#budgeting for debt repayment

Explore tagged Tumblr posts

Text

How to Manage Finances in a Marriage?

Managing finances in a marriage can be challenging, but with the right approach and mindset, it can also be a rewarding experience. When couples learn to handle their money wisely, they build a stronger foundation for their relationship. Financial planning for couples, budgeting tips for newlyweds, money management in marriage, and joint finances are essential topics that every couple should…

#1. Establish Joint Financial Goals financial goals for couples#aligning financial goals#budget management tips#budget meetings#budget planning process#budget tracking for couples#budgeting advice#budgeting and saving#budgeting apps for couples#budgeting categories for couples#budgeting challenges#budgeting discussions#budgeting for debt repayment#budgeting for emergencies#budgeting for financial goals#budgeting for newlyweds#budgeting goals#budgeting priorities#budgeting process#budgeting strategies for couples#budgeting tips#budgeting tips for married couples#budgeting tools for couples#budgeting worksheets#budgeting worksheets for couples#building an emergency fund#charitable donations#charitable giving goals#charitable giving tips#couples budget meetings

0 notes

Text

She did that

Even though it may be sad, many of us are starting to realize that student loans are not going to be paid off. Before the pandemmy I had over $16,355 in student loans. And like many others I didn’t receive a degree from the loans I took out. After talking with a neighbor and just thinking about my life. I decided to start paying them while they had no interest. I started paying off my debt in March. Keep in mind I am not a high earner (yet) and as of this day 6-15-23 I only have $6,957 left to pay off. I worked so much overtime. I didn’t buy new clothes. I don’t have a sugar daddy. I didn’t side hustle myself to death. I didn’t start a business. I didn’t scam anyone. I JUST WORKED MY 9-5. It was hard, but I will be done paying of my loans before September. I will be writing a post of how and why I decided to take this path. I may even start posting on TikTok. I want to be more open and I stepped away from this platform because I was struggling with some personal issues. Idk if anyone will read this, but if anyone does I want to just say, just start! Whether it’s student loans, taking charge of your health, making meaningful relationships. Just start you’ll mess up and when you do keep going. We’re all human, mess ups happen, and even giving up temporarily by taking breaks. But don’t don’t give up forever you got this! Till next time. Level Up on a Buck, but don’t stay stuck! >>>>> NEXT MANIFESTATION, OR MONEY GRAB?

#NextLevel#Next Level#Level Up#leveling up#level up on a buck#level up advice#debtfreejourney#debtfree#debtmanagement#personal debt#student loan#student loans#debt repayment#more money#money monday#money in the bank#make that money#money#Budget#cash#just girlboss things#bosslady#self sabotage#self love#self care#self improvement#self esteem

13 notes

·

View notes

Text

17 Money Secrets to Help You Become a Millionaire

Hey there, future millionaire! Do you dream of having lots of money one day? Well, guess what? It’s not impossible! In fact, I’m here to share 17 secrets about money that can help you become a millionaire. Sounds exciting, doesn’t it? Let’s dive in!

The earlier you start saving and investing your money, the more it can grow. It’s like planting a seed that grows into a big tree over time.

#personal finance#money management#wealth building#financial goals#saving#investing#budgeting#debt repayment#multiple income streams#emergency fund#financial education#wise investments#tax planning#mindful spending#technology tools#networking#market volatility#financial advice#patience#financial success.

2 notes

·

View notes

Text

How to Avoid Getting Trapped in a Debt Cycle with Personal Loans?

Taking a personal loan can be a smart financial decision when used wisely, but it can also lead to a dangerous debt cycle if not managed properly. Many borrowers find themselves struggling with multiple loans, high-interest rates, and recurring payments that become overwhelming. A debt cycle can damage your credit score, increase financial stress, and make it difficult to achieve long-term financial stability.

In this guide, we will discuss effective strategies to avoid falling into a debt trap with personal loans and how to regain financial control if you are already struggling with multiple debts.

1. Understanding the Debt Cycle

A debt cycle begins when a borrower takes a personal loan but struggles to repay it on time, leading to additional borrowing to cover existing debt. Over time, the accumulated interest and multiple loans create an endless loop of repayments.

Signs You Are in a Debt Cycle:

You are using new loans to pay off old ones.

You struggle to pay EMIs and other financial obligations.

Your credit card balances are constantly maxed out.

You are unable to save due to high loan payments.

2. How to Avoid Falling into a Debt Trap

1. Borrow Only What You Can Afford to Repay

Before applying for a personal loan, assess your ability to repay the amount comfortably. Ensure that your EMI does not exceed 30-40% of your monthly income.

2. Choose the Right Loan Tenure

Selecting an appropriate tenure can help in managing EMIs effectively. A longer tenure reduces your EMI but increases interest costs, while a shorter tenure results in higher EMIs but saves money on interest.

3. Compare Interest Rates Before Borrowing

Different lenders offer different interest rates for personal loans. Compare various loan options and choose the one with the lowest interest rate to reduce your repayment burden.

4. Avoid Unnecessary Borrowing

Many borrowers take out multiple loans for non-essential expenses like vacations, luxury items, or frequent shopping. Avoid unnecessary borrowing and focus on loans that serve essential financial needs.

5. Maintain a Good Credit Score

A high credit score helps you secure loans at lower interest rates. Pay your EMIs and credit card bills on time, avoid late payments, and monitor your credit report regularly.

6. Build an Emergency Fund

An emergency fund helps you cover unexpected expenses without relying on loans. Aim to save at least 3-6 months’ worth of expenses in a separate account.

7. Avoid Taking Multiple Loans Simultaneously

Managing multiple loans can be challenging, leading to increased financial stress. Try to clear existing debts before applying for a new personal loan.

8. Negotiate Loan Terms with Your Lender

If you are struggling with repayment, speak to your lender about restructuring your loan, reducing interest rates, or extending the tenure.

9. Pay More Than the Minimum EMI

If possible, pay extra towards your loan principal to reduce the outstanding balance faster and lower interest costs.

10. Track Your Expenses and Budget Wisely

Keeping track of your spending habits can help you identify areas where you can cut costs and allocate more funds towards loan repayments.

3. How to Get Out of a Debt Cycle

If you are already struggling with multiple loans, here’s how you can regain control of your finances:

1. Prioritize High-Interest Debts First

Follow the avalanche method by paying off the highest-interest loan first while making minimum payments on others. This will reduce overall interest costs over time.

2. Consider a Debt Consolidation Loan

A debt consolidation loan combines multiple debts into one with a lower interest rate, making repayment easier and reducing overall interest expenses.

3. Refinance Your Loan for Lower Interest Rates

If interest rates have dropped, refinancing your personal loan with a lower rate can help reduce EMIs and overall repayment costs.

4. Increase Your Income

Look for ways to increase your earnings, such as freelancing, part-time jobs, or selling unused assets to help pay off loans faster.

5. Reduce Unnecessary Expenses

Cut back on luxury spending, dining out, and other non-essential expenses to free up cash for debt repayment.

6. Use Windfalls to Pay Off Debt

Any unexpected financial gains, such as bonuses, tax refunds, or incentives, should be directed toward loan repayment rather than spent on unnecessary purchases.

7. Seek Financial Counseling

If you are struggling to manage your debt, consult a financial advisor who can provide professional guidance and suggest personalized debt repayment strategies.

4. The Long-Term Impact of Managing Debt Wisely

Avoiding a debt cycle and managing personal loans effectively can have several long-term benefits:

Improved Credit Score: Timely payments and reduced debt levels contribute to a stronger credit profile.

Lower Stress Levels: Managing debt effectively reduces financial stress and provides peace of mind.

Better Financial Opportunities: A healthy financial profile increases your chances of qualifying for lower-interest loans and better financial products.

Increased Savings and Investments: Avoiding debt traps allows you to save and invest more for future financial goals.

5. Conclusion: Take Control of Your Debt Today

A personal loan can be a helpful financial tool when used responsibly, but it can also lead to financial instability if not managed properly. To avoid getting trapped in a debt cycle, borrow wisely, track your expenses, and prioritize timely repayments.

If you are already facing financial difficulties, take proactive steps to restructure your debts, increase your income, and seek professional advice if necessary. By making informed financial decisions and maintaining disciplined borrowing habits, you can achieve long-term financial stability and avoid the pitfalls of excessive debt.

#nbfc personal loan#personal loan online#fincrif#loan apps#bank#personal loans#finance#personal loan#loan services#personal laon#Personal loan#Debt cycle#Loan repayment#Financial planning#Loan management#Debt consolidation#Loan interest rate#EMI management#Credit score improvement#Loan refinancing#Debt trap#Budgeting tips#Loan prepayment#Loan restructuring#Loan default#Debt-to-income ratio#Emergency fund#Financial stability#Loan settlement#Personal finance tips

0 notes

Text

Mastering Debt Management: The Key to Financial Freedom

Introduction Mastering Debt Management: Debt can be a significant obstacle to achieving financial freedom. Whether it’s credit card debt, student loans, or a mortgage, managing debt effectively is crucial for financial success. In this comprehensive guide, we’ll explore powerful strategies to master debt management, regain control of your finances, and pave the way to financial independence.

Understanding Different Types of Debt:

#Mastering debt management#Debt management#Financial freedom#Debt repayment strategies#Credit card debt#Debt consolidation#Budgeting tips#Emergency fund#Financial planning#Master Your Finances course#Debt-free living

0 notes

Photo

Is it Really That Simple? I question whether financial management is really as simple as income minus expenses equals savings. Common beliefs about saving while carrying debt, arguing that true financial stability comes from prioritizing debt repayment over building emergency funds. The discussion touches on key financial habits, including the impact of high-interest debt, home equity lines of credit (HELOCs), and why debt should never be mistaken for financial security. Thought-provoking and practical, this post encourages readers to rethink their approach to debt and savings. #debtfreeliving, #financialplanning, #savingmoney, #budgeting, #debtrepayment, #HELOC, #emergencyfund (via Is it Really That Simple?)

0 notes

Text

Budgeting 101: The Simple Steps to Take Control of Your Finances

Written by D. Marshall Jr Are you tired of living paycheck to paycheck, feeling stressed about money, or wondering where all your hard-earned cash goes each month? If so, you’re not alone. I’ve learned that many people struggle with managing their finances, but the good news is that budgeting can empower you to take control of your financial future. In this guide, we’ll explore the essentials of…

#50/30/20 Rule#Budgeting#Debt Repayment#Expense Tracking#Financial Goals#Financial Literacy#Money Management#Personal Finance#Savings Tips#Zero-Based Budgeting

0 notes

Text

How to Finally Pay Off Your Student Loan Debt

Perhaps like millions of others, student loan debt is that dark cloud that hovers over you. Every month, you pay off the obligations, but the balance barely seems to budge. Frustrating, exhausting, and often wondered with a sense of hopelessness: “Will I ever be debt-free?” Yes, it’s possible – once one plans and commits – to pay off student loan debt. Here’s how you can regain control of your…

#Budgeting Tips#debt repayment plan#debt-free#financial freedom#pay off debt#personal finance#student loan forgiveness#student loan repayment#Student Loans

0 notes

Text

Mastering Student Loans: A Guide to Managing, Repaying, and Refinancing Your Debt

Student loans can be a significant financial burden, but with the right strategies, you can effectively manage, repay, and even refinance your debt to improve your financial health. Whether you’re just starting to pay off your student loans or looking for ways to make your payments more manageable, this guide will walk you through the key steps to managing student loans and offer tips to help you stay on top of your repayment plan.

1. Understanding Your Student Loans

Before you can effectively manage your student loans, it’s essential to understand what type of loans you have and the terms associated with them. Here are the key things to know:

Federal vs. Private Loans: There are two main types of student loans: federal and private. Federal loans are funded by the government and typically offer more borrower protections, such as income-driven repayment plans and loan forgiveness options. Private loans are provided by banks, credit unions, or other lenders and may have variable interest rates and fewer repayment options.

Loan Terms and Interest Rates: Each loan comes with specific terms, including the interest rate, repayment period, and monthly payment amount. Federal loans often have fixed interest rates, while private loans may have fixed or variable rates. Understanding these terms is crucial for creating a repayment plan that works for you.

Grace Periods: Most federal student loans have a grace period, typically six months after you graduate or leave school, during which you don’t have to make payments. Private loans may or may not offer a grace period. It’s important to know when your payments will begin so you can prepare.

To help you stay organized and keep track of your loans, consider using a Student Loan Tracker.

Student Loan Tracker: Available on Amazon, this tracker helps you organize your loans, track your payments, and monitor your progress toward repayment. Check it out here.

2. Creating a Repayment Plan

Once you’ve identified the type of loans you have and their terms, the next step is to create a repayment plan that fits your budget and financial goals. Here’s how to get started:

Choose the Right Repayment Plan: Federal student loans offer several repayment plans, including standard, graduated, and income-driven options. Standard repayment plans have fixed payments over 10 years, while graduated plans start with lower payments that increase over time. Income-driven plans base your monthly payments on your income and family size, which can make payments more affordable.

Prioritize High-Interest Loans: If you have multiple loans, prioritize paying off the ones with the highest interest rates first. This will reduce the total interest you pay over time and help you pay off your loans faster. Continue making the minimum payments on all your loans while putting extra money toward the highest-interest loan.

Consider Auto-Pay: Many lenders offer a discount on your interest rate if you sign up for automatic payments. Auto-pay ensures that you never miss a payment and can save you money over the life of the loan.

Explore Deferment or Forbearance: If you’re experiencing financial hardship, you may qualify for deferment or forbearance, which temporarily pauses your loan payments. However, interest may continue to accrue, so these options should be used as a last resort.

To help you create a repayment plan and stay on top of your payments, consider using a Student Loan Repayment Calculator.

Student Loan Repayment Calculator: Available online, this tool helps you estimate your monthly payments, compare repayment plans, and see how extra payments can reduce your loan balance. Check it out here.

3. Making Extra Payments to Pay Off Your Loans Faster

One of the most effective ways to pay off your student loans faster is by making extra payments whenever possible. Here’s how to do it:

Pay More Than the Minimum: If you can afford to, pay more than the minimum amount due each month. Even small extra payments can make a significant difference over time by reducing the principal balance and the amount of interest you’ll pay.

Make Biweekly Payments: Instead of making one monthly payment, consider splitting your payment in half and paying biweekly. This results in an extra payment each year, which can help you pay off your loans faster without significantly impacting your budget.

Apply Windfalls to Your Loans: If you receive a windfall, such as a tax refund, bonus, or inheritance, consider using a portion of it to make an extra payment on your student loans. Lump-sum payments can have a big impact on reducing your loan balance.

To help you track your extra payments and stay motivated, consider using a Debt Snowball Tracker.

Debt Snowball Tracker: Available on Amazon, this tracker helps you visualize your progress and stay motivated as you pay off your loans. Check it out here.

4. Refinancing Your Student Loans

Refinancing your student loans can be a great way to lower your interest rate and reduce your monthly payments, especially if you have private loans with high-interest rates. Here’s what you need to know about refinancing:

Eligibility: To qualify for refinancing, you typically need a good credit score, steady income, and a low debt-to-income ratio. If you don’t meet these criteria, you may need a co-signer to qualify for a lower interest rate.

Pros and Cons of Refinancing: The main advantage of refinancing is the potential to lower your interest rate, which can save you money over the life of the loan. However, if you refinance federal loans into a private loan, you’ll lose access to federal protections, such as income-driven repayment plans and loan forgiveness options.

Shop Around for the Best Rates: Different lenders offer different interest rates and terms, so it’s important to shop around and compare offers before refinancing. Look for lenders that offer low fixed rates, no origination fees, and flexible repayment terms.

To compare refinancing offers and find the best option, consider using a Student Loan Refinancing Comparison Tool.

Student Loan Refinancing Comparison Tool: Available online, this tool helps you compare rates and terms from different lenders to find the best refinancing option for your situation. Check it out here.

5. Exploring Loan Forgiveness and Repayment Assistance Programs

If you work in certain professions or meet specific criteria, you may be eligible for loan forgiveness or repayment assistance programs that can help reduce or eliminate your student loan debt. Here are some common programs to explore:

Public Service Loan Forgiveness (PSLF): This federal program forgives the remaining balance on your federal student loans after you’ve made 120 qualifying monthly payments while working full-time for a qualifying employer, such as a government agency or nonprofit organization.

Teacher Loan Forgiveness: If you’re a teacher working in a low-income school or educational service agency, you may be eligible for up to $17,500 in loan forgiveness on your federal student loans after five years of service.

Income-Driven Repayment Forgiveness: If you’re enrolled in an income-driven repayment plan, any remaining balance on your federal student loans will be forgiven after 20 or 25 years of qualifying payments, depending on the plan.

State-Based Repayment Assistance Programs: Some states offer repayment assistance programs for borrowers who work in specific fields, such as healthcare, law, or education. These programs vary by state, so check with your state’s higher education agency to see what’s available.

To see if you qualify for loan forgiveness or repayment assistance, consider using a Loan Forgiveness Eligibility Tool.

Loan Forgiveness Eligibility Tool: Available online, this tool helps you determine whether you qualify for federal loan forgiveness programs and provides guidance on how to apply. Check it out here.

Conclusion

Managing student loans can be challenging, but with the right strategies, you can stay on top of your payments, pay off your debt faster, and explore options for refinancing or loan forgiveness. By understanding your loans, creating a repayment plan, and making extra payments when possible, you’ll be well on your way to reducing your student loan debt and improving your financial future.

Remember, paying off student loans is a marathon, not a sprint. Stay patient, stay consistent, and celebrate your progress along the way.

Helpful Items and Services Recap:

Student Loan Tracker

Student Loan Repayment Calculator

Debt Snowball Tracker

Student Loan Refinancing Comparison Tool

Loan Forgiveness Eligibility Tool

With the right tools and resources, you can take control of your student loans and work toward a debt-free future. You’ve got this!

#college#university#loans#budget#loan#finance#adulting#student#student life#academics#studying#study#tracker#tools#repayment#forgiveness#debt#snowball#refinance

1 note

·

View note

Text

Top 10 Budgeting Tips for Beginners: Start Managing Your Finances Today

Exciting news! Our new article, "10 Essential Budgeting Tips for Beginners: Take Control of Your Finances Today," is now live! Learn how to create a budget, save for emergencies, and more. Start your journey to financial stability now!

Budgeting At a Glance Budgeting is more than just a tool; it’s a powerful skill that empowers individuals to take control of their financial situation and achieve their financial goals. Whether you dream of a vacation, want to eliminate debt, or build an emergency fund, a well-structured budget can be your key to success. Starting a budget may seem daunting, especially if you’re new to it. But…

View On WordPress

#beginner&039;s guide to budgeting#budget planner#budgeting for beginners#budgeting strategies#budgeting tips#create a budget#debt repayment#effective budgeting tips#emergency fund#financial goals#financial literacy#financial planning#financial stability#how to budget#manage finances better#money management#personal finance#reduce expenses#save money#track spending habits

1 note

·

View note

Text

Discover the truth about $5000 personal loans in our in-depth blog post. Understand the hidden monthly costs and learn effective strategies to manage financial uncertainty. Whether you're considering a loan or already have one, gain valuable insights to make informed decisions. Click now to read more and take control of your finances!

#$5000 Personal Loans#Personal loan interest rates#Monthly payment calculation#Loan repayment strategies#Financial planning tips#Credit score impact#Loan application process#Managing loan payments#Debt consolidation#Budgeting for loans#Unsecured personal loans#Personal loan benefits#american#Hidden loan fees#Loan terms and conditions#Comparing loan offers#Fixed vs. variable interest rates

0 notes

Text

I am Trapped in Loan Cycle: How to Get Out of It?

Being trapped in a loan cycle can feel like you are on a never-ending financial treadmill. With each step, you struggle to keep up with the interest and payments, only to find yourself borrowing more just to stay afloat. If you find yourself in this daunting situation, know that there is a way out. Here are some steps to break free from the loan cycle and regain control of your financial…

View On WordPress

#avoid new debt#budgeting#credit counseling#debt consolidation#debt relief#debt repayment strategies#financial health#increase income#loan cycle#money-saving habits

0 notes

Text

Transform Your Finances in 2024: 8 Powerful Financial Resolutions to Follow

Powerful Financial Resolutions to Follow In 2024, it’s time to reflect on the past and pave the way for a brighter future in work, health, and, most importantly, finances. Seize the opportunity to take charge of your financial destiny by setting meaningful New Year’s resolutions. In this guide, discover eight financial resolutions that will propel you towards a more prosperous and secure…

View On WordPress

#budgeting#credit score#debt repayment#financial future#financial goals.#financial literacy#financial resolutions#financial stability#goal setting#investment portfolio#New Year&039;s resolutions#personal finance#progress monitoring#retirement planning#wealth management

0 notes

Text

How to Create a Financial Plan for Personal Loan Repayment?

A personal loan can be a great financial tool to manage unexpected expenses, fund major purchases, or consolidate debt. However, repaying the loan on time is crucial to maintaining financial stability and a good credit score. Without a well-structured financial plan, borrowers may struggle with high EMIs, increasing debt burden, and late payment penalties.

In this guide, we will walk you through the essential steps to create an effective financial plan for personal loan repayment. By following these strategies, you can ensure timely payments, reduce financial stress, and even save on interest costs.

1. Assess Your Current Financial Situation

Before creating a loan repayment plan, take a close look at your financial standing. Analyze:

✔ Total outstanding loan amount – Check how much of your personal loan is still unpaid. ✔ Monthly income sources – Identify your salary, freelance earnings, or passive income. ✔ Existing expenses – List fixed costs such as rent, utilities, and daily expenses. ✔ Other financial commitments – Include credit card dues, other loans, or savings goals.

How This Helps:

Knowing your income and expense balance allows you to set a realistic repayment strategy without overburdening your finances.

2. Choose the Right EMI Structure

Banks and NBFCs (Non-Banking Financial Companies) offer different EMI (Equated Monthly Installment) options based on loan tenure and interest rates. Choosing the right EMI structure can impact your repayment ability.

Types of EMI Options:

✔ Fixed EMI – The EMI remains the same throughout the loan tenure. ✔ Step-Up EMI – Lower EMIs at the start, which gradually increase over time. ✔ Step-Down EMI – Higher EMIs in the beginning, reducing over time.

How to Choose:

If your income is stable, a fixed EMI is ideal.

If you expect future salary hikes, a step-up EMI might be beneficial.

If you want to clear the debt quickly, a step-down EMI reduces interest outgo.

3. Set a Monthly Budget for Loan Repayment

Once you decide on your EMI, incorporate it into a monthly budget to ensure on-time repayment.

Steps to Create a Loan Budget:

✔ Allocate 30-40% of your income towards loan repayments. ✔ Cut back on unnecessary expenses like luxury purchases or frequent dining out. ✔ Prioritize essential expenses, such as rent, groceries, and utility bills. ✔ Avoid taking on new debt while repaying your existing personal loan.

💡 Pro Tip: Use budgeting apps or an Excel sheet to track expenses and ensure EMI payments are made on time.

4. Consider Making Prepayments to Reduce Interest Costs

If you have surplus funds, consider prepaying your personal loan to lower the outstanding principal and reduce interest payments.

Benefits of Prepayment:

✔ Reduces total interest payable over the loan tenure. ✔ Shortens the loan duration, helping you clear debt faster. ✔ Improves your credit score, making future loan approvals easier.

Things to Check Before Prepaying:

✔ Confirm whether your lender charges prepayment penalties (some banks charge 1-3% of the outstanding amount). ✔ Choose the right time – Prepaying early in the loan tenure gives the highest interest savings.

5. Create an Emergency Fund to Avoid Loan Defaults

Unexpected expenses like medical emergencies, job loss, or urgent home repairs can impact loan repayment. To prevent missing EMIs, set up an emergency fund.

How to Build an Emergency Fund:

✔ Save 3 to 6 months’ worth of expenses in a separate savings account. ✔ Use high-interest savings accounts or liquid mutual funds for quick access. ✔ Avoid using your emergency fund for discretionary expenses.

Having an emergency fund ensures that you can continue EMI payments even during financial setbacks.

6. Consider a Loan Balance Transfer for Lower Interest Rates

If your current personal loan has a high-interest rate, refinancing it through a loan balance transfer can help you reduce EMI payments.

Steps for a Loan Balance Transfer:

✔ Compare interest rates from different banks or NBFCs. ✔ Check for processing fees or balance transfer charges. ✔ Ensure that the new lender offers lower EMIs or better loan terms. ✔ Transfer the remaining loan amount to the new lender and enjoy reduced interest costs.

This strategy can help you save thousands in interest payments over time.

7. Use Windfalls or Bonuses for Repayment

If you receive a salary bonus, tax refund, or unexpected cash inflow, consider using a part of it to repay your personal loan.

Why Use Windfalls for Loan Repayment?

✔ Reduces outstanding loan balance and lowers EMI burden. ✔ Helps you become debt-free faster. ✔ Saves on total interest costs over the loan tenure.

Instead of spending bonus money on luxury purchases, use it for loan prepayment to improve financial stability.

8. Set Up Auto-Debit for EMI Payments

Late payments not only attract penalties but can also damage your credit score. To ensure timely EMI payments, set up an auto-debit feature with your bank.

Benefits of Auto-Debit for Loan EMIs:

✔ Avoids late payment penalties. ✔ Reduces the risk of missing EMI deadlines. ✔ Keeps your credit score intact.

Ensure that your bank account always has sufficient funds before the EMI due date to prevent auto-debit failures.

9. Avoid Taking Additional Debt During Repayment

Taking new loans while repaying your existing personal loan can increase financial pressure.

Why Avoid Multiple Loans?

✘ Increases monthly debt obligations. ✘ Affects your Debt-to-Income (DTI) ratio, reducing future loan eligibility. ✘ May result in higher interest rates on future borrowings.

Instead of taking on new loans, focus on repaying your current personal loan before considering new financial commitments.

10. Track Your Loan Repayment Progress Regularly

Monitor your loan repayment progress to ensure you are on track.

How to Track Loan Repayment:

✔ Check your loan statement regularly to see outstanding balance and interest paid. ✔ Use a loan EMI calculator to estimate prepayment benefits. ✔ Contact your lender to understand any modifications or restructuring options.

Tracking your progress helps you stay motivated and make adjustments to your financial plan if needed.

Final Thoughts: Stay Disciplined for a Debt-Free Future

Repaying your personal loan doesn’t have to be overwhelming. By creating a structured financial plan, you can:

✔ Make timely EMI payments. ✔ Reduce total interest costs. ✔ Improve your credit score. ✔ Become debt-free faster.

Following the above strategies will help you manage your personal loan repayment efficiently and achieve long-term financial stability.

#personal loan online#fincrif#loan apps#nbfc personal loan#personal loans#loan services#personal laon#personal loan#finance#bank#Personal loan#Loan repayment plan#Personal loan EMI#Debt repayment strategy#Loan prepayment#Loan balance transfer#Personal loan interest rate#Personal loan tenure#Loan repayment schedule#Personal loan EMI calculator#How to repay a personal loan#Debt management tips#Budget for loan repayment#EMI auto-debit#Loan prepayment penalty#Personal loan default impact#How to save on loan interest#Best way to repay a personal loan#Loan refinancing benefits#Debt-to-income ratio improvement

1 note

·

View note

Text

Conquering the Goliath: Advanced Maneuvers in the Student Loan Arena

Consolidation: The Unifier of Your Debt Battalions Consolidation is like summoning a council of your debts, uniting them under one banner for easier management. It’s not for everyone, but for those juggling multiple loans, it’s a strategy worth considering. Imagine Alex, who consolidated his federal loans, and found himself facing a single enemy instead of a horde, making his repayment strategy…

View On WordPress

#budgeting tips#celebrating financial milestones#credit score improvement#debt reduction strategies#emergency fund building#financial planning for graduates#income-driven repayment#investing while in debt#loan negotiation techniques#mental health and finances#personal finance education#post-debt financial planning#student loan management#student loan refinancing#student loan tax deductions

0 notes

Text

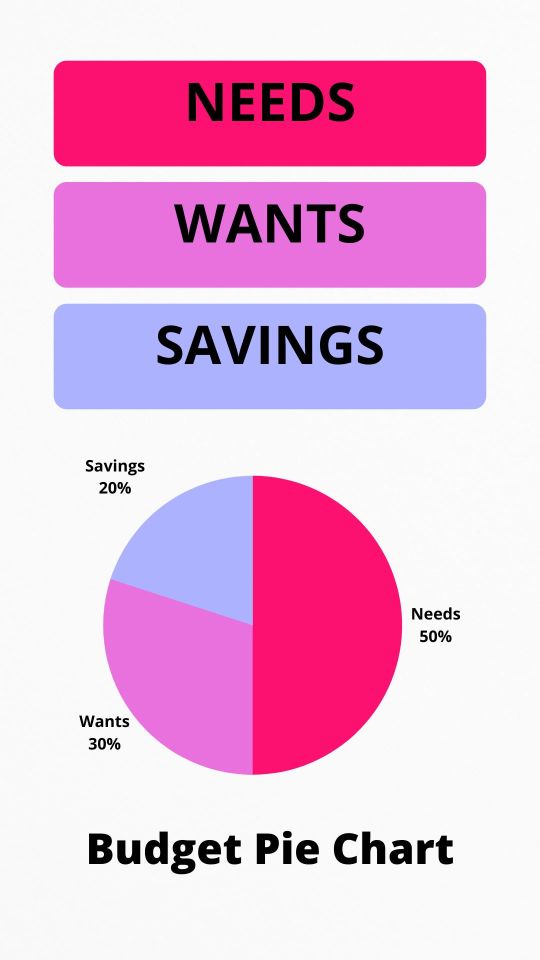

What is the 50/30/20 rule?

The 50/30/20 rule is a simple budgeting method that can help you to reach your financial goals. It divides your after-tax income into three categories: 50% for needs 30% for wants 20% for savings and debt repayment Needs are expenses that you must pay in order to live, such as housing, food, transportation, and utilities. Wants are expenses that are not essential, but that you enjoy, such as…

View On WordPress

0 notes