#audit management solution

Explore tagged Tumblr posts

Text

With Innrly | Streamline Your Hospitality Operations

Manage all your hotels from anywhere | Transformation without transition

Managing a hotel or a multi-brand portfolio can be overwhelming, especially when juggling multiple systems, reports, and data sources. INNRLY, a cutting-edge hotel management software, revolutionizes the way hospitality businesses operate by delivering intelligent insights and simplifying workflows—all without the need for system changes or upgrades. Designed for seamless integration and powerful automation, INNRLY empowers hotel owners and managers to make data-driven decisions and enhance operational efficiency.

Revolutionizing Hotel Management

In the fast-paced world of hospitality, efficiency is the cornerstone of success. INNRLY’s cloud-based platform offers a brand-neutral, user-friendly interface that consolidates critical business data across all your properties. Whether you manage a single boutique hotel or a portfolio of properties spanning different regions, INNRLY provides an all-in-one solution for optimizing performance and boosting productivity.

One Dashboard for All Your Properties:

Say goodbye to fragmented data and manual processes. INNRLY enables you to monitor your entire portfolio from a single dashboard, providing instant access to key metrics like revenue, occupancy, labor costs, and guest satisfaction. With this unified view, hotel managers can make informed decisions in real time.

Customizable and Scalable Solutions:

No two hospitality businesses are alike, and INNRLY understands that. Its customizable features adapt to your unique needs, whether you're running a small chain or managing an extensive enterprise. INNRLY grows with your business, ensuring that your operations remain efficient and effective.

Seamless Integration for Effortless Operations:

One of INNRLY’s standout features is its ability to integrate seamlessly with your existing systems. Whether it's your property management system (PMS), accounting software, payroll/labor management tools, or even guest feedback platforms, INNRLY pulls data together effortlessly, eliminating the need for system overhauls.

Automated Night Audits:

Tired of labor-intensive night audits? INNRLY’s Night Audit+ automates this crucial process, providing detailed reports that are automatically synced with your accounting software. It identifies issues such as declined credit cards or high balances, ensuring no problem goes unnoticed.

A/R and A/P Optimization:

Streamline your accounts receivable (A/R) and accounts payable (A/P) processes to improve cash flow and avoid costly mistakes. INNRLY’s automation reduces manual entry, speeding up credit cycles and ensuring accurate payments.

Labor and Cost Management:

With INNRLY, you can pinpoint inefficiencies, monitor labor hours, and reduce costs. Detailed insights into overtime risks, housekeeping minutes per room (MPR), and other labor metrics help you manage staff productivity effectively.

Empowering Data-Driven Decisions:

INNRLY simplifies decision-making by surfacing actionable insights through its robust reporting and analytics tools.

Comprehensive Reporting:

Access reports on your schedule, from detailed night audit summaries to trial balances and franchise billing reconciliations. Consolidated data across multiple properties allows for easy performance comparisons and trend analysis.

Benchmarking for Success:

Compare your properties' performance against industry standards or other hotels in your portfolio. Metrics such as ADR (Average Daily Rate), RevPAR (Revenue Per Available Room), and occupancy rates are presented in an easy-to-understand format, empowering you to identify strengths and areas for improvement.

Guest Satisfaction Insights:

INNRLY compiles guest feedback and satisfaction scores, enabling you to take prompt action to enhance the guest experience. Happy guests lead to better reviews and increased bookings, driving long-term success.

Key Benefits of INNRLY

Single Login, Full Control: Manage all properties with one login, saving time and reducing complexity.

Error-Free Automation: Eliminate manual data entry, reducing errors and increasing productivity.

Cost Savings: Pinpoint problem areas to reduce labor costs and optimize spending.

Enhanced Accountability: Hold each property accountable for issues flagged by INNRLY’s tools, supported by an optional Cash Flow Protection Team at the enterprise level.

Data Security: Protect your credentials and data while maintaining your existing systems.

Transforming Hospitality Without Transition

INNRLY’s philosophy is simple: transformation without transition. You don’t need to replace or upgrade your existing systems to benefit from INNRLY. The software integrates effortlessly into your current setup, allowing you to focus on what matters most—delivering exceptional guest experiences and achieving your business goals.

Who Can Benefit from INNRLY?

Hotel Owners:

For owners managing multiple properties, INNRLY offers a centralized platform to monitor performance, identify inefficiencies, and maximize profitability.

General Managers:

Simplify day-to-day operations with automated processes and real-time insights, freeing up time to focus on strategic initiatives.

Accounting Teams:

INNRLY ensures accurate financial reporting by syncing data across systems, reducing errors, and streamlining reconciliation processes.

Multi-Brand Portfolios:

For operators managing properties across different brands, INNRLY’s brand-neutral platform consolidates data, making it easy to compare and optimize performance.

Contact INNRLY Today

Ready to revolutionize your hotel management? Join the growing number of hospitality businesses transforming their operations with INNRLY.

Website: www.innrly.com

Email: [email protected]

Phone: 833-311-0777

#Innrly#Innrly Hotel Management Software#Bank Integrations in Hospitality Software#Tracking Hotel Compliance#hotel performance software#hotel portfolio software#Hotel Performance Management Software#hotel reconciliation software#Hotel Data Entry Software#accounting software hotels#hotel banking software#hospitality automated accounting software#hotel automation software hotel bookkeeping software#back office hotel accounting software#hospitality back office software#accounting hospitality software#Hotel Management Accounting Software#Hotel Accounting Software#Hospitality Accounting Software#Accounting Software for Hotels#Hotel Budgeting Software#Automate Night Audit Software#Automate Night Audit Process#Best Hotel Accounting Software#Best Accounting Software For Hotels#Financial & Hotel Accounting Software#Hospitality Accounting Solutions

2 notes

·

View notes

Text

Enhancing Safety and Efficiency with Aviation Compliance Software in India

In the fast-evolving aviation industry, ensuring regulatory compliance and seamless document management is paramount. Airlines, MROs (Maintenance, Repair, and Overhaul organizations), and aviation authorities require robust digital solutions to streamline operations while maintaining adherence to strict industry standards. This is where aviation compliance software in India plays a crucial role.

The Need for Aviation Compliance Software in India

India's aviation sector is experiencing exponential growth, making compliance with DGCA (Directorate General of Civil Aviation) regulations and international standards such as ICAO and IATA essential. Traditional manual processes often lead to inefficiencies, errors, and regulatory risks. Implementing aviation compliance software in India ensures real-time tracking of regulatory requirements, automated reporting, and seamless audit management, helping organizations maintain operational excellence.

Streamlining Operations with an Aviation Document Management System

A well-integrated aviation document management system is indispensable for handling critical documents, including aircraft maintenance logs, pilot certifications, safety manuals, and regulatory approvals. Digital document management enhances accessibility, version control, and security, reducing the risk of misplacement or non-compliance. With a centralized system, stakeholders can easily access, review, and approve essential aviation documents with just a few clicks.

Efficient Workflows with Document Approval Workflows in India

Regulatory compliance demands a structured approach to document processing. Implementing document approval workflows in India helps aviation organizations automate and track document approvals efficiently. These workflows eliminate bottlenecks, improve collaboration, and ensure that all approvals comply with industry standards before final submission. By leveraging technology, aviation companies can significantly reduce delays and enhance compliance readiness.

Key Benefits of Aviation Compliance Solutions

Regulatory Compliance: Automated updates on aviation regulations ensure that organizations always meet the latest standards.

Improved Efficiency: Eliminating paperwork reduces administrative burden, saving time and costs.

Enhanced Security: Secure cloud storage prevents unauthorized access and ensures data integrity.

Audit Readiness: Real-time tracking and digital records simplify audit preparation and compliance reporting.

Conclusion

The adoption of aviation compliance software in India, coupled with a robust aviation document management system and structured document approval workflows in India, is transforming the industry. As aviation continues to expand, embracing digital solutions will be key to maintaining safety, efficiency, and compliance. Investing in the right software ensures seamless operations and future-ready aviation management.

#aviation compliance software in india#audit tracking system#hipaa compliant workflow automation in india#document approval workflows in india#aviation document management system#healthcare data security solutions in india#accounts payable automation in india#healthcare regulatory compliance software in india

0 notes

Text

https://flowrocket.com/finance

#Accounting Advisory Servies USA#Accounting and Bookkeeping services for Business#Accouting and Bookkeeping services USA#Best Auditing Services in USA#Hire Accounting Associates in USA#Hire Audit Supervisor in USA#Hire Bookkeeping Associates in USA#Best CRM Software with Collaboration Tools#CRM solutions for Team Colloboration#Best construction CRM Software#CRM Solutions for Construction Management#Best contract management systems in USA#CRM Software for document management#Best CRM for customer support#CRM for customer service solutions#Customer service software in USA#Agile software development services USA#Business Process Automation USA#IT Consulting Service in USA#Lead management CRM software#Lead tracking CRM software#Best CRM for Financial Services#Financial Services CRM Software#Best GRC Software Solutions in USA#CRM for small businesses#CRM Solutions#Top CRM Software USA#Best CRM Software in USA#Industry Specific CRM Solutions#best free crm for insurance agents

0 notes

Text

Comprehensive Accounting Solutions: Helping Your Business Thrive with Expert Services

The services page of G&S Accountancy highlights their expertise in accounting, audit, tax, and advisory services tailored to meet diverse business needs. They provide comprehensive solutions to support financial compliance, strategic growth, and effective decision-making. For blog submissions or related content, it's recommended to contact them.

Small Business Accounting Services

The services page of G&S Accountancy highlights their expertise in accounting, audit, tax, and advisory services tailored to meet diverse business needs. They provide comprehensive solutions to support financial compliance, strategic growth, and effective decision-making. For blog submissions or related content, it's recommended to contact them.

Payroll

accounting services ensure accurate calculation and timely distribution of employee wages while maintaining compliance with tax regulations. These services handle payroll processing, tax deductions, benefits administration, and reporting, streamlining operations for businesses.

Audits provide the highest level of assurance with detailed examinations of financial statements to verify their accuracy and compliance.

Reviews offer a moderate level of assurance by analyzing financial data without extensive testing.

Compilations involve preparing financial statements based on client-provided data without assurance.

Cash Flow Management Services

Effective cash flow management ensures your business maintains a healthy balance between income and expenses. This service includes monitoring, analyzing, and optimizing cash inflows and outflows to improve liquidity, reduce financial risks, and support operational needs.

Bank Financing Services

Bank financing services help businesses secure loans and credit lines to support growth, manage operations, or address cash flow gaps. These services assist in preparing financial documents, developing loan proposals, and negotiating favorable terms with lenders.

Succession Planning Services

Succession planning services help businesses ensure a smooth transition of leadership and ownership. These services involve identifying potential successors, preparing them for future roles, and creating a clear transition strategy.

New Business Formation Services

Starting a new business can be overwhelming, but professional business formation services simplify the process. These services guide entrepreneurs through legal structures, registration, tax identification, licensing, and compliance requirements.

Nonprofit Organizations Services

Non-profit organizations require specialized services to navigate complex regulations, secure funding, and maintain financial health. These services include tax-exempt status assistance, financial reporting, grant management, and compliance with IRS guidelines.

Internal Controls Services

Internal controls are essential for protecting a business's assets, ensuring financial accuracy, and preventing fraud. These services include developing systems to monitor operations, safeguard data, and comply with regulations.

Visit Here For More Info https://gns-cpas.com/service/

#Accounting Services#Tax Advisory#Financial Audits#Business Consulting#Payroll Management#Cash Flow Solutions#Tax Planning#Non-Profit Support#Business Formation#Internal Controls

0 notes

Text

Advisory Service in uae

Navigate the complexities of business with LGA Auditing, your trusted partner for advisory services in the UAE. Our experienced team offers tailored solutions to help your business grow and succeed.

Our services include:

1. Financial Advisory: Optimize your finances with expert guidance. 2. Business Setup Consulting: Seamless company formation in UAE. 3. Tax Advisory: Stay compliant with UAE tax regulations. 4. Risk Management: Mitigate risks and ensure long-term success.

Whether you're a startup or an established enterprise, we provide strategic insights to make informed decisions.

#Auditing Firm Dubai#LGA Auditing UAE#Financial Audit Services#Tax Compliance Dubai#Internal Audits UAE#External Auditing Experts#Accounting and Auditing#VAT Audits Dubai#Corporate Audit Solutions#Risk Management Dubai#Financial Statement Audit#Audit and Assurance Dubai#Business Compliance Audits#Dubai Audit Consultants

0 notes

Text

SG Systems Global: The Best Company for Compliance Audit Management Software

In today’s fast-paced, highly regulated business environment, ensuring compliance with industry standards and regulations is more important than ever. Whether you’re in the food, pharmaceutical, healthcare, or financial industry, maintaining up-to-date audits and ensuring that operations comply with ever-evolving laws is critical to business success. However, managing compliance across different departments and jurisdictions can be time-consuming, complex, and prone to human error. This is where SG Systems Global shines as the best company for providing compliance audit management software.

SG Systems Global specializes in creating state-of-the-art compliance automation solutions that streamline the entire audit and compliance process, ensuring that businesses stay compliant, mitigate risks, and maintain operational efficiency. In this article, we will explore why SG Systems Global’s compliance audit management software is the best choice for companies looking to simplify their compliance management.

What is Compliance Audit Management Software?

Compliance audit management software is a comprehensive tool designed to help businesses automate and streamline their compliance audit processes. It enables companies to track, monitor, and manage compliance activities across departments, ensuring they meet regulatory requirements and internal policies. With robust reporting, monitoring, and auditing capabilities, compliance audit management software minimizes the risks associated with non-compliance, such as fines, penalties, and reputational damage.

SG Systems Global offers a powerful and intuitive compliance monitoring software that allows businesses to easily manage audits, track regulatory changes, and ensure that they are always prepared for inspections. The software helps automate the process of gathering evidence, conducting audits, generating reports, and implementing corrective actions in a systematic, transparent way.

Why SG Systems Global is the Best Choice for Compliance Audit Management Software

1. Comprehensive Compliance Automation Solutions

SG Systems Global provides compliance automation solutions that address the unique needs of various industries. Their software solutions are designed to automate repetitive tasks involved in managing compliance, such as document collection, audit preparation, reporting, and tracking regulatory changes.

By automating these processes, SG Systems Global ensures that businesses can maintain a comprehensive record of all audit-related activities and regulatory compliance efforts. This reduces the manual effort required to manage audits, improves productivity, and ensures that compliance tasks are completed on time and accurately.

Their compliance audit management software is capable of handling complex compliance requirements, making it ideal for industries with rigorous standards such as pharmaceuticals, food manufacturing, and healthcare. Whether it’s ensuring adherence to industry-specific regulations like FDA guidelines, GMP, or GDPR, SG Systems Global’s solutions offer businesses a single, unified platform to manage and track all their compliance activities.

2. Real-Time Monitoring and Reporting

One of the key features of SG Systems Global’s compliance monitoring software is real-time tracking and reporting. Businesses need the ability to monitor compliance status continuously, as well as produce real-time reports for internal and external stakeholders. SG Systems Global’s software allows businesses to keep track of audits, compliance gaps, and corrective actions in real-time, which is essential for maintaining compliance and minimizing risk.

The compliance audit management software automatically generates reports based on real-time data, allowing businesses to share compliance status with management, regulatory bodies, and auditors. These reports are fully customizable, offering businesses the flexibility to create detailed compliance records in the format required by specific regulations or standards. This helps companies stay audit-ready at all times.

3. Seamless Integration with Other Business Systems

Another advantage of SG Systems Global’s audit and compliance solutions is their ability to integrate seamlessly with other enterprise systems, including ERP (Enterprise Resource Planning), Quality Management Systems (QMS), and document management platforms. This integration enables businesses to consolidate all their compliance-related data into a single platform, improving overall efficiency and reducing the chance of discrepancies or data silos.

The software can automatically pull data from other systems, track changes to compliance metrics, and monitor the implementation of corrective actions, ensuring that all departments are aligned with the latest regulations. This integration simplifies the auditing process, making it easier for businesses to maintain up-to-date records and improve their overall compliance management strategy.

4. Risk Management and Mitigation

The consequences of non-compliance can be severe, ranging from financial penalties to damage to reputation. SG Systems Global’s compliance audit management software helps businesses proactively manage and mitigate these risks by identifying gaps in compliance and highlighting areas that need attention.

With automated reminders, risk assessments, and tracking of previous audit results, the software ensures that no critical compliance tasks are overlooked. It provides businesses with real-time insights into compliance status, enabling them to take immediate corrective actions when needed. This proactive approach helps businesses reduce the risk of non-compliance, avoid costly penalties, and maintain operational continuity.

5. Audit Trail and Full Transparency

One of the most important features of compliance audit management software is the ability to create an audit trail that tracks every compliance action and decision. SG Systems Global’s software provides a complete, transparent record of every audit step, from initial review to final corrective action. This audit trail ensures that businesses can easily demonstrate compliance to regulators, auditors, and other stakeholders.

With SG Systems Global’s solutions, businesses can track all changes made to compliance records, review audit logs, and generate detailed audit reports. This level of transparency not only makes it easier to pass audits but also helps businesses continuously improve their compliance processes by identifying trends and recurring issues.

6. Scalability and Customization

As businesses grow and their regulatory requirements become more complex, SG Systems Global’s compliance audit management software scales with them. The software is highly customizable, allowing businesses to adapt it to their specific needs and regulatory environments.

Whether a company is operating in one jurisdiction or across multiple regions with different compliance regulations, SG Systems Global’s solutions are flexible enough to meet diverse requirements. The system can be configured to align with industry standards, integrate with local regulations, and accommodate a wide range of compliance workflows.

7. Robust Security Features

In industries such as healthcare, pharmaceuticals, and financial services, data security and confidentiality are paramount. SG Systems Global understands the importance of maintaining a secure and protected audit trail, which is why their compliance monitoring software includes robust security features to protect sensitive compliance data.

The software employs advanced encryption, multi-factor authentication, and role-based access controls to ensure that only authorized personnel can access sensitive compliance information. These security measures help businesses maintain the integrity and confidentiality of their audit data, protecting them from data breaches and potential legal issues.

8. Expert Support and Consultation

SG Systems Global’s commitment to customer success extends beyond software implementation. They provide expert consultation and customer support to help businesses get the most out of their audit and compliance solutions. Whether it’s configuring the software to meet specific compliance needs, training staff on how to use the system, or offering ongoing technical support, SG Systems Global is there to ensure a smooth experience for their clients.

Conclusion: Why SG Systems Global is the Best Choice for Compliance Audit Management Software

SG Systems Global has proven to be the best choice for businesses seeking compliance audit management software. Their solutions offer comprehensive compliance automation, real-time monitoring, seamless integration with other business systems, and a proactive approach to risk management. With their intuitive and scalable compliance monitoring software, businesses in various industries can streamline their compliance processes, reduce risks, and ensure they remain audit-ready at all times.

By choosing SG Systems Global, businesses gain a reliable partner dedicated to ensuring compliance and supporting them through every step of the auditing process. Their advanced audit and compliance solutions provide the tools and insights necessary to navigate complex regulatory landscapes and mitigate the risks associated with non-compliance. Whether you're looking to automate compliance tasks, enhance visibility, or simplify reporting, SG Systems Global offers the expertise and technology to help you succeed.

#Compliance and Traceability Solutions#Compliance Audit Management Software#Compliance Automation Solutions#Compliance Automation Software

0 notes

Text

youtube

The Indian Accountant. is an accounting company headquartered in Kolkata, India, with operations globally. Our experienced staff of professionals includes Certified Public Accountants (CPAs), Enrolled Agents (EAs), Chartered Accountants (CA-India), and other professional staff in various stages of certification

#Accounting Services in USA#Bookkeeping Services in USA#importance of financial report#importance of financial reporting#Book Keeping Solutions#Financial Advisory Services#Small Business Accounting#Tax Compliance Services#Cash Flow Management#Company Formation and Registration#Self Assessment Tax Returns#Strategic Financial Planning#Auditing and Assurance#Budgeting and Forecasting#VAT Registration and Filing#Payroll management Services in USA#Tax Planning and Optimization in USA#Accountant Services in USA#Corporate Accounting in USA#Accounting Services for USA Businesses#Bookkeeping Services for USA Businesses#Youtube

0 notes

Text

The Role of Accounting Firms in Abu Dhabi in Supporting Startups and SMEs

Abu Dhabi, the capital of the UAE, has become a vibrant hub for startups and small to medium-sized enterprises (SMEs). With its strategic location, supportive government policies, and growing investment landscape, the city offers numerous opportunities for new businesses. However, navigating the complexities of finance, compliance, and taxation can be daunting for entrepreneurs. This is where Accounting firms in Abu Dhabi play a crucial role. Let’s explore how these firms support startups and SMEs in their journey to success.

1. Providing Financial Guidance

One of the primary roles of accounting firms is to provide financial guidance to startups and SMEs. These firms help entrepreneurs understand their financial health by offering insights into cash flow management, budgeting, and financial forecasting. With accurate financial data, businesses can make informed decisions and plan for future growth.

2. Tax Compliance and Planning

Navigating tax regulations in the UAE can be complex, especially for new businesses. Accounting firms in Abu Dhabi assist startups and SMEs with tax compliance, ensuring they meet all local regulations. They also provide strategic tax planning advice, helping businesses minimize their tax liabilities while remaining compliant with the law. This is particularly important with the introduction of VAT and other tax measures in the UAE.

3. Bookkeeping Services

Maintaining accurate financial records is vital for any business, but startups and SMEs often lack the resources to manage this effectively. Accounting firms offer comprehensive bookkeeping services, which allow business owners to focus on their core operations. Regular bookkeeping helps in tracking expenses, managing invoices, and preparing for audits.

4. Assisting with Business Setup

For startups, the process of setting up a business can be overwhelming. Accounting firms provide valuable assistance in this area, guiding entrepreneurs through the legal and financial requirements of establishing a company in Abu Dhabi. This includes obtaining the necessary licenses, understanding local regulations, and setting up accounting systems.

5. Financial Audits and Reviews

Regular financial audits are essential for businesses seeking investment or loans. Accounting firms conduct audits to ensure the financial statements are accurate and comply with regulations. For startups looking to attract investors, a clean audit can significantly enhance credibility and increase the chances of securing funding.

6. Advisory Services for Growth

As startups and SMEs grow, they face new challenges and opportunities. Accounting firms in Abu Dhabi provide advisory services that help businesses strategize for growth. This includes mergers and acquisitions, market entry strategies, and financial restructuring. Their expertise can be invaluable in navigating these complex decisions.

7. Facilitating Access to Funding

Access to capital is often a challenge for startups and SMEs. Accounting firms can assist in preparing financial projections and business plans that are crucial for securing funding from banks, venture capitalists, or angel investors. Their expertise in financial modeling can make a significant difference in how potential investors perceive a business.

8. Supporting Technology Integration

The rise of financial technology (fintech) has transformed the accounting landscape. Accounting firms in Abu Dhabi are increasingly incorporating technology into their services, helping startups and SMEs implement accounting software and automated solutions. This not only improves efficiency but also enhances the accuracy of financial reporting.

9. Networking and Connections

Many accounting firms have extensive networks that can benefit startups and SMEs. They can connect businesses with other professionals, potential clients, and investors, fostering valuable relationships that can drive growth. These connections are particularly beneficial in a city like Abu Dhabi, where networking can lead to new opportunities.

Conclusion

In a rapidly evolving business environment, the support of accounting firms in Abu Dhabi is invaluable for startups and SMEs. From financial guidance and tax compliance to business setup and growth strategies, these firms play a multifaceted role in helping businesses thrive. By leveraging their expertise, entrepreneurs can focus on what they do best — innovating and growing their businesses — while leaving the complexities of finance and compliance to the professionals. As Abu Dhabi continues to grow as a business hub, the partnership between startups, SMEs, and accounting firms will be essential for sustainable success.

#accounting firms#Abu Dhabi accountants#financial services#bookkeeping#tax services#audit services#payroll management#financial consulting#tax planning#business advisory#corporate finance#VAT services#accounting solutions#financial reporting#compliance services#CFO services#accounting software#SME accounting#forensic accounting#accounting outsourcing

0 notes

Text

Business Zakat Calculation in ALZERP Cloud ERP Software

Benefits of Using ALZERP for Zakat Calculation

ZATCA Compliant Software: ALZERP is designed to meet all ZATCA requirements, ensuring that Zakat calculations are accurate and compliant with Saudi tax regulations.

Efficient VAT Management: In addition to Zakat, ALZERP manages VAT reporting and compliance, providing an all-in-one solution for tax management.

Zakat Calculation Software: The built-in Zakat calculator simplifies the complex process of determining Zakat obligations, reducing errors and ensuring timely submissions.

Automated Tax Compliance: The software automates the tax compliance process, from calculation to submission, minimizing manual intervention and the risk of errors.

Zakat and Tax Automation: ALZERP integrates Zakat and tax processes, automating calculations, reporting, and compliance tasks.

Real-Time VAT Reporting KSA: The system offers real-time reporting, allowing businesses to stay up-to-date with their tax liabilities.

Saudi Tax Compliance Software: Tailored specifically for the Saudi market, ALZERP ensures businesses meet all local tax and Zakat obligations.

Tax Optimization Tool: By providing insights into Zakat and tax liabilities, ALZERP helps businesses optimize their financial strategies.

VAT Fraud Detection: The system includes features to detect and prevent VAT fraud, ensuring the integrity of financial transactions.

#ZATCA compliant software#VAT management#Zakat calculation software#Tax management system#ZATCA e-invoicing solution#Saudi tax compliance software#Zakat and tax automation#VAT reporting software KSA#ZATCA approved ERP#tax filing software#Zakat assessment tool#VAT return automation Saudi#ZATCA integration software#Saudi business tax management#Zakat and income tax software#Real-time VAT reporting KSA#ZATCA electronic invoicing#Saudi tax audit software#Zakat and VAT calculator#Automated tax compliance#ZATCA digital reporting platform#Saudi VAT reconciliation software#Zakat declaration software#Tax analytics for Saudi businesses#ZATCA-compliant e-invoicing system#tax planning software#Zakat and tax consultation tool#VAT management for Saudi SMEs#ZATCA data submission software#Saudi corporate tax software

0 notes

Text

At FineX Outsourcing we have clear liability with giving wide VAT Return HMRC relationship to ensure your business remains clear with all cost rules. Our party of experts is learned in the intricacies of VAT rules and HMRC essentials, raising the cycle smooth and crushing free for you. Our affiliations coordinate careful appraisals to ensure that each trade is tended to unequivocally, keeping the bet of messes up, and titanic locale to adhere to HMRC deadlines, avoiding any late trains or interest charges.

#VAT Return#HMRC#FineX Outsourcing#Tax Compliance#VAT Services#Business Tax#Accurate Calculations#Timely Submissions#Record Keeping#VAT Consultation#Tax Advice#Compliance Checks#Cost Effective Solutions#Professional Tax Services#Business Growth#Tax Experts#VAT Returns for Businesses#Outsourced Tax Services#Financial Accuracy#Tax Regulation Compliance#HMRC Deadlines#Tax Record Management#VAT Audit Preparation#VAT Law Expertise#VAT Filing Assistance#Tax Efficiency

0 notes

Text

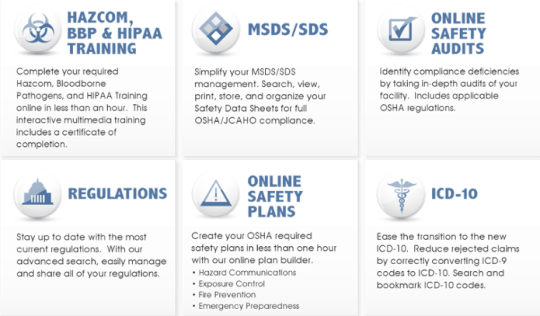

Medical waste disposal- Stay up to date with the currents regulations and compliances

#compliance#regulations#online safety#icd10#hipaa compliance#MSDS#online safety audits#medical waste disposal#medprodisposal#waste management#medical waste#pharmacy waste disposal#medical waste disposal solutions#medicines#biohazard sharps container#pharmaceutical waste management#disposal

0 notes

Text

Optimizing Compliance and Workflow Efficiency: The Role of Aviation and Healthcare Automation Software in India

Companies in aviation and healthcare should comply with rigid guidelines while guaranteeing consistent archive taking care of and information security. Carrying out cutting edge aviation compliance software in India and healthcare regulatory compliance software in India can reform these ventures by smoothing out cycles and diminishing dangers.

Aviation Compliance and Document Management

Aviation companies work in an exceptionally directed climate, requiring precise documentation, wellbeing reviews, and consistency following. A vigorous aviation document management system guarantees that every important record, manuals, and wellbeing conventions are effectively open and state-of-the-art.

Furthermore, an audit tracking system assumes an imperative part in guaranteeing adherence to administrative principles. It gives ongoing bits of knowledge into consistency status, lessening the gamble of infringement and upgrading functional straightforwardness.

Workflow Automation in Healthcare

The healthcare industry requests tough security and effectiveness in overseeing patient information and work processes. Executing HIPAA compliant workflow automation in India guarantees that healthcare suppliers keep up with information protection and administrative consistence. With automated workflows, healthcare companies can oversee endorsements, patient documentation, and consistence reviews flawlessly.

Moreover, healthcare data security solutions in India shield touchy patient data against digital dangers, guaranteeing vigorous assurance and administrative adherence.

Enhancing Document Approval and Accounts Payable Automation

For both Aviation and healthcare enterprises, it is fundamental to smooth out regulatory errands. Document approval workflows in India work with consistent endorsements across divisions, wiping out manual mistakes and postponements. Via robotizing archive steering and approval, associations can improve effectiveness and consistency.

Additionally, accounts payable automation in India works on monetary activities by diminishing manual receipt handling mistakes, accelerating installment endorsements, and guaranteeing consistency with monetary guidelines.

The Future of Compliance and Automation

As enterprises keep on embracing computerized change, putting resources into aviation compliance software in India and healthcare regulatory compliance software in India will become irreplaceable. These arrangements improve productivity and security as well as drive consistency with advancing guidelines.

For companies hoping to streamline their work processes, coordinating audit tracking systems, document approval workflows in India, and accounts payable automation in India is an essential push toward functional greatness. By utilizing state of the art innovation, companies can accomplish administrative consistence while working on generally efficiency and information security.

#aviation compliance software in india#audit tracking system#hipaa compliant workflow automation in india#document approval workflows in india#aviation document management system#healthcare data security solutions in india#accounts payable automation in india#healthcare regulatory compliance software in india

0 notes

Text

#Accounting Advisory Servies USA#Accounting and Bookkeeping services for Business#Accouting and Bookkeeping services USA#Best Auditing Services in USA#Hire Accounting Associates in USA#Hire Audit Supervisor in USA#Hire Bookkeeping Associates in USA#Best CRM Software with Collaboration Tools#CRM solutions for Team Colloboration#Best construction CRM Software#CRM Solutions for Construction Management#Best contract management systems in USA#CRM Software for document management#Best CRM for customer support#CRM for customer service solutions#Customer service software in USA#Agile software development services USA#Business Process Automation USA#IT Consulting Service in USA#Lead management CRM software#Lead tracking CRM software#Best CRM for Financial Services#Financial Services CRM Software#Best GRC Software Solutions in USA#CRM for small businesses#CRM Solutions#Top CRM Software USA#Best CRM Software in USA#Industry Specific CRM Solutions#best free crm for insurance agents

0 notes

Text

INTERAC Applications for Public Accounting | Intersoft Systems Inc

The INTERAC core accounting applications are easily tailored to accommodate the needs of a variety of businesses. Intersoft Systems, Inc. offers NTERAC Client Accounting, Payroll, Time and Billing, Practice Management Software Solutions.

#INTERAC Applications#Public Accounting#Accounting Software#Financial Management#Accountancy Tools#CPA Software#Financial Reporting#Tax Preparation#Audit Solutions#Accounting Automation

0 notes

Text

Company Liquidation Services in uae

LGA Auditing offers expert company liquidation services across the UAE, ensuring a smooth and compliant closure process. From document preparation to debt resolution, we handle every detail with precision. Trust us for hassle-free business liquidation in the UAE!

https://www.scribd.com/document/799230428/Company-Liquidation-Services-in-Dubai

#Auditing Firm Dubai#LGA Auditing UAE#Financial Audit Services#Tax Compliance Dubai#Internal Audits UAE#External Auditing Experts#Accounting and Auditing#VAT Audits Dubai#Corporate Audit Solutions#Risk Management Dubai#Financial Statement Audit#Audit and Assurance Dubai#Business Compliance Audits#Dubai Audit Consultants

0 notes

Text

Navigating the intricate landscape of financial management in the UAE presents

Navigating the intricate landscape of financial management in the UAE presents a unique set of challenges and opportunities for businesses of all sizes. From startups finding their footing to established multinational enterprises, grasping the significance of robust accounting practices, tax obligations, and VAT regulations is paramount.

Corporate Tax and VAT Dynamics in the UAE

Renowned for its tax-friendly environment, the UAE stands out for its absence of corporate and personal income taxes for most entities and individuals. However, nuanced tax regulations apply to specific industries and activities. Typically, businesses face a 20% corporate tax rate on taxable profits, while a 5% VAT is standard for most goods and services unless exemptions or zero-rated categories apply.

Exemplary VAT Consulting Support in the UAE

Navigating the intricacies of VAT compliance and optimization demands specialized expertise. FST Accounting emerges as a beacon of proficiency in Financial Consulting in the UAE. Leveraging a profound understanding of UAE tax frameworks and extensive hands-on experience, FST Accounting delivers tailor-made VAT consulting solutions, ensuring compliance and strategic tax maneuvering.

VAT Accounting Precision in the UAE

Accurate VAT accounting stands as a cornerstone for businesses operating in the UAE. VAT-registered entities must meticulously record transactions, apply the appropriate VAT rates, and diligently submit VAT returns to the Federal Tax Authority (FTA). FST Accounting steps in with comprehensive VAT accounting services, safeguarding compliance and fortifying tax positions.

UAE Corporate Tax Landscape Unveiled

While the UAE predominantly refrains from corporate income tax imposition, specific sectors like oil and gas entities and branches of foreign banks face corporate tax obligations. It's imperative for businesses within these realms to grasp their tax responsibilities and engage professional counsel for seamless implementation.

Diving into VAT Varieties

Within the UAE, VAT treatments primarily fall into two categories: standard-rated and zero-rated supplies. Standard-rated supplies incur a 5% VAT, while zero-rated supplies enjoy a 0% VAT rate. Examples of zero-rated supplies encompass select exports, international transportation, and healthcare services.

Embracing Excellence in Financial Management

For dependable accounting services, adept financial consulting, and meticulous tax preparation in the UAE, enterprises entrust FST Accounting. Serving as a conduit for success and compliance, FST Accounting emerges as the partner of choice in navigating the intricate realm of UAE financial regulations.

Tagged: Accounting services in UAE, Financial consulting in UAE, Tax preparation in UAE

#Accounting services Uae#Financial consulting Uae#Tax preparation uae#Bookkeeping solutions Uae#Small business accounting Uae#Payroll management Uae#Auditing services Uae#Tax planning Uae#Financial reporting Uae#CPA services Uae#Budgeting and forecasting Uae#Business advisory Uae#Financial analysis Uae#QuickBooks consulting Uae#Tax compliance Uae#certified accountant near me#cpa accountant near me#accountants near me#tax accountant near me#accounting services

0 notes