#investkraft

Explore tagged Tumblr posts

Text

An EMI calculator helps estimate your monthly loan payment before you borrow. It considers loan amount, interest rate and tenure to show you the financial commitment. This allows you to compare loans and plan your finances accordingly. There are EMI calculators for home, car, education and personal loans. You can easily find them online and enter loan details to calculate your EMI. Remember to consider processing fees, prepayment charges and other costs besides EMI before finalizing a loan.

#investkraft#loans#financial calculators#emi calculator#emi#online emi calculator#best emi calculator#emi calculator in india

2 notes

·

View notes

Text

🏡 Your Dream, Our Responsibility! 🏡 Looking for your perfect home? We make home loans easy and hassle-free. Get your 2BHK or 3BHK in a prime location with top connectivity! 🚀

#DreamHome#InvestKraft#HomeLoan#BuyYourHome#HouseHunting#RealEstateInvestment#LoanApproved#HomeBuying#FinancialFreedom#DreamBig#LuxuryLiving#AffordableHousing

0 notes

Text

Basic Home Loan

A Basic Home Loan is a fantastic option for those who value simplicity and affordability in their mortgage. While it lacks the bells and whistles of more feature-rich loans, its cost-effective nature makes it an appealing choice for many. Before committing, please take the time to compare lenders and assess your financial needs to make sure this type of loan is the perfect fit for your homeownership journey.

Ready to explore basic home loan options? Speak to a mortgage broker or your financial institution to get started today!: https://bit.ly/3AOUV8U

#investment#loans#finance#financial planning#banking#banks#money#investkraft#home loan#personal-finance

1 note

·

View note

Text

Apply For Home Loan

Welcome to our one-stop solution for home financing! Explore personalized home loan options that suit your needs and aspirations. Whether you're a first-time buyer or looking to upgrade, our seamless process ensures a stress-free journey to homeownership. Discover competitive rates, flexible terms, and expert guidance to make your dream home a reality. Your path to a secure and comfortable future starts here—explore our home loan offerings and take the first step towards unlocking the doors to your new home! Check out the Investkraft website to apply for a home loan.

Read More

0 notes

Text

#gallery-0-5 { margin: auto; } #gallery-0-5 .gallery-item { float: left; margin-top: 10px; text-align: center; width: 33%; } #gallery-0-5 img { border: 2px solid #cfcfcf; } #gallery-0-5 .gallery-caption { margin-left: 0; } /* see gallery_shortcode() in wp-includes/media.php */

Das Liegenschafts- und Hochbauamt informiert: BAU DER NEUEN ZWEIFELDERSPORTHALLE AM BIEL IST ABGESCHLOSSEN Ab sofort können auch Sportvereine die Halle nutzen

Der im Juni 2016 im Stadtrat beschlossene Neubau der Zweifeldsporthalle für das nahegelegene Clara-Wieck-Gymnasium (CWG) ist abgeschlossen. Seit Montag, 4. März 2019 läuft bereits der Probebetrieb durch das Clara-Wieck-Gymnasium. Heute kann die neue Sporthalle nun auch offiziell ihrer Bestimmung übergeben werden.

Der Hallenkörper ist eine leichte Stahlkonstruktion, gegliedert in einen umlaufenden niedrigen Gebäudeteil für Nebenräume (Sanitär-, Umkleide-, Technikräume) und einem hohen Hallenkörper. Die bauliche Ausführung der 2-Felder-Sporthalle für das Clara-Wieck-Gymnasium erfolgte als Standardvariante für den Schulsport zur Mitnutzung Vereine. Die Außenwände sind mit hoch wärmedämmenden zweilagigen Sandwich-Elementen und einer Metallfassade versehen. Alle Funktionen der Zweifeldsporthalle sind ausnahmslos barrierefrei zu erreichen sein. Im Gebäude wurde eine moderne und sparsame Haustechnik installiert, so dass die neue Sporthalle zukünftig deutlich weniger Energie benötigen wird, als die beiden alten Hallen.

Zur Baumaßnahme gehören ebenso neue Außenanlagen und Zuwegungen um das Gebäude. Hier befinden sich 18 Parkplätze für PKWs, 28 Stellflächen für Fahrräder und 2 Stellplätze für Behinderte. Die Ausführungen der Fahrstraßen wurden in Asphalt und die Stellplätze in Betonpflaster umgesetzt. Um den PKW-Fahrverkehr auf dem Grundstück weitestgehend zu unterbinden, befinden sich die wesentlichen Besucherparkplätze in unmittelbarer Nähe zum Turnerweg. Der Hauptzugang ist als großzügiger überdachter Bereich auf der Nord-Westseite konzipiert und dient für den Sportplatz gleichzeitig als kleine Tribüne.

Kosten: Der Kostenrahmen entsprechend des am 19. April 2018 geänderten Vorhabenbeschlusses konnte eingehalten werden. Dieser beläuft sich auf rund 4,3 Mio. Euro. Darin enthalten sind Fördermittel aus dem Programm VwV Investkraft „Brücken in die Zukunft“, Budget „Sachsen“ (Landesmittel) in Höhe von ca. 2,7 Mio. Euro. Ursprünglich geplant waren 3.909.600,00 EUR. Die jetzigen Gesamtkosten übersteigen das anfangs geplante Budget um ca. 10 Prozent.

Die vorbereitenden Arbeiten für den Neubau, wie der Abbruch alter Gebäude und Baufeldfreimachung (Rodung Bäume, Bodenaustausch) hatten im Februar 2017 begonnen. Nach der Grundsteinlegung im Juni folgte im September 2017 das Richtfest. Geplant war, die Halle für August 2018 fertig zu stellen und sie den zukünftigen Nutzern zu übergeben. Fehlende bzw. überteuerte Ausschreibungsangebote im Jahr 2017, witterungsbedingte Einflüsse auf den technologischen Ablauf (lange Austrocknungszeiten Beton, großer Hitze und sehr hoher Luftfeuchtigkeit), lange Lieferfristen für diverse Einbauelemente und nicht zuletzt auch die Insolvenz von Baufirmen machten diesem Vorhaben einen Strich durch die Rechnung. Auf Grund dessen verzögerte sich die Baufertigstellung um 6 Monate. Im Februar 2019 war es dann soweit: Der Bau der neuen Zweifeldsporthalle konnte abgeschlossen werden. Seit 4. März 2019 läuft bereits der Probebetrieb durch das Clara-Wieck-Gymnasium. Ab Donnerstag, 14. März 2019 ist dann auch die Nutzung der Halle durch Vereine möglich.

Am Bau Beteiligte Planer Architektur: Atelier ST|Gesellschaft von Architekten mbH Leipzig, Zweigstelle Zwickau Brandschutz: Atelier ST | Gesellschaft von Architekten mbH, Zwickau Tragwerksplanung: IB Gebr. Kaulfuß GbR, Zwickau Bauleitung: IB Stiehler Ingenieure, Zwickau Fachplaner ELT: DITAS-Technoprojekt GmbH, Zwickau Fachplaner HLS: IB Dr. Schlott & Partner GmbH, Zwickau Tiefbau Außenanlagen: IB für Tiefbau Kaiser, Planung und Bauberatung, Zwickau Baugrund: Baugrundbüro Dr. Hallbauer & Ebert Baufirmen: an der Baumaßnahme haben 33 Baufirmen mitgewirkt

Die Sportanlage am Biel mit Turnhalle ist Teil der Aktualisierung der Sportstättenleitplanung/Sportstättenübersicht. Die Halle wurde als Standardvariante für den Schul- und Vereinssport ausgeführt und ist Bestandteil der aktuellen Sportstättenleitplanung/Sportstättenübersicht.

Quelle: Presse- und Oberbürgermeisterbüro Stadtverwaltung Zwickau

Bau der neuen Zweifeldersporthalle Am Biel ist abgeschlossen Das Liegenschafts- und Hochbauamt informiert: BAU DER NEUEN ZWEIFELDERSPORTHALLE AM BIEL IST ABGESCHLOSSEN Ab sofort können auch Sportvereine die Halle nutzen… 531 more words

0 notes

Text

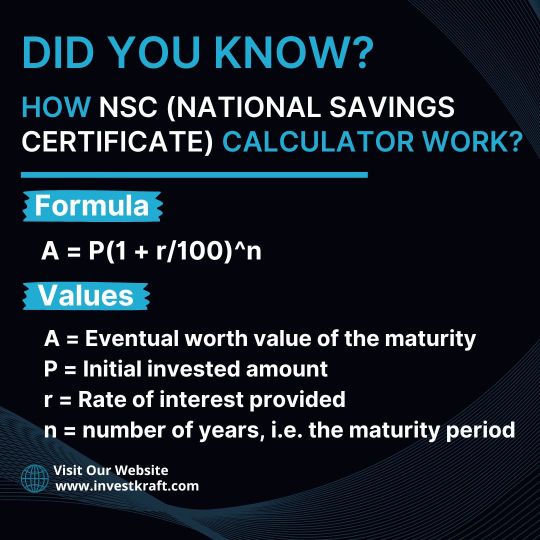

The National Savings Certificate (NSC) is a fixed-deposit scheme in India offering safe investment with attractive interest rates. Calculating its maturity amount aids financial planning by setting goals, comparing investments, and estimating tax liability. Factors affecting maturity include principal, interest rate, and tenure. Two methods are available: using an NSC calculator online or manual calculation using a formula. Understanding these methods helps in informed investment decisions.

#investkraft#investment#Financial Planning#nsc calculator#financial calculators#NSC Interest Rate#National Saving Certificate

2 notes

·

View notes

Text

Financial Security with Health Insurance: A Must-Have for Everyone

Many people believe that they don’t need health insurance because they are young and healthy. However, medical emergencies can strike at any time. This myth vs. fact illustration highlights the importance of health insurance in providing financial security and peace of mind. Don't wait for a crisis—secure your health and finances with the right insurance plan today!

#HealthInsurance#InsuranceMyths#FinancialSecurity#MedicalExpenses#Healthcare#InvestKraft#HealthInsuranceIndia#InsuranceFacts

0 notes

Text

🚀 Maximize Your Loan Efficiency! Get the best rates, fast approvals, and hassle-free processing with InvestKraft. Your dream loan is just a click away! 💰✨

🔗 Apply now at www.investkraft.com

#InvestKraft#SmartLoans#LoanApproval#EasyLoans#FinanceMadeSimple#LowInterestRates#FastApproval#DreamHome#FinancialFreedom#MoneyMatters

0 notes

Text

Home Loan for Women in 2025: A Comprehensive Guide

Home loans have become a vital tool for women in 2025 to achieve financial independence and homeownership. As governments, financial institutions, and organizations recognize the importance of empowering women through financial inclusion, various schemes, and benefits are tailored specifically for women applicants. Here’s a detailed look into the landscape of home loans for women in 2025.

1. Why Home Loans for Women are a Priority in 2025?

Women are increasingly playing a significant role in property ownership, and financial institutions aim to bridge the gender gap in homeownership. By offering special incentives, governments and banks seek to:

Promote gender equality in real estate ownership.

Encourage financial independence for women.

Stimulate the real estate sector by enabling a larger pool of buyers.

2. Key Benefits of Home Loans for Women in 2025

a. Lower Interest Rates

One of the most attractive features for women borrowers is the reduced interest rate on home loans. In 2025, banks typically offer a 0.05% to 0.10% concession on the prevailing rates. This translates to significant savings over the tenure of the loan.

b. Lower Stamp Duty Charges

In many states, women are eligible for reduced stamp duty charges when registering property. For example:

If the stamp duty for others is 6%, women may only be charged 4%.

c. Higher Loan-to-Value (LTV) Ratios

Women can access a higher LTV ratio, allowing them to borrow up to 90% of the property’s value, depending on their eligibility.

d. Longer Loan Tenure

Banks offer flexible repayment terms, with tenures extending up to 30 years, making EMIs more manageable for women borrowers.

e. Tax Benefits

Women co-owners or primary borrowers of a home loan can avail dual tax benefits under:

Section 80C: Deduction of up to ₹1.5 lakh on principal repayment.

Section 24(b): Deduction of up to ₹2 lakh on interest repayment.

3. Eligibility Criteria for Women Borrowers

While eligibility criteria are similar to other home loan applicants, certain preferences and flexibilities are extended to women:

Employment Status: Salaried, self-employed, or homemakers with sufficient co-applicant support.

Age: Typically between 21 to 60 years.

Income Criteria: A steady income source or joint application with a spouse/co-borrower.

Credit Score: A score above 700 ensures better loan terms.

4. Special Schemes for Women in 2025

a. Government Initiatives

Governments in 2025 continue to offer programs like Pradhan Mantri Awas Yojana (PMAY) with added benefits for women, such as mandatory ownership or co-ownership for availing subsidies.

b. Women-Centric Loan Products

Banks and housing finance companies have introduced tailored products for women, such as:

Loans with zero processing fees.

Faster loan disbursals.

Special schemes for first-time buyers.

c. Affordable Housing Schemes

Women are prioritized under affordable housing schemes, providing easier access to low-cost housing projects.

5. Documentation Required

To apply for a home loan in 2025, women need the following documents:

Identity Proof: Aadhaar, Passport, or Voter ID.

Address Proof: Utility bills or rental agreement.

Income Proof: Salary slips, IT returns, or business financials for self-employed.

Property Documents: Sale agreement, property title deed, etc.

Bank Statements: Last 6 months’ statements to verify financial stability.

6. Tips for Women Home Loan Applicants

Check Your Credit Score: Ensure a good credit history for better loan terms.

Negotiate Rates: Approach multiple lenders to find the best interest rate.

Consider Co-Ownership: Adding a co-borrower, like a spouse, can enhance eligibility and reduce the financial burden.

Utilize Tax Benefits: Plan your finances to maximize tax deductions.

Seek Professional Advice: Consult with financial advisors for optimal planning.

7. Challenges and Future Prospects

While the benefits are numerous, women may face challenges like limited income documentation or lack of credit history, especially homemakers. However, financial institutions are evolving, with many offering loans to such applicants based on other criteria like property value or co-applicant income.

The future looks bright for women in the housing finance sector, with technological advancements enabling faster approvals, AI-based eligibility checks, and greater inclusion of women in financial decision-making.

Conclusion

In 2025, home loans for women are more accessible, affordable, and empowering than ever before. By taking advantage of lower interest rates, tax benefits, and special schemes, women can secure their dream homes while strengthening their financial independence. Whether you're a salaried professional or a homemaker, homeownership is a realistic and rewarding goal with the right planning and resources.

Make 2025 the year you invest in your future—your dream home awaits!

0 notes

Text

What Documentation Do I Need to Calculate House Rent Allowance?

To calculate your House Rent Allowance (HRA), you'll need specific documents handy. Typically, you'll require proof of your rent payments, such as rent receipts or rental agreement copies. These documents verify the amount you pay for housing. Additionally, you may need to provide your salary slips, which demonstrate your income. Some organizations might also ask for a letter from your landlord confirming your tenancy. Remember, accurate documentation is crucial for a smooth HRA calculation process. If you're unsure about the required documents or need assistance with your HRA calculation, you can visit the Investkraft website. Investkraft offers helpful resources and tools to simplify financial planning, including guidance on calculating HRA.

#investkraft#HRA Calculator#House Rent Allowance#financial calculators#financial services#calculator

2 notes

·

View notes

Text

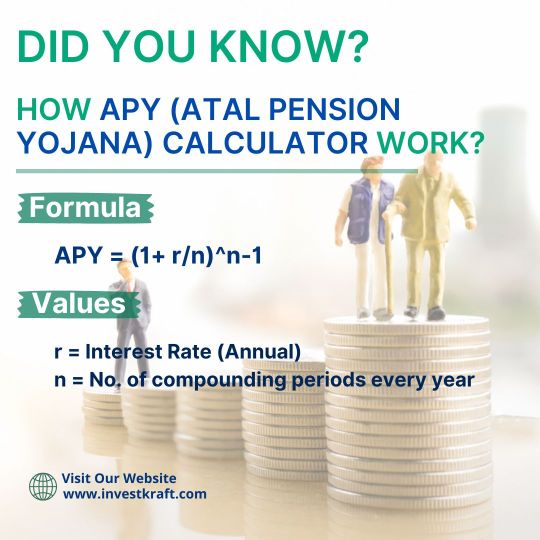

How Accurate Is the Atal Pension Yojana Calculator?

The accuracy of the Atal Pension Yojana (APY) Calculator, particularly on the Investkraft website, is generally reliable. This online tool estimates the pension amount one can receive under the APY scheme based on inputs like age, contribution amount, and the chosen pension plan. While it provides a useful estimate, it's essential to understand that the final pension amount may vary slightly due to factors such as changes in government regulations or economic conditions. However, Investkraft strives to keep its calculator updated to reflect any such changes, ensuring users get as accurate a prediction as possible. Overall, while the APY Calculator offers valuable insights into potential pension benefits, it's advisable to consult with financial experts for a comprehensive retirement planning strategy.

2 notes

·

View notes

Text

Can I Calculate NSC Returns Online?

Yes, you can easily calculate NSC (National Savings Certificate) returns online. Platforms like Investkraft offer user-friendly NSC calculators that help you estimate the returns on your investment. These calculators typically require you to input basic details such as the investment amount, the NSC's maturity period, and the prevailing interest rate. Investkraft's website provides a convenient tool where you can quickly input these details and get an instant estimate of your NSC returns. It's a hassle-free way to plan your investments and understand the potential gains from NSC investments. By using the NSC calculator on Investkraft's website, you can make informed decisions about your financial future without needing to perform complex calculations manually. It's a valuable resource for anyone considering NSC investments.

2 notes

·

View notes

Text

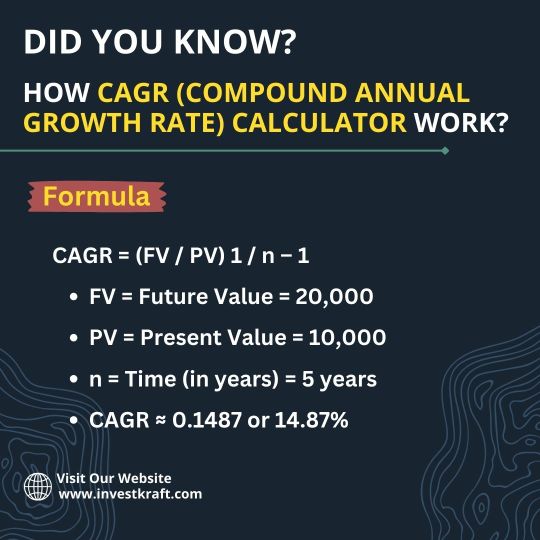

Looking for an Accurate Online CAGR Calculator?

If you're seeking an accurate online CAGR (Compound Annual Growth Rate) calculator, Investkraft website is your solution. With Investkraft, you can effortlessly determine the growth rate of your investments over multiple periods. This user-friendly tool simplifies complex calculations, making it accessible for everyone, from seasoned investors to beginners. Simply input your initial and final investment values, along with the time period, and let Investkraft do the rest. Accuracy is paramount when analyzing investment growth, and Investkraft ensures precise results every time. Whether you're planning your financial future or evaluating past performance, Investkraft's online CAGR calculator provides the reliable insights you need. Take control of your investments today with Investkraft and make informed decisions for a prosperous tomorrow.

#investkraft#finance#financial calculators#Compound Annual Growth Rate#CAGR Calculator#calculators#financial services

2 notes

·

View notes

Text

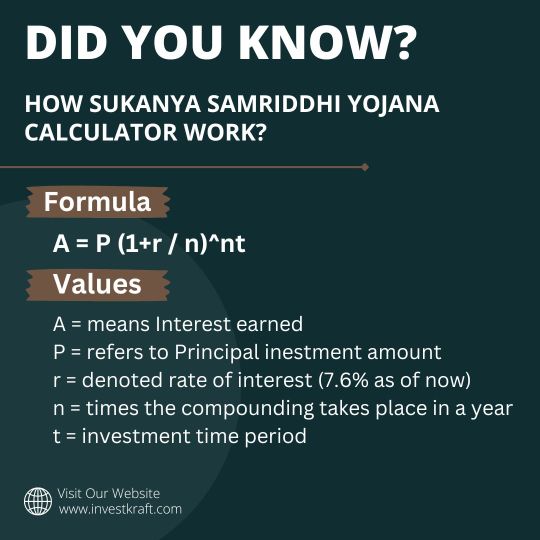

Curious About Sukanya Samriddhi Yojana Calculator?

Are you interested in planning for your daughter's future education and marriage expenses? The Sukanya Samriddhi Yojana Calculator can help you estimate potential returns on your investments. This handy tool allows you to input your investment amount and duration to calculate the future value of your savings under the Sukanya Samriddhi Yojana scheme. Whether you're considering starting a new investment or already have one, this calculator provides valuable insights into your financial planning. For a user-friendly experience, you can access the Sukanya Samriddhi Yojana Calculator on the Investkraft website. Investkraft offers a range of financial tools and resources to assist you in making informed investment decisions. Take advantage of this easy-to-use calculator to plan effectively for your daughter's financial needs.

#investkraft#finance#calculators#financial calculators#Sukanya Samriddhi Yojana#Sukanya Samriddhi Yojana Calculator

2 notes

·

View notes

Text

Which Online Recurring Deposit Calculator Provides the Most User-Friendly Interface?

Looking for a hassle-free way to calculate your recurring deposit savings? Look no further than Investkraft's online recurring deposit calculator. With its intuitive interface, Investkraft makes it easy for users of all levels to navigate and input their deposit details effortlessly. The calculator guides you step-by-step, allowing you to customize your savings plan according to your preferences. Investkraft's user-friendly design ensures that you can quickly access the information you need without any confusion. Whether you're a beginner or an experienced saver, Investkraft's online recurring deposit calculator simplifies the process, helping you make informed decisions about your financial goals. Say goodbye to complex calculations and hello to simplicity with Investkraft. Try it out today and see how easy saving can be!

#investkraft#finance#loans#calculator#Recurring Deposit#Recurring Deposit Calculator#financial calculators

2 notes

·

View notes

Text

Which Mutual Fund Return Calculator Offers the Best Projections?

When it comes to determining which mutual fund return calculator offers the most reliable projections, Investkraft's website stands out. Investkraft is renowned for its user-friendly interface and accurate financial tools. Their mutual fund return calculator utilizes advanced algorithms to analyze historical data, current market trends, and fund performance metrics. By inputting essential details such as investment amount, time horizon, and risk tolerance, users can receive precise projections of potential returns. Investkraft's calculator factors in various variables to provide realistic estimates, helping investors make informed decisions about their mutual fund investments. With Investkraft's trusted reputation and comprehensive features, their mutual fund return calculator is a top choice for individuals seeking dependable projections for their investment strategies.

2 notes

·

View notes