#PayPal merchant account

Explore tagged Tumblr posts

Text

#paypal#paypal credit card#paypal credit#paypal business account#paypal account#paypal business#pay pal#paypal app#paypal sign up#paypal card#paypal canada#paypal working capital#paypal card reader#paypal debit card#paypal pay in 4#paypal com prepaid#paypal invoice#paypal uk#paypal mastercard#create paypal account#apply for paypal credit#paypal business credit card#paypal prepaid#paypal loans#paypal honey#paypal loanbuilder#paypal credit card apply#buy crypto with paypal#paypal merchant account#paypal app download

1 note

·

View note

Text

0 notes

Text

Why do you need a merchant account?

#Why do you need a merchant account?#merchant account#what is a merchant account#merchant account providers#merchant account rates#merchant account pricing#high risk merchant account#merchant account fees#what is a merchant account and why do you need one#merchant account processing#what is a merchant account?#what is a merchant account and does your business need one?#merchant services#merchant account vs payment gateway#merchant accounts#merchant account rate#paypal merchant account

1 note

·

View note

Text

1 note

·

View note

Text

Hello everyone,

If you need authentic documents for setting up an account like payment gateways, banks, cash apps, Amazon, TikTok, Walmart, and more, please message me privately. I provide genuine documents, not altered ones.

Services offered:

- International Driver's Licenses

- ID Cards

- Passports with selfie verification

- Social Security Number (SSN) Cards

- Legitimate Utility Bills

- Bank/Card Statements

- Front/Back + Selfie images

- Various proof documents

- Limited Liability Company (LLC) and Employer Identification Number (EIN) services

- Document editing services available. Let's discuss your specific requirements.

Reach out via PM if interested.

1 note

·

View note

Text

#ecommerce#online#online store#paying#payment gateway#payment processing#payment systems#payments#payouts#small business#businesses#business#high risk merchant account#high risk payment gateway#paypal#payout#payout api#payment collection#payervault#payervault payment gateway

1 note

·

View note

Text

PayPal has updated their TOS to give your account data to merchants

Like many other companies. They've suddenly added some feature to give advertisers your data and automatically opted all active accounts in.

Turn it off here!!

source/more info

#paypal#small business#psa#idk what else to tag this. if anyone has suggestions please lmk#I think people from the EU are exempt bc you're the only ones with user protections lol. but spread the word I guess#honking

283 notes

·

View notes

Text

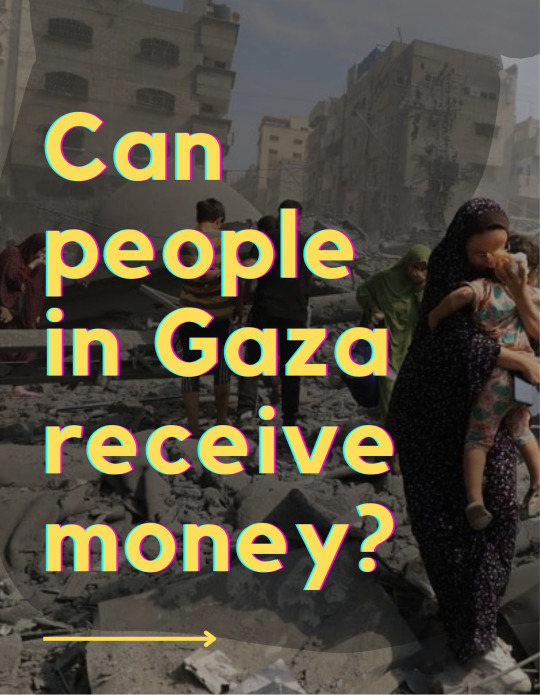

TLDR: Yes!

Part 1 of a learning series with @Se3raj.0 and Sky from Rebirth Garments about the current conditions in Gah-zah . If you learn something today please consider supporting Seraj at

bit.ly/serajfund

You can also read the full interview I did in the feb 25th GFM update!

@hibiscusly and I have been fundraising for Seraj for a month now! We have noticed that as soon as Ramadan started , support for many Gah-zahn’s GFM’s have gotten stagnant, our friends in Pal-eh-stein need consistent ongoing support in order to survive!

[Image descriptions: text graphics made by @love-notes-to-survivors adapted from my interview with @Se3raj.0 !

Image 1: text reads “Can people in Gah-zah receive money?” On top of a photo from the news of people standing on top of rubble

All of the other text graphics are in pink and black text on an ombre yellow to pink background with text that says “Dough-nate to Seraj: bit.ly/serajfund “ at the bottom of each slide.

Image 2: A few weeks ago, we connected with Seraj, a 20-year old IT student currently in the displacement tents with his family in Gah-zah, taking care of his family unit of nine and his extended family. We were able to confirm this via video calls with Seraj.

We learned the following information as to whether people in Gah-zah can receive funds and how from Seraj:

Image 3: There is only one ATM available in all of Gah-zah

In the whole of Gah-zah, there is only one ATM, which is in Rafah. There are no other banking facilities available, and there is a lot of crowding around this one ATM.

Image 4: People in Gah-zah who have money, such as merchants and somewhat rich people, deposit their cash into the bank in case an emergency happens, such as being displaced again, and their money is taken by the soldiers. This way, their money is in their accounts, rather than being on their person.

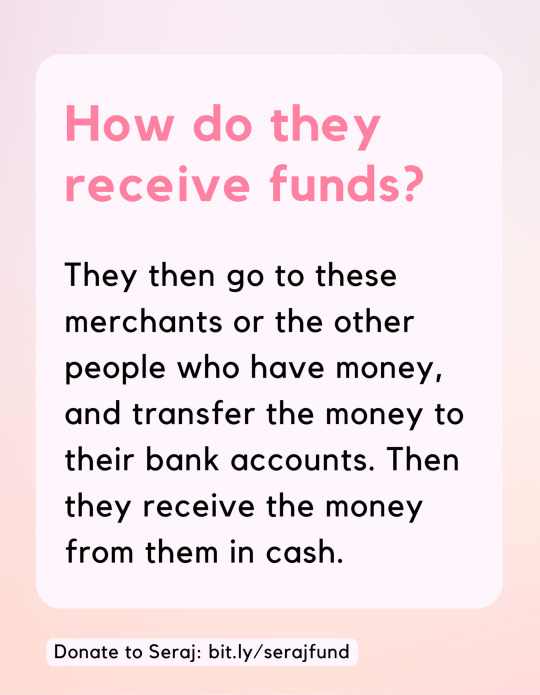

Image 5: How do they receive funds?

When Seraj and others receive money from a payment processer, like PayPal, they transfer it to the bank.

Image 6:

How do they receive funds?

They then go to these merchants or the other people who have money, and transfer the money to their bank accounts. Then they receive the money from them in cash.

Image 7:

Seraj is currently fuhnd-raizing for food, water, medication and supplies for warmth and cooking. If you’re able to, please contribute to his survival fund:

bit.ly/serajfund

End image description]

#palestine#save gaza#gazaunderattack#gaza genocide#gaza#free gaza#gaza strip#news on gaza#mutual aid#st patricks day

56 notes

·

View notes

Text

Looking through old memories of FB I found it (this is the entry of one side that reports racist and xenophobic shit, you understand what I mean)

"NEOFASZYSTA I ANTYSEMITA NOWYM SZEFEM ODDZIAŁU IPN

Czy ktoś jeszcze nie wierzy, że pisowski rząd wspiera faszystów?

Nowym szefem wrocławskiego IPN zostaje Tomasz Greniusz - wieloletni działacz neofaszystowskiego ONR. Podkreślający swą "aryjskość" i antysemityzm.

Za swój wzór do naśladowania uznaje belgijskiego SS-mana Leona Degrelle, ulubieńca Hitlera. Za hasło: "Polska cała tylko biała" - Greniuch podkreślał, że "oznacza supremację ludzi białych w Polsce". I bronił gestu hajlowania jako "pozdrowienia aryjskiej Europy".

Innym bohaterem Greniucha jest Adam Doboszyński, którego bojówki w 1936 roku terroryzowały żydowskich kupców w Myślenicach. Dzisiejszy szef lokalnego IPN w 2012 r. zorganizował "Marsz na Myślenice" razem z kolegami z ONR dla uczczenia pamięci o przedwojennych atakach na Żydów.

Greniuch w 2018 roku został odznaczony przez prezydenta Andrzeja Dudę Brązowym Krzyżem Zasługi. Niedługo później objął stanowisko stanowisko naczelnika IPN w Opolu.

I można by było to wszystko uznać za błędy młodości. Ale Greniuch nigdy nie odciął się od swoich wczesnych doświadczeń, ani od neofaszystowskiej ideologii.

___________

Nie ma dla nas "świętych krów". Nie uznajemy specjalnych kast, którym wolno więcej. Ścigamy rasistów, homofobów, faszystów, niezależnie czy ukrywają się pod eleganckim garniturem, czy przebierają w sutannę.

Wspieraj działania Ośrodka:

PayPal i karta płatnicza: www.omzrik.pl/wesprzyj-nas

Dane do przelewu:

nr konta 19 2490 0005 0000 4520 8435 8540

Ośrodek Monitorowania Zachowań Rasistowskich i Ksenofobicznych

Plac Dąbrowskiego 5

00-057 Warszawa

tytuł : "darowizna na działalność statutową"

IBAN : PL19249000050000452084358540

SWIFT: ALBPPLPW"

"Neo -fascist and anti -Semite with the new head of the IPN branch

Doesn't anyone believe that the Pisz government supports fascists?

Tomasz Greniusz - a longtime activist of the neo -fascist ONR - becomes the new head of the Wrocław IPN. Emphasizing its "Aryan" and anti -Semitism.

He considers his Belgian SS-man Leon Degrelle as his role model, Hitler's favorite. For the slogan: "Poland is only white" - Gorniuch emphasized that "means supremation of white people in Poland." And he defended the gesture of hajling as "greetings of Aryan Europe."

Adam Doboszyński is another hero of Graniuch, whose militias in 1936 terrorized Jewish merchants in Myślenice. Today's head of the local Institute of National Remembrance in 2012 organized a "march na Myślenice" together with colleagues from ONR to celebrate the memory of pre -war attacks on Jews.

In 2018, Gorniuch was awarded by President Andrzej Duda with the Bronze Cross of Merit. Shortly afterwards he took the position of the head of the Institute of National Remembrance in Opole. And all this could be considered the mistakes of youth. But Gorniuch has never cut himself off from his early experiences, nor from the neo -fascist ideology.

There are no "holy cows" for us. We do not recognize special castes, which are allowed more. We chase racists, homophobes, fascists, regardless of whether they hide under an elegant suit, do they change into a cassock.

Support the center of the center:

PayPal and payment card: www.omzrik.pl/wesprzy-nas Transfer data:

Account number 19 2490 0005 0000 4520 8435 8540

Monitoring Center for Racist and Xenophobic behavior

Dąbrowskiego Square 5

00-057 Warsaw

Title: "Donation for statutory activities" Iban: PL1924900005000000452084358540

Swift: AlbPplpw"

In the context of Elon Musk and the fact that some argue that he did not show the Nazi symbol, and "Roman" it comments on a lot…

What is the difference between the symbol of this Nazi from Poland (with a nationalist symbol), and what Elon Musk did?

Oh, yes, Elon is a white immigrant that has money and supports Israel's crimes, of course that it was not a Nazi symbol!

It is literally fucked up that even in Poland, the media themselves could call it what the fuck looks like!

I also found the words of Donald Tusk, which refused to arrest Benyamin Natajhu, it fits perfectly now

#israel is a terrorist state#palestine#free palestine#free gaza#israel#gaza#palestina#jumblr#jewblr#elon musk#donald trump#poland#rant#usa politics#wtf

12 notes

·

View notes

Text

is there any place online that is good for artists to gain a following or sell stuff cuz like. i would like to do commissions and make items to sell but every platform i have considered is bad and i also hate social media.

I also have a GoFundMe because I'm in a lot of debt and I don't know where or how to post to get the traction required.

Instagram did nothing for me when i used it because i would get likes and not follows. i get more follows on here but it's still not a lot and people unfollow me a lot also. i don't post my art or photography often on here right now anyway so im not sure if i can change that. but most users prefer to like posts instead of reblog them which is not helpful.

xitter is obviously a dump right now. i don't feel like selling my soul to Facebook or any Meta derivatives. YouTube algorithms actively shut down small creators. don't think I could keep up with the amount of content you have to churn out to be seen on there. everything else I've seen is either too small to gain a following or is just not built for that.

RedBubble takes big chunks of your money and is very oversaturated. Etsy is oversaturated and mostly full of AI generated drop ship garbage and people reselling mass produced items from Ali Express. the search on there sucks. Patreon needs to be paid for. Paypal and Stripe fees make Ko-Fi cost money also. Paypal can decide to shut down my account for no reason and steal my money. Stripe requires business information I don't have because I'm not a business yet. Shop requires a website to be integrated into which costs money, I assume they also charge fees. many merchants don't work in many places which would limit international sales. even local fairs have been taken over by drop shipping and 3d printed things (not original designs, multiple booths will have the same items...) and they are pretty expensive to attend, especially since they want you to have insurance.

I'm just totally lost on this.

#artists#advice#art#funding#fundraising#commissions#social media#audience#selling art#sewing#quilting#plush making#digital art#traditional art#paintings#ink#goauche#pet portraits#vet bills

6 notes

·

View notes

Text

Patreon is having payment issues 4/25/2024

I've been receiving comments from multiple people lately saying that they're having trouble signing up to my Patreon. For whatever reason their transactions are being declined. I apologize for the frustration! My spouse did their best to compile related info that might be causing the problem so I'll share it here for future reference.

1. Patreon requires an instant funding source (credit/debit card or bank account) to be associated with all PayPal transactions, even if there are already funds available in the PayPal account. The transaction will fail if your PayPal account is not linked to a card or bank account.

2. Authorizing international transactions through your bank/card, as they are sometimes automatically flagged and declined.

3. Authorizing P2P (peer to peer) payments through your bank/Paypal, as sending money through Patreon may be classified as a cash advance instead of a subscription. Issue may be specific to PayPal and/or Australian banks

4. Patreon's MCC (merchant code) may have changed to a "high risk" code associated with telemarketing, gambling, and porn sites. This may be resolved by telling the bank to allow high risk transactions.

This is the link most often provided to those experiencing issues with payment: https://support.patreon.com/hc/en-us/articles/203913799-Retry-my-declining-payment

Paypal specific: https://support.patreon.com/hc/en-us/articles/115001917686-Can-I-use-PayPal-on-Patreon

20 notes

·

View notes

Text

1 note

·

View note

Text

PayPal Merchant Account Requirements

#PayPal Merchant Account Requirements#paypal account#paypal business account#paypal merchant account#how to create paypal account#paypal business account vs personal#merchant account#create paypal account#paypal business account setup#paypal#business paypal account#paypal merchant id for personal account#paypal account kaise banaye#how to create paypal business account#set up paypal business account#paypal personal to business account change#paypal account create#how to verify paypal account

1 note

·

View note

Text

Just bought something off Amazon.de and... their FX rate was better than what my bank offers? Excuse me?

Accepting the merchant's FX offer is almost always a loser's game, e.g. I used paypal recently and their FX exchange fee was obscene so I just allowed it to hit my account as-is and let my bank handle it.

Meanwhile Amazon is out here with an offering .4 basis points better than my bank with the rate locked in? I mean thank you Jeff Bezos I guess but that was certainly not what I expected.

27 notes

·

View notes

Text

Best payout gateway in India with lowest charges and fastest setup.

PayerVault: Your Path to Instant Payouts and Secure Transactions

In a world where digital transactions reign supreme, having a reliable payout gateway at your disposal is essential. This is where PayerVault steps in, offering you a seamless experience that's not only efficient but secure too.

Unlocking Efficiency with Payout Gateways

Picture this: you run a thriving online business, and it's time to disburse payments to your vendors or employees. With PayerVault, you can kiss those tedious, manual processes goodbye. Payout gateways, especially PayerVault, streamline your financial operations, making transactions swift and error-free.

Real-Time Tracking: A Game-Changer

One of PayerVault's standout features is its real-time tracking capabilities. Say goodbye to the days of anxiously waiting for payment confirmations. With PayerVault, you get instant updates on successful transactions, allowing you to stay on top of your finances effortlessly.

Instant Payouts, Low Fees: A Winning Combination

PayerVault takes pride in offering instant payouts – a game-changer for businesses. Imagine the convenience of quick access to your funds. And the best part? PayerVault ensures this at minimal transaction fees, making it a cost-effective solution for businesses of all sizes.

User-Friendly Interface: No Hassle, Just Results

Worried about a steep learning curve? Don't be. PayerVault's user-friendly interface ensures that even if you're new to payout gateways, you'll have no trouble navigating the system. It's designed to simplify your financial operations, leaving you with more time to focus on what matters most – your business.

Why Choose PayerVault?

With PayerVault, you're not just opting for a payout gateway – you're choosing efficiency, security, and convenience. Our commitment to providing instant, secure transactions at competitive rates has made us a trusted name in the industry.

So, whether you're a budding entrepreneur, an e-commerce mogul, or a nonprofit organization, PayerVault has you covered. Say goodbye to payment hassles and embrace a future where financial transactions are seamless, secure, and efficient.

Join us at PayerVault and unlock a world of possibilities in the realm of payout gateways. It's time to experience finance the way it should be – fast, secure, and hassle-free.

"Explore PayerVault Today and Transform Your Financial Transactions!"

#payment gateway#payment processing#payment systems#payments#businesses#business#high risk merchant account#high risk payment gateway#payouts#payout#paypal#online#ecommerce#business growth#online payment gateway#online payment solutions#online payment systems#paying#internet#small business#online store#digital transformation

1 note

·

View note

Text

Buy Cash App account with 15% discount now. Get the most out of your money. We offer the best service and most trustworthy platform for buying, selling, or trading Cash App at a cheap price.

We provide Cash App account with high quality and cheap price. Buy now Cash App account!

What Is Cash App?

Buy Verified Cash App Account. Cash App is a mobile payment service developed by Block, Inc. (formerly Square, Inc.) that allows users to send, receive, and store money. It functions as a peer-to-peer (P2P) payment platform, similar to services like Venmo or PayPal, and is available for both iOS and Android devices. Users can instantly transfer money to others using their Cash App account. A free debit card linked to the Cash App account that allows users to spend their balance at stores or online.

Cash App supports direct deposits and allows users to receive their paychecks directly into the app. Users can buy and sell stocks or invest in Bitcoin through the app. Offers discounts when using the Cash Card at specific merchants. Users can withdraw their balance to their bank account or at ATMs using the Cash Card. Cash App is widely used for personal transactions, like splitting bills, paying rent, or transferring money between friends and family.

What Is Bеnеfits of Vеrifiеd Cash App Accounts?

Verified Cash app accounts offer various benefits, making transactions and usage more secure and convenient. Some of the key benefits include:

Higher Transaction Limits: Verified Cash App accounts can send and receive larger amounts of money compared to unverified accounts. This is especially useful for businesses or individuals who regularly handle large sums of money.

Increased Security: Verifying your identity adds an extra layer of security to your account, helping to protect against fraud and unauthorized access.

Direct Deposit: With a verified account, you can enable features like direct deposit for paychecks, tax refunds and other payments.

Cash Card: A verified Cash App account allows you to order and use a Cash App debit card (Cash Card), which can be used for in-store and online purchases.

Bitcoin & Stock Trading: Verified Cash App users can access additional features like buying, selling, and withdrawing Bitcoin, as well as investing in stocks directly through the app.

Customizable Features: You can customize your $Cashtag and use more personalized features, such as getting detailed transaction history, which is useful for budgeting and tracking spending.

Increased trust: A verified account gives more credibility, especially when using the app for business transactions. This ensures that your identity is confirmed, so that people are more willing to do business with you.

Tax Reporting: A verified account makes it easier to track transactions for tax purposes, as Cash App provides documentation of your financial activities.

Tax Reporting: A verified Cash App account makes it easy to track transactions for tax purposes, as the Cash app provides documentation of your financial activity.

These benefits make verified accounts much more functional and trustworthy for both personal and business use.

Why do people use Cash App?

People use Cash App for a variety of reasons, including:

Convenient Money Transfers: The Cash App allows users to quickly and easily send and receive money between friends, family or other contacts without the need for cash or checks.

Ease of use: The app has a simple, user-friendly interface, making it easy for people who may not be tech-savvy to manage payments. Peer-to-Peer Payments: This is commonly used to splitting bills, pay for group activities, or reimbursing others.

Direct Deposits: Users can receive their paycheck directly into their Cash App account, sometimes getting paid earlier than traditional banking methods.

Cash Card: The Cash App offers a physical debit card (cash card) that users can use to make purchases in stores or online or to withdraw cash from ATMs.

Bitcoin and Stocks: Cash App account enables users to buy and sell Bitcoin, as well as invest in stocks, making it attractive to those interested in small-scale investing.

Security: The Cash app provides security features like passcodes and notifications, giving users confidence in their transactions.

Discounts and Boosts: The app offers “Boosts” that give users discounts at select stores and restaurants when using the Cash Card, providing extra savings.

Cash App’s combination of functionality, security, and ease of use makes it popular for everyday financial transactions and investments.

24 Hours Reply/Contact Telegram: @smmvirals24 WhatsApp: +6011-63738310 Skype: smmvirals Email: [email protected]

2 notes

·

View notes