#books to learn finances

Explore tagged Tumblr posts

Text

The Best Books For Learning About Personal Finances

Your ability to make smart money decisions determines a lot about your quality of life. But, knowledge on how to manage your finances, save, invest, accumulate wealth, etc., is only sometimes known by learning. We at GreenSprout are dedicated to helping you make the best financial decisions for your family and future. Our GreenSprout team has outlined the best personal finance books and financial resources everyone must read before the year runs out.

The Best Personal Finance Books Everyone Must Read

I Will Teach You To Be Rich - Ramit Sethi

Ramit Sethi is a popular personal finance author. In this book, he outlines a six-week plan to live your best life according to your definitions. The book teaches its audience how to open high-yield savings accounts to earn interest, automate their account to save monthly, use credit cards, and maximize rewards. "I Will Teach You To Be Rich" helps you to strategize with your money and build money-making systems. The book is easy to read and understand. Many readers have testified of its impact after reading it.

The Automatic Millionaire - David Bach

This book borders mainly on how to automate your finances. It preaches that there are certain ways that you can set up your finances to allow them to operate on their own and develop into wealth.

The Simple Path To Wealth: Your Road Map To Financial Independence and a Rich, Free Life- JL Collins

This book is targeted at anyone who wishes to retire early. The different principles outlined in the book were written as though the author was writing a letter to his daughter. The book explicitly explains complicated details and provides lots of actionable advice on accumulating wealth. The book is rated 4.8 stars and has more than 3800 reviews on Amazon.

Retire Before Mom And Dad - Rob Berger

This book is majorly for anyone who wishes to get wealthy and retire early. It swims through the principles that make early retirement and financial independence possible. You can still read this book to learn the secrets to wealth, even if you do not wish to retire early.

Spend Well, Live Rich: How To Get What You Want With The Money You Have - Michelle Singletary

This book reflects on the life of the author's grandmother, who was able to raise five children; the author inclusive on a modest salary. The author discusses the principles that her grandmother used to maximize what she had. The book is best for anyone seeking budgeting inspiration or a beginner in personal finance.

youtube

When She Makes More- Farnoosh Torabi

Farnoosh Torabi is a personal finance expert and author. In this book, she discusses her reality as the breadwinner and a woman in an opposite-sex relationship. She discusses the struggles, realities, pros, and cons and explains how they maximize earnings while minimizing conflict.

The Financial Diet: A Total Beginner's Guide To Getting Good With Money - Chelsea Fagan and Lauren Ver Hage

This book generally helps readers to know more about money and life. It is best for young adults as it discusses investments, budgeting, retirement savings, debt repayment, etc. The book is very actionable and easy to understand.

#greensprout#greensprouttips#personal finances#finances#greensprout finances tips#books to learn finances#best books for personal finances#Youtube

2 notes

·

View notes

Text

The more you learn, the more you earn!!

#money#investing#finance#investment#i love books#love books#top books#best books#books#knowledge#learning#learnsomethingneweveryday#learn#stocks#save money#warren buffett#thereadmind#thereadmind.com#reading#bookish#life quotes#book#motivating quotes#inspiring quotes#quote#quoteoftheday#life quote#quotes#book quote

26 notes

·

View notes

Note

advice for people just wanting to be educated in the finance field?

I would start dipping your toe in the finance sections of reputable sources (i.e. Financial Times, Wall Street Journal, Harvard business review, MarketWatch, etc.) and start researching terms and companies you don’t know. I treat myself with a Bloomberg Businessweek subscription sent to my home because I love their design team and it’s actually very informative. You can also sign up for the Morning Brew finance newsletter, it’s free and I read it every morning to get a brief overview of what’s going on. Even just being informed of current events is helpful in learning about finance because all major events effect the market and businesses. Look at stock performance charts. Learn about different types of investment accounts and different kinds of investments. There are a lot of really great courses on platforms like Coursera as well, I just took one called Private Equity & Venture Capital from Università Bocconi. Flirt with equity crowdfunding platforms (I accidentally made a lot of money on one of these as an early investor with less than $1k). If you live in the US start looking into personal and business tax deductions. Even credit card rewards can actually get you a lot, I’ve gotten free hotel rooms and free flights from money I would have spent anyway. Investments also mean more than just individual stocks: could be index funds, mutual funds, bonds, CDs, REITs, forex, precious gems & metals, real estate, even some designer goods retain and increase in value if bought strategically and handled correctly. Even just having the fundamentals of a maxed out retirement account (a Roth IRA or a backdoor Roth IRA is my personal preference) full of index funds and mutual funds that are balanced well, a fully funded emergency fund of 3-12 months personal expenses, any debt above 7% interest paid off, and sinking funds for various expenses automatically set up in a high yield savings account will have you very well off. When you have a foundation like that you have the breathing room to change careers, take time off, buy investment properties, invest in volatile but potentially profitable ventures, start businesses, and set up additional streams of income.

#i am not a financial advisor but this is what I’ve learned from school and self education and personal trial and error#i think I’m gonna do a detailed finance books list if y’all would like that I think it could be very useful

152 notes

·

View notes

Text

WISDOM FROM RICH DAD.

From the book Rich DAD Poor DAD, by Robert Kiyosaki

1. Don’t work for money:

Rich don’t work for money. If you work for money, your mind will start thinking like an employee. If you start thinking differently like a rich man, you will see things differently. Rich works on their asset column, every dollar in their asset column is their hard-working employee.

2. Don’t be controlled by emotions:

Some people’s lives are always controlled by the two emotions of fear and greed. Fear keeps people in this trap of working hard, earning money, working hard, earning money, and hoping that it will reduce their fear. Secondly, most of us have the greed to get rich quickly. Yes, many people become rich overnight, but they have no financial education. So educate yourself and don’t be greedy or fearful.

3. Acquire assets:

Don’t buy liabilities on your way to financial freedom. People buy liabilities and think these are assets, but they are not. Many people buy luxuries first, like big cars, heavy bikes, or big houses to live in. But the rich buy assets and their assets buy luxuries. The rich buy houses and rent them, and they pay them for their Lamborghinis. The poor or middle class buy luxuries first, and the rich buy luxuries last.

4. Remember the KISS principle:

KISS stands for keeping it simple, and stupid. Don’t be too overloaded your mind when you are going to start your way to financial freedom. Things are simple and keep them simple. The simple thing to remember is assets put money in pocket and liabilities take money out of pocket. Always buy assets so they put money into your pocket.

5. Know the difference between assets and liabilities:

Assets are anything that puts money in your pocket, like stocks, bonds, real estate, mutual funds, rental properties, etc. Liabilities are anything that pulls money out of your pocket, like your house, your car, debt, etc. People think their home is their biggest asset, but it is not. A house is an asset when it generates money like when you rent a house, it generates money, and when your life in that house becomes a liability.

6. Don’t be a financial illiterate:

A person can be highly educated and become successful in their profession, but financially illiterate. Financial education is very important for any individual. Our schools and colleges did not teach us financial education. Many financial problems arise as a result of a lack of financial education. Start learning financial education and I suggest you read the book "Rich Dad, Poor Dad".

7. Increase your Wealth:

Wealth is defined as a person's ability to survive for a certain number of days in the future, or how long they could survive if they stopped working today. Consider your wealth and whether you would survive if you stopped working today for a year.

8. Mind your own business:

If you have a job, keep your job and start a part-time business and work it. Use the time that you spend on your iPhone, parties, or any other activity, to build your business. Never leave your job until you build your own business. Don’t struggle all of your life for someone else. Start your own business and grow your business.

9. Train your mind:

Your biggest asset is your mind. Many individuals watch opportunities with their eyes, but if you train your mind, you can see opportunities with your mind. If you train your mind well, it can create enormous wealth.

10. Learn technical skills:

Your financial IQ will be raised by learning these four technical skills:

Accounting is defined as the ability to read numbers. If you want to build an empire, then this is an essential skill. By learning this skill, you will be able to understand the strength and weaknesses of a business.

Investing: It is the science of making money.

Understanding markets: It is the science of supply and demand.

The Law: A person who has knowledge of the law of tax advantages and corporations can get rich faster than others.

11. Find opportunities that everyone else missed:

"Great opportunities are not seen with your eyes. They are seen with your mind. "

You can see many more opportunities with your mind than many people miss with their eyes. It is not rocket science, you just need to train your mind.

12. Learn to manage risk:

Investment is not risky, not knowing the investment is risky. If you want to reduce the risk, then increase your knowledge. This knowledge will not come by going to college, it will come by reading books or sitting with people who know the investment.

13. Learn management:

The main management skills are:

Management of cash flow

Management of system

Management of people

Sales and marketing are the most essential skills. The ability to sell and the ability to communicate with another human being, be it a customer, employee, fiancé, friend, or child, is a basic skill of personal success.

14. Manage fear:

“Failure inspires winners. Failure defeats losers.”

Everyone has a fear of losing money.

#books and reading#books#financial literacy#financial planning#personal finance#learning#positive thoughts#thepersonalquotes#beautiful words#self improvement#side hustle#entreprenuerlife#foryou

2 notes

·

View notes

Text

being actually so serious I thought I knew what inflation was and then someone explained to me the concept of "greedflation"/price gouging and ever since then I feel like I must be missing something because everyone's acting like those are those are different things like?????? "greedflation is when prices are raised even though supplies cost the same because it will generate more profit for the seller" ok "inflation is that also but instead of saying the seller did that we say the Market did and it was unavoidable!! but yes the seller is bringing in more profit as a result" like??? is something material actually different between inflation and greedflation or is it literally just a kind of framing device. bc if there is something material I am not comprehending it

#good idea generator#irl i actually learned what inflation was first and i was like ok!#until yrs later when i read about 'greedflation#which was defined in literally exactly the same way that i understood inflation#with a one sentence note that legitimized the concept of inflation w/o explaining#like (paraphrased bc swiss cheese memory) 'although inflation is a serious economic concern; greedflation is...'#which did not help at all because what i really needed was for someone to define them both right next to each other#admittedly i could try harder to fill this gap in my knowledge#i have tried to read books about finances but a large portion of them#are written by guys trying to be discount jordan belfort. and i dont even respect the name brand jordan belfort#so you can imagine i have dnf'd many economics related text for annoyingness of narrative voice

6 notes

·

View notes

Text

I have decided that I do not need to be the goth gf of a finance bro, I am going to become my own finance bro

#ive been BINGING financial literacy material i am so overwhelmed but i can feel the wrinkles forming in my brain#i have bought two starter books on finance#i am learning about high yield savings accounts#gonna dip my toes in investments#i wanna own a house#no one around me is gonna break the generational poverty so i guess i must

6 notes

·

View notes

Text

Why Charisma University’s Bachelor of Science in Finance is Your Gateway to Success

Charisma University stands out as a leader in finance education, offering a Bachelor of Science in Finance program designed to prepare students for the dynamic world of finance. Our program provides a comprehensive understanding of financial principles, markets, and instruments, ensuring that graduates are well-equipped to navigate the complexities of the financial sector.

What sets Charisma University apart is our commitment to real-world application. Our curriculum is not just theoretical but also practical, with case studies, simulations, and internships that immerse students in the realities of finance. This hands-on approach ensures that students graduate with the skills and experience needed to excel in the workplace.

Our faculty comprises seasoned professionals and academics with extensive industry experience. They bring a wealth of knowledge and insights to the classroom, providing students with a rich learning experience that goes beyond textbooks. Whether you aspire to be a financial analyst, investment banker, or financial planner, our program provides the tools and guidance to help you achieve your goals.

Moreover, Charisma University offers a global perspective, integrating international finance concepts into our curriculum. In today’s interconnected world, understanding global financial markets is crucial, and our program ensures that students are well-versed in these areas.

Charisma University is dedicated to your success. With a robust support system, including academic advising, career services, and networking opportunities, we help you every step of the way. Choosing Charisma University for your Bachelor of Science in Finance means choosing a program that is not just about getting a degree but about building a successful career in finance.

Join us at Charisma University and take the first step towards a rewarding future in finance.

#online university#student#university#charisma university#online learning#online courses#online education#books & libraries#finance Program#Bachelor of Science in Finance

0 notes

Text

_From Passion to Profit: How Bloggers Can Make Millions in a Year_

In the digital age, blogging has evolved from a hobby to a lucrative career path. With millions of blogs on the internet, it's no surprise that some bloggers have turned their passion into a million-dollar business. While it may seem like a pipe dream, making millions as a blogger is achievable with the right strategy, dedication, and monetization techniques.

_Identifying Profitable Niches_

The first step to making millions as a blogger is to choose a profitable niche. Focus on areas with high demand, such as:

1. _Health and Wellness_: Fitness, nutrition, and self-care are popular topics with a vast audience.

2. _Personal Finance_: People seek advice on managing money, investing, and getting out of debt.

3. _Travel and Adventure_: Share your travel experiences, tips, and recommendations with a global audience.

4. _Technology and Gadgets_: With new gadgets and software emerging daily, tech-savvy bloggers can capitalize on this trend.

5. _Marketing and Entrepreneurship_: Share your expertise on marketing, business growth, and entrepreneurship.

_Building a Loyal Audience_

To make millions, you need a massive and engaged audience. Focus on:

1. _High-Quality Content_: Create informative, entertaining, and valuable content that resonates with your audience.

2. _Consistency_: Regularly post content to keep your audience engaged and coming back for more.

3. _Email Marketing_: Build an email list and send targeted campaigns to nurture your audience.

4. _Social Media_: Leverage social media platforms to promote your blog, engage with your audience, and drive traffic.

_Monetization Strategies_

Once you have a loyal audience, it's time to monetize your blog. Consider:

1. _Affiliate Marketing_: Partner with brands to promote their products or services and earn a commission.

2. _Sponsored Content_: Work with brands to create sponsored posts, reviews, or tutorials.

3. _Display Advertising_: Use Google AdSense or other ad networks to generate revenue from display ads.

4. _Digital Products_: Create and sell ebooks, courses, or software products related to your niche.

5. _Membership or Subscription-Based Models_: Offer exclusive content, resources, or services for a recurring fee.

_Scaling Your Business_

To reach the million-dollar mark, you need to scale your business. Consider:

1. _Hiring a Team_: Employ writers, editors, designers, and marketers to help you create high-quality content and manage your blog.

2. _Outsourcing Tasks_: Use freelancers or virtual assistants to handle tasks like social media management, email marketing, and SEO.

3. _Investing in Technology_: Utilize tools like SEO software, email marketing platforms, and project management tools to streamline your workflow.

4. _Diversifying Your Income Streams_: Explore alternative revenue sources, such as podcasting, YouTube, or consulting services.

_Conclusion_

Making millions as a blogger requires dedication, hard work, and a willingness to learn and adapt. By choosing a profitable niche, building a loyal audience, and implementing effective monetization strategies, you can turn your passion into a lucrative business. Remember to scale your business, diversify your income streams, and stay focused on your goals to achieve success. With persistence and the right mindset, you can join the ranks of millionaire bloggers.

#success#commercial#finance#marketing#business#reading#book review#bookworm#book photography#bookish#blogger#wordpress#reader insert#readings#article#smartblooger#books#domian#hostinger#affiliatemarketing#make money online#work at home#learning#earn money online

0 notes

Text

#books#book review#book blog#reading#best books#top books#money#finance#investing#learning#self help#thereadmind#thereadmind.com#Ramit sethi

3 notes

·

View notes

Text

tis time for me to change my phone theme (took longer than I thought it would tbh)

#can y'all guess what it's going to be about ? 👀#if you said one piece/opla you'd be correct :3#I'm thinking of doing like a mix of anime and live action elements#and have a “slide/screen” for each character#Nami will DEFINITELY be the one in charge of all my finance/shopping stuff (obviously)#i feel like Luffy should get the games page cause he's the most “u got games on ur phone?” out of everyone#I don't know if I add Robin or not ;-; she is wifey but no opla cast yet#(cause she could be either my book related OR my language learning apps)#i have no cooking or workout apps so I can't go the obvious route with Sanji or Zoro#BUT !!! Usopp will probs be the Social Media Man cause that's him bby the most charismatic#OH !!#or the one where I keep all the streaming services paraphernalia (cause he's a Story Teller 🥺🥺🥺)#do i dare make Zoro the “fanfic bundle” (aka tumblr/kiwi browser/Pinterest/spotify) the Girl Blogging (if you will)#but then whERE DO I PUT SANJI ?????#im gonna have to plan this out really well tho cause all the apps will have to be different colors from each other#so I can't just download it all before hand#lil thingies I need tho#tangerines for nami#a sword icon for zoro#a slingshot for usopp#luffy's hat#i don't wanna get a cigarette for Sanji but I can if I must#(im putting so much effort into this... watch me change it in two months to a Hatchetfield theme)

1 note

·

View note

Text

"Somebody who doesn't read lives one life, somebody who reads an unlimited number of lives." - Mark Cuban, billionaire investor

#books#books and reading#drama#adventure#fantasy fiction#travel#booklr#fiction#nonfiction#learning#brainpower#finance

0 notes

Text

Retiring the US debt would retire the US dollar

THIS WEDNESDAY (October 23) at 7PM, I'll be in DECATUR, GEORGIA, presenting my novel THE BEZZLE at EAGLE EYE BOOKS.

One of the most consequential series of investigative journalism of this decade was the Propublica series that Jesse Eisinger helmed, in which Eisinger and colleagues analyzed a trove of leaked IRS tax returns for the richest people in America:

https://www.propublica.org/series/the-secret-irs-files

The Secret IRS Files revealed the fact that many of America's oligarchs pay no tax at all. Some of them even get subsidies intended for poor families, like Jeff Bezos, whose tax affairs are so scammy that he was able to claim to be among the working poor and receive a federal Child Tax Credit, a $4,000 gift from the American public to one of the richest men who ever lived:

https://www.propublica.org/article/the-secret-irs-files-trove-of-never-before-seen-records-reveal-how-the-wealthiest-avoid-income-tax

As important as the numbers revealed by the Secret IRS Files were, I found the explanations even more interesting. The 99.9999% of us who never make contact with the secretive elite wealth management and tax cheating industry know, in the abstract, that there's something scammy going on in those esoteric cults of wealth accumulation, but we're pretty vague on the details. When I pondered the "tax loopholes" that the rich were exploiting, I pictured, you know, long lists of equations salted with Greek symbols, completely beyond my ken.

But when Propublica's series laid these secret tactics out, I learned that they were incredibly stupid ruses, tricks so thin that the only way they could possibly fool the IRS is if the IRS just didn't give a shit (and they truly didn't – after decades of cuts and attacks, the IRS was far more likely to audit a family earning less than $30k/year than a billionaire).

This has become a somewhat familiar experience. If you read the Panama Papers, the Paradise Papers, Luxleaks, Swissleaks, or any of the other spectacular leaks from the oligarch-industrial complex, you'll have seen the same thing: the rich employ the most tissue-thin ruses, and the tax authorities gobble them up. It's like the tax collectors don't want to fight with these ultrawealthy monsters whose net worth is larger than most nations, and merely require some excuse to allow them to cheat, anything they can scribble in the box explaining why they are worth billions and paying little, or nothing, or even entitled to free public money from programs intended to lift hungry children out of poverty.

It was this experience that fueled my interest in forensic accounting, which led to my bestselling techno-crime-thriller series starring the two-fisted, scambusting forensic accountant Martin Hench, who made his debut in 2022's Red Team Blues:

https://us.macmillan.com/books/9781250865847/red-team-blues

The double outrage of finding out how badly the powerful are ripping off the rest of us, and how stupid and transparent their accounting tricks are, is at the center of Chokepoint Capitalism, the book about how tech and entertainment companies steal from creative workers (and how to stop them) that Rebecca Giblin and I co-authored, which also came out in 2022:

https://chokepointcapitalism.com/

Now that I've written four novels and a nonfiction book about finance scams, I think I can safely call myself a oligarch ripoff hobbyist. I find this stuff endlessly fascinating, enraging, and, most importantly, energizing. So naturally, when PJ Vogt devoted two episodes of his excellent Search Engine podcast to the subject last week, I gobbled them up:

https://www.searchengine.show/listen/search-engine-1/why-is-it-so-hard-to-tax-billionaires-part-1

I love the way Vogt unpacks complex subjects. Maybe you've had the experience of following a commentator and admiring their knowledge of subjects you're unfamiliar with, only have them cover something you're an expert in and find them making a bunch of errors (this is basically the experience of using an LLM, which can give you authoritative seeming answers when the subject is one you're unfamiliar with, but which reveals itself to be a Bullshit Machine as soon as you ask it about something whose lore you know backwards and forwards).

Well, Vogt has covered many subjects that I am an expert in, and I had the opposite experience, finding that even when he covers my own specialist topics, I still learn something. I don't always agree with him, but always find those disagreements productive in that they make me clarify my own interests. (Full disclosure: I was one of Vogt's experts on his previous podcast, Reply All, talking about the inkjet printerization of everything:)

https://gimletmedia.com/shows/reply-all/brho54

Vogt's series on taxing billionaires was no exception. His interview subjects (including Eisinger) were very good, and he got into a lot of great detail on the leaker himself, Charles Littlejohn, who plead guilty and was sentenced to five years:

https://jacobin.com/2023/10/charles-littlejohn-irs-whistleblower-pro-publica-tax-evasion-prosecution

Vogt also delved into the history of the federal income tax, how it was sold to the American public, and a rather hilarious story of Republican Congressional gamesmanship that backfired spectacularly. I'd never encountered this stuff before and boy was it interesting.

But then Vogt got into the nature of taxation, and its relationship to the federal debt, another subject I've written about extensively, and that's where one of those productive disagreements emerged. Yesterday, I set out to write him a brief note unpacking this objection and ended up writing a giant essay (sorry, PJ!), and this morning I found myself still thinking about it. So I thought, why not clean up the email a little and publish it here?

As much as I enjoyed these episodes, I took serious exception to one – fairly important! – aspect of your analysis: the relationship of taxes to the national debt.

There's two ways of approaching this question, which I think of as akin to classical vs quantum physics. In the orthodox, classical telling, the government taxes us to pay for programs. This is crudely true at 10,000 feet and as a rule of thumb, it's fine in many cases. But on the ground – at the quantum level, in this analogy – the opposite is actually going on.

There is only one source of US dollars: the US Treasury (you can try and make your own dollars, but they'll put you in prison for a long-ass time if they catch you.).

If dollars can only originate with the US government, then it follows that:

a) The US government doesn't need our taxes to get US dollars (for the same reason Apple doesn't need us to redeem our iTunes cards to get more iTunes gift codes);

b) All the dollars in circulation start with spending by the US government (taxes can't be paid until dollars are first spent by their issuer, the US government); and

c) That spending must happen before anyone has been taxed, because the way dollars enter circulation is through spending.

You've probably heard people say, "Government spending isn't like household spending." That is obviously true: households are currency users while governments are currency issuers.

But the implications of this are very interesting.

First, the total dollars in circulation are:

a) All the dollars the government has ever spent into existence funding programs, transferring to the states, and paying its own employees, minus

b) All the dollars that the government has taxed away from us, and subsequently annihilated.

(Because governments spend money into existence and tax money out of existence.)

The net of dollars the government spends in a given year minus the dollars the government taxes out of existence that year is called "the national deficit." The total of all those national deficits is called "the national debt." All the dollars in circulation today are the result of this national debt. If the US government didn't have a debt, there would be no dollars in circulation.

The only way to eliminate the national debt is to tax every dollar in circulation out of existence. Because the national debt is "all the dollars the government has ever spent," minus "all the dollars the government has ever taxed." In accounting terms, "The US deficit is the public's credit."

When billionaires like Warren Buffet tell Jesse Eisinger that he doesn't pay tax because "he thinks his money is better spent on charitable works rather than contributing to an insignificant reduction of the deficit," he is, at best, technically wrong about why we tax, and at worst, he's telling a self-serving lie. The US government doesn't need to eliminate its debt. Doing so would be catastrophic. "Retiring the US debt" is the same thing as "retiring the US dollar."

So if the USG isn't taxing to retire its debts, why does it tax? Because when the USG – or any other currency issuer – creates a token, that token is, on its face, useless. If I offered to sell you some "Corycoins," you would quite rightly say that Corycoins have no value and thus you don't need any of them.

For a token to be liquid – for it to be redeemable for valuable things, like labor, goods and services – there needs to be something that someone desires that can be purchased with that token. Remember when Disney issued "Disney dollars" that you could only spend at Disney theme parks? They traded more or less at face value, even outside of Disney parks, because everyone knew someone who was planning a Disney vacation and could make use of those Disney tokens.

But if you go down to a local carny and play skeeball and win a fistful of tickets, you'll find it hard to trade those with anyone outside of the skeeball counter, especially once you leave the carny. There's two reasons for this:

1) The things you can get at the skeeball counter are pretty crappy so most people don't desire them; and ' 2) Most people aren't planning on visiting the carny, so there's no way for them to redeem the skeeball tickets even if they want the stuff behind the counter (this is also why it's hard to sell your Iranian rials if you bring them back to the US – there's not much you can buy in Iran, and even someone you wanted to buy something there, it's really hard for US citizens to get to Iran).

But when a sovereign currency issuer – one with the power of the law behind it – demands a tax denominated in its own currency, they create demand for that token. Everyone desires USD because almost everyone in the USA has to pay taxes in USD to the government every year, or they will go to prison. That fact is why there is such a liquid market for USD. Far more people want USD to pay their taxes than will ever want Disney dollars to spend on Dole Whips, and even if you are hoping to buy a Dole Whip in Fantasyland, that desire is far less important to you than your desire not to go to prison for dodging your taxes.

Even if you're not paying taxes, you know someone who is. The underlying liquidity of the USD is inextricably tied to taxation, and that's the first reason we tax. By issuing a token – the USD – and then laying on a tax that can only be paid in that token (you cannot pay federal income tax in anything except USD – not crypto, not euros, not rials – only USD), the US government creates demand for that token.

And because the US government is the only source of dollars, the US government can purchase anything that is within its sovereign territory. Anything denominated in US dollars is available to the US government: the labor of every US-residing person, the land and resources in US territory, and the goods produced within the US borders. The US doesn't need to tax us to buy these things (remember, it makes new money by typing numbers into a spreadsheet at the Federal Reserve). But it does tax us, and if the taxes it levies don't equal the spending it's making, it also sells us T-bills to make up the shortfall.

So the US government kinda acts like classical physics is true, that is, like it is a household and thus a currency user, and not a currency issuer. If it spends more than it taxes, it "borrows" (issues T-bills) to make up the difference. Why does it do this? To fight inflation.

The US government has no monetary constraints, it can make as many dollars as it cares to (by typing numbers into a spreadsheet). But the US government is fiscally constrained, because it can only buy things that are denominated in US dollars (this is why it's such a big deal that global oil is priced in USD – it means the US government can buy oil from anywhere, not only the USA, just by typing numbers into a spreadsheet).

The supply of dollars is infinite, but the supply of labor and goods denominated in US dollars is finite, and, what's more, the people inside the USA expect to use that labor and goods for their own needs. If the US government issues so many dollars that it can outbid every private construction company for the labor of electricians, bricklayers, crane drivers, etc, and puts them all to work building federal buildings, there will be no private construction.

Indeed, every time the US government bids against the private sector for anything – labor, resources, land, finished goods – the price of that thing goes up. That's one way to get inflation (and it's why inflation hawks are so horny for slashing government spending – to get government bidders out of the auction for goods, services and labor).

But while the supply of goods for sale in US dollars is finite, it's not fixed. If the US government takes away some of the private sector's productive capacity in order to build interstates, train skilled professionals, treat sick people so they can go to work (or at least not burden their working-age relations), etc, then the supply of goods and services denominated in USD goes up, and that makes more fiscal space, meaning the government and the private sector can both consume more of those goods and services and still not bid against one another, thus creating no inflationary pressure.

Thus, taxes create liquidity for US dollars, but they do something else that's really important: they reduce the spending power of the private sector. If the US only ever spent money into existence and never taxed it out of existence, that would create incredible inflation, because the supply of dollars would go up and up and up, while the supply of goods and services you could buy with dollars would grow much more slowly, because the US government wouldn't have the looming threat of taxes with which to coerce us into doing the work to build highways, care for the sick, or teach people how to be doctors, engineers, etc.

Taxes coercively reduce the purchasing power of the private sector (they're a stick). T-bills do the same thing, but voluntarily (they the carrot).

A T-bill is a bargain offered by the US government: "Voluntarily park your money instead of spending it. That will create fiscal space for us to buy things without bidding against you, because it removes your money from circulation temporarily. That means we, the US government, can buy more stuff and use it to increase the amount of goods and services you can buy with your money when the bond matures, while keeping the supply of dollars and the supply of dollar-denominated stuff in rough equilibrium."

So a bond isn't a debt – it's more like a savings account. When you move money from your checking to your savings, you reduce its liquidity, meaning the bank can treat it as a reserve without worrying quite so much about you spending it. In exchange, the bank gives you some interest, as a carrot.

I know, I know, this is a big-ass wall of text. Congrats if you made it this far! But here's the upshot. We should tax billionaires, because it will reduce their economic power and thus their political power.

But we absolutely don't need to tax billionaires to have nice things. For example: the US government could hire every single unemployed person without creating inflationary pressure on wages, because inflation only happens when the US government tries to buy something that the private sector is also trying to buy, bidding up the price. To be "unemployed" is to have labor that the private sector isn't trying to buy. They're synonyms. By definition, the feds could put every unemployed person to work (say, training one another to be teachers, construction workers, etc – and then going out and taking care of the sick, addressing the housing crisis, etc etc) without buying any labor that the private sector is also trying to buy.

What's even more true than this is that our taxes are not going to reduce the national debt. That guest you had who said, "Even if we tax billionaires, we will never pay off the national debt,"" was 100% right, because the national debt equals all the money in circulation.

Which is why that guest was also very, very wrong when she said, "We will have to tax normal people too in order to pay off the debt." We don't have to pay off the debt. We shouldn't pay off the debt. We can't pay off the debt. Paying off the debt is another way of saying "eliminating the dollar."

Taxation isn't a way for the government to pay for things. Taxation is a way to create demand for US dollars, to convince people to sell goods and services to the US government, and to constrain private sector spending, which creates fiscal space for the US government to buy goods and services without bidding up their prices.

And in a "classical physics" sense, all of the preceding is kinda a way of saying, "Taxes pay for government spending." As a rough approximation, you can think of taxes like this and generally not get into trouble.

But when you start to make policy – when you contemplate when, whether, and how much to tax billionaires – you leave behind the crude, high-level approximation and descend into the nitty-gritty world of things as they are, and you need to jettison the convenience of the easy-to-grasp approximation.

If you're interested in learning more about this, you can tune into this TED Talk by Stephanie Kelton, formerly formerly advisor to the Senate Budget Committee chair, now back teaching and researching econ at University of Missouri at Kansas City:

https://www.ted.com/talks/stephanie_kelton_the_big_myth_of_government_deficits?subtitle=en

Stephanie has written a great book about this, The Deficit Myth:

https://pluralistic.net/2020/05/14/everybody-poops/#deficit-myth

There's a really good feature length doc about it too, called "Finding the Money":

https://findingmoneyfilm.com/

If you'd like to read more of my own work on this, here's a column I wrote about the nature of currency in light of Web3, crypto, etc:

https://locusmag.com/2022/09/cory-doctorow-moneylike/

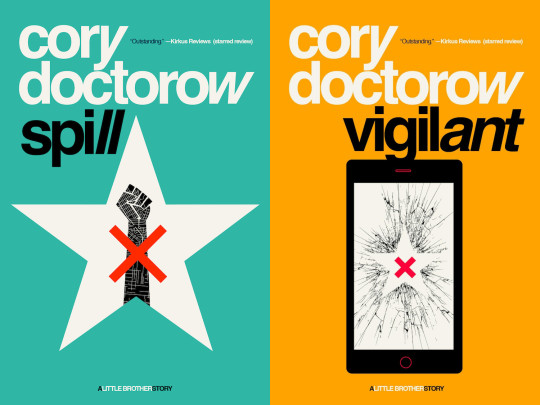

Tor Books as just published two new, free LITTLE BROTHER stories: VIGILANT, about creepy surveillance in distance education; and SPILL, about oil pipelines and indigenous landback.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/10/21/we-can-have-nice-things/#public-funds-not-taxpayer-dollars

#pluralistic#mmt#modern monetary theory#warren buffett#podcasts#pj vogt#billionaires#economics#we can have nice things#taxes#taxing billionaires#the irs files#irs files#jesse eisenger#propublica

1K notes

·

View notes

Text

Several weeks ago, my retirement-age mother requested that I play Baldur’s Gate 3 for her because she has trouble with controllers/keyboards and wanted “to see what all the fuss is about with that cute wizard boy.” For context, my mother and I have done this sort of thing in the past with certain RPGs (dragon age, mass effect, etc.), but it’s been a few years since she’s personally requested a game like this. Basically, I control her Tav but let her make all the choices so she can determine how the story plays out without worrying about mechanics. She treats it like a choose-your-own-adventure book.

Anyway, here is a list of some of the things my mother has said and/or chosen to do throughout the course of BG3 in no particular order:

She is (obviously) romancing Gale. She is quite smitten with him and his passion for books and learning; she also thinks he’s polite and qualifies as “relationship material.” She also REALLY likes the things he’s said about his cat so far (my mom is a cat lady), so I know she’s gonna flip shit when we meet Tara in Act III.

She’s playing a normal druid Tav with a generally good alignment. Her favorite spell is Spike Growth because she thinks it’s hilarious whenever enemies walk into the AOE and die. I usually end up having to cast it at least once per battle per her request. Sometimes twice.

Contrary to her alignment, my mother tasks me with robbing every single chest, crate, barrel, and burlap sack we come across; this also includes people and their pockets. The party is always at max carrying capacity. ALWAYS. She doesn’t like selling things because “what if I need them.” The camp stash is in literal shambles. There is no hope of organizing it. She’s got like fifty seven sets of rags and a billion pieces of random silverware.

She MUST talk to every animal and corpse in the game. I think five hours of her total playtime so far (47ish) has been spent speaking to animals as many times as humanly possible. Like, I was thorough in my own playthroughs, but this is on a whole other level.

She did NOT get Volo’s lobotomy, but she did let Auntie Ethel take her eye in hopes of a cure for the tadpole. I did not understand the logic then. I still do not understand it now.

She is far more interested in fashion than equipment stats. Do you have any idea how much gold I’ve had to spend on dyes just to make things match? SO much. Same vibe as that “please someone help me balance my finances my family is starving” tweet but instead of candles it’s thirty thousand fucking bottles of black and furnace red dye.

We broke the prisoners out of Moonrise, but they got on the boat too early and bugged the fight by leaving Astarion and Karlach behind. Wulbren Bongle somehow got stuck in combat mode even after engaging the cutscene on the docks below Last Light; he he kept trying to run ALL THE WAY BACK TO MOONRISE nine fucking meters at a time while I frantically tried to finish the fight with the Warden, otherwise Wulbren would have run straight into the shadow curse. (I would’ve let him go; fuck Wulbren Bongle, all my homies hate Wulbren Bongle. But my mom didn’t know that, and she wanted to keep him safe. So.)

She had me reload a save like eighteen times to save the giant eagles on top of Rosymorn Monastery. Wouldn’t even let me do non-lethal damage just to get past things. I think getting that warhammer for the dawnmaster puzzle took us like an hour and a half alone. (Yes, I know you can use any warhammer, but SHE didn’t.)

She’s started keeping an irl notebook to keep track of her quests between play sessions. She writes down ideas and strategies when she thinks of them during the week, then brings them to her next game session at my house. I think she wrote about three pages on possible approaches to the goblin fortress alone.

She insists that I pet Scratch and the owlbear cub before every single long rest, no exceptions. Sometimes I have to do it multiple times until she is absolutely sure that the animals know exactly how much she loves and cherishes them. She has also commissioned a crocheted owlbear plush from a friend of hers and is very excited.

I’m sure there’s a bunch of stuff I’m forgetting, but those are some fun things I thought of. She’s enjoying the game and is telling all of her retired friends to get it and play it for themselves. She asked me “what is Discord” yesterday and I think my life flashed before my eyes.

anyway shout out to my mom for being neat

Part 2 — Part 3 — Part 4 — Part 5

#bg3#baldur's gate 3#gale#gale of waterdeep#astarion#gale dekarios#laq talks#I talk#she stares at me real hard after she makes a choice too#like squinting to see if my expression gives anything away#if it was a good or bad call#I keep my face blank as shit it’s hilarious#I have not told her I’m writing fanfic for this game#nor will I ever#jesus christ

6K notes

·

View notes

Text

Courtship: Venus Signs (part 1)

Earth signs Desire commitment and a lasting partnership.

♑︎ Capricorn Venus:

Traits:

Loyal, protective, quietly romantic, reserved, thoughtful, and considerate in matters of love, romance, aesthetic, self-worth, and money.

Practical about themselves, understanding their worth in the material world and how others perceive them.

May appear aloof, but knows precisely what they want in a partner.

Will patiently wait for the right person who fulfills their needs and standards.

Prioritizes career or finances during single periods.

Potential imbalance if partnered with a water Mars sign, as they might yearn for love despite being comfortable alone.

Speaks highly of you, openly expressing affection and admiration.

Brings up your name in conversations, showcasing a deep pride and love.

Holds themselves to a standard of perfection, pushing for continuous improvement and sometimes feeling resentful for falling short.

Learns that self-worth is a gradual process, not a forced ascent.

Refined aesthetic taste with a strong inclination towards the arts, especially visual arts.

Enjoys concrete and physical expressions like sculpting, painting, and escaping into books.

Looks for love when it aligns with life plans and flows naturally.

Enjoys darker colors, earth tones, and may favor black without flashy appearances.

Dresses in a reserved, chic, professional, or vintage-inspired manner.

Appreciates rich earthy smells like coffee grounds, vetiver, and rainy woods, as well as clean spicy scents.

Loves food, particularly rich dishes with sentimental value.

Very good with money, enjoys it, and doesn't require much assistance.

Attraction Preferences:

Attracted to corporate types, mysterious, closed off, enigmatic, classy, and practical individuals.

May be drawn to businessmen, morticians, older people, architects, and mystics, venus in taurus, virgo, capricorn, scorpio & aquarius.

Romantic Behavior:

Takes love seriously with a guarded heart, feeling deeply in love.

Very romantic but often feels like gestures aren't sufficient, leading to inaction.

Shy and rarely flirts, but when they do it's straightforward and to the point.

Indicators of interest include trying to impress through achievements or appearance changes.

Finds dating challenging and tends to avoid it.

In relationships, seeks reassurance of worth, cherishment, and likes to be in charge but remains loyal for the long haul.

♉︎Taurus Venus:

Traits:

Intense, sweet, amorous, dependable, highly romantic, and artistic in matters of money, self-worth, and relationships.

Struggle with self-worth, often comparing themselves to a mental aesthetic and others' looks; need to recognize and appreciate their internal and external beauty.

Enjoys various creative pursuits, particularly art in all its forms, including poetry and fashion; may also have a love for cooking and music.

Craves pampering and security for genuine romantic love.

Adores style and cultivates a unique, expressive fashion sense rather than following trends.

Good with colors, with a preference for all colors, avoiding overly loud or aggressive shades.

Prefers luxurious and flavorful foods, often indulging in sweets; enjoys rich and intoxicating smells like vetiver and Spanish moss.

Envisions an ideal partner but may find it challenging to meet someone worthy.

Values luxury and comfort in relationships.

Willing to test suitors to identify the one truly devoted to love.

Surprisingly, adept at managing money; understands when to save and when to spend, with purchases typically substantial.

Attraction Preferences:

Looks for well-dressed, classy, debonair, and sturdy individuals who are reliable and appealing; may also be drawn to the starving artist.

Finds bankers, farmers, businesspeople, artists, singers, and chefs interesting romantically, as well as venus in capricorn, taurus, virgo, pisces and cancer.

Romantic Approach:

Shy and reticent in matters of the heart due to intense and deep feelings of love.

Signs of a Venus in Taurus crush include becoming soft-spoken, gentle, touchy, or direct stares.

Prefers silent coaxing and seduction, often not outwardly showing intentions but putting extra effort into appearance.

Enjoys giving little gifts and favors to catch someone's attention.

Loves being pursued, feeling special, and indulging in classical romance with all senses involved.

Like Capricorn, can wait patiently for the right match.

Envisions a future with you and strives to bring joy into your life.

Unable and unwilling to imagine a moment without you, showcasing deep emotional attachment

Craves physicality, contact, and commitment for a stable relationship; highly responsive and respects differences to achieve a harmonious equilibrium

♍︎ Virgo Venus:

Traits:

Analytical, helpful, idealistic, altruistic, and witty in dealing with aesthetic, self-worth, money, relationships, and romance.

Struggles with self-worth due to intense analysis of aesthetic and high expectations for perfection in artistic endeavors.

Needs to learn self-love by embracing flaws as part of the mortal experience.

May avoid Venusian activities out of fear of not being good enough, despite possessing skills in art, especially in sculpting, painting, gardening, and fitness.

Enjoys soft colors reminiscent of spring, woody browns, and greens.

Dresses in a conservative and professional style, conveying their identity concisely.

Prefers smells associated with comfort, cleanliness, citrus, vanilla, or fresh sheets.

Health-conscious and selective about food, considering taste and health reasons.

Analytical and good with money, excelling in facts, figures, and understanding the monetary value.

Attraction Preferences:

Attracted to practical, healing, intelligent, logical, and detail-oriented individuals.

Finds mechanics, scientists, doctors, researchers, and teachers attractive, venus in taurus, capricorn, virgo, cancer & scorpio.

Romantic Approach:

Shy and hesitant to initiate, prefers being pursued in romantic relationships.

Not inclined towards overt displays of affection or emotional expressions.

Tests partners subtly for devotion; silently contemplates moving on if betrayed.

Displays profound kindness, aiming to enhance your days with subtle yet impactful gestures.

May struggle with dating due to the ability to magnify minor flaws in others.

Indicates a crush by offering help with projects or problems, showing a genuine desire to assist.

Craves deep unconditional love and struggles with criticism due to self-critique.

Needs reassurance and to be cherished, emphasizing the existence of perfection through love.

Fire Signs: Seek thrill and excitement, desire an intoxicating romance.

♐Sagittarius Venus:

Traits:

Happy-go-lucky, adventurous, moralistic, and charitable in matters of self-worth, love, money, aesthetic, and romance.

Generally maintains a healthy self-worth with contagious perky confidence.

Enjoys flirting, playing the field, and has a childlike spirit, but must avoid becoming overly cocky.

Fondness for literature, poetry, spoken arts, and may engage in creative pursuits like music.

Views love as a game for entertainment.

Needs freedom; relationship flourishes with the right balance.

Prone to boredom and drawn to creative, unattainable partners.

Loves games, including sports or video games.

Looks for love randomly but avoids feeling tied down, keeping options open during the search.

Enjoys dramatic and vibrant colors that evoke a happy or jovial vibe.

Dresses in a comfortable and interesting sporty or hippy-esque manner.

Willing to compromise, recognizing the importance of give-and-take in maintaining the relationship.

Prioritizes the relationship over the desire for control.

Finds mentally stimulating and "foreign" foods delightful, especially spicy dishes.

Prefers earthy and floral smells, like fresh-cut flowers.

Attraction Preferences:

Attracted to different, free-thinking, scholarly, and jocular individuals.

May be drawn to professors, older people, athletes, large individuals, or sages, venus in sagittarius, leo, aries, aquarius and gemini.

Romantic Approach:

Doesn't take love too seriously and sees it as something to be enjoyed.

Expresses crush openly or tries to make the person laugh if attracted.

Enjoys dating, meeting new people, and tends to grow infatuated quickly.

Needs space and time to feel independent in romance.

Requires expansive and big gestures for true fulfillment.

Dislikes clichés, dense individuals, and clinginess.

Seeks a partner in crime and confidant for genuine engagement in a relationship.

♈︎Aries Venus:

Traits:

Pioneering, vivacious, unapologetic, and feisty in matters of self-worth, style, money, and relationships.

Healthy self-worth, with Venus influencing interests and self-definition.

In the arts for making striking, edgy statements rather than adhering to traditional beauty standards.

Fond of debate and mental combat; values independence and security for genuine love.

Striking style, athletic/provocative appearance, or an appearance that appears indifferent.

Fondness for warm colors and simple, comfortable fabrics; may enjoy spicy food and earthy smells.

Not overly concerned with money, views it as a necessity; can spend on expensive hobbies and toys.

Attraction Preferences:

Looks for spontaneous, fun-loving, extroverted, and exciting lovers; may find quiet but in-control individuals appealing.

Attracted to athletes, soldiers, mechanics (technical thinking), rebels, lawyers, construction workers, and rough individuals romantically and physically, venus in aries, leo, sagittarius, aquarius and gemini.

Romantic Approach:

Driven, direct, and open in the arena of love; willing to try anything once.

Sign of a Venus in Aries crush is teasing in good fun; loves to show off and impress the object of affection.

Enjoys the chase and seduction, though may grow bored quickly; awkwardly romantic and wants to pamper loved ones.

Enjoys the chase but may get bored once the conquest is achieved.

Requires physical and mental stimulation to stay in love.

In relationships, desires independence and control; dislikes being told what to do or competing.

Needy romantically, vocal, and somewhat pushy in expressing desires; values feeling appreciated and being treated as number one.

Reveals their vulnerable sides to you, emphasizing transparency and reciprocity.

Demonstrates an all-encompassing love once they've truly embraced their feelings for you.

♌︎Leo Venus:

Traits:

Bright, magnanimous, fun-loving, romantic, and superfluous in matters of self-worth, love, relationships, money, and aesthetic.

Self-worth can vary from low to overly high, often compensating and may appear arrogant.

Requires constant reassurance of self-value, sensitive to insults, and hides struggles behind a smile.

Enjoys the arts, excelling in activities where they can be in the spotlight, including sports and physical activities.

Seeks love when feeling unappreciated but waits for genuine needs.

Dresses in a sporty, casual, flashy, professional, or debonair style with a fondness for bright colors, gold, red, and occasionally black.

Enjoys giving attention and expects occasional reciprocity.

May become overwhelming when self-absorbed, needs grounding.

Loves spicy aromas, such as cinnamon, cardamom, and clove, as well as smooth scents like vanilla.

Enjoys indulging in various foods, especially childlike treats.

May spend generously, particularly for the enjoyment of others, requiring assistance in budgeting.

Attraction Preferences:

Attracted to showy, artistic, athletic, charismatic, and powerful individuals.

Loves glamour and grandiose declarations in relationships.

Seeks a loyal and committed partner who enhances their ego.

May find appeal in bosses, artists, actors, soldiers, royalty archetypes, and athletes.

Romantic Approach:

Goes all out in love, courting, pursuing, and wooing simultaneously.

Enjoys spectacular romance and is not shy about dating or the dating scene.

Expresses interest by going out of their way to impress and compliment, may straightforwardly communicate their feelings.

Desires to be treated like royalty, pampered, and made to feel special.

Expects reciprocity in passion, intensity, and drama to keep the relationship fresh.

Dislikes feeling unimportant and needs consistent expressions of love, yet maintains independence.

Water Signs: Seek a fairy tale romance, searching for a Prince or Princess.

♓︎Pisces Venus:

Traits:

Dreamy, romantic, loving, creative, and fantastical in matters of love, self-worth, money, relationships, and aesthetics.

May have a deluded sense of self, occasionally needing help to see themselves clearly.

Shy but enjoys occasional flirtation, especially in a playful context.

Attentively listens and remembers your words, valuing communication as a way to understand and love you better.

Enjoys hearing you talk, using it as an opportunity to deepen their understanding of you.

Enjoys art, particularly music, dance, and literature.

Often seeks love, viewing themselves as a part of a whole, searching for a profound connection.

Shy in pursuing but makes subtle gestures to be closer.

Needs to occasionally be more selfish in relationships.

Vulnerable to being taken advantage of due to an overly loving nature.

Loves colors reminiscent of the ocean and the sky, including dark to light blues, greens, purples, and black.

Fashion style can vary from free-flowing, ocean-breeze attire to trendy runway looks or understated appearances to avoid attention.

Enjoys aromas like the ocean, fruit, and candy.

Has a big appetite and loves seafood, sugary sweets, and food from different cultures.

Not overly materialistic but acquires money effortlessly, often spending it on loved ones.

Attraction Preferences:

Attracted to mystical, aloof, artistic, emotionally expressive, and structured individuals.

Compatibility with sailors, psychics, healers, artists, or therapists, venus in pisces, cancer, scorpio and maybe taurus.

Romantic Behavior:

Shy yet not afraid to initiate romantic gestures.

Signs of interest include leaving messages unread (a commitment test) and engaging in deep conversations beyond typical bedtime hours.

Prefers soulmate connections over casual dating.

Needs lots of love, affection, and care in a relationship.

Dislikes being perceived as overly dependent and can be disillusioned if their idealized image of a loved one shatters.

♋︎Cancer Venus:

Traits:

Affectionate, sentimental, sweet, romantic, and receptive in matters of self-worth, money, style, aesthetic, partnership, and love.

Healthy self-worth usually influenced by family perceptions and upbringing.

Tendency to become engrossed in memories, potentially distorting them, leading to psychic disharmony.

Enjoys emotionally fulfilling hobbies such as reading, acting, cooking, baking, gardening, and finds stimulation in architecture or interior design.

Looks for settling-down material in love, avoiding games.

Assumes the role of the nurturing mother in relationships.

Magnetic and alluring, attracts partners effortlessly.

Analyzes and evaluates relationships; values security and harmony.

Style may not always be fashionable but holds value and meaning, either following family styles or changing frequently to keep up with trends.

Fondness for pastels, silver shades, especially purple and blue, preferring a dapper look without being overly flashy.

Delighted by scents from home, ocean breeze, or a forest after rain, with a preference for earthy and fruity smells.

Loves cooking and food, attached to traditional dishes, with a craving for sweets and creamy treats.

Excellent with money, skilled in investment and business ownership.

Attraction Preferences:

Attracted to emotional, trustworthy, familiar, and loving individuals.

May also be drawn to sailors, travelers, royalty archetypes, poets, bodybuilders, and comedians, venus in cancer, scorpio, pisces, taurus and virgo.

Romantic Approach:

Shy but can pursue if necessary, values traditional romance and believes in love traditions like meeting the spouse's family.

Takes relationships seriously, finds letting go challenging.

Signs of a crush include blushing, bashfulness, attempts to talk, and revealing something emotional

Will push back if being used, prioritizes home harmony.

Invests considerable time in your company, fostering comfort and mutual ease.

Their presence brings a soothing calmness, contributing to a deep sense of connection.

Desires a fairy tale experience, appreciates sentimental mementos, and values cherishing shared memories.

Craves emotionality and feels hurt if emotions are disregarded, but can become clingy and manipulative if not moderated.

Extremely loyal and willing to weather the storm, not easily bored.

♏︎Scorpio Venus:

Traits:

Possessive, secretive, romantic, intense, loving, and creative in matters of self-worth, money, love, relationships, and mystique.

Tendency for relatively low self-worth, feeling unattractive, and presenting a facade to compensate, emphasizing the seriousness of love.

Craves cherishment and security for a safe and healthy self-worth.

Subconscious and energetically seductive, attracting both desired and unwanted things.

Displays creativity, viewing destruction as a form of creation, especially in music or activities involving breaking and destroying things.

Enjoys sports, video games, and may have various artistic talents.

Desires to merge and feel complete, often seeking love but may struggle when needing support.

Appreciates a variety of colors, with greens, purples, and blues drawing particular interest.

Dresses in a sporty, dark, artsy, or blending-in manner.

Prefers hypnotic and deep smells like dark chocolate, wine, and musky sea scents.

Enjoys spicy foods and exotic tastes that mentally and physically engage them.

Skilled with money and investing.

Attraction Preferences:

Attracted to intriguing, mysterious, closed-off, powerful, and emotionally intense individuals.

May find interest in surgeons, doctors, researchers, mystics, sailors, and chemists, venus scorpio, cancer, pisces, capricorn and virgo.

Romantic Approach:

Takes love seriously, aiming to make their significant other happy even if not overtly romantic.

Signs of a crush may include slight rudeness or playful power games, seeking attention harmlessly

Tests partners to determine worth, with potential psychological challenges.

Struggles to trust, but deepens emotionally when in love.

Sensitive to your emotions, quick to notice when you're feeling down.

Focuses on understanding and meeting your love language needs, especially during challenging times.

Serious about love, dating can be challenging.

Needs a partner who understands the intensity of their passions, values trust, and avoids deception.

Loyal and committed once invested in a relationship.

Air Signs: Seek innovators and intellectual connection in romance.

♒Aquarius Venus:

Traits:

Impersonal, creative, original, universal, and shocking in matters of relationships, love, aesthetic, self-worth, and money.

Usually has a healthy, if not detached, self-worth.

May distance themselves from the concept of "the self," which could be psychologically challenging.

Friendly and may unintentionally flirt; aesthetic taste is intriguing, embracing individuality and the arts.

Finds beauty in dreamy, surreal colors like pastels and neons.

Enjoys music, visual arts, poetry, and activities involving the mind like video games.

Looks for love when feeling a lack of a true community and seeks one-on-one connections.

Dress style may be striking, eclectic, modern, or fitting a group aesthetic with a hint of a hippy flair.

Enjoys scents like the ocean, clean, light, breezy, and sweet aromas like cotton candy.

Appreciates complex and unique flavors for mental stimulation.

Good with money but prone to sudden spending sprees.

Preferences in Others:

Likes individuals who are aloof, idiosyncratic, distant, unattainable, intelligent, and humanitarian.

Attracted to musicians, scientists, researchers, astrologers/mystics, and philanthropists, venus in aquarius, gemini, libra, aries and saggitarius.

Romantic Behavior:

Cerebral about love but values its importance.

Indicators of interest are sporadic and confusing, ranging from acting like you don't exist to wanting to hang out.

Struggles with the balance between independence and craving companionship

Craves stability and loyalty despite a logical façade.

Expresses feelings through late-night texts, sharing thoughts they might hesitate to say in person.

Fickle in courtship; captivates with eccentricities.

Values freedom, loyalty, and stability; may become depressed without them.

Not particularly fond of dating and may see it as a waste of time.

In a relationship, seeks reliability paired with excitement and random, unexpected events.

Once committed, tends to stay, being a fixed sign.

♊︎Gemini Venus:

Traits:

Charming, poetic, sociable, witty, and cunning in matters of self-worth, love, aesthetic, finances, and relationships.

Self-worth tied to communication skills and fitting into the community, needing to learn that being liked doesn't equate to true beauty.

Enjoys various creative pursuits, including dance, music, poetry, and a genuine love for conversation; may also have a fondness for sports.

Requires stimulation in a relationship, finds love more fun than necessary.

Trendy in fashion, stylish, adaptable to changing trends; values fashion as a form of communication.

Likes bright colors, especially various shades of blues, and tends to shy away from dark colors.

Enjoys a variety of food, likes to be intellectually engaged with what they eat, with a fondness for sour and childlike sweet foods.

Attracted to citrusy, sharp, and clean smells, such as fresh sheets.

Doesn't overly focus on money, invests well, and can be impulsive with hobbies or travel urges

Thrives on communication; requires mental stimulation.

Loses interest if not intellectually engaged.

Easily uses people for temporary connections until captivated elsewhere.

Attraction Preferences:

Attracted to intellectual, well-informed, sporty, suave, and aesthetically pleasing individuals; may appreciate the "wholesome person next door" aesthetics.

Finds PR people, librarians, professors, bosses, writers, actors, athletes, or local individuals attractive, compatible with venus in aquarius, gemini, libra, sagittarius & aries.

Romantic Approach:

Flirty, fun-loving, and eager in romantic relationships.

Displays goofiness or attempts to make the other person laugh when they have a crush.

Enjoys intellectual play and wants a partner who can match their quickness.

Thrives on humor, eureka moments, and engagement of the mind.

Enjoys the thrill of the chase but may grow bored with monotony; long-distance relationships can work well.

Loves learning about their partner, so keeping them guessing and engaged is crucial.

♎Libra Venus:

Traits:

Harmonious, diplomatic, balanced, romantic, and idealistic in self-worth, money, love, and relationships.

Self-worth is influenced by how others treat them, seeking approval and universal love, but can struggle with feeling not good enough.

Needs to learn self-love and not rely solely on others for integral well-being.

Enjoys flirting and charm, finding exhilaration in social interactions and fun with potential mates and friends.

Naturally gifted in the arts, excelling in fashion, architecture, and textiles.

Actively looks for love, deeming it important and feeling lonely without it.

Ruled by Venus; loves beauty, luxury, comfort, and diplomacy.

Attracts potential partners effortlessly due to appealing qualities.Has varied color preferences based on cultural definitions of balance, avoiding reactions in people.

Trendy and hip in dressing, adapting to current aesthetics without growing overly fond of styles.

Enjoys bright, sunny smells like orange and mango, along with fruity, gentle, and sugary scents.

Adores sweet foods, indulges the senses, and may overspend on luxuries, requiring help in budgeting.

Attraction Preferences:

Attracted to polite, intelligent, artistic, and politically savvy individuals.

May find interest in lawyers, decorators, doctors, venus in libra, gemini, aquarius, leo and sagittarius.

Romantic Approach:

Ruled by social convention, enjoys romantic gestures seen in movies and media.

Can be passive romantically but enjoys playing cat and mouse games, flirting, and having fun, even if shyly.

Signs of a crush include compliments, offers to help, and extending invitations to social events.

Needs a fun, light, and very romantic partner to feel complete.

Values trust in friends and lovers, seeking someone to share both joy and dark times

May withdraw if harmony is disrupted; values care and nurturing.

Can harbor deep rage if pushed to the limit in a toxic relationship.

Communicates emotions through their eyes, conveying the depth of their love without words.

Enjoys the dating scene, finding joy in getting to know potential partners.

Dislikes crass or unpleasant partners who embarrass them.

Lives in a realm of pure ideals, exhibiting prince/princess charming-like qualities.

#astrology#venus#venus in the signs#venus in aries#venus in taurus#venus in gemini#venus in cancer#venus in leo#venus in virgo#venus in libra#venus in scorpio#venus in sagittarius#venus in capricorn#venus in aquarius#venus in pisces#astrology observations#astro community#astro notes#lunarianscorpio

3K notes

·

View notes

Text

"How to Life" Masterlist

Cleaning and Tidying

Make your bed in the morning. It takes seconds, and it's worth it.

Reset to zero each morning.

Use the UFYH 20/10 system for clearing your shit.

Have a 'drop-zone' box where you dump anything and everything. At the beginning/end of the day, clear it out and put that shit away.

Automate your chores. Have a cleaning schedule and assign 15mins daily to do whatever cleaning tasks are set for that day. Set a timer and do it once the timer is up, finish the task you're on and leave it for the day.

Fold your clothes straight out of the tumble dryer (if you use one), whilst they're still warm. This minimises creases and eliminates the need for ironing.

Clean your footwear regularly and you'll feel like a champ.

Organisation and Productivity

Learn from Eisenhower's Importance/Urgency matrix.

Try out the two-minute rule and the Pomodoro technique.

Use. A. Planner. (Or Google Calendar, if that's more your thing.)

Try bullet journalling.

Keep a notebook/journal/commonplace book to dump your brain contents in on the regular.

Set morning alarms at two-minute intervals rather than five, and stick your alarm on the other side of the room. It's brutal, but it works.

Set three main goals each day, with one of them being your #1 priority. Don't overload your to-do list or you'll hit overload paralysis and procrastinate.

If you're in a slump, however, don't be afraid to put things like "shower" on your to do list - that may be a big enough goal in itself, and that's okay.

Have a physical inbox - a tray, a folder, whatever. If you get a piece of paper, stick it in there and sort through it at the end of the week.

Consider utilising the GTD System, or a variation of it.

Try timeboxing.

Have a morning routine, and guard that quiet time ferociously.

Have a folder for all your important documents and letters, organised by topic (e.g. medical, bank, university, work, identification). At the front of this folder, have a sheet of paper with all the key information written on it, such as your GP's details, your passport details, driving licence details, bank account number, insurance number(s), and so on.

Schedule working time and down time alike, in the balance that works for you.

Money

Have. A. God. Damn. Budget.

Use a money tracker like toshl, mint, or splitwise. Enter all expenses asap! (You will forget, otherwise.)

Have a 'money date' each week, where you sort through your finances from the past seven days and then add it to a spreadsheet. This will help you identify your spending patterns and whether your budget is actually working or not.

Pack your own frickin' lunch like a grown-up and stop buying so many takeaway coffees. Keep snacks in your bag.

Food and Cooking

Know how to cook the basics: a starch, a protein, a vegetable, and a sauce.

Simple, one-pot meals ("a grain, a green, and a bean") are a godsend.

Batch cook and freeze. Make your own 'microwave meals'.

Buy dried goods to save money - rice and beans are a pittance.

Consider Meatless Mondays; it's healthier, cheaper, and more environmentally friendly.

Learn which fruits and vegetables are cheapest at your store, and build a standard weekly menu around those. (Also remember that frozen vegetables are cheap and healthy.)

Learn seasoning combinations. Different seasoning, even with the exact same ingredients, can make a dish seem completely new.

Misc

Have a stock email-writing format.

Want to start running, but find it boring? Try Zombies, Run!.

Keep a goddamn first aid kit and learn how to use it.

Update your CV regularly.

Keep a selection of stamps and standard envelopes for unexpected posting needs. (It happens more regularly than you would think!)

#becoming her#live your best life#clean girl#main character#self care#it girl#romanticizing life#romanticizing school#self love#that girl#feminine energy#devine feminine#that girl energy#it girl energy#self esteem#green juice girl#becoming that girl#high value mindset#self improvement#level up journey#kpop#live your own life#love yourself#leveling up#morning routine#matcha#pink pilates princess#pilatesworkout#skincare#wonyongism

2K notes

·

View notes

Text

Discover the Benefits of a Master of Science in Finance from Charisma University

Are you aiming to elevate your career in finance? Charisma University’s Master of Science in Finance program offers an exceptional opportunity to gain advanced knowledge and skills in the finance sector. Our comprehensive curriculum is designed to provide a deep understanding of financial principles, analytical tools, and real-world applications that are critical for success in today's dynamic financial environment.

At Charisma University, we emphasize both theoretical knowledge and practical experience. Our program covers essential topics such as corporate finance, investment analysis, financial modeling, risk management, and international finance. This balanced approach ensures that our graduates are well-prepared to tackle complex financial challenges and excel in various finance-related roles.