#car loan EMI calculator

Explore tagged Tumblr posts

Text

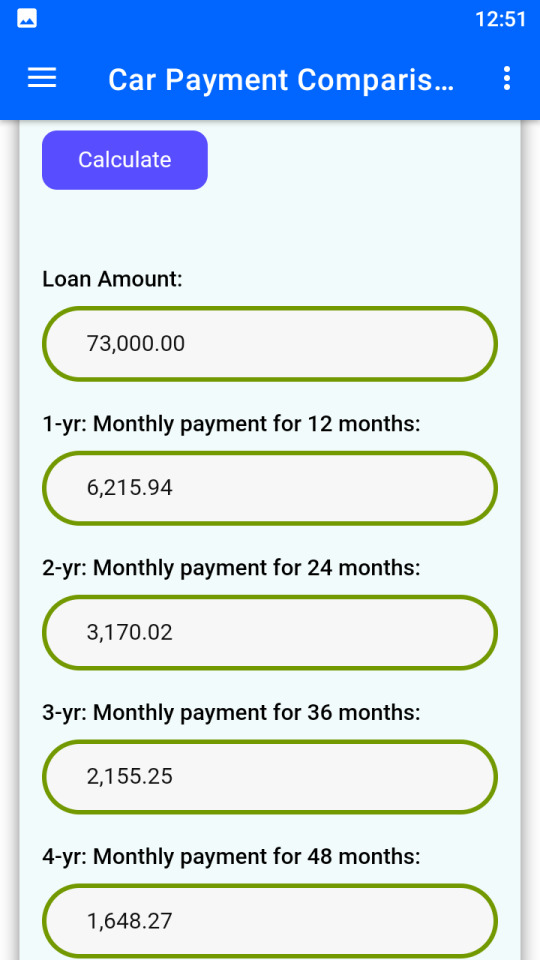

Know & compare the monthly payments from 1 year to 10 years. This App will show you the monthly payments required for car loans lasting 1 year, 2 years, 3 years, 4 years, 5 years, 6 years, 7 years, 8 years, 9 years & 10 years. Simply enter your total loan amount and the annual interest rate. Then press "Calculate", to see the monthly payments for each loan term.

#car payment calculator#auto loan calculator#vehicle loan comparison#monthly car payment estimator#car finance calculator#loan term comparison#car affordability calculator#auto financing tool#car loan repayment#interest rate calculator#car lease calculator#car loan EMI calculator#vehicle financing calculator#auto loan payment tracker#car purchase planning#car budget calculator#car loan interest calculator#auto finance planner#car loan schedule#loan amortization calculator#car cost estimator#easy car loan calculator#car financing made simple#monthly installment calculator#car loan planning tool#vehicle cost calculator#auto credit calculator#auto loan affordability#best car loan calculator#smart car finance app

0 notes

Text

#Car Loan EMI Calculator#Car Loan Interest Rate#Bike Loan Interest Rate#Bike Loan EMI Calculator#Two Wheeler Loan Interest Rate#personal loan for car purchase#personal loan to buy a car#personal loan for vehicle purchase#personal loan for car finance#personal loan for auto drivers#personal loan for buying a car#how to get a personal auto loan#personal loan car finance

0 notes

Text

Financial calculators are essential tools for anyone serious about financial planning. These calculators simplify difficult operations, saving time and effort. They help you choose the proper investment and calculate your loan EMIs. Whether you're seeking for the best or trusted financial calculator online, there's an option for everyone.

0 notes

Text

Audi A3

The Audi A3 is one of the top-rank compact luxury cars that buyers have always admired for its stylish and muscular look. With a well-deserved reputation for sharp handling and generous use of high technology, it is pleasant to drive. The inside of the Audi A3 is comfortable with great quality material used and the car has high fuel efficiency making it suitable for those who love classy cars.

#Audi A3#Book test drive at home#upcoming SUV in India 2025#car loan EMI calculator#Online car comparison#affordable car loan provider in India

0 notes

Text

0 notes

Text

Crack the Code to Affordable Car Financing: Harness the Car Loan EMI Calculator Advantage!

Unlock the secrets to affordable car financing with our innovative car loan emi calculator . Explore various repayment scenarios, optimize your budget, and find the perfect loan option tailored to your needs. Start driving towards financial freedom today!

0 notes

Text

New Car Loan Low Interest Rates

New car loan low interest rates are a hot topic for many prospective car buyers looking to finance their vehicle purchase affordably. As of recent trends, interest rates on new car loans have been relatively favorable, with many lenders offering competitive rates to attract borrowers.

The specific interest rates available for new car loans��can vary depending on several factors. These factors include the borrower's creditworthiness, the loan term, the amount financed, and prevailing market conditions. Generally, borrowers with excellent credit scores and stable financial backgrounds are more likely to qualify for the lowest interest rates.

In recent years, new car loan interest rates have been on a downward trend due to factors such as economic conditions, changes in monetary policy, and competition among lenders. As a result, many borrowers have been able to secure loans with rates ranging from around 2% to 5% APR (Annual Percentage Rate).

However, it's essential for borrowers to shop around and compare rates from multiple lenders to find the best deal available to them. Different lenders may offer different rates based on their individual lending criteria and risk assessment processes.

Additionally, borrowers can take steps to improve their chances of qualifying for low-interest rates on new car loans. These steps may include maintaining a strong credit score, reducing existing debt, saving for a larger down payment, and negotiating with lenders for better terms.

Ultimately, securing a low-interest rate on a new car loan can lead to significant savings over the life of the loan. By carefully researching options, comparing rates, and taking proactive steps to improve creditworthiness, borrowers can make informed decisions and ensure they get the most favorable terms possible for their new car purchase.

#Vehicle Loan#Canara vehicle#Vehicle loan calculator#Vehicle loan interest rate#Vehicle loan meaning#Vehicle loan agreement#Commercial vehicle loan#Two wheeler vehicle loan#New Car Loan Low Interest Rates#Car Loan EMI Calculator

0 notes

Text

CAR LOAN

Car loan is a financial assistance taken to purchase a car with minimal initial payment from your own pocket. The borrowed money from the lender can be repaid in equal monthly instalments over a period of time with an agreed rate of interest. Normally, car loans are secured with the vehicle itself that is being bought. READMORE

0 notes

Text

What is a Home Loan Calculator?

A Home Loan Calculator is an online tool that helps you estimate your Equated Monthly Installment (EMI), total interest payable, and the overall cost of your home loan. You can get a clear picture of your financial obligations before taking out a loan by inputting detailed information like loan amount, interest rate, and loan tenure.

If you want to calculate any loan or EMI, please click this source link.

#newcalculators#online free calculator#home loan#car loan calculator#personal loan calculator#EMI calculator#Loan calculator#Age calculator#GST calculator#Investment calculator#Online calculation tools

0 notes

Text

Quick Cash Solution: ₹10 Lakh Personal Loan, Low Interest Rates!

Don't let finances hold you back! Get a ₹10 lakh personal loan with low EMIs and fulfill your dreams effortlessly.

0 notes

Text

Use our EMI Calculator to precisely project monthly payments for personal, house, and car loans. Enter the loan amount, interest rate, and duration to instantly see the repayment schedules and make smart financial decisions. Make wise choices to achieve your financial objectives.

#emi calculator#emi calculator home loan#emi calculator car loan#emi calculator personal loan#emi calculator online

0 notes

Text

The single most powerful asset we all have is our mind. If it is trained well, it can create enormous wealth.

The Art of Saving Money

One of the toughest challenges for any individual is mastering the art of budgeting and having a consistent amount of savings every month.

I just learned about Kaikebo, a Japanese technique for budgeting that's over 100 years old. It combines mindfulness with spending decisions and helps you simply take control of your finances.

The kakeibo is a simple budgeting journal from Japan that helps you save money by setting goals and tracking spending. It encourages mindful thinking and reflection to improve your saving habits every month.

Kakeibo is a budgeting method that involves tracking every purchase, categorizing spending into needs, wants, culture, and unexpected expenses, and regularly reviewing expenses to track progress toward financial goals. The four categories of spending in kakeibo are needs, wants, culture, and unexpected expenses. Kakeibo is popular because it aligns with the Japanese value of "mottainai" and provides a straightforward way to manage finances.

Saving money is essential in today's fast-paced world for achieving financial independence, planning for life events, and creating a safety net. Developing a habit of saving can give you greater control over your financial future.

Kakeibo, a budgeting technique created by Japanese journalist Hani Motoko in 1904, helps individuals manage monthly expenses, understand spending habits, and practice frugality. It has gained popularity among young individuals for its effectiveness in saving for financial goals and accounting for unexpected costs.

Why i trust japanese art of saving money?

Between 1960 and 1994, Japanese households saved an average of one-sixth of their after-tax income, sometimes reaching nearly one-fourth, significantly higher than the 7.1% average savings rate of American households during the same period. While official statistics indicate that Japanese households are big savers, comparisons can be misleading due to differences in measurement across countries. Adjusting for these discrepancies, it appears that while Japan still saves more than the U.S., the actual difference is smaller than reported. Japan also has a higher savings rate in comparison to other countries, although there are various nations with differing savings behaviours.

Understanding the Kakeibo Method of Budgeting

The Kakeibo method is a Japanese budgeting technique that helps individuals manage their household expenses effectively. Created by journalist Hani Motoko in 1904, Kakeibo encourages mindful spending and can result in savings of up to 35% when practised consistently. The method involves categorizing all expenditures into four main areas: Needs (essential items for survival), Wants (non-essential luxuries), Culture (spending on cultural experiences), and Unexpected expenses (unforeseen costs). Practitioners maintain two notebooks to track their spending—one large notebook for categories and a smaller notebook for jotting down daily expenses. This process instils a sense of accountability and promotes financial discipline, aiding individuals in achieving their savings goals and preparing for emergencies.

How do you use Kakeibo in your life? An individual should use the following steps to incorporate Kakeibo in his life fruitfully:

1. Understand your fixed expenses You start with analyzing the monthly expenses, including your monthly fixed expenses such as rent, utility expenses, loan emis etc.

Fixed expenses are consistent monthly costs that are predictable and easy to incorporate into a budget, unlike variable expenses which fluctuate based on production levels. Key examples of fixed expenses include rent or mortgage payments, car payments, insurance premiums, property taxes, utility bills, child care costs, tuition fees, and gym memberships. To calculate fixed expenses, one should gather their budget or income statement, identify the non-variable expense categories, and sum the amounts from each category. Managing fixed expenses is crucial as they can significantly impact overall spending and understanding these costs can lead to better resource allocation and budgeting decisions

2. Effective Budgeting: Tracking Income and Expenses Here you include all the sources of income you are going to have over the next month. For salaried employees, these include their monthly income, and you also add back the deduction such as health insurance premiums or provident funds that are deducted first before giving you your salary. Non-salaried individuals such as entrepreneurs and freelancers can work with a future income they expect to generate over the next month.

The text outlines the steps necessary for effective budgeting, which includes tracking income and expenses, and comparing the two to ensure spending is managed. Key points include: 1. **Tracking Income**: Monitor gross monthly income, which includes salary and bonuses. To calculate annual gross income, multiply your hourly wage by your weekly hours, then multiply by 52 and divide by 12 for monthly figures. 2. **Tracking Expenses**: Understand fixed costs (e.g., rent, insurance) and flexible expenses (e.g., food, entertainment). Utilize tools such as bank statements and receipts for accurate tracking. 3. **Comparing Income and Expenses**: Subtract total expenses from total income. A positive result indicates that you are spending less than you earn while a negative result shows overspending. 4. **Creating a Budget**: Set financial goals, adjust spending accordingly, and apply budgeting rules like the 50/30/20 rule to effectively allocate your income. This guidance helps individuals maintain financial health by promoting awareness of their earnings and expenditures.

The 50/30/20 Budget Rule with Examples

Explore the power of the 50:30:20 budget rule for effective financial planning. Learn how to manage your money wisely and achieve financial balance using this proven budgeting principle. Take control of your finances and pave the way for financial freedom.

3. Determining Your Ideal Savings Rate

Here you decide how much exactly you wish to save over the next month. The goals should be such that they are not easily achievable or unrealistic that you can’t save anything.

Determining your ideal savings rate is influenced by individual financial situations, lifestyles, and goals. Experts recommend setting aside at least 20% of monthly income for savings, which aids in creating an emergency fund, managing unexpected expenses, and planning for long-term objectives such as retirement.

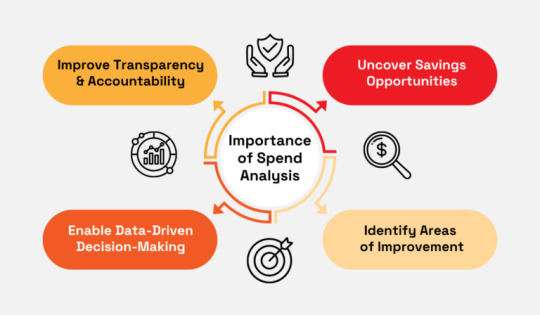

4. Analyze how much you can spend These expenses include all the expenses apart from your fixed expenses. Let’s try to understand all of these with an example. Let us assume you have an Income = 50000 Fixed Expenses (Rent, Utilities etc.) = 20000 Saving Goals = 10000 Then considering the above four points, the amount of money you are left to spend monthly is as follows: The money you can spend = Income – Fixed Expenses – Saving i.e. The money you can spend = 50000 – 20000 – 10000 = 20000 Thus, as an individual with a 50000 income, you are left with 20000 to manage all your expenses apart from your fixed expenses. Spend analysis is a method for understanding spending habits and identifying cost-saving opportunities. 1. Goal Identification: Clearly define what you aim to achieve with spend analysis, whether it's cost reduction or enhancing supplier performance. 2. Data Gathering: Collect all relevant spending data to ensure comprehensive analysis. 3. Data Management: Clean and organize this data to enhance accuracy and usability. 4. Spending Categorization: Group expenditures into categories to facilitate analysis. 5. Trend Analysis: Examine spending patterns to identify trends and recurring expenses. 6. Improvement Opportunities: Highlight areas where costs can be lowered or supplier performance can be enhanced. 7. Ongoing Monitoring: Regularly revisit and update insights to ensure they remain relevant. 8. Cost Reduction: Leverage insights to pinpoint specific areas for spending cuts. 9. Efficiency Improvement: Use findings to streamline operations for better efficiency. 10. Risk Mitigation and Strategic Support: Assess potential risks and utilize insights for informed strategic decision-making regarding investments or expansions.

By analyzing total expenditures, and zeroing in on specific business units, products, quantities, payment terms, and more, you get the answers to four crucial questions: What are we spending money on? Who are we spending it with? Are we getting what we need? Is there a better way to do this? The analysis can either be a comprehensive one or target just different categories of spend. Make your track record up to date regularly.

5. Divide the spending money by 4 The assumption being we have four weeks within a month. As an individual with 20000 spending money, you are allowed to spend a maximum of 5000 every week. Thus it would be best if you restricted your weekly expenses to 5000 such that you do not ever go over budget

The 40/30/20/10 rule is a budgeting method that allocates income into four distinct categories to help individuals manage their finances effectively. Key insights include: 1. Categories Explained:

The rule divides income into needs (40%), discretionary spending (30%), savings or debt repayment (20%), and charitable giving or financial goals (10%).

2. Needs Definition:

The 40% allocated for needs covers essential expenses like rent, mortgage, utilities, and groceries.

3. Discretionary Spending:

The 30% set aside for discretionary spending includes activities such as dining out, entertainment, and shopping.

4. Savings and Debt:

The 20% portion is intended for saving money or paying off existing debts, promoting financial security.

5. Charitable Giving:

The 10% of income is earmarked for donations or other financial goals, encouraging philanthropy.

6. Comparison to 50/30/20 Rule:

An alternative budgeting method, the 50/30/20 rule, simplifies the approach by categorizing income into needs (50%), wants (30%), and savings/investments (20).

7. Flexibility:

Both rules allow individuals to customize their financial plans according to personal priorities and circumstances.

8. Promotes Financial Awareness:

Adopting such rules encourages individuals to reflect on their spending habits and make informed financial decisions. The 40-30-20-10 rule offers a structured approach to budgeting that divides income into specific percentages for necessities, discretionary spending, savings, and charitable giving. The rule is grounded in long-standing financial wisdom, emphasizing the importance of living within one's means. It suggests allocating 40% of income for necessities like housing and groceries, 30% for discretionary expenses, 20% for savings or debt repayment, and 10% for charitable contributions.This budgeting method helps individuals create a balanced financial plan, tailoring it to their unique situations Differentiating between needs (essentials for survival) and wants (desires) is crucial for making informed financial decisions.The rule serves as a guideline, allowing for flexibility based on individual financial circumstances. Understanding and applying the rule can lead to improved financial health and future savings. Alternative budgeting methods similar to the 40-30-20-10 rule exist, offering variations in allocations while maintaining core principles. It provides a clear framework for managing finances, making it easier to track and control spending.

The Kakeibo method is a Japanese budgeting technique designed to help individuals manage their expenses and maximize savings by fostering mindful spending habits. 1. Definition of Kakeibo: Kakeibo translates to "household financial ledger" and was developed by journalist Hani Motoko in 1904 to aid homemakers in budget management. 2. Spending Awareness: The method encourages individuals to reflect on their spending habits, distinguishing between needs, wants, cultural expenses, and unexpected costs to better allocate their finances. 3. Categorization of Expenses: Kakeibo divides expenses into four categories: needs (essentials), wants (luxuries), culture (enriching experiences), and unexpected expenses (unforeseen costs). 4. Expense Tracking: Practitioners maintain two notebooks—one for ongoing expense tracking and another for summarizing weekly expenditures according to the four categories, promoting accountability. 5. Establishing Fixed Expenses: Users should first determine their fixed monthly costs, such as rent and utilities, which are critical for accurate budgeting. 6. Income Analysis: Assessing all sources of income and accounting for deductions (like health insurance) is essential for creating a realistic spending plan. 7. Setting Savings Goals: It is crucial to establish a specific savings target each month that is neither overly ambitious nor too easy to achieve, ensuring financial growth. 8. Budgeting Monthly Spending: After determining fixed expenses and savings goals, the remaining income is allocated as monthly spending money, which can be divided into weekly limits to maintain discipline. 9. Weekly Review: A comparison of planned versus actual spending at the end of each week fosters reflection on financial behavior and allows for adjustments in future spending to stay within budget. 10. Mindful Spending: The method encourages ongoing evaluation of expenses, helping individuals distinguish between essential and non-essential purchases to preserve their savings goals.

Other Kakeibo Lessons Delay any non-essential purchase till the next month. If you still feel the urge for that item after a month, analyze its affordability and what value it may add to your life. Always carry a shopping list when going to market for your monthly purchase.

The Kakeibo method is a disciplined approach towards expense management. This method teaches us the value of each expense made and the sacrifices that need to be made to achieve our targets.

We don't have to be smarter than the rest. We have to be more disciplined than the rest.

Warren Buffet said

Expense management is important because it helps companies control costs, meet budgets, and comply with regulations.

Thanks to all authors who wrote

Date of Publish: 10/ Jan / 2025

3 notes

·

View notes

Text

Calculate Your Car Loan EMI Instantly: Free Car Loan EMI Calculator

In the realm of automotive aspirations, where dreams of owning a car intersect with the realities of financial planning, a car loan EMI calculator emerges as an indispensable ally. This digital tool simplifies complex financial calculations, empowering prospective car buyers to make informed decisions with clarity and confidence.

The Role of Car Loan EMI Calculators

Gone are the days of manual calculations and guesswork in determining the Equated Monthly Installment (EMI) for a car loan. Car loan EMI calculators leverage advanced technology to provide instant and accurate EMI estimates based on essential inputs such as loan amount, interest rate, and repayment tenure. This precision not only aids in assessing loan affordability but also facilitates effective budget planning.

Precision and Clarity in Financial Planning

At the core of every car loan EMI calculator lies its ability to deliver precise EMI calculations. By inputting specific loan details, users gain immediate insights into the financial commitment required for their car purchase. This clarity allows them to adjust variables like loan amount and tenure to find an EMI that fits comfortably within their budget, ensuring financial stability and informed decision-making.

Empowering Comparison for Informed Choices

A key advantage of car loan EMI calculators is their capability to facilitate quick and efficient comparison of multiple loan options. Whether evaluating different lenders, interest rates, or repayment durations, these calculators provide side-by-side comparisons of resulting EMIs. This empowers borrowers to select the most suitable loan option aligned with their financial goals and preferences.

Insights into Interest Dynamics

Beyond EMI calculations, car loan EMI calculators offer insights into the dynamics of interest payments throughout the loan tenure. By breaking down each EMI into principal and interest components, these tools illustrate how payments contribute to reducing the loan balance and servicing interest obligations. This knowledge enables borrowers to strategize effectively, potentially reducing interest costs through options like prepayments.

User-Friendly Accessibility

Designed with user convenience in mind, car loan EMI calculators are accessible via web browsers or mobile applications. Their intuitive interfaces and straightforward input fields ensure ease of navigation, making them accessible to users of all backgrounds and proficiency levels. This accessibility allows borrowers to perform calculations conveniently, whether at home or on the go.

Beyond Cars: Versatility in Vehicle Financing

While primarily associated with car loans, the utility of EMI calculators extends to financing various vehicles such as motorcycles, recreational vehicles, and boats. The principles embedded in car loan EMI calculators are universally applicable, catering to a diverse range of vehicle financing needs.

Conclusion: Empowering Informed Decision-Making with a Financial Calculator

In conclusion, car loan EMI calculators represent a transformative tool in the landscape of vehicle financing. By providing accuracy in EMI calculations, enabling comprehensive comparison capabilities, and shedding light on interest dynamics, these calculators empower consumers to navigate the complexities of car financing with confidence. Whether you're planning your first car purchase or exploring financing options for your dream vehicle, leveraging a car loan EMI calculator ensures that your journey towards ownership is guided by clarity, informed choice, and financial prudence. Embrace the power of a financial calculator today to explore a smarter approach to car financing.

For more details visit : https://www.finowings.com

#Car Loan EMI Calculator#best Car Loan EMI Calculator#Car Loan EMI Calculator online#Vehicle Loan EMI Calculator#Car EMI Calculator#EMI calculator#Financial calculator

0 notes

Text

4 Top Selling Compact SUVs In India - A Detailed Guide

The compact SUV segment has gained significant popularity in India in recent years and almost all auto manufacturers are coming up with new models and variations of the models they already have. This is because customers are presented with a wide range of compact SUVs which they can easily choose from depending on their needs and their heart's desire. Here we review some of the Top Selling Compact SUVs in India and provide an online comparison to guide your decision.

Maruti Suzuki Vitara Brezza – The compact SUV classification is new in India, and, contingent upon Maruti’s deals information, the Vitara Brezza has been the Top Selling Compact SUVs in India from the time the automaker discharged the model in 2016. The cheerful petrol motor, tight structure, and accessibility to Maruti’s after-sales service ensure its credibility. The latest model came into the market in 2022 with a facing display, 360-degree camera, and six airbags.

Hyundai Venue – A new car on the block in the compact SUV segment has found substantial takers among car purchasers. The Venue has a provision of a sunroof, connected car technology, multiple numbers of engine-gearbox combinations and a healthy warranty period that make it rich in features. Another feature of uniqueness is the new iMT clutchless manual gearbox.

Kia Sonet – Entry point offering Sonet offers a tough fight to its relation Hyundai. The cabin is well equipped with segment firsts including a 10.25-inch touchscreen instrument cluster, ventilated seats, smart pure air purifier, etc. As for safety, there is nothing to complain about, up to 6 airbags will cater for safety necessities.

Tata Nexon – If one doesn’t find Nexon on the hit list of the selling cars then it deserves to be listed for its great looks and safety quotient. 5-star Global NCAP safety, a range of punchy engines, and newly added features sure put a lot into making the car a value-for-money.

We believe that this Online car comparison helps you understand the best options in the compact SUV market out there. From here take a test drive and try to understand the driving feel, space, comfort etc before you finally settle down for your most preferred compact SUV.

#Top Selling Compact SUVs In India#affordable car loan provider in India#Online car comparison#car loan EMI calculator#new luxury car launch in india 2024#upcoming electric cars in 2024

0 notes

Text

1 note

·

View note

Text

An EMI calculator helps estimate your monthly loan payment before you borrow. It considers loan amount, interest rate and tenure to show you the financial commitment. This allows you to compare loans and plan your finances accordingly. There are EMI calculators for home, car, education and personal loans. You can easily find them online and enter loan details to calculate your EMI. Remember to consider processing fees, prepayment charges and other costs besides EMI before finalizing a loan.

#investkraft#loans#financial calculators#emi calculator#emi#online emi calculator#best emi calculator#emi calculator in india

2 notes

·

View notes