#Predictive Models in Crypto

Explore tagged Tumblr posts

Text

Crystal Ball or Fool's Gold? Demystifying Predictive Models in Crypto

Introduction: Navigating the Cryptocurrency Landscape

We at Anbruggen Capital understand the allure and risks of the cryptocurrency market. Predictive models, like those we employ at Anbruggen Capital, have become essential tools for navigating this volatile landscape. But are they truly reliable indicators of future price movements, or are they merely modern-day iterations of a crystal ball?

Understanding Predictive Models: Approaches and Limitations

In our experience, predictive models play a crucial role in our investment strategies. We utilize a variety of approaches, including statistical models, machine learning algorithms, and technical analysis indicators, to gain insights into crypto price movements. By incorporating these models into our decision-making process, we aim to mitigate risks and capitalize on opportunities in the market.

Statistical Models: The Foundation of Forecasting

Statistical models, such as ARIMA, provide us with a baseline for forecasting by analyzing historical data. However, as Dave Martin one director at Anbruggen Capital knows, these models may struggle to capture the full complexity of the crypto market's dynamics.

Machine Learning Algorithms: Harnessing the Power of AI

Machine learning algorithms, on the other hand, offer a more sophisticated approach. At Anbruggen Capital, we leverage AI-powered models like Long Short-Term Memory networks to analyze vast datasets, including social media sentiment and news analysis. Yet, as we would attest, the effectiveness of these models depends on the quality of training data and their ability to adapt to unforeseen market events.

Technical Analysis Indicators: Insights into Market Sentiment

Technical analysis indicators, like RSI and Bollinger Bands, complement our predictive models by providing insights into market sentiment. However, Anbruggen Capital warns that while valuable, these indicators do not guarantee future price movements.

The Role of Historical Data: Shaping Predictive Models

We recognize the importance of historical data analysis in shaping our predictive models. By examining past price movements, trading volumes, and market events, we can identify patterns and correlations that inform our investment decisions. Anbruggen Capital emphasizes the need for comprehensive and accurate data to avoid flawed models and misleading predictions.

Conclusion: Using Predictive Models Wisely

In conclusion, predictive models for crypto prices are valuable tools, but they are not infallible prophecies. As Anbruggen Capital would advise, investors should use these models in conjunction with other strategies, such as risk management and fundamental analysis. While they can provide valuable insights, the crypto market remains inherently unpredictable, and even the most sophisticated models cannot guarantee future outcomes.

#anbruggen capital#davemartin#Predictive Models in Crypto#Cryptocurrency#cryptotrading#ethereum#bitcoinprice#cryptonews#BVI

0 notes

Text

Bitcoin's Future Price According to Industry Experts

Prominent figures in the financial and cryptocurrency sectors have made ambitious predictions regarding Bitcoin’s future value, reflecting their perspectives on its potential role in the global economy. Cathie Wood, CEO of Ark Invest, projects Bitcoin reaching $1 million by 2030. Her optimistic outlook is based on anticipated widespread adoption and Bitcoin’s potential to become a standard store…

#ARK invest#Arthur Hayes#Bitcoin#bitcoin preditcoin#bitmex#blockchain#BTC#Cathie Wood#crypto#cryptocurrency#finance#financial forecast#future#mark yusko#Michael Saylor#MicroStrategy#Mike Novogratz#peter brandt#plan b#price prediction#robert kiyosaki#Stock-to-Flow model#tim draper#tyler winklevoss

0 notes

Text

Why Did Donald Trump Create a Crypto Business?

Why Did Donald Trump Create a Crypto Business?

The Rise of Cryptocurrencies: A Commentary from a Digital Enthusiast As a media and gaming expert, I’ve seen technology take some wild turns — Does anyone remember the days when floppy disks ruled? Well, we’ve come a long way, and now we’re talking about digital money. One of the most exciting (and sometimes head-scratching) developments of recent years has been the rise of cryptocurrencies.…

#Bitcoin investment#Bitcoin news#Bitcoin price#Bitcoin trends#blockchain technology#Crypto Business#crypto business model#crypto diversification#crypto in gaming#crypto investing#crypto startups#cryptocurrency#cryptocurrency business#cryptocurrency business ideas#cryptocurrency future trends#cryptocurrency news#cryptocurrency predictions#cryptocurrency trends#digital investment#Donal Trump Crypto Business#Donald Trump and Elon Musk Crypto Business#Donald Trump crypto#Elon Musk Crypto Business#emerging tech#financial investment#Future of Crypto#future tech#Gaming and Crypto#investing in crypto#tech industry news

0 notes

Text

AI Trading

What is AI and Its Relevance in Modern Trading? 1. Definition of AI Artificial Intelligence (AI): A branch of computer science focused on creating systems capable of performing tasks that typically require human intelligence. These tasks include learning, reasoning, problem-solving, understanding natural language, and perception. Machine Learning (ML): A subset of AI that involves the…

#AI and Market Sentiment#AI and Market Trends#AI in Cryptocurrency Markets#AI in Equity Trading#AI in Finance#AI in Forex Markets#AI Trading Strategies#AI-Driven Investment Strategies#AI-Powered Trading Tools#Artificial Intelligence (AI)#Automated Trading Systems#Backtesting Trading Models#Blockchain Technology#Crypto Market Analysis#cryptocurrency trading#Data Quality in Trading#Deep Learning (DL)#equity markets#Event-Driven Trading#Explainable AI (XAI)#Financial Markets#forex trading#Human-AI Collaboration#learn technical analysis#Machine Learning (ML)#Market Volatility#Natural Language Processing (NLP)#Portfolio Optimization#Predictive Analytics in Trading#Predictive Modeling

0 notes

Text

Unlock the Future of Cryptocurrency with AIPANDA: Memecoin AI on the Ton Blockchain!

Step into the future of cryptocurrency with AIPANDA, where cutting-edge technology meets community-driven innovation. 🌐

🤖Engaging Conversations: AIPANDA

isn't just another AI model—it's your crypto companion. Engage in lively discussions, gain valuable insights, and share laughs along the way. With

AIPANDA

by your side, every interaction is an adventure.

🔍Insightful Insights:

Knowledge is power, and

AIPANDA

empowers you with real-time market analysis, trend predictions, and expert advice. Stay ahead of the curve and make informed decisions with confidence.

⚙️Seamless Task Automation: Say goodbye to tedious tasks and hello to efficiency.

AIPANDA

streamlines your crypto management with automated processes, smart alerts, and personalized reminders. Spend less time managing, and more time thriving.

🌈 Embrace the Future: Join the AIPANDA community and be part of something extraordinary. Together, we're redefining the possibilities of cryptocurrency and shaping the future of finance. Let's journey into tomorrow, hand in hand with AIPANDA.

Ready to embark on the ultimate crypto adventure? Visit our website

the only meme coin created by AI you need on @Ton_Blockchain

2. Add TON to your wallet Transfer TON to your wallet You can buy TON on exchanges like Okx, Mexc ... and then transfer it to your Tonkeeper wallet

and connect with us on

Panda AI (@aipandaton) on X

$AIPANDA - the only meme coin created by AI you need on @Ton_Blockchain

and

AI Panda Ton Community

AI Panda Community

to stay updated on the latest news and developments.

Don't miss out—embrace the future of cryptocurrency with AIPANDA today!

10 notes

·

View notes

Text

Future Digital Assets: An Exploration of the Crypto Trends

The cryptocurrency world is constantly changing with significant improvements, regulatory changes and market movements prompting companies to either adopt or expand their existing business models. So, what are the trends that will define digital assets in the future?

Now: Rising adoption of digital currencies by the mainstream financial institutions as well as businesses marks the crypto market in 2024. While original cryptocurrencies like Bitcoin and Ethereum are still leading, new entrants come in with novel features.

AI & Cryptocurrency Trading: AI Advances in cryptocurrency trading with machine learning algorithms that can analyze the data, predict market movements, and execute trades accurately. This makes trade execution more efficient and reduces human error.

On Blockchain innovations — recent changes in the Engineering discipline of blockchains such as, sharding or layer-2 solutions that improve scalability, security, and interoperability are helping make blockchain more reliable and flexible.

Investment Strategies in Digital Assets: You need to become familiar with various investment strategies available in Crypto market which includes the trends of the market, risk management and a proper diversification. Keeping an eye on those Bitcoin price predictions and Ethereum 2.0 updates are key to making decisions.

Regulation: “Governments and regulators around the world pay more attention to cryptocurrencies”. With the regulatory environment changing quickly, it is important to appreciate both compliance and growth possibilities.

Decentralized Finance (DeFi) — By providing decentralized versions of every financial service, DeFi is replace them with trust-minimized and highly-resistant smart contracts to provide similar services. These amenities facilitate the direct lending, borrowing and trading of digital assets without intermediaries—thereby providing users with an increased degree of financial autonomy.

Market Trend and Forecast: A thorough market trend enables to grasp market dynamics, whilst making sure about the reported forecasts, get declared predictions. One of the few remaining concepts is the volatility of crypto markets affected by sentiment, regulatory news and technological advancements.

On the level of adoption, we are experiencing a gradual increase in use cases as more organizations now receive payments with this digital asset as well as their customers conducting transactions which are growing.

Blockchain and AI: Combining features of blockchain with the capabilities of AI -this collaboration maximizes data security, improves efficiency and facilitates smarter decision-making, which mean that it can support new generation paradigms in many different markets.

#economy#investing#investment#entrepreneur#personal finance#startup#bitcoin#blockchain#crypto#ethereum

4 notes

·

View notes

Text

kos at Daily Kos:

In an election cycle full of the outrageous, absurd, and ridiculous, the newfound excitement among conservatives over a betting site is pretty much top-10 territory. Polymarket is a political betting site. Traders use crypto to place bets on the outcome of races and events. It is funded by venture capitalist Peter Thiel and happens to be statistician Nate Silver’s current employer, if you ever wonder about the ethics of running a (bullshit) predictive model while working at a gambling site. The crypto requirement means it’s heavily used by tech bros, so not exactly a representative sample of anything. For weeks, Vice President Kamala Harris was the bet to win the election, a fact that no one outside of the site’s users cared about. Yet over the last few days, that trend reversed, and on Monday, Trump’s chances rose dramatically.

[...] Trump’s supporters love to be scammed out of money, given how freely they let themselves be used and abused by MAGA grifters, including Trump himself. It’s not unreasonable for either crowdsourced MAGA deplorables or Musk or other wealthy Trump backers to drop a few hundred thousands on Polymarket. It gives them a fresh injection of hopium, even if the rest of the world looks at them with raised eyebrows, wondering how they could possibly be this stupid.

Markos Moulitsas (kos) writes in Daily Kos about the right’s obsession with Polymarket that has pushed pro-Trump agitprop that often shows Donald Trump as favored, in contrast with most polling that has shown Kamala Harris ahead.

2 notes

·

View notes

Text

sso's candle, and jumping into the ai bubble for publicity and investment

so yasmin told me to write about this bc not everyone might realise it. its a bit of a long topic so prepare. for legal reasons this is all my personal opinion :3

first off - the sso candle doesnt actually have anything to do with ai. i just wanna get that out of the way. i will come back to this later.

the sso candle ai promotional event is 2 things to me. one is, "probably someone at the company knew someone at the other company bc why else would this specific random collab ever happen" (and theyre not even a candle company? its a perfume company?)

but the other thing which is the main thing, is that we've entered the ai boom, or ai economic bubble. before this there was a crypto bubble, there's sort of been a mobile bubble, and we have the old classic dotcom bubble. summary of tech bubble is, a new shiny thing in tech makes ppl go OOOH!! I WILL THROW MY INVESTMENT MONEY AT THAT!! I BETTER HURRY AND NOT MISS THE TRAIN!! IM GOING TO GET FILTHY RICH BY INVESTING IN THE FUTURE!!! and many of these ppl dont actually understand the tech, and can therefore be exploited by startups or new projects targetting these investors, by just saying "we use the shiny thing that is the future and will make people rich".

just like the dotcom and crypto bubbles, everything that has "ai" in it is currently getting lots of attention both from media and from investors. things that are about "ai" are currently like "wow! youre using modern tech and this is the future!" and for all those ppl who dont know that much about ai or tech, or tech ppl who are easily influenced, it makes companies look cool and modern and forward if they include that current shiny thing.

what does sse achieve by making promotional vids and posts about an ai candle? attention from media and potential investors. the playerbase doesnt care. their target audience arent ppl who generally care much about ai, or even support its usage in creative fields.

they also count on that the playerbase wont be mad enough about it bc most players dont rly care or understand. which is prob going to be an accurate prediction. so they dont especially lose on it unless theres a genuine uproar, but even then, theres a lot of space in "genuine uproar" that still results in "no such thing as bad publicity".

so, thats my perspective on why sse did the ai candle thing. publicity for investors and the industry and media. it helps both sse and the little weird "ai" (side eyes) scent company who both get ai bubble points here. its completely unrelated to what players want or care about (and as many have said, players actually do want to buy things from sse - like plushies and other merch).

now to the last point. the candle isn't even ai, and it's really just an ai boom trending word thing for attention.

some ppl on ssoblr dont really understand what ai is or how it works, or how its already been in use for a long time. im not really gonna explain all of that but i do ask you to like... watch a video or read a wikipedia article or something and please educate yourself on what ai is and isnt. anyway,

supposedly this company feeds pictures into whatever ai model theyre supposedly using. the ai supposedly spits out things like "sunshine :) dirt :) chupacabra :)" from the customers phone pics and then actual perfumers mix blends based on what the ai supposedly told them from the pics.

idk if ur catching on here but, there are trained perfumers here who have seen the customers' pics with their own human eyes. they humanly blend scents based on the content of pics theyve humanly seen. (unless all perfumers at the company are also blind and the ai is their only way to find out whats in the pics, and if so, power to them, ofc.) and, at best, an ai has supposedly told them some generic image analysis terms, which are unlikely to be very helpful to the art of scent design.

there is absolutely nothing the supposed ai is actually doing here. theres no reason for it to be here. it contributes nothing to the process. exceeeeeppppttttt..... clicks!!!! articles. videos. wow! crazy ai scents! wow! ai horse candle!! thats crazy!!!!!!!!!!!!!!!! so future!!!!!!!!!!

the scent company is a classic tech bubble startup (allegedly from my perspective in my opinion). they dont even use ai (allegedly from my perspective in my opinion). they want a quick buck for looking like a modern futuristic business to the FOMO investors who fall for this every single time theres new shiny tech (allegedly from my perspective in my opinion). and sse collabs with them for pretty much the same reason (allegedly from my perspective in my opinion).

30 notes

·

View notes

Note

I think that there is definitely a place for AI, but it just feels like the companies behind it are trying to make their products the answer to everything, even when it doesn’t make sense, like when crypto and blockchain were starting

Like I don’t want AI writing wikis, that should just be a data entry any prediction on that part is a problem and probably inaccurate

Or an article trying to tell me how a blue moon actually gives of blue light

Like every good tool it should be the answer to a problem, but the problem popular AI seems to be solving is companies don’t want to pay people for content

But your examples of someone making their own models and sourcing their own data is fine in my opinion

oh absolutely, in no fuckin universe is AI any sort of replacement for a human being with fact checking capabilities and the ability to actually know and understand things. Most of its current use within industry is a load of grifter shit, and I'll be surprised if it works out in the long run with how hard it is for companies to like...actually turn any sort of profit with it lmao. Yeah no my advocacy for generative art starts with 'harmless (and clearly labeled) goofs' and ends with 'one of many items in an artist's toolkit'. ChatGPT in particular has materially made the internet worse and in a hilarious twist of fate has output so much garbage that its made ITSELF worse.

13 notes

·

View notes

Text

How Bitcoin is Probably Gearing Up for a New ATH

Bitcoin has consistently demonstrated its resilience and growth potential since its inception. As we observe its price movements and market dynamics, it becomes evident that Bitcoin might be gearing up for a new all-time high (ATH). Understanding the importance of ATHs in the context of Bitcoin and cryptocurrencies can provide valuable insights into the potential future trajectory of this digital asset.

Historical Performance and Previous ATHs

Bitcoin's journey has been marked by several significant ATHs, each catalyzing a surge in investor interest and mainstream media attention. The 2017 bull run saw Bitcoin reach an ATH of $19,783 on December 17, 2017, driven by a combination of retail investor frenzy and increasing awareness. Similarly, the 2020-2021 bull run pushed Bitcoin to a new ATH of $68,789 on November 10, 2021, fueled by institutional investments and macroeconomic factors.

Current Market Indicators

Several indicators suggest that Bitcoin is poised for another ATH:

Institutional Investments: Companies like MicroStrategy have acquired approximately 230,000 BTC as of 2024, worth billions of dollars.

Adoption Rates: PayPal reported over $5 billion in crypto trading volume in Q1 2024.

Technological Advancements: The Taproot upgrade, activated in November 2021, has enhanced Bitcoin's privacy and smart contract capabilities.

Regulatory Developments: The SEC's approval of spot Bitcoin ETFs in January 2024 has provided a more stable environment for growth.

Factors Contributing to the Potential ATH

Increased Adoption and Mainstream Acceptance: Major banks like JPMorgan and Goldman Sachs now offer Bitcoin-related services to their clients.

Technological Advancements: The Lightning Network's capacity has grown to over 5,000 BTC as of 2024, improving Bitcoin's scalability.

Macroeconomic Factors: With U.S. inflation rates hitting 7% in 2021, Bitcoin is increasingly seen as a hedge against economic instability.

Geopolitical Influences: Countries like El Salvador adopting Bitcoin as legal tender demonstrate its potential as a global, borderless currency.

The Importance of Dollar-Cost Averaging (DCA) into Bitcoin

Dollar-Cost Averaging (DCA) is a strategic investment approach where an individual invests a fixed amount of money into an asset at regular intervals, regardless of its price.

Benefits of DCA:

Mitigates market volatility

Reduces investment risk

Provides a disciplined approach to investing

Example of Successful DCA Strategy: An investor who consistently invested $100 weekly in Bitcoin from January 2019 to December 2023 would have seen a return on investment of over 300%, outperforming many who attempted to time the market.

Practical Advice for Implementing DCA:

Start with a fixed amount that fits your budget (e.g., $50-$500 per month)

Set a regular investment schedule (weekly or monthly)

Use reputable exchanges with automated purchasing options

Remain consistent regardless of market conditions

Expert Opinions and Predictions

Cathie Wood, CEO of Ark Invest: Predicts Bitcoin could reach $1 million per coin by 2030.

Plan B, creator of the Stock-to-Flow model: Forecasts Bitcoin reaching $100,000 by 2025.

Michael Saylor, CEO of MicroStrategy: Believes Bitcoin will replace gold as a store of value, potentially pushing its price to $500,000.

Potential Risks and Challenges

While the prospects for a new ATH are promising, potential risks include:

Market volatility: Bitcoin's price can fluctuate by over 10% in a single day.

Regulatory risks: Potential government crackdowns or unfavorable legislation.

Technological issues: The need for ongoing development to address scalability and security concerns.

Conclusion

Bitcoin's potential for reaching a new ATH is supported by a combination of historical patterns, current market indicators, and strategic investment approaches like DCA. As we move forward, staying informed and considering long-term investment strategies will be crucial for navigating the cryptocurrency landscape.

Key Takeaways:

Bitcoin has a history of reaching new ATHs, with the current record at $68,789.

Institutional adoption, technological advancements, and macroeconomic factors support potential growth.

Dollar-Cost Averaging can be an effective strategy for investing in Bitcoin.

While expert predictions vary, many see significant upside potential for Bitcoin.

Be aware of risks and challenges, including market volatility and regulatory uncertainties.

As you consider your investment strategy, remember that the cryptocurrency market is highly volatile. Always conduct thorough research and consider consulting with a financial advisor before making investment decisions.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#BTC#Crypto#Cryptocurrency#Blockchain#BitcoinATH#CryptoInvesting#CryptoNews#DigitalCurrency#FinancialFreedom#Investing#CryptoCommunity#BitcoinNews#CryptoAdoption#CryptoMarket#BitcoinPrice#CryptoGrowth#CryptoFuture#BTCtoTheMoon#BitcoinRevolution#BitcoinInvestment#CryptoTrends#HODL#BitcoinCharts#financial empowerment#unplugged financial#globaleconomy#financial experts#financial education#finance

4 notes

·

View notes

Text

How To Develop A Fintech App In 2024?

FinTech, short for financial technology, represents innovative solutions and products that enhance and streamline financial services. These innovations span online payments, money management, financial planning applications, and insurance services. By leveraging modern technologies, FinTech aims to compete with and often complement traditional financial institutions, improving economic data processing and bolstering customer security through advanced fraud protection mechanisms.

Booming FinTech Market: Key Highlights And Projections

Investment Growth In FinTech

In 2021, FinTech investments surged to $91.5 billion.

This represents nearly double the investment amount compared to 2020.

The significant increase highlights the rapid expansion and investor interest in the global FinTech market.

Projected Growth In Financial Assets Managed By FinTech Companies

By 2028, financial assets managed by FinTech firms are expected to reach $400 billion.

This projection indicates a 15% increase from current levels, showcasing the potential for substantial growth in the sector.

Usage Of Online Banking

About 62.5% of Americans used online banking services in 2022.

This figure is expected to rise as more consumers adopt digital financial services.

Key FinTech Trends In 2024

1. Banking Mobility

The transition from traditional in-person banking to mobile and digital platforms has been significantly accelerated, especially during the COVID-19 pandemic. The necessity for remote banking options has driven a surge in the adoption of smartphone banking apps. Digital banking services have become indispensable, enabling customers to manage their finances without needing to visit physical bank branches.

According to a report by Statista, the number of digital banking users in the United States alone is expected to reach 217 million by 2025. Many conventional banks are increasingly integrating FinTech solutions to bolster their online service offerings, enhancing user experience and accessibility.

2. Use Of Artificial Intelligence (AI)

AI in Fintech Market size is predicted at USD 44.08 billion in 2024 and will rise at 2.91% to USD 50.87 billion by 2029. AI is at the forefront of the FinTech revolution, providing substantial advancements in financial data analytics, customer service, and personalized financial products. AI-driven applications enable automated data analysis, the creation of personalized dashboards, and the deployment of AI-powered chatbots for customer support. These innovations allow FinTech companies to offer more tailored and efficient services to their users.

3. Development Of Crypto And Blockchain

The exploration and integration of cryptocurrency and blockchain technologies remain pivotal in the FinTech sector. Blockchain, in particular, is heralded for its potential to revolutionize the industry by enhancing security, transparency, and efficiency in financial transactions.

The global blockchain market size was valued at $7.4 billion in 2022 and is expected to reach $94 billion by 2027, according to MarketsandMarkets. These technologies are being utilized for improved regulatory compliance, transaction management, and the development of decentralized financial systems.

4. Democratization Of Financial Services

FinTech is playing a crucial role in making financial services more transparent and accessible to a broader audience. This trend is opening up new opportunities for businesses, retail investors, and everyday users. The rise of various digital marketplaces, money management tools, and innovative financing models such as digital assets is a testament to this democratization.

5. Products For The Self-Employed

The increasing prevalence of remote work has led to a heightened demand for FinTech solutions tailored specifically for self-employed individuals and freelancers. These applications offer a range of features, including tax monitoring, invoicing, financial accounting, risk management, and tools to ensure financial stability.

According to Intuit, self-employed individuals are expected to make up 43% of the U.S. workforce by 2028, underscoring the growing need for specialized financial products for this demographic. FinTech companies are responding by developing apps and platforms that address the unique financial needs of the self-employed, facilitating smoother and more efficient financial management.

Monetization of FinTech Apps

1. Subscription Model

FinTech apps can utilize a subscription model, which offers users a free trial period followed by a recurring fee for continued access. This model generates revenue based on the number of active subscribers, with options for monthly or annual payments. It ensures a steady income stream as long as users find the service valuable enough to continue their subscription.

2. Financial Transaction Fees

Charging fees for financial transactions, such as virtual card usage, bank transfers, currency conversions, and payments for third-party services, can be highly lucrative. This model capitalizes on the volume of transactions processed through the app, making it a significant revenue generator.

3. Advertising

In-app advertising can provide a consistent revenue stream. Although it may receive criticism, strategically placed banners or video ads can generate substantial income without significantly disrupting the user experience.

Types Of FinTech Apps

1. Digital Banking Apps

Digital banking apps enable users to manage their bank accounts and financial services without visiting a physical branch. These apps offer comprehensive services such as account management, fund transfers, mobile payments, and loan applications, ensuring transparency and 24/7 access.

2. Payment Processing Apps

Payment processing apps act as intermediaries, facilitating transactions between payment service providers and customers. These apps enhance e-commerce by enabling debit and credit card transactions and other online payment methods, supporting small businesses in particular.

To Read More Visit - https://appicsoftwares.com/blog/develop-a-fintech-app/

#app development#finance app development#finance app#real estate app development#mobile app development#fintech apps

2 notes

·

View notes

Text

From MR:

Hardly anyone associated with Future Fund saw the existential risk to…Future Fund, even though they were as close to it as one could possibly be.

I am thus skeptical about their ability to predict existential risk more generally, and for systems that are far more complex and also far more distant. And, it turns out, many of the real sources of existential risk boil down to hubris and human frailty and imperfections (the humanities remain underrated). When it comes to existential risk, I generally prefer to invest in talent and good institutions, rather than trying to fine-tune predictions about existential risk itself.

If EA is going to do some lesson-taking, I would not want this point to be neglected.

This is pretty awful logic. I have a raft of critiques of EA’s longtermism, but there is no model of how human expertise works here that tracks. The idea is that a...pandemic preparedness researcher doing deep dives into modelling plague risk should...have the ability to evaluate the internal financials of a crypto hedge fund better than a dozen+ financial institutions already have...and therefore *NOT* take millions of dollars being offered for them for free to do work they consider important today.

It is a pretty asinine ask, and one that flies in the face of EA’s entire point about longtermism - that right now society’s way of handling that is just the ‘genius’ of individual people like politicians and we have no institutions devoted to it, since individual humans are always flawed and specialization is only way to progress.

You can critique EA’s longtermism, I am not saying you can’t - what I am saying is that the fact that the people doing so didn’t do a full audit of their donors, something 0.000% of nonprofits do, teaches you very little about that critique. In a wider sense I am “EA has little to learn from the FTX debacle besides yikes that sucks” and this is a part of that.

12 notes

·

View notes

Text

Maximize Your Earnings with the Fastest Growing Crypto Platform

In an unprecedented move, United-CFX has unveiled its next-generation crypto trading platform, specifically designed to maximize user earnings through a powerful combination of artificial intelligence (AI) and real-time market insights. With its cutting-edge technology and intuitive features, United-CFX offers traders at all levels an unmatched opportunity to grow their portfolios efficiently and with precision.

As cryptocurrencies continue to dominate global financial discussions, United-CFX provides a solution for navigating the market’s volatility with confidence. By automating the trading process and providing instant data-backed recommendations, this new platform allows users to make informed decisions without the need for complex manual analysis. This launch marks a significant advancement in crypto trading technology, aiming to redefine how individuals interact with the digital currency market.

Why United-CFX Is Leading the Way in High-Earning Potential

Traditional trading methods struggle to adapt to the rapid pace of cryptocurrency market changes, leaving traders vulnerable to missed opportunities and financial losses. United-CFX directly addresses these limitations by implementing advanced AI algorithms that continuously track and analyze thousands of data points in real time. This dynamic functionality empowers users with timely insights, enabling them to capitalize on profitable trades and stay ahead of the market.

According to a representative from United-CFX, “Our mission is to bridge the gap between complex market data and accessible trading. With our platform, users can confidently maximize their earnings, thanks to AI-driven insights and automated trading processes. We designed United-CFX to be the ultimate resource for anyone seeking substantial gains in the crypto space.”

AI-Powered Trading: The Key to Consistent Profitability

At the heart of United-CFX lies its AI-powered trading engine, which processes vast amounts of data every second. This engine identifies patterns and trends that even experienced traders might overlook, providing users with predictions and suggestions that improve trading precision and profitability. With a blend of machine learning, historical data analysis, and predictive modeling, United-CFX is equipped to support traders in making high-stakes decisions with confidence.

The platform’s CEO shared insights on the AI system’s impact, saying, “Data is the backbone of successful trading, and our AI technology makes it accessible to all. United-CFX doesn’t just provide data; it interprets it in a way that drives smarter trading choices, ultimately leading to consistent profits. We’re here to give every trader—novice or expert—the advantage they need to succeed in this competitive market.”

Empowering Traders with Real-Time Market Analysis

The ability to act on real-time market analysis is crucial in today’s fast-paced cryptocurrency landscape. United-CFX provides its users with instant access to live market data, coupled with actionable insights that guide each trade. This continuous stream of up-to-date information is invaluable for traders looking to optimize their strategies and maximize earnings.

Users of United-CFX can benefit from detailed performance reports, personalized analytics, and predictive signals, all aimed at delivering the insights necessary to make data-driven decisions. The platform’s advanced dashboards display essential information in an easy-to-understand format, allowing traders to monitor performance without the need for multiple tools or complicated processes.

Customizable Features Tailored to Individual Trading Goals

Understanding that each trader has unique objectives and strategies, United-CFX is built with a suite of customizable features. Whether the goal is long-term investment or quick, high-frequency trades, United-CFX enables users to tailor their experience to fit their needs. From setting custom alerts to adjusting risk tolerance levels, users can mold the platform around their preferred trading style.

The CEO emphasized the importance of flexibility, stating, “With United-CFX, traders aren’t limited to one rigid approach. Our platform allows for a high degree of customization, giving users the tools they need to navigate the market on their own terms. By offering a versatile system, we’re making it easier for traders to achieve the specific outcomes they’re aiming for.”

A Secure and Accessible Platform for Global Users

Security remains a top priority for United-CFX, with robust encryption and security measures ensuring that user data and investments are well-protected. Recognizing the potential risks associated with digital asset trading, the platform integrates the latest in security protocols, making it a safe and reliable choice for traders.

Moreover, United-CFX is accessible to users worldwide, with full mobile compatibility that enables traders to monitor their portfolios and make decisions from anywhere. This flexibility allows users to stay connected to the market and maximize earnings, even when they’re on the move. With United-CFX, users have the convenience of secure, remote access to their investments.

Unlock Your Earning Potential with United-CFX Today

For those ready to take control of their crypto trading journey, United-CFX offers a sophisticated solution that turns market complexity into clear, actionable opportunities. By combining AI-driven insights with user-centric customization, the platform is built to deliver consistent profitability for traders at every experience level. United-CFX is the platform of choice for those looking to maximize earnings with confidence and efficiency.

Feedback from early adopters underscores the platform’s reliability and the impact of its AI-powered tools. Unlike traditional trading platforms, which demand constant manual analysis, United-CFX automates this process, ensuring that users have the data they need to make informed decisions without the heavy time commitment.

Your Gateway to Consistent Crypto Profits Starts Here

Don’t miss the opportunity to explore a smarter, faster way to trade crypto. With United-CFX, you can unlock your earning potential and access the tools needed to succeed in today’s rapidly changing crypto market. By embracing AI technology and real-time insights, United-CFX sets you on a path toward profitable trading that doesn’t miss a beat.

Visit United-CFX today to learn more about this revolutionary platform and join a community of traders who are maximizing their earnings with confidence. Experience the difference that AI-powered trading can make in your financial journey with United-CFX.

0 notes

Text

Crypto Currency News Today: Top Stories, Market Trends, and Insights

Cryptocurrency continues to make waves in the financial industry, driving innovation and influencing the global economy. As digital assets evolve, staying informed about crypto currency news today has become essential for investors, traders, and tech enthusiasts. Whether you're tracking market trends, exploring new crypto projects, or monitoring token prices, up-to-date information is key. In this article, we cover the latest happenings and top stories in the cryptocurrency world.

1. Bitcoin Price Update: What’s Driving Market Fluctuations?

One of the most searched topics in the crypto space is the Bitcoin price today. Bitcoin, the world's largest cryptocurrency by market capitalization, often sets the tone for the broader market. Recent fluctuations have been influenced by various factors, including macroeconomic conditions, regulatory developments, and major institutional investments. As Bitcoin continues to oscillate, understanding these market drivers is crucial for making informed trading decisions.

2. Shiba Inu Coin News: Is the Meme Coin Ready for a Comeback?

The Shiba Inu coin has captured the interest of investors and meme coin enthusiasts alike. Known for its volatility, the Shiba Inu coin often reacts sharply to market sentiment and social media trends. Today's updates suggest a potential rally fueled by increased trading volume and speculation about upcoming announcements. Keeping an eye on the latest Shiba Inu coin news can help investors stay ahead of market movements.

3. Altcoin Market Trends: New Coins Making an Impact

While Bitcoin and Ethereum dominate the headlines, there are plenty of promising altcoins making waves in the coin market. From emerging DeFi tokens to innovative blockchain projects, altcoins are capturing a significant share of investor attention. Recent developments in the altcoin space highlight the potential of lesser-known tokens, which could provide substantial returns for early investors. Following the latest updates in cryptocurrency news today can help you identify these rising stars.

4. Crypto Regulation Updates: What’s Changing in the Legal Landscape?

Regulatory news is a significant driver of the cryptocurrency news today. As governments around the world look to establish clearer guidelines for digital assets, new regulations can have a major impact on market dynamics. Recent discussions among U.S. lawmakers and international regulators signal potential shifts in the legal treatment of cryptocurrencies. Staying informed about these changes is crucial for investors looking to navigate the evolving regulatory environment.

5. NFT and AI Developments: Expanding the Crypto Frontier

Beyond traditional cryptocurrencies, developments in NFTs (Non-Fungible Tokens) and AI (Artificial Intelligence) are shaping the future of digital assets. The integration of AI into blockchain technology is creating new possibilities for data analysis, predictive modeling, and automated trading strategies. At the same time, NFTs continue to disrupt industries like art, gaming, and entertainment. Following updates on these emerging technologies in the crypto currency news space can give you a deeper understanding of their potential impact.

6. Market Predictions: What’s Next for Cryptocurrencies?

As we look ahead, many experts are making bold predictions about the future of the crypto market. With increasing institutional adoption and innovations in blockchain technology, the long-term outlook for digital assets remains positive. However, short-term volatility is expected as the market reacts to global economic shifts and regulatory news. Following the latest coins news crypto can help you make strategic investment decisions based on expert analysis and current market trends.

Conclusion: Stay Updated with Crypto Venture

Keeping up with the fast-paced world of cryptocurrencies requires access to reliable and real-time information. Crypto Venture, the world’s first video platform dedicated to crypto, AI, and NFT news, provides everything you need to stay informed. From daily updates on coins news crypto to expert insights on digital assets, Crypto Venture offers a comprehensive view of the market. Stay ahead of the curve and make smarter investment choices with the latest crypto currency news today.

0 notes

Text

Rocket-X Launching the Future: New Opportunities in the Crypto Market under Trump's New Policies

During his first term, Trump was known for his pragmatic economic policies and market-driven stance. In this campaign, his attitude towards cryptocurrency shifted from caution to open support. He promised to adopt more open policies to promote the healthy development of innovative digital assets. This policy shift undoubtedly brings new opportunities to the crypto industry, filling the market with optimism about the future.

In this policy context, Rocket-X — a decentralized project launch platform built on the Solana chain — has unique opportunities to capitalize on the benefits of these new policies. Rocket-X is dedicated to supporting high-quality Web3 projects and connects early investors with promising projects through a 1.5-tier market model. Trump’s supportive stance on cryptocurrency will boost Rocket-X’s innovative model, making it a focal point in the new market environment.

Trump’s Cryptocurrency Policy Proposals

During his campaign, Trump showed an open attitude towards the crypto market, proposing a series of policies favorable to industry development. These proposals signal a positive outlook for the crypto market, from support for decentralization to favorable tax policies.

Support for Decentralization and Reduced Regulation Trump and the Republican Party have long advocated for reduced regulation to foster innovation. He pledged to lower regulatory barriers in the blockchain and crypto industries, promoting technical freedom through decentralization. This move not only provides more space for blockchain technology to grow but also allows decentralized platforms like Rocket-X to maintain flexibility while complying with regulations.

Encouragement of Bitcoin Mining Trump emphasized the importance of Bitcoin mining, viewing it as part of U.S. manufacturing. He maintained close ties with miners during his campaign, even receiving donations from them. This stance contrasts sharply with the Biden administration’s proposed 30% mining tax, which was seen as detrimental to the industry, while Trump’s approach brings a more promising outlook for mining.

Establishing a National Bitcoin Reserve Trump proposed a plan to establish a national Bitcoin reserve, aiming to position the U.S. as a leader in the crypto space. This proposal, supported by Senator Cynthia Lummis, who introduced relevant legislation, would elevate Bitcoin to a national-level asset reserve, enhancing cryptocurrency’s global influence.

Favorable Tax Policies According to Galaxy Digital’s policy scorecard, Trump’s tax policies are friendlier to digital assets, providing investors with clearer and more favorable tax terms.

Potential Change in SEC Leadership Trump indicated that if re-elected, he would consider replacing the chairman of the U.S. Securities and Exchange Commission (SEC) to achieve a regulatory policy more supportive of digital assets.

These policy proposals lay a solid foundation for the growth of Rocket-X. As a decentralized launch platform, Rocket-X is committed to lowering project launch barriers and empowering users with more options through community governance and decentralized technology. Trump’s support for decentralized finance not only enhances Rocket-X’s regulatory resilience but also attracts more quality projects to choose Rocket-X for early-stage financing.

Potential Growth in the Crypto Market

Market Dynamics and Policy Impact Trump’s election and subsequent policy support provide strong momentum for the future growth of the crypto market. By reducing regulatory barriers and encouraging technological innovation, Trump’s administration offers robust support for blockchain, decentralized finance (DeFi), and digital assets. Experts generally predict significant growth in the crypto market over the next few years.

Investment Trends and Market Projections Driven by favorable policies, growing user demand and capital inflows are expected to increase the activity and market value of Bitcoin, Ethereum, and emerging projects. According to industry reports, the cryptocurrency market’s compound annual growth rate (CAGR) is expected to remain above 15%. Within this trend, platforms like Rocket-X, which focus on early-stage investment and project launches, will face substantial growth opportunities, offering more accessible channels for ordinary investors to enter high-potential projects.

Rocket-X’s Positioning and Advantages

Platform Positioning Rocket-X, as a launch platform based on the Solana chain, has a natural advantage in attracting quality projects and investors. Through its decentralized dual-review mechanism and low-threshold private offering model, Rocket-X meets the demand for high-quality projects, providing early financing opportunities for project owners and convenient access for investors to enter high-potential projects. Amid explosive growth in the crypto market, Rocket-X helps users seize policy dividends and achieve a win-win situation for both investors and project owners.

Competitive Advantages Rocket-X’s 1.5-tier market model aligns closely with Trump’s policies. By breaking the boundaries of traditional primary and secondary markets, Rocket-X provides project owners and investors with greater flexibility, enabling users to enter early-stage projects at low costs and enjoy the convenience brought by high liquidity.

Dual Review Mechanism Rocket-X’s dual review mechanism further ensures project quality. Every project must pass through both official and community screening, reducing investment risks. Compared to other platforms like CoinList and Binance Launchpad’s centralized model, Rocket-X’s community-governed model grants users more decision-making power, making the platform more transparent and trustworthy.

How Rocket-X Seizes New Opportunities

Under Trump’s new policies, Rocket-X faces unprecedented growth opportunities. Rocket-X plans to leverage its 1.5-tier market model fully to create a low-threshold, efficient financing environment for project owners and investors. This will accelerate early-stage financing while allowing ordinary investors to participate directly in promising projects.

Rocket-X will also strengthen its project review mechanism to ensure that all listed projects undergo rigorous dual screening, enhancing transparency and security to attract more conservative investors. The platform plans to pursue a global strategy, building partnerships with traditional financial institutions and DeFi projects, expanding its ecosystem, and providing project owners with global financing support.

Future Expectations

The policy benefits brought by Trump’s election will give Rocket-X a competitive edge in the crypto market. Its 1.5-tier market model and decentralized governance mechanism make it a driving force in the crypto market. By lowering investment barriers, enhancing project selection transparency, and empowering users, Rocket-X offers a more equitable opportunity in the market.

In the future, Rocket-X will continue to leverage policy support and market demand to optimize platform functions and revolutionize Web3 project launch models. Amid the sustained growth of the crypto market, Rocket-X aims to provide users with high-quality investment opportunities, helping project owners achieve their financing goals and solidify its leading position in the crypto market. Ultimately, with Trump’s policy support, Rocket-X is poised to bring users a secure, transparent, and high-yield investment environment, contributing to the healthy development of the crypto market.

0 notes

Text

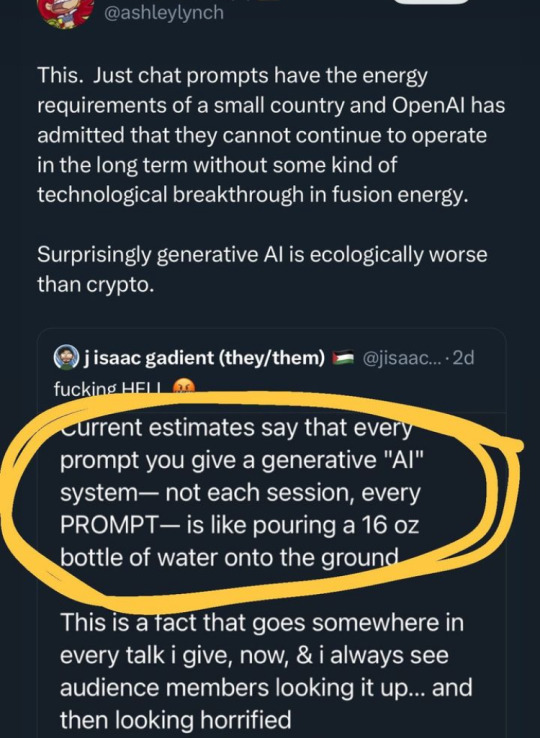

So this is all just... entirely false?

'AI' doesn't use a huge amount of water. What uses a huge amount of water are the giant datacenters that are required to process billions of queries a second. In truth, you can do everything that ChatGPT and DallE and Midjourney can do on your home system.

To put it in perspective: I can run Stable Diffusion on my home PC, using an Nvidia 1080. My entire system has a 750 watt power supply. Even if I spent 24 hours a day generating things, which no one does, the amount of power it would take would not in fact change my electric bill (which is around $50-70 a month and that's with appliances and a roommate with his own gaming pcs).

In fact, you can generate images with a gpu that has as little as 4gb vram, and maybe lower. Which means you could do it, entirely on your home system, without actually using much power.

That goes for training things as well. Training models and the like is usually a question of time, not power. More power makes it faster, but in general you don't need anything beyond what you would get from a normal gaming PC.

Now, text generation is a bit different. Text generation requires around 12-16gb vram, but that's because it's more complex than image generation. Furthermore, the big issue with text generation is that by and large it's a bullshit generator, devoid of context. But even still, it doesn't require massive amounts of power to do it.

What takes power is running millions of queries from all over the world, because in order to have say, Google, use chatgpt, you need to have that plugged into the Google datacenters. But saying that it's generative AI that makes internet datacenters use power is is a bit like saying that it's your muffler that makes car exhaust.

The thing about the internet is that it requires enormous amounts of power to function. People think of the internet like it's still 1995, but in reality the thing that needs all that power is the ability for you to check the internet on your phone from anywhere on earth. Because in order for that to happen, there needs to be infrastructure and that takes power.

Unlike crypto, which involves turning a hundred gpus into a supercomputer to solve massive equations for no conceivable purpose, generative AI is not actually doing anything that amazing or powerful under the hood, and doesn't require that much power. In fact, you can probably run stable diffusion locally on your average tablet these days.

TLDR: dall-e is not consuming massive amounts of power. The infrastructure required to connect to a sprawling network and then predict things based on that network does. In other words, google searching. The more you want computers to do for you, the more power it's going to take. It doesn't SEEM like it would take that much more power to go from looking at web pages yourself to having chatgpt look at them and then guess what it should say instead, but it does. But that's not because the tech is consuming it itself.

63K notes

·

View notes