#best forex trade system

Explore tagged Tumblr posts

Text

Forex MT4 Plataform, #BUY SWING TRADE #US30Cash INDEX $4.100 Profits. Official Website to have access: wWw.ForexCashpowerIndicator.com . Forex Cashpower Indicator Lifetime license one-time fee with No Lag & Non Repaint buy and sell powerful Signals with Smart algorithms that emit signals in big trades volume zones. Works in all Charts inside your Broker MT4 Plataform and all timeframes . ✅ NO Monthly Fees ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notifications 🔥 Powerful & Profitable AUTO-Trade Option . ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

#US30Cash#forex index#usd30cash#us500cash#us30cash#best forex trade system#forex volume indicators#nt4 bollinger bands#mt4 fibonacci#metatrader4 fibonacci

3 notes

·

View notes

Video

The Ultimate The Power of Our 2024 Scalping EA Robot Maximizing Profits ...

#youtube#best scalping ea#forex robot#forex trading#forex ea#forex scalper#forex bot#forex system#forex live#forex market#forexsignals#forextrading

0 notes

Text

FOREX TRADING EDUCTION & TRAINING

Learn Forex Market Trading with Expert Trainers. We are providing complete forex education from beginners to advance level.

#forex education#best trading strategy#day trading#how to trade forex#forex online trading#forexmarket#forex systems#forex trading#forex trading for beginners#Forex Trading#Forex Trader#Forex for Beginners#How to Trade Forex#Forex Strategy#Forex Signals#Learn Forex#Forex Trading for Beginners#Forex Course#Forex Market#Forex Trading Live#Forex Trading Strategy#Forex Lifestyle#Forex Education#Forex Trading Strategies#Simple Forex Strategy#Forex Tips#Live Forex#Live Forex Trade#Forex Strategies#Live Forex Trading

0 notes

Text

Why Start 2025 with Telegram Signal Copier?

Start the new year on the right foot with Telegram Signal Copier (TSC), the tool that transforms your trading into an efficient, reliable, and forward-thinking process. Here's how TSC can elevate your copy trading plans this year:

Efficiency at Its Best

Automate your trading seamlessly and focus on perfecting strategies instead of managing manual tasks. TSC’s lightning-fast execution ensures you capitalize on every time-sensitive opportunity.

Enhanced Accuracy

Eliminate human errors with TSC’s precision-driven system, faithfully replicating signals exactly as they���re received. No details missed, no opportunities wasted.

Multi-Account Management

Handle multiple trading accounts with ease. TSC simplifies account diversification, allowing you to manage them all from one platform.

Tailored Risk Management

Align your trades with your goals by customizing lot sizes, stop-losses, and take-profit levels. With tailored risk management, you can trade confidently and on your terms.

Continuous Learning Support

Gain access to valuable tutorials, guides, and expert insights to enhance your trading knowledge. TSC supports your journey toward smarter, more informed trading decisions.

Staying Ahead with Updates

Stay ahead with early access to TSC’s latest features and innovations. Adapt to market changes with tools that keep your strategy sharp and competitive.

Premium Signal Access

Unlock premium signals for Forex, Gold, and Indices via VIP Telegram channels. Backed by expert analysis, these signals provide you with an undeniable edge.

Community and Support

Be part of a thriving trader community while enjoying priority support from the TSC team. Whether it’s troubleshooting or trading guidance, you’ll have expert help at every step.

Start your trading journey this year with a tool designed to empower and elevate. With TSC, you’re equipped to tackle the markets with confidence and precision.

#telegram signal copier#telegram signals copier#TSc#Trade Copier#Signal Copier#Forex Signal Copier#Copier#forex education#forextrading#currency markets#economy#investing#xauusd#finance

2 notes

·

View notes

Text

The Ultimate Forex Brokers Comparison for South African Traders

Introduction:

The forex market in South Africa is one of the fastest-growing financial sectors, and selecting the right broker can make all the difference. In this Forex Brokers Comparison in South Africa, we will explore the best options available for traders in 2025. Whether you're just getting started or are looking for a more advanced trading experience, this guide will help you navigate your choices and make an informed decision.

Why Forex Trading in South Africa is Thriving:

Forex trading in South Africa has seen a steady rise in popularity over the past few years. This growth can be attributed to the country's stable financial regulations, mainly governed by the Financial Sector Conduct Authority (FSCA). With a secure regulatory framework, traders are assured of a safe trading environment. In addition, many brokers now offer dedicated services tailored for South African traders, including local deposit methods and customer support in native languages.

Key Features to Look for in a Forex Broker in South Africa:

When choosing a forex broker, several key factors should guide your decision:

Security and Regulation: Ensure your broker is regulated by the FSCA for a secure trading environment.

Trading Platforms: Popular platforms such as MT4 and MT5 offer robust features, but many brokers now offer proprietary platforms as well.

Low Spreads and Fees: Low trading costs are crucial to maximizing profits.

Customer Support: 24/7 support in the South African time zone can enhance your trading experience.

Account Types: Brokers offering diverse account types with local payment options can cater to a wide range of traders.

Top Forex Brokers for South African Traders in 2025:

Eightcap: Known for its low spreads, quick deposits, and intuitive platform, Eightcap is perfect for both beginners and seasoned traders.

IC Markets: With low spreads and fast execution, IC Markets is ideal for scalpers and day traders.

FP Markets: Offering excellent customer support and a user-friendly platform, FP Markets provides an outstanding trading experience.

Octa: Specializing in accounts suitable for South African traders, Octa stands out for its commitment to local customers.

BlackBull: If you're after low-cost trading with access to a wide range of assets, BlackBull is a top contender.

XM: XM’s global reach and local support make it a solid choice for traders looking for both global opportunities and local assistance.

FXPro: Known for its top-tier services and robust tools, FXPro is ideal for traders seeking a complete package.

FBS: FBS’s user-friendly interface and attractive promotions make it an appealing option for beginners.

Comparing Forex Brokers in South Africa: Which One is Right for You?

Choosing the right broker depends on your trading needs. For beginner traders, brokers with easy-to-use platforms and strong customer support, like FBS and Eightcap, might be the best fit. Experienced traders, however, may benefit from IC Markets or FP Markets, which offer advanced tools and low-cost trading. If you're focused on low spreads, BlackBull and Octa are excellent options.

The Future of Forex Trading in South Africa:

As we look toward 2025, the future of forex trading in South Africa appears promising. Technological advancements, such as AI-based trading tools and faster transaction systems, are set to make trading more efficient. Moreover, evolving regulations may offer even greater protection for traders. Staying informed about the latest trends and innovations will help traders maintain a competitive edge.

Conclusion:

In conclusion, choosing the right forex broker is critical for successful trading in South Africa. With the Forex Brokers Comparison in South Africa above, you are equipped with the knowledge to make an informed decision. Visit Top Forex Brokers Review for more in-depth insights and to explore detailed broker reviews

2 notes

·

View notes

Text

Advanced Tips and Tricks for Global Market Trading

Trading in the global market can be both exciting and profitable if you employ the right strategies. Whether you're dealing with Forex, commodities, or other investments, these advanced tips will set you up for success.

Master Technical Analysis: Technical analysis is crucial for predicting market movements. Learn to read charts and use indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD). These tools help you identify trends and make informed trading decisions.

Choose the Best Trading Platform: Selecting the right trading platform is essential. Look for platforms that offer real-time data, analytical tools, and a user-friendly interface. Good platforms also provide educational resources and excellent customer support.

Diversify Your Investments: Diversification reduces risk. Spread your investments across different asset classes like Forex, commodities, and stocks. This approach ensures that your portfolio is protected from market volatility.

Stay Updated with Market News: Keeping up with global news, economic events, and market trends is vital. Regularly read financial news and reports. Use economic calendars to track important events that might impact your trades.

Implement Risk Management Strategies: Effective risk management is key to long-term success. Use stop-loss orders to limit potential losses and ensure no single trade can hurt your portfolio too much. This way, you can trade with confidence.

Follow Expert Insights: Industry experts and analysts provide valuable insights. Platforms like TradingView and social media channels can offer advanced strategies and techniques. Learning from these experts can enhance your trading approach.

Use Automated Trading Systems: Automated trading systems can execute trades based on pre-set criteria, helping you take advantage of market opportunities without constant monitoring. Understand the algorithms and monitor their performance regularly.

Focus on Continuous Learning: The trading world is always changing. Participate in webinars, attend workshops, and take online courses to stay updated with the latest strategies and trends. Continuous learning helps you stay ahead.

Monitor Your Performance: Regularly review your trades and performance. Keep a trading journal to track your decisions, outcomes, and lessons learned. This practice helps you improve your strategies and avoid repeating mistakes.

Partner with Reliable Brokers: Choosing a reliable broker is crucial. Look for brokers with competitive spreads, low fees, and robust security measures. A good broker provides the tools and support you need for successful trading.

Trust APM for more expert insights and trading solutions.

5 notes

·

View notes

Text

Improving Client Relationships Using CRM in Forex Brokerage

The key to success in the cutthroat world of Forex trading is building and maintaining customer connections. The tools and technologies that enable effective client management change along with the industry. Customer Relationship Management (CRM) software is one such product that has grown to be essential for Forex brokerages.

A Good CRM system is the cornerstone of every profitable Forex brokerage, serving as the primary interface for managing customer relations and optimizing corporate operations as a whole. Choosing the Best CRM solution is essential due to the growing need for efficient operations and tailored services.

Forex brokerages need CRM systems that are not only reasonably priced but also have special features designed to meet their requirements. Presenting ForexCRM, the best CRM solution in the business, which gives brokerages access to cutting-edge features at a reasonable price.

Thanks to ForexCRM and other affordable CRM solutions, brokerages may now affordably manage client interactions with the resources they need. Brokerages of all sizes can make use of CRM's scalable features and features to maximize customer engagement and retention.

ForexCRM's extensive feature set, created especially for Forex brokerages, is what makes it unique. With features like integrated trading platforms, Contest Management, smooth onboarding procedures, sophisticated analytics, Social Trading, and Liquidity Feeds, ForexCRM provides a comprehensive answer to satisfy the many demands of contemporary brokerages.

Brokerages may automate tedious operations, optimize communication channels, and obtain insightful data about customer behavior and preferences by utilizing ForexCRM. Brokerages may expand their company, provide individualized services, and cultivate enduring loyalty by centralizing client data and interactions.

ForexCRM provides customized solutions to simplify complex processes, making it an asset for New brokerage Formation, licensing, and regulatory compliance initiatives. With features like compliance checklists and customizable onboarding workflows, ForexCRM streamlines the registration and licensing process and guarantees prompt approvals.

Brokerages may effortlessly manage regulatory compliance while reducing risk thanks to specialized modules for KYC and AML compliance. Furthermore, ForexCRM makes regulatory reporting system connection easier, allowing for accurate submissions and providing transparency to authorities. All things considered, ForexCRM gives brokerages the confidence they need to successfully negotiate regulatory difficulties, which helps them succeed in the cutthroat Forex business.

In summary, CRM is essential to improving client connections in the Forex brokerage sector. Brokerages can stay ahead of the curve by offering great customer experiences and retaining a competitive edge in the industry with feature-rich and reasonably priced systems like ForexCRM. Unlock the full potential of client relationship management for your Forex brokerage by selecting the finest CRM available.

3 notes

·

View notes

Text

Understanding the Working Model of Forex Prop Trading Firms

Most of the passionate people in trading know prop businesses but may need to learn exactly what they do. Property trading firms, or prop firms for short, are niche businesses that invite experienced traders to use their trading abilities on behalf of the company. Prop trading is distinguished from traditional trading by this special structure, which gives traders several benefits and chances in the financial sector.

Essentially, a prop trading company is a financial marketplace that provides funds to knowledgeable traders to trade stocks, commodities, and currencies, among other financial instruments. Through this extract, we intend to clear up the mystery surrounding prop trading and offer a thorough grasp of how it operates within the dynamic context of financial markets.

Business Model of Forex Prop Trading Firms

Capital Allocation and Proprietary Trading Desk:

Forex Prop Trading Companies differentiate themselves from one another based on the capital they offer their dealers. Capital allocation, which allows traders to profit from huge amounts of money above their own capital, is the cornerstone of their business plan. The best forex prop trading firms thoroughly assess risk before disbursing cash to traders.

These assessments consider the trader's approach, prior performance, and additional variables. Based on this evaluation, the company determines how much cash to provide each trader, ensuring that the strategy remains balanced and risk-controlled. Prop trading firms use the profit-sharing model in return for the provided funds. Traders do this by contributing a percentage of their profits to the business.

Trading Strategies and Risk Management:

Exclusive Trading in Forex Businesses uses a wide variety of trading techniques to take advantage of the existing market opportunities and turn it into a profit. Some of the most important trading tactics and risk management techniques these organizations use are statistical arbitrage, high-frequency trading, algorithmic trading, and quantitative strategies. Using sophisticated algorithms and fast data feeds, high-frequency trading allows for the execution of several deals in a matter of milliseconds. Using predefined algorithms to carry out trading strategies is known as algorithmic trading.

These algorithms can examine market data, spot trends, and automatically execute trades by preset parameters. Statistical analysis and mathematical frameworks are used to find trading opportunities in the quantitative trading process. Finding and taking advantage of arithmetic correlations between various financial instruments is the process of statistical arbitrage. By employing this tactic, traders hope to profit from transient disparities in price or mispricing among connected assets. You can control your earnings and losses more with a very successful risk management strategy.

Technology and Tools:

The capacity of Forex Prop Trading Organizations to utilize advanced technologies and apply skillful instruments to maneuver through the intricacies of the financial markets is critical to their success. Discover in this article how these companies' operations rely heavily on technology such as data analytics, trading algorithms, direct market access (DMA), etc. Large volumes of market data are processed in real-time by these companies using sophisticated analytics techniques.

Traders can obtain important insights that guide their trading methods by looking at past data and detecting patterns. Prop businesses use several trading tactics, one of which is algorithmic trading. These systems automate the execution of trades based on predefined conditions using intricate algorithms. A "direct market access" technique enables traders to communicate with financial markets directly and eliminates the need for middlemen. Forex Prop Trading Firms use DMA to provide quick and effective order execution by executing transactions with the least delay.

Regulatory Framework:

Similar to other financial operations, prop trading is subject to several laws and rules that are designed to maintain market stability, equitable treatment, and transparency. Prop trading rules differ from nation to nation, but they are always intended to balance encouraging financial innovation with discouraging actions that would endanger the system. For instance, the US Dodd-Frank Act has placed several limitations on prop trading, especially for commercial banks. The purpose of these restrictions is to restrict trading activity that carries a high risk of destabilizing the financial system.

The minimum capital requirements for forex prop trading firms are frequently outlined in regulations. Regulators seek to improve the overall stability of the financial system and lower the danger of insolvency by setting minimum capital limits. Regulations also require prop trading companies to use effective risk management techniques, such as defining profit goals and using complex techniques like volatility/merger arbitrage to reduce risk. The execution of trading methods by forex proprietary trading firms is mostly dependent on prop traders. It is essential for a prop trader to be be clear about the legal and regulatory landscape in which they operate.

Success Factors and Challenges

The best Forex prop firms rely on a number of variables to be successful, including personnel management, technology, technological adaptation, good risk management, and strategic alliances. Prop businesses must address the difficulties of market saturation, liquidity constraints, technology risks, market volatility, talent retention, and regulatory compliance to succeed in the competitive and constantly changing world of forex trading.

The reason being that forex markets are dynamic, there is a chance that prices would observe fluctuations quickly and unexpectedly. In order to overcome increased volatility, best prop firms for forex need to have strong risk management methods. Businesses that rely heavily on technology run the risk of experiencing cybersecurity attacks and system malfunctions. Strong cybersecurity safeguards, regular monitoring, and upgrades are necessary to mitigate these dangers.

Conclusion

Navigating the intricacies of financial markets requires a thorough understanding of the Forex Proprietary Trading Firms operating model. It involves more than just making profitable trades; it also involves understanding the bigger picture, including subtle regulatory differences, new technological developments, and risk management techniques.

Prop traders need to be aware of the legal and regulatory landscape, the value of utilizing technology, and the crucial role they play in the success of their companies, regardless of their level of experience. The robustness and success of the larger financial ecosystem are strengthened by ongoing education and interaction with the complex components of Forex Proprietary Trading Firms.

2 notes

·

View notes

Text

Get The Best Signals of Gold With TP and SL And Gain More Than 5% Daily

Follow Me on MQL5

تداولالأسهم, #فوركس, #تداولالعملات, #تداولالسلع, #تحليلفني, #تحليلأساسي, #استراتيجياتالتداول, #إدارةرأسالمال, #تجارةيومية, #تعلمالتداول, #اقتصادياتعالمية, #تداولعبر_الإنترنت.

GoldTrading #PreciousMetals #InvestInGold #Bullion #GoldPrice #GoldMarket #GoldInvestment #Commodities #TradingStrategy #GoldAnalysis #GoldBullion #BullionTrading #GoldCoins #GoldCharts #GoldFutures #GoldSpot #GoldStocks #GoldNews #GoldInvestor #MetalTrading #trick #xauusd #gold #Forex #forextrading #PriceAction #priceactionstrategy

#forex live#live forex signals#live forex trading#forex signals live#eurusd live#live trading#forex live trading#live forex trading session#live signals forex#xauusd#gold#trade#fx#trading ideas#forex trading ideas#supply and demand#xauusd analysis today#gold forecast#gold price#gold live#xauusd forecast#forex signal#live trading forex#live forex#gold usd#gold xauusd indicator#xauusd live#gold trading live#forex trading live#xauusd live signal

4 notes

·

View notes

Text

#US500Cash +700 Pips Protected with Stop Loss in positive área.

2025V Update Version. Official Website: wWw.ForexCashpowerIndicator.com

.

Forex Cashpower Indicator *Lifetime license* one-time fee with No Lag & Non Repaint buy and sell powerful Signals with Smart algorithms that emit signals in big trades volume zones. Works in all Charts inside your Broker MT4 Plataform and all timeframes.

.

✅ NO Monthly Fees/ New 2025 Version

✅ NON REPAINT / NON LAGGING

🔔 Sound And Popup Notifications

🔥 Powerful & Profitable AUTO-Trade Option

.

✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.**

.

( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ).

.

✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options.

.

🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

#forexindicator #forexsignals #forextrading #fxtrading

#forexmarket #forexlife #stocks #success #daytrader #US500cash

#us500cash#forexsignals#forexindicators#indicatorforex#forexindicator#cashpowerindicator#forex#forextradesystem#forexprofits#forexvolumeindicators#forexchartindicators#best forex trade system#forex templates download#fx trade system#mt4 indicators#metatrader signals service#how trade forex#best forex signals service

0 notes

Text

Make a Trade with the Best ECN Forex Broker

Using an Electronic Communications Network brokers match buy and sell orders on the currency exchange market. In the forex (foreign exchange) market, the ECN forex broker is essentially an automated trading system that automatically matches orders between buyers and sellers. It effectively expedites the order execution process and makes it much more transparent at the same time. They must get in and out of the market quickly, meaning ECN’s lightning fast execution is a huge benefit.

3 notes

·

View notes

Text

What is Automated Forex Trading? How Does It Work?

Forex trading has evolved significantly over the years, with automation playing a crucial role in simplifying and optimizing trading strategies. Automated Forex trading allows traders to execute trades based on pre-set criteria without manual intervention.

This guide will break down how automated trading works, its pros and cons, popular trading platforms, and how to choose the best AI signal copier for automation.

What is Automated Forex Trading?

Automated Forex trading, also known as algorithmic trading, is a method of executing trades using pre-programmed rules and strategies. These systems analyze market conditions, identify trading opportunities, and place trades without human intervention. Traders use automated trading to eliminate emotions, enhance speed, and improve trading consistency.

Automated trading comes in various forms, including:

Expert Advisors (EAs)

Forex Robots

Copy Trading

Social Trading

How Does Automated Forex Trading Work?

Automated trading follows a systematic approach:

Market Analysis: Algorithms scan market conditions and analyze price action.

Signal Generation: The system detects buy or sell opportunities based on indicators.

Trade Execution: Orders are placed automatically according to predefined criteria.

Risk Management: Stop-loss, take-profit, and trailing stop mechanisms manage risk.

Monitoring & Optimization: Traders can adjust and optimize strategies based on performance.

Pros and Cons of Automated Forex Trading

Pros of Automated Trading

✅ Eliminates Emotional Trading

✅ Faster Execution

✅ Backtesting Capabilities

✅ 24/7 Trading

✅ Improved Risk Management

Cons of Automated Trading

❌ Technical Failures

❌ Over-Optimization Risks

❌ Lack of Adaptability

How to Choose the Best AI Signal Copier for Automated Trading?

Choosing the right AI signal copier is crucial for success in automated trading. Consider the following factors:

Reliability: Choose a copier with a strong track record and minimal downtime.

Execution Speed: Faster trade execution ensures better pricing.

Customization Options: Ability to set risk parameters and trade sizes.

Compatibility: Works with major trading platforms like MT4, MT5, and cTrader.

Support & Security: Reliable customer support and secure data encryption.

Best Copier for Automated Forex Trading

A top choice for traders looking to automate signals is Telegram Signal Copier (TSC). It allows seamless copying of signals from Telegram channels to trading platforms, ensuring precision and efficiency. With features like risk management, customizable settings, and instant execution, it’s an ideal solution for traders relying on automated signals.

Conclusion

Automated Forex trading is a game-changer for traders looking to streamline their strategies and minimize manual effort. By leveraging platforms like MetaTrader and AI-powered tools like Telegram Signal Copier, traders can enhance their efficiency and profitability. As automation technology continues to advance, traders who embrace it will gain a competitive edge in the Forex market.

#Telegram Signal Copier#TSC#Automated Forex Trading#Automated Trading#forex trading#forex education#forextrading#currency markets

0 notes

Text

Best MLM Software services in Lucknow: Empowering Network Marketing

SigmaIT Software Designers Pvt. Ltd. is the top provider of best MLM software services in Lucknow, offering customized solutions tailored to various business models, including Binary, Matrix, Unilevel, and Hybrid plans. Our software ensures seamless operations, security, and automation, making MLM business management efficient and hassle-free.

Why Choose SigmaIT for MLM Software Services? -

Custom MLM Solutions – We develop personalized software to fit your specific business model and requirements.

User-Friendly Interface – Our intuitive UI makes it easy for both administrators and distributors to navigate.

Secure & Reliable – Advanced encryption and security protocols ensure data safety and privacy.

Scalability – Our software grows with your business, allowing smooth expansion.

Automated Commission Calculations – Reduce errors with precise calculations of commissions and payouts.

E-Wallet & Payment Gateway Integration – Support multiple payment methods, including digital wallets and cryptocurrencies.

Multi-Language & Multi-Currency Support – Expand globally with multilingual and multi-currency functionalities.

CRM & Lead Management – Track and manage leads efficiently to boost conversions.

Mobile Compatibility – Our software is responsive and app-based, ensuring business accessibility anywhere.

Key Features of Our MLM Software -

Multi-Level Commission Structure

Real-Time Business Analytics & Reports

Product & Order Management

E-Commerce Integration

Automated Tax Calculations (GST, VAT, etc.)

Member Management System

Promotional & Marketing Tools

Admin & User Dashboard

SMS & Email Notifications

Industries We Serve -

SigmaIT’s MLM software caters to diverse industries, including:

Health & Wellness

E-Commerce

Cryptocurrency & Forex Trading

Real Estate

Education & Training

Affiliate Marketing

Direct Selling Businesses

Why SigmaIT is the Best in Lucknow? -

SigmaIT Software Designers Pvt. Ltd. is recognized for its commitment to excellence, innovation, and customer satisfaction. Our expert developers ensure that businesses receive top-notch, feature-rich MLM software to enhance performance and drive success.

Get in Touch Today! -

Looking for the best MLM software services in Lucknow? Contact SigmaIT Software Designers Pvt. Ltd. for expert consultation and cutting-edge solutions tailored to your MLM business needs. Visit SigmaIT Software Designers Pvt. Ltd. or call us at.

Contact Information -

Email — [email protected]

Phone — 9956973891

Address — 617, NEW -B, Vijay Khand, Ujariyaon, Vijay Khand 2, Gomti Nagar, Lucknow, Uttar Pradesh 226010

#bestmlmsoftwarecompanyinlucknow#mlmsoftwaredevelopmentcompanyinlucknow#bestmlmsoftwareservicesinlucknow#multilevelmarketingsoftwarelucknow#mlmsoftwareinlucknow

0 notes

Text

EASY_SetAnalyzeDB()

EASY_SetAnalyzeDB() EASY Set Analyze isn’t just a fancy tale. There’s a real ecosystem behind it, complete with actual databases and complex integrations. We use Big Data technology to store and process every trade our EASY Bots make 🤖 How does it work? Inside our database, we have a special table that creates a rating for set files. We record info for each operation, including which parameters were used, the final outcome, and which bot made the trade. Then a rating is formed: profitable settings become favorites, while losing ones go into the “needs improvement” category. When a bot initializes, it requests the “best” set file from the database and automatically loads it. The whole process — from updating data to applying new settings — is fully automated ⚡️ For experienced developers, this might not sound super magical — big companies have used similar tools in analytics for a long time. But in the world of trading robots, almost no one has offered this functionality yet. A simple MQL5 script can’t do it: you need web development skills, database management, and server infrastructure knowledge. We’ve spent years building this system so it works like clockwork. Now you don’t have to reinvent the wheel — our EASY Bots already have all the “gear” they need for analysis and auto-tuning. Just install your trading robot, pick the parameters, and the system takes care of the rest. Less routine, more clarity, no “fairy tales” — everything has been tested in real practice. Want to see it in action? Send a message to @forexroboteasybot — we’ll show you real examples! // #EasySetAnalyze #EASYBots #forex #algorithmictrading #mt5bot #EASYServices

0 notes

Text

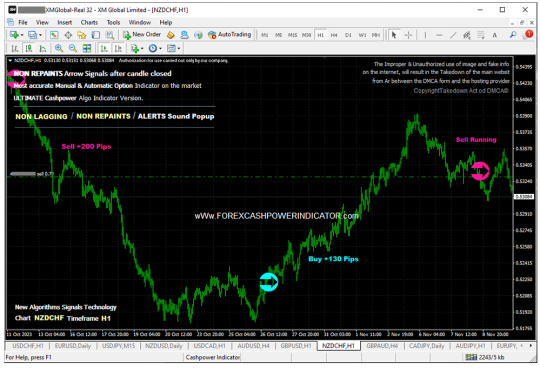

Forex Metatrader4 Shows last 3 NON REPAINT signals with more than 330+ Pips positive in #NZDCHF. Sell trade running opens to next Week. More info in official website. wWw.ForexCashpowerIndicator.com . Cashpower Indicator Lifetime license one-time fee with No Lag & Non Repaint buy and sell Signals. ULTIMATE Version with Smart algorithms that emit signals in big trades volume zones. . ✅ NO Monthly Fees ✅ * LIFETIME LICENSE * ✅ NON REPAINT / NON LAGGING ✅ Less Signs Greater Profits 🔔 Sound And Popup Notification ✅ Minimizes unprofitable/false signals 🔥 Powerful & Profitable AUTO-Trade Option . ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🔔 New Ultimate CashPower Reversal Signals Ultimate with Sound Alerts, here you can take No Lagging precise signals with Popup alert with entry point message and Non Repaint Arrows Also. Cashpower Include Notification alerts for mt4 in new integration. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

#forexsignals#cashpowerindicator#forex#forexprofits#forexindicators#forexchartindicators#forexvolumeindicators#forextradesystem#forexindicator#indicatorforex#best forex broker bonus#best forex trading platform#best forex traders#best forex broker#best forex strategy#best forex trade system#forex trading#stockmarket#investing stocks#forex stock#stocktrading#stock market#technical analysis#barang selalu ready stock#stockholm

1 note

·

View note