#green card holder taxes

Explore tagged Tumblr posts

Text

8 Exit Tax Traps When Expatriating from the United States

Introduction

Living and working abroad after leaving the US might be a fascinating experience. However, there are certain potential hazards to be aware of in the complex tax environment for US citizens residing overseas. To navigate this intricate system effectively, seeking Green Card Holder Taxes assistance is crucial. Learning about these departure tax traps can guarantee an effortless transition and help avoid significant tax costs.

What Are Exit Taxes?

US citizens who give up their residence or permanent residency status are subject to a series of tax laws known as exit taxes. Your taxable income may be greatly impacted by such laws, especially when you have capital gains on specific assets.

The Following Are Eight Typical Exit Tax Traps to Watch Out For:

Unrealized Capital Gains on Stock Options: If you exercise stock options issued by a US business after moving overseas, you can be liable for capital gains taxes.

Capital Gains Tax Deferral: US citizens who inherit stocks or real estate from a US decedent are typically exempt from paying capital gains taxes until they sell the item. This postponement could be lifted upon expatriation, though.

Gifts to US Spouses: If you are no longer a US resident, you may be liable for gift taxes on gifts to a US spouse that exceed the yearly exclusion limit.

Sale of US Real Estate: When a non-resident sells US real estate, they often have to file a US tax return and may have to pay capital gains taxes.

Passive Income: Even after leaving the country, income from passive US-based sources, including partnerships or rental properties, may be liable to US income taxes.

PFICs: You may be subject to intricate tax regulations and perhaps harsh tax rates if you own stock in Passive Foreign Investment Companies (PFICs).

Social Security Payments: Foreigners who haven't worked in the US for a sufficient number of quarters may have their payments taxed or even decreased.

FATCA and FBAR Requirements: US citizens who have certain financial holdings overseas may still be subject to the Foreign Account Tax Compliance Act (FATCA) and must file Reports of Foreign Bank and Financial Accounts (FBARs) after they have left the country.

How to Avoid Exit Tax Traps

Even though handling departure taxes might be difficult, you can reduce your tax liability with careful preparation and expert advice. The following actions can be taken:

Speak with an Expert on Taxation: Consult a certified tax expert with experience in expatriate taxes. They can assist you in comprehending your unique tax circumstances and creating a strategy to reduce your departure tax obligation.

Make A Plan: It is best to begin expatriation planning as soon as possible. You might reduce your possible tax obligations by structuring your affairs with the assistance of a tax expert.

File Form 8854: You may choose to file Form 8854 to elect to mark unrealized capital gains to market value if you are leaving the United States. If you decide to sell the assets in the future, this can assist you avoid paying capital gains taxes.

Expat Tax Services in Hyderabad

Our team of skilled tax experts at Accelero Corporation can assist US citizens in Hyderabad, India, with the intricacies of expatriation taxes. We can offer thorough advice on exit tax planning, tax return preparation, and other tax-related issues because we are aware of the difficulties experienced by foreign nationals.

Conclusion

Although leaving the United States to live abroad might be a fulfilling experience, it's important to consider any possible tax ramifications. You may guarantee a seamless transfer and reduce your tax obligations by being aware of exit tax traps and getting expert advice from Expat Tax Services in Hyderabad, such as Accelero Corporation.

#green card holder taxes#usa citizen tax services in hyderabad#usa tax filer in india#usa citizen tax services

0 notes

Text

Green Card Holder Taxes Simplified for Startups Accelero specialises in Green Card Holder Taxes, guaranteeing that your startup tax returns are correct and compliant for foreign firms.

#USA INDIA Taxes#USA Citizen Tax Services in Hyderabad#Green Card Holder Taxes#India Foreign Tax Credit in Hyderabad#Expat Tax Services#USA Tax Service In Hyderabad#USA Tax Filer In India#USA Tax filer In India Green Card Holder#USA Citizen Tax Services

0 notes

Text

The housing emergency and the second Trump term

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveill ance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/12/11/nimby-yimby-fimby/#home-team-advantage

Postmortems and blame for the 2024 elections are thick on the ground, but amidst all those theories and pointed fingers, one explanation looms large and credible: the American housing emergency. If the system can't put a roof over your head, that system needs to go.

American housing has been in crisis for decades, of course, but it keeps getting worse…and worse…and worse. Americans pay more for worse housing than at any time in their history. Homelessness is at a peak that is soul-crushing to witness and maddening to experience. We turned housing – a human necessity second only to air, food and water – into an asset governed almost entirely by market forces, and so created a crisis that has consumed the nation.

The Trump administration has no plan to deal with housing. Or rather, they do have plans, but strictly of the "bad ideas only" variety. Trump wants to deport 11m undocumented immigrants, and their families, including citizens and Green Card holders (otherwise, that would be "family separation" and that's cruel). Even if you are the kind of monster who can set aside the ghoulishness of solving your housing problems by throwing someone in a concentration camp at gunpoint and then deporting them to a country where they legitimately fear for their lives, this still doesn't solve the housing emergency, and will leave America several million homes short.

Their other solution? Deregulation and tax cuts. We've seen this movie before, and it's an R-rated horror flick. Financial deregulation created the speculative mortgage markets that led to the 2008 housing crisis, which created a seemingly permanent incapacity to build new homes in America, as skilled tradespeople retired or changed careers and housebuilding firms left the market. Handing giant tax cuts to the monopolists who gobbled up the remains of these bankrupt small companies minted a dozen new housing billionaires who preside over companies that make more money than ever by building fewer homes:

https://www.fastcompany.com/91198443/housing-market-wall-streets-big-housing-market-bet-has-created-12-new-billionaires

This isn't working. Homelessness is ballooning. The only answer Trump and his regime have for our homeless neighbors is to just make it a crime to be homeless, sweeping up homeless encampments and busting homeless people for "loitering" (that is, existing in space). There is no universe in which this reduces homelessness. People who lose their homes aren't going to dig holes, crawl inside, and pull the dirt down on top of themselves. If anything, sweeps and arrests will make homelessness worse, by destroying the possessions, medication and stability that homeless people need if they are to become housed.

Today, The American Prospect published an excellent package on the housing emergency, looking at its causes and the road-tested solutions that can work even when the federal government is doing everything it can to make the problem worse:

https://prospect.org/infrastructure/housing/2024-12-11-tackling-the-housing-crisis/

The Harris campaign ran on Biden's economic record, insisting that he had tamed inflation. It's true that the Biden admin took action against monopolists and greedflation, including criminal price-fixing companies like Realpage, which helps landlords coordinate illegal conspiracies to rig rents. Realpage sets the rents for the majority of homes in major metros, like Phoenix:

https://www.azag.gov/press-release/attorney-general-mayes-sues-realpage-and-residential-landlords-illegal-price-fixing

Of course, reducing inflation isn't the same as bringing prices down – it just means prices are going up more slowly. And sure, inflation is way down in many categories, but not in housing. In housing, inflation is accelerating:

https://www.latimes.com/opinion/story/2024-03-08/inflation-housing-shortage-economy-cpi-fed-interest-rate

The housing emergency makes everything else worse. Blue states are in danger of losing Congressional seats because people are leaving big cities: not because they want to, but because they literally can't afford to keep a roof over their heads. LGBTQ people fleeing fascist red state legislatures and their policies on trans and gay rights can't afford to move to the states where they will be allowed to simply live:

https://www.nytimes.com/2024/07/11/business/economy/lgbtq-moving-cost.html

So what are the roots of this problem, and what can we do about it? The housing emergency doesn't have a unitary cause, but among the most important factors is fuckery that led to the Great Financial Crisis and the fuckery that followed on from it, as Ryan Cooper writes:

https://prospect.org/infrastructure/housing/2024-12-11-housing-industry-never-recovered-great-recession/

The Glass-Steagall Act was a 1933 banking regulation created to prevent Great Depression-style market crashes. It was killed in 1999 by Bill Clinton, who declared, "the Glass–Steagall law is no longer appropriate." Nine years later, the global economy melted down in a Great Depression-style market crash fueled by reckless speculation of the sort that Glass-Steagall had prohibited.

The crash of 2008 took down all kinds of industries, but none were so hard-hit as home-building (after all, mortgages were the raw material of the financial bubble that popped in 2008). After 2008, construction of new housing fell by 90% for the next two years. This protracted nuclear winter in the housing market killed many associated industries. Skilled tradespeople retrained, or "left the job market" (a euphemism for becoming disabled, homeless, or destroyed). Waves of bankruptcies swept through the construction industry. The construction workforce didn't recover to pre-crisis levels for 16 years (and of course, by then, there was a huge backlog of unbuilt homes, and a larger population seeking housing).

Meanwhile, the collapse of every part of the housing supply chain – from raw materials to producers – set the stage for monopoly rollups, with the biggest firms gobbling up all these distressed smaller firms. Thanks to this massive consolidation, homebuilders were able to build fewer houses and extract higher profits by gouging on price. They doubled down on this monopoly price-gouging during the pandemic supply shocks, raising prices well above the pandemic shortage costs.

The housing market is monopolized in ways that will be familiar to anyone angry about consolidation in other markets – from eyeglasses to pharma to tech. One builder, HR Horton, is the largest player in 3 of the country's largest markets, and it has tripled its profits since 2005 while building half as many houses. Modern homebuilders don't build: they use their scale to get land at knock-down rates, slow-walk the planning process, and then farm out the work to actual construction firms at rates that barely keep the lights on:

https://www.thebignewsletter.com/p/its-the-land-stupid-how-the-homebuilder

Monopolists can increase profits by constraining supply. 60% of US markets are "highly concentrated" and the companies that dominate these markets are starving homebuilding in them to the tune of $106b/year:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3303984

There are some obvious fixes to this, but they are either unlikely under Trump (antitrust action to break up builders based on their share in each market) or impossible to imagine (closing tax loopholes that benefit large building firms). Likewise, we could create a "homes guarantee" that would act as an "automatic stabilizer." That would mean that any time the economy slips into recession, this would trigger automatic funding to pay firms to build public housing, thus stimulating the economy and alleviating the housing supply crisis:

https://www.peoplespolicyproject.org/wp-content/uploads/2018/04/SocialHousing.pdf

The Homes Guarantee is further explained in a separate article in the package by Sulma Arias from People's Action, who describes how grassroots activists fighting redlining planted the seeds of a legal guarantee of a home:

https://prospect.org/infrastructure/housing/2024-12-11-why-we-need-homes-guarantee/

Arias describes the path to a right to a home as running through the mass provision of public housing – and what makes that so exciting is that public housing can be funded, administered and built by local or state governments, meaning this is a thing that can happen even in the face of a hostile or indifferent federal regime.

In Paul E Williams's story on FIMBY (finance in my back yard), the executive director of Center for Public Enterprise offers an inspirational story of how local governments can provide thousands of homes:

https://prospect.org/infrastructure/housing/2024-12-11-fimby-finance-in-my-backyard/

Williams recounts the events of 2021 in Montgomery County, Maryland, where a county agency stepped in to loan money to a property developer who had land, zoning approval and work crews to build a major new housing block, but couldn't find finance. Montgomery County's Housing Opportunities Commission made a short-term loan at market rates to the developer.

By 2023, the building was up and the loan had been repaid. All 268 units are occupied and a third are rented at rates tailored to low-income tenants. The HOC is the permanent owner of those homes. It worked so well that Montgomery's HOC is on track to build 3,000 more public homes this way:

https://www.nytimes.com/2023/08/25/business/affordable-housing-montgomery-county.html

Other – in red states! – have followed suit, with lookalike funds and projects in Atlanta and Chattanooga, with "dozens" more plans underway at state and local levels. The Massachusetts Momentum Fund is set to fund 40,000 homes.

https://www.nytimes.com/2023/08/25/business/affordable-housing-montgomery-county.html

The Center for Public Enterprise has a whole report on these "Government Sponsored Enterprises" and the role they can play in creating a supply of homes priced at a rate that working people can afford:

https://prospect.org/infrastructure/housing/2024-12-11-fimby-finance-in-my-backyard/

Of course, for a GSE to loan money to build a home, that home has to be possible. YIMBYs are right to point to restrictive zoning as a major impediment to building new homes, and Robert Cruickshank from California YIMBY has a piece breaking down the strategy for fixing zoning:

https://prospect.org/infrastructure/housing/2024-12-11-make-it-legal-to-build/

Cruickshank lays out NIMBY success stories in cities like Austin and Minneapolis adopting YIMBY-style zoning rules and seeing significant improvements in rental prices. These success stories are representative of a broader recognition – at least among Democratic politicians – that restrictive zoning is a major contributor to the housing emergency.

Repeating these successes in the rest of the country will take a long time, and in the meantime, American tenants are sitting ducks for predatory landlords, With criminal enterprises like Realpage enabling collusive price-fixing for housing and monopoly developers deliberately restricting supplies to keep prices up (a recent Blackrock investor communique gloated over the undersupply of housing as a source of profits for its massive portfolio of rental properties), tenants pay more and more of their paychecks for worse and worse accommodations. They can't wait for the housing emergency to be solved through zoning changes and public housing. They need relief now.

That's where tenants' unions come in, as Ruthy Gourevitch and Tara Raghuveer of the Tenant Union Federation writes in their piece on the tenants across the country who are coordinating rent strikes to protest obscene rent-hikes and dangerous living conditions:

https://prospect.org/infrastructure/housing/2024-12-11-look-for-the-tenant-union/

They describe a country where tenants work multiple jobs, send the majority of their take-home pay to their landlords – a quarter of tenants pay 70% of their wages in rent – and live in vermin-filled homes without heat or ventilation:

https://www.phenomenalworld.org/analysis/terms-of-investment/

Public money from Freddie Mae and Fannie Mac flood into the speculative market for multifamily homes, a largely unregulated, subsidized speculative bonanza that lets the wealthy make bets and the poor pay their losses.

In response, tenants unions are popping up all across the country, especially in red state cities like Bozeman, MT and Louisville, KY. They organize for "just cause" evictions that ban landlords from taking their homes away. They seek fair housing voucher distribution practices. They seek to close eviction loopholes like the LA wheeze that lets landlords kick you out following "renovations."

The National Tenant Policy Agenda demands "national rent caps, anti-eviction protections, habitability standards, and antitrust action," measures that would immediately and profoundly improve the lives of millions of American workers:

https://docs.google.com/document/d/1JF1-fTalW1tOBO0FhYDcVvEd1kQ2HIzkYFNRo6zmSsg/edit

They caution that it's not enough to merely increase housing supply. Without a strong countervailing force from organized tenants, new housing can be just another source of extraction and speculation for the rich. They say that the Federal Housing Finance Agency – regulator for Fannie and Freddie – could play an active role in ensuring that new housing addresses the needs of people, not corporations.

In the meantime, a tenants' union in KC successfully used a rent strike – where every tenant in a building refuses to pay rent – to get millions in overdue repairs. More strikes are planned across the country.

The American system is in crisis. A country that cannot house its people is a failure. As Rachael Dziaba writes in the final piece for the package, the situation is so bad that water has started to flow uphill: the cities with the most inward migration have the least job growth:

https://prospect.org/infrastructure/housing/2024-10-18-housing-blues/

It's not just housing, of course. Americans pay more for health care than anyone else in the rich world and get worse outcomes than anyone else in the rich world. Their monopoly grocers have spiked their food prices. The incoming administration has declared war on public education and seeks to relegate poor children to unsupervised schools where "education" can consist of filling in forms on a Chromebook and learning that the Earth is only 5,000 years old.

A system that can't shelter, feed, educate or care for its people is a failure. People in failed states will vote for anyone who promises to tear the system down. The decision to turn life's necessities over to unregulated, uncaring markets has produced a populace who are so desperate for change, they'll even vote for their own destruction.

#pluralistic#hysteresis#bubbles#bubblenomics#finance#nimby#yimby#restrictive zoning#localism#maslows hierarchy of needs#realpage#the rents too damned high#housing#weaponized shelter#rent strikes#tenants unions#the american prospect

255 notes

·

View notes

Text

Conirs - TCOT Worldbuilding

@darkandstormydolls @aestheic-writer18 You two wanted worldbuilding and Class systems, so here ya go :]

The Southern Kingdom of Jeskyin, Feyrama, is ruled by a six-member Oligarchy.

5/6 Members are The Five Noble Houses/Families.

All Families have A Seat Holder/ Conir and their Heir

The Heir is Chosen from one of the collection of the Lowest generation that is old enough to participate. They are all given a test, and the test determines which ones are most eligible. But after that, 5/6 of The Conirs must vote that the heir is suitable to take the position.

The Conir families are all the same rank, but they have been put into an order based on wealth and influence.

Santel - Seat Holder: Miati Santel - Heir: Atlas Santel - Relationship: 3rd cousins once removed

Oliss - Seat Holder: Tanik Oliss - Heir: None at the moment (Spoilers: This will be a big plotpoint)

Rayeli - Seat Holder: Falcon Rayeli - Heir: Shyre Rayeli - Relationship - Father and Daughter

Kanqoa - Seat Holder: Vivian Kanqoa - Heir: Everra Kanqoa - Relationship: 1st cousin Once removed

Rookwood - Seat Holder: Findazi Rookwood - Heir: Vel Rookwood - Uncle and Nephew

Each Family Has a Color Theme, and it is customary for the Conirs and Heirs to hold Bodyguard Contests when the Heirs are getting of eligible age, or they lose one of their previous bodyguards.

Colors:

Rayeli has Red and Gold

Santel has Gold and Blue

Oliss has Black and Green

Kanqoa has Purple and Silver

Rookwood has Burgandy/Maroon and Silver

But after these families, there is one more Conir. This is the Military Conir. This seat is currently held by Orvik Szykean

The Military Conir is a general voted in by the soldiers and has to go through a vote by the Conirs as well 5/6 just like the heirs to be accepted. (Military's colors are generally Black, silver, and white)

Each Conir Seat is in charge of one aspect of the city, and Each has a name.

The Fineuan Seat (Fin-nay-win) - Law enforcement, Military, and Defense - Held by Orvik - Represented by an Amethyst

The Mynxha Seat (Minks-ha) - Welfare of the people, Healthcare, and Trade - Santel House - Represented by Garnets or Rubies

The Venmest Seat (Vehn-mest) - Laws, Finances, and Taxes - Oliss House - Represented by Opals

The Tairan Seat (Tah-ree-inn) - Negotiations, Peace talks, and Archives - Rayeli House - Represented by Aquamarine

The Levonn Seat (Ley-von) - Jobs, Distribution of Supplies, and transportation - Kanqoa House - Represented by Topaz

The Amnivent Seat (Am-nee-vent) - Agriculture and Resources - Rookwood House - Represented by Emerald

Conirs are referred to with the title ‘Your Grace’, and the heirs with the title of ‘My Lord’ or ‘My lady’

Each Conir Family has 3 Secondary Noble Families to help them enforce and Do their jobs, while The Fineuan Seat has the entirety of the military.

The Heir's Job is to be their Conir Seat Holder's right hand and do everything they can to learn and help until it is their turn to take over.

Sometimes they step in with other Conirs to help while a new heir is being chosen, or just for educational purposes.

Conirs must have basic knowledge of their peer's stations, because most major decisions and things require meetings and votes.

So there you have it! Conirs! Feyrama's Leaders!

Oh, then there's also the Cards, But I'm not getting into THAT detail unless someone really wants it

#ellia's rambling#ellia writes#ellia tcot#ellia's tcot#the cursed one's throne#creative writing#fiction writing#writing community#writer things#writerscommunity#writers on tumblr#writeblr#writers#writing#writer#fantasy stuff#fantasy#fantasy fiction#fantasy world#worldbuilding

10 notes

·

View notes

Text

Tamagotchi x Village Vanguard Collection

Bandai Japan has just announced a collaboration with Village Vanguard! Village Vanguard is a self proclaimed exciting book store in Japan that sells books, miscellaneous goods, and more. The collection is all about vintage Tamagotchi from 1996!

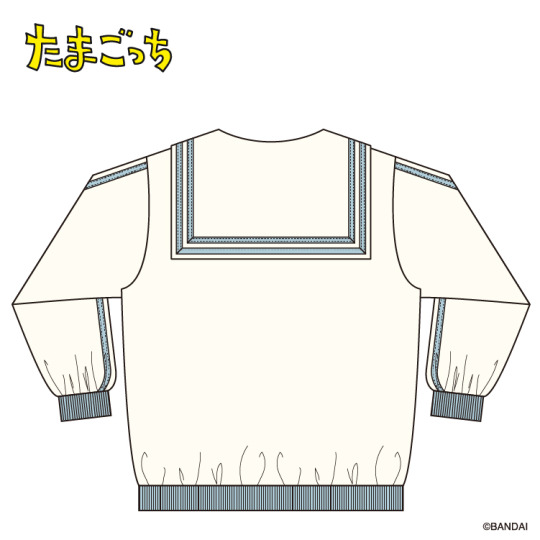

First are three types of sailor jerseys, first is the white one featuring Mametchi, the blue one featuring Pochitchi, and last the light blue one featuring Nyorotchi. These will sell for ¥4,950 including tax each.

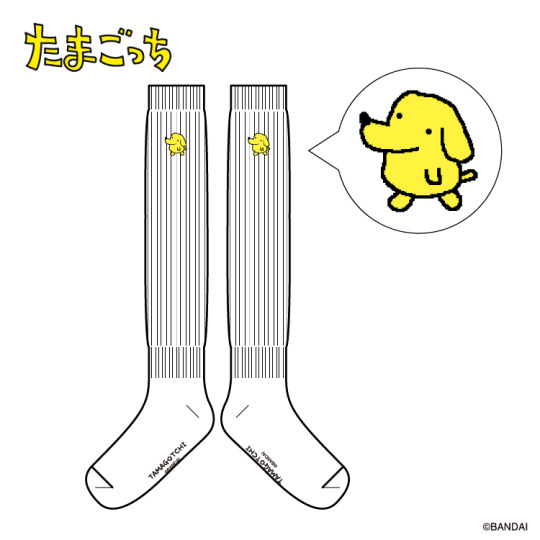

Second is 3 styles of loose long socks, which are white and feature either Mametchi, Pochitchi, or Nyorotchi. These will sell for ¥1320 including tax each.

Third is 3 styles of quarter socks which are black and feature Mametchi, Pochitchi, or Nyorotchi. These will sell for ¥660 including tax each.

Fourth is 3 styles of Tamagotchi tote bags, the first one features the Tamagotchi UFO on a dark blue bag, second is Mametchi on a white tote bag, and third is blue clock Tamagotchi P1 on a white tote bag. These will sell for ¥2970 each.

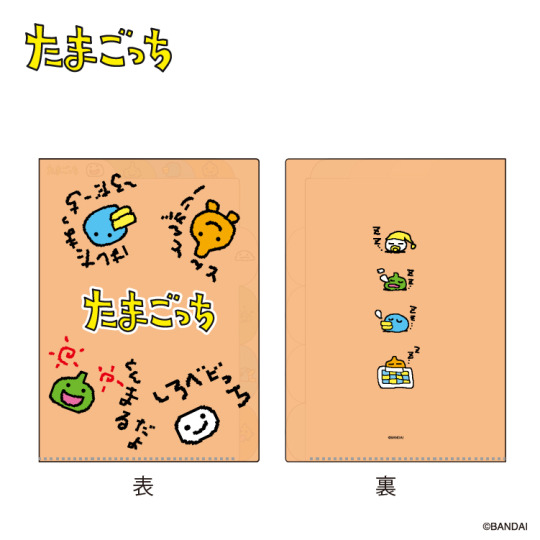

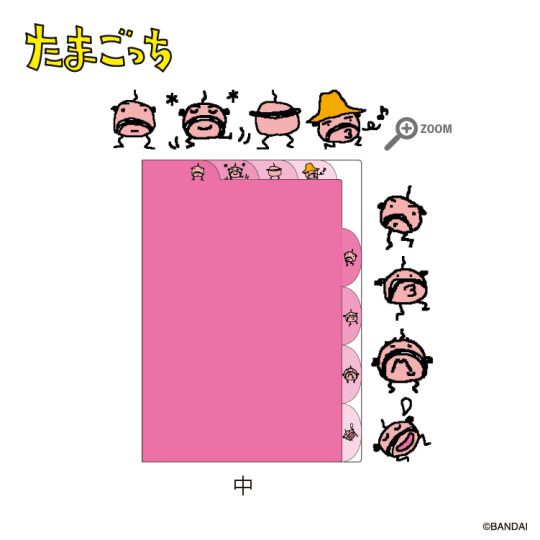

Fifth is 2 kinds of Tamagotchi card holders. The first one is a green frame featuring color vintage sprites of Mametchi and Tamatchi and the Tamagotchi UFO. Second is a pink frame featuring the many personalities of Oyajitchi. These will sell for ¥990 including tax) each.

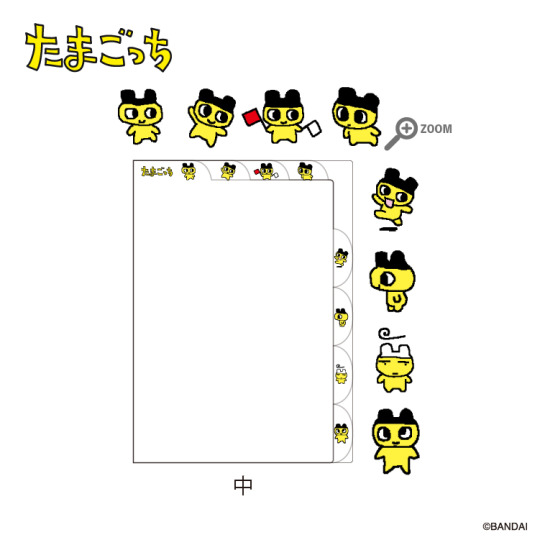

Sixth is 4 types of clear files, with vintage character sprites in different colors, great for staying organized. These will for ¥550 including tax each.

Village Vanguard is also hosting a social media contest. Simply locate the contest post on the official Village Vanguard Twitter profile, follow, and repost the campaign by December 16th, 2023 for a chance to win!

Sales of the collection will start Saturday, December 16th, 2023 both in store and in person. There are no purchase restrictions, but numbered tickets may be distributed randomly. There are no preorders for the collection. The list of stores carrying the collection is available here.

#tamapalace#tamagotchi#tmgc#tamatag#virtualpet#bandai#collaboration#collection#villagevanguard#village vanguard#jp#japan#news

20 notes

·

View notes

Text

Registering to vote is required in order to cast ballots in elections in all states except North Dakota.1

Under Articles I and II of the U.S. Constitution, the manner in which federal and state elections are conducted is determined by the states. Since each state sets its own election procedures and regulations, it is important to contact your state or local elections office to learn your state’s specific election rules.

How to Vote

With the exception of state-specific rules, the basic steps to voting are the same almost everywhere.

Voter registration is required in every state except North Dakota.

Every state allows absentee voting.2

Most states assign voters to vote at specific polling places or voting locations.

The U.S. Election Assistance Commission lists federal election dates and deadlines by state.

Who Cannot Vote?

The right to vote is not universal. Some people, depending on their circumstances and state laws, will not be allowed to vote.

Non-citizens, including permanent legal residents (green card holders), are not allowed to vote in any state.

Some people who have been convicted of felonies cannot vote. These rules may vary by state.

In some states, persons who have been legally declared mentally incapacitated cannot vote.3

Voter Registration

Voter registration is the process used by the government to ensure that everyone who votes in an election is legally eligible to do so, votes in the correct location, and only votes once. Registering to vote requires that you give your correct name, current address, and other personal information to the government office that runs elections where you live. It might be a county, state, or city office.

Registering to Vote

When you register to vote, the elections office will look at your address and determine which voting district you will vote in. Voting in the right place is important because who you get to vote for depends on where you live. For example, if you live on one street, you may have one set of candidates for the city council; if you live on the next block over, you may be in a different council ward and be voting for completely different people. Usually, the people in a voting district (or precinct) all go to vote in the same location. Most voting districts are fairly small, though in rural areas a district can stretch for miles.

Whenever you move, you should register or re-register to vote in order to make sure you always vote in the right place. College students who live away from their permanent residence can usually register legally in either of their addresses.

Who Can Register to Vote?

To register in any state, you need to be a U.S. citizen, 18 or older by the next election, and a resident of the state. Most, but not all, states have two other rules as well: you can't be a felon (someone who has committed a serious crime), and you can't be mentally incompetent. In a few places, you can vote in local elections even if you are not a U.S. citizen. To check the rules for your state, call your state or local elections office.

Where Can You Register to Vote?

Since elections are run by states, cities, and counties, the rules on registering to vote are not the same everywhere. But there are some laws in place for every state: for example, under the "Motor Voter" law, motor vehicle offices across the United States must offer voter registration application forms.

The National Voter Registration Act of 1993 requires states to offer voter registration forms at any and all offices offering public assistance. This includes state and local government buildings such as public libraries, schools, offices of city and county clerks (including marriage license bureaus), fishing and hunting license bureaus, government revenue (tax) offices, unemployment compensation offices, and offices that provide services to persons with disabilities.

You can also register to vote by mail in most states. Call your local elections office and ask them to send you a voter registration application or go online to download and print the form yourself. Then, just fill it out and send it to your local election office. Visit the Election Official Directory by the U.S. Vote Foundation to find contact information for your office.

Especially when elections are coming up, most political parties set up voter registration stations in public places such as shopping malls and college campuses. They may try to get you to register as a member of their political party, but you don't have to do so in order to register to vote. Some states will require you to vote for the political party you are registered with in primary and caucus elections, but all registered voters may vote for whichever candidates they choose in the general election.4

Note

Filling out the voter registration form does not make you automatically registered to vote. Sometimes application forms get lost, they aren't filled out correctly, or another mistake happens that prevents an application from being accepted. If in a few weeks you have not received a card from the elections office telling you that you are registered, give them a call. If there's a problem, ask for a new registration form, fill it out carefully, and mail it back. The Voter Registration card you receive will probably tell you exactly where you should go to vote. Keep your Voter Registration card in a safe place.

What Information You Have to Provide

While voter registration application forms vary depending on your state, county, or city, they always ask for your name, address, date of birth, and status of U.S. citizenship. You also have to give your driver's license number, if you have one, or the last four digits of your Social Security number. If you don't have either a driver's license or a Social Security number, the state will assign you a voter identification number.5 These numbers are to help the state keep track of voters. Check the form carefully, including the back, to see the rules for the place where you live.

Party Affiliation: Most registration forms will ask you for a choice of political party affiliation. If you wish to do so, you can register as a member of any political party, including Republican, Democrat, Green, Libertarian, and other third parties. You can also choose to register as "independent" or "no party." Be aware that some states will not let you vote in primary elections without selecting a party affiliation when you register. But even if you never select a political party or vote in any party primary elections, you will be allowed to vote in the general election for any candidate.

When to Register

In many states, you need to register at least 30 days before Election Day. However, some states are much more accommodating. In Connecticut, for example, you can register as few as seven days before an election. Iowa and Massachusetts accept applications up to 10 days prior. Federal law says that you can't be required to register more than 30 days before the election. Details on registration deadlines in each state can be found on the U.S. Election Assistance Commission website.

As of 2019, 21 states and the District of Columbia allow same-day registration:

California

Colorado

Connecticut

Hawaii

Idaho

Illinois

Iowa

Maine

Maryland

Michigan

Minnesota

Montana

Nevada

New Hampshire

New Mexico

North Carolina

Utah

Vermont

Washington

Wisconsin

Wyoming

In all of these states except North Carolina (which allows same-day registration only during early voting), you can go to the polling place, register, and vote at the same time.6 Bring identification, proof of address, and anything else your state requires for this. In North Dakota, you can vote without registering.

#How to Register to Vote in the United States#how to vote in the us#us election#us voting rights#how to vote

17 notes

·

View notes

Text

USCIS Forms That Commonly Require Certified Translations

When you're in the process of submitting an immigration application to the United States Citizenship and Immigration Services (USCIS), you may encounter a variety of forms that require certified translations. But what exactly does that mean for you? And which forms are the most likely to need translated documents? Let’s break it down in a way that’s easy to understand.

What is a Certified Translation?

Before diving into the specific forms, let’s start with the basics. A certified translation is a translation of a document that includes a signed statement from the translator or translation service. This statement confirms that the translation is accurate and complete to the best of their knowledge and ability. USCIS translation requires these translations to ensure that all documents are properly understood, and that your case is reviewed accurately.

So, when do you need a certified translation? Let’s go through some of the most common USCIS forms that will likely require one.

1. Form I-130: Petition for Alien Relative

This is one of the most common forms used for family-based immigration petitions. If your documents (such as a birth certificate or marriage certificate) are in a language other than English, you’ll need to provide a certified translation. This helps USCIS understand your familial relationship with the person you're petitioning for.

What needs translation: Birth and marriage certificates, court orders, or other legal documents in foreign languages.

2. Form I-485: Application to Register Permanent Residence or Adjust Status

If you're adjusting your status to become a permanent resident (a green card holder), you’ll need to provide various supporting documents. If any of these documents, like your passport, birth certificate, or marriage records, aren’t in English, certified translations will be required.

What needs translation: Birth certificates, marriage certificates, passports, police records, or any other documents not in English.

3. Form N-400: Application for Naturalization

When applying for U.S. citizenship, any non-English documents related to your application (like your birth certificate or prior immigration paperwork) will need to be translated. A certified translation ensures that the USCIS officer can read and understand your documents.

What needs translation: Birth certificates, passports, naturalization certificates, or any other official documents in a foreign language.

4. Form I-821: Application for Temporary Protected Status (TPS)

If you’re applying for Temporary Protected Status, many applicants come from countries where official documents are not in English. Form I-821 might require translations of various supporting documents, like birth or marriage certificates, identity documents, or even police records.

What needs translation: Birth certificates, marriage certificates, police records, or identity documents.

5. Form I-601: Application for Waiver of Grounds of Inadmissibility

If you’re applying for a waiver, you may need to submit supporting evidence that includes documents in a language other than English. These documents could include things like medical records, letters of support, or other personal documentation. Certified translations are needed to ensure USCIS can assess the full context of your application.

What needs translation: Medical records, letters of support, personal documents, or court orders.

6. Form I-864: Affidavit of Support

When sponsoring a relative to immigrate, you may need to provide evidence of your financial support. If any financial documents, such as tax returns, bank statements, or employment records, are in another language, certified translations will be required.

What needs translation: Tax returns, pay stubs, employment records, or any financial documents in a foreign language.

Why Certified Translations Matter

Certified translations are essential because they help ensure that all the details of your application are clear and accurate. USCIS relies on these translations to make decisions about your case. A certified translation provides assurance that the translation is not only accurate but also compliant with USCIS standards.

Using a professional translator or translation service ensures that your documents will meet the specific requirements set by USCIS, preventing any unnecessary delays or complications in your immigration journey.

In Conclusion

When submitting your USCIS forms, it's important to ensure that all supporting documents are translated accurately and certified when needed. Forms like the I-130, I-485, N-400, and others commonly require certified translations, especially if they involve foreign-language documents. By working with a trusted translator, you can make sure that your immigration process goes as smoothly as possible, without any added stress over missing or incorrect translations. If you’re unsure whether a document needs translation, it’s always a good idea to double-check with a professional translation service that specializes in USCIS requirements. After all, the goal is to get your paperwork right the first time and move forward with confidence

0 notes

Text

Atlanta, GA Immigration Lawyer: Navigating the Path to Naturalization

Naturalization is the process through which a lawful permanent resident (green card holder) becomes a U.S. citizen. Citizenship offers numerous benefits, including the right to vote, greater job opportunities, and the ability to sponsor family members for immigration. However, the naturalization process can be complex, with strict eligibility requirements and detailed documentation needed. An experienced Atlanta, GA immigration lawyer can guide you through the process, ensuring that your application is accurate and complete to maximize your chances of success.

What is Naturalization?

Naturalization is the legal process by which foreign nationals voluntarily become U.S. citizens after meeting specific requirements. It involves demonstrating a commitment to the United States and its values, including knowledge of the country’s history, government, and English language proficiency. Once naturalized, individuals gain the same rights and responsibilities as native-born citizens.

Eligibility for Naturalization

To apply for naturalization, applicants must meet several criteria set by U.S. Citizenship and Immigration Services (USCIS). The most common eligibility requirements include:

Age Requirement: Applicants must be at least 18 years old.

Permanent Residency: Applicants must have held a green card for at least five years (or three years if married to a U.S. citizen).

Continuous Residence and Physical Presence: Applicants must have continuously resided in the U.S. for at least five years (or three years for spouses of U.S. citizens) and must have been physically present in the U.S. for at least half of that time.

Good Moral Character: Applicants must demonstrate good moral character, which means avoiding serious criminal activities, paying taxes, and adhering to U.S. laws.

English and Civics Knowledge: Applicants must pass an English language test and a civics test covering U.S. history and government.

Oath of Allegiance: Applicants must be willing to take the Oath of Allegiance to the United States, renouncing allegiance to other countries.

The Naturalization Process

The naturalization process involves several steps, each requiring careful attention to detail. Here is an overview of the process:

Prepare Form N-400: The application for naturalization, Form N-400, must be completed accurately and submitted with the required documentation, including proof of residency, identity, and payment of fees. An immigration lawyer can help ensure that your application is error-free.

Biometrics Appointment: After submitting the application, applicants are scheduled for a biometrics appointment, where their fingerprints, photograph, and signature are collected for a background check.

Naturalization Interview: Applicants must attend an interview with a USCIS officer, during which their application will be reviewed, and they will take the English and civics tests. Preparation is key to passing this stage, and a lawyer can help applicants practice for the interview.

Receive USCIS Decision: After the interview, USCIS will either approve, deny, or continue the application (if additional information is needed). An experienced immigration lawyer can assist in addressing any issues that may arise.

Oath Ceremony: Once approved, applicants attend a naturalization ceremony, where they take the Oath of Allegiance and officially become U.S. citizens.

Challenges in the Naturalization Process

While the process may seem straightforward, applicants often face challenges such as:

Incomplete or Incorrect Documentation: Errors in the application or missing documentation can result in delays or denials.

Language Barriers: Limited English proficiency can make it difficult to pass the language and civics tests.

Criminal Records: Certain criminal offenses or unresolved legal issues may disqualify applicants from showing good moral character.

Complex Immigration History: Past immigration violations or extended trips outside the U.S. may complicate the process.

An Atlanta immigration lawyer can address these challenges by ensuring your application is thorough and accurate and by providing solutions tailored to your situation.

How an Immigration Lawyer Can Help

An experienced immigration lawyer can provide invaluable assistance throughout the naturalization process by:

Assessing Eligibility: A lawyer can evaluate your circumstances to determine whether you meet all the requirements for naturalization and advise on any potential issues.

Preparing the Application: Completing Form N-400 and gathering the necessary documents can be daunting. A lawyer ensures that all paperwork is accurate and complete to avoid delays or denials.

Interview Preparation: Many applicants find the naturalization interview intimidating. An immigration lawyer can help you prepare for the questions and practice for the English and civics tests.

Addressing Denials or Delays: If your application is denied, a lawyer can help you understand the reasons and explore options for reapplying, appealing, or filing a motion to reopen your case.

Expediting the Process: A lawyer can identify ways to expedite your application if you have urgent reasons for seeking citizenship, such as employment opportunities or family needs.

Conclusion

Becoming a U.S. citizen through naturalization is a life-changing milestone that offers countless benefits and opportunities. However, the process requires careful attention to detail and compliance with strict requirements. An Atlanta, GA immigration lawyer can provide the expertise and support you need to successfully navigate the naturalization process. Whether you’re starting your application or facing challenges along the way, consulting with a qualified immigration lawyer can make all the difference in achieving your dream of U.S. citizenship.

0 notes

Text

Breaking Down the Basics: Citizenship Eligibility Explained

Becoming a citizen of any country is a significant milestone. It offers not only a sense of belonging but also access to a host of rights and privileges, from voting to government protection while abroad. However, the road to citizenship isn't always straightforward. This guide will break down the basic Eligibility requirements for citizenship, helping you navigate the process with clarity.

What is Citizenship?

Citizenship is a legal status that grants an individual certain rights and responsibilities within a country. While methods of acquiring citizenship vary across nations, they typically fall under three main categories: birthright citizenship, naturalization, and citizenship by descent or marriage.

Let’s explore the eligibility requirements in detail.

Common Eligibility Criteria for Citizenship

Though each country has its own unique rules, here are the most commonly encountered criteria:

1. Residency Requirements

Most countries require individuals to live within their borders for a specific period before applying for citizenship. This is to ensure that applicants have integrated into the society and understand its cultural and legal systems.

Example: In the United States, applicants must have been permanent residents (green card holders) for at least 5 years (or 3 years if married to a U.S. citizen) before applying.

Note: Time requirements vary, so check your country’s specific rules.

2. Language Proficiency

Many countries mandate that applicants demonstrate basic proficiency in the national language(s). This ensures effective communication and participation in civic life.

Example: Canada requires applicants to prove their ability to speak and understand English or French.

3. Knowledge of the Country

Applicants are often required to pass a citizenship test or interview that assesses their knowledge of the country’s history, government, and cultural norms.

Example: The U.S. Naturalization Test includes questions about American history, the Constitution, and government structure.

4. Good Moral Character

Applicants must generally demonstrate good moral character, which means they should not have a significant criminal record or any activities deemed harmful to the country.

Example: In many nations, serious crimes or repeated offenses can disqualify applicants.

5. Commitment to the Country

Some countries require applicants to take an oath of allegiance, affirming their loyalty and commitment to the nation.

Example: The U.S. citizenship process culminates in a naturalization ceremony where applicants recite the Oath of Allegiance.

6. Financial Stability

Applicants may need to show they can financially support themselves and are not reliant on state aid.

Example: Some countries assess whether applicants have paid taxes or meet certain income thresholds.

7. No Threat to National Security

Background checks are conducted to ensure that applicants do not pose a security risk to the country.

Special Pathways to Citizenship

Some individuals may qualify through special circumstances, such as:

Marriage: Marrying a citizen of the country can shorten the path to citizenship in many cases.

Descent: Individuals with a parent or grandparent from the country may qualify for citizenship by descent.

Exceptional Contribution: Some countries grant citizenship to individuals who have made significant contributions to sports, culture, or science.

Steps to Determine Your Eligibility

Research Your Target Country’s Requirements: Visit the official immigration or government website for accurate information.

Consult a Legal Expert: If you’re unsure about the process, seek advice from an immigration lawyer.

Prepare Required Documentation: Gather documents like residency permits, tax records, and language proficiency certificates.

Complete Application Forms: Fill out the necessary paperwork and pay application fees.

Attend Interviews and Exams: Prepare for language tests, citizenship tests, and interviews as needed.

Common Challenges and Tips for Success

Challenge 1: Complex Paperwork

Citizenship applications often involve detailed forms and supporting documents.

Tip: Double-check requirements and keep copies of all documents.

Challenge 2: Meeting Language Requirements

If you’re not fluent in the country’s official language, this can be a hurdle.

Tip: Take language classes or practice regularly to improve your skills.

Challenge 3: Lengthy Processing Times

Citizenship processes can take months or even years.

Tip: Be patient and track your application status regularly.

Conclusion

Obtaining citizenship is a rewarding but meticulous process. By understanding the basic eligibility requirements and preparing ahead, you can significantly improve your chances of success. Remember, every country’s process is unique, so research and adaptability are key.

If you’re ready to take the next step, start by assessing your eligibility and gathering the necessary documents. Your journey to citizenship begins today!

0 notes

Text

US Expat Taxes: Guide to Income Tax Filing in 2025

Introduction Do you reside or work in India as a US citizen? If so, you are likely aware of the difficulty in filing taxes for foreign residents in the United States. While there are cultural and professional benefits to living overseas, paying taxes can be a further cause of stress. This tutorial will give a straightforward but thorough review of US expat taxes in 2025, with a focus on Expat Tax Services in Hyderabad, specifically for Indian tourists.

US Expats' Tax Filing Requirements in India

Whichever country where you might live in the world, you must typically submit a US tax return as a US citizen. This also includes American foreigners residing in India. Generally, you have until June 15th of the coming year to file your US expat tax return. However, US citizens living abroad are given an extension through June 15th of the following year. It's important to remember that you still need to file a return even if you have no outstanding US tax demands.

Knowing About Foreign Earned Income Exclusion and Earned Income Exclusion

US expats working in India may greatly benefit from the following two main tax exclusions:

Absence of Earned Income: This limitation enables US foreign nationals to exclude a particular amount of their income from employment from their tax bills. The maximum earned income exclusion for the 2025 tax year is $130,000, not $112,000.

Exclusion of Foreign Earned Income: Under the Foreign Earned Income Exclusion (FEIE), US foreign nationals are able to deduct their earned income from US taxes. You must physically be in a foreign nation for at least 365 days for 18 consecutive months or reside there for 330 full days within 12 months to be eligible for the FEIE in 2025.

India Foreign Tax Credit Accounting Solution

You might be able to claim a foreign tax credit on your US tax return if you pay income taxes to the Indian government. The income taxes you pay to a foreign government are deducted from your US tax liability, dollar for dollar, thanks to this credit. You can make sure you are claiming all the credits you are entitled to by navigating the intricacies of India Foreign Tax Credit Accounting with the assistance of Accelero Corporation.

Tax Implications of Foreign Bank Accounts

If the total value of your foreign financial accounts at any time throughout the year reaches $10,000, you must file a Report of Foreign Bank and Financial Accounts (FBAR) if you have any accounts outside of the US. Any interest received on these accounts may also have tax considerations.

Additional Considerations for US Expats in India

State Taxes: US residents residing overseas may be liable for state taxes in addition to federal taxes. To find out if you must file a state tax return, it's crucial to study the tax regulations in your home state.

Self-Employment: To record your business income and costs, you must include a Schedule C with your US tax return if you work for yourself in India.

Conclusion

Although filing US expat taxes in India can be challenging, you can make sure you are abiding by all US tax regulations and utilizing all available tax benefits with careful preparation and the help of an experienced tax expert. A group of skilled experts at Accelero Corporation can guide you through the complexities of paying US expat taxes in India. To arrange a consultation and discover more about our accounting Solutions, get in touch with us right now.

#expat tax services#green card holder taxes#usa citizen tax services in hyderabad#india foreign tax credit in hyderabad#India Foreign Tax Credit Accounting Solution

0 notes

Text

How American Taxation Services Dubai Assist Expats with IRS Compliance

Expats living in Dubai face unique challenges when it comes to their tax obligations. For U.S. citizens, navigating the complexities of IRS compliance while living abroad can seem overwhelming. Thankfully, American taxation service Dubai offers specialized solutions to ensure that expats remain in good standing with the IRS. These services help U.S. citizens comply with U.S. tax laws, avoid penalties, and even take advantage of various tax benefits available to those living overseas.

In this comprehensive article, we explore how these services assist expats with IRS compliance, the various challenges they face, and the specific services offered to help them manage their U.S. tax responsibilities efficiently.

Understanding IRS Compliance for U.S. Expats in Dubai

Living in Dubai as an Expat Tax Services Canada brings many benefits, including a tax-free salary. However, this does not exempt U.S. citizens from filing taxes with the IRS. The U.S. tax system operates on a citizenship-based taxation principle, which means that U.S. citizens must report their global income, regardless of where they live. This requirement can be a daunting task for expats, who are often unfamiliar with the intricacies of international tax laws and the paperwork involved.

Filing Requirements for U.S. Expats

U.S. citizens and green card holders living in Dubai must file annual tax returns with the IRS. The key tax filing forms for U.S. expats include:

Form 1040 (U.S. Individual Income Tax Return): This is the standard form for filing taxes, where expats report their worldwide income.

Form 2555 (Foreign Earned Income Exclusion): This form allows expats to exclude a certain amount of their foreign income from U.S. taxation, provided they meet specific requirements.

Form 1116 (Foreign Tax Credit): Expats may also be eligible to claim a foreign tax credit for taxes paid to Dubai or another foreign country, helping to avoid double taxation.

The filing deadline for Expat Tax Services Canada is typically June 15th (extended from the standard April 15th), giving them extra time to gather the necessary documents. Despite the extended deadline, expats must remain proactive in staying compliant to avoid penalties.

Challenges Faced by U.S. Expats in Dubai with IRS Compliance

While Dubai’s tax-free status is appealing, U.S. Expat Tax Services Canada often face several challenges when it comes to IRS compliance. These challenges include:

Complexity of Taxation: The U.S. tax code is notoriously complex, and the requirements for U.S. expats are no exception. Understanding the various exclusions, deductions, and credits available to expats can be a daunting task.

Language Barriers: Expats may not be familiar with legal and financial jargon, making it difficult to understand the tax forms and requirements.

Double Taxation: Although Dubai does not impose personal income taxes, U.S. expats must still file U.S. taxes on their worldwide income. Without proper planning, expats can face double taxation on the same income—both in the U.S. and Dubai.

Filing Deadlines: Meeting the deadlines for IRS filing is critical. Missed deadlines can result in penalties, interest charges, and even the potential loss of eligibility for certain tax benefits.

American taxation service Dubai are designed to address these challenges and guide expats through the complex tax system.

How American Taxation Services in Dubai Help Expats with IRS Compliance

American taxation service Dubai provides essential support to U.S. Expat Tax Services Canada to ensure they meet their IRS obligations while minimizing their tax liabilities. Here are the key services they offer:

1. Expert Tax Filing Assistance

The most fundamental service offered by taxation professionals in Dubai is assistance with filing U.S. tax returns. These professionals are well-versed in the tax laws that apply to expatriates, including eligibility for the Foreign Earned Income Exclusion (FEIE) and the Foreign Tax Credit (FTC). By utilizing these credits and exclusions, expats can reduce or eliminate their U.S. tax liabilities.

Foreign Earned Income Exclusion (FEIE): The FEIE allows eligible expats to exclude up to a certain amount of their earned income (around $120,000 for 2024) from U.S. taxation.

Foreign Tax Credit (FTC): This credit helps expats offset the taxes they pay to the UAE or other foreign governments, reducing the likelihood of double taxation.

2. Tax Planning and Strategy

American taxation services Dubai do not simply assist with filing taxes; they also offer tax planning to help expats optimize their tax situation. Tax professionals provide valuable advice on how to structure income, claim applicable deductions, and maximize tax credits. This proactive approach helps expats make informed decisions throughout the year to minimize their U.S. tax burden.

3. Guidance on Compliance with FATCA and FBAR

In addition to income tax filing, U.S. expats must comply with other reporting requirements, including the Foreign Account Tax Compliance Act (FATCA) and the Foreign Bank Account Report (FBAR). These forms are designed to ensure that U.S. citizens report their foreign financial accounts and assets to the IRS.

FATCA (Form 8938): This form requires expats to report foreign financial assets if they exceed certain thresholds.

FBAR (FinCEN Form 114): U.S. citizens must file an FBAR if they have foreign bank accounts with a total balance exceeding $10,000.

Failure to comply with these reporting requirements can result in severe penalties, making it essential for expats to work with professionals who understand these forms and deadlines.

4. Resolving Tax Issues and Penalties

Sometimes, Expat Tax Services Canada may find themselves facing IRS penalties for past non-compliance. Whether they missed deadlines, failed to file necessary forms, or simply did not understand their obligations, tax professionals can help resolve these issues. They may assist with:

Penalty Abatement Requests: Tax professionals can help expats apply for penalty relief under certain circumstances, such as reasonable cause.

Tax Amnesty Programs: There are programs like the Streamlined Filing Compliance Procedures that help expats catch up on their tax filings without facing harsh penalties. These programs are available to expats who have not intentionally avoided taxes.

5. Annual Tax Reporting and Updates

Even after filing taxes, expats must continue to comply with the IRS each year. American taxation service Dubai offers annual tax reporting to ensure expats stay compliant with changing tax laws. These services provide ongoing updates and advice on how new tax reforms or international agreements may affect an expat’s tax filing requirements.

6. Real-Time Support and Consultation

One of the key benefits of hiring American taxation service Dubai is the availability of real-time support and personalized consultations. Tax professionals can answer questions about unique situations, such as dual-status tax issues, the tax implications of changing residency, or complex financial matters like owning foreign businesses or real estate.

The Importance of IRS Compliance for U.S. Expats in Dubai

Staying compliant with U.S. tax laws while living abroad is not just about avoiding penalties—it's also about protecting one’s financial future. IRS compliance ensures that U.S. expats can:

Maintain Social Security Benefits: By continuing to pay U.S. taxes, expats ensure that they receive the full range of benefits from the U.S. Social Security system.

Avoid Legal Consequences: Non-compliance with IRS tax laws can result in legal actions, including fines and wage garnishments.

Ensure Financial Stability: Timely filing and payment of taxes help expats avoid complications when returning to the U.S. or when dealing with estate planning matters.

Conclusion

American taxation service Dubai plays a vital role in helping U.S. expats navigate the complexities of IRS compliance while living abroad. With expert assistance in tax filing, tax planning, and resolving issues with the IRS, these services ensure that expats stay on top of their U.S. tax obligations without unnecessary stress or penalties. Expat Tax Services Canada can benefit from comprehensive support that helps them optimize their tax situation, comply with reporting requirements, and maintain their financial security.

0 notes

Text

Cross-Border Financial Planning: A Crucial Guide for U.S. and Canadian Expats

In an increasingly globalized world, moving across borders has become more common than ever. Among the most traveled routes for relocations are between the United States and Canada, two neighboring countries with interconnected economies and cultures. However, with these opportunities comes the complexity of cross-border financial planning, a critical yet often overlooked aspect of the expatriation process. Whether you're moving from the U.S. to Canada or vice versa, understanding tax implications, financial reporting requirements, and investment strategies is vital to safeguarding your wealth and achieving financial stability.

Why Cross-Border Financial Planning Is Essential

Relocating between the U.S. and Canada introduces unique financial challenges. These challenges often stem from differences in taxation systems, legal regulations, and retirement savings structures. Cross-border financial planning is a specialized service designed to address the nuanced needs of individuals navigating these complexities.

A well-structured plan ensures that expatriates minimize tax burdens, comply with reporting obligations, and align their financial goals with the laws of both countries. Here's why it is indispensable:

Taxation Complexity: Both the U.S. and Canada have distinct tax systems that overlap for cross-border taxpayers. The United States, for instance, taxes its citizens and permanent residents on their worldwide income, regardless of where they live. This often creates dual taxation concerns for individuals who live and earn income in Canada. Without a clear strategy, expatriates can face steep penalties and unnecessary tax exposure.

Retirement Planning: Pension plans and retirement accounts such as 401(k)s in the U.S. and RRSPs in Canada are governed by different rules. Without proper guidance, you risk mismanaging these accounts, which can lead to penalties or lost savings.

Currency and Investment Management: Currency fluctuations, investment rules, and estate planning differ significantly between the two countries. If not managed properly, these factors can erode wealth over time.

Compliance Requirements: Both countries impose strict reporting requirements for financial accounts, assets, and income. For instance, failing to report foreign assets to the U.S. government can result in heavy fines under the Foreign Account Tax Compliance Act (FATCA).

This is where the expertise of a Canada U.S. Expat Advisor becomes invaluable.

Tax Implications of Living Across Borders

1. U.S. Citizens Living in Canada

American citizens and green card holders are required to file a U.S. tax return annually, even if they live abroad. This means that income earned in Canada, such as wages, business income, or investment earnings, must be reported to the IRS.

However, the Canada-U.S. Tax Treaty provides some relief by reducing the risk of double taxation. Key provisions include:

Foreign Earned Income Exclusion (FEIE): U.S. citizens working in Canada can exclude a portion of their earned income from U.S. taxation.

Foreign Tax Credits: Taxes paid to the Canadian government can offset U.S. tax liabilities on the same income.

Tax-Free Savings Accounts (TFSAs): While TFSAs are tax-free in Canada, the U.S. treats them as taxable accounts, leading to complications if not properly accounted for.

Additionally, U.S. citizens must report any Canadian financial accounts exceeding $10,000 in aggregate to the U.S. Treasury Department using the Foreign Bank Account Report (FBAR).

2. Canadian Residents Living in the U.S.

Canadians living in the U.S. must navigate a similarly complex tax landscape. While the U.S. taxes its residents on worldwide income, Canadians who maintain certain ties to Canada may also have ongoing tax obligations there.

Key considerations include:

Departure Tax: When Canadians move to the U.S., they may be deemed to have disposed of certain assets, triggering a "departure tax." Proper planning can help reduce this burden.

Registered Retirement Savings Plans (RRSPs): Canadians living in the U.S. must decide whether to continue holding RRSPs or roll them into U.S.-based accounts. The tax treatment of RRSPs under U.S. law can be advantageous if handled correctly.

Filing Obligations: Canadians in the U.S. may need to file Canadian tax returns for specific income sources, such as rental income or investments.

Reporting Requirements for Cross-Border Residents

Understanding and complying with reporting requirements is a cornerstone of Canada U.S. Tax Planning. Both countries require detailed financial disclosures to ensure transparency and prevent tax evasion.

U.S. Reporting Requirements

FBAR: U.S. citizens and residents must report foreign bank accounts if their total value exceeds $10,000 at any point during the year. This includes Canadian accounts like TFSAs, RRSPs, and RESPs.

Form 8938: Under FATCA, U.S. taxpayers must report specified foreign financial assets, including investments and insurance policies, that exceed certain thresholds.

Income Reporting: All income, including foreign wages, rental income, and dividends, must be reported to the IRS.

Canadian Reporting Requirements

Foreign Income Verification Statement (T1135): Canadian residents with foreign investments over CAD 100,000 must disclose these assets to the Canada Revenue Agency (CRA).

Departure Returns: When leaving Canada, residents must file a final return to report income earned until the date of departure and any deemed dispositions.

Continuing Obligations: Canadians who retain property or income sources in Canada must continue filing annual tax returns for these items.

How a Cross-Border Financial Advisor Can Help

A Canada U.S. Expat Advisor specializes in navigating the complexities of cross-border financial matters. Their expertise can be instrumental in helping you:

1. Reduce Tax Exposure

Strategic tax planning is at the heart of cross-border financial planning. Advisors can leverage tax treaties, exemptions, and credits to minimize dual taxation. For example:

Proper use of foreign tax credits ensures that taxes paid in one country offset liabilities in the other.

Advisors can guide the optimal timing of income realization to take advantage of lower tax rates or treaty provisions.

2. Optimize Retirement Savings

Retirement accounts are a key consideration for expatriates. A cross-border financial advisor can help:

Transition RRSPs or 401(k)s without triggering unnecessary tax events.

Ensure compliance with both countries' tax laws while maximizing contributions and withdrawals.

3. Manage Investments and Currency Risks

Investing across borders requires careful planning to comply with securities laws, avoid excessive fees, and mitigate currency risks. Advisors can structure portfolios that balance growth potential with tax efficiency, taking into account exchange rate volatility.

4. Ensure Reporting Compliance

Navigating reporting requirements is a daunting task for many expats. A cross-border advisor ensures that all necessary forms—such as FBARs, Form 8938, or T1135—are filed accurately and on time, avoiding costly penalties.

5. Provide Peace of Mind

Perhaps the greatest benefit of working with a cross-border advisor is peace of mind. With their guidance, you can focus on enjoying your new life abroad while leaving complex financial matters in capable hands.

Choosing the Right Cross-Border Financial Advisor

Not all financial advisors are equipped to handle cross-border scenarios. When selecting an advisor, look for these qualities:

Expertise in Cross-Border Tax Planning: Ensure the advisor has deep knowledge of tax treaties, filing obligations, and strategies to reduce dual taxation.

Licensing in Both Countries: Advisors licensed in both the U.S. and Canada are better equipped to provide comprehensive guidance.

Experience with Expatriates: Look for a track record of helping expats navigate similar transitions.

Holistic Approach: The advisor should address all aspects of your financial life, from taxes to investments to estate planning.

Conclusion: A Necessity, Not a Luxury

Moving between the U.S. and Canada presents exciting opportunities but also significant financial challenges. Cross-border financial planning is not a luxury—it is a necessity for anyone seeking to protect their wealth, reduce tax exposure, and comply with reporting requirements.

By working with a specialized Canada-U.S. Expat Advisor, you can navigate these complexities with confidence. Whether you're planning a permanent move or a temporary relocation, proactive Canada U.S. Tax Planning ensures that your financial future is as seamless and rewarding as your cross-border journey.

0 notes

Text

Comprehensive Expat Tax Preparation for Global Citizens

Getting into Expat Tax Preparation can feel overwhelming, especially when dealing with US tax obligations from abroad. Whether you're a US citizen or a Green Card holder residing outside the US, understanding your tax duties is crucial. Expat Tax Preparation with AmTax simplifies the process, ensuring compliance without unnecessary complexities. Our expertise lies in making sure you meet all IRS requirements, no matter where you live. By tailoring solutions to fit individual needs, we ensure you stay on top of your taxes without the usual stress. Trust AmTax for reliable Expat Tax Preparation that keeps you in good standing with US tax laws while you focus on enjoying life overseas. Make tax time straightforward with AmTax.

0 notes

Text

Eight Reasons Why Skilled Foreign Workers in the US Should Consider Immigrating to Canada

If you’re a skilled foreign worker in the United States looking for new opportunities, Canada offers several compelling reasons to make the move up north. In fact, the United States consistently ranks as one of the top countries of residence for candidates invited to apply for Canadian permanent residency (PR), according to the 2023 Express Entry year-end report.

With a shared border and a long-standing relationship, Canada and the US maintain close connections that can make the transition smoother for skilled workers. If you’re considering your next move, here are eight key reasons why you should think about immigrating to Canada.

Table of Contents

Faster Pathways to Permanent Residency

Faster Pathways to Citizenship

Work-Life Balance

Severance Pay

Publicly Funded Universal Healthcare

Paid Parental Leave

Old Age Security

A Welcoming Culture

1. Faster Pathways to Permanent Residency

Canada offers several pathways to permanent residency (PR) for skilled workers, making it easier and faster than other countries like the US. One of the most popular routes is the Express Entry system, which evaluates candidates based on age, education, work experience, and language proficiency. Skilled foreign workers in the US, particularly those with professional experience and qualifications, will likely be eligible for Canada’s Federal Skilled Worker Program (FSWP), which is managed through Express Entry.

Once a profile is created, candidates are placed into a pool, and the highest-ranking individuals are invited to apply for PR during periodic draws. A top-ranking candidate can receive an invitation to apply (ITA) within just a few weeks, and permanent residency can be granted within a few months—often in under five months.

In contrast, obtaining a US employment-based green card is a lengthy and often uncertain process, especially for applicants from countries with high demand, such as India and China. The wait time can exceed ten years for some workers.

2. Faster Pathways to Citizenship

After obtaining permanent residency in Canada, you can apply for Canadian citizenship after living in the country for three out of the last five years. This is a faster route to citizenship than in the US, where green card holders must wait five years to apply or three years if they are married to a US citizen.

3. Work-Life Balance

Canada has a strong culture of work-life balance, and many provinces have laws that protect workers' right to disconnect after hours. Canada has a well-regulated holiday system, with 10 to 13 paid holidays per year, depending on the province.

In contrast, while the United States recognizes 11 federal holidays, private employers are not required to observe them. Furthermore, Canadian workers are legally entitled to at least two weeks of paid vacation each year, with many jurisdictions offering three weeks or more for long-tenured employees. In the US, there are no federal vacation minimums, and employers are not obligated to pay out accrued vacation time upon termination.

4. Severance Pay

In Canada, severance pay is a legal right for employees who are terminated without cause. The minimum requirement in all provinces is one week’s notice or pay in lieu of notice. In some cases, employees are entitled to additional severance under common law, which depends on the length of employment and the terms of the contract.

In contrast, many US states follow “at-will” employment, meaning employers can terminate employees at any time, for any reason, without providing severance or even notice.

5. Publicly Funded Universal Healthcare

One of the most significant advantages of living in Canada is its universal healthcare system, which is funded through taxes. All permanent residents are eligible for public health insurance, ensuring you will not lose coverage for medical care if you lose your job. Additionally, if you have employer-provided health coverage, it’s relatively affordable, with most Canadians paying between 75-140 CAD per month for supplementary insurance.

In contrast, losing a job in the US often means losing your health insurance coverage, and employer-sponsored health plans can be expensive, with premiums averaging 978 CAD (702 USD) per month.

6. Paid Parental Leave

Canada offers a generous parental leave system. New parents can take up to 76 weeks of paid leave, funded through the Employment Insurance program. This includes maternity leave (up to 15 weeks) and parental leave (up to 69 weeks), which can be split between both parents.

In contrast, the US only provides 12 weeks of unpaid parental leave under the Family and Medical Leave Act (FMLA), which is much less supportive compared to Canada’s paid benefits.

7. Old Age Security

Canada provides a monthly pension to retirees through Old Age Security (OAS), which can be up to 989.63 CAD per month (in 2024). Additionally, low-income retirees may receive an extra benefit, the Guaranteed Income Supplement (GIS), which can add up to 1,086.88 CAD per month. Both benefits are indexed to inflation and are based on residency, not previous employment contributions.

The US does not provide a comparable benefit to OAS, though retirees can receive Social Security benefits based on their work history. If you move to Canada, you can still collect your US Social Security benefits when you retire.

8. A Welcoming Culture

Canada is known for its diverse and inclusive culture, with a population that celebrates ethnic and cultural differences. The 2021 Canadian census identified over 450 ethnic or cultural origins, and the country ranks first on the Gallup Migrant Acceptance Index. Canada actively supports newcomers through government-funded settlement services, including language classes and assistance with the integration process.