#cma certification

Explore tagged Tumblr posts

Text

youtube

#cma certification#cma classes in mumbai#cma course in bangalore#cma requirements#cma course in mumbai#Youtube

2 notes

·

View notes

Text

CMA Foundation Coaching in Bangalore

The CMA Foundation exam is the first step toward becoming a Certified Management Accountant (CMA India). Conducted by the Institute of Cost Accountants of India (ICMAI), this exam requires a strong foundation in accounting, cost management, taxation, and business laws.

If you're looking for the best CMA Foundation coaching in Bangalore, TheCMAguy is your ultimate destination. With expert faculty, structured study plans, and in-depth mock test practice, TheCMAguy helps students clear the CMA Foundation exam on their first attempt.

Why Choose CMA Foundation Coaching in Bangalore?

Many students try to prepare for the CMA Foundation exam through self-study, but they often face challenges like:

❌ Difficulty in understanding complex concepts in accounting & costing❌ Lack of structured preparation and time management❌ No access to expert faculty for doubt-solving❌ Limited exposure to exam-style mock tests

This is why enrolling in a top CMA Foundation coaching institute in Bangalore can make a huge difference.

✔ Expert Guidance – Learn from ICMAI-certified professionals with years of experience. ✔ Exam-Focused Study Plans – Structured learning ensures complete syllabus coverage before exams. ✔ Mock Tests & Performance Tracking – Get real exam simulation and instant feedback. ✔ Flexible Learning Options – Offline, online, and recorded lectures available. ✔ Personalized Mentorship – One-on-one doubt-solving sessions with expert faculty.

📢 Want to clear CMA Foundation on your first attempt? Join TheCMAguy today!

What Makes TheCMAguy the Best CMA Foundation Coaching in Bangalore?

At TheCMAguy, we provide a student-centric approach to help aspirants excel in the CMA Foundation exam.

📌 1️⃣ Experienced Faculty & Concept-Based Learning

✔ Learn from India’s top CMA faculty with years of industry experience. ✔ Simplified teaching methods with real-life case studies. ✔ Strong focus on conceptual clarity, not just rote memorization.

📌 2️⃣ Comprehensive Study Material & Mock Tests

✔ ICMAI-patterned study material, revision notes, and formula sheets. ✔ Regular chapter-wise tests and full-length mock exams to track progress. ✔ Performance analysis and feedback sessions to improve weak areas.

📌 3️⃣ Flexible Learning Options – Online & Offline

✔ Classroom Coaching – Interactive face-to-face learning sessions. ✔ Live Online Classes – Attend from anywhere with real-time faculty support. ✔ Recorded Sessions – Access lectures anytime for revision.

📌 4️⃣ Personalized Mentorship & Career Guidance

✔ One-on-one doubt-solving and mentoring sessions with faculty. ✔ Career counseling to help students understand future opportunities in CMA Inter and CMA Final.

📢 Looking for the best CMA Foundation coaching in Bangalore? Join TheCMAguy today!

CMA Foundation Syllabus & Exam Pattern 2024

The CMA Foundation syllabus 2024 consists of four subjects, each carrying 100 marks.

📌 Paper 1: Fundamentals of Business Laws & Business Communication

Indian Contract Act, 1872

Sale of Goods Act, 1930

Business Communication Basics

📌 Paper 2: Fundamentals of Financial & Cost Accounting

Accounting Principles & Concepts

Costing Methods & Techniques

Journal Entries, Ledger & Trial Balance

📌 Paper 3: Fundamentals of Business Mathematics & Statistics

Ratio, Proportion & Indices

Probability & Time Series Analysis

📌 Paper 4: Fundamentals of Economics & Management

Micro & Macro Economics

Business Cycles & Inflation

Principles of Management

📌 CMA Foundation Exam Pattern

✔ Mode of Exam – Online (Computer-Based Test) ✔ Total Papers – 4 ✔ Total Marks – 400 (Each paper carries 100 marks) ✔ Type of Questions – Objective (MCQs) ✔ Passing Criteria – 40% in each subject & 50% aggregate

📢 Need structured study material and expert coaching? Enroll with TheCMAguy today!

How to Crack CMA Foundation Exam on Your First Attempt?

1️⃣ Follow a Structured Study Plan

✔ Complete one subject at a time before moving on to the next. ✔ Dedicate at least 3-4 hours daily for focused preparation.

2️⃣ Practice Regular Mock Tests

✔ Attempt full-length mock tests under timed conditions. ✔ Analyze mistakes and focus on weak areas.

3️⃣ Revise Regularly

✔ Prepare summary notes and formula sheets for quick revision. ✔ Revise at least two subjects daily in the last month before the exam.

📢 Want expert mentorship for CMA Foundation? Join TheCMAguy now!

FAQs – Most Asked Questions About CMA Foundation

1️⃣ What is the eligibility for CMA Foundation?

Students who have passed Class 12 from a recognized board are eligible to register for CMA Foundation.

2️⃣ How long does it take to complete CMA Foundation?

Most students complete CMA Foundation in 6 months with structured coaching and regular practice.

3️⃣ Is CMA Foundation difficult?

The exam is moderate in difficulty, but conceptual clarity and regular practice are key to success.

4️⃣ Can I prepare for CMA Foundation without coaching?

Yes, but joining a structured coaching program significantly improves the chances of clearing the exam on the first attempt.

5️⃣ What is the passing percentage for CMA Foundation?

Students need to score at least 40% in each subject and 50% aggregate to pass the exam.

6️⃣ What are the career options after CMA Foundation?

After completing CMA Foundation, students can pursue CMA Inter, leading to career opportunities in corporate finance, auditing, taxation, and cost management.

📢 Want to clear CMA Foundation with expert coaching? Join TheCMAguy today!

CMA Coaching in Bangalore – TheCMAGuy, Your Path to Success

The Certified Management Accountant (CMA India) qualification is one of the most respected certifications for professionals in cost management, financial analysis, and strategic decision-making. Conducted by the Institute of Cost Accountants of India (ICMAI), the CMA certification offers incredible career opportunities in corporate finance, taxation, and auditing.

If you are looking for the best CMA coaching in Bangalore, choosing the right institute is crucial. A well-structured coaching program ensures you receive expert guidance, high-quality study materials, and practical exam strategies to clear the CMA exam on the first attempt.

At TheCMAGuy, we offer top-notch CMA coaching in Bangalore, helping students achieve exam success and career growth with the right blend of conceptual learning and practical application.

Why CMA Coaching in Bangalore is Essential for Success?

The CMA exam is challenging, covering subjects like cost accounting, taxation, law, and financial management. Many students struggle with time management, complex calculations, and practical applications, making coaching essential.

Here’s why joining a professional CMA coaching center in Bangalore can make a difference:

✔ Expert Faculty – Learn from industry professionals and experienced CMAs. ✔ Structured Study Plan – Get a well-organized syllabus with time-bound preparation. ✔ Mock Tests & Revision – Attempt exam-like tests to improve speed and accuracy. ✔ Real-World Application – Gain practical knowledge to excel in your career. ✔ One-on-One Mentorship – Get personalized guidance to clarify doubts and boost confidence.

📢 Want to ace your CMA exams? Join TheCMAGuy today!

Why Choose TheCMAGuy for CMA Coaching in Bangalore?

When it comes to CMA coaching in Bangalore, TheCMAGuy is the #1 choice for students who want structured learning, expert mentorship, and exam-focused preparation.

1️⃣ Experienced Faculty with Industry Expertise

At TheCMAGuy, our faculty includes CMA-certified professionals and finance experts who bring real-world experience into classroom learning. We focus on:

✔ Concept-based teaching instead of rote learning. ✔ Practical application of cost and financial management concepts. ✔ Latest CMA exam pattern updates & industry case studies.

2️⃣ Structured Course Curriculum for Exam Success

CMA exams require a strategic approach to cover the vast syllabus effectively. Our CMA coaching program in Bangalore follows:

🔹 Live interactive classes covering all CMA subjects in detail. 🔹 Regular mock tests and practice sessions to improve accuracy. 🔹 Exam-oriented approach to help students pass in one attempt. 🔹 Personalized study plans for working professionals and students.

3️⃣ Flexible Learning Options – Online & Offline Classes

We offer multiple learning modes to cater to students from different backgrounds:

✔ Classroom Coaching – For students who prefer in-person learning with faculty interaction. ✔ Live Online Coaching – Attend real-time interactive classes from anywhere. ✔ Recorded Video Lectures – Ideal for working professionals who need flexible study schedules.

💡 Missed a class? No worries! We provide access to recorded lectures for revision anytime.

📢 Looking for flexible CMA coaching in Bangalore? Join TheCMAGuy today!

4️⃣ Personalized Mentorship & Doubt-Solving Support

At TheCMAGuy, we believe that every student is unique. That’s why we offer:

✔ One-on-one mentorship with CMA experts. ✔ Doubt-solving sessions for tricky concepts. ✔ Career guidance for CMA-certified professionals.

📢 Need expert support? Enroll at TheCMAGuy now!

5️⃣ Proven Success Rate & Student Placements

Our structured coaching program has helped hundreds of students clear the CMA exams successfully. Many of our students are now placed in top companies, financial institutions, and multinational corporations.

With TheCMAGuy’s expert coaching, students gain:

✔ In-depth conceptual clarity. ✔ Practical knowledge in cost and management accounting. ✔ High-confidence to tackle real-world finance challenges.

📢 Want to secure your future as a CMA professional? Join TheCMAGuy today!

What You’ll Learn in CMA Coaching at TheCMAGuy

Our CMA coaching program covers all key subjects in-depth:

📌 CMA Foundation Subjects:🔹 Fundamentals of Financial Accounting 🔹 Fundamentals of Laws & Ethics 🔹 Fundamentals of Business Mathematics & Statistics

📌 CMA Intermediate Subjects:🔹 Financial Management & Business Data Analytics 🔹 Cost Accounting & Performance Management 🔹 Direct & Indirect Taxation 🔹 Company Accounts & Audit

📌 CMA Final Subjects:🔹 Strategic Cost Management 🔹 Financial Reporting 🔹 Tax Management & Practice 🔹 Corporate Laws & Compliance

Each subject is taught with concept-based clarity, case studies, and real-world applications.

Final Thoughts – The Best CMA Coaching in Bangalore

If you’re serious about becoming a Certified Management Accountant (CMA), then joining the best coaching institute is crucial. At TheCMAGuy, we offer:

✅ Expert-Led Coaching with CMA Professionals✅ Comprehensive Study Materials & Mock Tests✅ Flexible Learning – Online & Offline Classes✅ Personalized Mentorship & Career Guidance✅ High Student Success Rate & Job Placements

The Chartered Accountancy (CA) qualification, offered by the Institute of Chartered Accountants of India (ICAI), is one of the most prestigious and challenging certifications in the field of accounting, finance, taxation, and auditing. As we enter 2025, ICAI has made certain updates to the CA exam format, and it’s important for aspirants to understand the structure and syllabus to prepare effectively.

If you're planning to pursue CA, this guide will help you navigate the CA exam format for 2025, covering exam levels, paper structure, marking scheme, and key updates.At SuccessEdge, we provide expert CA coaching in Bangalore, helping students clear their exams with structured study plans, personalized mentorship, and exam-oriented training

#bcom#cmausa#bangalore#commerce#cma certification#ca online classes#cmausacoachingbangalore#cmacoachingbangalore#cmacourse#finance

0 notes

Text

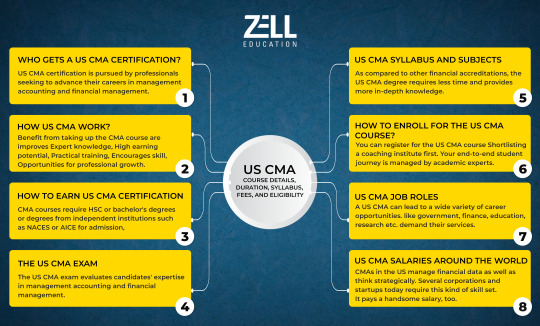

US CMA Course Details

Professionals wishing to progress in management accounting and financial management can earn the esteemed US Certified Management Accountant (CMA) credential. Two sections make up the course's structure: While Part 2 discusses financial decision-making, encompassing subjects like cost management, internal controls, and risk management, Part 1 concentrates on financial reporting, planning, performance, and control. In order to demonstrate their mastery of financial analysis and strategic decision-making, candidates must pass both sections of the test. Candidates must have two years of relevant work experience in addition to passing the examinations. With potential for leadership roles in accounting, corporate management, and finance as well as worldwide recognition, the US CMA qualification improves professional prospects.

#cma#us cma#cma course#cma course details#cma exam#cma fees#cma eligibility#cma exemptions#cma certification#cma job#cma student#cma subjeccts#cma syllabus

0 notes

Text

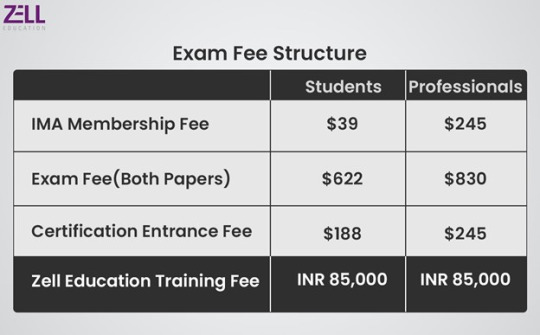

CMA Fees

Those seeking the esteemed CMA certification must pay the CMA (Certified Management Accountant) fees. Exam registration, membership, and study materials are all included in the pricing structure, which offers a variety of payment alternatives. In order to join the IMA, candidates must first pay an admission fee. Then, they must pay separate costs for each section of the CMA exam. Study materials, review courses, and, if necessary, reexamination fees are examples of additional expenses. The candidate's location and membership status affect the CMA fees. The CMA designation provides access to more lucrative job options and increased earning potential in management accounting and finance, despite the fees being an investment.

#cma#cma course#cma exam#cma fees#cma eligibility#cma student#cma india#cma certification#cma syllabus

0 notes

Text

CMA In India

A distinguished credential for experts in cost accounting, financial management, and business strategy, the CMA (Cost Management Accounting) certification in India is granted by the Institute of Cost Accountants of India (ICMAI). The purpose of this certification is to provide people with knowledge of financial analysis, cost control, and strategic decision-making. Employers in a variety of industries, including industry, banking, and government, greatly value the CMA India qualification, which provides prospects for career progression in senior financial and managerial positions.

0 notes

Text

CMA In India

The Institute of Cost Accountants of India (ICAI) in India offers the esteemed CMA (Cost and Management Accountant) certification, which is concentrated on cost management, financial analysis, and strategic decision-making. Professionals who complete the program will have the necessary abilities to maximize corporate resources and enhance financial performance. Candidates must successfully complete three exam levels, practical training, and a required amount of work experience in order to earn the CMA certification. With its potential to provide insights that promote efficiency and profitability, CMAs are essential in a variety of industries, including manufacturing, services, and public organizations. Professionals who hold this qualification have better job opportunities and can make substantial contributions to the development of businesses.

#US CMA#US CMA COURSE#CMA INDIA#CMA ELIGIBILITY#CMA EXEMPTION#CMA EXAM#CMA FEES#CMA JOB#CMA SALARY#CMA STUDENT#CMA CERTIFICATION

0 notes

Text

Why Do Accounting Leaders Need CMA Certification? Decode the Benefits!

In today’s competitive accounting world, earning a Certified Management Accountant (CMA) certification can truly set you apart. Whether you're an experienced professional looking to level up or someone just starting their career, the CMA designation opens doors to CMA career opportunities, higher salaries, global opportunities, and leadership roles. Companies are increasingly on the lookout for finance experts who not only understand the numbers but can also think strategically and drive business decisions. This makes the CMA one of the most valuable management accountant certifications in the industry. In this guide, we’ll dive into why getting your CMA is more than just a credential—it’s a smart move for anyone serious about advancing in an accounting career.

CMA Certification: A Path to Global Recognition

One of the standout benefits of CMA certification is its global recognition. Unlike some finance certifications that are region-specific, the CMA is recognized worldwide, making it a valuable credential whether you’re working in the U.S., Europe, India, or beyond. The certification is granted by the Institute of Management Accountants (IMA), a global professional organization that has certified CMAs in over 140 countries.

In today’s interconnected world, companies are increasingly looking for finance professionals who understand global markets and can navigate the complexities of international business. The CMA credential ensures you have the necessary skills to manage accounting functions across borders and in various industries, including manufacturing, healthcare, banking, and tech.

Industries and Countries in Demand for CMAs:

United States: As one of the largest financial hubs, the U.S. has a significant demand for CMAs in both public and private sectors.

India: With its growing economy and a strong focus on finance professionals, India is rapidly becoming a top market for CMAs.

Middle East: With the rise of large multinational companies, the demand for certified professionals in finance has increased in countries like the UAE and Saudi Arabia.

Increased Earning Potential for CMAs

One of the most compelling reasons to pursue CMA certification is the financial reward. According to IMA’s Global Salary Survey, CMAs earn a significant premium over their non-certified counterparts. The report shows that CMAs in the U.S. earn, on average, 58% more in total compensation than those without the designation.

Regional Salary Data:

United States: CMAs in the U.S. earn an average base salary of $40,000.

India: In India, CMAs can expect an average CMA salary of ₹6 lakhs per annum, with experienced professionals earning upwards of ₹20 lakhs.

Europe: European CMAs often command high salaries in finance and leadership roles, ranging between €60,000 and €100,000 annually.

When you compare the earning potential of CMAs to non-certified finance professionals, the difference is clear. Over the span of a career, CMAs can earn significantly more, making the certification a wise investment.

CMA vs. CPA: Choosing the Right Certification

While both the CMA and Certified Public Accountant (CPA) designations are highly respected in the finance world, they cater to different career paths. Understanding the key differences between the two can help you make an informed decision about which certification is right for you.

Key Differences Between CPA & CMA

Focus Area:

CMA: Management accounting and strategy

CPA: Public accounting and auditing

Global Recognition:

CMA: High, across various industries

CPA: Primarily U.S.-focused

Typical Roles:

CMA: Financial analyst, CFO, Controller

CPA: Auditor, Tax Specialist

Salary:

CMA: High earning potential globally

CPA: High, especially in audit and tax

Exam Format:

CMA: 2-part exam focusing on financial management and decision-making

CPA: 4-part exam focusing on auditing, regulation, and business concepts

If you’re interested in management accounting, strategic decision-making, and global career opportunities, the CMA certification is the ideal choice. On the other hand, if you’re focused on tax, auditing, or public accounting in the U.S., the CPA may be better suited to your goals.

Career Flexibility and Growth with CMA Certification

The CMA certification is highly versatile and opens the door to various career paths across industries. CMAs are equipped with a unique skill set that combines accounting, financial analysis, and business strategy, which makes them highly valuable in senior management roles.

Career Paths for CMAs:

Chief Financial Officer (CFO): As a CFO, you’ll be responsible for managing the financial actions of a company, including budgeting, financial planning, and risk management.

Financial Analyst: In this role, you’ll provide insights and analysis on financial data to help businesses make informed decisions.

Controller: Controllers oversee the preparation of financial reports and ensure compliance with accounting principles and regulations.

Leadership and Strategic Decision-Making Skills

One of the key benefits of the CMA certification is the focus on leadership and strategic decision-making. Unlike other certifications that focus mainly on technical accounting, the CMA emphasizes the ability to analyze financial data and use it to guide business decisions. This skill set is highly valued in senior management positions, where decision-making based on financial insights is critical.

Skills Acquired Through CMA Training:

Financial Planning and Analysis: CMAs are trained to prepare detailed financial plans and forecasts that help businesses achieve their goals.

Strategic Management: Understanding how financial data impacts long-term business strategy is a key skill for CMAs.

Risk Management: CMAs are well-equipped to assess and mitigate financial risks, ensuring the long-term stability of the business.

These skills make CMAs ideal candidates for leadership roles in finance departments, giving them a clear edge over other professionals.

Job Security and Demand for CMAs During Economic Uncertainty

In an ever-changing global economy, job security is a key concern for many professionals. One of the lesser-known benefits of the CMA certification is its ability to provide stability during economic downturns. During recessions or periods of economic uncertainty, companies often look to financial experts to help them navigate cost management, budgeting, and strategic decision-making. CMAs are particularly well-suited to these tasks due to their focus on both financial and strategic management.

Examples of Demand During Economic Crises:

During the 2008 financial crisis, many companies relied heavily on management accountants to control costs and optimize financial performance.

The COVID-19 pandemic also saw a rise in demand for CMAs, as businesses sought experts to manage cash flow and reassess financial strategies.

CMA’s Role in the Age of Automation and AI

The role of a CMA is evolving with technological advancements. Automation and artificial intelligence (AI) are reshaping the finance industry, and CMAs are uniquely positioned to adapt to these changes. As businesses increasingly adopt automation for repetitive accounting tasks, the demand for professionals who can analyze data and make strategic decisions is on the rise.

Key Tech-Savvy Skills for CMAs:

Data Analytics: CMAs are trained to interpret complex financial data, providing insights that drive business strategy.

Automation: CMAs are expected to manage and implement automation tools in finance departments, ensuring that these tools are used effectively.

AI in Decision-Making: As AI becomes more integrated into financial management, CMAs will play a critical role in interpreting AI-driven insights and applying them to business strategy.

The CMA certification ensures that finance professionals are not just accounting experts, but also skilled in leveraging technology to enhance business performance.

Networking and Professional Development

Networking is a crucial component of career growth, and CMAs benefit from being part of a global professional community. The Institute of Management Accountants (IMA) provides numerous networking opportunities through conferences, seminars, and online forums, giving CMAs access to a global network of professionals.

Professional Development Opportunities:

IMA Events: IMA regularly hosts events where CMAs can meet industry leaders, attend workshops, and stay updated on the latest trends in finance.

CMA Alumni Networks: Being part of a global community of CMAs can open doors to new career opportunities and mentorship.

Networking is not just about building relationships; it’s about staying connected to industry trends and continuing professional development throughout your career.

Conclusion

The CMA certification is more than just a credential; it’s a pathway to a successful and fulfilling career in finance. From increased earning potential and global recognition to leadership opportunities and tech-savvy skills, the benefits of CMA certification are clear. If you’re looking to enhance your career and take the next step toward leadership in finance, pursuing the CMA is a wise investment in your future.

Ready to start your journey toward becoming a CMA? Explore the CMA course at Miles and take the first step in achieving your career goals today!

0 notes

Text

Adarsh Dudheria's Rapid CMA Success: Certified in Just 6 Months!

Join Adarsh Dudheria on his inspiring journey from starting his CMA with Miles to achieving certification in record time. Discover the dedication and strategies that propelled him to success in just six months, setting a powerful example for aspiring accountants. Watch now to see how hard work and the right guidance can accelerate your career!

To know more, visit: https://shorturl.at/XsKTF

0 notes

Text

Give your resume a career-enhancing boost with a Certified Management Accountant (CMA) certification. Discover the top 5 advantages of earning this prestigious credential. From increasing your earning potential to expanding your career opportunities, the CMA certification can significantly impact your professional growth. Our blog explores how this certification sets you apart in the competitive job market and provides the expertise needed for leadership roles in finance and management. Read our blog to learn more about how a CMA certification can elevate your career!

0 notes

Text

CMA Certification focuses on strategic management accounting skills

On the other hand, the CMA certification focuses on strategic management accounting skills. It emphasizes cost management, financial analysis, and performance management. CMA professionals possess in-depth knowledge of managerial accounting techniques, aiding organizations in making informed decisions to achieve their strategic objectives.

0 notes

Text

CS Test Series – The Key to Cracking Company Secretary Exams

The Company Secretary (CS) exams, conducted by the Institute of Company Secretaries of India (ICSI), are one of the most prestigious professional exams in India. Whether you're preparing for CS Executive Entrance Test (CSEET), CS Executive, or CS Professional, one thing remains constant – practice is the key to success.

A structured CS test series helps students assess their preparation, improve time management, and enhance their confidence before appearing for the final exam. At 100X Commerce, we provide high-quality CS test series designed to help students succeed in their ICSI exams.

Why is a CS Test Series Important?

Many CS aspirants focus only on reading textbooks and study materials but fail to test themselves in a real exam-like environment. This can lead to:

❌ Poor time management – Difficulty in completing the paper on time. ❌ Struggles with ICSI’s unique question patterns – Unexpected case study-based and legal interpretation questions. ❌ Lack of answer-writing practice – Weak presentation in theory-based papers. ❌ Low confidence and exam stress – Unfamiliarity with the paper structure.

A well-structured CS test series helps you:

- Understand the ICSI exam pattern and marking scheme. - Improve answer-writing skills for law and compliance-based questions. - Develop speed and accuracy with structured practice. - Identify weak areas and focus on improvement before the final exam.

Want to test your CS preparation? Take a CS mock test with 100X Commerce today!

CS Exam Test Series – A Must for Every Level

At 100X Commerce, we offer CS test series for all three levels – from beginners to advanced students.

CSEET Test Series – Build a Strong Foundation

The CS Executive Entrance Test (CSEET) is the first level of the CS journey. Since it includes MCQs, legal reasoning, and business communication, mock test practice is essential.

- Practice MCQ-based questions with proper time management. - Understand the reasoning & legal aptitude section effectively. - Develop conceptual clarity in Business Communication, Economics, and Current Affairs.

Looking for a CSEET test series? Try a free CS mock test at 100X Commerce today!

CS Executive Test Series – Essential for Mid-Level Preparation

The CS Executive exam is a crucial stage that requires a deep understanding of corporate law, securities law, and financial management.

A CS Executive test series helps students:

- Master theoretical and practical application of company laws. - Practice answer writing for legal case studies and compliance-based questions. - Understand how to structure long-form answers for maximum marks.

Want the best test series for CS Executive? Take a free CS mock test with 100X Commerce today!

CS Professional Test Series – The Final Stage of the CS Journey

The CS Professional is the last and most challenging level of the CS course. This level requires a deep understanding of governance, risk management, and corporate restructuring.

A CS Professional test series ensures that you:

- Develop an exam temperament to handle high-pressure scenarios. - Master answer-writing for open-ended and case-study-based questions. - Refine your legal interpretation and compliance-based knowledge.

Want to clear CS Professional on your first attempt? Practice with 100X Commerce’s CS test series now!

ICSI Mock Test vs. CS Test Series – What’s the Difference?

Many students wonder whether ICSI mock tests are enough or if they should enroll in a CS test series. Here’s the difference:

Feature

ICSI Mock Test

CS Test Series by 100X Commerce

Question Variety

ICSI-style papers

Covers ICSI + additional practice questions

Detailed Solutions

Basic solutions

In-depth explanations & step-by-step approach

Performance Analysis

Not provided

Personalized feedback & score analysis

Chapter-wise Tests

No

Yes – Helps in step-by-step learning

While ICSI mock tests are useful, they don’t provide the detailed insights and structured practice that a high-quality CS test series does.

Want expert-curated CS test series? Join 100X Commerce today!

How to Use a CS Test Series for Maximum Benefit?

Here’s how you can make the most of your CS exam test series:

- Attempt Chapter-Wise Tests First – Strengthen your concepts before full-length mocks. - Simulate Exam Conditions – Take the tests under timed conditions with no distractions. - Analyze Your Mistakes – Review incorrect answers and understand where you went wrong. - Work on Weak Areas – Focus more on topics where you lost marks. - Revise Before Retaking Tests – Attempt the same test again to measure improvement.

💡 Following this strategy ensures maximum retention and exam success.

FAQs – Most Asked Questions About CS Test Series

1️⃣ How many mock tests should I take before the CS exam?

You should take at least 5-6 full-length mock tests per subject and multiple chapter-wise tests for best results.

2️⃣ Where can I get a free CS test series?

You can try a CS test series free of cost at 100X Commerce and experience high-quality mock tests.

3️⃣ Which is the best test series for CS Executive?

The best test series for CS Executive should include: - ICSI-patterned mock tests - Chapter-wise & full-length practice tests - Detailed performance analysis

Get all of this with 100X Commerce’s CS Executive test series!

4️⃣ What is the difficulty level of ICSI mock tests?

ICSI mock tests are moderate to difficult and closely resemble the actual exam, but practicing with a test series helps improve performance significantly.

5️⃣ Is a CS test series necessary to pass the exam?

Yes! A CS test series helps students master ICSI’s exam pattern, improve time management, and build confidence—which are all critical for passing the exam.

6️⃣ Can I take CS mock tests online?

Yes! 100X Commerce offers online CS mock tests that you can attempt anytime, anywhere.

Want to boost your CS exam preparation? Join 100X Commerce today and practice with the best CS test series!

#bcom#finance#cmacourse#cmausa#bangalore#commerce#cma certification#ca online classes#cmausacoachingbangalore#cmacoachingbangalore

0 notes

Text

CMA Syllabus

The two extensive sections that make up the Certified Management Accountant (CMA) curriculum are intended to provide in-depth understanding of financial management and management accounting. Financial reporting, planning, performance, and control are the main themes of Part 1, which also covers performance management, internal controls, planning and budgeting, and external financial reporting. Financial decision-making is covered in Part 2, which includes topics including corporate governance, risk management, internal controls, cost management, and investment decisions. The curriculum places a strong emphasis on strategic decision-making abilities and real-world application, guaranteeing that applicants are equipped for leadership positions. Candidates must show mastery of these areas in order to pass the CMA exam, giving them the know-how to be successful in management accounting and financial roles around the world.

#cma#cma course#us cma#cma exam#cma fees#cma eligibility#cma exemptions#cma certification#cma job#cma salary#cma student#cma india

0 notes

Text

CMA Course

A specialized professional curriculum for those seeking proficiency in financial management and management accounting is the Certified Management Accountant (CMA) course. The course, which is provided by the Institute of Management Accountants (IMA), addresses important topics such ethical standards, financial planning, analysis, control, and decision-making. By supporting corporate decision-making and guaranteeing efficient financial control, the CMA certification gives professionals the ability to manage strategic financial obligations. The CMA designation provides access to advanced professional options in management, accounting, and finance due to its widespread recognition. The course offers a thorough foundation for success in the fast-paced sector of management accounting, making it perfect for anyone hoping to hold leadership positions in business and finance.

#cma#cma course#cma exam#cma fees#cma eligibility#cma exemptions#cma certification#cma job#cma salary#cma student#cma india#us cma

0 notes

Text

US CMA Certification

Professionals with expertise in management accounting and financial management can obtain the internationally renowned US CMA (Certified Management Accountant) certification from the Institute of Management Accountants (IMA). Financial planning, performance, and control are the main topics of Part 1 of this certification, while financial decision-making, analysis, and risk management are covered in Part 2. The US CMA certification improves career prospects and creates chances for leadership roles in accounting, finance, and business management worldwide by demonstrating proficiency in strategic financial management.

0 notes

Text

Best CMA course provider in Dubai

Look no further for the premier CMA course provider in Dubai than YourOwn Institute. In 2024, we continue to set the standard for excellence in CMA education, offering a comprehensive program designed to equip students with the skills and knowledge needed to thrive in today's competitive business environment. Our expert faculty, cutting-edge curriculum, and personalized approach ensure that every student receives the support they need to succeed. With a focus on practical application and real-world scenarios, our CMA Course in Dubai prepares graduates to excel in their careers from day one. Choose YourOwn Institute for an unparalleled educational experience and a pathway to professional success.

0 notes

Text

What is the Use of Business Analytics in Accounting?

Business analytics has become an essential tool in the field of accounting, transforming how financial data is analyzed and utilized. By leveraging advanced data analysis techniques, business analytics provides valuable insights that help accountants and financial professionals make more informed decisions. This integration enhances the precision and efficiency of various accounting processes, making it a crucial component in modern accounting practices.

Business analytics in accounting involves the use of statistical methods, data mining, predictive modeling, and other analytical techniques to interpret financial data. This allows accountants to uncover patterns, trends, and anomalies that might not be evident through traditional accounting methods. For instance, predictive analytics can help in forecasting future financial performance, enabling businesses to make proactive decisions. Additionally, real-time data analysis helps in monitoring financial transactions as they occur, allowing for immediate detection and correction of errors or fraudulent activities.

Professionals with a master's in accounting can greatly benefit from knowledge of business analytics. Many advanced accounting programs now incorporate business analytics into their curriculum, recognizing its importance in the industry. A master's degree that includes training in business analytics equips accountants with the skills needed to analyze large datasets, use sophisticated analytical tools, and translate complex data into actionable business insights. This combination of accounting expertise and analytical proficiency makes graduates highly desirable in the job market.

For those aspiring to work in the US, having a background in both accounting and business analytics can open up numerous opportunities. The demand for professionals who can interpret financial data and provide strategic insights is high across various sectors, including public accounting firms, corporate finance departments, and government agencies. Companies in the US are increasingly seeking accountants who are not just number crunchers but also strategic advisors who can use data to drive business decisions. This trend underscores the value of integrating business analytics into accounting roles.

Furthermore, possessing business analytics skills can lead to specialized roles such as forensic accounting, where data analysis is crucial for investigating financial discrepancies and fraud. It can also enhance roles in management accounting, where professionals use data to advise on business strategy and performance improvement.

In conclusion, the integration of business analytics in accounting significantly enhances the field by providing deeper insights and more precise financial analysis. For those pursuing a master's in accounting, gaining proficiency in business analytics can make them more competitive in the job market and better equipped to meet the demands of modern accounting roles. As businesses increasingly rely on data-driven decision-making, accountants with analytical skills are well-positioned to thrive, especially for those looking to work in the US.

#cma course details#cma certification#cma course full form#Best cma institute in India#cma subjects#cma registration fees#cma course qualification#cpa course details#cpa certification#cpa course full form

0 notes