#auto loan payment tracker

Explore tagged Tumblr posts

Text

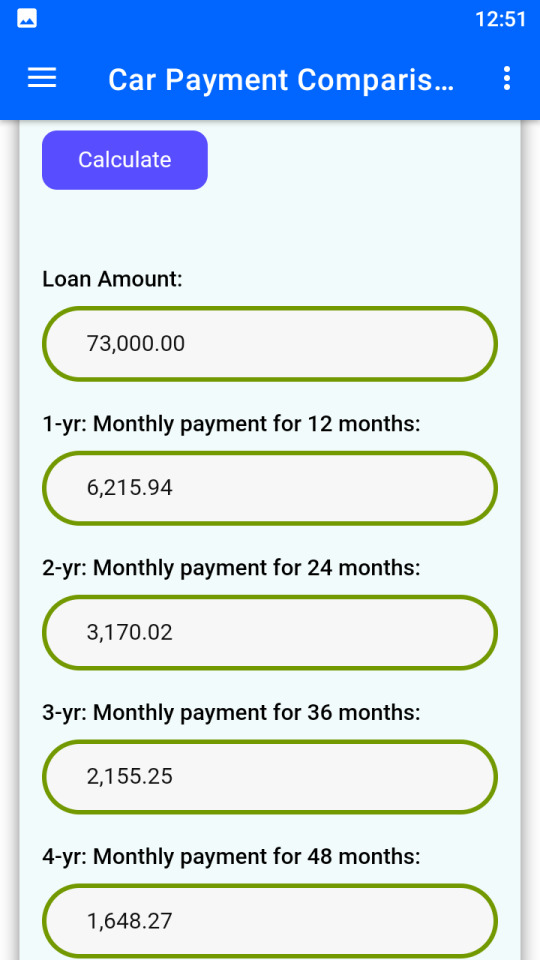

Know & compare the monthly payments from 1 year to 10 years. This App will show you the monthly payments required for car loans lasting 1 year, 2 years, 3 years, 4 years, 5 years, 6 years, 7 years, 8 years, 9 years & 10 years. Simply enter your total loan amount and the annual interest rate. Then press "Calculate", to see the monthly payments for each loan term.

#car payment calculator#auto loan calculator#vehicle loan comparison#monthly car payment estimator#car finance calculator#loan term comparison#car affordability calculator#auto financing tool#car loan repayment#interest rate calculator#car lease calculator#car loan EMI calculator#vehicle financing calculator#auto loan payment tracker#car purchase planning#car budget calculator#car loan interest calculator#auto finance planner#car loan schedule#loan amortization calculator#car cost estimator#easy car loan calculator#car financing made simple#monthly installment calculator#car loan planning tool#vehicle cost calculator#auto credit calculator#auto loan affordability#best car loan calculator#smart car finance app

0 notes

Text

Transforming Your Vision into a Digital Reality

Introduction to Digital Transformation

In today’s fast-paced world, embracing digital transformation is no longer optional—it’s essential. But what does it truly mean to take your vision and bring it into a digital reality? Whether you’re looking to improve your credit, calculate your next big auto loan, or optimize your financial strategies, digital tools can be your best allies.

Understanding Credit Repair Services

What Are Credit Repair Services?

Credit repair services are designed to help individuals improve their credit scores by addressing errors, negotiating with creditors, and offering tailored advice. These services bridge the gap between financial difficulties and long-term solutions.

How Credit Repair Services Work

Credit repair professionals analyze your credit report to identify inaccuracies or negative marks. They then communicate with credit bureaus and lenders to resolve these issues. Some services also provide ongoing monitoring to ensure your credit stays in top shape.

Benefits of Professional Credit Repair

Expertise in navigating credit laws.

Time-saving solutions for busy individuals.

Improved credit scores leading to better financial opportunities.

Common Myths About Credit Repair

Myth: Credit repair is illegal. Fact: Credit repair services operate within legal frameworks.

Myth: You can’t fix bad credit. Fact: While it takes time, credit repair is highly effective with the right strategy.

Auto Loan Calculator: A Financial Game-Changer

What Is an Auto Loan Calculator?

An auto loan calculator is a simple yet powerful tool that helps you estimate your monthly payments, interest rates, and overall loan costs. It’s like having a financial GPS for your car-buying journey.

How to Use an Auto Loan Calculator Effectively

Input the loan amount, interest rate, and loan term.

Adjust values to compare scenarios.

Analyze how down payments affect monthly costs.

Benefits of Calculating Auto Loans Ahead of Time

Prevents overspending by giving a clear budget.

Helps in negotiating better loan terms.

Saves time and minimizes surprises.

Top Features to Look For in an Auto Loan Calculator

Easy-to-use interface.

Detailed breakdown of principal and interest.

Prepayment options for smarter planning.

Credit Score Improvement Tips

Importance of a Good Credit Score

Your credit score isn’t just a number—it’s a gateway to financial freedom. From lower interest rates to increased borrowing power, a high credit score opens doors.

Quick Wins to Boost Your Credit Score

Paying Bills on Time

Every missed payment is a step back. Set reminders or automate payments to ensure consistency.

Reducing Credit Utilization

Keeping your credit usage below 30% of your limit shows financial responsibility.

Avoiding Common Mistakes That Hurt Your Credit

Closing old credit cards unnecessarily.

Applying for too many loans at once.

Integrating Digital Solutions for Financial Wellness

Leveraging Technology for Better Financial Decisions

Apps and platforms now offer personalized advice, real-time tracking, and seamless management of finances. It’s like having a financial assistant in your pocket.

How to Transform Financial Goals into Reality

Define clear objectives, use digital tools to track progress, and adapt strategies as needed. Consistency is key.

The Connection Between Financial Health and Digital Innovation

How Digital Tools Simplify Credit and Loan Management

Gone are the days of spreadsheets and guesswork. Tools like credit trackers and loan calculators automate the heavy lifting, making it easier to focus on what matters most.

Personalizing Financial Plans Using Technology

From AI-powered budgeting apps to advanced analytics, technology tailors financial plans to fit your lifestyle and goals.

Conclusion

Digital transformation is not just for businesses; it’s a lifeline for individuals seeking financial clarity and empowerment. By embracing tools like credit repair services, auto loan calculators, and credit improvement strategies, you’re not just improving your financial health—you’re stepping into a future full of possibilities.

0 notes

Text

Mastering Student Loans: A Guide to Managing, Repaying, and Refinancing Your Debt

Student loans can be a significant financial burden, but with the right strategies, you can effectively manage, repay, and even refinance your debt to improve your financial health. Whether you’re just starting to pay off your student loans or looking for ways to make your payments more manageable, this guide will walk you through the key steps to managing student loans and offer tips to help you stay on top of your repayment plan.

1. Understanding Your Student Loans

Before you can effectively manage your student loans, it’s essential to understand what type of loans you have and the terms associated with them. Here are the key things to know:

Federal vs. Private Loans: There are two main types of student loans: federal and private. Federal loans are funded by the government and typically offer more borrower protections, such as income-driven repayment plans and loan forgiveness options. Private loans are provided by banks, credit unions, or other lenders and may have variable interest rates and fewer repayment options.

Loan Terms and Interest Rates: Each loan comes with specific terms, including the interest rate, repayment period, and monthly payment amount. Federal loans often have fixed interest rates, while private loans may have fixed or variable rates. Understanding these terms is crucial for creating a repayment plan that works for you.

Grace Periods: Most federal student loans have a grace period, typically six months after you graduate or leave school, during which you don’t have to make payments. Private loans may or may not offer a grace period. It’s important to know when your payments will begin so you can prepare.

To help you stay organized and keep track of your loans, consider using a Student Loan Tracker.

Student Loan Tracker: Available on Amazon, this tracker helps you organize your loans, track your payments, and monitor your progress toward repayment. Check it out here.

2. Creating a Repayment Plan

Once you’ve identified the type of loans you have and their terms, the next step is to create a repayment plan that fits your budget and financial goals. Here’s how to get started:

Choose the Right Repayment Plan: Federal student loans offer several repayment plans, including standard, graduated, and income-driven options. Standard repayment plans have fixed payments over 10 years, while graduated plans start with lower payments that increase over time. Income-driven plans base your monthly payments on your income and family size, which can make payments more affordable.

Prioritize High-Interest Loans: If you have multiple loans, prioritize paying off the ones with the highest interest rates first. This will reduce the total interest you pay over time and help you pay off your loans faster. Continue making the minimum payments on all your loans while putting extra money toward the highest-interest loan.

Consider Auto-Pay: Many lenders offer a discount on your interest rate if you sign up for automatic payments. Auto-pay ensures that you never miss a payment and can save you money over the life of the loan.

Explore Deferment or Forbearance: If you’re experiencing financial hardship, you may qualify for deferment or forbearance, which temporarily pauses your loan payments. However, interest may continue to accrue, so these options should be used as a last resort.

To help you create a repayment plan and stay on top of your payments, consider using a Student Loan Repayment Calculator.

Student Loan Repayment Calculator: Available online, this tool helps you estimate your monthly payments, compare repayment plans, and see how extra payments can reduce your loan balance. Check it out here.

3. Making Extra Payments to Pay Off Your Loans Faster

One of the most effective ways to pay off your student loans faster is by making extra payments whenever possible. Here’s how to do it:

Pay More Than the Minimum: If you can afford to, pay more than the minimum amount due each month. Even small extra payments can make a significant difference over time by reducing the principal balance and the amount of interest you’ll pay.

Make Biweekly Payments: Instead of making one monthly payment, consider splitting your payment in half and paying biweekly. This results in an extra payment each year, which can help you pay off your loans faster without significantly impacting your budget.

Apply Windfalls to Your Loans: If you receive a windfall, such as a tax refund, bonus, or inheritance, consider using a portion of it to make an extra payment on your student loans. Lump-sum payments can have a big impact on reducing your loan balance.

To help you track your extra payments and stay motivated, consider using a Debt Snowball Tracker.

Debt Snowball Tracker: Available on Amazon, this tracker helps you visualize your progress and stay motivated as you pay off your loans. Check it out here.

4. Refinancing Your Student Loans

Refinancing your student loans can be a great way to lower your interest rate and reduce your monthly payments, especially if you have private loans with high-interest rates. Here’s what you need to know about refinancing:

Eligibility: To qualify for refinancing, you typically need a good credit score, steady income, and a low debt-to-income ratio. If you don’t meet these criteria, you may need a co-signer to qualify for a lower interest rate.

Pros and Cons of Refinancing: The main advantage of refinancing is the potential to lower your interest rate, which can save you money over the life of the loan. However, if you refinance federal loans into a private loan, you’ll lose access to federal protections, such as income-driven repayment plans and loan forgiveness options.

Shop Around for the Best Rates: Different lenders offer different interest rates and terms, so it’s important to shop around and compare offers before refinancing. Look for lenders that offer low fixed rates, no origination fees, and flexible repayment terms.

To compare refinancing offers and find the best option, consider using a Student Loan Refinancing Comparison Tool.

Student Loan Refinancing Comparison Tool: Available online, this tool helps you compare rates and terms from different lenders to find the best refinancing option for your situation. Check it out here.

5. Exploring Loan Forgiveness and Repayment Assistance Programs

If you work in certain professions or meet specific criteria, you may be eligible for loan forgiveness or repayment assistance programs that can help reduce or eliminate your student loan debt. Here are some common programs to explore:

Public Service Loan Forgiveness (PSLF): This federal program forgives the remaining balance on your federal student loans after you’ve made 120 qualifying monthly payments while working full-time for a qualifying employer, such as a government agency or nonprofit organization.

Teacher Loan Forgiveness: If you’re a teacher working in a low-income school or educational service agency, you may be eligible for up to $17,500 in loan forgiveness on your federal student loans after five years of service.

Income-Driven Repayment Forgiveness: If you’re enrolled in an income-driven repayment plan, any remaining balance on your federal student loans will be forgiven after 20 or 25 years of qualifying payments, depending on the plan.

State-Based Repayment Assistance Programs: Some states offer repayment assistance programs for borrowers who work in specific fields, such as healthcare, law, or education. These programs vary by state, so check with your state’s higher education agency to see what’s available.

To see if you qualify for loan forgiveness or repayment assistance, consider using a Loan Forgiveness Eligibility Tool.

Loan Forgiveness Eligibility Tool: Available online, this tool helps you determine whether you qualify for federal loan forgiveness programs and provides guidance on how to apply. Check it out here.

Conclusion

Managing student loans can be challenging, but with the right strategies, you can stay on top of your payments, pay off your debt faster, and explore options for refinancing or loan forgiveness. By understanding your loans, creating a repayment plan, and making extra payments when possible, you’ll be well on your way to reducing your student loan debt and improving your financial future.

Remember, paying off student loans is a marathon, not a sprint. Stay patient, stay consistent, and celebrate your progress along the way.

Helpful Items and Services Recap:

Student Loan Tracker

Student Loan Repayment Calculator

Debt Snowball Tracker

Student Loan Refinancing Comparison Tool

Loan Forgiveness Eligibility Tool

With the right tools and resources, you can take control of your student loans and work toward a debt-free future. You’ve got this!

#college#university#loans#budget#loan#finance#adulting#student#student life#academics#studying#study#tracker#tools#repayment#forgiveness#debt#snowball#refinance

1 note

·

View note

Note

Aunties, I no longer have any credit card debt, but I still have a car payment. Before, I was following the 50/30/10 rule (30% to debt and 10% for charity), but that left nothing for savings. I am tempted to put all my money toward my car, but there's been months where I needed extra and didn't have it. Ideally, what percentage of my income should go to paying of debt and what for savings?

Fuck if I know!

We generally don't like hard percentage rules, because everyone's financial situation is different. 50/30/10 might be fine for some people. But others might need to spend 70% on housing alone, and others might have expensive medications or other requirements that make it impossible to spend 10% on charity every month.

It's a lot more nuanced and personalized to use an income tracker to study your actual required expenditures for a few months, and then determine what YOU personally can afford to allocate to each category. Here's how to do that:

Budgets Don't Work for Everyone—Try This System Instead

Aggressively paying off debt works best if you have a solid emergency fund in place to cover those times when you need a little extra and don't have it. So prioritize creating an emergency fund before you really tackle that auto loan debt!

You Must Be This Big to Be an Emergency Fund

21 notes

·

View notes

Link

Never in U.S. history has there been a moment like this: Trillion-dollar proposals are pouring forth from Capitol Hill in a mad bid to save the economy from the ravages of a pandemic.

On the other hand, 2008, when toxic mortgage assets made “bailout” a political buzzword, wasn’t so long ago.

Back then, Congress, to revive a financial system paralyzed by devastating mortgage losses, opened the nation’s wallet wide, passing a $700 billion bailout. The following year, as unemployment rose, credit froze and public coffers dried up, it kicked in $840 billion more in a stimulus bill designed to save and create jobs and jump-start consumer spending. Of course, these helicopter drops of taxpayer cash seemed ripe for waste and fraud, so we decided to track where the money went.

What we learned from dogging those massive efforts provides some important lessons for today’s crisis. Many of the proposals lawmakers put forth this week — a grab bag of rescues for affected industries, broad loan programs and cash payments — the U.S. tried not too long ago.

Here’s a key takeaway: The reason we can easily update you on the pitfalls of the 2008-09 bailout is … it never actually ended. (And guess who keeps updating ProPublica’s Bailout Tracker?) Massive interventions have a way of leaving a mark. The government took over Fannie Mae and Freddie Mac, the giant mortgage finance entities, in 2008, and they remain in conservatorship. Tens of millions each month are still going out under the Troubled Asset Relief Program, the bailout’s misleading moniker, through next year. (We’ll get back to what TARP ended up doing in a bit.)

So, while a crisis provoked by a rampaging global virus certainly looks a lot different from one caused by toxic mortgage assets, the proposed solutions already on the table really aren’t.

President Donald Trump’s marquee proposal, also embraced by some Democrats, is a $500 billion plan to send stimulus money to American taxpayers as soon as early April. But history shows that the much-anticipated cash relief might not come as fast, or end up as well targeted, as the Trump administration is promising.

The Bush administration tried a similar stimulus measure in February 2008 when it sent $600 tax rebate checks to middle-class workers, with additional money for parents with children. But workers didn’t get them for three to five months — much longer than the two to three weeks Treasury Secretary Steven Mnuchin is currently promising.

When the checks did arrive, people didn’t run out and buy things. Most of the money was saved or used to pay down debt.

When President Barack Obama took over, he pitched a much larger, but ultimately insufficient stimulus package, designed around “shovel-ready” projects, safety net spending and investments in clean energy. Many people forget that the biggest item was a middle-class tax cut. But instead of sending checks, the administration chose to dribble the money out in paychecks at about $10 a week over two years, hoping that this way consumers would spend more of it. They didn’t.

There’s even more reason to believe that the proposed stimulus checks will be saved this time.

By definition, stimulus programs aim to get people to go out and spend, creating demand that creates jobs. But to slow the spread of the coronavirus, government officials are telling, and in some places ordering, people to stay home. Extra money would certainly help workers who’ve lost their jobs or seen their hours cut. It might even encourage people stuck at home to buy new laptops and TVs, helping foreign manufacturers and domestic warehouse workers and truckers. But as popular as tossing cash from helicopters might be, lack of money is not the reason people with jobs aren’t spending right now.

Economic studies have shown there may be more efficient ways to spend $500 billion to aid those in need, such as expanding food assistance, unemployment benefits and other safety net programs as well as incentives to stem the tide of layoffs.

One of the most effective programs from Obama’s stimulus package was a $50 billion fund to shore up state and local budgets, which has been credited with saving the jobs of more than 300,000 teachers and support staff. Sending money to local governments could help down the line as tax revenues plummet along with the economy.

The Trump administration and Congress could do something similar with private businesses now, encouraging them to pay their workers during shutdowns, as Honda has pledged to do.

One proposal floated in a recent Treasury Department memo obtained by The Washington Post is a program that would guarantee $300 billion in loans to help small businesses meet payroll for eight weeks.

But policymakers should also consider the success that Germany had during the last recession with a program known as “work sharing.”

The idea is that businesses will eventually need to ramp up again whenever this especially unpredictable crisis is over. Under work sharing, instead of laying workers off, employers reduce hours, and the government pays partial unemployment benefits to make up for lost wages. For some workplaces, such a program could also achieve the goal of social distancing or allow people a way to balance the new child care and teaching demands caused by school closures.

But according to the National Conference of State Legislatures, more than 20 states don’t offer work sharing programs.

There’s also a lesson from the bailout about what happens when Congress hands an administration broad authority without clear direction or restrictions.

One clear lasting legacy of the 2008-09 bailout is a chronically flawed mortgage modification program, one launched with the promise of saving millions of people from foreclosure, but characterized by ongoing chaos, lax enforcement of its rules and failure. The program was rolled out months after the Treasury Department had quickly pumped hundreds of billions into banks with few strings attached.

This happened because, with pressure to act quickly in 2008, Congress gave the Treasury Department broad discretion to essentially make things up as it went. That’s how — and why — even though the TARP was conceived as a giant program to buy up toxic mortgage assets, the government almost immediately abandoned that idea. Instead, the Treasury Departments of both Bush and Obama spun out an array of programs, successfully bailing out AIG, large banks and the auto industry — and only later launched a notably unsuccessful program for homeowners. (For a rundown of who paid the money back, see here.)

It’s the kind of freedom Trump’s Treasury Department appears to covet: Its recent proposal suggests giving it the authority to send $50 billion to the airlines and $150 billion to “other severely distressed sectors,” with the Treasury determining the “appropriate interest rate and other terms and conditions.”

The TARP had relatively robust oversight built in, and it’s an aspect that should be repeated, said Neil Barofsky, who served as the special inspector general for the TARP from 2008 to 2011.

“You cannot push out $1 trillion without scandal. There’s going to be crime, there’s going to be fraud,” he said. “But with strong and effective oversight, you can limit it.”

Not only did the TARP have Barofsky’s office, but there was also the Congressional Oversight Panel, which was headed by a Harvard professor named Elizabeth Warren. The SIGTARP, as Barofsky’s office was known, released scathing reports and brought criminal cases against bankers who’d lied on their bailout applications, while Warren’s panel publicly raked Treasury Secretary Timothy Geithner over the coals for being too generous to banks while doing far too little for ordinary people.

Whatever proposals are ultimately adopted, taxpayers should be able to see how the government is spending their money. In 2009, Obama’s stimulus package created an accountability and transparency board, requiring any entity that received contracts, grants or loans to file quarterly reports that were posted publicly on a government website.

Extending the idea to all federal spending was supported by people as far apart politically as then-Vice President Joe Biden and former Rep. Darrell Issa, R-Calif., who chaired the House oversight committee. Some provisions made it into law, but the larger effort failed to get traction, and the board and its website shut down in 2015. Perhaps it’s time to resurrect the idea. Without adequate testing, we may not know the full reach of COVID-19; but at least should be able to track the money spent to respond to the crisis it’s leaving behind.

12 notes

·

View notes

Text

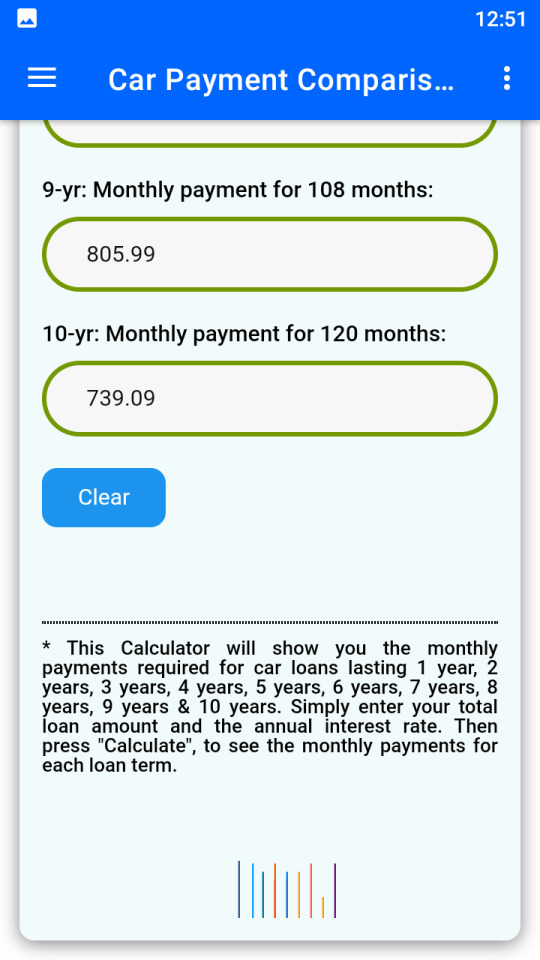

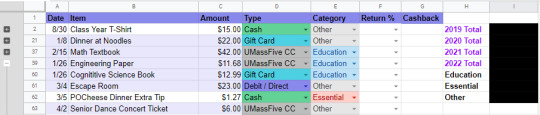

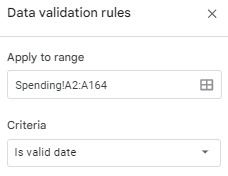

My Expense Tracking Spreadsheet

When I started college, I created a simple expense tracker in Google Sheets a row for each purchase and columns for things like the date, item, category, and amount. Over the last three years, I’ve continued to log purchases and iterate on the design of this tracker. When I last wrote about this spreadsheet in my post on banking and personal finance in college, I’d just added the type column to keep track of the type of payment (cash, gift card, debit/direct, or credit).

Now that I have four credit cards, I’ve replaced my generic credit option with separate options for each card. Upon getting my first cashback credit card last summer (the Citi Double Cash), I’ve also added columns for tracking this cashback. However, to be honest, this hasn’t been that useful and I’ve had to create a separate sheet for tracking cashback as the vast majority of my credit card purchases have been for things I will be reimbursed for and thus don’t track as personal spending. For instance, a few weeks back my Design Clinic team and I had a bonding dinner that I charged to my newest credit card (the Capital One SavorOne), but will be reimbursed in the near future.

Speaking of credit cards, the most important thing to know about using them responsibly is that they should be paid off on time and in full. In other words, they should be treated like a debit card in that you should never spend money you don’t have in your bank account. Compared with debit cards, credit cards offer more fraud protections which makes them a safer bet for online purchases. And, if you can be responsible, getting a credit card early on can help you to build your credit score which can help you down the line in getting the lowest interest rates on auto loans and mortgages. On the flip side, if you can’t be responsible you really should steer clear of credit cards to avoid credit card debt and the associated double-digit interest rates. If you read to the end, I’ll also give my pick for the best student credit card.

Another minor change that I’ve made to my master finance spreadsheet is that I no longer have separate sheets for each year and instead simply collapse past years by grouping rows together. Additionally, I’ve added a ton of additional sheets for tracking other finance-related things like my income, gift card balances, credit score, and credit utilization. I am well aware that this post may not be interesting to the average person, but I really do love spreadsheets and have become increasingly interested in personal finance. In the sections that follow, I’ll be going through my expense tracker column by column and sharing some of the fun formulas and formatting tricks.

Column A - Date

Nothing particularly special here, but I do have data validation to ensure that what I’ve entered is in the proper date format.

Column B - Item

This column is also pretty simple and just contains a text description of the purchase.

Column C - Amount

Another obvious column, but I do make sure to use the currency format.

Column D - Type

This is where the fun begins! For this column, I use data validation rules to create a drop-down menu and to format each option! Each of my credit card options are color-coded to match their respective physical card and in the case of my authorized user card, it is color-matched to my gift card option.

Column E - Category

My categories (education, essential, and other) have remained unchanged since the first version of this tracker. That said, I plan to update these categories once I graduate college.

Column F - Return Percent

In this column I again use data validation rules for the drop-down menu and formatting. Additionally, I have a formula that automatically sets the cashback rate based on the selected credit card. My Citi Double Cash for instance is a flat 2% cash card, so the rule below automatically accounts for this. Additionally, as I’ll primarily use my Capital One SavorOne on its 3% categories, automatically setting the return percent to 3% is very helpful. Furthermore, I can still easily override these rules as need be. (More about the SavorOne to come at the end of this post).

=IF(D2="Double Cash CC",2%,IF(D2="SavorOne CC", 3%,))

Column G - Cashback

This column just calculates my cashback by multiplying the amount by the cashback rate. The rule below is slightly more advanced in that it leaves the cell empty if the cashback is $0. I also have a simple conditional formatting rule to add a purple background to the non-zero cells.

=IF(C2*F2 = 0,,C2*F2)

Column I - Total / Category Totals

This column sums up my expenses for a given year. In other words for most rows of the spreadsheet, columns H and I are empty. (I know I skipped over H, but it just contains labels for column I). For the annual total, I just sum up my category totals. For category totals, I use the SUMIF function. I also sometimes use this column for other subtotals for specific semesters, seasons, or months.

=SUMIF(E2:E19,"Education",C2:C19)

Best Student Credit Card

First of all, a disclaimer that I am not an actual financial advisor, and this recommendation is just based on my own research and personal experience. Be sure to do your own research first and ensure you can handle the responsibility of having a credit card.

The Capital One SavorOne Rewards for Students is my top pick for students. This is a great first credit card because Capital One has an easy-to-use app that allows you to view your current balance and recent transactions, pay your bill, and monitor your credit score with CreditWise. While I highly recommend learning about credit scores prior to getting your first credit card, CreditWise will help you to better understand the factors that impact your credit score through its credit score simulator. CreditWise also provides you with access to your TransUnion credit report on a weekly basis. Of all my credit cards, the Capital One app is by far the most useful and user friendly.

In terms of earnings, it earns 3% back on restaurants, dining, entertainment, and popular streaming services. It also earns 1% back on all other purchases, has no foreign transaction fees (great for studying abroad!), and most importantly has no annual fee. This earning structure matches the non-student versions of the card and as far as I’m concerned is really solid for students and non-students alike. While you need to be a student to appy for this card, the good news is that upon graduating you’ll retain all of the rewards and benefits. The main advantage of the student version is that it is easier to qualify for. One additional feature that was announced last month is that the card offers a complementary Uber One membership along with 10% back on Uber purchases through November 14th of 2024.

I intentionally left my discussion of the earning scheme to the end, because as a student your goal should be to build your credit history and learn how to use a credit card responsibly. If you are interested in this credit card you check if you are pre-approved (with no impact on your credit score) and/or apply using my referral link.

1 note

·

View note

Text

Ynab budgeting how to video

Variable expenses are things you have more control over, such as groceries, travel, dining out, shopping, and charitable donations. In general, your budget should be divided into three categories of expenses: fixed, discretionary, and savings.įixed expenses are things you can’t avoid paying, such as rent or a mortgage, utilities, and loans. You can make a budget for a specific time frame (monthly or annual are the most common). Take how much you expect to earn next month and use the expenditure percentages from step three to estimate what you can spend. You can now set up next month’s budget.For instance, maybe your typical $500 grocery bill jumps to $700 in November and December, or you pay your homeowners insurance premium at the beginning of each year. Estimate how much you’ll spend in different categories each month over the next year.Use last year’s pay stubs as a reference point and adjust as needed (perhaps you recently got a raise or finalized a new business deal). Estimate how much you’ll earn each month over the next year.Variable/discretionary ordinary living expenses (such as food, clothing, household expenses, medical payments, and other items for which your monthly spending tends to fluctuate).Fixed costs (such as housing payments, utility bills, charitable contributions, insurance premiums, and loan payments).Separate your spending categories into main buckets.(This is an especially useful exercise if you have uneven income.) For instance, let’s say you spent $500 in January on groceries, which was 12% of your household earnings. Note how much you spent in each category every month, as well as what percentage of your monthly income that spending represented. Categorize all of your expenses over the past year.Add up your take-home pay over the past year.Most institutions let you export your transactions as a CSV file that you can open in Google Sheets, Excel, or Numbers. A year’s worth can give you a good sense of how much you tend to spend over a given period of time. Collect all of your bank and credit card statements over the past year.(Ever get hit with a large bill, such as for an auto repair or emergency dental treatment? Those kinds of things can throw your budget off track.) Spreadsheet-based budgets (and some other budgeting tools) prompt you to create a myriad of categories and assign a dollar amount to each one, which is not only overwhelming but also likely to fail. It tracks your spending, revolving bills, savings goals, and earnings history to estimate how much you have left to spend in a given month in any category you want. We recommend Simplifi for most people because it’s a happy medium between the two. Conversely, zero-balance apps encourage a more hands-on approach, forcing you to account for every dollar you bring in (X amount for savings, Y amount for rent, and so on), but they tend to be idiosyncratic and costly. Tracking apps offer a 30,000-foot view of your finances, display your transactions in real time, and require very little effort to set up. When you roll your own spreadsheet, it’s surprisingly complex to allow for cleared and uncleared transactions.There are two basic types of budget apps: trackers ( à la Mint) and zero-balancers. YNAB walks you through the process of reconciling your account. Reviewing Your (shared) transactions and resolving any discrepancies, aka budget reconciliation, is also very simple. You might actually keep a true budget instead of a ledger. If that happens it’s much easier to help them be engaged from the beginning thanks to a dedicated budgeting tool. Think about the following: your partner might want to pitch in from time to time, or sooner or later the person managing the budget will change. It provides a better, more efficient interface than Excel. It’s a system that doesn’t need maintenance and it’s constantly improving. It takes most of the work of your hands allowing you to purely focus on budgeting. When talking about limitations it can be good to compare to YNAB. These accounts can be investment accounts but also a mortgage. This an overview of my tracking accounts.

0 notes

Text

Remote Vehicle Shutdown Market Overview with Qualitative analysis, landscape & Forecast by 2025

Remote Vehicle Shutdown Market was valued at USD xx million in 2018 and is projected to reach around USD xx million by 2025, at a CAGR of 8.0% during the forecast period. The base year considered for the study is 2018 and the forecast period is 2019-2025. Banks and finance companies are using such devices to lock down vehicles for loan nonpayers on time as an outcome the market is enjoying constant demand.

Scope of Global Remote Vehicle Shutdown Market Reports –

Remote Vehicle Shutdown is a system used in car. This is a device helps the user to disable the car through the remote within a 50m radius using radio pulses. The remote vehicle lockdown devices are being combined with a comprehensive security device which provides complete vehicle security inclusive of GPS tracking and anti-theft security alarm.

Global remote vehicle shutdown market report is segmented on the basis of system, end-user, vehicle type and regional & country level. Based upon system, global remote vehicle shutdown market is segmented into manual and automatic. Based upon end-user, market is segmented as personal use and commercial use. By end-user, market is divided into passenger vehicle, transport vehicle and others. The regions covered in this remote vehicle shutdown market report are North America, Europe, Asia-Pacific and Rest of the World. On the basis of country level, the market of Remote Vehicle Shutdown is sub divided into U.S., Mexico, Canada, U.K., France, Germany, Italy, China, Japan, India, South East Asia, Middle East Asia (UAE, Saudi Arabia, Egypt) GCC, Africa, etc.

Remote Vehicle Shutdown Market Key Players

OnStar Corporation

PassTime GPS

Cobra Car Tech Ltd

LoJack Corporation

Sonic Electronix, Inc.

TracknStop

Fleetsmart

The Tracker

EMCO Software

Frotcom International Remote Vehicle Shutdown market is in its emerging stage; therefore, the competition is increasing. Technological development and the product development may provide the growth to the market.

Market Dynamics –

Increasing cases of theft of vehicles and cargos provides the need for automated systems that helps in securing the vehicle or the cargo. Additionally, the transportation industry is observing huge losses due to the thefts. Thus leads the increase in the demand of remote vehicle shutdown. Moreover, the increase in the number of auto loans has bound lenders to use a new technology such as remote vehicle shutdown, which let them to remotely disable the ignition of a car when a debtor falls overdue on payments. Increasing sales of passenger car is also supplements the remote vehicle shutdown market growth. For instance; globally around 78.6 million passenger cars have sold in 2017 and it is continuously increasing. Auto lenders and police are also using the remote vehicle shutdown technology in the United States which let them to remotely halt high-speed hunt. The factors such as car hacking can be a restrain to the market growth over the forecast period. In spite of that, technological development in this field may provide an opportunity to market.

Remote Vehicle shutdown technology market is dominated by North America, followed by Europe, South America, Asia Pacific and the Middle East and Africa region. In North America, growing concerns about safety of vehicles is one of the key factors driving the growth of this market in this region. For example in 2014, the remote vehicle shutdown is installed in around 2 million vehicles in the U.S. Europe is expected to show the strong growth in this market due to increasing demand for the safety of the vehicle. Asia Pacific is anticipated to witness a lucrative growth in the remote vehicle shutdown market within the forecast period. China and India are markets that hold massive potential for this technology and demand is expected to grow significantly in these markets. Middle East and Africa market, especially UAE helps as a hub for global trade and many companies involved in logistics and fleet services are possible to incorporate this technology in their vehicles.

Key Benefits

Global Remote Vehicle Shutdown Market report covers in-depth historical and forecast analysis.

Global Remote Vehicle Shutdown Market research report provides detail information about Market Introduction, Market Summary, Global market Revenue (Revenue USD), Market Drivers, Market Restraints, Market Opportunities, Competitive Analysis, Regional and Country Level.

Global Remote Vehicle Shutdown Market report helps to identify opportunities in marketplace.

Global Remote Vehicle Shutdown Market report covers extensive analysis of emerging trends and competitive landscape.

Remote Vehicle Shutdown Market Segmentation:-

By System - Manual, Automatic

By End-User - Personal Use, Commercial Use

By Vehicle Type - Passenger Vehicles, Transport Vehicles, Others

By Region:

North America, US, Mexico, Chily, Canada, Europe, UK, France, Germany, Italy, Asia Pacific, China, South Korea, Japan, India, Southeast Asia, Latin America, Brazil, The Middle East and Africa, GCC, Africa, Rest of Middle East and Africa

Table of Content

Chapter – Report Methodology

1.1. Research Process

1.2. Primary Research

1.3. Secondary Research

1.4. Market Size Estimates

1.5. Data Triangulation

1.6. Forecast Model

1.7. USP's of Report

1.8. Report Description

Chapter - Superyacht Market Overview: Qualitative Analysis

2.1. Market Introduction

2.2. Executive Summary

2.3. Superyacht Market Classification

2.4. Market Drivers

2.5. Market Restraints

2.6. Market Opportunity

2.7. Superyacht Market: Trends

2.8. Porter's Five Forces Analysis

2.9. Market Attractiveness Analysis

Chapter – Superyacht Market Overview: Quantitative Analysis

Chapter - Superyacht Market Analysis: Segmentation By Type

Chapter - Superyacht Market Analysis: Segmentation By Application

Continued....

About Us:

Brandessence Market Research and Consulting Pvt. ltd.

Brandessence market research publishes market research reports & business insights produced by highly qualified and experienced industry analysts. Our research reports are available in a wide range of industry verticals including aviation, food & beverage, healthcare, ICT, Construction, Chemicals and lot more. Brand Essence Market Research report will be best fit for senior executives, business development managers, marketing managers, consultants, CEOs, CIOs, COOs, and Directors, governments, agencies, organizations and Ph.D. Students. We have a delivery center in Pune, India and our sales office is in London.

Contact us at: +44-2038074155 or mail us at [email protected]

0 notes

Link

1. WALNUT

Walnut is considered to be one of the most useful money -management apps that are available on both Android as well as iOs devices. Some of the features offered by Walnut include:

Tab on expenses – The app allows you to keep a tab on your monthly expenses. It gives you regular updates about the amount of money you have spent in the month, it intimates you about the accumulated credit card bill, etc. This helps you to keep a tab on your expenses quite effectively.

Auto payment of bills – The app pays your due bills automatically. The auto=payment feature on the app is of great help, especially to those who tend to miss the due dates and end up defaulting on their bills.

Categorizes expenses – The app categorizes all the expenses and tells you how much you spent on travel, dining, groceries, entertainment and so on. This helps you to understand your own spending patterns and make alterations if needed.

SMS scanning – The app regularly scans the SMSes received on your mobile device. It alerts you about the spends and informs you about any fraudulent transactions that may have taken place.

With these interesting features on offer, Walnut proves to be very handy for anyone who needs some digital assistance to manage their money.

2. GOODBUDGET

The next app on the list is the highly-rated GoodBudget app. Another one of the personal finance management apps that is available both to the Android as well as the iOs users, it helps you to plan out your monthly expenses. It also helps you to save by telling you about your various overheads and pointing out spending patterns. Here are the top features of this app:

Online envelopes – The most unique feature of this app is online envelopes. You can create separate envelopes for all your expenses such as groceries, utilities, fuel, savings, etc. You can allocate funds to each envelope and stick to your monthly budget accordingly.

Option to share budget – Not only does the app help you to make and use your own budget, but it also gives you the option to share the budget with your family members. This helps you to stay on the same page with close family members such as your spouse or parents with whom you share the familial financial load.

Payment of dues – The app offers the autopay option with which you can clear your monthly dues on time without having to worry about forgotten due dates.

Debt payoff plans – The app helps you to create specific debt-payoff plans. With the help of these, you can adjust your EMIs and clear off all your dues in a comfortable manner.

These features make the GoodBudget app so popular among users not just in India, but all around the world.

3. EZ FINANCIAL CALCULATORS

The EZ Financial Calculators app is one of the well-received personal finance management apps that helps thousands of people to keep a check on their finances. Here are the top features of this money-management app:

Complete set of financial calculators – You will find a whole lot of calculators on this app. With the help of these, you can calculate everything including your tax liabilities, your home loan interest rate, your retirement fund requirements, your insurance premium rates, the returns on various investments and so on.

Easy transfer of results – Not only does this app help you to calculate the various figures and amounts, but it also makes it easy for you to share the results with anyone you wish to. You can email the results to your family or friends as and when you want to do so.

Error-free calculations – Most of the financial calculations undertaken by this app are very complex and comprise of various layers. Manual calculations can lead to several errors, but the app offers completely error-free results. This is a major advantage of using the EZ Financial Calculators app.

Expert advice – The app has provisions for its users to get expert advice. You can speak to a financial expert on the app and get specific answers to your money related queries.

With these features, the EZ Financial Calculators are among the most popular expense manager apps in use presently.

4. CHILLR

One of the handiest expense manager apps, Chillr is a very popular and widely used app in India. The features of this app include:

Mobile banking – The app allows you to transfer money, receive money and make quick recharges. These features allow you to use the app as a mobile banking app. It makes it easy for you to manage all your financial transactions from one source.

Utility bill payments – The app also allows you to make your utility bill payments such as paying your electricity bill, telephone bill, gas bill and so on. You also get attractive discounts and cashback when you pay your bills from the app.

Remind friends about payments – The app has a very novel feature through which you can send reminders to your friends who owe you money. The app will directly remind them of the amount they owe you. They can pay you the money directly on the app itself.

As you can see, the features are quite interesting and make money management quite a simple task for you.

5. MONEY MANAGER EXPENSE & BUDGET

The Money Manager Expense & Budget app is available for the Android as well as the iOs users. It helps you in the following ways:

Deposits money into the account – As soon as you receive your monthly salary, the app deposits the specified amount of money into your account.

Pays money out – When you command the app to make payments, it automatically does so on specific dates specified by you. This helps you to manage your expenses in a very disciplined manner.

The double bookkeeping feature of this app makes it one of the most popular money management apps in India.

6. MONEFY – MONEY MANAGER

This is a very straightforward and one of the most simple personal finance management apps, but it offers excellent solutions to anyone who tends to check their expenses. Here are some of the features:

Tracks all expenses – Whether it is something large as paying your monthly home loan EMI or something as small as paying cab fare, you can feed in all your expenses into the app and keep a tab on your spends. The app makes separate categories for your expenses and prepares charts for you to get a better understanding of the money you spend.

Synchronised data entry – The app allows you to simultaneously enter data from your mobile phone, tab or laptop. You can download the app on any device and log in using your Dropbox credentials. This makes it simple for you to enter all your financial details, as soon as you complete a transaction.

Choice of language and currency – The app provides you with a choice of your language and currency. This makes it easy for you to plan your finances even when you travel to a different country and use a different currency.

The Monefy – Money Manager app is thus one of the best money management apps available currently.

7. MTRAKR MONEY MANAGER

The mTrakr Money Manager app is a highly efficient personal management app that allows you to manage your expenses in an excellent manner by offering these features:

SMS Scanning – The app scans your SMS inbox and collects data about all your credit card and debit card spends. You do not have to manually feed in the data to the app regarding your expenses as the data is automatically collected by the app.

Automatic categorizing – The app is one of the few money management apps that has the automatic categorizing feature. The expenses are categorised under different columns and you can see where you have spent throughout the month. This is a very handy feature and allows you to get better results in a quicker manner.

Budget planner – The app also has a budget planning feature with the help of which you can have a customised budget plan ready each month. This helps to make money management a lot easier as you already know what to spend and when to spend.

Expert advice – The app offers expert advice related to money management. If you need any help on how to reduce your monthly expenses or on the different types of investment options, you can find helpful information on the app itself.

The features offered by the mTrakr Money Manager app are very good and helpful for anyone looking to streamline their expenses.

8. EXPENSE MANAGER

The final app to feature on this list is the Expense Manager app. This is another highly-rated and much in use expense manager app that helps people by offering the following benefits:

Free to use – The Expense Manager app is a completely free very easy financial management app to use. It is available to the iOs as well as the Android users across the world.

Track finances – The app has an in-built feature with the help of which it can track all your financial transactions and this can tell you about your expenses. It also keeps a check on your income and tells you how much money you have spent and what you have left in your account.

Picture entry – When you use this app, you do not need to feed in the data related to your expenses manually. You can simply click a photograph of a receipt and upload it on the app and the needful will be done. This is a truly unique feature that makes this app very popular.

Financial calculators – The app has many in-built financial calculators such as the tax calculators, interest calculators, EMI calculators and so on. With the help of these tools, you can easily understand your financial liabilities and see where you need to pay what.

These features are very efficient indeed and make the Expense Manager one of the best personal finance management apps to use in India.

9. QYKLY

The Qykly app is an extremely good and effective personal finance management app that allows you to perform various financial tasks including:

Expense tracker – The app has an expense tracker that allows you to check where you spend your money each month. The expense tracker is easy to use and is very effective in categorizing your expenses in an accurate fashion. Monthly budget maker – If you need help planning your monthly finances, you should ideally make a budget at the beginning of the month. With the help of the Qykly app, you can make a very effective monthly budget and stick to it.

Highly secured – The app uses multiple layers of security with added passwords to ensure your financial data remains safe. Sadly, online financial frauds are very prevalent and so you cannot trust every money management app that you come across. Qykly is a verified and safe app that you can use without any fear or worries whatsoever.

SMS scanner – The app has a feature through which it scans the SMS inbox of your phone. Apart from retrieving financial details through this, the app also identifies travel PNRs and helps you plan your finances when you travel.

These are the unique features that make the Qykly app a very popular wealth management app among users in India.

10. SMART SPENDS

Smart Spends is an app that allows you to keep a comprehensive tab on all your expenses, thereby helping you to streamline your spends and save effectively. The features of this app are:

Automatic aggregation – A very unique feature of this app is that automatically aggregates all your monthly expenses and categorizes them in groups. This makes it very simple for you to check where you spent how much and understand your spending pattern more effectively.

Tracks investments – The app also scans your financial transactions and tracks all your investments. It sends you a report about the same and allows you to keep a tab on your investments as well.

Pays bills – Much like the other personal finance management apps, the Smart Spends app can be used to make monthly bill payments. You can set up the auto-pay options on the app for various dues.

With the help of these features, the Smart Spends app allows you to take charge of your expenses in a smooth and hassle-free manner.

Conclusion -

As you can see, there are some excellent personal money management apps available in India these days. Download the personal finance management apps on to your smart devices and use them diligently to get better control over your finances. The expense manager apps are quite user-friendly and easy to use and they are also available widely.

#Financial Wellness Platform#Employees Financial Wellness#Financial Stress#Employee Retention Guide#Financial Planning Guide#Financial Wellness Guide

0 notes

Text

LTV restrictions dominate broker criteria searches

Covid-19 maximum loan-to-value restrictions was the most searched-for criteria by brokers in both the residential and buy-to-let sector in May, according to Knowledge Bank’s latest tracker. In the residential market “Covid-19: furloughed workers” was the second most popular search term as brokers grappled with lenders’ changes to affordability rules. Second charge brokers also focussed their searches on maximum LTVs and temporary restrictions to LTVs as a result of Covid. In the equity release market each of the top five broker searches changed between April and May illustrating the wide range of borrowers considering later life mortgages. Top equity release searches included: “married couple application in single name”, “flat roofs” and ‘lodger/boarder/rent a room”. Knowledge Bank lender relationship manager Matthew Corker says: “The market is clearly going through a seismic change, with both lenders’ criteria and borrowers’ circumstances undergoing rapid shifts. “As the ‘new normal’ begins to take shape, brokers are going to need to have their wits about them – and make use of all the tools they have available – to keep pace with the changes, and continue to provide their clients with the best possible service.” Tenet Group is to provide its network members and directly-authorised clients with access to Knowledge Bank’s mortgage criteria search system. Knowledge Bank holds more than 100,000 criteria from over 200 lenders enabling brokers to search criteria across the residential, buy-to-let, equity release, self-build, second charges, bridging, commercial and overseas mortgage markets. Knowledge Bank chief executive Searches for ‘Covid-10: temporary maximum LTV restrictions’ topped four mortgage categories in April, shows new data from Knowledge Bank. The search string was number one for residential, buy-to-let, second charge and bridging. Within the residential category, ‘Internal/AVM/desktop valuations’ came second, followed by ‘Covid-10: furloughed workers.’ In BTL, the second position was also based around valuations, Users of Iress’ Xplan Mortgage software are now able to check mortgage product criteria using Knowledge Bank. Since the coronavirus issue took hold in the UK along with the various announcements regarding payment holidays, there have been 4,000 criteria changes, and before this, 9,200 in Q1 2020. “It is clearly impossible for anyone to keep Broker searches for the minimum age at which lenders would allow equity release surged in February, hinting at demand from younger clients. While typically the minimum eligible age for equity release is 55, applied to the youngest application for joint equity release mortgages, this can vary from lender to lender so is often higher. The This guide from Johnson Fleming will take you through the required communication and also give ideas for additional actions that will ensure your auto-enrolment project is a success. The topics in this guide include: the letters you need to send out; what to send and when; the importance of employee engagement; and what to consider as additional communication. More than ever we must display a united front in promoting our industry and helping both colleagues and clients through these difficult times UK Finance says that it expects households to continue snapping up fixed-rate mortgage products despite the dramatic cuts in the Bank of England base rate. The conclusion comes from the trade body’s quarterly household finance review and has been made because of the fact that lenders have committed to continue to offer product transfers to Paradigm Mortgage Services members in England and Wales will now have access to Ipswich Building Society’s products as the lender has lifted its postcode restrictions. From today, Paradigm member firms will be able to register with the Ipswich via its website and begin submitting business within 24 hours and use Ipswich’s intermediary portal for residential, Via mortgagestrategy.co.uk Find The Latest Skipton Mortgage Rates here Read the full article

0 notes

Text

CREDIT MONKEY REVIEW

Credit Monkey Review

A credit repair company can boost your credit score instantly by removing negative items from your credit report. However, many people find them expensive to use. Credit Monkey works differently. They can instantly boost your credit score by 120 points without hidden fees. There is no enrollment fee and you can use the service for only $99 per month. Credit Monkey can help you clean up your past and work toward a better financial future. They are staffed with credit professionals who know how to work for you to get your credit score back to where it should be. They work with the three major credit reporting bureaus to adjust your credit score while you sit back and relax. Here is everything you need to know about Credit Monkey and how they can help instantly boost your credit score.

APPLY NOW

Who is Credit Monkey?

Credit Monkey is a credit repair service that can instantly boost your credit score once you sign up. They have special software that goes over every item on your credit report and disputes any negative items with Experian, Equifax and Transunion. These are the three major credit reporting bureaus that generate your credit report. It’s important to find a service that will work with all three companies to make sure that your credit reports match. You could always try to do this by yourself, but we recommend you leave it to the experts. This is especially true if you have many items on your report that need to be removed!Close Credit Monkey makes it very clear that they offer a specialized product and service. They have been in business since 2010 and are headquartered in Delaware. However, the company’s teams are distributed across the country. Their sales team is in Texas. The legal team is based in New York and the customer service team is located in California. They offer a free consultation to determine whether they can help you. During this meeting, you’ll talk with a manager about your credit situation and how their software and services can help. All of their staff is certified in-house and they go through extensive training and screenings. This means you are guaranteed to speak to a professional financial advisor every time you call.

The team at Credit Monkey makes it easy for you to utilize their service. You can sign up using any mobile device by visiting their website. The team gets started right away after you endorse the electronic agreement and upload all required information. They immediately start preparing disputes on your behalf against the three major credit reporting bureaus. Whereas most companies take months to deliver results, the team at Credit Monkey promises results within ten days. They do this by using the most high tech software available. Every time your credit report changes, they will contact you and conduct a 20 to 30 minute call to discuss the changes and plan for the next bout of disputes. Credit Monkey keeps you well-informed and teaches you how to make better decisions. You’ll be assigned a dedicated account manager as soon as you sign up. He or she can help you make decisions and will advise you on your progress. They will also send you instructions on how to get your credit reports from the three credit reporting bureaus. You’ll be asked to register and run a Credit Wizard program where you’ll be given access to a live personal account manager. You’ll also be given access to your credit reports, an online dashboard, real-time progress reports, and a score tracker. All information is stored on the cloud, which means that you don’t have to worry about backing it up or losing your information. Your dedicated account manager will also keep in touch with you by texting, calling or emailing when changes are made. $99 monthly Negative items and unlimited disputes $199 monthly Negative items + inquiries + unlimited disputes $299 monthly Negative items + public items + inquires + unlimited disputes

Why You Should Choose Credit Monkey

Along with cleaning up your past, Credit Monkey provides you with tools to make sure you make better choices in the future. They are staffed with professionals who know which items on your credit report are bringing your score down and how to get them off. Their professional staff knows the law and will work with the three major credit reporting bureaus to dispute any items that may negatively affect your credit score. Unlike other credit repair services, Credit Monkey does not nickel and dime you by charging for each individual dispute. They allow you to sign up without an enrollment fee and guarantee results before six months. “ Credit Monkey offers a money back guarantee to ensure that you’re getting the best service possible and not falling for a scam. The company identifies more as a financial technology firm than a credit repair service. They were ranked as one of American’s fastest growing companies as a financial technology firm by Inc. Magazine for five years in a row. The company believes that their results speak for themselves. They do not mail dispute letters or fuss with paperwork, faxing, or emailing. They also offer a $1,000 money back guarantee if you’re not satisfied with their services and promise same day service (within 24 hours of signing up). Here is a list of some other guarantees that Credit Monkey offers: $0 enrollment fee $99 per month Permanent removals $1,000 guaranteed money back if Credit Monkey fails to do their job Guarantee approval for an auto or home loan or your money back (no other company in the business offers this guarantee) We like that Credit Monkey guarantees permanent removals from your credit report. This is important because most companies can’t guarantee this. Other companies might be able to remove an item from your past credit history, but there is no guarantee that it won’t show up on your report again in the future. After all, why would you pay a fee for a service to remove items from your report if they are just going to show up again one day? Credit Monkey promises that items that are removed from your credit report will never come back. This means that you won’t have to worry about your credit score dropping again once you work hard to get it back up. They do this by using real time credit tracking software that allows them to track the status of all your accounts. Their software syncs directly to the credit bureaus and is FCRA compliant. Other companies send dispute letters, but this takes weeks and even months to work. This means that you have to continue to pay them for months of service without seeing results.

How Does Credit Monkey Work?

Research shows that a single negative item on your credit report can bring your score down by a whopping 120 points. This can be the difference between getting approved for a loan or a credit card and being denied. A low credit score means you might be denied an auto loan or a house. This is why it’s important to improve your credit score. For many people, their credit is held back by mistakes that were made in the past. You can dispute these negative items with the credit reporting bureaus yourself, but it’s best to leave it to the experts. Otherwise, you can waste a lot of time and money trying to remove items from your report without success. Here is a step-by-step guide to how Credit Monkey works: Sign up online at Credit monkey website and log into your secured client access accountSet up an identity IQ and upload your documentsCredit Monkey will send you a digital agreement. Sign this and return it.Choose your monthly payment option and then open up to 10 active credit accounts.Credit Monkey will get to work right away! Credit Monkey helps you clean up your past, monitor your progress and help you restore your future credit. They work aggressively with the credit reporting bureaus to remove any negative or unfair items from your report. One negative credit item may reduce your score by 120 points. Removing them helps boost your credit score so that you can get back to being approved for major purchases. Then they help you monitor your progress around the clock. They set you up with a client portal that you can access online 24/7. Credit Monkey will send you reminders when they hit key targets. This includes dates and credit changes. You’ll be able to watch your credit score go up right before your eyes.CloseCredit Monkey also gives you access to helpful resources that can help you boost your credit. They have more than 500+ free credit education videos on their website. They also have blogs and articles that can help boost your credit score. You can also meet with your dedicated blog manager to get tips on how you can better manage your finances in the future based on your past spending habits. Finally, Credit Monkey helps you build up so that you don’t even need their services again! They will help you build a solid foundation that you can continue to improve upon in the future. They’ll show you how to move forward with healthy tradelines and activity by guiding you through the credit process. Their goal is to make sure you understand how credit works. After they remove items from your report, they will work hard to ensure you have the tools needed to keep moving forward and improving your credit score. The only service fee they charge is $99 per month. There are no enrollment or hidden fees, and you can use them as both a resource and a credit repair service to get back where you need to be.

Credit Monkey Pros and Cons

A credit repair company holds its value because it boosts your credit score, and there is no price you can put on that! However, credit Monkey is so much more than that. They are equipped with the highest level of technology to ensure that negative items won’t make their way back to your report once removed. They sync their software directly to the three major credit reporting bureaus so that you can track your changes and improvements as they happen. They also provide you with resources and a knowledgeable staff that will help you continue to boost your credit score after you’re done with their services. Credit Monkey offers extensive money back guarantees. This means that you have nothing to lose if you decide to try it. They promise that you’ll be approved for a home or auto loan after using their services or you’ll get your money back. However, many people think that a credit repair service company is not worth their time because they can dispute these challenges themselves. This requires hours of your time preparing dispute letters and then months on end waiting to hear back from them. One of the benefits of working with Credit Monkey is that you don’t have to do this. They hook their software up directly to the credit reporting bureaus and track your progress as you go. It’s an ideal service if you have many negative items that need to be removed. If not, then you may not need it. Here are some pros and cons of the service.

Credit Monkey PROS

$0 enrollment fee (other companies charge you money to sign up)No hidden fees$99 monthly fee, which is much lower than what other companies chargeCredit Monkey has advanced software that other companies don’t (they can sync their software to the credit reporting bureaus to track your progress)You’ll be assigned a dedicated account manager who tracks your account and updates you on changesYou can access your account online 24/7There is a free consultation to help you decide if their services are right for youThey provide you with helpful resources to make sure you keep your credit score up once you’re done with their serviceAll negative items that are removed are guaranteed to stay off your report forever (other companies can remove these items, but they may find their way back onto your report later)They do not place an inquiry on your credit report when you sign upThey are certified to operate in all 50 statesThey promise results within 10 days (most companies take up to six months before you see results)No contracts and you can cancel your service anytimeBBB accredited serviceCredit Monkey helps you build your credit by setting up as many as 10 active credit accountsThey are staffed with in-house professionals who know the law and can help remove negative items from your credit report better than you could by yourselfYou can choose from three tiers of services

Credit Monkey CONS

The monthly fee can be high to use their service if you choose the $299 per month plan. However, most companies charge more than this and don’t promise results. Credit Monkey also does not charge an enrollment fee. They use superior technology and are staffed with experts who can help. Plus, there are no contracts and you can cancel your membership at anytime. If you’re not satisfied, remember that there is a $1,000 month back guarantee.

How To Apply Credit Monkey

01. To apply, you’ll need to visit the Credit Monkey website. The website will walk you through their service using a step-by-step guide. The first thing you’ll need to do is fill out a form.02. You’ll need to enter the following details: Your name, Phone number, Email address, Address, Social security number, Date of birth, Your monthly payment plan ($99, $199 or $299 per month)03. Next you’ll be able to sign in through your portal and follow the steps provided by your dedicated account manager. Remember that you can do a free consultation before applying to determine if this service is right for you.CloseConclusion The above review of Credit Monkey is based solely on the opinion of Creditnervana. Credit Monkey uses a four-step process to help repair your credit and then build a foundation for the future. They use superior software that syncs with the three major credit reporting bureaus to track your changes as they knock negative items off your report. Credit Monkey also guarantees that these items will not return to your report in the future. They provide you with the tools you need to help make better financial decisions going forward to ensure your credit score remains in good standing. They also guarantee that you’ll be approved for a car or auto loan after their services. You can choose from three payment options that range from $99, $199 and $299 per month. We recommend doing a free consultation with them to determine if they are a good fit for you before signing up. Read the full article

0 notes

Text

Credit Monkey Review

Credit Monkey Review

A credit repair company can boost your credit score instantly by removing negative items from your credit report. However, many people find them expensive to use. Credit Monkey works differently. They can instantly boost your credit score by 120 points without hidden fees. There is no enrollment fee and you can use the service for only $99 per month. Credit Monkey can help you clean up your past and work toward a better financial future. They are staffed with credit professionals who know how to work for you to get your credit score back to where it should be. They work with the three major credit reporting bureaus to adjust your credit score while you sit back and relax. Here is everything you need to know about Credit Monkey and how they can help instantly boost your credit score.

APPLY NOW

Who is Credit Monkey?

Credit Monkey is a credit repair service that can instantly boost your credit score once you sign up. They have special software that goes over every item on your credit report and disputes any negative items with Experian, Equifax and Transunion. These are the three major credit reporting bureaus that generate your credit report. It’s important to find a service that will work with all three companies to make sure that your credit reports match. You could always try to do this by yourself, but we recommend you leave it to the experts. This is especially true if you have many items on your report that need to be removed!Close Credit Monkey makes it very clear that they offer a specialized product and service. They have been in business since 2010 and are headquartered in Delaware. However, the company’s teams are distributed across the country. Their sales team is in Texas. The legal team is based in New York and the customer service team is located in California. They offer a free consultation to determine whether they can help you. During this meeting, you’ll talk with a manager about your credit situation and how their software and services can help. All of their staff is certified in-house and they go through extensive training and screenings. This means you are guaranteed to speak to a professional financial advisor every time you call.

The team at Credit Monkey makes it easy for you to utilize their service. You can sign up using any mobile device by visiting their website. The team gets started right away after you endorse the electronic agreement and upload all required information. They immediately start preparing disputes on your behalf against the three major credit reporting bureaus. Whereas most companies take months to deliver results, the team at Credit Monkey promises results within ten days. They do this by using the most high tech software available. Every time your credit report changes, they will contact you and conduct a 20 to 30 minute call to discuss the changes and plan for the next bout of disputes. Credit Monkey keeps you well-informed and teaches you how to make better decisions. You’ll be assigned a dedicated account manager as soon as you sign up. He or she can help you make decisions and will advise you on your progress. They will also send you instructions on how to get your credit reports from the three credit reporting bureaus. You’ll be asked to register and run a Credit Wizard program where you’ll be given access to a live personal account manager. You’ll also be given access to your credit reports, an online dashboard, real-time progress reports, and a score tracker. All information is stored on the cloud, which means that you don’t have to worry about backing it up or losing your information. Your dedicated account manager will also keep in touch with you by texting, calling or emailing when changes are made. $99 monthly Negative items and unlimited disputes $199 monthly Negative items + inquiries + unlimited disputes $299 monthly Negative items + public items + inquires + unlimited disputes

Why You Should Choose Credit Monkey