#Swing trading

Explore tagged Tumblr posts

Text

Enhancing Swing Trading Success with SEBI-Registered Investment Advisors and Strategic Trade Ideas

Introduction

In the dynamic world of stock trading, swing trading has emerged as a favored strategy for investors aiming to capitalize on short- to medium-term price movements. To navigate this approach effectively, leveraging the expertise of SEBI-registered investment advisors and employing well-researched trade ideas can be instrumental in achieving consistent returns.

The Role of SEBI-Registered Investment Advisors

The Securities and Exchange Board of India (SEBI) mandates that investment advisors adhere to stringent qualifications and ethical standards. Engaging with a SEBI registered investment advisor ensures that investors receive unbiased, professional guidance tailored to their financial goals and risk tolerance. These advisors offer insights into market trends, assist in portfolio management, and help in formulating strategies that align with individual investment objectives.

Developing Effective Trade Ideas

Trade ideas are actionable strategies based on thorough analysis of market conditions, technical indicators, and fundamental data. For swing traders, identifying stocks with strong momentum, clear chart patterns, or upcoming catalysts is crucial. Regularly reviewing market conditions and adjusting strategies accordingly ensures alignment with current trends.

Identifying the Best Stocks to Swing Trade

Selecting the right stocks is fundamental to successful swing trading. Traders often look for stocks exhibiting volatility, liquidity, and identifiable patterns. In the Indian market, companies such as Kotak Mahindra Bank, NTPC, and Tata Steel have been highlighted as potential candidates for swing trading due to their market performance.

The Synergy of Expert Guidance and Informed Trade Ideas

Combining the personalized advice of SEBI-registered investment advisors with well-researched trade ideas creates a robust framework for swing trading. Advisors can help tailor strategies to individual needs, while informed trade ideas provide the basis for timely and effective decision-making. This synergy enhances a trader's ability to navigate market fluctuations and capitalize on emerging opportunities.

Conclusion

Incorporating the expertise of SEBI-registered investment advisors and developing effective trade ideas are pivotal components of a successful swing trading strategy. This integrated approach empowers traders to make informed decisions, manage risks proficiently, and work towards achieving their financial goals in the dynamic landscape of the stock market.

0 notes

Text

Unlocking the Power of TradingView: The Best Charting Platform for Traders

A sleek and modern TradingView dashboard displaying real-time charts, candlestick patterns, and powerful technical indicators like RSI and MACD. Are you looking for a powerful, easy-to-use charting tool to enhance your trading? Whether you’re a beginner or an experienced trader, TradingView is one of the best platforms for technical analysis, market insights, and strategy building. And here’s…

#Affiliate Marketing#Automated trading#Candlestick patterns#Crypto trading#Day trading#Forex trading#Investing#MACD#Market analysis#Online trading#passive income#RSI#Stock market#Swing trading#Technical analysis#Trading alerts#Trading bots#Trading platform#Trading signals#Trading strategies#Trading tools#TradingView#TradingView charts#TradingView indicators#TradingView plans#TradingView pricing#TradingView review

0 notes

Text

PERFORMANCE OF CALL TRACKER 🤩🤩 Date - 28TH FEB 2025 Profit - 56975/-🔥🔥 Investment- 40 Lac

#banknifty#stockmarket#banking#bankniftytrading#bankniftypattern#tradingreport#my post#market trends#viralpost#trade results#trade war#earnings#people over profit#global#futures#profitability#stocks#share market#ipo#financenews#swing trading#stock trading#investing stocks#shares#like

0 notes

Text

📈 Master the Forex Market with Patience Consistency beats luck in Forex. The best trades aren’t forced.....they’re executed with precision and patience. Stay disciplined, stay profitable. 💡

PipInfuse - Your expert Forex Trading and Investment management consulting partner

#forex traders#forex analysis#forex market#forex trading#crypto#swing trading#online trading#day trading#investment#pipinfuse

0 notes

Text

4/9-Weekly EMA Crossover Strategy

I recently came across a reddit post from some random guy in Brazil. He mentioned the 4/9 EMA cross was pretty successfull so I wanted to try it.

Period = Weekly Initial Size = $1000 Stop Loss = -$50 Opening Condition = 4 period EMA > 9 period EMA Closing Conditions = Close < 20EMA

0 notes

Text

Unlocking Success: The Best Trading Strategy for Options

Options trading offers a world of opportunities for traders, combining flexibility, leverage, and risk management. However, the key to success lies in identifying and implementing the best trading strategy for options. This article explores proven strategies that can help traders maximize profits while minimizing risks.

Why Options Trading?

Options trading provides traders with the ability to:

Leverage Investments: Control larger positions with less capital.

Manage Risks: Use options to hedge against potential losses.

Adapt to Markets: Profit in bullish, bearish, or neutral conditions.

The best trading strategy for options depends on market trends, volatility, and individual goals.

Top Options Trading Strategies

Bull Call Spread Ideal for bullish markets, this strategy involves buying a call option and selling another at a higher strike price. It reduces costs while capping profits, making it a balanced approach for moderate gains.

Iron Condor This low-risk strategy works well in stable markets. It combines a bull put spread and a bear call spread, allowing traders to profit from minimal price fluctuations.

Straddle Strategy Perfect for high-volatility scenarios, this involves buying both a call and a put option at the same strike price. It allows traders to profit from significant price movements in either direction.

Protective Put A defensive strategy, the protective put is used to safeguard an existing position. By purchasing a put option, traders can limit potential losses while maintaining upside potential.

Covered Call This conservative strategy involves selling call options against owned stock. It generates income through premiums while offering limited upside.

Choosing the Best Strategy

The best trading strategy for options depends on several factors:

Market Conditions: Use bullish strategies like the bull call spread in rising markets and defensive strategies like the protective put in declining ones.

Risk Tolerance: Choose strategies like the iron condor for low risk or the straddle for high-reward scenarios.

Investment Goals: Align strategies with your financial objectives, whether they involve income generation, capital appreciation, or hedging.

Tips for Success in Options Trading

Stay Updated: Monitor market news, earnings reports, and macroeconomic indicators.

Use Technical Analysis: Identify key levels of support, resistance, and trends to time entries and exits effectively.

Practice Risk Management: Always use stop-loss orders and allocate a portion of your portfolio to options.

Diversify: Spread your trades across different strategies and sectors to mitigate risks.

Conclusion

Mastering the best trading strategy for options requires a blend of market knowledge, disciplined execution, and continuous learning. By implementing proven strategies like the bull call spread, iron condor, and protective put, traders can navigate various market conditions with confidence.

Start exploring these strategies today to unlock the full potential of options trading!

0 notes

Text

Get Expert Stock Market Advisory and Daily Trade Ideas That Work

Boost your trading performance with expert trade ideas and a trusted stock market advisory. All our recommendations come from a SEBI registered investment advisor, ensuring compliance and credibility. Discover the best stocks to swing trade, receive actionable tips, and stay updated with market trends��all in one place.

0 notes

Text

youtube

0 notes

Text

Gain valuable insights into trading strategies with comprehensive analysis of markets, industries, and individual companies. Wealthspikes will teach you how to make informed decisions, understanding the nuances of buying, selling, and profiting across diverse financial markets.

You'll explore methods to assess market trends, evaluate industry growth, and analyze corporate performance, giving you the skills needed to navigate complex financial landscapes confidently. Whether you're interested in stocks, forex, commodities, or other markets, this course covers the essential strategies and tools to trade effectively and maximize your profits with clarity and ease.

#Trading strategies#Financial instruments#Currencies trading#Derivatives trading#Day trading#Swing trading#investing#investing strategies#make money daily#trading consultation#trading services#wealth growth

1 note

·

View note

Text

Weekly RSI Ascending/Descending (pt2)

Using daily candles for better precision. A continuation of https://www.tumblr.com/patrickbatoon/772173459217383424/weekly-rsi-ascendingdescending?source=share

---

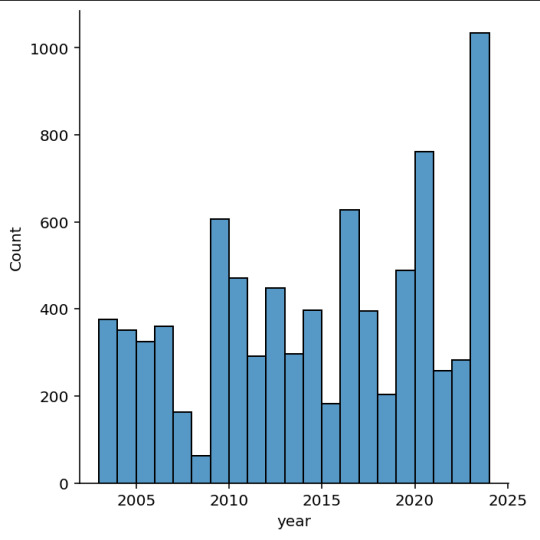

The Weekly RSI trend strategy was incredibly promising, so I wanted to take this further with more granular data. For this exploration I ended up using Daily candle data of the Russell1000 with the same timeframe of 01-JAN-2020 to 01-JAN-2025

The core strategy remains the same:

Entry: 3 consecutive increases in weekly RSI(14) using RSI-smoothed(14). For daily candles this can be computed using RSI(70) and RSI-smoothed(70).

Exit: Close < EMA20: If the close of the stock crosses below the 20-day EMA, fully exit the position.

I ended up removing the 50-week EMA filter since I found it excludes key reversals.

Broad market entry conditions as filters:

$VIX - week over week decrease. The VIX measures expected 1-year volatility as a percentage. Increases in this measure is driven by Put/Call options pricing, however its primarily associated with Put buying for downside protection

$RSP - Closeempirically found that this acts as a filter for potential key reversals and breakouts

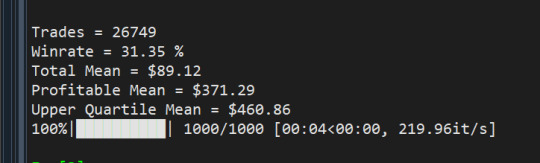

Results:

From 01-JAN-2020 to 01-JAN-2025 it appears that the winrate is much lower than the weekly backtests suggested, but it ends up catching more false signals on the day-to-day.

Trades = 6420 Winrate = 35.72 % Total Mean = $39.84 Profitable Mean = $194.94 Upper Quartile Mean = $266.74

From 01-JAN-2020 to 01-JAN-2025

Trades = 19168 Winrate = 38.62 % Total Mean = $40.43 Profitable Mean = $177.11 Upper Quartile Mean = $257.12

---

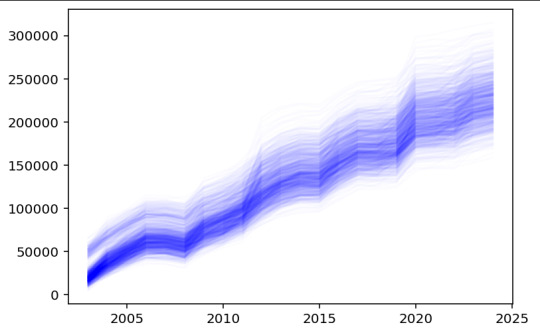

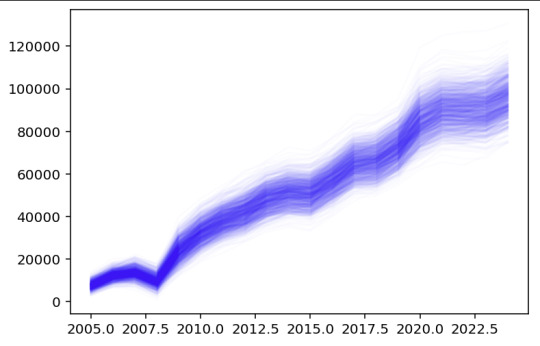

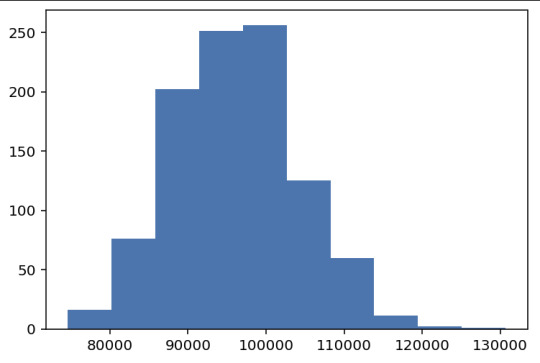

Lastly, with the vast number of trades included in the backtest, I wanted to simulate the universe of possible outcomes through a Monte Carlo simulation. This was done by sampling 120 trades per year (10 trades per month) and determining the portfolio growth.

0 notes

Text

Major News Ahead of IPL 2025 Mega Auction: Will Rishabh Pant Play for RCB? Is His Exit from Delhi Capitals Really on the Cards? With the heat rising for the massive preparation of IPL 2025, this question is bound to pop up: Will Rishabh Pant move to Royal Challengers Bangalore? This is widely floated in the trending speculations about his future with Delhi Capitals. Let's discuss this and see if Pant is really leaving Delhi Capitals or not. https://battleroof.com/opinion-battle

#opinion trading#option trading#swing trading#cricket#rishabh pant#IPL 2025#ipl mega auction#bcci#cricketfans#fans opinion

0 notes

Text

Mastering the Markets: The Importance of Stock Market Advisory, SEBI Registered Investment Advisors, and Strategic Trade Ideas

Navigating the complexities of the financial markets can be daunting for beginners and seasoned investors alike. With constant market fluctuations, economic changes, and a vast array of investment instruments, having access to professional insights is not just a luxury—it's a necessity. This is where stock market advisory services, guidance from a SEBI registered investment advisor, and actionable Trade Ideas come into play.

Understanding Stock Market Advisory Services

Stock market advisory services offer tailored financial guidance and recommendations to help investors make informed decisions. These services typically include equity research, portfolio management suggestions, risk analysis, and timely stock alerts. Whether you are looking to build long-term wealth or engage in short-term trading, these advisories help optimize your strategy based on market trends and individual risk appetite.

What sets a good advisory apart is their ability to interpret market signals and convert them into actionable insights. They remove the guesswork from investing, empowering clients with the confidence to execute profitable trades and build resilient portfolios.

The Role of a SEBI Registered Investment Advisor

The Securities and Exchange Board of India (SEBI) mandates strict guidelines for anyone offering investment advice. A SEBI registered investment advisor is someone who complies with these regulations and provides professional, ethical, and transparent advice.

Choosing a SEBI registered advisor ensures you are receiving unbiased recommendations based on your financial goals, not commissions. These advisors go through a rigorous certification process, ensuring they possess the knowledge, skills, and accountability to assist investors in making the right decisions.

By working with a SEBI registered investment advisor, investors gain access to strategies that are compliant with the latest legal frameworks and grounded in robust financial analysis. This adds an essential layer of trust and security to your investment journey.

Why Trade Ideas Matter

The financial markets are vast, and spotting the best opportunities often requires time, experience, and advanced tools. This is where curated Trade Ideas play a crucial role.

Whether you are a swing trader, a momentum investor, or a value seeker, timely Trade Ideas help identify entry and exit points for high-potential stocks. These ideas are backed by technical and fundamental analysis, giving traders a competitive edge.

High-quality trade ideas not only reduce research time but also enhance decision-making with real-time data, indicators, and expert opinions. In essence, they bring clarity to market noise and offer a structured way to approach trading.

Integrating All Three for Investment Success

The synergy between stock market advisory services, a SEBI registered investment advisor, and expert Trade Ideas creates a solid foundation for any investor. This trio ensures that your investment approach is data-driven, compliant, and geared toward your personal goals.

Whether you are just starting out or looking to refine your existing strategy, leveraging professional advisory services, trusted regulatory-backed advice, and actionable trade ideas can significantly improve your market outcomes.

Conclusion

In today’s fast-paced market environment, relying on gut instinct alone is no longer sufficient. The combination of reliable stock market advisory, guidance from a SEBI registered investment advisor, and access to powerful Trade Ideas gives investors the edge they need to thrive. As markets continue to evolve, so too should your approach—and these tools can guide you every step of the way.

0 notes