#Bitcoin price

Explore tagged Tumblr posts

Note

Ok but what if price found out the new rookie was a virgin and immediately decides he has to have her. Not just sexually. He needs to make her his pretty little house wife and domesticate her. Bonus points if he reader is stubborn/feisty which adds to the challenge of domesticating you. He wants to make sure you fully depend on him at all times. Take you from an aggressive and strong soldier to a soft and sweet wife/mother. From filling enemies with lead to filling him and his children’s stomachs with home cooked food 🩷🩷🩷🩷

His first order of business would be to tell you that you’re not experienced enough in battle to kill anyone and he makes you stay with him the entire time. He doesn’t let you get any action, he’s the one doing all the work. Trying to subconsciously tell you “look at how big and strong I am!! I’d take such good care of you and our babies!!”

Getting the feminine urge to actually write a story like this because I’m in love with him

🪤

he'd be so horrible to you, manipulating you into loving him. ignoring your cries and sobs to be free, holding you tightly every night :((;

forcing you to become something you didn't want to be. swapping your military gear for a pretty dress, short with easy access to your cunny. whining when he takes you to your home, throwing you over his broad shoulders, his hands grasping at your body.

he just wants to fuck some sense into you; after constant and consistent fighting, yelling and sobbing at him, begging and pleading with him to go back to the military, the place were you felt the most strong.

price made you feel small, worthless. his hands groping at your body, nails biting into your flesh, sucking hard bruises onto your neck. becoming intoxicated and addicted to the way his cock felt inside your walls; unused, soft and tight. clenching around his girth and unable to hold back your moans, his fingers wrapping around your neck gently, holding you delicately and whispering praises into your ear whilst his hips rammed into you roughly.

his tip leaking semen into you, heavy, fat balls slapping against your tight ass, his cum staining your walls and staining your body with his aroma; musky and sweaty, masculine and strong. :((

he wants to show you how well of a father he can be; strong and masculine, potent sperm made to form multiple babies. the idea of rubbing your stomach when it aches and swells with growth, his small babies inside you and kicking, kissing your cheek and wiping your tears away, reassuring you that this was right choice. :((((

#call of duty modern warfare#cod x reader#cod mw2#modern warefare ii#cod x y/n#cod headcanons#cod imagine#cod modern warfare#cod mw22#orla speaks#john price x reader#cod price#captain price#captain john price#john price#bitcoin price#price#price mw2#call of duty mwii#mw2 fanfic#call of duty mw2#mw2 2022#mw2 fanart#mw2 x reader#mw2022#mw2 141#mwiiedit#cod mwii#modern warefare 2#modern warfare 2

164 notes

·

View notes

Text

Bitcoin's Bull Run: Is the $100,000 Milestone Imminent?

#Bitcoin#Cryptocurrency#Bitcoin Price#Crypto News#Blockchain#Investing#Finance#Technology#Future Of Money#Trump is the GOAT#Supergirl#Batman#DC Official#Home of DCU#Kara Zor-El#Superman#Lois Lane#Clark Kent#Jimmy Olsen#My Adventures With Superman#Daily Planet

7 notes

·

View notes

Text

Why Bitcoin’s $77K Floor and Pakistan’s Crypto Pivot Could Reshape Trading with CELOXFI in Focus

The crypto market’s rollercoaster just took another wild turn, and the chatter is heating up. Bitcoin’s flirting with a supposed “bottom” at $77K, while Pakistan’s throwing its hat in the ring with plans to legalize digital assets. It’s the kind of news that keeps traders up at night—part hype, part hope, and a whole lot of “what’s next?” Amid this chaos, the spotlight’s shifting to how platforms like CELOXFI might steady the ship for U.S. traders hungry for clarity in a space that’s anything but predictable. So, what’s really going on here, and why does it matter?

Let’s start with the big call shaking up the market. Arthur Hayes, the BitMEX co-founder who’s never shy about stirring the pot, dropped a bombshell in a recent analysis. He’s pegging Bitcoin’s floor at $77,000, claiming the dreaded quantitative tightening (QT) phase—central banks’ go-to for sucking liquidity out of the system—is basically toast. To him, the macro storm that’s been rattling crypto is calming down, and Bitcoin’s resilience is shining through. It’s a bold take, no doubt, especially with the market still licking its wounds from the latest correction. Traders are watching closely, some nodding along, others skeptical, but everyone’s asking: is this the signal to jump back in?

Meanwhile, half a world away, Pakistan’s making moves that could ripple far beyond its borders. The government’s cooking up a legal framework to greenlight crypto, aiming to lure international cash and tame the Wild West vibe that’s long spooked regulators there. It’s a 180 from their old stance—less “ban it” and more “bring it”—driven by a hunger to tap blockchain’s economic juice. For a market that’s been under the radar, this could be a game-changer, opening doors for global players and giving digital assets a legit foothold in South Asia. The buzz? It’s not just about Pakistan—it’s a sign more nations might follow suit.

So where does this leave the average U.S. trader, still jittery from scams like that $32M Spanish Ponzi bust? Volatility’s nothing new in crypto, but these shifts—Hayes’ floor call and Pakistan’s pivot—hint at a market finding its footing. That’s where platforms built for the grind come in. CELOXFI platform analysis shows it’s doubling down on what matters: real-time data to track these swings, encryption that doesn’t mess around, and compliance that keeps things above board. For Americans burned by hype-and-dump schemes, it’s less about chasing moonshots and more about trading with eyes wide open.

Hayes’ optimism isn’t blind, though. He’s leaning on Bitcoin’s knack for thriving when fiat systems wobble—think inflation jitters or geopolitical mess. If he’s right, and $77K holds, it’s a green light for traders to rethink their plays. Pair that with Pakistan’s push to regulate, and you’ve got a global scene that’s less shadowy, more structured. Platforms like CELOXFI fit naturally here, offering tools to dissect market noise and manage risk without the fluff. It’s not about flashy promises—it’s about giving U.S. investors a shot at navigating this new terrain without getting rug-pulled.

Pakistan’s move, meanwhile, isn’t just local news. As more countries flirt with crypto laws, the domino effect could steady the market long-term. Imagine a world where digital assets aren’t just for the degens but a legit piece of the financial puzzle. For traders, that means picking platforms that can roll with these punches—ones that prioritize security and transparency over smoke and mirrors. CELOXFI platform analysis highlights its edge: cutting through the chaos with insights that don’t leave you guessing.

The market’s mood? Cautious but buzzing. Bitcoin’s $77K floor could be the reset button traders need, while Pakistan’s crypto embrace might signal a broader thaw. For U.S. investors, it’s a chance to ditch the blind bets and lean into platforms that deliver the goods—think risk management that actually works and data you can trust. The future’s still a gamble, sure, but with these shifts, it’s looking less like a crapshoot and more like a calculated play.

Curious how this all shakes out? Keep an eye on the trends and dig into platforms that can handle the heat. For more on navigating this wild ride, check out https://www.celoxfi.com/index.html.

3 notes

·

View notes

Text

Donald Trump signs order to establish strategic bitcoin reserve

US President Donald Trump signed an executive order on Thursday creating a strategic bitcoin reserve, a day before meeting with cryptocurrency industry executives at the White House.

The document also introduces the United States Digital Asset Stockpile, a fund to hold other digital assets seized by authorities.

Under the executive order, the US will stop selling confiscated bitcoins and develop a strategy to hoard them, but at no additional cost to taxpayers. Altcoins (Ethereum, Solana, XRP, Cardano, etc.) will go into a separate fund, but the government will not buy them.

In the text of the decree bitcoin is called “digital gold,” and its limited issue is seen as a strategic advantage. According to Arkham data, there is $18.4 billion in cryptocurrencies on the wallets controlled by the US authorities, of which $17.98 billion accounts for 198,100 BTC.

The full text of the decree is published on the White House website. Details on the creation and operation of the reserve fund will be discussed at a crypto summit at the White House on March 7.

Ahead of this summit, David Sacks, appointed by Trump to the position of “cryptocurrency czar” in the administration, calculated a loss of about $17bn from the sale of bitcoin by the US government. According to him, this much cost the American taxpayers “lack of a long-term strategy.”

After Trump signed the executive order, Sacks wrote that the reserve would be made up of federal government-owned bitcoins seized as part of court cases. “This means it won’t cost taxpayers a cent,” Sacks added.

The bitcoin exchange rate fell more than 5 per cent after the publication of Trump’s crypto reserve decree (from $90k to $85k), but then partially recovered, reaching $88.5k at 10:30 a.m. on March 7.

Read more HERE

#world news#news#world politics#usa#usa news#usa politics#united states#america#trump#trump administration#donald trump#donald trump news#cryptocurrency#cryptocurreny trading#cryptocurency news#bitcoin#cryptomarket#bitcoin news#bitcoin price#bitcoin mining#bitcoin investment

5 notes

·

View notes

Text

#sutta stories#bitcoin price#bitcoin mining#bitcoin#bitcoin news#bitcoin investing#money management#money saving#money#investment

2 notes

·

View notes

Text

Bitcoin Santa. 🎅🏻💵💲🟥🟩💰

#santa claus#santa#kris kringle#papa noel#Noel#saint nicholas#saint nick#basquiat#cryptocurrency#crypto currency#bitcoin#bitcoins#bitcoin price prediction#bitcoin price surge#bitcoin price#christmas#christmas 2024#blockchain#bitcoin mining#bitcoin halving#wall street#nasdaq#stock market#crypto trading#crypto trends#crypto token#crypto transactions#christmas stocking#jean michel basquiat#investment

6 notes

·

View notes

Text

🚀 NBC Promo Alert: 28% OFF on Our Article Publishing Services! 🚀

Are you a project or exchange looking to amplify your reach and credibility? This is your moment! We’re offering an exclusive 28% discount on our article publishing services for a limited time. This will be your gateway to greater visibility and influence in the industry. Why Choose Our Publishing Services? In the competitive world of finance and cryptocurrency, standing out is…

2 notes

·

View notes

Text

Bitcoin is about to undergo a correction - further growth, selling on a bullish trend is not recommended, the correction may be sideways for several weeks / a great option for a long-term purchase /

2 notes

·

View notes

Text

Bitcoin (BTC) gained significant momentum this week, pushing toward a $1 trillion market cap. Trading over $23,000 and approaching $23,500, Bitcoin leads the crypto market surge.

Cryptocurrencies prices heatmap, source: Coin360

Altcoins also saw strong gains despite Bitcoin dominating the spotlight. Ethereum (ETH) remains above $1,500, while Ripple (XRP) is up 1.60% at $0.4165, and Polkadot (DOT) has risen 2.42%.

Altcoin season is evident with Cardano (ADA), Binance Coin (BNB), Litecoin (LTC), Bitcoin Cash (BCH), and Chainlink (LINK) all recording minor gains. The overall crypto market capitalization has surged past $1 trillion, though Bitcoin’s dominance has dropped to 41.17%.

Top gainers include GALA, up over 27%, and other strong performers like Trust Wallet Token, Avalanche, Enjin Coin, Flax Share, and GMX token, each gaining over 10%.

Top gainers and losers of the day: CoinMarketCap

Despite Genesis Capital’s bankruptcy on Jan. 19, the market sentiment remains bullish, with investors continuing to enter the crypto space. Over the week, market capitalization climbed 7%, and 11 of the top 80 coins saw gains of 18% or more.

Bitcoin price analysis

Bitcoin is at $23,003.26, up 0.13% in the last 24 hours, with a market cap of $444.7 billion. Bitcoin has risen 36% over the past 30 days, with support at $22,200 and resistance at $24,000. Trading above the 21-day EMA, Bitcoin shows bullish control, with the RSI above 50 and a positive MACD indicating potential sideways trading before another move.

Ethereum Price Analysis

Ethereum is trading at $1,591.12, consolidating above $1,500 despite a slight dip. Its market cap is $186 billion. Up over 33% in the past 30 days, Ethereum shows bullish sentiment. Support is at $1,540 and resistance at $1,620. A stagnant triangle pattern suggests an imminent directional move, with the RSI neutral and MACD bullish. The Stochastic RSI in the overbought zone indicates a potential pullback before further gains. Overall, the sentiment remains positive for ETH.

In January's final week, the market cap surpassed $1 trillion, while Bitcoin’s dominance rose.

3 notes

·

View notes

Text

Bitcoin #CryptoAnalysis #BitcoinPrice #Cryptocurrency #Bitcoin2024 #Investing #FinancialFreedom #MarketTrends

ethereum

bitcoin price analysis

crypto news today

bitcoin

btc prediction

bitcoin price

btc price

bitcoin analysis today

buy bitcoin

bitcoin analysis

cryptocurrency news

altcoins

btc

crypto news

btc price prediction

bitcoin prediction

cardano

crypto today

bitcoin news today

altcoin daily

finance

bitcoin technical analysis

btc news today

bitcoin news

bitcoin crash

bitcoin btc price prediction

crypto market

crypto

bitcoin price prediction

btc technical analysis

cryptocurrency

bitcoin price today

cryptocurrencies

btc bitcoin price prediction

btc news

ripple

stock market

bitcoin halving

xrp

bitcoin today

eth

altcoin

bitcoin btc price

crypto crash

investing

bitcoin bull run

price prediction

btc today

bitcoin price analysis 20

#Bitcoin#CryptoAnalysis#BitcoinPrice#Cryptocurrency#Bitcoin2024#Investing#FinancialFreedom#MarketTrends#ethereum#bitcoin price analysis#crypto news today#bitcoin#btc prediction#bitcoin price#btc price#bitcoin analysis today#buy bitcoin#bitcoin analysis#cryptocurrency news#altcoins#btc#crypto news#btc price prediction#bitcoin prediction#cardano#crypto today#bitcoin news today#altcoin daily#finance#bitcoin technical analysis

2 notes

·

View notes

Text

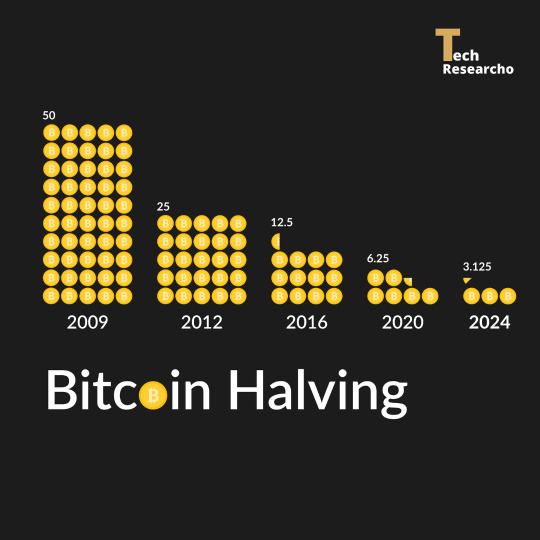

The rewards for mining Bitcoin are about to be chopped in half for miners in a scheduled event called “the halving.” This anti-inflationary measure is predicted to occur on or about April 17, 2024.

2 notes

·

View notes

Note

Ma’am, your snow leopard Price can have me at any time, any place. I am a slut on all fours, ready for Price 😩😩

snow leopard price biting into your neck, whining around him as his dug into you, drawing out ruby coloured liquid. canines deep inside your neck, lapping his tongue at your wound, sucking the blood out of it;

whining around him, his thighs against the back of your own, furry coat rubbing against you, kisses tenderly placed to the back of your nape. sucking hard purple and blue bruises around your neck, whining out and they layered around you like a necklace.

paws pawing at your chest, breasts plump and full, balls slapping against your tight ass, thick and heavy painful balls begging to leak into your wet hole, slick running down your throat and coating it in the thin liquid.

his cock nestled deep inside you, blankets around your bodies as his broad and plush hips rammed against you, ass bouncing with each hard thrust towards your body - knocking the wind out your lungs, claws digging into your hips and thick fingers wrapped around your neck, tight and suffocating as you grasped at his hands, gasping for breath.

#cod x reader#call of duty modern warfare#cod mw2#modern warefare ii#cod x y/n#cod imagine#orla speaks#cod headcanons#cod modern warfare#cod mw22#john price x reader#cod price#captain price#captain john price#john price#bitcoin price#mwiiedit#cod mwii#call of duty mwii#mwii fanart#mw2 fanfic#call of duty mw2#mw2 2022#mw2 x reader#mw2022#mw2 fanart#price mw2#call of duty#call of duty fanart#snow leopard price

34 notes

·

View notes

Text

Why Bitcoin Price is Up Today: BTC Hits $47k

The price of Bitcoin is significantly going up today December 9 due to confidence over a potential approval of a spot ETF by the SEC. The flagship cryptocurrency has witnessed a sharp price spike according to live data from CoinMarketCap. Earlier, the price of the coin topped $45,000 before retracting a bit and hanging around the $45k zone. However, a significant surge has pushed the price of the…

View On WordPress

2 notes

·

View notes

Text

Hi😍😍

عيد سعيد عليكم وعلي الأسرة الكريمة 🤩🤩🤩

#shopping clothes#accounting review#accounting services#Al Ahly#Al Nassr#Al Qadsiah#animals#Augsburg#bank construction#Bayern#béchamel#bitcoin price#bolognese pasta#borsa making#breakfast ideas#candidate Trump#candy products#changes#chicken recipes#operating systems#pasta recipe#planets#potato dishes#potato recipes#print services#Rahim#respiratory course#resume writing#Stade d&039;Abidjan#stuffed intestines

1 note

·

View note

Text

Why Bitcoin price forecasts are misleading

The Bitcoin price is influenced by facts and news. Forecasts are based on assumptions and expectations, so no one should rely on them.

We regularly report on the facts and news that influence the Bitcoin price. In the recent past, in addition to geopolitical and other factors, the United States and its president have had a particularly strong influence on Bitcoin and crypto prices. This will likely continue for some time.

Psychological factors, including fear and greed, are always at play. If investors rush in panicked hordes in the same direction and sell all their assets, prices plummet. If greed dominates and there is a surge in buying, the pendulum swings in the other direction.

These effects are also reflected in the Fear & Greed Index, which measures market sentiment and is expressed in values between 0 and 100 and in red, yellow, or green.

The fact that the index returned from the fear-ridden red zone (30) to the yellow neutral zone (45) from last Sunday to Monday is due in particular to three events. First, crypto ETFs are no longer being sold in large quantities, but are now being bought again. Second, there are hopes and the visible hint of a possible easing of tensions in the tariff trade war. And third, US Senator Cynthia Lummis underscored her Bitcoin Act with the concrete proposal that the US could buy Bitcoin with sold gold reserves. This would allow the US to continuously increase Bitcoin reserves without imposing a tax burden on US citizens.

Therefore, once again: Good news influences Bitcoin and crypto prices. And this news also influences Bitcoin forecasts from all quarters.

In contrast to news, which is usually based on concrete facts or developments, forecasts are often made from the fabric of conviction, belief, and expectation. Positive forecasts are sometimes also accompanied by euphoria.

A Gallery of Optimistic Forecasts A selection of forecasts from recent months made by prominent companies and exponents in interviews on major platforms or at symposiums:

Larry Fink, Blackrock Blackrock founder Fink sees Bitcoin soon rising to $700,000, especially if markets need to hedge against further currency devaluation and economic uncertainty.

Cathie Wood, Ark Invest Founder and CEO Wood believes Bitcoin prices could climb to $1.5 million by 2030.

“Bitcoin will become a hedge against inflation and currency risks in emerging markets – institutional adoption could cause the price to explode.”

Brian Armstrong, Coinbase Co-founder and CEO Armstrong expects Bitcoin to surpass the market capitalization of gold and the price per Bitcoin to reach $1 million.

“The US has numerous reserves – gold, oil, and various rare minerals – I believe the world is moving toward a Bitcoin standard for money.”

Geoffrey Kendrick, Standard Chartered Analyst Kendrick expects the Bitcoin price to reach $200,000 in 2025 and then exceed $500,000 in 2029.

A gallery of pessimistic forecasts Some forecasts or stances from exponents and institutions published in interviews or on their own platforms:

Peter Schiff, economist and economic commentator Schiff believes that Bitcoin has nothing to do with digital gold and could therefore fall below the $10,000 mark again.

“Bitcoin is a bubble that will burst – there is no intrinsic value.”

Bank for International Settlements (BIS) The BIS considers Bitcoin worthless in the long term.

“Cryptocurrencies do not fulfill a central function as money; their role is purely speculative.”

Nouriel Roubini, Economist Roubini sees Bitcoin falling to $0 in the long term.

“Bitcoin is a pure fraud – not a means of payment, not a store of value, not a security.”

Paul Krugman, Economist and Nobel Prize Winner Krugman denies Bitcoin any value and sees no future for the asset.

“Bitcoin will never fulfill its promise of serving as digital money.”

European Central Bank (ECB) ECB representatives describe Bitcoin as a purely speculative asset that could drag investors down. Or, according to the authors, Bitcoin creates inequalities and widens the gap between rich and poor.

“The Bitcoin boom is artificially created – and the last twitching of a long-outdated construct”

International Monetary Fund (IMF) The IMF sees crypto assets as a threat to financial stability, calls for stricter global regulation, vigorously opposes Bitcoin, and warns against “parallel payment systems outside of state control.”

Those who selectively gather information fall into the pit of their own hopes.

In our galleries of positive and negative forecasts, we have omitted euphoric statements from dreamers and fantasists. We have quoted only reputable exponents and institutions of rank, name, and importance.

The conviction of the selected exponents may be considered credible, but their forecasts are nevertheless not reliable. Forecasts are generally rarely reliable because they are based on a framework of assumptions. They are based on conviction and experience, but also on belief and expectations.

Furthermore, forecasters simply cannot foresee future developments. Developments that render any kind of forecast obsolete overnight. What might actually come true under the best of circumstances may turn into the opposite if the weather deteriorates or unforeseeable events occur.

Forecasts for Bitcoin and crypto prices can be misleading when selective investors only perceive and accept those predictions that align with their own hopes and desires.

It is therefore advisable to consume forecasts with fantastic numbers as opinions and entertainment. Forecasts only become facts when the stated targets are actually achieved.

Following your convictions is a good thing. In the context of investments, however, it should be solely your own conviction. And this conviction is not born out of hope or whispering; true conviction is based on facts and tangible developments.

0 notes

Text

What is happening to the US economy and stock market?

The last fortnight or so has seen quite a turn in views on both the US economy and stock market. Starting with the economy we noted this on the 26th of February. So let us simply stick to a view that private-sector business surveys have picked up a clear slowing this month. So in the words of Todd Terry it looked like “something was going on”. Then on March 4th we looked at the way the pace of…

#Ark Innovation#Atlanta Fed#Bitcoin Price#business#Cathie Wood#Doge#economy#Finance#Investing#Jim Cramer#politics#recession fears#stocks#Tesla#Treasury Secretary Bessent#Trump 2.0#US GDP

1 note

·

View note