#Trading with RSI and MACD

Explore tagged Tumblr posts

Text

Trading Strategies for Channel Patterns

How to Trade Channel Patterns: A Comprehensive Guide Trading in financial markets often requires a keen understanding of price action and chart patterns. One of the most popular and versatile tools in technical analysis is the Channel Pattern. This guide will walk you through what channel patterns are, how to identify them, and actionable strategies for trading these patterns effectively. By the…

#Advanced trading techniques#Ascending Channels Trading#Breakout Trading Strategies#Channel Patterns for Beginners#Chart Patterns in Trading#Day Trading Channel Patterns#Descending Channels Explained#Fibonacci Levels in Channel Patterns#Forex Channel Pattern Trading#Horizontal Channel Trading Tips#How to Trade Channels#Identifying Channel Patterns#learn technical analysis#Risk management in trading#Stock Market Channel Analysis#stock markets#stock trading#successful trading#Support and Resistance Lines#Swing trading strategies#technical analysis#Technical analysis strategies#Trading Channel Patterns#Trading with RSI and MACD

0 notes

Text

Sniper entry Scalper mode on #XAUUSD Gold Signal M1 Timeframe MT4. Non Repaint signals more info in official Website: wWw.ForexCashpowerIndicator.com . Cashpower Indicator Lifetime license one-time fee with No Lag & Non Repaint buy and sell powerful Signals with Smart algorithms that emit signals in big trades volume zones. . ✅ NO Monthly Fees ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notifications 🔥 Powerful & Profitable AUTO-Trade Option . ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

#indicatorforex#forexindicator#forexsignals#cashpowerindicator#forex#forextradesystem#forexindicators#forexprofits#forexvolumeindicators#forexchartindicators#forex trading xauusd#forex indicators volume#forex indicators macd#forex bollinger bands#forex rsi#forex fibonacci

2 notes

·

View notes

Text

Fibonacci Trading: Forex Trading Strategy Explained

Fibonacci trading is a popular forex trading strategy that utilizes the Fibonacci sequence and its ratios to predict potential price movements and retracement levels. This method helps traders identify entry and exit points, making it an essential tool in forex trading. Understanding Fibonacci Sequence The Fibonacci sequence is a series of numbers where each number is the sum of the two preceding…

#CCI#DeFi#Divergence#Downtrend#Entry and Exit Points#Fibonacci Levels#Fibonacci Retracement#Forex#Forex Trading#MACD#Market Conditions#Market Volatility#Moving Average#Moving Average Convergence Divergence#Predictability#Price Action#Price Charts#Price Movement#Price Movements#Relative Strength#Risk Management#RSI#Stop-Loss#Support And Resistance#Trading Decisions#Trading Strategy#Volatility

3 notes

·

View notes

Text

Unlocking the Power of TradingView: The Best Charting Platform for Traders

A sleek and modern TradingView dashboard displaying real-time charts, candlestick patterns, and powerful technical indicators like RSI and MACD. Are you looking for a powerful, easy-to-use charting tool to enhance your trading? Whether you’re a beginner or an experienced trader, TradingView is one of the best platforms for technical analysis, market insights, and strategy building. And here’s…

#Affiliate Marketing#Automated trading#Candlestick patterns#Crypto trading#Day trading#Forex trading#Investing#MACD#Market analysis#Online trading#passive income#RSI#Stock market#Swing trading#Technical analysis#Trading alerts#Trading bots#Trading platform#Trading signals#Trading strategies#Trading tools#TradingView#TradingView charts#TradingView indicators#TradingView plans#TradingView pricing#TradingView review

0 notes

Text

Mastering Solana's Volatility: Unlocking Strategic Trading Levels for Optimal Returns

Solana has recently demonstrated remarkable resilience in the cryptocurrency market, experiencing a substantial rebound after briefly touching the $75-80 price range. This notable recovery not only showcases Solana's volatile nature but also indicates strong market resilience and sustained investor interest. According to insights from Daan Crypto, a prominent figure in the crypto trading community, Solana's market behavior has presented both challenges and opportunities for investors, emphasizing the importance of strategic price levels.

The analysis highlights the swift response of the market to favorable buying zones, with Solana's price bouncing back impressively from the $75-80 region. Daan Crypto's trading experience underscores the nuanced strategy required to navigate Solana's market successfully, emphasizing timing and patience as crucial factors.

Traders are advised to monitor key levels identified in the analysis. A potential retreat to the $75 level is considered an attractive entry point, signaling confidence in Solana's ability to rally. Additionally, the analysis identifies a critical resistance zone between $138-148, marking pivotal levels for determining Solana's future price trajectory.

Solana's recent market growth is reflected in its current value of $97.85, indicating a 0.73% increase in the last 24 hours. The surge in trading volume, reaching $2.88 billion, further emphasizes heightened market activity. With a market cap of $42 billion, Solana holds a significant position in the cryptocurrency market, ranking fifth by CoinMarketCap.

Technical analyses provide additional support for Solana's bullish outlook. The Moving Average Convergence Divergence (MACD) indicator signals positive momentum, and the Relative Strength Index (RSI) nearing the 50 mark suggests a potential bullish trend in the near term. The positioning of the 20 Exponential Moving Average (EMA) over the 50-EMA adds to the optimistic outlook, indicating the potential for further gains in Solana's market performance.

0 notes

Text

Here Is A List Of The Most Common Trading Indicators

In trading, an indicator is a statistical measure of market conditions used to forecast price changes. These are some of the most commonly used trading indicators, which are typically available on trading platforms like KuCoin: Simple Moving Average (SMA): An average of the price over a certain number of periods (like days or hours). The formula for SMA is (A1+A2+A3…+An)/n, where A is the asset…

View On WordPress

#ATR#Average True Range#Bollinger Bands#crypto trading#EMA#Exponential Moving Average#Fibonacci Retracement#MACD#Moving Average Convergence Divergence#Relative Strength Index#RSI#Simple Moving Average#SMA#Stochastic Oscillator#trading indicators#Volume Weighted Average Price#VWAP

1 note

·

View note

Text

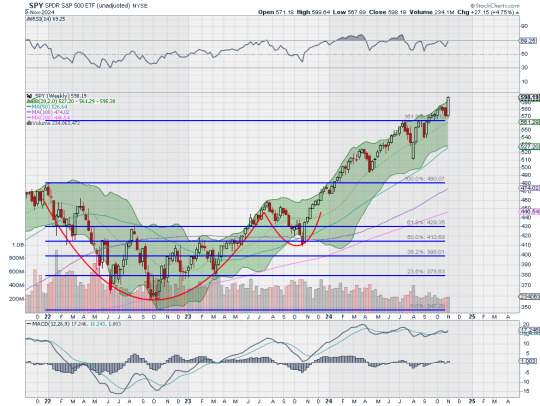

What to expect from the stock market this week

Last week, the review of the macro market indicators saw with October in the books and heading into the election and FOMC meeting, equity markets experienced a Halloween spooking. Elsewhere looked for Gold ($GLD) to continue its uptrend while Crude Oil ($USO) consolidated at the bottom of a broad range. The US Dollar Index ($DXY) looked to consolidate in its uptrend while US Treasuries ($TLT) pulled back in their consolidation. The Shanghai Composite ($ASHR) looked to continue the short term move higher while Emerging Markets ($EEM) pulled back in their uptrend.

The Volatility Index ($VXX) looked to remain at a neutral level, above the base established this year, and was likely to stay there at least until after the election. This might make for choppy light trading for equity markets to start next week. Their charts looked strong on the longer timeframe though. On the shorter timeframe both the $QQQ and $SPY had reset momentum measures lower and could reverse or turn bearish, likely a couple of days’ time would tell. The $IWM did not seem concerned about an election or Fed policy, churning sideways.

The week saw major movements happen following the election. It played out with Gold pulling back from its high Wednesday before a partial recovery while Crude Oil found some strength and moved higher in a choppy range. The US Dollar jumped to a 4 month high while Treasuries fell back to a 5½ month low Wednesday before a recovery. The Shanghai Composite continued the move to the upside while Emerging Markets chopped in a wide range.

Volatility crashed down to the low end of the range since August. This put a stiff breeze at the backs of equities and they started to move up Tuesday and then accelerated Wednesday through the end of the week. This resulted in the SPY and QQQ printing a new all-time highs Wednesday, Thursday and Friday and the IWM gapping up to a 1 year high. What does this mean for the coming week? Let’s look at some charts.

The SPY came into the week at the 50 day SMA on the daily chart in a pullback from the top. It had a gap left open from the end of the week. It held there on Monday and then started higher Tuesday, into the gap. It gapped up Wednesday to finish at a new all-time high and leaving an island below. It followed that up with new all-time highs Thursday and Friday. The Bollinger Bands® are open to the upside. The RSI is rising deep in the bullish zone with the MACD positive and rising.

The weekly chart shows a strong, long bullish candle rising from the 161.8% extension of the retracement of the 2022 drop. The 200% extension is now within view at 614 above. The RSI is rising near overbought territory in the bullish zone with the MACD drifting up and positive. There is no resistance above 599.60. Support lower sits at 585 and 580 then 574.50 and 571.50 before 565.50 and 556.50. Uptrend.

With the Presidential Election and November FOMC meeting in the rearview mirror, equity markets showed jubilation as they vaulted higher. Elsewhere look for Gold to in its uptrend while Crude Oil consolidates in a broad range. The US Dollar Index continues to move to the upside while US Treasuries consolidate in their pullback. The Shanghai Composite looks to continue the move higher while Emerging Markets chop in their short term uptrend.

The Volatility Index looks to remain low and drifting lower following the election making it easier for equity markets to continue higher. Their charts look strong on both timeframes, especially the SPY and QQQ. The IWM has now joined the party, a stone’s throw away from making its first new all-time high in 2 years. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview November 8, 2024

44 notes

·

View notes

Text

Forex Trading

Forex trading, or foreign exchange trading, involves buying and selling currencies to profit from changes in exchange rates. Here’s a detailed guide to get you started:

1. Understanding Forex Trading

Currency Pairs: Forex trading always involves trading one currency for another. Currencies are quoted in pairs (e.g., EUR/USD, GBP/JPY). The first currency is the base currency, and the second is the quote currency.

Pips: The smallest unit of movement in a currency pair’s exchange rate. For most pairs, a pip is 0.0001.

Leverage: Allows you to control a large position with a relatively small amount of money. While leverage can amplify profits, it also increases risk.

2. Setting Up Your Forex Trading

Choose a Reliable Broker: Select a forex broker that offers a user-friendly trading platform, competitive spreads, and good customer service. Look for brokers with a solid reputation and proper regulatory oversight (e.g., regulated by the Financial Conduct Authority (FCA) or the Commodity Futures Trading Commission (CFTC)).

Open a Trading Account: After selecting a broker, open a trading account. Many brokers offer demo accounts where you can practice trading without real money.

Deposit Funds: Fund your trading account with an amount you’re comfortable with. Remember, forex trading can be risky, so only invest money you can afford to lose.

3. Develop a Trading Strategy

Technical Analysis: Uses historical price data and charts to forecast future price movements. Key tools include indicators (like Moving Averages, RSI, MACD) and chart patterns (like head and shoulders, flags).

Fundamental Analysis: Involves analyzing economic indicators, news events, and other factors that might impact currency values. Key indicators include GDP, interest rates, inflation, and employment data.

Risk Management: Set stop-loss and take-profit orders to manage risk and protect your capital. Determine how much you’re willing to risk on each trade.

4. Executing Trades

Place Orders: Use your broker’s trading platform to place trades. You can choose from various order types, such as market orders, limit orders, and stop orders.

Monitor and Adjust: Keep track of your trades and the market conditions. Adjust your strategies and positions as needed based on market movements and your trading plan.

5. Continuous Learning and Improvement

Stay Informed: Follow financial news, economic reports, and market analyses to stay up-to-date with factors affecting currency markets.

Review and Reflect: Regularly review your trades to understand what worked and what didn’t. Learning from past trades helps improve your strategy.

Adapt: Forex markets are dynamic and can change quickly. Be ready to adapt your strategies to new market conditions.

6. Avoiding Common Pitfalls

Overleveraging: Using high leverage can lead to significant losses. Start with lower leverage until you gain more experience.

Emotional Trading: Avoid making decisions based on emotions. Stick to your trading plan and strategy.

Lack of Research: Ensure you conduct thorough research and analysis before making trading decisions.

Resources for Learning Forex Trading

Books: “Trading in the Zone” by Mark Douglas, “Currency Trading for Dummies” by Brian Dolan and Kathleen Brooks.

Online Courses: Platforms like Coursera, Udemy, and Babypips offer courses on forex trading.

Websites: Follow financial news on websites like Bloomberg, CNBC, and Reuters.

business, forex, art, usbiz, usa art, fine art, trading, forex trading

12 notes

·

View notes

Text

Mastering forex signals for trend following: a comprehensive guide

The foreign exchange market, or Forex, is a dynamic and ever-changing arena where traders seek to capitalize on currency price movements. One popular trading strategy is trend following, which involves identifying and following the prevailing market direction. Forex signals play a crucial role in assisting traders to navigate the complexities of trend following. In this comprehensive guide, we will explore the intricacies of Forex signals for trend following, helping you understand how to leverage them effectively for successful trading.

Understanding Trend Following

Trend following is a strategy that seeks to capitalize on the directionality of market prices. The basic premise is simple: identify the prevailing trend and place trades in the same direction. Trends can be upward (bullish), downward (bearish), or sideways (range-bound). Successful trend following involves entering a trade at the beginning of a trend and exiting when the trend shows signs of reversal.

The Role of Forex Signals

Forex signals serve as triggers for traders, indicating opportune moments to enter or exit a trade. These signals are generated through a thorough analysis of market data, including technical indicators, fundamental factors, and sometimes a combination of both. For trend following, signals become particularly crucial as they guide traders on when to jump on a trend and when to step aside.

Key Components of Forex Signals for Trend Following

1. Technical Indicators:

Moving Averages: These are fundamental tools in trend following. A moving average smoothens price data to create a single flowing line. Traders often look for crossovers, where short-term moving averages cross above long-term ones, as a signal to enter a trade.

Relative Strength Index (RSI): RSI measures the speed and change of price movements. A high RSI may indicate overbought conditions, suggesting a potential reversal, while a low RSI may indicate oversold conditions, signaling a potential buying opportunity.

Moving Average Convergence Divergence (MACD): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

2. Fundamental Analysis:

While trend following is predominantly a technical strategy, incorporating fundamental analysis can enhance the accuracy of signals. Economic indicators, interest rates, and geopolitical events can significantly impact currency trends.

3. Price Action:

Pure price action analysis involves studying the historical price movements of a currency pair. Identifying patterns, such as higher highs and higher lows in an uptrend, can provide strong signals for trend following.

Choosing a Reliable Signal Provider

With the plethora of signal providers available, it's essential to choose a reliable one. Consider the following factors:

Track Record: A provider's historical performance is a crucial indicator of their reliability. Look for providers with a consistent track record of accurate signals.

Transparency: Transparent signal providers disclose their methods, including the criteria for generating signals and their risk management strategies.

Risk-Reward Ratio: A good signal provider should have a clear risk-reward ratio for each signal, helping you manage your trades effectively.

Implementing Forex Signals for Trend Following

Once you've selected a signal provider or developed a reliable system, the implementation phase is critical. Here are some tips:

Risk Management: Set clear risk parameters for each trade. This includes defining the percentage of your trading capital you're willing to risk on a single trade.

Position Sizing: Adjust the size of your positions based on the strength of the signal and the volatility of the market.

Stay Informed: While signals provide valuable insights, staying informed about broader market trends and events is crucial. Unexpected news can impact the Forex market.

Continuous Evaluation: Regularly assess the performance of your chosen signals and be prepared to adjust your strategy if market conditions change.

Conclusion

Forex signals for trend following can be powerful tools in a trader's arsenal, helping to identify and capitalize on market trends. However, success in Forex trading requires a comprehensive understanding of both the strategy and the market itself. By combining technical indicators, fundamental analysis, and a disciplined approach to risk management, traders can use Forex signals to navigate the complex world of trend following with confidence. Remember, no strategy guarantees success, and ongoing learning and adaptation are essential for long-term success in the Forex market.

Source:

#TradeSignals#FinancialFreedom#StockMarketAlerts#InvestingWisdom#ProfitableTrades#MarketAnalysis#TradingSignals#DayTrading#ForexProfit#CryptoSignals#MarketTrends#InvestmentTips#SmartTrading#TradeSmart#TechnicalAnalysis#RiskManagement#ProfitPotential#TradingStrategies#StockPicks#EconomicIndicators#TradingEducation#MarketInsights#OptionsTrading#MarketWatch#TradeStrategy#FinancialMarkets#ForexTrading#CryptoInvesting#AlgorithmicTrading#StockMarketNews

28 notes

·

View notes

Text

Pi Network (PI) Holds Key Support - Is a Rebound Possible Ahead

Pi Network's native cryptocurrency, Pi (PI), has recently experienced significant volatility, with its price fluctuating between $1.30 and $2.00. As of March 12, 2025, PI is trading at approximately $1.67, reflecting an 18.52% increase over the past 24 hours. citeturn0search8

A key factor influencing PI's price dynamics is the upcoming Pi Day on March 14, marking the sixth anniversary of the project's launch. This date is also the deadline for users to complete their Know Your Customer (KYC) verification and migrate their mined PI from the testnet to the mainnet. Failure to do so may result in forfeiture of balances, adding pressure on users to finalize the migration. citeturn0search5

The anticipation surrounding a potential Binance listing has further fueled speculation. A recent community vote revealed that 86% of participants support PI's listing on Binance. While Binance has yet to make an official announcement, the community remains optimistic that such a listing could enhance liquidity and drive PI's price upward. citeturn0search7

Technical analysis indicates that PI is holding above the $1.40 support level. The Moving Average Convergence Divergence (MACD) shows a mild bullish crossover, suggesting potential upward momentum. However, the Relative Strength Index (RSI) stands at 35, indicating that the asset is approaching oversold territory. Key resistance levels are identified at $1.50 and $2.00. citeturn0search0

In summary, PI is currently maintaining key support levels amid market volatility. The upcoming Pi Day announcements and the potential Binance listing are pivotal events that could influence PI's price trajectory. Investors are advised to monitor these developments closely, as they may present opportunities for a rebound or signal further consolidation.

more in farmation click here

#PiNetwork#PiCoin#Crypto#Blockchain#Cryptocurrency#DigitalCurrency#PiDay#CryptoTrading#CryptoInvesting#CryptoNews#PiNetworkCommunity#FutureOfFinance#PiToTheMoon#Decentralized#Web3

2 notes

·

View notes

Text

Momentum Trading: Forex Trading Strategy Explained

Momentum trading is a strategy that seeks to capitalize on the continuance of existing trends in the market. By focusing on the strength of price movements, traders can make informed decisions and optimize their profits. What is Momentum Trading? Momentum trading involves buying and selling currency pairs based on recent price trends. The core idea is that strong movements in the market tend to…

#Currency Pairs#Divergence#Economic Indicators#Forex#Forex Trading#Leverage#MACD#Market Conditions#Market News#Momentum Trading#Moving Average Convergence Divergence#Moving Averages#Price Movements#Relative Strength#Risk Management#RSI#Stochastic Oscillator#Stop-Loss#Stop-Loss Orders#Take-Profit#Trading Strategy

3 notes

·

View notes

Text

Best Platforms to Trade for Forex in 2025

Forex trading continues to captivate traders worldwide, offering a dynamic and lucrative avenue for financial growth. In 2025, identifying the best platforms to trade for forex has become more crucial than ever, as technology and market demands evolve. From user-friendly interfaces to advanced tools for technical analysis, these platforms are tailored to meet the needs of both novice and seasoned traders. Whether you're diving into major currency pairs, exploring exotic options, or utilizing automated trading strategies, choosing the right platform is the foundation for success.

Core Features of Top Forex Trading Platforms

Forex trading platforms in 2025 must combine advanced functionality with accessibility to meet diverse trader needs. The following core features highlight what distinguishes the best platforms.

User-Friendly Interface

A user-friendly interface enhances efficiency and reduces errors, especially for beginners. Key features include:

Intuitive navigation for rapid trade execution.

Customizable layouts to match user preferences.

Comprehensive tutorials for ease of onboarding.

Efficient design with minimal lag, even during high volatility.

Example Platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are renowned for streamlined interfaces designed to accommodate traders at all levels.

Comprehensive Charting Tools

Forex trading requires precision, and advanced charting tools are critical for analysis. The following charting tools enhance strategy formulation:

Drawing Tools: Support for trendlines and channels.

Indicators: Integration of MACD, RSI, Bollinger Bands, and Fibonacci Retracement.

Timeframes: Options to analyze data across multiple periods.

Custom Indicators: Flexibility to program and integrate personal strategies.

Automation and Algorithmic Trading

Automation is indispensable for modern forex trading. Platforms like cTrader and NinjaTrader excel with features like:

Pre-built Strategies: Ready-to-use templates for scalping and trend following.

Custom Algorithms: Integration with programming languages such as C# and Python.

Backtesting: Evaluate strategies with historical data.

Integration with APIs: Seamless syncing with advanced trading bots.

Mobile Accessibility

Forex traders increasingly require the flexibility of trading on-the-go. Mobile accessibility ensures:

Synchronization: Real-time updates between desktop and mobile devices.

Push Notifications: Alerts for market changes and trade execution.

Compact Design: Optimized for smaller screens without losing functionality.

App Examples: MT4 and MT5 apps, offering full trading capabilities on iOS and Android.

Key Takeaway: Platforms combining a robust desktop experience with seamless mobile integration empower traders with unmatched convenience.

The best forex trading platforms for 2025 excel in usability, advanced charting, automation, and mobile functionality. By integrating these features, platforms like MT5, cTrader, and TradingView offer versatile solutions for traders of all expertise levels.

Trading Instruments Supported by Leading Platforms

The diversity of trading instruments available on forex platforms is crucial for building effective strategies and achieving long-term trading success. This section explores the breadth and advantages of various trading instruments.

1. Major Currency Pairs

Major currency pairs, such as EUR/USD, USD/JPY, and GBP/USD, dominate forex markets due to their high liquidity and tighter spreads. Leading platforms like MetaTrader 5 and TradingView offer advanced tools for analyzing these pairs, enabling traders to capitalize on predictable movements.

Key Features:

High liquidity ensures minimal price fluctuations during trades.

Access to real-time market data for precise decision-making.

Supported by most trading strategies, including scalping and swing trading.

These pairs are ideal for traders seeking consistent opportunities in stable market conditions.

2. Exotic Pairs

Exotic pairs combine major currencies with currencies from emerging markets, such as USD/TRY or EUR/SEK. While they offer higher potential rewards, they also come with increased volatility and wider spreads.

Risks and Rewards:

Volatility: Significant price movements create potential for larger profits.

Higher Spreads: Costs can be prohibitive for short-term trading strategies.

Economic Dependence: Price movements often correlate with specific geopolitical or economic conditions.

Platforms like cTrader often feature analytical tools tailored for exotic pair trading, helping traders manage the associated risks.

3. CFDs and Futures

Contracts for Difference (CFDs) and futures are derivatives enabling traders to speculate on forex price movements without owning the underlying assets. Futures contracts are often traded on platforms like NinjaTrader, while CFDs are supported on MetaTrader platforms.

CFDs vs. Futures in Forex Trading

Wider spreads but no commissionCommissions and exchange fees

CFDs and futures cater to traders seeking flexibility and hedging opportunities in volatile markets.

4. Spot Forex vs. Forward Contracts

Spot forex trades settle instantly at prevailing market rates, making them ideal for day traders. Forward contracts, however, lock in future exchange rates and are often used by businesses to hedge against currency fluctuations.

Spot Forex:

Instant execution for quick trades.

Supported by platforms like TradingView, which offers robust charting tools.

Forward Contracts:

Customizable settlement dates.

Reduced risk of unfavorable exchange rate changes.

Forward contracts are frequently utilized for long-term strategies requiring stability.

5. Options Trading in Forex

Forex options provide traders the right, but not the obligation, to buy or sell currencies at a predetermined price. Options trading is supported on platforms like MetaTrader 5, offering flexibility for speculative and hedging strategies.

Advantages:

Defined risk due to limited loss potential.

Compatibility with advanced trading strategies like straddles and strangles.

Access to multiple expiration dates for tailored strategies.

Options trading is an excellent choice for traders seeking diversification and controlled risk in uncertain markets.

Market Indicators for Effective Forex Trading Forex trading in 2025 requires mastery of market indicators for successful trades. Platforms integrating technical tools like RSI, Bollinger Bands, and Fibonacci retracements provide invaluable support for analyzing currency pairs and spotting trends.

1: Moving Averages and RSI

Moving averages and RSI (Relative Strength Index) are staples in forex trading for spotting trends and identifying overbought or oversold market conditions. Here's how they work:

Moving Averages:

Smooth out price data for better trend analysis.

Common types: Simple Moving Average (SMA) and Exponential Moving Average (EMA).

Platforms like MetaTrader 5 (MT5) allow customizable moving average periods for traders’ needs.

RSI:

Measures the speed and change of price movements.

Values above 70 indicate overbought conditions, while below 30 signals oversold.

Both indicators are excellent for detecting market reversals and consolidations, making them essential for scalping and swing trading strategies.

2: Bollinger Bands and Fibonacci Retracements

Bollinger Bands and Fibonacci retracements are complementary tools for determining price ranges and potential reversals.

Bollinger Bands:

Comprised of a central moving average and two bands (standard deviations).

Highlights volatility and identifies breakout opportunities in exotic pairs and minor pairs.

Fibonacci Retracements:

Based on key levels derived from the Fibonacci sequence (23.6%, 38.2%, 61.8%, etc.).

Used to forecast retracement zones for entry and exit points.

Platforms like TradingView provide advanced integration of these tools for technical analysis.

3: Pivot Points and Volume Analysis

Pivot points and volume analysis serve as complementary methods for intraday traders.

Pivot Points:

Calculate potential support and resistance levels based on previous trading sessions.

Widely used in day trading to set intraday targets.

Volume Analysis:

Measures market activity to validate price movements.

Higher volume during breakouts confirms trends.

Together, these indicators help traders plan risk-reward ratios effectively and refine strategies. Platforms offering integrated market indicators like RSI, Fibonacci retracements, and volume analysis provide forex traders with precise insights for decision-making. Combining these tools with strategic risk management and discipline ensures a competitive edge in forex trading for 2025.

Risk Management Tools in Forex Platforms

Risk management is the cornerstone of sustainable forex trading. Platforms offering advanced tools like Stop-Loss Orders and Position Sizing empower traders to mitigate risks while optimizing potential gains.

1. Stop-Loss Orders

Stop-loss orders safeguard capital by automatically closing trades at pre-set levels. Key benefits include:

Capital Protection: Prevents losses from spiraling during volatile markets.

Emotional Discipline: Reduces impulsive decisions by automating exit points.

Wide Platform Integration: Available on MetaTrader 4, TradingView, and cTrader for seamless trading execution.

2. Take-Profit Orders

Take-profit orders lock in profits when the market reaches a target price. Steps for setting take-profit orders effectively:

Analyze Moving Averages and RSI to determine target levels.

Input the price level in trading platforms like NinjaTrader or MT5.

Monitor trade performance and adjust as needed.

3. Position Sizing Calculators

Accurate position sizing minimizes overexposure to any single trade. Here’s how these calculators work:

Calculate lot sizes based on account balance, risk percentage, and stop-loss distance.

Adjust trade sizes to align with Risk-Reward Ratios.

Enable traders to maintain diversified exposure.

4. Risk-Reward Ratio Analysis

Risk-reward ratios evaluate trade viability by comparing potential profits to losses. Tips for effective use:

Aim for a minimum ratio of 1:2 or higher.

Utilize tools like Bollinger Bands to estimate price movements.

Integrated calculators on platforms like MT4 simplify these computations.

5. Diversification Tools

Diversification spreads risk across multiple trading instruments. Features on platforms include:

Multi-asset trading options: CFDs, Futures, and Currency Pairs.

Portfolio analysis tools to track exposure by instrument type.

Real-time updates for Exotic Pairs and niche markets.

6. Backtesting Strategies

Backtesting allows traders to evaluate strategies using historical data. Its advantages are:

Testing risk management techniques like Stop-Loss Orders without live market risk.

Platforms such as TradingView support customizable backtesting scripts.

Insights into strategy weaknesses improve long-term profitability.

With advanced tools for Stop-Loss Orders, Position Sizing, and Backtesting, modern forex trading platforms empower traders to proactively manage risks. Leveraging these features leads to more disciplined and effective trading.

Psychological and Strategic Insights for Forex Trading

Mastering trading psychology is key to navigating the complexities of forex. Platforms enhance this through features that promote discipline, performance tracking, and trader confidence, empowering strategic growth and mitigating psychological pitfalls.

Building Discipline Through Alerts

Platforms offering robust alert systems, like MetaTrader 5, help instill discipline by:

Preventing Overtrading: Custom alerts signal market entry points, limiting impulsive trades.

Time Management: Reminders help traders stick to predefined schedules.

Market Trend Notifications: Alerts for moving averages or Relative Strength Index (RSI) changes enable focused decisions.

Tracking Performance Metrics

Trading platforms integrate tools that help traders evaluate performance, including:

Win/Loss Ratio Analysis: Shows trade success rates.

Equity Curve Monitoring: Visualizes account performance trends.

Journal Features: Logs trade entries and exits for review.

Customizable Dashboards

Platforms like TradingView allow traders to configure dashboards by:

Adding favorite currency pairs and indicators like MACD or Bollinger Bands.

Creating multi-screen setups to monitor multiple trades.

Integrating news feeds to stay updated with central bank announcements.

Educational Resources

The inclusion of in-platform education fosters confidence through:

Interactive Tutorials: Step-by-step videos on strategies like swing trading or technical analysis.

Webinars and Live Sessions: Experts discuss trading instruments like CFDs and options.

AI-based Learning Modules: Adaptive lessons based on trader performance.

By integrating tools for discipline, self-awareness, and strategy refinement, trading platforms empower users to overcome psychological challenges, enhance risk management, and make data-driven decisions for long-term success.

Conclusion

Forex trading in 2025 offers exciting opportunities, but success begins with choosing the right platform. As highlighted throughout this content pillar, top trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView stand out for their robust features, diverse trading instruments, and advanced integrations. These platforms empower traders to navigate the complexities of the forex market through tools such as technical indicators like Moving Averages and RSI, risk management solutions like stop-loss orders and position sizing calculators, and integrations with vital economic indicators such as GDP, inflation, and central bank announcements.

The best forex trading platforms not only provide access to currency pairs, CFDs, and other instruments but also integrate cutting-edge charting tools, educational resources, and analytics to build confidence and discipline—critical factors in mastering the psychological demands of trading.

By understanding the interplay between platform features, market tools, and strategy development, traders can optimize their approach to trading forex in 2025. Whether you're focused on scalping, day trading, or long-term swing trading, the right platform will be your foundation for executing trades effectively, managing risk, and staying informed in a fast-paced market.

Take the insights from this guide to make an informed decision, choosing a platform that aligns with your trading goals and enhances your ability to trade forex with precision and confidence. With the right tools and strategies in hand, you're poised to navigate the evolving forex market and unlock its full potential in 2025 and beyond.

2 notes

·

View notes

Video

youtube

ADAUSD 19 Consecutive Successes! PrimeXAlgo vs Traditional Trading: How AI is Changing the Investment LandscapeA comparative analysis of PrimeXAlgo and traditional trading methods: Success Rate: PrimeXAlgo's 27 consecutive successes vs typical success rates Technology: 2,500 indicator AI analysis vs manual chart analysis Speed: Real-time signals vs delayed information Scope: Diverse markets vs limited expertise areas Watch a deep comparison that proves the superiority of AI with data!https://primexalgo.comtelegramhttps://t.me/primexalgofacebookhttps://facebook.com/profile.php?id=615665...discordhttps://discord.com/channels/1288670367401...instagramhttps://instagram.com/primexalgox.comhttps://x.com/PrimeXAlgo#PrimeXAlgo,#AITrading,#GoldInvestment,#BitcoinTrading,#TradingSuccess,#FX,#FOREX,#GOLD,#Chart,#TradingChart,#Stock,#Finance,#Investment,#primexalgo,#primex,#ConsecutiveSuccess,#Financial,#AIBOT,#BOT,#BOTtrading,#crypto,#cryptocurrency,#Forex trading,#Buy,#Sell,#Long,#Short,#indicator,#Strategy,#MACD,#RSI,#Bollinger Bands,#Oscillator,#Volume,#Charts,#Scalper,#Trend,#Bond,#Options,#Derivative,#Liquidity,#Leverage,#Margin,#Hedging,#Arbitrage,#Bull market,#Bear market,#BTC,#Bitcoin,#spread

2 notes

·

View notes

Text

Ethereum ETFs Awaited in the Crypto Market: FOMO on the Horizon?

In a significant development, several traditional asset managers from the world of traditional finance (TradFi) have filed applications for the creation of spot Ethereum Exchange-Traded Funds (ETFs). This move is seen as a crucial step toward mainstream adoption of Ethereum (ETH), the second-largest cryptocurrency by market capitalization. Notable firms such as VanEck, 21Shares, ARK, Hashdex, Grayscale, Invesco, Galaxy, BlackRock, and Fidelity have submitted proposals, each with varying deadlines set between May and August 2024.

The filing of these ETF applications has ignited anticipation in the crypto market, with investors and enthusiasts closely watching the developments. The diverse set of deadlines for ETF proposals suggests that the cryptocurrency community can expect heightened interest and trading activity leading up to and during these timelines. The prospect of Fear Of Missing Out (FOMO) gripping the market has been highlighted, potentially resulting in increased market participation.

#Ethereum#ETF#Exchange-Traded Funds#ETH#cryptocurrency#FOMO#chart analysis#Relative Strength Index (RSI)#Moving Average Convergence Divergence (MACD)#Know Sure Thing (KST)#cryptocurrency market#Cryptotale

0 notes

Text

Forex Trading Strategies: Navigating Market Trends Amid Economic Shifts

Forex traders need adaptable strategies to thrive in unpredictable market conditions. This post focuses on forex trading methods such as scalping, market trend analysis, and risk management.

Gold is currently experiencing bearish momentum, with RSI divergence suggesting further declines. While short-term pullbacks may occur, traders can capitalize on these movements with scalping strategies aimed at price dips.

Silver’s price action shows a pullback, but the overall market remains bearish. RSI and MACD signals hint at potential for a temporary rally. Scalping traders should focus on short-term selling opportunities.

The U.S. dollar continues to strengthen as inflation fears delay potential rate cuts. The DXY index reflects this, offering opportunities for traders to go long on USD pairs, including USDJPY and USDCHF.

GBPUSD is maintaining a bearish trend, with minimal resistance to further declines. Short-term pullbacks could offer opportunities for scalping, but the long-term outlook remains negative.

The Australian dollar is showing consolidation, lacking clear direction. Traders should wait for a breakout before entering positions, using proper forex risk control measures to manage volatility.

NZDUSD is in a downtrend, with RSI suggesting a possible short-term reversal. However, the broader trend remains bearish, offering short-term selling opportunities for scalpers.

EURUSD remains weak, with both RSI and MACD signaling further declines. Scalping traders can take advantage of short pullbacks while keeping a bearish outlook.

USDJPY continues its bullish momentum, supported by strong buying pressure. Traders should use caution and manage risk, looking for potential overbought signals.

USDCHF is moving upward, but a pullback seems likely. Traders can capitalize on small price movements through scalping strategies while managing risk.

USDCAD shows signs of a potential pullback after an uptrend. Traders should wait for confirmation and use forex signals to time entries and exits effectively.

With effective forex trading methods like scalping, market analysis, and risk control, traders can adapt to market fluctuations and maximize profits.

#Forex trading methods#Forex scalping strategies#Forex market trends#Forex risk control#Forex signal trading

3 notes

·

View notes

Text

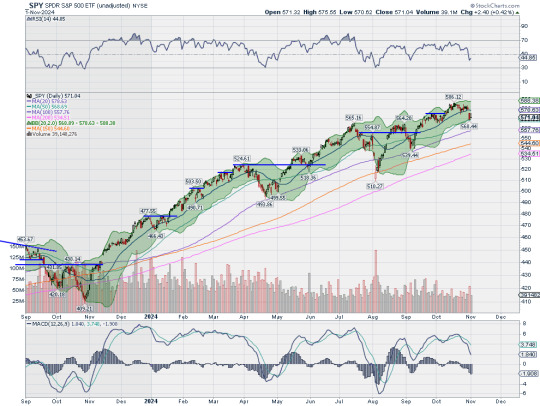

What to expect from the stock market this week

Last week, the review of the macro market indicators saw with just one full week of trading to go ahead of the election and November FOMC meeting, equity markets were set to go into the week after one of choppy trading. Elsewhere looked for Gold ($GLD) to continue its uptrend while Crude Oil ($USO) consolidated at the bottom of a broad range. The US Dollar Index ($DXY) continued to move to the upside while US Treasuries ($TLT) pulled back in consolidation. The Shanghai Composite ($ASHR) looked to continue the short term move higher while Emerging Markets ($EEM) consolidated in their young uptrend.

The Volatility Index ($VXX) looked to remain low and stable making the path easier for equity markets to the upside. Their charts looked strong, especially on the longer timeframe. On the shorter timeframe both the $QQQ and $SPY had reset on momentum measures as they moved sideways. The $IWM continued to disappoint with another sputtered break out reversing.

The week played out with Gold ripping to a new all-time high before profit taking left it little changed on the week while Crude Oil gapped down Monday and slowly recovered through Friday. The US Dollar met resistance and consolidated at the late July high while Treasuries held in a tight range consolidating the pullback. The Shanghai Composite shifted to consolidating the move higher while Emerging Markets continued to drift lower threatening the short term uptrend.

Volatility ticked up to touch recent resistance and held. This put pressure on equities midweek and they pulled back Wednesday and Thursday before a bounce Friday. This resulted in the SPY breaking its 5 month winning streak in October and the QQQ falling just short of retesting the all-time high. The IWM continued in its own world moving mostly sideways. What does this mean for the coming week? Let’s look at some charts.

SPY Daily, $SPY

The SPY came into the week consolidating near the all-time high and above the 20 day SMA on the daily chart. It continued to hold there in a tight trading range through Wednesday. Thursday saw it gap down through the 20 day SMA and run to the 50 day SMA and lower end of the Bollinger Bands®. This was the 1st touch of the 50 day SMA in 6 weeks. It held there with an inside day Friday, a possible bottom signal. The RSI also pulled back, bouncing at the September low, and remaining in the bullish zone. The MACD is dropping but positive.

The weekly chart shows a second down week with a longer body candle. It remains well above the 20 week SMA though in healthy territory. The RSI on this timeframe is pulling back in the bullish zone with the MACD looking to cross down and positive. There is support lower at 565.50 and 556.50 then 549.50 and 545.50 before 542. Resistance higher is at 571.50 and 574.50 then 580 and 585. Pause in Uptrend.

SPY Weekly, $SPY

With October in the books and heading into the election and FOMC meeting, equity markets experienced a Halloween spooking. Elsewhere look for Gold to continue its uptrend while Crude Oil consolidates at the bottom of a broad range. The US Dollar Index looks to consolidate in its uptrend while US Treasuries pullback in their consolidation. The Shanghai Composite looks to continue the short term move higher while Emerging Markets pullback in their uptrend.

The Volatility Index looks to remain at a neutral level, above the base established this year, likely at least until after the election. This could make for choppy light trading for equity markets to start next week. Their charts look strong on the longer timeframe though. On the shorter timeframe both the QQQ and SPY have reset momentum measures lower and could reverse or turn bearish, likely a couple of days’ time will tell. The IWM does not seem concerned about an election or Fed policy churning sideways. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview November 1, 2024

25 notes

·

View notes