cma student#cma subjeccts#cma syllabus

0 notes

Text

CMA Course

A specialized professional curriculum for those seeking proficiency in financial management and management accounting is the Certified Management Accountant (CMA) course. The course, which is provided by the Institute of Management Accountants (IMA), addresses important topics such ethical standards, financial planning, analysis, control, and decision-making. By supporting corporate decision-making and guaranteeing efficient financial control, the CMA certification gives professionals the ability to manage strategic financial obligations. The CMA designation provides access to advanced professional options in management, accounting, and finance due to its widespread recognition. The course offers a thorough foundation for success in the fast-paced sector of management accounting, making it perfect for anyone hoping to hold leadership positions in business and finance.

#cma#cma course#cma exam#cma fees#cma eligibility#cma exemptions#cma certification#cma job#cma salary#cma student#cma india#us cma

0 notes

Text

Is the CMA USA Exam Difficult to Clear in India

Cracking the CMA USA Exam: A Simple Guide for Indian Students

The US CMA (Certified Management Accountant) is one of the most prestigious accounting certifications, globally recognised and accredited by the Institute of Management Accountants (IMA). Many aspiring professionals consider it a stepping stone to a successful career in management accounting. However, the CMA exam is challenging, and preparation requires strategy, dedication, and the right guidance.

Challenges in CMA USA Exam Preparation

Where to Start? Many students are unaware of how to begin. Enrolling in a reliable CMA coaching program can provide the right direction and study plan.

Vast Syllabus The CMA USA exam has two parts covering financial planning, performance, analytics, and strategic financial management. A structured approach and study materials are crucial.

Time Management With a comprehensive syllabus, managing time efficiently is key. Creating a study schedule and taking mock exams can help streamline preparation.

Exam Structure and Pattern

The CMA USA exam consists of two parts:

Part 1: Financial Planning, Performance, and Analytics

Part 2: Strategic Financial Management

Each part has 100 MCQs and two essay-type questions, with a total exam duration of 4 hours.

How Indian Students Can Succeed

Join a CMA coaching institute for structured learning.

Self-study and practice with mock tests to improve speed and accuracy.

Understand the exam format and syllabus to focus on important topics.

Maintain health and well-being to stay focused and stress-free.

Key Exam Dates (2025)

January-February: Exams from Jan 1 — Feb 28 (Registration closes Feb 15)

May-June: Exams from May 1 — June 30 (Registration closes June 15)

September-October: Exams from Sep 1 — Oct 31 (Registration closes Oct 15)

Fees and Exam Centres in India

Professional Fees: Entrance — $300, Exam per part — $495, Membership — $295

Student Fees: Entrance — $225, Exam per part — $370, Membership — $49

Exam Centres: Ahmedabad, Bangalore, Kolkata, Chennai, Hyderabad, Mumbai, Delhi, Trivandrum

Final Tips to Crack CMA USA

Attempt mock exams regularly.

Review and track your progress.

Stay disciplined and manage time effectively.

Stay healthy, get enough sleep, and exercise to stay focused.

Conclusion

The CMA USA exam is challenging but achievable with the right preparation. A structured study plan, professional coaching, and self-discipline can help you clear the exam successfully. Stay consistent, work hard, and take advantage of available resources.

For expert guidance and structured preparation, NorthStar Academy offers comprehensive coaching programs tailored to help you clear the CMA USA exam with ease. Your journey to becoming a Certified Management Accountant starts today!

0 notes

Text

ACCA vs. US CMA – Which is Better for Your Career? 💼📈 Are you considering a career in finance and accounting? Wondering whether ACCA (Association of Chartered Certified Accountants) or US CMA (Certified Management Accountant) is the right choice for you? 🤔

Both ACCA and US CMA are globally recognized qualifications, but they serve different career paths.

✅ ACCA: Ideal for those aiming for global finance, auditing, and taxation roles. Recognized in Europe, the UK, and Commonwealth countries.

✅ US CMA: Best suited for professionals targeting management accounting, corporate finance, and decision-making roles. Highly valued in the USA, Middle East, and multinational companies.

Which is Tougher? 🔥 📌 ACCA has 13 papers, with a flexible approach to passing them. 📌 US CMA consists of 2 parts, focusing on financial management and strategic decision-making.

Which is More Rewarding? 💰 💡 ACCA professionals land roles in Big 4 accounting firms, investment banks, and MNCs. 💡 US CMA holders secure positions as finance managers, CFOs, and management accountants in top corporations.

If you're aiming for the best finance and accounting career, choose wisely! Both ACCA and US CMA can elevate your global career prospects.

🚀 Want expert guidance on ACCA or US CMA? FINAIM is here to help! 💡 Learn from industry experts, get exclusive study resources, and secure a high-paying career in finance.

👉 Follow FINAIM for more insights & start your success journey today! VISIT: https://finaim.in/cma-course-in-delhi/ FINAIM ADDRESS: 3rd Floor, Phelps Building, 9 A, Block A, Connaught Place, New Delhi, Delhi 110001 PHONE NO: 087009 24049

#ACCA #USCMA #FinanceCareer #Accounting #Finaim #CareerGrowth #Big4 #FinanceJobs #CMAvsACCA #CharteredAccountant #FinancialSuccess #ManagementAccounting #GlobalRecognition

#US CMA#ACCA#FINAIM#US CMA COURSE#ACCA JOBS IN INDIA#US CMA PART2#US CMA OFFLINE CLASSES#ACCA FEES IN INDIA#BEST FINANCE COACHING IN INDIA#BEST US CMA COACHING IN INDIA#US CMA SYLLABUS#US CMA DURATION

0 notes

Text

Wegyde ACCA Coaching Institute in Kerala, Cochin

#ACCA Coaching kerala#ACCA Classes in Cochin#ACCA Coaching Center in kerala#ACCA Classes in kerala#ACCA Offline Coaching Classes kerala#Best ACCA Coaching in kerala#ACCA with Anshul Mittal#CA Anshul Mittal Classes#CMA career opportunities#CMA coaching Kerala#CMA Institute online coaching#FR Online Classes Kerala#Income Tax Classes Cochin#Jobs after ACCA#ACCA Free classes#How to pass ACCA exemptions for acca#ca exemptions for acca#acca exemptions for cma#cima exemptions for acca#cfa acca exemptions

0 notes