#charity donation tax deduction

Explore tagged Tumblr posts

Text

The world’s largest population of blind people lives in India. Over 8 million people, to be exact. The majority of them lack access to even the most basic medical facilities because they reside in the nation’s most underdeveloped regions. But did you know that if they had received prompt treatment, nearly half of them might not have become blind? Sightsavers India realises the importance of eye health and thus through its programmes ensures availability of affordable, quality eye health services in rural districts, urban slums, government schools and to the underprivileged community.

#charity donation tax deduction#list of top ngos in india#online charity#best ngo to donate in india#charitable donation tax deduction#best charities to donate to#best fundraising platform#best ngo in delhi ncr#most famous ngo in india#most popular ngo in india#most trusted ngo in india#best ngo foundation in india#online giving foundation india#top international ngo in india#top most ngo in india#best ngo for donation#best ngo in india to donate

1 note

·

View note

Text

time to pay the boyfriend tax again (brian is coming to a venue near us and i'm the one with money)

#the real question#are boyfriend tax costs tax deductibles#1. it's literally the boyfriend tax. it has tax in the name.#2. it's basically charity work and donations are tax deductible#the front bottoms#tfb#brian sella#brian solo show#flyingmodelr0ckets mentioned

16 notes

·

View notes

Text

the nature of the panopticon that is social media is some of y'all really act like hippa and bank account info aren't private information that y'all are under no obligation to disclose and legally do not have to

#the only people who need to know about your donations is the irs#idk about local tax law internationally#i should look up if charity donations are tax deductible in the uk

5 notes

·

View notes

Text

How to Fundraise for Sightsavers Effectively?

When an eye issue impairs the visual system and its functioning, it is called vision impairment. A person with vision impairment has significant lifelong repercussions. Timely access to high-quality eye care can help to reduce many of these negative impacts. One of the most impactful ways to help these people is to support NGOs that are into eye care or volunteer the time in them. In addition to making a positive difference in the lives of others, donors in many countries can also get the benefit of a charitable donation tax deduction. visit: https://sightsaversin.blogspot.com/2024/12/how-to-fundraise-for-sightsavers.html

0 notes

Text

Your support is crucial to sustaining this transformation. Make a donation for a tax deduction today!

0 notes

Photo

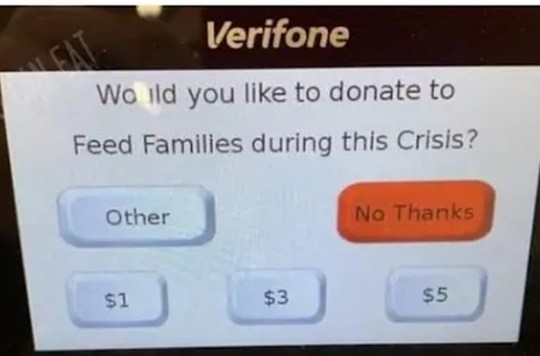

SYABM comic 70 “Donation Aggravation”.

[ Older comics | Chronological order | Subreddit ]

Some people get really mad about a computer asking them to give pennies.

AP says this meme is false.

Customer donations aren’t income, legally. So they can’t be ducked from the company’s tax bill.

Tax Policy Center says the same thing, and points out that consumers forget to deduct their donations.*

This meme was apparently popularized by, of course, TikTok.

Also, if they get a tax break, so what?

The point of that is to encourage charity and social benefit. If you care more about the tax break than whether they’re actually helping anyone, I think your priorities are skewed.

And getting a tax break means the company has more money to spend on stuff like...the charity. Or employee raises. Or just staying open.

I know the implication is that they must be insincere, but it doesn’t actually prove anything. It’s just point-scoring.

I recently saw people complaining that Panda Express falsely takes the credit for their charity, which is entirely funded by donations from customers and employees. PE Cares openly and explicitly says so on their website.

PE also covers the admin costs for PEC. All of them.

And as someone pointed out, they could just as easily...not have the charity. In fact, it would be easier.

Heck, during the Hawaii Wildfires, PE donated meals to first responders and displaced people. And, oh yes, they matched donations to the Red Cross.

...It’s a “Cancel” button.

Those are often different from regular choices, so people don’t click them accidentally. Heck, sometimes they’re made that way so they’re easier to see.

No 5D chess subliminal messages required.

And if you’re so easily influenced that a button color can change your mind, that’s on you.

“Saying your assumptions about us are wrong are gaslighting, even when I have no actual evidence I am also confident that everyone does this, which justifies my assumption that any given company does this.”

It’s especially irritating because gaslighting is about perception. But assumptions are not actual perceptions, and perceptions are wrong all the time.

I also saw people in the Youtube comments complaining about grocery store food waste, because apparently stores love to waste money, and are not influenced by picky consumers or legal concerns (PDF).

I’ve argued with these types before, and naturally, they defaulted to attacking me instead of my argument. Didn’t even pretend to have any actual evidence. Unlike me. Just doubled down.

And, again, what does this have to do with charity?

Plenty of companies actually, quietly donate everything to charity that they can. But that doesn’t make the news as much. Sometimes because that leads to people trying to take advantage.

Incidentally, during the Texas blackout a few years back, one grocery store tried to donate their food to a charity. Except it was physically impossible for them to get there before the food expired, due to the bad weather.

People saw the store throw out the ruined food (under police guard), and said the store was selfish.

One Youtube comment said the Bible claimed people shouldn’t give openly. Okay, but that’s about self-aggrandizement and egotism, not just asking for donations and trying to set an example for others, out of actual caring.

I think the real motive is a combination of anti-corporate NPC hate, and the desire to attack the requester instead of admitting they just don’t want to donate.

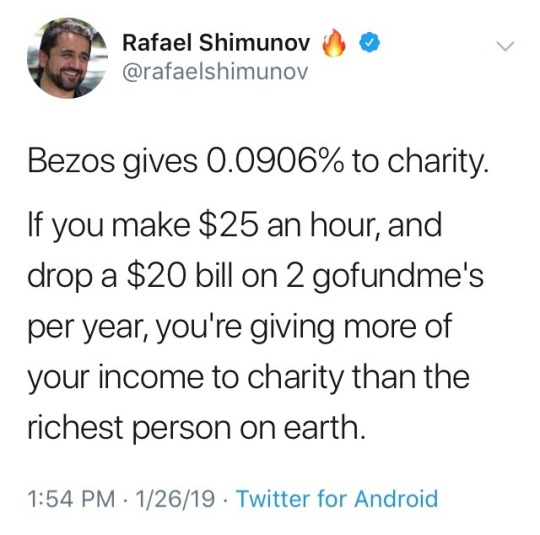

And I gotta wonder what the overlap is with the folks who insist billionaires can “easily” afford to pay taxes that are more than what many people make in their entire lives, because it’s a small amount relative to their total wealth.

* Did see someone once claim that people pay higher taxes for donating. They may have been referring to people not knowing they can deduct donation. Which is, um, not the company’s fault. At all.

Behind the Scenes: This is the first comic drawn in Krita that I’ve animated. In fact, it’s my first Krita animation, ever.

And unfortunately for me, Krita can’t animate Vector layers or groups. I only figured that out after a literal hour looking up tutorials (which didn’t help). And it’s a tad irritating, because I often use vector layers AND groups.

So I had to manually create each frame. Three different elements with three different timings. Had to break out the paper and pencil and plot it out.

Kinda fun, actually.

This is also the first commentary in a long time that I didn’t write before I finished the comic. In fact, I’m doing it completely raw. All I had was the saved image and a link to the Youtube thread in question.

Comic Inspirations:

That one freakout scene in Bocchi the Rock.

The kiosks at my local McDonald’s.

Whatever this is;

48 notes

·

View notes

Note

Beyoncé’s donation is shady af, even worse than the sux. She donated that money to her own charity, and apparently it’s a charity that doesn't have any public tax form, so they can do whatever with that money without anyone knowing.

Hate to break it to you, but a $2.5 million donation is still a $2.5 million donation.

That was the point of my post - that Beyoncé actually donated money (even if to her organization) and the Sussexes have only bothered to do a papwalk. That despite how much the Sussexes claim to be passionate about service and support, they can’t put money where their mouth is - they prefer put your money there.

Beyoncé’s charity probably works much like Archewell, and most other celebrity charities, in that they disburse grants and scholarships so when Beyonce donates to it, she gets twice the tax-write off - the first deduction on her donation, the second on the grants. It’s pretty common.

20 notes

·

View notes

Note

Hey Sam, I remember reading a post or response from you about how to give to charities anonymously, but now that I’m searching, I’m finding a few different responses but still have questions. Any chance you could do a round up post? Wondering about the following:

1. How to give cash

2. How to give small amounts anonymously (e.g., if you can’t set up a DAF)

3. How to opt out of being sent branded junk if you can’t give anonymously, because it will end up in the garbage (seriously, no more pens, stickers or magnets please)

4. In giving anonymously, how important is the tax receipt? I only take the standard deduction on my taxes… is there a reason to bother with tracking the receipts?

Appreciate your help!

Ah yeah, it's rough knowing how to do some of these things. I've written about some of them, probably most of them, but disparately over several posts, so let me see if I can answer succinctly and all in one place.

How to give cash: You are pretty much confined to two options, giving cash to a staffer in person or mailing cash in an envelope. If you have access to the office of the nonprofit you may be able to swing by and drop the cash off, but it's not super convenient and often not possible. If you're at an event you can hand it in an envelope to a staffer, and that's really the only way my organization gets cash donations, but that requires you to be at the event. And technically I can't recommend mailing cash since the risk of theft is a real one. Giving cash is fine legally, but nonprofits often aren't thrilled with it because it can put their staff at risk and also there's, well, there's no way to track that donation to a person. But yeah, throw them dollars between two thick sheets of paper and mail that in with a note saying "This is for the XYZ organization" so they know they can accept it.

2. Giving small amounts anonymously: It depends on how you're defining 'small'; I have a DAF (for the readers: a Donor Advised Fund -- I talk a little about them here but I've never gone indepth) which has no minimum deposit or minimum monthly contribution, but they do have a minimum donation amount of $20. To me that's not especially large, but I know to many people it can be. Pretty much the only way to give an amount smaller than $20 anonymously is to give online through the nonprofit's website using a cash giftcard (like a Visa gift debit card), and just not give an address. If you custom-order checks you can sometimes order checks without a home address, or with the bank's address, and pay with one of those, but I've never tried that.

If you do use a DAF (and I can recommend Charityvest, they've been mine for several years now) you can always set up to pay small amounts into it and just have them send all that money in a lump sum once or twice a year. I pay in $75/mo and from that they pay out three $20 donations a month, and at the end of the year the extra $180 that has just sat there becomes a nice extra donation. Always bearing in mind of course that once you pay into a DAF that money is gone, you can't claw it back even if you haven't "donated" it yet -- just putting money in a DAF is considered a donation. Readers, if you're curious about DAFs I recommend googling, lots of banks have "what is a DAF" pages, but if you're not finding what you want to know do feel free to come ask me.

3. Opting out of swag when not giving anonymously: I'm tempted to just say "Ya can't" because it's hard, especially with larger orgs. Even if you opt out, often you'll still get mailings that are considered "stewardship" (maintaining a relationship) rather than "solicitation" (asking for giving) and swag counts as stewardship. You can always start with sending the org a letter saying "Please put me on a Do Not Contact list, I will continue to give but don't want to get your swag". If that doesn't work, start returning mailings -- if you get something from the org don't even open it, just write "return to sender -- no longer resident" and drop it in the mail. This is not guaranteed effective; some places will either just change the name to 'resident' or retry every so often just in case. You can call the org and ask to speak to "records" or "data", and then just be super up front: "I want to keep supporting you but I really don't want the swag, how do I get that turned off?" They can help, but if you give to another similar org, a lot of times orgs will do "list exchanges" where they swap mailing lists, and if the org does that and you're on the other org's list, you get put right back on the "ok to mail" list for the first org.

I will say, swag is very, very cheap and gets results, so you can also look at this as "well, it was wasted on me, but the five cents this pen cost will get them $1 from someone, so in accepting it, I am still helping them to gain donations." This depends on your tolerance for waste, of course, which I'll talk more about in a minute.

(I personally like getting magnets, because I put stickers over top of whatever's printed on the magnet, cut it out to the shape of the sticker, and behold! I have a cool magnet!)

4. Tax receipting: I'm not a CPA or a tax lawyer and I fucked this up the last time I talked about it, so take this with a grain of salt, but there is an "above and beyond" deduction -- after the standard deduction I believe you can deduct an additional up-to-$300 for charitable giving, and if you were to be audited you'd need receipts to prove that. (As I said, if you're planning on this, fact-check first, I am not a strong source for this information.) (Edited to add: comments informed me this is no longer the case, so I'm glad I added in the disclaimer :D) If you give via a DAF, no problem; the DAF tracks where and when and how much you gave, so I could use my DAF's records as "receipts". You can also, if you lost or didn't get a receipt, contact the org and ask them for your giving record for the year. Here's the problem -- if you are giving in a way that allows you to avoid giving your address, there may be no way to get those receipts, since you can't prove their record with your name on it is you. So if you want receipts but want to give semi-anonymously definitely make sure they have your email address. If you're giving $300 a year, you probably want to take that deduction; if you're giving $20 a year, probably it isn't worth it. But yeah, to get a receipt you generally have to give them enough information for them to identify you, but you don't need giving receipts if all you take is the standard deduction.

All in all, the options are -- give cash and get no receipt, give via DAF or using a giftcard and get receipts to your email, give with your address attached and just hope they honor your request to be removed from swag mailing, or give however you want, put up with the swag, and bear in mind that them sending you the pen or magnet or keychain wasn't much of a problem or cost for them and will get them money from someone.

Honestly, option four isn't the least irritating, but it's probably the least labor-intensive for you. But it really is a question of what you want from your relationship to the nonprofits you support, and how passionately you feel about the "waste" status of swag they send. Only you can determine where your tolerance point is between "having to put in so much effort not to get this stuff" and "having to throw this stuff in a landfill". It's a regrettable part of being a donor and building a relationship with a nonprofit, but we in the nonprofit field do appreciate your giving and your tolerance :) While there are some outlier bad-actors in the space, trust me, for most nonprofits, nothing we do is gratuitous. Almost all of us are on such a thin wire that if something costs us money and doesn't get us more money, it gets binned very quickly.

93 notes

·

View notes

Text

just thought we'd make a little pinned post with all our information :-)

we're two artists, girlfriends -- kohi & andie! we run a foster-based cat rescue (named paws & purrs) from our home here in san antonio tx. it is an official 501(c)3 public charity & all donations are tax deductible. to date, we've tnr'd over 70 cats & fostered around 50 cats & kittens of all ages. we also love making art of our kiddos, along with our favorite franchises.

#art for our artwork

#andieanswers or #kohianswers or just #answers for all our asks that we've responded to!

#pawspurrsco for all our rescue posts!

andie uses procreate primarily & kohi / jas uses clip studio paint! we travel to conventions around the country & work really hard on taking care of neonates & rescue work here in our area, so responses may be a little slow, but we try our best!

you can support us best through:

our patreon + our main shop + our chewy wishlist + our rescue site

or follow our different social media accounts:

youtube (vlogs) + instagram

thanks! :-)

233 notes

·

View notes

Text

Transform Lives with Sightsavers India Donation - Support Our Vision Today

Sightsavers India is a non-profit organization dedicated to preventing blindness and promoting equality for people with disabilities. Sightsavers India Donation can help them provide essential eye care services, education, and advocacy programs to those in need. Join us in the fight against avoidable blindness and make a difference today.

#charities to donate to near me#top ngo in delhi ncr#top ngo websites in india#accept donations online in india#best donation website india#best indian ngo for donation#best ngo to donate money#best online charity donation sites#charitable giving tax deduction#charity commission online services#charity fundraising platforms#charity sites online#donate money online india#genuine charities#genuine charity organizations#good charities to donate to#online charity donation india#online charity donation sites#online charity fundraising#online charity organizations#online charity website#online donation ngo india#online donation platform india#online donation sites india#online fundraising for nonprofits#online fundraising platforms for nonprofits#online giving platforms for nonprofits#top ngos to work for in india

0 notes

Text

For anybody who’s looking to donate to alleviate conditions in Gaza, a good charity is Doctors Without Borders. Also known as Medicins Sans Frontieres or MSF (they’re headquartered in France).

My uncle’s doctor recently returned from two months working at various field hospitals in Gaza for MSF, and they kept him hard at work doing amputations, births, you name it. As well as medical care MSF also organize to distribute clean water, food, etc.

They have boots on the ground in the war zone, doing important humanitarian work. They’re a much scrutinized charity with a solid reputation. And since MSF is incorporated as a charity in most world countries, your donation is probably tax-deductible. Which might sound frivolous, but every little bit helps. I actually donated more because I knew I was getting some of it back come tax time.

10 notes

·

View notes

Note

You’ve probably been asked this question before, but does the government tax you for your commissions? If so, how?

i do pay taxes on my income yes, the 'how' is bit of a long and boring answer though so im going to put it under the cut (fyi im in australia so my info is only applicable to australians)

-first off, in australia you have a tax-free threshold of about $18,500, govt doesnt really seem to care if you report your earnings under that or not, idk though you should check whether or not you legally Have To. better to stay on the tax mans good side.

-i have an accountant who does the maths and lodges my taxes for me, all i have to do is payg the ATO an amount of money 4 times a year based on my reported earnings

-i report my earnings once a year around july-ish, but if you have a tax agent i believe the ATO tends to give you more leeway on When exactly you do your annual taxes

-i am a registered sole trader, this means that while i run a business, i don't have employees other than myself, so i dont pay the taxes business owners with employees would.

-businesses that make over 70k aud/year have to pay GST, which is a 10% tax on all sales within australia. this does not affect my customers abroad and it does mean my australian customers get a special invoice :)

-if you hold onto your receipts, you can get certain things as a tax write off, ex. new work computer, new drawing tablet, office chair, as long as it is justifiably related to your business and you dont abuse it, on the off chance you get audited youll be safe as houses

-see if any charities you donate to can be tax write-offs too. thats just general advice but plenty of charities are tax deductible so go crazy.

#croaks#make sure to fact check me against the ato website if any of this is relevant to you btw#i dont think im wrong but i could be#also with the price of food and living and the fact that im 23 with very little to my name in terms of equity#it does rankle a bit that i have to pay so much while rupert murdoch pays $0#money sucks but i need it to live

189 notes

·

View notes

Text

ive seen some people really upset that their tax dollars are funding the palestinian genocide (about 25% of your taxes go the the military). for future reference your donations to a charity can be deducted from your taxes if it is a 501(c) organization, or falls under section 170(c). you can find 501(c) organizations using this search function on the irs website or you can generally find out if a charity has a 501(c) on their website. Doctors Without Borders is a 501(c) organization and charity navigator has this list of 501(c) organizations that are sending aid to palestine and/or israel so make sure to do your research if you pick a charity from this list because it may be a zionist organization

33 notes

·

View notes

Note

How does one go about getting a quilt appraised?

To get a quilt appraised, you need to find someone who is trained to appraise quilts (it is good to make sure that they are accredited first, a good certification to check for is the Professional Association of Appraisers – Quilted Textiles certification, or the American Quilter's Society). Their websites have a list of appraisers who you can make appointments with. You can also sometimes find appraisers at quilt shows. You will need to bring the quilt in person, and it is recommended that you bring any purchase receipts for materials and patterns if you made the quilt.

Quilts with sentimental value, substantial costs and materials, or quilts made with the intention of donation (example, charity raffle of museum) should be appraised. This is so you can have insurance should anything happen to it, and in the case of donations, the opportunity to claim tax deductions for a donation.

You can also get an appraisal to assist in pricing a quilt if you're selling them.

Keep in mind that the appraisal quote may need to be updated every few years or so, because the value of things may change.

Hope this helps!

6 notes

·

View notes

Text

Together, we can help build a future where every child's dreams are nurtured and their rights are protected. You can also avail of a tax deduction on your donation. So wait no more and support CRY America now!

1 note

·

View note

Text

Just Cats Tasmania are setting up a facility on the North West Coast! This is incredible news as we are sorely lacking a proper cat management facility here. It also provides a closer option for those in Strahan and Queenstown, so even better.

The only problem: the government so far refuses to allocate any funds for the project (which will save not only cats, but wildlife too). But the issue can't wait any longer, so Just Cats have created a fundraiser, hoping to raise $50,000 to start the new facility. Every dollar helps, so if you can donate even the smallest amount, it would be much appreciated.

Info about Just Cats:

Official charity. All donations over $2 are tax deductible for Australians (not sure about international donors).

They are a no-kill shelter complete with vet clinics for the animals in their care. You can read about a couple of their rescue stories here: https://www.justcats.org.au/cats-we-have-rescued

They routinely have hundreds of cats and kittens in their care.

They have a dedicated team of volunteers and foster carers.

They provide crisis care and boarding facilities.

They have been running for 13 years and have proven themselves a capable organisation.

All cats are de-sexed before being made available for adoption, meaning less unwanted litters. All cats are also vaccinated and microchipped.

Their mascot, Gavin, is the biggest boi I have ever seen!

Photo sourced from Just Cats Facebook page.

2 notes

·

View notes