#forex indicators volume

Explore tagged Tumblr posts

Text

Sniper entry Scalper mode on #XAUUSD Gold Signal M1 Timeframe MT4. Non Repaint signals more info in official Website: wWw.ForexCashpowerIndicator.com . Cashpower Indicator Lifetime license one-time fee with No Lag & Non Repaint buy and sell powerful Signals with Smart algorithms that emit signals in big trades volume zones. . ✅ NO Monthly Fees ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notifications 🔥 Powerful & Profitable AUTO-Trade Option . ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

#indicatorforex#forexindicator#forexsignals#cashpowerindicator#forex#forextradesystem#forexindicators#forexprofits#forexvolumeindicators#forexchartindicators#forex trading xauusd#forex indicators volume#forex indicators macd#forex bollinger bands#forex rsi#forex fibonacci

2 notes

·

View notes

Text

Reversal Trading: Forex Trading Strategy Explained

In the dynamic world of forex trading, strategies are essential for navigating the volatile market. One such effective strategy is reversal trading. This technique involves identifying points at which a trend is likely to reverse direction. Understanding and mastering this strategy can provide traders with significant advantages, enabling them to capitalize on market shifts. This article delves…

#Candlestick Patterns#Divergence#Downtrend#Entry and Exit Points#Fibonacci Retracement#Forex#Forex Strategy#Forex Trading#Geopolitical Events#Market Conditions#Market Indicators#Market Sentiment#Moving Average#Overtrading#Price Movements#Profitability#Relative Strength#Reversal Signals#Reversal Trading#Risk Management#RSI#Stop-Loss#Support And Resistance#Trading Strategy#Trading Techniques#Trading Volume#Trend Following#Uptrend#Volume Analysis

0 notes

Text

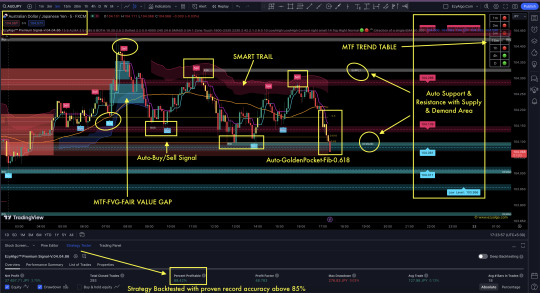

without taking any risks and using a consistently successful strategy? What are some strategies or tools that can achieve this?

Leverage Key Levels and Signals with (EzyAlgo) Premium Indicator for AUD/JPY Trading Success!-Full Strategy Explained in Details

Key Insights:

Support and Resistance Levels: Support: Key levels where AUD/JPY might find buying interest and halt its decline. Resistance: Levels where selling pressure might emerge, potentially stopping upward movement.

Trend Analysis: Indicates if AUD/JPY is in an upward (bullish), downward (bearish), or sideways (consolidating) trend.

Trading Signals: Buy Signal: Indicates a potential upward movement, suggesting entering long positions.Sell Signal: Indicates a potential downward movement, suggesting entering short positions.

Volatility Insights: Provides information on expected price volatility to help manage risk and position sizes.

Timeframe Consideration: Signals are relevant to specific timeframes (e.g., intraday, daily, weekly) and should align with your trading strategy.

EzyAlgo Premium Indicator Singly Proven & Backtested with above 80–85% accuracy always, regardless of whether the market is sideways or trending. It offers perfect entry after detecting major key levels at confluence points. Here are the rules:

Key Levels:

Buy/Sell Signal must be generated.

Signal must be above Demand Area with POI (Point of Interest) Level.

Identified Swing High/Low to determine the trend.

Wait for Trend Tracker Confirmation with Color change or signal candle closing above Tracker.

Green Dot must be generated nearby within 1–3 candles in our EzyAlgo Trend Oscillator.

Extra Key Levels:

Trendline support.

Auto Golden Pocket Area (-0.618) met in the same place.

If all these conditions are met, it constitutes a 90% accurate signal. Otherwise, no trades are initiated. The indicator also highlights key levels for additional confirmation.

This strategy aims to provide a robust framework for identifying trading opportunities and optimizing trades

Get Access to EzyAlgo indicators: https://ezyalgo.com/Join our Free Telegram Channel: https://t.me/EzyAlgoSolutionsJoin our WhatsApp Channel: https://wa.me/message/HTHBVTMYZRJEO1

#forexsignals#forex trading#forex market#forex education#forex indicators#tradingview#tradingviewindicator#indicator#technical analysis#volume profile#candlestick#stock market

1 note

·

View note

Text

Gulf Brokers Reviews : LEGIT or Scam?

Gulfbrokers offer trading of forex, futures, shares, indices and commodities with focus on hydrocarbons and metals. Main advantage of this broker is a wide spread of possible leverage trading. Possible leverage goes as high as 1:500. This means that demanding investors can close their high risk/ high reward deals through this platform.

Services

Considerable advantage of gulbrokers.ae is that there are no fees on deposits or withdrawals while trading through their platform. There are no universal trading rules as every instrument has its own specific set of terms and conditions.

Trading information

Gulfbrokers.ae offers a choice between app and web based (phones and desktops) clients. Both clients run on MT 5 platform which is nowadays standard. Thirty days demo is also available. It is more than enough time for a tryout. Signing up is fast and easy. It is necessary to input some personal information after which you immediately receive an email with your login information. The whole process is easy.

Both applications are lean and easy to use. There are two ways of using them. The traditional one is achieved by either right clicking anywhere in the application and selecting the new order options, or by clicking on the corresponding button on the top menu. This calls up a menu in which you select various parameters of the trade such as: take profit, volume or deviation. Moreover, there is also a possibility of fast trading by enabling the one click trading function, which will allow you to quickly process a large number of trades.

2 notes

·

View notes

Text

"Navigating Financial Markets: A Beginner's Guide to Investment Success"

Financial markets refer broadly to any marketplace where securities trading occurs, including the stock market, bond market, forex market, and derivatives market. Financial markets are vital to the smooth operation of capitalist economies.

What Are Financial Markets?

Financial Markets include any place or system that provides buyers and sellers the means to trade financial instruments, including bonds, equities, the various international currencies, and derivatives. Financial markets facilitate the interaction between those who need capital with those who have capital to invest.

Types of Financial Markets

There are several different types of markets. Each one focuses on the types and classes of instruments available on it.The following are different types of financial markets:

Stock Market.

Bond market.

Foreign Exchange Markets.

Commodity markets.

Derivative Market.

Futures Market.

Over-the-counter (OTC) Market.

Stock Market

Perhaps the most ubiquitous of financial markets are stock markets. These are venues where companies list their shares, which are bought and sold by traders and investors. Stock markets, or equities markets, are used by companies to raise capital and by investors to search for returns. Most stock trading is done via regulated exchanges, which plays an important economic role because it is another way for money to flow through the economy.

Bond market

Bonds are issued by corporations as well as by municipalities, states, and sovereign governments to finance projects and operations.For example, the bond market sells securities such as notes and bills issued by the United States Treasury. The bond market is also called the debt, credit, or fixed-income market.

Foreign Exchange Markets.

The Foreign Exchange Market (commonly known as the Forex Market or FX Market) is a global decentralized marketplace where currencies are traded. It is the largest financial market in the world, with a daily trading volume exceeding $7 trillion as of recent estimates. The Forex market operates 24 hours a day, five days a week, enabling participants from different time zones to engage in trading activities continuously.

Commodity Markets

Commodities markets are venues where producers and consumers meet to exchange physical commodities such as agricultural products (e.g., corn, livestock, soybeans), energy products (oil, gas, carbon credits), precious metals (gold, silver,platinum).

These are known as spot commodity markets, where physical goods are exchanged for money.However, the bulk of trading in these commodities takes place on derivatives markets that utilize spot commodities as the underlying assets.

Derivative Market

Derivatives are financial instruments whose value is derived from an underlying asset or a group of assets. These assets range from stocks, bonds, commodities, currencies, interest rates, or market indices. The derivatives market is a financial marketplace where derivative contracts are bought and sold.

A derivative is a contract between two or more parties whose value is based on an agreed-upon underlying financial asset (like a security) or set of assets (like an index).Rather than trading stocks directly, a derivatives market trades in futures and options contracts and other advanced financial products that derive their value from underlying instruments like bonds, commodities, currencies, interest rates, market indexes, and stocks.

Futures Market

Futures markets are where futures contracts are listed and traded. Unlike forwards, which trade OTC, futures markets utilize standardized contract specifications, are well-regulated, and use clearinghouses to settle and confirm trades.

Options markets, such as the Chicago Board Options Exchange (CBOE), similarly list and regulate options contracts. Both futures and options exchanges may list contracts on various asset classes, such as equities, fixed-income securities, commodities, and so on.

OTC Market

An over- the- counter (OTC) market is a decentralized market—meaning it does not have physical locations, and trading is conducted electronically—in which market participants trade securities directly (meaning without a broker).While OTC markets may handle trading in certain stocks (e.g., smaller or riskier companies that do not meet the listing criteria of exchanges), most stock trading is done via exchanges.

Certain derivatives markets, however, are exclusively OTC, making up an essential segment of the financial markets. Broadly speaking, OTC markets and the transactions that occur in them are far less regulated, less liquid, and more opaque.

Examples of Financial Markets

The above sections make clear that the "financial markets" are broad in scope and scale. To give two more concrete examples, we will consider the role of stock markets in bringing a company to IPO and the role of the OTC derivatives market in the 2008-09 financial crisis.

How Do Financial Markets Work?

Despite covering many different asset classes and having various structures and regulations, all financial markets work essentially by bringing together buyers and sellers in some asset or contract and allowing them to trade with one another. This is often done through an auction or price - discovery mechanism.

What Are the Main Functions of Financial Markets?

Financial markets exist for several reasons, but the most fundamental function is to allow for the efficient allocation of capital and assets in a financial economy. By allowing a free market for the flow of capital, financial obligations, and money, the financial markets make the global economy run more smoothly while allowing investors to participate in capital gains over time.

The Bottom Line

Financial markets provide liquidity, capital, and participation that are essential for economic growth and stability. Without financial markets, capital could not be allocated efficiently, and economic activity such as commerce and trade, investments, and growth opportunities would be greatly diminished.

Many players make markets an essential part of the economy—firms use stock and bond markets to raise capital from investors. Speculators look to various asset classes to make directional bets on future prices.

At the same time, hedgers use derivatives markets to mitigate various risks, and arbitrageurs seek to take advantage of mispricings or anomalies observed across various markets. Brokers often act as mediators that bring buyers and sellers together, earning a commission or fee for their services.

Compete Risk Free with $100,000 in Virtual Cash

Put your trading skills to the test with our free stock simulator. Compete with thousands of Investopedia traders and trade your way to the top! Submit trades in a virtual environment before you start risking your own money. Practice trading strategies so that when you're ready to enter the real market, you've had the practice you need.

Steps to Begin Investing in Financial Markets

Educate Yourself:

Learn the basics of financial instruments and how markets operate. Books, online courses, and tutorials are excellent resources.

Set Clear Goals:

Define your investment objectives, whether it’s saving for retirement, purchasing a home, or building wealth.

Determine Your Risk Tolerance:

Assess how much risk you’re comfortable taking. Younger investors might take more risks, while those nearing retirement may prefer safer investments.

Choose the Right Market:

Decide whether to focus on stocks, bonds, forex, or a mix, depending on your goals.

Open a Trading Account:

Select a reputable broker or trading platform that aligns with your investment preferences and provides user-friendly tools.

Start Small:

Begin with modest investments to gain experience and confidence.

Monitor and Adjust:

Keep track of your portfolio’s performance and make adjustments as needed to stay on track with your goals.

Common Mistakes to Avoid

Lack of Research:

Investing without understanding the market or the asset can lead to losses.

Overtrading:

Frequent buying and selling can erode returns due to fees and poor timing.

Ignoring Risk Management:

Always set stop-loss orders and consider hedging strategies to limit potential losses.

Chasing Trends:

Avoid following market hype without assessing its long-term viability.

Neglecting Diversification:

Overconcentration in a single asset or sector can magnify risks.

Conclusion

Financial markets are the backbone of the global economy, providing a platform for investment, risk management, and wealth creation. Understanding their structure and dynamics is essential for anyone looking to navigate the world of finance effectively. Whether you’re an investor or simply curious about the markets, staying informed is the first step toward making confident and informed decisions.

Navigating financial markets may seem challenging at first, but with education, clear goals, and disciplined strategies, anyone can become a successful investor. Start small, stay informed, and focus on long-term growth to make the most of the opportunities financial markets offer. Remember, investing is a journey, not a sprint, so approach it with patience and confidence.

2 notes

·

View notes

Video

youtube

ADAUSD 19 Consecutive Successes! PrimeXAlgo vs Traditional Trading: How AI is Changing the Investment LandscapeA comparative analysis of PrimeXAlgo and traditional trading methods: Success Rate: PrimeXAlgo's 27 consecutive successes vs typical success rates Technology: 2,500 indicator AI analysis vs manual chart analysis Speed: Real-time signals vs delayed information Scope: Diverse markets vs limited expertise areas Watch a deep comparison that proves the superiority of AI with data!https://primexalgo.comtelegramhttps://t.me/primexalgofacebookhttps://facebook.com/profile.php?id=615665...discordhttps://discord.com/channels/1288670367401...instagramhttps://instagram.com/primexalgox.comhttps://x.com/PrimeXAlgo#PrimeXAlgo,#AITrading,#GoldInvestment,#BitcoinTrading,#TradingSuccess,#FX,#FOREX,#GOLD,#Chart,#TradingChart,#Stock,#Finance,#Investment,#primexalgo,#primex,#ConsecutiveSuccess,#Financial,#AIBOT,#BOT,#BOTtrading,#crypto,#cryptocurrency,#Forex trading,#Buy,#Sell,#Long,#Short,#indicator,#Strategy,#MACD,#RSI,#Bollinger Bands,#Oscillator,#Volume,#Charts,#Scalper,#Trend,#Bond,#Options,#Derivative,#Liquidity,#Leverage,#Margin,#Hedging,#Arbitrage,#Bull market,#Bear market,#BTC,#Bitcoin,#spread

2 notes

·

View notes

Text

Which is Better: Forex, Crypto, or Stock? A Deep Dive into Prop Firm Tech

INTRODUCTION

The financial landscape is constantly changing, and with new changes comes the production of more choices than ever for traders. The most common include Forex, cryptocurrency, and stock trading. Each market has special characteristics and advantages but carries difficulties, so the emergence of prop firm tech allowed trading to become more accessible and efficient. In this blog, we will be talking about the pros and cons of

Forex, crypto, and stock trading and how prop firm tech can enhance your trading experience.

Underlying the Markets

Forex Market

Forex represents the world’s largest financial market, referring to that market where currency trades occur.

High Liquidations: Forex offers a level of liquidation that is high. Its trading volumes exceed $6 trillion, allowing the traders to comfortably enter and leave positions. Forex is traded 24 hours a day on weekdays, thus offering ample convenience for the traders.

Leverage: Most Forex brokers are highly leveraged. This means that a trader controls much larger positions with lesser capital.

Challenges despite the advantages:

The leverage might create a highly volatile currency price and the highest risk it causes is that it is an effect of its highly volatile nature.

There is an overwhelming complexity in managing economic indicators, and there are geopolitical factors too, which are not easy to handle for new traders.

Crypto Market

The crypto market is trading in digital currencies such as Bitcoin, Ethereum, and more than 5,000 altcoins.

Benefits:

Volatility: The crypto market is volatile. Within a very short duration, one can gain tremendous returns.

Decentralized: With cryptocurrencies, there is a decentralized peer-to-peer network so that no banks are used to monitor transactions.

It is open: All it needs is an internet connection to create opportunities with this kind of market, and it reaches across the globe.

Regulatory Risks: The regulation of the crypto market is not well-established, so it is an uncertain area.

Security Risks: Crypto space is highly prevalent with hackers as well as scams. Hence, the traders must beware of the same.

Stock Market

Definition: the stock market represents an entity where shares of publicly traded companies are traded

Benefits

Governance and Transparency: Since the stock market is very well governed, it offers some kind of security for investors.

Dividends: Most stocks pay dividends thereby ensuring that the investor earns some income from the shares.

Research and Analysis: There is much information to make stock analysis hence helping the traders come to a conclusion.

Drawbacks

Market Hours: the stock market only operates within fixed hours thereby limiting trading.

Lesser Volatility Stock prices often exhibit much slower movements in comparison to Forex and crypto price swings, potentially leading to reduced profit margins.

Prop Firm Tech: Revolutionizing Trading

There has always been a high level of diversity in markets, and for this reason, prop firm tech has emerged as the real deal. Proprietary firms provide capital to traders while engaging them with the latest technology to enhance their trading strategy.

This is how prop firm tech is revolutionizing the game of trading:

Access to Capital

Prop firms also enable traders to gain access to significant capital, thus they can take bigger positions and can hence gain larger profits. Such is truly rewarding for Forex and crypto traders who may not have that much money required to trade even in the best possible way.

Sophisticated Trading Platforms

Proprietary trading firms invest in advanced trading technology that gives traders cutting-edge platforms offering a high level of data provision, sophisticated charting tools, and automated trading features. This tech can significantly enhance the trading experience across Forex, crypto, and stocks.

Risk Management Tools

Prop firm tech also features powerful risk management tools, which can help in minimizing the trader’s loss and ensure the safety of capital. Such tools are quite essential in volatile markets like Forex or even cryptocurrencies, whose prices tend to change rapidly.

Education and Training

Alarge number of prop firms offer educational resources, mentorship, or training for the development of a required skill base by the traders. Support is highly important to any new traders entering Forex, crypto, or even the stock market.

Community and Networking

Trading with a prop firm usually involves trading with other people. This facilitates several things: you will have to have a community of fellow traders, exchanging insights and ideas, strategies you’re implementing, and support you give someone else.

Feature | Forex | Cryptocurrency | Stock Market

Liquidity | High | Varies by asset | High (for major stocks)

Volatility | Moderate to High | High | Moderate

Trading Hours | 24/5 | 24/7 | Limited (specific hours)

Leverage | High | Varies | Low to Moderate

Regulation | High | Low (still evolving) | High

Education | Available (varied by broker) | Limited (varies widely) | Extensive (research available)

Technology | Advanced prop firm tech available | Emerging tools | Established trading platforms

Conclusion

Is Forex, cryptocurrency, or stock trading the best?

The above question doesn’t have a definitive answer, since each market has specific positives and negatives suited to different types of trading. However, with the help of rising prop firm tech, the tools and resources available to every trader can improve trading experiences across all markets.

If you are looking for high liquidity and flexibility, Forex may be the choice. For people who seek high returns and have no fear of volatility, then cryptocurrency may be the way to go. Meanwhile, for those wanting a more regulated environment with an abundance of readily available research, stock trading may be the way to go.

Based on which one is best depends on the trading style of the individual, his risk tolerance, and preferences, you could consider your options while maximizing your trading potential with the benefits of prop firm tech, irrespective of the market.

#proptech#forex prop firms funded account#fxproptech#prop firms#best prop firms#funded#prop trading firms#funded trading accounts#my funded fx#best trading platform#propfirmtech

2 notes

·

View notes

Text

Forex Trading Advisor @novagad

I’ve been a Forex Trader since 2007 and an instructor since 2017.

Forex Trading: Exploring the Global Financial Frenzy

In the vast and dazzling world of financial markets, there's one beast that roars louder than the rest: Forex trading. It's a domain where fortunes are made (and sometimes lost) faster than you can say "exchange rate."

But what exactly is it about Forex that has millions of people hooked, eyes glued to screens, fingers poised over keyboards, and hearts racing like they've had one too many espressos? Let's dive deeper into the world of currency trading and uncover the secrets behind its irresistible allure.

1. The 24/5 Convenience Store of Trading

First and foremost, Forex trading operates 24 hours a day, five days a week. Unlike the stock market, which opens and closes like a sleepy small-town shop, the Forex market is like a neon-lit convenience store that never sleeps.

Traders from New York to Tokyo can engage in their currency escapades whenever the mood strikes. This flexibility allows part-time traders to moonlight after their day jobs and early birds to catch the worm in real-time market action.

2. The Seductive Leverage

Leverage in Forex is like having a turbocharger in a sports car. It gives traders the ability to control larger positions with a relatively small amount of capital. It's the dream of making big bucks with a small investment.

Of course, leverage is a double-edged sword—one moment you're racing at full throttle, and the next, you're careening off a cliff. But for many, the potential for high returns is too tempting to resist.

impressive gains. For those who relish a challenge and have a knack for puzzles, Forex trading offers a never-ending mental workout.

3. The Global Playground

Forex is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. Yes, you read that right—trillion with a T! This immense liquidity ensures that traders can enter and exit positions with ease, without worrying about slippage.

Plus, the sheer variety of currency pairs means there's always something to trade, whether you're bullish on the dollar, bearish on the euro, or just feeling adventurous about the Malaysian ringgit.

4. The Democratization of Trading

Gone are the days when Forex trading was exclusive to big banks and hedge funds. The rise of online trading platforms has leveled the playing field, allowing anyone with a computer and an internet connection to join the fun.

And with a plethora of educational resources, webinars, and demo accounts available, the Forex market is as inclusive as it is vast. It's like the world's biggest, most volatile party, and everyone's invited.

5. The Thrill of the Chase

Let's face it: Forex trading comes with an undeniable adrenaline rush. The fast-paced nature of the market, the constant flux of prices, and the never-ending stream of economic news and geopolitical events create an environment that's as exhilarating as it is unpredictable.

It's like being on a financial rollercoaster, with every twist and turn bringing new opportunities and risks. For many, it's this thrill that keeps them coming back for more, despite the occasional stomach-churning drops.

6. The Intellectual Challenge

Forex trading isn't just about clicking buy and sell; it's a cerebral game of strategy, analysis, and psychology. Traders spend hours poring over charts, deciphering technical indicators, and keeping up with economic data.

It's a constant test of wits and nerve, where making the right call can yield impressive gains. For those who relish a challenge and have a knack for puzzles, Forex trading offers a never-ending mental workout.

7. The Quest for Financial Independence

At its core, the popularity of Forex trading is driven by a simple, powerful desire: the quest for financial independence.

The dream of making a living from trading, of being your own boss, of earning money from anywhere in the world with just a laptop and an internet connection—it's a compelling vision.

While the reality can be tough and the road fraught with risks, for many, the potential rewards make it a journey worth embarking on.

8. The Bottom Line: Why Forex Trading is Gaining Popularity

Forex trading is no joke, my friend. It's a vibrant and global marketplace that offers incredible opportunities to make some serious dough, keep your brain buzzing, and achieve financial independence.

What makes it so darn attractive, you ask? Well, it's a 24/7 affair, meaning you can jump in whenever you please. Plus, there's this thing called leverage that gives you some extra oomph.

And let's not forget about the internet, which has made trading accessible to just about anyone. Oh, and did I mention the sheer adrenaline rush you get from the chase? It's like being on a rollercoaster ride you just can't resist.

9. But let's get real, shall we?

Now, let's not kid ourselves. Forex trading isn't some magical money-making machine that spits out cash on demand. It requires some serious learning, discipline, and a healthy dose of respect for the risks involved.

But here's the deal: If you're willing to put in the effort and approach it with a clear, strategic mindset, the rewards can be absolutely mind-blowing. We're talking big bucks, my friend.

So, whether you're a seasoned trader who knows the ropes or a curious newbie eager to dip your toes in the Forex waters, the world of trading is calling your name. Just remember to buckle up because it's going to be one heck of a wild ride.

Get ready to feel the rush!

Thanks for reading and please consider upvoting it, if you liked the content :)

4 notes

·

View notes

Text

Forex MT4 Plataform, #BUY SWING TRADE #US30Cash INDEX $4.100 Profits. Official Website to have access: wWw.ForexCashpowerIndicator.com . Forex Cashpower Indicator Lifetime license one-time fee with No Lag & Non Repaint buy and sell powerful Signals with Smart algorithms that emit signals in big trades volume zones. Works in all Charts inside your Broker MT4 Plataform and all timeframes . ✅ NO Monthly Fees ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notifications 🔥 Powerful & Profitable AUTO-Trade Option . ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

#US30Cash#forex index#usd30cash#us500cash#us30cash#best forex trade system#forex volume indicators#nt4 bollinger bands#mt4 fibonacci#metatrader4 fibonacci

3 notes

·

View notes

Text

Triangle Chart Pattern: Forex Trading Indicator Explained

The triangle chart pattern is a common and versatile formation used by forex traders to predict potential market movements. This pattern helps traders identify periods of consolidation and subsequent breakouts, providing valuable insights for making informed trading decisions. In this article, we will explore the triangle chart pattern, its types, and how to effectively use it in forex…

#Chart Patterns#Currency Pairs#DeFi#Entry and Exit Points#Forex#Forex Traders#Forex Trading#Market Movements#Price Action#Price Movements#Stop-Loss#Take-Profit#Technical Analysis#Trading Decisions#Trading Indicator#Trading Strategies#Volume Analysis

0 notes

Text

Day Trading Forex: Everything You NEED To Know!

Are you interested in exploring the world of forex trading and want to take advantage of short-term price movements? Day trading forex might be the perfect strategy for you.

In this article, we will delve into the ins and outs of day trading forex, from understanding the forex market to developing effective strategies and managing risks. So let’s get started!

Introduction to Day Trading Forex

Benefits of Day Trading Forex

Day trading forex offers several advantages compared to other trading styles. Some of the benefits include:

Potential for quick profits: Day traders seek to profit from intraday price movements, aiming to close positions before the market closes.

High liquidity: The forex market is the largest and most liquid financial market globally, providing ample trading opportunities.

Flexibility: Traders can choose from a wide range of currency pairs and trade during different market sessions.

Lower capital requirements: Compared to other markets, forex trading allows for smaller initial investments, enabling traders to start with less capital.

Understanding Forex Market

To become a successful day trader in forex, it’s essential to have a solid understanding of the market dynamics.

Major Currency Pairs

The forex market consists of various currency pairs, but some major pairs dominate the trading volume. These include EUR/USD, GBP/USD, USD/JPY, and USD/CHF, among others. Familiarize yourself with these major currency pairs and their characteristics.

Market Hours

The forex market operates 24 hours a day, five days a week. However, certain trading sessions offer higher volatility and trading opportunities. The major sessions include the London, New York, Tokyo, and Sydney sessions. Knowing the active market hours can help you optimize your trading strategy.

Getting Started with Day Trading Forex

Before diving into day trading forex, you need to set up your trading infrastructure.

Setting Up a Trading Account

Choose a reputable forex broker that provides a user-friendly trading platform, competitive spreads, reliable execution, and comprehensive customer support. Ensure the broker is regulated by a recognized authority.

Selecting a Reliable Forex Broker

Research different forex brokers and compare their offerings, including trading costs, available currency pairs, leverage options, and deposit/withdrawal methods. Read reviews from other traders to gauge the broker’s reputation and reliability.

Funding Your Trading Account

Technical and Fundamental Analysis

Successful day trading forex relies on a combination of technical and fundamental analysis techniques.

Candlestick Patterns

Candlestick patterns provide valuable insights into price dynamics. Learn to identify patterns such as doji, engulfing, and hammer, which can signal potential reversals or continuations in the market.

Moving Averages

Moving averages help smooth out price fluctuations and identify trends. Experiment with different moving average periods, such as the 50-day and 200-day moving averages, to identify potential entry and exit points.

Support and Resistance Levels

Support and resistance levels are price levels at which the market tends to bounce or reverse. Identify key support and resistance levels using horizontal lines on your charts and incorporate them into your trading decisions.

Economic Indicators

Economic indicators, such as GDP growth, inflation rates, and employment data, can significantly impact currency prices. Stay informed about major economic releases and their potential effects on the forex market.

News Events

Popular Day Trading Strategies

To succeed in day trading forex, you need to implement effective trading strategies that suit your trading style and risk appetite.

Scalping

Scalping involves making multiple trades within a short time frame, aiming to capture small profits from quick price movements. Scalpers often rely on tight spreads and fast execution to capitalize on these rapid price changes.

Breakout Trading

Breakout traders look for significant price breakouts above resistance or below support levels. They aim to enter trades early in a new trend to maximize profit potential. Breakout strategies often utilize technical indicators to confirm breakouts.

Momentum Trading

Risk Management in Day Trading Forex

Managing risk is crucial in day trading forex to protect your capital and preserve long-term profitability. Here are a few ways to help manage your risk:

Setting Stop-Loss Orders

Always use stop-loss orders to limit potential losses on each trade. Determine an appropriate level for your stop-loss order based on your risk tolerance and the characteristics of the currency pair you are trading.

Implementing Proper Position Sizing

Calculate your position size based on the size of your trading account and the percentage of capital you are willing to risk per trade. Avoid overexposing your account by trading positions that are too large relative to your account size.

Managing Leverage

Emotions and Psychology in Day Trading

Controlling emotions and maintaining a disciplined mindset are crucial in day trading forex.

Controlling Greed and Fear

Greed and fear are common emotions that can cloud judgment and lead to irrational trading decisions. Develop self-awareness and discipline to overcome these emotions and make objective trading choices.

Maintaining Discipline

Stick to your trading plan and avoid impulsive trades driven by emotions. Follow your strategy and trading rules consistently, even when faced with market fluctuations.

Developing a Trading Plan

Building a Trading Routine

Establishing a structured trading routine can help you stay organized and make better trading decisions.

Pre-market Analysis

Before the market opens, conduct a thorough analysis of the currency pairs you are interested in trading. Review economic calendars, technical indicators, and news events that may impact the market.

Executing Trades

Once the trading day begins, execute your trades based on your predefined strategies and analysis. Stick to your risk management rules and avoid impulsive trades based on emotions.

Reviewing and Analyzing Trades

Resources and Tools for Day Traders

Several resources and tools can assist day traders in their trading activities.

Educate Yourself

It is important to stay up to date and learn constantly when you are day trading. It’s always a good idea to begin your journey with a day trading forex course such as the Cash on Demand Trades Education or The Ultimate Forex Strategy

Trading Platforms

Choose a user-friendly trading platform that provides real-time charts, technical indicators, order execution capabilities, and access to relevant news and analysis.

Charting Software

Utilize charting software to analyze price patterns, apply technical indicators, and identify potential trade setups. Popular charting platforms include MetaTrader, TradingView, and NinjaTrader.

Economic Calendars

Stay informed about upcoming economic events and news releases using economic calendars. These calendars provide information on scheduled economic indicators, central bank meetings, and other market-moving events.

Online Communities and Forums

Engage with other day traders through online communities and forums. Participate in discussions, share ideas, and learn from experienced traders. Collaborating with like-minded individuals can enhance your trading knowledge and skills.

Tips for Successful Day Trading

Consider the following tips to improve your day trading performance:

Stay Informed and Educated: Continuously update your knowledge about the forex market, trading strategies, and risk management techniques. Follow reputable sources of market analysis and stay informed about economic developments.

Practice Risk Management: Always prioritize risk management to protect your capital. Implement appropriate stop-loss orders, manage your position sizes, and avoid overtrading.

Start with Small Positions: When starting out, focus on small position sizes to minimize risk. Gradually increase your position sizes as you gain experience and confidence in your trading abilities.

Keep Emotions in Check: Emotions can cloud judgment and lead to poor trading decisions. Maintain emotional discipline, stick to your trading plan, and avoid impulsive actions driven by fear or greed.

Review and Learn from Your Trades: Regularly review your trading performance, analyze your trades, and identify areas for improvement. Learn from both successful and unsuccessful trades to refine your strategy.

Final Thoughts

Day trading forex offers exciting opportunities for traders to profit from short-term price movements in the forex market.

By understanding the market dynamics, implementing effective strategies, managing risks, and maintaining emotional discipline, you can increase your chances of success in day trading forex.

4 notes

·

View notes

Text

Forex For Dummies: A Hobbyist’s Guide to Currency Trading

Hello there, fellow traders and aspiring enthusiasts! I’ve been navigating the fascinating world of Forex trading as a hobby for a good few years now. If you’re considering diving into this exhilarating pastime, you’ve come to the right place. This article will serve as your introduction to Forex trading, breaking down the key terms, concepts, and processes you’ll need to know.

Quick Plug: Hey, I’m Ingrid Olsen, dabbling in Forex trading whenever I get a chance. I’ve been using decodefx.com (by Decode Global) for my trades and seriously, it’s a game-changer. User-friendly, secure, and filled with useful features — it’s got everything you need for a smooth trading experience. Give it a go, and you’ll see what I mean!

The ABCs of Forex

Forex — short for foreign exchange — is all about trading one currency for another. It’s the world’s most liquid financial market, with daily trading volumes exceeding a staggering $5 trillion. What’s unique about Forex is that it’s decentralized — there’s no central exchange, and trades happen directly between two parties, round the clock, five days a week.

Let’s Talk Pairs

In the Forex market, currencies are traded in pairs, like EUR/USD (Euro/US Dollar). The first currency listed (EUR) is known as the ‘base’ currency, and the second one (USD) is the ‘quote’ or ‘counter’ currency. The value of a currency pair indicates how much of the quote currency it takes to buy one unit of the base currency. So, if EUR/USD is trading at 1.20, it means you need 1.20 US dollars to buy 1 Euro.

Interpreting Forex Quotes

When you see a Forex quote, you’ll notice two prices: the ‘bid’ and ‘ask’ price. The ‘bid’ is the price you can sell the base currency for, while the ‘ask’ is the price you can buy it. The difference between these two prices is the ‘spread’ — which is essentially your broker’s commission for the trade.

Going Long or Short

In Forex trading, you can ‘go long’ or ‘go short’. Going long means you’re buying the base currency because you believe it will increase in value against the quote currency. Conversely, going short means you’re selling the base currency as you think its value will decrease.

The Power of Leverage

One distinctive aspect of Forex trading is the use of ‘leverage’. Leverage is like a loan from your broker, allowing you to control a much larger amount than your actual investment. For instance, with 100:1 leverage, you can control $100,000 with just a $1,000 investment. But be careful — while leverage can amplify your gains, it can also magnify your losses.

The Art of Analysis

Successful Forex trading involves market analysis. This usually involves:

Fundamental Analysis: Examining economic data, political events, and social factors that could affect currency values. These can range from policy changes to economic reports and global events.

Technical Analysis: Using charts and statistical indicators to predict future price movements. Techniques might include analyzing trend lines, support and resistance levels, and using mathematical indicators.

Minimizing Risk

Forex trading, like any investment, carries risk. It’s crucial to manage this risk by setting stop-loss orders to limit potential losses, never risking more than a small percentage of your trading capital on a single trade, and keeping emotions out of trading decisions.

Finding a Broker

To start trading Forex, you’ll need to open an account with a Forex broker. Look for a regulated broker with a user-friendly platform, competitive spreads, good customer service, and hassle-free deposit and withdrawal options.

Final Thoughts

Forex trading can be a thrilling hobby, but it’s important to understand the basics before jumping in. Take the time to learn and practice (many brokers offer demo accounts), and don’t be afraid to ask for advice. Remember, the aim is not just to make profits, but also to enjoy the journey of becoming a savvy Forex trader. Happy trading!

Ingrid Olsen

3 notes

·

View notes

Text

The Hidden Power of the Force Index & Consumer Confidence Index: Next-Level Forex Tactics Why Most Traders Overlook These Key Indicators (And Why You Shouldn’t) If you’ve ever felt like your trades are moving against you faster than your willpower at an all-you-can-eat buffet, you’re not alone. Many traders get lost in the noise, blindly following the RSI, MACD, or Bollinger Bands without realizing there are hidden gems lurking in plain sight. Enter the Force Index and the Consumer Confidence Index (CCI)—two of the most underrated yet game-changing indicators in Forex trading. If used correctly, they can help you anticipate market moves, sidestep emotional pitfalls, and get ahead of the herd before they even know what hit them. Let’s break down these elite tactics and uncover how these two indicators can supercharge your trading strategy. The Force Index: The Secret Weapon of Smart Traders What is the Force Index? Developed by legendary trader Alexander Elder, the Force Index (FI) measures the power behind price movements. Unlike lagging indicators that leave you playing catch-up, the FI helps traders spot shifts in momentum before they become obvious to the masses. How the Force Index Works The Force Index is calculated as: This tells you three things: - Magnitude (How strong the price move is) - Direction (Whether the move is bullish or bearish) - Volume Impact (How much force is behind the move) How to Use the Force Index Like a Pro 1. Spot Reversals Before They Happen Most traders wait for a trend change confirmation before entering a trade, but by then, the smart money has already made its move. A spike in the Force Index often signals that momentum is shifting before the price does. Pro Tip: Look for divergence between price action and the Force Index—if prices are climbing but FI is weakening, a reversal might be on the horizon. 2. Ride Strong Trends with Confidence Forget squinting at a dozen indicators. If the Force Index is rising along with price, the trend has real momentum. Ninja Tactic: Use a 13-day EMA of the Force Index to smooth out noise and confirm strong trends. 3. Identify Breakouts with Precision A sudden surge in the Force Index often precedes breakouts. This is because volume and price movement are increasing together—a telltale sign that institutional traders are stepping in. Quick Hack: Combine the Force Index with support/resistance levels. A breakout confirmed by a high FI value is a high-probability trade setup. Consumer Confidence Index: The Market’s Mood Detector The Consumer Confidence Index (CCI) measures how optimistic or pessimistic consumers feel about the economy. It might not seem like a “trading” indicator, but make no mistake—this data influences currency strength like a hidden puppet master. Why Consumer Confidence Matters in Forex High consumer confidence usually means: - Strong economic growth → Higher spending → Central banks tightening policy → Stronger currency Low consumer confidence often leads to: - Economic slowdown → Less spending → Interest rate cuts → Weaker currency Elite Tactics for Trading with the CCI 1. Predict Interest Rate Moves Before the Fed Does The CCI is often a leading indicator of central bank decisions. If consumer confidence is high for several months, there’s a good chance rate hikes are coming—which means a bullish setup for the currency. Pro Move: Track historical CCI trends and compare them to central bank policy shifts. 2. Trade Risk-On vs. Risk-Off Sentiment When confidence is high, riskier assets (like AUD, NZD, and emerging market currencies) tend to outperform safe-haven assets (USD, JPY, CHF). When confidence drops, the opposite happens. Strategic Play: If consumer confidence plunges unexpectedly, consider shifting towards safe-haven currencies before the market fully reacts. 3. Pair It with Technicals for Maximum Accuracy Use the CCI in combination with price action and volume-based indicators (like the Force Index). If consumer confidence is soaring and the Force Index confirms strong momentum, the odds of a successful trade are stacked in your favor. Bringing It All Together: A Step-by-Step Guide to Execution - Monitor the CCI monthly reports (Check economic calendars like those on StarseedFX). - Analyze the trend—Is consumer confidence rising or falling? - Check the Force Index on your trading charts—Is there a volume-backed momentum shift? - Align with central bank policy trends—Is the market pricing in interest rate changes? - Execute high-probability trades—Go long on strong currencies in bullish conditions, and short weak currencies when sentiment tanks. Final Thoughts: Stay Ahead of the Curve Most traders chase price action like a cat chasing a laser pointer. But you now have two secret weapons: the Force Index and the Consumer Confidence Index. These indicators let you anticipate moves before the rest of the market catches on. Start using them today, refine your strategy, and watch your trading confidence (and profits) grow. Want real-time updates on the latest economic indicators? Get exclusive insights and daily analysis at StarseedFX. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Video

youtube

ETHUSDT 31 Consecutive Successes! AI Trading Based on 2,500 Indicators: Unveiling PrimeXAlgo's Innovative Technology A deep dive into PrimeXAlgo's cutting-edge AI trading technology Utilizes a dataset of 2,500 comprehensive indicators No repainting on real-time chart analysis 100% legal and ethical algorithms Provides real-time buy, sell, and neutral signals Discover the state-of-the-art trading solution born from AI and big data!https://primexalgo.comtelegramhttps://t.me/primexalgofacebookhttps://facebook.com/profile.php?id=615665...discordhttps://discord.com/channels/1288670367401...instagramhttps://instagram.com/primexalgox.comhttps://x.com/PrimeXAlgo#PrimeXAlgo,#AITrading,#GoldInvestment,#BitcoinTrading,#TradingSuccess,#FX,#FOREX,#GOLD,#Chart,#TradingChart,#Stock,#Finance,#Investment,#primexalgo,#primex,#ConsecutiveSuccess,#Financial,#AIBOT,#BOT,#BOTtrading,#crypto,#cryptocurrency,#Forex trading,#Buy,#Sell,#Long,#Short,#indicator,#Strategy,#MACD,#RSI,#Bollinger Bands,#Oscillator,#Volume,#Charts,#Scalper,#Trend,#Bond,#Options,#Derivative,#Liquidity,#Leverage,#Margin,#Hedging,#Arbitrage,#Bull market,#Bear market,#BTC,#Bitcoin,#spread

2 notes

·

View notes

Text

STOCK MARKET INVESTMENT

Investing in financial markets offers various avenues for potential growth, with the forex (foreign exchange) and stock markets being two prominent options. Understanding the distinctions between these markets is crucial for investors aiming to align their strategies with their financial goals. This article delves into the key differences between forex and stock market investments, exploring aspects such as market structure, trading hours, liquidity, volatility, and the role of forex bank liquidity in enhancing trading experiences.

Market Structure and Instruments

Forex Market: The forex market involves the trading of currencies, where participants buy one currency while simultaneously selling another. This decentralized global market operates over-the-counter (OTC), with transactions occurring directly between parties without a centralized exchange. Major currency pairs, such as EUR/USD, GBP/USD, and USD/JPY, dominate trading activities.

Stock Market: In contrast, the stock market centers on buying and selling shares of publicly listed companies through centralized exchanges like the New York Stock Exchange (NYSE) or the London Stock Exchange (LSE). Investors acquire ownership stakes in companies, with the potential to benefit from capital appreciation and dividends.

Trading Hours

Forex Market: Operating 24 hours a day, five days a week, the forex market follows a continuous cycle across major financial centers, including London, New York, Tokyo, and Sydney. This round-the-clock availability allows traders to respond promptly to global economic events and news.

Stock Market: Stock markets have specific operating hours, typically aligning with the business hours of their respective countries. For instance, the NYSE operates from 9:30 a.m. to 4:00 p.m. Eastern Time. Trading outside these hours is limited to pre-market and after-hours sessions, which often come with reduced liquidity.

Liquidity and Volatility

Liquidity: Liquidity refers to the ease with which assets can be bought or sold without causing significant price changes. The forex market boasts high liquidity due to its vast trading volume, estimated at over $6 trillion daily. This liquidity ensures that currency pairs can be traded swiftly, with minimal price fluctuations. In contrast, the stock market’s liquidity varies among different stocks, with large-cap stocks typically offering higher liquidity than small-cap stocks.

Volatility: Volatility measures the degree of price variation over time. The forex market is known for its higher volatility compared to the stock market, presenting opportunities for quick profits but also increased risks. Stock market volatility can be influenced by company-specific news, earnings reports, and broader economic indicators.

Leverage and Risk

Forex Market: Forex trading often involves the use of leverage, allowing traders to control large positions with a relatively small amount of capital. While leverage can amplify profits, it also increases the potential for significant losses, making risk management essential.

Stock Market: Leverage in stock trading is generally more restricted. Investors can use margin accounts to borrow funds for trading, but regulatory bodies impose limits to protect against excessive risk.

Role of Forex Bank Liquidity

In the forex market, liquidity is a critical factor influencing trading efficiency and pricing. Liquidity providers, such as banks and financial institutions, play a pivotal role by offering buy and sell prices for currency pairs, ensuring that traders can execute orders seamlessly. Platforms like Forex Bank Liquidity enhance trading experiences by providing:

Accurate Forex Signals: Professional analysts deliver precise and timely forex signals, aiding traders in making informed decisions.

Real-Time Market Data: Access to up-to-date market information enables traders to stay ahead of market movements.

Customized Solutions: Tailored services cater to both retail and institutional clients, aligning with diverse trading styles and strategies

Conclusion

Choosing between forex and stock market investments depends on individual financial objectives, risk tolerance, and trading preferences. The forex market offers high liquidity, 24-hour trading, and opportunities for leveraged positions, appealing to traders seeking flexibility and rapid market engagement. Conversely, the stock market provides avenues for long-term investment in company equities, with potential benefits from dividends and capital growth. Understanding the distinct characteristics of each market empowers investors to make strategic decisions aligned with their financial goals.

#forextrading#forex education#forexsignals#forex expert advisor#forex market#forex#bankliquidity#https://t.me/forexbankliquidity

0 notes

Text

Soft US Data Pummels Wall Street, Gold Consolidates

US Composite PMI data slumped to 50.4 on Friday, a 17-month low. Geopolitical uncertainty around US tariff policies weighed on the data, pushing US stocks through the exit door. Oil prices fell by 3.0%. The US dollar was mixed; US yields fell, but gold remained steady.

The S&P 500 dropped 1.71%, the Nasdaq plunged 2.20%, and the Dow Jones retreated 1.69%.

None of this will set up Asian markets for a good start, with President Trump's social media accounts remarkably restrained this weekend. Japan is closed for the Emperor's birthday, reducing regional trading volumes, while the outcome of the German elections is likely to weigh on the Euro as far-right parties make strong gains.

Asia's data calendar is quiet this week, with the Bank of Korea expected to cut by 0.25% tomorrow. All eyes will now be on US personal consumption and expenditure data due this Friday. President Trump's social media accounts will undoubtedly be good for some volatility.

Friday’s price action on Wall Street confirmed the risk of a top in US stock markets, as discussed in last Tuesday's note. The S&P 500 and Dow Jones have traced out material highs on the charts, while the Nasdaq has failed at resistance once again but is clinging to medium-term support.

The S&P 500 flirted with resistance at 6,130.00 last week but ultimately failed, closing well below support at 6,063.00 on Friday to close at 6,016.00. The nearby 50-day moving average (DMA) at 6,013.00 could provide some interim support, but the technical picture suggests further losses towards 5,700.00. The MACD momentum indicator has not turned strongly negative, further reinforcing the bearish outlook.

SPX500Roll Daily

Likewise, the Dow Jones Index (DJI) has fallen through triangle support. Resistance at 45,050.00 was insurmountable, and support at 44,235.00 failed on Thursday. Losses accelerated to 43,428.00 on Friday. The DJI should target 44,000.00 initially, extending to 43,000.00 in the sessions ahead.

US30Roll Daily

The Nasdaq failed again above 22,000.00 last week, closing at 21,603.50 on Friday. Unlike the S&P 500 and DJI, it is still clinging to support at its 50-DMA and the base of the wedge at 21,200.00. Failure could signal deeper losses towards 19,800.00; however, a longer-term and more material high is only confirmed by the loss of trendline support around 19,500.00. The MACD remains positive despite Friday's sell-off, offering tech bulls a ray of hope.

NAS100Roll Daily

Gold remains impervious to the noise afflicting other asset classes and is still clearly the street's preferred haven trade. It edged 0.11% lower to $29,36.00 an ounce on Friday, and overall, last week's gentle retreat looks more technically driven as investors book some gains, not a material change in bullish sentiment. The Relative Strength Index (RSI) remains overbought, suggesting gold may still have some modest downside potential.

Gold has backed off a test of $2950.00 and $3,000.00 for now, but support at $2,890.00, $2,860.00, and $2,790.00 looks rock-solid still. Only failure at $2,790.00 would signal a bigger correction lower.

XAUUSD Daily

Disclaimer:

The information contained in this market commentary is of general nature only and does not take into account your objectives, financial situation or needs. You are strongly recommended to seek independent financial advice before making any investment decisions.

Trading margin forex and CFDs carries a high level of risk and may not be suitable for all investors. Investors could experience losses in excess of total deposits. You do not have ownership of the underlying assets. AC Capital Market (V) Ltd is the product issuer and distributor. Please read and consider our Product Disclosure Statement and Terms and Conditions, and fully understand the risks involved before deciding to acquire any of the financial products provided by us.

The content of this market commentary is owned by AC Capital Market (V) Ltd. Any illegal reproduction of this content will result in immediate legal action.

0 notes