#bill payment innovation

Explore tagged Tumblr posts

Text

plutos ONE Wins 'Fintech Startup of the Year 2024' by Outlook Business: Redefining Innovation in India's Fintech Landscape

India’s fintech industry continues to be a hotbed of innovation, and at its forefront is plutosONE, the youngest TSP (Technology Service Provider) for the Bharat Connect (BBPS). We are thrilled to share that our company has been honored with the prestigious 'Fintech Startup of the Year 2024' award by Outlook, recognizing our relentless pursuit of excellence in bill payment solutions, consumer engagement, and incentivization platforms. This milestone highlights our pivotal role in transforming the way businesses and customers interact within the financial ecosystem.

A Decade of Leadership: The Evolution of plutos ONE

Our journey, spanning over 14 years, is a testament to our vision of making financial transactions seamless and rewarding. Starting in 2010 as a merchant aggregator for leading Brands in India, we quickly expanded our expertise. Over the years, we added industry giants like ICICI, SBI, HDFC, and Mastercard to our portfolio and became synonymous with innovation.

Fast forward to 2022, plutos ONE emerged as a licensed and empaneled BBPS TSP, offering a comprehensive suite of cutting-edge fintech solutions for banks and financial networks. These include:

Conversational AI Solutions for bill payments via WhatsApp and other platforms.

Incentives and Engagement Platforms to reward customers for every transaction.

Biller Onboarding Services, including onboarding, settlements, and refunds.

Simplify your billing process with our Unified Presentment Management System. Consolidate bills, automate payments, and improve customer satisfaction.

Agent Institution BBPS, enabling banks to activate new agent institutions seamlessly.

India’s Largest Incentive Platform

Apart from bill payment innovations, we operate India’s largest Merchant-funded Offers Platform. With partnerships spanning over 300+ online brands, 60+ cities for dining and hotel offers, and 3,000+ wellness points, we have cemented our reputation as the ultimate rewards ecosystem for customers and businesses. Collaborating with industry leaders like Myntra, Burger King, McDonald’s, Cult.Fit, and Visa, our platform offers unmatched value for its users.

A Comprehensive Bill Payment Stack

Our BBPS solutions are tailored to empower banks and customers alike. Our bill payment stack includes:

COU TSP (Customer Operating Unit TSP): Streamlining bill acceptance from customers.

BOU TSP (Biller Operating Unit TSP): Enabling billers to issue invoices and receive payments efficiently.

Payments on WhatsApp: Delivering chatbot-led payment solutions for ultimate convenience.

AI-driven solutions for rapid activation of agent institutions.

Partnering with India’s Financial Giants

Our success stems from strong partnerships with major players in the Indian financial ecosystem. These include NPCI (RuPay, UPI, Bharat Connect), HDFC Bank, Kotak Mahindra Bank, Punjab National Bank, and Bandhan Bank. Our role in managing card activation and loyalty platforms for banks and large brands further underscores our capabilities.

Recognition as the Fintech Startup of the Year

Winning the “Fintech Startup of the Year 2024 award” is not just an acknowledgment of our innovative solutions but also a celebration of our commitment to empowering India’s digital economy. By leveraging cutting-edge technology, we have made bill payments more accessible, engaging, and rewarding for millions of users.

A Vision for the Future

As we look ahead, our team remains committed to pioneering solutions that redefine financial services in India. From upcoming innovations like UPI TPAP solutions to scaling our BBPS capabilities, we are well-poised to shape the future of fintech in India.

Conclusion

Our journey from a merchant aggregator to a leader in India’s fintech space is nothing short of remarkable. With a robust suite of BBPS solutions, the largest merchant-funded offers platform, and partnerships with leading banks, we exemplify the spirit of innovation and excellence.

We are immensely grateful to our customers and clients for their trust and continued support, which drives us to innovate and excel every day. A heartfelt thank you to Outlook for recognizing our efforts with the 'Fintech Startup of the Year' award. This acknowledgment inspires us to strive harder and achieve greater milestones and reaffirms our position as a transformative force in the industry. As India’s fintech ecosystem continues to grow, plutos ONE stands as a beacon of progress, innovation, and success.

#fintech startup#fintech company in India#fintech award#fintech startup of the year#plutos.ONE#Bharat Bill Payment System#BBPS TSP#digital payments#fintech solutions#bill payment innovation#incentives platform#Outlook awards

0 notes

Text

Bill Payment Kiosk

click to know more: https://panashi.ae/bill-payment-kiosk.html Experience the convenience of paying your bills without waiting in long queues using Panashi’s bill payment kiosk

Click to know more: https://lnkd.in/gN8vBDxN

It's fast, secure, and available 24/7. Our user-friendly interface is fully customizable and offers multilingual support. It also accepts cash in any denomination and offers a variety of payment options, including cardless payments.

0 notes

Text

Things the Biden-Harris Administration Did This Week #31

August 9-16 2024

President Biden and Vice-President Harris announced together the successful conclusion of the first negotiations between Medicare and pharmaceutical companies over drug prices. For years Medicare was not allow to directly negotiate princes with drug companies leaving seniors to pay high prices. It has been a Democratic goal for many years to change this. President Biden noted he first introduced a bill to allow these negotiations as a Senator back in 1973. Thanks to Inflation Reduction Act, passed with no Republican support using Vice-President Harris' tie breaking vote, this long time Democratic goal is now a reality. Savings on these first ten drugs are between 38% and 79% and will collectively save seniors $1.8 billion dollars in out of pocket costs. This comes on top of the Biden-Harris Administration already having capped the price of insulin for Medicare's 3.5 million diabetics at $35 a month, as well as the Administration's plan to cap Medicare out of pocket drug costs at $2,000 a year starting January 2025.

President Biden and Vice President Harris have launched a wide ranging all of government effort to crack down on companies wasting customers time with excessive paperwork, hold times, and robots rather than real people. Some of the actions from the "Time is Money" effort include: The FTC and FCC putting forward rules that require companies to make canceling a subscription or service as easy as signing up for it. The Department of Transportation has required automatic refunds for canceled flights. The CFPB is working on rules to require companies to have to allow customers to speak to a real person with just one button click ending endless "doom loops" of recored messages. The CFPB is also working on rules around chatbots, particularly their use from banks. The FTC is working on rules to ban companies from posting fake reviews, suppressing honest negative reviews, or paying for positive reviews. HHS and the Department of Labor are taking steps to require insurance companies to allow health claims to be submitted online. All these actions come on top of the Biden Administration's efforts to get rid of junk fees.

President Biden and First Lady Jill Biden announced further funding as part of the President's Cancer Moonshot. The Cancer Moonshot was launched by then Vice-President Biden in 2016 in the aftermath of his son Beau Biden's death from brain cancer in late 2015. It was scrapped by Trump as political retaliation against the Obama-Biden Administration. Revived by President Biden in 2022 it has the goal of cutting the number of cancer deaths in half over the next 25 years, saving 4 million lives. Part of the Moonshot is Advanced Research Projects Agency for Health (ARPA-H), grants to help develop cutting edge technology to prevent, detect, and treat cancer. The President and First Lady announced $150 million in ARPA-H grants this week focused on more successful cancer surgeries. With grants to Tulane, Rice, Johns Hopkins, and Dartmouth, among others, they'll help fund imaging and microscope technology that will allow surgeons to more successfully determine if all cancer has been remove, as well as medical imaging focused on preventing damage to healthy tissues during surgeries.

Vice-President Harris announced a 4-year plan to lower housing costs. The Vice-President plans on offering $25,000 to first time home buyers in down-payment support. It's believed this will help support 1 million first time buyers a year. She also called for the building of 3 million more housing units, and a $40 billion innovation fund to spur innovative housing construction. This adds to President Biden's call for a $10,000 tax credit for first time buyers and calls by the President to punish landlords who raise the rent by over 5%.

President Biden Designates the site of the 1908 Springfield Race Riot a National Monument. The two day riot in Illinois capital took place just blocks away from Abraham Lincoln's Springfield home. In August 1908, 17 people die, including a black infant, and 2,000 black refugees were forced to flee the city. As a direct result of the riot, black community leaders and white allies met a few months later in New York and founded the NAACP. The new National Monument will seek to preserve the history and educate the public both on the horrible race riot as well as the foundation of the NAACP. This is the second time President Biden has used his authority to set up a National Monument protecting black history, after setting up the Emmett Till and Mamie Till-Mobley National Monument on Emmett Till's 82nd birthday July 25th 2023.

The Department of The Interior announced $775 million to help cap and clean up orphaned oil and gas wells. The money will help cap wells in 21 states. The Biden-Harris Administration has allocated $4.7 billion to plug orphaned wells, a billion of which has already been distributed. More than 8,200 such wells have been capped since the Bipartisan Infrastructure Law passed in 2022. Orphaned wells leak toxins into communities and are leaking the super greenhouse gas methane. Plugging them will not only improve the health of nearby communities but help fight climate change on a global level.

Vice-President Harris announced plans to ban price-gouging in the food and grocery industries. This would be a first ever federal ban on price gouging and Harris called for clear "rules of the road" on price rises in food, and strong penalties from the FTC for those who break them. This is in line with President Biden's launching of a federal Strike Force on Unfair and Illegal Pricing in March, and Democratic Senator Bob Casey's bill to ban "shrinkflation". In response to this pressure from Democrats on price gouging and after aggressive questions by Senator Casey and Senator Elizabeth Warren, the supermarket giant Kroger proposed dropping prices by a billion dollars

#Thanks Biden#Joe Biden#kamala harris#Politics#us politics#american politics#Medicare#drug prices#health care#cancer#Cancer moonshot#customer service#Housing#housing crisis#racism#black history#race riot#climate crisis#cost of living#food prices#shrinkflation

1K notes

·

View notes

Text

Doesn’t feel like real money when it’s a swipe card or a button on a screen, does it? Does it? Doesn’t feel like gambling when it’s a loot box of random cosmetics and power boosts that can make your character better, does it? Does it? Doesn’t feel like gambling when it’s a cattle prod shot straight into the happy chemical dopamine factory inside your skull, when it’s making your synapsis light up with happy funtime feelings, when it’s not real, not real, not real until the bill comes due. Plenty real then, every time, and that’s the biggest gamble of them all: can you keep playing until the piper comes for payment? Can you keep the party going?

Pleasure Island is everywhere thanks to them. They have brought the lights and dazzle and glory of the midway to every pocket, to every home and every hand, and they are with you for every microtransaction, for every midnight call of “it’s only a dollar for another spin, what’s a dollar, I can afford a dollar?” that doesn’t account for the hundred dollars already poured into the gaping electronic maw.

They are a god without care and without compassion, and that don’t mind you breaking yourself against their stygian shore. They were born of human innovation, and one day they will die when there are no more humans left to innovate, to toss virtual coins into their collection plates and exalt in their potential gains. They know nothing of tomorrow, nothing of yesterday; they dream only of the now, of the glory and the glitter, the lights, the buzzing chimes.

They are always victorious. After all, the house, as they say, always, always wins.

106 notes

·

View notes

Text

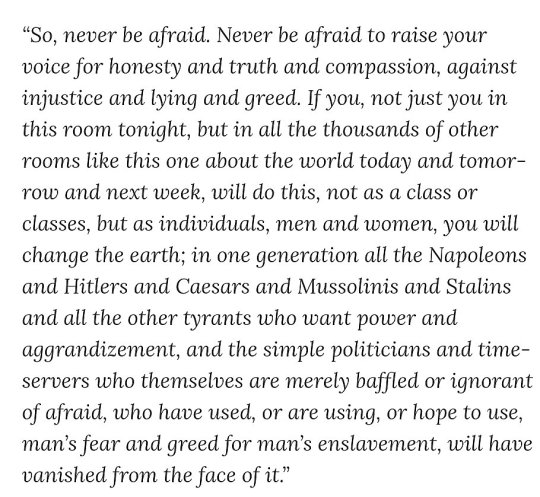

William Faulkner, "Never be afraid" :: [(From a speech delivered May 28, 1951 at Fulton Chapel, University of Mississippi)]

* * * *

LETTERS FROM AN AMERICAN

September 25, 2024

Heather Cox Richardson

Sep 26, 2024

In 2004 a senior advisor to President George W. Bush famously told journalist Ron Suskind that people like Suskind lived in “the reality-based community.” They believed people could find solutions to problems through careful study of discernible reality. But, the aide continued, Suskind’s worldview was obsolete. “That’s not the way the world really works anymore,” the aide said. “We are an empire now, and when we act, we create our own reality. And while you’re studying that reality— judiciously, as you will—we’ll act again, creating other new realities, which you can study too, and that’s how things will sort out. We’re history’s actors…and you, all of you, will be left to just study what we do.”

We appear to be in a moment when the reality-based community is challenging the ability of the MAGA Republicans to create their own reality.

Central to the worldview of MAGA Republicans is that Democrats are socialists who have destroyed the American economy. Trump calls Harris a “radical-left. Marxist, communist, fascist” and insists the economy is failing.

In Pittsburgh, Pennsylvania, today, Harris laid out her three-pillar plan for an “opportunity economy.” She explained that she would lower costs by cutting taxes for the middle class, cutting the red tape that stops housing construction, take on corporate landlords who are hiking rental prices, work with builders and developers to construct 3 million new homes and rentals, and help first-time homebuyers with $25,000 down payment assistance. She also promised to enact a federal ban on corporate price gouging on groceries and to cap prescription drug prices by negotiating with pharmaceutical companies.

Harris said she plans to invest in innovation by raising the deduction for startup businesses from its current $5,000 to $50,000 and providing low- or no-interest loans to small businesses that want to expand. Her goal is to open the way for 25 million new small businesses in her first four years, noting that small businesses create nearly 50% of private sector jobs in the U.S.

Harris plans to create manufacturing jobs of the future by investing in biomanufacturing and aerospace, remaining “dominant in AI, quantum computing, blockchain, and other emerging technologies, and expand[ing] our lead in clean energy innovation and manufacturing.” She vowed to see that the next generation of breakthroughs—“from advanced batteries to geothermal to advanced nuclear—are not just invented, but built here in America by American workers.” Investing in these industries means strengthening factory towns, retooling existing factories, hiring locally, and working with unions. She vowed to make jobs available for skilled workers without college degrees and to cut red tape to reform permitting for innovation.

“I am a capitalist,” she said. “I believe in free and fair markets. I believe in consistent and transparent rules of the road to create a stable business environment. And I know the power of American innovation.” She said she would be pragmatic in her approach to the economy, seeking practical solutions to problems and taking good ideas from wherever they come.

“Kamala Harris, Reagan Democrat!” conservative pundit Bill Kristol posted on social media after her speech.

For his part, Trump has promised an across-the-board tariff of 10% to 20% that billionaire Mark Cuban on the Fox News Channel called “insane” and Quin Hillyer of the Washington Examiner warned “would almost certainly cause immense price hikes domestically, goad other countries into retaliating, and perhaps set off an international trade war” that could “wreck the economy.” Cuban then told Jake Tapper of CNN that Trump’s promise to impose 10% price controls on credit card interest rates and price caps is “Socialism 101.”

Yesterday, more than 400 economists and high-ranking U.S. policymakers endorsed Harris, and today, the members of former South Carolina governor Nikki Haley’s presidential leadership teams in Michigan, Iowa, and Vermont announced they would be supporting Harris, in part because of Trump’s economic policies.

While Trump insisted yet again today that “the economy is doing really, really badly,” the stock market closed at a record high today for the fourth day in a row.

In other economic news, for nine years, Trump has said he will find a cheaper and better way to provide healthcare to Americans than the Affordable Care Act, although on September 10 he admitted he has only the “concepts of a plan.” Today the Treasury Department released statistics showing that 4.2 million small business owners have coverage through the ACA. Losing that protection would impact 618,590 small business owners in Florida, 450,010 in California, 423,790 in Texas, and 168,070 in Georgia.

Trump has made a claim that crime has risen dramatically under President Joe Biden and Vice President Kamala Harris central to his campaign rhetoric. The opposite is true. Two days ago, on September 23, the Federal Bureau of Investigation released its official report on crime statistics from 2023 compared with 2022. Those statistics showed that murder and non-negligent manslaughter fell by 11.6%. Rape fell by 9.4%. Aggravated assault fell by 2.8%. Robbery fell by 0.3%. Hate crimes fell by 0.6%.

Central to the worldview of MAGA Republicans is that immigration weakens a nation and that immigrants increase crime and disease. First Republican vice presidential nominee Ohio senator J.D. Vance and then Trump himself repeatedly advanced the lie that Haitian immigrants in Springfield, Ohio, are eating their neighbors�� pets and bringing disease.

Clergy members from multiple faiths have asked politicians to stop their lies about Haitian immigrants, and today the leader of Haitian Bridge Alliance, a nonprofit organization that represents the Haitian community, filed a charges against Trump and Vance for disrupting public services, making false alarms, telecommunications harassment, and aggravated menacing and complicity.

Immediately, Representative Clay Higgins (R-LA), who in the past supported Ku Klux Klan leader David Duke and filmed a selfie inside a gas chamber at Auschwitz, posted on social media: “Lol. These Haitians are wild. Eating pets, vudu, nastiest country in the western hemisphere, cults, slapstick gangsters…but damned if they don’t feel all sophisticated now, filing charges against our President and VP. All these thugs better get their mind right and their *ss out of our country before January 20th.”

After an outcry, Higgins took the post down. According to House speaker and fellow Louisiana Republican Mike Johnson, who called Higgins a “very principled man,” Higgins took it down after he “prayed about it.” Johnson seemed unconcerned about his colleague’s racism, saying, “we believe in redemption around here.”

But in a statement, House minority leader Hakeem Jeffries (D-NY) called Higgins’s statement “vile, racist and beneath the dignity of the United States House of Representatives. He must be held accountable for dishonorable conduct that is unbecoming of a Member of Congress. Clay Higgins is an election-denying, conspiracy-peddling racial arsonist who is a disgrace to the People’s House. This is who they have become. Republicans are the party of Donald Trump, Mark Robinson, Marjorie Taylor Greene, Clay Higgins and Project 2025. The extreme MAGA Republicans in the House are unfit to govern.”

On Monday, Dan Gooding of Newsweek reported that although Trump said on September 18 he would go to Springfield, he will not. Republican Ohio governor Mike DeWine had warned that the local community would not welcome a visit from the former president.

Republican politicians and candidates, including Trump, embraced North Carolina gubernatorial candidate and current lieutenant governor Mark Robinson, who trumpeted the extremists’ MAGA narrative. The September 19 revelation by CNN reporters Andrew Kaczynski and Em Steck that Robinson had boasted on a pornography website that he considers himself a “black NAZI!”, would like to reinstate slavery, and would like to own some people himself, and shared the sexual kinks in which he engaged with his wife’s sister prompted most of his campaign staff to resign.

Andrew Egger of The Bulwark reported today that on a different online forum, Robinson called for a political assassination as well as making racist attacks on entertainer Oprah Winfrey and former president Barack Obama. Robinson has called all the information released about him “false smears” and has said “[n]ow is not the time for intra-party squabbling and nonsense,” but declined help tracking down those he claims falsified his online comments. Today, multiple media outlets reported that top staff in Robinson’s government office are stepping down.

Reality hit hard this week in Texas, too, where U.S. Bankruptcy Judge Christopher Lopez yesterday approved the auctioning off of conspiracy theorist Alex Jones’s media business, the aptly-named InfoWars. Jones insisted that the 2012 Sandy Hook Elementary School shooting was a “hoax” designed to whip up support for gun restrictions, and that the grieving parents were played by “crisis actors.” Juries found Jones guilty of defaming the families of the murdered children and causing them emotional distress.

The auction of his property will enable the families to begin to collect on the more than $1 billion the jurors determined Jones owed them for his reprehensible and harmful behavior.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Letters From An American#Heather Cox Richardson#election 2024#William Faulkner#quotes#MAGA poison#racism#Mark Robinson#Clay Higgins#the economy#the middle class

20 notes

·

View notes

Text

also preserved on our archive

By Jessica Rendall

In addition to Pfizer and Moderna's new formulas, Novavax's protein-based shot is an option for COVID vaccination this season.

We're on the cusp of the fall season, which means respiratory viruses like flu, RSV and COVID are expected to keep spreading as weather cools and more people gather indoors.

Luckily, we've got vaccines in stock to help prevent respiratory viruses from turning into severe illnesses {NADI'S NOTE: Vaccination only minimizes the risk of long covid by a maximum of 30% in some people. The best protection still remains distancing when you can and masking when you cannot}. In addition to flu vaccines for the general public and RSV vaccines for older adults and pregnant people, new COVID vaccines from Pfizer-BioNTech, Moderna and Novavax are available this season to reduce the risk of hospitalization.

This means adults have a choice in which COVID vaccine they receive: an mRNA vaccine by Moderna or Pfizer, or Novavax, a protein-based vaccine that targets the virus in a more "traditional" way. All three have been authorized by the US Food and Drug Administration. While Moderna and Pfizer have been widely used over the last few years, the Novavax vaccine is building up a bit of a following.

Novavax, a protein-based vaccine, is an option for those who don't want or can't take an mRNA vaccine. Novavax may also be appealing to those wanting to experiment with the "mix-and-match" approach to COVID boosters as a way to potentially strengthen the immune response.

"Even though mRNA vaccines dominate the market for COVID vaccines, it remains important to have multiple different types of technologies against various pathogens because each may have specific use cases," Dr. Amesh Adalja, an infectious disease expert and senior scholar with Johns Hopkins Center for Health Security, said in an email.

Here's everything we know about Novavax this year. Also, read more about the at-home flu vaccine that will be available next year and how you can order more free COVID tests online.

How is Novavax different from Pfizer and Moderna? Novavax is a protein-based vaccine, which people have associated with a "traditional" approach to vaccination. This is compared with mRNA technology, which does not use dead or weakened virus as an ingredient in the vaccine but instead uses genetic code to instruct the recipient's immune system to respond.

However, Adalja said that calling Novavax traditional may be a "misnomer" because it brings its own innovation to the table. Novavax uses an insect virus that has been genetically engineered to express spike proteins, Adalja explained, which are then incorporated into the vaccine.

"The vaccine itself is coupled with an immune system booster, called an adjuvant, which increases its immunity," he said, referencing a component existing vaccines have also incorporated.

This year, there are also slight differences between Novavax and Pfizer and Moderna's updated vaccines. Both mRNA vaccines have been tweaked to target the KP.2 strain of COVID-19, which is a slightly more recent version of the virus than what Novavax targets, which is KP.2's "parent" JN.1. While the FDA ultimately decided KP.2 was preferred in vaccines, all of them are expected to help protect against severe disease and death.

However, no COVID vaccines this season will be covered free of charge by the US government. While most people's insurance is expected to continue footing the bill, adults without private or public health insurance will be responsible for payment. The Bridge Access Program was expected to provide COVID vaccines for free to people without health insurance through this year, though it ended early in August due to lack of funding.

According to GoodRx, which has a coupon available for Novavax, the retail price of the protein-based vaccine is about $191.

Who should get Novavax? Does Novavax have different side effects? Novavax was authorized by the FDA for use in adults and children 12 and older, so younger kids can't get this vaccine. But for most adults, which COVID vaccine you should choose depends on your preference and what your neighborhood pharmacy has in stock.

People may opt for Novavax for different reasons, though. For people who do not want to take an mRNA vaccine, having a protein-based vaccine like Novavax available means they can still be vaccinated for the fall and winter season.

Other people may be interested in Novavax for its use in the "mix-and-match" approach to boosting, which in the past has been associated with a strong immune response.

There is some early research that suggests Novavax may have fewer short-term side effects, such as muscle fatigue and nausea, but "we can't say this for sure," Joshua Murdock, a pharmacist and pharmacy editor of GoodRx, said in an email.

"This isn't proven, and side effects do vary by person," Murdock said. He added the CDC doesn't recommend one vaccine over the other, even in people who are immunocompromised.

In general, mRNA vaccines have been found to be fairly "reactogenic" compared to other vaccines, Adalja said, noting that it also depends on the individual. But if someone had a bad experience with the mRNA vaccine, Adalja said, they "may fare better with the Novavax vaccine."

Some flu-like side effects can be expected post-vaccine, no matter which one you choose. This includes symptoms like headache, tiredness, a sore arm and even chills. Not experiencing symptoms doesn't mean your immune system isn't kicking in, but experiencing some side effects may signal that your immune system is responding to the jolt, so to speak.

In rare cases, myocarditis or heart inflammation problems have been associated with COVID vaccination, particularly in younger men and adolescents within the two weeks following vaccination. Research so far shows that Novavax, like mRNA vaccines, may also carry this rare side effect though.

Following high levels of COVID this summer in the US, more information will be needed to see how all vaccines and their freshly targeted formulas fare against the virus that's expected to continue to spread this fall and winter.

"There's no strong evidence that one vaccine is preferable to another in specific individuals, but that will be an important avenue to study for more precision-guided vaccine recommendations," Adalja said.

How to find a Novavax vaccine Novavax announced on Sept. 13 that doses of its vaccine will be available at the following pharmacies:

CVS Rite Aid Walgreens Costco Publix Sam's Club Kroger Meijer Other independent pharmacies or grocers Novavax also has a vaccine finder on its website. To use it, type in your ZIP code in the small search box, and pharmacies nearby with the vaccine in stock will be displayed.

#mask up#covid#pandemic#covid 19#wear a mask#public health#coronavirus#sars cov 2#still coviding#wear a respirator#novavax

17 notes

·

View notes

Text

The United Nations (but not only) has clearly chosen to focus its push on introducing digital ID systems to some of the world’s developing countries, particularly in Africa.

What’s referred to in reports as “a comprehensive initiative” is now taking place across the continent, driven by the UN development agency UNDP, as well as the UN Innovation Network, and even UNESCO (Education, Scientific, and Cultural Organization). This is one of the components of what’s known as the UN’s Global Digital Compact.

Such initiatives are sold in those countries as a way to develop better access to services and improve “digital inclusion.”

Related: Digital ID, Bill Gates vaccine record, and payments system combo to be trialed in Africa

But opponents around the world say the schemes create large, centralized surveillance networks prone to misuse, particularly without stringent safeguards in place.

7 notes

·

View notes

Text

Japanese family farm goes solarpunk

While Japan continues to drive the high-tech smartification of agriculture, what is the role of digitalisation for a diversified, agroecological family farm in a rural part of Hyogo Prefecture? Matteo Metta writes this report from Hashimoto Farm in Ichijimachō to share his observations on how digitalisation fits into the everyday life of this small-scale, mixed organic farm, as well as digitalisation’s role in the context of the increasing socio-ecological threats faced by the village, from typhoons and landslides, to depopulation and societal ageing.

The Hashimoto family is composed of four members: Hashimoto, Keiko and their two sons who now live outside the farmhouse. Volunteers, woofers, researchers, practitioners and interns from all over the world come here to work in exchange for learning organic farming in a Japanese rural setting. The 1.2 hectare farm is scattered in many disjointed plots. It is certified under the common organic certification (JAS). As an organic farm, they produce and directly sell any sort of local vegetables and rice. They rear chickens too, an important element for closing the organic nutrient cycle between the soil, human consumption and plants. Some of the seeds sown on the farm are locally selected, saved and exchanged with other farmers, while others are bought from the market. When organic seeds are unavailable, Shinji-san resorts to conventional ones. Besides farming and direct selling, the farm hosts and provides training and organic farming educational activities to school children, young people and adult farm workers.

Weekly open farmers’ markets (called “marché” in Japan) are not common in this remote village of rural Japan. Bigger discount shops or supermarkets can provide a variety of goods, including food products. Although some of Hashimoto Farm’s produce is used for self-consumption or donated annually to local charities for children and single mothers in need, the farm income depends on the selling of their organic produce mainly through two direct sale channels:

Shinzenha-ne, a cooperative buying, selling and delivering organic products.

Ashi no Kai, a small-scale network that connects consumers with producers and is specialised in home delivery of organic produce in the Hyogo and Osaka prefectures.

Consumer cooperatives are quite advantageous for farmers because they can reach bigger and more stable food demand from the whole prefecture instead of just the village and spend less time and energy physically attending local markets. Except for placing the exact demand of requested food in the box, the rest of the supply chain activities is in the charge of the consumer cooperative (receiving orders, food collection, assemblage of food boxes for each consumer, box delivering, billing, transferring payments, etc.).

“Digitalisation, as many technological innovations, is inevitable. We need to make it useful for us though. The problem is not the technology per se, but the system in which we live.”

Even if both cooperatives offer online means for consumers to select their products, much of the communication and transactions with consumers and farmers are still based on paper, phone calls and fax. Although this system might mean spending less hours inputting digital data, learning how to use a computer and relying less on external skills to maintain or repair any possible errors or damage, some of the limitations mentioned by Keiko-san about this direct selling system are:

Asynchronisation: the weekly orders made by the consumers through these two consumer cooperatives might not be automatically synchronised with the stock available on the farm.

Material and energy costs: paper is still circulating in these transactions, which often requires also expensive physical deployment of the operators or fax messages.

Overall, this farm-to-consumers’ door delivery system has been running for many years and is proven within the specific social, demographic and geographical conditions of rural Japan. Yet, this system is not error-free, e.g., mismatching order-farm stock, mismatching consumer quality expectation and farmers’ explanations of product defects, etc.

10 notes

·

View notes

Text

How to Choose the Right Micro ATM Service Provider for Your Needs?

In today's world, financial transactions need to be fast, secure, and accessible to everyone. As Micro ATM Services grow in popularity, selecting the right Micro ATM Services Provider is essential for businesses and individuals looking to benefit from these compact and efficient banking solutions. This guide explores key factors to consider when choosing the right provider and highlights the impact of technology-driven solutions.

Understanding Micro ATM Services Providers

A Micro ATM Services Provider is a company or entity that supplies, operates, and maintains Micro ATM devices for business correspondents or other users. These providers play a pivotal role in extending banking services to remote areas by offering hardware, software, and operational support. Choosing a reliable provider ensures that transactions are secure, seamless, and efficient.

Key Factors to Consider When Choosing a Micro ATM Services Provider

1. Reliability and Reputation The reputation of a provider is critical. Research their track record and client testimonials. Providers with proven reliability can ensure consistent uptime and minimal technical issues. Established names in the industry often have better infrastructure and support systems.

2. Range of Services Offered Different providers offer varying levels of services. Ensure that the provider offers a comprehensive package, including cash withdrawals, deposits, balance inquiries, and fund transfers. Some providers also enable utility bill payments and government subsidies distribution. This versatility adds value to the service.

3. Technology and Security Advanced technology is at the core of any successful Micro ATM Services Provider. Look for providers that offer secure devices equipped with biometric authentication and encryption. Technology-driven providers, such as Xettle Technologies, leverage cutting-edge solutions to ensure reliable and safe transactions. Such features are essential to building trust among users.

4. Business Software Integration For businesses, seamless integration with existing systems is crucial. Check whether the provider offers compatible Business Software that simplifies transaction management and reporting. This integration can save time and reduce errors in operations.

5. Customer Support and Training A good provider should offer robust customer support and training programs for operators. This includes resolving technical issues, providing user manuals, and conducting workshops to train business correspondents. Proper training ensures smooth operations and better service delivery.

6. Cost and Pricing Models Evaluate the cost structure of the provider. While affordability is important, it is equally crucial to assess the value offered. Compare pricing models, maintenance charges, and transaction fees among multiple providers to find one that suits your budget and needs.

7. Scalability and Customization As your business grows, your needs might change. Choose a provider that offers scalable solutions and customizable features. This flexibility ensures that the services remain relevant and useful in the long term.

The Role of Technology in Selecting a Provider

Technology is the backbone of Micro ATM Services. Providers that invest in state-of-the-art technology deliver faster, more secure, and reliable services. For instance, companies like Xettle Technologies lead the industry with innovative solutions that enhance user experience. Their focus on secure software, user-friendly interfaces, and robust connectivity ensures seamless financial transactions, even in areas with limited infrastructure.

Benefits of Choosing the Right Micro ATM Services Provider

1. Improved Customer Satisfaction A reliable provider ensures efficient and error-free transactions, which improves customer trust and satisfaction. End-users are more likely to adopt formal banking channels when they experience secure and hassle-free services.

2. Enhanced Financial Inclusion By choosing a dependable Micro ATM Services Provider, businesses can extend banking services to unbanked and underbanked populations. This not only promotes financial inclusion but also fosters economic growth in remote areas.

3. Streamlined Business Operations For businesses, the integration of Micro ATM systems with business software simplifies financial management. Automated reporting, transaction tracking, and reduced manual errors contribute to operational efficiency.

4. Increased Profitability A good provider offers cost-effective solutions that enable businesses to maximize their returns. Affordable maintenance and transaction fees, coupled with reliable service, ensure sustainable profitability.

Challenges in Selecting a Provider

While the benefits are clear, selecting the right provider can be challenging. Connectivity issues in remote areas, varying service quality among providers, and hidden costs are common obstacles. Thorough research and due diligence can help mitigate these

2 notes

·

View notes

Text

Credit Card Payment Gateway Innovations: Enhancing E-Commerce Platforms

Article by Jonathan Bomser | CEO | Accept-credit-cards-now.com

In today's rapidly changing e-commerce landscape, the ability to process payments efficiently is the cornerstone of online business success. Credit card payment gateways have emerged as the driving force behind these seamless transaction experiences. As technology continues to advance, innovative payment gateway solutions are making waves, transforming how businesses handle credit card transactions and manage financial processes. In this article, we embark on a journey to explore the latest trends and cutting-edge developments in credit card payment gateways. We'll uncover how these innovations are shaping e-commerce platforms to cater to diverse needs, including high-risk transactions, credit repair services, and the CBD industry.

DOWNLOAD THE CREDIT CARD PAYMENT GATEWAY INFOGRAPHICS HERE

Revolutionizing Payment Processing for High-Risk Ventures Businesses operating in high-risk sectors, such as gaming, adult entertainment, or travel, often face significant challenges when it comes to conventional payment processing solutions. The answer to these challenges lies in the form of high-risk merchant accounts and specialized payment gateways. These tailor-made solutions go beyond ensuring secure transactions; they also provide a suite of risk management tools to shield businesses against fraud and other threats.

Empowering E-Commerce with Seamless Payment Solutions The rise of e-commerce has fundamentally transformed how we shop, and credit card payment gateways are pivotal in shaping this transformation. By enabling online credit card payments, businesses can provide their customers with a convenient and efficient checkout experience. Modern payment gateways offer a range of options, including the acceptance of credit and debit card payments, ensuring that customers can choose their preferred payment method.

Supporting the Credit Repair Industry Credit repair companies play a crucial role in helping individuals improve their credit scores and financial well-being. To cater to the unique payment needs of this sector, specialized merchant processing and payment gateway solutions have emerged. These solutions not only ensure secure credit repair payment processing but also seamlessly integrate with credit repair service platforms.

Navigating the Complexities of CBD Payment Processing The burgeoning CBD industry, while experiencing exponential growth, grapples with its high-risk status and intricate regulatory landscape. CBD merchants can now leverage specialized high-risk CBD payment processing solutions, meticulously tailored to meet the exacting demands of their industry. These solutions ensure stringent compliance with regulations while providing a frictionless payment experience for customers.

Innovative Strides in Payment Gateway Solutions Innovative payment gateway providers continuously enhance their services to meet the dynamic needs of contemporary e-commerce. Advanced features like tokenization for secure card storage, multi-currency support, and subscription billing have become commonplace. These features not only streamline payment processes but also cultivate customer trust and loyalty.

Prioritizing Data Security in Payment Gateways Data security remains a paramount concern for both businesses and customers engaging in online transactions. Leading payment gateways prioritize data security by implementing robust encryption, adhering to the Payment Card Industry Data Security Standard (PCI DSS), and integrating two-factor authentication. These measures instill confidence in customers, encouraging them to conduct more online transactions.

youtube

A Unified Approach: Comprehensive Credit Card Payment Services Many payment gateway providers now offer a comprehensive suite of services beyond payment processing. These services may encompass fraud prevention tools, in-depth analytics and reporting, and seamless integrations with other e-commerce tools. By adopting this unified approach, businesses can streamline their operations and provide customers with a seamless and satisfying online experience.

In an era where e-commerce reigns supreme, credit card payment gateways are evolving incessantly to harmonize with the shifting landscape. From the intricate domain of high-risk industries to the specialized realm of credit repair services and the ever-burgeoning horizon of CBD merchants, pioneering payment processing solutions are driving growth and setting new standards for online transactions. By embracing these innovations and selecting the right payment gateway partner, businesses can unlock new avenues of success in the digital realm.

#credit card payment#credit card processing#high risk merchant account#high risk payment gateway#high risk payment processing#merchant processing#payment processing#accept credit cards#Youtube

21 notes

·

View notes

Link

In a ground-breaking development in healthcare innovation, NS Hospital, Kollam , has etched its name in history by inaugurating India's first SBI Grapes IDMR...

#sbi#grapesinnovativesolutions#grapesidmr#HealthcareInnovation#NSHospital#Kollam#DigitalTransformation#HospitalManagement#hospitalmanagementsoftware#clinicsystemsoftware

2 notes

·

View notes

Text

Brazil secretary sees potentially “dramatic” reduction in tax evasion with reform

Model could also curtail fraud and help lower VAT rate, secretary says

The overall operational model of the tax reform—which includes electronic fiscal documents, pre-filled assessments, and split payment, has a “dramatic” potential to reduce tax evasion and fraud and could contribute to a lower Value Added Tax (VAT) burden, according to Daniel Loria, director of the extraordinary secretariat for tax reform.

He said the government estimates a potential reduction of R$150 billion annually. This amount, he noted, equates to approximately 3 percentage points (p.p.) in the VAT rate. “Every percentage point in the VAT rate corresponds to about R$50 billion. I would say one of the main goals of this model is to collect more from those who aren’t paying properly, thereby achieving a lower reference rate for all taxpayers,” Mr. Loria said.

These comments were made during Mr. Loria’s participation in an event hosted in São Paulo by the Tax Law Center at FGV Direito SP, focusing on tax reform and the technology sector.

“The split payment is one of the major technological innovations in the bill,” Mr. Loria remarked, referring to Supplementary Bill (PLP) 68/2024. The bill, currently under Senate review, proposes the regulation of the two taxes that will represent VAT in a dual form: the Contribution on Goods and Services (CBS), collected federally, and the Tax on Goods and Services (IBS), which will be administered by states and municipalities, as established in Constitutional Amendment 132/2023, part of the tax reform.

Continue reading.

2 notes

·

View notes

Text

The Rise of Fintech: Transforming Financial Services for the Digital Age

In recent years, Fintech—short for Financial Technology—has emerged as a disruptive force in the financial services industry. From mobile payments to blockchain technology, fintech innovations are reshaping how individuals, businesses, and financial institutions interact with money. As digital tools continue to evolve, they offer new ways to improve financial efficiency, transparency, and inclusivity.

The rapid rise of fintech is not just a trend; it's a transformative shift that’s reshaping financial landscapes globally. In this article, we will explore what fintech is, how it’s transforming various sectors of financial services, and what the future holds for this exciting industry.

1. What is Fintech?

Fintech is a term that encompasses any technology that improves and automates financial services. This can include innovations in areas like mobile payments, online banking, investment platforms, and even the use of artificial intelligence in managing financial portfolios.

Fintech aims to make financial services more accessible, efficient, and secure. By leveraging digital tools, it allows individuals to manage their finances with ease, whether they're sending money across borders, applying for a loan, or investing in the stock market.

2. The Evolution of Fintech

The roots of fintech can be traced back to the late 20th century, with the introduction of online banking and electronic payments. However, it wasn't until the late 2000s, with the rise of smartphones and digital apps, that fintech truly took off.

The 2008 financial crisis also played a significant role in the development of fintech. Traditional banks struggled, leading to the rise of alternative financial solutions. Startups began creating apps and platforms to offer services such as peer-to-peer lending, robo-advisors, and even digital currencies like Bitcoin.

Today, fintech is booming, with countless companies and startups offering innovative financial products and services that rival traditional financial institutions.

3. The Key Sectors of Fintech

Fintech covers a broad range of sectors, each offering unique innovations that are transforming the way we think about and use financial services. Here are some of the key areas:

a. Digital Payments

One of the most recognizable sectors of fintech is digital payments. Apps like PayPal, Venmo, and Apple Pay have made sending and receiving money faster, more convenient, and cheaper than traditional methods.

Consumers can now make purchases, pay bills, and send money internationally with just a few taps on their smartphone, without needing to rely on banks or physical cash.

b. Lending and Borrowing

Fintech has disrupted the lending industry by providing alternatives to traditional bank loans. Peer-to-peer lending platforms such as LendingClub and Funding Circle allow individuals to lend directly to borrowers, cutting out the middleman and often providing better rates for both parties.

Additionally, fintech lenders have made it easier for small businesses and individuals with less-than-perfect credit scores to access loans through automated credit scoring systems.

c. Investment Platforms

The rise of fintech has made investing more accessible to the general public. Gone are the days when investing required a hefty minimum deposit and working with a financial advisor.

Now, thanks to robo-advisors like Betterment and Wealthfront, individuals can invest with little to no minimum, receiving tailored investment advice through algorithms that automatically adjust portfolios based on risk tolerance and market conditions.

d. Insurtech (Insurance Technology)

Insurtech is another growing sector of fintech, aiming to simplify and improve the insurance industry. From comparing quotes to filing claims, insurance technology platforms like Lemonade are providing a seamless, user-friendly experience for consumers.

These innovations are making insurance more affordable and efficient, particularly for younger consumers who value the convenience of digital interactions.

e. Cryptocurrency and Blockchain

Perhaps the most transformative development in fintech is the rise of cryptocurrencies and blockchain technology. Cryptocurrencies like Bitcoin and Ethereum offer decentralized alternatives to traditional currencies, while blockchain technology provides a secure and transparent way to record transactions.

While still relatively new, cryptocurrencies and blockchain are expected to have far-reaching implications for everything from cross-border payments to smart contracts.

4. How Fintech is Changing Financial Services

Fintech’s influence is broad and deep, transforming almost every facet of financial services. Here’s a closer look at how it’s reshaping the industry:

a. Improving Access to Financial Services

One of the biggest advantages of fintech is that it provides greater access to financial services, particularly for underserved populations. For example, fintech platforms allow people in developing countries, who might not have access to traditional banking, to open accounts and manage their finances using just a smartphone.

Fintech has also revolutionized access to credit. Through digital lending platforms, individuals and small businesses can get loans faster and more easily than ever before, often bypassing the hurdles of traditional banks.

b. Lowering Costs

Fintech companies operate more efficiently than traditional financial institutions, often passing these savings on to consumers in the form of lower fees and better interest rates. This is especially true in sectors like peer-to-peer lending and digital payments, where middlemen have been cut out of the equation.

c. Faster Transactions

In the traditional financial world, sending money, especially internationally, can be a slow and expensive process. Fintech has made these transactions faster, with some payments happening in real time. Digital wallets, payment processors, and blockchain technology are all contributing to instantaneous money transfers, no matter where you are in the world.

d. Personalized Financial Management

Thanks to the use of big data and machine learning, fintech companies can provide highly personalized services. For example, investment platforms use algorithms to create tailored portfolios, while budgeting apps help users track and optimize their spending habits based on individual behavior.

This level of personalization is helping consumers and businesses alike make better financial decisions, driving growth and improving financial health.

5. The Role of Artificial Intelligence in Fintech

Artificial intelligence (AI) is playing a significant role in the fintech industry. AI is used to streamline processes, enhance customer experiences, and improve security measures. For example, chatbots powered by AI can handle basic customer inquiries, freeing up human agents to focus on more complex tasks.

AI also plays a crucial role in fraud detection and cybersecurity, identifying unusual patterns in data and flagging potential threats in real time.

6. Fintech Regulations and Challenges

As fintech continues to grow, so do the regulatory challenges that come with it. Governments and financial institutions around the world are working to create regulatory frameworks that both encourage innovation and protect consumers.

Some key concerns in fintech include data privacy, cybersecurity, and the risk of financial exclusion if certain populations are unable to keep up with technological advances.

There’s also the challenge of navigating the global landscape, as fintech companies often operate in multiple countries, each with its own regulations and standards.

7. The Future of Fintech

The future of fintech looks incredibly promising, with AI, blockchain, and cryptocurrencies leading the charge. Experts predict that in the next few years, we’ll see even more integration between traditional financial institutions and fintech companies, blurring the lines between the two.

In addition to more widespread adoption of digital currencies, the fintech industry is expected to play a key role in financial inclusion, helping to bridge the gap for the 1.7 billion people globally who remain unbanked.

8. How to Get Started in Fintech

If you're interested in fintech, there are plenty of ways to get started. Whether you’re a consumer looking to take advantage of new financial tools, or a professional considering a career in the industry, now is the perfect time to dive in.

Explore Fintech Platforms: Start using digital banking apps, robo-advisors, or digital wallets to familiarize yourself with how fintech works.

Learn About Blockchain and AI: These two technologies are central to the future of fintech. There are plenty of online courses and resources available to help you learn the basics.

Invest in Fintech: Many fintech companies are publicly traded, offering opportunities for you to invest in the future of finance.

9. The Benefits of Fintech for Businesses

Fintech isn’t just changing the landscape for consumers—it’s also revolutionizing how businesses operate. From streamlining payment processes to improving access to capital, fintech is enabling businesses to operate more efficiently and scale faster.

Some benefits for businesses include:

Lower Transaction Fees: Fintech payment processors offer competitive rates compared to traditional banks.

Access to Funding: Digital lending platforms and crowdfunding have opened up new ways for businesses to access funding.

Improved Cash Flow Management: With real-time payment solutions, businesses can improve cash flow and reduce the wait times associated with traditional banking.

10. Conclusion: Fintech is Here to Stay

In conclusion, fintech is not just a buzzword—it’s a revolution that’s changing the way we interact with money and financial services. Whether it’s through digital payments, AI-powered financial tools, or blockchain-based systems, fintech is making finance faster, more accessible, and more secure.

The rise of fintech has already transformed many aspects of financial services, and it shows no signs of slowing down. As technology continues to advance, we can expect fintech to play an even larger role in the global economy.

Are you ready to explore the future of finance? Click here to learn more and stay ahead of the curve with the latest insights: The Rise of Fintech.

#fintech#financetips#investing stocks#personal finance#management#investing#finance#crypto#investment#blockchain#solana#crypto market

2 notes

·

View notes

Text

Excerpt from this story from Anthropocene Magazine:

I write about the climate and energy for a living and even I can’t quite wrap my head around how cheap low-carbon power technologies have gotten. The cost of onshore wind energy has dropped by 70% over just the last decade, and that of batteries and solar photovoltaic by a staggering 90%. Our World in Data points out that within a generation, solar power has gone from being one of the most expensive electricity sources to the cheapest in many countries—and it’s showing little signs of slowing down.

So where does this all end?

Back in the 1960s, the nuclear industry promised a future in which electricity was too cheap to meter. Decades later, the same vision seems to be on the horizon again, this time from solar. It seems, well, fantastic. Perhaps (almost) free renewable power leads to climate utopia. Then again, should we be careful what we wish for?

The Road To Decarbonization Is Paved With Cheap Green Power

1. More renewables = less carbon. The math isn’t complicated. The faster we transition to clean energy, the less carbon dioxide we’re adding to the atmosphere and the fewer effects of global warming we will suffer.While humanity is still emitting more greenhouse gases than ever, the carbon intensity of electricity production has been dropping for well over a decade.

2. Cheap, clean power also unlocks humanitarian goals. Modern civilization rests on a foundation of electricity. Beyond its obvious uses in heating, cooling, cooking, lighting and data, electricity can decarbonize transportation, construction, services, water purification, and food production. Increasing the supply and reducing the cost of green electricity doesn’t just help the climate, it improves equity and quality of life for the world’s poorest.

3. Scrubbing the skies will take a lot of juice. Once we get emissions under control, it’s time to tackle the mess we’ve made of the atmosphere. Today’s direct air capture (DAC) systems use about two megawatt hours of electricity for every ton of CO2 plucked from fresh air. Scale that up to the 7 to 9 million tons we need to be removing annually in the US by 2030, according to the World Resources Institute, and you’re looking at about 0.5% of the country’s current energy generation. Scale it again to the nearly 1,000 billion tons the IPCC wants to sequester during the 21st century, and we’ll need every kilowatt of solar power available—the cheaper the better.

Cheap Power Has Hidden Costs

1. Cheap technology doesn’t always mean cheap power. If solar cells are so damn cheap, why do electricity bills keep rising? One problem is that renewables are still just a fraction of the energy mix in most places, about 20% in the US and 30% globally. This recent report from think-tank Energy Innovation identifies volatility in natural gas costs and investments in uneconomic coal plants as big drivers for prices at the meter. Renewables will have to dominate the energy mix before retail prices can fall.

2. The cheaper the power, the more we’ll waste. Two cases in point: cryptocurrency mining and AI chat bots. Unless we make tough social and political decisions to fairly price carbon and promote climate action, the market will find its own uses for all the cheap green power we can generate. And they may not advance our climate goals one inch.

3. Centuries of petro-history to overcome. Cheap power alone can only get us so far. Even with EVs challenging gas cars, and heat pumps now outselling gas furnaces in the US, there is a monumental legacy of fossil fuel systems to dismantle. Getting 1.5 billion gas cars off the world’s roads will take generations, and such changes can have enormous social costs. To help smooth the transition, the Center for American Progress suggests replacing annual revenue-sharing payments from coal, oil, and natural gas production with stable, permanent distributions for mining and oil communities, funded by federal oil and gas revenue payments.

5 notes

·

View notes

Text

Unlock convenience with our telecom self-service kiosk!

Discover all the amazing features packed into this innovative solution. From bill payments to SIM card issuance and replacements, managing your telecom needs has never been easier!

visit: https://panashi.ae/telecom-solutions.html

#panashi#kiosk#TelecomKiosk#selfservicekiosk#SIMCard#Recharge#ActivateService#EWallet#Multilingual#PaymentOptions#TelecomSolutions#technology#ai#machinelearning

2 notes

·

View notes

Text

Talee: Your Ultimate Personal Finance Companion

In an age where financial stability and smart money management are crucial, Talee emerges as a beacon of innovation and practicality. This comprehensive personal finance management tool is designed to help individuals take control of their financial lives. From budgeting to investment tracking, Talee offers a suite of features tailored to meet the diverse needs of its users.

Understanding Talee

Talee is an all-encompassing personal finance app aimed at making money management straightforward and efficient. Its user-friendly interface and robust features ensure that users can handle their finances with ease and precision. Whether you’re looking to budget better, save more, or keep track of your investments, Talee has got you covered.

Highlighting Talee’s Features

Simplified Budgeting: Talee’s budgeting feature allows users to set realistic budgets based on their income and expenditure patterns. The app provides detailed insights into spending habits, helping users identify potential savings. With its intuitive design, users can effortlessly adjust their budgets and track their progress in real-time.

Automated Expense Tracking: One of the most challenging aspects of personal finance is keeping track of daily expenses. Talee automates this process by linking directly to users’ bank accounts and credit cards, categorizing transactions, and providing a clear picture of where money is being spent. This automation not only saves time but also ensures accuracy.

Goal-Oriented Savings: Whether you’re saving for a big purchase, a vacation, or an emergency fund, Talee makes it easy to set and achieve your financial goals. Users can create multiple savings goals, allocate funds towards them, and track their progress. The app also offers tips and strategies to help users save more efficiently.

Comprehensive Investment Tracking: For those who invest, Talee offers a sophisticated investment tracking tool. By linking investment accounts, users can monitor portfolio performance, track asset allocation, and receive insights into market trends. This feature is designed to help users make informed investment decisions and optimize their portfolios.

Bill Payment Reminders: Missing a bill payment can result in late fees and a negative impact on your credit score. Talee’s bill reminder feature ensures that users never miss a payment. The app sends timely notifications for upcoming bills, helping users stay organized and avoid unnecessary penalties.

Insightful Financial Reports: Understanding your financial health is crucial for making informed decisions. Talee provides detailed financial reports and analyses, offering insights into spending patterns, income sources, and investment returns. These reports are designed to help users make strategic adjustments to their financial plans.

Why Talee Stands Out

Intuitive Design: Talee’s interface is clean, intuitive, and easy to navigate. It is designed to be accessible for users of all tech skill levels, ensuring a smooth and enjoyable user experience.

Top-Notch Security: Security is a paramount concern for Talee. The app employs advanced encryption techniques and security measures to protect users’ financial data. Users can trust that their sensitive information is secure.

Highly Customizable: Talee offers a high degree of customization, allowing users to tailor the app to their specific financial needs. From setting custom budget categories to personalizing savings goals, Talee adapts to each user’s unique financial situation.

Multi-Platform Access: Talee is available on multiple platforms, including iOS, Android, and web. This ensures that users can access their financial information anytime, anywhere, providing flexibility and convenience.

Community Support: Talee boasts a vibrant community of users who share tips, advice, and support. Additionally, Talee’s customer support team is readily available to assist with any issues or questions, ensuring users always have the help they need.

The Future of Personal Finance with Talee

Talee is committed to continuous improvement and innovation. The development team is constantly working on adding new features and enhancing existing ones to meet the evolving needs of its users. Future updates are set to include advanced financial planning tools, enhanced investment tracking, and expanded integration options with various financial institutions.

As the landscape of personal finance grows more complex, Talee stands as an indispensable tool for managing money effectively. By providing a comprehensive, user-friendly platform, Talee empowers individuals to take charge of their financial future. Whether you’re just beginning your financial journey or looking to refine your financial strategies, Talee offers the tools and insights you need to succeed.

Talee is more than just a personal finance app; it is a comprehensive financial companion designed to simplify and enhance the way you manage your money. With its innovative features and commitment to user satisfaction, Talee is set to become an essential part of personal finance management for people around the world.

website: https://talee.co.uk

2 notes

·

View notes