#car payment calculator

Explore tagged Tumblr posts

Text

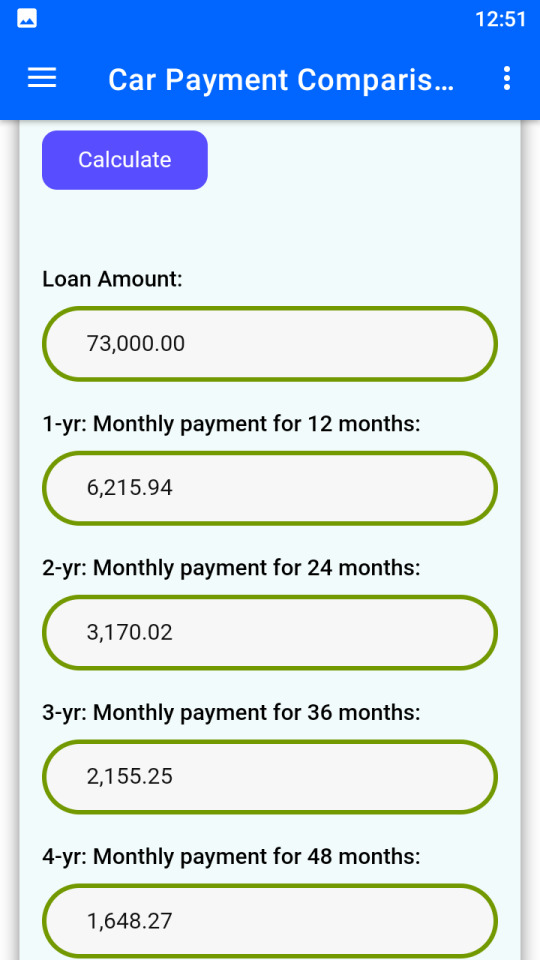

Know & compare the monthly payments from 1 year to 10 years. This App will show you the monthly payments required for car loans lasting 1 year, 2 years, 3 years, 4 years, 5 years, 6 years, 7 years, 8 years, 9 years & 10 years. Simply enter your total loan amount and the annual interest rate. Then press "Calculate", to see the monthly payments for each loan term.

#car payment calculator#auto loan calculator#vehicle loan comparison#monthly car payment estimator#car finance calculator#loan term comparison#car affordability calculator#auto financing tool#car loan repayment#interest rate calculator#car lease calculator#car loan EMI calculator#vehicle financing calculator#auto loan payment tracker#car purchase planning#car budget calculator#car loan interest calculator#auto finance planner#car loan schedule#loan amortization calculator#car cost estimator#easy car loan calculator#car financing made simple#monthly installment calculator#car loan planning tool#vehicle cost calculator#auto credit calculator#auto loan affordability#best car loan calculator#smart car finance app

0 notes

Text

they should let me explode things with my mind. for enrichment.

#borbtalks#yay i love unexpected additions to my budget#yay i love new policies that make it so im paying extra for shit i can't even use#(mandatory parking spot getting new permit system. permit is tied to a vehicle. i don't own a car.#i can't get a permit for guests to use my spot. im effectively paying for a parking spot i can't even use.#have already asked landlord if i can stop paying for it. since their new rules make it so i can't even use it)#(and like 95% of rental assistance programs like the one i use will help with utility payments. but not the one im in !!#which they don't make fucking clear on their site !!!#and of course the unit i picked i have to pay all the utilities on my own !!!!#AND they just changed policies so if i had signed my lease after the new year i could've gotten a much cheaper rent#BUT NO IM UNLUCKY AND HAD TO MOVE OUT BEFORE I KILLED MYSELF. BC SPENDING XMAS WITH MY FAMILY WOULD'VE DONE THAT#aha.#medicaid suggested i should apply for food stamps even before i moved out#but according to a calculator. even with all my new housing costs with rent and utilities. i would only get the absolute minimum in snap#besties is a stressful interview + application process worth it for only $20/a month#like woohoo. i could get a teensy bit of money off my grocery bill. this is totally worth it /s)#dont get me wrong i would choose this stress over living with my parents any day. but that doesn't mean this isn't stressful

9 notes

·

View notes

Text

Genuinely what I do for fun now is open up my credit card apps and then a browser with a credit card repayment calculator, then input numbers until I run out of wiggle room in my budget

#if I used my savings I could technically pay off my credit card w the lowest balance now#but my fear is that if I do that I'll start using the card when I'm in a pinch again#and I'll end up racking up more debt#since I'm so focused on paying it off rn I literally will not even think about using it#but if I paid it off I would have slightly more money to put towards the next credit card payment#and then in September my Self loan will mature and they'll send me my $500#so I could put all of that towards my credit cards too. or maybe make an extra car payment#or maybe just put it in my savings account.#idk. it'd probably be smart to put it towards the credit cards. at least half of it.#but literally this is all I think about when I have free time#if I'm just sitting around I'll be like. hm. I wonder if there's more money I can scrap together#let's open up the calculator app#once they're paid off tho..... omg. that's an extra $200 a month I'd have#things would be just a little easier

4 notes

·

View notes

Text

FIXED THE CLUNK IN MY CAAAARRR AND IT DIDNT COST ME A DIIIMMMEEE IT WAS LITERALLY A LOOSE BOLTTTTTTT 🎉🎉🎉🎉🎉

#chow.txt#the clunk was SO BAD i was so upset#and plotting my car’s funeral and calculating a new car payment#IT WAS A LOOSE BOLTTT

12 notes

·

View notes

Text

Applying for a loan to buy a car, hopefully it's fine. I should be able to Qualify rather easily for a 19,000 dollar loan. And I can swing 500 dollar per month payment MAX but if I've calculated it correctly the monthly payment should be 350, then plus insurance at like 150, I should be good! As I earn like 3000 a month.

The car is a 2015 Bright Yellow Jeep Wrangler that my mom's friend is selling! I hope I can get it :)

#I'm paying off my student loans though they're currently in deferment#So that's like 140 a month#+ the 500 (or more I'm flexi the max I can pay a month for car + insurance is 600)#plus the 107 a month for my phone#so 747 a month (847 if it ends up being 600)#I don't pay rent for now luckily but my max rent I'm willing to pay is 1600#with that the monthly cost is 2347#that leaves 653 for everything else#if I don't include paying max rent then it's 2253 left#Pretty good I think!#If I eschew paying my student loans until the grace period ends thats 2393#additionally I've calculated all this with the MAX payments and rounding up so it will likely be less#:)#I am a bit worried about it as I am a freelancer but it should be fine

4 notes

·

View notes

Text

I wonder if I can save money on food when moving out by just getting a 30 day supply of “just add water” MREs and cutting the portions in half? The only other food items I’d get would be flour and rice (in bulk), and maybe eggs, so I could pay only around 200 dollars in food for a supply of two months or potentially longer. It would work wonders for my executive dysfunction, not having to cook much. Plus, I could save money on gas by not having to drive to the store very often. I could also grow food indoors.

#This is what the cult gets for constantly drilling “calculate the cost” into my head#I’m an insufferable cheapskate (AKA: extremely frugal when I want to be)#I need calorie-rich foods… maybe I should start buying canned food from Ollie’s now and storing it away in my room#while I’m stable#Then when it’s time to move#I just transport all the cans there#I probably won’t have a car when I leave; but I have a bike with giant panniers on it so I’ll just use that as transportation#get a place within biking distance of my work; get an online job in the summer; do voiceover work and YouTube#Even if the rent is higher; I won’t have car payments to make#I’ll probably look like death warmed over from the food budgeting and constant biking but hey! No meetings!#And any social situations I’m required to participate in I’ll get paid for!#No love-bombing; no unwanted hugging#Can’t wait#It’s a shame there isn’t much public transportation around here other than the occasional bus stop#I wish we had a subway or train station

4 notes

·

View notes

Text

Empowering Financial Decisions with Modern Calculators: Your Key to Financial Success

In an era where information is readily available, financial empowerment is key to making informed decisions. Thanks to the digital age, we have access to an impressive array of calculators that can simplify complex financial tasks. Let's explore the world of Modern Calculators and discover how these tools can empower you in various aspects of your financial journey.

1. Rectangle Body Shape Calculator

Your body shape plays a significant role in fashion choices. The Rectangle Body Shape Calculator not only identifies your body shape but also offers tailored fashion advice to help you look and feel your best.

2. Pear Body Shape Calculator

Enhance your style by understanding your body shape. The Pear Body Shape Calculator provides insights and fashion tips specifically designed for pear-shaped individuals.

3. Triangle Body Shape Calculator

Confidence in your wardrobe starts with knowing your body shape. The Triangle Body Shape Calculator identifies your body type and offers fashion recommendations to elevate your style.

4. Car Payment Calculator GA

Planning to buy a car in Georgia? The Car Payment Calculator GA simplifies the process by helping you estimate your monthly car payments, ensuring they fit comfortably within your budget.

5. Mobile Home Mortgage Calculator

Homeownership is a dream for many, and mobile homes provide an affordable path. The Mobile Home Mortgage Calculator assists in estimating your monthly mortgage payments, making homeownership more achievable.

6. Car Payment Calculator Illinois, Colorado, Virginia

If you're relocating to Illinois, Colorado, or Virginia, this calculator helps you estimate car payments in different states, ensuring your budget aligns with your new location.

7. Car Payment Calculator AZ

Considering a vehicle purchase in Arizona? The Car Payment Calculator AZ enables you to calculate potential car payments, allowing you to budget effectively.

8. FintechZoom Mortgage Calculator

Mortgages can be complex, but the FintechZoom Mortgage Calculator simplifies the process. Calculate mortgage payments, explore interest rates, and understand your amortization schedule with ease.

9. Construction Loan Calculator

Building your dream home? The Construction Loan Calculator estimates your construction loan requirements and monthly payments, ensuring a smooth building process.

10. Aerobic Capacity Calculator

Your fitness journey starts with understanding your aerobic capacity. Calculate your fitness level and tailor your workouts for optimal results using this essential tool.

11. Aircraft Loan Calculator - Airplane Loan Calculator

For aviation enthusiasts, owning an aircraft is a dream come true. The Aircraft Loan Calculator simplifies the financial side of aviation, helping you understand loan terms and payments.

12. Manufactured Home Loan Calculator

Thinking about a manufactured home? This calculator provides invaluable insights into potential loan payments, making homeownership in a manufactured home more achievable.

13. Classic Car Loan Calculator

Passionate about classic cars? The Classic Car Loan Calculator helps estimate classic car loan payments, bringing you closer to your dream vehicle.

14. FintechZoom Loan Calculator

Whether you need a personal or business loan, the FintechZoom Loan Calculator equips you to estimate monthly payments and assess the financial impact of borrowing.

15. ATV Loan Calculator

Ready for off-road adventures? The ATV Loan Calculator calculates potential ATV loan payments, ensuring your outdoor escapades are within reach.

16. Farm Loan Calculator

Aspiring farmers can benefit from the Farm Loan Calculator. It simplifies estimating loan payments and planning expenses for a successful agricultural venture.

17. Pool Loan Calculator

Turn your backyard into a paradise with a pool. The Pool Loan Calculator helps you understand the cost of financing your dream pool, making planning easy.

18. Solar Loan Calculator

Considering solar energy? Calculate the financial impact of a solar energy system on your budget and savings with the Solar Loan Calculator, helping you make eco-friendly choices.

19. Mobile Home Loan Calculator

Contemplating a mobile home purchase? Estimate potential mobile home loan payments to make an informed decision about your future home.

20. Bridge Loan Calculator - Bridging Loan Calculator

Real estate investors often use bridge loans for flexibility. The Bridge Loan Calculator simplifies the process of evaluating your bridge loan requirements, facilitating smarter investment decisions.

21. Hard Money Loan Calculator

Hard money lending can be a viable financing option. Use this calculator to assess potential hard money loan terms and payments, ensuring you make sound financial choices.

22. HDFC SIP Calculator

Systematic Investment Plans (SIPs) are an excellent way to grow your wealth. The HDFC SIP Calculator helps plan your investments and understand potential returns on your SIP portfolio.

23. Step Up SIP Calculator

Planning to increase your SIP investments gradually? The Step Up SIP Calculator allows you to calculate the benefits of incremental investment increases on your wealth accumulation.

24. What Calculators Are Allowed on The ACT

For students preparing for the ACT, understanding which calculators are permitted during the exam is crucial. This article provides valuable insights into the types of calculators allowed, ensuring you're well-prepared for test day.

In conclusion, Modern Calculators offers a wide range of calculators that simplify complex tasks and empower you to make informed decisions in various aspects of your life. These calculators are your tools for financial empowerment, helping you achieve your goals and secure your financial future. Explore them today and embark on your journey to financial success!

#Rectangle Body Shape#Pear Body shape#Triangle Body Shape#Car Payment Calculator GA#Mobile Home Mortgage Calculator#Car Payment Calculator Illinois#Colorado#Virginia#Car Payment Calculator AZ#FintechZoom Mortgage Calculator#Construction Loan Calculator#Aerobic Capacity Calculator#Aircraft Loan Calculator - Airplane Loan Calculator#Manufactured Home Loan Calculator#Classic Car Loan Calculator#FintechZoom Loan Calculator#ATV Loan Calculator#Farm Loan Calculator#Pool Loan Calculator#Solar Loan Calculator#Mobile Home Loan Calculator#Bridge Loan Calculator - Bridging Loan Calculator#Hard Money Loan Calculator#HDFC SIP Calculator#Step Up SIP Calculator

2 notes

·

View notes

Text

Understanding New Loan Disclaimers In The United States 2024

Have you ever dreamed of a new car, a comfortable home renovation, or finally tackling a mountain of student loans? Borrowing money can be a great way to achieve your goals, but it’s important to understand what you’re really getting into. That’s where loan disclaimers come in – they’re like a little map hidden in a treasure chest, guiding you to understand the true cost and terms of your…

View On WordPress

#access bank federal government loan disclaimer#balloon loan disclaimer#caliber home loans disclaimer#citibank loan disclaimer#commercial loan commitment disclaimers#commercial loan disclaimers#disclaimer for blank loan documents#disclaimer for business plan for bank loan#disclaimer for interest free loans#disclaimer statement for loan#disclaimer&039;s statement for loan#disclaimers bfs capital loans#disclaimers bfs loans#disclaimers for discussing business loans#disclaimers for discussing loans#employer 401k loan disclaimer#equipment loan disclaimer#flagstar loan payment disclaimer#jay farner quicken loans disclaimer#jay farner quicken loans disclaimer approval only valid#loan calculator disclaimer#loan disclaimer#loan disclaimer examples#loan disclaimers in the united states#loan term sheet disclaimer#loaner car disclaimer#loans pursuant disclaimer#nationstar mortgage llc dba mr cooper loans disclaimer#non bank loan disclaimers#opploans loan disclaimer

0 notes

Text

Where Do I Find Easy-to-Access Car Loan Payment Calculator in Canada?

Visit CarEvo to use our easy-to-access car loan payment calculator in Canada. It can help you estimate your monthly repayments accurately and conveniently. This valuable tool has helped prospective buyers make informed decisions about their car financing options, enabling them to choose a loan plan that aligns with their financial goals.

0 notes

Text

Early Loan Repayment Calculator

Looking for a way to save money on your loan? The Early Loan Repayment Calculator is here to help. Early Loan Repayment will reduce a big amount of total financing costs. Whether you're repaying a mortgage, car loan, or personal loan, this app shows how much you can save by overpaying even a small amount.

#early loan repayment calculator#loan payoff calculator#mortgage early repayment#car loan extra payment#personal loan prepayment#loan savings calculator#debt repayment planner#extra loan payment calculator#financial savings tool#loan overpayment calculator

0 notes

Text

₊˚⊹ ᰔ a guide to maintaining financial wellness ᝰ.ᐟ

having good money habits can be insanely difficult. i know i personally struggle with impulsive spending, and i’m sure we’ve all fallen victim to the “i’m just treating myself” mindset. financial stress and even financial depression can feel so daunting and overwhelming, so i’m here to help you guys (and myself as well) manage your money better!

let’s begin !!

ᝰ.ᐟ set aside funds

it’s important that when every paycheck hits your bank account to immediately set aside some funds into your savings account. whether it’s 10-20% of your paycheck or even $20-$100, set aside some money into your savings!

it also might help to have that savings account be locked so that you can still put money in, but you can’t take money out. let that savings amount pile up and don’t touch it until you’re absolutely ready to make that big purchase!

ᝰ.ᐟ set aside any cash

get a piggybank or even one of those money organizing binders to set aside any cash that may come your way! keep that cash away from your wallet so you won’t be tempted to use it in any outside purchases. and, same as the first point, that cash will start to pile up!

ᝰ.ᐟ purchase needs rather than wants

let’s start getting out of that “i’m gonna treat myself” mindset!! while it’s nice to treat yourself, we really should only be doing it every once in a while. we can also find different ways of treating/rewarding ourselves that don’t require spending any money! (i can make a separate blog post on this if you guys would like!)

especially when you’re trying to save up for school, a new apartment, a new car, or whatever it may be, it’s really important to keep your purchases to only things that are absolutely necessary.

ᝰ.ᐟ keep track of automatic payments

especially if you have a subscription of any kind, keep track of when those automatic deductions from your account are happening. make note of when your next billing date is and how much you’re being charged for each month/year.

this would also be a good way to determine what subscriptions you really need/want to keep and which ones you can do without and unsubscribe to! i did a full cleanse of my subscriptions list and kept the ones i definitely wanted to keep. sometimes you never really realize how much money your losing when you’re subscribed to things that have no use to you anymore!

ᝰ.ᐟ plan accordingly

when your paycheck comes in and you have all these payments that are coming up yet you still need to buy groceries or get gas or whatever, make sure to plan your funds ahead of time! this way, it’ll help you budget for your groceries & any other necessities as well as help you determine how much money you can set aside into your savings and even calculate how much extra funds you might have to spend on for more personal things!

𝜗𝜚 final notes 𝜗𝜚

don’t let these tips make you feel like you can’t treat yourself to something! as i mentioned earlier, you can still treat yourself to nice things, but it might be best to do it once in a while! i know most of us associate success with money, and to reach success with money we have to learn to be more mindful about how we spend our money and how we manage it.

live and love, babe.

sincerely, juno ⭑.ᐟ

#milkoomis#girlblogger#girlblogging#it girl#that girl#girl blog aesthetic#it girl tips#becoming that girl#finance#money#money management#money manifestation#money saving#spending habits#personal growth#self improvement

200 notes

·

View notes

Text

Where Are You? NANAMI KENTO

There hadn’t been a day at work this long since the last Christmas. Corporations all decide they want to reward people they owe at the same time, and with the help of other departments, your job is: finalizing these payments, ensuring the calculations are right, and ensuring the people they are paying are actually doing what they’re supposed to.

This is done with three other previously mentioned departments, and even though you were the youngest compared to the middle-aged and older people around you, you were the only one who technically knew how to do all the jobs. Unfortunately, that meant you had to pick up some slack.

Sighing, you pull into the garage, letting the large door descend behind you. When you hop out of your SUV and turn the doorknob to the house, it’s pitch black.

The only noise comes from the clacking of your heels against the hardwood floors and the shuffling of items in your purse. You can almost hear your own thoughts.

“I’m home,” you call out, notifying your husband of your arrival.

There’s no response. You continue your scout for him, walking through the house leisurely, half-expecting him to be in the movie room upstairs or maybe the master bedroom you share, but you’re stumped when you don’t find him in either. His car was in the garage, so where was he?

Finally, it dawns on you to check his office. You make your way down the hallway and turn the corner into the last door, calling his name, only knowing the house is habited by the faint, golden light emanating from the doorway.

“Kento?”

Gently, you guide yourself past his bookcases, warily eyeing him down when you finally spot him. You’d expected him to be reading, or deep into his desktop, but he wasn’t.

He’s behind his dark, mahogany desk, leaning back far into the swivel chair. There are papers strewed around his usually pristine workstation and an empty mug of coffee resting on it. There’s also a low lamp that glows on the end of the surface, illumining his face as well as some of the office.

His expression is distant. His hair isn’t the gelled perfection it usually is. As you walk closer, your eyes dart to the clear glass in his scarred hand, sloshing some burnt-colored liquid in it. His reading spectacles rest nearby on the papers, not even on his face.

He moves to take a sip, lazily bringing the coolness to his lips, and only then does he notice you standing there. His eyes flicker to you, taking in your form before him. It’s odd, you think. Your husband has the keenest senses of anyone you know. He did hear you coming, right?

His tie is loose around his neck as if he were tugging at it previously, and his dress shirt reveals more of his chest than he likes when he’s working. The few buttons undone from the collar was doing absolute wonders for it. You swallow, the unwanted idea of your own workday completely forgotten.

“Kento.” You speak again—not too loud as if it would disturb the quiet atmosphere. He doesn’t provide a response this time either, but his eyes do glance up from your lower half to your eyes, and now, focused on your lips.

Your lips. That fucking red lip. That deep, red color that you wear to the office with your tights and pencil skirt and heels. Everyday, he curses that you’re blessed with a larger chest, because that cleavage you leave with makes him want to buy out your entire fucking office and monitor all your meetings himself. He’s seen the old dickheads on your floor, probably eyeing you as you walk by, comparing you to their own wives. And if not them, the forty-year-olds that that just can’t wait to peel his fat diamond ring off your finger as if they could take better care of you. Pay for your nails and hair and the Louboutins you strut in wearing.

He feels himself not only growing in his pants just looking at you, but frustrating himself as he imagines anyone else doing the same. Maybe it’s the alcohol in his system that’s fucking with his senses. And is it fucking with them, or just simply bringing them forth?

Relatively, your husband sports a rather stoic expression. But now, you’re watching the furrow in his brows deepen as he gazes pensively at your body, the glimmering watch on his arm ticking by in the silence.

When you’re scanning him back, you hadn’t even realized he’d finally reverted his attention to your eyes.

“How was work?” He inquires, his voice deep and rough. He shifts slightly, adjusting his position.

Swallowing, you force your stare to him. “Fine.”

There’s a beat of silence, the tension palpable in the air.

You finally break it, nodding to his untidy desk, “How was work?”

He takes a glimpse of it momentarily, swishing the liquor calmly before downing it in one go. He places the glass back down beside the bottle of what you now see is whiskey, his pace and demeanor like the calming serenity before a storm.

Shrugging nonchalantly, he answers. “Fine.”

You hum in acknowledgment, now taking casual steps around the wood to him. His eyes follow you like a cat to a laser, and his chair twists in correlation.

When you finally come to a stop before him, he allows your fingers to delicately trail up his collarbone, all the way around his neck as he blinks at you through his lashes. He always makes a point to pamper you; to be touching you in some way but not yet. His hands strain hanging over his lap.

You can’t tell if he relaxes or tenses when the pad of your thumb brushes along his cheek. His orbs remain stuck to yours, low and searching through your soul as the light adds a hazy hue to his face.

Under your fingers, there’s the growing stubble that he often punctually shaves off. As you brush along it, his eyes flutter shut, only to reopen like he remembered he preferred to look at you.

“You’ve been drinking.”

He doesn’t respond to your observation. His expression remains the same, his mind too fixed to process your words.

His tongue does prod at the inside of his cheek though, his gaze dropping below your face, then lower, and lower, until you’re slightly coming forward, his hands finally releasing from their spot to cup behind your thighs.

His fingers pinch at the tights you have on and he exhales, letting them go and caressing the skin above them instead.

When you don’t think he is going to say anything at all, he grumbles. “You wore this?”

Your brows come in to crease as you tilt your head at him. He’d never been controlling with what you wear. In fact, he dared another man to say anything to you, because if they did, there’s no question they knew you were married. Nanami was not an unknown name, and once again, the shiny ring. “Yeah, why?”

“You look beautiful,” he sighs, but it’s almost a grumble.

He’s addressing you directly until his attention shifts back to the tights you’re wearing, and the subtle sincerity in his expression disappears. “Thank yo–”

“Burn these.”

He hates them. How they hug you just right. How they don’t actually come all the way up. They stop right where the fabric of your work skirt begins, so it’s only covered completely when you’re standing up straight. When you’re walking—or worse, sitting—it’s like a visible garter.

Meanwhile, you huff on your way to complain, but out of curiosity, you ask slyly, “Why? They’re my favorite.”

Because your thighs fill them out. Because he knows other men imagine running their fingers along the supple skin underneath.

You feel soft massages just under your cheeks. And then you gasp when something is being pulled tightly against your skin, followed by the loud sound of tearing fabric.

Suddenly your tights are no longer tights—they’re split largely down your legs.

“Because they’re my favorite too,” he says casually, rubbing the affected area. “I’ll buy you new ones that I don’t like as much.”

As if punctuating his statement, he finds his way up your skirt, grabbing a handful of you in the process and pulling you down onto him. When you’re perched on top and your hands relocate to his shoulders, he moves his own to cup your face just as you did him. His thumb innocuously glides along your skin until it drags down your lip, smudging the red lipstick there.

The action inches a smile onto your face. After a beat of watching his distracted silence, you grab his attention.

“What, you miss me?” You tilt your head.

He will usually shut his eyes to mask when he’s rolling them, but he doesn’t this time. He knows you can tell just by the state he’s in. “Brat.”

With a teasing giggle, you begin to kiss his face, your red lip marks covering his light skin. When he can’t take any more, despite how calming it usually is, he grabs your chin and pushes his lips to yours, ignoring the remnants of your lipstick that will taint his own.

Should I make a part 2??

©️hxltic

#nanami kento#kento x reader#jjkaisen#jjk#jjk nanami#jujutsu nanami#nanami x reader#nanami x you#jujutsu kaisen nanami#jjk kento#kento x you#jujutsu kento#kento x y/n#jjk nanami kento

93 notes

·

View notes

Text

I can not fucking believe I'm going to have to ask for help AGAIN of this magnitude but

Our fucking car got repossessed because the repossession notice got sent to my parents' address where we got it originally registered and they didn't bother to let us know (i guess it's on me for not wanting to talk to them but iykyk). We thought we had until Friday at least when Owen got paid but haha, apparently fucking not.

I don't know what the fuck we're gonna do because with all the fees it's gonna be like 2500. We've got 150 at the most.

That's just the amount due (I guess it's also on me for not checking to see HOW far behind we were, we made a small payment earlier because we thought we had more time) but we still have to pay all the fucking fees that come with having your car towed.

I'm so fucking sorry to have to have for so much help so soon after I just did but I don't know what the hell I'm going to do.

p/aypal is here if you want to donate, if not I'd super appreciate you sharing this.

UPDATE: There's no way in hell we're gonna be able to make 2500 in ten days, so Owen and I are thinking of fixing the corolla sitting in my mom's yard. My family is notoriously unreliable and tends to hold things over my head later down the line, so we're gonna try to take it to a shop and get it repaired instead of doing what my mother suggested and having my father help Owen fix it. That's gonna cost a lot of money because something about the motor is blown, so I'm gonna keep circulating this (I'll see if I can't get a cost calculated soon). We have 400 dollars, but we're relying on grocery delivery and uber right now which is insanely expensive. I'd appreciate it if you guys would continue to support us, even though I feel SO bad for asking for help. Like I said, no pressure to donate, but if you could share this I'd be even more grateful.

76 notes

·

View notes

Text

Ch. 1 | Ch. 2 | Ch. 3 | Ch. 4 | Ch. 5 | Ch. 6 | Ch. 7 | Ch. 8 | Ch. 9 | Ch. 10 | Ch. 11 | Ch. 12 | Ch. 13 | Ch. 14 |

Smoke Signals

Chapter One - Damn Mailbox

W/C: 5K

Eddie x Fem reader - Grumpy!Bartender!Eddie x Shy!Reader

Relocating to the small town of Knife’s Edge in hopes of leaving your old life behind and starting brand new solves all of your problems, right? Wrong. It only creates more and one of them may live right next door. Side effects may include blaring music at 3AM, a scowling neighbor, and one too many shots of tequila on several occasions. (That The Bourbon will not be comping.)

A/N: I'm super excited to start this lil series, I've had this idea for a little while and I can never resist writing total opposites, it's just so fun to explore their dynamic when they want to reject each other so bad. Also a lot of this fic is inspired by Smoke Signals by Phoebe Bridgers (hence the name). As always I would love your feedback and any comments y’all have 🙂 OH and finally...the hugest largest biggest thank you to @uglypastels for beta reading and proof reading and all that good stuff, it was SO appreciated and really helped smooth things out ILY Z YOU'RE SO GOOD AT WHAT YOU DO 💜

Masterlist

Next

Morning dew was like an old friend, someone you hadn’t paid attention to since childhood but felt so familiar with, so…safe. Maybe it was a little too ridiculous to find security in a few dew drops but arriving in a new town with a population of less than five hundred would have that effect. Twists and turns of windy roads unknown, trees larger than any house, and barely any infrastructure would all frazzle anyone not accustomed to its elements. Normally you wouldn’t get car sick but these roads were a beast you’d never encountered before in your life, stomach threatening to send back your lunch of tuna on white bread and a bag of Doritos. You refused to let bile even trace your tongue so with just enough self control, you swallowed any sickness down and pushed forward. Now you were hunched over in the driver’s seat, the door open as you sucked in the fresh mountain air, perfect lengthy blades of grass grazing the bottom of the door. Just before you, up the driveway made up of damp dirt, was home. A home you were a stranger to at the moment but hoped to at least become acquaintances with. Lower expectations created less disappointment. If you dive in head first, you can only guarantee yourself vulnerability and pain, slow and steady was the only pace.

It’s not permanent; you are just figuring things out.

It’s what you kept preaching to yourself during the altitude change, where flatter land transformed into large mountains, the tallest peaks coated in white. Where your ears popped and your brain felt pressure. And then shortly after, you were submerged deep into the forests, far from home, where you knew there was no going back for quite some time. It was a trial run although it didn’t feel that way when the moving truck packed with your life pulled up just minutes after you, delivering every piece of your life to some cabin in a secluded town that was nearly invisible on any map. Temporary was starting to feel foreign when everything felt more set in stone.

You’d think a town called ‘Knife’s Edge’ would steer you away and maybe that was the intent when it was first named; to ward off newcomers who had no business being out in the woods. But it only intrigued you. From what you could find out in a few tourism magazines, Knife’s Edge was not somewhere you went for a getaway, not according to the locals who were a tight knit community where everyone knew everyone. The economy relied on the small businesses down in The Village, on Main Street which according to your calculations was about five miles down the road and around the lake then up. That was the extent of knowledge you’d had on your new home and yes, maybe you should have gathered more information before daring to even place a down payment on some random cabin in the woods but when a new start calls, you either answer the phone or stare at it until nothing happens. The cabin was either yours if you paid the down payment or it would’ve been torn down and sold to the neighbor for more land which would’ve sent you on your way again, on a wild goose chase for a new place that you could fit into. Not that you were too sure that you’d even fit in here. But it seemed too obvious that this was where you were meant to be when the realtor advised that it was yours at a low down payment, a steal. So you’d try to make it work.

The moving truck’s door startled you, slamming against the top as two men got to work, unloading all your belongings. You figured this was your cue to exit your beat-up sedan to unlock the front door–wide-paneled and made of a beautiful dark oak. The crunch of pebbles and dirt alerted the movers to your presence where you let them know you were going to open up so they could begin their tedious process, one of them grumbling something incoherent in response. As you approached even closer, there were knicks and dents decorating the surface of the door but it seemed to add to the essence. The wooden steps creaked underneath your weight and upon glancing around the porch, you found two well built rocking chairs that the previous owner must have left behind. Other than that, there were pine needles and other debris from the surrounding nature caked in the corners, some scattered along the rest of the floor that would need to be swept up but it wasn’t an urgent task in comparison to actually setting up your bed and other necessities.

The lock was stubborn as you twisted the key but with one more persistent shove and turn, it clicked and you were able to push your way in, the hinges painfully squeaking as you made a mental note to pick up some WD40. The air inside was stale, smelling of dust and maybe a half hearted spritz of air freshener. Or maybe it was drenched in air freshener but it did little to nothing to cover up the smell of an old abandoned cabin; you weren’t sure. It was a modest size, the kitchen off to the right, tucked into the corner with a small island in the center. The living room was the first room you walked into from the front, the floorplan more open than you’d expected. A little to the left was a narrow hallway with shutter doors lining both sides, you assumed one side had to be the laundry. The door at the end had to be the bedroom and the door just before you embark into the hall had to be the bathroom but you had no time to explore right now.

Morning light trickled in through the kitchen window just above the stove, creating a beautiful hue against the wood paneling of the walls which you only noticed as you came back in, setting a box that was labeled ‘kitchen’ on the counter before rushing back out to retrieve more of your belongings. It was too early to be doing such strenuous work but that's what you get for securing a slot with the moving company first thing in the morning. In hindsight, you didn’t realize you were signing yourself up to meet said moving truck at 6:00 AM but in your defense, you’d never done this before.

By 7:00 AM the truck was fully unloaded and on its way out and with it went the grumpy movers, more than likely unsatisfied with the fact that they’d have to trek back down the mountain. You graciously offered them an extra twenty bucks which they gladly took but still appeared crabby nonetheless. Now for the part you had been dreading the most: unpacking each box and putting everything in its respective place. But first, you wanted to take it all in. You were right; the laundry was on the left side of the hall behind the shutter door and on the other side was a closet. The bedroom was settled right where you had guessed, at the end of the hall and rather than being empty, it now held your bed and mattress, sheets still yet to be found among the boxes labeled ‘bedroom’ in thick sharpie. The wallpaper was something you could do without but maybe you’d find time to peel it off later and replace it with something more to your taste. Currently the bedroom walls were lined with floral designs and pale blue stripes and if you could be honest, the design was a bit too busy for your liking. But it was a roof over your head for a good price so complaining was out of the equation.

At the opposite end of the hall, just off the living room was the bathroom, sporting a less off putting wallpaper of faded yellow and white vertical stripes. You first ensured your hygiene essentials were in place, toothbrush and toothpaste in a glass on the sink, towels on the rack, and soaps set up in the shower including shampoo, conditioner, and bar of Dove. Having these accessible was a priority, cleanliness being one of the most important factors of your daily routine.

Clothes were next and you’d forgotten a box in your trunk of your most worn items of clothing that you could pick through until you were fully settled. Lazily carrying yourself back to the driveway where your maroon sedan sat on top of the copper-toned dirt, you do a double take when you realize your mailbox was taken out, wood splintering out of the ground as the poor box lays among the grass at the edge of the street. From what you could remember, it was fully intact when you first drove up so you’re forced to conclude that the movers you’d tipped generously must have run it over and not given it a second thought.

The half of the mailbox that rested on the ground was a lot heavier than it looked and you would’ve thought it was made of cement just by the weight. You felt pathetic dragging it up the driveway, creating a prominent line in the dirt along the way. A brief break in getting the damn thing up to your porch has you about half way up the driveway, glancing around at your surroundings, only to finally take into account that you had a neighbor relatively close by, a cabin similar to yours only a few hundred yards away except it was a darker wood and a red pickup sat idle in front of it.

You braced yourself, catching your breath to continue hauling the mailbox back until you can figure out how to repair it when your eyes catch on figure, a man making his way down the steps of the cabin you’d just been analyzing. And you’re quick to shy away until you realize he’d already been looking at you, a cocky grin on his face as he slowly, almost tauntingly stepped off his porch. The way he walked closer reminded you of a lion declaring its territory, especially with the mane of curls he had, shaggy and brunette. He wasn’t close enough to allow you to examine any further; however, you caught the click of his tongue before he spoke.

“Gonna get splinters draggin’ wood around like that.”

It’s all he says, a toothpick between his teeth before he turns on his heel, combat boot digging into the soil and it’s only then that you realize he wasn’t offering assistance, he was simply picking up the hose connected to his spigot to rinse off his windshield which now that he’d drawn attention to it, was filthy with mud and leaves. He wore a red and black flannel which reminded you of a lumberjack but this man just didn’t fit that description based on your short interaction with him. Or rather his interaction with you. Your first indication was that he had no facial hair; he was clean-shaven. And his tight jeans that had black rips at the knees didn’t seem very suitable for a job that required a larger range of motion.

Without any further acknowledgement of your existence, he hopped in his truck and sped off around the bend without a care in the world. He was a resident douchebag and you’d never even spoken a word to him. You quickly realized you were still stood in the middle of the driveway with half a mailbox, grunting in protest as you lugged it the rest of the way up to the porch, leaning it against the railing for future contemplation on how to repair it or if you’d have to fork up money for a brand new one. That was a problem for future you and though future you would be pissed at past you for putting the responsibility on her, you had other things to sort out such as unpacking the rest of the kitchen so you’d be able to actually use it to feed yourself. And then of course you’d have to make your way into town a ways down the road to actually get groceries because not a crumb of anything edible was packed. Aside from a bag of Chex Mix that sat in the passenger seat of your car that you’d picked up at a gas station.

–

Going overboard was an understatement when it came to how much you’d actually gotten done. By 12:00 PM you almost had each room unpacked and put away, moving boxes discarded next to the front door to be thrown out later. Your plan was to finish off the kitchen and then go into town. Instead you finished the kitchen and moved from room to room with more motivation than you’d ever experienced in your life. Maybe it was the adrenaline of living alone, no one else could tell you what to do or where to put things. It was all up to you and maybe you were a little drunk off that power. Regardless, you were now worn out and that energy didn’t last very long. At least you had a freshly made bed for when you came back, that’s what you would reward yourself with.

If you go grocery shopping then you can come back and nap.

There were still various projects to be done, items to be organized, and objects without a home but for the most part, you could sleep peacefully with the work you’d done today. The floors were yet to be cleaned and the fridge still needed a good scrub down but that could wait until tonight after you properly refueled.

Humming to some song you’d heard on the radio earlier, you make your way out the door, patting your pockets for your keys and wallet, both of which you had before locking up and heading for the car. You rolled your eyes passing the mutilated mailbox, settling into the driver’s seat with an ache in your back from the grueling labor in the early hours of the morning. Shifting into drive and then rapidly back to park, you remember that these roads are foreign to you and that you could easily get lost and possibly become a bear’s lunch with your luck. With a tug, the glove box opens and reveals the map you had set in it before embarking on our journey. The map that was mailed to you of the town didn’t seem very complicated. But if you happened to make a wrong turn it could land you amongst some rocky cliffs which you thought better to stay away from. So you carefully examined the route to town, what the people here seemed to call The Village Square. You took the liberty of drawing your house on the map, a cute little doodle in blue gel pen and then proceeding to draw the rest of the route in the same blue so you’d always have it.

This was it. A fresh start where no one knew your name. This would be good for you. At least that's what you kept trying to convince yourself.

Goodbye someone else’s daughter and hello new self-made woman.

–

You weren’t lost. You were just…exploring.

Okay, you were a little lost but the signs for The Village Square kept passing you by and yet you found yourself also passing the same exact pine trees–and you knew they were the same pine trees because every time you saw them you thought ‘hey that kinda looks like a dog’. At some point it started to feel as if you were spawning in and out of some dimension until you finally turned into a lot directly behind one of the signs, sick of this game of hide and seek. There were no signs for parking which is why you’d passed by so many times in the first place, and now it seemed like you were behind a restaurant of some kind. This couldn’t be where everyone parked, right? Anxiety was pooling in your stomach and before you could sike yourself out, you ultimately decided to park and walk from here. You would only be a few minutes and hopefully you’d be able to muster up the courage to ask someone where to park from now on, even if it did make you seem like an idiot.

Leaves crunched under your sneakers, an obvious indication of the Fall season trickling one leaf at a time. As if you were a wary animal, you cautiously walked around the building, finding that it was someplace called The Bourbon; the letters written out in neon red lights that weren’t yet illuminated, the open sign in the window dull signifying they were closed. You let your eyes roam up and down the street, small businesses lined up all the way through and a few patrons, clearly with an agenda making their way along the sidewalks. It was a cute place, nestled in a little valley. Instead of plain old cement the sidewalks were cobblestone and overall it seemed to be a pedestrian oriented community with several cross walks and barely any traffic.

From here you had no idea how to get to Marvin’s Grocery, which seemed to be one of the only produce stores around according to your map. The others were a little more out of the way, your house conveniently only around five miles away from The Village Square. The shops you passed as you attempted to gain a sense of direction were exquisite. Mom-and-pop shops that either smelled of delicious baked goods or hunger-inducing aromas that filled your nostrils with savory goodness. The smell would haunt you in the best way for days to come. A candle shop piqued your interest, as well as a flower shop that bloomed so beautifully among the muted tones of the brick buildings around it.

Everything was so unlike what you were used to, back home things were more commercialized, built for quantity not quality. Here it seemed to be the polar opposite which you could appreciate. Corporations were the root of all evil and you had yet to see one single corporation among the several businesses you passed so far. People seemed friendly but also confused by your presence, offering you a meaningful wave accompanied by a puzzled expression written on every face you encountered. You were a stranger and it was becoming more apparent the deeper you found yourself in the square. Some people whispered and you happened to snag onto a few words, mostly grasping ‘is she new?’. In return, you graced them with a polite smile. It wasn’t like you to initiate small talk or approach new friendships. If they happened, they happened per the other party’s account, not yours, never one to try and stand out in the crowd only making this infinitely more uncomfortable for you, which was no one’s fault other than your own insecurity.

Eventually you were able to come face to face with the giant ‘Marvin’s Grocery’ sign which looked to be handpainted in big white letters outlined in black with a few cartoony carrots, a tomato, and a head of lettuce. Wandering around for an extra ten minutes and refusing to ask for help certainly wasn’t ideal but it did familiarize you with the shops you would soon be buying from on the regular. And it did give you a soft introduction to the small population of Knife’s Edge which despite the name, the people seemed lovely enough.

The store wasn’t the slightest bit crowded and it wasn’t very large either. A mother and her two kids skimmed one of the aisles while an older man pondered over the produce, apples specifically. Grabbing a cart, you begin gathering the items you had sorted out on a list in your head. First bananas, grapes, and blueberries, you didn’t want to bother with too much produce as it went bad fast and you were only one person so those would do for now. Then you moved on to pantry essentials, canned goods that you could stock up on and always have on hand. Green beans, corn, peas, baked beans, even soups such as tomato, cream of mushroom, and the standard chicken noodle.

You’d built up a cart full in no time, and by then, no one else was around so you noted that this time would be perfect to get your shopping done in the future so as to avoid as many people as possible. The cashier was a woman, probably in her early sixties who seemed not all that intimidating which you were grateful for. She smiles warmly and you appreciate the sentiment, grinning back at her as you place each item at the register.

“You’re new. But I bet you’ve already had an earful of that, haven’t you?” She lightly teases.

You laugh softly, avoiding eye contact while still trying to remain well mannered, taking notice in small glances that the woman’s name tag reads Donnie in bold red letters as well as the ‘help wanted’ sign perched up against the window. She seems friendly, a little rough around the edges though in the sense that she had several tattoos that disappeared into the rolled up sleeve of her blue crewneck sweater as well as a fire in her icy blue eyes. You could already guess that she was quite the character.

“Don’t let them scare you off.” Donnie carefully bags the eggs with a few more light items, her confidence radiating, as if she doesn’t even need to try, as if it just comes to her so naturally. Something you could only wish for every once in a blue moon. “We don’t get many newbies. They’ll get it outta their system.” Her voice is a tad scratchy but smooth otherwise, bringing a strange sense of comfort.

“Thank you.” A mouse may as well have been louder than you but you tried and that’s what counts, right? New people were not your thing but they would have to become your thing, moving to a place where no one knew you existed and all. Or maybe you could fly under the radar? It couldn’t hurt to become the mysterious outsider that spoke to no one although it wasn’t a very realistic ambition.

This was fucked. You thought to yourself in the solitude of your brain. Of course the second thoughts were coming now and not before you bought the damn property that tied you to this place. Initially, the idea was a temporary situation far from home but the deeper you delved into this town, the more permanent it started to feel. Not just anyone up and moved here and that was clear by the reaction you pulled from several onlookers. And yet you moved here, bought that damn cabin with the money left to you from your father’s estate, and ultimately, left everything you knew in a manic state. A mid life crisis in your early twenties.

“Miss, your change.” The woman broke through your thoughts and you must have shifted into autopilot, not even remembering handing her any money in the first place.

“S-sorry.” You mutter, collecting the filthy coins in your palm, shoving them into the front pocket of your jeans which you knew would be a pain to dig out later but again, that was an issue for future you. She hated your guts.

“No prob–”

It was abrupt, your exit but despite your rude departure, she called out “I’m Donnie!” and you never felt like a shittier person. She was welcoming you to her home and you didn’t even have the decency to introduce yourself. That’s how it looked at least, on the inside you were panicking and needed to isolate yourself immediately.

You must have looked like a maniac carrying your groceries in a near sprint toward the direction of your car. Everyone else seemed to move at such a mellow pace, not a single vein close to popping out of stress whereas you looked like you’d crumble under the slightest inconvenience. Which you would if you didn’t get to the car fast enough. A small misstep causing you to trip? No chance, you wouldn’t show your face again for weeks. Your groceries spilling all over the pavement because of said possible misstep? You would consider moving all over again.

Thankfully the majority of the walk back to the little lot behind one of many businesses was blacked out, your heart practically pumping in your ear the whole time. What you couldn’t black out from was the man-the same man from this morning smoking a cigarette as he stared at your car. Fear drenched you; you couldn’t gauge his expression with his back to you but you could guess he wasn’t going to be smiling with the way he was lingering, shuffling his boots back and forth in contemplation.

Announcing yourself felt like the most daunting task in the world, humiliation melting into your skin like an uncomfortable burn. Maybe some higher power heard your pathetic struggle because the crunch of your sneaker on a perfectly placed leaf called his attention to you, his head snapping in your direction instantly.

The urge to just run was strong but you maintained whatever cool was left within you, fingers waving at him weakly.

His expression was blank, unreadable. He didn’t say a word as you slowly inched your way closer to the vehicle, only eyeing your every movement like a predator protecting his territory, much like he did that same morning. The closer view of his face showcased his stoic yet soft features, eyes almost puppy dog-like but something glazed over them, a facade of some kind. Something that overtook the puppy dog nature they were capable of and replaced them with a cruel glare. The shape of his nose was endearing at least, rounded at the tip and tinted pink from the cold.

“You just park anywhere you want where you’re from?” He asks, gesturing vaguely with a tip of his cigarette toward the car.

Your shaky breath has him furrowing his brows at you, seemingly offended. It’s not in your nature to offend people but you can’t seem to stop doing it, especially today whether you mean to or not. But you definitely don’t think you mean to.

“N-no, ‘m sorry.”

“Sorry?” He mocks, scoffing before inhaling a puff of smoke once more.

“I-I uh, I’m leaving. It won’t happen again.” You rush out, all the while forcing yourself not to cry. “I just–I couldn’t find parking–I was driving around and—there was no–I couldn’t–”

“Don’t let it happen again.” He warns, stern but easing up on his intense demeanor.

“Promise.” You whisper, a tear betraying you and rolling down your cheek to which you quickly gather your grocery bags in one hand to swat away at your cheek. It’s too late, he already saw.

No empathy is detected in his stare, not that you feel you deserve any. It was just an observation. “Now, get out of my lot.” It’s a demand, a non-negotiable demand that if you were brave enough to argue, would probably have him towing your shitty little sedan.

So you nod, blinking back the water works as best you could while tossing your groceries into the passenger seat, him watching the whole time. With your seatbelt suddenly feeling like the most complicated thing in the world, you expect to look up and meet pure rage but instead your ears perk up at a few knocks on the window. Rolling it down as fast as possible with the manual handle, the man stands towering over you, cigarette abandoned sometime in between you getting in the car and struggling to remember how a seatbelt works. Did he have more choice words for you for illegally parking on what he deemed ‘his lot’? You really didn’t want to stick around to find out but you had no choice.

“Left on Main. Then right on Cherry.” His dark eyes hinted at hues of warm honey but they were briskly dismissed by his cold attitude.

“What?”

“Next time. So you don’t turn into my damn lot again.”

You still didn’t know what he meant by ‘his lot’ and you didn’t have the backbone to ask. You did however fully get the message that you were to never park here again and were now aware of which streets to search for to avoid it at all costs. You’d memorize every detail of it if it meant you could steer clear of the apathetic man before you. With a nervous nod, you were off, not once looking back just as he did that morning except he had more grit in his actions, you just came off as a scared church mouse. You never even caught his name and you didn’t mind not knowing it at this rate seeing as he was all bite and bark for no good reason.

This place never felt so far from home. Nowhere was home. Your heart was in a sense homeless, lost and longing for the connections that these people had with each other that you couldn’t seem to tap into even if your life depended on it. In all fairness, it had only been a few hours and you couldn’t gauge your success based on that but it was tugging on your brain like a parasite, eating away at your final optimistic thoughts.

I don’t belong here.

I don’t fit in.

The drive ‘home’ was flooded with tears and muffled sobs into your now sticky sleeve, coated in snot and if anyone were to pass you along the way you would look psychotic with how your face scrunched up at every exhale, doing your best to keep yourself quiet despite being the only one in the car. You were always doing your best. Always to please others. And it never worked.

~end~

Masterlist

Next

tags - @gravedigginbbydoll @ohauggieo @spicysix @lunatictardis @ali-r3n @batkin028 @mrsjellymunson @witchwolflea @emma77645

#eddie munson x reader#eddie munson#eddie munson fluff#eddie munson fic#eddie x reader#eddie munson smut#eddie munson x fem reader#eddie munson x female reader#eddie munson angst#bartender!eddie#eddie munson au#bartender!eddie munson#eddie munson imagine#eddie munson x you#eddie munson fanfic#eddie munson fanfiction

426 notes

·

View notes

Text

Things you should do while planning to move out

Calculate all your monthly expenses and add them to a google sheet, things to include: rent, food, phone bill, laundry, Misc, Dentist, Takeout, car payments, power and light, and if you have pets add the expenses from that

Start saving! Do the 50: 30:20 rule. -Needs 50%: Food/groceries, bills & utilities, housing & rent, Transportation. -Wants 30: Shopping, dining out, entertainment, travel. -Savings 20: emergency fund, Savings account, retirement fund, investments, debt payment, stocks, crypto

Make a five year plan (find ideas online)

Prepare yourself mentally to live alone

170 notes

·

View notes

Text

In its simplest and most elemental form, check kiting is the simple practice of stealing money or valuable goods by paying for them with a check that you know (or ought to know) will be rejected because there aren’t sufficient funds in the bank account to honor it. In this form it is known to the specialists as “paper hanging,” and it’s often a crime of desperation or one carried out with stolen checkbooks rather than a calculated commercial decision—there are obvious disadvantages to a method of stealing that requires you to give the victim your name and address. It is possible to make paper hanging into both a systematic fraud and a lifestyle, as Frank Abagnale did (and wrote about in his autobiography, Catch Me If You Can, later made into a movie starring Leonardo DiCaprio). Abagnale got over the main drawback by adopting a nomadic lifestyle and impersonating an airline pilot, something that also allowed him to travel for free, to date flight attendants during the high period of Pan Am recruitment sexism, and to have a plausible excuse for needing to cash checks all the time and not having a permanent local address. But as a commercial fraud carried out by businesspeople, check kiting is a little bit more sophisticated and takes advantage of a peculiarity of the American banking system. [...] The important technical detail here is that because paper checks are particularly common in America, and because the check-clearing cycle is so long, American banks have—unusually in a global context—historically been very generous when it comes to allowing their business customers to make payments out of “uncleared funds,” that is to say checks that have been deposited into their account but that have not yet been endorsed by the bank that they are drawn on. Effectively, when you deposit a check, you get access to a short-term interest-free loan, lasting for the duration of the check-clearing cycle. This raises the possibility of a form of fraud that is the equivalent of NFL football and pumpkin pie—something that Europeans would no doubt enjoy greatly if they tried it, but that is so deeply embedded into the overall American way of doing things that it doesn’t really travel.

What you do (in the simplest form) is that you open accounts in two banks. Call them Bank A (from which you get a checkbook with pictures of trees in it) and Bank B (which gives you a checkbook full of pictures of sports cars). Pretend for the time being that you put a token hundred bucks into each account. But now you write a check for $500,000 from your “trees” checkbook and deposit it in your Bank B account. That check is going to bounce, for certain. Except… it will only bounce when the check gets presented, and in the meantime, thinking that you have $500,000 in the bank, Bank B will not mind if you write a sports-car check and deposit it in Bank A. If Bank A sees the sports-car check, they will not mind honoring the trees check for the time being, while they are waiting for the sports-car check to clear. If they honor that check, then you can write another check to Bank B, and so on…

Of course, this looks like a bit of a closed system—you can make the checks going back and forth look as big as you like, but if you ever take the money out in cash or spend it on something, the checks will actually bounce and turn you into just another paper hanger. But creating the illusion of having two bank accounts with half a million dollars in each can be profitable in itself because as well as allowing customers to make payments out of uncleared funds, American banks used to be quite generous about paying interest on deposits as soon as they were made. In the heyday of check kiting in the early 1980s when interest rates were in the midteens and bank computer systems in their infancy, you could have earned quite a lot out of the simple kiting scheme described above, unless someone happened to notice. And although even a dull bank clerk might spot a kite based on two banks and checks going back and forth every few days, if you bring more banks into the scheme (“chaining”) and intermingle the kite with the ordinary back-and-forth cash flow of a large operating business, it becomes very difficult to detect.

Interest rates are back baby, guess it is time to bring back kiting

32 notes

·

View notes