#eurusd live

Explore tagged Tumblr posts

Text

Get The Best Signals of Gold With TP and SL And Gain More Than 5% Daily

Follow Me on MQL5

تداولالأسهم, #فوركس, #تداولالعملات, #تداولالسلع, #تحليلفني, #تحليلأساسي, #استراتيجياتالتداول, #إدارةرأسالمال, #تجارةيومية, #تعلمالتداول, #اقتصادياتعالمية, #تداولعبر_الإنترنت.

GoldTrading #PreciousMetals #InvestInGold #Bullion #GoldPrice #GoldMarket #GoldInvestment #Commodities #TradingStrategy #GoldAnalysis #GoldBullion #BullionTrading #GoldCoins #GoldCharts #GoldFutures #GoldSpot #GoldStocks #GoldNews #GoldInvestor #MetalTrading #trick #xauusd #gold #Forex #forextrading #PriceAction #priceactionstrategy

#forex live#live forex signals#live forex trading#forex signals live#eurusd live#live trading#forex live trading#live forex trading session#live signals forex#xauusd#gold#trade#fx#trading ideas#forex trading ideas#supply and demand#xauusd analysis today#gold forecast#gold price#gold live#xauusd forecast#forex signal#live trading forex#live forex#gold usd#gold xauusd indicator#xauusd live#gold trading live#forex trading live#xauusd live signal

4 notes

·

View notes

Text

Funded 50k account one step challenge with The Trading Pit Honest review with The Trading Pit Prop Firm https://www.thetradingpit.com/challenges-overview?ref=rua

20% Discount Voucher Code Name: ALEXOCT120 Different type of Prop Firm They are provide 1-Step CFD Challenge it is very good service four catagory CFD Challenge VIP ACCOUNT BALANCE €100000 Executive CHALLENGE ACCOUNT BALANCE: €50,000 Standard CHALLENGE ACCOUNT BALANCE: €20,000 Lite CHALLENGE ACCOUNT BALANCE: €10,000

#forextrading#forexsignals#xauusd#XAUUSD Live#forexmarket#FTMO#The Trading Pit#Prop Firm#propfirm#eurusd#review#discount#cupons#traders#trade#livetrading

1 note

·

View note

Video

youtube

EURUSD 106 Consecutive Successes!

🔥 | AI Trading Signals for Stock Markets"

Description: 🚀 Breaking News: PrimeXAlgo OIL Achieves 27 Consecutive Trading Successes!

Revolutionizing Oil Trading with Advanced AI Technology:

✅ 27 Consecutive Successful Trades

✅ Real-Time Live Chart Analysis

✅ No Repainting Signals

✅ AI-Powered Decision Making

🔍 Unique Features:

Analysis of 2,500+ Market Indicators

Cross-Market Compatibility (Oil, Gold, Bitcoin, Nasdaq)

Real-Time Signal Generation

100% Legal & Ethical Trading Technology

Works in All Time Zones

Advanced AI Implementation

💹 Markets Coverage:

Oil Trading

Commodities

Cryptocurrency

Forex

Stocks

Indices

🌐 Join Our Trading Community: Website: https://primexalgo.com Telegram: https://t.me/primexalgo Discord: https://discord.com/channels/1288670367401119888/1288670564126294078 Instagram: https://instagram.com/primexalgo X/Twitter: https://x.com/PrimeXAlgo Facebook: https://www.facebook.com/profile.php?id=61566510386136

⏰ Video Timeline: 0:00 - Introduction 1:30 - Oil Trading Success Story 3:00 - Technology Overview 4:30 - Live Trading Demo 6:00 - Implementation Guide 8:00 - Results & Testimonials

Start maximizing your oil trading potential with PrimeXAlgo today!

#OilTrading #AITrading #TradingSignals #CommodityTrading #PrimeXAlgo #FinancialMarkets #TradingSuccess #OilMarket #AITechnology #TradingStrategy #Investment #Finance #Trading

Tags: primexalgo oil, oil trading signals, ai trading oil, commodity trading, trading algorithm, oil market analysis, oil trading strategy, automated trading, oil price prediction, trading indicators, real-time trading, technical analysis, oil market signals, crude oil trading, energy trading, market analysis, trading technology, ai trading system, oil futures, market prediction.

2 notes

·

View notes

Photo

Forex #EURUSD Sell Trade with HUNTER Indicator

.

Forex #EURUSD Sell Trade with HUNTER Indicator. Trading running Live with 90 Pips Positive

🎓 Powerfull Forex Non Repaint signals to make constant profits. Lifetime License of HUNTER Forex Indicator. To know more in Official website and click Visit: https://www.hunterforexindicator.com/ and click inside Official website inside the worpress Post.

💲 The Hunter Forex Indicator for Metatrader4 is a Fixed and No Repaint signals send/mabe by calculations inside the market capable of antecipating forces of moviments in EXAUSTED ZONES of the trends inside MT4 charts. This Is one of the Best modern Indicator concept.

🔊 Sound Alerts with 🔊Visual Popup alerts email 🔊 alerts actvation option. This Power indicator help you open your trades with maximum eficiency. Start catch the best moment of the Forex Pairs Market to open your trades and take better decisions.

4 notes

·

View notes

Text

The Hidden Playbook for Day Trading the Euro New Zealand Dollar (EURNZD) Why Most Traders Miss the Best EURNZD Setups (And How You Can Nail Them) If you've ever felt like trading Euro New Zealand Dollar (EURNZD) is like trying to predict a cat’s next move—chaotic, irrational, and somehow still eerily predictable—then congratulations, you’re already ahead of the game. Most traders stick to the major pairs, missing out on the sneaky profit potential that crosses like EURNZD provide. And that’s where this hidden playbook comes in. By the end of this article, you’ll know how to spot the best setups, sidestep common mistakes, and execute high-probability trades that could make your trading journal look like a Wall Street success story. The Silent Assassin of the Forex Market: Why EURNZD Is a Goldmine for Day Traders Most traders stick to EURUSD or GBPUSD, unaware that EURNZD offers something special: volatility with precision. This pair moves in larger daily ranges, averaging 100-150 pips per day—way more than many majors. That means better profit opportunities if you know how to handle it. Here’s what makes EURNZD special: - More predictable trends due to economic divergence between Europe and New Zealand. - Spikes in volatility thanks to RBNZ (Reserve Bank of New Zealand) policy shifts. - Excellent mean reversion potential (it loves to return to the median after extreme moves). But don’t just take my word for it. According to Jared Johnson, professional trader and founder of Day Trading FX Live, "EURNZD provides high-reward setups when paired with strong sentiment shifts in risk appetite." The Underground Strategy: The Fibonacci Trap on EURNZD If you've ever tried to trade EURNZD with basic support and resistance lines, you know it can fake you out faster than a magician at a poker table. Instead, use the Fibonacci Trap, a next-level technique that helps you catch deep pullbacks before the market takes off. Here’s how it works: - Identify a strong trend on the 1-hour or 4-hour chart. - Draw a Fibonacci retracement from the latest swing high to swing low (or vice versa). - Look for price to pull back into the 61.8% - 78.6% zone (this is the liquidity trap). - Wait for a strong rejection candle (a pin bar, engulfing candle, or inside bar fakeout). - Enter with a tight stop below the 78.6% and target the previous high/low. The “Liquidity Grab” Secret: Stop Hunting the Smart Way Market makers love to hunt stops around key levels. But what if you could use that knowledge to your advantage? Enter the Liquidity Grab strategy. How to execute it: - Identify obvious support/resistance zones where retail traders are placing stops. - Wait for a false breakout (a quick spike beyond the level, followed by a sharp reversal). - Enter on the retracement back into the range, confirming the stop hunt is over. - Place your stop just below/above the fakeout wick. - Target the opposite range boundary or a 2R minimum. This method is especially deadly on EURNZD because it tends to have aggressive stop-hunting wicks. Knowing this can put you one step ahead of retail traders. EURNZD Day Trading Pitfalls: Avoid These Rookie Mistakes Even the best traders can get caught off guard if they ignore these common traps: ❌ Overtrading the pair: EURNZD moves big, but that doesn’t mean you need to trade every single move. Stick to high-probability setups. ❌ Ignoring news catalysts: This pair reacts heavily to economic releases from both Europe and New Zealand. Set alerts for: - RBNZ interest rate decisions - European inflation reports - Global risk sentiment shifts (watch the S&P 500 for clues!) ❌ Using the wrong position sizing: Because EURNZD has larger daily ranges, using the same lot size as EURUSD can lead to blown accounts. Use a Smart Trading Tool to calculate precise lot sizes based on risk. Ready to Trade Smarter? Take It to the Next Level If you want to master EURNZD and turn volatility into profit, check out these resources: - Latest Forex News – Stay ahead of the market with live updates. - Free Forex Course – Learn the secrets of professional traders. - Community Membership – Get daily insights and elite strategies. - Smart Trading Tool – Automate risk management and optimize trade sizing. Final Thoughts: The Key to EURNZD Success Day trading Euro New Zealand Dollar is not for the faint-hearted, but with the right tools, strategies, and mindset, you can extract massive opportunities. 🔹 Key Takeaways: - Trade with Fibonacci Traps to catch deep pullbacks. - Use the Liquidity Grab strategy to profit from stop hunts. - Avoid common mistakes like overtrading and ignoring news catalysts. Want to level up? Join our community and start trading like a pro. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Market Analysis: Gold, Forex & USD Trends Amid Fed Uncertainty

Gold Gold prices are gaining traction, with bullish momentum growing as the MACD shows an increase in volume. While the RSI signals an overbought condition, price action continues to respect the bullish structure, suggesting further upward movement. However, Federal Reserve Chair Jerome Powell's remarks to the House Financial Services Committee add a layer of uncertainty. Powell indicated that inflation remains a challenge, and further rate cuts would not occur until clear progress is made toward the Fed’s 2% target. In this context, gold retains its role as a hedge against a potentially inflated dollar. Price action forecasting suggests medium-term gains seem likely unless unexpected moves disrupt this trajectory. Until significant changes occur in dollar prices, the bullish outlook for gold remains intact. Traders focusing on major and minor currency pairs will keep a close eye on gold’s impact on broader forex markets.

Silver Silver remains in a state of consolidation but has recently shown a strong upward movement after rebounding from the 31.4724 level and the EMA200. Bullish momentum is evident in both the MACD and RSI. While prices are likely to continue higher, 32.5177 stands as a critical resistance level. If this level fails to break, silver may resume its consolidation phase. Investors looking for short-term forex gains may find silver’s movement an important indicator for potential trades.

DXY (U.S. Dollar Index) The dollar is currently experiencing bearish movement, with prices softening unexpectedly. This contrasts with the fundamentals, as hot CPI data suggests the Federal Reserve will maintain rates. The decline in the dollar may reflect traders taking profits, which temporarily pushes prices lower before a potential rebound. Price action forecasting indicates that technical indicators show the MACD with muted volume, and the RSI is nearing oversold levels, hinting at a possible slowdown in the selling momentum.

GBPUSD The British pound is experiencing a rebound after a recent slowdown in prices. The RSI approaches overbought territory, while the MACD remains crossed under, indicating a continuation of bearish pressure. Despite this recent uptick, the overall structure remains bearish following a break below the previous swing low. In the broader view, the pound remains consolidated, with further bearish movement likely unless the dollar stabilizes. Trading platform features will be crucial for traders monitoring volatility in this pair.

AUDUSD The Australian dollar remains in consolidation, showing no significant changes in market behavior. The previous break above resistance was short-lived, and prices quickly returned to the consolidation zone. The market awaits more definitive price movements before determining a clearer direction. Compounding forex profits strategies may be affected by AUDUSD’s prolonged range-bound movement.

NZDUSD The New Zealand dollar is similarly consolidated, with no clear direction in prices. Following a brief recovery above the EMA200 after its recent fall, the kiwi remains range-bound. Further price developments are necessary to provide a clearer outlook. Traders looking for short-term forex gains will closely monitor potential breakouts.

EURUSD The euro is showing bullish momentum as it tests a previous lower swing high. While the RSI indicates increasing bullish momentum, the MACD shows no clear direction. If the euro fails to break above the current resistance zone, the overall bearish structure remains intact. Until a decisive breakout occurs, expectations lean toward continued bearish movement. Trading platform features will play a key role in managing risk in this currency pair.

USDJPY The yen has performed as expected, rising following its most recent price break. This movement reflects the Bank of Japan’s response to Trump’s tariff policies. Both the MACD and RSI show increased bullish momentum, suggesting further gains. However, in the immediate term, consolidation is likely before the next leg higher. Price action forecasting will help traders determine key entry points.

USDCHF The Swiss franc is consolidating after breaking above a key resistance zone, but the overall price action remains bullish. While the MACD has crossed upward, it shows muted volume, and the RSI reflects exaggerated selling levels, indicating reduced bearish momentum. The broader expectation is for continued bullish movement, though further developments are needed to confirm this trajectory.

USDCAD The Canadian dollar remains under pressure but lacks sufficient volume to sustain the downward move. As a result, no major changes are noted, and the CAD may lean toward bullish movement, driven by fundamentals tied to the dollar. More price action forecasting is needed to determine its direction.

COT Reports Analysis AUD - WEAK (5/5) GBP - WEAK (3/5) CAD - WEAK (5/5) EUR - WEAK (5/5) JPY - STRONG (5/5) CHF - WEAK (4/5) USD - STRONG (4/5) NZD - WEAK (5/5) GOLD - STRONG (5/5) SILVER - STRONG (5/5)

Conclusion

Market participants should stay prepared for increased volatility as inflation data approaches. Whether trading major and minor currency pairs, monitoring short-term forex gains, or using price action forecasting to make strategic decisions, the upcoming data release could bring fresh opportunities and risks. With trading platform features becoming increasingly sophisticated, traders should leverage these tools to navigate the shifting landscape effectively. For further insights, visit Rich Smart.

0 notes

Text

#DeepSeekR1

#Bitcoin

#Cardano

#XRP

#GOLD

#Silver

#USDT

#USDJPY

#EURUSD

#GBPUSD

0 notes

Text

Unlocking Forex Market Trends: Strategies and Insights for Success

Market Overview Asian stock markets and the U.S. dollar paused on Wednesday as investors anticipated potential rate cuts in Canada and awaited a crucial U.S. inflation report. Markets have priced in an 85% probability of a Federal Reserve rate cut next week. However, with Wall Street indices nearing record highs, there is a risk of disappointment.

Canada, having already cut rates by 125 basis points in this cycle, is expected to deliver another 50 basis points cut, lowering its overnight rate to 3.25%. This prediction follows a sharp rise in Canada’s unemployment rate to 6.8% in November, the highest in eight years. Similarly, markets are pricing in a European Central Bank rate cut on Thursday, and the Swiss National Bank has a 61% chance of implementing a 50-basis-point cut, potentially easing the franc’s rally.

In Australia, the Reserve Bank kept rates steady at 4.35% on Tuesday but changed its tone by removing language about maintaining restrictive policies. This shift caused the Aussie dollar to tumble, reflecting growing expectations for rate cuts. Traders using Rich Smart FX's currency trading techniques can leverage these pivotal events to adapt strategies effectively.

Market Analysis

GOLD GOLD prices have turned bullish, breaking past the previous swing high. The RSI shows strong momentum with divergence, indicating a possible market shift soon. The MACD also signals robust momentum and buying strength. Geopolitical risks and the anticipated U.S. rate cut next week support further bullish movement. Analysts predict that GOLD could reach a new high before the rate cut announcement. China resuming GOLD purchases to boost reserves also strengthens GOLD’s position. This scenario offers substantial opportunities with DBGMFX's forex trading signals for traders seeking to capitalize on commodity market trends.

SILVER SILVER prices remained flat after yesterday’s trading session, showing no movement beyond the previous swing high. Current lows might represent a bottom before a bullish continuation. The RSI indicates consolidation, while the MACD suggests weakening bearish momentum with crossover signals hinting at a bullish shift. Overall, price action supports another bullish run leading into next week, as highlighted by GFS Markets' trusted forex signals.

DXY The dollar holds gains ahead of the CPI report. The RSI shows oversold conditions despite weak price pullbacks, highlighting strong bullish momentum. The MACD has recently crossed, but as with the previous crossover, this one may be short-lived. Price momentum remains consolidated as traders await inflation data that will shape next week’s rate-cut expectations. Utilizing Topmax Global's advanced currency trading strategies can help navigate these mixed signals.

GBPUSD Current charts show the Pound in consolidation, awaiting clues from the CPI report to determine market direction. Both the MACD and RSI are neutral, reflecting market uncertainty. Scalpers might find value in these conditions using World Quest FX's scalping strategies for beginners to navigate the volatility.

AUDUSD The Aussie dollar has fallen to new lows, with the MACD indicating strong bearish momentum. While the RSI signals exaggerated levels and a potential pullback, bearish continuation is expected. A deeper retracement may lead to further dollar weakness. Traders can apply Axel Private Market's advanced forex trading plans to prepare for significant rate movements.

NZDUSD The Kiwi faces increased selling momentum, supported by the RSI and MACD. Despite a minor price pullback, overbought RSI levels confirm bearish conditions. Analysts expect continued selling pressure as price action signals bearish continuation. Rich Smart's forex trading strategies are useful for traders identifying prolonged bearish trends.

EURUSD The Euro shows buying continuation, though current price action suggests consolidation. The MACD has crossed into bullish territory, but the RSI indicates overbought levels despite weak market movements. Analysts expect a bearish reversal in price momentum, with continued consolidation as traders await further ECB clarity. GFS Markets' trusted forex signal providers can guide timing in such scenarios.

USDJPY The Yen continues to weaken as prices trend higher, showing strong buying momentum. Despite a pullback, the MACD suggests bullish continuation, and the RSI remains oversold. Market sentiment favors further price increases, indicating ongoing buying strength. Traders can use Rich Smart FX's momentum trading techniques for success.

USDCHF The Franc has weakened amid expectations of an SNB rate cut. The MACD shows increased buying momentum, supported by the RSI despite smaller levels and divergence. Analysts forecast continued bullish activity in the Franc’s price movement. Monitoring DBGMFX's forex trading signals offers insight into timing effective trades.

USDCAD The Canadian dollar is under pressure ahead of the expected Bank of Canada rate cut. A significant cut could weaken the CAD further, pushing prices beyond 1.41774. The RSI shows exaggerated selling levels, while the MACD suggests a deeper retracement possibility. However, current price levels might already represent the bottom before further upward movement. Employing Topmax Global's forex trading strategies ensures readiness to act on strong signals.

#Scalping indicators#Trading entry and exit#Automated trading signals#Forex portfolio strategy#Forex market trends

0 notes

Text

#bitcoin#stock market#stock news#forex market#bit coin news#investing stocks#stock management#bit coin market#finance

0 notes

Text

📈💰 Don’t miss out on today’s trade signals! 🚀 Take advantage of our expert analysis for potential profits! 🔥 TRADE SIGNALS OF 12–02–2024 are in:

EURUSD SELL — 1.0793 TARGET — 1.0731 SL — 1.1120

USDJPY BUY — 149.1510 TARGET — 150.4342 SL — 137.8420

GOLD SELL — 2024.1850 TARGET — 1992.4014 SL — 2116.8200

ETHEREUM BUY — 2500.7200 TARGET — 2733.3927 SL — 1782.3825

More Trade Signals

Visit Our Website — Capital Street FX

Latest Technical Analysis

Best Deposit Bonus

Open Live Account

Daily Article

#bitcoin#forex#tradable bonus#deposit bonus#best deposit bonus#swing trading#0 commission#0 spread account#24/7 trading#day trading

0 notes

Text

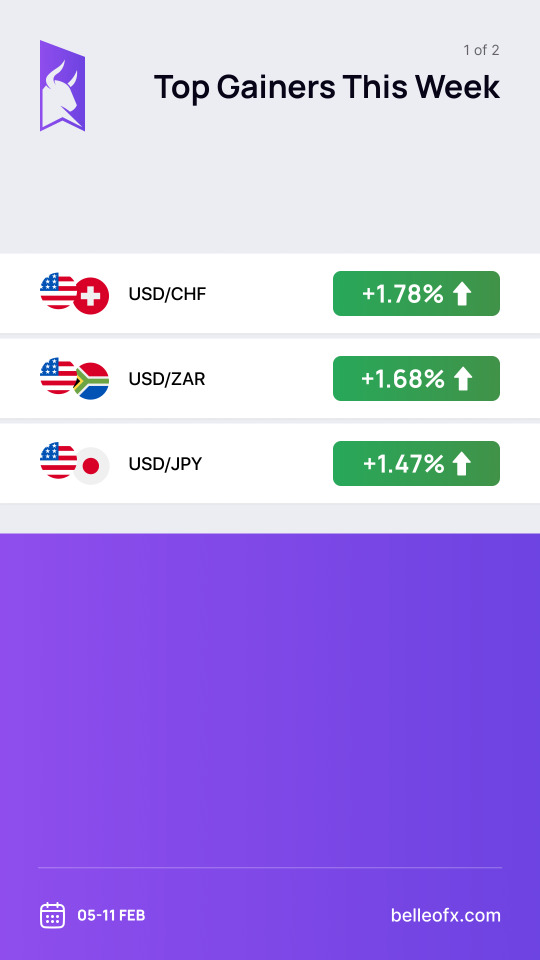

Presenting our weekly top performers and underperformers [05 Feb - 11 Feb, 2024]:

📈Top Gainers This Week ✓ USDCHF +1.78% ✓ USDZAR +1.68% ✓ USDJPY +1.47%

📉Top Losers This Week ☒ EURUSD -0.59% ☒ AUDUSD -0.83% ☒ GBPUSD -1.90%

Ready to take control of your trading journey? Open your live trading account today - Seize the Bull within you! 📈🐃

Join now: https://pa.belleofx.com/en/signup

BelleoFX Market Updates

0 notes

Video

youtube

EURUSD 83 Consecutive Successes!

Title: "PrimeXAlgo NVDA: 31 Consecutive Winning Trades!

🔥 | AI Trading Signals for Stock Markets"

Description: 🚀 Breaking News: PrimeXAlgo OIL Achieves 27 Consecutive Trading Successes!

Revolutionizing Oil Trading with Advanced AI Technology:

✅ 27 Consecutive Successful Trades

✅ Real-Time Live Chart Analysis

✅ No Repainting Signals

✅ AI-Powered Decision Making

🔍 Unique Features:

Analysis of 2,500+ Market Indicators

Cross-Market Compatibility (Oil, Gold, Bitcoin, Nasdaq)

Real-Time Signal Generation

100% Legal & Ethical Trading Technology

Works in All Time Zones

Advanced AI Implementation

💹 Markets Coverage:

Oil Trading

Commodities

Cryptocurrency

Forex

Stocks

Indices

🌐 Join Our Trading Community: Website: https://primexalgo.com Telegram: https://t.me/primexalgo Discord: https://discord.com/channels/1288670367401119888/1288670564126294078 Instagram: https://instagram.com/primexalgo X/Twitter: https://x.com/PrimeXAlgo Facebook: https://www.facebook.com/profile.php?id=61566510386136

⏰ Video Timeline: 0:00 - Introduction 1:30 - Oil Trading Success Story 3:00 - Technology Overview 4:30 - Live Trading Demo 6:00 - Implementation Guide 8:00 - Results & Testimonials

Start maximizing your oil trading potential with PrimeXAlgo today!

#OilTrading #AITrading #TradingSignals #CommodityTrading #PrimeXAlgo #FinancialMarkets #TradingSuccess #OilMarket #AITechnology #TradingStrategy #Investment #Finance #Trading

Tags: primexalgo oil, oil trading signals, ai trading oil, commodity trading, trading algorithm, oil market analysis, oil trading strategy, automated trading, oil price prediction, trading indicators, real-time trading, technical analysis, oil market signals, crude oil trading, energy trading, market analysis, trading technology, ai trading system, oil futures, market prediction.

2 notes

·

View notes

Text

Supertrend Indicator + Trailing Stop Loss: The Hidden Blueprint for Bulletproof Forex Trades Ever had a trade flip on you faster than a pancake at Sunday brunch? You were sure it was a winner—only to watch it nosedive like you accidentally shorted your own luck. Welcome to the wild world of Forex. But today, we’re cutting through the noise with an underground, lethal combo: Supertrend Indicator + Trailing Stop Loss. This duo is your secret weapon for locking profits while dodging market whiplash. Let’s dive in. Why Most Traders Treat Stops Like Expired Milk (And Lose Because of It) Here’s the brutal truth: many traders slap a static stop loss on their trade and call it a day. That’s like fastening your seatbelt after you’ve already crashed. The Myth: Static stop losses = safety. The Reality: Static stops often get hit before a trade has time to bloom, especially with volatile pairs like GBPJPY or EURUSD during major news releases. Data Point: According to a study by DailyFX, over 70% of retail traders hit their stops prematurely. (source) The Supertrend Indicator: More Than Just a Fancy Green Line Think of the Supertrend Indicator as the cool, silent sniper of technical analysis. It plots the current trend direction based on the Average True Range (ATR). When the price is above the line, you’re in bullish territory. When below? Bears are partying. But here’s the twist most traders miss: The real magic happens when you sync Supertrend with a dynamic trailing stop loss. According to Andrew Lockwood, a veteran trader at Forex Signals: “Static stop losses are like training wheels. Dynamic trailing stops, paired with indicators like Supertrend, are how pros stay in the game.” (source) Underground Hack: Using Supertrend As Your Trailing Stop Loss Step-by-Step: The Ninja Method - Set Up Supertrend Indicator - Parameters: ATR Period = 10, Multiplier = 3 (adjust based on volatility). - Enter on Confirmation - Buy when the price closes above the Supertrend line (green). - Sell when it closes below the line (red). - Trail Your Stop Using Supertrend - Instead of a fixed stop, manually adjust your stop loss along the Supertrend line as the trade progresses. Why It Works: - Supertrend adapts to volatility; your stop loosens during wild swings and tightens in calm markets. - Reduces the chance of getting wicked out before the real move. Hidden Patterns That Most Traders Overlook ATR Surges Predict Big Moves When ATR spikes, it often precedes explosive breakouts. This is when trailing stops shine. Example: During the March 2023 banking crisis, EURUSD spiked over 400 pips in a week. Traders using ATR-based trailing stops rode the entire wave. Advanced Tactic: Double Confirmation with RSI Divergence Combine Supertrend with RSI Divergence for sniper-like accuracy: - Supertrend Turns Green + Bullish RSI Divergence → Buy Signal. - Supertrend Turns Red + Bearish RSI Divergence → Sell Signal. Pro Insight: Jared Johnson, founder of Day Trading FX Live, emphasizes: “Combining divergence with Supertrend filters out noise and keeps you aligned with institutional flows.” (source) Case Study: How a Trailing Stop Saved My GBPJPY Trade (And My Weekend Beer Money) It was a typical Thursday. I was long on GBPJPY after a clean Supertrend crossover. By Friday, the pair was pumping like it had Red Bull for breakfast. I trailed my stop using the Supertrend line. Suddenly, a Bank of Japan announcement blindsided the market. GBPJPY dipped but kissed my trailing stop before reversing up. Result: +320 pips. Without the trailing stop? That would’ve been a margin call with a side of tears. Debunking the Supertrend-Trailing Stop Myth Myth: “Trailing stops always choke profits.” Truth: When coupled with Supertrend, trailing stops flex with market conditions, allowing you to bag larger moves while minimizing premature exits. Elite Tactics to Level Up 1. ATR Calibration Trick Adjust your ATR period based on market session volatility: - London Session: ATR(7) for precision. - Asian Session: ATR(14) to avoid noise. 2. Multi-Timeframe Confirmation Align Supertrend signals on 1H and 4H for higher-probability trades. If both say “buy,” you’re stacking the odds. 3. News-Proof Your Stop Before major events like NFP, widen your stop buffer by multiplying ATR by 1.5. Volatility spikes often hunt standard stops. Final Takeaway: Trade Like a Pro, Not Like a Lottery Ticket Buyer Combining the Supertrend Indicator with a Trailing Stop Loss is more than a strategy; it’s an evolution in trade management. You safeguard profits, ride trends longer, and sleep better (unless you’re dreaming of Lambos). Ready to elevate your game? Access cutting-edge tools and expert strategies: - Latest Forex News & Economic Indicators - Free Forex Courses - Join the StarseedFX Community - Free Trading Plan & Journal - Smart Trading Tool Key Points Summary: - Supertrend + Trailing Stop adapts to volatility, protecting profits. - Use ATR surges as breakout signals. - Combine with RSI Divergence for sniper entries. - Multi-timeframe analysis boosts accuracy. - Customize stops for news events and session volatility. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

0 notes