#Accountant Services in USA

Explore tagged Tumblr posts

Text

youtube

The Indian Accountant. is an accounting company headquartered in Kolkata, India, with operations globally. Our experienced staff of professionals includes Certified Public Accountants (CPAs), Enrolled Agents (EAs), Chartered Accountants (CA-India), and other professional staff in various stages of certification

#Accounting Services in USA#Bookkeeping Services in USA#importance of financial report#importance of financial reporting#Book Keeping Solutions#Financial Advisory Services#Small Business Accounting#Tax Compliance Services#Cash Flow Management#Company Formation and Registration#Self Assessment Tax Returns#Strategic Financial Planning#Auditing and Assurance#Budgeting and Forecasting#VAT Registration and Filing#Payroll management Services in USA#Tax Planning and Optimization in USA#Accountant Services in USA#Corporate Accounting in USA#Accounting Services for USA Businesses#Bookkeeping Services for USA Businesses#Youtube

0 notes

Text

Hey folks, friendly reminder that, even though I might be a queer leftist, I’m ALSO a born and raised country hick. If you’re out here posting that the folks out in west North Carolina (my home state) and the rest of Southern Appalachia somehow “deserved” the catastrophic damage that Helene brought, block me. I’m not asking you to block me for my own internet experience, I’m telling you that it is within your best interest to block me.

To the folks at home who are donating supplies, sharing links, or even just prayin’ or keeping those impacted in your hearts, I love you and appreciate your kindness. Please keep it up, if possible, this won’t be “fixed” in a week, in fact, it never will be. This is Katrina level, there are already 200 confirmed dead, and they haven’t even started looking for the deceased.

I hope everyone reading this has the day they deserve <3

#I apologize if there’s spelling mistakes#i wrote this real quick and it’s 4 am#also before anyone asks#so far my family is safe#the folks I know out west are mostly accounted for#and service is still down so i’m praying that the ones who aren’t just don’t have access to their phone right now#<3#helene#hurricane helene#helene aftermath#tropical storm helene#north carolina#southern appalachia#southern usa#yall means all#western north carolina#appalachia#my txt#important

36 notes

·

View notes

Text

https://iptvuniverse.store/

@onepiecegifs-blog @luffytarhoe

🏴☠️ Set Sail with One Piece – Now Streaming on Iptv Universe ⚓

Join Monkey D. Luffy and the Straw Hat Pirates on their epic adventure to find the legendary One Piece treasure and become the Pirate King! With unforgettable characters, jaw-dropping battles, and heartwarming moments, One Piece is the ultimate anime for fans of action, adventure, and friendship.

Why Watch One Piece on Iptv Universe ✅ All Episodes Available – Stream the entire saga, from East Blue to Wano, anytime you want. ✅ HD Quality Streaming – Watch every battle, transformation, and epic scene in stunning clarity. ✅ No Interruptions – Enjoy uninterrupted viewing with no ads. ✅ Affordable Pricing – Unlimited access to One Piece and thousands of other shows at unbeatable rates. ✅ Multi-Device Access – Stream on your phone, tablet, smart TV, or wherever you go.

⚔️ Don’t Miss the Adventure! Relive every iconic moment or start your journey from the beginning. One Piece is perfect for fans new and old!

📩 DM us or visit https://iptvuniverse.store/ to start streaming One Piece today!

#anime and manga#anime#anime manga#manga art#anime art#accounting#iptv subscription#arcane netflix#netflix series#netflix shows#tv shows#tv edits#tv series#iptv uk#best iptv#iptv usa#iptv service#netflix#one piece#one piece x reader#one piece luffy#monkey d luffy#manga#manga panel#shonen

4 notes

·

View notes

Text

Why Tax Advisory Services in USA Are Your Compass

The United States tax code is notoriously intricate, a labyrinth of rules and regulations that can leave even the most seasoned business owner or individual feeling lost. This is where tax advisory services in USA come in, acting as your trusted guide through the complexities of the tax landscape. Mercurius & Associates LLP (MAS), a leading provider of tax advisory services in USA, understands the unique challenges faced by individuals and businesses. We offer a comprehensive suite of services tailored to your specific needs, helping you:

Minimize Tax Burden: Our expert advisors analyze your financial situation and identify opportunities for tax optimization, ensuring you keep more of your hard-earned money. Stay Compliant: We navigate the ever-changing tax code on your behalf, ensuring your filings are accurate and timely, avoiding costly penalties and audits. Plan for the Future: Whether you're a growing startup or a seasoned entrepreneur, MAS helps you develop tax-efficient strategies for long-term success. Here are just a few ways MAS can assist you: International Tax Planning: We guide you through the complexities of cross-border transactions and investments, mitigating your global tax risk. Business Entity Structuring: We help you choose the optimal business structure for tax efficiency and asset protection. Mergers & Acquisitions: We advise on the tax implications of M&A transactions, ensuring a smooth and profitable process. Estate & Gift Tax Planning: We safeguard your legacy by developing strategies to minimize estate and gift taxes. But MAS goes beyond just numbers. We believe in building strong relationships with our clients, providing personalized attention and clear communication throughout the process. We're not just your tax advisors; we're your partners in financial success. Investing in tax advisory services in USA is an investment in your future. Choosing MAS means you gain access to a team of experienced professionals who are passionate about helping you achieve your financial goals. Ready to take control of your taxes and unlock your financial potential? Contact MAS today for a free consultation and discover how our Tax advisory services in USA can guide you through the maze of the US tax code.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services#Tax advisory services in USA

4 notes

·

View notes

Text

How to Make Sure You're Withholding and Reporting Your Taxes Correctly

Taxes are an inevitable part of life for most individuals and businesses. Whether you're a salaried employee, a freelancer, or a business owner, understanding how to withhold and report your taxes correctly is crucial to avoid potential legal troubles and financial headaches down the road. In this article, we will explore the key steps and considerations to ensure that you're handling your taxes in a responsible and compliant manner.

Know Your Tax Obligations

The first and most critical step in ensuring you're withholding and Outsource Management Reporting your taxes correctly is to understand your tax obligations. These obligations vary depending on your employment status and the type of income you earn. Here are some common categories of taxpayers:

1. Salaried Employees

If you're a salaried employee, your employer typically withholds income taxes from your paycheck based on your Form W-4, which you fill out when you start your job. It's essential to review and update your W-4 regularly to ensure that your withholding accurately reflects your current financial situation. Major life events like marriage, having children, or significant changes in your income should prompt you to revisit your W-4.

2. Freelancers and Self-Employed Individuals

Freelancers and self-employed individuals often have more complex tax obligations. You are responsible for estimating and paying your taxes quarterly using Form 1040-ES. Keep detailed records of your income and expenses, including receipts and invoices, to accurately report your earnings and deductions.

3. Small Business Owners

If you own a small business, your sales tax responsibilities extend beyond your personal income. You must separate your business and personal finances, keep meticulous records of all business transactions, and file the appropriate business tax returns. The structure of your business entity (e.g., sole proprietorship, partnership, corporation) will determine the specific tax forms you need to file.

4. Investors and Property Owners

Investors and property owners may have to report income from dividends, interest, capital gains, or rental properties. These income sources have their specific tax reporting requirements, and it's essential to understand and comply with them.

Keep Accurate Records

Regardless of your tax situation, maintaining accurate financial records is essential. Detailed records make it easier to report your income and deductions correctly, substantiate any claims you make on your tax return, and provide documentation in case of an audit. Here are some record-keeping tips:

Organize Your Documents: Create a system to store your financial documents, including receipts, invoices, bank statements, and tax forms. Consider using digital tools for easier record keeping.

Track Income and Expenses: Keep a ledger or use accounting software to record all income and expenses related to your financial activities. Categorize expenses correctly to maximize deductions and credits.

Retain Documents for Several Years: The IRS typically has a statute of limitations for auditing tax returns, which is generally three years. However, in some cases, it can extend to six years or indefinitely if fraud is suspected. To be safe, keep your tax records for at least seven years.

Understand Deductions and Credits

Deductions and credits can significantly reduce your tax liability. Deductions reduce your taxable income, while credits provide a dollar-for-dollar reduction of your tax bill. Familiarize yourself with common deductions and credits that may apply to your situation:

Standard Deduction vs. Itemized Deductions: Depending on your filing status and financial situation, you can choose between taking the standard deduction or itemizing your deductions. Itemizing requires more documentation but can result in greater tax savings.

Tax Credits: Explore available tax credits, such as the Earned Income Tax Credit (EITC), Child Tax Credit, and Education Credits. These credits can provide substantial savings, especially for low- to moderate-income individuals and families.

Business Expenses: If you're self-employed or a small business owner, be aware of deductible business expenses, including office supplies, travel expenses, and home office deductions.

Seek Professional Assistance

Tax laws are complex and subject to change. Seeking professional assistance from a certified tax professional or CPA (Certified Public Accountant) can be a wise investment. Tax professionals can help you:

Maximize Deductions: They are well-versed in the intricacies of tax law and can identify deductions and credits you might overlook.

Ensure Compliance: Tax professionals can ensure that you are complying with current tax laws and regulations, reducing the risk of costly errors or audits.

Provide Tax Planning: They can help you create a tax-efficient strategy to minimize your tax liability in the long term.

Represent You in Audits: If you face an audit, a tax professional can represent you and help navigate the process.

File Your Taxes on Time

Filing your taxes on time is crucial to avoid penalties and interest charges. The tax filing deadline for most individuals is April 15th. However, if you need more time, you can file for an extension, which typically gives you until October 15th to submit your return. Keep in mind that an extension to file is not an extension to pay any taxes owed, so pay as much as you can by the original deadline to minimize interest and penalties.

Consider Electronic Filing

Electronic filing (e-filing) is a secure and convenient way to submit your tax return to the IRS. It reduces the risk of errors and ensures faster processing and quicker refunds, if applicable. Many tax software programs offer e-filing options, making it easy for individuals and businesses to submit their returns electronically.

Stay Informed and Adapt

Tax laws can change from year to year, so staying informed is essential. Follow updates from the IRS and consult outsourcing sales tax services professionals or resources to understand how changes in tax laws may affect you. Be proactive in adapting your tax strategies to maximize savings and remain compliant with current regulations.

In conclusion, withholding and reporting your taxes correctly is a responsibility that should not be taken lightly. Understanding your tax obligations, keeping accurate records, leveraging deductions and credits, seeking professional assistance when needed, and filing on time are essential steps to ensure a smooth and compliant tax-filing experience. By following these guidelines, you can navigate the complexities of the outsourcing sales tax services system with confidence and peace of mind. Remember that taxes are a fundamental part of our society, and paying them correctly ensures that essential public services and infrastructure are funded for the benefit of all.

2 notes

·

View notes

Text

Cost-Effective Financial Analysis Services - Centelli

Unlock accurate, timely, and actionable insights with Centelli’s Financial Analysis Services. As a trusted finance and accounting outsourcing provider, we help businesses save up to 65% in costs while ensuring data-driven financial decisions.

Our Financial Analysis Services Cover:

Comprehensive financial reporting for clear business insights

Detailed budgeting analysis to optimize spending

Insightful forecasting for strategic planning

In-depth performance reviews to track financial health

And more!

Our financial analysis experts work as an extension of your team, helping you assess your company’s finances and create a strong roadmap for growth.

Why Choose Us?

Get accurate financial insights for better profitability

Improve cash flow management & strategic investments

Access to our seasoned finance specialists

Tailored solutions for unique business needs

Boost accuracy, transparency, and compliance

By outsourcing your financial analysis process to us, you gain the expertise needed to make smarter, data-driven decisions without the overhead costs.

Contact us now to discover how our financial analysis services can drive business success!

#Financial Analysis Services#Finance Accounting#Accounting Services#Outsourced Accounting#centelli#Atlanta#USA

0 notes

Text

#usa#accounting#business#finance#startup#services#business loan#loan against property#mortgage loan#home loan#agriculture loan#bank

0 notes

Text

#real estate#Small businesses#properties#business owners#start ups#online accounting#virtual accounting#online data entry services#small business accountant#bookkeeping in USA

0 notes

Text

US Expat Taxes: Guide to Income Tax Filing in 2025

Introduction Do you reside or work in India as a US citizen? If so, you are likely aware of the difficulty in filing taxes for foreign residents in the United States. While there are cultural and professional benefits to living overseas, paying taxes can be a further cause of stress. This tutorial will give a straightforward but thorough review of US expat taxes in 2025, with a focus on Expat Tax Services in Hyderabad, specifically for Indian tourists.

US Expats' Tax Filing Requirements in India

Whichever country where you might live in the world, you must typically submit a US tax return as a US citizen. This also includes American foreigners residing in India. Generally, you have until June 15th of the coming year to file your US expat tax return. However, US citizens living abroad are given an extension through June 15th of the following year. It's important to remember that you still need to file a return even if you have no outstanding US tax demands.

Knowing About Foreign Earned Income Exclusion and Earned Income Exclusion

US expats working in India may greatly benefit from the following two main tax exclusions:

Absence of Earned Income: This limitation enables US foreign nationals to exclude a particular amount of their income from employment from their tax bills. The maximum earned income exclusion for the 2025 tax year is $130,000, not $112,000.

Exclusion of Foreign Earned Income: Under the Foreign Earned Income Exclusion (FEIE), US foreign nationals are able to deduct their earned income from US taxes. You must physically be in a foreign nation for at least 365 days for 18 consecutive months or reside there for 330 full days within 12 months to be eligible for the FEIE in 2025.

India Foreign Tax Credit Accounting Solution

You might be able to claim a foreign tax credit on your US tax return if you pay income taxes to the Indian government. The income taxes you pay to a foreign government are deducted from your US tax liability, dollar for dollar, thanks to this credit. You can make sure you are claiming all the credits you are entitled to by navigating the intricacies of India Foreign Tax Credit Accounting with the assistance of Accelero Corporation.

Tax Implications of Foreign Bank Accounts

If the total value of your foreign financial accounts at any time throughout the year reaches $10,000, you must file a Report of Foreign Bank and Financial Accounts (FBAR) if you have any accounts outside of the US. Any interest received on these accounts may also have tax considerations.

Additional Considerations for US Expats in India

State Taxes: US residents residing overseas may be liable for state taxes in addition to federal taxes. To find out if you must file a state tax return, it's crucial to study the tax regulations in your home state.

Self-Employment: To record your business income and costs, you must include a Schedule C with your US tax return if you work for yourself in India.

Conclusion

Although filing US expat taxes in India can be challenging, you can make sure you are abiding by all US tax regulations and utilizing all available tax benefits with careful preparation and the help of an experienced tax expert. A group of skilled experts at Accelero Corporation can guide you through the complexities of paying US expat taxes in India. To arrange a consultation and discover more about our accounting Solutions, get in touch with us right now.

#expat tax services#green card holder taxes#usa citizen tax services in hyderabad#india foreign tax credit in hyderabad#India Foreign Tax Credit Accounting Solution

0 notes

Text

https://flowrocket.com/finance

#Accounting Advisory Servies USA#Accounting and Bookkeeping services for Business#Accouting and Bookkeeping services USA#Best Auditing Services in USA#Hire Accounting Associates in USA#Hire Audit Supervisor in USA#Hire Bookkeeping Associates in USA#Best CRM Software with Collaboration Tools#CRM solutions for Team Colloboration#Best construction CRM Software#CRM Solutions for Construction Management#Best contract management systems in USA#CRM Software for document management#Best CRM for customer support#CRM for customer service solutions#Customer service software in USA#Agile software development services USA#Business Process Automation USA#IT Consulting Service in USA#Lead management CRM software#Lead tracking CRM software#Best CRM for Financial Services#Financial Services CRM Software#Best GRC Software Solutions in USA#CRM for small businesses#CRM Solutions#Top CRM Software USA#Best CRM Software in USA#Industry Specific CRM Solutions#best free crm for insurance agents

0 notes

Text

0 notes

Text

The Indian Accountant. is an accounting company headquartered in Kolkata, India, with operations globally. Our experienced staff of professionals includes Certified Public Accountants (CPAs), Enrolled Agents (EAs), Chartered Accountants (CA-India), and other professional staff in various stages of certification

#Accounting Services in USA#Bookkeeping Services in USA#importance of financial report#importance of financial reporting#Book Keeping Solutions#Financial Advisory Services#Small Business Accounting#Tax Compliance Services#Cash Flow Management#Company Formation and Registration#Self Assessment Tax Returns#Strategic Financial Planning#Auditing and Assurance#Budgeting and Forecasting#VAT Registration and Filing#Payroll management Services in USA#Tax Planning and Optimization in USA#Accountant Services in USA#Corporate Accounting in USA#Accounting Services for USA Businesses#Bookkeeping Services for USA Businesses

0 notes

Text

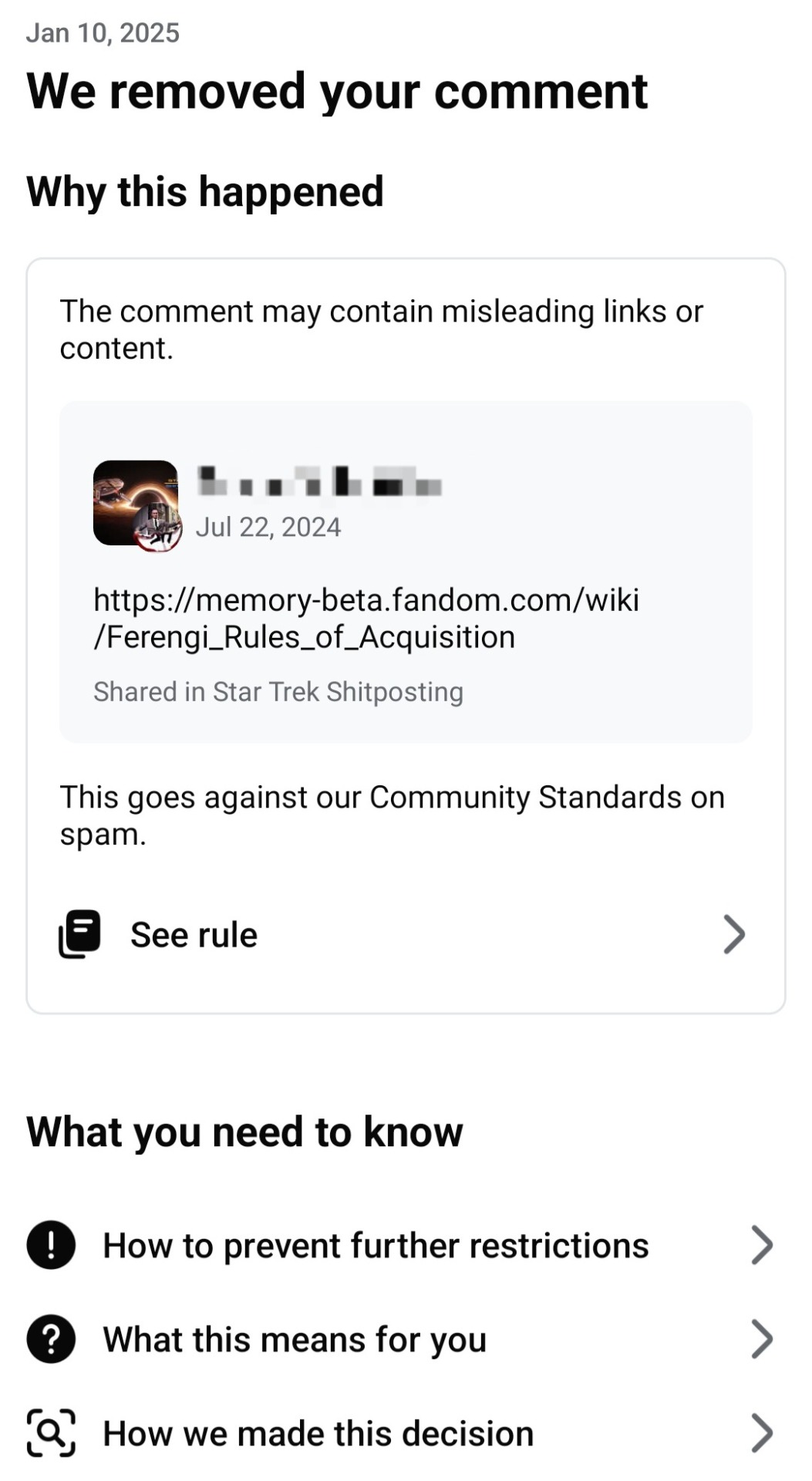

I don't have to explain the irony of this, surely

#its like one of those#jeff lee johnson#paintings where it just gets wilder the longer you look#like do i start with the fact it took then six months to find that comment#or do i start with the incredibly intense irony of “the rules of acquisition” being against the meta terms of service somehow#or perhaps the fact that i linked to a star trek website in a star trek shitposting group so that's “spam”#but the ACTUAL SPAM is fine tho?????? ok#i'm in the process of downloading all my data actually in preparation for a full deletion#which sucks bc my account can legally drink alcohol in the usa now thats how old it is#FUCK YOU ZUC#star trek shitposting#is the only reason i was still there anyway so

0 notes

Text

Trusted Financial Management Outsourcing for Cost-Effective Business Success in the USA

Qualitas Accounting Inc has established itself as a trusted partner for businesses seeking exceptional accounting and financial solutions. With a team of seasoned professionals, the firm delivers a wide array of services tailored to meet the specific needs of clients across industries. From start-ups to established enterprises, Qualitas Accounting supports businesses on their financial journeys with precision, reliability, and innovation.

Their expertise lies in simplifying complex financial processes, ensuring compliance, and providing actionable insights to drive business growth. Whether it's optimizing daily bookkeeping tasks or offering strategic financial advice, their solutions are grounded in a deep understanding of modern business challenges. This commitment to quality and efficiency has made them a standout choice for businesses looking for personalized and dependable accounting services.

Professional Virtual CFO and Outsourced Bookkeeping Services for Scaling Small Businesses

Among their key offerings, Qualitas Accounting is recognized as one of the premier accounting firms Columbia MO, providing reliable services to support local businesses. For companies seeking efficient financial management, they serve as a leading bookkeeping outsourcing company USA, streamlining operations so organizations can focus on growth.

Expanding their reach across the nation, Qualitas Accounting excels in finance and accounting outsourcing USA, helping businesses achieve cost-effectiveness and improved productivity by leveraging their expertise. Additionally, they specialize in virtual CFO services USA, offering high-level strategic guidance and oversight for entrepreneurs who want to scale effectively while maintaining financial discipline.

Choosing Qualitas Accounting Inc means partnering with a firm dedicated to making your financial processes seamless and your goals achievable. With their comprehensive range of services and client-centric approach, Qualitas Accounting remains a trusted ally for businesses striving for financial success. Experience the difference with Qualitas Accounting Inc—reach out today to explore how their tailored solutions can elevate your business to new heights!

#accounting firms Columbia MO#bookkeeping outsourcing company USA#finance and accounting outsourcing USA#virtual CFO services USA

0 notes

Text

Optimize Your Business with Finance & Accounting Outsourcing Services (FAO) USA

Transform your financial operations with our expert finance and accounting outsourcing services USA. Our comprehensive FAO solutions are designed to enhance efficiency, reduce costs, and ensure accuracy in your financial processes. From bookkeeping and financial reporting to payroll management and tax compliance, we handle all aspects of finance and accounting.

Partner with us to streamline your financial workflows, improve cash flow management, and focus on your core business activities. Experience the benefits of professional finance and accounting outsourcing services today!

#FAO#Finance & Accounting#Finance & Accounting Outsourcing Services#USA#Business#business to business

0 notes

Text

Simplify Your Finances with Expert Accounting and Tax Consultancy

Managing your taxes and accounting can be overwhelming, especially with ever-changing regulations. Whether you're a business owner or an individual, hiring a professional tax consultant can save you time, money, and stress. From maximizing deductions to ensuring compliance, experts help streamline your financial journey.

If you're looking for reliable guidance, explore our services. Let us take the complexity out of taxes so you can focus on what matters most. To get the Best Tax consultant in USA please visit the link theaccountingandtax.com

#accounting#Tax consultant in Toronto#Best Tax consultant in Canada#Best Tax consultant in USA#Tax preparation expert in USA#Tax preparation expert in canada#Tax consultation service in Toronto#US Tax consultants in Toronto#Canadian Tax Consulting Service#International Tax Consultants in Toronto#Expats Tax Consultant in Toronto#tax consulting services

1 note

·

View note