#bank financial statement analysis

Explore tagged Tumblr posts

Text

How Does Bank Statement Analysis Enhance Credit Underwriting in Financial Institutions?

What is a Bank Statement Analysis?

Bank statement analysis is a systematic review of the transactions recorded in a bank statement, used primarily to assess an individual’s or company’s financial health and stability. This process is essential in credit underwriting, where banks and financial institutions evaluate whether a borrower is capable of repaying a loan. By examining how money is received and spent, lenders can get a detailed picture of the borrower’s financial behaviour, cash flow stability, and overall creditworthiness.

Through this analysis, financial institutions gain insights into several critical aspects of a borrower’s financial life. For instance, regular deposits may indicate a steady income, while frequent overdrafts could signal financial mismanagement. By identifying these patterns, lenders can make informed decisions about the level of risk involved in lending to a particular individual or business.

Moreover, bank statement analysis goes beyond just assessing current financial health; it also helps in projecting future financial behavior. This predictive capability is invaluable in credit underwriting as it allows lenders to anticipate potential financial difficulties before they arise, enabling proactive management of loan portfolios. In addition, understanding spending habits and financial commitments through bank statement analysis aids in customizing lending products to better suit the borrower’s needs. This personalized approach not only enhances customer satisfaction but also strengthens the institution's relationship with its clients, fostering loyalty and trust.

The Role of Bank Statement Analysis in the Financial Sector

In the financial sector, understanding the cash flow of potential borrowers is crucial for risk management. Bank statement analysis provides a factual basis for making lending decisions by highlighting the financial strengths and vulnerabilities of the borrowers. It allows lenders to assess:

Income Stability: Regular income entries reflect financial stability.

Cash Flow: Timing and consistency of cash inflows and outflows.

Financial Commitments: Recurring expenses and existing liabilities.

Spending Behaviour: Patterns that might indicate financial distress or mismanagement.

Key Components of Bank Statements

A bank statement typically includes the following components, each providing valuable insights into the account holder’s financial activities:

Account Holder Information: Identity verification to prevent fraud.

Account Summary: Overview of the financial status at the beginning and end of the period.

Detailed Transactions: All the inflows and outflows during the statement period, providing a trail of financial activities.

Utilization of Bank Statement Analyzers in Credit Underwriting

The adoption of bank statement analyzers in credit underwriting has revolutionized how financial institutions assess credit risk. These tools automate the extraction and analysis of financial information, offering advantages such as:

Efficiency: Rapid processing of data to speed up the credit decision process.

Accuracy: Reduced human error in data interpretation.

Scalability: Ability to handle large volumes of applications.

Financial Insights Derived from Bank Statement Analysis

By thoroughly analyzing bank statements, lenders can:

Detect Early Warning Signs: Unusual transactions or abrupt changes in spending can indicate potential financial distress.

Evaluate Financial Discipline: Regular savings and consistent payment of bills show financial responsibility.

Assess Profitability and Growth: For businesses, consistent revenue growth and profitability are good indicators of a healthy company.

Statistical Insights in Bank Statement Analysis

The power of bank statement analysis can be illustrated through various statistics:

A study by found that businesses that maintain average monthly balances of at least 10% of their annual revenues are 30% more likely to maintain long-term financial stability.

According to a report, applicants with irregular income patterns are 15% more likely to default on loans than those with steady incomes.

Data from a financial analytics firm indicated that 20% of loan defaults were associated with borrowers who had significant fluctuations in their monthly expenses.

Advanced Techniques in Bank Statement Analysis

Modern bank statement analyzers employ advanced techniques such as:

Machine Learning: To identify patterns and predict future behavior based on historical data.

Data Visualization: Graphical representation of data to spot trends and outliers more effectively.

Natural Language Processing (NLP): To interpret transaction descriptions and categorize them automatically.

Challenges and Solutions in Bank Statement Analysis

Despite its advantages, bank statement analysis faces challenges such as:

Data Overload: Handling the massive volume of data can be overwhelming.

Privacy Concerns: Ensuring the security and confidentiality of personal and financial data.

Complexity of Analysis: Especially with non-standardized financial statements.

Solutions include:

Adopting Robust Data Management Systems: To handle large datasets efficiently.

Implementing Strong Cybersecurity Measures: To protect sensitive data.

Continuous Training and Development: Ensuring that financial analysts are equipped with the latest tools and knowledge.

Conclusion: The Future of Financial Analysis

Bank statement analysis is becoming increasingly sophisticated, with new technologies enhancing the accuracy and depth of financial insights. As financial institutions continue to embrace digital transformation, the role of bank statement analyzers will expand, becoming a fundamental aspect of financial assessments. This progression not only helps in accurate credit underwriting but also empowers consumers and businesses to understand and improve their financial health, fostering a more financially literate and stable society.

As the landscape of financial technology evolves, the integration of advanced analytical tools is reshaping traditional banking practices. These innovations are democratizing access to financial insights, allowing both individuals and businesses to make informed decisions about their financial futures.

The future of bank statement analysis is likely to see even more integration with artificial intelligence and blockchain technologies, further enhancing transparency and trust in financial transactions. AI-driven insights will provide more personalized financial advice, helping consumers optimize their spending and saving habits. Meanwhile, blockchain could offer an immutable record-keeping system that enhances the security and accuracy of financial data.

In this new era, collaboration between financial institutions, fintech companies, and regulatory bodies will be key to ensuring that these technological advancements are leveraged ethically and responsibly. By prioritizing consumer privacy and data protection, while also fostering innovation, the financial sector can build a robust framework that supports sustainable growth and financial inclusion for all.

Ultimately, as bank statement analysis becomes more accessible and comprehensive, it will not only enhance the efficiency of credit underwriting but also contribute to the broader goal of creating a more equitable financial ecosystem. This shift will empower consumers with the knowledge and tools they need to achieve financial well-being, paving the way for a future where financial literacy is the norm rather than the exception.

#cart#fintech#novel patterns#account aggregator#bfsi#myconcall#credit underwriting#finance#wealth management#genesis#Financial Statement#financial assessment#Credit statement#fraud#fraud detection#bank statement#bank statement analysis#bank statement analyzer

1 note

·

View note

Text

Simplifying Your Financial Management

Streamline your financial management with our expert account and bookkeeping services. We provide accurate, timely, and reliable financial solutions to help your business stay organized and compliant. Partner with us to focus on growth while we handle your books with precision.

#Accounting#Bookkeeping#Financial Management#Accounts Receivable#Accounts Payable#Financial Reporting#Tax Preparation#Payroll Services#Audit#Budgeting#Financial Analysis#Invoice Processing#Bank Reconciliation#Expense Tracking#Cash Flow Management#Ledger Maintenance#General Ledger#Balance Sheet#Income Statement#Profit and Loss#VAT Filing#Compliance#Accounting Software#QuickBooks

1 note

·

View note

Text

OneInfini's online course on General Banking is the perfect way to kick-start your career in the banking industry. Our expert instructors will guide you through the essentials of banking, from customer service and financial analysis to investment strategies and portfolio management.

#banking#finance#financial analysis#investment strategies#risk management#compliance#customer service#loans#credit#commercial banking#investment banking#financial management#financial statements#accounting#career development#professional skills#online learning

0 notes

Photo

Take the best bank statement analysis tool in India and analyze bank statements from Perfios. We have the best teams to analyze all your bank statements.

0 notes

Text

GONE GIRL. masterlist

if you know the whereabouts of this person, please call 911 or contact the kildare county sheriff's department at 252-290-6688

NAV ! Part One. Part Two.

CASE NUMBER: 2023-KILDARE-002

CASE NAME: L/N, Y/N - Missing Person

DATE SUBMITTED: July 24, 2023 (Investigation Ongoing)

AGENCY: Kildare County Police Department

EVIDENCE TECHNICIAN: Officer J. Gingham

ITEMS ENCLOSED:

1. Incident Report

2. USB Containing Witness Statements

3. USB Containing Suspect Interviews

4. Anonymous Tips & Alleged Sightings

5. Manilla Folder of Crime Scene Photos

6. Subpoenas for Phone Records

6.1. Victim's Call Logs

7. Subpoenas for Text Messages

7.1. Victim's Text Messages

8. Search Warrant for 313 Lakeshore Drive

8.1. Bottle of Unidentified Pills (Pending Analysis)

8.2. Encrypted Flashdrive (Pending Analysis)

8.3. Victim's Diary

8.4. Threatening Letter (Pending Handwriting Analysis)

8.5. Calender with Day of Disappearance Circled

8.6. Shattered Picture Frame of Victim and R. Cameron

8.7. Cellphone Charger

8.8. Hairbrush (Collected for DNA)

9. Search Warrant for R. Cameron's Room at 115 Kingsford Street

9.1. Pair of Victim's Underwear

9.2. Collection of Naked Photos of Victim

9.3. "R" Pendant Necklace (Victim was Last Seen Wearing)

9.4. Bloody T-Shirt (Pending Analysis)

10. Victim's Purse (Recovered at Old Church on Whickam Road)

10.1. Wallet with ID

10.2. Torn QuickFuel Reciept

10.3. Baggie with Unidentified White Powder (Pending Analysis)

10.4. ChapStick Classic Cherry Lip Balm

10.5. Keyring: House Key for 313 Lakeshore Drive, House Key for 231 Bradford Road, Unidentified Key, Heart Locket Keychain with R. Cameron's Picture Inside

10.6. White, Silver, and Red Sobriety Chips

10.7. Sunglasses

10.8. Lo Loestrin Fe Birth Control

10.9. Crumpled Photo of Victim and Unidentified Man

10.10. Pink Hello Kitty Lighter

10.11. Switchblade

10.12. Trident Pineapple Twist Gum

11. Copy of Missing Person's Flier

12. Incident Reports from 313 Lakeshore Drive

13. Subpoena of Victim's Bank Statements and Financial Records

13.1. Victim's Bank Statements and Financial Records

14. Subpoena of Victim's Medical Records

14.1. Victim's Medical Records

CHAIN OF CUSTODY LOG INCLUDED

notes .ᐟ the layout isn't very pretty, but you get the idea. it's a detailed account of everything in the evidence box thus far

taglist .ᐟ @starkeysprincess / @cometmultiverse / @iheartjjmaybnk / @all4l0vee / @kissesfrmriri / @bradshawed / @fallbhind / @rafeslittleangel / @bakugouswaif / @fakedhearts / @avada-kedavra-bitch-187 / @riaras-everthroner / @memoirofasparklemuff1n / @rafeysangelbaby

୭ৎ

#🎀#𖦹 ׂ 𓈒 📖 sol writes .ᐟ#rafe cameron#rafe cameron x reader#rafe cameron au#rafe cameron angst#rafe#rafe x reader#rafe au#rafe angst#rafe cameron x fem!reader#rafe cameron x female reader#rafe cameron x pogue!reader#rafe x fem!reader#rafe x female reader#rafe x pogue!reader#outer banks#outer banks au#obx#obx au#outer banks fanfiction#obx fanfiction#rafe cameron fanfic#rafe cameron fanfiction#rafe fanfiction#rafe obx#obx rafe cameron#rafe outer banks

398 notes

·

View notes

Note

different anon, but the "theist DNI" ask was hilarious to me because I am still reeling from the post and especially OP going "the gods aren't really gods (because they're not omnipotent but just really powerful)" in it and then in the replies doubling down on the standpoint of "gods aren't real" - apparently just over the bank, basically conflating real world and Exandria in one fell swoop with this Universal Truth(tm) - because of course they can't produce any analysis of worth. they refuse to engage with basic tenets of the setting that do not fit their particular worldview. it really time and again comes back to people being unable to engage with religious concepts beyond a very superficial and milque-toast "Christianity evil, actually"

Yeah, this is true for like...a lot of the people claiming Campaign 3 is Great and we are all Not Leftist nor Intellectual Enough nor Capable of Parsing Black and White Morality; they say that and then they make and reblog posts with messages like "well you see the Good Brown People who were Colonized will Always be radicalized solely in the name of their own liberation haha don't look at any historical events from the last century", and in the end I do think it is all mostly in the name of trying to support the conclusion that killing the gods is definitely the right answer, and trying to work backwards from there to make the text fit.

I really didn't address the point that their arguments about the gods not being "real gods" were absolutely nonsensical (pro-tip: in a media analysis you can't just reference other works of fiction nor, if any of these ignoramuses did, literary and/or political theory, without actually analyzing them and drawing comparisons in the service of a thesis; "gods in this work are different than the gods in Exandria" is not actually a meaningful statement given that it's like yes Runescape and Exandria are two entirely different settings, things are different) but as always, follow the thread and the implications and you'll find the problems: so if the problem is that the gods are powerful but not all powerful, or don't admit they're not all powerful...does that mean they're ok? If they had given Ashton and Imogen what they wanted, would that mean that killing the titans and Aeor was totally fine? Is your argument that the gods are a colonizing force because they are from outside of Exandria and because they (with the people of Exandria) killed the titans (but the people of Exandria are ok for doing this for reasons of [crickets]) or is your argument that they are a colonizing force bc they didn't kiss your blorbo so sweetly on the head and tell them everything they were doing was good and correct? Because this really is leaning towards the latter. It is, again, an individual grievance falsely claimed to be a system of oppression.

And that's really the key. We are looking at a party with a lot of valid personal traumas, but virtually nothing in the way of in-world systemic oppression, and I do not think it is a coincidence that this party has a unique appeal for a group of people who are overwhelmingly white, overwhelmingly from financially stable upbringings, overwhelmingly from wealthy Western countries, and overwhelmingly people who were raised Christian, left the religion, became some kind of dullard nihilist who labors under the misapprehension that this makes them leftist, and really, really fucking hate being reminded that they are not, in fact, remotely close to being Christianity's greatest victims. It has a unique appeal for people who are obsessed with painting themselves as powerless to enact change - who, as I said in earlier tags and also like a billion posts dating back to at least early 2023, fetishize and glorify a lack of agency - because then haha you can't blame them! they can't do anything! I think they're REALLY mad, actually, that one of the most prominent critiques of Campaign 3 has become "this indecision and inaction and endless waffling is actually insufferable" because that drives a spike through the idea that you can evade judgment through doing nothing, despite this being like, one of the most basic ethical concepts. And again just as I don't think the CR cast is doing THAT message on purpose any more so than a (horrendously flawed to the point of failure) anticolonialism message, I just think that the mismatch of plot and character and the multitude of issues in the execution have unintentionally presented themselves in this manner.

Anyway yeah this inability to consider the idea that maybe Bells Hells have a wildly limited viewpoint and so do you is superficial, it's self-obsessed, and it's so goddamn banal.

35 notes

·

View notes

Text

Chart Observations, Charts of Selena & Analysis of the day of death. RIP Queen!

SPOOKY SEASON! Okay so in light of all hallows eve, I was feeling kind of morbid this morning and started to analyse how an assassination would appear in the charts of the legends we lost.

I'm starting this series starting with the Queen Selena Quintanilla

Observations

Feel free to comment of leave your own observations.

Selena Quintanilla was born on April 16, 1971, in Lake Jackson, Texas.

She was murdered on March 31, 1995, in Corpus Christi, Texas, by Yolanda Saldívar.

Astrological Analysis with Example Connections

Selena’s Natal Chart Influences: Indicators of Vulnerability and Fame

Sun in Aries (Self-Determination and Fame): Her Aries Sun (ambition, independence) ruled by Mars (conflict, intensity) suggests a life marked by public visibility and an inner fire, but also potential clashes, especially within her relationships. The energy of Aries can attract passionate, even confrontational, dynamics, as seen in her final interaction with Saldívar, leader of fan club and boutique.

Venus in Pisces (Compassion and Trust):

Venus in Pisces reflects Selena’s deeply compassionate, forgiving, and trusting nature, which contributed to her broad appeal. However, Pisces (illusion) can sometimes blur boundaries, making those with this placement prone to seeing only the best in others, which could leave them vulnerable to betrayal. Selena’s Venus in Pisces (forgiveness, idealism) represents her tendency to trust others easily, seeing only the good in them. This could have made her more vulnerable to manipulation by someone close, as Pisces is often blind to hidden dangers within relationships. (Pisces rules mysteries, secrets, something that is hidden and unknown.)

North Node in Sagittarius (Public Influence): The North Node in Sagittarius (public exposure) aligns with a life of influence in the public sphere but also reveals potential risks associated with placing trust in those beyond her immediate family circle. Sagittarius emphasizes growth and risk, which may have exposed her to hidden threats.

Astrological Transits on March 31, 1995: The Day of the Assassination

Mars Conjunct Selena’s Saturn in Pisces (Conflict and Karmic Reckoning): On the day of her assassination, Mars (planet of aggression/fights/war and conflict) was conjunct Selena’s Saturn in Pisces. Mars (violence, aggression) in conjunction with Saturn (endings, karmic lessons) in Pisces (hidden enemies, secrets) represents a confrontation that culminated in betrayal and death. Pisces’ secretive influence implies that unresolved tensions with Saldívar were exposed, leading to a violent end.

Pluto Opposing Selena’s Moon in Taurus (Financial Betrayal and Emotional Vulnerability): Pluto in Scorpio (secrecy, intensity) opposing the Moon in Taurus (personal security, finances) highlights betrayal involving money and trust, with the emotional impact felt deeply by Selena. The financial element is underscored as she confronted Saldívar about bank statements, catalyzing the violent encounter.

The Impact of Transiting Pluto and Mars in Selena’s Natal Chart

Transiting Pluto in Scorpio (Themes of Death and Hidden Motives): Pluto (death, hidden motives) in Scorpio (intensity, revenge) amplified themes of betrayal and secrecy, bringing unresolved tensions with Saldívar to the surface. Scorpio’s association with power struggles implies that Selena’s final confrontation involved deep-rooted issues, reflecting Pluto’s fateful influence on her life.

Mars Activating Saturn in Pisces (Hidden Conflicts Resurfacing): The Mars-Saturn conjunction in Pisces signifies hidden or latent issues that reach a breaking point, often with sudden or final consequences. Pisces, representing things unseen, suggests an enemy within her inner circle whose hidden motives were finally exposed. Mars (aggression, action) conjunct Saturn (karmic consequences, boundaries) in Pisces (secrets, illusions) triggered hidden conflicts and brought long-standing issues with Saldívar into full view.

Moon in Sagittarius Conjunct Selena’s North Node (Life Path and Legacy): The Moon in Sagittarius aligned with Selena’s North Node on the day of her death, amplifying themes of fate and life mission. The Moon (emotions, public connection) in Sagittarius (legacy, life mission) conjunct her North Node (destiny) points to a pivotal moment that defined her path and influence. This aspect symbolizes the transformative impact of her passing, leaving an enduring legacy aligned with her life’s purpose.

Venus Opposite Pluto (Possessiveness and Betrayal): Venus in Taurus (relationships, loyalty) opposing Pluto in Scorpio (secrets, power struggles) emphasizes intense dynamics within relationships, suggesting themes of possessiveness, control, and betrayal. This alignment reflects Saldívar’s obsessive attachment to Selena and the tragic outcome of this toxic relationship.

Pluto’s influence over Venus mirrors the obsessive and possessive dynamics that culminated in violence, revealing hidden motives in their relationship.

Summary

Influences such as Mars conjunct Saturn in Pisces, Pluto in Scorpio opposing her Moon, and Venus opposing Pluto paint a vivid image of betrayal, hidden motives, and an escalating confrontation fueled by jealousy and possessiveness .Each Example Connection reveals how astrological symbols mirrored real-life events, from the violent confrontation in a private setting to Selena’s unyielding trust in someone from her inner circle. Her astrological transits on March 31, 1995, echo themes of trust, karmic reckoning, and finality, as aspects aligned in ways that exposed vulnerabilities and triggered hidden tensions, ultimately marking the end of her bright and beloved life.

#astro observations#selena#selena quintanilla perez#selena quintanilla#90s#1994#astrology#astrology placements#astro community#astrology observations#astro notes#birth chart#astrology tumblr#natal astrology#natal chart#astrology signs#astrology notes#astrological observations#astro placements#astro tumblr#astro posts#birth chart placements#birth chart analysis#natal chart observations#natal chart placements#natal chart analysis#aries mars#aries#aries astrology#taurus

36 notes

·

View notes

Text

For all the time Republicans spend complaining about the economic struggles faced by everyday Americans, they remain steadfast in their commitment to ensuring major corporations can continue squeezing their customers.

Late Wednesday afternoon, the GOP-controlled House Financial Services Committee voted to advance a bill that would repeal a new Consumer Financial Protection Bureau (CFPB) rule that drastically reduces the caps on credit card late fees - from $30-$41 to $8.

The legislation would also repeal the CFPB's ban on automatic adjustment of late fees due to inflation. In the Democratic-controlled Senate, where the bill is expected to fail, a similar repeal measure was introduced by Banking, Housing, and Urban Affairs Committee Ranking Member Tim Scott (R-S.C.) — who has recently devoted most of his energy to fawning over Donald Trump — and co-sponsored by 12 other Republicans.

“Credit card companies penalize consumers with exorbitant late fees that far exceed their actual costs, raking in billions of dollars in profits on the backs of those who can least afford it,” said Chuck Bell, advocacy program director for Consumer Reports, in a statement urging Congress to reject the repeal.

According to Republicans on the committee, however, lowering late fees will “harm consumers by shifting costs to responsible consumers who pay on time in the form of higher annual fees and higher interest rates,” while removing incentives for timely payments.”

An analysis published this week by the watchdog group Accountable.US found that Republicans on the committee have “received over $7.9 million from industry groups against this rule and the largest credit issuers.”

(continue reading)

#politics#republicans#tim scott#late fees#credit cards#credit card late fees#banking#the cruelty is the point#house financial services committee#bank fees#all skinfolk aint kin folk#vote da bums out

33 notes

·

View notes

Text

I have been unfairly sued by the Trump Hating Democrat Attorney General of New York State, Letitia James, over the false fact that I inflated my Financial Statements in order to borrow money from Banks, etc. The Judge in the case, Arthur F. Engoron, refused to allow this case to go to the “Commercial Division,” where it belongs, because he is a Trump Hater beyond even A.G. James, who campaigned against me spewing horrible inflammatory statements which are False & Defamatory. I am not even allowed a Jury! The facts of this case are simple. 1) I AM WORTH MUCH MORE THAN THE NUMBERS SHOWN ON MY FINANCIAL STATEMENTS. 2) I DIDN’T EVEN INCLUDE MY MOST VALUABLE ASSET, MY BRAND/GOODWILL. 3) THE BANKS WERE PAID BACK IN FULL, OFTEN EARLY, THERE WERE NO DEFAULTS, THE BANKS MADE MONEY, WERE REPRESENTED BY THE BEST LAW FIRMS, & WERE VERY “HAPPY.” THERE WERE NO VICTIMS! 4) ON THE FRONT PAGE OF THE FINANCIAL STATEMENTS THERE IS A STRONG “DISCLAIMER CLAUSE” TELLING ALL NOT TO RELY ON THESE….(continued)

Page 2: FINANCIAL STATEMENTS. THE DISCLAIMER CLAUSE TELLS ANYONE REVIEWING THE DATA, INCLUDING FINANCIAL INSTITUTIONS, TO DO THEIR OWN RESEARCH AND ANALYSIS - IT IS A NON RELIANCE CLAUSE, AND COULD NOT BE MORE CLEAR. ADDITIONALLY TO MY BEING WORTH FAR MORE THAN IS SHOWN IN THE “FULLY DISCLAIMED” FINANCIAL STATEMENTS, AGAIN NOT PUTTING DOWN A VALUE FOR MY BIGGEST ASSET, BRAND/GOODWILL, THE COMPANY HAS HUNDREDS OF MILLIONS OF DOLLARS IN CASH, AND VERY LITTLE DEBT. It is a great company that has been slandered and maligned by this politically motivated Witch Hunt. It is very unfair, and I call for help from the highest Courts in New York State, or the Federal System, to intercede. THIS IS NOT AMERICA!

12 notes

·

View notes

Text

At least nine Yemeni employees of United Nations agencies have been detained by Yemen’s Houthi rebels under unclear circumstances, authorities said Friday, as the rebels face increasing financial pressure and airstrikes from a US-led coalition.

Others working for aid groups also likely have been taken.

The detentions come as the Houthis, who seized Yemen’s capital nearly a decade ago and have been fighting a Saudi-led coalition since shortly after, have been targeting shipping throughout the Red Sea corridor over the Israel-Hamas war in the Gaza Strip.

But while gaining more attention internationally, the secretive group has cracked down at dissent at home, including recently sentencing 44 people to death.

Regional officials, speaking to The Associated Press on condition of anonymity as they were not authorized to brief journalists, confirmed the UN detentions.

Those held include staff from the United Nations human rights agency, its development program, the World Food Program and one working for the office of its special envoy, the officials said.

The wife of one of those held is also detained.

The UN declined to immediately comment.

The Mayyun Organization for Human Rights, which similarly identified the UN staffers held, named other aid groups whose employees were detained by the Houthis across four provinces the Houthis hold — Amran, Hodeida, Saada and Saana.

Those groups did not immediately acknowledge the detentions.

“We condemn in the strongest terms this dangerous escalation, which constitutes a violation of the privileges and immunities of United Nations employees granted to them under international law, and we consider it to be oppressive, totalitarian, blackmailing practices to obtain political and economic gains,” the organization said in a statement.

Activists, lawyers and others also began an open online letter, calling on the Houthis to immediately release those detained, because if they don’t, it “helps isolate the country from the world.”

Yemen’s Houthi rebels and their affiliated media organizations did not immediately acknowledge the detentions.

However, the Iranian-backed rebels planned for weekly mass demonstrations after noon prayers Friday, when Houthi officials typically speak on their actions.

It’s unclear what exactly sparked the detentions.

However, it comes as the Houthis have faced issues with having enough currency to support the economy in areas they hold — something signaled by their move to introduce a new coin into the Yemeni currency, the royal.

Yemen’s exiled government in Aden and other nations criticized the move as the Houthis turning to counterfeiting. Aden authorities also have demanded all banks move their headquarters there.

“Internal tensions and conflicts could spiral out of control and lead Yemen into complete economic collapse,” warned Yemeni journalist Mohammed Ali Thamer in an analysis published by the Carnegie Endowment for International Peace.

Bloomberg separately reported Thursday that the US planned to further increase economic pressure on the Houthis by blocking their revenue sources, including a planned $1.5 billion Saudi payment to cover salaries for government employees in rebel-held territory.

The war in Yemen has killed more than 150,000 people, including fighters and civilians, and created one of the world’s worst humanitarian disasters, killing tens of thousands more.

The Houthis’ attacks on shipping have helped deflect attention from their problems at home and the stalemated war.

But they’ve faced increasing casualties and damage from US-led airstrikes targeting the group for months now.

Thousands have been imprisoned by the Houthis during the war.

An AP investigation found some detainees were scorched with acid, forced to hang from their wrists for weeks at a time or were beaten with batons.

5 notes

·

View notes

Text

Unleashing the Power of AI-Driven Finance: Novel Patterns at Singapore Fintech Festival

As one of the most significant and esteemed events in the financial technology industry, the Singapore Fintech Festival (SFF) serves as a hub for revolutionary ideas, innovative solutions, and conversations that shape the sector. Each year, SFF attracts participants from around the globe, including bankers, tech developers, regulators, investors, and fintech entrepreneurs, all driven by a shared objective: to propel the future of finance. The 2024 festival has continued this tradition, brimming with enthusiasm and insights as companies showcase their latest developments in artificial intelligence, blockchain, cybersecurity, and more.

In this ever-changing landscape, Novel Patterns distinguished itself by presenting an impressive array of AI-driven solutions. As the financial sector undergoes digital transformation, companies are on the lookout for tools that can optimize processes, bolster security, and satisfy growing customer demands. Novel Patterns has been leading the charge in these advancements, developing solutions that not only keep up with industry evolution but also propel innovation forward.

The festival atmosphere was charged with discussions on how artificial intelligence is reshaping financial services. From the bustling exhibition halls to the deep-dive sessions with industry experts, it was clear that automation and AI-driven insights are now essential components in finance. Whether through predictive analytics, enhanced customer support, or real-time data processing, AI is transforming how financial institutions operate.

For Novel Patterns, SFF was the ideal platform to demonstrate how its products — Genesis, CART, and MyConCall — are addressing these trends and supporting the next generation of financial services

Genesis: The All-in-One Platform for Modern Fund Management

In today’s world, where data-driven insights and efficient processes are crucial for achieving success, Genesis provides fund managers with a distinct advantage. This all-encompassing platform is tailored to meet the changing demands of both investors and regulatory authorities, delivering clarity and control over the intricate aspects of fund management.

Attendees at SFF were particularly impressed with how Genesis addresses some of the toughest challenges in investment management:

Efficient Portfolio Allocation and Tracking: With Genesis, fund managers can seamlessly allocate assets across a diverse portfolio, reducing manual processes and enhancing accuracy.

Real-Time Reporting and Transparency: Genesis provides clear, insightful reporting that keeps both managers and clients informed, building trust and improving transparency.

Automated Compliance: The platform incorporates compliance features that help managers stay on top of changing regulations, ensuring that every decision meets legal and industry standards.

For investment professionals, Genesis serves not merely as a tool but as a strategic asset that enhances their workflow and fosters client trust. At SFF, financial firms have identified Genesis as a game-changing solution that consolidates efficiency, compliance, and transparency in one platform while also providing the scalability necessary for growth in a fiercely competitive market.

CART (Credit Assessment and Robotic Transformation): Accelerating Lending with AI

CART addresses critical needs in the lending process:

Instant Data Extraction & Analytics from Unstructured Financial Documents: Traditional credit assessments can be time-consuming and prone to errors. CART streamlines this by automatically extracting and analyzing data from bank statements, invoices, and other unstructured documents in seconds.

Risk and Fraud Detection: CART’s AI-driven risk scoring and pattern analysis highlight potential fraud indicators and categorize applicants by risk level, empowering lenders to make safer and more profitable decisions.

Improved Decision-Making Speed: By accelerating the entire credit assessment process, CART allows lenders to respond to applicants faster, increasing customer satisfaction and enabling quicker loan disbursements.

During SFF, CART created significant excitement among participants, especially those from established banks and fintech firms eager to integrate AI for enhanced lending efficiency. A key highlight was CART’s capability to boost lending speed by as much as 40%. Attendees at our booth witnessed firsthand how this solution can assist financial institutions in meeting the growing demand for swift and precise loan processing.

MyConCall: Setting New Standards for Secure Financial Communication & Digital Onboarding

In the realm of finance, confidentiality is not merely important — it is essential. With MyConCall, Novel Patterns delivers a secure, compliant, and user-friendly communication platform tailored to the specific requirements of financial teams. As concerns about data breaches and regulatory demands escalate, MyConCall ensures peace of mind with encrypted communication and improved data security.

Key features that make MyConCall essential for finance teams:

End-to-End Encryption for Voice and Video Calls: MyConCall ensures that sensitive discussions remain private and secure, with encryption safeguarding every interaction.

Compliance-Ready Features: Built with regulatory compliance in mind, MyConCall offers features that make record-keeping and data privacy seamless and stress-free.

Enhanced Collaboration Tools: Beyond secure calls, MyConCall provides file-sharing options, meeting scheduling, and other tools that support team collaboration without compromising security.

SFF 2024 participants, including representatives from major financial institutions and up-and-coming fintech companies, were attracted to MyConCall as a safe alternative to traditional communication methods. They recognized its ability to minimize compliance risks while enabling seamless, secure, and efficient communication within financial teams.

A Vision for the Future: Partnering to Build a Smarter, Faster, and Safer Financial Landscape

Novel Patterns’ experience at the Singapore Fintech Festival was not just about presenting products; it was also about fostering a community of like-minded individuals who share a belief in technology’s potential to transform the financial industry. The discussions we engaged in, the insights we gathered, and the relationships we cultivated reaffirmed our dedication to pushing the limits of what is achievable in fintech.

By showcasing solutions like Genesis, CART, and MyConCall, Novel Patterns is empowering organizations to enhance their processes while also contributing to a wider transformation that emphasizes efficiency, security, and inclusivity in finance.

We are thrilled to continue this journey and spread our message of financial innovation to various platforms around the globe. As we anticipate future events, we are excited to introduce new features, broaden our offerings, and strengthen our collaborations with innovative institutions worldwide.

The Journey Continues: Join Us in Redefining Financial Innovation

Our time at SFF 2024 was truly inspiring. We eagerly anticipate more chances to connect, collaborate, and innovate in the months ahead. With each event, Novel Patterns remains dedicated to providing solutions that create value, enhance security, and empower financial institutions to flourish in a rapidly digitalizing world.

#cart#fintech#novel patterns#account aggregator#bfsi#myconcall#credit underwriting#finance#wealth management#genesis#credit assessment#Financial Assessment#financial innovation#Bank Statement Analyzer#bank statement analysis#AI Driven#Singapore Fintech Festival

0 notes

Text

Income reform heads for hibernation after leaders’ response in Brazil

Fiscal adjustment package appears less contentious following FEBRABAN luncheon in São Paulo

The fiscal adjustment package seemed less contentious after the Brazilian Federation of Banks (FEBRABAN) luncheon on Friday (29) in São Paulo. In the discussions and speeches by Ministers Fernando Haddad, Simone Tebet, and Esther Dweck, along with Central Bank Director Gabriel Galípolo with bankers and financial market executives present, the atmosphere felt more relaxed. The exchange rate, which opened at R$6.10 per dollar and dropped to R$6 per dollar, seemed to confirm the easing tension.

It wasn’t just the lemongrass tea served during the lunch that calmed the mood. In the morning, the Lower House Speaker Arthur Lira and Senate President Rodrigo Pacheco spoke with Mr. Haddad. What should have been said? “The same as was said to the president yesterday, of course.” On Thursday afternoon, both Mr. Lira and Mr. Pacheco visited the Palácio do Planalto and told President Lula that the fiscal adjustment had a better chance in Congress than the income reform.

Before Mr. Haddad arrived at FEBRABAN, Mr. Lira and Mr. Pacheco had already set the stage from afar. The Lower House speaker took to social media platform X to reaffirm an “unwavering” commitment to the fiscal framework, given the impacts of high inflation and exchange rates on the poorer populations. However, he did not express the same commitment regarding the income reform: “Any other governmental initiative implying revenue waiver will be addressed only next year, and only after a careful and above all realistic analysis of its funding sources and effective impact on public accounts.”

Subsequently, in a press statement, the Senate president echoed this sentiment. He stated that Congress should support the adjustment measures, even if not very “popular,” but added that the issue of income tax “although it is everyone’s wish, is not on the agenda right now.”

Continue reading.

2 notes

·

View notes

Text

Bookkeeping Services in Delhi by SC Bhagat & Co.

Managing finances efficiently is the backbone of any successful business. Whether you are a startup, a small business, or a large enterprise, having a proper bookkeeping system in place is essential to ensure financial health and compliance with tax regulations. If you are looking for bookkeeping services in Delhi, SC Bhagat & Co. is a trusted partner to help streamline your financial records.

Why Bookkeeping is Essential for Your Business Bookkeeping involves the systematic recording, organizing, and tracking of all financial transactions made by a business. It provides a clear view of your business's financial status, helping you make informed decisions. Effective bookkeeping helps in:

Financial Analysis: By maintaining up-to-date financial records, businesses can regularly assess their financial health. Tax Compliance: Proper bookkeeping ensures all financial documents are in order for accurate and timely tax filing. Cash Flow Management: Tracking cash flow helps in maintaining sufficient funds for daily operations. Budgeting: It provides accurate data for future budgeting, reducing financial risks. Benefits of Outsourcing Bookkeeping Services Outsourcing bookkeeping tasks to professionals like SC Bhagat & Co. brings numerous benefits:

Cost Savings: You eliminate the need for an in-house accounting team, which saves on salaries, office space, and other resources. Accuracy: Professional bookkeepers have the experience and tools to ensure accuracy in your financial records. Time Efficiency: Outsourcing allows you to focus on core business activities while the experts handle your books. Compliance and Expertise: SC Bhagat & Co. ensures that your business complies with all financial and tax regulations, helping you avoid penalties. SC Bhagat & Co. – Your Reliable Bookkeeping Partner SC Bhagat & Co. is a renowned firm in Delhi offering comprehensive bookkeeping services. With years of experience, they cater to businesses across various industries. Here’s why SC Bhagat & Co. stands out:

Customized Solutions: They understand that every business has unique needs and provide tailored bookkeeping services. Expert Team: Their team of certified professionals is well-versed in the latest accounting software and bookkeeping practices. Accuracy and Timeliness: They ensure that all financial records are accurate and delivered on time, helping you stay ahead in your financial management. Confidentiality: The firm maintains high levels of data security to ensure your sensitive financial information is protected. Services Offered by SC Bhagat & Co. SC Bhagat & Co. offers a wide range of bookkeeping and accounting services, including:

Daily Transaction Recording: Keeping track of daily sales, purchases, payments, and receipts. Bank Reconciliation: Ensuring that your bank statements match your business's financial records. Expense Tracking: Managing all expenses to help reduce overheads and increase profits. Financial Reporting: Providing comprehensive financial reports, including balance sheets, income statements, and cash flow statements. Tax Preparation: Ensuring all financial records are in order for accurate and timely tax filings. Why Choose SC Bhagat & Co. for Bookkeeping Services in Delhi? SC Bhagat & Co. is a reliable name for bookkeeping services in Delhi, offering a combination of expertise, experience, and excellent customer service. By choosing them, you ensure:

Accurate and Timely Reports Comprehensive Bookkeeping Solutions Cost-effective Services Compliance with Latest Financial Regulations Final Thoughts Keeping accurate financial records is critical for the success and growth of your business. By outsourcing your bookkeeping services in Delhi to SC Bhagat & Co., you not only ensure compliance and accuracy but also gain access to expert advice, allowing you to focus on growing your business.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices

2 notes

·

View notes

Text

Nordholm: Redefining Accounting and Bookkeeping Success in Dubai, UAE

Amid Dubai's dynamic economic landscape, Nordholm emerges as the beacon for unparalleled Accounting and Bookkeeping Services in Dubai. Our tailored approach transcends norms, offering bespoke financial solutions finely crafted to meet the diverse needs of businesses in the UAE.

Our seasoned professionals reimagine Bookkeeping Services, seamlessly navigating complex processes like Company Formation, Visa Protocols, Bank Account Establishment, HR Management, Payroll Administration, and VAT Compliance. As strategic partners, we empower enterprises with the guidance and expertise needed for triumphant growth.

At the core of our commitment lies adherence to International Financial Reporting Standards (IFRS). Leveraging our expertise, we meticulously document daily transactions and furnish comprehensive financial reports, ensuring seamless compliance with UAE laws.

Explore Our Tailored Spectrum of Specialized Services:

Efficient Accounts Payable Management: Streamlining payable accounts for operational fluency.

Regular Bank Reconciliation Services: Ensuring steadfast accuracy in bank statements.

Meticulous General Bookkeeping Duties: Attending to foundational tasks with precision.

Essential Profit and Loss Statement Preparation: Proficiently evaluating financial performance.

Optimal Accounts Receivable Management: Seamlessly tracking and managing receivables.

Compliance-driven Employee Benefits Management: Expertly handling benefits in accordance with regulations.

Timely Payroll Processing Services: Accurately managing payroll for streamlined HR operations.

Insightful Financial Reporting and Analysis: Providing data-backed reports for informed decision-making.

Tailored Expert Accounting Guidance: Crafting strategies tailored to specific business needs.

Beyond merely addressing immediate accounting requisites, our mission at Nordholm is to erect resilient frameworks that pre-emptively tackle potential financial hurdles. With an unwavering commitment to providing the Best Accounting and Bookkeeping Services in Dubai, we alleviate the burdens of financial management, enabling businesses to soar toward enduring success.

#DubaiAccounting#BookkeepingServices#FinancialManagement#UAEFinance#AccountingSolutions#NordholmDubai#BusinessConsulting#VATCompliance

7 notes

·

View notes

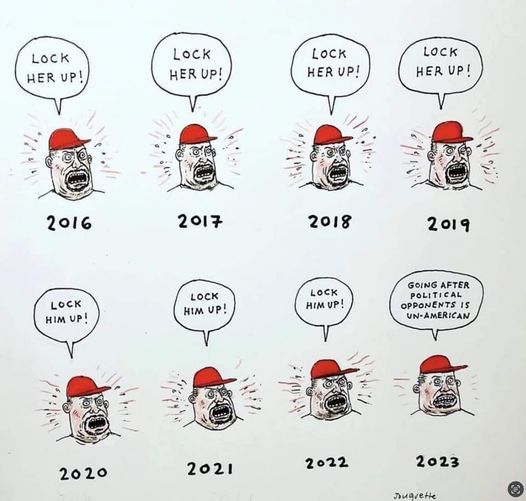

Photo

Jesse Duquette, The Daily Don

* * * *

The Trump indictment.

On a day of non-stop coverage of the indictment of Donald J. Trump, less is more.

Here are the facts that matter:

The people of the State of New York filed this Indictment against Donald Trump.

The indictment alleges 34 felony counts of falsification of business records.

The Manhattan District Attorney separately released this Statement of Facts. If you have time, read the 13-page document in full. It sets forth the essential facts and legal theories for everything that will transpire in the case of People of New York v. Donald Trump.

Important allegations in the Statement of Facts include the following:

From August 2015 to December 2017, the Defendant [Trump] orchestrated a scheme with others to influence the 2016 presidential election by identifying and purchasing negative information about him to suppress its publication and benefit the Defendant's electoral prospects. In order to execute the unlawful scheme, the participants violated election laws and made and caused false entries in the business records of various entities in New York.

[Michael Cohen] who then worked for the Trump Organization as Special Counsel to [Trump] covertly paid $130,000 to an adult film actress shortly before the election to prevent her from publicizing a sexual encounter with the Defendant. [Michael Cohen] made the $130,000 payment through a shell corporation he set up and funded at a bank in Manhattan. This payment was illegal, and [Cohen] has since pleaded guilty to making an illegal campaign contribution . . . .

In a conversation captured in an audio recording in approximately September 2016 concerning Woman 1's account, the [Trump] and [Cohen] discussed how to obtain the rights to Woman 1's account from AMI and how to reimburse AMI for its payment.

[Trump] directed [Cohen] to delay making a payment to Woman 2 as long as possible. He instructed Lawyer A that if they could delay the payment until after the election, they could avoid paying altogether, because at that point it would not matter if the story became public.

During a 58-minute appearance before Judge Juan Merchan, Donald Trump pleaded not guilty to all charges in the indictment.

Judge Merchan declined to impose a gag order, although he cautioned the parties to exercise restraint in making out-of-court statements. Trump promptly disregarded the judge's cautionary warning by making incendiary statements during an evening speech at Mar-a-Lago.

Judge Merchan set the next hearing in the case for December 2, 2023.

Discussion of the indictment.

The indictment alleges financial crimes were committed to protect Trump's presidential prospects. The cover-up was part of a broad ranging “catch-and-kill” strategy that continued into Trump's first months as president.

The indictment has provoked a torrent of criticism by legal commentators. Most of the criticism hinges on the fact that the underlying offenses of financial fraud are typically charged as misdemeanors. Here, they are charged as felonies. To leverage misdemeanors into felonies, New York must prove that Trump intended to commit other crimes.

Alvin Bragg identified those other crimes during a news conference, which include:

tax fraud,

facilitating false statements by the National Enquirer's parent company (AMI),

violation of state election laws, and

violation of federal election laws.

Most commentators focus on the difficulty of proving the last two crimes—violations of federal and state election laws. For example, one of my favorite legal commentators, Ian Millhiser, has annoyed me greatly with this article in Vox, The dubious legal theory at the heart of the Trump indictment, explained.

Millhiser's analysis is as good as it gets—but I disagree. At the core of Millhiser's criticism is this:

Bragg has evidence that Trump acted to cover up a federal crime, but it is not clear that Bragg is allowed to point to a federal crime in order to charge Trump under the New York state law.

Millhiser suggests that Bragg must prove a federal crime to prevail. Not true, entirely. Bragg can rely on uncharged state crimes—including violations of New York election laws and income tax violations, as Bragg said in his news conference. Moreover, as Millhiser concedes above, "it is not clear" whether an uncharged federal crime will suffice. The relevant New York statute says that a person is guilty of a felony under state law

when he commits the crime of falsifying business records [and has] the intent to commit another crime . . . .

The New York statute refers generally to "another crime," not a "state crime" or a federal crime. Just "another crime." Millhiser says that ambiguity might get Trump off the hook. I doubt it. The statute is plain on its face. Trump will undoubtedly make Millhiser's argument, but I believe Trump will lose the argument.

Okay, that's as deep as I will examine the legal issues. The issues are more complicated than I have described above, and there are other worrisome defenses (including the timing of the payments—all of which occurred after Trump took office).

Despite my disagreement with Millhiser, his analysis is excellent and cannot be easily dismissed. If you are interested in a deep dive into the alleged weaknesses of Bragg's case, Millhiser's article is an excellent resource. See also Mark Joseph Stern in Slate, Donald Trump indictment is not the slam-dunk case Democrats wanted.

Although two of my favorite legal commentators are raising red flags, I think Bragg can convince the judge that the false financial records were part of a broad-ranging "catch-and-kill" strategy designed to violate state and federal election and tax laws. That should be enough to get the case to the jury.

Trump cannot appeal any pre-trial rulings, which means that if the judge denies the expected motions to dismiss, the trial will take place in the spring of 2024. By then, Trump should be defending two federal indictments and one from Georgia.

Robert B. Hubbell Newsletter

#Robert B. Hubbell#Robert B. Hubbel Newsletter#Trump Indictment#Jesse Duquette The Daily Don#justice#legal#Millhiser

29 notes

·

View notes

Text

Unlocking the UAE's Golden Visa Maze: Insider Tips for Success

Welcome, aspiring adventurers, to the exciting world of Golden Visas Services in the UAE! If you've ever dreamt of unlocking new opportunities, exploring vibrant cultures, or building a brighter future in one of the world's most dynamic hubs, then you're in the right place. In this guide, we'll be your compass, navigating the Golden Visa maze with insider tips and expert advice to ensure your journey is not just successful but also fulfilling. So, grab your map, pack your enthusiasm, and let's set sail on this exhilarating voyage towards your Golden Visa dream!

1. Understanding Golden Visa Eligibility Criteria

Before setting sail, ensure you're eligible. The UAE offers Golden Visas to investors, entrepreneurs, talented professionals, and retirees. Each category has specific criteria, like investment thresholds or retirement fund requirements. Check your eligibility based on your profile and aspirations.

2. Gathering the Required Documents

Assemble your crew of documents for the journey. Common documents include passport copies, proof of investment, bank statements, and a clean criminal record certificate. For investors, additional documents like business plans, trade licenses, and property ownership deeds may be required. Double-check the specific document checklist based on your chosen Golden Visa category.

3. Plotting Your Investment Strategy

Choosing the right investment is crucial. Opt for real estate, business ventures, or innovation projects that align with UAE regulations and contribute to the economy. Research thriving industries, consult with financial advisors, and consider long-term sustainability when crafting your investment strategy.

4. Crafting a Stellar Business Plan

A well-crafted business plan is your treasure map to Golden Visa approval. Highlight your business concept, market analysis, financial projections, and growth strategies. Emphasize how your venture will create jobs, drive innovation, or enhance the UAE's economic landscape. Tailor your business plan to showcase value, feasibility, and alignment with UAE's vision for growth and development.

5. Navigating the Golden Visa Application Process

Embark on your Golden Visa application journey through the relevant government authority, such as the Federal Authority for Identity and Citizenship (ICA), the Ministry of Economy, or local immigration departments. Follow the online application portal or engage with authorized representatives for a smooth submission process. Timing, transparency, and professional assistance are key for success.

6. Insider Tips for Smooth Sailing

Apply During Economic Stability: Submit your application during periods of economic growth and stability for higher chances of approval.

Engage Legal or Immigration Consultants: Consider hiring legal or immigration consultants for expert guidance and assistance throughout the application process.

Be Transparent and Consistent: Disclose accurate information and ensure consistency across all documents to avoid delays or rejections.

Showcase Long-Term Commitment: Highlight your commitment to long-term engagement in the UAE through investment diversification or strategic partnerships.

As we reach the shores of our Golden Visa adventure, it's time to reflect on the invaluable insights and strategies we've uncovered. From understanding eligibility criteria to crafting stellar business plans and navigating the application process, you've gained the tools and knowledge needed to steer your course towards success.

Remember, patience and preparation are your steadfast companions in this journey. Keep abreast of UAE's visa policies, adapt your strategies as needed, and stay committed to your long-term goals. Whether you're an investor, entrepreneur, or talented professional, the UAE's Golden Visa offers a gateway to new horizons and endless possibilities.

#GoldenVisa#GoldenVisaServices#MainlandGoldenVisa#LongTermResidencyVisa#InvestorVisa#GoldenVisaServicesUAE#365proservices#proservices#uaevisaservices#uaeconsultancy#businesssetupdubai

5 notes

·

View notes