#paypal business account vs personal

Explore tagged Tumblr posts

Text

PayPal Merchant Account Requirements

#PayPal Merchant Account Requirements#paypal account#paypal business account#paypal merchant account#how to create paypal account#paypal business account vs personal#merchant account#create paypal account#paypal business account setup#paypal#business paypal account#paypal merchant id for personal account#paypal account kaise banaye#how to create paypal business account#set up paypal business account#paypal personal to business account change#paypal account create#how to verify paypal account

1 note

·

View note

Text

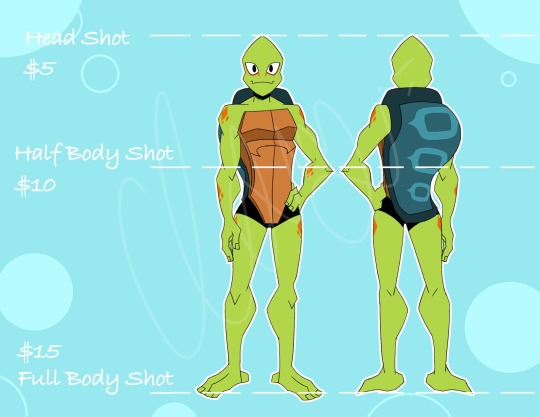

Commissions Open!

Yoah! I am now opening art commissions. I have thought of doing it for a while now, so I might as well get started.

Please read all rules thoroughly and make sure to follow all of them. I want to make sure this is a smooth process that leaves everyone satisfied, but I apologize if I make any mistakes as I am new to this.

If you do commission me, I would like to preface with a thank you, and that I look forward to working with you! Hope you have a good day!

Commission Rules:

What I Won’t Do:

No NSFW

No Mechs

No Extreme Gore (graphic deaths, organs everywhere, mass amounts of blood, etc.)

No Commercial Art

Nothing Hateful

No Self Harm or Suicide

Payment:

Only accept PayPal

Half Payment Upfront

Must Fill out Google Form

DO NOT Claim Art as your own

You are free to upload it but be sure to credit and link to my profile

I will not upload you work but may use it as for future portfolios

Commission Details:

Basic Illustrations:

Simple Lighting and Shading

Flat Colors

Limited (simplistic) Backgrounds

Detailed Illustrations:

Fully Rendered

Fully Fleshed Out Backgrounds

Basic Comics:

Solid Colored Characters

Limited (simplistic) Backgrounds

No Lighting. Limited Shading

Detailed Comics:

Fully Colored Characters

Full Backgrounds (depending on panel)

Detailed Lighting and Shading

Note - Stylization based on request

Ex) sketchy line art vs clean

Ex) Colored vs Monochrome

Ex) Rotmnt esc style vs Personal style

There are certain styles I replicate or can at a request but it will depend commission by commission

Message me on here if you have any questions

Google Form Link:

#art#artwork#commission#art commisions#art commissions open#commissions open#open commissions#tmnt#tmnt art#tmnt fanart#rise of the teenage mutant ninja turtles#rotmnt fanart#rise of the tmnt#rotmnt art#teenage mutant ninja turtles fanart#usagi yojimbo#yuichi usagi#miyamoto usagi#Yuichi Usagi fan art#samurai rabbit

24 notes

·

View notes

Note

Ahhh im excited to get a reading! Will you be adding more options for the fs section before this next batch of readings? Also did you put your real name on your paypal? Or can we enter a nickname or something. I'm creating an account later just for this but I'm super anal about privacy and don't want to put my real name iykwim lol

"Will you be adding more options for the fs section"

I have! Below are the new additions:

What will you tolerate + dislike about them

What will you love about them

Who do you think they are VS who they actually are

The gossip about you two as a pair (what will people talk about)

First argument between you two

I'm not sure if I will add more, but if you have any suggestion, do let me know, I'll consider it but no promise that it will be added.

"Can we enter a nickname on paypal"

For personal accounts, technically you can, but just know that it goes against their user agreement, i.e. doing it comes with risks. According to this website, it probably won't cause much problem if you only use paypal as an intermediary; meaning that you just want to transfer money from your bank using paypal to the seller. But if you want to use the money in your paypal account (not your bank), or if you want to withdraw money from paypal into your bank, they will ask for identifications. This is to prevent fraudulent activities.

I haven't tried it, so I can't confirm it will be smooth sailing. Most people I've seen use their real names, or I assume so since they look legit. The only people who will see your name are the people you send your money to (me, for example). Most businesses and sellers don't really care much about who you are, unless you cause problems or steal their money.

If you want to take the risk and use a nickname, please avoid using the obvious ones like BiscuitLover. Also apparently you can change your account name only once, so be careful.

2 notes

·

View notes

Text

How to Convert Shopify Store to Mobile App: A Step-by-Step Guide

With mobile commerce on the rise, convert Shopify store to mobile app is one of the best ways to stay competitive in today’s market. More consumers are opting to shop via mobile apps for their convenience, speed, and user-friendly experience. By turning your Shopify store into a mobile app, you can increase customer engagement, enhance user experience, and boost sales. This guide will walk you through the step-by-step process of converting your Shopify store into a mobile app.

Why Convert Your Shopify Store into a Mobile App?

Growing Mobile Commerce Trend

Mobile commerce has seen exponential growth in recent years, accounting for a significant portion of e-commerce sales. More consumers are now using smartphones to shop, making mobile apps an essential tool for businesses looking to capture this growing market.

Improved User Experience

Mobile apps offer a smoother and faster shopping experience compared to websites, particularly on mobile devices. Apps allow users to browse products, make purchases, and interact with your brand without the need for a web browser. This creates a more seamless and user-friendly experience that encourages customer retention.

Enhanced Customer Engagement

A mobile app gives you the ability to engage directly with your customers through features such as push notifications, personalized recommendations, and exclusive offers. These tools help build customer loyalty and drive repeat purchases.

Choose the Right Mobile App Builder

Native vs. Hybrid Mobile App

When converting your Shopify store into a mobile app, you need to decide whether to build a native or hybrid app. Native apps are developed for specific platforms (iOS or Android), while hybrid apps work across multiple platforms. Native apps tend to offer better performance and user experience, but hybrid apps are more cost-effective and faster to develop.

Explore Shopify App Builders

There are several app builders specifically designed for Shopify store owners that allow you to convert your store into a mobile app with ease. Some popular options include:

Shopify Mobile App Builder by Plobal Apps

Tapcart

Shopify Mobile App Builder by Vajra

Shopify Mobile App Builder by Shopney

These app builders are easy to use and offer a variety of features to help you create a mobile app without needing to code.

Install and Set Up the Mobile App Builder

Connect Your Shopify Store

Once you’ve chosen the app builder, the next step is to connect it with your Shopify store. Most app builders provide a direct integration process, allowing you to import your store’s products, categories, and other essential details seamlessly. This integration ensures that any changes made to your Shopify store are automatically reflected in your mobile app.

Customize the Design and Layout

App builders allow you to customize the design and layout of your mobile app to match your brand’s look and feel. You can select from pre-built templates, customize colors, fonts, and even the navigation style. A well-designed app that aligns with your brand identity will help create a consistent experience for your customers.

Integrate Essential Features

Optimize for User Experience

When designing your mobile app, ensure that it’s optimized for user experience. Features like a simplified checkout process, easy navigation, and fast loading times are critical for keeping users engaged and reducing cart abandonment rates.

Add Push Notifications

Push notifications are one of the most powerful tools for engaging customers. Use them to send personalized offers, reminders, and product recommendations directly to your users’ devices. Push notifications can help boost customer retention and drive sales.

Implement In-App Payments

Your mobile app must include secure payment methods to facilitate seamless transactions. Integrate popular payment gateways such as Apple Pay, Google Pay, PayPal, or credit card payments to give users a variety of options to complete their purchases safely.

Focus on App Security

Protect User Data

As with any e-commerce platform, security is paramount. Ensure that your app complies with data protection regulations and uses secure encryption methods to protect user information, including payment details and personal data.

Implement Multi-Factor Authentication

Consider adding multi-factor authentication (MFA) for account logins to increase the security of your app. MFA requires users to verify their identity using two or more verification methods, reducing the risk of unauthorized access to their accounts.

Test Your Mobile App

Conduct Beta Testing

Before launching your app, it’s important to conduct thorough testing. Many app builders provide tools for beta testing, allowing you to test your app with a small group of users. Use this testing phase to identify any issues with functionality, user interface, or performance. Gathering feedback from beta testers will help you refine the app before the official launch.

Check Compatibility Across Devices

Ensure that your app works well on various devices and screen sizes. Test it on both iOS and Android platforms to make sure it delivers a smooth experience for users, regardless of the device they’re using.

Launch Your Mobile App

Submit to App Stores

Once your app is fully developed and tested, it’s time to launch it. Submit your app to both the Apple App Store and Google Play Store for review. Be prepared for a waiting period, as app stores usually take a few days to review and approve apps.

Create a Launch Strategy

Your app’s success depends on a strong launch strategy. Announce the launch to your existing customers via email, social media, and your Shopify store. Offer exclusive deals or promotions to encourage users to download and start using the app. You can also use influencers and digital marketing to increase the visibility for your app.

Promote Your App

Use App Store Optimization (ASO)

App store optimization (ASO) is crucial for increasing the visibility of your mobile app. Use relevant keywords in your app’s title and description to help potential customers find it more easily in app store searches. Additionally, include high-quality images, a demo video, and positive user reviews to make your app more attractive.

Engage Users with Loyalty Programs

Encourage app downloads and repeat usage by offering a loyalty program. Reward customers for making purchases through the app with exclusive discounts, points, or cashback offers. A loyalty program can help retain users and drive more sales through the app.

Monitor and Improve Performance

Track Key Metrics

Once your app is live, monitor its performance closely. Key metrics to track include:

User engagement: How frequently users interact with the app.

Retention rate: The percentage of users who return to the app after their first use.

Conversion rate: How many users complete purchases within the app.

Average order value: The average amount customers spend on each purchase.

Tracking these metrics will help you identify areas that need improvement and optimize the app for better performance.

Update Regularly

To keep users engaged and ensure your app runs smoothly, regularly update it with new features, bug fixes, and security patches. Listen to user feedback and continuously refine your app to meet their evolving needs.

Provide Excellent Customer Support

Offer Multiple Support Channels

A successful app requires excellent customer support. Provide multiple support channels such as live chat, email, and phone support to help users resolve any issues they may encounter while using the app. Prompt and effective customer service is key to maintaining customer satisfaction and loyalty.

Build a Knowledge Base

Create a knowledge base or FAQ section within the app to help users find answers to common questions quickly. This will reduce the number of support queries and improve the overall user experience.

Conclusion

Converting your Shopify store into a mobile app can transform your e-commerce business. With mobile commerce on the rise, using a Shopify mobile app builder allows you to reach a broader audience, improve customer engagement, and boost sales. By following key steps like choosing the right app builder, integrating essential features, ensuring security, and promoting your app effectively, you can launch a successful mobile app for your Shopify store. Regular updates, performance monitoring, and great customer support will help ensure long-term success.

#convert shopify store to mobile app#convert shopify to mobile app#mobile app for shopify store#turning your shopify store into a mobile app#shopify mobile app builder

0 notes

Text

B-u-y Verified Paypal Accounts

B-u-ying verified PayPal accounts can boost your online transactions' security and efficiency. Verified accounts offer enhanced trustworthiness and fewer limitations.

If you want to more information just knock us – Contact US

24 Hours Reply/Contact

Telegram: @Seo2Smm

Skype: Seo2Smm

WhatsApp: +1 (413) 685-6010

▬▬▬▬▬▬▬▬▬▬▬

Online businesses and freelancers require reliable payment solutions for global transactions; verified PayPal accounts provide that reliability. With verification, PayPal confirms that an account's information is accurate and in compliance with their policies, reducing the risk of payment holds and limitations on sending or receiving money.

The Importance Of Paypal Verification

Verified PayPal accounts convey trust and reliability. Complete verification of a PayPal account involves linking and confirming a bank account or credit card, which establishes credibility with both PayPal and potential customers. This process is essential for those who want to use PayPal as a key business tool.

Boosting Trust With Verified Status

Trust in online transactions is paramount. A verified PayPal status signals to customers that you are recognized as a trusted seller or B-u-yer. It tells customers that PayPal has confirmed your identity. This little checkmark can be the key to securing more transactions and growing your business.

Limits And Features Of Unverified Vs. Verified Accounts

Differences between unverified and verified PayPal accounts are significant:

Account Type

Sending Limits

Withdrawal Limits

Features

Unverified

Limited

Limited

Basic transactions

Verified

Higher

No limit

Full access to features

Higher sending and no withdrawal limits empower verified account holders with full access to PayPal's features, facilitating smoother and larger transactions.

Why People Seek Verified Paypal Accounts

Many opt for verified PayPal accounts to unlock its full potential. A verified status offers enhanced trust and capabilities. Users can lift various restrictions, making their online transactions smoother and more reliable. Let's delve into specifics.

Immediate Access To Full Features

Verified PayPal accounts provide immediate access to all features. Users enjoy seamless online payments, quicker checkouts, and easier fund management. This access is crucial for both personal use and business transactions. Here are the benefits:

No waiting for feature availabilities

Instant use of PayPal’s comprehensive services

Enhanced security for peace of mind

Navigating Transaction Limits

With verification, PayPal lifts limits on sending and receiving money. This means users conduct high-volume transactions without interruptions. Here's a glance at the advantages:

Before Verification

After Verification

Limited sending amount

Increased sending limits

Monthly withdrawal cap

Higher withdrawal ceilings

Verified accounts offer a smooth financial journey. They enable users to transact large amounts for both personal and business growth.

Risks Associated With B-u-ying Accounts

Navigating the murky waters of B-u-ying verified PayPal accounts can lead to choppy seas. Risks are real and consequences severe. This discussion will help you understand what's at stake.

Legal Consequences

Unpacking the legal suitcase, we find it's overpacked with complications. PayPal's terms of service state clearly: No account transfers allowed. Here's what could happen:

Immediate Account Suspension: Say goodbye to funds and features.

Potential Lawsuits: Risk a legal battle with PayPal.

Blacklisting: Future accounts could vanish into thin air.

Account Security Concerns

Imagine waking to a nightmare of hijacked accounts. Here's the security lowdown:

Password Pranks: Sellers can regain control, locking you out.

Fraud Alerts: Suspicious activity? Account may face lockdown.

Data Leaks: Personal info could take a public stroll.

Fact is, your financial health could take a hit. Think long-term, play it safe.

Steps To Verify Your Own Paypal Account

Getting your PayPal account verified enhances trust and unlocks additional features. It's easy to do. Follow these steps to add credibility to your digital wallet.

Linking Bank Accounts And Credit Cards

Begin by linking your bank and card. This step ties your financial sources to PayPal. You can then make payments and receive money.

Log into your PayPal account.

Click 'Wallet' at the top of the page.

Select 'Link a bank' or 'Link a credit card'.

Enter your details and hit 'Link Card/Bank'.

PayPal will make two small deposits into your bank account.

Check your bank statement in 2-3 days.

Return to PayPal and enter the deposit amounts.

This process verifies your linked sources.

Confirming Personal Information

Next, confirm your personal information. PayPal requires proof you are who you say you are.

Provide your full legal name.

Share your address exactly as it appears on bills or bank statements.

Submit your date of birth.

Enter your taxpayer identification number.

PayPal will review your information. They may ask for additional proof. This could be a photo ID or a utility bill.

The Market For Verified Paypal Accounts

The digital era has seen a surge in demand for verified PayPal accounts. These accounts are essential for secure online transactions. They are crucial for businesses and freelancers. The market for these accounts has grown rapidly. It caters to those needing immediate access without the wait for verification.

Online Platforms And Forums

Various online platforms offer verified PayPal accounts for sale. Interested B-u-yers must tread cautiously. Not all sellers are trustworthy. Forums dedicated to digital services are hotspots for these transactions. They are often frequented by both B-u-yers and sellers.

Secure marketplaces exist and provide B-u-yer protection.

Private sellers can be found in niche forums and groups.

Pricing Structures Explained

Verified PayPal accounts come at different prices. The cost depends on several factors. These include account age, transaction history, and available balance. Let's break down the common pricing structures.

Account Type

Price Range

Basic Verified Account

$30 - $50

Business Verified Account

$100 - $150

Seasoned Account with History

$200 - $500+

Look for sellers that offer after-sale support. Check for reviews or testimonials for additional safety. Understand the terms before purchasing. Always use secure payment methods for the transaction.

Understanding Paypal's Policies

PayPal stands out as a leader in online payment solutions. Its robust platform offers users the ability to send and receive funds with ease. However, the integrity of its system relies on strict adherence to its policies. Comprehending these policies is crucial when you consider B-u-ying a verified PayPal account. Let's delve into the terms and conditions to ensure smooth financial transactions.

Terms Of Service Agreements

Terms govern your PayPal account usage. These legal agreements are necessary to understand before you proceed with any PayPal-related decision. Below is a breakdown of key highlights from PayPal's terms:

Account Setup: information must be accurate and truthful.

Transaction Limits: these may apply depending on your account type.

Usage Restrictions: PayPal outlines activities that are prohibited.

Violating these terms can lead to restrictions on your account. It's essential to review these terms thoroughly. A link to the full agreement is typically available at PayPal's footer on their homepage.

Consequences Of Policy Violations

Non-compliance with PayPal's policies can trigger significant consequences. Actions taken by PayPal may include:

Account Limitations: temporary restrictions on sending or withdrawing funds.

Frozen Funds: PayPal may hold your balance due to suspicious activity.

Account Closure: severe or repeated violations can result in permanent closure.

Prevention is better than remediation. Familiarize yourself with the causes of these penalties to avoid pitfalls.

Alternatives To B-u-ying Verified Accounts

Stepping into online transactions may tempt you to B-u-y verified PayPal accounts. Yet, legitimate, safe options exist that keep you within PayPal's terms and offer comparable convenience. Let's delve into secure alternatives to B-u-ying verified accounts.

Using Prepaid Cards

Using Prepaid Cards

Prepaid cards offer a straightforward solution to those needing a PayPal account without the hassle of verification.

Purchase a prepaid card from a trusted retailer.

Attach the card to your PayPal account.

Keep track of the balance for seamless transactions.

Various prepaid options exist with features like reloadability and minimal fees, making them smart choices for savvy online spenders.

Exploring Other Payment Processors

Exploring Other Payment Processors

Seeking alternatives to PayPal opens a world of possibilities. Numerous platforms offer varied features tailored to different needs.

Processor

Benefits

Stripe

Developer-friendly with robust API

Skrill

Low-cost international transfers

Venmo

Simple peer-to-peer transactions

Research each processor's terms to find your perfect fit, keeping in mind ease of use, fees, and security features.

Spotting Scams In Account Sales

Shopping for verified PayPal accounts? Be savvy and spot scam signs. Learn about usual tricks in account sales. Stay safe and informed. Let's dive in and learn how to spot scams effectively.

Red Flags And Warning Signs

Too Good to Be True Prices: Rock-bottom prices signal scams.

Sketchy Payment Methods: If sellers avoid PayPal, be wary.

No History or Feedback: Trust sellers with track records.

Vague Descriptions: Clear account details show legitimacy.

Rushed Sales: Scammers pressure quick decisions.

Listen to instincts. They warn you. Check each account sale with care.

Protecting Yourself From Fraud

Security is priority. Keep transactions safe. Use steps below:

Research the Seller: Good sellers have positive feedback and history.

Secure Websites Only: Ensure the URL begins with 'https://'.

Use Reputable Platforms: B-u-y from known, secure marketplaces.

Documentation is Key: Legitimate sales have proper paperwork.

Payment Escrow: This protects your funds until service is verified.

Follow these steps. Avoid scams. Secure a genuine verified PayPal account.

The Role Of Account Verification In Fraud Prevention

The digital world thrives on trust and security, where verifying user accounts stands as a critical shield against fraud. Account verification is not just a formality; it's a robust barrier to safeguard users. When it comes to financial transactions, platforms like PayPal prioritize user safety by implementing strict verification protocols. These protocols ensure that only genuine users can carry out transactions.

How Verification Deters Scammers

Verified PayPal accounts are like badges of trust. PayPal uses various methods to confirm an account holder's identity. This process helps to filter out potential scammers who often avoid platforms where they must provide concrete evidence of their authenticity. Verification acts as a deterrent for those with malicious intent, making it significantly harder for them to operate under false pretenses.

Document checks prevent anonymous usage.

Linking of bank accounts secures user identity.

Phone and email confirmations add extra layers of security.

Paypal's Measures To Protect Users

PayPal's commitment to user safety manifests in a multi-layer defense system. Verified accounts undergo a meticulous security check process. This provides a safe space for online financial engagements.

Security Feature

Function

Two-factor Authentication

Ensures user logins are guarded

End-to-end Encryption

Secures transaction details

Fraud Monitoring

Continuously checks for suspicious activity

Not only does PayPal fortify user accounts, but it also educates users on safety practices. By understanding the importance of verification, users become active participants in creating a fraud-resistant community.

Testimonials And Stories

Stories shape our thoughts. When eyeing verified PayPal accounts, testimonials tell much. They offer peeks into real-world outcomes, from wins to woes.

Success And Horror Stories

Success tales inspire. Meet Jane. She snagged a verified PayPal account. Smile-wide, she recounts seamless transactions and broadened business horizons. Bullet-proof confidence in online dealings, she beams.

Yet, mishaps lurk. A horror story surfaced – Tom’s account, albeit verified, got frozen. A click, a slight mishap, and weeks spent untangling digital knots. Arduous hours and calls, a cautionary tale of vigilance and the fine print.

Quick transactions turned profits for Jane

Unexpected freezes pained Tom’s business

Learning From Others' Experiences

Peers' experiences are gold mines. A table of stories reveals patterns. It's about lessons without first-hand risks.

User

Experience

Insight

Emily

Simple setup, no glitches

Follow verification steps closely

Luke

Account flagged, payment on hold

Keep all business info transparent

Take cues. Aim like Emily; steer clear like Luke. Advance informed, with risks calculated. Balance the scales of e-commerce with wisdom from community chronicles.

Paypal And E-commerce

PayPal stands as a pivotal pillar in the e-commerce world. It bridges the gap between consumers and products. Seamless, secure transactions define modern-day online shopping. A verified PayPal account guarantees trust and reliability, both crucial for online sellers and marketplaces.

The Necessity Of Verified Accounts For Sellers

Sellers require verified PayPal accounts to ensure a smooth business operation. The verification badge serves as a sign of authenticity and boosts B-u-yer confidence. Unverified accounts risk transaction limitations and potential business disruptions. Verified status unlocks:

No withdrawal cap

Increase in credibility

Fewer transaction disputes

Enhanced account security

Impact On Customer Satisfaction

Note: Consider using icons or images from the theme to enhance visual appeal for 'thumbs up' and 'thumbs down'.

Customer satisfaction in e-commerce relies on the assurance of safe payments. Verified accounts contribute to this assurance significantly. They offer:

Advantages

Impact

Quick transactions

Positive user experience

Better protection

Trust build-up

Effortless refunds

Satisfied customers

Global reach

Broadened market scope

Thus, a verified PayPal account is not just a necessity, but a cornerstone for thriving in the competitive landscape of e-commerce.

Technicalities Of Transferring Ownership

When you B-u-y a verified PayPal account, understanding how to legally transfer ownership is key. This involves changing personal details. You must also prepare for any disputes or claims. Let’s delve into the technical steps to ensure a smooth transition.

Change Of Personal Details

Update Email: Replace the previous owner's email with yours. Use PayPal's account settings.

Reset Password: Create a new, strong password for security.

Change Contact Information: Edit the phone number and address under the profile section.

Bank Information: Link your bank account or credit card to the PayPal account.

Dealing With Disputes And Claims

Check Resolution Center: Review any open issues before transferring.

Resolve Pending Disputes: Address any active disputes to clear account status.

New Owner Verification: Provide necessary documents to PayPal to verify the new ownership.

Contact Support: If issues arise, reaching out to PayPal support is essential.

Preparing For Long-term Use

Having a verified PayPal account is crucial for smooth online transactions. Yet, it needs care like a garden. Here's how to prepare for the long haul.

Maintaining Account Health

To keep your account fit, regular check-ups are key. Here's how you do it:

Update personal info: Change outdated details fast.

Secure log-ins: Use strong passwords and change them often.

Monitor activity: Check transactions daily. Spot issues early.

Link a bank: Attach a bank account for a safety net.

Avoiding Limitations And Bans

Staying under the radar prevents trouble. Follow these steps:

Read rules: Know what's allowed. Stick to it.

Speak up: Contact support if something seems off.

Go slow: Don’t rush big money moves. It raises flags.

Be honest: Provide real info always. Fakes lead to falls.

The Ethics Of B-u-ying And Selling Accounts

The Ethics of B-u-ying and Selling Accounts spark lively debate. Opinions vary widely.

Moral Considerations

Trust and honesty are pillars of online commerce.

B-u-ying validated PayPal accounts blurs these lines, raising ethical questions.

Is it fair to bypass account creation rules?

Does it impact users unknowingly?

Industry Perspectives On Account Trading

Industry

View on Account Trading

Financial Services

Critical due to security risks.

E-commerce Platforms

Against, to maintain user trust.

Legal Perspectives

Limited by regulations and laws.

Future Of Online Payments And Verifications

The digital payment landscape constantly evolves, offering greater convenience and security. Verified PayPal accounts signify this shift, ensuring safer transactions in the e-commerce world. Understanding the future of online payments and verifications is crucial for both consumers and merchants aimed at staying ahead in the digital economy.

Trends In Digital Wallets

As transactions move online, digital wallets have become the backbone of e-commerce. These platforms offer speedy checkouts and robust security, transforming how we think about money.

Mobile-First Approach: Integration with smartphones for on-the-go access.

Crypto-Compatible: Wallets now support cryptocurrencies, broadening usage.

Loyalty Integration: Users earn rewards directly through their digital wallets.

Innovations In User Verification

User verification processes are now more sophisticated to combat fraud. Verified PayPal accounts are a testament to the robust methods in place. The following are at the forefront:

Biometric Security: Fingerprint and facial recognition to ensure user authenticity.

Two-Factor Authentication: Adds an extra layer of security beyond passwords.

AI Monitoring: Intelligent systems detect and prevent unauthorized access.

Frequently Asked Questions For B-u-y Verified Paypal Accounts

Are Verified Paypal Accounts Safe To B-u-y?

Verified PayPal accounts are generally considered safer due to identity confirmation. However, purchasing accounts from third parties is risky and against PayPal's terms of service. It can lead to account suspensions or legal issues.

What Benefits Do Verified Paypal Accounts Offer?

Verified PayPal accounts offer increased trust and credibility with B-u-yers and sellers, higher transaction limits, and reduced chances of payments being held. They also provide a more seamless and secure transactional experience on the platform.

How Can I Verify My Own Paypal Account?

To verify your own PayPal account, link it to a bank account or credit card, and confirm the details. PayPal will make two small deposits, and you must enter those amounts on PayPal's website for verification.

Can I Get Banned For B-u-ying A Paypal Account?

Yes, B-u-ying or selling PayPal accounts violates PayPal's User Agreement. Engaging in this activity can lead to permanent account bans and legal actions by PayPal.

Conclusion

Navigating the digital landscape requires reliable financial tools. A verified PayPal account becomes that trusted companion for seamless transactions. Whether you're expanding your e-commerce reach or ensuring smooth freelance payments, the decision to purchase a verified account can set the foundation for hassle-free online business.

Embrace the security and convenience this choice offers and set sail toward your digital success with confidence.

1 note

·

View note

Text

Learn more about Venmo the Peer to Peer payment app

Always wondered about what Venmo is, or have you used the service and still have some questions about their weekly/daily transaction limits, cryptocurrencies, and other questions relating to Venmo such as payment errors? I have written a short article to help you understand a little more about Venmo, the social payments service also called a peer-to-peer (P2P) payment app.

About Venmo

Venmo is a popular social payments service that is currently used by millions of people to quickly and easily make and share payments with friends, family, and approved businesses. Venmo's peer-to-peer (P2P) payment app is freely available for iPhones and Android phones and is simple to download and set up. The only issue with Venmo is that there is a maximum weekly limit on your transactions, this limit depends if you are a verified user or not.

The following provides some answers to some of the questions you may have with using the Venmo peer-to-peer (P2P) payment app.

Venmo vs Paypal

Venmo is a peer-to-peer (P2P) payment app that is very similar to Paypal. However, Venmo is used more often as a way to make and share payments with friends and family, while Paypal is more widely used by small to large scale businesses as a way to securely make payments for goods and services online. Currently, Paypal owns Venmo so it does make sense there is a subtle difference in the use of such a platform.

What’s the most money you can send using Venmo?

When you sign up for Venmo, your person-to-person sending limit is initially set to $299.99; however, once you confirm your identity, you become a verified user and your weekly rolling limit is set to $4,999.99.

Note: Venmo will continue to place limits on customer's transactions until you have confirmed your identity and received verification. Additionally, the rolling weekly limit is considered your maximum daily limit as well.

Complete Payment Limits using Venmo

Venmo does not allow unlimited spending, so they do have spending limits specific to person-to-person payments, purchases with the Venmo Mastercard® Debit Card, online and in-app purchases made with your Venmo account, and purchases using your in-store QR code.

Spending limits for new, non verified Venmo accounts:

If you have just opened an account and have not yet completed identity verification, you will have a weekly spending limit of $299.99. This Venmo limit includes person-to-person payments and payments to authorized merchants.

Spending limits for verified Venmo accounts:

If you have completed identity verification, your combined weekly spending limit is $6,999.99. This limit includes person-to-person payments, in-app and online purchases, and purchases with your Venmo Mastercard Debit Card, and purchases using your in-store QR code.

Overall Combined Sending Limit: $6,999.99, however as you will see the person-to-person spending limit is capped at $4,999.99.

Person-to-Person Payments on Venmo:

Venmo Maximum Weekly Spending: $4,999.99

Venmo Per Transaction Limit $4,999.99

Authorized Merchant Payments:

Venmo Maximum Weekly Spending: $6,999.99

Venmo Per Transaction Limit $2,999.99

Venmo Mastercard Debit Card Purchases:

Maximum Weekly Spending: $6,999.99

Per Transaction Limit $2,999.99

Venmo Mastercard Debit Card transactions are subject to additional limits:

ATM withdrawals, over-the-counter withdrawals, and cashback daily limit: $400.00 (this limit resets daily at 12:00 AM CST).

Per merchant daily limit: $3,000.00.

What Happens if you hit your weekly limit

Regardless if you are a verified user or not, when you reach your weekly limit, you will be required to wait a week until you can use Venmo. Once you are allowed to use Venmo your transaction can start counting again towards your weekly limit.

Venmos' Cryptocurrency limits

Venmo has a specific limit on CryptoCurrencies. You are limited to $20,000 in cryptocurrency purchases per week. There is also a limit of $50,000 in cryptocurrency purchases in a 12-month period.

What to do if you send money to the wrong person (You paid the wrong person)

This is a common question and one that highlights the issues of using such a service. Understandably mistakes can be made however the moment you send a payment in Venmo, the funds are made available to the recipient, regardless of who the recipient is.

It is not possible to cancel a payment to an existing Venmo account.

Paid the wrong person:

As explained Venmo If you send a payment to another user with a similar name, your first step is to send that user a charge request for the same amount of the payment so they can pay you back.

You should include a note asking them to pay you back for the money you sent by mistake, and once they accept the request the payment will be added to your Venmo account.

If you don’t hear back from them or need help sending a charge request, contact the Venmo support team and they will try and help you out. Unfortunately, there is no guarantee Venmo will be able to help recover the money.

When you contact Venmeo on this particular issue you need to ensure you include the following details to expedite the process:

Username of the person that you sent the funds to

Amount of the payment

Date of the payment

Username, phone number, and email address of the person that you meant to pay

Paid the wrong person who does not have an Active Venmo account?

If you sent a payment to the wrong person who is a New User – meaning you paid an email address or phone number that isn’t associated with an active Venmo account yet – you can go ahead and cancel the payment to take those funds back yourself.

Canceling a Venmo Payment

It is not possible to cancel a payment to an existing Venmo account. Once you send a payment, the funds are available to the recipient right away. If you need the payment returned, please have the recipient send you a payment for the same amount. Upon return, you can transfer those funds from your Venmo account to your bank account. If you accidentally pay your friend twice or made a duplicate payment, have the recipient pay you back for one of the payments.

If you sent a payment to an email address or phone number that isn’t associated with an active Venmo account yet – you can cancel the payment to take those funds back yourself.

As Venmo states on their website Venmo Support can only reverse a payment if the recipient gives their explicit permission, their account is in good standing, and they still have the funds available in their Venmo account. Venmo Support cannot reverse a payment at the sender’s request.

Are you a victim of a Venmo Scam?

Everyone is not perfect, and unfortunately, a scam can happen to customers of Venmo. So if you feel you have been a victim of a Scam you can contact Venmo by filling out their online form. However please note that there is no guarantee you will get your money back Contact Form for Venmo.

0 notes

Text

How Do Venmo Limits Compare With Other Payment Services?

Venmo is a popular payment service that offers a variety of features and benefits, including fast and easy money transfers, social payment options, and low fees. However, when it comes to limits, Venmo has some limitations compared to other payment services.

Venmo vs PayPal Limits

Venmo has a weekly transaction limit of USD 7,000 for personal accounts and USD 25,000 for business accounts (assuming you have verified your Venmo identity). Corresponding limits for verified PayPal personal and business accounts are USD 10,000 and USD 60,000.

Venmo vs Wise (formerly TransferWise) Limits

Wise (formerly Transfer Wise) is a payment service that offers international money transfers with competitive exchange rates and low fees. Transfer Wise have no minimum or maximum limits, although some transfers may require additional verification or documentation.

It is important to note that Venmo transfer limits are just one factor when choosing a payment service. Other factors to consider include fees, exchange rates, delivery options, and security features.

Ultimately, the best payment service for you will depend on your specific needs and preferences, as well as the features and limitations of each platform.

What Are Venmo Limits For Personal Accounts?

Venmo limits for personal accounts apply to purchases as well as sending and receiving money on the platform.

Here are Venmo transaction limits1 for personal accounts:

For unverified Venmo personal accounts (when identity verification has not been completed yet), there is a Venmo weekly spending limit of USD 299.99. Venmo limit includes payments made for purchases as well as sending money to others. The good news is that you can easily increase this limit by verifying your Venmo account. To do so, go to the "Me" tab and then Settings and then "Identity Verification".

If you have successfully verified your Venmo account, you can make weekly purchases of up to USD 7,000 and send up to USD 60,000 via your account.

If you wish to withdraw money from your Venmo account to your bank account, here are Venmo's withdrawal limits to be aware of:

If you are an unverified Venmo account holder, you can send up to USD 999.99 per week to your bank account.

If your Venmo account is verified, you can send up to USD 19,999.99 to your account every week. Just be aware that there is a cap of USD 5,000 per transfer so you may need to do multiple transfers if you wish to send more than that amount per week.

Finally, it is also possible to send money to your Venmo account. If you wish to do so, below are Venmo's deposit limits:

Up to USD 10,000 per week via a bank account.

Up to USD 2,000 per week via a debit card.

Venmo limits for various transaction types depend on whether your account is verified or not. Verify your identity to enjoy higher limits.

What Are Venmo Limits For Business Accounts?

Venmo limits for business accounts are structured similar to those for personal accounts but with some important differences. Business accounts have higher limits to accommodate larger transaction volumes and higher account balances.

Here are the main Venmo transaction limits 3 for business accounts:

If you have an unverified Venmo business account, the limit is USD 2,499.99 per week. Similar to personal accounts, you can easily verify your Venmo business account by going to Settings and then "Identity Verification" from your business profile on the Venmo app.

If you verify your business account, the limit is USD 25,000 per week.

If you wish to withdraw money from your Venmo business account3 to your bank account, here are the pertinent limits:

Unverified account - USD 999.99 per week.

Verified account - USD 49,999.99 per week.

Note that there is also a limit of USD 10,000 per withdrawal for Instant Transfers to your debit card, and USD 50,000 per withdrawal for Instant Transfers to your bank account.

Finally, if you want to fund your Venmo business account using your bank account or debit card, here are Venmo's deposit limits:

Up to USD 10,000 per week using your bank account.

Up to USD 2,000 per week using your debit card.

Venmo limits for business accounts vary depending on whether your account is verified or not. Make sure to verify your business' identity to enjoy higher limits.

0 notes

Text

Bad Credit Business Loans Review- $50,000 Guarantee Approval Bad Credit Business Loans No Credit

youtube

Navigating the World of Alternative Business Loans: A Guide for LLCs, DBAs, S-Corps, and C-Corps

As a seasoned financial advisor, I often get questions about the best business loan options for entrepreneurs, particularly those with alternative business structures like LLCs, DBAs, S-corporations, and C-corporations. In this blog post, I'll delve into the world of alternative business loans, where credit scores and traditional lender requirements may not be the primary focus.

Understand the Difference: Alternative vs. Traditional Business Loans

One key distinction you need to understand is that alternative business loans often come with higher interest rates compared to traditional bank or SBA loans. However, these lenders are not as focused on your credit score, D&B number, net 30s, or Paydex score. Instead, they're more interested in the overall functionality and revenue of your business.

Qualifying for Alternative Business Loans

Home-Based Businesses: Don't let a home-based business address deter you. Many alternative lenders are open to funding businesses operating out of a residential address.

Profitability over Losses: Avoid consistently reporting losses on your tax returns, as this can hinder your ability to secure funding.

Establish a Business Bank Account: Ensure you have an active business bank account and make regular deposits to build up your business credit rating, which can help you transition to traditional lenders down the line.

Exploring Alternative Lender Options

Here are some alternative lender options to consider, along with their key requirements:

Lender 1: Near Side

Loan amounts up to $10,000 after 90 days of business activity

No focus on credit score, D&B number, net 30s, or Paydex score

Lender 2: PayPal Loan Builder

Loan amounts vary, but a 620 credit score is preferred

Consider opening a PayPal business account to leverage their working capital loan with no credit check

Lender 3: Uplift Capital

Loan amounts from $10,000 to $500,000

Minimum 500 credit score, with a focus on average monthly revenue of $10,000

Lender 4: Reliant Funding

Loan amounts from $5,000 to $400,000

Minimum 525 credit score and at least 6 months in business with $5,000 monthly revenue

Lender 5: Rapid Finance

Loan amounts from $500 to $5 million

Minimum 500 credit score and at least $55,000 monthly revenue with 3 months in business

Remember, these alternative lenders are focused on the overall health and revenue of your business, rather than your personal credit profile. By understanding their requirements and exploring these options, you can unlock the funding you need to take your business to the next level.

If you have any further questions or would like to discuss your specific financing needs, feel free to schedule a consultation with me. I'm here to help guide you through the maze of alternative business loans and find the best solution for your entrepreneurial journey.

YouTube Source: https://www.youtube.com/watch?v=0lK-0bUAklc YouTube Channel: https://www.youtube.com/channel/UCwTiSgSSNPiNANoB2cREAAg Related Content: https://www.pinterest.com/pin/624663410847294654/

0 notes

Text

PayPal business account vs personal http://dlvr.it/T5c8Vr

0 notes

Text

Protecting Your Privacy When Buying and Using a Used Phone

Acquiring a used phone can be a smart financial move, offering access to premium devices without breaking the bank. However, as you transition into using a pre-owned mobile device, it's imperative to prioritize your privacy. Your smartphone is a treasure trove of personal information, and failing to secure it properly can lead to data breaches, identity theft, or unauthorized access to your digital life. In this comprehensive guide, we will explore essential steps and practices to safeguard your privacy when buying and using a used phone. From vetting sellers to securing your device, we'll cover all the bases to ensure your digital world remains private and secure.

Researching Sellers and Sources:

Before you even buy a used phone, conducting thorough research on the seller and the source of the device is crucial to protect your privacy.

Reputable Sellers: Opt for established, reputable sellers, whether you're buying from an individual or a retailer. Look for positive reviews and ratings from previous customers. Established businesses tend to have better quality control and customer service.

Avoiding Stolen Phones: Check the phone's IMEI (International Mobile Equipment Identity) number to ensure it's not reported as stolen or blacklisted. You can do this through online IMEI checkers or by contacting your mobile carrier.

Refurbished vs. Second-hand: Consider purchasing a certified refurbished phone from the manufacturer or an authorized dealer. These devices are thoroughly tested, often come with warranties, and provide an extra layer of security compared to buying from an individual.

Performing a Secure Transaction:

When buying your used phone, employ secure transaction methods to protect your financial information.

Payment Security: Use secure payment methods like PayPal or a credit card. These methods offer buyer protection and can help dispute charges if the phone does not meet your expectations.

Avoid Cash Transactions: Avoid cash transactions whenever possible. They lack the protection mechanisms provided by digital payment methods and leave no paper trail in case of disputes.

Receipts and Records: Always request and keep a copy of the transaction receipt. This document can be valuable for warranty claims or disputes.

Data Sanitization Before Use:

Before you start using your newly acquired phone, it's essential to ensure that all previous owner's data is completely wiped.

Factory Reset: Perform a factory reset to erase all data and settings. Go to the phone's settings and look for the "Factory Reset" or "Erase All Content and Settings" option. Follow the on-screen instructions.

Remove Google/iCloud Accounts: Make sure any associated Google or iCloud accounts are removed. Failure to do so may result in the previous owner having access to your device's data.

Secure Erase: Consider using a secure erase utility, especially if you're concerned about data recovery. These tools overwrite the storage with random data, making it nearly impossible to recover the previous owner's information.

Set Up Strong Security Measures:

Once your used phone is wiped clean, it's time to establish robust security measures to safeguard your data and privacy.

Password or PIN: Set up a strong, unique password or PIN to unlock your device. Avoid easily guessable combinations like "1234" or "password."

Biometric Authentication: Enable biometric authentication features like fingerprint recognition or facial recognition, if available. These add an extra layer of security.

Two-Factor Authentication (2FA): Enable 2FA for your email, social media, and other accounts. This provides an additional security barrier even if someone gains access to your phone.

App Permissions and Privacy Settings:

Configure your app permissions and privacy settings to limit what information apps can access.

App Permissions: Review and manage app permissions. Disable unnecessary permissions like location tracking if they aren't essential for the app's functionality.

Privacy Settings: Navigate to your phone's privacy settings and limit data collection by the operating system. Adjust settings like location services, ad tracking, and data sharing as per your preferences.

App Security: Regularly update your apps to ensure you have the latest security patches. Delete any unused or outdated apps to reduce potential vulnerabilities.

Protecting Your Internet Connection:

Securing your internet connection is vital to prevent unauthorized access to your device and data.

Use a Secure Wi-Fi Network: Avoid connecting to public or unsecured Wi-Fi networks, especially when accessing sensitive information or making online transactions.

VPN (Virtual Private Network): Consider using a VPN to encrypt your internet connection when browsing the web or using apps. A VPN adds an extra layer of security, especially when using public Wi-Fi.

Data Backup and Encryption:

Regular data backup and encryption are crucial to protect your personal information.

Regular Backups: Set up automatic backups to ensure you don't lose important data in case of device loss or data corruption. Both iOS and Android offer built-in backup options.

Data Encryption: Enable device encryption to protect your data from unauthorized access, especially if your device is lost or stolen. This is typically available in your device's security settings.

Device Tracking and Remote Wiping:

In the unfortunate event that your phone is lost or stolen, having tracking and remote wiping capabilities can help protect your data.

Find My Device (Android) or Find My iPhone (iOS): Activate these built-in features to track your device's location and remotely erase its data if necessary. Ensure you know how to use these features in case of an emergency.

Third-party Anti-Theft Apps: Consider installing third-party anti-theft apps that offer additional features like capturing photos of potential thieves or sounding alarms remotely.

Regular Security Updates:

Stay vigilant by keeping your device's operating system up to date.

Software Updates: Install security updates and operating system upgrades as soon as they become available. These updates often contain patches for known vulnerabilities.

System Monitoring: Enable system monitoring tools that notify you of suspicious activity or unauthorized access attempts.

Safe App Downloads:

Be cautious when downloading and installing apps to prevent malware and privacy breaches.

Official App Stores: Download apps only from official app stores like the Google Play Store or Apple App Store. These platforms have security measures in place to screen for malicious apps.

App Permissions: Review app permissions and avoid installing apps that require unnecessary access to your personal information.

Dispose of Your Old Phone Securely:

If you're replacing your old phone with a used one, ensure you dispose of it securely to protect your privacy.

Data Erasure: Before selling or recycling your old phone, perform a thorough data erasure to remove all personal information.

Remove SIM and Memory Cards: Don't forget to remove your SIM card and any additional memory cards from your old phone.

Buying and using a used phone can be a cost-effective choice, but it comes with privacy risks. By following the steps and practices outlined in this comprehensive guide, you can significantly enhance the security of your personal information and digital life. Remember that safeguarding your privacy is an ongoing process that requires diligence and regular maintenance. Stay informed about emerging threats and security best practices to keep your used phone secure, and enjoy the benefits of a budget-friendly device without compromising your privacy.

0 notes

Link

0 notes

Text

How to Choose the Right QuickBooks Merchant Services for Your Business

QuickBooks Merchant Services (QBS) is a payment processing provider that offers credit card, debit card and electronic check processing. If your business accepts credit cards for transactions, you should consider getting QBS and setting up a merchant account with them. However, there are many other options out there that may be better suited to your needs. For example, if you already have another merchant account but want an integrated solution like QBS, or if you have specific requirements such as managing inventory or working with high-risk industries such as gambling or adult entertainment—those types of things can make it difficult to compare different services based solely on price alone because they're all going to be pretty similar in terms of cost per transaction fees charged by QBS vs other providers who offer integrated solutions like this one does too so what makes one better than another?

What is QuickBooks Merchant Services?

QuickBooks Merchant Services is a payment processing service that allows you to accept payments from your customers. It can be used to accept credit cards, debit cards, and check payments online or at your business location.

How Do You Choose the Right QuickBooks Merchant Services for Your Business?

Let's take a look at some of the most important factors to consider:

Cost: You should always know what you're paying for and how much it will cost. That way, if there are any unexpected fees or charges, they won't come as a surprise when they show up on your bill. It's also important that your merchant service provider is clear about their pricing so there aren't any surprises down the road.

Customer Service: You need someone who knows what they're doing when it comes to helping with technical issues or answering questions about how things work--and being able to reach someone quickly when something goes wrong is crucial! If something does go wrong (and things always go wrong), then make sure there's good customer support available before signing up with any company.

What to Consider Before You Choose a Merchant Services Provider for Your Business.

Before you choose a merchant services provider for your business, consider the following:

The type of business you have. For example, if you're an online retailer that accepts credit card payments online, then choosing a provider like PayPal or Square makes sense because they have apps that allow customers to check out via their smartphones.

The features that are most important to your business. Some providers offer more than others--for example, some offer free payment processing while others charge fees every time an order is processed; some provide 24/7 customer support while others only operate during normal business hours (and some don't even have phone numbers).

Price should also be taken into consideration when comparing different providers; however, don't just look at the price tag alone! You should also consider other factors such as security measures taken by each company so that your customers' personal information remains secure at all times during transactions made through their platform(s).

How to Find a Merchant Services Provider That's Right for Your Business.

To find the right merchant services provider, you need to consider several factors. First and foremost, you should make sure that they offer the kind of payment processing solutions that are right for your business. If you're an eCommerce company with a lot of online sales, for example, then it makes sense to go with an established provider like PayPal or Stripe rather than Square or Intuit (the makers of QuickBooks).

Secondly: check their reputation! A good way to do this is by reading reviews on sites like Yelp or Trust pilot; these sites allow users who have been served by the company in question leave feedback about their experiences working together--so if there are any negative comments anywhere online about either party's customer service skills then perhaps reconsidering signing up with them altogether!

Thirdly: make sure they have access to all kinds of different technologies if possible as well as offering 24/7 support during normal business hours so that if anything goes wrong at any time during day-to-day operations then someone will always be there helping customers solve problems quickly without having wait around too long before getting answers."

Use these tips and choose the right merchant services provider for your business.

To choose the right merchant services provider for your business, you should:

Choose a merchant services provider that meets your business needs. Your business needs will vary depending on what type of business you run and how much money you make. For example, if you're an online retailer who sells products in bulk, then it's important to find a provider that can handle high volumes of transactions quickly and efficiently. On the other hand, if your company only sells small items like cupcakes or manicures on occasion through sites like Etsy or Fiverr (and doesn't have many employees), then it might not matter as much if the software takes longer than usual to process payments because there won't be many customers buying things at once anyway!

Choose a QuickBooks Merchant Services provider that works with other companies like yours in terms of size and industry type--this way they'll know what kinds of questions are likely coming up during onboarding (and maybe even have some answers ready!). This will also help ensure compliance with regulations such as PCI DSS standards which require businesses using credit card data storage systems/services follow strict security protocols regarding encryption key management etc...

Conclusion

We hope you've found this article helpful and informative. With so many options out there, it can be difficult to know where to start when choosing the right merchant services provider for your business. But by following these tips, we're confident that you'll find the perfect match in no time at all!

0 notes

Text

How to start a virtual clinic

Practical steps for setting up your business

Though starting a virtual clinic is exciting — and beneficial for doctors and patients alike — it can be overwhelming. You want to make sure you do right by your patients and follow the law, but where do you start? Here are five steps to help guide you.

1. Get to know local laws

If you’re not already in practice, you need to set up your business in the eyes of the law. Consult an attorney who specializes in corporate law and your local medical board for information on how you can incorporate your clinic.

You also need to set up a business bank account and get any licenses necessary to operate. The U.S. Small Business Administration (SBA) or a local small business incubator or association can provide you with resources and information on how to do this.

If you want to get reimbursed for virtual visits, find out if your state has a parity law that covers telemedicine. A parity law requires private insurers to cover these visits the same way they’d cover an in-person visit.

Currently, 43 states and the District of Columbia have these parity laws on the books. And most insurance providers will cover at least some telehealth services, as will Medicare and Medicaid.

Check state laws to determine what you can and can’t do in a virtual visit. For example, some states won’t let you see a patient for the first time via a virtual visit. Others won’t let you prescribe controlled substances, like Adderall, during a telehealth appointment.

2. Give patients the virtual clinic rundown

Change is scary for most people, especially for those who are unwell and seeking care. Your patients should have information about when your virtual clinic will open and how it will work — even if you’re still going to offer in-person visits. So, as you prepare to start your virtual clinic, keep your patients’ needs and concerns top of mind by doing the following:

Provide an overview of the virtual clinic in person during your next appointment and via email, website, or direct mail. Explain which services will be provided, how they’ll be administered, which conditions are eligible/excluded, how to book virtual appointments, and basic troubleshooting tips and tricks. To ease your patients’ fears or concerns, you can also lay out the patient perks of a telemedicine experience, like avoiding unnecessary wait times and travel to and from the clinic while having access to on-demand help and specialists.

Update contact information for all of your patients so you can easily disseminate virtual clinic updates and documents — including patient consent forms, signup sheets, patient surveys, and general information.

Digitize all your patients’ physical charts. By keeping patient charts in a digital location for virtual appointments, you can be sure all their personal data is organized and accessible.

Discuss payment options before your patients’ first virtual visit. Will they be paying out of pocket for these appointments, or will insurance cover their visit? If they’re paying out of pocket, be sure to have some sort of payment processing platform in place, like Venmo or PayPal, for added customer convenience and security. If their visits are covered by insurance, make sure you know the process for submitting claims (direct billing vs patient submittal) to prevent confusion, mishandling of funds, or a billing backlog.

3. Set up privacy protection

Patients should feel safe during virtual consultations. They should feel confident that though their appointment is virtual, everything else is just as it would be in a doctor’s office and their private, personal information is securely protected.

Begin each virtual session by confirming their identity and making sure they’re ready to have a confidential conversation. If someone is in the room with them, follow the same principles you would in your physical clinic and ask them if they’re OK with that person’s presence. Be focused and attentive, and never answer another call or leave the room while you’re speaking to the patient.

While technology can be beneficial, it can also be dangerous if it’s improperly used or on an unsecured wireless network. For optimum safety of both your patients’ and clinic’s sensitive data, make sure all software is working properly and updated regularly with adequate anti-malware and antivirus applications.

4. Create a space for virtual clinic appointments

In addition to the areas where you normally see patients, set up an area, like a private office, where you can conduct virtual visits. This should be a quiet space with good lighting so that your patients can see you clearly and feel like they’re getting the same amount of attention they would in person.

Invest in the right equipment for virtual visits. Most of the video conferencing tools you’ll use require a good quality camera, a microphone, and a computer or mobile device. You probably already have this hardware, but you might want to invest in a webcam and microphone so your patients can see and hear you better.

5. Choose your software

Before you pay for any software programs, make sure they comply with the Health Insurance Portability and Accountability Act (HIPAA). The software provider should sign a business associate agreement (BAA), which is required to protect you against HIPAA violations should patient information be compromised on their end.

There are a lot of video conferencing platforms that are specifically for healthcare, like Doxy.me, VSee, and Updox. While Zoom may be best known for its enterprise platform, it does offer a HIPAA-compliant product, Zoom for Healthcare. You could also use Cisco Webex as it is also HIPAA-compliant. The idea is to choose something that’s easy for both you and your patients.

Pick something that will help you with processes like patient intake, informed consent, collecting payment, and scheduling. Jotform offers HIPAA-compliant forms with customizable templates and payment gateway integrations.

For example, before you have a virtual visit with a patient, you can send them a link to an informed consent form to fill out so that they’re aware of their privacy rights. With Jotform, you can embed an electronic signature widget, which lets your patient sign the form. They can then send it back to you before the appointment so you have it on file.

Technical Doctor's insight:

Contact Details : [email protected] or 877-910-0004 www.technicaldr.com

0 notes

Text

Picoworkers vs Rapidworkers : wath is the difference between picoworkers and rapidworkers? which is better?( earn money online Without investment )

If you are a fun of MiCro Jobs and have been working online for a while, you might probably have come across either Picoworkers, Rapidworkers or both. These are two fantastic online market places for workers to perform smaller tasks and earn some dollars. In this article we are discussing Picoworkers vs Rapidworkers, which is better?

What is Rapidworkers?

Different definitions but same meaning, Rapid workers assist individuals, small businesses and professionals in establishing low-cost jobs. These jobs are marketing campaigns that have intentions of increasing sales, ensuring website ranking, and Social media following.

How Rapidworkers Work?

Working on Rapidworkers is almost same as Picoworkers however, for the benefit of the Picoworkers vs Rapidworkers review, we will make it short and snappy.

Visit Rapidworkers and create an account

Fill up your details and check your inbox to confirm your email address

Hover to the dashboard and choose a job that you can perform

Perform the job as per the description of the employer and submit

That’s all. Move to next until you are tired.

Advantages of Rapidworkers

Like the above, Rapidworkers have their advantages and disadvantages.

Free to Join: Joining Rapidworkers is free, and no cost attached. All you need to do is to enter your email address to proceed.

Disadavantages of Rapidworkers

Clumsy interface: Talking of a horrible interface, Rapidworkers isn’t impressive. The website interfere is with unnecessary colors making it look terrible.

Bad for Employers: Many employers have complained about how spammy the website is. It appears the check and balances on workers are limited, hence making employers pay the price.

Limited Payment methods: Rapid workers have only one payment which is PayPal. This makes it very difficult for workers from most developing and non-PayPal countries to work on the site.

Minimum Payments: Rapid workers have a minimum withdrawal method of $8 whiles their counterpart is $8. The gab is huge and difficult to attain considering this is a Microtask platform that earns you a little over cents.

What is Picoworkers?

Picoworkers is an absolute unique freelance market platform that links freelancers to potential customers around the world. If you in a die-hard need of people to perform minor tasks such as commenting on YouTube, visiting the website, testing your apps, you have no worries. Picoworkers has always got your back!! With no specific skill required, working on Picoworkers is flexible and non-discriminatory.

How Picoworkers Work ?

Like many clumsy Platforms, Picoworkers is straight forward. You need to first create an account, confirm your email, and head straight to your dashboard. The platform provides a straight forward avenue to search jobs and work.

Login your account and click on Find Jobs.

Read the Job Instruction

Perform the task as requested by the employer.

When done, scroll down to the required proof. Required proofs are evidence the employer expects from the worker to be sure they completed job. If the required proof is wrong, the employer may deny your payment. So you need to take a critical look at what you submitting to the employer

Picoworkers Payments

Picoworkers have many withdrawals and deposit methods you can choose. As a worker, you have Crypto, Skrill, PayPal and Skrill to choose from. These make it more flexible, irrespective of your location. You can freely withdraw money on Picoworkers.

For employers, Picoworkers provide a flexible means to deposit. Airtm, PayPal, Crypto and Masters/Visa Card deposits are all available for deposits on Picoworkers. This makes the platform more globally competitive and accessible to anyone.

Advantages of Picoworkers

Picoworkers is global: The platform has no limitation irrespective it of your present location.

Workers can perform Picoworkers jobs from anywhere: They do not limit jobs to present location they allow employers to post in specific countries and target international zone.

Flexible withdrawal methods: Picoworkers have one of the most flexible withdrawal methods, as mentioned above. They have up to 4 methods to withdraw money from any country.

Plenty of jobs available: Talking of crowd, Picoworkers have more employers than any Microtask platform and therefore have many jobs available for workers to perform.

Referral bonuses: It’s not surprising they are growing quick. Picoworkers have one of the juicy referral systems that rewards you 5% of every task and deposit made by your down-line forever.

Ease of Navigation: Comparing to other Microtask platforms, Picoworkers have a straightforward and nice website interface for navigation.

Picoworkers vs Rapidworkers Which is Best?

Both Picoworkers and Rapidworkers are legit and honest platforms to make money. Though you may not able to buy your dream car houses from these sites, at least you can buy beer if you use your spare-time to perform tasks and earn cents.

My personal review of Picoworkers and Rapidworkers are that both platform requires vigorous efforts to earn money. However, if you ask me, I will choose Picoworkers any day over Rapidworkers. Reasons are that Picoworkers seem to be very innovative and developing quickly. Their website also attracts many people around the world.

#picoworkers#rapidworkers#micro-jobs#earnmonyonline#earnmoneyonlinefromhome#EarnMoneyOnlineWithoutInvestment#earn money online#earn money online without investment#earn money online from home

1 note

·

View note

Note

ngl asking for people who self-identify as "antis" is already biasing your results because the term originated from fans being defensive over getting called out (eg the types who sincerely think fandom culture is ""puritan""). fair number of people started to use the term ironically and it might be evening out but overall the post calling for responses on the survey still comes off as something written in bad faith?

I wrote a rather long and involved response and then tumblr ate it. Goshdarn.

Fair warning, this is a hyperfixation and I’m coming off of a migraine so this may not be very cogent. Please read this in the over excited tones of someone infodumping about emulsifiers, with no animosity intended.

So, tl;dr and with a lot fewer links, I’m incredibly interested by your perspective that “anti” originated as a derogatory term.

As far as I am aware, the etymological history of the word “anti” being used pejoratively is coming from some very new debates.

I’m also noting that you had no feedback regarding the content of the questions themselves, which I would be interested in hearing as I am genuinely coming from a place without censure.

The term “anti” actually is a self-descriptor that arose in the Livejournal days, where you’d tag something as “Anti ___” for other like minded people to find. (For example, my cursory google search pulled up 10 Anti Amy Lee communities on LJ).

I’m a self-confessed old. I was back in fandom before Livejournal, aaaall the way back in the Angelfire days. Webrings children! We had webrings! And guest books for you to sign!

I’m going to take a swing for the fences here Anon, so if I’m wrong please let me know, but I’m going to guess you became active as a fan in the past 5-8 years based of your use of the term puritan.

There’s actually a HUGELY new debate in fandom spaces! Previously, it was assumed that:

a) All fandom spaces are created and used by adults only.

b) If you were seeing something, it’s because you dug for it.