#payouts

Explore tagged Tumblr posts

Text

How Aadhaar Payments Help You Save Time and Money

In today’s fast-paced digital world, financial transactions need to be quick, easy, and secure. Aadhaar-enabled payment services (AEPS) provide a seamless way to conduct transactions, ensuring instant money transfer and secure payment processing. Whether you are a business owner, a retailer, or an individual, Aadhaar payments can save you both time and money in multiple ways.

No Need for Bank Visits or ATMs

Traditional banking often involves long queues, paperwork, and waiting times at banks or ATMs. With Aadhaar payments, you can withdraw or transfer money directly from your Aadhaar-linked bank account using just your fingerprint and Aadhaar number. This eliminates the need to visit a bank or ATM, saving both time and travel expenses.

Instant Money Transfer with Minimal Effort

One of the biggest advantages of Aadhaar payments is the ability to perform instant money transfer without delays. Whether you need to send money to a family member or make a payment for goods or services, Aadhaar banking enables real-time transactions. Unlike traditional bank transfers that may take hours or even days, Aadhaar payments happen instantly, ensuring that funds are available when needed.

Secure Payment Processing Reduces Fraud Risks

Security is a major concern when it comes to digital payments. Aadhaar payments ensure secure payment processing by using biometric authentication, such as fingerprint or iris scanning, instead of passwords or PINs that can be forgotten or stolen. Since each Aadhaar number is unique, fraud risks are significantly reduced, making it one of the safest payment methods.

No Need for Debit or Credit Cards

Carrying debit or credit cards comes with risks, such as theft, loss, or misuse. Aadhaar payments eliminate this concern as they do not require any physical cards. Users can simply authenticate transactions with their biometric details, ensuring a smooth and secure experience. This also means no more worries about card renewal fees, PIN resets, or card maintenance charges.

Low Transaction Costs Mean More Savings

Traditional banking and digital wallets often charge service fees for fund transfers, withdrawals, and other transactions. Aadhaar payments typically come with minimal or no charges, allowing users to save on unnecessary banking costs. This is particularly beneficial for small businesses and individuals who rely on frequent transactions.

Helps Small Businesses and Retailers Save Time

For businesses, time is money.Aadhaar based payments allow merchants and small retailers to receive payments instantly without waiting for bank clearances. Since AEPS transactions require only biometric authentication, customers can make payments even if they do not have a smartphone or internet access, reducing delays and improving business efficiency.

Enables Financial Inclusion in Rural Areas

In remote areas, access to banking facilities can be limited. Aadhaar payments bridge this gap by allowing people to withdraw and transfer money without needing a physical bank branch. This not only saves time spent traveling to the nearest bank but also makes financial services more accessible, especially for those who do not have traditional banking knowledge.

Government Benefits Directly in Your Account

Many government subsidies, pensions, and welfare schemes are now directly transferred to Aadhaar-linked bank accounts. This eliminates the need for middlemen, ensuring that beneficiaries receive their money without delays or additional costs. It also prevents corruption and leakage of funds, making sure every rupee reaches the intended recipient.

Simplifies Bill Payments and Daily Transactions

From paying utility bills to purchasing essentials, Aadhaar payments make everyday transactions faster and hassle-free. No more standing in long queues for bill payments or withdrawing cash from ATMs. With just an Aadhaar number and biometric verification, payments can be completed within seconds.

24/7 Availability for Convenience

Unlike traditional banking services that operate within limited hours, Aadhaar payments are available 24/7. Whether it's early morning or late at night, users can perform transactions at any time, making financial management more convenient and efficient.

Conclusion

Aadhaar payments are transforming the way financial transactions are conducted in India. With instant money transfer, secure payment processing, and minimal costs, they provide a fast, safe, and cost-effective way to manage money. Whether for individuals, businesses, or rural communities, Aadhaar-enabled payments offer significant savings in both time and money, making them a game-changer in India’s digital financial landscape.

2 notes

·

View notes

Text

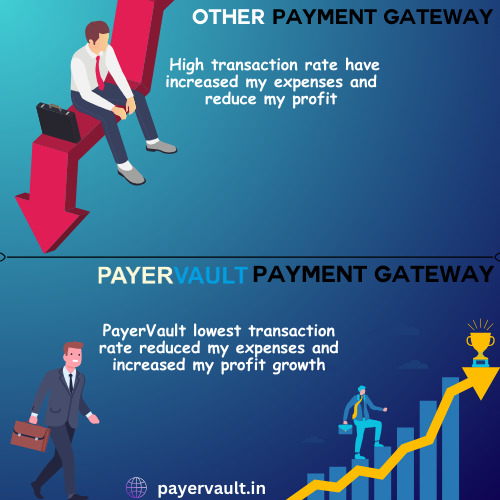

Ready to revolutionize your business's online transactions? Payervault offers seamless payment solutions at the lowest charges. Get started today! 💻💳 #Payervault #PaymentGateway #OnlineBusiness" Visit the website to learn more- https://payervault.in/

#finance#payments#payment solutions#business consulting#payment gateway#payment collection#paying#payouts#payment processing#payment services#payment systems#ecommerce#online#online shops offer#online store#online shopping#small business

3 notes

·

View notes

Text

Harrods asks courtroom to safeguard Al Fayed’s property for victims’ payouts

Unlock the Editor’s Digest free of charge Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly e-newsletter. Harrods has requested the Excessive Court docket to nominate particular executors to the property of its late former proprietor, Mohamed Al Fayed, in an try to open up one other route for compensation for alleged victims of his sexual abuse. The luxurious London…

0 notes

Photo

PRIMA PAGINA The Times di Oggi domenica, 25 maggio 2025

#PrimaPagina#thetimes quotidiano#giornale#primepagine#frontpage#nazionali#internazionali#news#inedicola#oggi year#page#wire#bates#versus#bureaucrats#post#office#quasi#offered#claim#court#frustrating#victim#payouts#told#leave#demands#scheme#fears#civil

0 notes

Text

Kentucky Derby 2025 payouts: Churchill Downs sets wagering records for third straight year Read More...

#KentuckyDerby2025#ChurchillDowns#WageringRecords#HorseRacing#DerbyDay#BettingTrends#Payouts#ThoroughbredRacing#HorseRacingFans#KentuckyDerby

0 notes

Text

Y a este momento de mi vida le llamo Felicidad

Gracias Honeygain team, han sido más de 15 meses de intensa navegación a veces día y noche, pero es de las pocas aplicaciones que SI CUMPLE; SI PAGA, obvio de los 20 dólares toca pagar un impuesto de 1,70 US $ pero bueno al menos logramos capitalizar la navegación y comenzar a generar ingresos residuales navegando por internet, que era la teoría y tesis de la que muchos se reían y hoy por hoy es cada vez más una auténtica realidad, un tren en el que si no se suben más temprano que tarde puede que sea para lamentos, o apostamos?

#Honeygain#payouts#pagos#negocios#ionternet#plataformas#aplicaciones#si pagan#dividendos#utilidades#ingresos#residuales#libertad#financiera#mente#pensamiento#consciencia#ibagué#colombia#escrito#tolima

0 notes

Text

NSA Nuhu Ribadu Wanted Billions In Payouts To Fund His Political Ambition –Binance Executive Gambaryan

Tigran Gambaryan, a former US federal agent and Binance employee, has made startling allegations against the National Security Adviser (NSA) Nuhu Ribadu following his release from detention in Nigeria. Detained in February 2024 and released in October 2024 after the Nigerian government dropped money laundering charges against him following U.S. diplomatic pressure, Gambaryan claims that Ribadu…

0 notes

Text

https://www.reuters.com/world/asia-pacific/new-zealand-announces-payouts-children-teens-abused-care-2024-12-18/

0 notes

Text

UPI Payout API

Rainet Technology has introduced an innovative service known as the UPI Payout API Service, revolutionising how businesses handle transactions in India. The UPI Payout service leverages the Unified Payments Interface (UPI) system, which is renowned for its seamless, real-time payment capabilities. This service is designed to facilitate bulk disbursements, making it an ideal solution for businesses that need to manage mass payouts efficiently.

The UPI Payout API enables companies to integrate this powerful payment solution directly into their existing systems, allowing for the automated processing of transactions. This integration significantly reduces the time and effort required to manage large-scale payments, whether for vendor payments, employee salaries, or customer refunds. By using the UPI Payout API, businesses can ensure that their transactions are secure, fast, and reliable, thus enhancing their operational efficiency and customer satisfaction.

Rainet Technology's UPI Payout API service stands out due to its robustness and ease of integration. The API is designed to be user-friendly, providing comprehensive documentation and support to assist businesses in the integration process. Moreover, it supports various types of transactions, ensuring flexibility and adaptability to different business needs. With the UPI Payout API, businesses can benefit from the extensive reach of UPI, which is widely accepted across India, ensuring that transactions can be made to virtually any bank account in the country.

In summary, the UPI Payout API service by Rainet Technology offers a cutting-edge solution for businesses looking to streamline their payment processes. By integrating the UPI Payout API, companies can automate and expedite their financial transactions, leading to improved efficiency and customer experience. This service not only underscores Rainet Technology's commitment to innovation but also highlights the transformative potential of UPI in the digital payment landscape.

Visit Website: https://rainet.co.in/payin-and-payout.php

#payin#payin api#payout#payout account#cashfree payout#payouts api#payouts#instant payout#instant withdrawal#pay in pay out#bbps api provider#bbps login#paytm upi integration api#upi api integration#upi integration#education portal development company#bbps#upi payment gateway#upi integration api#upi payment gateway integration

0 notes

Text

Confused about the difference between payouts and payments? This pivotal guide from DataNimbus clarifies how each affects your business, helping you streamline operations and enhance financial efficiency. Dive into the essentials of business transactions and discover practical tips to manage your money smarter. Perfect for entrepreneurs and business managers looking to optimize their financial processes.

#business finance#financial management#payouts#payments#business operations#DataNimbus#financial optimization

0 notes

Text

Empowering Lives: The Human Side of Automating Submerchant Payouts

Introduction

In the dynamic landscape of e-commerce and digital transactions, the connection between Merchants and Submerchants is more than a transaction-it’s a lifeline for those like Damini. Damini is a single working mother, dedicating six days a week to earn a daily wage from Royal Restaurant – a submerchant operating within the realms of an agreement with Chokhi Dhani Luxury Resort (Merchant). Each transaction involves a unique commission structure, with the submerchant obligated to pay a certain percentage to both the Merchant and the bank.

This arrangement, outlined in the Merchant-Sub Merchant agreement, often leads to delays in payments, creating a poignant struggle for Damini as she strives to meet the basic needs for her three children. The challenges extend beyond financial hurdles, impacting the very fabric of daily life for those dependent on timely wages.

Read more - https://datanimbus.com/blog/empowering-lives-the-human-side-of-automating-submerchant-payouts/

0 notes

Text

Spotify's New Payout Policy - How Will It Affect Emerging Artists?

Intro: Layin’ It Down The rap game has always been tough for upcoming artists, especially when it comes to getting paid for their work. The recent changes in Spotify’s payout policy have left many in the game wondering how it will affect their hustle. Let’s break it down and see what’s good with this new policy and what it means for emerging artists. What’s Good with Spotify Now? An up-and-coming…

View On WordPress

0 notes

Text

Payouts vs. Payment: A Brief Overview

Payouts vs payments – and why it’s important to understand the difference

In the world of FinTech, the terms “payments” and “payouts” are often used interchangeably. However, it is crucial to recognize that these concepts are distinct from each other, and product teams are starting to understand their significance and how to address challenges in these areas.

Differences between the two

While there may be various interpretations among FinTech professionals, at its core, online payments – particularly in the world of digital commerce – primarily refer to the transactional aspect of transfer of funds, for instance, making a purchase or applying a charge. On the other hand, payouts focus on how the funds collected in a payment are actually settled”paid out” to the ultimate beneficiaries. For example, in an online transaction on UberEats for a $15 sandwich, the payment processed could be split into multiple tranches allocated to the restaurant, the delivery partner, and pay fact/payment gateway commissions. Read More

0 notes

Text

cub calls himself "a champion of the people" in his twitter bio and i've always thought it's pretty funny bc like. what does that mean. but recently i've noticed i don't think he's like ever taken a sponsorship (not that i've seen at least and i've watched probably like 700 cub videos). he doesn't even have a business email anywhere. no patreon or anything. he does have a discord for twitch subs but you only need to subscribe once and you won't be kicked out when the sub expires. bro really is the champion of the people

#he said brands and companies DNI#cubfan135#this only brings back the age old question of is he secretly rich bc id imagine the youtube and twitch payout isnt huge with his views#golf is such a rich person hobby

3K notes

·

View notes

Text

Transforming Transactions: Navigating the Future of Payouts with Nabpower Payment Gateway

Embark on a journey of financial innovation and efficiency with Nabpower Payment Gateway in our latest blog post. Explore the dynamic world of payouts and witness how Nabpower is redefining the landscape with tailored solutions for businesses of all sizes. From rapid fund transfers to comprehensive reporting, discover how Nabpower is reshaping the payout experience.

Effortless Fund Transfers: Delve into the seamless and efficient fund transfer process facilitated by Nabpower. Explore how businesses can effortlessly execute payouts to beneficiaries, ensuring a swift and hassle-free experience.

Diverse Payout Options: Highlight the range of payout options offered by Nabpower. Whether it's bank transfers, digital wallets, or other methods, businesses can customize payouts to suit the preferences of their recipients.

Automated Payout Solutions: Showcase Nabpower's automated payout solutions, designed to streamline repetitive processes. Explore how businesses can save time and resources by automating the payout workflow, ensuring accuracy and efficiency.

Real-Time Reporting and Analytics: Illustrate the power of real-time reporting and analytics provided by Nabpower. Businesses gain insights into payout trends, transaction histories, and recipient data, enabling informed decision-making and financial transparency.

Customizable Payout Rules: Emphasize Nabpower's flexibility with customizable payout rules. Businesses can tailor payout parameters to align with specific criteria, ensuring that payouts are executed in accordance with their unique requirements.

Enhanced Security Measures: Highlight the enhanced security measures integrated into Nabpower's payout system. Explore encryption protocols and authentication processes that safeguard financial transactions, instilling trust in both businesses and recipients.

Seamless Integration with Platforms: Showcase Nabpower's seamless integration capabilities with various platforms. Businesses can easily integrate Nabpower's payout solutions into their existing systems, optimizing workflows and enhancing overall operational efficiency.

User-Friendly Payout Dashboard: Illustrate the user-friendly nature of Nabpower's payout dashboard. Businesses can manage payouts, track transaction statuses, and access comprehensive reports through an intuitive interface, ensuring a smooth user experience.

Global Payout Capabilities: Emphasize Nabpower's global payout capabilities, allowing businesses to reach recipients worldwide. Explore how businesses can expand their reach and cater to a diverse audience with Nabpower's cross-border payout solutions.

Future Innovations in Payout Technology: Conclude the blog post by offering a glimpse into the future innovations planned for Nabpower's payout technology. Invite businesses to stay tuned for upcoming features that will continue to redefine and elevate their payout experiences.

By delving into the capabilities of Nabpower Payment Gateway's payout solutions, this blog post aims to inform businesses about the advantages and convenience of leveraging Nabpower for efficient, secure, and innovative payouts.

0 notes