#Car Payment Calculator GA

Explore tagged Tumblr posts

Text

Empowering Financial Decisions with Modern Calculators: Your Key to Financial Success

In an era where information is readily available, financial empowerment is key to making informed decisions. Thanks to the digital age, we have access to an impressive array of calculators that can simplify complex financial tasks. Let's explore the world of Modern Calculators and discover how these tools can empower you in various aspects of your financial journey.

1. Rectangle Body Shape Calculator

Your body shape plays a significant role in fashion choices. The Rectangle Body Shape Calculator not only identifies your body shape but also offers tailored fashion advice to help you look and feel your best.

2. Pear Body Shape Calculator

Enhance your style by understanding your body shape. The Pear Body Shape Calculator provides insights and fashion tips specifically designed for pear-shaped individuals.

3. Triangle Body Shape Calculator

Confidence in your wardrobe starts with knowing your body shape. The Triangle Body Shape Calculator identifies your body type and offers fashion recommendations to elevate your style.

4. Car Payment Calculator GA

Planning to buy a car in Georgia? The Car Payment Calculator GA simplifies the process by helping you estimate your monthly car payments, ensuring they fit comfortably within your budget.

5. Mobile Home Mortgage Calculator

Homeownership is a dream for many, and mobile homes provide an affordable path. The Mobile Home Mortgage Calculator assists in estimating your monthly mortgage payments, making homeownership more achievable.

6. Car Payment Calculator Illinois, Colorado, Virginia

If you're relocating to Illinois, Colorado, or Virginia, this calculator helps you estimate car payments in different states, ensuring your budget aligns with your new location.

7. Car Payment Calculator AZ

Considering a vehicle purchase in Arizona? The Car Payment Calculator AZ enables you to calculate potential car payments, allowing you to budget effectively.

8. FintechZoom Mortgage Calculator

Mortgages can be complex, but the FintechZoom Mortgage Calculator simplifies the process. Calculate mortgage payments, explore interest rates, and understand your amortization schedule with ease.

9. Construction Loan Calculator

Building your dream home? The Construction Loan Calculator estimates your construction loan requirements and monthly payments, ensuring a smooth building process.

10. Aerobic Capacity Calculator

Your fitness journey starts with understanding your aerobic capacity. Calculate your fitness level and tailor your workouts for optimal results using this essential tool.

11. Aircraft Loan Calculator - Airplane Loan Calculator

For aviation enthusiasts, owning an aircraft is a dream come true. The Aircraft Loan Calculator simplifies the financial side of aviation, helping you understand loan terms and payments.

12. Manufactured Home Loan Calculator

Thinking about a manufactured home? This calculator provides invaluable insights into potential loan payments, making homeownership in a manufactured home more achievable.

13. Classic Car Loan Calculator

Passionate about classic cars? The Classic Car Loan Calculator helps estimate classic car loan payments, bringing you closer to your dream vehicle.

14. FintechZoom Loan Calculator

Whether you need a personal or business loan, the FintechZoom Loan Calculator equips you to estimate monthly payments and assess the financial impact of borrowing.

15. ATV Loan Calculator

Ready for off-road adventures? The ATV Loan Calculator calculates potential ATV loan payments, ensuring your outdoor escapades are within reach.

16. Farm Loan Calculator

Aspiring farmers can benefit from the Farm Loan Calculator. It simplifies estimating loan payments and planning expenses for a successful agricultural venture.

17. Pool Loan Calculator

Turn your backyard into a paradise with a pool. The Pool Loan Calculator helps you understand the cost of financing your dream pool, making planning easy.

18. Solar Loan Calculator

Considering solar energy? Calculate the financial impact of a solar energy system on your budget and savings with the Solar Loan Calculator, helping you make eco-friendly choices.

19. Mobile Home Loan Calculator

Contemplating a mobile home purchase? Estimate potential mobile home loan payments to make an informed decision about your future home.

20. Bridge Loan Calculator - Bridging Loan Calculator

Real estate investors often use bridge loans for flexibility. The Bridge Loan Calculator simplifies the process of evaluating your bridge loan requirements, facilitating smarter investment decisions.

21. Hard Money Loan Calculator

Hard money lending can be a viable financing option. Use this calculator to assess potential hard money loan terms and payments, ensuring you make sound financial choices.

22. HDFC SIP Calculator

Systematic Investment Plans (SIPs) are an excellent way to grow your wealth. The HDFC SIP Calculator helps plan your investments and understand potential returns on your SIP portfolio.

23. Step Up SIP Calculator

Planning to increase your SIP investments gradually? The Step Up SIP Calculator allows you to calculate the benefits of incremental investment increases on your wealth accumulation.

24. What Calculators Are Allowed on The ACT

For students preparing for the ACT, understanding which calculators are permitted during the exam is crucial. This article provides valuable insights into the types of calculators allowed, ensuring you're well-prepared for test day.

In conclusion, Modern Calculators offers a wide range of calculators that simplify complex tasks and empower you to make informed decisions in various aspects of your life. These calculators are your tools for financial empowerment, helping you achieve your goals and secure your financial future. Explore them today and embark on your journey to financial success!

#Rectangle Body Shape#Pear Body shape#Triangle Body Shape#Car Payment Calculator GA#Mobile Home Mortgage Calculator#Car Payment Calculator Illinois#Colorado#Virginia#Car Payment Calculator AZ#FintechZoom Mortgage Calculator#Construction Loan Calculator#Aerobic Capacity Calculator#Aircraft Loan Calculator - Airplane Loan Calculator#Manufactured Home Loan Calculator#Classic Car Loan Calculator#FintechZoom Loan Calculator#ATV Loan Calculator#Farm Loan Calculator#Pool Loan Calculator#Solar Loan Calculator#Mobile Home Loan Calculator#Bridge Loan Calculator - Bridging Loan Calculator#Hard Money Loan Calculator#HDFC SIP Calculator#Step Up SIP Calculator

2 notes

·

View notes

Text

₊˚⊹ ᰔ a guide to maintaining financial wellness ᝰ.ᐟ

having good money habits can be insanely difficult. i know i personally struggle with impulsive spending, and i’m sure we’ve all fallen victim to the “i’m just treating myself” mindset. financial stress and even financial depression can feel so daunting and overwhelming, so i’m here to help you guys (and myself as well) manage your money better!

let’s begin !!

ᝰ.ᐟ set aside funds

it’s important that when every paycheck hits your bank account to immediately set aside some funds into your savings account. whether it’s 10-20% of your paycheck or even $20-$100, set aside some money into your savings!

it also might help to have that savings account be locked so that you can still put money in, but you can’t take money out. let that savings amount pile up and don’t touch it until you’re absolutely ready to make that big purchase!

ᝰ.ᐟ set aside any cash

get a piggybank or even one of those money organizing binders to set aside any cash that may come your way! keep that cash away from your wallet so you won’t be tempted to use it in any outside purchases. and, same as the first point, that cash will start to pile up!

ᝰ.ᐟ purchase needs rather than wants

let’s start getting out of that “i’m gonna treat myself” mindset!! while it’s nice to treat yourself, we really should only be doing it every once in a while. we can also find different ways of treating/rewarding ourselves that don’t require spending any money! (i can make a separate blog post on this if you guys would like!)

especially when you’re trying to save up for school, a new apartment, a new car, or whatever it may be, it’s really important to keep your purchases to only things that are absolutely necessary.

ᝰ.ᐟ keep track of automatic payments

especially if you have a subscription of any kind, keep track of when those automatic deductions from your account are happening. make note of when your next billing date is and how much you’re being charged for each month/year.

this would also be a good way to determine what subscriptions you really need/want to keep and which ones you can do without and unsubscribe to! i did a full cleanse of my subscriptions list and kept the ones i definitely wanted to keep. sometimes you never really realize how much money your losing when you’re subscribed to things that have no use to you anymore!

ᝰ.ᐟ plan accordingly

when your paycheck comes in and you have all these payments that are coming up yet you still need to buy groceries or get gas or whatever, make sure to plan your funds ahead of time! this way, it’ll help you budget for your groceries & any other necessities as well as help you determine how much money you can set aside into your savings and even calculate how much extra funds you might have to spend on for more personal things!

𝜗𝜚 final notes 𝜗𝜚

don’t let these tips make you feel like you can’t treat yourself to something! as i mentioned earlier, you can still treat yourself to nice things, but it might be best to do it once in a while! i know most of us associate success with money, and to reach success with money we have to learn to be more mindful about how we spend our money and how we manage it.

live and love, babe.

sincerely, juno ⭑.ᐟ

#milkoomis#girlblogger#girlblogging#it girl#that girl#girl blog aesthetic#it girl tips#becoming that girl#finance#money#money management#money manifestation#money saving#spending habits#personal growth#self improvement

202 notes

·

View notes

Note

Hey Bitches! Long-time reader, first time asker :)

I have a budgeting question!

I'm a 21 year old student living with my (employed) partner independent from both our families. I'm unemployed at the moment, but will be starting a (min wage, limited hours, career-benefiting, year-long-contracted) job starting next month. I'll also be looking into selling plasma and/or picking up a gig app to supplement the pay

I find that a lot of what makes budgets useful doesn't really work for me because most of my spending areas that can be minimized have already been minimized, and I limit and track myself so much already because I know I don't have a lot of wiggle room to spend frivolously. So most of the time, I use a spending tracker spreadsheet

However, my credit union has a built-in budget feature I like to poke around on sometimes, too. It can be nice to have a goal in mind and to feel like I did a good job at the end of the month when (most) everything is green (I was over-budget for my cat by 11 cents last month)

BUT! I can only set a budget for one month's length. This seems to be the norm and is pretty common when I look at budgeting examples

This is great for things that happen on a monthly basis (like gas, for example), where, after years of tracking my spending data, I have a solid idea of how much I can realistically expect to spend in that time. But it really sucks for things that aren't as frequent, but do happen on a regular basis (like car registration or tuition, which come once a year and every few months, respectively)

I'm kind of at a loss for how to represent or calculate these kinds of items on a budget/spending tracker (like when I'm pulling for an average over a length of time, or categorizing my spending when one value is superbly high in a sea of much smaller numbers)

Gas is about $50/month, car registration is about $100/year. I think it's a poor representation to say I need $150/month for auto expenses. I'm not spending that $100 most of the time, but I'm not expecting to pay it most of the time, so it feels wrong to say I'm saving a ton of money every month. But it also isn't great to have only $50 budgeted when registration month rolls around and I'm in the red by $100 (not to mention inconsistent maintenance of wildly varying cost)

Likewise, I wouldn't say I'm under-budget by $2,000 on the months I don't have tuition due, but it can't be correct to have a $0 budget that gets super red every three months. Dividing it up to $666 a month gets the same problem where I'm either super green, not spending anything, "saving" a ton, or very in the red, very over-budget when my tuition actually comes due. There is an option to split up payments, but it adds a $50 payment plan fee, which (in addition to generally being shitty by punishing anyone who doesn't make the lump sum) doesn't feel worth it just to make my books look nice

I've seen some recommendations to use a sinking fund for these expenses, putting money aside each month in preparation for the big expense, but

A. where exactly do you put that portion "aside" into? I have a checking, savings, (secured) credit card, and a CD account (the latter two of which I can't easily move money around in). Besides putting money into my savings account from my checking (which, when employed and receiving income, I already do), I don't understand how this works. Do people just open and have several accounts going for each expense that isn't on a monthly pattern?

And B. I'm in a fortunate enough position that I'm (just barely! Job is coming with amazing timing!) able to make single payments on these expected bigger expenses without having to meticulously save up for them. It doesn't fix my budget being wonky on months with/out these non-monthly expenses, and I would like to actually have a working budget, but do I even need to make a sinking fund if I can afford it with the habits/systems I already have?

I've also seen people using different budgets for different times. Most often, this is seasonal: a winter budget with higher heating expenses planned, a summer budget with lower heating expenses planned kind of deal. This feels closer to what I'm looking for than a sinking fund, but making a different monthly budget around each varying expense and overlapping occurrences (or lack thereof) feels cumbersome and tedious (to make, keep track of, alter, and change every month)

I could have a yearly budget, but it feels risky to go such a long time without knowing how on-track I am and my life is so in flux right now that I don't know what to expect that far into the future. Plus, like I said, I only have the option for monthly budgets in my credit union.

I expect having a more stable and higher income will help a lot (assuming I can get there). As will not having to pay for huge-stressful-chunks-of-savings-every-three-months-except-for-summertime tuition (I'll be done next year almost to the day!). I know there will still be yearly and bi-yearly expenses (and surprises) that I'll have to be ready to pay for, but I'm hoping I'll have more staggering control.

So, I've come to you, Bitches, if there is a better way to address these big, non-monthly expenses, or if I'm just missing something in one of the suggestions above, I'd be jazzed to hear about it and not have to wait to better grasp this part of my finances.

Thank you, Bitches!!

THIS IS EXACTLY WHY WE DON'T THINK BUDGETS ARE RIGHT FOR EVERYONE.

My first instinct is to tell you to ignore your bank's budgeting software. It doesn't matter. You're doing great with your personal spending tracker and you seem to have a very good hold of your expenses. So that's an option.

The other option is combining the budget with a sinking fund. Some banks will include "buckets" within your account that you can access through their online portal. For example, my Ally HYSA allows me to set up buckets within the account so I can budget for what I'm saving for our kitchen renovation, for example. It makes using a sinking fund real easy.

But not every bank has that functionality! So again, I can't stress enough how much a budget just might not be right for your situation right now.

Budgets Don’t Work for Everyone—Try the Spending Tracker System Instead

Ask Not How Much You Should Save, Ask How Much You Should Spend

Did we just help you out? Join our Patreon!

#budget#budgeting#spending money#saving money#personal finance#money#money tips#adulting#frugal#finance#money management#cash

43 notes

·

View notes

Note

So her merch is basically a beige expensive Amazon wish list, how does she make money from these ‘curated’ high end goods. So where is the income stream, and has she had to ask the designer houses permission. As a designer I wouldn’t want any association with the awful woman.

So I did some poking around the ShopMy website and it looks like how much commission Meghan earns is independently negotiated between her and the brands.

Here's a really fascinating Q&A of how ShopMe works, if anyone's interested:

I don't think she's making much on commission from these brand deals. TikTok Shop (which seems to be setting the industry standard these days) is around 15%. I think Meghan might get 20-25% but that is a very rough guesstimate.

It is an income stream, but it's a very small one. If we look at where Meghan is making money, it's here:

ShopMe commissions

Merch deals and papwalks

As Ever (which Netflix is probably taking a significant chunk)

Coffee investment

Speaking fees (but I don't think she's doing that anymore)

Archewell donations

It might look like a lot, but I don't think it is, not when you consider the expenses she has:

$14.5 million mortgage

Utilities (and water is expensive in SoCal)

Ordinary living expenses - food, clothes, things the kids need, car lease payments, gas

Staff expenses - household staff, Archewell staff, As Ever staff, social media people

Awards and red carpet gala tickets

Travel

Fauxyal tours and associated expenses - airfare, cost of clothes, accommodations

24/7 personal security everywhere

Harry's lawsuits

Operational expenses for Archewell and As Ever

Adding up the balance sheets, I think Meghan is still on the hustle and, if rumors are true, they're living largely on the interest from Harry's trust funds with generous subsidies from Charles (the mortgage and housing costs) and sponsors (most of the travel). I do think she's in for a rude awakening if the divorce is here because their cost of living has far surpassed their means and, as we've discussed here before, they're not dependent on the BRF so Charles isn't bailing either of them out with massive Diana-sized (or even polite Fergie-sized) settlements.

Also Meghan didn't pay for anything having to do with the production of her show, including the house she used. That was all Netflix.

Edit: I forgot about Harry's BetterUp thing. That's another income stream for them, but Meghan loses that income stream in a divorce unless she is awarded alimony/child support and Harry's "salary" is calculated into the payments.

31 notes

·

View notes

Text

Stop Wasting Money! The ONE Budgeting Trick That Actually Works

Are you tired of feeling like your money slips through your fingers? Do you constantly wonder where it all went at the end of the month? You're not alone. Many people struggle with budgeting, often because they try complex systems that are difficult to maintain. But what if there was a simple, effective budgeting trick that actually works? There is! It's called the 50/30/20 budget, and it might just be the key to finally taking control of your finances.

[Include an image here of someone looking stressed about bills or money, or a graphic representing money slipping through fingers. A simple image of a budget pie chart would also work well.]

This method, popularized by Senator Elizabeth Warren and her daughter Amelia Warren Tyagi in their book "All Your Worth: The Ultimate Lifetime Money Plan," 1 simplifies budgeting by categorizing your spending into three main buckets:

1. Needs (50%): These are your essential expenses – the things you absolutely must pay for. Think:

Housing: Rent or mortgage payments, property taxes, homeowner's insurance

Utilities: Electricity, gas, water, internet, phone bills

Transportation: Car payments, gas, public transportation fares, car insurance

Groceries: Food and household supplies

Healthcare: Insurance premiums, doctor visits, prescriptions

Minimum Debt Payments: Monthly payments on credit cards, student loans, etc. (Only the minimums are included here; extra payments go into the "Wants" or "Savings" categories)

2. Wants (30%): This category covers your discretionary spending – the things you enjoy but aren't essential. This is where you have the most flexibility to cut back if needed. Examples include:

Dining Out: Restaurant meals, takeout coffee

Entertainment: Movies, concerts, streaming subscriptions

Hobbies: Gym memberships, craft supplies, sports leagues

Clothing: Non-essential purchases

Travel: Vacations, weekend getaways

Gifts: Presents for birthdays and holidays

[Include an image here of someone enjoying a "want" – maybe dining out, on vacation, or enjoying a hobby.]

3. Savings & Debt Repayment (20%): This is crucial for your financial future. It includes:

Emergency Fund: Building a cushion for unexpected expenses (job loss, medical bills, car repairs)

Retirement Savings: Contributing to your 401(k), IRA, or other retirement accounts

Debt Repayment (Beyond Minimums): Paying down credit card debt, student loans, or other high-interest debt aggressively

Investments: Investing in stocks, bonds, or other assets

Savings Goals: Saving for a down payment on a house, a new car, or other long-term goals

[Include an image here representing savings goals – maybe a piggy bank, a house, or a graduation cap.]

How to Make the 50/30/20 Budget Work for You:

Calculate Your Net Income: Determine your take-home pay after taxes and other deductions.

Categorize Your Spending: Track your expenses for a month or two to see where your money is currently going. Use budgeting apps, spreadsheets, or even a notebook to monitor your spending in each category.

Allocate Your Income: Based on your net income, calculate how much you should be spending in each category (50%, 30%, 20%).

Adjust as Needed: The 50/30/20 rule is a guideline, not a strict law. You may need to adjust the percentages based on your individual circumstances and financial goals. For example, if you live in a high-cost-of-living area, you might need to allocate a larger percentage to needs.

Track and Review: Regularly monitor your spending to ensure you're staying within your budget. Review your progress monthly and make adjustments as needed.

Benefits of the 50/30/20 Budget:

Simplicity: It's easy to understand and implement.

Flexibility: It allows for adjustments based on individual needs.

Focus on Goals: It encourages saving and debt repayment.

Awareness: It helps you understand where your money is going.

Challenges and How to Overcome Them:

Tracking Expenses: Consistently tracking your spending can be challenging. Use budgeting apps or link your bank accounts to make it easier.

Sticking to the Budget: It can be tempting to overspend in the "Wants" category. Be mindful of your spending habits and prioritize your financial goals.

Unexpected Expenses: Life throws curveballs. Having an emergency fund is crucial for handling unexpected costs without derailing your budget.

Conclusion:

The 50/30/20 budget is a powerful tool for gaining control of your finances. Its simplicity and flexibility make it a sustainable approach to budgeting, allowing you to meet your needs, enjoy your wants, and achieve your financial goals. So, stop wasting money and give this budgeting trick a try. You might be surprised at how much of a difference it can make!

3 notes

·

View notes

Text

I always want to know what the numbers mean in todays money, so for convenience I listed the results of an inflation calculator for the amounts:

1969 tweet claims:

1969 house price: ~$144k

1969 down payment: $425

1969 monthly payment: ~$1532

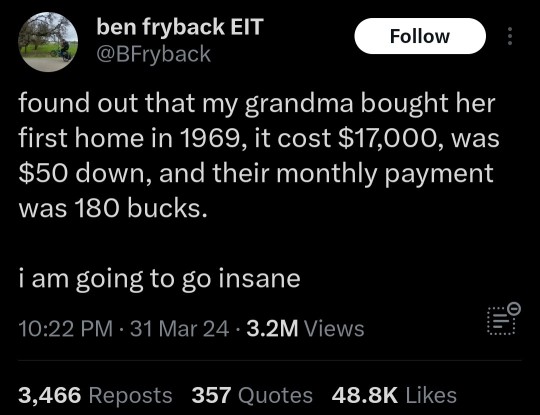

1936 year in review from the 'pages of yore - nostalgia news report':

yearly income: ~$38k

new car: ~$16.5k

new house: ~$88k

loaf of bread: $1.80

gallon of gas: $2.25

gallon of milk: $10.79

gold per ounce: ~$464

silver per ounce: $8.54

16K notes

·

View notes

Text

Can You Take a Personal Loan to Relocate to a New City?

Relocating to a new city can be an exciting yet challenging experience. Whether you are moving for a new job, education, or personal reasons, the costs associated with relocation can be overwhelming. Expenses such as moving services, transportation, security deposits, temporary accommodation, and setting up a new home can quickly add up. If you are wondering whether you can take a personal loan to cover these expenses, the answer is yes. But is it the right decision for you? Let's explore the advantages, disadvantages, and key considerations before taking a personal loan for relocation.

1. Understanding the Cost of Relocation

Before deciding on financing options, it's essential to estimate the total expenses involved in relocating to a new city. Here are some common costs to consider:

Moving Services – Packing, transportation, and unpacking costs.

Travel Expenses – Flight, train, or fuel costs if driving.

Security Deposits & Rent – Advance rent, brokerage fees, and security deposits.

Temporary Accommodation – Hotel or rental expenses before settling in.

Furniture & Appliances – Buying new or transporting existing furniture.

Utility Connections – Setting up electricity, water, internet, and gas.

Miscellaneous Expenses – Unexpected costs such as legal fees, pet relocation, and insurance.

Given these financial commitments, many individuals consider a personal loan to manage their relocation expenses smoothly.

2. Can You Use a Personal Loan for Relocation?

Yes, you can use a personal loan to finance your relocation. Unlike home loans or car loans that are meant for specific purposes, a personal loan is an unsecured loan that can be used for any financial need, including moving expenses.

Banks, NBFCs, and online lenders offer personal loans with flexible repayment options and competitive interest rates, making them a viable option for covering relocation costs.

3. Benefits of Taking a Personal Loan for Relocation

A. Quick Access to Funds

One of the biggest advantages of a personal loan is that it provides immediate access to funds, often within 24 to 48 hours of approval.

B. No Collateral Required

Since personal loans are unsecured, you don’t need to pledge any assets as security, making the process hassle-free.

C. Fixed Repayment Tenure

Most personal loans come with a structured repayment plan, allowing you to choose a tenure that fits your budget.

D. Can Cover All Expenses

Unlike relocation assistance programs that might have limitations, a personal loan can be used for any moving-related expense, from travel to setting up a new home.

E. Helps Preserve Savings

Instead of exhausting your savings, a personal loan can help you manage relocation costs while keeping your emergency fund intact.

4. Downsides of Using a Personal Loan for Relocation

A. Interest Costs

Personal loans generally have higher interest rates compared to secured loans, increasing the total cost of borrowing.

B. Monthly Repayment Obligation

Taking a personal loan means you must commit to fixed monthly payments, which can be a burden if you are transitioning between jobs or facing financial uncertainty.

C. Impact on Credit Score

Late payments or defaulting on your personal loan can negatively impact your credit score, making it harder to secure future loans.

D. Processing Fees & Hidden Charges

Lenders may charge processing fees, prepayment penalties, or other additional costs that can add to your financial burden.

5. Key Factors to Consider Before Taking a Personal Loan for Relocation

A. Assess Your Financial Stability

Before taking a personal loan, evaluate your financial situation and future income prospects to ensure you can manage repayments comfortably.

B. Compare Loan Offers

Different lenders have varying interest rates and loan terms. Comparing multiple offers can help you secure the best deal.

C. Calculate Your Loan Repayments

Use a personal loan EMI calculator to determine your monthly repayment amount and ensure it aligns with your budget.

D. Check for Employer Relocation Benefits

If you are relocating for a job, check whether your employer offers relocation assistance before opting for a personal loan.

E. Explore Alternative Financing Options

Instead of a personal loan, consider:

Employer-provided relocation allowances.

Using a credit card with a 0% interest promotional offer.

Borrowing from family or friends.

Using savings if feasible.

6. When Is a Personal Loan a Good Choice for Relocation?

A personal loan can be beneficial if:

You need immediate funds to cover relocation costs.

You don’t have enough savings or emergency funds.

Your employer does not provide relocation assistance.

You can afford the monthly EMI without financial stress.

You have a stable income to repay the loan.

7. When Should You Avoid Taking a Personal Loan for Relocation?

A personal loan may not be the best choice if:

You already have multiple existing loans or financial obligations.

You have enough savings to cover the moving costs.

The interest rates are too high, making repayment difficult.

Your future income is uncertain or unstable.

8. How to Apply for a Personal Loan for Relocation

A. Check Your Credit Score

A higher credit score improves your chances of getting a loan at a lower interest rate.

B. Compare Lenders

Research different banks, NBFCs, and online lenders to find the best personal loan options.

C. Gather Required Documents

Common documents required include:

Identity proof (Aadhar, PAN, passport, etc.).

Address proof.

Income proof (salary slips, bank statements, or ITR documents).

Employment verification letter (if applicable).

D. Submit Application Online or Offline

Most lenders offer online applications, making the process quick and hassle-free.

E. Loan Approval & Disbursement

Once approved, the funds will be disbursed to your bank account, ready to be used for relocation expenses.

9. Conclusion: Is a Personal Loan a Smart Choice for Relocation?

Taking a personal loan for relocation can be a practical solution if planned wisely. It provides financial flexibility, quick access to funds, and can help manage the cost of moving without draining your savings. However, it’s essential to consider the long-term repayment commitment, interest rates, and your financial stability before making a decision.

If you can secure employer relocation assistance, use savings, or find a lower-cost borrowing option, it may be better to explore those first. But if you need immediate funds and have a solid repayment plan, a personal loan can be a valuable financial tool to ease your transition to a new city.

#fincrif#nbfc personal loan#bank#personal loans#personal loan online#personal laon#finance#loan apps#loan services#personal loan#Personal loan#Relocation loan#Moving expenses loan#Personal loan for moving#Personal loan for relocation#Best personal loan for relocation#Loan for moving to a new city#Relocation financing options#Personal loan for shifting expenses#Personal loan eligibility#Personal loan interest rates#Quick personal loan approval#Personal loan EMI calculator#Personal loan without collateral#Instant personal loan#Emergency personal loan#How to finance relocation#Personal loan for job relocation#Loan for house shifting#Personal loan for travel expenses

0 notes

Text

Imagine a Different Canada

Imagine waking up in a world where the weight of survival isn’t crushing your spirit before the day even begins. A world where wages match the cost of living—where a hard day’s work means not just scraping by, but thriving.

Picture walking into a grocery store, filling your cart without second-guessing every price tag, without calculating whether you can afford fresh fruit or gas this week. Imagine rent or mortgage payments that don’t devour entire paychecks, leaving you with nothing but stress and empty cupboards.

Think of a Canada where homes aren’t just investment properties for the wealthy but real, attainable places where families grow, laugh, and build their futures. A world where no one has to choose between heating their home and putting food on the table.

Now, envision a life free from the constant anxiety of sky-high taxes siphoning away what little remains of your paycheck, while billion-dollar corporations find loopholes to hoard wealth. A society where fairness isn’t just a talking point but a lived reality.

Imagine walking through your community and seeing fewer boarded-up storefronts, fewer food bank lineups, and more local businesses thriving because people can afford to support them. Streets filled with hope instead of quiet despair.

Think of the relief of knowing that if life throws a curveball—an illness, a job loss, a car repair—you won’t spiral into financial ruin. Where dignity isn’t reserved for the privileged, but a basic human right for every working Canadian.

This isn’t a fantasy. It’s not some utopian dream beyond reach. It’s what we could have if our government prioritized people over corporate profits, if policies reflected the reality of working Canadians instead of the interests of the elite.

We don’t need more “thoughts and prayers” from politicians who have never known what it’s like to go to bed hungry. We need action. We need change.

Because life isn’t meant to be a never-ending struggle to survive. It’s meant to be lived.

#canada#canadian politics#ontario#share#british columbia#life#living wage#why#politics#scientificresearch#canadian#canadá#reality change#game changer#change#prayer#pray for me#pray for one another

1 note

·

View note

Text

Effective Budgeting Techniques: Strategies for Creating and Maintaining a Budget to Manage Expenses and Achieve Financial Goals

Introduction

In this SEO-optimized guide, we’ll cover: ✅ Why budgeting is crucial for financial success ✅ The most effective budgeting techniques ✅ How to track expenses and cut unnecessary costs ✅ Tips to stick to your budget and achieve long-term financial goals

If you’re ready to take control of your finances, keep reading! 🚀

Why Budgeting is Important for Financial Success

A budget is a financial roadmap that helps you:

✔️ Track where your money goes ✔️ Avoid overspending and unnecessary debt ✔️ Save for emergencies and future goals ✔️ Achieve financial freedom faster

💡 Example: Without a budget, you might spend $500/month on dining out, without realizing how much it affects your ability to save or invest. A budget helps you make informed decisions about where your money goes.

How to Create an Effective Budget: Step-by-Step Guide

Step 1: Calculate Your Total Income

Before creating a budget, you need to know how much money you have coming in each month.

✔️ Include all sources of income (salary, side gigs, rental income, etc.). ✔️ Use net income (after taxes) instead of gross income.

📌 Example: If you earn $5,000 per month after taxes, this is your starting point for budgeting.

Step 2: Track Your Expenses

Understanding your spending habits is key to controlling your finances.

✔️ Review bank & credit card statements to identify spending categories. ✔️ Use budgeting apps like Mint, YNAB, or EveryDollar for automatic tracking. ✔️ Categorize your expenses into fixed (rent, car payment) and variable (groceries, entertainment).

📌 Example of Expense Categories:Expense CategoryEstimated CostRent/Mortgage$1,500Utilities$150Groceries$400Transportation$200Entertainment$150Subscriptions$50Savings$500Investments$300

💡 Tip: Many people underestimate their spending on small items like coffee and fast food—track every dollar!

Step 3: Choose a Budgeting Method That Works for You

There is no one-size-fits-all budget. Here are the top budgeting techniques to help manage your expenses:

1. The 50/30/20 Rule (Best for Beginners)

✔️ 50% Needs (rent, food, transportation, bills) ✔️ 30% Wants (entertainment, dining out, subscriptions) ✔️ 20% Savings & Debt Repayment (retirement, emergency fund, debt payoff)

📌 Example: If your income is $4,000/month: ✔️ $2,000 for needs ✔️ $1,200 for wants ✔️ $800 for savings & debt repayment

💡 Best for: People who want a simple and flexible budgeting approach.

2. Zero-Based Budgeting (Best for Maximizing Every Dollar)

✔️ Every dollar is assigned a purpose (income - expenses = $0). ✔️ Forces you to prioritize savings, debt repayment, and investments. ✔️ Great for tracking every dollar you spend.

📌 Example: If you earn $3,500/month, every dollar should be allocated to bills, savings, debt payments, and fun money—so there’s no leftover cash sitting idle.

💡 Best for: People who want full control over their finances.

3. Envelope Budgeting (Best for Avoiding Overspending)

✔️ Cash-based budgeting system where you set aside money in envelopes. ✔️ Helps prevent overspending by limiting cash for each category. ✔️ Works well for people who struggle with credit card debt.

📌 Example: Withdraw $600 for groceries, $200 for gas, and $100 for entertainment—once the envelope is empty, you can’t spend more.

💡 Best for: People who prefer cash over digital transactions.

4. Pay Yourself First Budget (Best for Saving More Money)

✔️ Automatically allocate savings before spending on anything else. ✔️ Encourages consistent investing and wealth-building. ✔️ Ideal for people who struggle with saving money.

📌 Example: If you earn $5,000/month, set up an automatic transfer of $1,000 to savings and investments before spending on anything else.

💡 Best for: People who want to prioritize savings and retirement goals.

How to Stick to Your Budget and Achieve Financial Goals

Creating a budget is easy—sticking to it is the hard part. Here are proven strategies to help you stay on track:

1. Automate Your Finances

✔️ Set up auto-pay for bills and savings contributions. ✔️ Use budgeting apps to track spending automatically.

2. Review Your Budget Monthly

✔️ Adjust your budget based on income changes or unexpected expenses. ✔️ Look for areas where you can cut costs and save more.

3. Reduce Unnecessary Expenses

✔️ Cancel unused subscriptions (gym, streaming services, etc.). ✔️ Cook at home instead of eating out frequently. ✔️ Shop smart—use discounts, cashback apps, and buy in bulk.

4. Use the "No-Spend Challenge" Method

✔️ Pick a category to eliminate spending on for a month (e.g., no eating out). ✔️ Redirect that money into savings or investments.

💡 Example: If you spend $150 on coffee & fast food per month, a no-spend challenge can save that money instead.

5. Set Clear Financial Goals

✔️ Short-Term Goals: Save for a vacation, build an emergency fund. ✔️ Long-Term Goals: Buy a house, retire early.

💡 Tip: Set SMART financial goals (Specific, Measurable, Achievable, Relevant, Time-bound) to stay motivated.

Need a Personal Loan Up to $100K? Low Credit Options Available up to $50K.

Book a Free Consult - https://prestigebusinessfinancialservices.com

Final Thoughts: Master Your Budget & Take Control of Your Finances

📌 Budgeting is the key to financial success, helping you: ✅ Track and manage expenses effectively ✅ Avoid debt and save more money ✅ Invest wisely and build long-term wealth

🚀 Want to take control of your financial future? Start budgeting today!

Need a Personal Loan Up to $100K? Low Credit Options Available up to $50K.

Book a Free Consult - https://prestigebusinessfinancialservices.com

💬 What’s your favorite budgeting strategy? Share in the comments!

Prestige Business FInancial Services LLC

"Your One Stop Shop To All Your Personal And Business Funding Needs"

Website- https://prestigebusinessfinancialservices.com

Email - anthony@prestigebfs.com

Phone- 1-800-622-0453

1 note

·

View note

Text

The 50/30/20 Rule: How Much Should You Spend on Rent?

Finding the perfect apartment for rent in Conway,AR is an exciting journey, but it’s important to stay within your budget. Rent is often the biggest monthly expense, so how much should you realistically spend?

A common and effective budgeting method is the 50/30/20 rule, which helps renters manage their finances without financial strain. Whether you’re a first-time renter, a student, or a professional looking for a new home, this budgeting strategy can help you make smart financial decisions.

At The Urban Loft Co., we understand that affordability matters. In this guide, we’ll break down the 50/30/20 rule, show you how to calculate your ideal rent budget, and share tips on how to make the most of your income while renting in Conway.

What is the 50/30/20 Rule?

The 50/30/20 rule is a simple budgeting framework that divides your after-tax income into three categories:

50% – Needs: Essential expenses like rent, utilities, groceries, insurance, and transportation.

30% – Wants: Non-essential spending such as dining out, shopping, subscriptions, and entertainment.

20% – Savings & Debt Repayment: Building an emergency fund, saving for the future, or paying off loans and credit cards.

This rule ensures that you can afford your rent while still enjoying life and preparing for financial stability.

How Much Should You Spend on Rent Using the 50/30/20 Rule?

Since rent falls under the "needs" category, it should be covered within the 50% portion of your budget. However, keep in mind that this 50% also includes other necessities like:

Utilities (electricity, water, internet, gas)

Groceries and basic household expenses

Insurance (health, renters, car)

Transportation (gas, car payments, public transit, rideshares)

What If Your Rent is Too High?

If your rent is above 35% of your income, here are some strategies to stay financially comfortable:

1. Adjust Your Budget

Cut back on non-essential spending (dining out, streaming services, impulse shopping).

Look for utility-inclusive apartments to reduce monthly costs.

Use energy-efficient appliances to lower your utility bills.

2. Choose the Right Location

While living in downtown Conway might be more expensive, areas slightly outside the city center can offer lower rent while still being accessible to work, school, and entertainment.

3. Look for Special Offers & Discounts

Many apartment communities, including The Urban Loft Co., offer move-in specials, discounted security deposits, or flexible lease options. Always ask about current promotions to save money.

Should You Ever Spend More Than 50% on Rent?

While the 50/30/20 rule is a great guideline, there are cases where you might spend more than 50% on rent, such as:

Living in a high-cost area where affordable housing is limited

Choosing a luxury apartment with premium amenities

Having low debt and a strong financial cushion

If your rent takes up more than half of your income, try to compensate by reducing discretionary spending or increasing your earnings through a side hustle or career growth.

Finding Affordable Apartments for Rent in Conway

If you’re looking for a high-quality yet budget-friendly apartment in Conway, The Urban Loft Co. offers modern living spaces with affordable rental options.

Why Choose The Urban Loft Co.?

Spacious, modern floor plans – Open-concept layouts with sleek finishes.

Prime Conway location – Close to shopping, dining, and entertainment.

Pet-friendly options – Because your furry friends deserve a home too!

Flexible lease options – Short-term, long-term, and move-in specials available.

Secure & stylish living – Gated communities, on-site maintenance, and smart home features.

Whether you’re a student, young professional, or family, we have the perfect home for you without breaking your budget.

Ready to Find Your Dream Apartment in Conway?

Now that you know how to budget for rent using the 50/30/20 rule, it’s time to find the perfect apartment that fits your lifestyle and financial goals.

Explore Our Available Rentals: https://theurbanloftco.com/conway

Call Us: (501) 391-3521

Your dream apartment is waiting—let’s find your perfect home today!

0 notes

Text

Car Financing for Students in Vancouver: Tips to Drive Away Smart

As a student in Vancouver, balancing classes, part-time jobs, and a social life is challenging enough—add car financing to the mix, and it can feel overwhelming. But owning a car doesn’t have to be a distant dream. With the right strategy, you can navigate car financing Vancouver like a pro and find a vehicle that fits your budget and lifestyle. Whether you’re commuting to UBC, exploring the North Shore, or road-tripping to Whistler, here’s how to drive away smart as a student.

1. Start with a Realistic Budget

Before diving into car financing Vancouver, it’s crucial to know what you can afford.

What to consider:

Monthly payments: Aim for no more than 10–15% of your income.

Down payment: Save at least 10% of the car’s price to reduce your loan amount.

Additional costs: Factor in insurance, fuel, maintenance, and parking fees.

Pro Tip: Use online loan calculators to estimate payments and avoid overextending yourself.

2. Build (or Improve) Your Credit Score

Your credit score plays a key role in securing favorable financing terms. As a student, you might have limited credit history, but there are ways to build it.

How to start:

Get a student credit card: Use it responsibly and pay off the balance each month.

Become an authorized user: Ask a parent or guardian to add you to their credit card.

Pay bills on time: Set up automatic payments to avoid missed deadlines.

Why it matters: A higher score can qualify you for lower interest rates, saving you money over time.

3. Explore Student-Specific Financing Options

Many lenders and dealerships offer programs tailored to students, including:

Lower interest rates: For borrowers with limited credit history.

Flexible down payments: Some programs require as little as 5% down.

Co-signer options: A parent or guardian can help you qualify for better terms.

Pro Tip: Compare offers from banks, credit unions, and dealerships to find the best deal.

4. Choose the Right Car

As a student, practicality and affordability should guide your choice.

What to look for:

Fuel efficiency: Save money on gas, especially with Vancouver’s high fuel prices.

Reliability: Choose a car with a strong track record for durability.

Insurance costs: Some models are cheaper to insure than others.

Vancouver-specific tip: Consider a compact car for easy parking in the city.

5. Understand Loan Terms

Loan terms can make or break your financing experience.

Key points to know:

Interest rates: Lower is better. Compare rates from different lenders.

Loan term: Shorter terms (24–48 months) save you money in interest.

Total cost: Don’t just focus on monthly payments—calculate the overall cost.

Avoid: Loans with prepayment penalties or hidden fees.

6. Take Advantage of Student Discounts

Many automakers and dealerships offer discounts for students, including:

Cash rebates: Reduce the purchase price of your car.

Low APR financing: Special rates for recent graduates or current students.

Free maintenance packages: Save on oil changes and tire rotations.

Pro Tip: Bring your student ID and ask about available discounts.

7. Test Drive and Inspect

Before committing to car financing Vancouver, ensure the car is the right fit.

What to check:

Mechanical condition: Have a trusted mechanic inspect the car.

Test drive: Evaluate how it handles Vancouver’s rainy streets and steep hills.

Vehicle history: Use services like Carfax to check for accidents or repairs.

Why Trust Vancouver Preowned for Student Car Financing?

At Vancouver Preowned, we specialize in helping students navigate the car financing process with ease. Our team:

Offers transparent, no-pressure advice tailored to your needs.

Provides a wide selection of reliable, affordable vehicles.

Guides you through every step, from pre-approval to paperwork.

With decades of local expertise, we’re here to make your car-buying experience smooth and stress-free.

Ready to Hit the Road? Visit Vancouver Preowned today to explore our inventory and discover how easy car financing Vancouver can be. Your dream car is just a test drive away!

0 notes

Text

By Catie Edmondson and Andrew Duehren

Top Republicans are passing around an extensive menu of ideas to cover the cost of a massive tax cut and immigration crackdown bill. They could create a 10 percent tariff on all imports, bringing in an estimated $1.9 trillion. They could establish new work requirements for Medicaid recipients, bringing in $100 billion in savings.

They have even calculated that they could generate $20 billion by raising taxes on people who can use a free gym at the office, according to a 50-page list of options that the House Budget Committee has circulated in recent days.

The bigger challenge for Republican leaders is trying to figure out what can pass Congress and be signed by President Trump. With slim majorities in both chambers, they are searching for the right mix of policy changes that could offset some of the costs of Mr. Trump’s most expensive proposals, placating spending hard-liners who are concerned about ballooning the government’s debt, while also maintaining the support of more centrist members who are loath to slash popular programs.

House Republicans huddled in the Capitol on Wednesday to discuss a mix of options on the table.

Complicating their task is a political challenge: Many of the cuts Republicans are contemplating target programs aimed at helping low-income Americans, all in the service of paying for the extension of tax cuts that disproportionately benefit the wealthy.

The overarching goal is to push through a behemoth bill that cuts taxes and clamps down on immigration using a process called reconciliation, which would allow Republican leaders to avoid a filibuster and move legislation through the Senate with a simple majority, even if all Democrats are opposed.

Many of the G.O.P.’s anti-spending members have said they cannot support a bill that adds significantly to the nation’s debt. But most of the major policies Mr. Trump wants included in the legislation are extremely expensive. Extending the tax cuts he signed into law in 2017 alone is expected to cost $5 trillion.

That has left Republicans casting about for ways to offset those costs. The budget panel’s menu of possibilities includes everything from major clawbacks of current policy to lower-hanging fruit. Among many others, there are proposals to repeal major health care subsidy programs established by the Affordable Care Act, put caps on Medicaid funding, and end a policy that makes employer-provided meals and lodging tax-exempt.

Here’s a look at what Republicans are considering.

Longtime conservative goals, like slashing Medicaid

Republicans have long sought to scale back Medicare and Medicaid, the government programs for the elderly and poor, and the budget panel’s list outlined a slew of options for doing so, including reducing federal Medicaid payment rates and establishing work requirements for the program’s recipients.

One option floated by the committee would try to undercut the Affordable Care Act’s Medicaid expansion, which led to a ballooning in program enrollment. It would reduce the share of Medicaid costs the federal government pays for, increasing the burden on states.

Another on the list would impose work requirements for Medicaid recipients on able-bodied adults without dependents, with exemptions for pregnant women, students and primary caregivers of dependents. Work requirements would cause 600,000 people to lose coverage, according to estimates from the Congressional Budget Office, cutting federal spending by at least $100 billion over the next decade.

House Budget Committee aides estimated that they could recoup as much as $800 billion with a rollback of clean energy efforts, including repealing tax credits created in Mr. Biden’s landmark bill meant to reduce health costs, reduce greenhouse gas emissions and raise taxes on corporations. The rollback would also include nixing a climate regulation, put in place by the Biden administration, that is designed to ensure that the majority of new passenger cars and light trucks sold in the United States are all-electric or hybrids by 2032.

But undoing huge swathes of the Inflation Reduction Act could prove politically perilous. Some hard-right lawmakers have argued that Republicans should completely repeal the law, but others — particularly those with large clean-energy businesses in their districts or states — have implored congressional leaders to allow some of the measures to remain. Eighteen House Republicans last year wrote to Speaker Mike Johnson warning that “a full repeal would create a worst-case scenario where we would have spent billions of taxpayer dollars and received next to nothing in return.”

The aides who prepared the Budget Committee’s menu of cuts seem to have factored that into their calculations.

“Based on political will, there are several smaller reform options available (starting as low as $3 billion) that would repeal a smaller portion of these credits,” their document reads. Of course, those options also yield far fewer savings, and would be less likely to placate the spending hawks whose votes they need to push through any package.

Dozens of trims that could raise costs for Americans

Republicans are also considering a raft of proposals that would amount to small changes to the nation’s fiscal balance but could impose new costs on Americans. Among them are new taxes on free gyms at offices, as well as employer-provided meals and lodging.

The budget panel document also proposed taxing all scholarship and fellowship income, which is currently exempt from taxes, which would produce an additional estimated $54 billion in federal revenue.

Lucrative but politically difficult options like ending the home mortgage deduction

House Republicans’ list includes options that could generate trillions of dollars in savings. But those are likely to face near-insurmountable opposition from lobbyists and some lawmakers in their own ranks.

The proposals include ending the tax deduction for interest on home mortgages, one of the most prized sections of the tax code. While Republicans limited the deduction in their 2017 tax law, ending it entirely could save an additional $1 trillion over 10 years, according to the budget panel document. Real estate agents and lawmakers from suburban districts with many homeowners would most likely balk at such a measure.

Taxing imports into the United States, a step Mr. Trump has frequently urged, could also be lucrative. The document lists a 10 percent tariff on all goods as one option worth nearly $2 trillion, though many Republicans have said they do not believe Mr. Trump’s tariffs should be passed into law.

A proposal to tax imports but exempt exports, called a border adjustment plan, could raise $1.2 trillion, according to House Republicans’ document. Many economists like the idea of taxing goods based on where they are sold, rather than where they are produced, but a previous Republican effort to pass a destination-based plan failed in 2017 after companies pushed back on it.

The House Republican menu includes several other tax increases, including denying corporations the ability to deduct state and local taxes. Business groups are already organizing against those prospects.

Even more tax cuts, such as on tips and overtime pay

Beyond extending their last round of cuts, Republicans are interested in lowering taxes even further. Mr. Trump campaigned on making several forms of income, including tips and overtime, tax free.

The House Republican document offers clues about how Congress may actually approach Mr. Trump’s ideas. Their proposal for not taxing tips, for example, would only exempt tips from the income tax. That means tipped income would still be subject to the payroll taxes that fund Social Security and Medicare.

Structuring the proposal that way would mean low-wage tipped workers would save less. It would also preserve their ability to claim full retirement and health care benefits and reduce the overall cost of the tax cut, which the budget panel document said would cost $106 billion.

At the same time, not taxing overtime pay could cost as much as $750 billion over a decade, according to the budget panel.

A group of House Republicans, along with Mr. Trump, are hoping to raise the $10,000 limit on the state and local tax deduction as part of the bill. Raising the limit to $30,000 for married couples and $15,000 for individuals would cost $500 billion, the document estimates, and some lawmakers want to raise the cap even further.

Mr. Trump has flirted with lowering the corporate tax rate after slashing it to 21 percent in 2017, and the document shows House Republicans are considering reducing it to as low as 15 percent.

0 notes

Text

Novated Leasing Electric Vehicle: Future-Proof Your Driving with Great Tax Savings

In a world rapidly shifting towards sustainability, Novated Leasing Electric Vehicle options are becoming increasingly popular. These arrangements not only align with eco-friendly goals but also present significant financial benefits for employees and employers alike. Let’s dive into why this leasing option is a game-changer for both your wallet and the planet.

What is Novated Leasing?

Novated Lease is a three-way agreement between an employee, their employer, and a leasing company. This arrangement allows employees to lease a vehicle using pre-tax income, reducing their taxable salary and ultimately saving money. Employers handle the payments through salary deductions, making it a seamless process for both parties.

When applied to electric vehicles (EVs), novated leasing becomes even more appealing due to the unique advantages these cars offer.

Why Choose a Novated Leasing Electric Vehicle?

Switching to an electric vehicle under a novated lease offers a range of benefits that cater to modern lifestyles and sustainability efforts:

1. Cost Savings Through Tax Benefits

A Novated Lease Calculator can demonstrate the potential tax savings from leasing an EV. These savings stem from reducing your taxable income and taking advantage of Fringe Benefits Tax (FBT) exemptions that many electric vehicles qualify for. This makes EVs a financially smart choice.

2. Environmental Benefits

Electric vehicles contribute significantly to reducing greenhouse gas emissions. By choosing an EV through novated leasing, you’re not just saving money—you’re making a meaningful contribution to a healthier planet.

3. Lower Running Costs

Electric vehicles are known for their lower operating expenses compared to petrol or diesel cars. From reduced fuel costs to fewer maintenance needs, the overall expense of running an EV is significantly lower.

4. Access to the Latest EV Models

With a novated lease, upgrading to the latest EV model every few years is easier. This means you’ll always have access to cutting-edge technology and improved range capabilities without worrying about depreciation.

5. Simplified Budgeting

A novated lease bundles costs like registration, insurance, and maintenance into one manageable payment. This makes it easier to keep track of your expenses and avoid unexpected bills.

How Does a Novated Lease Calculator Help?

Understanding the financial benefits of a Novated Lease is crucial, and that’s where a Novated Lease Calculator comes in. This tool allows you to:

Estimate your potential tax savings

Compare the costs of leasing different EV models

Determine the overall affordability of a novated lease

Using a calculator ensures you make an informed decision tailored to your budget and lifestyle.

Testimonials: Real Stories from Novated Lease Users

"Switching to an EV through a novated lease was the best decision I’ve made! The tax savings were incredible, and I love the convenience of having everything bundled into one payment. Plus, driving an EV feels great knowing I’m reducing my carbon footprint."

— Sarah J., Sydney

"The Novated Lease Calculator was a game-changer for me. It showed me exactly how much I’d save, and it helped me choose the perfect EV for my needs. The process was straightforward, and I couldn’t be happier with my decision.”

— Michael T., Melbourne

The Role of Employers in Novated Leasing

Employers also stand to benefit from supporting novated leases for electric vehicles. Offering such arrangements can:

Attract and retain top talent by providing desirable benefits

Demonstrate a commitment to sustainability

Enhance the company’s green credentials

By facilitating novated leases, employers can create a win-win situation for themselves and their employees.

Key Considerations for Novated Leasing Electric Vehicles

While the advantages are clear, there are some important factors to keep in mind:

Eligibility: Check if your employer offers novated leasing and confirm which EV models qualify for FBT exemptions.

Residual Value: At the end of the lease term, you may have the option to purchase the vehicle by paying its residual value. Ensure this aligns with your financial goals.

Usage Requirements: Understand any mileage limits or usage restrictions associated with the lease.

The Future of Driving is Electric

As governments and industries worldwide push for sustainable transportation, electric vehicles are becoming the norm. By opting for a Novated Leasing Electric Vehicle, you’re not just future-proofing your driving but also taking a significant step towards a greener, more cost-effective lifestyle.

Whether you’re an employee looking to maximize your income or an employer aiming to boost workplace benefits, novated leasing makes EVs accessible and affordable. Use a Novated Lease Calculator to explore your options today and join the movement towards sustainable driving.

0 notes

Text

Using Food As A Way To Control

I generally do grocery shopping for our household every Thursday. I have done this for years. Lately, I have been asking my husband, double-checking if there is enough money on the credit card or the debit card now for me to shop. When I messaged him on Wednesday morning to ask him, he never replied back. So, I asked him Wednesday evening. He was annoyed that I keep asking him. I asked if I could shop on Thursday, if not, to tell me which day. He at first said he gets paid on Thursday. That doesn't answer the question. I asked if there would be money available for me to shop Thursday morning. He said he didn't know when the money would post. Doesn't make sense to me because when I worked in payroll, we could tell people by when to expect their money to be deposited into their accounts. He played dumb, but eventually said the money should be there by Thursday afternoon.

I felt all along that he was setting me up to be humiliated in public. Him not answer my questions, him giving indirect responses to my questions, playing dumb, acting like he doesn't know why I keep asking. Of course, I keep asking because sometimes I have gone to get gas and the card is declined. Or I go to buy dinner and it is declined. Or I go to buy anything over the counter medication for our son and it is declined. And at no time does he express that I hold off making any purchases due to lack of money or a need to cancel a card. He prefers and enjoys to allow me to find out at the time of purchase.

To keep asking him is giving him too much attention, he likes the begging and he likes withholding from me. He knows I cannot definitively say he is lying unless I go shop and find out with my payment not going through.

So, I went grocery shopping on Friday morning (to make sure to give his check time to post), fully expecting to have my card declined. We went to our evening meeting on thursday in peace (silence with no interaction is our peace) despite the horrific morning events. Friday morning was calm enough. Our son made it to school in peace. But of course, he held a grudge from Thursday morning's events and he has to have his revenge in some fashion. So, I was in expectation.

On Friday morning, I took time to make my grocery list. I spent an hour and a half grocery shopping, because I use an app to calculate everything to try not to go over the budget. I weigh produce and calculate the exact costs before putting into the cart. I used the self-check out lane and scanned all my items. The attendants were monitoring so I was dreading the attention I would get once my purchase didn't go through. I inserted the card. Payment declined. I called my husband. He naturally gaslighted me, trying to make me think we had not discussed that I would go shopping on Thursday, at first, and then I changed to Friday to make sure his check had time to post, based on what he told me. He flat out lied and said he didn't know I was going shopping. I had messaged him about it. I spoke to him face to face. Plus I always go shopping once a week on Thursday. After denying that he knew I was planning to shop, he said something about a replacement card might be coming. So, he failed to tell me that the card I had was useless because he ordered a replacement. Very purposeful. Very mean. This is what narc husbands do to regain control. All because I wanted to give my son more protein at breakfast time.

I had to leave the food. I apologized and left. Now, I can only wonder how long it will be before I can shop again for food, or if I ever will be authorized by him to shop with his card. Today, it was more nonsense. At 1:30, I had my son sit down to eat lunch. He was repeatedly saying he was hungry, running back and forth between me in the kitchen and his dad outside. I was aware that he was having our son help him sometimes with the car he was working on by asking him to get him a washcloth or things like that. My son didn't seem to be glued to his hip and was running in and out, so I didn't feel like his dad would be upset if he came in for lunch. After all, it was lunchtime.

Well, he came storming in demanding that I ask him if our son can come in to eat lunch if he is outside with him. I truly didn't realize that not having our son outside with him was detrimental to what he was doing. I didn't realize our son's stopping to eat lunch was such a hindrance to the work he was doing. Like, I said, he was running in and out and while he was in checking if I had food ready for him, I asked him to sit down and eat.

What type of Christian father demands that before his son is allowed to sit down and eat lunch when it is lunchtime and his son is obviously hungry, that he be asked first and whenever he gives permission, the son can go. Well, I know my husband does not care when our son is hungry. He doesn't care if it's lunchtime, doesnt even keep track of time that way. He said he didn't care about lunchtime, today when I said "But it's lunch time".

We exchanged words because I thought he was ridiculous. He is a 7 yr old kid with special needs. He is not his hired worker whom he depends upon to get jobs done. Even his workers at his business have a lunchtime, at which time they drop everything to go eat. They leave when it's time to clock out at 5pm. But my son and I don't get to clock out, or take breaks, or rest, or eat unless and only if he consents to it or else we have to pay.

There is no goodness in him. No love whatsoever. I resisted his nonsense and told him that instead of my asking him if our son could go eat lunch, he should have been keeping track of the time and asking our son if he was hungry and ready to eat lunch. He should have sent him to me to eat lunch. He started threatening me, telling me if I did that again to see what would happen. He muttered, "I guess I will have to throw out more food." Absolutely diabolical.

0 notes

Text

What Does Mileage Reimbursement Cover and What Benefit Does It Have for Vehicle Owners?

Mileage reimbursement is a common practice in many modern businesses. It compensates employees for using their automobiles for work-related activities. This agreement ensures that the automobile owners receive rightful compensation. However, the specifics of the coverage and how you receive payments remain unclear. There are essential components that might confuse a lot of customers and create false expectations. In this blog, we will cover the reimbursement procedure in detail and provide you with all of the necessary details and tips.

The Essential Concepts of Mileage Reimbursement

Mileage reimbursement is an important part of employee compensation. This financial system was created to reward employees who use personal vehicles for work-related activities. It’s critical to separate mileage reimbursement from standard salary raises or performance bonuses. So, what does mileage reimbursement cover, and what benefit do you get? It serves as a targeted reimbursement method to cover travel expenditures spent for work. The Internal Revenue Service (IRS) has a significant function in standardizing mileage reimbursement across the United States. Annually, the IRS publishes an official mileage rate that acts as an initial guide for businesses across the country. For example, for the fiscal year 2024, the IRS reimbursement rate has been 67 cents per mile. This figure includes all of the costs connected with operating a vehicle for business, including gasoline, vehicle depreciation, insurance, and maintenance fees. Organizations that follow this rate maintain fair and consistent reimbursement policies. This also reduces the administrative processes in managing employee travel expenditures. In the modern business setting, this strategy encourages transparency and equal treatment in spending management, which benefits both employers and employees.

What Does Mileage Reimbursement Cover?

Mileage reimbursement covers various types of vehicle expenses, such as fuel costs, insurance premiums, vehicle depreciation expenses, tire wear and tear, repairs, and general maintenance costs. These reimbursement amounts, types, and conditions vary based on the employer and their location. To clarify what it includes, let’s take a look at all the major aspects that it covers. The modern mileage reimbursement system includes the following aspects:

Fuel costs;

Insurance;

Vehicle depreciation;

Tire wear and tear;

Maintenance and repairs;

Let’s see what mileage reimbursement includes:

Fuel Costs: Fuel expenses often take a significant amount of driving expenses. These are daily costs that add up every time you use your automobile. If you are wondering, it makes no difference whether you drive a gas-guzzling SUV or an eco-friendly hybrid – the rate remains the same.

Insurance: You should know that the cost of your auto insurance does not vary if you use the vehicle for work. However, the mileage rate includes part of insurance costs, which will help you make up for the overall expense.

Vehicle depreciation: Over time, vehicles lose their value. The reimbursement includes a portion to cover the decrease in your car’s value. For instance, if you bought a car for $20,000 and it is now worth $15,000, you have a depreciation of $5,000. The rate usually compensates for part of it.

Vehicle Tires wear out the fastest. The more you drive, the more harm is done to them. Whatever type of tires you require, the rate will cover some of the costs.

Maintenance and repairs: Of course, when you travel, your auto requires frequent oil changes, more replacements, and several routine maintenance. Your mileage reimbursement also takes this components into consideration.

How to Calculate Mileage Reimbursement?

Calculating business mileage reimbursement is straightforward. You need two simple steps to calculate the exact amount. Hence, you need to follow these steps:

Step 1. Track your business miles. Step 2: Multiply the number of miles by the reimbursement rate. Let’s see how it works based on the example. First, you need to know how many miles you have covered. Imagine you drove 80 miles for work this week. Then, you need the reimbursement rate. The current reimbursement rate is 67 cents per mile. To calculate the mileage reimbursement amount, you need to multiply the miles by the rate. So, the reimbursement would be 100 miles x $0.67 = $67. Companies often use mileage-tracking apps to speed up and simplify the process. These apps can instantly track your mileage and simultaneously calculate your mileage reimbursement.

What are the Differences Between Mileage Reimbursement and Actual Expenses?

Many firms allow workers to choose between mileage reimbursement and real expenditure reimbursement. This flexibility allows you to choose the approach that best matches your circumstances. Let’s analyze the main differences and benefits of each strategy. Actual expenses require precise documentation. This complex method includes gasoline costs, maintenance fees, insurance rates, and even depreciation. The company (employer) then reimburses you for the portion of the expenses that are directly linked to business use. For instance, if your work-related driving is 40% of your total vehicle usage, the company would reimburse you for 40% of documented vehicle expenses. Actual expenditure reimbursement may be helpful for several scenarios:

Employees who own expensive or high-performance automobiles with significant operational expenses may profit from this strategy.

Extensive business travel: Those who travel frequently for work may be able to reclaim a greater portion of their real expenditures.

Older car maintenance: People using older automobiles that need regular repairs may find this strategy more financially lucrative.

Fluctuating gasoline prices: In areas where gas prices are variable, actual expenditure reimbursement can better represent current expenses.

While this approach might have prospective financial benefits, it needs careful tracking and an extensive understanding of car expenditures. Employees must balance the possible rewards with the necessary administrative effort.

Mileage Reimbursement and Taxes

Mileage reimbursement and tax requirements typically cross in a variety of ways. A solid understanding of them will allow you to save money and prevent difficulties with tax processes. First, let’s clarify a frequent misconception: correctly handled mileage reimbursements are not taxable income. If your company compensates you at or below the IRS standard rate (67 cents per mile), and you keep accurate records of your business travels, you’re fine. This money will not appear on your W-2. Therefore, you are not obligated to report it. But what happens if your firm is really generous? If they repay more than the IRS rate, the surplus is taxable income. For instance, if you are refunded 75 cents per mile, the additional 8 cents every mile will be reported on your W-2 as taxable income. In addition, self-employed individuals are in a different situation. They can deduct mileage charges straight on their tax forms, which might result in large tax reductions. However, they must choose between the regular mileage rate and actual costs for the year; no mixing and matching is permitted. Here’s a useful tip: always keep accurate records. The IRS enjoys paperwork. A comprehensive mileage record may turn into your greatest friend if you ever get inspected. You can also install a mileage monitoring tool to streamline the process and verify accuracy. Remember that tax regulations change regularly. So, always stay informed and check with a tax professional to maximize your advantages while minimizing your tax liability. To sum up, here are the scenarios when the mileage reimbursement is not taxable:

It doesn’t exceed the IRS standard rate. It can be equal to or less than the IRS mileage rate;

You provide an accurate record of your business mileage;

If your company compensates more than the official standard IRS rate, the excess is taxable income;

Self-employed persons can subtract mileage charges on their tax forms. They apply the identical IRS standard rate.

Tips to Maximize Your Mileage Reimbursement

The following tips can help you significantly boost your mileage reimbursement and, hence, your financial resources.