#Trade for Forex

Explore tagged Tumblr posts

Text

Best Platforms to Trade for Forex in 2025

Forex trading continues to captivate traders worldwide, offering a dynamic and lucrative avenue for financial growth. In 2025, identifying the best platforms to trade for forex has become more crucial than ever, as technology and market demands evolve. From user-friendly interfaces to advanced tools for technical analysis, these platforms are tailored to meet the needs of both novice and seasoned traders. Whether you're diving into major currency pairs, exploring exotic options, or utilizing automated trading strategies, choosing the right platform is the foundation for success.

Core Features of Top Forex Trading Platforms

Forex trading platforms in 2025 must combine advanced functionality with accessibility to meet diverse trader needs. The following core features highlight what distinguishes the best platforms.

User-Friendly Interface

A user-friendly interface enhances efficiency and reduces errors, especially for beginners. Key features include:

Intuitive navigation for rapid trade execution.

Customizable layouts to match user preferences.

Comprehensive tutorials for ease of onboarding.

Efficient design with minimal lag, even during high volatility.

Example Platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are renowned for streamlined interfaces designed to accommodate traders at all levels.

Comprehensive Charting Tools

Forex trading requires precision, and advanced charting tools are critical for analysis. The following charting tools enhance strategy formulation:

Drawing Tools: Support for trendlines and channels.

Indicators: Integration of MACD, RSI, Bollinger Bands, and Fibonacci Retracement.

Timeframes: Options to analyze data across multiple periods.

Custom Indicators: Flexibility to program and integrate personal strategies.

Automation and Algorithmic Trading

Automation is indispensable for modern forex trading. Platforms like cTrader and NinjaTrader excel with features like:

Pre-built Strategies: Ready-to-use templates for scalping and trend following.

Custom Algorithms: Integration with programming languages such as C# and Python.

Backtesting: Evaluate strategies with historical data.

Integration with APIs: Seamless syncing with advanced trading bots.

Mobile Accessibility

Forex traders increasingly require the flexibility of trading on-the-go. Mobile accessibility ensures:

Synchronization: Real-time updates between desktop and mobile devices.

Push Notifications: Alerts for market changes and trade execution.

Compact Design: Optimized for smaller screens without losing functionality.

App Examples: MT4 and MT5 apps, offering full trading capabilities on iOS and Android.

Key Takeaway: Platforms combining a robust desktop experience with seamless mobile integration empower traders with unmatched convenience.

The best forex trading platforms for 2025 excel in usability, advanced charting, automation, and mobile functionality. By integrating these features, platforms like MT5, cTrader, and TradingView offer versatile solutions for traders of all expertise levels.

Trading Instruments Supported by Leading Platforms

The diversity of trading instruments available on forex platforms is crucial for building effective strategies and achieving long-term trading success. This section explores the breadth and advantages of various trading instruments.

1. Major Currency Pairs

Major currency pairs, such as EUR/USD, USD/JPY, and GBP/USD, dominate forex markets due to their high liquidity and tighter spreads. Leading platforms like MetaTrader 5 and TradingView offer advanced tools for analyzing these pairs, enabling traders to capitalize on predictable movements.

Key Features:

High liquidity ensures minimal price fluctuations during trades.

Access to real-time market data for precise decision-making.

Supported by most trading strategies, including scalping and swing trading.

These pairs are ideal for traders seeking consistent opportunities in stable market conditions.

2. Exotic Pairs

Exotic pairs combine major currencies with currencies from emerging markets, such as USD/TRY or EUR/SEK. While they offer higher potential rewards, they also come with increased volatility and wider spreads.

Risks and Rewards:

Volatility: Significant price movements create potential for larger profits.

Higher Spreads: Costs can be prohibitive for short-term trading strategies.

Economic Dependence: Price movements often correlate with specific geopolitical or economic conditions.

Platforms like cTrader often feature analytical tools tailored for exotic pair trading, helping traders manage the associated risks.

3. CFDs and Futures

Contracts for Difference (CFDs) and futures are derivatives enabling traders to speculate on forex price movements without owning the underlying assets. Futures contracts are often traded on platforms like NinjaTrader, while CFDs are supported on MetaTrader platforms.

CFDs vs. Futures in Forex Trading

Wider spreads but no commissionCommissions and exchange fees

CFDs and futures cater to traders seeking flexibility and hedging opportunities in volatile markets.

4. Spot Forex vs. Forward Contracts

Spot forex trades settle instantly at prevailing market rates, making them ideal for day traders. Forward contracts, however, lock in future exchange rates and are often used by businesses to hedge against currency fluctuations.

Spot Forex:

Instant execution for quick trades.

Supported by platforms like TradingView, which offers robust charting tools.

Forward Contracts:

Customizable settlement dates.

Reduced risk of unfavorable exchange rate changes.

Forward contracts are frequently utilized for long-term strategies requiring stability.

5. Options Trading in Forex

Forex options provide traders the right, but not the obligation, to buy or sell currencies at a predetermined price. Options trading is supported on platforms like MetaTrader 5, offering flexibility for speculative and hedging strategies.

Advantages:

Defined risk due to limited loss potential.

Compatibility with advanced trading strategies like straddles and strangles.

Access to multiple expiration dates for tailored strategies.

Options trading is an excellent choice for traders seeking diversification and controlled risk in uncertain markets.

Market Indicators for Effective Forex Trading Forex trading in 2025 requires mastery of market indicators for successful trades. Platforms integrating technical tools like RSI, Bollinger Bands, and Fibonacci retracements provide invaluable support for analyzing currency pairs and spotting trends.

1: Moving Averages and RSI

Moving averages and RSI (Relative Strength Index) are staples in forex trading for spotting trends and identifying overbought or oversold market conditions. Here's how they work:

Moving Averages:

Smooth out price data for better trend analysis.

Common types: Simple Moving Average (SMA) and Exponential Moving Average (EMA).

Platforms like MetaTrader 5 (MT5) allow customizable moving average periods for traders’ needs.

RSI:

Measures the speed and change of price movements.

Values above 70 indicate overbought conditions, while below 30 signals oversold.

Both indicators are excellent for detecting market reversals and consolidations, making them essential for scalping and swing trading strategies.

2: Bollinger Bands and Fibonacci Retracements

Bollinger Bands and Fibonacci retracements are complementary tools for determining price ranges and potential reversals.

Bollinger Bands:

Comprised of a central moving average and two bands (standard deviations).

Highlights volatility and identifies breakout opportunities in exotic pairs and minor pairs.

Fibonacci Retracements:

Based on key levels derived from the Fibonacci sequence (23.6%, 38.2%, 61.8%, etc.).

Used to forecast retracement zones for entry and exit points.

Platforms like TradingView provide advanced integration of these tools for technical analysis.

3: Pivot Points and Volume Analysis

Pivot points and volume analysis serve as complementary methods for intraday traders.

Pivot Points:

Calculate potential support and resistance levels based on previous trading sessions.

Widely used in day trading to set intraday targets.

Volume Analysis:

Measures market activity to validate price movements.

Higher volume during breakouts confirms trends.

Together, these indicators help traders plan risk-reward ratios effectively and refine strategies. Platforms offering integrated market indicators like RSI, Fibonacci retracements, and volume analysis provide forex traders with precise insights for decision-making. Combining these tools with strategic risk management and discipline ensures a competitive edge in forex trading for 2025.

Risk Management Tools in Forex Platforms

Risk management is the cornerstone of sustainable forex trading. Platforms offering advanced tools like Stop-Loss Orders and Position Sizing empower traders to mitigate risks while optimizing potential gains.

1. Stop-Loss Orders

Stop-loss orders safeguard capital by automatically closing trades at pre-set levels. Key benefits include:

Capital Protection: Prevents losses from spiraling during volatile markets.

Emotional Discipline: Reduces impulsive decisions by automating exit points.

Wide Platform Integration: Available on MetaTrader 4, TradingView, and cTrader for seamless trading execution.

2. Take-Profit Orders

Take-profit orders lock in profits when the market reaches a target price. Steps for setting take-profit orders effectively:

Analyze Moving Averages and RSI to determine target levels.

Input the price level in trading platforms like NinjaTrader or MT5.

Monitor trade performance and adjust as needed.

3. Position Sizing Calculators

Accurate position sizing minimizes overexposure to any single trade. Here’s how these calculators work:

Calculate lot sizes based on account balance, risk percentage, and stop-loss distance.

Adjust trade sizes to align with Risk-Reward Ratios.

Enable traders to maintain diversified exposure.

4. Risk-Reward Ratio Analysis

Risk-reward ratios evaluate trade viability by comparing potential profits to losses. Tips for effective use:

Aim for a minimum ratio of 1:2 or higher.

Utilize tools like Bollinger Bands to estimate price movements.

Integrated calculators on platforms like MT4 simplify these computations.

5. Diversification Tools

Diversification spreads risk across multiple trading instruments. Features on platforms include:

Multi-asset trading options: CFDs, Futures, and Currency Pairs.

Portfolio analysis tools to track exposure by instrument type.

Real-time updates for Exotic Pairs and niche markets.

6. Backtesting Strategies

Backtesting allows traders to evaluate strategies using historical data. Its advantages are:

Testing risk management techniques like Stop-Loss Orders without live market risk.

Platforms such as TradingView support customizable backtesting scripts.

Insights into strategy weaknesses improve long-term profitability.

With advanced tools for Stop-Loss Orders, Position Sizing, and Backtesting, modern forex trading platforms empower traders to proactively manage risks. Leveraging these features leads to more disciplined and effective trading.

Psychological and Strategic Insights for Forex Trading

Mastering trading psychology is key to navigating the complexities of forex. Platforms enhance this through features that promote discipline, performance tracking, and trader confidence, empowering strategic growth and mitigating psychological pitfalls.

Building Discipline Through Alerts

Platforms offering robust alert systems, like MetaTrader 5, help instill discipline by:

Preventing Overtrading: Custom alerts signal market entry points, limiting impulsive trades.

Time Management: Reminders help traders stick to predefined schedules.

Market Trend Notifications: Alerts for moving averages or Relative Strength Index (RSI) changes enable focused decisions.

Tracking Performance Metrics

Trading platforms integrate tools that help traders evaluate performance, including:

Win/Loss Ratio Analysis: Shows trade success rates.

Equity Curve Monitoring: Visualizes account performance trends.

Journal Features: Logs trade entries and exits for review.

Customizable Dashboards

Platforms like TradingView allow traders to configure dashboards by:

Adding favorite currency pairs and indicators like MACD or Bollinger Bands.

Creating multi-screen setups to monitor multiple trades.

Integrating news feeds to stay updated with central bank announcements.

Educational Resources

The inclusion of in-platform education fosters confidence through:

Interactive Tutorials: Step-by-step videos on strategies like swing trading or technical analysis.

Webinars and Live Sessions: Experts discuss trading instruments like CFDs and options.

AI-based Learning Modules: Adaptive lessons based on trader performance.

By integrating tools for discipline, self-awareness, and strategy refinement, trading platforms empower users to overcome psychological challenges, enhance risk management, and make data-driven decisions for long-term success.

Conclusion

Forex trading in 2025 offers exciting opportunities, but success begins with choosing the right platform. As highlighted throughout this content pillar, top trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView stand out for their robust features, diverse trading instruments, and advanced integrations. These platforms empower traders to navigate the complexities of the forex market through tools such as technical indicators like Moving Averages and RSI, risk management solutions like stop-loss orders and position sizing calculators, and integrations with vital economic indicators such as GDP, inflation, and central bank announcements.

The best forex trading platforms not only provide access to currency pairs, CFDs, and other instruments but also integrate cutting-edge charting tools, educational resources, and analytics to build confidence and discipline—critical factors in mastering the psychological demands of trading.

By understanding the interplay between platform features, market tools, and strategy development, traders can optimize their approach to trading forex in 2025. Whether you're focused on scalping, day trading, or long-term swing trading, the right platform will be your foundation for executing trades effectively, managing risk, and staying informed in a fast-paced market.

Take the insights from this guide to make an informed decision, choosing a platform that aligns with your trading goals and enhances your ability to trade forex with precision and confidence. With the right tools and strategies in hand, you're poised to navigate the evolving forex market and unlock its full potential in 2025 and beyond.

2 notes

·

View notes

Text

How to Choose the Best Broker for Stock, Forex, and Crypto Trading in 2024?

Navigating the world of trading can be overwhelming, especially when it comes to selecting the right broker to meet your trading requirements. Whether you’re interested in stocks, forex, or cryptocurrencies, the choice of broker can significantly impact your trading experience and success. In this post, we’ll explore the key factors to consider when choosing a broker and introduce you to ForexJudge.com, a reliable resource that offers comprehensive reviews and detailed analysis of the world’s best brokers.

Factors to Consider When Choosing a Broker

Regulation and Security:

Ensure the broker is regulated by a reputable financial authority. Regulation provides a level of security and oversight, protecting you from fraudulent activities.

Look for brokers that offer robust security measures, including encryption and two-factor authentication, to safeguard your funds and personal information.

Trading Platform:

A good trading platform should be user-friendly, reliable, and equipped with essential tools for analysis and trading.

Consider whether the platform offers mobile compatibility if you plan to trade on-the-go.

Fees and Commissions:

Compare the fees and commissions charged by different brokers. Lower fees can significantly enhance your profitability, especially if you trade frequently.

Be aware of hidden fees, such as withdrawal charges, inactivity fees, or charges for additional services.

Range of Assets:

Ensure the broker offers the range of assets you’re interested in trading. If you plan to diversify your portfolio, choose a broker that provides access to stocks, forex, and cryptocurrencies.

Some brokers specialize in specific asset classes, so make sure your chosen broker aligns with your trading preferences.

Customer Support:

Reliable customer support is crucial, especially if you encounter issues with your account or trading platform. Look for brokers that offer multiple support channels, including live chat, phone, and email.

Check reviews to gauge the quality and responsiveness of the broker’s customer service.

Education and Resources:

Many brokers offer educational resources such as tutorials, webinars, and market analysis. These resources can be invaluable, especially for beginners.

A broker that provides regular market updates and trading insights can help you stay informed and make better trading decisions.

How ForexJudge.com Can Help

With so many brokers available, making an informed choice can be challenging. This is where ForexJudge.com comes in. ForexJudge is a trusted platform that has compiled detailed reviews and analysis of the world’s best brokers. By providing comprehensive information and user feedback, ForexJudge helps traders make well-informed decisions.

Detailed Broker Reviews

ForexJudge offers in-depth reviews of brokers across various asset classes, including stocks, forex, and cryptocurrencies. Each review covers critical aspects such as regulation, fees, trading platforms, and customer support. By reading these reviews, you can gain valuable insights into the strengths and weaknesses of different brokers, helping you choose the one that best meets your needs.

User Feedback and Ratings

In addition to expert reviews, ForexJudge features user feedback and ratings. This community-driven aspect allows traders to share their experiences and provide honest assessments of brokers. This real-world feedback can offer a clearer picture of what to expect and help you avoid potential pitfalls.

Regular Updates and Alerts

The trading world is dynamic, with brokers frequently updating their services, fees, and policies. ForexJudge keeps you informed with regular updates and alerts, ensuring you have the latest information at your fingertips. This proactive approach helps you stay ahead of the curve and make timely decisions.

Making the Final Decision

When choosing a broker, it’s essential to consider your trading goals, risk tolerance, and preferred asset classes. By leveraging the resources available on ForexJudge, you can make a well-informed decision that aligns with your trading strategy.

Steps to Follow:

Identify Your Needs:

Determine what you want to trade (stocks, forex, crypto) and what features are most important to you (low fees, robust platform, educational resources).

Research and Compare:

Use ForexJudge’s detailed reviews and user feedback to compare different brokers. Pay close attention to factors such as regulation, fees, and customer support.

Test the Platform:

Many brokers offer demo accounts. Use these to test the trading platform and ensure it meets your needs before committing real funds.

Start Small:

When you choose a broker, start with a small investment to test the waters. As you gain confidence and experience, you can increase your trading capital.

Conclusion

Choosing the right broker is a crucial step in your trading journey. By considering factors such as regulation, fees, trading platforms, and customer support, you can make an informed choice that enhances your trading experience.

For a reliable resource in your broker selection process, turn to ForexJudge.com. With its comprehensive reviews, user feedback, and regular updates, ForexJudge provides the insights you need to make the best decision for your trading needs.

Happy trading, and may your investments be fruitful!

#Forex Trading Reviews#Best Forex Brokers#Crypto trading#Financial News Services#Forex Trading Forum#How to get money back from Forex scam#Forex Scams#Crypto Scams#Best Forex Trading Platforms#Financial Calendar

145 notes

·

View notes

Text

Time to take this office apart ft my needy little helper I won't miss much about this office, but I will definitely miss the stunning view and the breathtaking sunrises I had every morning. I haven't decided whereabouts my office will be going in my new house yet but I'm looking forward to switching things up and creating my brand new trading den ⚫.

#forexmarket#forextrading#forexstrategy#forex#bitcoin#free usdt#cryptocurrency#cryptonews#crypto#stock market#stock trading#investment#learnsomethingneweveryday#learn forex trading

44 notes

·

View notes

Text

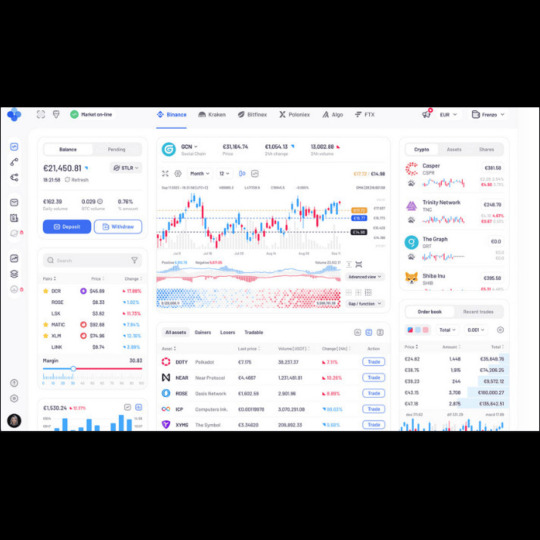

i have a profitable crypto bot that can trade automatically on your account

4 notes

·

View notes

Text

Crypto Meets Forex: Navigating Risks and Opportunities in 2025

Based on my experiences, I have seen various innovations of money with Bitcoin and other cryptocurrencies bringing major changes in the financial market. The overall flow of bitcoins is now stronger, and fluctuations in coins such as Polkadot or Dogecoin increase — all this affects the Forex market. This is where we traders get both the challenge and the thrill to perform, but with the right strategic plans in place, it is a brilliant chance to expand.

Why Crypto is Vital for Forex Traders

In the fast-paced world of trading, volatility is where the action is, and crypto delivers that in spades. While Forex markets move with global economic trends, crypto thrives on sentiment and speculation, making it a goldmine for those who know how to adapt.

Volatility Creates Opportunities: Coins like Bitcoin can swing dramatically in a single day, offering quick wins for prepared traders.

Crypto-Fiat Connections: Bitcoin’s rise often hints at movements in fiat pairs like EUR/USD or USD/JPY.

2025 — A Game-Changer: With Bitcoin adoption growing, I believe the next few years could redefine how crypto and Forex markets interact.

How I Approach the Crypto-Forex Connection

Stay Informed: Whether it’s new regulations in Europe or tech updates from Silicon Valley, the crypto market moves fast. Keeping up with global news helps me anticipate opportunities.

Manage Risk Like a Pro: Crypto’s volatility is thrilling, but it’s also risky. I use tools like stop-loss orders and position sizing to protect my capital while staying in the game.

Watch Market Overlaps: When Bitcoin rallies, I often notice shifts in fiat currencies. Understanding these connections can turn crypto trends into Forex profits.

Adapt My Strategy: Adding crypto pairs like BTC/USD or ETH/EUR to my portfolio has opened new doors. It’s a way to diversify and catch moves I might have missed otherwise.

Why I Trust ORION Wealth Academy

For me, trading is about constant learning and growth, and ORION Wealth Academy has been a game-changer. Their approach to Forex and crypto education is unmatched, offering tools and strategies that work for traders at all levels.

Here’s what makes ORION stand out: ✅ Expert coaching on navigating both crypto and Forex markets. ✅ Daily analysis to stay on top of key trends like Bitcoin’s momentum. ✅ Practical lessons tailored to beginners and seasoned traders alike. ✅ Weekly signals that help me spot opportunities in this fast-moving landscape.

ORION doesn’t just teach you how to trade — it prepares you to excel in markets where crypto and Forex intersect.

Looking Ahead to 2025

As we move into 2025, the relationship between crypto and Forex will only grow stronger. Here in France, I see more traders adapting to these changes, ready to embrace the challenges and opportunities they bring.

If you’re ready to navigate this dynamic market, join ORION Wealth Academy. Their insights and strategies have helped me trade smarter and more confidently.

Start your journey today — because 2025 won’t wait for anyone.

#forexeducation#forexmarket#forex#forextrading#forexbroker#investment#forex online trading#forexsignals#forextips

6 notes

·

View notes

Text

4 notes

·

View notes

Text

How do I copy Telegram Signals to MT4?

To copy Telegram signals to MT4, you need a Telegram Signal Copier, which automates trade execution from Telegram messages to your MT4 account.

First, Install the TSC software on your PC or VPS, then connect your Telegram account using an API key or login credentials. Link your MT4 account by entering your broker details.

Next, configure your trade settings, including lot size, risk management, and trade filters. Enable auto-trading to ensure orders are executed instantly. Monitor trade execution logs and adjust settings as needed to optimize performance.

For the best results, use a low-latency VPS to minimize delays. A good copier should support multiple signal formats like "BUY EUR/USD @ 1.0850 SL 1.0800 TP 1.0900" and include features like image recognition and multi-Take Profit levels.

If you're looking for a reliable copier, Telegram Signal Copier (TSC) is a great choice, offering advanced features such as image signal detection, risk-based position sizing, and instant trade execution.

Let me know if you’d like recommendations for the best Telegram Signal Copiers!

#Telegram Signal Copier#TSC#Trade Copier#Signal Copier#Forex Copier#forextrading#forex education#currency markets

3 notes

·

View notes

Text

9 notes

·

View notes

Text

#options trading tips#options trading strategies#options#options trading for beginners#options strategies#trading strategies#trading strategy#trading indicators#options trading#forex market#forex broker#forex education#forexsignals#for example#forextrading#forex#forex analysis#forex expert advisor#forex indicators#forex traders#forextips#forexscalping#crypto business#crypto airdrop#crypto analysis#crypto#crypto ads#crypto advertising#crypto community#crypto currency

5 notes

·

View notes

Text

youtube

Benzinga Interviews NVSTly: The Future of Social Investing

Join Benzinga as they sit down with NVSTly, the cutting-edge platform revolutionizing social trading and investing. In this exclusive interview, NVSTly shares insights on empowering retail traders, fostering transparency, and building a thriving community for investors of all levels. Discover how NVSTly is shaping the future of trading with innovative features, real-time trade tracking, and global collaboration.

Join NVSTly:

Website: nvstly.com

Mobile App: Available on Google Play and App Store

Discord Community: Join Now

#crypto#cryptocurrency#finance#fintech#forex#futures#investing#investors#stock market#startup#business#Youtube#stocks#nasdaq#financial#investing stocks#investment#blockchain#personal finance#finances#economy#economic#forextrading#forex market#futures trading#stock trading#markets#invest#awards#award winning

3 notes

·

View notes

Text

3 notes

·

View notes

Text

أهمية التوصيات في تداول الفوركس

يعد تداول الفوركس واحدًا من أكثر أنواع الاستثمارات شيوعًا في العالم اليوم. ومع ذلك، فإن النجاح في هذا المجال يتطلب معرفة متعمقة وتحليل دقيق للسوق. لذلك، يلجأ العديد من المستثمرين إلى استخدام التوصيات للحصول على توجيهات وإرشادات موثوقة.

يقدم موقع InvestTradeGM خططًا متنوعة تلبي احتياجات جميع المستثمرين، من المبتدئين إلى المحترفين. تتضمن هذه الخطط توصيات فوركس مخصصة تساعد المستثمرين على اتخاذ قرارات مستنيرة وزيادة فرصهم في تحقيق الأرباح.

من خلال الاعتماد على توصيات فوركس من موقع InvestTradeGM، يمكن للمستثمرين الاستفادة من الخبرة والمعرفة العميقة التي يتمتع بها فريق التحليل بالموقع. توفر هذه التوصيات رؤى دقيقة وتحليلات موثوقة للسوق، مما يساعد المستثمرين على تحديد أفضل الفرص واتخاذ القرارات الصحيحة في الوقت المناسب.

فهم أهمية التوصيات

تساعد التوصيات في تقليل المخاطر المرتبطة بتداول الفوركس. عندما تعتمد على التوصيات المقدمة من خبراء ذوي خبرة، يمكنك تجنب الأخطاء الشائعة التي يقع فيها العديد من المبتدئين. التوصيات تعتمد على تحليلات دقيقة للسوق وبيانات موثوقة، مما يساعدك على اتخاذ قرارات مدروسة ومبنية على أسس علمية.

خطط وأسعار متنوعة

يوفر موقع InvestTradeGM خططًا متنوعة تناسب مختلف مستويات المستثمرين. سواء كنت مبتدئًا تتطلع إلى دخول سوق الفوركس لأول مرة، أو كنت مستثمرًا محترفًا تبحث عن استراتيجيات جديدة، ستجد الخطة التي تناسبك.

تشمل الخطط المقدمة مزايا عديدة، مثل التحليلات اليومية للسوق، التوصيات الفورية، وتقارير الأداء. هذه الميزات تساعدك في تحقيق أفضل نتائج ممكنة من استثماراتك.

استراتيجيات تداول متقدمة

تعتمد التوصيات المقدمة من InvestTradeGM على استراتيجيات تداول متقدمة تستند إلى تحليلات دقيقة للسوق. يمكنك الاعتماد على هذه التوصيات لتحديد الفرص المثلى للتداول وتحقيق أرباح مستدامة. بالإضافة إلى ذلك، توفر التوصيات توقعات تستند إلى بيانات موثوقة، مما يساعدك على اتخاذ قرارات مستنيرة.

الدعم الفني والتدريب

إلى جانب التوصيات، يوفر موقع InvestTradeGM دعمًا فنيًا شاملًا وتدريبًا مستمرًا للمستثمرين. يمكنك الاستفادة من الدورات التدريبية وورش العمل التي تركز على تعليمك أساسيات التداول واستراتيجيات الفوركس المتقدمة. هذا التدريب يساعدك على تحسين مهاراتك وزيادة فهمك للسوق، مما يعزز فرصك في تحقيق الأرباح.

بالإضافة إلى ذلك، يوفر الموقع دعمًا فنيًا على مدار الساعة للإجابة على أي استفسارات قد تكون لديك. يمكنك التواصل مع فريق الدعم في أي وقت للحصول على المشورة والتوجيهات اللازمة للتعامل مع أي تحديات قد تواجهك في السوق. هذا الدعم المستمر يضمن أنك لن تكون وحدك في رحلتك الاستثمارية.

توصيات فوركس: أداة النجاح

في الختام، يعتبر الحصول على توصيات فوركس من موقع InvestTradeGM أداة حيوية لكل من يسعى لتحقيق النجاح في سوق الفوركس. هذه التوصيات توفر لك التوجيهات الضرورية لاتخاذ القرارات الصحيحة وتقليل المخاطر. بفضل التحليلات الدقيقة والخبرة الواسعة للفريق، يمكنك الاستفادة من أفضل الفرص الاستثمارية المتاحة وتحقيق أهدافك المالية بثقة ونجاح.

إذا كنت ترغب في تحقيق النجاح في سوق الفوركس، فإن الحصول على التوصيات من مصدر موثوق مثل InvestTradeGM يعد خطوة أساسية. ابدأ اليوم واستفد من الخطط المميزة والأسعار المناسبة لتصبح مستثمرًا ناجحًا في هذا السوق المثير.

11 notes

·

View notes

Text

Here’s a dose of motivation to keep you pushing forward!

3 notes

·

View notes

Text

#forex robot#forex#forextrading#forex market#investing#finance#algo trading#forex expert advisor#invest#financial

13 notes

·

View notes

Text

The trend is your friend! 🫂

Maybe we can turn this into an intro to Forex series. Let me know what you think in the comments 🫶

For more join us:-

#forex#forex education#forexmentor#forex indicators#forexsignals#crypto#forex market#forex expert advisor#forex broker#forexmastery#learn forex trading in jaipur#learn forex trading#trending#market strategy#market analysis

2 notes

·

View notes

Text

4 notes

·

View notes