#MedicalExpenses

Explore tagged Tumblr posts

Text

Understanding Your Rights as a Georgia Car Accident Victim

Car accidents can be overwhelming and leave you feeling lost, confused, and unsure of your next steps. If you or a loved one has been injured in a car accident in Georgia, it’s understandable to feel worried about your rights and the path forward. The aftermath of an accident can be stressful, especially when dealing with injuries, medical bills, and the legal complexities that follow. You may be wondering what your rights are as a victim, who is responsible for the accident, and how to ensure you get the compensation you deserve.

At Keenan Law Firm, we understand that dealing with a car accident can be one of the most difficult challenges you may face. The emotional and physical toll can be exhausting, but you don’t have to go through this alone. Our team is here to guide you through the process and help you understand your rights as a car accident victim. We know the confusion and worry that often accompany such a situation, and we want to provide you with the clarity and support you need to move forward.

What You Should Do After a Car Accident

Immediately following a car accident, your safety and well-being are the most important factors to consider. If you are able, check yourself and others involved for injuries. It is essential to call for medical assistance even if you feel fine because injuries may not be apparent right away. Seeking medical treatment is crucial not just for your health, but also for documenting any injuries that might arise in the future.

Once you have ensured that everyone is safe and emergency help is on the way, it is important to exchange information with the other driver involved in the accident. You should gather names, contact details, insurance information, and driver’s license numbers. Additionally, if you are able to do so, take photos of the scene, including any visible damages to vehicles and the surrounding environment. This documentation will be important when filing your claim.

Determining Fault in a Car Accident

One of the most common questions car accident victims have is who is at fault. In Georgia, as in most states, the determination of fault is critical because it affects who is liable for paying damages. Georgia operates under a comparative negligence rule, which means that even if you are partially at fault for the accident, you can still pursue compensation for your injuries. However, the amount of compensation you receive will be reduced by your percentage of fault in the accident.

For example, if you were 30% responsible for the accident and the total damages amounted to $100,000, you would be entitled to 70% of that amount, or $70,000. This is an important aspect of Georgia law that affects how much you may be able to recover. The more clearly fault can be attributed to the other driver, the stronger your case will be. This is where having an experienced attorney on your side can make a difference in the outcome of your case.

Your Rights as a Car Accident Victim in Georgia

As a car accident victim in Georgia, you have certain legal rights that protect you and allow you to seek compensation for your losses. These rights are designed to help you recover both financially and physically from the accident. Below are some of the key rights you have under Georgia law.

First, you have the right to seek compensation for your medical expenses. This includes all costs associated with your treatment, such as doctor visits, hospital stays, surgeries, physical therapy, and any other necessary medical care. If you are unable to work because of your injuries, you also have the right to claim lost wages. This can help alleviate the financial burden of not being able to earn a living while you recover.

Second, you have the right to pursue compensation for your pain and suffering. Pain and suffering refer to the physical pain and emotional distress you experience as a result of the accident. While it may be difficult to quantify, this type of compensation is an important part of holding the responsible party accountable for the harm they have caused you.

Additionally, if the accident was caused by someone else’s negligence, you have the right to pursue punitive damages. These are meant to punish the at-fault driver for particularly reckless or dangerous behavior and to deter others from acting in a similar manner. However, punitive damages are not awarded in every case, and the severity of the other driver’s actions plays a significant role in determining whether they will be granted.

How an Attorney Can Help You in Your Case

If you have been injured in a car accident, you may be wondering whether you need an attorney. In many cases, the help of an experienced attorney can significantly improve the chances of a successful outcome. Car accident claims can be complex, and having someone on your side who understands the ins and outs of the legal process can be invaluable.

An attorney can help you navigate the claims process, ensuring that you meet all deadlines and provide the necessary documentation to support your case. They can also help you negotiate with insurance companies to ensure that you receive a fair settlement for your injuries and damages. Insurance companies often try to minimize payouts, but an attorney can fight for your rights and help you secure the compensation you deserve.

If your case goes to court, an attorney can represent you and advocate on your behalf. They will work to prove that the other party was at fault and ensure that your rights are protected throughout the legal process. With the right attorney, you will have the support you need to get the best possible result for your case.

The Importance of Timely Action

One of the most important things you can do as a car accident victim is to take timely action. In Georgia, the statute of limitations for personal injury claims is two years from the date of the accident. This means you must file your lawsuit within this time frame or risk losing your right to seek compensation. It is important to act quickly to ensure that evidence is preserved, witnesses can be interviewed, and your claim is filed before time runs out.

Delaying legal action can make it more difficult to build a strong case. The longer you wait, the more challenging it can be to gather the necessary evidence and obtain testimony from witnesses. This is why it is critical to contact an attorney as soon as possible after your accident. An attorney can guide you through the process and ensure that you don’t miss any important deadlines.

If you have been involved in a car accident in Georgia, you don’t have to face this challenging time alone. At Keenan Law Firm, we understand the stress and uncertainty that come with being injured in an accident. Our team is here to provide you with the support, guidance, and legal representation you need to achieve a successful outcome in your case.

We are committed to ensuring that your rights are protected and that you receive the compensation you deserve. If you or a loved one has been injured in a car accident, reach out to us today for a consultation. Let us help you understand your rights and take the necessary steps toward recovery.

#GeorgiaCarAccident#CarAccidentVictim#LegalRights#PersonalInjury#CarAccidentLaw#GeorgiaLaw#Compensation#MedicalExpenses#PainAndSuffering#PunitiveDamages#AttorneySupport#KeenanLawFirm#InsuranceClaims#CarAccidentHelp#InjuryClaims#LegalGuidance#TimelyAction#AccidentRecovery#LegalRepresentation#CarAccidentClaims#ComparativeNegligence#GeorgiaInjuryLaw

0 notes

Text

Understanding the Compensation for Spinal Cord Injuries

If you or a loved one is facing the aftermath of a spinal cord injury, it is natural to feel overwhelmed, confused, and uncertain about what comes next. These types of injuries can change a life in an instant, leaving you with many questions about how to move forward and seek compensation for your suffering. As you try to navigate through medical appointments, rehabilitation, and the emotional strain of recovery, it can be difficult to understand what kind of compensation you may be entitled to. We want you to know that you do not have to face this journey alone. Our firm is here to provide the guidance and support you need during this difficult time. We understand what you are going through, and we are dedicated to helping you get the best possible outcome for your case.

Spinal cord injuries can happen in a variety of situations, such as car accidents, falls, workplace injuries, and even medical malpractice. The consequences of these injuries are often life-changing, and they can result in long-term physical and emotional challenges. Understanding what compensation might be available to you can help ease some of the burden and provide a sense of justice as you heal. Below, we will explore the different types of compensation available for spinal cord injuries and how they can help you recover from the financial, emotional, and physical costs that come with such a serious injury.

What Types of Compensation Can Be Available for Spinal Cord Injuries?

The compensation for spinal cord injuries typically falls into several categories. The primary goal of any injury claim is to ensure that the injured party receives fair and just compensation for their losses. These losses can be financial, emotional, and physical, and the compensation will reflect that. Below are the common types of compensation that may be awarded in spinal cord injury cases:

Medical Expenses

One of the most significant areas of compensation for a spinal cord injury is the medical costs that follow. These injuries often require immediate medical attention and long-term care. Treatment may include surgeries, hospital stays, rehabilitation, physical therapy, and assistive devices such as wheelchairs or specialized equipment. In many cases, the costs of medical treatment can quickly add up, and it is essential that you pursue compensation for these expenses to avoid financial strain.

Lost Wages and Earning Capacity

Spinal cord injuries often leave victims unable to return to work. Depending on the severity of the injury, the victim may be permanently disabled and unable to continue in their chosen profession or any other job. Compensation for lost wages and future earning capacity can help make up for the income that is lost due to the injury. This type of compensation can be crucial in supporting the injured party and their family, especially if the injury leads to long-term financial hardship.

Pain and Suffering

In addition to the direct financial losses, victims of spinal cord injuries are entitled to compensation for their pain and suffering. Spinal cord injuries can result in severe physical pain, emotional distress, and a diminished quality of life. While it is difficult to place a specific dollar amount on pain and suffering, this type of compensation is meant to provide some measure of justice for the physical and emotional toll that the injury has taken on the individual.

Home Modifications and Assistive Devices

Many spinal cord injury victims need modifications to their homes to accommodate their new physical limitations. This can include installing ramps, widening doorways, or creating accessible bathrooms and kitchens. Additionally, some individuals may require specialized assistive devices, such as powered wheelchairs, hospital beds, or other equipment that helps them maintain independence. Compensation for these costs can significantly reduce the financial strain that comes with making these necessary changes.

Long-Term Care and Support

In cases where the injury is particularly severe, the victim may require long-term care and assistance for the rest of their life. This can include hiring caregivers, receiving ongoing medical treatments, and securing the necessary equipment to help with daily living. The cost of long-term care is often very high, and compensation for these expenses is crucial to ensuring that the victim receives the care they need.

Factors That Affect Compensation for Spinal Cord Injuries

The amount of compensation you may receive for your spinal cord injury will depend on various factors. Some of the key elements that affect compensation include:

Severity of the Injury

The more severe the injury, the higher the potential compensation. Spinal cord injuries are classified based on their severity, with injuries that result in partial or complete paralysis typically leading to higher compensation. In cases where the injury results in permanent disability, the compensation is generally more substantial due to the long-term effects on the individual’s ability to live independently.

Cause of the Injury

The circumstances surrounding the injury will also impact the amount of compensation. If the injury was caused by another person’s negligence, such as a car accident or workplace accident, the responsible party may be liable for the damages. If the injury was caused by a product defect or unsafe premises, the party responsible for maintaining safety may be held accountable. The more clearly negligence can be established, the stronger the case will be, and the greater the potential compensation.

Impact on Daily Life

Spinal cord injuries can have a profound effect on a person’s daily life, from their ability to work to their ability to perform basic tasks. The more significant the impact on daily life, the higher the compensation may be. If the injury leads to a loss of independence, emotional distress, or a diminished quality of life, these factors will be taken into account during the claims process.

Age and Health of the Victim

The age and health of the victim can also influence the amount of compensation. Younger individuals with a spinal cord injury may have a longer life expectancy, which could result in higher long-term care costs. Older individuals may have fewer years of potential income loss, but they may face more challenges in recovering from the injury. Each case is unique, and the specific details of the victim’s age and health will be considered when determining compensation.

Why You Need Legal Assistance for Your Spinal Cord Injury Case

Spinal cord injury cases can be incredibly complex. Insurance companies often do everything they can to minimize the amount of compensation paid out, and they may try to deny liability or reduce the value of the claim. This is why it is so important to have an experienced attorney by your side who can help you navigate the legal process and advocate for your rights. An attorney will help gather evidence, communicate with medical professionals, and negotiate with insurance companies to ensure that you receive fair compensation for your injury.

At Christian & Christian Law, we understand the emotional, physical, and financial toll that a spinal cord injury can take on you and your family. We are committed to fighting for your rights and ensuring that you receive the compensation you deserve. If you or a loved one has suffered a spinal cord injury, do not hesitate to contact us. Our team is ready to offer you the support and legal expertise needed to secure a successful outcome in your case. Let us help you focus on your recovery while we handle the complexities of your legal case. Reach out to us today for a consultation.

#SpinalCordInjury#PersonalInjuryLaw#LegalHelp#InjuryCompensation#MedicalExpenses#LostWages#PainAndSuffering#LongTermCare#DisabilityRights#ChristianAndChristianLaw#JusticeForInjury#LegalSupport#SpinalCordRecovery#HomeModifications#InjuryClaim

0 notes

Text

Unexpected Medical Bills? Here's How to Get Help in Korea!

Dealing with high medical bills from an unexpected illness or accident? The Catastrophic Medical Expense Support Program in Korea can cover up to 50 million KRW annually, easing your financial worries. Learn who qualifies, what benefits you can access, and how to apply. This government initiative could be the safety net you need during tough times. 💡 Curious? Click the link below to find out more and start your journey to financial relief!

#HealthcareSupport#MedicalAidKorea#FinancialRelief#GovernmentSupport#MedicalExpenses#재난적의료비지원#한국의료제도#의료비부담해결#정부지원프로그램#건강과재정#follower_for_follower#FollowBack#Republic_of_Korea

0 notes

Text

Navigating the Health Insurance Claims Process in India

In a country where healthcare costs are a significant concern, understanding the health insurance claims process is crucial for ensuring that you receive the benefits you've paid for. With about 500 million people covered by health insurance in India, many individuals find themselves confused or overwhelmed when it comes to filing claims. A study shows that nearly 40% of policyholders face issues during the claims process, which can lead to delays and frustration. Here’s a comprehensive guide to help you navigate the claims process effectively and ensure that you receive timely reimbursement for your medical expenses.

Understand the Types of Claims

There are two primary types of health insurance claims in India:

Cashless Claims: This allows you to receive treatment without making an upfront payment. The insurer settles the hospital bill directly with the network hospital. As of 2023, more than 12,000 hospitals in India are part of various insurers' cashless networks, facilitating easier access to care.

Reimbursement Claims: If you receive treatment from a non-network hospital or prefer to pay out of pocket initially, you can file for reimbursement. You will need to pay the hospital bill and submit the required documents to your insurer for repayment.

Gather Required Documentation

When filing a claim, documentation is critical. Common documents required include:

Claim Form: Most insurers provide a standard claim form, which must be filled out accurately.

Hospital Bills: Original bills detailing the treatment received, including the breakdown of costs.

Discharge Summary: This document contains information about your hospitalization, including diagnoses and treatments received.

Prescriptions and Test Reports: Ensure you include all relevant medical documentation to support your claim.

A 2022 report indicated that approximately 30% of claims were delayed due to incomplete documentation, highlighting the importance of thorough preparation.

Notify Your Insurer Promptly

Most health insurance policies require you to notify your insurer within a specific time frame, often within 24 hours of hospitalization for planned admissions and within 48 hours for emergencies. Failing to do so can lead to claim rejections. A timely notification allows your insurer to process the claim efficiently, particularly for cashless claims.

Follow Up Regularly

After submitting your claim, stay in touch with your insurer. Regular follow-ups can help expedite the process and ensure that you are informed about any additional documentation or steps required. A 2021 survey found that around 50% of policyholders who followed up received their claims settled faster than those who did not.

Be Aware of Common Rejection Reasons

Understanding common reasons for claim rejections can help you avoid pitfalls:

Policy Exclusions: Familiarize yourself with the exclusions in your policy to prevent submitting claims for ineligible treatments.

Pre-existing Conditions: Claims related to pre-existing conditions are typically not covered during the waiting period. Ensure you know your policy’s terms.

Incomplete Documentation: Missing documents can lead to delays or rejections, so double-check that you have everything required.

Utilize Grievance Redressal Mechanisms

If you encounter issues with your claim, such as delays or denials, most insurers have a grievance redressal process. Familiarize yourself with this process, including the contact details and steps to escalate your complaint. According to IRDAI, about 50% of grievances are resolved within a month, but being proactive can expedite the resolution.

Conclusion

Navigating the health insurance claims process can be challenging, but with the right information and preparation, you can ensure that your claims are processed smoothly. Understanding the types of claims, gathering the necessary documentation, notifying your insurer promptly, and following up regularly are essential steps in this process. By being informed and proactive, you can maximize your health insurance benefits and avoid unnecessary stress during medical emergencies. Remember, health insurance is your safety net—understanding how to use it effectively is key to protecting your health and finances.

0 notes

Text

Flexible Financing with CareCredit

Looking for a way to manage healthcare expenses more easily? The CareCredit health, beauty, and wellness credit card might be the solution you need. With CareCredit, you can enjoy flexible financing options that allow you to pay over time, making it easier to fit care into your budget. Here’s why CareCredit is a great choice: 1. Promotional Financing: Offer valid on orders of $200 and above. 2. Easy Prequalification: Please do verify your eligibility you no need to pay anything and your credit score will not be affected. 3. Instant Decision: With our system, you will get approval of your application within the shortest time. 4. No Annual Fee: Enjoy financing without additional charges on one’s annual fee. CareCredit is welcome at over 266,000 providers, specialties include general care, cosmetic, emergency care, neurology, OB/GYN and orthopedic care and many others. Employer reimbursement is a suitable method of providing for the out of pocket expenses and the other expenditure that may not be covered for you and your family.

Visit: Financing

0 notes

Text

https://theindianpharma.com/blog-post/cost-of-omalizumab-injection-for-asthma-therapy/

Omalizumab injection, used for asthma therapy, is a targeted treatment designed to manage moderate to severe allergic asthma. This biologic medication works by binding to immunoglobulin E (IgE), preventing allergic reactions that can trigger asthma symptoms. The cost of Omalizumab can be significant, as it is a specialized treatment, but it offers substantial benefits for patients who do not respond well to traditional asthma therapies.

#OmalizumabInjectionCost#AsthmaTherapy#OmalizumabForAsthma#AllergicAsthmaTreatment#BiologicMedication#AsthmaManagement#HealthcareCosts#AsthmaCare#OmalizumabPrice#PatientSupport#MedicalExpenses#PrescriptionMedication#AsthmaControl#FinancialOptions#InsuranceCoverage#RespiratoryHealth#SpecializedTreatment#CostOfTreatment#theindianpharma

0 notes

Text

Discover the benefits of a personal loan! Whether it's for wedding expenses, pay credit card bills, sudden medical expenses, plan a vacation, relocation needs, we've got you covered. Enjoy quick access to funds, flexible repayment options, low interest rates, and hassle-free application process. Apply now and take control of your finances!

0 notes

Photo

🌟 Tax Tip: Deductible Medical Expenses 🌟 If you itemize your deductions, you may be eligible to deduct certain medical and dental expenses on your tax return. Here’s what you need to know: 1. Eligibility: You can deduct medical and dental expenses paid for yourself, your spouse, and your dependents during the taxable year. These expenses must exceed 7.5% of your adjusted gross income (AGI). 2. What’s Deductible?: - Fees to doctors, dentists, surgeons, chiropractors, psychiatrists, psychologists, and nontraditional medical practitioners. - Inpatient hospital care or residential nursing home care (if medical care is the primary reason for being in the nursing home). - Acupuncture treatments. - Inpatient treatment for alcohol or drug addiction. - Smoking-cessation programs and prescription drugs for nicotine withdrawal. - Weight-loss programs for specific diseases diagnosed by a physician. - Insulin and prescription medicines. - Admission and transportation costs for medical conferences related to chronic illnesses. - Expenses for false teeth, eyeglasses, hearing aids, guide dogs, crutches, and wheelchairs. - Transportation primarily for essential medical care (e.g., gas, parking, taxi, ambulance). 3. Not Deductible: - General health expenses like nutritional supplements and vitamins. Remember to keep records of your medical expenses and consult IRS Publication 502 for more details12. Stay informed and maximize your tax benefits! 💡💰 #TaxTips #MedicalExpenses #FinancialWellness Disclaimer: Always consult a tax professional for personalized advice. This post is for informational purposes only.

0 notes

Text

🩺💼 Understanding Medical Expenses in Personal Injury Claims! 📝💰

In our latest blog post, we delve into the intricacies of calculating medical expenses in personal injury claims. Medical costs play a significant role in determining compensation for injuries sustained due to negligence.

Our comprehensive guide breaks down:

👩⚕️ The Various Components of Medical Expenses 📈 How Medical Costs Are Calculated 💰 Factors That Influence Compensation 💡 Tips for Documenting Medical Expenses Effectively

Navigating medical expenses in a personal injury claim can be complex, but with the right knowledge, you can ensure fair compensation for your injuries. Read our blog to learn more! https://lockamylawyers.com/blog/medical-expenses-in-personal-injury-claims-how-they-are-calculated/

1 note

·

View note

Text

Birth Injury? Protecting Your Child's Future is Our Focus.

At Braude Injury Lawyers, our team understands the lifelong impact a birth injury can have on your child and your family. Our dedicated team is committed to advocating for your child's rights and securing the compensation they deserve for medical expenses, therapy, and future care needs.

We fight tirelessly to hold negligent parties accountable and ensure your child has the resources necessary for a brighter future. Contact Braude Injury Lawyers today for a professional consultation. Let us help you navigate this challenging time and advocate for your child's well-being.

Need more information? Tap here> https://www.findinjurylaw.com/birth-injuries/6-reasons-to-hire-a-birth-injury-lawyer/

1 note

·

View note

Text

Why American Health Care Is So Expensive | What Can We Do About It | The Shadow

youtube

Uncover the reasons behind the soaring costs of American healthcare in 'The Shadow: Why American Health Care Is So Expensive | What Can We Do About It.' Journey through the complex layers of the healthcare system, examining the factors that contribute to its high expenses. From administrative complexities to pharmaceutical pricing, we'll navigate the landscape and explore potential solutions. Join us in understanding the challenges and seeking pathways toward a more affordable and accessible healthcare future. Knowledge is power; let's shed light on the shadows of the American healthcare system.

0 notes

Text

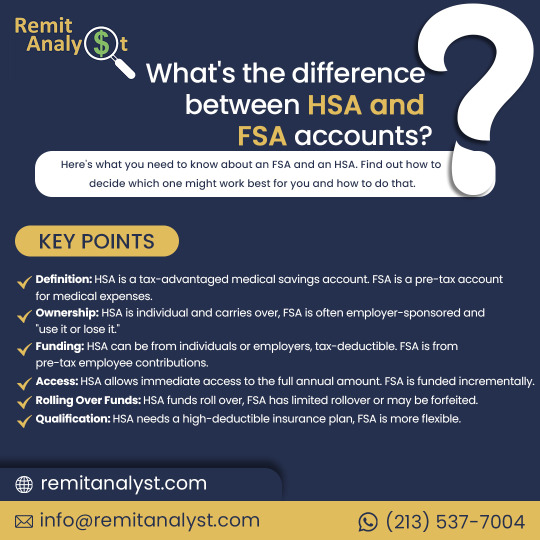

What's the difference between HSA and FSA accounts?

HSA (Health Savings Account) and FSA (Flexible Spending Account). Let's break down the differences between these options and help you make informed choices!

Health Savings Account (HSA)

🔹 Imagine it like a healthcare piggy bank - money goes in tax-free!

🔹 You control it, and it stays with you, even if you change jobs or health plans.

🔹 Contributions are tax-deductible, which is like giving yourself a little financial boost.

🔹 The funds in your HSA can grow over time, providing a nest egg for future medical expenses.

🔹 You need a high-deductible health plan (HDHP) to be eligible for an HSA.

Flexible Spending Account (FSA) 🔸 Think of it as a yearly budget for medical expenses - you plan ahead.

🔸 Funded by pre-tax dollars from your paycheck, reducing your taxable income.

🔸 Use it or lose it - generally, you need to spend the funds within the plan year or a grace period.

🔸 Great for predictable, planned medical expenses like copayments, deductibles, or prescriptions.

🔸 Typically, your employer offers FSA options as part of your benefits package.

difference between HSA and FSA accounts depends on your health needs and financial situation. If you anticipate high medical expenses, an HSA could be a great long-term savings tool. If you have predictable costs and want to save on taxes, an FSA might be your best bet!

Remember, it's your healthcare and your money - understanding these options can put you in the driver's seat. Choose wisely and stay financially healthy! 💪🏥

Discover the Best Rates! Send money to India hassle-free from the USA with RemitAnalyst. Get the top exchange rates and seamless online money transfers. Convert USD to INR effortlessly. Start saving on every transfer now!

#HealthcareSavings#FinancialWellness#HSAExplained#FSAInsights#MoneyMatters#MedicalExpenses#BudgetingTips#HealthcareEducation#SaveSmart#EmpowerYourWallet#HSA#FSA#HealthcareFinance101

0 notes

Text

who accepts bright health insurance?

In this comprehensive article, we will delve into the world of Bright Health Insurance, a prominent health insurance provider. We aim to provide you with an in-depth understanding of Bright Health Insurance, including its coverage areas, benefits, and how it works. Whether you're a current policyholder or someone exploring health insurance options, this article will guide you through the essential aspects of Bright Health Insurance.Let's discuss who accepts bright health insurance?

What is Bright Health Insurance?

Bright Health Insurance is a well-established health insurance provider that offers a wide range of health coverage plans. They prioritize delivering quality healthcare to their members, ensuring access to a comprehensive network of healthcare providers. Bright Health Insurance aims to simplify the complex world of health insurance and make it more accessible for individuals and families.

Bright Health Insurance Coverage Areas

One of the key advantages of choosing Bright Health Insurance is its extensive coverage areas. They have a vast network of healthcare providers and facilities in various regions, making it easier for members to access medical services. The company's coverage includes both urban and rural areas, ensuring that members have convenient access to healthcare, regardless of their location. Related:which of the following is a reason someone should get health insurance?

Benefits of Choosing Bright Health Insurance

When selecting a health insurance provider, it's crucial to consider the benefits they offer. Bright Health Insurance provides several advantages, making it an attractive choice for policyholders. Some of the benefits include: - Comprehensive Coverage: Bright Health Insurance offers a wide range of coverage options, including medical, prescription drugs, preventive care, mental health, and more. - Affordable Plans: They offer competitive premium rates and a variety of plan options to suit different budget and healthcare needs. - Personalized Care: Bright Health Insurance focuses on personalized healthcare, ensuring that members receive the attention and care they need. - In-Network Savings: Members can benefit from cost savings by choosing healthcare providers within the Bright Health network. - Innovative Tools: The company provides innovative tools and resources to help members manage their health effectively.

How Does Bright Health Insurance Work?

Understanding how Bright Health Insurance works is essential for potential policyholders. The process is straightforward and involves the following steps: - Selecting a Plan: The first step is to choose a health insurance plan that aligns with your healthcare needs and budget. - Enrollment: Once you've selected a plan, you can enroll in Bright Health Insurance through their website or an authorized agent. - Choosing Providers: After enrollment, you can browse the network of healthcare providers and select a primary care physician (PCP) if required. - Seeking Medical Services: When you need medical services, simply visit an in-network healthcare provider, and your insurance will cover eligible expenses. - Managing Your Policy: Bright Health Insurance offers online tools to help you manage your policy, track claims, and access important documents.

Who accepts bright health insurance?

⁍ Healthcare Providers that Accept Bright Health Insurance Now that we've covered the basics of Bright Health Insurance let's explore the network of healthcare providers that accept their insurance. This information is vital for policyholders as it ensures they can access healthcare services with ease. 1. Healthcare Providers in the Bright Health Network Bright Health Insurance collaborates with a diverse range of healthcare providers, including hospitals, clinics, and medical professionals. Their extensive network ensures that policyholders have access to quality care in their local area. 2. In-Network vs. Out-of-Network Providers In-network providers are healthcare professionals and facilities that have contracts with Bright Health Insurance. Visiting in-network providers typically results in lower out-of-pocket costs for policyholders. Out-of-network providers, on the other hand, may have higher fees, and policyholders may be responsible for a larger portion of the expenses. How to Find Bright Health-Accepted Doctors Locating healthcare providers that accept Bright Health Insurance is simple. You can use the provider directory available on their website to search for physicians, specialists, and facilities in your area. Related:What is a beneficiary for health insurance Tips for Selecting Healthcare Providers with Bright Health Insurance When choosing a healthcare provider within the Bright Health network, consider the following tips: - Credentials and Experience: Research the credentials and experience of the healthcare provider to ensure they meet your healthcare needs. - Location: Choose a provider or facility conveniently located near your home or workplace. - Patient Reviews: Read patient reviews and testimonials to gauge the quality of care provided by the healthcare professional. - Specialties: If you require specialized care, ensure that the provider has expertise in the relevant field. Understanding Referrals and Specialists with Bright Health Insurance In some cases, policyholders may require a referral from their primary care physician (PCP) to see a specialist. Understanding the referral process and the specialists covered by your plan is essential to make the most of your insurance benefits. ⁍ Hospitals and Medical Facilities In this section, we will focus on hospitals and medical facilities covered by Bright Health Insurance. Access to high-quality medical facilities is vital for policyholders, and Bright Health Insurance ensures that its network includes top-rated hospitals and clinics. • Hospitals Covered by Bright Health Insurance Bright Health Insurance provides coverage for a wide range of hospitals, allowing policyholders to access medical services in their region. • Top-rated Hospitals in the Bright Health Network Being part of a network that includes top-rated hospitals ensures that policyholders have access to exceptional medical care. • Emergency and Urgent Care Coverage with Bright Health Insurance Understanding emergency and urgent care coverage is crucial, as accidents and unexpected medical needs can arise at any time. • Coverage for Outpatient Services and Surgeries Outpatient services and surgeries are common medical needs, and having coverage for these services is essential for policyholders. • Mental Health and Behavioral Facilities Mental health care is an integral part of overall well-being. Bright Health Insurance offers coverage for mental health and behavioral services, ensuring members can seek the help they need. Related:What are the pros and cons of health insurance? ⁍ Prescription Medications and Pharmacies Accepting Bright Health Insurance Prescription drug coverage is a critical aspect of any health insurance plan. In this section, we will explore how Bright Health Insurance handles prescription medications and pharmacies within its network. Prescription Drug Coverage with Bright Health Insurance Bright Health Insurance offers prescription drug coverage as part of its plans, allowing policyholders to obtain necessary medications. How Formularies Work with Bright Health Insurance Formularies are lists of medications covered by insurance plans. Understanding how formularies work can help policyholders save on prescription costs. Retail Pharmacies in the Bright Health Network Bright Health Insurance partners with various retail pharmacies, providing members with multiple options for filling their prescriptions. Mail-Order Pharmacy Services with Bright Health Insurance Mail-order pharmacy services offer convenience and cost savings for prescription refills. Bright Health Insurance may offer this option to its policyholders. Tips for Cost-Effective Prescription Refills To minimize prescription costs, consider these tips: - Generic Alternatives: Opt for generic medications whenever possible, as they are typically more affordable. - Mail-Order Options: Utilize mail-order pharmacy services for long-term medications to save on copayments. - Medication Formularies: Check the formulary list to see if your prescribed medication is covered. ⁍ Additional Services In this final section, we will explore some additional services and benefits covered by Bright Health Insurance. Understanding these extra perks can help policyholders make the most of their health insurance plans. • Preventive Care Services Bright Health Insurance emphasizes preventive care to promote overall health and well-being. Policyholders may have access to various preventive services such as vaccinations, screenings, and annual check-ups at little or no cost. • Maternity and Pregnancy Coverage For expecting parents, Bright Health Insurance often includes coverage for maternity and pregnancy-related services. This coverage may include prenatal care, childbirth, and postpartum care. • Pediatric Services Bright Health Insurance plans typically cover pediatric care, including well-child visits, vaccinations, and pediatric specialists. • Telehealth Services Telehealth services have gained popularity in recent years, offering a convenient way for policyholders to access medical consultations remotely. Bright Health Insurance may provide telehealth options for certain medical conditions. • Vision and Dental Coverage Some Bright Health Insurance plans may offer optional coverage for vision and dental services, ensuring comprehensive health coverage for policyholders and their families. • Fitness and Wellness Programs To encourage healthy lifestyles, Bright Health Insurance may provide access to fitness and wellness programs that promote physical activity and overall wellness. • Chronic Condition Management For individuals with chronic health conditions, Bright Health Insurance may offer specialized programs and resources to manage and support their health needs. • 24/7 Member Support Bright Health Insurance prioritizes member satisfaction and typically provides 24/7 customer support to assist with inquiries, claims, and policy management. • Health Savings Account (HSA) Options Some Bright Health Insurance plans may offer Health Savings Accounts (HSA) that allow policyholders to save money tax-free for qualified medical expenses. Related: How Does International Health Insurance Work?

Conclusion

Bright Health Insurance stands as a reliable and comprehensive health insurance provider, offering a broad range of benefits and coverage options to its members. With a focus on personalized care and an extensive network of healthcare providers, policyholders can access quality healthcare services conveniently. As with any health insurance plan, it's essential for individuals and families to review the specific coverage details, costs, and in-network providers before enrolling in Bright Health Insurance. By understanding the offerings and taking advantage of the various services provided, policyholders can make the most of their health insurance and secure their well-being for the future. Remember, health insurance is a critical investment in your health and peace of mind, and Bright Health Insurance aims to make that journey smoother and more accessible for everyone. Get an Latest Update Read the full article

#24/7membersupport#BrightHealthInsurance#chronicconditionmanagement#comprehensivehealthcoverage#fitnessandwellnessprograms#healthinsurancebenefits#healthinsurancecoverage#HealthSavingsAccount(HSA)#healthcarenetwork#healthcareproviders#healthcareservices#insuranceplans#maternitycoverage#medicalexpenses#pediatricservices#personalizedcare#policydetails#policyholders#preventivecareservices#telehealthoptions#trustedhealthinsuranceprovider#visionanddentalcoverage

0 notes

Text

#HealthInsuranceTaxTips#TaxImplications#PremiumTaxCredit#EmployerSponsoredInsurance#HealthSavingsAccounts#MedicalExpenses#TaxBenefits

0 notes

Text

The HSA, HRA and FSA – which is right for you?

Navigating the differences between Health Savings Accounts (HSAs), Health Reimbursement Accounts (HRAs), and Flexible Spending Accounts (FSAs) can be challenging, but each offers unique tax advantages for managing healthcare costs. HSAs are individually owned and must be paired with high-deductible health plans, allowing tax-free growth and rollover of unused funds. HRAs are employer-funded and reimburse employees for qualifying medical expenses, while FSAs let employees set aside pre-tax money for healthcare expenses but may have a "use it or lose it" policy.

#HealthSavingsAccounts(HSAs)#FlexibleSpendingAccounts(FSAs)#Health ReimbursementAccounts(HRAs)#Taxadvantagedhealthaccounts#Healthcarecost management#Prescriptionsavings#High-deductiblehealthplans#Medicalexpense reimbursement#Pretaxhealthcaresavings#Employer-sponsoredhealthplans#Affordable healthcareoptions#Prescriptioncostsavings#OnlinepharmacyNewJersey#Direct-to-consumerpharmacy#Genericmedicinediscounts#HSAvsFSAvsHRA#Health accountbenefits#Prescriptiondrugcoverage#DiRxonlinepharmacy#Tax-freemedical savings

0 notes

Text

FROM FRIENDS OF KARRL FOSTER As many of you may know, Karrl experienced a medical emergency resulting in an extended 3 week hospital stay, the majority of which was spent in ICU, including 2 surgical procedures, at-home care, physical therapy, and prescriptions, the expenses are piling up quickly. We are asking for your help to alleviate the financial strain, Medical expenses, Bills, Aftercare, and Living expenses on Karrl's shoulders [ NO AMOUNT IS SMALL ]. Please consider donating to Karrl's recovery fund and help us spread the word by sharing this campaign with your friends, family, and social networks.

#emergencyfund #virtualevent #patrons #peertopeer #startuplife #teamspirit #founders #crowdlending #communitybuilding #funding #crowdfunding #fundraising # medicalexpenses #support #fundly #campaign #money

VISIT : https://zeep.ly/QQvTS

3 notes

·

View notes