#online payment systems

Explore tagged Tumblr posts

Text

Top 10 Online Payment Systems in the UK

Finding the right online payment system is essential for smooth business operations and better transaction handling. This blog lists the top 10 online payment systems in the UK, detailing their strengths, weaknesses, and ideal use cases to help you make an informed choice. Read the whole blog to know more.

#online payments#online payment systems#uk#accept online payments#payment solutions#payment processing#payment processor

0 notes

Text

Payment Solutions | Payment Processing Company | AGS Transact

AGS Transact is a leading payment company in India offers online payment systems and digital payment solutions for banking, retail and petroleum automation.

#Payment solutions#payment company#Digital payment solutions#online payment systems#retail automation

0 notes

Text

Our DCV services, offered by wholly owned subsidiary, Securevalue India, are used by banks and financial institutions to safely and efficiently transport cash as per their requirement.

https://www.agsindia.com/

0 notes

Text

Razorpay vs. PayerVault: Exploring the Power of Payment Solutions

Unveiling the Perfect Payment Partner for Your Business

As someone deeply immersed in the world of online transactions and e-commerce, I've always believed in the transformative power of the right payment gateway. The choices we make in this realm can significantly impact our business operations and bottom line. Today, I'm excited to delve into a comparison between two prominent payment solutions: RazorPay and PayerVault. Buckle up; it's going to be an insightful ride!

Razorpay Payout API: A Quick Overview

RazorPay, a well-known name in the payment gateway arena, has garnered recognition for its versatile offerings. Its Payout API promises efficient fund disbursal and an array of features designed to cater to businesses of all sizes. However, as the saying goes, "With great power comes great complexity."

PayerVault: Your Gateway to Simplicity and Efficiency

Enter PayerVault, a hidden gem in the world of payment solutions. This Indian-born payment gateway boasts some impressive advantages. Here's why I believe it deserves a closer look:

1. Speedy Setup:

One of the most frustrating aspects of integrating a payment gateway can be the time it takes. RazorPay may take days or even weeks for the setup process. In contrast, PayerVault promises integration within just two hours. Yes, you read that correctly! In today's fast-paced digital landscape, time is money, and PayerVault understands that.

2. Instant Settlement:

When it comes to online transactions, the faster, the better. PayerVault offers the fastest payment settlement in India, ensuring that businesses have access to their funds without unnecessary delays. This is a game-changer, especially for startups and small businesses that rely on a steady cash flow.

3. Cost-Effectiveness:

Financial efficiency matters, and PayerVault delivers. With competitive pricing and a transparent fee structure of just 1% (compared to RazorPay's 1.9% to 3%), it's a cost-effective choice for businesses looking to optimize their expenses.

4. User-Friendly Interface:

Managing financial transactions can be daunting, but PayerVault's user-friendly platform simplifies the process. It's designed with the end-user in mind, reducing the learning curve and ensuring a hassle-free experience.

5. Robust Security:

In the world of online payments, security is paramount. PayerVault prioritizes data protection, implementing robust encryption and safety measures to safeguard sensitive financial information.

Real-Life Success Stories:

Still not convinced? Let's dive into real-life success stories. I recently had the privilege of interacting with an Indian online business owner who made the switch to PayerVault. The results were impressive:

Meet Raj, the Founder of 'TechTrends' - An Indian E-commerce Marvel

Raj, the mastermind behind TechTrends, had been facing payment gateway woes with a competitor for years. The setup was cumbersome, the settlement times were slow, and the fees were eating into his profits. That's when he discovered PayerVault.

Within just two hours of integrating PayerVault, Raj witnessed a significant transformation in his business. His customers were delighted with the swift payment process, resulting in increased conversions. The real-time tracking provided by PayerVault offered him invaluable insights into his financial operations, leading to smarter decision-making.

In just three months of implementing PayerVault, TechTrends experienced a remarkable 15% increase in revenue. The streamlined payment collection process reduced friction for customers, resulting in a more pleasant shopping experience.

Closing Thoughts:

In the battle of payment gateways, it's clear that PayerVault holds its own. With its lightning-fast setup, instant settlement, affordability, user-friendliness, and unwavering commitment to security, it's changing the game for businesses in India.

So, if you're in the Indian market for a domestic payment gateway that simplifies rather than complicates, consider giving PayerVault a try. It might just be the missing piece in your financial puzzle.

Join the conversation, explore your options, and elevate your payment game with PayerVault!

#ecommerce#online#online store#paying#payment gateway#payment processing#payment systems#payments#payouts#small business#online payment gateway#business growth#online payment systems#payment gateway with lowest charges in india#payervault payment gateway#high risk payment gateway#online shopping#online business#internet#internet safety#payout#payout api#razorpay#payervault#payoff#paypal#payment services

1 note

·

View note

Text

May my building's management company step on legos for the rest of their life.

#don't mind me having a moment#welcome to the new payment system!!! it's SUPER convenient and MUCH BETTER than the old one!#please pay no attention to the fact that you have to PAY FOR THE PRIVILEGE of paying your rent online now :D

2 notes

·

View notes

Text

akljfdklaf im in trouble bc i always wait the day b4 to pay my uni fees bc like idk what if smth happens yk yah n the online payment is down for local cards and now i hv to make a wire transfer but again these dumbass forms they want you to fill out without giving you an example or info on what the fields mean/require and cri la madre is mad with me alsdjf;kasdjsd

#she's justified but also forms shldnt be so stupd#and also the online payment system shldnt be down#grrrrrrrrrr#cloud nonsense

6 notes

·

View notes

Text

Get free vouchers by paying your bills! Enjoy savings and perks when you settle your bills. Don't miss out on this fantastic offer – grab your free vouchers today!

#bill pay#online bill payment#pay bills#bharat bill pay system#bill payments#pay bills online#plutos ONE

2 notes

·

View notes

Text

Events Management Software - Clearevent

ClearEvent is a powerful event management software designed to streamline the planning, organization, and execution of events of all sizes. With its intuitive interface and comprehensive features, ClearEvent enables event organizers to manage registrations, budgets, schedules, and communications all in one place. The platform simplifies team collaboration, automates administrative tasks, and provides real-time insights to ensure seamless event execution. Whether you're planning a corporate conference, festival, or community gathering, ClearEvent offers the tools needed to enhance efficiency, reduce stress, and deliver a successful event experience. https://clearevent.com/features/event-communication/

#Online Event Ticketing System#Conference Management Software#Accept Online Payments#Ticket Management System#Ticket Management Software#Sell Event Tickets Online

0 notes

Text

Best Restaurant Software In India

The restaurant industry in India is booming, with diverse cuisines, unique dining concepts, and fast-paced services driving customer satisfaction. Managing a restaurant, however, can be a daunting task. Thankfully, restaurant software in India has emerged as a game-changer, streamlining operations and helping restaurant owners focus on what matters most — serving their customers. In this blog, we’ll explore the benefits, features, and top options available in the realm of restaurant software in India.

Why You Need Restaurant Software in India

The Indian market offers a wide variety of restaurant software tailored to meet the needs of different types of establishments, whether you own a fine dining restaurant, a café, or a food delivery service. These tools help you manage operations with ease while enhancing the dining experience for your customers.

Features to Look for in Restaurant Software in India

Before choosing the best restaurant software in India for your business, it’s essential to identify the features that suit your requirements. Here are some key functionalities to consider:

✅ Point of Sale (POS) System: A robust POS system is the backbone of any restaurant software. It ensures seamless billing and order management.

✅ Inventory Management: Effective inventory management helps track stock levels, reduce waste, and forecast needs accurately.

✅ Online Order Integration: With food delivery services on the rise, integration with online platforms like Swiggy and Zomato is a must.

✅ Table Management: This feature is crucial for dine-in restaurants, allowing you to manage reservations and seating arrangements efficiently.

✅ Customer Relationship Management (CRM): CRM tools help maintain customer loyalty by storing data and creating targeted offers.

✅ Analytics and Reporting: Detailed insights into your restaurant’s performance enable better decision-making.

✅ Multi-Language Support: In a diverse country like India, having software that supports multiple languages can be a big advantage.

Benefits of Using Restaurant Software in India

✅ Improved Efficiency: Automation reduces errors and speeds up operations.

✅ Better Customer Experience: Quick service and personalized offers make diners happy.

✅ Cost Savings: Effective inventory management minimizes waste and saves money.

✅ Enhanced Online Presence: Integration with food delivery apps helps expand your reach.

Top Restaurant Software in India

Here is a curated list of some of the best restaurant software in India:

Petpooja: Known for its versatility, Petpooja offers features such as POS, inventory tracking, and online order integration. It’s ideal for all kinds of restaurants.

2. POSist: This cloud-based software is perfect for scaling up businesses. It provides advanced CRM tools, table management, and analytics.

3. inresto: A great choice for dine-in restaurants, inresto focuses on reservation management, feedback collection, and marketing automation.

4. Torqus: Torqus is a popular restaurant software in India that emphasizes ease of use and customization. It’s excellent for startups and chains.

5. UrbanPiper: If online orders are your primary focus, UrbanPiper’s integration with top food delivery platforms ensures a seamless experience.

6. NuznInfotech: NuznInfotech stands out with its comprehensive features like POS, inventory control, CRM, and online order integration. It’s one of the top choices for restaurant software in India, catering to both small outlets and large chains.

Choosing the Right Restaurant Software in India

When selecting restaurant software in India, consider the following tips:

Assess Your Needs: A small café’s requirements differ from a large chain’s. List your priorities before making a choice.

Check Reviews: User reviews and testimonials can provide valuable insights into the software’s performance.

Opt for a Demo: Most providers offer free trials or demos. Use this to test the features and interface.

Budget Consideration: Balance cost with functionality to get the best value for your investment.

The Future of Restaurant Software in India

With advancing technology, restaurant software in India is becoming more sophisticated. AI-driven analytics, voice-command interfaces, and blockchain-based solutions for payment security are some trends to watch. These innovations promise to make restaurant operations even more streamlined and customer-focused.

#best restaurant software in india#best pos software for restaurants in india#best billing software for restaurant in india#restaurant management software#best restaurant management software#restaurant POS software India#best POS billing software India#restaurant billing system India#restaurant POS system#restaurant operations software India#cloud-based restaurant management software#restaurant inventory management software India#restaurant reservation software India#restaurant ordering system software#best restaurant CRM software India#restaurant software for small business#best food delivery management software India#restaurant point of sale system India#restaurant kitchen management software#food and beverage management software India#best restaurant management tools#online ordering system for restaurants India#restaurant staff management software India#restaurant menu management software India#all-in-one restaurant software India#restaurant ordering and payment software#integrated restaurant POS software#restaurant business management software India#best restaurant management platform

0 notes

Text

The United States online food delivery market size reached US$ 29.1 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 68.6 Billion by 2032, exhibiting a growth rate (CAGR) of 9.8% during 2024-2032. The growing preference for convenient and fast service among consumers, rising reliance on smartphones and high internet penetration, and increasing adoption of advanced technologies to enhance user service are some of the factors impelling the market growth.

#United States Online Food Delivery Market Report by Platform Type (Mobile Applications#Websites)#Business Model (Order Focused Food Delivery System#Logistics Based Food Delivery System#Full Service Food Delivery System)#Payment Method (Online#Cash on Delivery)#and Region 2024-2032

1 note

·

View note

Text

ATMs & CRMs – Unveiling Their Benefits in India’s Evolving Payment Landscape | AGS India

Both ATMs and CRMs facilitate various banking transactions, CRMs offer the additional functionality of cash recycling, making them more advanced and sophisticated machines.

#Billing software#Billing Machine#Fintech company#Digital payments#cash payment#cash management services#online payment systems#Cash transit#QR code payment#cashless transaction in India#Digital payment solutions#payment company#RFID solutions#Payment solutions#fuel management system#cashless payment#fraud prevention#Banking automation#retail automation#Banking outsourcing

0 notes

Text

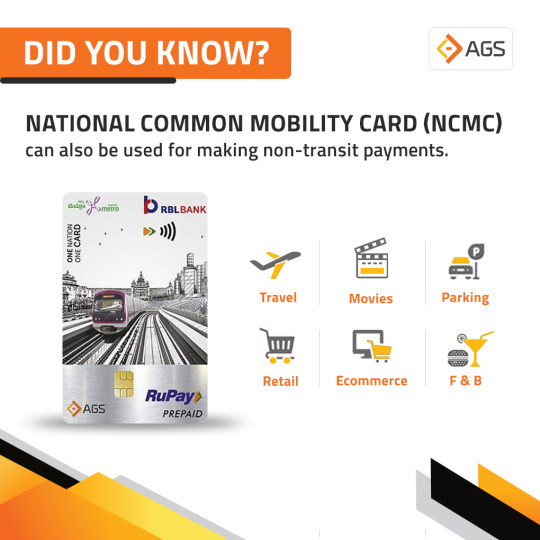

DidYouKnow National Common Mobility Card or #NCMC can be used for non-transit payments as well?

https://www.agsindia.com/

0 notes

Text

Build the Future of Gaming with Crypto Casino Development Solutions

#In a world where innovation drives the gaming industry#the rise of crypto casino game development is reshaping the way players and developers think about online gambling. This is because blockch#allowing developers and entrepreneurs to create immersive#secure#and decentralized casino experiences in unprecedented ways. This is not a trend; it's here to stay.#The Shift towards Crypto Casinos#Imagine a world that could be defined by transparency#security#and accessibility for your games. That's precisely what crypto casino game development is trying to bring to the table. Traditionally#online casinos have suffered because of trust issues and minimal choices for payment options. This changes with blockchain technology and c#Blockchain in casino games ensures that all transactions are secure#transparent#and tamper-proof. Thus#players can check how fair a game is#transfer money into and out of the account using cryptocurrencies#and maintain anonymity while playing games. It is not only technologically different but also culturally. This shift appeals to a whole new#What Makes Crypto Casino Game Development Unique?#Crypto casino game development offers features that set it apart from traditional online casinos. Let’s delve into some of these groundbrea#Decentralization and TransparencyBlockchain-powered casinos operate without centralized control#ensuring all transactions and game outcomes are verifiable on a public ledger. This transparency builds trust among players.#Enhanced SecurityWith smart contracts automating processes and blockchain technology securing transactions#crypto casinos significantly reduce the risk of hacking and fraud.#Global AccessibilityCryptocurrencies break the barriers that traditional banking systems have#making it possible for players from around the world to participate without having to think about currency conversion or restricted regions#Customizable Gaming ExperiencesDevelopers can customize crypto casino platforms with unique features such as NFT rewards#tokenized assets#and loyalty programs#making the game more interesting and personalized.#Success Story of Real Life#Crypto casino game development has already brought about success stories worldwide. Among them

0 notes

Text

Efficient Payment Collection can

Maximize your E-commerce Profits

Unlock the potential of your e-commerce venture! Dive into a real-world success story that reveals the transformative power of streamlined payment collection.

🌟 Case Study:

Meet 'E-Shop India,' an Indian e-commerce startup that achieved a remarkable 30% boost in revenue within a mere three months. The catalyst for this growth? PayerVault, India's leading payment collection API. Explore how this innovative solution transformed their financial operations.

🔑 Key Insights:

Discover the direct impact of efficient payment collection on revenue growth.

Learn how offering diverse payment methods can lead to higher conversion rates.

Get the facts with data-driven insights.

Witness a shift from payment hassles to customer convenience.

🚀 Take your e-commerce business to new heights! Unleash the potential of PayerVault's payment collection solutions and pave the way for revenue growth.

🔗 Read the Full Story: Link to the Case Study

#PaymentCollection #EcommerceSuccess #PayerVault #CaseStudy #RevenueBoost"

#ecommerce#online store#paying#payment gateway#payments#payouts#payment systems#payment processing#small business#online#payment collection#business growth#sales#shopify#onlinebusiness#ecommerce solutions#ecommerce software development#ecommerce store#payervault#online payment systems#online payment gateway#digital transformation#digital payment solution#payout#payment services#businesses#business#high risk merchant account#high risk payment gateway

0 notes

Text

How much time does it take to develop an app?

The time required to develop a mobile app is determined by its complexity, features, and platform (iOS, Android, or both). Typically, it can take between 3 and 9 months. The process starts with planning and research, which typically takes 2-4 weeks to determine the app's goal, target audience, and important features. The design phase (4-8 weeks) is the next step, during which wireframes and prototypes are used to create the user interface (UI) and user experience.

The development phase, which includes coding, takes the longest—ranging from 2 to 6 months or more, depending on whether the app is simple (e.g., a calculator) or complicated, with features such as real-time chat, payment systems, or AI. Testing and quality assurance take 2-6 weeks to correct errors, verify compatibility, and improve performance. Finally, the deployment phase takes approximately 1-2 weeks for app store submissions and approvals.

Third-party integrations, design revisions, and team skill can all influence the timeline. Working with an experienced app development team guarantees efficiency and quality. Whether you're creating a basic or complicated software, proper planning and teamwork can help to speed up the process.

#marketing#seo#branding#digital#content marketing#online marketing#digital marketing agency#digital marketing#email marketing#digital marketing in banglore#features#and platform (iOS#Android#or both). Typically#target audience#The development phase#which includes coding#a calculator) or complicated#with features such as real-time chat#payment systems#verify compatibility#and improve performance. Finally#Third-party integrations#design revisions

0 notes